Complete text - 2015–16 Departmental Performance Report - Treasury Board of Canada Secretariat

Erratum

Subsequent to tabling in Parliament and online publication of the Rapport ministériel sur le rendement de 2015-2016, two translation errors were corrected in sections II and III of the HTML and PDF versions of the French report.

- In the “Priorité 6 : Un Secrétariat ouvert, souple et propice à la collaboration” subsection, the starting date for the initiative “Favoriser un milieu de travail plus dynamique, plus ouvert et plus connecté” has been modified from “” to “.”

- In the “Tendances relatives aux dépenses du ministère” subsection, the paragraph describing the variance between the 2013-14 and 2014-15 total program expenditures has been modified from “60 milliards” to “60 millions.”

These changes do not affect the rest of the information contained in the report.

© Her Majesty the Queen in Right of Canada,

represented by the President of the Treasury Board, 2016

Catalogue No. BT1-22E-PDF

ISSN: 1490-1498

Table of Contents

- President’s message

- Structure of this report

- Results highlights

- Section I: Organizational overview

- Section II: Our context, our performance, our lessons learned

- Operating environment

- Risks identified at start of year

- Risks identified at mid-year

- Performance analysis by priority

- Priority 1: Open and transparent government

- Priority 2: Better service for Canadians

- Priority 3: Better oversight, information and reporting to Parliament

- Priority 4: Aligning resources for results

- Priority 5: Workforce of the future

- Priority 6: Open, agile and collaborative Secretariat

- Lessons learned to improve performance

- Section III: Expenditure and human resources overview

- Section IV: Financial statements

- Section V: Supplementary information

- Section VI: Organizational contact information

President’s message

Scott Brison

I am pleased to present the 2015–16 Departmental Performance Report of the Treasury Board of Canada Secretariat. We promised Canadians a government that would bring real change. We set the bar high, and we have been clear about how we define success.

In my mandate letter, the Prime Minister gave me an ambitious set of priorities in this regard. I am encouraged by our progress so far, and have been constantly impressed by the commitment and collaboration of federal employees, who are a force for positive change in our country.

In 2015–16, we engaged, listened and laid the foundation for future success. We defined the approach to Open Government and revitalizing access to information and laid the groundwork for public consultations. We initiated a culture change in the public service by working on a strategy to recruit the best and the brightest people, including millennials and mid-career professionals to its ranks. We took early action to restore fair labour laws for the public service and introduced legislation to repeal Bill C-59, which had provided the government with the authority to unilaterally override the collective bargaining process and impose a new sick leave system on the public service.

We are off to a good start, but there is much more to do to deliver better public services for Canadians. Going forward, the Secretariat will continue to seek opportunities to work in the spirit of openness, innovation and collaboration, and I know I can count on a fully engaged, dedicated and professional public service. Together, we will make the Government of Canada the best it can be.

I invite all Canadians to read this report to find out more about our efforts at the Treasury Board of Canada Secretariat to create the effective, responsible government Canadians expect and deserve.

The Honourable Scott Brison

President of the Treasury Board

Structure of this report

In keeping with the new Policy on Results, the Treasury Board of Canada Secretariat is piloting a new format for departmental performance reports. Lessons learned will inform future reporting to parliamentarians and to Canadians.

Results highlights

Highlights of the Treasury Board of Canada Secretariat’s results

- Worked on creating a new Treasury Board Policy on Communications and Federal Identity, which took effect . The new policy gives government departments more options for engaging with Canadians in today’s digital environment.

- Laid the groundwork for public consultations on Open Government and access to information.

- Developed a strategy to improve cost estimating in the federal government, which will help make cost information more transparent and of a high quality to better support decision making.

- Laid the groundwork for a new Treasury Board Policy on Results, which took effect . The new policy will strengthen the federal government’s ability to deliver results and to demonstrate how tax dollars contribute to outcomes for Canadians.

- Demonstrated commitment to good‑faith bargaining by introducing legislation on , to repeal Bill C-59, which had provided the government with the authority to unilaterally override the collective bargaining process and impose a new sick leave system on the public service.

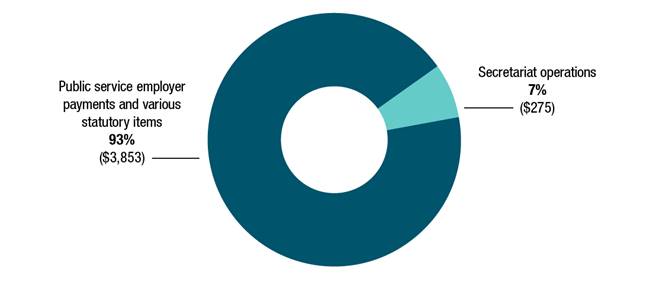

Actual spending: $4,127,888,742

This consists of $275.3 million (7 per cent) for Treasury Board of Canada Secretariat operations, $2.7 billion (65 per cent) for the employer’s share of insurance premiums for public servants and public service pensioners, and $1.2 billion (28 per cent) for the employer’s share of contributions to the public service pension plan.

Actual full‑time equivalents: 1,807

Section I: Organizational overview

Organizational profile

Minister: The Honourable Scott Brison, President of the Treasury Board

Organizational head: Yaprak Baltacıoğlu, Secretary of the Treasury Board

Ministerial portfolio: The minister’s portfolio consists of the Treasury Board of Canada Secretariat and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board: the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada.

Related legislation: The Financial Administration Act is the act that establishes the Treasury Board itself and gives it powers with respect to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year established: 1966

Raison d’être

The Treasury Board of Canada Secretariat is the public service central agency that acts as the administrative arm of the Treasury Board.

The Treasury Board is a committee of Cabinet. It is responsible for accountability and ethics; financial, personnel and administrative management; comptrollership; and approving regulations and most orders-in-council.

Roles and responsibilities

The Treasury Board of Canada Secretariat has four principal roles. Figure 1 indicates those roles and outlines the responsibilities related to each.

Spending oversight

Reviews spending proposals and authorities; reviews existing and proposed government programs for efficiency, effectiveness and relevance; and provides Parliament and Canadians with information on government spending.

Regulatory oversight

Develops and oversees policies to promote good regulatory practices; reviews proposed regulations to ensure that they adhere to the requirements of government policy; and advances regulatory cooperation across jurisdictions.

Administrative leadership

Leads government‑wide initiatives; develops policies and sets the strategic direction for government administration related to service delivery and access to government information, as well as the management of assets, finances, information and technology.

Employer

Develops policies and sets the strategic direction for people management in the public service; manages total compensation (including pensions and benefits) and labour relations; undertakes initiatives to improve performance in support of recruitment and retention objectives.

Key facts

$155.8 billion in planned statutory spending (2015–16)

$95.3 billion in planned voted expenditures (2015–16)

$99.0 billion in direct program spending (2015–16)

200 government‑wide policy instruments

$7.4 billion in internal services spending across government (2015–16)

There are about 2,600 regulations across all federal regulators.

About 25,000 full-time employees perform regulatory functions in the federal government.

About 190,000 employees work in the core public administration.

About 163,000 unionized members are represented by 15 bargaining agents.

For more information on the Secretariat and its responsibilities, see the Organizational Structure section of the Secretariat’s website.

Strategic outcome and program alignment architecture

The Strategic Outcome that the Secretariat strives to achieve and the programs that contribute to it are as follows:

- Strategic Outcome: Good governance and sound stewardship to enable efficient and effective service to Canadians

Section II: Our context, our performance, our lessons learned

Operating environment

The Secretariat operates in an external environment of economic fluctuations, rapid technological change, geopolitical instability and increased security concerns. The Secretariat’s internal environment is being shaped by the growth, aging and increased diversity and mobility of Canada’s population. To adapt to the external and internal environment, the federal government needs new skill sets, needs to invest in information technology (IT) and innovation, and needs to take a government‑wide approach to solving problems.

Risks identified at start of year

At the start of the 2015–16 fiscal year, the Secretariat identified the highest risks to its ability to deliver results for Canadians. Throughout the year, it made significant efforts to respond to these risks. The risks were as follows:

- Security vulnerabilities

- Misalignment between existing skills and future needs

- Gaps in information provided to Parliament and Cabinet

Security vulnerabilities

To address the risk of disruptions to federal government programs and services that stem from the increased frequency and sophistication of threats, the Secretariat expanded the risk response to include measures that address both cyber and physical threats. The Secretariat coordinated the federal government’s response to a number of critical cyber‑incidents. The response resulted in an action plan, a revised IT Incident Management Plan, and a strengthened Enterprise Security Architecture framework. The Secretariat will continue to adapt its risk response to keep pace with technology in order to counter significant threats.

Figure 2 provides the latest available statistics on cybersecurity in the federal government.

100 million

Attempts to access government network

Per day

374

Incidents investigated

to

41

Organizations affected

to

40

Percentage of incidents that targeted federal government industry and business development sector Figure 2 footnote *

to

Misalignment between existing skills and future needs

To maintain a public service that has the skills and talent to meet the federal government’s future needs, the Secretariat improved how it forecasts and analyzes workforce needs across the public service.

The Secretariat also worked with the Canada School of Public Service, the Public Service Commission of Canada, the Privy Council Office and departments to develop a strategy for attracting and recruiting millennials and mid-career Canadians to the public service and for retaining and developing them.

There is now a better understanding of what skill gaps exist, and strategies are being put in place to address them. As a result, the risk of a misalignment between current skills and future needs has been relatively reduced.

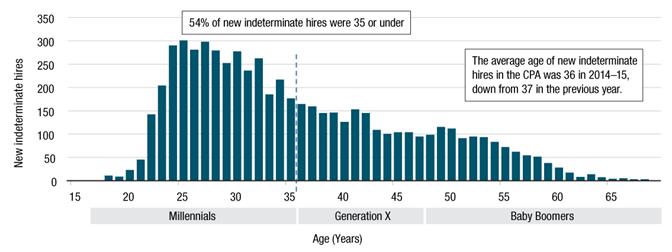

Figure 3 shows the most recent data available on the number of new hires to indeterminate positions in the federal public service by age.

Figure 3 - Text version

This bar graph shows the number of new indeterminate hires in the core public administration in 2014–15, by age.

The number of new indeterminate hires is presented along the Y axis, in increments of 50, starting at 0 and ending at 350. The age of new indeterminate hires is presented along the X axis, starting at 15 and increasing by 5‑year increments, ending at 65.

The ages are divided into three generational groups:

- Ages 15 to 35: Millennials

- Ages 36 to 47: Generation X

- Ages 48 to 69: Baby boomers

| Age (years) | New indeterminate hires |

|---|---|

| 15 | 0 |

| 16 | 0 |

| 17 | 1 |

| 18 | 11 |

| 19 | 9 |

| 20 | 23 |

| 21 | 45 |

| 22 | 142 |

| 23 | 204 |

| 24 | 290 |

| 25 | 301 |

| 26 | 281 |

| 27 | 298 |

| 28 | 279 |

| 29 | 252 |

| 30 | 277 |

| 31 | 236 |

| 32 | 262 |

| 33 | 185 |

| 34 | 217 |

| 35 | 176 |

| 36 | 164 |

| 37 | 159 |

| 38 | 145 |

| 39 | 146 |

| 40 | 126 |

| 41 | 153 |

| 42 | 145 |

| 43 | 109 |

| 44 | 100 |

| 45 | 104 |

| 46 | 104 |

| 47 | 95 |

| 48 | 98 |

| 49 | 115 |

| 50 | 112 |

| 51 | 91 |

| 52 | 95 |

| 53 | 93 |

| 54 | 83 |

| 55 | 72 |

| 56 | 62 |

| 57 | 54 |

| 58 | 51 |

| 59 | 38 |

| 60 | 28 |

| 61 | 17 |

| 62 | 8 |

| 63 | 14 |

| 64 | 7 |

| 65 | 4 |

| 66 | 5 |

| 67 | 3 |

| 68 | 0 |

| 69 | 3 |

| 70 | 0 |

| 71 | 0 |

| 72 | 0 |

| 73 | 0 |

| 74 | 0 |

| 75 | 1 |

In 2014–15, 54 per cent of new indeterminate hires were 35 or under, and their average age was 36, down from 37 in the previous year.

Gaps in information provided to Parliament and Cabinet

To address potential gaps in information provided to Parliament and Cabinet, the Secretariat improved its information management practices and business processes, and increased measures for due diligence. The Secretariat also made more performance information available through the TBS InfoBase. The number of activities under way to improve performance information, the renewed focus on and senior management commitment to results and evidence-based decision making have reduced these gaps. However, work is still needed to strengthen performance information and data analysis capacity in the Secretariat.

Risks identified at mid-year

The mandate letter given to the new President of the Treasury Board in November 2015 set out high expectations for progress on a number of government priorities in a short time frame. The initiatives undertaken to address the priorities are complex and horizontal. Close cooperation among departments and greater stakeholder engagement are required.

Most of the initiatives involve increased IT capacity and investment. The Secretariat identified three additional risks at mid‑year. If these three risks materialize, they will have a considerable impact on the Secretariat’s ability to deliver on its priorities. The Secretariat is monitoring these risks closely and is adjusting its responses where required.

The three additional risks are as follows:

- Slow pace of implementation

- Insufficient government-wide project delivery capacity

- Limited IT capacity

Slow pace of implementation

The government set high expectations for the public service for high‑quality advice and timely delivery of results for Canadians. The Secretariat has a solid track record, but there is still a risk that the priority initiatives will not yield the desired results or will not be implemented at the expected pace. To address the risk, the Secretariat adopted a results and delivery approach.

Results and delivery approach

This approach involves clear goals and performance indicators for all commitments. The approach is being led by the Chief Results and Delivery Officer and is supported by a small Results and Delivery Unit.

The Secretariat’s tools and processes for implementing the results and delivery approach have served as models for other federal departments. In the coming year, the Secretariat’s efforts will focus on strengthening an evidence-based approach to implementation of initiatives and decision making.

Insufficient government-wide project delivery capacity

At the start of 2015–16, the risk of insufficient capacity to support government‑wide project delivery was limited to the back office transformation initiative, which aims to replace the myriad human resources management, financial management and information management platforms of federal government departments with government‑wide systems. This transformation presents a challenge, particularly for an organization as large and complex as the federal government. The launch of new horizontal initiatives mid‑year extended the risk of insufficient capacity to other initiatives such as Open Government, Service Strategy and Revitalizing Access to Information.

The Secretariat’s response to the risk of insufficient project delivery capacity focused on strengthening governance for the back office transformation so that it could lead an integrated approach to enterprise-wide decision making and resource allocation, as well as on the project delivery capacity for the back office. The risk is being mitigated in other horizontal initiatives both through leveraging governance, and through efforts to attract, develop and retain additional skills and talent.

Limited IT capacity

There is a risk that the current IT infrastructure and expertise may not be sufficient to support achieving the Secretariat’s priorities. In 2015–16, the Secretariat started implementing a response to this risk that focuses on three main objectives: acquiring new technology, optimizing the current IT infrastructure, and developing the internal expertise needed to support new technologies.

Performance analysis by priority

With the change of government in , new priorities were announced in the President of the Treasury Board’s mandate letter. This resulted in a reset of the five organizational priorities that the Secretariat identified in its 2015–16 Reports on Plans and Priorities and the development of a new performance measurement framework with more outcome‑based indicators aimed at measuring what matters to Canadians.

The 2015–16 Departmental Performance Report outlines progress made on the five new priorities, on the initiatives related to them, and on their respective indicators. It also outlines work on the sixth priority, which builds on the ongoing work to modernize the Secretariat’s internal operations.

Progress on each priority and the associated initiatives is based on the assessment of the Secretariat’s progress against the key milestones identified as part of the results and delivery approach.

Priority 1: Open and transparent government

The promise: The Government of Canada promised to make government more open and transparent.

The Secretariat is supporting this commitment by leading efforts to improve Canadians’ access to government information and to their own personal information held by government, and to provide better opportunities for engaging with government. Greater openness and transparency will help keep the government focused on Canadians’ values and expectations.

Where we started

Canadians want to participate in government decision making and want government to be more open. Data shows that the government needs to invest to improve how it interacts with citizens.

As of the end of 2014–15, only 49 per cent of government departments and agencies had published their data sets, so a wealth of information is untapped.

In 2014–15, the government answered 87.5 per cent of information requests within set timelines. Maintaining service standards is challenging because of the growing number and the complexity of requests.

In 2014–15, the government answered 82.5 per cent of personal information requests within set timelines, but the process is still too complicated.

What we are doing

To support this priority, the Secretariat is undertaking the following initiatives:

- Open Government so that Canadians have increasing access to government data and information.

- Revitalizing access to information so that Canadians have timely access to the federal government information they are entitled to access.

- Streamlining requests for personal information so that Canadians have timely access to the personal information that the federal government has about them.

- Modernizing the government’s communication policy so that Canadians can actively engage with the federal government through a variety of channels.

- Strengthening accountability for government advertising to make sure that advertising is non‑partisan.

What we delivered in 2015–16

Open Government

Start date: ; Ongoing

Supports sub‑program 1.3.4 Transformation Leadership

- An additional $11.5 million over five years was allocated in Budget 2016 for the Secretariat to double its capacity to support Open Government.

- Laid the groundwork for online and in-person public consultations on Open Government across the country to get Canadians’ views on a new plan for Open Government.

- Worked on Canada’s Third Biennial Plan to the Open Government Partnership.

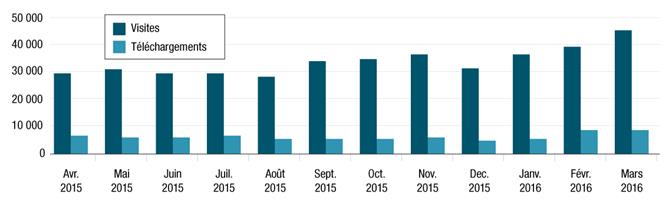

Figure 4 shows the increased number of visits to and downloads from the Open Government Portal in 2015–16.

Figure 4 - Text version

This bar graph shows the number of visits to and downloads from the Open Government Portal in 2015–16.

| Month | Visits | Downloads |

|---|---|---|

| April 2015 | 29,000 | 5,000 |

| May 2015 | 31,000 | 4,000 |

| June 2015 | 28,000 | 4,000 |

| July 2015 | 29,000 | 4,500 |

| August 2015 | 27,000 | 3,500 |

| September 2015 | 33,000 | 3,500 |

| October 2015 | 34,000 | 3,400 |

| November 2015 | 35,000 | 3,500 |

| December 2015 | 31,000 | 3,300 |

| January 2016 | 36,000 | 4,400 |

| February 2016 | 39,000 | 8,000 |

| March 2016 | 44,000 | 7,800 |

Revitalizing access to information

Start date: ; End date: To be determined

Supports sub‑program 1.2.3 Information Management and Information Technology Policy

- $3.1 million over two years was allocated in Budget 2016 to support the government’s commitment to revitalize access to information.

- Announced a two-step approach to revitalize access to information:

- Step 1: The Secretariat laid the groundwork for public consultations on improvements to the Act. Over 2016–17, the government will move forward on implementing its proposals for improving access to information and will make other changes identified through consultations.

- Step 2: The government will begin the first full five-year review of the Act in 2018.

Streamlining requests for personal information

Start date: ; Ongoing

Supports sub‑program 1.2.3 Information Management and Information Technology Policy

- $9.8 million over five years was allocated in Budget 2016 to enhance Canadians’ access to their own personal information held by government.

- Laid the groundwork for consultations on implementing a 30-day guarantee for personal information requests, backed up by a written explanation when a response is not provided within 30 days.

- Defined the approach to a simple, central website where Canadians can submit access to information requests and privacy requests to any government institution.

Modernizing the government’s communication policy

Start date: ; End date:

Supports sub‑program 1.2.4 Externally Facing Policy

- Laid the groundwork for the new Treasury Board Policy on Communications and Federal Identity, which took effect . The new policy gives government departments more options for engaging with Canadians in today’s digital environment.

Strengthening accountability for federal government advertising

Start date: ; End date: To be determined

Supports sub‑program 1.2.4 Externally Facing Policy

- Worked on establishing an independent external review process to make sure that advertising is non‑partisan.

- Developed the Directive on the Management of Communications, which took effect .

Priority 2: Better service for Canadians

The promise: The Government of Canada has committed to making it easier to access government services online and to establishing new performance standards for federal services in order to meet the rising expectations of Canadians and businesses.

The Secretariat is supporting this commitment through various initiatives, including advancing a Government of Canada Service Strategy and establishing and tracking new performance standards for key government services. It is also leading efforts to ensure that the government’s back office functions are aligned to support better services for Canadians.

Where we started

Citizens expect their government to deliver high‑quality services when they need them. Recent surveys indicate that, with more and more people having access to and using the Internet and mobile devices, expectations of online government services are also increasing. People want a dynamic, simplified experience.

Usage of the three main Government of Canada service channels

In person: 8 million clients assisted

Telephone: 54 million calls to the 1 800 O‑Canada service and hotlines for Employment Insurance, Canada Pension Plan, Old Age Security, and tax and benefits hotlines

Online: 326 million website visits and account logins to Canada.ca, the Canada Revenue Agency and the Service Canada websites, and the “My Account” feature

Satisfaction with federal services is lower than the average for services delivered by any government in Canada.

The federal service delivery landscape is broad and fragmented, and many services are still not available online.

What we are doing

To support this priority, the Secretariat is undertaking the following initiatives:

- Advancing a new Government of Canada Service Strategy to support government‑wide improvements to service delivery to Canadians and businesses. These improvements include secure access to government services for Canadians and businesses, building on the foundation of the Treasury Board Policy on Service.

- Establishing and tracking new service performance standards that reflect clients’ priorities, expectations and satisfaction and that clearly indicate progress and results.

- Enterprise-wide back office transformation to make Government of Canada operations more efficient, ultimately allowing public servants to be more responsive to citizens’ needs and providing employees with renewed tools and processes.

What we delivered in 2015–16

Advancing a new Government of Canada Service Strategy

Start date: ; End date: To be determined

Supports sub‑program 1.2.4 Externally Facing Policy

- In collaboration with service departments, developed a framework for the service strategy that includes objectives, core elements and an approach for developing and implementing the strategy and for tracking performance.

- $17.8 million over five years was allocated in Budget 2016 to support the development of a client‑first service strategy and to finish migrating government websites to Canada.ca.

- Government of Canada web presence for Canadians improved through a single, mobile-friendly, user-centric, easily accessible and searchable Canada.ca website that went live in December 2015.

Establishing and tracking new service performance standards

Start date: ; End date:

Supports sub‑program 1.2.4 Externally Facing Policy

- Collected preliminary performance information to inform the development of new performance standards, which must be established under the new Treasury Board Policy on Service, which took effect in 2015–16.

Enterprise-wide back office transformation

Start date: ; Ongoing

Supports sub‑program 1.3.4 Transformation Leadership

- Brought 32 organizations representing about 41,000 employees into a new human resources system, which supports managers in their staffing and classification actions and human resources professionals in their policy compliance role.

- $70.2 million was allocated in Budget 2016 to support the development of a business case and to transform human resources, financial and information management services.

- Established a governance committee of deputy ministers to lead an integrated approach to enterprise-wide decision making and resource allocation.

- Created an Enterprise Project Management Office to manage back office transformation activities and to address the need for sustained leadership.

- Led a sub-component of this initiative, Financial Management Transformation, which focused on the preparatory work to build a single, shared financial and materiel management system solution (SAP) for departments and agencies with low financial management business complexity. In the future, these organizations will use the same platform, which will create efficiencies across business processes and standardize data.

- Completed an environmental scan that identified gaps and outlined a strategy for the integration of human resources and finance data and systems.

Priority 3: Better oversight, information and reporting to Parliament

The promise: The Government of Canada has committed to improving financial oversight and to using the best available information.

The Secretariat will work to improve the alignment and quality of financial information provided to Parliament and will update Treasury Board policies to take a more modern approach to comptrollership.

Where we started

Cabinet ministers and parliamentarians need accurate and timely financial information so that they can make informed decisions about laws, programs and services that affect Canadians every day. Each fiscal year, the budget and the Main Estimates are tabled in Parliament around the same time. That timing means that the Main Estimates for the year do not usually reflect the spending plans set out in the budget for that year.

It takes an average of 13 months after the funding for an initiative is announced for the organization to receive the funds.

Treasury Board policies related to financial management are prescriptive and limit departments’ ability to take informed risks. This impacts the work of more than 22,000 public servants who deliver financial services and manage assets in support of federal government programs.

The capacity to identify the costs of legislative and program proposals varies among departments.

What we are doing

To support this priority, the Secretariat is undertaking the following initiatives:

- Improving oversight and reporting to Parliament to allow for increased scrutiny of government spending by Parliament and for timely implementation of budget measures.

- Transparent, high‑quality costing to support decision-making.

- Modernizing comptrollership to transform various aspects of financial management and to support professional development and talent management among financial management professionals.

What we delivered in 2015–16

Improving oversight and reporting to Parliament

Start date: ; End date:

Supports sub‑program 1.1.2 Expenditure Analysis and Allocation Management

- Consulted with key stakeholders including the Treasury Board, Cabinet, Parliament, the Parliamentary Budget Officer, external experts and the media about how to align the budget and estimates processes to make planning, spending and tracking of tax dollars more timely and transparent.

- Improved reporting to Parliament on anticipated lapses by publishing new data online in the 2015–16 Supplementary Estimates (C).

- Took steps to ensure that the 2016–17 Supplementary Estimates (A) reconcile funding announced in Budget 2016 with funding requested through the 2016–17 Estimates so that Parliament can track spending more easily and hold the government to account.

Transparent, high‑quality costing

Start date: ; Ongoing

Supports sub‑program 1.1.1 Cabinet Decision Support

- The Costing Centre of Expertise performed an enhanced review of 68 high‑value, high‑risk Cabinet documents with a total estimated value of $75 billion.

- Promoted the creation of a professional designation in cost estimating to increase costing capacity in the federal government.

In the spotlight: Strategy for improving cost estimating in the federal government

The Secretariat’s Costing Centre of Expertise has developed a strategy to improve costing capacity in departments and agencies so that they can provide better cost information in support of decision making. The strategy includes the following:

- An ongoing assessment of the maturity of the cost‑estimating function in key departments

- A partnership between the Centre and the International Cost Estimating and Analysis Association to create a Canadian professional designation in cost estimating

- The continued development of costing guidance

- An active community of practice made up of professionals from different departments who meet monthly to share information, tools and ideas to strengthen and advance costing in the federal government

Modernizing comptrollership

Start date: ; End date: December 2016

Supports sub‑program 1.2.1 Financial Management Policy

- Started reviewing how financial management professionals are recruited, developed and retained.

- Developed a vision and strategy for a renewed Next Generation Chief Financial Officer (CFO) development program to address a demographic gap in the CFO community. This work involved extensive research on the current state of the community, career aspirations, training, skill sets and future movement.

- In collaboration with the University of Ottawa, developed and piloted a seven-month leadership development program. A total of 42 executives and managers participated in the program, which was created to promote cross-pollination among the Internal Audit, Finance, Procurement, Evaluation and Planning communities and to develop key leadership competencies in support of comptrollership talent management efforts.

- Launched an onboarding program for new chief audit executives to support them in delivering high‑quality internal audit services to departments and in turn support deputy ministers in their role as accounting officers.

- Released a revised Guidebook for Departmental Audit Committees to keep pace with changes in the internal audit function across government over the last several years.

Priority 4: Aligning resources for results

The promise: The Government of Canada has committed to aligning resources with results that have the greatest positive impact on the lives of Canadians.

The Secretariat will play a lead role in promoting new approaches to programs and policies across government and will work at changing the management culture in order to enhance the quality and use of data and performance information government-wide.

Where we started

Canadians expect the government to implement effective and efficient programs and services that meet their needs. The government cannot meet this expectation unless it has evidence on which to base decisions about program improvements. Making program improvements requires modern procurement policies, a streamlined policy suite and a willingness to try new approaches and to take intelligent risks.

Less than 50 per cent of large departments use information from their performance measurement frameworks and strategies, evaluations and other results-based management tools to support their proposals to Cabinet and Treasury Board.

- 62 per cent of large departments and agencies (LDAs) consistently use performance information to identify risks.

- 68 per cent of LDAs consistently use performance information to establish priorities.

- 68 per cent of LDAs consistently use performance information to support resource allocations.

The Secretariat currently supports over 200 Treasury Board policy instruments, including 8 frameworks, 74 policies, 73 directives and 79 standards. As a result, rules lack clear accountabilities, and are hard to find and hard to apply.

The current suite of procurement-related policies is outdated. The rules and roles need to be simplified, clarified and updated.

What we are doing

To support this priority, the Secretariat is undertaking the following initiatives:

- Experimenting with new approaches to ensure that ongoing innovation and measurement is integrated into policy and program design and delivery.

- Managing for results to ensure that Government of Canada organizations focus on results that matter to Canadians, and that they demonstrate the results through regular public reporting and evaluation.

- Modernizing procurement in collaboration with Public Services and Procurement Canada so that government procurement is easier and delivers better value for money.

- Renewing the policy suite so that it is streamlined and supports modern management.

What we delivered in 2015–16

Experimenting with new approaches

Start date: ; Ongoing

Supports sub‑program 1.1.2 Expenditure Analysis and Allocation Management

- Consulted with other government departments to assess needs and determine best approach.

Managing for results

Start date: ; Ongoing

Supports sub‑programs 1.1.1 Cabinet Decision Support and 1.2.5 Organizational Management Policy

- Laid the groundwork for the Treasury Board Policy on Results, which took effect . The new policy will improve how the government expresses its results and measures its performance, and how it uses this information to allocate resources to and align them with core responsibilities and priorities, with a view to improving how it reports to Canadians.

Modernizing procurement

Start date: ; End date:

Supports sub‑program 1.2.1 Financial Management Policy

- As of , draft policy instruments were produced for internal consultation purposes.

Renewing the policy suite

Start date: ; End date:

Supports sub‑program 1.2 Management Policies Development and Monitoring

- Started reviewing all Treasury Board policy instruments to streamline rules; clarify accountabilities; improve users’ experience; and focus on performance, innovation and balanced risk taking.

Priority 5: Workforce of the future

The promise: The Government of Canada has committed to working with the public service to provide effective and professional services for Canadians.

The Secretariat will help the Government of Canada fulfill its role as a modern employer by supporting good-faith collective bargaining and by leading action to create a healthy, harassment-free workplace. This includes efforts to reinforce the core public service values of promoting both official languages, a respectful workplace, and diversity and inclusion.

Where we started

The federal public service is a key contributor to Canadian democracy and is recognized in Canada and around the world for its non-partisanship, professionalism and reliability. It is Canada’s largest employer, employing about 190,000 people in the core public administration. The government’s ability to meet its commitments depends on a healthy and respectful public service workplace and on a productive and engaged public service that represents the diversity and linguistic duality of Canada’s population.

Mental health

In 2015–16, 49 per cent of long-term disability claims related to mental health.

Respectful workplace

In the 2014 Public Service Employee Survey, 79 per cent of employees indicated that their organization treated them with respect—up 3 per cent from 2011. However, 19 per cent reported having experienced harassment in the workplace in the previous two years.

Official languages

Making bilingual services available when and where required is challenging given changing demographics, new service delivery models and increasing public expectations.

Diversity and inclusion

All four employment equity groups (women, visible minorities, persons with disabilities and Aboriginal peoples) meet workforce availability levels, but three of the four groups are under-represented among public service executives (women, visible minorities and Aboriginal people).

Collective bargaining

All but one collective agreement in the core public administration and separate agencies expired in 2014. The collective agreement for the Canada Revenue Agency expired in 2012. Delays in collective bargaining create financial pressures, program complexity and an unstable labour relations environment.

Recruitment

Recruitment rates remain high, but opportunities exist to recruit the skills and the demographic profiles that the workforce will need in the future. The average age of new hires into indeterminate positions in the federal public service was 36 in 2014–15, down from 37 the previous year.

What we are doing

To support this priority, the Secretariat is undertaking the following initiatives:

- Improving mental health in the public service workplace.

- Supporting a workplace free from harassment and sexual violence so that people who work in the public service feel safe and respected.

- Making sure that federal services are delivered in compliance with the Official Languages Act.

- Increasing the number of Indigenous Canadians and members of other minority groups in leadership positions so that public service leaders reflect the diversity of Canada’s population.

- Strengthening the recruitment strategy and the engagement of new public servants.

- Bargaining in good faith to restore a culture of respect for and within the public service.

- Introducing a new labour relations regime for the Royal Canadian Mounted Police.

What we delivered in 2015–16

Improving mental health

Start date: ; Ongoing

Supports sub‑program 1.2.2 People Management Policy

- In early 2015, the joint Task Force on Mental Health was created to improve mental health and safety in the federal workplace and to study how the government can best align with the Mental Health Commission of Canada’s National Standard of Canada for Psychological Health and Safety in the Workplace. The task force is a collaborative employer-union forum for addressing issues of mutual concern.

- The Technical Committee of the task force submitted its first report to the Steering Committee of the Task Force in .

A workplace free from harassment and sexual violence

Start date: ; Ongoing

Supports sub‑program 1.2.2 People Management Policy

- Created an interdepartmental working group to make recommendations to support a workplace free from harassment and sexual violence.

- Continued working with departments to promote a culture of respect based on the Values and Ethics Code for the Public Sector.

Official languages

Start date: ; Ongoing

Supports sub‑program 1.2.2 People Management Policy

- The President of the Treasury Board’s Annual Report on Official Languages 2014–15 was tabled.

- The report indicated that most federal institutions continued to ensure that communications and services to the public were offered in both official languages in bilingual offices, and that they put measures in place to create and maintain a work environment that is conducive to the use of both official languages in bilingual regions.

Minority groups in positions of leadership

Start date: ; Ongoing

Supports sub‑program 1.2.2 People Management Policy

- Provided support to a new Governor in Council appointment process led by the Privy Council Office and to talent management efforts in order to improve access by women, Indigenous Canadians and minority groups to executive positions in the public service.

- Led the Champions and Chairs Circle for Aboriginal Peoples, which has set Aboriginal leadership development and mentoring as a priority.

- The Chairs Circle will be working to build on initiatives that have succeeded elsewhere in the federal public service, including the Leadership Development Initiative at Indigenous and Northern Affairs Canada and the Aboriginal Mentoring Pilot Project at National Defence.

- Presented the new workforce availability estimates based on data from the 2011 census in the 23rd Annual Report to Parliament on Employment Equity in the Public Service of Canada.

Strengthening the recruitment strategy and the engagement of new public servants

Start date: ; Ongoing

Supports sub‑program 1.2.2 People Management Policy

- To help reduce the average age of new indeterminate employees, the Secretariat worked with the Canada School of Public Service, the Public Service Commission, the Privy Council Office and departments to develop a strategy for attracting, recruiting, developing and retaining millennials and mid-career Canadians.

- The Secretariat continued to work with departments to identify key skills and occupational requirements to inform future public service recruitment efforts.

Bargaining in good faith

Start date: ; Ongoing

Supports sub‑program 1.3.2 Labour Relations

- Introduced legislation on to repeal provisions of Bill C-59 that gave the government the authority to unilaterally override the collective bargaining process and impose a new sick leave system.

- Negotiations continued between the Government of Canada and most bargaining agents, including the Public Service Alliance of Canada and the Professional Institute of the Public Service of Canada.

New labour relations regime for the Royal Canadian Mounted Police

Start date: ; Ongoing

Supports sub‑program 1.3.2 Labour Relations

- Introduced legislation on , to create a new labour relations regime for the Royal Canadian Mounted Police (RCMP) that will give RCMP members and reservists a right to make choices about representation in labour relations matters.

In the spotlight: New labour relations regime for Royal Canadian Mounted Police

Key elements of the new proposed regime:

- Freedom for RCMP members and reservists to choose whether to be represented by a bargaining agent

- Independent, binding arbitration as the dispute resolution process for bargaining impasses, with no right to strike

- A single, national bargaining unit for RCMP members appointed to a rank and for reservists

The bill was drafted following extensive consultations with regular members of the RCMP and jurisdictions that have agreements with the RCMP for police services.

Priority 6: Open, agile and collaborative Secretariat

The promise: The Secretariat has committed to creating a more open, agile and collaborative organization that fosters respect and innovation, empowers employees to excel in their work, and maximizes benefits for Canadians.

To accomplish this, the Secretariat launched This is TBS, an initiative that brings together all of the Secretariat’s internal transformational initiatives under three streams of work: supporting a high-performing workforce; fostering a more dynamic, open, and networked workplace; and adopting lean and efficient business practices. These initiatives support Blueprint 2020 commitments.

Where we started

In 2013, the Secretariat’s leaders launched This is TBS to reach out to employees and learn about their needs, and to generate ideas about and build momentum for the transformation. This is some of what we heard:

More support is needed to develop skills for the future, for both managers and employees.

Employees do not have access to the technology they need to do their jobs quickly and efficiently from different locations.

More effort is needed to adopt innovative practices and to encourage networking. “Red tape” and too many layers of hierarchy are slowing our efforts.

In 2015–16, the Secretariat was tasked with an ambitious agenda that consisted of multiple complex and priority initiatives with tight deadlines. To deliver on this agenda the organization must be agile, work collaboratively, adopt lean and efficient business practices, and take intelligent risks.

What we are doing

To support this priority, the Secretariat is undertaking initiatives under the following themes:

- Supporting a high-performing workforce that is agile and that strives to maintain a respectful and healthy work environment.

- Fostering a more dynamic, open and networked workplace by, for example, renewing and consolidating office space to meet Workplace 2.0 standards and re‑engineering back office technology to better manage information.

- Adopting lean and efficient business practices that create opportunities for transferring skills and knowledge, streamlining processes, and empowering employees.

What we delivered in 2015–16

Supporting a high-performing workforce

Start date: ; Ongoing

Supports sub‑program 1.5.4 Human Resources Management Services

Progress on creating a respectful and healthy work environment

- Made the “Every Day” commitment to employees.

- Developed Taking Action, a document that presents the concrete steps the Secretariat plans to take to address the concerns expressed in the 2014 Public Service Employee Survey. By developing this document, the Secretariat aims to support effective people management, expand and modernize communication and engagement, articulate key management commitments and foster sustained culture change. Implementation of the steps identified in Taking Action is under way.

- Piloted skip‑level meetings, which give employees an opportunity to meet with their leaders to hear about and provide input on priorities and operational issues, and which foster stronger communication at all levels.

- Appointed a Wellness Champion to promote a culture that encourages wellness of the mind, body and workplace at the Secretariat and to develop an organizational wellness strategy.

In the spotlight: “Every Day”

“Every Day” is a commitment by Secretariat executives to Secretariat employees to support a respectful, fulfilling and productive work environment each and every day. “Every Day” describes the sort of workplace and workforce the Secretariat wants to have—one that will attract, retain and develop the very best people. This means the following:

- Senior management that respects and engages employees face-to-face, communicates clear expectations, gives employees what they need to do their jobs, engages employees in decision making and promptly informs them of changes that affect them

- Employees who are excited, empowered, supported, enabled, and given opportunities to develop and grow

Progress on creating an agile workforce

- Implemented mobility initiatives, such as the Employee Skills Inventory and micro-missions, to help employees acquire skills and experience in areas other than their own and develop new perspectives to enhance their career opportunities.

- Reached more than 1,000 employees through in-house workshops on values and ethics, harassment prevention, working in Workplace 2.0, and communicating effectively to prevent conflict.

- Created, as a pilot project, a Talent Management Advisory Committee for the EC occupational group, which represents about one quarter of the Secretariat’s employees. The Committee’s work is built into the process for managing employee performance.

Fostering a more dynamic, open and networked workplace

Start date: ; End date:

Supports sub‑programs 1.5.6 Information Management Services, 1.5.7 Information Technology Services, 1.5.8 Real Property Services

Completed phase 1 of the Secretariat’s Workplace Renewal Initiative

- Consolidated the Secretariat’s operations from 12 to 3 locations in downtown Ottawa, reducing the Secretariat’s office space by 30 per cent.

- Moved 1,500 employees (65 per cent of the Secretariat’s workforce) to a new building at 90 Elgin Street, which is fit up to Government of Canada Workplace 2.0 standards.

- The new workplace has open space on each floor to foster collaboration. It also has over 929 square metres of meeting space that includes large multi-purpose rooms that can hold up to 200 people; interview rooms; training rooms; a telepresence room; informal collaboration areas; and space for hosting foreign delegates, the media and other visitors.

- Employees can use audiovisual and video conferencing technology to collaborate online, in real time, from multiple locations.

- Moved the remaining 800 employees (35 per cent) to a building close to 90 Elgin to optimize operational effectiveness by reducing employees’ travel time between buildings.

- Consolidated 3,353 linear metres of Secretariat records to provide additional safeguards for sensitive information.

Introduced new technology tools and practices for managing information and enhancing security, including the following:

- Deployed the new information management system, GCDOCS, on both the Protected B and Secret networks. Employees can now search for, retrieve and reuse information more easily, which has reduced duplication and costs and led to improvements in how the Secretariat manages other departments’ sensitive information.

- Replaced all desktop computers (about 2,300) with laptops or tablets, and provided WiFi access so that Secretariat employees can work anywhere in the building. The increased employee mobility promotes a digital work culture and drastically reduces paper consumption.

Adopting lean and efficient business practices

Start date: ; Ongoing

Supports sub‑programs 1.5.1 Management and Oversight Services, 1.5.2 Communications Services, 1.5.4 Human Resources Management Services, 1.5.5 Financial Management Services

- Continued leaning and automating the contract initiation process to provide Secretariat employees and managers with simplified self-serve online smart forms for purchasing supplies and services to supplement their resources and deliver results.

- Streamlined and improved the consultation process for developing the Secretariat’s risk-based audit and evaluation plans in order to reduce the time spent on the process.

- Implemented a new method to reduce processing time for internal staffing actions.

- Expanded the functionality of the Secretariat’s financial system so that credit card transactions can be reconciled automatically and to make financial forecasting more accurate.

For more information on organizational priorities, see the President of the Treasury Board’s mandate letter on the Prime Minister of Canada’s website.

Lessons learned to improve performance

In 2015–16, the Secretariat focused on laying the foundation for delivering on the priorities set out in the Prime Minister’s mandate letter to the President of the Treasury Board and on adopting a results and delivery approach. The Secretariat is off to a good start. All priority initiatives are under way and on track.

Staying on track and sustaining success over the long term, however, will not be easy. As implementation of these initiatives continues, a culture shift will be needed at the Secretariat. This culture shift will present both challenges to be addressed and opportunities to be seized.

Figure 5 - Text version

This graphic shows the six elements of the culture shift that is required in the Secretariat to implement its priority initiatives. Each aspect is depicted as a mechanical gear, and the cogs of each are connected with the cogs of the next.

The six aspects of the culture shift are as follows:

- Increased collaboration

- Increased use of quality data

- Innovative approaches

- Stakeholder engagement

- Results and delivery

- Intelligent risk-taking

Ongoing prioritization and sequencing key to delivering on multiple priorities

The Secretariat realized early in the process that delivering on multiple new priority initiatives in a short time would be challenging. The challenge resulted largely from the volume of work and from the potential implications on the ability to deliver and on employee workload.

The Secretariat prioritized the initiatives according to their importance, materiality and scope. For all high‑priority initiatives, delivery charters were developed. These charters provide an in-depth assessment of priorities so that senior management can check on progress, compare progress across priorities, identify actions and reassess how resources are allocated.

As implementation progresses, the Secretariat will continue to explore ways to further prioritize and sequence to help minimize the risk of not delivering the desired results on time and to support the ultimate goal of maximizing benefits to Canadians.

Quality, available and timely data key to evidence-based decisions

As part of the results and delivery approach, the Secretariat started work to reorient its performance measurement framework to focus more on outcome-based results and on measures aimed at assessing what matters to Canadians. Although the move is intended to support evidence-based decision making, this new approach will work only if meaningful, quality and timely data are available.

The Secretariat therefore increased its efforts in this area. It started assessing available data and exploring options for addressing gaps, including investment gaps. Options being considered include developing interim indicators to measure short‑term progress until the new data systems are in place, and increasing collaboration with other departments in order to leverage expertise and systems across government.

The Task Force on Mental Health provides a good model of cooperation between the Government of Canada and federal public sector unions

The joint task force created in early 2015 to improve mental health and safety in the federal workplace has proven to be a good model of cooperation between the federal government and public sector unions for addressing issues of mutual concern. The task force released its first report in December 2015, which contained concrete recommendations for improving mental health in federal public service organizations. These recommendations were strengthened with the release of a second report, in May 2016. The Secretariat is considering using this model of cooperation in other areas of mutual concern, such as diversity and inclusion.

Enterprise-wide collaboration requires new ways of working

The Secretariat’s engagement in enterprise-wide initiatives such as back office transformation is relatively new. As with any new undertaking, some changes are difficult to implement, particularly early in the process when existing structures and rules are not conducive to new ways of working. The large number of stakeholders also presents a challenge, because they all have different capacities, requirements, and competing priorities.

To address these challenges, the Secretariat is taking a number of steps. These include staggered approaches through piloting and re-adjustment as necessary, as well as creation of new governance bodies that reflect the complexity, scope and diversity of stakeholders while clearly establishing decision rules necessary to harmonize various interests. The Secretariat recognizes that more could be done in this area. Moving forward, the Secretariat will focus on improving change management and communication by better integrating projects and planning.

Maintain Blueprint 2020 momentum by focusing on real changes for employees and engagement activities that resonate with them

Maintaining momentum and employee curiosity on an evergreen vision that includes many long‑term transformational initiatives is not easy, particularly given the constant pressure to deliver short-term results in the face of competing priorities.

In response, the Secretariat engaged leaders at all levels through various forums, including the This is TBS Steering Committee and town halls. It also maintained conversation on transformation through engagement activities that resonated with employees. For example, a café-style event was held during National Public Service Week that gave employees a chance to provide input on the main actions needed to respond to the results of the Public Service Employee Survey.

The Secretariat remained focused on areas of work where it can show progress in order to make the changes real for its employees.

Section III: Expenditure and human resources overview

Actual expenditures

| Main Estimates | Planned spending | Total authorities available for use | Actual spending (authorities used) | Difference (actual minus planned) |

|---|---|---|---|---|

| 6,892,444,333 | 6,892,444,333 | 6,270,667,911 | 4,127,888,742 | -2,764,555,591 |

| Planned | Actual | Difference (actual minus planned) |

|---|---|---|

| 1,844 | 1,807 | -37 |

Budgetary performance summary

| Strategic Outcome, Program(s) and Internal Services | 2015–16 Main Estimates | 2015–16 Planned spending | 2016–17 Planned spendingBudgetary performance summary note * | 2017–18 Planned spendingBudgetary performance summary note * | 2015–16 Total authorities available for use | 2015–16 Actual spending (authorities used) | 2014–15 Actual spending (authorities used) | 2013–14 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Note: Any minor numerical differences are due to rounding. |

||||||||

| Strategic Outcome: Government is well managed and accountable, and resources are allocated to achieve results | ||||||||

| Management frameworks | N/A | N/A | N/A | N/A | N/A | N/A | 54,481,225 | 57,875,343 |

| People management | N/A | N/A | N/A | N/A | N/A | N/A | 128,785,777 | 57,834,089 |

| Expenditure management | N/A | N/A | N/A | N/A | N/A | N/A | 30,431,157 | 35,573,464 |

| Financial management | N/A | N/A | N/A | N/A | N/A | N/A | 31,231,325 | 31,291,934 |

| Strategic Outcome: Good governance and sound stewardship to enable efficient and effective service to Canadians | ||||||||

| Decision-making support and oversight | 47,506,141 | 47,506,141 | 50,579,535 | 49,568,557 | 44,582,570 | 41,781,563 | N/A | N/A |

| Management policies development and monitoring | 73,826,361 | 73,826,361 | 68,090,606 | 68,236,105 | 67,999,885 | 65,041,366 | N/A | N/A |

| Government-wide program design and delivery | 50,671,220 | 50,671,220 | 53,256,595 | 52,997,096 | 134,545,152 | 90,757,746 | N/A | N/A |

| Government-wide funds and public service employer payments | 6,645,161,074 | 6,645,161,074 | 6,230,254,397 | 6,230,254,397 | 5,941,211,076 | 3,852,630,170 | 2,898,360,909 | 2,629,221,633 |

| Sub-total | 6,817,164,796 | 6,817,164,796 | 6,402,181,133 | 6,401,056,155 | 6,188,338,683 | 4,050,210,845 | 3,143,290,393 | 2,811,796,463 |

| Internal Services sub-total | 75,279,537 | 75,279,537 | 65,624,896 | 69,130,661 | 82,329,228 | 77,677,897 | 78,399,289 | 80,724,486 |

| Total | 6,892,444,333 | 6,892,444,333 | 6,467,806,029 | 6,470,186,816 | 6,270,667,911 | 4,127,888,742 | 3,221,689,682 | 2,892,520,949 |

In 2015–16, the Secretariat revised its Program Alignment Architecture to better reflect core business activities and support the achievement of expected results. Due to significant differences between the Secretariat’s previous Program Alignment Architecture and current structure, historical spending for fiscal year 2013–14 and 2014–15 has not been restated.

The budgetary performance summary table on the previous page provides the following:

- Main Estimates for 2015–16

- Planned spending for 2015–16, as reported in the Secretariat’s 2015–16 Report on Plans and Priorities (RPP)

- Planned spending for 2016–17 and 2017–18 for government commitments set out in ministerial mandate letters and as reported in the Secretariat’s 2016–17 RPP

- Total authorities available for use in 2015–16, which reflects the authorities received to date, including in-year contributions from other government departments for the government-wide back office transformation initiative, which the Secretariat is leading

- Actual spending for 2015–16, 2014-15 and 2013–14, as reported in the Public Accounts

Additional details on planned spending are provided as supplementary information.

The Government-Wide Funds and Public Service Employer Payments program is the largest portion of the Secretariat’s planned spending. On average, 58 per cent of this program’s funding is transferred to other federal organizations for items such as government contingencies, government-wide initiatives, compensation requirements, operating and capital budget carry forward, and paylist expenditures (Central Votes 5, 10, 15, 25, 30 and 33). The Secretariat’s total funding available for use is reduced accordingly. The remaining 42 per cent of this program’s funding is used to pay the employer’s share of the contributions to employee pension, insurance and benefits plans.

Overall, planned spending is projected to decrease by $422 million from 2015–16 to 2017–18. The decrease can be largely attributed to a reduction in Central Vote 30, Paylist Requirements. Payments for the elimination of accumulated severance are nearing completion and are expected to return to historical reference levels by 2016–17.

Actual spending increased by $906 million from 2014–15 to 2015–16. Most of that increase, $718 million, can be attributed to statutory items, largely due to an actuarial adjustment made in relation to the Public Service Superannuation Act. The rest of the increase, $236 million, related to public service employer payments to incrementally restore the financial health of the Service Income Security Insurance Plan (SISIP). This plan is providing benefits to an increased number of medically released Canadian Armed Forces members who served in the Afghanistan mission. These increases were offset by a $48‑million decrease in the Secretariat’s operating expenditures, mostly related to the sunset of funding received in 2014–15 for the payout of an out-of-court settlement under the White class action lawsuit launched against the Crown in 2014.

Actual spending increased by $329 million from 2013–14 to 2014–15. This was primarily attributed to funding received in 2014–15 to top up the SISIP reserves to a sustainable level and to implement approved benefit changes to the Public Service Health Care Plan (PSHCP) totalling $269 million. The remaining increase of $60 million is mainly the result of new funding received for the payout of the out-of-court settlement mentioned above.

Departmental spending breakdown

Figure 6 - Text version

This pie chart shows the breakdown of the Treasury Board of Canada Secretariat’s actual spending for 2015–16 in two categories: public service employer payments and various statutory items, which accounted for 93 per cent of actual spending, or $3,853 million; and Secretariat operations, which accounted for 7 per cent of actual spending, or $275 million).

The Secretariat spent a total of $4.1 billion toward achieving its Strategic Outcome. Departmental operations accounted for 7 per cent of total spending. The balance, 93 per cent, relates to the Secretariat’s role in supporting the Treasury Board as employer of the core public administration.

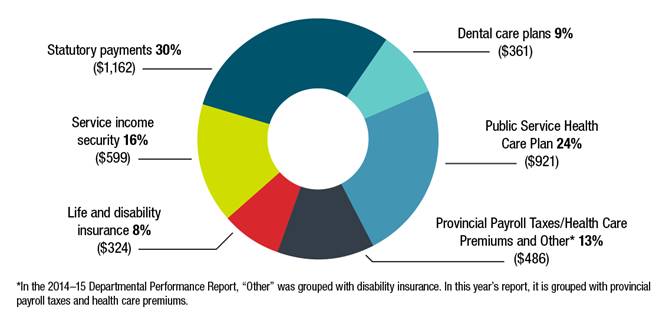

Figure 7 - Text version

This pie chart shows the breakdown of the Treasury Board of Canada Secretariat’s actual spending on public service employer payments and various statutory items for 2015–16. The pie chart is divided into six spending categories, broken down as follows:

| Category | Amount | Percentage of total |

|---|---|---|

| Statutory payments | $1,162 million | 30% |

| Public Service Health Care Plan | $921 million | 24% |

| Service income security | $599 million | 16% |

| Provincial Payroll Taxes / Health Care Premiums and Other Note: In the 2014–15 Departmental Performance Report, “Other” was grouped with disability insurance. In this year’s report, it is grouped with provincial payroll taxes / health care premiums. | $486 million | 13% |

| Dental care plans | $361 million | 9% |

| Life and disability insurance | $324 million | 8% |

Total spending for public service employer payments was $2.7 billion in 2015–16. The amount includes payments made under public service benefit plans, legislated amounts payable to provinces and associated administrative expenditures. Statutory payments, which relate to the employer contributions made under the Public Service Superannuation Act and other retirement acts and the Employer Insurance Act totalled $1.2 billion.

Departmental spending trends

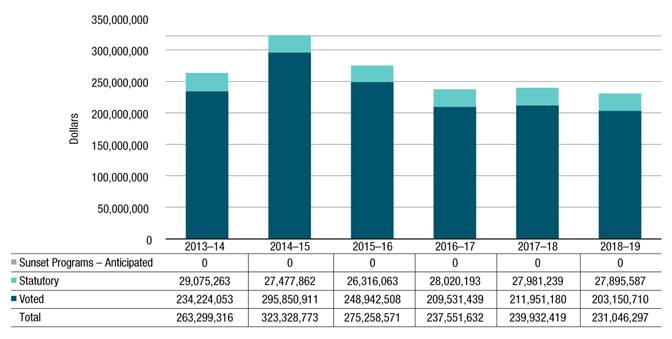

Figure 8 - Text version

This bar graph illustrates the Secretariat’s actual spending (Vote 1) for fiscal years 2013-14, 2014-15 and 2015-16 and planned spending for fiscal years 2016-17, 2017-18 and 2018-19. Financial figures are presented in dollars along the y axis, increasing by $50 million and ending at $350 million. These are graphed against fiscal years 2013-14 to 2018-19 on the x axis

For each fiscal year, amounts for the Secretariat’s program expenditures (Vote 1), statutory vote (largely comprised of contributions to employee benefit plans), and anticipated sunset programs are identified.

No amount is reported in 2013-14 to 2018-19 as sunset programs - anticipated.

In 2013-14, actual spending was $29,075,263 for statutory items, $234,224,053 for program expenditures for a total of 263,299,316.

In 2014-15, actual spending was $27,477,862 for statutory items and $295,850,911 for program expenditures for a total of 323,328,773.

In 2015-16, actual spending was $26,316,063 for statutory items and $248,942,508 for program expenditures for a total of 275,258,571.

Planned spending for statutory items goes from $28,020,193 in 2016-17, to $27,981,239 in 2017-18 and to $27,895,587 in 2018-19.

Planned spending for program expenditures goes from $209,531,439 in 2016-17, to $211,951,180 in 2017-18, and to $203,150,710 in 2018-19.

Total planned spending goes from $237,551,632 in 2016-17, to $239,932,419 in 2017-18, and to $231,046,297 in 2018-19.

The Secretariat’s operating expenditures include salaries, non-salary costs to deliver programs and statutory items related to the employer’s contributions to the Secretariat’s employee benefit plans.

Total program expenditures increased by $60 million between 2013–14 and 2014–15, mostly because new funding was received for the payout of an out-of-court settlement to eligible claimants under the White class action lawsuit.

The decrease of $48 million between 2014–15 and 2015–16 actual spending resulted mostly from reduced expenditures in 2015–16 related to the settlement in the White case and a decrease in spending related to the Workspace Renewal Initiative (phase I). Those decreases were partially offset by expenditures incurred to support the Government-Wide Back Office Transformation Initiative.

A further decrease of $37.7 million between 2015–16 and 2016–17 is attributed to the sunset of funding received for the same out-of-court settlement and for the Government-Wide Back Office Transformation Initiative.

Program expenditures are anticipated to decrease by $6.5 million from 2016–17 to 2018–19, mostly due to the sunsetting of the Workspace Renewal Initiative (phase II) and the reprofiling of Workplace Wellness and Productivity Strategy funding to accommodate project timelines that have been impacted by ongoing collective bargaining.

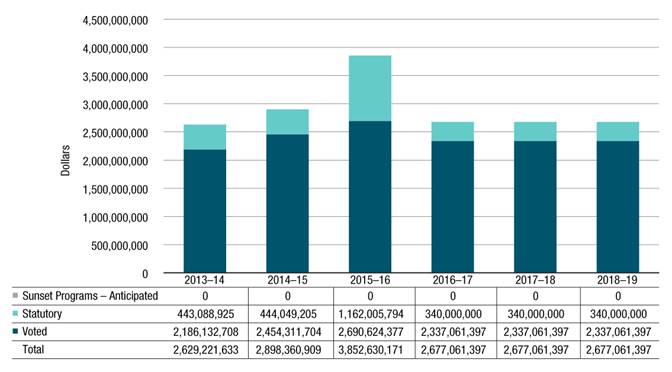

Figure 9 - Text version

This bar graph illustrates the Secretariat’s actual spending for the public service employer payments (Vote 20) and various statutory items for fiscal years 2013-14, 2014-15 and 2015-16 and planned spending for fiscal years 2016-17, 2017-18 and 2018-19. Financial figures are presented in dollars along the y axis, increasing by $500 million and ending at $4.5 billion. These are graphed against fiscal years 2013-14 to 2018-19 on the x axis.

For each fiscal year, amounts for the Secretariat’s public service employer payments (Vote 20), statutory items (largely comprised of payments under the Public Service Pension Adjustment Act), and anticipated sunset programs are identified.

No amount is reported in 2013-14 to 2018-19 as sunset programs - anticipated.

In 2013-14, actual spending was $443,088,925 for statutory items and $2,186,132,708 for public service employer payments for a total of 2,629,221,633.

In 2014-15, actual spending was $444,049,205 for statutory items and $2,454,311,704 for public service employer payments for a total of 2,898,360,909.

In 2015-16, actual spending was $1,162,005,794 for statutory items and $2,690,624,377 for public service employer payments for a total of 3,852,630,171.

Planned spending for statutory items will remain the same for fiscal years 2016-17 to 2018-19 in the amount of $340,000,000.

Planned spending for public service employer payments will remain the same for fiscal years 2016-17 to 2018-19 in the amount of $2,337,061,397.

Total planned spending will remain the same for fiscal years 2016-17 to 2018-19 in the amount of $2,677,061,397.

Expenditures for public service employer payments and statutory items represent the employer’s share of contributions required by the insurance plans sponsored by the Government of Canada. These amounts also include statutory items for payments under the Public Service Pension Adjustment Act and employer contributions made under the Public Service Superannuation Act, the Employment Insurance Act and related acts.

The increase of $269 million from 2013–14 to 2014–15 is largely attributed to public service employer payments. This increase was mostly to address a funding shortfall in the SISIP to provide benefits to the increased number of medically released Canadian Armed Forces members who served in the Afghanistan mission. Also contributing to the increase was the implementation of approved changes to the PSHCP that were negotiated in 2014.

The increase of $954 million from 2014–15 to 2015–16 is attributed to statutory items of $718 million, which is largely due to an actuarial adjustment made in relation to the Public Service Superannuation Act, and an increase of $236 million related to public service employer payments to incrementally restore the financial health of the SISIP.

Planned expenditures for 2016–17 are anticipated to decrease by $1,176 million from 2015–16, largely because of the actuarial adjustment noted above and because of a further decrease in contributions, which is to start in 2016–17. To a lesser extent, the decrease is also attributable to a payment made in 2015–16 for the SISIP that returned the plan to a sustainable position, partially offset by higher plan unit costs, membership utilization rates and benefit enhancements under the PSHCP.

Planned spending for statutory items in 2016–17 to 2018–19 has been updated to reflect the change made in the actuarial adjustment amount for future years in relation to the Public Service Superannuation Act.

Expenditures by vote

For information on the Treasury Board of Canada Secretariat’s voted and statutory expenditures, consult the Public Accounts of Canada 2016, which is available on the Public Services and Procurement Canada website.

Section IV: Financial statements

Financial statements highlights

The highlights presented in this section are drawn from the Secretariat’s financial statements. The financial statements were prepared using Government of Canada accounting policies, which are based on Canadian public sector accounting standards.

The figures provided in this section of the report may be different from those provided in other sections. The figures provided in other sections were prepared on an expenditure basis. The figures in this section were prepared on an accrual basis. The difference relates to accrual entries such as the recognition of services without charge received from other government departments, the acquisition of capital assets and related amortization expenses, as well as to accrued liability adjustments.

| Financial information | 2015–16 planned results | 2015–16 actual results | 2014–15 actual results | Difference (2015–16 actual minus 2015–16 planned) | Difference (2015–16 actual minus 2014–15 actual) |

|---|---|---|---|---|---|

| Total expenses | 2,962,600,282 | 4,152,291,564 | 3,185,488,729 | 1,189,691,282 | 966,802,835 |

| Total net revenues | 13,268,175 | 11,701,966 | 10,782,961 | (1,566,209) | 919,005 |

| Net cost of operations before government funding and transfers | 2,949,332,107 | 4,140,589,598 | 3,174,705,768 | 1,191,257,491 | 965,883,830 |

Note: Refer to the Secretariat’s 2015-16 Future-Oriented Statement of Operations for more information on planned results.

The Secretariat’s total expenses in 2015–16 included approximately $3.8 billion related to public service employer payments for government-wide benefits programs, such as the employer’s share of the Public Service Health Care Plan (PSHCP), the Public Service Dental Care Plan (PSDCP), and other insurance and pension programs. Total expenses also included contributions of $1.2 billion to the Public Service Pension Plan (PSPP) related to actuarial deficits. The Secretariat’s total net revenues of $11.7 million in 2015–16 mainly include internal support services that the Secretariat provided to other government departments and the recovery of PSPP administration costs.