Modernizing Canada’s Employment Insurance (EI) Program: Consultations – The What we heard report (Phase 1)

On this page

Overview

EI modernization

The Government of Canada is committed to modernizing the Employment Insurance (EI) program for the 21st century. It intends to build a stronger program that covers all workers. That will include workers in seasonal employment and self-employed workers. The government is also committed to making EI easier to apply for and better able to adapt when the job market and the needs of workers and employers change.

The goal is to build a modern EI program that is:

- resilient

- accessible

- adequate

- financially sustainable

A crucial part in developing this modern EI system is gathering input from interested Canadians and EI experts. During Phase 1 of the consultations, everyone who took part shared their opinions on key issues and priorities for the program. Read the backgrounder to learn about the themes covered during these consultations.

The technological challenge

Developing a modern EI program will take time and will require a new information technology structure. The current technology supports the needs of millions of Canadians but it is also 50 years old and is made up of a mix of 150 system solutions that have been added over the years to deliver benefits. We will need to make changes to modernize the program in stages over several years. This will ensure that service to Canadians is not impacted. We will make the first changes in 2022 with the planned EI sickness benefit extension from 15 to 26 weeks.

About the consultations

We are taking a phased approach to the consultations to make sure we get the best advice possible on all the important EI issues.

- Phase 1 (August 2021 to February 2022) of the consultations is complete. It focused on gathering input from interested Canadians and stakeholders on the changing nature of work, access to EI, simplifying EI, self-employed and gig workers, life events, seasonal work and the Premium Reduction Program (PRP). This report summarizes what we heard during the first phase of EI consultations

- Phase 2 will explore issues related to EI adequacy and financing to complement Phase 1 consultations on the broad theme of EI access, while also taking a deeper dive into some areas discussed in Phase 1 that require further focused examination, such as supports for the self-employed, seasonal work and the PRP

The first phase

In August 2021, the department of Employment and Social Development Canada (ESDC) launched the first phase of the consultations. A national roundtable was led by the Minister of Employment, Workforce Development and Disability Inclusion, the EI Commissioner for Workers and the EI Commissioner for Employers.

The process for consultations on Phase 1 ended on February 17, 2022, also with a national roundtable led by the Minister and the Commissioners, who also all provided a joint statement. We heard from Canadians in the following ways:

- public online survey: A national online survey was open for all Canadians from August 2021 to November 2021. Over 1900 respondents shared their views on EI modernization through the survey. See Annex A for further details on the profile of survey respondents

- written submissions: Over 70 submissions were received from a cross-section of national and regional labour and employer organizations and other key stakeholders between August 2021 and March 2022. See Annex B for the profile of stakeholders who have provided written submissions

- targeted stakeholder sessions: Over 20 national and regional roundtables were jointly hosted by the EI Commissioner for Workers and EI Commissioner for Employers as well as either the Minister of Employment, Workforce Development, and Disability Inclusion, her delegates or departmental officials. More than 200 stakeholders from across the country participated representing workers, employers, unions, industry groups, academics, labour market experts and other key stakeholders, including self-employed and gig worker associations, parent and family associations, community advocacy groups, and health organizations. See Annex C for list of roundtable participants

What we heard – key takeaways

We summarize in this section the views from those who participated in Phase 1 of the consultations. The key takeaways identified here should not be projected as being representative of the entire Canadian population or of all ESDC stakeholders.

Overall priorities for EI modernization

We heard from stakeholders that the EI program continues to be a crucial part of Canada’s social safety net but it has not kept up with the realities of today’s labour market and changes in the workforce. More Canadians are working in non-traditional forms of employment and work arrangements. The needs of families are also evolving, and we heard loud and clear that the way EI impacts families needs comprehensive reform. We also heard that numerous changes over the years have resulted in a complex, burdensome program. Simplifying it also needs to be a priority.

Workers and stakeholders representing workers emphasized the need to:

- improve access for those who contribute but may be excluded through reduced criteria and more flexible qualifying rules

- ensure workers have equitable access to their full benefit entitlement

- provide more flexible supports for parents when accessing and combining benefits

- address the situation of misclassified employees first when developing supports for self-employed and gig workers

“The EI program is extremely important to workers, employers, communities, and regional economies across the country. Despite the original intent of the program, it no longer provides the level of support that workers need to bridge periods where they have no attachment to the labour market.”

Written submission

Employer groups emphasized the need to:

- make sure EI is financially viable, limiting premium rate increases and reduce administrative burden on employers

- focus on the program’s core insurance principles of income support following job loss

- position the EI program to respond in times of job loss, while not contributing to labour shortages

- make sure people stay connected to the labour market including through upskilling and re-skilling in labour shortage periods

“EI is an important program for workers (…) It is essential that the federal government keep in mind the realities of job creators and avoid changes to the EI system that will impose further costs and create disincentives for Canadians to participate in the workforce.”

Written submission

Access to EI

Under permanent EI eligibility requirements, access to EI regular benefits for the unemployed is determined based on variable entrance requirement (VER) rules. This means that claimants applying for regular benefits are required to show that they worked between 420 and 700 insurable hours in the qualifying period (usually the 52 weeks before the claim). The number of hours needed to qualify for EI varies because it is based on the monthly unemployment rate in the EI region where claimants live. The higher the regional unemployment rate, the fewer insurable hours required to qualify.

Budget 2021 introduced a temporary measure of 420 hours as a common national entrance requirement for workers to qualify for both regular and special benefits for a period of one year. With the end of COVID-19 temporary measures, a return to the regional variation for EI eligibility rules is set to resume in September 2022.

During the consultations, there were general calls among worker groups and some support among employers to remove the regional variations in EI eligibility rules. If that happened, the same qualification rules would apply to all unemployed Canadians, in the same circumstances, wherever they live.

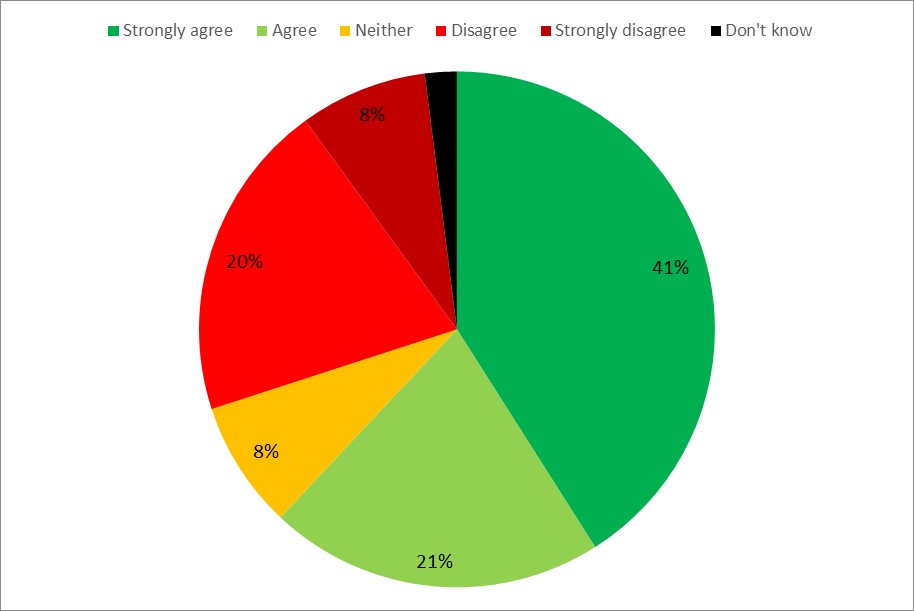

As illustrated in Figure 1, 62% of survey respondents (43% of employer respondents) agreed that EI entrance requirements should be the same regardless of where you live across Canada. Some said the differences in EI entrance requirements are unfair. They noted that regional unemployment rates do not necessarily reflect labour market realities for all sectors and workers within a geographic area, noting disparities in access to EI between full-time versus part-time workers and between those living in urban versus non-urban regions. In addition, unemployed workers may not have the necessary qualifications for the jobs offered in their region, noted the respondents, so even if jobs are available, not all workers would be qualified to do the work.

Participants in the consultations (including survey respondents and through written submissions) were divided about what the appropriate threshold should be for a common entrance requirement. Labour groups favoured lower thresholds (360 and 420 hours were common suggestions), while employer groups preferred higher thresholds. Employers are also concerned about the potential impact on premiums and potential impact on labour supply.

Worker groups also recommended:

- lowering the hours threshold and/or instituting a hybrid model where the number of weeks might qualify someone in order to better capture part-time and precariously employed workers, who are predominantly women

- eliminating the one-week waiting period before receiving benefits

- facilitating access to EI for workers who combine benefits because of successive life events

“The priority of EI reform should be to expand access to EI benefits. […] Barriers to access limit the ability of EI to serve as an effective automatic stabilizer in economic downturns.”

Roundtable participant

"It is essential that we do not lose sight of the purpose of the EI system and avoid making it the solution to all social issues, no matter how noble." (translation)

Roundtable participant

Text description of figure 1

| Response | Percentage |

|---|---|

| Strongly agree | 41% |

| Agree | 21% |

| Neither | 8% |

| Disagree | 20% |

| Strongly disagree | 8% |

| Don't know | 2% |

Simplifying EI

Since its inception more than 80 years ago, the EI program has grown and become more complex. Several stakeholders said that the program should be simplified to make it easier for workers and employers to understand and use. In their view, there are opportunities to simplify the application requirements, including the Record of Employment and the coding for reasons for leaving a job. Some employers said that it was difficult to determine the reason for quitting and were not sure how to fill in the form.

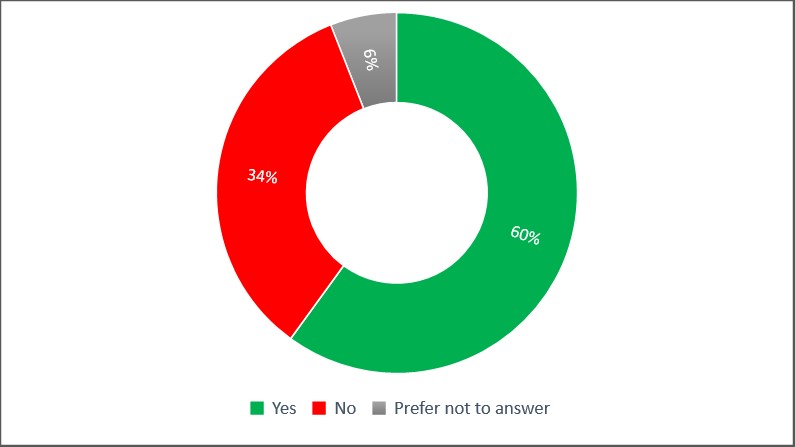

We also asked about the EI temporary simplification measures in effect until September 2022. These measures have simplified the rules around the treatment of severance, vacation pay, and other monies paid on separation during the pandemic. There was support from labour groups for simplified monies on separation rules, that is to say, removing vacation pay and severance pay received on job separation from earnings calculations. In the survey, we asked about the temporary measure that allows claimants who receive severance pay to receive their EI benefits at the same time. 60% of respondents were in favour of making this measure permanent, as shown in Figure 2.

Text description of figure 2

| Response | Percentage |

|---|---|

| Yes | 60% |

| No | 34% |

| Prefer not to answer | 6% |

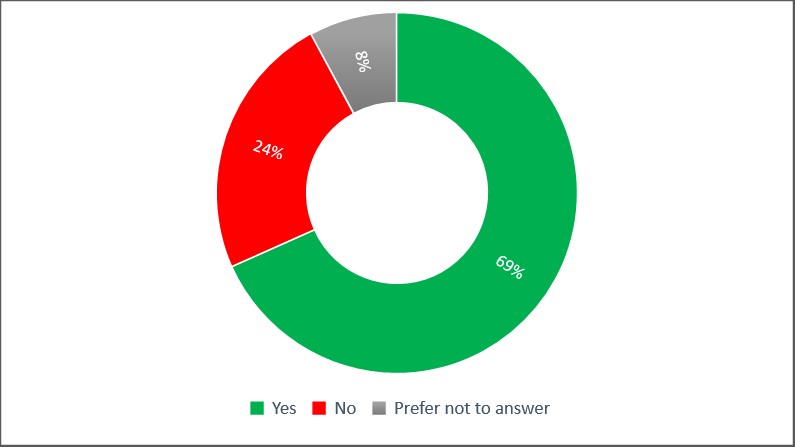

There was also general support for easing rules around the reasons for job separation. To simplify and improve access to EI for those who hold multiple jobs, workers who become unemployed are temporarily able to access EI as long as their most recent job loss was with just cause (for example, a layoff.) We asked about this temporary simplification measure. 69% of the survey respondents agreed that this measure should be made permanent, as shown in Figure 3.

Text description of figure 3

| Response | Percentage |

|---|---|

| Yes | 69% |

| No | 24% |

| Prefer not to answer | 8% |

A requirement to qualify for EI is that the person lost their job with just cause, which means typically people who quit or are fired from their job do not qualify for EI. Labour stakeholders recommended easing or removing the “quit” and “fire” disqualifications or to limit these disqualifications to a period of time (for example, 3 weeks). They noted that these disqualifications are more likely to impact women and vulnerable workers in part-time, multiple jobs. They are more likely to leave a job because of harassment, discrimination or other justified reasons that may not be recorded by employers.

Employers cautioned against easing rules in a way that may leave workers with little incentive to find another job. They were also concerned that these measures may result in higher premiums and costs. Many employers noted that it is important to limit access to EI when an individual is fired with just cause. Employer groups indicated that employers generally do not want to be responsible for assessing an employee’s reason for quitting.

Participants in the consultations also recommended building some flexibility into the program for claimants to be able to “try out” a new job while on claim without impacting their entitlements should they leave after a trial period.

“I think the government should consider simplifying the qualifications for EI so claims can be processed faster.”

Survey respondent

Life events

EI maternity and parental benefits are key supports to parents welcoming a new child into their home. The government is also committed to introducing a 15-week benefit for adoptive parents, including LGBTQ2 families.

During the consultations, there was support for providing the same EI benefits for parents who adopt and biological parents. There was also general support for providing more flexibility for parents in how they use and share their weeks of parental benefits, while not constraining employers’ need to plan to cover absences.

Stakeholders representing adoptive parents explained the ways in which the experience of adoptive parents is different from that of birth parents: for example, many adopted children are older and sometimes come from traumatic situations. Participants noted that a 15-week benefit for adoptive parents (that matches what is available to biological parents) would help with building an emotional bond between parents and their children and would assist their children with adapting to a new environment.

“The faces of children and youth being adopted have changed dramatically - kids are typically older, have sibling groups and have special needs. We are asking for a more equitable and inclusive system at 15 weeks of attachment leave, which is the same as for parents who gave birth.”

Roundtable participant

Some stakeholder groups and experts recommended that parents be allowed to use parental benefits as needed during the first 2 or more years of a child’s life. Employers cautioned that multiple non-continuous leaves might make it more difficult for them to plan for covering absences and may have an impact on staffing costs and administrative burden.

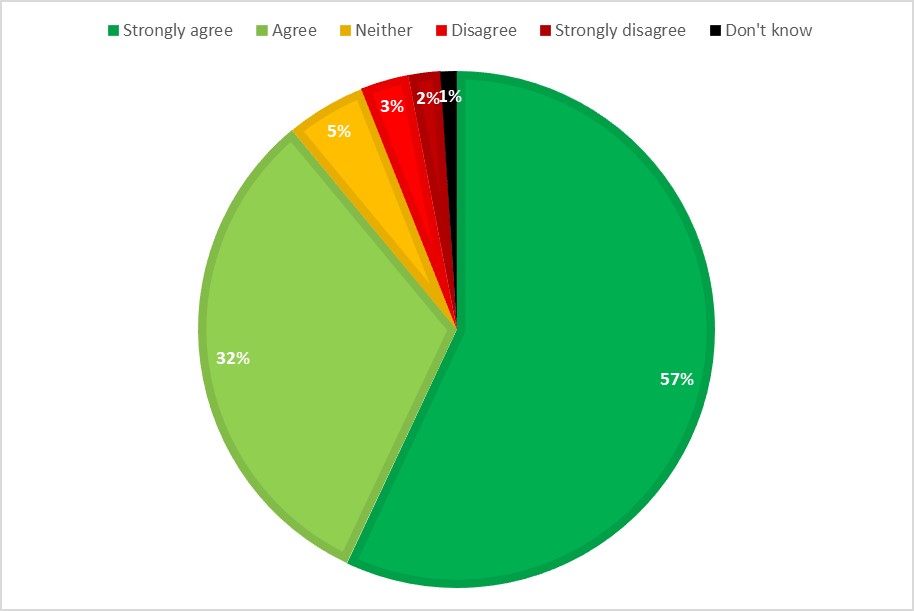

There was support for eliminating limits on combining special benefits and regular benefits when experiencing life events in close succession: for example, 89% of survey respondents agreed that parents who lose their job prior to welcoming a child should be able to access EI benefits for job loss without having any impact on their EI maternity and/or parental benefits (See Figure 4).

Text description of figure 4

| Response | Percentage |

|---|---|

| Strongly agree | 57% |

| Agree | 32% |

| Neither | 5% |

| Disagree | 3% |

| Strongly disagree | 2% |

| Don't know | 1% |

Parent groups suggested that there should be greater flexibility in the rules to encourage parents to maintain a connection to the workplace during leave periods without being penalized. The United Kingdom’s “keeping in touch days,” which allow parents to work up to 10 days while on claim, was seen as model worth exploring.

A number of labour participants requested that the replacement rate for EI benefits be increased. The current replacement rate for part-time and low income workers was seen as being too low for beneficiaries to be able to cover basic living expenses. It was noted that an added benefit of raising the replacement rate would be to incentivize higher income earners in 2-parent families to also take parental leave.

Self-employment and gig work

“When you are self-employed, you never know from one month to the next what your income will be.”

Survey respondent

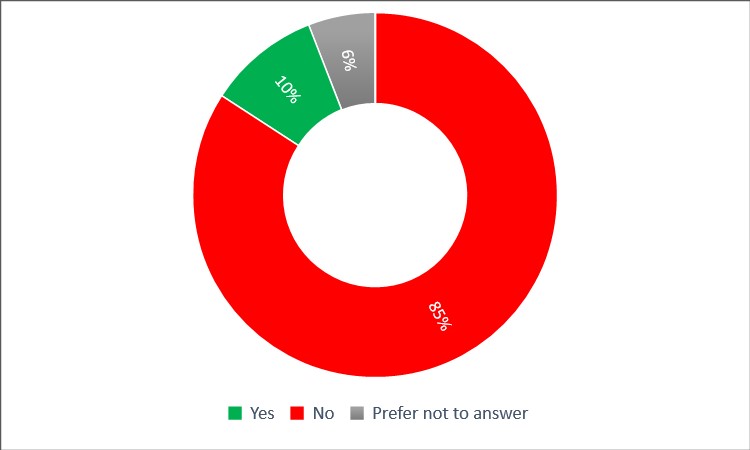

Of the gaps in the EI program highlighted by the COVID-19 pandemic, none was more evident than the circumstances facing Canada's self-employed and gig workers. Throughout the consultations, there was recognition that many self-employed and contract workers lack access to financial supports in times of hardship and would benefit from an income support program. 85% of survey respondents (and 94% of self-employed respondents) believe that before the introduction of temporary COVID measures, there were not enough financial supports available for the self-employed during periods of hardship (see Figure 5).

Text description of figure 5

| Response | Percentage |

|---|---|

| No | 85% |

| Yes | 10% |

| Prefer not to answer | 6% |

Participants in the consultations noted that the self-employed are a highly diverse group so before developing a new benefit for the self-employed, the term self-employment needs to be better defined.

Many worker groups recommended that as a priority, the government should review whether some workers are being misclassified as independent contractors. This would prevent them from accessing the same benefits as employees. Because of the complexity, stakeholders and experts recommended more consultations on this issue.

Some stakeholders suggested that any income support program for the self-employed should be flexible because of the unique experiences of self-employed workers and the different sectors in which they work.

We also heard from numerous self-employed workers in the arts and cultural sectors. They asked that the EI program better reflect their current labour market realities. For example, many are paid flat fees per contract, regardless of the length of the contract and work required to prepare in-between contracts.

"A dancer will practice every day, a visual artist will have to clean his studio between different works, go buy his material, a singer will rehearse his songs before the day of the recording, all of them will have to fill out their tax returns, do their financial statements, etc. This reality is the daily work of the artist and the self-employed worker, but does not bring ANY remuneration. Whereas an employee who performs all his tasks for a company will be paid. This must be taken into account in a modernization of employment insurance." (translation)

Roundtable participant

A slight majority of participants would prefer that joining any new income support program be voluntary rather than mandatory: 53% of survey respondents favoured “opt-in and voluntary” and 41% “mandatory.” The rest preferred not to answer the question.

A number of stakeholders were concerned that if joining was voluntary, there may not be a sufficient number of contributors to keep the program affordable and accessible. Some pointed to the current EI special benefits for self-employed workers. It is a voluntary opt-in program but has low enrollment.

Participants were clear that any new self-employed benefit would need a solid financing model. For example, some participants asked who would pay the employer portion of the premiums. And how would it be affordable enough to encourage workers to opt-in?

Several participants noted that the Quebec Parental Insurance Plan provisions for the self-employed is an excellent model.

Some workers are in mixed employment situations. These types of workers receive income from a job where they are an employee in a traditional employer-employee relationship, and also receive income from some form of self-employment. To help support evolving work conditions, many stakeholders said any future program should be flexible enough to accommodate their access to EI benefits – perhaps by lessening the “availability for work” requirements within EI.

Workers in seasonal industries

"First, it's important to mention that it's not the workers who are seasonal but their jobs." (translation)

Written submission

Work in seasonal industries in Canada can be unpredictable and this can impact workers' access to EI benefits.

Fluctuations in regional unemployment rates and the availability of work for workers in seasonal industries during their on-seasons and off-seasons of work are important factors. They affect the number of insurable hours a worker needs to qualify for EI benefits, the number of weeks they are entitled to receive benefits, and their weekly EI benefit rate.

In areas with higher proportions of work in seasonal industries, there are more unemployed workers looking for fewer available jobs during the off-season. This makes it especially difficult to find work after being laid off from a seasonal job.

We heard from participants that workers in seasonal industries are an important asset to those industries and regions. They stressed the importance of better understanding and defining seasonal work, including regional and sectoral differences to inform any EI changes going forward. For example, some observed that while seasonal work is often associated with rural areas and natural resource sectors, seasonal work also exists in urban areas in the tourism and education sectors. Participants said that seasonal workers should be treated the same across the country.

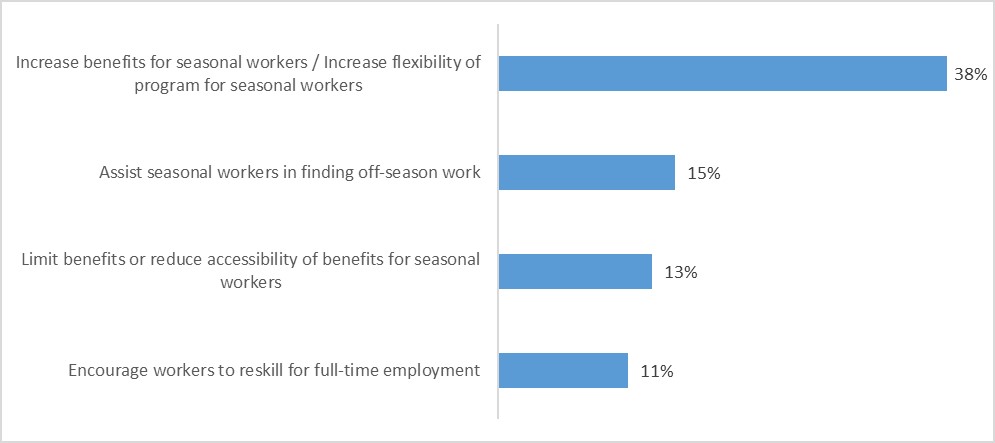

There were also suggestions that more resources should be invested in helping to equip workers in seasonal industries to find work off season. Suggestions included helping workers develop skills for off-season jobs and offering more flexibilities for accepting short-term work while on EI. Figure 6 illustrates the most common responses to the question of how the EI program can provide better support to workers in seasonal industries.

Text description of figure 6

| Top responses | Percentage |

|---|---|

| Increase benefits for seasonal workers / Increase flexibility of program for seasonal workers | 38% |

| Assist seasonal workers in finding off-season work | 15% |

| Limit benefits or reduce accessibility of benefits for seasonal workers | 13% |

| Encourage workers to reskill for full-time employment | 11% |

Employers cautioned about potential labour shortages in seasonal industries. Specifically, any program change should not reduce the incentive to work. Within seasonal industries, there is an expectation that workers will return year after year. To maintain this pattern, and to help guard against labour shortages, they recommended strengthening existing measures such as the Working While on Claim provisions in the EI program.

Some worker groups also asked that the current use of the formula to determine the weekly benefit rate for an EI claimant be replaced by a different formula, such as best 12 weeks, in recognition that work hours may vary throughout the season.

In an attempt to address challenges faced by workers in seasonal industries, the government designed a pilot project. The project tested the targeting of additional income support by providing up to an additional five weeks of EI regular benefits to qualifying workers living in one of the 13 targeted regions.

The consultations found general support for the pilot project, even though some criticized the mechanism used to identify potential beneficiaries. Some suggested that “seasonal layoff” should be included as a reason for separation on records of employment forms to help identify workers in seasonal industries. Some participants recommended expanding the pilot project and increasing the number of additional weeks of benefits available.

Those who did not support making the pilot project permanent questioned whether it was the best mechanism to achieve the desired results. They suggested that greater emphasis be placed on other measures such as promoting greater labour mobility within Canada and supporting workers in finding seasonal jobs beyond the season they typically work. Meaning a worker who works a summer job could also have the opportunity to work during the fall, winter or spring in other lines of work.

“We employ multiple seasonal staff each summer and I always worry that they will not be able to access EI once the season has ended.”

Survey respondent

“You want the work product from seasonal workers but you don’t want them to be seasonal, I am not sure how that works.”

Roundtable participant

Premium reduction program (PRP)

The PRP allows employers to apply for a reduction of EI premiums if they offer income-protection coverage to employees through a short-term disability plan that is similar to EI sickness benefits. Employer-sponsored short-term disability plans can reduce the financial and administrative load on the EI program by acting as the first payer, which the government recognizes through the premium reduction. Employees also receive a portion of the employer's savings directly from their employer.

We heard from participants that there is low awareness of the PRP and that the government should consider communicating with employers and employees of its advantages as EI is modernized. Participants recognized that insurers currently play an important role in helping employers and employees navigate the system and suggested greater collaboration with insurers to raise awareness of the PRP and any changes to it, including as part of its delivery.

The government may require changes to the PRP as part of its extension of EI sickness benefits from 15 to 26 weeks, as reaffirmed in Budget 2022. During the consultations, we heard that there was general agreement that employers with plans that already meet the current requirements should not be penalized by the extension of the EI sickness benefits program to 26 weeks.

Employers and insurers indicated that they will need time to consider what the impact of the change will be on short-term disability plans. For unionized workplaces, potential adjustments to benefit plans offered by employers will also need to be negotiated.

Participants observed that the landscape for benefits continues to evolve and the PRP needs to adapt. As such, it was suggested that the requirements for the program be eased and that greater flexibility be provided for more employer-sponsored plans to qualify. Participants also called for simplifying the application process, including ensuring that it can be easily completed online. Some participants suggested increasing the financial incentives for employers to participate, in particular small and medium-sized employers. Finally, labour stakeholders asked for greater transparency on how the employees’ share of premiums are returned to them.

“One of the obstacles is the lack of awareness of what the requirements are (…). If an employer has already set up and met requirements, it should not be onerous to submit an application for the PRP.”

Roundtable participant

“The Premium Reduction Program could be useful to small and medium sized enterprises if it were better known as it may encourage them to explore short-term disability plans and participate in the PRP program.”

Written submission

Other issues raised in consultations

Many participants raised a number of other issues of importance to them with respect to EI modernization, which were not in scope for Phase 1 of the consultations. Several of these issues, including the adequacy of benefits and EI financing, will be covered in Phase 2 of the consultations to provide participants with additional opportunities for input on these topics.

Adequacy of benefits

Labour groups and experts submitted several proposals and called for a number of changes which would increase the adequacy of benefits, including:

- increasing the replacement rate or establishing a minimum floor as was provided during the pandemic ($500/week)

- increasing the duration of regular benefits (varies depending on the regional unemployment rate and insurable hours of employment)

- increasing the Maximum Insurable Earning threshold ($60,300 in 2022)

- eliminating the divisor used to determine the benefit amount

- increasing the EI Family Supplement, a top-up for low-income claimants with children

“When I was doing a full-time job with minimum wage, I was getting $2000 per month. But when I apply for EI, I receive 55% of my salary which is $1100 only. How can I survive on 55% of my income?”

Written submission

Financial sustainability of EI

There was common agreement among participants in the consultations that building a more inclusive and responsive EI program will require a strategy to ensure the long-term financial sustainability of the program. Employers expressed concerns that changes to the program and the impact of pandemic-related expenditures would lead to a steep increase in EI premiums affecting the financial sustainability of their businesses.

They recommended exploring options to keep premiums manageable, including revising the ratio of employer to employee contributions.

Both workers and employers called for the government to consider different EI financing models. For example, some participants suggested that the government could partially finance EI expenditures, as it did prior to the 1990s – or stop funding special benefits through premiums. Some participants also requested that the program cover the costs incurred during the pandemic, and that these costs not be passed on to employers and workers through higher premiums.

“EI rates should be indexed appropriately and ensure stable, predictable rates so that the program helps mitigate economic cycles. Once the EI program is modernized, it will also be equally important to guarantee its sustainability. That includes ensuring EI revenues be used exclusively for the EI program.”

Written submission

Incentives to work and training

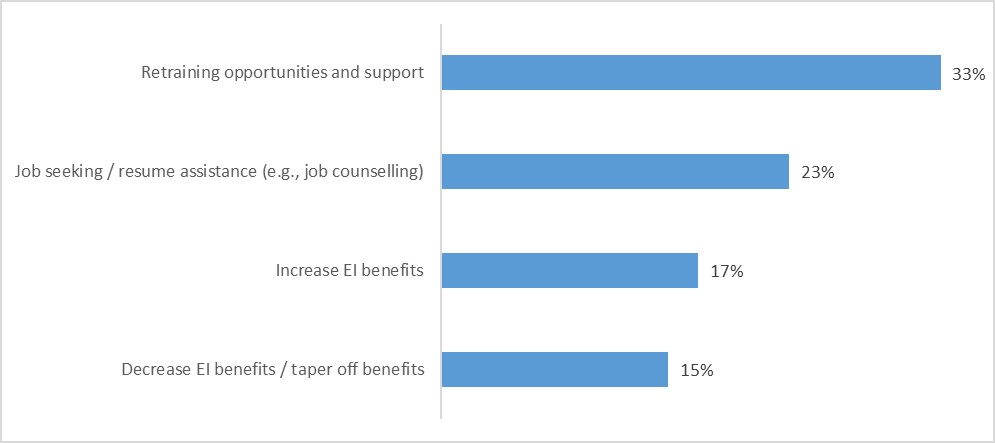

Participants underscored the need for more flexibility for working while on claim and exploring expanding the Work-Sharing program. There were overarching calls for more flexibility and employer incentives to support training while on EI as a priority, including suggestions to remove the disqualification for those who quit to return to school. When asked how the EI program could better support unemployed individuals in returning to work, the most common answers related to providing retraining opportunities and support (see Figure 7).

Text description of figure 7

| Top response | Percentage |

|---|---|

| Retraining opportunities and support | 33% |

| Job seeking / resume assistance (for example, job counselling) | 23% |

| Increase EI benefits | 17% |

| Decrease EI benefits / taper off benefits | 15% |

“For many workers in the oil and gas sector to adequately transition to new jobs, they will need to upgrade their skills or re-train to work in a different trade. The EI program must support these workers and their families during this transitional period by allowing them to access EI benefits.”

Written submission

Migrant workers

Worker groups said that migrant workers pay into the program but rarely take advantage of it. They recommended providing them greater access to the program.

Delivery and oversight of benefits

Participants raised a number of issues related to the delivery and oversight of the benefits. Some of the more commonly raised recommendations were:

- restoring the Service Canada liaison service

- increasing regional presence to assist claimants and employers

- simplifying the application process, including more plain language instructions

- strengthening the monitoring of potential abuse

Board of Appeal and tripartite management

Participants requested the re-establishment of an EI Board of Referees and a return to a tripartite funding model.

Labour disputes

Labour groups requested reviewing the rules around EI eligibility at the end of labour disputes when operations have not fully resumed as well as considering benefits to workers during a lockout.

Next steps

During the consultations, we heard agreement from many participants across Canada and across sectors that the EI program needs to be modernized. We heard that we need a program that works when unemployment is high as well as in times of labour shortages. We heard that we need a program that is simpler and more accessible.

During Phase 2 of our consultations we will further examine issues such as adequacy of benefits and EI financing, and will take a deeper dive into some of the issues raised during Phase 1.

Annexes

Annex A – Profile of survey respondents

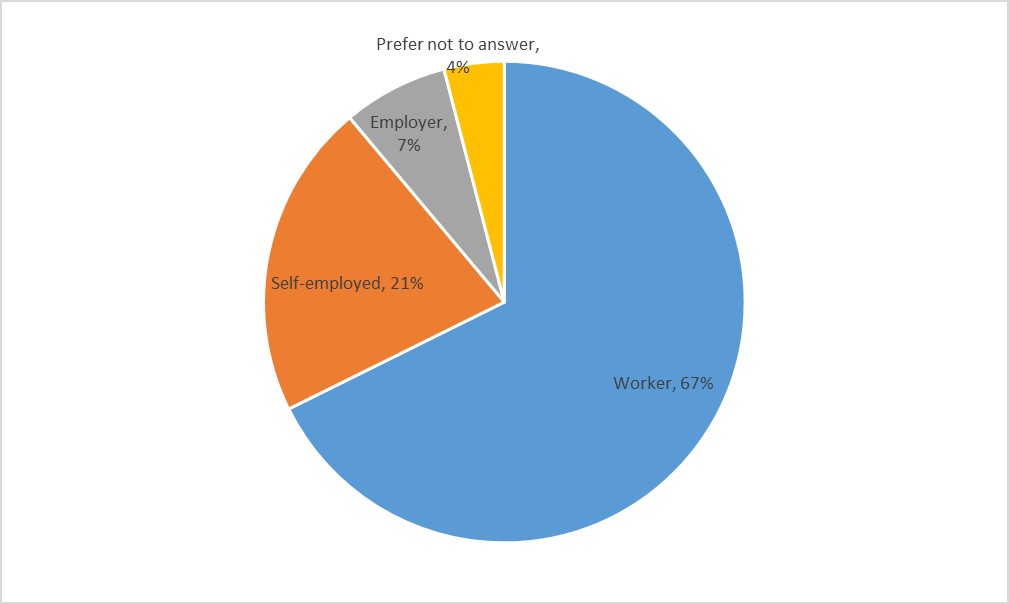

1912 respondents completed the survey, which was publicly available on the consultations website between August 9, 2021 and November 19, 2021.

- 83% of respondents completed the survey as individuals and 17% as representatives of an organization

- Of the individual respondents:

- 67% identified as workers; 21% as self-employed; 7% as employers

- 67% have prior EI experience

- 33% male, 67% female

- Of the organizational respondents, 55% represented employers. 14% were national in scope and all provinces and territories were covered

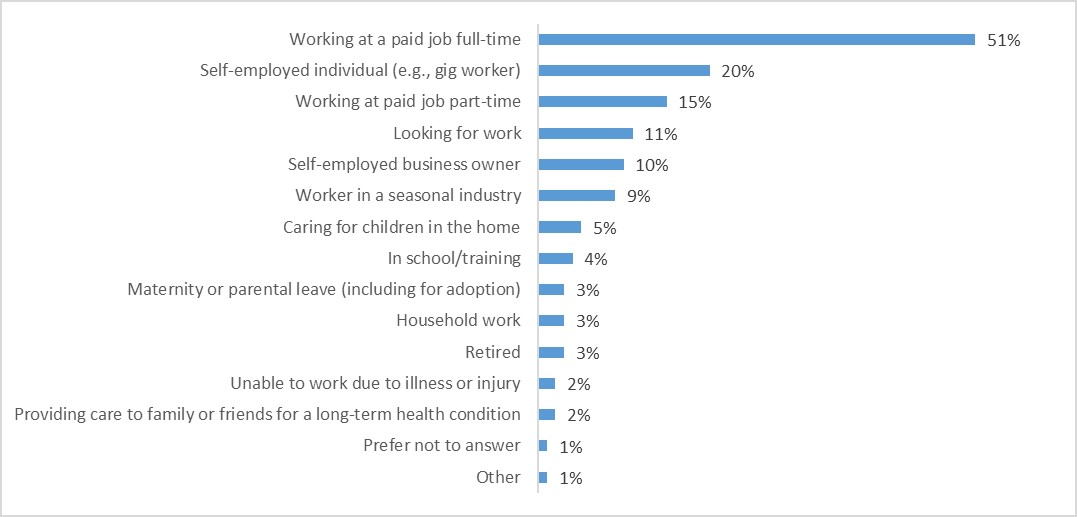

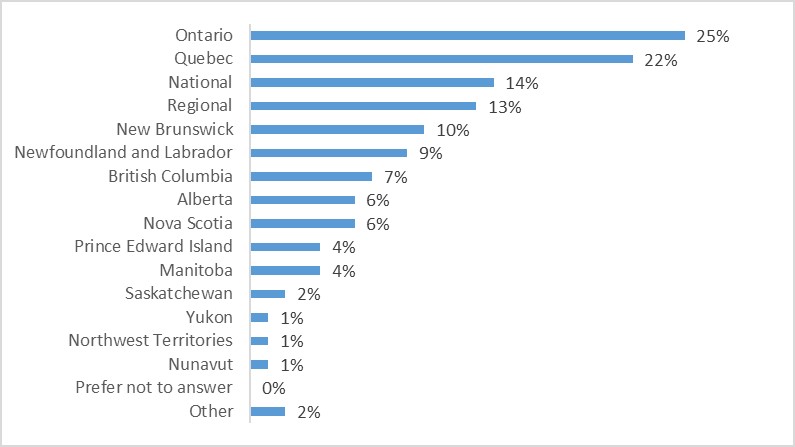

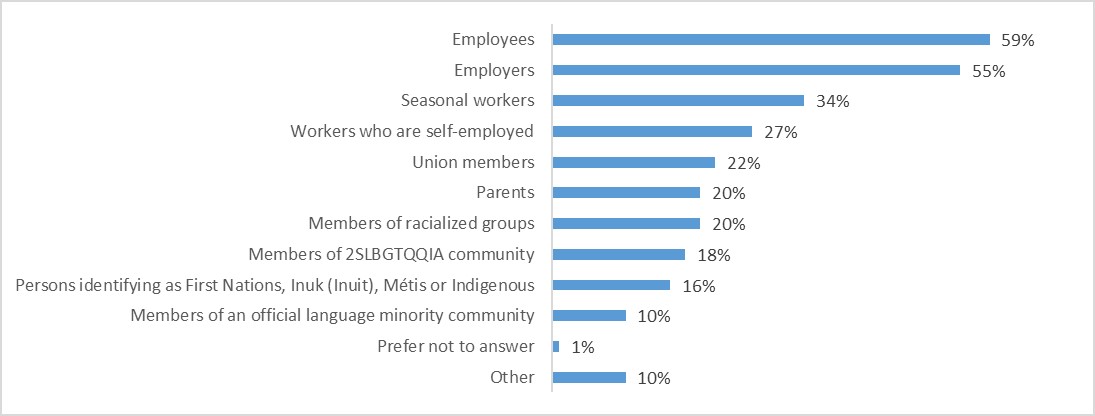

- Further details on respondents can be found in Figures 8, 9, 10 and 11

Text description of figure 8

| Survey respondents | Percentage |

|---|---|

| Worker | 67% |

| Self-employed | 21% |

| Employer | 7% |

| Prefer not to answer | 4% |

Text description of figure 9

| Survey respondents | Percentage |

|---|---|

| Working at a paid job full-time | 51% |

| Self-employed individual (for example, gig worker) | 20% |

| Working at paid job part-time | 15% |

| Looking for work | 11% |

| Self-employed business owner | 10% |

| Worker in a seasonal industry | 9% |

| Caring for children in the home | 5% |

| In school/training | 4% |

| Maternity or parental leave (including for adoption) | 3% |

| Household work | 3% |

| Retired | 3% |

| Unable to work due to illness or injury | 2% |

| Providing care to family or friends for a long-term health condition | 2% |

| Prefer not to answer | 1% |

| Other | 1% |

Text description of figure 10

| Location | Percentage |

|---|---|

| Ontario | 25% |

| Québec | 22% |

| National | 14% |

| Regional | 13% |

| New Brunswick | 10% |

| Newfoundland and Labrador | 9% |

| British Columbia | 7% |

| Alberta | 6% |

| Nova Scotia | 6% |

| Prince Edward Island | 4% |

| Manitoba | 4% |

| Saskatchewan | 2% |

| Yukon | 1% |

| Northwest Territories | 1% |

| Nunavut | 1% |

| Prefer not to answer | 0% |

| Other | 2% |

Text description of figure 11

| Type of perspective | Percentage |

|---|---|

| Employees | 59% |

| Employers | 55% |

| Seasonal workers | 34% |

| Workers who are self-employed | 27% |

| Union members | 22% |

| Parents | 20% |

| Members of racialized groups | 20% |

| Members of 2SLBGTQQIA community | 18% |

| Persons identifying as First Nations, Inuk (Inuit), Métis or Indigenous | 16% |

| Members of an official language minority community | 10% |

| Preferred not to answer | 1% |

| Other | 10% |

Annex B – Profile of stakeholders providing written submissions

58 submissions were received during the open call for submissions from August 6, 2021 to November 19, 2021. An additional 14 submissions were received between November 19, 2021 and February 28, 2022.

| Type of Stakeholder | Number |

|---|---|

| Labour and worker organization | 20 |

| Employer group | 13 |

| Organization representing arts, culture, contractual and gig workers | 11 |

| Health/disability insurance organization | 5 |

| Other (other community/social support organizations, academics) | 23 |

| Total | 72 |

Annex C – List of roundtables and participants

National opening roundtable (August 5, 2021)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Business Council of Canada

- Canada’s Building Trades Union

- Canadian Chamber of Commerce

- Canadian Federation of Independent Business

- Canadian Labour Congress

- Canadian Payroll Association

- Canadian Union of Postal Workers

- Confédération des Syndicats Nationaux

- Fédération des Travailleurs et Travailleuses du Québec

Roundtable on EI access (December 10, 2021)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Canadian Chamber of Commerce

- Canadian Federation of Independent Business

- Canadian Labour Congress

- Canadian Manufacturers and Exporters

- Canadian Payroll Association

- Conseil du patronat du Québec

- Conseil National des Chômeurs et Chômeuses

- Council of Canadians with Disabilities

- Fédération des Travailleurs et Travailleuses du Québec

- Mouvement Autonome et Solidaire Des Sans-Emploi

- Unifor

Roundtable on life events and parents’ needs (December 13, 2021)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- ACORN Canada

- Adopt4Life

- Brock University

- Canadian Chamber of Commerce

- Canadian Federation of Independent Business

- Canadian Labour Congress

- Canadian Payroll Association

- Child and Youth Permanency Council of Canada

- Conseil du patronat du Québec

- Moms at Work

- Unifor

Roundtable on self-employment (December 14, 2021)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Canada’s Building Trades Unions

- Canadian Chamber of Commerce

- Canadian Federation of Independent Business

- Canadian Freelance Union

- Canadian Labour Congress

- Canadian Payroll Association

- Conseil du patronat du Québec

- Conseil National des Chômeurs et Chômeuses

- Direct Sellers Association

- Gig Workers United

- Income Security Advocacy Centre

- West Scarborough Community Legal Services

Roundtable on life events and business and labour perspectives (December 16, 2021)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Canadian Labour Congress

- Canadian Teachers' Federation

- Federally Regulated Employers - Transportation and Communications

- Toyota Motor Manufacturing Canada

- Unifor

- Workers' Action Centre

Regional roundtable – Newfoundland and Labrador (January 11, 2022)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Association for New Canadians in NL

- Association of Seafood Producers

- Canadian Union of Public Employees

- Gros Morne Co-Operative Association

- Hospitality Newfoundland and Labrador

- Longshoremen's Protective Union

- Newfoundland and Labrador Federation of Labour

- Newfoundland Aquaculture Industry Association

- NL Employers Council

- Restaurants Canada

- St. John’s Board of Trade

- TradesNL

- Unifor Fish Food and Allied Workers

Regional roundtable – New Brunswick (January 12, 2022)

Hosts

- Parliamentary Secretary to the Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Agricultural Alliance of New Brunswick

- Aide et soutien aux travailleuses et travailleurs saisonniers du Nouveau-Brunswick

- Bricklayers and Allied Craft Workers Local 8 NB

- Chamber of Commerce Chaleur

- Chamber of Commerce for Greater Moncton

- Coalition des Chambres de Commerce de la Péninsule Acadienne

- Coalition for Pay Equity in NB

- Fredericton Chamber of Commerce

- New Brunswick Building Trades Council

- New Brunswick Business Council

- New Brunswick Federation of Labour

- Unifor

Regional roundtable – Nova Scotia (January 13, 2022)

Hosts

- Minister of Immigration, Refugees and Citizenship

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Atlantic Chamber of Commerce

- Atlantic Provinces Economic Council

- Canadian Union of Postal Workers Nova Scotia

- Canadian Union of Public Employees Nova Scotia

- Cape Breton Fish Harvesters Association

- Coldwater Lobster Association

- Eastern Shore Fishermen's Protective Association

- Forestry Sector Council

- Halifax Chamber of Commerce

- Nova Scotia Federation of Agriculture

- Nova Scotia Federation of Labour

- Nova Scotia Nurses’ Union

- Southern Nova Scotia Seasonal Workers Alliance

- Tourism Industry Association of Nova Scotia

- Unifor

Regional roundtable – Québec (January 14, 2022)

Hosts

- Secrétaire parlementaire du ministre du Logement et de la Diversité et de l’Inclusion (Logement)

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Alliance des centres-conseils en emploi

- Centrale des syndicats démocratiques

- Centrale des syndicats du Québec

- Conseil d'intervention pour les femmes au travail

- Conseil national des chômeurs et chômeuses

- Conseil québécois des ressources humaines en tourisme

- Fédération des chambres de commerce du Québec

- La Fédération nationale des communications et de la culture

- Mouvement Action-Chômage Lac-St-Jean

- Union des artistes

Regional roundtable – Prince Edward Island (January 18, 2022)

Hosts

- Minister of Employment, Workforce Development and Disability

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Atlantic Provinces Trucking Association

- Canadian Federation of Independent Business

- Canadian Homebuilders Association

- Canadian Union of Public Employees

- Creative PEI

- Greater Charlottetown Area Chamber of Commerce

- PEI Business Women's Association

- PEI Federation of Labour

- PEI Fishermen's Association

- PEI Seafood Processors Association

- Prince Edward Island Nurses' Union

- Prince Edward Island Union of Public Sector Employees

- Restaurants Canada

- Tourism Industry Association of Prince Edward Island

- Unifor

Regional roundtable – Territories (January 20, 2022)

Hosts

- Parliamentary Secretary to the Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Baffin Regional Chamber of Commerce

- Northern Territories Federation of Labour

- Northwest Territories Tourism

- NWT and Nunavut Chamber of Mines

- NWT Chamber of Commerce

- Tourism Industry Association of Yukon

- Travel Nunavut Industry Association

- Union of Northern Workers

- Yukon Chamber of Commerce

- Yukon Federation of Labour

Regional roundtable – Alberta (January 26, 2022)

Hosts

- Minister of Tourism and Associate Minister of Finance

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Alberta Chamber of Commerce

- Alberta Construction Association

- Alberta Enterprise Group

- Alberta Federation of Labour

- Alberta Hotel and Lodging Association

- Canadian Life and Health Insurance Association

- Unifor

- United Farmers of Alberta Co-operative Ltd.

- Workers' Resource Center

Regional roundtable – Ontario (January 31, 2022)

Hosts

- Parliamentary Secretary to the Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- ACTRA Toronto

- Directors Guild of Canada

- DoorDash

- Good Jobs for All Coalition

- Greater Sudbury Chamber of Commerce

- Ontario Disability Employment Network

- Ontario Federation of Labour

- Restaurants Canada

- Timmins Chamber of Commerce

- Uber Technologies Inc.

- Unifor

- United Food and Commercial Workers

- United Steelworkers Local 6500

- Vanier Community Services Centre

Regional roundtable – Manitoba (February 1, 2022)

Hosts

- Parliamentary Secretary to the Minister of Environment and Climate Change

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Business Council of Manitoba

- Canadian Federation of Independent Business

- Canadian Federation of Students – Manitoba

- Canadian Restaurant and Foodservices Association - Manitoba and Saskatchewan

- Community Unemployed Help Centre

- Construction Association of Rural Manitoba

- Human Resource Management Association of Manitoba

- Manitoba Aerospace Inc.

- Manitoba Government and General Employees’ Union

- Social Planning Council of Winnipeg

- Unifor

- United Food And Commercial Workers Canada Local 832

- Winnipeg Construction Association

Regional roundtable – British Columbia (February 2, 2022)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- BC Building Trades

- BC Council of Film Unions

- BC Federation of Labour

- Canadian Federation of Independent Business

- Community Legal Assistance Society (British Columbia)

- Delta Chamber of Commerce

- Migrant Workers Centre

- Sunshine Coast Resource Centre

- Surrey Board of Trade

- Unifor

- Whistler Chamber of Commerce

Regional roundtable – Saskatchewan (February 3, 2022)

Hosts

- Parliamentary Secretary to the Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Alliance Energy

- Indigenous Chamber of Commerce Saskatchewan

- Saskatchewan Arts Alliance

- Saskatchewan Chamber of Commerce

- Saskatchewan Federation of Labour

- Unemployed Workers Help Centre

- Unifor

Roundtable on improving the Premium Reduction Program, No. 1 (February 7, 2022)

Hosts

- Director General, EI Policy, Employment and Social Development Canada

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Canada Life

- Canadian Federation of Independent Business

- Canadian Labour Congress

- Canadian Life and Health Insurance Association

- Canadian Payroll Association

- HUB International

- ICBA Benefit Services

- Manulife Canada

- Metro Inc.

- Restaurants Canada

- SunLife

- Unifor

Roundtable on improving the Premium Reduction Program, No. 2 (February 9, 2022)

Hosts

- Director General, EI Policy, Employment and Social Development Canada

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Canada Life

- Canadian Federation of Independent Business

- Canadian Labour Congress

- Canadian Life and Health Insurance Association

- Canadian Payroll Association

- HUB International

- Manulife Canada

- Metro Inc.

- Restaurants Canada

- SunLife

- Unifor

Roundtable on seasonal work, No. 1 (February 10, 2022)

Hosts

- Associate Assistant Deputy Minister, Skills and Employment Branch, Employment and Social Development Canada

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Action-Chômage Côte-Nord

- Association of Seafood Producers

- Atkinson Charitable Foundation

- Canadian Federation of Independent Business

- Confédération des syndicats nationaux

- Conseil de la Première Nation des Innus Essipit

- Landscape Ontario

- McMaster University

- Mouvement Action Chômage Gaspésie

- Newfoundland and Labrador Federation of Labour

- Nursery and Landscaping Association

- Tourism Industry Association of Nova Scotia

- University of Ottawa

Roundtable on seasonal work, No. 2 (February 11, 2022)

Hosts

- Associate Assistant Deputy Minister, Skills and Employment Branch, Employment and Social Development Canada

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Aide et soutien aux travailleuses et travailleurs saisonniers du Nouveau-Brunswick

- Canadian Federation of Agriculture

- Canadian Federation of Musicians

- Fédération des chambres de commerce du Québec

- Fédération des travailleurs et travailleuses du Québec

- Forest Products Associations of Canada

- Hotel Association of Canada

- Inter-provincial EI Working Group

- Mouvement autonome et solidaire des sans-emploi

- New Brunswick Federation of Labour

- Nova Scotia Fisheries Sector Council

- Ontario Fruit and Vegetable Growers’ Association

- PEI Federation of Labour

- Québec Vert : La communauté du végétal et du paysage

- Unifor

National closing roundtable (February 17, 2022)

Hosts

- Minister of Employment, Workforce Development and Disability Inclusion

- Commissioner for Workers

- Commissioner for Employers

Participating organizations

- Canada’s Building Trades Union

- Canadian Chamber of Commerce

- Canadian Federation of Independent Business

- Canadian Freelance Union

- Canadian Labour Congress

- Canadian Manufacturer’s and Exporters

- Canadian Payroll Association

- Confédération des Syndicats Nationaux

- Conseil du patronat du Québec

- Conseil national des chômeurs et chômeuses

- Fédération des Travailleurs et Travailleuses du Québec

- Gig Workers United

- Retail Council of Canada

- Unifor

Page details

- Date modified: