Departmental Results Report 2018–19

Minister's message

Minister of Finance

As the Minister of Finance, I am pleased to present the 2018-19 Departmental Results Report for the Department of Finance Canada. This report highlights how Finance has delivered results that contribute to the Government's goal of strengthening the middle class.

Canada's economy is sound and growing. Since 2015, Canadians have created more than one million new jobs, while stronger wage growth is helping more Canadians get ahead. With a steadily declining net debt relative to the size of its economy, Canada has the best balance sheet among G7 countries, and has a "triple A" credit rating from the three most recognized credit rating agencies.

The Department has supported strong action to address climate change while helping Canadian businesses stay competitive. We have made home ownership more affordable for first-time homebuyers. We have made great strides in reducing Canada's poverty levels to the lowest in our recorded history. We have successfully defended key Canadian industries from unjust tariffs, and helped secure trade agreements that will propel Canada forward.

With the introduction of the First Time Home Buyer Incentive, Canada will help qualified first time homebuyers purchase their first homes. Through this incentive, first time buyers will see a reduction in monthly mortgage payments without an increase in the amount required for a down payment.

In 2015, the Government committed to achieving up to $3 billion in annual savings by 2019-20 through a number of targeted changes to federal tax expenditures. In support of this commitment, the Government launched a tax expenditure review. Over the four-year period ending in 2018-19, this resulted in savings of $3.9 billion, and will lead to estimated savings of more than $3 billion annually, starting in 2019-20.

In Budget 2019, the Department advanced the Government's commitment to fairness and equality through the inclusion of a Gender Statement and the release of a comprehensive Gender Report containing a summary of the Gender Based Analysis (GBA+) for each of the 195 federal budget measures.

The Department also supported efforts to implement the federal carbon pollution pricing system, which has been designed to ensure that there is a price on carbon pollution across the country, while maintaining affordability for households and ensuring that Canadian companies can compete and succeed in a competitive global marketplace.

The Department actively participated in negotiations to conclude the Canada-United States-Mexico Agreement, and for the development and implementation of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. To defend steel and aluminum workers and protect their industries, countermeasures and safeguards were implemented in response to tariffs applied by the United States.

The Department provided high-quality and timely analysis on the Government's Poverty Reduction Strategy which targets a 20% reduction in poverty by 2020, and a 50% reduction in poverty by 2030. Between 2015 and 2017, the Government of Canada met its first poverty reduction target three years ahead of schedule as the poverty rate fell by more than 20% to 9.5%. By achieving this target, Canada is now at the lowest poverty rate in its history.

All of these reported achievements indicate solid progress for our economy and our country, but we know that more work lies ahead. I look forward to working with the Department to advance our progress by investing in people and communities so that we can continue to grow Canada's economy in a responsible way to the benefit of all Canadians, now and into the future.

Original signed by

The Honourable William F. Morneau, P.C., M.P.

Minister of Finance

Results at a glance

What funds were used?

The Department of Finance Canada's actual spending for 2018-19 (dollars):

94,097,710,160

Who was involved?

The Department of Finance Canada's actual full-time equivalents (FTEs) for 2018-19:

810

The Department of Finance Canada focused its attention and resources on four priorities that collectively summarize its achieved results for the 2018-19 fiscal year. These priorities stemmed from the Department's operating environment, its risks and opportunities, as well as government-wide priorities and mandate letter commitments. The Department's priorities for 2018-19 were:

- Sound fiscal management: to ensure effective management of the economic and fiscal framework, including responsible management of the federal budget and the federal debt[1];

- Inclusive and sustainable economic growth: to provide opportunities for all Canadians to participate in the economy and benefit from economic growth by ensuring that growth today is not at the expense of future prosperity[2];

- Sound social policy framework: to manage transfer payments between provinces and territories, and in collaboration with our stakeholders to develop policy proposals that are consistent with, and deliver on, the Government's social policy priorities; and

- Effective International Engagement: to support the Government in maintaining Canada's leadership and engagement globally and to deepen its trading relationships.

Key Results:

In 2018-19, the Department achieved significant results in support of the four priorities above.

In line with the Minister's commitment to gender budgeting, the Department included a Gender Statement in Budget 2019 as well as a GBA+ analysis of the impacts for each of the 195 measures included in the federal budget. This builds on the launch of the Gender Results Framework in Budget 2018.

In support of inclusive and sustainable economic growth, the Department provided advice and analysis on the development of a suite of policy initiatives announced in Budget 2019 directed at improving housing affordability, increasing the housing supply, and strengthening the rules around Canada's housing market. This included the First Time Home Buyer Incentive, which helps qualified first-time homebuyers purchase their first home.

