Industry Testing Guide

Official title: Canada Education Savings Program System: Industry Testing Guide

Introduction

Outlines the guidelines and processes for Industry Testing of the CESP system.

Disclaimer: RESP promoters

The information contained on this page is technical in nature and is intended for Registered Education Savings Plan (RESP) and Canada Education Savings Program promoters. For general information, visit the RESP section.

Versions

- Version Number: 5.5

- Version Date: October 2015

Document Version History:

-

Version: 1.0

- Date: October 15, 1998

- Description: Initial Version

-

Version: 2.0

- Date: March 3, 2000

- Description: Updates including testing forms pass criteria, re-certification requirements, SIR testing

-

Version: 3.0.1

- Date: November 15, 2000

- Description: Updates in regards to Release 3.0.1

-

Version: 3.0.1.1

- Date: November, 2001

- Description: Updates including removal of Release 3.0.1 reference, live data, process

-

Version: 4.0

- Date: March, 2005

- Description: Updates in regards to Release 4.0

-

Version: 4.1

- Date: December, 2005

- Description: Updates in regards to the 511-12 transaction.

-

Version: 4.2

- Date: July, 2006

- Description: Updated section 3.3, 4 & 4.1 to remove confusion. Also added Annex B & C

-

Version: 4.3

- Date: November 23, 2007

- Description: Updated industry testing email addresses & Annex A

-

Version: 4.4

- Date: March 2009

- Description: Updated section 3.5, 4.1 & 4.2, updated address & changed the name of ViaSafe

-

Version: 4.5

- Date: March 2012

- Description: Updated with transaction Origin Scenario testing, Record Type 700 Summary reporting testing and Testing requirement Matrix.

-

Version: 5.0

- Date: April 2013

- Description: Updated with Saskatchewan Advantage Grant for Education Savings (SEAGES) testing

-

Version: 5.5

- Date: November 2014

- Description: Updated with British Columbia Training and Education Savings Grant (BC TESG) testing

-

Version: 5.5

- Date: October 2015

- Description: Updated the word document for the Alberta Grant.

Key Terms

-

Agent

- An organization to which the responsibilities as outlined in a trustee's agreement have been conferred to. Employment and Social Development Canada (ESDC) requires a letter from the trustee identifying who will act as their agent, as well as a letter from the agent accepting responsibility for the duties as outlined in the letter from the trustee.

-

Production run

- Term used to describe the processing of the industry transactions by the Canada Education Savings Program (CESP) system.

-

Promoter

- The organization ultimately responsible for the administration of the Registered Education Savings Plan (RESP) and, specifically, the organization that has secured approval for the RESP specimen plan from Canada Revenue Agency.

-

Protected

- Safeguard of particularly sensitive information with high risk of injury to individuals, specific public or private interests. This information is marked ‘protected’ and is kept in secure areas.

-

Sender

- The organization sending information electronically to the CESP and receiving payments from the Program. This organization must be the trustee of the RESP or an administrative agent for the RESP trustee. When the RESP trustee has appointed an agent to fulfill these duties, the agent may be the RESP promoter or can be another organization, provided there is only one agent per RESP specimen plan. However, the CESP does not consider a service provider who merely facilitates the electronic transmission to be the “sending organization” on behalf of the RESP trustee.

-

Service provider

- The organization assigned by the sender to provide support services for RESPs.

-

Trustee

- An organization that has a signed agreement with ESDC and is authorized to offer its services to the public as a trustee for a particular specimen plan.

Note to the Reader

Please review this document and contact us prior to developing your Industry Testing plan.

This document is intended for senders and their service providers supplying electronic data files to the Canada Education Savings Program (CESP) system relating to Industry Testing.

Comments and questions regarding this document may be addressed to:

- Employment and Social Development Canada

- Canada Education Savings Program - Monitoring Team

- 140, Promenade du Portage, Phase IV, Mailstop: Bag 4

- Gatineau, QC

- K1A 0J9

- Telephone: 1-888-276-3632

- E-mail: cesp-pcee.indtest@hrsdc-rhdcc.gc.ca

1.0 Introduction

This document has been prepared to outline guidelines and processes for Industry Testing of the Canada Education Savings Program (CESP) system. It should be read in conjunction with the current version of the CESP Interface Transaction Standards(ITS).

1.1 Purpose of Industry Testing

Industry Testing is an ongoing mandatory activity to ensure a high data quality of the senders' data files in order to reduce the number of rejected transactions and Canada Education Savings Grant (CESG), Canada Learning Bond (CLB) and provincial incentives requests. In addition, it helps the financial organizations prepare their Information Management systems for reporting transactions to the CESP. It also serves as an informal point of contact for financial organizations on issues related to the CESP system.

1.2 Scope

This document is limited to the Industry Testing process and includes criteria for satisfying the related requirements.

1.3 Industry Testing Schedule

Senders can schedule a testing timeframe with the Monitoring team at any time. Once the files have been sent, an e-mail should be forwarded to the Industry Testing mailbox at cesp-pcee.indtest@hrsdc-rhdcc.gc.ca following the instructions in Section 3.3.1.

1.4 Service Levels

Typically, results are returned within 3 working days (time between the latter of receipt of file or e-mail request received by the CESP and results being returned to the sender).

1.5 Industry Testing Self-Assessment Questionnaire

As presented under Annex G, the self-assessment questionnaire replaces the on-site phase II testing. Although it is not currently a requirement to pass Industry Testing it is part of the process and must be completed within the prescribed time frame.

The purpose of this questionnaire is for CESP to obtain information to provide assurance that a promoter's systems-related processes function as required. This information may be used as part of future monitoring or compliance activities

The questionnaire may be tailored based on the type of Industry Testing activity the promoter is undergoing.

2.0 Industry Data and Test Results

2.1 Confidentiality

Test data provided by senders can contain live data including actual Social Insurance Number (SIN) information and financial information and is considered ‘protected’. The data volume information, client information, etc. is competitive information and it is treated with confidentiality, as are test results. Any specific information about a promoter, agent or service provider will not be disclosed to any other promoter, agent or service provider.

All test files must be forwarded using secure methods only, as specified in section 3.3.2. Test files submitted in violation of this security requirement will not be tested by the Monitoring team under any circumstances.

2.2 Archiving of Industry Test Data

Industry input test data files, not test results or output files are archived for a 6-month period and may be re-processed for multiple tests during this period upon request. Test files cannot be reprocessed under prior releases of the CESP system or CESP ITS versions.

3.0 Industry Test Process

3.1 Overview

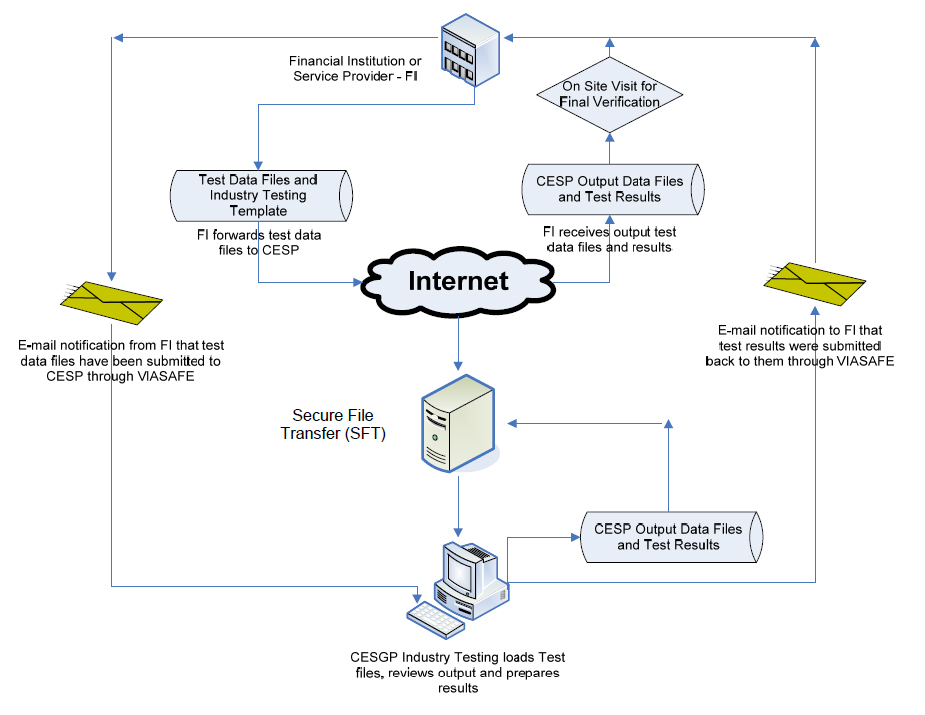

The following industry test context diagram illustrates the industry testing process:

Description of image: CESP Industry Testing Flow

- Financial Institution (FI) or service provider creates a test file and sends it through Managed Secure File Transfer (MSFT).

- FI or service provider notifies CESP by email that a file was submitted.

- CESP loads and tests the file, review output and prepares the results.

- CESP sends results through MSFT along with an email to the FI or service provider.

- FI or service provider receives test data and results.

Each participating sender is responsible for providing a file or set of files for testing. Service providers must submit separate files for each sender they represent.

Industry Testing will provide testing on filenames prefixed with ‘T’ and ‘Z’. Results relating to files prefixed with a ‘T’ will be reported back to the sender in terms of number of transactions sent, processed, errors found, contracts registered and success rate per transaction type submitted for the test. This may include one file or multiple files. In the case of multiple files, a cumulative success rate will be provided.

Industry testing for filenames prefixed with ‘Z’ relate to the summary file or Record Type 700 (RT700) in the Interface Transaction Standards. A script is run on the RT700 file to ensure accuracy of data formatting for each of the fields within the file. The summary file is the 5th file submitted for testing.

3.2 Creating Industry Test File(s)

The creation of data files is an internal process to each sender.

3.2.1 Recommendations for Testing

Senders should gradually increase complexity, size of tests as success is achieved as follows:

- Start small with sample test records to validate against current CESP ITS;

- Work from smaller to larger files in single production run;

- Submit files that simulate multiple production runs; and

- Once success is achieved, it is recommended that senders intentionally introduce errors in order to test their system's error handling capability.

3.3 Submitting Industry Test File(s)

3.3.1 Submission Requirements

The following information must be included in the e-mail forwarded to the Industry Testing e-mail address at the time the data test files are submitted:

(The Industry Testing e-mail is cesp-pcee.indtest@hrsdc-rhdcc.gc.ca )

- Name of sender, promoter, trustee; also provide name of service provider if one is used;

- Filename(s) being submitted for testing;

- When the files be submitted through Secure File Transfer (SFT) or Viasafe (Never submit files by e-mail);

- Name of the contact person and contact information for data and results;

- Identification of whether the file(s) contains live data or not. Please note that only specimen plan and Business Numbers provided by CRA can be used;

- CESP release number or version of the Interface Transaction Standards being used; and

- Any special instructions on how to process the files (e.g. special test cases such as simulation of multiple production runs).

3.3.2 Secure Methods for Submitting Test Files

Outlined below are the details regarding submitting files to CESP in a secure manner:

3.3.2.1 Electronic Submission

Secure File Transfer (SFT) is the departmental approved internet connectivity solution software for transmitting files electronically. Files will be accepted only after the sender has successfully completed connectivity testing.

Files sent through SFT are not automatically queued up for testing; therefore, they must be followed by an e-mail to the CESP listing the information required with each submission (refer to section 3.3.1). The CESP will not test a file until the e-mail is received.

Files cannot be directly sent through email to the Monitoring Team.

The following e-mail address must be used to notify of an electronic submission through SFT with the information noted in 3.3.1: cesp-pcee.indtest@hrsdc-rhdsc.gc.ca

3.3.2.2 Physical Media

Although SFT is the preferred method of transferring files, the CESP will also accept testing files on compact disc CD-ROM (DOS/Windows). If transferred by CD-ROM, a bonded courier must be used in order to accept delivery. Currently, the only departmental approved compression software is WinZip. Files provided from senders that cannot be decompressed will be rejected.

Note: Please include the information listed in section 3.3.1 on the data medium label.

Send test files to:

-

Courier Address:

Employment and Social Development Canada

Canada Education Savings Program - Monitoring Team

140 Promenade du Portage, Phase IV, Mailstop: Bag 4

Gatineau, Quebec

K1A 0J9

3.4 Processing Industry Test Files

Each industry test is processed against a non-populated database. The database schema is not populated in order to give the sender complete control over the data environment used to run the test. It is intended to assist the sender in interpreting industry test results. It should be noted that the sender is responsible for the creation of a baseline file where contracts, subscribers and beneficiaries are loaded into the database.

At this time, SIR and CRA validation performed in Production are not conducted in Industry Testing. It is a simulated process whereby the beneficiary SIN data passes all SIR validation edits.

The Industry Testing environment is based on the current date. Therefore, future dated transactions will be rejected and the sender must advise the Monitoring team of the testing month in which the sender wishes to process the data files. This notification would also be included in the Special Instructions (refer to Section 3.3.1.).

3.5 Running the Test

The input file(s) will be loaded into the system one at a time until they have all been validated. Financial processing will be performed on all of the input files simultaneously unless otherwise specified by the sender. Files that are illegible or do not adhere to the confidentiality requirements will not be processed and senders will be advised accordingly.

For each simulated production run, the following output files will be generated. Please note that, if the data test file does not meet the submission and security requirements (refer to sections 2.1 and 3.3.1), an output file will not be generated.

- .ser – Severe Error Report: severe error report when the transaction in its entirety is rejected;

- .err – Error Report: error report for format and business rule errors on data within the transactions submitted;

- .pro – Processing Report: transaction report for successful transactions;

- .reg – Contract Registration Report: registration report for registration of contracts; and

- .svr – SIN Validation Report: The CESP will verify its beneficiary SIN information with the SIR on a monthly basis.

Note: Please refer to the current version of the CESP ITS for a description of format and output files.

3.6 Reporting Results

Test results and transaction information will be returned to the sender using the same method as the test files were received. The filename of test results will be in the following format:

T (indicates a testing file) + BN (15 characters) + Date (YYYYMMDD) + Test# (5 digits).doc

Note: BN represents the business number, as defined in the CESP ITS.

3.7 Receiving Industry Test Results from CESP

The CESP output transaction files should be loaded into the sender's system to update the processed transactions and record CESG, CLB and provincial incentive amounts within their systems.

4.0 Passing Industry Testing

A report (Transaction Processing Results) has been developed in the CESP system that documents the success rate of Industry Testing files submitted by the senders. This report provides volume and quality success rates by transaction type. Annex A, B , C, D, E & F serves as a guide tosenders providing the minimum requirements needed in order to successfully complete Industry Testing. RT511-12 is not a mandatory record type but it must be tested if you choose to use it.

4.1 Success Criteria

4.1.1 Approved specimen plans are used

For Industry Testing, only approved specimen plans (those used in the production data files) will be accepted into the database; transactions that are processed against non-approved specimen plans will be rejected.

4.1.2 Volume Criteria

In order to be successful from an Industry Testing perspective, senders must submit a minimum of 1,085 transaction records (if 511-12 transaction type is not being tested) and 1,115 transaction records (if 511-12 transaction type is being tested). The maximum limit is 50,000 transaction records per Industry Test. This requirement can be met with a minimum of five files. The entire set of test file(s) must have at least 15 of each financial transaction types. The testing of reversal transactions is completed in file four, while summary transactions (RT700) are tested in file five.

In the case where the reason for testing is required due to a merger or amalgamation, the same volume requirement is to be met. However, where the sender is submitting files for their own purposes, there will be no volume requirement.

When a new promoter undergoes Industry Testing, the 150 contracts test must contain live data. This will provide the CESP with confirmation that the promoter has met the minimum criteria of having 150 contracts in a "registerable" status. Additional transactions may be required for different situations.

Note: The transactional integrity of the sample file is the sender's responsibility. Non-adherence may unnecessarily cause a failure to satisfy Industry Testing requirements.

4.1.3 Quality Criteria

In order to meet the quality criteria, the following must be met:

-

Quality of Functionality

The quality will be determined based on the ratio of successful transactions to processed transactions for each transaction type. Adherence to the Interface Transaction Standards will be verified as outlined in the Industry Testing Success Criteria (Annex B and Annex C).

-

Quality of Data

The quality of data criteria will be assessed based on a minimum load success rate of 90% for each transaction type. The success rate is determined by taking the number of transactions loaded successfully divided by the number of transactions processed for each transaction type.

4.2 Re-testing Conditions

Re-testing will be required under the following circumstances:

- Situations where a new software base is implemented such as when promoters merge or amalgamate (new data from a different source) or when the sender is changing service provider. It should be noted that this type of testing requires the submission of data simulating business from the original sender prior to the merger or amalgamation, data for the sender in terms of existing business and business from the original sender.

- The release of a new version of the Interface Transaction Standards. Each participating sender will have to re-test to ensure conformance to the new specifications.

- When modifications are made to the sender’s system after successfully completing industry testing.

- When a sender’s transactions are repeatedly generating unacceptable error rates (see Monthly Error Rate Monitoring table), they may be withdrawn from monthly production runs until lower error rates are established in Industry Testing.

| Step | Description |

|---|---|

| 1 | Reports are generated for promoter error percentages and for promoter erred contribution amounts on a monthly basis. CESP's Monitoring Team evaluates and provides assistance where possible to promoters with an overall error rate percentage of 10% or greater and/or an erred contribution amount of $750,000 or greater. |

| 2 |

If a promoter maintains an error rate percentage of 15% or more, or an erred contribution amount of $1,000,000 or more, for any 4 months within a 6 month timeframe, a letter of notification is sent to the promoter detailing problematic errors and requesting that the promoter respond with an action plan within 30 days. CESP's Monitoring Team will continue to evaluate and work with the promoter during this time to help lower their overall error and/or erred contribution percentage(s). |

| 3 | CESP approves the action plan (may request minor changes) and schedules promoter for follow-up testing/on-site visit. |

| 4 | Following the agreed upon action plan period, CESP verifies that the action plan has been implemented. If so, promoters will be advised when their action plan meets CESP requirements and will continue with Step 6 of this document. |

| 5 |

Promoters with action plans that are not implemented will receive a formal notice from the Director and be given a final 60 days to resolve the issue. Formal notices will be copied to the promoter's Trustee and proper signing authorities. Failure to implement the plan or resolve the issue will cause a promoter to be notified as per Step 7 of this document. |

| 6 | Following action plan implementation, promoter error rates will continue to be monitored. If a promoter remains above a 15% error rate and/or an erred contribution amount of $1,000,000 or more for any 2 months within the next 4 month period following the implementation of an action plan will proceed to Step 7. |

| 7 | CESP will provide a 30 day notice that it intends to suspend payments under section 4.6 of the trustee agreement. All CESP incentive payments to the promoter will be suspended for a period of 60 days |

| 8 | While under suspension, the promoter must address their major errors with the assistance of the Monitoring Team. Production files will not be submitted and processed in production for a 60 day period. |

| 9 |

The promoter will be allowed to submit a production file for regular processing and evaluation after the 60 day suspension period has elapsed. If the error rate of this file is:

|

4.3 Testing Conditions

Testing is required under the conditions below. It is the promoter's responsibility to contact the CESP's Monitoring team and make arrangements to undergo Industry Testing. Once contacted and informed of the changes, the Monitoring team will inform promoters of which tests must be conducted.

| Basic Test | ACESG Test | CLB Test | SAGES Test | BCTESG Test | 511-12 Test | Transfer Test | Reversal of previous business Test | |

|---|---|---|---|---|---|---|---|---|

| New Promoter / New Incentive | x | * | * | * | * | * | ||

| System Conversion | x | * | * | * | * | * | x | |

| Change in Service Provider | x | * | * | * | * | * | x | x |

| System update / release of a new version | x | * | * | * | * | * | x | |

| Spec Plan transfer or plan amendment | x | * | * | * | * | * | x | x |

| Promoter change of BN or contract number | x | * | * | * | * | * | x | x |

- * Applicable if incentive is offered.

- x Mandatory

4.4 Testing Information

All tests performed under Annex B and C to include the following record and transaction types: 100-01, 200-03, 200-04, 400-13, 400-14, 400-19, 400-21, 400-22, 400-23, 400-24, 410-30, 411-40.

4.4.1 Basic CESG Test

Annex B and C (include transaction type 400-11 CESG information only).

4.4.2 ACESG

Annex B and C (include transaction type 400-11 with and without PCG information).

4.4.3 CLB

Annex B and C (include transaction type 400-24 with PCG information).

4.4.4 SAGES

Annex B and C (include transaction type 410-30).

4.4.5 BCTESG

Annex B and C (include transaction type 411-40).

4.4.6 511-12 Test

Annex D (includes transaction type 511-12).

4.4.7 Transfer Test

Annex E of Industry Testing guide 5.5

4.4.8 Reversal Test

Annex F of Industry Testing guide 5.5

Annexes

Annex A

Information Gathering Questionnaire

To be completed by the promoter and returned to the Monitoring team before Industry Testing commences.

1. Who will be the primary and/or secondary contacts during Industry Testing?

Primary Contact Name:

Title:

Phone Number:

Secondary Contact Name:

Title:

Phone Number:

2. Provide the Promoter BN and approved specimen plan(s) that will be used during Industry Testing.

Promoter BN:

Approved Specimen Plan(s):

3. Did you receive the required documentation from the Enrolment team?

- Yes

- No

4. Has your PKI Key and SFT account been set up?

- Yes

- No

5. When do you plan on beginning Industry Testing?

Provide start date:

6. Are all transactions submitted in the production file created by the system?

- Yes

- No

If no, please provide additional details:

7. Has regression testing been done on your system to ensure that the new updates do not introduce new bugs or errors?

- Yes

- No

8. What incentives will be tested for?

- Canada Education Savings Grant (CESG)

- Additional Canada Education Savings Grant (ACESG)

- Canada Learning Bond (CLB)

- Saskatchewan Advantage Grant for Education Savings (SAGES)

- British Columbia Training and Education Savings Grant (BCTESG)

9. Will you be using an internally built system or will you be using a service provider?

- Internally built system

- Service provider:

10. If using a service provider, please explain in detail their responsibilities in regards to the processing, creation and submission of production files.

11. Will you be testing the RT511-12 transaction?

- Yes

- No

Test files sent through SFT are not automatically queued for Industry Testing; they must be followed by an e-mail to the CESP. Industry Testing will not begin until a notification email has been received with the following information:

- Name of sender, promoter, trustee; also provide name of service provider if one is used;

- Filename(s) being submitted for testing;

- When the files be submitted through Secured File Transfer (SFT) or Viasafe (Never submit files by e-mail);

- Name of the contact person and contact information for data and results;

- Identification of whether the file(s) contains live data or not. Please note that only Specimen Plans and Business Number provided by CRA can be used;

- CESP release number or version of the Interface Transaction Standards being used; and

- Any special instructions on how to process the files (e.g. special test cases such as simulation of multiple production runs).

To notify the CESP of your test file submissions, the Industry Testing email address is: cesp-pcee.indtest@hrsdc-rhdcc.gc.ca

Annexe B

| Description | Record Type | Transaction Type |

Description |

Data Format Success Rate | Overall Success Rate | Volume of Transactions | Transaction Location |

|---|---|---|---|---|---|---|---|

| Contract | 100 | 1 | Contract Information | 95% | 90% | 100 (10 for 511) | File 1 |

| Ben/Sub Info. | 200 | 3 | Beneficiary Information (Ben birthdates in 2007 or later) | 95% | 90% | 100 (10 for 511) | File 1 |

| 4 | Subscriber Information | 95% | 90% | 100 (10 for 511) | File 1 | ||

| Financial Transactions | 400 | 11 | Contribution (CESG) | 95% | 90% | 15 | File 2 |

| PCG SIN (ACESG) | 95% | 90% | 15 | File 2 | |||

| PCG BN (ACESG) | 95% | 90% | 15 | File 2 | |||

| Contribution (ACESG) PCG SIN - without Given or Surname | 95% | 90% | (5 for 511) | File 3 | |||

| Contribution (SAGES) | 95% | 90% | 15 for SAGES | File 3 | |||

| 13 | EAP | 95% | 90% | 15 | File 3 | ||

| 14 | PSE Contribution Withdrawal | 95% | 90% | 15 | File 3 | ||

| 19 | Transfer in | 95% | 90% | 15 | File 3 | ||

| 21 | Grant Repayment | ||||||

| Reason - 01 Contribution Withdrawal | 95% | 90% | 15 | File 3 | |||

| Reason - 02 AIP | 95% | 90% | 15 | File 3 | |||

| Reason - 03 Contract Termination | 95% | 90% | 15 | File 3 | |||

| Reason - 04 Ineligible Transfer | 95% | 90% | 15 | File 3 | |||

| Reason - 05 Ineligible Ben. Replacement | 95% | 90% | 15 | File 3 | |||

| Reason - 06 Payment to Educ. Institution | 95% | 90% | 15 | File 3 | |||

| Reason - 07 Revocation | 95% | 90% | 15 | File 3 | |||

| Reason - 08 Ceases to meet sibling only cond. | 95% | 90% | 15 | File 3 | |||

| Reason - 09 Deceased | 95% | 90% | 15 | File 3 | |||

| Reason - 10 Over contribution withdrawal | 95% | 90% | 15 | File 3 | |||

| Reason - 11 Other | 95% | 90% | 15 | File 3 | |||

| Reason - 12 Non-resident | 95% | 90% | 15 | File 3 | |||

| 22 | Termination Adjustment | 95% | 90% | 15 | File 3 | ||

| 23 | Transfer out | 95% | 90% | 15 | File 3 | ||

| 24 | Request for CLB using transaction dates that are 2 years before the current benefit year. See Annex C (Transaction Origin #6). | ||||||

| PCG SIN | 95% | 90% | 15 | File 2 | |||

| PCG BN | 95% | 90% | 15 | File 2 | |||

| SAGES | 410 | 30 | Request for SAGES (associated to SAGES contributions) | 95% | 90% | 15 | File 2 |

| BCTESG | 411 | 40 | Request for BCTESG | 95% | 90% | 15 | File 2 |

| Description | Record Type | Transaction Type | Description Reversals | Data Format Success Rate | Overall Success Rate | Volume of Transactions | Transaction Location |

|---|---|---|---|---|---|---|---|

| Financial Transactions Reversals | 400 | 11 | Contribution (CESG - with no PCG information) | 95% | 90% | 15 | File 4 |

| PCG SIN (ACESG) | 95% | 90% | 15 | File 4 | |||

| PCG BN (ACESG) | 95% | 90% | 15 | File 4 | |||

| 13 | EAP | 95% | 90% | 15 | File 4 | ||

| 14 | PSE Contribution Withdrawal | 95% | 90% | 15 | File 4 | ||

| 19 | Transfer in | 95% | 90% | 15 | File 4 | ||

| 21 | Grant Repayment | ||||||

| Reason - 01 Contribution Withdrawal | 95% | 90% | 15 | File 4 | |||

| Reason - 02 AIP | 95% | 90% | 15 | File 4 | |||

| Reason - 03 Contract Termination | 95% | 90% | 15 | File 4 | |||

| Reason - 04 Ineligible Transfer | 95% | 90% | 15 | File 4 | |||

| Reason - 05 Ineligible Ben. Replacement | 95% | 90% | 15 | File 4 | |||

| Reason - 06 Payment to Educ. Institution | 95% | 90% | 15 | File 4 | |||

| Reason - 07 Revocation | 95% | 90% | 15 | File 4 | |||

| Reason - 08 Ceases to meet sibling only condition | Reversal not as a 1010 error code will be generated | ||||||

| Reason - 09 Deceased | 95% | 90% | 15 | File 4 | |||

| Reason - 10 Over contribution withdrawal | 95% | 90% | 15 | File 4 | |||

| Reason - 11 Other | 95% | 90% | 15 | File 4 | |||

| Reason - 12 Non-Resident | 95% | 90% | 15 | File 4 | |||

| 22 | Termination Adjustment | 95% | 90% | 15 | File 4 | ||

| 23 | Transfer out | 95% | 90% | 15 | File 4 | ||

| 24 | CLB | ||||||

| Stop Bond 15 PCG SIN or BN | 95% | 90% | 15 | File 4 | |||

| PCG 15 SIN or BN | 95% | 90% | 15 | File 4 | |||

| SAGES | 410 | 31 | Cancel - Request for SAGES (associated to SAGES contributions) | 95% | 90% | 15 | File 4 |

| BCTESG | 411 | 41 | Cancel - Request for BCTESG | 95% | 90% | 15 | File 4 |

| PCG Amendment Transaction | 511 | 12 | Request for ACESG on Existing trans. without PCG | 95% | 90% | 15 | File 4 |

| Request for ACESG on Existing trans. with PCG | 95% | 90% | 15 | File 4 | |||

| Summary Transaction | 700 | Summary Reporting Transaction | 100% | 100% | 15 | File 5 | |

Annexe C

New transaction structure and reporting to complete Industry Testing as per ITS 5.5

Test File 2

New – To assist in the generation of Transaction Origin #1:

Ensure 2 CESG or ACESG requests (400-11 with or without PCG information) are for the same beneficiary. Each transaction should have a contribution amount of $3,000. Transaction dates should be different so that CESG is not prorated between transactions.

The earlier transaction will be paid full CESG while the later request will receive partial CESG payment and a refusal reason of 1 – Annual limit exceeded.

New – For the generation of Transaction Origin #6:

Ensure 15 CLB requests (400-24) have transaction dates that are 2 years before the current year (Example: Current year is 2013, submit CLB requests with transaction date of 2011).

In the transaction processing report (.pro file), multiple CLB payments will be received. An initial payment will be processed with a Transaction Origin #0 and subsequent payments of $100 will be processed with a Transaction Origin #6.

New – For the generation of Transaction Origin #4:

Notice: 5 of the CESG requests (400-11) will receive full CESG in the 2nd period. Changes will be made to the PCG’s income level in the 3rd period to create Transaction Origin #4.

New – For the generation of Transaction Origin #7:

Notice: 5 of the CLB requests will be refused bond payment due to entitlement or custody. Custody or entitlement will then be awarded during the processing of File 3 and CLB will be paid (as long as CLB requests are active) with a Transaction Origin #7 being generated.

- Submit 5 CLB requests (400-24) to check EAPs (400-13).

- Submit 5 CLB requests (400-24) to check Transfer IN (400-19).

- Submit 5 CLB requests (400-24) to check Transfer OUT (400-23).

- Submit 5 CLB requests (400-24) to check Termination Adjustments (400-22).

- Submit 5 CLB requests (400-24) to check Grant Repayment (400-21).

NEW – After File 2 processing, provide a screenshot(s) showing all transaction origins received. You will be asked to submit this screenshot in the Self-Assessment Questionnaire (refer to Annex G of this document).

Test File 3

- Submit 5 EAP transactions (400-13) - CLB EAP Amount field must be greater than zero using beneficiaries from above transactions.

- Submit 5 Transfer IN transactions (400-19) - CLB Amount field must be between $0.01 and $ 20,000.

- Submit 5 Transfer OUT transactions (400-23) - CLB Amount field must be between $0.01 and $ 20,000.

- Submit 5 Termination Adjustment transactions (400- 22) - CLB Amount field must be between $0.01 and $ 20,000.

- Submit 5 Grant Repayment transactions (400-21) - CLB Amount field must be greater than zero using beneficiaries from above transactions.

Test File 4

New – For the generation of Transaction Origin #1:

Submit a reversal transaction for the CESG or ACESG request that received full CESG in Test File 2.

New - Transaction Origin #2:

Notice: One CESG initiated transaction will be added to the transaction processing report (.pro file). Position 68 will contain Transaction Origin #2. Please note that this transaction will include a promoter transaction ID that has not been created by your system.

New – Transaction Origin #8:

If testing the 511-12 transactions refer to Annex D of this document.

New – After File 4 processing, provide a screenshot(s) to the Monitoring team with all transaction origins received. You will be asked to submit this screenshot in the Self-Assessment Questionnaire (refer to Annex G of this document).

Annex D

RT511-12 Testing

If you choose to test the RT511-12 separately, promoters must submit baseline information and RT511-12 transactions as follows:

st - File Baseline Data

10 - RT100

10 - RT200-03

10 - RT200-04

5 - RT400-11 with No

PCG info

5 - RT400-11 with PCG info (SIN’s only, No

PCG Given Name, No

PCG Surname)

2nd File - RT511 Transactions

5 - RT511-12 to test adding PCG info as an ACESG request

5 - RT511-12 to test corrections of previously submitted PCG info

Testing of the 511-12 transaction will produce a transaction origin of 8 after File #2. Provide screenshot to the Industry Testing team of this transaction origin. Submit this screenshot in the Self-Assessment Questionnaire (refer to Annex G of this document).

Annex E

Transfer Test

Possible situations where a transfer test may be required include but are not limited to: change of Business Number, change of contract numbers, transfer by plan amendment, merger, amalgamation, etc.

| Description | Record Type |

Transaction Type |

Description | Data Format Success Rate |

Overall Success Rate |

Volume of Transactions |

Transaction Location |

|---|---|---|---|---|---|---|---|

| Contract | 100 | 1 | Contract Information (old spec plan ID) For testing only |

100% | 100% | All contracts | File 1 |

| Ben/Sub Info | 200 | 3 | Beneficiary Information (old spec plan ID) For testing only |

100% | 100% | All | File 1 |

| 4 | Subscriber Information (old spec plan ID) For testing only |

100% | 100% | All | File 1 | ||

| Financial Transactions | 400 | 23 | Transfer out (old spec plan ID) | 100% | 100% | All | File 1 |

| Contract | 100 | 1 | Contract Information (new spec plan ID) | 100% | 100% | All contracts | File 2 |

| Ben/Sub Info | 200 | 3 | Beneficiary Information (new spec plan ID) | 100% | 100% | All | File 2 |

| 4 | Subscriber Information (new spec plan ID) | 100% | 100% | All | File 2 | ||

| Financial Transactions | 400 | 19 | Transfer in (new spec plan ID) | 100% | 100% | All | File 2 |

| 21 | Grant Repayment – Repay Reason #03 Contract Termination (old spec plan ID) |

100% | 100% | All | File 2 | ||

| Total | 100% | 100% | |||||

IMPORTANT: The CESP would like to remind promoters that when changes are made to a system, the contract ID field's Source Data Definition Standard (Interface Transaction Standards section 2.7) must not be changed. This poses significant risks in terms of data integrity and implications with CRA contract registration.

Ex. Old system, contract ID field is alphanumeric. In the new system, the contract ID field must stay the same (alphanumeric). Old system, contract ID field is numeric. In the new system, the contract ID field must stay the same (numeric).

The Interface Transaction Standards states that the contract ID must be allotted a 15 character positional alphanumeric field.

Annex F

Reversal Test

Possible situations where a transfer may be required include but are not limited to: change of Business Number, change of contract numbers, transfer by plan amendment, merger, amalgamation, etc.

15 financial transactions must be sent in, then reversed and resubmitted with different amounts. This is to verify that the new system has access and the functionality to correct data under the old system.

| Description | Record Type |

Transaction Type |

Transactions from old Promoter | Data Format Success Rate |

Overall Success Rate |

Volume of Transactions |

Transaction Location |

|---|---|---|---|---|---|---|---|

| Contract | 100 | 1 | Contract Information | 100% | 100% | 15 | File 1 |

| Ben/Sub Info | 200 | 3 | Beneficiary Information | 100% | 100% | 15 | File 1 |

| 4 | Subscriber Information | 100% | 100% | 15 | File 1 | ||

| Financials | 400 | 11 | Contribution | 100% | 100% | 15 | File 1 |

| Total | 100% | 100% | 60 | ||||

| Description | Record Type |

Transaction Type |

Transactions from old Promoter | Data Format Success Rate |

Overall Success Rate |

Volume of Transactions |

Transaction Location |

|---|---|---|---|---|---|---|---|

| Reverse | 400 | 11 | Reverse transactions submitted by old Promoter | 100% | 100% | 15 | File 2 |

| Resubmit | 400 | 11 | Resubmit with different contribution amounts | 100% | 100% | 15 | File 2 |

| Total | 100% | 100% | 30 | ||||

Annex G

Canada Education Savings Program

Self-Assessment Questionnaire

Promoter Name:

Promoter BN:

Specimen Plan ID:

Promoter Contact:

Service Provider Name (if applicable):

Instructions

Please follow these steps to expedite the review process:

- Answer each question with as much detail as possible.

- Provide and embed screenshots in this document when required.

- Provide any other relevant information or documentation to support your responses.

- If you have any questions concerning the questionnaire, please contact:

[CESP Officer name, phone # and email address, cesp-pcee.indtest@hrsdc-rhdcc.gc.ca]. - Once the questionnaire is complete, please sign the declaration and return the original signed copy along with supporting documentation within three (3) weeks to:

- Attn: [CESP Officer in charge of the file]

- Canada Education Savings Program

- 140 promenade du Portage, Bag 4

- Phase 4, Gatineau, QC

- K1A 0J9

Promoter Declaration

I declare that all information provided in this assessment form is accurate and true, and is based on the live system that is currently used to send transactions to the Canada Education Savings Program.

I understand that the Canada Education Savings Program may request further information or documentation and may conduct further systems verification to validate the information I have provided.

NAME:

TITLE:

SIGNATURE:

DATE:

1. Transaction Mapping

In your system what transaction codes are used for the following transaction types?

- Contract Information (RT100-01):

- Beneficiary Information (RT200-03):

- Subscriber Information (RT200-04):

- Canada Education Savings Grant Request (RT400-11):

- Educational Assistance Payment Transaction (RT400-13):

- Post-Secondary Education Transaction (RT400-14):

- Transfer IN Transaction (RT400-19):

- Termination Adjustment Transaction (RT400-22):

- Transfer OUT Transaction (RT400-23):

- Canada Learning Bond Request (RT400-24):

- Saskatchewan Advantage Grant Request (RT410-30):

- British Columbia Training and Education Savings Grant Request (RT411-40):

- Financial Reversal Transaction (Reversal flag of 2):

2.Contract Creation

- Provide screenshot(s) displaying how a contract is opened in your system (include Beneficiary and Subscriber screens).

- Provide a screenshot(s) displaying the registration status and when applicable, the reason for registration failure received in the Contract Status report (RT950).

- If a contract is deemed not registered, please explain the process followed to register the contract.

- Once a contract is set as ‘Individual/Sibling Only’ (status of 1) can it be changed to non-Individual/Sibling Only (status of 0)?

- If yes, please explain the process to repay CESG or CLB.

- Provide a screenshot(s) displaying the various relationship types in the RT200.

- A Social Insurance Number (SIN) failure at the Social Insurance Registry (SIR) will generate a 7006 error and prevent payment to the beneficiary. Explain the process to correct beneficiary information errors found in the Error report (RT800).

- What is the process to correct all other errors received in the Error report (RT800)?

3. CESG and CLB payments

- Provide screenshot(s) displaying how CESG and additional CESG are requested in your system.

- Provide screenshot(s) displaying how CLB is requested in your system.

- Provide screenshot(s) displaying how a CLB request is cancelled in your system.

- Provide the screenshots that you collected during the Industry Testing process (after the processing of File #2 and File #4).

4. Saskatchewan Advantage Grant for Education Savings (SAGES) Grant payments

- Provide screenshot(s) displaying how SAGES is requested in your system.

- Provide screenshot(s) displaying how SAGES refusal reasons and transaction origins reported in the RT910 will be displayed in your system.

5. British Columbia Training and Education Savings Grant (BCTESG) payments

- Provide screenshot(s) displaying how BCTESG is requested in your system.

- Provide screenshot(s) displaying how BCTESG refusal reasons and transaction origins reported in the RT911 will be displayed in your system.

6. Transfers

- Provide screenshot(s) displaying how a transfer IN transaction is processed in your system.

- Provide screenshot(s) displaying how a transfer OUT transaction is processed in your system.

- How is the original contract creation date maintained after a transfer IN transaction is processed in your system?

7. Educational Assistant Payment (EAP) and Post-Secondary Education (PSE)

- Provide screenshot(s) displaying how an EAP is processed in your system.

- Does your system track the $7200 EAP CESG limit? If so, can it be overridden?

- Are EAP formulas calculated by your system?

- Explain how the EAP formulas are applied to calculate portions of the EAP CESG, EAP CLB and EAP Provincial incentives.

- Provide screenshot(s) displaying how a PSE withdrawal is processed in your system.

8. Grant Repayments

- Provide a screenshot(s) displaying all repayment reason codes.

- Does your system automatically calculate the grant amount to be repaid?

9. Contract Terminations

- Provide screenshot(s) of how a contract termination is processed in your system?

- Explain what controls are in place to ensure that no CESG and CLB are paid to or remains in a terminated contract?

10. Notional Accounts

- Provide screenshot(s) displaying all RESP notional accounts and explain in detail how they are updated with each transaction.

11. Errors and Pending Transactions

- Are errors submitted repeatedly to the CESP system as a tracking mechanism?

- If your system allows for transactions to remain pending or unfiled to ESDC, how do you ensure all transactions are tracked and submitted in a timely manner?

- Are Subscribers and/or PCGs notified when an error or refusal reason affects their payment

If so, how are they notified and are they notified to contact SIR or Canada Revenue Agency (CRA)? - Explain how reversals are processed in your system?

Page details

- Date modified: