Archived - Departmental Performance Report 2014–15

The Department of Finance Canada plays a leadership role in contributing to a strong economy and sound public finances. The Department develops and implements the fiscal and economic policies that support growth, productivity and fairness. Its work is key to the future success of Canada and Canadians.

This annual performance report describes the Department of Finance Canada’s achievements in meeting its priorities.

Canada’s government is committed to a realistic, sustainable, and transparent fiscal plan designed to address the economic times in which we live. We will direct our resources to those initiatives that will have the greatest, positive impact on the lives of Canadians.

The mandate that I received from the Prime Minister directed me to seek out and listen to the views of Canadians, to collaborate and to build consensus. I am working on behalf of Canadians to achieve our shared priorities of economic growth, job creation and greater prosperity for all.

I want to thank the employees of the Department of Finance Canada for their continued service to Canadians. I count on their support as we work to improve our country and the lives of all Canadians by focusing on a healthy economy with a strong and growing middle class.

Appropriate Minister: William F. Morneau

Institutional Head: Paul Rochon

Ministerial Portfolio: Department of Finance

Enabling Instruments: The Minister of Finance has direct responsibility for a number of acts and is assigned specific fiscal and tax responsibilities relating to other acts that are under the responsibility of other ministers, including the:

- Financial Administration Act;

- Income Tax Act;

- Payment Clearing and Settlement Act;

- Federal-Provincial Fiscal Arrangements Act;

- Customs Act;

- Customs Tariff;

- Excise Act, 2001;

- Excise Tax Act;

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act; and

- Special Import Measures Act.

Key legislation and acts are available on the Department of Justice Canada’s website.

Year of Incorporation / Commencement: 1867

The Department of Finance Canada contributes to a strong economy and sound public finances for Canadians. It does so by monitoring developments in Canada and around the world to provide first-rate analysis and advice to the Government of Canada and by developing and implementing fiscal and economic policies that support the economic and social goals of Canada and its people. The Department also plays a central role in ensuring that government spending is focused on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal organizations and acts as an effective conduit for the views of participants in the economy from all parts of Canada.

Created in 1867, the Department of Finance Canada was one of the original departments of the Government of Canada and had as its primary functions bookkeeping, administering the collection and disbursement of public monies, and servicing the national debt. Today, the Department helps the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, international and financial sector policies and programs. It plays an important central agency role, working with other departments to ensure that the government’s agenda is carried out and that ministers are supported with high-quality analysis and advice.

The Department's responsibilities include:

- Preparing the federal Budget and the fall Update of Economic and Fiscal Projections;

- Preparing the Annual Financial Report of the Government of Canada and, in cooperation with the Treasury Board of Canada Secretariat and the Receiver General for Canada, the Public Accounts of Canada;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Designing and administering major transfers of federal funds to the provinces and territories;

- Developing financial sector policy and legislation; and

- Representing Canada in various international financial institutions and organizations.

The Minister of Finance is accountable for ensuring that his responsibilities are fulfilled both within his portfolio and with respect to the authorities assigned through legislation.

- 1.1 Program: Economic and Fiscal Policy Framework

- 1.1.1 Sub-Program: Taxation

1.1.2 Sub-Program: Economic and Fiscal Policy, Planning, and Forecasting

1.1.3 Sub-Program: Economic Development Policy

1.1.4 Sub-Program: Federal-Provincial Relations and Social Policy

1.1.5 Sub-Program: Financial Sector Policy

1.1.6 Sub-Program: International Trade and Finance

- 1.1.1 Sub-Program: Taxation

- 1.2 Program: Transfer and Taxation Payment Programs

- 1.2.1 Sub-Program: Fiscal Arrangements with Provinces and Territories

1.2.2 Sub-Program: Tax Collection and Administration Agreements

1.2.3 Sub-Program: Commitments to International Financial Organizations

1.2.4 Sub-Program: Receipts from and Payments to Individuals and Organizations

- 1.2.1 Sub-Program: Fiscal Arrangements with Provinces and Territories

- 1.3 Program: Treasury and Financial Affairs

- 1.3.1 Sub-Program: Federal Debt Management

1.3.2 Sub-Program: Major Federal-Backed Entities’ Borrowing

1.3.3 Sub-Program: Prudential Liquidity and Reserves Management

1.3.4 Sub-Program: Domestic Currency System

- 1.3.1 Sub-Program: Federal Debt Management

- Internal Services

Sound fiscal management

The Department of Finance Canada will ensure effective management of the fiscal framework, including implementation of the federal budget.

Ongoing

- 1.1 Economic and Fiscal Policy Framework

- 1.3 Treasury and Financial Affairs

What progress has been made toward this priority?

- The Department successfully prepared the 2015 federal budget and advanced the implementation of related legislation.

- Other departmental actions included supporting the implementation of improvements to the integrity and the fairness of the tax system, such as measures to ensure that corporations do not realize unintended tax benefits on synthetic equity arrangements, and to strengthen an existing anti-avoidance rule meant to prevent corporations from converting their taxable capital gains into tax-free dividends.

- The Department continued to systematically review and deliver advice on federally owned assets to improve their efficiency and effectiveness and to ensure value for taxpayers.

- The Department ensured that funding to meet government financial requirements was raised in a timely manner and in quantities sufficient to meet operational needs. The Department also provided timely, cost-effective and well-managed funding for Crown corporations and other federal-backed entities.

- The Department provided advice on economic development and the fiscal situation to the Minister on a regular basis.

- Monthly highlights and details of the government's fiscal performance were published in the Department’s Fiscal Monitor.

Sustainable economic growth

The Department will continue to play a leadership role in putting in place policies that encourage productivity-enhancing investments and that facilitate workforce participation.

Ongoing

- 1.1 Economic and Fiscal Policy Framework

What progress has been made toward this priority?

- The Department supported the government’s economic agenda by providing high-quality and timely analysis and advice on the fiscal and economic implications associated with sectoral, regional and microeconomic policy issues, policies and programs.

- The Department developed and maintained strong working relationships with provincial and territorial officials through the Canada Pension Plan Committee.

- The Department supported the development and implementation of business tax measures, including a reduction in the small business tax rate from 11 per cent to 9 per cent by 2019 and an accelerated capital cost allowance for manufacturers to boost productivity-enhancing investment in machinery and equipment over the next 10 years.

- The Department worked on legislative and regulatory proposals to sustain and reinforce the stability of the financial sector, to strengthen Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime, to broaden discretionary retirement income savings options, and to protect Canadian consumers.

- The Department concluded the implementation phase of the Venture Capital Action Plan to catalyze the development of a sustainable venture capital ecosystem in Canada. The Plan has resulted in the establishment of four private sector-led large-scale funds of funds. In addition, the government catalyzed early investments through the high-performing funds initiative by investing an aggregate of $50 million in four high-performing private sector-led venture capital funds.

Sound social policy framework

The Department will manage the major transfer payment programs providing financial support to provinces and territories and will continue work with departments and other central agencies to develop policy proposals that are consistent with, and deliver on, the government’s social policy priorities.

Ongoing

- 1.1 Economic and Fiscal Policy Framework

- 1.2 Transfer and Taxation Payment Programs

What progress has been made toward this priority?

- The Department prepared briefings for the Minister and senior government officials on major transfers and social policies and programs related to health care, immigration, the labour market, post-secondary education, justice, public safety, Aboriginal peoples, cultural programs, persons with disabilities and veterans.

- The Department provided analysis and recommendations leading to the inclusion of new social policy measures, including the extension of Employment Insurance Compassionate Care Benefits, the enrichment of the benefits and services provided to veterans, and the introduction of new measures to improve national security.

- Provincial and territorial finance ministers were presented with their transfer amounts for 2015–16 at the December 2014 Finance Ministers’ Meeting.

- The Department developed and maintained strong working relationships with provincial and territorial officials through the Canada Pension Plan Committee.

Effective international engagement

The Department will advance Canada’s leadership internationally, with a focus on the G20 Framework for Strong, Sustainable and Balanced Growth.

Ongoing

- 1.1 Economic and Fiscal Policy Framework

- 1.2 Transfer and Taxation Payment Programs

What progress has been made toward this priority?

- The Department, on behalf of Canada, continued to co-chair the Working Group on the G20 Framework for Strong, Sustainable, and Balanced Growth, which is the key international mechanism for economic cooperation. As co-chair of the Framework Working Group (along with India), Canada has played a catalytic role in the development of comprehensive growth strategies by G20 members—strategies that aim to lift G20 gross domestic product by at least 2 per cent by 2018.

- The Department supported the government’s bilateral and regional trade agenda, most notably the ongoing trade negotiations with Trans-Pacific Partnership countries. In addition, the Department continued to implement and assess tariff measures announced in the 2014 budget through legislation and regulation processes.

- The Department provided policy advice related to the International Assistance Envelope, including aid-effectiveness policies.

Pursue excellence and high performance through increased collaboration, innovation, use of new technologies, and sound resource management.

New

- The strategic outcome and all programs

What progress has been made toward this priority?

- In the 2014–15 Management Accountability Framework results, the Department was identified as demonstrating two notable practices: Financial Management and Risk Management. The Department had some of the strongest 2014 Public Service Employee Survey results.

- The Department began implementing its Blueprint 2020 action plan and made achievements in its three identified portfolios: infrastructure, people and policy. The Department has also contributed to Destination 2020 priorities, including crowd-sourcing innovation, virtual collaboration and connecting employees with senior management.

- Key people management achievements include the implementation of revised candidate assessment methods for the annual departmental University Recruitment Campaign, on-the-job learning opportunities for nearly 20 per cent of employees, the completion of an upward feedback survey, and the implementation of a new competency profile to be used in selection processes for professional administrative support staff.

- With respect to the government-wide Transformation of Pay Administration Initiative, the Department completed a partial transfer of pay accounts to the Public Service Pay Centre on schedule in February 2015. Monthly departmental dashboards show the highest levels of readiness and data quality in preparation for the full transfer of pay accounts and the Phoenix implementation scheduled for October 2015.

Ensure a secure and reliable information technology (IT) infrastructure and implement a collaborative, client-focused approach for information management (IM).

Previously committed to

- The strategic outcome and all programs

What progress has been made toward this priority?

- The Department routinely performed scans to detect viruses and malware, applied security updates and patches on both networks, and performed regular maintenance on its computer network in partnership with Shared Services Canada.

- The Department’s Executive Committee approved a three-year departmental IM/IT Strategic Plan that identifies priority projects for the Department, including the development of tools, applications and knowledge to enable collaboration and innovation in a digital business operating environment.

- The Department worked closely with Shared Services Canada and the Treasury Board of Canada Secretariat to advance IM/IT transformation initiatives such as Pay Modernization, Web Renewal and Email Transformation.

- The Department made progress on actions identified through the Blueprint 2020 engagement exercise to implement the use of new technologies. These technologies include digital signs in support of internal communications, the Department’s new state of the art conference centre, and continued progress toward paperless processes, including a pilot project on electronic approval. A new project was launched to support real-time co-authoring through SharePoint, as well as a pilot project for workflow with electronic approval.

Over the past year, the global economy continued to expand at a modest pace, as the impact of stronger growth in the United States was weighed down by only a modest expansion in the euro area, by continued slowdown in China, and by contraction or stagnation in Japan, Brazil and Russia. In the context of ongoing modest global growth, a key development was the decline in crude oil prices of about 50 per cent since mid-2014. For Canada, as a producer and net exporter of crude oil, lower prices led to a downward revision of domestic growth projections for 2014–15.

Continued uncertainty in global economic conditions highlights the importance of coordinated international decision making. The Department of Finance Canada continued to monitor risks to the global economic outlook, consulted with international partners, particularly in the G7 and G20 Finance Ministers’ and Leaders’ processes, and coordinated appropriate policy responses with international partners (for example, G20 growth strategies). It continued to monitor evolving uncertainties associated with economic and financial market outcomes, notably the risks associated with the vulnerabilities in the Canadian housing market.

The following table describes five of the top departmental risks that were identified in the 2014–15 Report on Plans and Priorities and discusses the effectiveness of the risk response strategies.

Key Risks

| Risk | Risk Response Strategy | Link to Program Alignment Architecture |

|---|---|---|

There is a risk that the requirement for coordinated international decision making will increase further and significantly affect the priorities and workload of the Department. (Risk Level: 4) |

The Department continued ongoing monitoring of global economic conditions, focusing on access to market intelligence, interaction with external authorities, and engagement with organizations. In-depth and frequent engagement between departmental staff and the network of finance and economic counsellors continued. The Department continued to engage in key forums for international economic coordination, including the G7, G20 and International Monetary Fund, and to serve as co-chair of the Working Group on the G20 Framework for Strong, Sustainable, and Balanced Growth. Coordination with other government departments continued to support alignment of international economic, trade and development priorities with domestic priorities, including the alignment and coordination of International Assistance Envelope decisions with broader domestic priorities. The above risk mitigation strategies have been implemented as intended and have been useful in mitigating risks. In particular, these strategies helped the Department support the provision of analysis and advice to key decision makers and maintain a high level of engagement in international organizations and with partners to influence decisions and effectively advance Canadian views. |

|

There is a risk that volatility on the state of the economic recovery will challenge the Department’s ability to provide accurate strategic advice and policy recommendations. (Risk Level: 3) |

Private sector surveys were conducted in June, September and December 2014, and in March 2015. In addition, the Minister of Finance met with private sector economists to discuss the economic outlook in June and October 2014, and in April 2015. As well as conducting its own internal analysis, the Department remained actively engaged with private sector economists during this period, to remain abreast of their current views on the economy. The above risk mitigation strategies have been implemented as intended and have been useful in mitigating the risks associated with an uneven global economic recovery. In particular, these strategies have helped to mitigate the risk posed by the significant decline in global crude oil prices since mid-2014. As a result, the Department has been able to maintain the provision of accurate strategic advice and policy recommendations to the Minister of Finance and the government. |

|

There is a risk that the Department will not have the infrastructure, resources and authorities needed to address, on an urgent basis, an evolving and uncertain economic and financial sector environment. (Risk Level: 3) |

Ongoing recruitment, training and development of personnel with specialized knowledge continued. Investments were prudently managed within a low-risk tolerance framework. Regular market reports continued to monitor vulnerabilities in financial markets. The above risk mitigation strategies have been implemented as intended and have been useful in mitigating the impact of financial market volatility and vulnerabilities that may impact the work conducted by the Department. |

|

There is a risk that the Department will have a reduced ability to hire new talent, which could affect the Department’s ability to provide quality policy advice and services to produce the fall update, budget, and other key documents. (Risk Level: 5) |

Practices were further aligned with the Treasury Board Directive on Performance Management, and improvements were made to the performance management program. Branches allocated resources to priority activities, redeploying resources based on changes in the operating environment. The 2014–15 Human Resources Plan was implemented and monitored. Performance management results of non-EX employees were reviewed horizontally, including talent management, development and succession planning considerations for key positions. A new unit responsible for the integration of performance management, employee development, talent management and employee recognition was created. The professional development program for Access to Information and Privacy (ATIP) officers, particularly in relation to competency and progression requirements, was updated. Blueprint 2020 action plan initiatives, which seek to increase efficiencies and productivity, were implemented. The above risk mitigation strategies have been implemented as intended and the Department has maintained its ability to hire new talent, as necessary. Furthermore, the implemented Blueprint 2020 action plan activities have supported increased departmental efficiencies and productivity. |

|

There is a risk that a security breach either related to the physical or IT work environment or to misuse of privileged information, a conflict of interest situation or a breach of privacy will impact the delivery of critical services. (Risk Level: 6) |

The dual network operational environment was used to segregate the most sensitive information assets. The computer network environment was routinely scanned and monitored, security patches and updates were applied, and maintenance was performed. The Department worked with Shared Services Canada to develop an integrated plan to relocate departmental services to the enterprise data centre. Ongoing security awareness training was delivered to new employees as part of the orientation sessions, and the IT Security awareness program was advanced by ensuring that employees receive situational awareness training, including instructions on how to handle and report suspicious or unusual emails. Information and updates relating to the Policy on Acceptable Network and Device Use were posted on the intranet. The above risk mitigation strategies have been implemented as intended. The Department expects that the continual delivery of IT security awareness training will reduce employee vulnerability to phishing, which would contribute to the increased protection of sensitive departmental information assets. |

|

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

Difference (actual minus planned) |

|---|---|---|---|---|

| 87,615,730,740 | 87,615,730,740 | 85,764,595,533 | 85,683,154,816 | (1,932,575,924) |

Human Resources (Full-Time Equivalents [FTEs])

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 774 | 765 | (9) |

Budgetary Performance Summary for Strategic Outcome and Programs (dollars)

| Strategic Outcome(s), Program(s) and Internal Services | 2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2013–14 Actual Spending (authorities used) |

2012–13 Actual Spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Strategic Outcome: 1. A strong economy and sound public finances for Canadians | ||||||||

| 1.1 Economic and Fiscal Policy Framework | 86,840,289 | 86,840,289 | 70,864,539 | 59,102,669 | 137,331,601 | 124,886,930 | 90,992,374 | 81,328,189 |

| 1.2 Transfer and Taxation Payment Programs | 61,060,094,306 | 61,060,094,306 | 63,809,601,256 | 66,765,312,869 | 61,971,275,326 | 61,902,703,494 | 60,171,246,077 | 57,360,555,306 |

| 1.3 Treasury and Financial Affairs | 26,419,500,000 | 26,419,500,000 | 25,726,000,000 | 27,278,000,000 | 23,600,697,770 | 23,600,697,770 | 25,258,792,413 | 26,148,248,975 |

| Subtotal | 87,566,434,595 | 87,566,434,595 | 89,606,465,795 | 94,102,415,538 | 85,709,304,697 | 85,628,288,194 | 85,521,030,864 | 83,590,132,470 |

| Internal Services Subtotal | 49,296,145 | 49,296,145 | 39,931,317 | 38,935,287 | 55,290,836 | 54,866,622 | 57,841,315 | 50,468,976 |

| Total | 87,615,730,740 | 87,615,730,740 | 89,646,397,112 | 94,141,350,825 | 85,764,595,533 | 85,683,154,816 | 85,578,872,179 | 83,640,601,446 |

In 2014–15, actual spending for the Department of Finance Canada was $2 billion less than planned spending. This variance is explained by actual spending being $2.8 billion lower than planned in the Treasury and Financial Affairs Program and by actual spending being $800 million higher than planned in the Transfer and Taxation Payment Programs Program. The variance in the Treasury and Financial Affairs Program is due to interest rates being lower than anticipated at the time of the 2013 Update of Economic and Fiscal Projections, which formed the basis of the amount reported in the 2014–15 Report of Plans and Priorities. The variance in the Transfer and Taxation Payment Programs Program was mainly because some transfer payments amounts were finalized only following the publication of the 2014–15 Report on Plans and Priorities.

The variance between planned and actual spending for the Economic and Fiscal Policy Framework Program is explained by increased spending for the Canadian Securities Regulation Regime Transition Office, offset by lower than anticipated expenditures for government advertising programs, 2013 budget initiatives, and staff turnover.

Actual spending in 2014–15 for Internal Services exceeded planned spending by $5.6 million as a result of expenditures funded through the Supplementary Estimates process.

Alignment of 2014-15 Actual Spending With the Whole-of-Government Framework (dollars)

| Strategic Outcome | Program | Spending Area | Government of Canada Outcome | 2014–15 Actual Spending |

|---|---|---|---|---|

| A strong economy and sound public finances for Canadians | 1.1 Economic and Fiscal Policy Framework | Economic Affairs | Strong Economic Growth | 124,886,930 |

| 1.2 Transfer and Taxation Payment Programs | All spending areas | All outcomes | 61,902,703,494 | |

| 1.3 Treasury and Financial Affairs | Economic Affairs | Strong Economic Growth | 23,600,697,770 |

Total Spending by Spending Area (dollars)

| Spending Area | Total Planned Spending | Total Actual Spending |

|---|---|---|

| Economic Affairs | 42,367,862,594 | 39,988,132,831 |

| Social Affairs | 44,695,762,000 | 44,695,735,363 |

| International Affairs | 502,810,000 | 944,420,000 |

| Government Affairs | 0 | 0 |

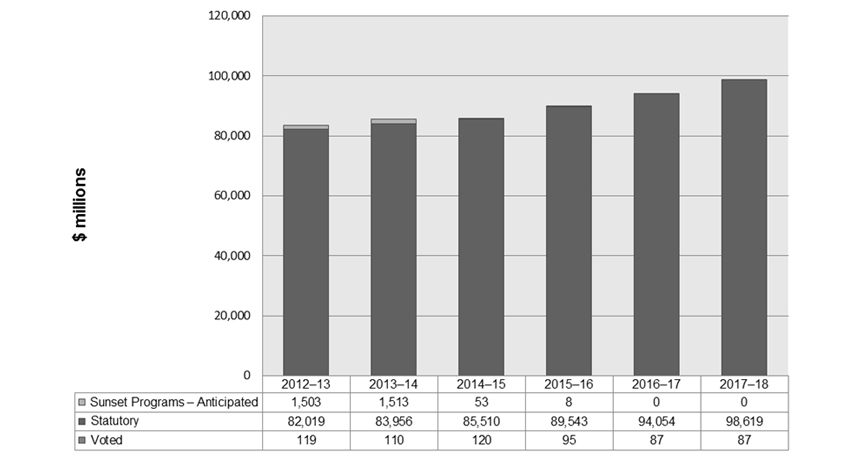

Departmental Spending Trend Graph

In the graph above, the amounts from 2012–13 to 2014–15 represent actual expenditures, whereas the amounts from 2015–16 to 2017–18 represent planned expenditures as presented in the 2015–16 Report on Plans and Priorities.

The one upward trend depicted in the graph reflects legislated increases in annual transfer payments and forecasted increases in interest expenditures on the government’s debt instruments.

Sunset programs represent, on average, less than 1 per cent of the spending shown.

This Program is the primary source of advice and recommendations to the Minister of Finance on issues, policies and programs of the Government of Canada related to the areas of economic, fiscal and social policy; federal-provincial relations; financial affairs; taxation; and international trade and finance. The work conducted by this Program involves extensive research, analysis, and consultation and collaboration with partners in both the public and private sectors, including the Cabinet and the Treasury Board; Parliament and parliamentary committees; the public and Canadian interest groups; departments, agencies and Crown corporations; provincial and territorial governments; financial market participants; the international economic and finance community; and the international trade community. In addition, this Program includes policy advice on the development of Memoranda to Cabinet, negotiation of agreements, drafting of legislation and sponsoring of bills through the parliamentary process, which are subsequently administered by other programs within the Department and by other government departments and agencies. The aim of this Program is to create a sound and sustainable fiscal and economic framework that will generate sufficient revenues and provide for the management of expenditures in line with the Budget Plan and financial operations of the Government of Canada.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2014–15 Difference (actual minus planned) |

|---|---|---|---|---|

| 86,840,289 | 86,840,289 | 137,331,601 | 124,886,930 | 38,046,641 |

Human Resources (Full-Time Equivalents [FTEs])

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 481 | 453 | (28) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| A sound economic, social, fiscal and financial policy framework. | Percentage of leading international organizations and major ratings agencies that rate Canada’s economic, social, fiscal, and financial policy framework as favourable. | 80 per cent | 100 per cent |

| Ministers and senior government officials are equipped to make informed decisions on economic, fiscal and financial sector policies, programs and proposals. | Percentage of recommendations/agreed upon areas for improvement following audits and/or evaluations that are on track or have been implemented within the planned time frames. | 100 per cent | 87.5 per cent |

| Percentage of recommendations/agreed upon areas for improvement following the annual federal budget post-mortem process that were implemented. | 100 per cent | 100 per cent |

The Department of Finance Canada analyzed economic and fiscal developments in Canada and abroad to advise the Minister on implications for the fiscal framework, as well as on economic and financial issues related to the government’s policies and commitments, including the return to balanced budgets. The Department continued to ensure that ministers and senior government officials were equipped to make informed decisions by conducting transparent, timely and accurate fiscal planning.

In 2014–15, the Department also implemented a number of measures to promote a stable, efficient and competitive financial sector and to ensure that domestic financial markets function well. The strength of Canada’s performance in this area is reflected in the World Economic Forum’s ranking of Canada’s banking system as the soundest in the world.

The Department supported progress internationally and domestically on implementing G20 commitments related to financial stability—notably, proposing in the 2015 budget to implement a Taxpayer Protection and Bank Recapitalization Regime for Canada’s systemically important banks, to develop measures to increase market discipline in residential lending and reduce taxpayer exposure to the housing sector, and to build resilient financial institutions.

The Department has been successful in implementing audit and evaluation recommendations within planned time frames in order to improve the quality of information it provides to ministers and senior government officials. In 2014–15, seven of eight agreed upon recommendations were implemented within the planned time frames. Implementation of the outstanding recommendation was delayed but is expected to be completed in 2015–16.

Actual spending in 2014–15 for the Economic and Fiscal Policy Framework Program exceeded planned spending by $38 million. The principal factor contributing to this variance was that spending for the Canadian Securities Regulation Regime Transition Office was $44 million greater than planned in the 2014–15 Report on Plans and Priorities, reflecting the timing of the funding request received from the Transition Office.

Increased spending for the Canadian Securities Regulation Regime Transition Office was offset by lower than anticipated expenditures for government advertising programs, for 2013 budget initiatives (Cooperative Capital Markets Regulator, comprehensive financial consumer code, Target Benefit Plans), and for staff. In addition, there was a realignment of legal services expenditures to Internal Services, as required by the Guide on Internal Services Expenditures: Recording, Reporting and Attributing.

The number of actual FTEs in 2014–15 was lower than planned because of staff turnover. These reductions also affected related Sub-Programs.

This Sub-Program develops and evaluates federal taxation policies and legislation, and negotiates international tax treaties and tax information exchange agreements as well as tax elements of comprehensive land claim and self-government agreements with Aboriginal governments. It also provides advice and recommendations for changes aimed at improving the tax system while raising the required amount of revenue to finance government priorities. It focuses on the following areas: personal income tax, business income tax, sales and excise tax, and Aboriginal tax policy. It is also involved with multilateral international tax policy matters, federal-provincial tax coordination, federal-provincial tax collection and reciprocal taxation agreements, federal-Aboriginal tax administration agreements, and tax policy research and evaluation. Improvements to the competitiveness, efficiency, simplicity and fairness of Canada’s tax system increase incentives for Canadians and Canadian businesses to realize their full potential, thereby encouraging investment, promoting economic growth, and increasing Canadians’ standard of living. These improvements also strengthen Canadians’ confidence in the tax system.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 21,329,932 | 21,499,089 | 169,157 |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 156 | 148 | (8) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Ministers and senior government officials have timely access to evidence-based analysis, research and advice on matters that impact the Government of Canada’s tax policy agenda. | Percentage of agreed upon deadlines for briefing material that were met. | 90 per cent | 65 per cent |

| Degree to which overall findings of audits and/or evaluations are favourable. | Favourable | Favourable |

The Department of Finance Canada provided the Minister and senior officials with high-quality tax policy advice and analysis, including options to promote jobs and growth and to improve the fairness and integrity of the tax system. The months of May and September represent the review period for the briefing material performance indicator. This Sub-Program deals with complex subject matter, which often requires extra diligence and detailed oversight. Because the Sub-Program deals with legislative drafting in addition to policy development, some briefing material prepared in May and September for the review period was delayed beyond original deadlines. In particular, in September 2014 the Sub-Program had already begun its preparations for the 2015 budget and was actively engaged in preparing for the family tax measures announced in October 2014. Where the agreed upon deadlines were not met, briefing material was nevertheless provided in a sufficiently timely manner to be used for the intended purposes.

The Department provided advice and analysis on a number of measures announced or confirmed in the 2015 budget. These measures include the reduction of the small business tax rate from 11 per cent to 9 per cent by 2019 and the provision of accelerated capital cost allowances to encourage investment over the next 10 years in machinery and equipment used in manufacturing, and in facilities that liquefy natural gas.

Building on past actions, the 2015 budget also announced measures to reduce the tax compliance burden for businesses and other tax filers, including a two-thirds reduction in the frequency of required remittance payments for the smallest new employers and the expansion of the use of the Canada Revenue Agency’s Business Number to a greater range of government programs, which allows a single identifier to be used to electronically register, provide and update information.

The Department provided analysis on measures announced in the 2015 budget to ensure that corporations do not realize unintended tax benefits on synthetic equity arrangements and to improve an existing anti-avoidance rule meant to prevent corporations from converting their taxable capital gains into tax-free dividends, further supporting the government’s efforts to improve the integrity and fairness of the tax system.

The Department also provided analysis on measures announced in October 2014 to provide tax relief and benefit increases for families with children. The 2015 budget also announced further tax relief for Canadians, including seniors.

Internationally, the Department supported the government’s ongoing commitment to participate in the Organisation for Economic Co-operation and Development / G20 project on Base Erosion and Profit Shifting. This project aims to develop coordinated multilateral solutions to address international tax planning strategies used by multinational enterprises to inappropriately minimize their taxes. Input from stakeholders solicited in the 2014 budget has helped shape Canada’s ongoing participation in the international discussions. G20 Leaders have committed to finalizing the project by the end of 2015.

The Department also continued to negotiate international tax treaties and tax information and exchange agreements with other countries. In particular, the Department supported the government’s efforts to improve the exchange of tax information between countries. In November 2014, Canada and the other G20 countries endorsed a new common reporting standard developed by the Organisation for Economic Co-operation and Development for the automatic exchange of financial account information.

The variance between actual and planned spending and the variance in FTEs for this Sub-Program was due to higher than anticipated staff turnover.

This Sub-Program analyzes Canada’s economic and fiscal situation, as well as the fiscal position of other levels of government and of governments in other countries, and advises on the government’s economic policy framework, its budget planning framework, and spending priorities. This Sub-Program is responsible for monitoring and preparing forecasts of Canada’s economic and fiscal position and plays a lead role in the management of the government’s fiscal framework. The Sub-Program also provides analytical support on a wide range of economic and financial issues related to the government’s macroeconomic and structural policies. This Sub-Program is necessary to help ensure that fiscal planning in the Government of Canada is transparent and supports long-term fiscal sustainability. Sound fiscal planning provides significant benefits to Canadians and businesses in Canada. It gives the government the strength to withstand fiscal and economic challenges and ensures that the costs of investments and services are not passed on to future generations. Sound economic and fiscal policies also enable the Canadian economy to better respond to various economic shocks.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 18,527,917 | 17,923,106 | (604,811) |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 70 | 69 | (1) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Ministers and senior government officials have timely access to evidence-based analysis, research and advice on matters that impact the Government of Canada’s economic and fiscal agenda. | Percentage of agreed upon deadlines for briefing material that were met. | 90 per cent | 100 per cent |

| Degree to which overall findings of audits and/or evaluations are favourable. | Favourable | No audits or evaluations of this Sub-Program were conducted in 2014–15. |

The Department of Finance Canada analyzed economic and fiscal developments in Canada and advised the Minister on the implications for the government’s fiscal framework. As well, the Department provided the Minister with analysis on a wide range of economic and financial issues related to the government’s policies, such as developments in oil prices and the housing market; conducted four surveys of private sector forecasters; and continued to assess potential risks to the economic outlook. The months of May and September represent the review period for the briefing material performance indicator.

Given the complex interaction between international and domestic economic and policy developments, the Department closely monitored economic developments in our major trading partners, particularly the United States and Europe. In addition, the Department took the lead role in facilitating the annual economic surveillance of Canada carried out by international organizations, such as the International Monetary Fund.

The Department’s ability to interpret economic data and understand the implications of sector-specific policy actions on broader macroeconomic outcomes depends on having access to high-quality and timely data to aid in policy development and on having well-informed staff that is able to make use of this resource. An example was the Department’s work over the past year on issues related to the Canadian housing market. The Department will continue work to ensure that it has access to quality data and that analysts have appropriate training in order to interpret and make use of such data.

For this Sub-Program, actual spending was less than planned spending. Advertising expenditures were lower than anticipated, but this was partially offset by paylist expenditures (parental and maternity allowances and entitlements on cessation of employment) and the government-wide payment in arrears initiative, which were not included in 2014–15 planned spending.

This Sub-Program is responsible for fulfilling the challenge function of the Department of Finance Canada by monitoring major economic policy issues and proposals under development in the applicable departments, as well as providing policy advice to the Minister regarding the financial implications and relevance of the government’s microeconomic policies and programs and proposals for the funding of programs. The Sub-Program focuses on monitoring research, economic developments and proposals, and developing regional and sectoral policy analysis in the areas of knowledge-based economy, defence, transportation, public infrastructure, environment, energy and resources, agriculture and fisheries. It also plays a lead role in advising on corporate restructuring affecting Crown corporations and other corporate holdings. To prepare the government’s annual budget and estimate the size of the budget balance, the Department needs to assess and make recommendations on numerous proposals for new program spending emanating from government departments and the private sector. This activity is critical if the government is to make choices that contribute to advancing economic growth.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 5,810,478 | 5,485,757 | (324,721) |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 44 | 41 | (3) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Ministers and senior government officials have timely access to evidence-based analysis, research and advice on the fiscal and economic implications associated with sectoral and microeconomic policy. | Percentage of agreed upon deadlines for briefing material that were met. | 90 per cent | 95 per cent |

| Degree to which overall findings of audits and/or evaluations are favourable. | Favourable | Favourable |

The Department of Finance Canada provided ministers and senior officials with high-quality and timely analysis and advice on the fiscal and economic implications associated with sectoral, regional and microeconomic policy issues, policies and programs to assist in preparing for meetings of Cabinet and its committees and in developing the annual budget and fiscal update. The months of May and September represent the review period for the briefing material performance indicator.

The Department concluded the implementation phase of the Venture Capital Action Plan to catalyze a private sector-led venture capital sector in Canada. Over the reporting period, the Department participated actively in negotiations with interested provinces, private investors and private sector fund managers for the creation of three large-scale venture capital funds of funds.

The Department continued to systematically review and deliver advice on federally owned assets, to improve their efficiency and effectiveness and to ensure value for taxpayers.

The Department also led the development and coordination of a $5.8 billion federal infrastructure initiative announced in November 2014.

Findings in the 2014 Fall Report of the Auditor General of Canada regarding the Department of Finance Canada’s role in providing support to the automotive sector were favourable. In particular, the Auditor General concluded that the Department prudently estimated the financial risks of providing support during the 2008 economic downturn.

The variance between actual and planned spending and the variance in FTEs for this Sub-Program are explained by higher than anticipated staff turnover.

This Sub-Program is responsible for coordinating federal-provincial fiscal arrangements between Canada and the provinces and territories that enable the funding of national priorities and support reasonably comparable services at reasonably comparable tax rates across the country. It is also responsible for fulfilling the challenge function of the Department by providing policy analysis and advice to the Minister regarding the fiscal and economic implications of the government’s social policies and programs related to health care, immigration, justice and public safety, employment insurance and pensions, post-secondary education, Aboriginal and cultural programs, as well as programs for seniors, persons with disabilities, veterans and children. The Sub-Program conducts research and provides analysis and advice to the Minister and senior government officials to assist in preparation for meetings of Cabinet and its committees, the annual budget, fiscal updates, and responsibilities with respect to Employment Insurance and the Canada Pension Plan legislation. It is also responsible for preparing legislation and regulations under the responsibility of the Minister of Finance. Long-term, predictable, stable, transfer support for provinces and territories and improvements to the social policy framework contribute to improved public services for Canadians, support the quality of Canada’s communities, health care, education and social safety net programs, and promote equality of opportunity for all citizens. At the same time, Canada’s productivity and economic prosperity are enhanced by these supports and programs.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 6,548,271 | 6,043,650 | (504,621) |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 51 | 47 | (4) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Ministers and senior government officials have timely access to evidence-based analysis, research and advice on the fiscal and economic implications associated with federal-provincial relations and social policies, programs and issues. | Percentage of agreed upon deadlines for briefing material that were met. | 90 per cent | 92 per cent |

| Degree to which overall findings of audits and/or evaluations are favourable | Favourable | No audits or evaluations of this Sub-Program were conducted in 2014–15. |

The Department of Finance Canada provided the Minister and senior government officials with evidence-based analysis and advice on current and emerging issues related to social policy and major transfer payments. The months of May and September represent the review period for the briefing material performance indicator. By ensuring effective communication with other government departments and central agencies at all levels of officials, the Department has been proactive in identifying potential pressures and has been responsive in addressing emerging and urgent issues and policy development.

In particular, the Department provided analysis and recommendations leading to the inclusion of a significant number of new policy measures in the 2015 budget, such as the extension of the Employment Insurance Compassionate Care Benefits, the enrichment of the benefits and services provided to veterans, the introduction of new measures to improve national security, and the enhancement of Canada Student Loans and Canada Student Grants. The Department also prepared an Annex to the 2015 budget to describe how fiscal balance is being maintained in the federation.

The Department developed and maintained strong working relationships with provincial and territorial officials through the Canada Pension Plan Committee.

The Department routinely engaged provincial and territorial officials both bilaterally and through meetings of the Fiscal Arrangements Committee, the Transfers Sub-Committee and the Senior Financial Arrangements Committee Working Group. Internet-based conferencing has enabled a higher frequency of meetings.

At the Finance Ministers’ Meeting of December 2014, provincial and territorial finance ministers were presented with their transfer amounts for 2015–16.

The variance between actual and planned spending and the variance in FTEs for this Sub-Program are explained by higher than anticipated staff turnover.

This Sub-Program ensures the overall stability, soundness, efficiency, and competitiveness of Canada’s financial sector in support of strong, sustainable growth in the Canadian economy. This Sub-Program provides analysis of Canada’s financial services sector and financial markets, and develops the legislative and regulatory framework governing federally regulated financial institutions (banks, trust companies, insurance companies, and co-operative credit associations) and federally regulated defined benefit pension plans. This Sub-Program is also responsible for issues related to anti-money laundering and anti-terrorist financing. It plays a lead role in conducting Canada’s relations and negotiating Canada’s commitments with foreign governments in the area of trade in financial services.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 25,537,424 | 65,506,627 | 39,969,203 |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 92 | 90 | (2) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Ministers and senior government officials have timely access to evidence-based analysis, research and advice on matters that impact the Government of Canada’s financial sector policy agenda. | Percentage of agreed upon deadlines for briefing material that were met. | 90 per cent | 75 per cent |

| Degree to which overall findings of audits and/or evaluations are favourable. | Favourable | No audits or evaluations of this Sub-Program were conducted in 2014–15. |

The Department of Finance Canada continued to monitor economic developments in Canada and abroad and provided the Minister and senior government officials with high-quality analysis, research and advice on matters that impact the financial sector policy agenda. The months of May and September represent the review period for the briefing material performance indicator. Overall, 75 per cent of briefing notes prepared in May and September for the review period were delivered on or before the date requested, while an additional 11 per cent were delivered one day late. More recently, the Sub-Program has significantly improved its performance in meeting agreed upon deadlines.

The Department anticipated and prepared for evolving uncertainties associated with economic and financial markets outcomes—in particular, the risks associated with the vulnerabilities in the Canadian housing market. Through the Senior Advisory Committee, the Department worked closely with its partner agencies to identify key vulnerabilities to financial stability and potential responses.

The Department worked on legislative and regulatory proposals to reinforce the stability of the financial sector, to strengthen Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime, to support retirement savings, to protect Canadian consumers, and to strengthen the governance of Canada’s payments sector. It conducted research and analysis and evaluated policy proposals related to a variety of issues, including the capital markets regulatory framework, and improving market discipline in, and reducing taxpayer exposure to, the housing sector. In the 2015 budget, the government proposed to amend the Bank Act to implement a comprehensive financial consumer code to strengthen and modernize the financial consumer framework and respond to the diverse needs of Canadians.

The Department and its partner agencies continued to work closely with the international community on the elaboration and implementation of the G20 financial sector reform agenda. Work in this area included the proposal in the 2015 budget to implement a Taxpayer Protection and Bank Recapitalization Regime for Canada’s systemically important banks.

The Department supported the government’s collaborative efforts with British Columbia, Ontario, Saskatchewan, New Brunswick, Prince Edward Island and Yukon to establish a Cooperative Capital Markets Regulatory System. On September 8, 2014, participating jurisdictions confirmed their commitment to the Cooperative System by signing a memorandum of agreement, and released draft provincial capital markets legislation and complementary federal legislation for public comment.

Despite Canada's relatively strong financial sector performance, the recent international financial turmoil has demonstrated the need for the government to ensure that it is equipped with a broad range of flexible tools to safeguard financial stability and to address potential problems in financial markets as they arise. Resources were allocated to the examination of systemic vulnerabilities in a number of areas, in particular the housing sector, and of other potential risks to the financial sector. A contingency plan was updated on an ongoing basis, and legislative and regulatory measures were developed and reviewed to mitigate risk.

Actual spending for this Sub-Program exceeded planned spending primarily because of $44 million in payments to the Canadian Securities Regulation Regime Transition Office that were not included in the 2014–15 Report on Plans and Priorities, reflecting the timing of the funding request from the Transition Office. This was partially offset by operating expenditures that were $4 million lower than planned, primarily related to 2013 budget initiatives (Cooperative Capital Markets Regulator, comprehensive financial consumer code, Target Benefit Plans). As well, 2014–15 planned legal services expenditures included under Financial Sector Policy Sub-Program are now charged to Internal Services, as required by the Guide on Internal Services Expenditures: Recording, Reporting and Attributing.

The aim of this Sub-Program is to promote sustainable international economic growth and financial stability, secure access to key markets for Canadian exporters and investors and to reduce tariffs where possible in order to enhance the competitiveness of domestic industries and expand commercial opportunities for them. This Sub-Program also manages the Department’s participation in international financial institutions such as the IMF, World Bank, and the European Bank for Reconstruction and Development, and international economic coordination groups such as the G7, G20, and the Asia-Pacific Economic Co-operation forum. Canada’s economic performance and future prosperity depend on a strong and stable global economy, as well as trade and investment flows supported by high standards of multilateral, regional, and bilateral trade and investment agreements. Canadian leadership and influence on international economic, financial, development, and trade issues increase financial and economic stability.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 9,086,267 | 8,428,701 | (657,566) |

Human Resources (FTEs))

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 68 | 58 | (10) |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Ministers and senior government officials have timely access to evidence-based analysis, research and advice on matters that impact the Government of Canada’s international trade and finance policy agenda. | Percentage of agreed upon deadlines for briefing material that were met. | 90 per cent | 79 per cent |

| Degree to which overall findings of audits and/or evaluations are favourable. | Favourable | No audits or evaluations of this Sub-Program were conducted in 2014–15. |

The Department of Finance Canada closely monitored global economic conditions, including heightened risks to stability, and provided the Minister and key decision makers with high-quality and evidence-based analysis and advice. The months of May and September represent the review period for the briefing material performance indicator. Key reasons for the missed target in providing briefing material include delays in receiving required information from external sources (for example, G20 material) and the fact that rapidly evolving events necessitated delays in briefing material in order to provide the most recent and accurate information. Where the agreed upon deadlines were not met, briefing material was nevertheless provided in a sufficiently timely manner to be used for the intended purposes.

Over the reporting period, the ongoing and elevated risk emanating from the evolving situation in Greece, volatility in global financial markets, exchange rate realignments and the geopolitical crisis in Ukraine involving Russia underscored the importance of high-level engagement and dialogue at international forums and quick responses to complex economic developments and emerging risks. The Department’s capacity to monitor macroeconomic developments continued to be enhanced in 2014–15, with a particular focus on emerging market volatility, the persistent low inflation rate in Europe and quantitative easing by the European Central Bank, the impact of the fall in global oil prices, geopolitical tensions in Ukraine, and the financial crisis in Greece. Strengthened analytical capacity has been key to ensuring that the Minister and senior officials are well briefed and effectively promote Canada’s position internationally.

As co-chair of the Working Group on the G20 Framework for Strong, Sustainable and Balanced Growth, Canada played a catalytic role in the development of comprehensive growth strategies by G20 members, which aim to lift G20 gross domestic product by 2 per cent by 2018. These strategies were a key deliverable for the 2014 G20 Leaders’ Summit and will continue to be supported by the G20. Canada also played an active and critical role in ensuring that the Action Plan delivered by G20 Leaders reflected a strong and effective response to the short- and medium-term challenges facing G20 members.

The Department provided policy advice related to the International Assistance Envelope, including aid-effectiveness policies, and supported Canada’s leadership role at major multilateral development banks by engaging with shareholders, providing advice to Executive Directors, and following through on multilateral debt relief and replenishment commitments. The Department also supported Canada’s efforts to promote economic and social stability in Ukraine by facilitating the provision of $400 million in low-interest loans to the country’s newly elected government.

The Department continued to support the government’s bilateral and regional trade agenda—notably, the ongoing trade negotiations with Trans-Pacific Partnership countries and the implementation of legislation for the Canada-Korea free trade agreement. In addition, the Department continued to implement and assess tariff measures announced in the 2014 budget through legislation and regulation processes.

The Department continued to improve its knowledge management systems and practices. A new approval process for the Minister was adopted following an Office of the Auditor General recommendation that federal departments should demonstrate how funding provided to multilateral organizations and reported as Official Development Assistance meets the three conditions of section 4(1) of the Official Development Assistance Accountability Act.

The variance between actual and planned spending and the variance in FTEs for this Sub-Program are explained by higher than anticipated staff turnover.

The Department of Finance Canada mandate includes the supervision, control and direction of all matters relating to the financial affairs of Canada that are not by law assigned to the Treasury Board or any other Minister. This Program includes the administration and payment of transfers to provinces and territories, including fiscal equalization, the Canada Health Transfer and the Canada Social Transfer, in support of health and social programs and other shared priorities. In addition, it includes the administration of taxation payments to provinces and territories as well as to Aboriginal governments in accordance with legislation and negotiated agreements. Also included in this Program are commitments and agreements with international financial organizations aimed at supporting the economic advancement of developing countries. In addition, from time to time, the federal government will enter into agreements or enact legislation to respond to unforeseen pressures. These commitments can result in payments, generally statutory transfer payments, to a variety of recipients, including individuals, organizations, and other levels of government.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2014–15 Difference (actual minus planned) |

|---|---|---|---|---|

| 61,060,094,306 | 61,060,094,306 | 61,971,275,326 | 61,902,703,494 | 842,609,188 |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 0 | 0 | 0 |

| Note: Full-time equivalents for this Program and its related Sub-Programs are not shown separately but are instead incorporated into the FTE count for Program 1.1 (Economic and Fiscal Policy Framework). | ||

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| The Government of Canada meets its transfer and taxation payment commitments. | Degree to which the Government of Canada is meeting its transfer and taxation payment commitments. | Met | Met |

The Department of Finance Canada administered transfer payments to provinces and territories as set out in legislation and managed the payment of amounts to provinces, territories and Aboriginal governments in accordance with the terms and conditions established in the Tax Collection Agreements, Tax Administration Agreements, Comprehensive Integrated Tax Coordination Agreements, the Federal-Provincial Fiscal Arrangements Act and the First Nations Goods and Services Tax Act.

The federal government provided almost $65 billion to provinces and territories for the Canada Health Transfer, the Canada Social Transfer, Equalization and Territorial Formula Financing. The Department will continue to ensure that payments to provincial and territorial governments are made on time and in compliance with legislation and regulations.

The Department also met all its transfer payment commitments to international financial organizations. In addition, the Department facilitated the provision of $400 million in two loans to help Ukraine stabilize its economy and promote social development. The loans, provided under the Minister of Finance’s authority under the Bretton Woods and Related Agreements Act, were disbursed by Export Development Canada acting as the government’s agent. By facilitating the loans, the Department helped the Government of Canada meet its transfer payment commitment to Ukraine.

Actual spending for the Transfer and Taxation Payment Programs Program was $843 million more than planned. This variance was mainly due to the timing of payments made to the International Development Association as a result of changes in the payment mechanism from demand notes to direct payments, and to $367 million in transfer payments to provinces that were not included in the 2014–15 Report on Plans and Priorities. These payments consisted of $169 million for the Establishment of a Canadian Securities Regulation Regime and Canadian Regulatory Authority, $103 million for Fiscal Stabilization, and $95 million for the Incentive for Provinces to Eliminate Taxes on Capital. These transfer payments were not included in the 2014–15 Report on Plans and Priorities because final calculations were not complete prior to its publication or because other government jurisdictions had not met all of the legislative requirements for payment at that time.

In accordance with the Federal-Provincial Fiscal Arrangements Act, and other related Acts and regulations, this Sub-Program administers transfer payments to provinces and territories as set out in legislation, including fiscal equalization, Territorial Formula Financing, and support for health and social programs through the Canada Health Transfer and the Canada Social Transfer. Long-term, predictable, stable transfer support for the provinces and territories contributes to improved public services for Canadians and supports the quality of life in Canada's communities. In addition, from time to time, the federal government may provide additional, time-limited, targeted support to provinces and territories in areas of shared priorities.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 60,552,284,305 | 60,878,093,490 | 325,809,185 |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Fiscal arrangements with provinces and territories are efficiently managed. | Percentage of payments reviewed that did not reveal errors. | 100 per cent | 100 per cent |

| Percentage of payments that were made within the required time frames. | 100 per cent | 100 per cent |

The Department of Finance Canada continued to manage the major transfer payment programs in support of fiscal arrangements with provinces and territories. All payments made to provinces and territories were timely and accurate. No areas of internal control weakness were identified through internal testing of key control points during the reporting period.

The Department’s Internal Audit and Evaluation Division completed the Audit of the Control Framework for Transfer Payments in December 2014. The audit concluded that the Department has effective controls to ensure that transfer payment transactions are authorized in accordance with legislative requirements and delegated authorities; effective controls to ensure that transfer payment transactions are recorded accurately and in a timely manner; effective internal controls over financial reporting for transfer payments; and an effective ongoing monitoring program in support of the transfer payment process.

Actual spending was higher than planned spending because some transfer payments amounts were finalized only following the publication of the 2014–15 Report on Plans and Priorities. These payments consisted of $169 million for the Establishment of a Canadian Securities Regulation Regime and Canadian Regulatory Authority, $103 million for Fiscal Stabilization, and $95 million for the Incentive for Provinces to Eliminate Taxes on Capital.

This Sub-Program manages the payment of amounts to provinces, territories and Aboriginal governments in accordance with the terms and conditions established in the Tax Collection and Tax Administration Agreements, the Federal-Provincial Fiscal Arrangements Act and the First Nations Goods and Services Tax Act. This includes payments related to provincial and territorial personal income tax and corporate income tax as well as Aboriginal sales and income taxes.

Tax collection agreements with provinces and territories allow the federal government to streamline service and reduce compliance and administrative costs by having a single tax form and a single tax collector. Tax administration agreements with Aboriginal governments allow the federal government to vacate and share a negotiated portion of its Goods and Services Tax and personal income tax room with Aboriginal governments and to administer Aboriginal tax regimes.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 0 | 0 | 0 |

| Note: No financial resources are shown for this Sub-Program because it relates to Tax Collection Agreements and Tax Administration Agreements whereby the federal government administers certain taxes on behalf of participating provinces, territories and Aboriginal governments, and then transfers amounts to those governments on whose behalf the taxes were administered. | ||

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Tax collection and administration obligations/arrangements are efficiently managed. | Percentage of payments reviewed that did not reveal errors. | 100 per cent | 100 per cent |

| Percentage of payments that were made within the required time frames. | 100 per cent | 100 per cent |

The Department of Finance Canada continued to work with provinces and territories to improve and enhance the application and administration of the Tax Collection Agreements. The Department also continued to work with the Office of the Auditor General on the annual audit of payments made under the Tax Collection Agreements and the Comprehensive Integrated Tax Coordination Agreements, as well as on the annual reports prepared under specified auditing procedures for Tax Administration Agreements with Aboriginal governments.

The Department continued to work with the Harmonized Sales Tax (HST) provinces through the Tax Policy Review Committee and the Revenue Allocation Sub-Committee to discuss operation of the HST.

Following reviews of the First Nations Goods and Services Tax Administration Agreements and the First Nations Personal Income Tax Administration Agreements, changes continued to be implemented to simplify the agreements and decrease the administrative burden.

With respect to Tax Administration Agreements, the Department participated in more than 10 negotiation tables. The Department also facilitated potential sales tax arrangements between provinces and Indian bands.

The Department made all payments in accordance with the terms and conditions of the agreements and in accordance with the schedules or timing set out in the agreements. No external audit issues have been noted. Departmental internal testing of key control points did not identify any areas of internal control weakness.

This Sub-Program administers Canada’s international financial commitments associated with Paris Club and the Canadian Debt Initiative (CDI) debt rescheduling agreements and for financial support to international organizations. It administers transfer payments to Export Development Canada (EDC) and the Canadian Wheat Board (CWB) in order to compensate these agencies when their scheduled receipts from debtor countries have been reduced by Canada’s participation in Paris Club debt or debt service reduction agreements and/or the CDI. It also administers Canada’s commitments under the Multilateral Debt Relief Initiative (MDRI). These payments compensate the IMF, the World Bank and the African Development Fund for cancelling debt owed to them by heavily indebted poor countries. The objective of bilateral and multilateral debt relief is to reduce the debt load of developing countries, put them back onto a path of financial sustainability and to free up resources in their national budgets to support their development objectives. This Sub-Program also administers the issuance and encashment of demand notes and capital subscriptions for Canada’s commitments with international financial institutions, such as the International Development Association (IDA) and the European Bank for Reconstruction and Development (EBRD), to enable these institutions to fulfill their mandate.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 502,810,001 | 944,420,000 | 441,609,999 |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Commitments to international financial organizations are efficiently funded. | Percentage of payments reviewed that did not reveal errors. | 100 per cent | 100 per cent |

| Percentage of payments that were made within the required time frames. | 100 per cent | 100 per cent |

The Department of Finance Canada fulfilled its commitments to international financial organizations. In April 2014, the Department made its last of three International Development Association (IDA) payments ($441.6 million) to the World Bank Group under the IDA16 replenishment period. In January 2015, the Department made its first of three annual payments to the World Bank Group ($441.6 million) under the IDA17 replenishment period.

The Department provided $51.2 million to the Multilateral Debt Relief Initiative through the World Bank Group, and $10 million toward the AgResults initiative via the World Bank Group.

Internal review showed that all payments were made in a timely manner, and no errors were revealed. No issues were noted by the World Bank Group.

Actual spending was $441.6 million more than planned spending. This amount represents Canada’s first of three annual installments under the 17th International Development Association (IDA) replenishment period. The variance was due to a change in the financial instrument for IDA payments, from demand notes to direct payments, resulting in Canada’s annual payments being made in January rather than in April. Canada’s annual contribution to the IDA has not changed, and there was no budgetary impact.

From time to time, the Government will enter into agreements or legislation to provide targeted support to individuals and organizations to address unforeseen priorities arising from current events. This Sub-Program manages the payment of such commitments in accordance with the agreed to terms and conditions.

Budgetary Financial Resources (dollars)

| 2014–15 Planned Spending |

2014–15 Actual Spending |

2014–15 Difference (actual minus planned) |

|---|---|---|

| 5,000,000 | 80,190,004 | 75,190,004 |

Performance Results

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Payments owed to and due from individuals and organizations are efficiently managed. | Percentage of payments reviewed that did not reveal errors. | 100 per cent | 100 per cent |

| Percentage of payments that were made within the required time frames. | 100 per cent | 100 per cent |