For fiscal year 2018-19, the Department supported the Government in providing a total of $75.4 billion in support to provinces and territories through the Canada Health Transfer, Canada Social Transfer, Equalization and Territorial Formula Financing. Through these transfer payments, the Department continued to support the Minister's priority of having a sound social policy framework. In further support of this priority, the Department contributed to the development of a new self-government fiscal policy for Indigenous governments as part of the Collaborative Fiscal Policy Process led by Crown-Indigenous Relations and Northern Affairs Canada.

To ensure effective international engagement, the Department supported Canada's G7 Presidency by leading discussions at this forum on the future of the global economy and the shared responsibility to create sustainable economic growth. The Department also actively contributed to the Government-wide trade efforts on a number of topics including: tariffs, financial services, trade remedies, currency and fisheries subsidies in various settings including the Canada-United States-Mexico Agreement (CUSMA) and at the World Trade Organization (WTO).

For more information on the Department of Finance's plans, priorities and results achieved, see the "Results: what we achieved" section of this report.

Results: what we achieved

Core Responsibility

1.1 Economic and Fiscal Policy

Description

This core responsibility is the main source of advice and recommendations to the Minister of Finance, other ministers and senior government officials on the development of the federal budget and Fall Economic Statement. In addition, this core responsibility is also the main source of advice to the Government of Canada on economic, fiscal and social policy; federal-provincial relations, including transfer and taxation payments; the financial sector; tax policy; and international trade and finance.

Results

The Canadian Gender Budgeting Act (2018)

In 2018-19, the Government passed the Canadian Gender Budgeting Act,enshrining the Government's commitment to decision-making that takes into consideration the impacts of policies on all Canadians in a budgetary context.

In response to the reporting requirements of the Canadian Gender Budgeting Act the Department published the Gender Report, demonstrating concerted efforts to incorporate GBA+ in the policy development process and to make the Government's analysis available to Canadians.

In 2018-19, the Department continued to support the Government's economic policy agenda by providing high quality and timely analysis and advice on broad macroeconomic and fiscal policies, tax and tariff policy, financial sector policy, and the economic implications associated with sectoral, regional and microeconomic policy issues and programs.

Over the course of 2018-19, the Department continued to advance the Government's commitment to fairness and equality through gender budgeting. With Budget 2018, Canada set a new standard of gender budgeting as a core pillar of budget-making – legislating higher standards and making meaningful investments towards a greater gender equality. Building on that commitment, Budget 2019 included a Gender Statement which provided an overview of where Canada stands in relation to the indicators in the Gender Results Framework. These areas of measure include: Education and Skills Development; Economic Participation and Prosperity; Leadership and Democratic Participation; Gender Based Violence and Access to Justice; Poverty Reduction; Health and Well Being; and Gender Equality Around the World. In addition to the Budget 2019 Gender Statement, the Department also undertook a GBA+ analysis for each of the 195 measures included in the federal budget, and published a comprehensive summary of the results in a separate document titled: the Gender Report.

Budget 2019 also provided a breakdown of savings resulting from recent improvements to the federal tax system. Many of these improvements were informed by the comprehensive review of federal tax expenditures undertaken by the Department in 2016. As a result of this review, over the four-year period ending in 2018-19, savings of $3.9 billion were generated. In addition to these savings, the Department continued to provide analysis and advice in support of the Government's efforts to improve the fairness and integrity of Canada's tax system, as well as protect Canada's tax base.

In order to support strong and sustainable economic growth, the Department continued to efficiently manage the federal government's currency, debt and international reserves by developing and implementing a Debt Management Strategy for 2018-19. Through this strategy, the Government looked to raise stable, low cost financing and to support well-functioning markets for Government of Canada securities. In addition, to increase transparency and access to Canadians with respect to the federal debt and international reserves, the Department published the Debt Management Strategy, the Debt Management Report and the Report on the Management of Canada's Official International Reserves.

During 2018-19, the Department continued to support the Government's participation in the Organisation for Economic Co-operation and Development (OECD) and G20 Base Erosion and Profit Shifting (BEPS) initiative. This initiative aims to improve and update the international tax system and ensure a coherent and consistent response to cross-border tax avoidance by multinational enterprises. As a result of the BEPS initiative, large multinational enterprises in Canada and elsewhere are now required to file country-by-country reports on the global allocation of their income and taxes, as well as on the nature of their global business activities. These reports were first exchanged between participating tax administrations in June 2018. In addition, in 2018-19, Canada ratified the multilateral instrument (MLI) to update bilateral tax treaties to include, among other things, a treaty based anti-avoidance rule. The Department supported the progress of MLI legislation through Parliament during the fiscal year, with the legislation receiving Royal Assent in June 2019.

In 2018-19, the Department assessed options to support Canada's competitiveness in the face of international developments such as the 2017 United States tax reform. As a result, the 2018 Fall Economic Statement introduced three important changes to Canada's tax system. Specifically, these changes aimed to:

- Allow businesses to immediately write off the full cost of machinery and equipment used for the manufacturing or processing of goods;

- Allow businesses to immediately write off the full cost of specified clean energy equipment; and

- Through the new Accelerated Investment Initiative, allow businesses of all sizes and in all sectors of the economy to write off a larger share of the cost of newly acquired assets in the year the investment is made.

During 2018-19, the Department devoted significant resources toward implementing the fuel charge component of the federal carbon pollution pricing system enacted under the Greenhouse Gas Pollution Pricing Act. The federal system is comprised of a fuel charge on fossil fuels and an output-based pricing system for large industrial facilities. This system has been specifically designed to ensure that there is a price on carbon pollution across the country, while also taking steps to maintain affordability for households and ensuring that Canadian companies can compete and be successful in a competitive global marketplace. In provinces that do not have a carbon pollution pricing system in place that meets the requirements set out in the federal standard, the Government is returning:

- The bulk of direct fuel charge proceeds to individuals and families through tax-free Climate Action Incentive payments; and

- The remainder of charge proceeds to support small and medium-sized business, municipalities, universities, colleges, schools, hospitals, non-profit organizations, and Indigenous communities.

In 2018-19, the Department continued to monitor the housing and mortgage markets in Canada. The Department provided advice to the Minister on trends and policies to manage potential areas of vulnerability to financial stability and economic growth, as well as improved housing affordability for Canadians. In addition, Budget 2019 announced support for first-time homebuyers and the increase of housing supply through partnerships and targeted investments. This support also strengthened the rules and compliance in Canada's housing market.

To ensure a sound, efficient and competitive financial sector, the Department continued its work to advance priority financial sector policy directions announced in Budget 2019, including:

- Furthering the Government's review into the potential merits of open banking, including the appointment of an Advisory Committee to provide advice to the Minister, and roundtable consultations with Canadians;

- Developing legislation to implement a new retail payments oversight framework in Canada, which would support an innovative and well-functioning payments system; and

- Supporting sustainable financing to help companies and financial institutions address climate issues and capitalize on clean growth opportunities, including through the work of Canada's Expert Panel on Sustainable Finance.

In order to enhance the benefit security and sustainability of federally-regulated defined benefit pension plans, the Department undertook national consultations on enhancing the retirement security of Canadians and introduced amendments to the Pension Benefits Standards Act, 1985.

In its advisory capacity on Canada's anti-money laundering and anti-terrorist financing (AML/ATF) framework, the Department completed national consultations with private sector stakeholders and announced legislative and regulatory amendments. These amendments aimed to increase the effectiveness of Canada's AML/ATF regime, including changes to the Canada Business Corporations Act, the Criminal Code of Canada, and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and its associated regulations. The Department also announced new funding for law enforcement and regulatory agencies. This funding will assist in the creation of a pilot project that will bring together dedicated intelligence and law enforcement experts to strengthen inter-agency coordination. In addition, this funding will also assist in the creation of a multi-disciplinary centre of expertise on trade fraud and trade-based money laundering.

On international trade, in 2018-19 the Department supported the advancement and implementation of Canada's trade framework. The Department participated in the conclusion of negotiations of the CUSMA as well as ongoing trade negotiations with Mercosur and the Pacific Alliance. The Department supported the implementation of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the amended Canada-Israel Free Trade Agreement as well as the Government's trade diversification strategy. The Department's active contribution to government-wide trade efforts pertained to a number of topics including: tariffs, financial services, trade remedies, currency and fisheries subsidies in various trade fora such as trade agreements and at the WTO. In addition, the Department also contributed to efforts to assess and respond to the growing number of trade measures taken by other countries, some of which affect Canadian interests.

As a response to the United States' tariffs on Canadian steel and aluminum products, the Department developed and implemented countermeasures on imports from the United States. To defend the interests of the Canadian steel industry and workers, the Department implemented safeguards on steel products.

In August 2018, the Government of Canada finalized the purchase of the entities that own and manage the Trans Mountain Pipeline System, the Trans Mountain Expansion Project, and the associated Puget Sound Pipeline. The transaction was undertaken through the Trans Mountain Corporation, a new subsidiary of the Canada Development Investment Corporation (CDEV). This Crown Corporation and its subsidiaries report to Parliament through the Minister of Finance. In 2018-19, the Department continued to support the Minister by providing advice on the Government's oversight and policy role as the owner of the Trans Mountain entities.

In June and December 2018, federal, provincial, and territorial finance ministers met to discuss a number of issues of importance for Canada's economy. These issues included Canada-US relations, the housing market, the coordinated approach to cannabis taxation, and money laundering and other criminal activities. During the June meeting, ministers heard from several Canadian business leaders who shared their experiences and perspectives on Canada's current business environment and their thoughts on the role of policymakers and how they can better support Canada's competitiveness, while working together to achieve long-term goals for Canadians.

In 2018-19, the federal government provided a total of $75.4 billion in support to provinces and territories through the Canada Health Transfer, Canada Social Transfer, Equalization and Territorial Formula Financing. Further, following consultations with all provincial and territorial governments, the Minister of Finance's authority to make Equalization and Territorial Formula Financing payments was renewed for a five-year period beginning April 1, 2019 through Budget 2018. Improvements to the accuracy and efficiency of the calculation of entitlements were made through regulatory amendments, which were published in the Canada Gazette Part II, Vol. 152, No.14 on July 11, 2018.

In support of effective international engagement, the Department led Canada's participation in a number of areas at the OECD, the International Working Group on Export Credits, the Paris Club and APEC. Further, the Department actively contributed to policy development for multilateral development banks (MDB), by urging the MDBs to work together to promote sustainable and inclusive growth, to mobilize private finance for development, and to promote women's economic empowerment. The Department also supported the Minister in his role as Governor at the International Monetary Fund, the Work Bank Group, the Asian Infrastructure Investment Bank, and the European Bank for Reconstruction and Development. In addition, the Department also supported the restructuring of Canada's International Assistance Envelope to increase transparency and promote innovation.

In 2018-19, the Department continued to co-chair with India the G20 working group on the framework for strong, sustainable, balanced and inclusive growth. This is a forum for G20 members to develop macroeconomic coordination. In the co-chair role, Canada led G20 members in discussing potential responses to risks facing the global economy and medium term challenges such as the impact of technology on the future of work and an aging population. The Department also led Canada's participation, alongside the Central Bank of Canada, in three G20 Infrastructure Working Group meetings to promote infrastructure as an asset class and led three G20 International Financial Architecture Working Group meetings.

In 2018-19, the Department actively supported Canada's Presidency of the G7, playing a leading role in planning, organizing and providing policy advice in support of the G7 Finance Ministers and Central Bank Governors meeting in Whistler, British Columbia. The Department also supported other government departments in the preparation of the G7 Leaders' Summit in Charlevoix, Quebec. Following the delivery of Canada's G7 Finance Track priorities, the Department worked closely with its international partners to ensure a smooth transition to the French G7 Presidency in 2019.

The Department's achieved results respond to complex and horizontal issues that require ongoing discussions, consultations and coordination with central agencies, other departments and governments, and external stakeholders. The Department maintained high-level engagement and strong collaborative relationships with domestic and international partners to succeed in fulfilling its commitments and delivering for Canadians. Over the course of 2018-19, the Department continued to strengthen its analytical capacity as a key to ensuring that the Minister and senior officials were equipped to make informed decisions.

| Departmental results | Performance indicators | Target | Date to achieve target | 2018–19 Actual results |

2017–18 Actual results |

2016–17 Actual results |

|---|---|---|---|---|---|---|

| Canadians enjoy stronger, more sustainable and inclusive economic growth that contributes to higher standards of living. | 1.1 Gross domestic product per capita (ranking among the Organisation for Economic Co-Operation and Development OECD countries). | Ranking among the countries with the 15 highest levels of Gross domestic product per capita. | 2018-19 | Ranked 14th among 36 OECD countries | Ranked 14th among 36 OECD countries | Ranked 14th among 36 OECD countries |

| 1.2 Employment rate among the population age 15 to 64 (ranking among the OECD countries). | Ranking among the countries with the 15 highest employment rates. | 2018-19 | Ranked 13th among 36 OECD countries | Ranked 13th among 36 OECD countries | Ranked 11th among 36 OECD countries | |

| 1.3 Real disposable income across income groups[3]. | Growth is broad-based across income groups. | 2018-19 | Report not yet available | Report not yet available | Bottom quintile: 1.9% Second quintile: 1.4% Third quintile: 1.2% Fourth quintile: 1.2% Top quintile: 1.0% | |

| Canada's public finances are sound, sustainable and inclusive. | 2.1 Federal debt-to-Gross domestic product (GDP) ratio. | Stable over the medium-term (defined as the end of the 5-year projection period for the budget). | 2018-19 | Met | Met | Met |

| 2.2 The annual federal budget includes an assessment of the impact of new expenditure and revenue measures on different groups of women and men. | Presence of a clear "Gender Statement" in the annual budget document where the impact of budgetary measures is presented from a gender perspective. | 2018-19 | Yes | Yes | Yes | |

| Canada has a fair and competitive tax system. | 3.1 Taxes on labour income. | Lower than the G7 average. | 2018-19 | Met | Met | Met |

| 3.2 Total business tax costs. | Lower than the G7 average. | 2018-19 | Data not available[4] | Data not available[4] | Met | |

| Canada has a sound and efficient financial sector. | 4.1 Percentage of leading international organizations and major ratings agencies that rate Canada's financial policy framework as favourable. | 100% | 2018-19 | 100% | 100% | 100% |

| 4.2 Ranking of Canada's financial sector in the World Economic Forum's Global Competitiveness Report[5]. | Above the G7 average. | 2018-19 | Above the G7 average Canada: 865 G7 average: 835 | Above the G7 average Canada: 5.44 G7 average: 4.81 | Above the G7 average Canada: 5.30 G7 average: 4.71 | |

| The Government of Canada's borrowing requirements are met at a low and stable cost to support an effective management of the federal debt on behalf of Canadians. | 5.1 Percentage of the Government's borrowing requirements are met within the fiscal year. | 100% | 2018-19 | 100% | 100% | 100% |

| 5.2 Canada's sovereign rating. | Equal to or better than the G7 average. | 2018-19 | Canada was the highest rated among G7 countries | Canada was the highest rated among G7 countries | Canada was the highest rated among G7 countries | |

| The Government of Canada effectively supports provinces, territories and Indigenous governments. | 6.1 Degree to which timely statutory federal transfer programs assist and support provincial and territorial governments in delivering important public services, including accessible and quality health care (on a scale of 1 to 5). | 100 per cent of payments to provincial and territorial governments were made within the required timeframes; (100 per cent of payments reviewed did not reveal errors). | 2018-19 | 5 | 5 | 5 |

| 6.2 Degree to which payment issues identified with respect to tax agreements with provinces, territories and Indigenous governments are addressed (on a scale of 1 to 4).[6] | 2 (mostly addressed). | 2018-19 | Not applicable | 2 (mostly addressed) | Not applicable | |

| Canada maintains its leadership and engagement globally and deepens its trading relationships. | 7.1 Canada's ranking in the domestic market access pillar of the World Economic Forum Global Enabling Trade Report. | Best of G7 countries. | 2018-19 | Data not yet available[5] | Data not yet available | Met |

| 7.2 Percentage of Finance Canada's international assistance payments that are publicly reported on a monthly basis to support aid transparency. | 100% | 2018-19 | Met | New indicator for 2018-19 | New indicator for 2018-19 |

| 2018–19 Main Estimates |

2018–19 Planned spending |

2018–19 Total authorities available for use |

2018–19 Actual spending (authorities used) |

2018–19 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 93,932,481,327 | 93,932,481,327 | 94,123,157,409 | 94,052,730,919 | 120,249,592 |

| 2018–19 Planned full-time equivalents |

2018–19 Actual full-time equivalents |

2018–19 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 534 | 548 | 14 |

Financial, human resources and performance information for the Department of Finance's Program Inventory is available in the GC InfoBase.

1.2 Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are:

- Acquisition Management Services

- Communications Services, including Access to Information and Privacy and Parliamentary Affairs

- Financial Management Services

- Human Resources Management Services

- Information Management Services

- Information Technology Services

- Legal Services

- Materiel Management Services

- Management and Oversight Services

- Real Property Management Services

- Security Services

Results

In both 2018 and 2019, the Department was designated as one of the National Capital Region's Top Employers and one of Canada's Top Employers for Young People, in part because of its commitment to the development of employees through learning initiatives, experiential learning and work assignments.

With respect to recruitment and talent management, the university recruitment and the economist development programs remain the flagship programs that attract and retain the Department's high-performing workforce. The suite of learning and development programs are currently under review, with a view to developing a departmental talent management strategy, to ensure that managing talent and promoting diversity are considered at every stage of employee's careers within the Department.

To promote a healthy work environment, the Department continued to offer Informal Conflict Management System services, providing employees with strategies to resolve and prevent workplace issues. As well, the Department provided valuable training through "The Working Mind program". This program provides tools to both employees and managers to recognize and address mental health considerations in the workplace, while helping employees gain a better understanding of their own mental health. In addition, branch Wellness Ambassadors continue to promote awareness and increase attention to wellness considerations in decision-making within the organization.

| 2018–19 Main Estimates |

2018–19 Planned spending |

2018–19 Total authorities available for use |

2018–19 Actual spending (authorities used) |

2018–19 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 39,069,589 | 39,069,589 | 46,116,970 | 44,979,241 | 5,909,652 |

| 2018–19 Planned full-time equivalents |

2018–19 Actual full-time equivalents |

2018–19 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 228 | 262 | 34 |

Analysis of trends in spending and human resources

Actual expenditures

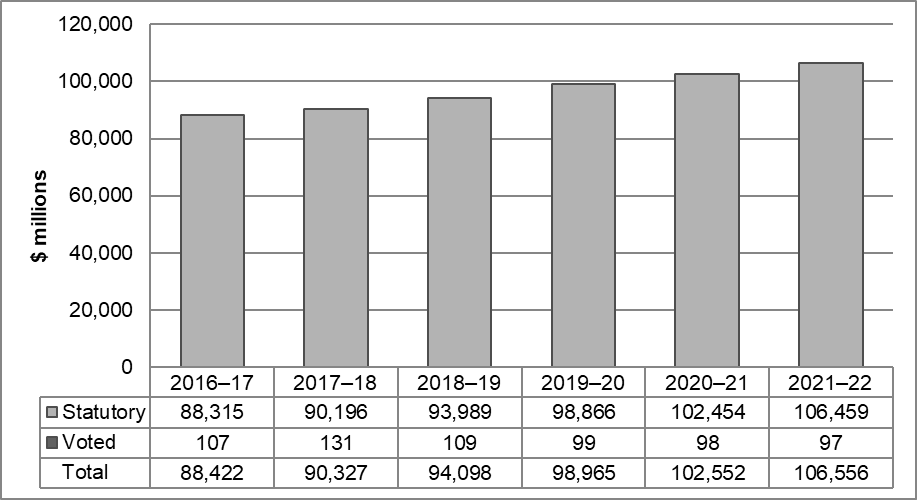

Text version

This bar graph shows the Department of Finance Canada's total actual and planned expenditures, including statutory and voted spending, from 2016-17 to 2021-22.

In 2016–17, statutory spending was $88.3 billion and voted spending was $107 million. Total spending was $88.4 billion.

In 2017–18, statutory spending was $90.2 billion and voted spending was $131 million. Total spending was $90.3 billion.

In 2018–19, statutory spending was $94.0 billion and voted spending was $109 million. Total spending was is $94.1 billion.

In 2019–20, statutory spending of $98.9 billion and voted spending of $99 million are planned. Total planned spending is $99 billion.

In 2020–21, statutory spending of $102.5 billion and voted spending of $98 million are planned. Total planned spending is $102.6 billion.

In 2021-22, statutory spending of $106.5 billion and voted spending of $97 million are planned. Total planned spending is $106.6 billion.

In the graph above, the amounts from 2016-17 to 2018-19 represent actual expenditures, whereas the amounts from 2019-20 to 2021-22 represent planned expenditures as presented in the 2019-20 Departmental Plan.

| Core Responsibilities and Internal Services | 2018–19 Main Estimates |

2018–19 Planned spending |

2019–20 Planned spending |

2020–21 Planned spending |

2018–19 Total authorities available for use |

2018–19 Actual spending (authorities used) |

2017–18 Actual spending (authorities used) |

2016–17 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 93,932,481,327 | 93,932,481,327 | 98,925,279,991 | 102,512,301,034 | 94,123,157,409 | 94,052,730,919 | 90,282,485,447 | 88,379,210,698 |

| Subtotal | 93,932,481,327 | 93,932,481,327 | 98,925,279,991 | 102,512,301,034 | 94,123,157,409 | 94,052,730,919 | 90,282,485,447 | 88,379,210,698 |

| Internal Services | 39,069,589 | 39,069,589 | 39,594,484 | 39,425,693 | 46,116,970 | 44,979,241 | 44,232,684 | 42,341,540 |

| Total | 93,971,550,916 | 93,971,550,916 | 98,964,874,475 | 102,551,726,727 | 94,169,274,379 | 94,097,710,160 | 90,326,718,131 | 88,421,552,238 |

The cumulative increase of $5.7 billion in spending from 2016-17 to 2018-19 mainly relates to:

- Legislated and forecasted increases for the Canada Health Transfer and Fiscal Arrangements with Provinces and Territories transfer payment programs ($4.0 billion);

- A net increase in market debt due to the increase in the outstanding unmatured debt balance and increases in the effective average interest rates from 2017-18 to 2018-19 ($1.1 billion); and

- A payment to the Canada Infrastructure Bank (CIB) for its first investments in the Réseau express métropolitain project in Montreal ($0.6 billion).

Actual human resources

| Core Responsibilities and Internal Services | 2016–17 Actual full-time equivalents | 2017–18 Actual full-time equivalents | 2018–19 Planned full-time equivalents |

2018–19 Actual full-time equivalents | 2019–20 Planned full-time equivalents | 2020–21 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 480 | 515 | 534 | 548 | 576 | 565 |

| Subtotal | 480 | 515 | 534 | 548 | 576 | 565 |

| Internal Services | 254 | 254 | 228 | 262 | 233 | 233 |

| Total | 734 | 769 | 762 | 810 | 809 | 798 |

The increase in the number of full-time equivalents from 2016-17 to 2018-19 is mainly attributable to increases in funding for key government priorities.

Expenditures by vote

For information on the Department of Finance Canada's organizational voted and statutory expenditures, consult the Public Accounts of Canada 2018–2019.

Government of Canada spending and activities

Information on the alignment of the Department of Finance Canada's spending with the Government of Canada's spending and activities is available in the GC InfoBase.

Financial statements and financial statements highlights

Financial statements

The Department of Finance Canada's financial statements (unaudited) for the year ended March 31, 2019, are available on the departmental website.

Financial statements highlights

| Financial information | 2018–19 Planned results |

2018–19 Actual results |

2017–18 Actual results |

Difference (2018–19 Actual results minus 2018–19 Planned results) |

Difference (2018–19 Actual results minus 2017–18 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 94,221,277,973 | 94,225,505,059 | 90,198,441,124 | 4,227,086 | 4,027,063,935 |

| Total revenues | - | 623 | 380 | 623 | 243 |

| Net cost of operations before government funding and transfers | 94,221,277,973 | 94,225,504,436 | 90,198,440,744 | 4,226,463 | 4,027,063,692 |

| Financial Information | 2018–19 | 2017–18 | Difference (2018–19 minus 2017–18) |

|---|---|---|---|

| Total net liabilities | 742,622,522,441 | 727,750,599,465 | 14,871,922,976 |

| Total net financial assets | 178,473,317,181 | 176,976,869,787 | 1,496,447,394 |

| Departmental net debt | 564,149,205,260 | 550,773,729,678 | 13,375,475,582 |

| Total non-financial assets | 11,896,292 | 13,214,340 | (1,318,048) |

| Departmental net financial position | 564,137,308,968 | 550,760,515,338 | 13,376,793,630 |

Supplementary information

Corporate information

Organizational profile

Appropriate minister: William F. Morneau

Institutional head: Paul Rochon

Ministerial portfolio: Department of Finance

Enabling instrument: The Minister of Finance has direct responsibility for a number of Acts, and is assigned specific fiscal and tax policy responsibilities relating to other acts that are under the responsibility of other ministers. A list of some of these Acts can be found below:

- Asian Infrastructure Investment Bank Agreement Act

- Bank Act

- Bank for International Settlements (Immunity) Act

- Bank of Canada Act

- Bills of Exchange Act

- Borrowing Authority Act

- Bretton Woods and Related Agreements Act

- Budget Implementation Acts[8] (under various titles)

- Canada Deposit Insurance Corporation Act

- Canada Pension Plan[9]

- Canada Pension Plan Investment Board Act

- Canadian International Trade Tribunal Act

- Canadian Gender Budgeting Act

- Canadian Payments Act

- Canadian Securities Regulation Regime Transition Office Act

- Cooperative Credit Associations Act

- Currency Act

- Customs Tariff

- Depository Bills and Notes Act

- European Bank for Reconstruction and Development Agreement Act

- Excise Act, 2001

- Excise Tax Act

- Federal-Provincial Fiscal Arrangements Act

- Financial Administration Act

- Financial Consumer Agency of Canada Act

- First Nations Goods and Services Tax Act

- Greenhouse Gas Pollution Pricing Act (Part 1)

- Income Tax Act

- Income Tax Conventions Interpretation Act

- Insurance Companies Act

- Interest Act

- Nova Scotia and Newfoundland and Labrador Additional Fiscal Equalization Offset Payments Act

- Office of the Superintendent of Financial Institutions Act

- Payment Card Networks Act

- Payment Clearing and Settlement Act

- Pension Benefits Standards Act, 1985

- Pooled Registered Pension Plans Act

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Protection of Residential Mortgage or Hypothecary Insurance Act

- Royal Canadian Mint Act

- Tax-Back Guarantee Act

- Trust and Loan Companies Act

- Winding-up and restructuring Act (Parts II and III)

Key legislation and acts are available on the Justice laws website.

Year of incorporation / commencement:1867[10]

Raison d'être, mandate and role: who we are and what we do

"Raison d'être, mandate and role: who we are and what we do" is available on the Department of Finance's website.

For more information on the department's organizational mandate letter commitments, see the Minister's mandate letter.

Operating context and key risks

Global economic activity has moderated over the course of 2018-19, except in the United States where real GDP growth was particularly strong in 2018 at 2.9%.

As expected, protectionist sentiment and trade tensions continued in 2018-19. Over the past year, global growth prospects have been revised down and global uncertainty remains elevated, weighing on global trade and the investment outlook. This deteriorating external environment has led major central banks to start easing their policy stance or signal their readiness to do so. In Canada, the domestic economy held up fairly well throughout 2018-19, but external weakness weighed on the outlook, which complicated tracking and addressing medium-term risks identified at the beginning of the fiscal year. This includes, most notably, pressures from changing demographics, weak investment and productivity growth, lower oil and commodity prices, and elevated household indebtedness.

The complex and horizontal issues with which the Department is concerned required ongoing discussions, consultations and coordination with central agencies, other departments and governments, and external stakeholders. In this context, the Department of Finance Canada needed to maintain high-level engagement and strong collaborative relationships with domestic and international partners to fulfill its commitments and deliver for Canadians.

The decisions and actions of the Department's employees can have far-reaching impacts on the Canadian public and economy. As a knowledge–based organization, the Department recognizes that its employees are its strength. The Department will thus continue to focus on providing its employees with a healthy and enabling work environment, so that it can attract, develop and retain a diverse and high–performing workforce that is fully committed to the success of the organization.

Reporting Framework

The Department of Finance's Departmental Results Framework and Program Inventory of record for 2018–19 are shown below.

Supporting information on the Program Inventory

Financial, human resources and performance information for the Department of Finance Canada's Program Inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Department of Finance Canada's website:

- Departmental Sustainable Development Strategy

- Details on transfer payment programs of $5 million or more

- Gender-based analysis plus

- Horizontal initiatives

- Response to parliamentary committees and external audits

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

Department of Finance Canada

15th Floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Phone: 613-369-3710

Facsimile: 613-369-4065

TTY: 613-995-1455

Email: fin.publishing-publication.fin@canada.ca

Media enquiries

Phone: 613-369-4000

Comments or questions regarding Department of Finance Canada publications and budget documents

Email: fin.publishing-publication.fin@canada.ca

Appendix: definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown Corporations.

Core Responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel)

A report on the plans and expected performance of an appropriated department over a three-year period. Departmental Plans are tabled in Parliament each spring.

Departmental Result (résultat ministériel)

A Departmental Result represents the change or changes that the department seeks to influence. A Departmental Result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

Departmental Result Indicator (indicateur de résultat ministériel)

A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

Departmental Results Framework (cadre ministériel des résultats)

Consists of the department's Core Responsibilities, Departmental Results and Departmental Result Indicators.

Departmental Results Report (rapport sur les résultats ministériels)

A report on an appropriated department's actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

full-time equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+])

An analytical process used to help identify the potential impacts of policies, Programs and services on diverse groups of women, men and gender differences. We all have multiple identity factors that intersect to make us who we are; GBA+ considers many other identity factors, such as race, ethnicity, religion, age, and mental or physical disability.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2018–19 Departmental Results Report, those high-level themes outlining the government's agenda in the 2015 Speech from the Throne, namely: Growth for the Middle Class; Open and Transparent Government; A Clean Environment and a Strong Economy; Diversity is Canada's Strength; and Security and Opportunity.

horizontal initiative (initiative horizontale)

An initiative where two or more departments are given funding to pursue a shared outcome, often linked to a government priority.

non-budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement)

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement)

The process of communicating evidence-based performance information. Performance reporting supports decision-making, accountability and transparency.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

priority (priorité)

A plan or project that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s) or Departmental Results.

program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

result (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization's influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique)

A long-term and enduring benefit to Canadians that is linked to the organization's mandate, vision and core functions.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.

[1] This achieved result relates to a mandate letter commitment.

[2] This achieved result relates to a government-wide priority.

[3] Indicator 1.3 measures inflation-adjusted growth in disposable household incomes across five income groups, ranging from the bottom 20% to the top 20%. Household income is adjusted for household size by dividing household income by the square root of the household size.

[4] KPMG, the third party provider for this indicator has not produced its report on total business tax costs since 2016. Consequently, results are unavailable for the 2017-18 and 2018-19 reporting periods. This indicator will be reviewed as part of the 2020-21 reporting cycle.

[5] The 2018 World Economic Forum's Global Competitiveness Report introduced the new Global Competitiveness Index 4.0, which scores each country's financial system between 0 and 100. The 2017 and 2016 Reports used a different indicator, which gave a score between 1 and 7. Therefore the scores for 2016-17 and 2017-18 are not necessarily comparable to the scores for 2018-19.

[6] Data for indicator 6.2 are reported every three years in respect of payment issues that arise during the previous three-year period. The last reporting for this indicator was included in the 2019-20 Departmental Plan for fiscal years 2015-16 to 2017-18. Results from fiscal year 2018-19 will be included in the next three-year reporting period ending in fiscal year 2020-21.

[7] The world Economic Forum Global Enabling Trade Report 2016 is the latest version of this report. Consequently, results are unavailable for the 2017-18 and 2018-19 reporting periods. This indicator will be reviewed as part of the 2019-20 reporting cycle.

[8] The Minister of Finance is the responsible minister for all budget implementation acts although not expressly named as such in each Act.

[9] Although not named as a responsible minister for the Canada Pension Plan (the responsible ministers are the Minister of Families, Children and Social Development and the Minister of National Revenue), the Minister of Finance has substantial duties under this Act and is jointly responsible with the Minister of Families, Children and Social Development for laying an annual report on the administration of the Act before Parliament.

Page details

- Date modified: