EI Monitoring and Assessment Report 2012Chapter 3: Impacts and Effectiveness of Employment Benefits and Support Measures (EBSMs—EI Part II)

Notice: Refer to the Table of contents to navigate through the EI Monitoring and Assessment Report .

Activities delivered under Part II of the Employment Insurance Act help Canadians to prepare for, find and maintain employment. These activities include Employment Benefits and Support Measures (EBSMs), pan-Canadian programming and functions of the National Employment Service (NES).

This chapter provides information on the programming delivered under Part II of the Employment Insurance (EI) Act during 2011/12. Section I provides a national overview of EBSM similar programming delivered by provincial and territorial governments (P/Ts) under Labour Market Development Agreements (LMDAs) with the Government of Canada. This analysis also includes clients supported by Part II funding through Aboriginal Skills and Employment Training Strategy (ASETS) agreement holders. Section II summarizes individual P/T employment programming activities in the context of each jurisdiction's labour market conditions and employment priorities. New to this chapter this year, section III summarizes the first annual national quantitative analysis of the medium-term net impacts and outcomes of EBSMs. Section IV focuses on HRSDC's delivery of pan-Canadian activities that are not included in the LMDAs, as well as the administration of certain NES functions.

Notes to Reader

- The data used to analyze EBSM activities were collected from provinces, territories and ASETS agreement holders. Accordingly, the data were processed through several systems using a variety of sources. Governments continue to improve data quality and collection to ensure accurate, reliable and consistent information. While all data sets are verified before publication, systems and operational changes may affect the comparability of data from year to year. These instances are noted, where applicable.

- Throughout this chapter, the 2007/08 fiscal year is used as the reference period for pre-recession comparisons. References to average levels of activity, historic averages, and highs and lows use the 10-year period from 2002/03 to 2011/12 as a frame of reference.

- Statistics Canada's Labour Force Survey is the source of labour market data reported herein. Data for Canada and the provinces are fiscal-year averages, calculated using unadjusted data, while monthly references are seasonally adjusted. Data for the Northwest Territories, Yukon and Nunavut are calculated using four points of three-month moving average data. In discussions of employment trends by industry, standard industry titles are taken from the North American Industry Classification System (NAICS).

I. NATIONAL OVERVIEW

In 2011/12, EBSM-similar programming activity (clients served, interventions and expenditures, as well as key performance indicators) declined in most parts of the country, returning to levels at or near those reached in 2007/08, before the late 2000's recession. These declines are attributed to a combination of two factors: the return to more positive labour market conditions and the end of Economic Action Plan funding.

Labour Market Conditions

In many parts of the country, 2011/12 saw continued improvement in labour market conditions, with average national employment growth of 1.3%. Stronger labour markets generally reduce the demand for training, particularly for active claimants with stronger labour market attachment. These individuals are more likely to be close to job ready and therefore are more apt to take advantage of emerging employment opportunities or seek quick Employment Assistance Services (EAS) interventions, rather than opting for longer term Employment Benefits activities.

Economic Action Plan Funding

In response to the economic downturn that began in 2008, the Government of Canada announced its Economic Action Plan (EAP), which included measures to temporarily support unemployed workers. As part of the EAP, the government invested an additional $500 million in each of two fiscal years—2009/10 and 2010/11—to augment regular LMDA funding. P/Ts used these funds, which amounted to a 24% increase in regular LMDA funds over the two fiscal years, to address the rising demand for employment programming prompted by the downturn. In 2011/12, LMDA allocations returned to their regular level.

Canada: EBSM Key Facts

| EI | Non-Insured | Pan-Canadian |

|---|---|---|

416,935

|

214,587

|

14,773

|

| Active | Former | Non-Insured |

50.6%

|

16.2%

|

33.2%

|

| Youth (15-24)1 |

Core Age (25-54) |

Older Workers (55+) |

19.8%

|

69.9% - | 10.2%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 159,279 | 18.1%

|

| Support Measures: EAS | 788,779 | 18.3%

|

| Pan-Canadian | 14,615 | 8.5%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 16.8% | 0.0 - |

| Support Measures: EAS | 83.2% | 0.0 - |

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $1,220.6 | 18.2%

|

| Support Measures: EAS | $565.8 | 26.0%

|

| LMPs and R&I | $149.0 | 12.5%

|

| Pan-Canadian | $156.9 | 2.0%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 326,892 |

| Returns to Employment | 185,029 |

| Unpaid Benefits ($ Million) | $1,002.9 |

1 Age distribution does not equal 100%, as the "unknown" category is not reported here. Date of birth is not collected for clients in SD-Apprentices and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

This year, P/Ts and Aboriginal organizations helped 646,295 clients to prepare for, obtain and maintain employment. As could be expected, given stronger labour market conditions and the return to regular funding levels, this total represented a decrease of 14.5% compared with 2010/11. At the same time, it was substantially higher than the number of clients served in 2007/08 (612,622), before the EAP. These clients participated in 962,673 interventions, which was 18.1% lower than the total in 2010/11 but still comparable to activity in 2007/08. While the mix of Employment Benefits and EAS interventions was unchanged year over year, the EAS share of total interventions was significantly higher than the historic average and was up 3.7 percentage points from the pre-recession level. At the same time, the growing emphasis on apprenticeships meant that the number of Skills Development-Apprentices interventions was at or above pre-recession levels in most parts of the country. Conversely, Skills Development-Regular interventions reached a 10-year low and also accounted for their lowest share of Employment Benefits interventions in the last 10 years. Total expenditures for EBSM-similar programming fell at a faster rate than did the number of both clients served and interventions, dropping 19.1% to $2.1 billion.

1. Canada's Labour Market

As noted above, the national labour market regained strength in 2011/12. The labour force expanded modestly (+0.8%), while employment continued the recovery that began in 2010/11, climbing 1.3% to 17,345,900, the highest level observed since the beginning of the time series in 1976/77. Record highs were also seen in 11 jurisdictions across the country. Canada's employment gains were concentrated in full-time employment, offsetting a small loss in part-time work. Since employment growth outpaced the labour force expansion, unemployment decreased, and Canada's unemployment rate fell 0.5 percentage points to 7.4%. Unemployment rates in nine jurisdictions decreased or remained stable year over year.

2. Client Profile and Participation

As noted, the number of clients served was 14.5% lower year over year. There were also changes in the mix of clients served by client type, age, and equity group.

2.1 Client Types

Three types of clients participate in EBSMs: active claimants, former claimants and non-insured clients. In 2011/12, the distribution of clients served by client type continued to shift, part of a long-term trend that reflects increased demand from former claimants and non-insured clients.

Active claimants, who have an active claim for EI Part I benefits, typically have stronger recent labour force attachment and tend to be able to return to work more quickly than those with weaker ties to the labour market. Active claimants often seek out short-term interventions under EI Part II.

A total of 326,892 active claimants accessed EBSMs, a 12.2% decrease year over year, which, as noted above, reflected strengthening labour market conditions. Moreover, while active claimants' share of total clients served was up slightly year over year, this group's share has declined significantly over the longer term, falling from a high of 63.3% in 2003/04 to 50.6% this year.

Former claimants are no longer eligible for EI Part I; however, they remain eligible for EI Part II under certain criteria Footnote 1 . Since former claimants do not receive Part I income support and are fully supported by Part II, EBSM-similar expenditures increase disproportionately with their level of participation.

In 2011/12, the number of former claimants fell 8.3% to 104,816. However, at 16.2% of all clients served, this client segment reached a 10-year peak in its share of total clients served.

Non-insured clients have no substantive or recent labour force attachment. They include new labour force participants and individuals who were formerly self-employed. While these clients are not eligible for Employment Benefits under EI Part II, they are eligible for the services delivered under EAS.

The number of non-insured clients served fell 20.3% to 214,587, and their share dropped from 35.6% to 33.2%. Despite this year-over-year decline, their share has been trending upwards for the past 10 years and is now significantly higher than the norm for this group.

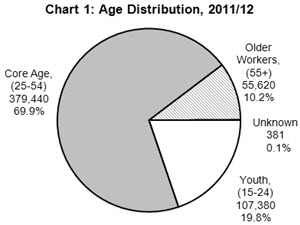

2.2 Age Distribution Footnote 2

Table equivalent of Chart 1

| Age | 2011/12 | |

|---|---|---|

| # | % | |

| 15–24 Youth | 107,380 | 19.8 |

| 25–54 Core Age | 379,440 | 69.9 |

| 55+ Older Workers | 55,620 | 10.2 |

| Unknown | 381 | 0.1 |

| Total | 542,821 | 100.0 |

There were modest changes in the distribution of clients by age group in 2011/12. Youth (15–24) participation was up slightly year over year, and their share, which has gradually increased over the past several years, climbed to 19.8%. Similarly, older workers (55+) now account for a greater share of total clients served, reaching a 10-year high of 10.2% this year. The share of core-age workers (25–54) has been slipping over the past five years, and fell to 69.9% in 2011/12, compared with a high of 73.0% in 2006/07. These shifts mirror changes in the levels of unemployment of these groups: youth and older workers comprise a growing share of national unemployment, while unemployment among core-age workers has declined as economic conditions have improved.

2.3 Designated Groups Footnote 3

To ensure equity principles are observed in the delivery of EBSM-similar programming, HRSDC monitors the participation of women, persons with disabilities, Aboriginal people and members of visible minority groups.

- Women participated in 430,405 interventions in 2011/12, a decline of 18.2% year over year. Women represented 46.7% of all participants, virtually unchanged from 2010/11 and higher than their share of national unemployment (44.6%).

- Persons with disabilities participated in 55,580 interventions, which was 14.3% lower than the number in 2010/11. Despite the decline, this client group represented 6.0% of all participants in 2011/12, its highest share since 2007/08.

- Aboriginal people participated in 56,316 interventions, a decline of 15.0% year over year. This group's share of total interventions was unchanged at 6.1%.

- Members of visible minority groups participated in 49,546 interventions, a drop of 30.9% compared with 2010/11. After climbing to 6.4% last year, this group's share of total interventions fell back to approximate the pre-recession level of 5.4%.

3. Interventions: Employment Benefits Footnote 4

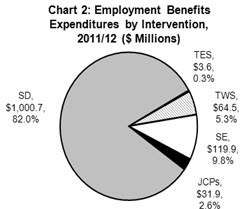

Table equivalent of Chart 2

| Intervention | 2011-2012 | |

|---|---|---|

| ($ Millions) | % | |

| TWS | 64,5 | 5.3 |

| SE | 119,9 | 9.8 |

| JCPs | 31,9 | 2.6 |

| SD | 1,000,7 | 82.0 |

| TES | 3,6 | 0.3 |

| Total | 1,220,6 | 100.0 |

Employment Benefits, which are available to active and former claimants only, generally involve longer term interventions that can last from several weeks to a year or more. Employment Benefits comprise Skills Development-Regular (SD-R), Skills Development-Apprentices (SD-A), Targeted Wage Subsidies (TWS), Self-Employment (SE), Job Creation Partnerships (JCPs) and Targeted Earnings Supplements (TES). A new component of Skills DevelopmentSD-Group (SD-G) was introduced in 2011/12; it is expected that some jurisdictions will start delivering SD-G in 2012/13.

In 2011/12, Employment Benefits interventions fell 18.1% to 159,279. This decline reflected a shift away from longer term interventions toward a focus on quicker returns to work. Employment Benefits accounted for 16.8% of all EBSM interventions delivered in 2011/12, a figure that was unchanged year over year, but significantly lower than the historical average. Employment Benefits expenditures fell 18.2% to $1.22 billion.

3.1 Skills Development

In 2011/12, SD-R interventions fell 31.1% to a 10-year low of 65,234, while SD A interventions fell 3.9% to a four-year low of 61,575. Traditionally, SD accounts for the largest proportion of Employment Benefits interventions and expenditures, and this trend continued in 2011/12, despite the year-over-year declines. SD represented 79.6% of Employment Benefits interventions, down from 81.6% last year. SD expenditures, which fell 19.9% to $1 billion, represented 82.0% of Employment Benefits expenditures, down slightly from 83.6%.

EBSMs in Action: Skills Development

A client applied for SD funding to attend a college certificate program in British Columbia. An undiagnosed learning disability proved to be a barrier to her success, but with counselling and assistance, she was able to remain in the program. While it took a bit longer, this client successfully pursued her career goal and received her certificate.

The Province of Manitoba is dedicated to improving access to Red Seal apprentice designations, essential skills and pre-employment training opportunities in rural, northern and remote areas. Training and job opportunities are focused on mining, roads and dam construction in the north. In 2011/12, Manitoba apprentices and their employers received a boost through the launch of AccessManitoba, a client-centred, online service-delivery system that allows businesses, entrepreneurs and individuals to register for programs and submit online applications.

3.2 Targeted Wage Subsidies

The use of TWS increased in 2011/12, with interventions rising 7.7% to 13,404. TWS' share of all Employment Benefits interventions also increased, climbing from 6.4% to 8.4% year over year. Most of this increase was concentrated in Ontario, as many P/Ts saw declines year over year. TWS expenditures fell 14.9% to $64.5 million, reflecting significant decreases in the average cost per intervention in most P/Ts. This decline is partially attributed to a shorter average TWS duration; in stronger labour markets, employers require less of an incentive to hire lower skilled workers.

EBSMs in Action: Targeted Wage Subsidies

Ontario has integrated its Job Placement with Incentive program into its new Employment Services delivery model. Eligible clients are referred directly to an appropriate job placement to receive valuable on-the-job experience. This new delivery model enabled Ontario to help more clients: in 2011/12, the number of TWS-similar interventions delivered in Ontario more than doubled when compared with the 2010/11 number, climbing from 1,126 to 2,335 (+1,209).

3.3 Self-Employment

Participation in SE decreased significantly in 2011/12, falling to a 10-year low of 7,967 (-30.6%). SE interventions represented 5.0% of all Employment Benefits interventions, down from 5.9% last year. At the same time, SE expenditures fell 3.1% to $119.9 million.

EBSMs in Action: Self-Employment

In the Northwest Territories, eligible clients get help to pursue self-employment or start a business. Support may include money for travel and living expenses, tuition, childcare, and special equipment and supports, as well as mentoring by a qualified business expert. In 2011/12, a client became frustrated at being unable to find and retain long-term employment. With counselling and guidance from a business consultant, combined with financial support, he developed a business plan and is now operating a successful commercial and residential cleaning service.

3.4 Job Creation Partnerships

A total of 3,463 JCP interventions were delivered in 2011/12, a decrease of 19.1% year over year. Since 2002/03, JCP interventions have declined 67.1%. JCPs' share of total benefit interventions has also fallen, dropping from 5.7% in 2002/03 to 2.2%. JCP expenditures fell 22.1% to $31.9 million.

3.5 Targeted Earnings Supplements

Quebec offers TES-similar programming through its Return to Work Supplement program. This program provides financial assistance to participants for expenses related to returning to work, such as the cost of new tools and clothing. This TES-similar benefit supported 7,636 participants in 2011/12, a 1.0% increase year over year. Quebec's total expenditure for this benefit fell 6.5% to $3.6 million.

4. Interventions: Support Measures

The Support Measures authorized by Part II of the EI Act comprise Employment Assistance Services (EAS), Labour Market Partnerships (LMPs), and Research and Innovation (R&I). Through LMDAs, P/Ts are responsible for delivering these measures at the regional and local levels, while HRSDC retains responsibility for pan-Canadian delivery of LMPs and R&I (see section IV). Support Measures are available to all unemployed individuals in Canada, including non-insured clients, though LMPs and R&I are generally not associated with direct client service and therefore do not have participants or interventions.

4.1 EAS Interventions

To assist all unemployed individuals, P/Ts design and deliver services similar to EAS. These interventions are usually reported in one of three categories: Employment Services, Group Services and Individual Counselling. In total, 788,799 EAS interventions were delivered in 2011/12, which was a decline of 18.3% year over year but still markedly higher than the levels seen in the years prior to the late 2000's recession. EAS expenditures fell 26.0% to $565.8 million.

EBSMs in Action: Employment Assistance Services

In the Dehcho and North Slave regions of the Northwest Territories, the Conseil de développement économique des Territoires du Nord Ouest received EAS funding to complement existing employment programming by offering complete, high-quality services to French-speaking individuals.

4.1.1 Employment Services

A total of 492,394 Employment Services interventions were delivered in 2011/12, which was 19.3% lower than the previous year but 10.7% higher than the pre recession level. Employment Services traditionally account for the majority of EAS interventions, and this pattern continued in 2011/12, as these interventions represented 62.4% of all EAS interventions.

EBSMs in Action: Employment Assistance Services

In 2011/12, BC prepared to open a new network of 85 WorkBC Employment Services Centres and 114 satellite offices that will offer a full suite of employment programs while ensuring quick and easy access through a single door. Employment advisors will provide job seekers with a range of services from needs assessment to building their resumes, taking additional training, or developing other skills that will help them find success in their job search. People living in smaller communities, as well as specialized populations (including immigrants, youth, Aboriginal people, francophones, people with multiple barriers, survivors of violence and/or abuse, people with disabilities and people living in rural and remote areas) will have access to the full suite of employment services.

4.1.2 Group Services

At 40,391, the number of Group Services interventions fell 21.4% year over year but was 12.8% higher than the pre-recession level. Group Services' share of total EAS interventions was slightly lower at 5.1%, compared with 5.3% in 2010/11

EBSMs in Action: Employment Assistance Services

EAS funding helps many Nova Scotia agencies and organizations provide job resource centres, case management services and workshops across the province. A long-tenured worker with no formal education or certification approached a job resource centre for assistance. Through assessments, research, conversations with employers and training facilities, and coaching from centre staff, he decided that he would enjoy working in a trade. His plan of action was formed: if he completed high school at the adult high school, focusing on science and math, he would qualify for acceptance into a trades training program, with financial support to attend training. He subsequently graduated class valedictorian and is now on his way to a new career.

4.1.3 Individual Counselling

The number of Individual Counselling interventions fell 15.6% to 255,994. Individual Counselling represented 32.5% of all EAS interventions, up from 31.4% last year.

4.2 Labour Market Partnerships

The LMP measure is designed to enable employers, employee and employer associations, community groups, and communities to work together to develop and implement strategies to deal with labour force adjustments and meet human resources requirements. In 2011/12, P/Ts allocated $147.2 million to LMPs, which was a year-over-year decrease of 12.5%.

EBSMs in Action: Labour Market Partnerships

With the economy changing and workplaces adjusting accordingly, women in New Brunswick need resilience to cope with demanding times and new skills to excel in the workplace. To understand and analyze the changing learning and development needs of women leaders and translate these needs into specific actions for leadership development, New Brunswick used LMP funds to support three provincial focus groups. As a result, a provincial advisory board consisting of leading New Brunswick women's organizations was formed to help develop programs to meet the needs identified in the focus groups and to develop funding and marketing strategies.

In Ontario, the Council for Automotive Human Resources (CAHR) used LMP funding to provide tools and resources to help workers in the vehicle manufacturing industry adapt to changes in their work environment, and continuously upgrade their knowledge, skills and competencies through lifelong learning.

4.3 Research and Innovation

Research and Innovation (R&I) initiatives are designed to identify better ways of helping people prepare for, return to, or maintain employment, and participate productively in the labour force. The total P/T investment in R&I initiatives was $1.8 million in 2011/12, an 11.5% drop from 2010/11.

EBSMs in Action: Research and Innovation

Manitoba used R&I funds to assess the needs of the core client groups that access labour market services. The goal of this project was to provide a perspective on the needs and characteristics of Manitoba's client groups, helping to inform future policy and program development and resource allocation. The primary objectives of this research were to identify Manitoba's main client groups and their characteristics as they relate to employment service needs; assess the extent to which Manitoba is meeting the employment service needs of its clients; and analyze the demand for programs and services by client segment. Manitoba has recently received the final report detailing the findings of the research. It is using the study to develop enhanced service delivery models to more effectively meet the needs of its clients, in alignment with labour market demand.

5. Expenditures

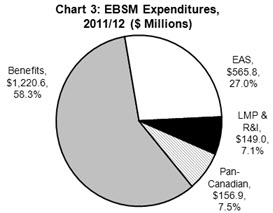

Table equivalent of Chart 3

| 2011-2012 | ||

|---|---|---|

| Expenditures | ($ Millions) | % |

| Benefits | $1,220,6 | 58.3% |

| EAS | $565,8 | 27.0% |

| LMP & R&I | $149,0 | 7.1% |

| Pan-Canadian | $156,9 | 7.5% |

| Total | $2,092,3 | 100.0% |

As discussed, the total national expenditure of $2.1 billion mainly comprised investments in programming delivered directly to unemployed individuals through Employment Benefits and EAS. The total also included expenditures on the two Support Measures—LMPs and R&I—that are not delivered directly to clients, and on the pan-Canadian activities described in section IV of this chapter.

Actual expenditures in each of these categories of programming decreased in 2011/12. Employment Benefits remained the largest category of expenditures, representing 58.3% of the total, up from 57.7% last year. Similarly, pan-Canadian activities rose from 6.2% to 7.5% of the total, while the share represented by LMPs and R&I increased from 6.6% to 7.1%. EAS' share of total expenditures fell from 29.5% to 27.0%.

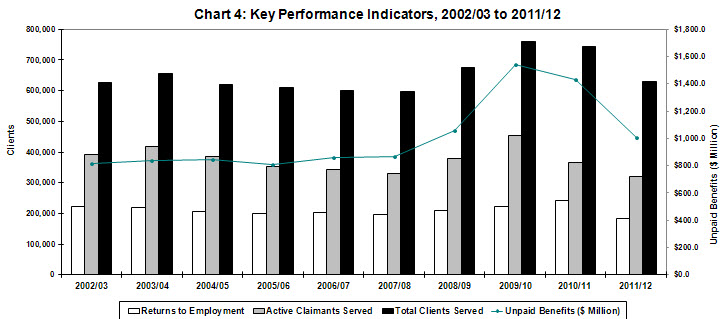

6. Key Performance Indicators Footnote 5

HRSDC monitors the results of EBSM-similar programming delivered by P/Ts through three key performance indicators:

- the number of active EI claimants served;

- the number of EI clients who returned to employment following an intervention; Footnote 6 and

- the amount of unpaid EI Part I benefits resulting from the returns to employment.

All three indicators declined year over year, with 2011/12 results more closely mirroring the pre-recession period of 2007/08, as illustrated in Chart 4.

Table equivalent of Chart 4

| Year | Returns to Employment | Active Claimants Served | Total Clients Served | Unpaid Benefits ($ Million) |

|---|---|---|---|---|

| 2002/03 | 221,943 | 392,644 | 627,880 | $814.52 |

| 2003/04 | 218,876 | 416,426 | 655,028 | $839.00 |

| 2004/05 | 207,073 | 385,213 | 620,787 | $843.08 |

| 2005/06 | 198,727 | 353,542 | 611,420 | $807.47 |

| 2006/07 | 203,692 | 342,145 | 602,157 | $856.30 |

| 2007/08 | 196,498 | 329,127 | 595,910 | $866.90 |

| 2008/09 | 207,927 | 380,181 | 676,842 | $1,056.70 |

| 2009/10 | 222,526 | 453,781 | 758,761 | $1,540.30 |

| 2010/11 | 243,452 | 365,978 | 742,907 | $1,430.40 |

| 2011/12 | 184,245 | 319,784 | 630,537 | $1,002.90 |

As has been demonstrated, improving labour markets and emerging employment opportunities resulted in lower demand for EBSM-similar programming in 2011/12. This is reflected in the number of active EI claimants served, which fell 12.2% to 326,892 as the recovery took hold. The number of active claimants served had been trending downwards since 2002/03, before climbing to record highs during the late 2000's recession.

The number of EI clients who returned to work generally followed this same pattern but fell at a higher rate in 2011/12, dropping 24.0% to 185,029.

Unpaid benefits—which represent savings to the EI account—rose during the EAP years (2009/10 and 2010/11), due to the combination of a sharp increase in total clients served, the extension of regular EI benefits during the recession and the increase in the share of active claimants served under Part II. In 2011/12, unpaid benefits fell 29.9% to $1 billion.

7. Managing for Results

Each P/T conducts an extensive annual planning process for EBSM programming in which it sets out mutually agreed targets for the three key performance indicators. P/Ts provide these targets to the Government of Canada as part of their annual plan. These targets are usually posted on P/T web sites.

In 2011/12, P/Ts participated in various initiatives to ensure the effective and efficient design and delivery of EBSM-similar programming. Working with stakeholders, with particular emphasis on their employer communities, P/Ts monitored and evaluated the extent to which their programming was aligned with the needs of the labour market, and used the findings to identify gaps and refine service offerings.

Over the past few years, many jurisdictions have implemented new client service delivery models to increase flexibility and enhance service delivery to meet the needs of unemployed Canadians. As well, most P/Ts have introduced management information systems that have enhanced data collection and analysis. These enriched data contribute to improvements in program design and delivery.

II. PROVINCIAL AND TERRITORIAL EBSM ACTIVITIES

This section analyzes provincial and territorial EBSM-similar activity in 2011/12, linking trends in clients served, interventions and expenditures to local labour market conditions and employment programming priorities.

To address their unique labour market challenges, P/Ts deliver employment programming under LMDAs individually negotiated with the Government of Canada. Under the LMDAs, P/Ts receive funding to support the delivery of their own programs that are similar to the EBSMs established in Part II of the EI Act. Footnote 7 P/Ts design and deliver virtually all EI-funded employment programming, with the exception of the pan-Canadian activity discussed in section IV of this chapter.

Across the country, P/Ts continued to identify skills and labour shortages as the key labour market challenges they planned to address with EBSM-similar programming in 2011/12. They placed a priority on developing and delivering skill training to meet current and future skill requirements, and optimizing the existing labour supply by working to increase the labour force participation of underrepresented groups, including new immigrants.

As noted in section I, 2011/12 saw national declines in the delivery of EBSM-similar programming, as measured by clients served, interventions delivered and expenditures, as well as by the three key EBSM performance indicators. While these year-over-year declines could be expected, given the return to regular LMDA funding and improving labour markets, EBSM-similar activity this year was generally comparable with the average levels seen over the past 10 years, with the following notable trends.

- There has been a continuing shift away from longer term Employment Benefits interventions toward EAS interventions. This year, most P/Ts reached record highs in the EAS share of total interventions. This shift underlines the growing emphasis on helping to address labour shortages, as well as on assisting job-ready clients to connect with available employment opportunities, reflecting the most appropriate mix of programs and services in stronger labour markets.

- At the same time, investments in apprenticeship training (SD-A) equalled or exceeded the long-term average for these interventions in most parts of the country, reflecting the priority placed on skill training to address skill shortages, as well as the trend away from longer term interventions.

- P/Ts are continuing to implement more sophisticated case management and third-party delivery systems.

1. Newfoundland and Labrador

Newfoundland and Labrador: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

12,432

|

2,031

|

|

| Active | Former | Non-Insured |

69.3%

|

16.6%

|

14.0%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

| 24.9% | 65.8%

|

9.2%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 7,652 | 14.1%

|

| Support Measures: EAS | 12,605 | 10.1%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 37.8% | 1.1

|

| Support Measures: EAS | 62.2% | 1.1

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $106.3 | 15.4%

|

| Support Measures: EAS | $20.9 | 29.4%

|

| LMPs and R&I | $4.7 | 13.9%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 10,027 |

| Returns to Employment | 6,335 |

| Unpaid Benefits ($ Million) | $26.71 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments

The labour market of Newfoundland and Labrador strengthened in 2011/12. Employment rose to a record high of 225,600, an increase of 3,300 (+1.5%) year over year. The labour force expanded modestly to 258,900, another record high, and unemployment fell to a five-year low of 33,300 (-4.9%). As a result, the province’s unemployment rate dropped from 13.6% in 2010/11 to 12.9%, the lowest rate in the province since 1975/76.

Newfoundland and Labrador’s 2011/12 strategic priorities addressed ongoing challenges, including labour and skill shortages, an aging population, out-migration especially among youth and retention of immigrants. The province also identified limited access to human resource planning expertise as a challenge for small enterprises, and prioritized continued work with stakeholders to strengthen labour market development planning. Newfoundland and Labrador planned to support skills development to meet the requirements for a skilled workforce, and to encourage the labour force attachment of underrepresented individuals.

Labour market gains in 2011/12 led to a modest reduction in the demand for employment programming. The number of clients participating in EBSM-similar programming in Newfoundland and Labrador fell to 14,463. Active clients represented 69.3% of the total, down from a high of 79.8% in 2003/04. During the same period, the proportion of former claimants remained stable, while the proportion of non-insured clients jumped from 4.5% in 2002/03 to 14.0% in 2011/12. The number of interventions delivered in Newfoundland and Labrador fell to 20,257, while expenditures for EBSM-similar programming were $131.9 million.

1.1 Employment Benefits

Employment Benefits interventions decreased to 7,652 and represented 37.8% of all interventions. SD continued to account for the majority of Employment Benefits interventions, reaching a five-year high of 73.2%, as the province sought to improve skills to meet changing labour market needs. At the same time, JCPs represented 17.6% of all interventions, representing a new low for this intervention. Employment Benefits expenditures totalled $106.3 million.

| Employment Benefits | |

|---|---|

| TWS | Newfoundland and Labrador Wage Subsidy |

| SE | Newfoundland and Labrador Self-Employment Benefit |

| JCPs | Newfoundland and Labrador Job Creation Partnerships |

| SD | Newfoundland and Labrador Skills Development |

| Support Measures | |

| EAS | Newfoundland and Labrador Employment Assistance Services |

| LMPs | Newfoundland and Labrador Labour Market Partnerships |

1.2 Support Measures: EAS

The province delivered 12,605 EAS interventions, a 10.1% decrease from the previous year, and 62.2% of the total delivered in 2011/12. Individual Counselling was the sole EAS reported, reflecting the high priority assigned to delivering specialized services to address the complex needs of unemployed individuals. EAS expenditures were $20.9 million.

1.3 Other Support Measures: LMPs

Newfoundland and Labrador’s total expenditure for LMPs rose to $4.7 million and accounted for 3.6% of total EBSM-similar expenditures, down from 11.3% in 2002/03. LMP funding increased to support labour market strategies and activities to deal with labour force adjustments and human resources requirements.

1.4 Managing for Results

In July 2011, Newfoundland and Labrador launched a three-year strategic plan that identified three keys to improving labour force development: ensuring a supply of skilled and available workers; enabling client access to a continuum of social support; and developing a culture of service excellence. The province will present annual performance reports on the new strategy.

2. Prince Edward Island

Prince Edward Island: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

3,495

|

1,340

|

|

| Active | Former | Non-Insured |

60.4%

|

11.9%

|

27.7%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

26.7%

|

65.1% | 8.1%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 2,224 | 10.8%

|

| Support Measures: EAS | 4,980 | 47.5%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 30.9% | 11.6

|

| Support Measures: EAS | 69.1% | 11.6

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $20.4 | 13.7%

|

| Support Measures: EAS | $4.9 | 3.1%

|

| LMPs and R&I | $1.8 | 0.4%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 2,921 |

| Returns to Employment | 2,034 |

| Unpaid Benefits ($ Million) | $8.16 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

In 2011/12, Prince Edward Island’s labour market continued to strengthen. The labour force expanded for a fifth consecutive year (+2.3%), while employment grew to a record high of 72,300 (+2.6%). Unemployment was almost unchanged and the Island’s unemployment rate was 11.4%, compared with 11.5% last year.

As the province sought to equip Islanders to participate in the labour market, LMDA-supported programming was identified as a key component of Prince Edward Island’s economic development strategy, Island Prosperity–A Focus for Change. Specific employment programming priorities to address the Island’s labour market challenges were developed based on the strategy. One of the highest priorities was addressing the shortages of skills and labour created by a combination of rising demand for certain skills, an aging population and the out-migration of educated youth. PEI planned to focus on supporting newcomers, skill training and skill enhancement to help Islanders secure and maintain employment.

In 2011/12, the number of clients served on Prince Edward Island climbed to a high of 4,835 (+6.9%). Non-insured clients represented 27.7% of this total, a proportion that has more than doubled since 2002/03, when this group represented 12.6% of clients. The Island has experienced an increase in international migration that has prompted enhancements to programs and services to assist newcomers with language acquisition, acculturation, credential recognition, training and employment, as well as initiatives aimed at recognizing and celebrating diversity. This focus has resulted in an increase in the number of non-insured clients served. The share of active clients fell to 60.4%, the lowest since 2002/03 and, at 11.9%, the share of former claimants was also lower year over year. In total, 7,204 interventions were delivered, and expenditures fell to $27.1 million.

2.1 Employment Benefits

The number of Employment Benefits interventions delivered on Prince Edward Island fell to 2,224, representing a low of 30.9% of total interventions. TWS was the sole Employment Benefit that reported an increase (+9.8%). In the last four years, this intervention’s share of total Employment Benefits has almost quadrupled, from 4.8% to 18.6%. In an effort to stem the out-migration of well-educated youth, the province emphasized TWS programming to help integrate individuals into the local labour market. All other Employment Benefits shares declined. Even with this year’s decline, SD continued to be the most frequently used intervention on the Island, representing 65.8% of all Employment Benefits interventions, underlying the province’s commitment to meeting the demand for skilled workers in tight sectors of the labour market. Employment Benefits expenditures totalled $20.4 million.

| Employment Benefits | |

|---|---|

| TWS | Employ PEI |

| SE | Self-Employ PEI |

| JCPs | Work Experience PEI |

| SD | Training PEI—Individual Training PEI—Apprentice |

| Support Measures | |

| EAS | Employment Assistance Services |

| LMPs | Labour Market Partnerships |

| R&I | Research and Innovation |

2.2 Support Measures: EAS

With 4,980 interventions, EAS represented 69.1% of the 2011/12 total. Employment Services continued to be the most common EAS intervention, representing 68.0% of interventions (3,388). A decrease in employment toward the end of the year bolstered demand for these services, primarily for help with job search skills and résumé writing. In addition, enhancements to data capture and coding improved Employment Services data collection. Individual Counselling interventions fell to 32.0% of the total. EAS expenditures reached a high of $4.9 million.

2.3 Other Support Measures: LMPs

Prince Edward Island’s total expenditure for LMPs was almost unchanged at $1.8 million. LMP funding, which accounted for 6.6% of total EBSM-similar programming expenditures, was used to develop and promote labour market intelligence, career awareness, training curricula related to industry requirements and best practices for investing in worker training. The province also encouraged industry and community involvement in identifying and addressing labour market issues.

2.4 Managing for Results

Ensuring LMDA programming is aligned with emerging trends is vital to economic growth. Prince Edward Island continued to consult stakeholders to address emerging labour market needs, and ensure that programs and services effectively meet the needs of employers and individuals. In June 2011, SkillsPEI commissioned a labour market review to evaluate the effectiveness of labour market development programs and policies, and its service delivery model.

3. Nova Scotia

Nova Scotia: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

13,339

|

4,247

|

|

| Active | Former | Non-Insured |

58.3%

|

17.6% | 24.1%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

20.7%

|

70.3%

|

8.8%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 5,118 | 11.8%

|

| Support Measures: EAS | 30,167 | 7.6%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 14.5% | 0.6

|

| Support Measures: EAS | 85.5% | 0.6

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $58.1 | 20.4%

|

| Support Measures: EAS | $21.2 | 4.4%

|

| LMPs and R&I | $1.0 | 0.7%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 10,250 |

| Returns to Employment | 6,734 |

| Unpaid Benefits ($ Million) | $25.38 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

Labour market conditions in Nova Scotia were generally consistent with those observed in 2010/11. An extremely modest gain pushed employment to a record high of 454,100. The labour force contracted by less than 1.0%, which resulted in lower unemployment. Consequently, the unemployment rate fell from 9.3% last year to a three-year low of 8.6%. Despite modest improvements over the past two years, Nova Scotia’s labour market has not fully recovered from the recession.

Nova Scotia faces many labour market challenges, including skills and labour shortages, a shrinking labour force, a declining birth rate, youth out-migration and an aging population. The province’s 2011/12 LMDA plan continued to support the workforce strategy component of jobsHere, Nova Scotia’s economic development strategy. This strategy comprises three interrelated priorities: fostering the right skills for good jobs; growing the economy through innovation; and helping businesses compete globally. Other jobsHere priorities include providing access to programs and services that meet labour market development needs, and increasing the capacity of the provincial labour market to retain and add jobs requiring higher literacy and numeracy in an increasingly knowledge-based economy. Nova Scotia planned to work with community groups, training providers and businesses to address these priorities.

A total of 17,586 clients accessed EBSM interventions in Nova Scotia in 2011/12. Active clients represented 58.3% of this total, compared with 68.6% in 2002/03. At 17.6%, the proportion of former claimants remained stable. Almost one quarter (24.1%) of all clients served were non-insured. EBSM clients participated in 35,285 interventions, and total expenditures fell to $80.3 million.

3.1 Employment Benefits

Nova Scotia delivered 5,118 Employment Benefits interventions in 2011/12, representing 14.5% of total interventions, down from 52.8% in 2002/03. SD-R declined to 58.6% of total Employment Benefits interventions, an eight-year low, while SD-A’s share rose from 24.2% last year to 26.0%. Despite year-over-year declines, SD-A and SD-R combined represented 84.6% of all Employment Benefits interventions, reflecting the province’s commitment to helping Nova Scotians transition to new employment and develop the skills required in an increasingly knowledge-based economy. Employment Benefits expenditures fell to $58.1 million.

| Employment Benefits | |

|---|---|

| TWS | Nova Scotia Targeted Wage Subsidy |

| SE | Nova Scotia Self-Employment Benefit |

| JCPs | Nova Scotia Job Creation Partnerships |

| SD | Nova Scotia Skills Development |

| Support Measures | |

| EAS | Nova Scotia Employment Assistance Services |

| LMPs | Nova Scotia Labour Market Partnerships |

3.2 Support Measures: EAS

Employment growth in the second half of the year lessened the demand for employment services, and interventions fell to 30,167. Even so, EAS’ share of all interventions, which climbed from just 47.2% in 2002/03 to 85.5% this year, reflected Nova Scotia’s strong focus on providing access to programs and services. The province emphasized Employment Services (51.8%) and Individual Counselling (47.5%) over Group Services (0.6%). EAS expenditures fell to $21.2 million.

3.3 Other Support Measures: LMPs

At $1.0 million, Nova Scotia’s total expenditures for LMPs were stable year over year.

3.4 Managing for Results

In 2011/12, Nova Scotia prepared to launch a new client management system to support the delivery of labour market programs. The Labour Market Program Support System (LaMPSS) Footnote 8 helps the province make the most efficient use of staff and financial resources, while enhancing program delivery

4. New Brunswick

New Brunswick: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

12,824

|

4,217

|

|

| Active | Former | Non-Insured |

61.4%

|

13.9%

|

24.7%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

33.7%

|

58.6%

|

7. 6%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 9,472 | 16.1%

|

| Support Measures: EAS | 24,318 | 4.9%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 28.0% | 2.6

|

| Support Measures: EAS | 72.0% | 2.6

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $74.2 | 19.6

|

| Support Measures: EAS | $10.7 | 24.8

|

| LMPs and R&I | $4.5 | 75.5%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 10,459 |

| Returns to Employment | 9,017 |

| Unpaid Benefits ($ Million) | $30.85 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

New Brunswick’s labour market gradually weakened for a second consecutive year. After reaching a high of 359,400 in 2009/10, employment fell to a five-year low of 351,600 (-0.9%) in 2011/12. With unemployment increasing (+1.9%) and the labour force contracting (-0.6%), the unemployment rate reached an eight-year high of 9.7%.

In 2011/12, New Brunswick planned to make strategic investments through innovative programs, services and partnerships to help its citizens secure and maintain full-time employment. The province identified a two-fold labour market challenge: maximizing participation rates to fill vacancies and address the need for skilled workers, while continuing to improve literacy skills. New Brunswick sought to address these challenges by working with employers to enhance adult literacy, promoting continuous learning, assisting workers with job matching and collaborating with stakeholders to meet their training needs.

In 2011/12, 17,041 clients participated in EBSM-similar interventions in New Brunswick. Participation by client type remained stable: active clients represented 61.4% of all clients, followed by non-insured clients at 24.7% and former claimants at 13.9%. The number of interventions delivered in the province fell to an eight-year low of 33,790. EBSM-similar programming expenditures totalled $89.4 million.

4.1 Employment Benefits

A total of 9,472 interventions were delivered in New Brunswick in 2011/12. As was the case in most parts of the country, Employment Benefits’ share of total interventions decreased year over year, falling to a three-year low of 28.0%, compared with 43.2% in 2002/03. SD-R and SD-A both decreased year over year; SD-R declines were attributed in part to a series of changes in eligibility criteria. Despite these decreases, SD represented 87.9% of all Employment Benefits interventions in 2011/12, attesting to the province’s vision of assisting New Brunswickers to acquire skills to secure and maintain employment. Employment Benefits expenditures fell to $74.2 million.

| Employment Benefits | |

|---|---|

| TWS | Workforce Expansion—Employer Wage Subsidy |

| SE | Workforce Expansion—Self-Employment Benefit |

| SD | Training and Skills Development Program |

| Support Measures | |

| EAS | Employment Assistance Services |

| LMPs | Adjustment Services |

| R&I | Research and Innovation |

4.2 Support Measures: EAS

Though lower year over year, EAS interventions (24,318) accounted for 72.0% of all interventions delivered this year, a significant change from the 56.8% seen in 2002/03. Employment Services represented 39.6% of all EAS interventions, a three-year high, while the share of Individual Counselling fell to the 2007/08 level. The marked shift to EAS delivery resulted from the province’s commitment to assisting job-ready individuals who were actively seeking employment. At the same time, New Brunswick increased the services available to clients facing multiple barriers. EAS expenditures rose 24.8% to $10.7 million.

4.3 Other Support Measures: LMPs and R&I

New Brunswick’s expenditures for LMPs and R&I climbed 75.5% to $4.5 million. All of this increase was associated with a sharp increase in LMPs (+81.8%), with funds used to help employers in expanding industry sectors manage their human resource needs. R&I expenditures fell 17.7% to $133,000.

4.4 Managing for Results

New Brunswick has improved programming by increasing its availability and flexibility, ensuring that programs and services are more focused on clients’ needs. Program delivery is designed based on evidence from analyses of past and current client experiences. Ongoing program evaluations measure program effectiveness, and guide the design and delivery of the province’s employment programming.

Further, New Brunswick continuously engages various stakeholders to identify and address needs within the parameters of the province’s programming. Currently, New Brunswick is reviewing program support to employers to identify gaps and ways to work more effectively with employers, communities and industry groups to meet their needs.

5. Quebec

Quebec: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

146,188

|

47,049

|

|

| Active | Former | Non-Insured |

62.7%

|

13.0%

|

24.3%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

16.6%

|

71.2%

|

12.2%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 43,268 | 11.5%

|

| Support Measures: EAS | 182,141 | 9.2%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 19.2% | 3.5

|

| Support Measures: EAS | 80.8% | 3.5

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $353.5 | 21.8%

|

| Support Measures: EAS | $129.3 | 4.4

|

| LMPs and R&I | $106.3 | 13.4%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 146,1883 |

| Returns to Employment | 52,872 |

| Unpaid Benefits ($ Million) | $219.42 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

3 When setting targets Quebec includes both active and former claimants.

Conditions in the Quebec labour market were markedly stable year over year, with only modest changes seen in all of the major labour force characteristics. The provincial unemployment rate was unchanged at 7.9%.

In 2011/12, Quebec continued to face several labour market challenges, including limited labour force participation of underrepresented groups, an aging workforce and skill shortages. Quebec aligned its priorities to address these challenges, working toward employment recovery and gains, increased labour force participation, higher productivity, enhanced capacity of businesses to adapt to change, and a business model that would ensure efficiency by modernizing service delivery. To this end, Quebec planned to invest in developing the skills of its workforce, notably underrepresented groups. Quebec also planned to assist businesses to build a diverse workforce by connecting employers and job seekers.

In 2011/12, 193,237 clients participated in EBSM-similar programming in Quebec, similar to the previous year. Non-insured clients represented 24.3% of this total, which was significantly higher than in recent years. Conversely, active claimants fell to just 62.7% of the total, down from an average of 64.7% since 2002/03. At 13.0%, former claimants’ share has remained relatively stable. These clients participated in 225,409 interventions, with expenditures totalling $589.2 million.

5.1 Employment Benefits

Mirroring the national trend, the number of Employment Benefits interventions delivered in Quebec fell to 43,268, representing 19.2% of total interventions, the lowest share in 10 years. The province focused on interventions to help job-ready clients get back into the workforce quickly, which resulted in increases in both TWS (+23.1%) and TES (+1.0%). While SD use declined, these longer term interventions accounted for 62.6% of all Employment Benefits interventions delivered in 2011/12. Footnote 9 Employment Benefits expenditures fell 21.8% to $353.5 million.

| Employment Benefits | |

|---|---|

| SD | Manpower Training Measure Job Readiness |

| TWS | Wage Subsidy |

| SE | Support for Self-Employment Measure |

| TES | Return to Work Supplement |

| Support Measures | |

| EAS | Labour Market Information Job Placement Job Research and Assistance Services |

| LMPs | Job Cooperation Services Manpower Training Measure for Enterprises |

| R&I | Research and Innovation Strategy |

5.2 Support Measures: EAS

As part of its efforts to modernize its service delivery and encourage quicker returns to work, Emploi-Quebec reviewed its client pathway in June 2011 and now provides immediate assistance to clients identified as close to job ready. In addition, Quebec now includes services such as job placement and labour market information in its EAS interventions data, which contributed to the year-over-year increase in interventions delivered. As a result, the number of EAS interventions rose 9.2% to 182,141. Moreover, the EAS share of total interventions jumped to 80.8%, compared with a low of 72.1% in 2007/08. The province focused on Individual Counselling as a means of directly assisting job-ready individuals to return to the labour market. Group Services interventions declined, while the number of Employment Services interventions remained stable. EAS expenditures totalled $129.3 million.

5.3 Other Support Measures: LMPs and R&I

At $105.9 million, Quebec’s total expenditure for LMPs represented almost 18.0% of the province’s total expenditures for EBSM-similar programming, comparable with figures for the last few years. In addition to providing SD support to the employed workforce, LMP funds supported an analysis of Quebec’s workforce, the development of human resource functions within the employer community and the reclassification of licensed workers. Similarly, R&I funding has remained relatively stable at less than 1% of total expenditures and amounted to $419,000 in 2011/12.

5.4 Managing for Results

To continue to improve its delivery of services, Emploi-Quebec conducted a post-intervention survey with businesses that had benefited from an intervention. The survey, conducted in early 2012, gathered feedback on Emploi-Quebec’s contributions to increased job satisfaction, productivity, the capacity to adapt to change and the stability of the workforce.

6. Ontario

Ontario: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

85,854

|

46,170

|

|

| Active | Former | Non-Insured |

48.3%

|

16.7

|

35.0%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

18.3%

|

71.4%

|

10.2%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 37,245 | 28.7%

|

| Support Measures: EAS | 108,570 | 49.2%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 25.5% | 5.9

|

| Support Measures: EAS | 74.5% | 5.9

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $325.8 | 4.5%

|

| Support Measures: EAS | $216.4 | 44.9%

|

| LMPs and R&I | $10.5 | 54.2%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 63,780 |

| Returns to Employment | 33,347 |

| Unpaid Benefits ($ Million) | $221.66 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

Ontario’s labour market continued to strengthen in 2011/12, with employment reaching a new high of almost 6.75 million (+1.5%). While employment was slightly higher year over year, the labour force was stable. As a result, unemployment declined, and Ontario’s unemployment rate fell from 8.4% in 2010/11 to a three-year low of 7.7%.

Ontario faces multiple labour market challenges, including an aging population, long-term unemployment (i.e., people who have been unemployed more than 27 weeks) and growing demand in high-skilled sectors. The province is also experiencing low labour force participation and modest outcomes for specific groups, including immigrants, Aboriginal people, persons with disabilities and youth. To address these challenges in 2011/12, Ontario identified a mix of employment programs and services that would enable its clients to succeed in the labour market. The province planned to focus its investments on training, including literacy and basic skills programs, and on efforts to provide work experience to help Ontarians acquire the knowledge and skills they need to prepare for suitable jobs.

In 2011/12, 132,024 clients participated in EBSM-similar programming in Ontario. Active claimants represented 48.3% of this total, down from a high of 76.3% in 2002/03. At 16.7%, former claimants have more than doubled their share since 2002/03 (7.5%). After peaking at 48.2% last year, non-insured clients’ share dropped back to 35.0%, still more than double the share 10 years ago (16.2%). Ontario delivered 145,815 EBSM-similar interventions. Shifts in the types of clients served and the types of interventions delivered reflected Ontario’s strengthening economy and may also be partially attributed to the province’s new Employment Service model, which changed the method for tracking EAS interventions. Expenditures for EBSM-similar programming totalled $552.7 million.

6.1 Employment Benefits

Ontario delivered 37,245 Employment Benefits interventions in 2011/12. TWS has been integrated into the province’s Employment Service and is now referred to as Job Placement with Incentive. Footnote 10 These interventions jumped 107.4% (+1,209) to a three-year high of 2,335, and raised the TWS-similar share of total Employment Benefits interventions to 6.3%, up from 2.2% last year. SD-A’s share also increased, consistent with the province’s commitment to skill training. Employment Benefits expenditures totalled $325.8 million.

| Employment Benefits | |

|---|---|

| TWS | Job Placement with Incentive |

| SE | Ontario Self-Employment Benefit |

| JCPs | Ontario Job Creation Partnerships |

| SD-R | Second Career |

| SD-A | Skills Development-Apprenticeship |

| Support Measures | |

| EAS | Ontario Employment Assistance Services/Employment Service |

| LMPs | Ontario Labour Market Partnerships |

6.2 Support Measures: EAS

As noted, Ontario has introduced a new model for delivering employment services. Under this model, service providers record one counselling session per client case file, regardless of the number of EAS interventions the client receives. As a result, year-over-year comparisons are difficult to make. A total of 108,570 EAS interventions were recorded in 2011/12, all of which were recorded under Individual Counselling. Footnote 11 EAS expenditures totalled $216.4 million.

6.3 Other Support Measures: LMPs

Ontario’s total expenditures for LMPs in 2011/12 were $10.5 million, 1.9% of the total expenditure for EBSM-similar programming, compared with a 10-year high of 5.0% in 2002/03.

6.4 Managing for Results

To assess the performance of its service providers and overall employment programming, Ontario developed a performance management system centered on seven core measures and standards that form its Service Quality Standard (SQS). The SQS allows the province to monitor the performance of its service providers according to customer service quality, effectiveness and efficiency. As part of the annual business planning cycle, Ontario requires each service delivery site to identify continuous improvement targets. After the first full year of implementation, Ontario has sufficient SQS data to complete an initial analysis of the results and performance of the network.

Employment Ontario offers a flexible suite of programs designed to address barriers to employment. Indicators are used to assess a client’s employment barriers and inform the development of a service plan leading to sustainable employment. These indicators are aggregated to the network level and allow for an assessment of Ontario’s ability to achieve results for clients with complex service needs.

7. Manitoba

Manitoba: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

15,609

|

13,704

|

|

| Active | Former | Non-Insured |

40.4%

|

12.9%

|

46.8%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

21.0%

|

71.5%

|

7.4%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 6,635 | 24.9%

|

| Support Measures: EAS | 45,013 | 7.0%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 12.8% | 4.6

|

| Support Measures: EAS | 87.2% | 4.6

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $29.0 | 31.1%

|

| Support Measures: EAS | $10.3 | 9.8%

|

| LMPs and R&I | $5.5 | 2.1%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 11,834 |

| Returns to Employment | 8,714 |

| Unpaid Benefits ($ Million) | $40.97 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

After eight years of steady growth, Manitoba’s labour market conditions were stable in 2011/12. Modest changes in the labour force and employment caused the unemployment rate to edge up from 5.3% last year to 5.4%.

Manitoba established strategic priorities for 2011/12 to address ongoing challenges associated with skill and labour shortages attributed in part to an aging workforce and a shrinking labour pool. Addressing these shortages is seen as key to Manitoba’s economic growth and continued labour supply. The province planned to optimize the participation of the existing labour supply, and to assist groups of individuals who face barriers to entering and remaining in the labour market. These groups include Aboriginal people, underemployed workers and income assistance recipients. Manitoba also planned to focus on helping immigrants successfully integrate into the labour market. To help Manitobans meet employers’ requirements for skilled workers in rural, northern and remote communities, the province sought to provide adequate training across all regions of the province. For example, Manitoba planned to enhance and expand the Red Seal apprenticeship system to meet the demands of its changing labour market.

In 2011/12, 29,313 clients participated in EBSM-similar programming in Manitoba. This number represented a year-over-year decline of 11.5%, and reflected both stability in Manitoba’s economy and a return to activity levels observed prior to the economic downturn. Active claimants accounted for 40.4% of this total, down from a high of 53.8% in 2003/04. At 12.9%, the share of former claimants remained relatively stable compared with the past several years. The proportion of non-insured clients rose from a low of 33.8% in 2003/04 to 46.8% this year. The number of interventions delivered in Manitoba rose 1.5% to 51,648. At the same time, expenditures fell 21.2%, to $44.8 million.

7.1 Employment Benefits

Employment Benefits interventions fell to 6,635, representing just 12.8% of total interventions, down from a high of 18.9% in 2009/10. This decline is consistent with the trend of economic recovery in Manitoba. More Manitobans are using short-term measures and fewer are participating in Employment Benefits, due in part to the strength of Manitoba’s economy and the expansion of employment opportunities.

With a very modest increase year over year, SD-A reached a 10-year high (3,690) and accounted for over half of all Employment Benefits interventions delivered during the year. That proportion reflected Manitoba’s plan to expand apprenticeship opportunities to meet the needs of the labour market by addressing skill and labour shortages. Employment Benefits expenditures fell to $29.0 million.

| Employment Benefits | |

|---|---|

| TWS | Wage Subsidies |

| SE | Self-Employment |

| JCPs | Employment Partnerships |

| SD | Skills Development |

| Support Measures | |

| EAS | Employment Assistance Services |

| LMPs | Labour Market Partnerships |

| R&I | Research and Innovation |

7.2 Support Measures: EAS

EAS interventions rose to a 10-year high of 45,013, accounting for 87.2% of all interventions, compared with a low of 81.1% in 2009/10. In keeping with the province’s plan to optimize the existing labour supply, emphasis shifted toward Employment Services interventions. With more clients seeking access to job-focused employment preparation services, these interventions climbed 63.1% to a high of 28,462. At the same time, Individual Counselling interventions fell 32.7% to 16,551. Total EAS expenditures rose 9.8% to $10.3 million.

7.3 Other Support Measures: LMPs and R&I

Manitoba’s total expenditure for LMPs and R&I totalled $5.5 million, accounting for 12.3% of total expenditures for EBSM-similar programming. While LMP expenditures increased 3.4% to $4.7 million, R&I fell 5.4% to $753,000.

7.4 Managing for Results

In 2011/12, Manitoba undertook a planning process to develop a more efficient client service model. As a result, Manitoba has defined a full-spectrum service response that takes a client from entry into the system through successful retention in the workplace. A multi-tiered approach to employment counselling will be applied, and the service response will reflect the intensity of service that each client needs. Employer engagement is critical to getting clients into sustainable employment, and employer services will be delivered from Manitoba’s integrated service locations. The province will start implementing the new model in late 2012/13.

8. Saskatchewan

Saskatchewan: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

13,892

|

870

|

|

| Active | Former | Non-Insured |

72.0%

|

22.1%

|

5.9%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

15.5%

|

77.5%

|

7.0%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 8,396 | 5.6%

|

| Support Measures: EAS | 12,294 | 41.7%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 40.6% | 10.0

|

| Support Measures: EAS | 59.4% | 10.0

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $29.8 | 17.5%

|

| Support Measures: EAS | $5.5 | 20.4%

|

| LMPs and R&I | $2.5 | 33.5%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 10,624 |

| Returns to Employment | 6,083 |

| Unpaid Benefits ($ Million) | $54.13 |

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.

2 Totals may not add due to rounding; does not include accounting adjustments.

Labour market conditions in Saskatchewan improved slightly in 2011/12. A modest increase pushed employment to a record high (527,100). In combination with a stable labour force, this resulted in a 9.2% decrease in unemployment. Consequently, the unemployment rate fell from 5.3% in 2010/11 to 4.8%.

Saskatchewan’s economic growth has created demand for skilled workers in many sectors. At the same time, the province faces challenges, including high rates of unemployment among First Nations, Métis and youth, and a tightening of the labour supply with accompanying labour shortages. Saskatchewan recognizes the need to increase the delivery of individualized services for clients facing multiple employment barriers and to make the province’s employment services more effective. To this end, Saskatchewan outlined five key strategic priorities: increase the labour force participation of its growing young First Nations and Métis populations; increase skill training opportunities to meet existing and future labour market demands; support an accessible advanced education system that responds to learners’ needs and contributes to an innovative economy; attract and retain newcomers to the province; and improve the overall effectiveness of its employment services.

In 2011/12, the total number of clients served rose 9.7% to 14,762. After climbing to a high of 78.2% in 2007/08, active claimants’ share of total clients fell to 72.0%, which was still slightly above the historical average. Similarly, the proportion of non-insured clients was slightly above average at 5.9%. Conversely, former claimants’ share, at 22.1%, was slightly below average. These clients participated in 20,690 interventions, which was an increase of 17.7% year over year. As Saskatchewan’s economy strengthened and jobs were more readily available, clients sought short-term EAS interventions to help them to return to the labour market, rather than accessing longer term training opportunities. Total expenditures for EBSM-similar programming fell 19.2% to $37.8 million.

8.1 Employment Benefits

The number of Employment Benefits interventions delivered in Saskatchewan fell to a three-year low of 8,396. In support of the province’s emphasis on skill training opportunities to meet the continuing demand for apprentices in a growing economy, SD-A increased (+3.2%) to a record high of 6,702 (+209). Moreover, SD-A continued to account for the majority of Saskatchewan’s Employment Benefits interventions, representing 79.8% of this year’s total. At the same time, individuals with marketable skills were able to transition back into the labour market quickly; therefore, fewer individuals sought longer term training opportunities. Consequently, SD-R interventions fell to an eight-year low of 1,566. SE also declined, falling to a four-year low. Saskatchewan discontinued the use of TWS in favour of maintaining support for apprentices. As a result, expenditures for Employment Benefits fell to $29.8 million.

| Employment Benefits | |

|---|---|

| TWS | Job Start/Future Skills |

| SE | Self-Employment Program |

| JCPs | Employment Programs |

| SD | Skills Training Benefit Provincial Training Allowance |

| Support Measures | |

| EAS | Workforce Development |

| LMPs | Sector Partnerships Regional Planning and Partnerships |

8.2 Support Measures: EAS

In 2011/12, Saskatchewan shifted away from longer Employment Benefits interventions to shorter EAS interventions. The province delivered 12,294 EAS interventions in 2011/12, an increase of 41.7% year over year. The focus on delivering interventions for clients facing multiple barriers resulted in a significant increase in Employment Services (+351.2%) and Group Services interventions (+43.4%). Individual Counselling interventions fell 18.7%. Expenditures fell to $5.5 million.

8.3 Other Support Measures: LMPs and R&I

Saskatchewan’s combined expenditures for LMPs and R&I fell to $2.5 million, accounting for 6.7% of the 2011/12 total, down from a peak of 19.3% in 2003/04. The province used LMP funding for needs assessments and human resource planning. These activities supported program alignment and effectiveness.

8.4 Managing for Results

Saskatchewan, Canada and five tribal councils committed to working together to increase the labour force participation of First Nations people. A steering committee will identify priority areas for collaboration, including youth career planning and skills development; strategies to address employment and training barriers; short-term training in areas such as literacy, adult basic education and essential skills; and training and employment opportunities developed in partnership with the private and public sectors and industry.

9. Alberta

Alberta: EBSM Key Facts

| EI | Non-Insured | |

|---|---|---|

62,360

|

65,098

|

|

| Active | Former | Non-Insured |

32.5%

|

16.4%

|

51.1%

|

| Youth (15–24)1 |

Core Age (25–54) |

Older Workers (55+) |

23.7%

|

67.2%

|

9.0%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 21,264 | 11.5%

|

| Support Measures: EAS | 264,427 | 14.7%

|

| 2011/12 | Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | 7.4% | 0.3

|

| Support Measures: EAS | 92.6% | 0.3

|

| 2011/12 ($ Million) |

Year-over-Year Change |

|

|---|---|---|

| Employment Benefits | $76.5 | 33.2%

|

| Support Measures: EAS | $29.6 | 18.1%

|

| LMPs and R&I | $0.8 | 13.7%

|

| Indicator | Total |

|---|---|

| Active Claimants Served | 41,394 |

| Returns to Employment | 25,776 |

| Unpaid Benefits ($ Million) | $223.61 |

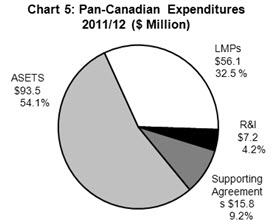

1 Age distribution does not equal 100%, as the “unknown” category is not reported here. Date of birth is not collected for clients in SD-A and Group Services.