Canadian Heritage’s quarterly financial report for the quarter ended September 30, 2019

On this page

- 1. Introduction

- 2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

- 3. Risks and uncertainties

- 4. Significant changes in relation to operations, personnel and programs

- 5. Approval by senior officials

- Statement of authorities (unaudited)

- Departmental budgetary expenditures by standard object (unaudited)

1. Introduction

This second quarterly financial report should be read in conjunction with the 2019-20 Main Estimates and Budget Implementation Vote items approved as of September 30, 2019 along with 2018-19 Main Estimates and Budget Implementation vote items. It has been prepared by management as required by section 65.1 - Quarterly financial reports of the Financial Administration Act and is in the form and manner prescribed by the Treasury Board in accordance with the special purpose financial reporting framework described in the GC4400 policy instrument. The second quarterly report has not been subject to an external audit or review.

The quarterly financial report outlines the results, risks and significant changes in operations, personnel and programs and includes financial information tables for the quarter. The purpose of the quarterly financial information tables is to provide a comparison of in-year departmental spending with authorities granted by Parliament, as well as comparative financial information for the preceding year.

1.1. Authority, mandate and program activities

The Department of Canadian Heritage and its Portfolio organizations play a vital role in the cultural, civic and economic life of Canadians. Our policies and programs promote an environment where Canadians can experience dynamic cultural expressions, celebrate our history and heritage and build strong communities. The Department invests in the future by supporting the arts, our official and indigenous languages and our athletes and the sport system.

Further details on the Department of Canadian Heritage’s (PCH) authority, mandate and program activities can be found in the 2019-20 Departmental Plan and the 2019-20 Main Estimates.

1.2. Basis of presentation

This second quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department’s spending authorities granted by Parliament, and those used by the department consistent with the Main Estimates and Budget Implementation Vote items approved as of September 30, 2019 for the 2019-20 fiscal year.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

PCH uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3. Canadian Heritage financial structure

PCH has a financial structure composed of voted budgetary authorities that include Vote 1 – Operating expenditures and Vote 5 – Grants and Contributions, and Statutory authorities which are composed of contributions to employee benefits plans, Ministers’ Salary and motor car allowances and Statutory Payments for Lieutenant Governors.

2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

2.1. Statement of authorities

PCH’s 2019-20 authorities available for use at the end of the second quarter have increased by approximately $179.1 million when compared to the same quarter of 2018-19. More specifically, the total available for use increased by $170.8 million in Vote 5 - Grants and Contributions, $6.9 million in Vote 1 - Operating expenditures and $1.4 million in Statutory authorities.

The following table provides details on the changes in authorities observed from 2018-19 to 2019-20 at the end of the second quarter:

| Items | Vote 1 | Vote 5 | Statutory | Total |

|---|---|---|---|---|

| Funding for Action Plan for Official Languages (2018-2023) (Budget 2018) | 6.4 | 63.4 | 0.1 | 69.9 |

| New funding to support Artists, Cultural Events and Commemorations (Budget 2019) | 1.3 | 34.1 | 0.1 | 35.5 |

| Funding for the Creative Export Strategy in order to sustain and stimulate the exports and international promotion of Canadian creative works | 6.2 | 11.0 | 0.5 | 17.7 |

| New funding to support the development and implementation of a new federal anti-racism strategy (Budget 2019) | 7.0 | 9.7 | 0.2 | 16.9 |

| New funding to support the implementation of the proposed Indigenous Languages Act (Budget 2019) | 0.4 | 14.6 | 0.1 | 15.1 |

| New funding for Digital Democracy Project to address online disinformation (Budget 2019) | 1.9 | 9.4 | 0.3 | 11.6 |

| Funding for Strengthening Multiculturalism initiative (Budget 2018) | 1.9 | 9.1 | 0.3 | 11.3 |

| Funding to support gender parity in the Canadian Sports System (Budget 2018) | 0.9 | 7.9 | 0.1 | 8.9 |

| New funding to ensure a safe and healthy sport system to enable Canadian sports organizations to promote accessible, ethical, equitable and safe sports (Budget 2019) | 0.0 | 6.0 | 0.0 | 6.0 |

| New funding for Canadians with Visual Impairments and other print disabilities to support Canada's independent publishing industry to increase the production of accessible reading materials (Budget 2019) | 0.3 | 4.0 | 0.1 | 4.4 |

| Funding to support the preparation of the 2026 FIFA World Cup | 0.0 | 2.5 | 0.0 | 2.5 |

| Increase in funding to support Indigenous Youth and Sport (Budget 2018) | 0.0 | 1.5 | 0.0 | 1.5 |

| Other Adjustments | (3.1) | 1.4 | (0.4) | (2.1) |

| Decrease in funding to support the Youth Employment Strategy (YES) | (0.2) | (3.8) | 0.0 | (4.0) |

| Decrease in funding compared to 2018-19 for the Year-End Carry Forward | (5.4) | 0.0 | 0.0 | (5.4) |

| Sunsetting of funds for the Grants and Contributions Modernization Project and repayment of the loan to the TB Management Reserve | (10.7) | 0.0 | 0.0 | (10.7) |

| Grand Total | 6.9 | 170.8 | 1.4 | 179.1 |

2.2. Departmental budgetary expenditures by standard object

Total expenditures for the second quarter of 2019-20 have increased by $65.7M (24%) from $270.5M to $336.2M compared to the same quarter of 2018-19.

The Vote 5 – Grants and Contributions expenditures for the second quarter of 2019-20 increased by $65.4M, from $215.8M to $281.2M. This 30% increase is mainly due to the following items:

- $18.5M – Canada Media Fund: the increase is mainly caused by the anticipated funding for Investing in Canadian Content;

- $7.2M – Development of Official Languages Communities Program: the increase is mainly caused by the timing in payments which were more significant in 2019-20 second quarter compared to the same quarter in 2018-19;

- $6.9M – Multiculturalism Program: the increase is mainly caused by the new funding to support the development and implementation of a new federal anti-racism strategy;

- $14.6M increase mainly caused by the new funding to enhance support for Artists, Cultural Events and Commemorations

- $6.2M – Canada Music Fund;

- $5.8M – Canada Arts Presentation Fund (mainly related to Harbourfront Center);

- $2.6M – Building Communities through Arts & Heritage;

- $3.6M – Museum Assistance Program: the increase is mainly caused by the timing in payments which were more significant in 2019-20 second quarter compared to the same quarter in 2018-19;

- $3.1M – Canada History Fund: the increase is mainly caused by the new funding to support the Digital Democracy Project;

- $3.0M – Canada Periodical Fund: the increase is mainly due to the timing in payments which were more significant in 2019-20 second quarter compared to the same quarter in 2018-19;

- $2.3M – Sport Support Program: the increase is mainly caused by the new funding to ensure a safe and healthy sport system to enable Canadian sports organizations to promote accessible, ethical, equitable and safe sports;

- $2.1M – TV5: the increase is mainly caused by the anticipated funding to support the creation, development and launch of a Francophone digital platform with TV5Monde public broadcasters.

The Vote 1 – Operating expenditures for the second quarter of 2019-20 have increased by $2.3M, from $48.3M to $50.6M compared to the same quarter of 2018-19. This 5% increase is mainly due to the net effect of the below items:

- $1.9M increase in Other subsidies and payments expenditures due to an increase in interdepartmental settlement expenses compared to the second quarter of 2018-19;

- $1.8M increase in Personnel expenditures mainly due to new funding announced in Budget 2019, which resulted in an increase of PCH salary expenditures in comparison to the same quarter of 2018-19;

- $0.3M increase in Information expenditures is explained by more spending in audio-visual services and communication research services in this quarter compared to the same quarter in 2018-19;

- $0.3 million decrease in revenues credited to the vote collected in this quarter compared to the second quarter of 2018-19, which increases PCH net expenditures.

Partially offset by:

- $1.5M decrease in Professional and Special services expenditures for Information Technology and Telecommunication consultants mainly due to the Grants and Contributions Modernization Project and internal spending restraint measures under the Chief Information Officer Branch;

- $0.7M decrease in Acquisition of machinery and equipment expenditures due to the timing of planned computer equipment purchases which were bought earlier in 2018-19 compared to 2019-20.

Statutory Expenditures for the second quarter of 2019-20 have decreased by $1.9M from $6.3M to $4.4M compared to the same quarter of 2018-19. This 30% decrease is mainly due to the timing in the recording of payments related to contributions to employee benefit plans in 2019-20. These expenses will be recorded in the next quarter.

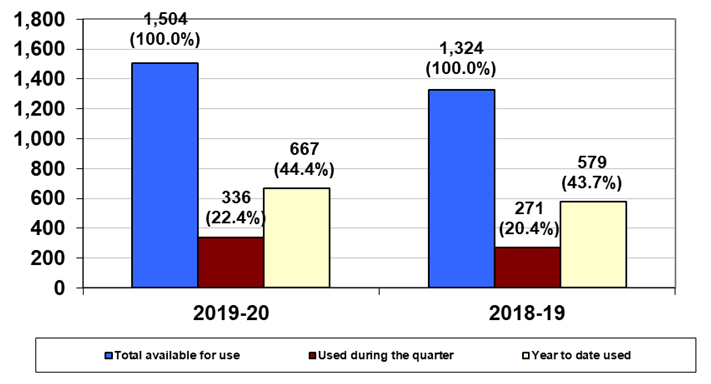

As noted in the table below, PCH has spent 22.4% ($336.2M) of its authorities in the second quarter of 2019-20, which is similar in percentage to last year’s consumption of 20.4% ($270.5M).

Expenditures compared to annual authorities (in millions of dollars) – text version:

| 2019-20 | 2018-19 | |

|---|---|---|

| Total available for use | 1,504 (100.0%) | 1,324 (100.0%) |

| Used during the quarter | 336 (22.4%) | 271 (20.4%) |

| Year-to-date used | 667 (44.4%) | 579 (43.7%) |

3. Risks and uncertainties

Canadian Heritage continues to operate in a time of change. The standardization and consolidation of processes, as part of the government-wide initiatives such as Financial Management Transformation (FMT) initiative, requires the analysis of financial and non-financial risks and the implementation of adequate internal controls and other risk mitigation strategies to ensure effective and efficient processes in order to support strong management oversight.

The Government of Canada has implemented a new pay system in 2015 as part of the pay transformation initiative. Since its implementation, Phoenix has experienced issues—under and over payments to employees—which Public Services and Procurement Canada (PSPC) is working hard to resolve. In order to mitigate against this impact, PCH has issued emergency salary advances to affected employees. Further, the department has strengthened and invested in its Internal Services, in particular in the human Resources and Financial Management branches in order to better support PCH employees. PCH has also put controls in place to monitor this risk and will monitor the situation closely in consultation with PSPC and Treasury Board Secretariat.

4. Significant changes in relation to operations, personnel and programs

Since the first quarter of 2019-20, there were changes to Canadian Heritage’s organizational structure which in turn resulted in changes to senior management personnel.

The Citizenship, Heritage and Regions sector was divided into two new sectors. The first one, Community and Identity Sector is under the leadership of Charles Slowey as Assistant Deputy Minister and the second, Official Languages, Heritage and Regions Sector is led by Maia Welbourne who has joined PCH as Assistant Deputy Minister.

These changes are effective since August 26, 2019.

5. Approval by senior officials

Approved by:

Original signed

Hélène Laurendeau, Deputy Minister

Gatineau, Canada

Date: November 26, 2019

Original signed

Eric Doiron, Chief Financial Officer

Gatineau, Canada

Date: November 21, 2019

Statement of authorities (unaudited)

| Authorities | Total available for use for the year ending March 31, 2020* | Used during the quarter ended September 30, 2019 | Year to date used at quarter-end 2019-20 | Total available for use for the year ending March 31, 2019* | Used during the quarter ended September 30, 2018 | Year to date used at quarter-end 2018-19 |

|---|---|---|---|---|---|---|

| Vote 1 - Operating expenditures | 203,521 | 50,572 | 94,759 | 196,611 | 48,310 | 94,161 |

| Vote 5 - Grants and contributions | 1,272,919 | 281,178 | 561,773 | 1,102,160 | 215,828 | 472,420 |

| Statutory - Contributions to employee benefit plans | 24,920 | 4,060 | 10,151 | 23,569 | 5,892 | 11,785 |

| Statutory - Minister of Canadian Heritage - Salary and motor car allowance | 88 | 22 | 44 | 86 | 29 | 50 |

| Statutory - Minister of State (Minister of Sport and Persons with Disabilities) - Motor car allowance | 88 | 0 | 0 | 2 | 0 | 0 |

| Statutory - Salaries of the Lieutenant Governors | 1,196 | 346 | 718 | 1,196 | 453 | 730 |

| Statutory - Payments under the Lieutenant Governors Superannuation Act (R.S.C., 1985, c. L-8) | 637 | 0 | 0 | 637 | 0 | 0 |

| Statutory - Supplementary Retirement Benefits - Former Lieutenant-Governors | 182 | 0 | 0 | 182 | 0 | 0 |

| Spending of Crown Asset Proceeds | 5 | 0 | 0 | 20 | 0 | 0 |

| Total Budgetary authorities | 1,503,556 | 336,178 | 667,445 | 1,324,463 | 270,512 | 579,146 |

| Total authorities | 1,503,556 | 336,178 | 667,445 | 1,324,463 | 270,512 | 579,146 |

| *Includes only Authorities available for use and granted by Parliament at quarter-end. | ||||||

Departmental budgetary expenditures by standard object (unaudited)

| Expenditures | Total available for use for the year ending March 31, 2020* | Used during the quarter ended September 30, 2019 | Year to date used at quarter-end 2019-20 | Total available for use for the year ending March 31, 2019* | Used during the quarter ended September 30, 2018 | Year to date used at quarter-end 2018-19 |

|---|---|---|---|---|---|---|

| Personnel | 191,989 | 44,905 | 90,237 | 184,579 | 44,953 | 89,587 |

| Transportation and communications | 4,611 | 885 | 1,691 | 3,810 | 948 | 1,864 |

| Information | 2,140 | 709 | 1,228 | 3,580 | 422 | 707 |

| Professional and special services | 29,046 | 4,079 | 7,480 | 23,006 | 5,561 | 9,071 |

| Rentals | 4,095 | 1,133 | 1,762 | 3,940 | 986 | 1,772 |

| Repair and maintenance | 879 | 184 | 301 | 871 | 180 | 259 |

| Utilities, materials and supplies | 2,529 | 600 | 859 | 3,600 | 615 | 994 |

| Acquisition of machinery and equipment | 3,255 | 507 | 750 | 6,347 | 1,195 | 1,461 |

| Transfer payments | 1,273,738 | 281,178 | 561,773 | 1,102,979 | 215,828 | 472,420 |

| Other subsidies and payments | 1,231 | 4,012 | 4,739 | 1,708 | 2,121 | 4,190 |

| Total gross budgetary expenditures | 1,513,513 | 338,192 | 670,820 | 1,334,420 | 272,809 | 582,325 |

| Expenditures | Total available for use for the year ending March 31, 2020* | Used during the quarter ended September 30, 2019 | Year to date used at quarter-end 2019-2020 | Total available for use for the year ending March 31, 2019* | Used during the quarter ended September 30, 2018 | Year to date used at quarter-end 2018-2019 |

|---|---|---|---|---|---|---|

| Revenue credited to the Vote | -9,957 | -2,014 | -3,375 | -9,957 | -2,297 | -3,179 |

| Total Revenues netted against expenditures | -9,957 | -2,014 | -3,375 | -9,957 | -2,297 | -3,179 |

| Total net budgetary expenditures | 1,503,556 | 336,178 | 667,445 | 1,324,463 | 270,512 | 579,146 |

| *Includes only Authorities available for use and granted by Parliament at quarter-end. | ||||||

Page details

- Date modified: