Departmental Results Report 2020–21

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

The Honourable Randy Boissonnault P.C., M.P.

Minister of Tourism and Associate Minister of Finance

From the Ministers

In 2020-21, the Department of Finance spearheaded our government's work to help millions of Canadians through the COVID-19 pandemic.

We delivered direct payments to seniors and families. We kept businesses going, particularly small businesses, and helped workers stay connected to their jobs, with the wage and rent subsidies and loans for small businesses. We procured PPE, tests, vaccines, and provided emergency funding to provinces and municipalities. The federal government provided more than 8 out of every 10 dollars spent to fight the pandemic.

We did this because it was the right thing to do. We also did it because we knew it was an investment in our economy that would pay off. Our goal was to prevent economic scarring. We wanted to emerge from this pandemic with our economic muscle intact; ready, as a country, to come roaring back.

The pandemic triggered the steepest economic contraction in Canada since the Great Depression. At its worst, it cost 3 million Canadians their jobs as our GDP shrank by 17 per cent.

This was a once-in-a-generation trauma. When it first hit, many predicted it would take years to rebuild.

Thanks to the resilience of Canadians, our GDP has already returned to near pre-pandemic levels. We have already more than recovered lost jobs, a healing which took eight months longer after the much milder 2008 recession. In fact, as of December 2021 we have recovered 108 per cent of the jobs lost at the peak of the pandemic, significantly outpacing the U.S. where just 84 per cent of lost jobs have been recovered so far.

We came into this crisis with the lowest net debt-to-GDP ratio in the G7 and we have increased our relative advantage during the pandemic. Our government will continue to be a responsible and prudent fiscal manager.

Our national focus, once we emerge from COVID-19, must be growth and competitiveness. As we move beyond this fight, we will turn our resolve towards fighting climate change, advancing reconciliation with Indigenous peoples, making life more affordable for middle class families, and building an economy that is stronger, fairer, more competitive, and more prosperous for all Canadians.

Signed,

Results at a glance and operating context

What funds were used?

The Department of Finance Canada's actual spending for 2020-21 (dollars):

117,660,227,875

Who was involved?

The Department of Finance Canada's actual full-time equivalents (FTEs) for 2020-21:

877

Operating Context

For well over a year, Canadians have been living through the greatest global public health challenge of our lifetime. The impact of the COVID-19 pandemic began, both globally and here in Canada, in mid-March 2020, just before the beginning of the 2020-21 fiscal year. From the start, the Department of Finance Canada (the Department) was at the epicentre of Canada's Economic Response Plan given its central role for helping shape economic and fiscal policy, all while operating in a remote work environment.

Canada entered 2020 in the midst of a sustained period of economic expansion and job creation, with the second fastest growing economy in the G7 and the lowest net debt-to-Gross Domestic Product (GDP) ratio in the group. However, COVID-19 interrupted this trend, bringing about the deepest and fastest worldwide recession since the Great Depression. Canada's real GDP fell by a record 13 percent over the first half of 2020. The crisis had an unparalleled impact on the Canadian labour market, with more than three million Canadians losing their jobs and another 2.5 million Canadians working significantly reduced hours.

Supporting the COVID-19 response

Of the Department's total spending of $117.7 billion, approximately

$96.4 billion was for transfer payments and COVID-19 support measures, which included support provided to provinces and territories through the Safe Restart Agreement ($13.0 billion) and the Safe Return to Class Fund ($2.0 billion).

Following the first wave of infections, economic activity and employment rebounded at a faster pace than expected over the summer of 2020 as restrictions eased, businesses reopened, and Canadians adapted. The recovery then shifted into a slower gear in Fall 2020 and into 2021 as successive waves of infections spread and public health restrictions tightened again.

Since day one of this crisis, the Department moved rapidly to provide advice and support on the many measures included in the government's response to the pandemic. New programs were developed and rolled out in quick succession, including the Canada Emergency Response Benefit, Canada Emergency Wage Subsidy, Safe Restart Agreement, Safe Return to Class Fund, Essential Workers Support Fund, the Business Credit Availability Program, and other business support measures. Together, these programs meant that people could stay home and stay safe, businesses could keep employees on the payroll and rehire laid off workers and, as conditions improved, schools and businesses could safely reopen. In total, direct departmental program spending on COVID-19 totalled more than $19.7 billion.

As the year unfolded, the Department continued to provide timely analysis and advice on the government's evolving support measures, including:

- Implementation of the Canada Emergency Rent Subsidy and related Lockdown Support to replace the Canada Emergency Commercial Rent Assistance program.

- Increasing the loan and forgiveness amounts available through the Canada Emergency Business Account and the creation of the Highly Affected Sectors Credit Availability Program (HASCAP).

- Creation of the Large Enterprise Emergency Financing Facility (LEEFF) to provide financing support to large Canadian companies to protect Canadian jobs and help Canadian businesses weather the economic downturn brought on by COVID-19.

- A new round of temporary support for families with children in the form of the Canada Child Benefit Young Child Supplement for delivery in 2021.

- Extensions and modifications to the Canada Emergency Wage Subsidy program to better reflect the evolving nature of the pandemic and address the needs of a broader range of employers, and the creation of the Canada Recovery Hiring Program to help businesses hire more workers as the economy reopens.

The Government of Canada's COVID-19 economic response was key in bridging Canadians and businesses through the disruption caused by the pandemic and stabilizing the economy. Canada's economic response, including Budget 2021 investments, was one of the largest and most expeditious among G7 countries and helped engineer a near-term economic turnaround at a faster-than-anticipated pace compared with some peers. As the fiscal year concluded, Canada's real GDP was less than two percent below its pre-pandemic level, with more than 80 percent of jobs lost at the onset of the pandemic regained.

Results at a Glance

Throughout 2020-21, the Department continued to support the Minister of Finance and the former Minister of Middle Class Prosperity and Associate Minister of Finance in delivering on a responsible fiscal plan that invests in people and initiatives that impact Canadians' quality of life. Concerted effort was made to advance work in four key priorities, with a focus on supporting the Government of Canada in delivering an Economic Response Plan to support Canadians during the COVID-19 global pandemic.

I. Sound fiscal management

Over the course of the year, the Department operated in a dynamic financial context marked by continuing technological change and shifting macroeconomic realities due to the pandemic. The Department continued to ensure effective management of the economic and fiscal framework, including responsible management of the federal budget and the federal debt. In support of this priority, the Department:

- Analyzed, planned and coordinated the preparation of the 2020 Fall Economic Statement and Budget 2021.

- Implemented a sound fiscal plan by continuing to assess Canada's current and future economic conditions in order to formulate quality economic policy advice and provide the basis for accurate fiscal planning.

- Managed the government's currency, debt and foreign reserves to achieve government objectives, including the unprecedented funding of the government's response to COVID-19 support to Canadians.

In addition to responding to the COVID-19 crisis, work continued on enhancing the fairness, neutrality, competitiveness and efficiency of Canada's tax system. Analysis and advice provided by the Department culminated in new proposals, announced in the 2020 Fall Economic Statement, to ensure that the Goods and Services Tax/Harmonized Sales Tax (GST/HST) will apply fairly and effectively to the growing digital economy, and in Budget 2021, aimed at addressing aggressive tax planning schemes.

II. Strong, inclusive and sustainable growth

Strong, inclusive, and sustainable growth was at the heart of the Department's policy agenda in the development of regional, sectoral, and microeconomic policies and programs that benefit all Canadians. For example, work in support of the federal Canada Emergency Response Benefit helped ensure that workers laid off due to COVID-19, including many without access to Employment Insurance, could make ends meet. This significant support was instrumental in helping Canada flatten the curve as Canadians could afford to stay home during the initial wave of the pandemic.

The Department led the extensions and modifications to the Canada Emergency Wage Subsidy, which provides a strong incentive for employers to keep workers on the payroll. The Department also led the development of the Canada Recovery Hiring Program to enable employers to rehire workers as the economy recovers, as well as the development of the Canada Emergency Rent Subsidy and Lockdown Support, which provided organizations affected by the pandemic with direct and easy-to-access support for rent, mortgage interest and other eligible property expenses. In addition, the Department led the development of the Canada Emergency Business Account, which provided interest-free, partially forgivable loans to small employers and not-for-profit organizations. Guidance was provided on measures needed to protect Canadians and businesses from the impacts of COVID-19. The Department also ensured funding proposals were informed by Gender-based Analysis Plus (GBA+).

In addition, the Department:

- Led on creating the Large Enterprise Emergency Financing Facility (LEEFF).

- Played a significant role in establishing the Business Credit Availability Program and the Highly-Affected Sectors Credit Availability Program.

- Provided support to Western provinces for inactive and orphan oil and gas well clean-up.

Finally, proposals were developed to expand the Canada Workers Benefit. These changes, announced in Budget 2021, helped approximately one million additional Canadians in low-wage jobs return to work and increased the benefits available for some of Canada's most vulnerable.

Work was also focused on options for strengthening Canada's climate plan and supporting the growth of Canada's clean technology businesses, including proposed corporate tax rate reductions for zero-emission technology manufacturing. As announced in Budget 2021, work on an investment tax credit for carbon capture, utilization, and storage, and other incentives aimed at meeting Canada's goal of net-zero emissions by 2050 is underway.

Over the course of the past year, the Department provided high quality and timely policy advice to the Minister to ensure Canada's financial sector remained well positioned to address vulnerabilities and risks, as well as support inclusive and sustainable economic growth. Several measures were advanced to support a stable, resilient and innovative financial sector, including in the areas of:

- the domestic housing financing system,

- a secure financial data sharing framework,

- a retail payments oversight framework,

- consumer protection in banking,

- anti-money laundering and terrorist financing frameworks, and

- financial sector vulnerabilities and risks.

III. Sound social policy framework

The Department continued to manage major transfer payments to provinces and territories and worked in collaboration with stakeholders, other government departments, central agencies and provincial and territorial partners to develop policy proposals that deliver on the government's social priorities. To support this priority, the Department:

- Provided $81.6 billion in support to provinces and territories through the Canada Health Transfer (CHT), Canada Social Transfer, Equalization and Territorial Formula Financing.

- Managed payments made to support provincial and territorial responses to COVID19, including through the Safe Restart Agreement, Safe Return to Class Fund, Essential Workers Support Fund and additional CHT payments.

- Supported a January 2021 meeting of federal, provincial, and territorial Ministers of Finance to discuss the COVID-19 pandemic, federal government's plan to jumpstart the Canadian economy once the virus is under control, and health care funding.

- Supported the Minister of Finance in chairing regular calls with provincial and territorial Finance Ministers to ensure a collaborative approach to the pandemic response.

- Prepared policy research in support of the next renewal of the legislation governing Equalization and Territorial Formula Financing.

- Worked with other government departments to support reconciliation with Indigenous Peoples.

- Worked in collaboration with provinces and territories to advance the 2019-2021 triennial review of the Canada Pension Plan (CPP).

IV. Effective international engagement

A focus was also placed on monitoring international, economic and financial conditions and developments to manage risks associated with pressures on the fiscal framework and Canada's economic growth and competitiveness. This work supported the government's commitment to maintain Canada's leadership and engagement globally and to deepen its trading relationships. In support of this priority, the Department led or contributed to several international priorities, which:

- Advanced free trade agreement negotiations (e.g., Canada-UK and Canada-Mercosur) and at the World Trade Organization (WTO) in the areas of tariffs, trade remedies, financial services, and fisheries subsidies, and supported efforts to reform the WTO.

- Implemented the Canada-United States-Mexico Agreement (CUSMA) and the Canada-UK Trade Continuity Agreement.

- Engaged across key international settings (e.g., the G7, G20, and the Paris Club), as well as in the governance and operations of major international financial institutions (e.g., the International Monetary Fund, the World Bank Group, the Asian Infrastructure Investment Bank, and the European Bank for Reconstruction and Development).

- Supported the Government's COVID-19 response by making legislative amendments, providing relief from tariffs on medical goods, and contributing to the international coordination of COVID-19 responses.

- Supported international efforts to improve debt transparency and sustainability across the international system to support international financial stability and sustainable economic growth.

- Led Canada's participation in negotiations on export credits to promote a level playing field for Canadian exporters.

- Engaged in financial sector policy dialogues with key trading partners.

For more information on the Department of Finance Canada's plans, priorities and results achieved, see the "Results: what we achieved" section of this report.

Results: what we achieved

Core responsibility

Economic and Fiscal Policy

Description

Develop the federal budget and Fall Economic Statement, as well as provide analysis and advice to the Government of Canada on economic, fiscal, and social policy; federal-provincial relations, including the transfer and taxation payments; the financial sector; tax policy; and international trade and finance.

Results

Support to the development of the government's economic policy agenda was at the heart of the Department's work this past year. High quality and timely analysis and advice was provided on a broad range of economic, fiscal, tax and tariff, and financial sector policies. In particular, the Department played a pivotal role in developing and supporting work on the Government of Canada's economic response to the COVID-19 pandemic. This results section provides a specific account of the Department's key contributions to the pandemic response, as well as other achievements in support of its four priority areas.

I. Sound fiscal management

In 2020-21, Canada faced a once-in-a-century pandemic and global economic crisis, which challenged the Department to provide first-rate and timely analysis against the backdrop of a rapidly evolving health and economic situation. Analysis was provided on complex issues, using real-time data, on changing global and domestic economic conditions, as well as fiscal policy responses and implications for the federal budget framework.

The Department's ongoing stewardship of the Canadian economy and budgetary framework positioned Canada well to face the COVID-19 crisis and recession. Canada entered the crisis in a strong fiscal position, including its low and stable debt burden, enabling the government to take decisive action to put in place the support necessary for people and businesses to weather the storm and support a robust and inclusive recovery of the Canadian economy.

It was in this context that the Department developed a Fall Economic Statement (FES) to provide an update on the Canadian economy, which demonstrated the Government of Canada's unprecedented investment had effectively managed to stabilize the economy through the COVID-19 crisis. With a focus on responsible fiscal management, the FES included policies to support Canadians through the pandemic and ensure that Canada's future economy is resilient, inclusive, and strong for everyone.

Similarly, the Department supported Ministers in laying out a sound and prudent fiscal plan in Budget 2021 to respond to Canada's evolving economic needs, support Canadians as the country emerges from the crisis, and provide significant investments to accelerate the recovery and boost productivity. The Department looked at several related economic indicators, notably related to job creation, to identify when support measures will need to be scaled back. This "fiscal guardrails" approach, which is guided by economic data, is designed to help ensure the recovery is tailored to the needs of Canadians and the circumstances at hand.

Ongoing support to the government's commitment to protect Canada's low debt advantage was also provided, so that borrowing costs remain low, and future generations are not burdened with COVID-19-related debt. The approach, combined with Canada's history of prudent fiscal management aimed to ensure that, despite the unprecedented actions taken to fight the virus, Canada will continue to have the lowest net debt-to-GDP ratio of G7 countries.

Throughout the year, action continued on efficiently managing the federal government's currency, market debt and international reserves as the Department:

- Introduced the Debt Management Strategy for 2020-21 to support the government's debt management objectives of raising stable, low cost funding, to maintain well-functioning markets for Government of Canada securities and maximize the financing of COVID-19-related debt.

- Provided ongoing transparency to Canadians with respect to the management of the federal debt and international reserves by publishing the Debt Management Strategy, Debt Management Report, the Report on the Management of Canada's Official International Reserves, Borrowing Authority Act – Report to Parliament 2020 and Extraordinary Borrowing Report to Parliament.

- Delivered advice to the Funds Management Committee on the appropriate mix of assets to ensure the liquid reserves portfolio achieves the key objectives of capital preservation, maintaining high liquidity, and optimizing returns.

In addition, the Department developed advice aimed at enhancing the fairness and effectiveness of Canada's tax system. Work was advanced with international partners, in a process led by the Organisation for Economic Co-operation and Development (OECD), to ensure that corporations in all sectors, including digital corporations, pay their fair share of taxes on their activity in Canada and are subject to an agreed minimum level of tax.

In the 2020 Fall Economic Statement, the government announced changes to the tax rules for employee stock options. Consistent with the government's policy objectives, and reflecting input received through stakeholder consultations, the changes will limit the benefit of the employee stock option deduction for high-income earners working at mature companies while ensuring that start-ups and emerging Canadian businesses can continue to grow and attract key talent.

II. Strong, inclusive and sustainable growth

Amid the COVID-19 challenges, the Department continued to advance the Government's commitment to fairness and equality through gender budgeting (including GBA+) and fulfilling the requirements of the Canadian Gender Budgeting Act, which support Canada's long-term sustainable and inclusive growth. Existing gender budgeting expertise was enhanced and work continued to strengthen the quality of GBA+ performed as part of policy development and budgeting processes.

Quality of Life Framework

Budget 2021 introduced a Quality of Life Framework to ensure quality of life measurements are better integrated into decision-making and budgeting. The Department led the development of this framework, expanding on the existing GBA+ toolkit. While GBA+ provides a means to understand who is affected by government policy, the Quality of Life Framework is based on the global evidence about the determinants of human well-being, and takes a further step beyond GBA+ to consider the nature of expected impacts of budget measures.

A comprehensive approach was used to develop more integrated and inclusive thinking to guide and support effective decision-making in this area, particularly in the face of complex challenges such as the pandemic and climate change. Accordingly, the Gender Report in Budget 2021 was expanded and renamed the Impacts Report to reflect this new and expanded approach to decision-making. Support was provided to identify investments needed in federal data. These included data to fill key quality of life gaps and improve the disaggregation of federal data sets for distinctions-based Indigenous information and a new census of the environment.

Reconciliation

Another key area of work involved support for the government's economic and reconciliation policy objectives. This included leading the Step 2 engagement process on Indigenous economic participation in Trans Mountain. This phase involved further engagement with the 129 Indigenous groups identified as potentially impacted by the Trans Mountain Expansion Project on opportunities for meaningful economic participation in the project. Progress towards achieving the government's objectives included meeting bilaterally with over 78 Indigenous groups between June 1, 2020 and March 31, 2021, as well as contracting a facilitator to lead six multilateral sessions between Canada and Indigenous groups between April and July 2021. The Department established contribution agreements with 47 groups to provide between $50,000 and $70,000 in funding towards the cost of each group's participation in the Step 2 engagement process.

Environment

On December 12, 2020, the government's first annual report on the Greenhouse Gas Pollution Pricing Act was published by the Minister of Environment and Climate Change. The Department contributed to the preparation of this important report by preparing the financial tables and associated commentary, accounting for how federal fuel charge proceeds were collected and distributed in all provinces and territories where the fuel charge applied.

Supporting Businesses

Important analysis, advice and program development work was undertaken throughout the year to support Canadian businesses through the pandemic and help them grow and succeed as the economy recovers.

The Department led on creating the Large Enterprise Emergency Financing Facility (LEEFF), a program providing bridge financing to large Canadian companies affected by COVID-19. LEEFF support was key to protecting thousands of Canadian jobs that were affected by the COVID-19 pandemic.

The Department played a significant role in the establishment of the Business Credit Availability Program and in developing the program parameters of the Highly-Affected Sectors Credit Availability Program, which have been critical to extending liquidity to businesses to maintain their operations and recover from the pandemic.

In addition, the Department executed payments to Western provinces for enhanced inactive and orphan oil and gas well clean-up to support workers in the energy sector as part of Canada's COVID-19 Economic Response Plan. These payments have provided important support to regional Western economies as they were facing economic hardship brought on by the effects of COVID-19 and the associated drop in oil prices.

The Department led the extensions and modifications to the Canada Emergency Wage Subsidy, designed to prevent job losses by encouraging employers to keep employees on the payroll. The Department also led the development of the Canada Recovery Hiring Program to enable employers to rehire workers laid off as a result of the pandemic, as well as the development of the Canada Emergency Rent Subsidy and Lockdown Support, which provides organizations affected by the pandemic with direct and easy-to-access support for rent, mortgage interest and other eligible property expenses. These programs play a critical role in preserving jobs and supporting organizations impacted by the pandemic as the economy recovers.

Resilience of the food system and hunger supports

The Department supported timely decision-making to safeguard food value chains and food security. Programming included help provided to farmers, food businesses, and food processors to ensure a safe and reliable food supply. Supports were also established for the fisheries sector with dedicated programming for fish harvesters and fish processors.

The Department also supported measures to improve access to food for Canadians facing social, economic, and health impacts of the COVID-19 pandemic, with initiatives to support food banks and community hunger organizations and through further measures to redirect perishable products to vulnerable Canadians.

Task Force on Women in the Economy

Secretariat support was provided to the Task Force on Women in the Economy, announced by the Government on March 8, 2021. Recognizing that the COVID-19 pandemic has had an unequal impact on women, the Task Force draws on a diverse group of experts to advise the Deputy Prime Minister and Minister of Finance, and the Associate Minister of Finance on plans for a robust, inclusive and feminist recovery.

Basic Personal Amount and top-up payments

On April 30, 2021, the government introduced its budget implementation bill, which included a proposal to increase to the Basic Personal Amount. In addition to providing advice on this proposal, the Department provided analysis on a special top-up payment under the Goods and Services Tax (GST) Credit to support low and modest-income Canadians and, to help families with children, a top-up to the Canada Child Benefit and a new round of temporary support in 2021 in the form of the Canada Child Benefit Young Child Supplement.

Domestic housing finance system

Work was undertaken on measures to create more equitable access to housing in Canada in the areas of financial stability, housing affordability and supply, and the insured mortgage borrower stress test. The Department:

- Monitored the Insured Mortgage Purchase Program and its expiry in December 2020, including the development of ministerial regulations on temporary changes to portfolio insurance rules.

- Advised on CMHC mortgage securitization programs, including annual limits and increased fees for approved issuers.

- Expanded the First-Time Home Buyer Incentive to enhance eligibility in the higher priced markets of Toronto, Vancouver, and Victoria (the expansion increases the income threshold of eligible buyers in these markets from $120,000 to $150,000, and allows eligible buyers to purchase a home up to 4.5 times their household income, an increase from the current limit of 4 times household income).

- Advised on the establishment of a new minimum qualifying rate for insured mortgages (also known as the "stress test") to align with the Office of the Superintendent of Financial Institutions in the uninsured mortgage market.

- Continued to track and review the ongoing progress of the Canada-British Columbia Expert Panel on the Future of Housing Supply and Affordability, which released its interim "What We Heard" report containing the results of its broad-based stakeholder consultations in British Columbia in December 2020.

Financial sector vulnerabilities and risks

Collaboration took place throughout the year with financial sector agencies, through fora such as the Senior Advisory Committee, the Financial Institutions Supervisory Committee, and their respective sub-committees, to monitor vulnerabilities and risks in the financial sector and discuss the use of tools and powers of the Minister and agencies to mitigate systemic risks. As well, financial institutions were engaged on a regular basis to discuss financial sector risks, including credit trends of their household and business clients on a sectoral and regional basis, the delivery of government support programs, and regulatory forbearance issues during the pandemic.

Federally regulated pensions

For federally regulated pensions, the Department:

- Implemented Solvency Special Payments Relief Regulations, 2020, to provide temporary, short-term funding relief for federally regulated defined benefit plan sponsors through a moratorium on special solvency payments from April 1, 2020 until December 30, 2020.

- Undertook consultations on potential options for temporary broad-based solvency funding relief in 2021, and ways to address the sustainability of federally regulated defined benefit plans and accommodate variable payment life annuities for federally regulated pension plans.

- Provided $150,000 over three years to the National Pension Hub to support pension research focused on improving retirement savings outcomes for Canadians and developing solutions to pension challenges, as well as $12.5 million over 10 years to the Global Risk Institute to continue its work in developing new approaches to financial risk management.

- Committed to modernize the federal unclaimed assets regime by expanding the scope of the regime to include unclaimed balances from terminated federally regulated pension plans.

Anti-money laundering and anti-terrorist financing

In the area of anti-money laundering and anti-terrorist financing (AML/ATF) frameworks, the Department:

- Completed amendments to the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations to align measures with international standards and apply stronger customer due diligence requirements and beneficial ownership requirements to designated non-financial businesses and professions.

- Processed new funding requests to: support the Financial Transactions and Reports Analysis Centre of Canada's (FINTRAC) mandate and relocation; establish a team of dedicated forensic accountants at Public Services and Procurement Canada to support law enforcement in money laundering and terrorist financing investigations; modernize the Canada Border Services Agency and FINTRAC's cross-border currency reporting systems; and support the Government of Canada's participation in the Commission of Inquiry into Money Laundering in British Columbia.

- Developed statutory amendments to strengthen Canada's AML/ATF regime, including changes to enable FINTRAC to recover its compliance costs; clarify its ability to obtain and disclose additional information; strengthen criminal penalties and the money services businesses registration framework; regulate armoured car services for AML/ATF purposes; and other technical amendments.

- Published key findings of public consultations on the proposed creation of a publicly accessible registry (or registries) of the beneficial owners who own and control Canadian corporations, in cooperation with Innovation, Science and Economic Development Canada.

- Conducted joint analysis with the government of British Columbia through the working group established in 2018 to examine issues related to fraud, tax evasion and money laundering.

- Contributed to strengthening information sharing between law societies and the Government of Canada as part of a working group with the Federation of Law Societies of Canada, that held several meetings in 2020-21 and continues to explore issues related to money laundering and terrorist financing in the legal profession.

Payments system modernization

The Department supported the modernization of Payments Canada's payment systems. As well, the Department implemented legislative changes to the Canadian Payments Act to modernize the governance framework of Payments Canada and introduced the Retail Payments Activities Act to implement a new retail payments oversight framework and advance work on regulations that will support the framework.

Secure Financial Data Sharing Framework

Support was also provided to the Advisory Committee on the Merits of Open Banking to consult stakeholders and prepare their findings. Through this work, external experts were engaged in the areas of competition and governance and advised on the creation of a secure data sharing framework.

III. Sound social policy framework

Priorities were adjusted throughout the year to ensure a sound social policy framework remained in place and to support a multi-jurisdictional approach to managing the COVID-19 pandemic. In addition to one-time pandemic support paid through the Canada Health Transfer (CHT), the Department facilitated $81.6 billion in transfers to provinces and territories through the CHT, Canada Social Transfer, Equalization and Territorial Formula Financing. Additionally, the Department continued to support joint meetings of federal, provincial, and territorial Ministers of Finance and regular calls between the Minister of Finance and provincial and territorial counterparts to discuss and promote a collaborative approach to Canada's response to the pandemic.

Analysis and advice were also provided on COVID-19 related issues, including:

- Canada's public health response to the pandemic, encompassing health system preparedness, making unprecedented levels of support available to provinces and territories through the Safe Restart Agreement ($13 billion), the Safe Return to Class Fund ($2 billion), and additional Canada Health Transfer payments, ensuring adequate supplies of personal protective equipment, covering the full cost of vaccines and providing support for vaccine rollout campaigns, building up Canada's life sciences and bio-manufacturing capacity, and supporting mental health – including for populations disproportionally impacted by COVID-19.

- Analysis of the health, social and economic impacts of COVID-19 in Indigenous communities.

- Reconciliation with Indigenous Peoples, including supporting the Minister of Crown-Indigenous Relations and the Minister of Indigenous Services in developing a new fiscal relationship with Indigenous Peoples.

- Emergency income support measures to support Canadians affected by COVID-19, including the Canada Emergency Response Benefit, Canada Emergency Student Benefit, Essential Workers Wage Top-up, and the suite of Canada recovery benefits.

Over the course of the year, work was advanced on other important social policy files where the

Department:

- Conducted policy research in support of the next renewal of the legislation governing Equalization and Territorial Formula Financing, which must take place before March 31, 2024.

- Established a Canada-wide system of early learning and child care, as announced in Budget 2021.

- Advanced major investments to support training and work opportunities for students and workers in support of the economic recovery, including enhancements to student financial assistance, youth job placement opportunities and new investments in training for workers, as part of the 2020 Fall Economic Statement and Budget 2021.

- Developed strategies to stabilize and modernize government benefit and program delivery systems.

- Modernized the Fiscal Stabilization program, as announced in the 2020 Fall Economic Statement.

- Supported the federal response to the National Inquiry into Missing and Murdered Indigenous Women and Girls, as well as the development of Bill C-15 United Nations Declaration on the Rights of Indigenous Peoples Act, and the implementation of An Act respecting First Nations, Métis and Inuit children, youth and families.

- Collaborated with provinces and territories to advance the 2019-2021 triennial review of the Canada Pension Plan (CPP).

IV. Effective international engagement

While the worldwide effects of the COVID-19 pandemic affected international engagements, the Department's work continued and resulted in:

- Customs duties and tax relief on goods imported for emergency use, and customs duties relief for goods such as medical supplies and personal protection equipment in response to COVID-19.

- Extended legislated time limits for certain trade remedy proceedings in response to business shutdowns and restrictions caused by the pandemic.

- Legislative amendments to facilitate Export Development Canada's COVID-19 response.

- Mobilization of resources to meet urgent financing needs of vulnerable developing countries, including humanitarian and development assistance through advocacy efforts targeted at international financial institutions, including the International Monetary Fund (IMF), the World Bank Group and the other Multilateral Development Banks.

The Department also adapted economic monitoring practices to focus on the short and medium-term global economic impacts of COVID-19, the international economic response to the pandemic, and global stimulus needed to build back better.

In addition, increased efforts were made to coordinate international vaccine delivery and support the IMF, OECD and G7/G20 in addressing the economic and financial impacts of the pandemic. Contributions also were made to other international response measures, such as the G20 Debt Service Suspension Initiative (DSSI), the G20 Common Framework for Debt Relief beyond the DSSI, and plans for the new allocation of US$650 billion in Special Drawing Rights (an international reserve asset created by the IMF to supplement its member countries' official reserves). Furthermore, the Department participated in the successful disbursement of resources provided through the Nineteenth Replenishment of the International Development Association or "IDA" (the concessional arm of the World Bank Group that supports low-income countries) and participated in the launch of the IMF's 16th General Review of Quotas, leading to the increase of Canada's loan commitment, from $2 billion to $3 billion, to the IMF's Poverty Reduction and Growth Trust.

Advice on issues related to Canada's import policy, to support the competitiveness of Canadian manufacturers and to protect industries against unfair trade throughout the COVID-19 recovery, was provided throughout the year. This work involved reviewing and advising on stakeholder proposals for legislative and regulatory changes to Canada's trade remedy system, as well as on various tariff relief requests and budget proposals to improve customs duties and tax collection. As well, the Department conducted public consultations and provided advice on potential retaliatory surtaxes against U.S. tariffs on Canadian aluminum.

Following the government's commitment to explore border carbon adjustments as proposed in the 2020 Fall Economic Statement, the Department provided advice and initiated a work program for detailed inter-departmental analysis. This work was carried out in close collaboration with other federal departments, including Environment and Climate Change Canada and Global Affairs Canada. Analysis on key considerations relating to border carbon adjustments is ongoing, along with continued engagement with international partners.

As the year unfolded, work also continued in support of Canada's government-wide trade priorities as follows:

- Advanced negotiations in free trade agreements (e.g., Canada-UK and Canada-Mercosur) or at the World Trade Organization (WTO) in the areas of tariffs, trade remedies, financial services, and fisheries subsidies.

- Implemented the Canada-United States-Mexico Agreement (CUSMA), and the Canada-UK Trade Continuity Agreement (along with other Brexit-related regulatory amendments).

- Coordinated financial sector policy dialogues with key trading partners through the Canada-EU Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- Supported Canadian leadership of the Ottawa Group on the Trade and Health Initiative and, more broadly, on achieving meaningful reform to the WTO and modernizing the multilateral rules-based trading system.

The Department also led Canada's participation in negotiations on export credits at the OECD and at the International Working Group on Export Credits aimed at promoting a level playing field for Canadian exporters. Similarly, departmental officials led Canada's participation in meetings on debt sustainability and transparency issues across the international system.

Finally, contributions were made to the development of policies at International Financial Institutions (IFIs) for which the Minister of Finance is Canada's Governor. These IFIs include the Asian Infrastructure Investment Bank, the European Bank for Reconstruction and Development, the IMF and the World Bank Group. This included participation in various IFI committees and meetings to ensure that these institutions fully mobilized the required resources to meet the urgent financing needs of vulnerable countries as a result of the COVID-19 pandemic.

In terms of G7 and G20 participation, support was provided to the Prime Minister, Ministers, Deputy Minister and Associate Deputy Minister in multilateral summits and meetings. Department officials took part in G7/G20 committees and working groups. This included supporting the Government of Canada's contributions on issues, such as the coordinated economic response to the COVID-19 pandemic, as well as addressing the disproportionate impacts of the pandemic on specific populations, including women and youth. Support also was provided to the Prime Minister's leadership in the United Nation's Financing for Development in the Era of COVID-19 and Beyond initiative, which he co-chaired with the Prime Minister of Jamaica and the United Nations Secretary-General.

Overall, these international efforts contributed to Canada's COVID-19 recovery efforts and to the future prosperity of Canadians by supporting global economic stability and growth.

Results:

Gender-based analysis plus

Over the course of 2020-21, the Department continued to advance the government's commitment to fairness and equality through gender budgeting as set out in the Canadian Gender Budgeting Act and in support of its commitment to inclusive and sustainable economic growth.

The work of the Department has focused on addressing the effects of COVID-19 on Canadians and the Canadian economy. While COVID-19 and related public health measures have affected all Canadians in one way or another, the type, severity and extent of the impacts of COVID-19 vary considerably across social and demographic characteristics. Leveraging two key tools for gender budgeting, GBA+ and the Gender Results Framework, the Department identified the impacts of COVID-19 on diverse groups of Canadians and made sure these were taken into consideration in decision making. This was demonstrated in the July 2020 Economic and Fiscal Snapshot, the 2020 Fall Economic Statement, and more recently in Budget 2021.

Budget 2021 builds on the groundwork laid in Budget 2019 and subsequent Economic and Fiscal Updates by expanding beyond identifying who could be affected by an initiative to also include the nature of those impacts through a new Quality of Life Framework. The Quality of Life Framework provides an evidence-based and holistic way of assessing the main determinants of good quality of life through a comprehensive set of five domains: prosperity, health, society, environment and good governance. This expanded analysis informed the development of Budget 2021's Impacts Report, which replaced the Gender Report.

Additionally, as per the reporting requirements of the Canadian Gender Budgeting Act, the Department released the 2021 Report on Federal Tax Expenditures that included a GBA+ study that focuses on differential impacts by other identity factors. This study provides a snapshot in time of the differential impacts of the federal personal income tax system by age group, income group, family type and area of residence. Given the inherent progressive nature of the federal tax system, the analysis shows that, overall, it tends to favour economically disadvantaged groups (i.e., groups which report lower proportions of total pre-tax income compared to the proportions of filers they represent). As was the case for women, the shares of after-tax income held by younger filers, members of the lower family income quintiles, sole parents and rural area residents were higher than their shares of pre-tax income.

To further support GBA+ work, the Task Force on Women in the Economy was established to advise the Deputy Prime Minister and Minister of Finance, and the former Minister of Middle Class Prosperity and Associate Minister of Finance on policies and measures to support women's employment. The Department of Finance has provided secretariat support to the Minister and the work of this Task Force.

| Departmental results | Performance indicators | Target | Date to achieve target | 2018–19 Actual results |

2019–20 Actual results | 2020–21 Actual results |

|---|---|---|---|---|---|---|

| Canadians enjoy stronger, more sustainable, and inclusive economic growth that contributes to higher standards of living | 1.1 Gross Domestic Product (GDP) per capita (ranking among Organisation for Economic Co-operation and Development (OECD) countries) | Ranking among the countries with the 15 highest levels of GDP per capita | 2020-2021 | Ranked 14th among 36 OECD countries | Ranked 15th among 37 OECD countries | Ranked 15th among 38 OECD countries |

| 1.2 Employment rate among the population 15 to 64 in age (ranking among OECD countries) | Ranking among the countries with the 15 highest employment rates | 2020-2021 | Ranked 13th among 36 OECD countries | Ranked 13th among 37 OECD countries | Ranked 19th among 38 OECD countriesFootnote 1 | |

| 1.3 Real disposable income across income groups | Growth is broad-based across income groups | 2020-2021 | Bottom 20%: 1.8% growth

Second 20%: 1.2% growth

Middle 20%: 1.2% growth

Fourth 20%: 1.0% growth

Top 20%: 0.5% growth |

Report not yet available | Report not yet available | |

| Canada's public finances are sound, sustainable and inclusive | 2.1 Federal debt-to-gross domestic product ratio | Stable over the medium-term (defined as the end of the 5-year projection period for the budget) | 2020-2021 | Met | Met | MetFootnote 2 |

| 2.2 The annual federal budget includes an assessment of the impact of new expenditure and revenue measures on different groups of women and men | Presence of a clear "Statement" in the annual budget document, where the impact of budgetary measures is presented from a gender perspective to foster more inclusive growth | 2020-2021 | Met | Data not availableFootnote 3 | Met | |

| Canada has a fair and competitive tax system | 3.1 Taxes on labour income | Lower than the G7 average | 2020-2021 | Met | Met | Met |

| 3.2 Total business tax costs | Lower than the G7 average | 2020-2021 | Data not available | Data not available | Data not availableFootnote 4 | |

| Canada has a sound efficient financial sector | 4.1 Percentage of leading international organizations and major ratings agencies that rate Canada's financial policy framework as favourable | 100% | 2020-2021 | 100% | 100% | 100% |

| 4.2 Ranking of Canada's financial sector in the World Economic Forum's Global Competitiveness Report | Above the G7 average (2019) | 2020-2021 | Above the G7 average Canada: 86 G7 average: 83 |

Above the G7 average Canada: 87 G7 average: 83 |

No data available for 2020Footnote 5 | |

| The Government of Canada's borrowing requirements are met at a low and stable cost to support effective management of the federal debt on behalf of Canadians | 5.1 Percentage of the Government's borrowing requirements met within the fiscal year | 100% | 2020-2021 | 100% | 100% | 100% |

| 5.2 Canada's sovereign rating | Equal to or better than the G7 average | 2020-2021 | Canada was the second highest rated among G7 countries, tied with the US | Canada was the second highest rated among G7 countries, tied with the US | Canada was the second highest rated among G7 countries, tied with the US | |

| The Government of Canada effectively supports provinces, territories and Indigenous governments | 6.1 Degree to which timely statutory federal transfer programs assist and support provincial and territorial governments in delivering important public services, including accessible and quality health care (on a scale of 1 to 5) | 5 (100% of payments reviewed did not reveal errors; 100 % of payments to provincial and territorial governments were made within the required time frames) | 2020-2021 | 5 | 5 | 5 |

| 6.2 Degree to which payment issues identified with respect to tax agreements with provinces, territories and Indigenous governments are addressed (on a scale of 1 to 4) | 2 (mostly addressed) | 2020-2021 | Not applicable | Not applicable | 1 (fully addressed) | |

| Canada maintains its leadership and engagement globally and deepens its trading relationships | 7.1 Canada's ranking in the domestic market access pillar of the World Economic Forum Global Trading Report | Best of G7 countries | 2020-2021 | Data not available | Data not available | Data not availableFootnote 6 |

| 7.2 Percentage of the Department of Finance's international assistance payments that are publicly reported on a monthly basis to support aid transparency | 100% | 2020-2021 | Met | Met | Met |

| 2020–21 Main Estimates |

2020–21 Planned spending |

2020–21 Total authorities available for use |

2020–21 Actual spending (authorities used) |

2020–21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 99,483,805,884 | 99,483,805,884 | 117,817,447,684 | 117,609,934,584 | 18,126,128,700 |

| 2020–21 Planned full-time equivalents |

2020–21 Actual full-time equivalents |

2020–21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 582 | 569 | -13 |

Financial, human resources and performance information for the Department of Finance's Program Inventory is available in GC InfoBase.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are:

- Acquisition Management Services

- Communication Services

- Financial Management Services

- Human Resources Management Services

- Information Management Services

- Information Technology Services

- Legal Services

- Material Management Services

- Management and Oversight Services

- Real Property Management Services

Results

During an extraordinary year due to the exceptional circumstances brought about by the COVID-19 pandemic, Internal Services played a critical role in supporting departmental employees so they could continue to do their jobs and deliver results for Canadians.

Guidance and training was provided on managing effectively from a distance and new, tailored resources were made available to all employees to support their mental health and wellness. All employees were equipped to work effectively from home, including the provision of remote access to departmental networks. The Department also continued to modernize and transform its workplace technology as part of broader government-wide initiatives. This included introducing the GCcollaboration solution, which gave employees access to video conferencing tools that increased the effectiveness and efficiency of remote work, while balancing enhanced security requirements.

In addition to the pandemic, social movements over the year prompted reflection on the unjust treatment of Black people, other racialized groups, and Indigenous peoples in our society. In January 2021, the Clerk of the Privy Council released a Call to Action to address systemic racism and to foster a culture of inclusiveness and equality. The Department responded by committing to measures that will establish a culture at the Department that reflects diversity while promoting inclusion. An Anti-Racism Champion was appointed and an Anti-Racism Committee was established to develop an Action Plan to foster inclusiveness, address systemic barriers and improve the representation of equity-deserving groups at all levels within the Department.

For the ninth consecutive year, the Department was designated as one of the National Capital Region's Top Employers and seventh consecutive year as one of the National Capital Region's Top Employers for Young People, in part because of its commitment to the development of employees through work assignments, coaching and a combination of formal and informal training. As well, to further promote a healthy work environment and in line with the amended Canada Labour Code, a new Work Place Harassment and Violence Prevention Policy was developed in 2020-21 and implemented in early 2021-22.

| 2020–21 Main Estimates |

2020–21 Planned spending |

2020–21 Total authorities available for use |

2020–21 Actual spending (authorities used) |

2020–21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 41,257,072 | 41,257,072 | 48,911,034 | 50,293,291 | 9,036,219 |

| 2020–21 Planned full-time equivalents |

2020–21 Actual full-time equivalents |

2020–21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 249 | 308 | 59 |

Analysis of trends in spending and human resources

Actual expenditures

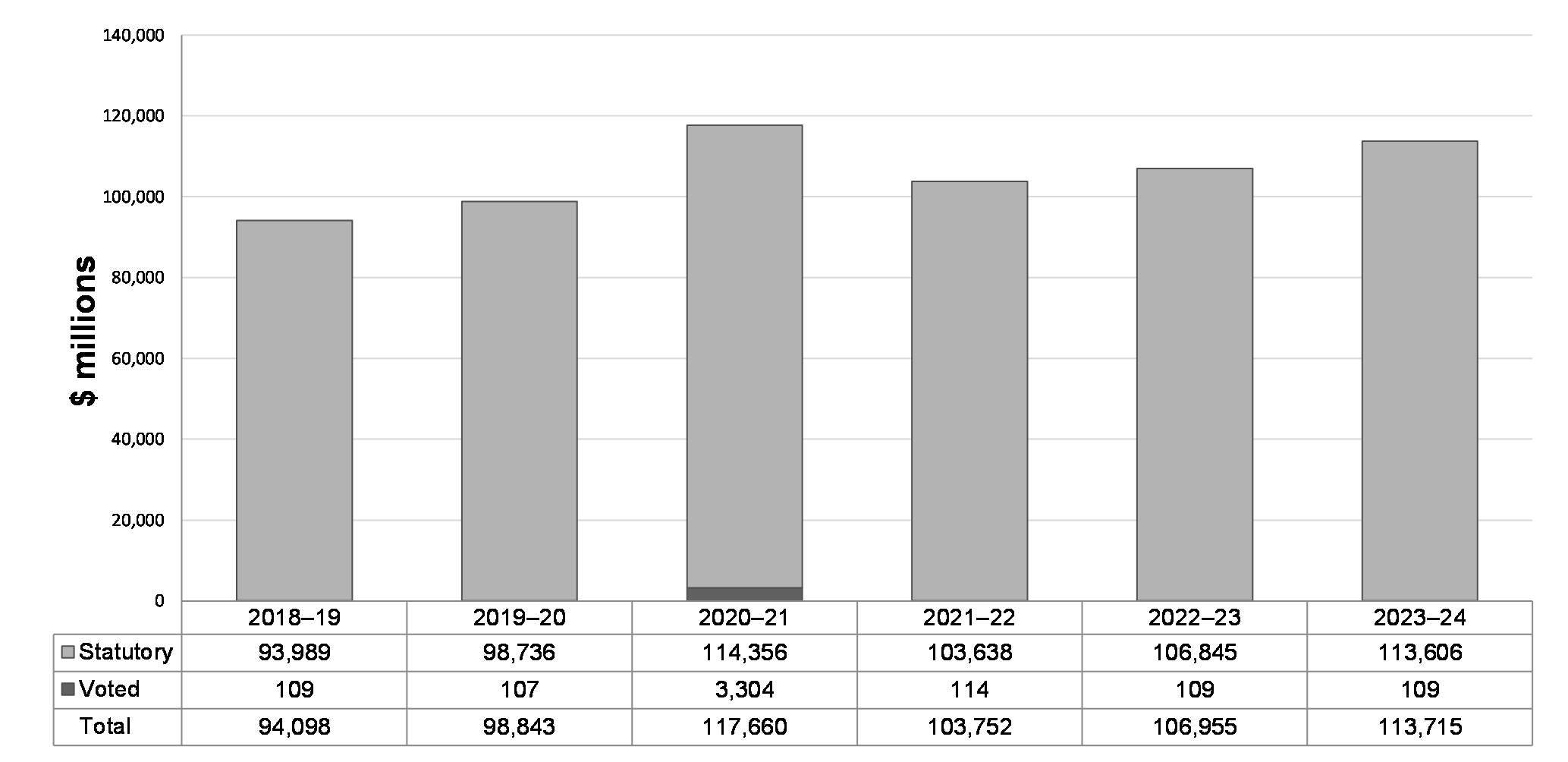

Departmental spending trend graph

The following graph presents planned (voted and statutory spending) over time.

In the graph above, the amounts from 2018-19 to 2020-21 represent actual expenditures, whereas the amounts from 2021-22 to 2023-24 represent planned expenditures as presented in the 2021-22 Departmental Plan.

| Core responsibilities and Internal Services | 2020–21 Main Estimates |

2020–21 Planned spending |

2021–22 Planned spending |

2022–23 Planned spending |

2020–21 Total authorities available for use |

2018–19 Actual spending (authorities used) | 2019–20 Actual spending (authorities used) | 2020–21 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 99,483,805,884 | 99,483,805,884 | 103,708,910,767 | 106,911,739,643 | 117,817,447,684 | 94,052,730,919 | 98,798,711,515 | 117,609,934,584 |

| Subtotal | 99,483,805,884 | 99,483,805,884 | 103,708,910,767 | 106,911,739,643 | 117,817,447,684 | 94,052,730,919 | 98,798,711,515 | 117,609,934,584 |

| Internal Services | 41,257,072 | 41,257,072 | 42,725,140 | 42,798,801 | 48,911,034 | 44,979,241 | 43,969,170 | 50,293,291 |

| Total | 99,525,062,956 | 99,525,062,956 | 103,751,635,907 | 106,954,538,444 | 117,866,358,718 | 94,097,710,160 | 98,842,680,685 | 117,660,227,875 |

Actual human resources

| Core responsibilities and Internal Services | 2018–19 Actual full-time equivalents | 2019–20 Actual full-time equivalents | 2020–21 Planned full-time equivalents |

2020–21 Actual full-time equivalents | 2021–22 Planned full-time equivalents | 2022–23 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 548 | 558 | 582 | 569 | 595 | 596 |

| Subtotal | 548 | 558 | 582 | 569 | 595 | 596 |

| Internal Services | 262 | 286 | 249 | 308 | 251 | 251 |

| Total | 810 | 844 | 831 | 877 | 846 | 847 |

Expenditures by vote

For information on the Department of Finance Canada's organizational voted and statutory expenditures, consult the Public Accounts of Canada 2020–2021.

Government of Canada spending and activities

Information on the alignment of the Department of Finance Canada's spending with the Government of Canada's spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

The Department of Finance Canada's financial statements (unaudited) for the year ended March 31, 2021, are available on the departmental website.

Financial statement highlights

| Financial information | 2020–21 Planned results |

2020–21 Actual results |

2019–20 Actual results |

Difference (2020–21 Actual results minus 2020–21 Planned results) |

Difference (2020–21 Actual results minus 2019–20 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 99,602,648,202 | 122,721,756,542 | 100,312,421,147 | 23,119,108,340 | 22,409,335,395 |

| Total revenues | - | 65 | 51 | 65 | 14 |

| Net cost of operations before government funding and transfers | 99,602,648,202 | 122,721,756,477 | 100,312,421,096 | 23,119,108,275 | 22,409,335,381 |

| Financial information | 2020–21 | 2019–20 | Difference (2020–21 minus 2019–20) |

|---|---|---|---|

| Total net liabilities | 1,142,509,655,357 | 787,090,575,792 | 355,419,079,565 |

| Total net financial assets | 180,138,378,106 | 195,387,406,117 | -15,249,028,011 |

| Departmental net debt | 962,371,277,251 | 591,703,169,675 | 370,668,107,576 |

| Total non-financial assets | 9,956,571 | 10,857,410 | -900,839 |

| Departmental net financial position | 962,361,320,680 | 591,692,312,265 | 370,669,008,415 |

Corporate information

Organizational profile

Appropriate ministers:

The Honourable Chrystia Freeland, P.C., M.P.

The Honourable Randy Boissonnault, P.C., M.P.

Institutional head: Michael Sabia

Ministerial portfolio: Department of Finance

Enabling instrument[s]: The Minister of Finance has direct responsibility for a number of Acts and is assigned specific fiscal and tax policy responsibilities relating to other acts that are under the responsibility of other ministers. A list of some of these Acts can be found below:

- Air Travellers Security Charge Act

- Asian Infrastructure Investment Bank Agreement Act

- Bank Act

- Bank for International Settlements (Immunity) Act

- Bank of Canada Act

- Bills of Exchange Act

- Borrowing Authority Act

- Bretton Woods and Related Agreements Act

- Budget Implementation ActsFootnote 7 (under various titles)

- Canada Deposit Insurance Corporation Act

- Canada Pension PlanFootnote 8

- Canada Pension Plan Investment Board Act

- Canadian International Trade Tribunal Act

- Canadian Gender Budgeting Act

- Canadian Payments Act

- Canadian Securities Regulation Regime Transition Office Act

- Cooperative Credit Associations Act

- Currency Act

- Customs Tariff

- Depository Bills and Notes Act

- European Bank for Reconstruction and Development Agreement Act

- Excise Act, 2001

- Excise Tax Act

- Federal-Provincial Fiscal Arrangements Act

- Financial Administration Act

- Financial Consumer Agency of Canada Act

- First Nations Goods and Services Tax Act

- Greenhouse Gas Pollution Pricing Act (Part 1)

- Income Tax Act

- Income Tax Conventions Interpretation Act

- Insurance Companies Act

- Interest Act

- Nova Scotia and Newfoundland and Labrador Additional Fiscal Equalization Offset Payments Act

- Office of the Superintendent of Financial Institutions Act

- Payment Card Networks Act

- Payment Clearing and Settlement Act

- Pension Benefits Standards Act, 1985

- Pooled Registered Pension Plans Act

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Protection of Residential Mortgage or Hypothecary Insurance Act

- Royal Canadian Mint Act

- Special Import Measures Act

- Tax-Back Guarantee Act

- Trust and Loan Companies Act

- Winding-up and restructuring Act (Parts II and III)

Year of incorporation / commencement: 1867

Raison d'être, mandate and role: who we are and what we do

"Raison d'être, mandate and role: who we are and what we do" is available on the Department of Finance Canada's website.

For more information on the department's organizational mandate letter commitments, see:

The Honourable Chrystia Freeland, P.C., M.P., Deputy Prime Minister and Minister of Finance

The Honourable Randy Boissonnault, P.C., M.P., Minister of Tourism and Associate Minister of Finance

Operating context

Information on the operating context is available on the Department of Finance Canada's website.

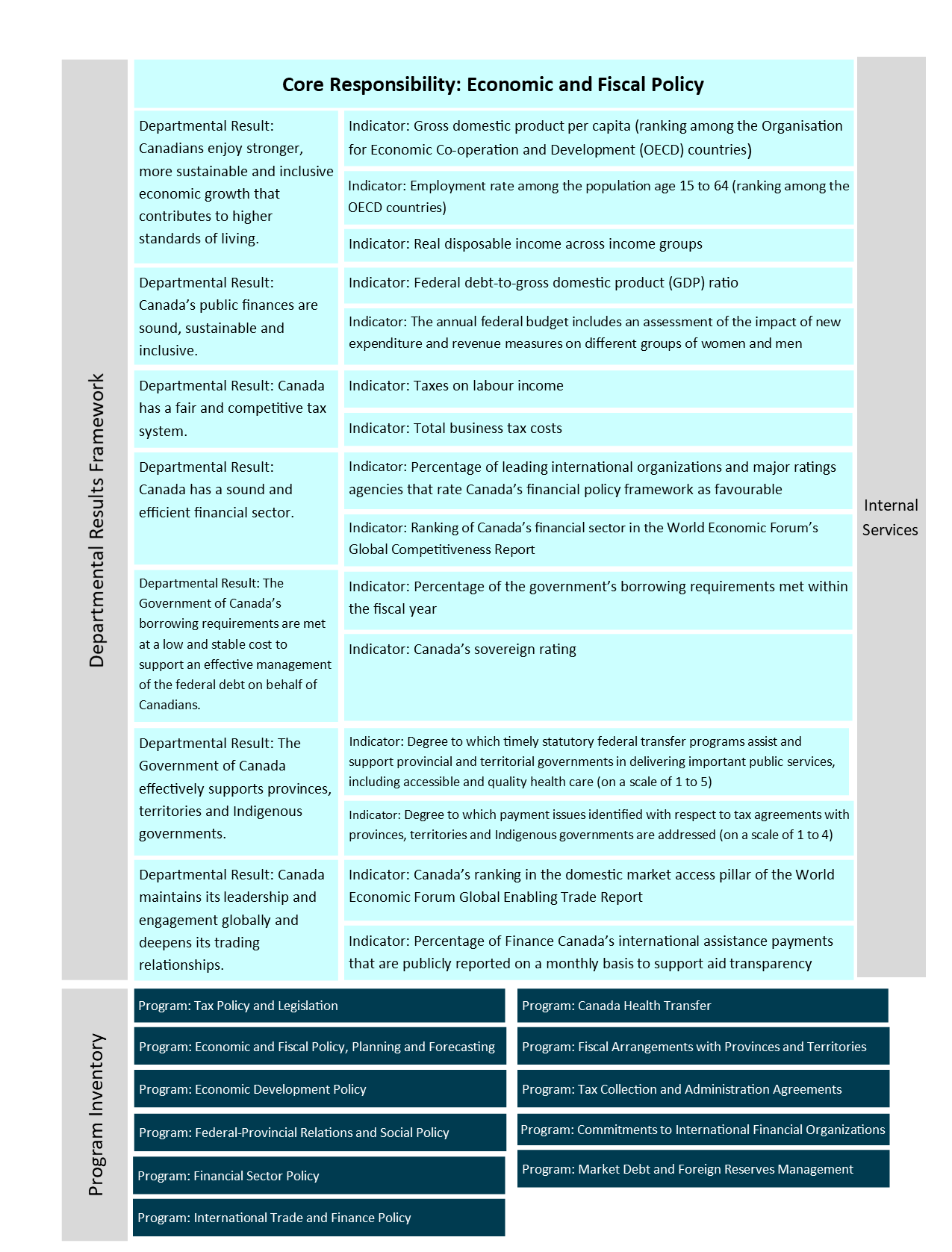

Reporting framework

The Department of Finance Canada's Departmental Results Framework and Program Inventory of record for 2020–21 are shown below:

Supporting information on the program inventory

Financial, human resources and performance information for the Department of Finance Canada's Program Inventory is available in GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Department of Finance Canada's website:

- Reporting on Green Procurement

- Details on transfer payment programs

- Gender-based analysis plus

- Response to parliamentary committees and external audits

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA+ of tax expenditures.

Organizational contact information

Mailing address:

Department of Finance Canada

15th Floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Telephone: 613-369-3710

Fax: 613-369-4065

Email: fin.publishing-publication.fin@canada.ca

Website: Department of Finance Canada website

Appendix: definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

core responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel)

A report on the plans and expected performance of an appropriated department over a 3year period. Departmental Plans are usually tabled in Parliament each spring.

departmental priority (priorité)

A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

departmental result (résultat ministériel)

A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

departmental result indicator (indicateur de résultat ministériel)

A quantitative measure of progress on a departmental result.

departmental results framework (cadre ministériel des résultats)

A framework that connects the department's core responsibilities to its departmental results and departmental result indicators.

Departmental Results Report (rapport sur les résultats ministériels)

A report on a department's actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

experimentation (expérimentation)

The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

fulltime equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the fulltime equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person's collective agreement.

gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+])

An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race ethnicity, religion, age, and mental or physical disability.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2020–21 Departmental Results Report, those high-level themes outlining the government's agenda in the 2019 Speech from the Throne, namely: Fighting climate change; Strengthening the Middle Class; Walking the road of reconciliation; Keeping Canadians safe and healthy; and Positioning Canada for success in an uncertain world.

horizontal initiative (initiative horizontale)

An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

nonbudgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement)

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement)

The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

program inventory (répertoire des programmes)

Identifies all the department's programs and describes how resources are organized to contribute to the department's core responsibilities and results.

result (résultat)

A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization's influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.

Page details

- Date modified: