*UPDATE* Remote Work Reimbursement Support Message

November 16, 2020 – Defence Stories

The following direction issued on September 11, 2020, regarding the support and reimbursement for certain expenses related to remote work, includes an update to the timelines for reimbursement.

This update is also reflected in the following CANFORGEN (link available only on the DWAN) and is the only update being made to the original guidance at this time.

All other guidelines and limits remain in effect and any further updates will be communicated as soon as possible.

Please see the “Timelines” section below for the updated information.

The past few months have been a challenging time for many Defence Team members requiring significant adjustments. For those working remotely, it has presented some very real hurdles. For some, this includes the details regarding the functionality of your workspaces.

Many Defence Team members have retrieved regular office equipment and supplies as recommended in the last communique on this topic. Some others have had to purchase specific items to ensure that work duties can continue to be performed remotely in the most effective way possible.

With that in mind, the following represents new direction regarding reimbursement of some of the costs related to working from home and is in line with other government departments:

General Guidance

- If you require equipment to support your remote work, you must first utilize existing processes to acquire what you need from your office space.

- If you require additional IT equipment, you should then utilize existing DND inventory while following the current guidance regarding what personal peripherals can be used at home.

- If there are still more requirements, or you feel you cannot conduct remote work with what is available, then a discussion should take place between you, your delegated manager, and the Health and Safety Advisor or General Safety Officer to determine how you can be accommodated, or if a return-to-the-workplace plan needs to be created.

- Delegated managers must continue to approve and track the removal of all IT and supporting equipment as per the established tracking mechanisms.

- In addition, you may now be reimbursed for certain expenses that have occurred during the past months

Claimable Amounts

- The maximum amount that each person can claim is set at $300 before taxes.

- Under exceptional circumstances, Level 1s (L1s) and their senior delegated RC managers may approve up to $500 before taxes.

Eligibility

- In order to be eligible for reimbursement, the work had to have been performed in your normal full-time assigned duties.

- Contractors and CAF Class A Reservists are not eligible to claim expenses.

- Questions regarding eligibility of claimable miscellaneous expenses are to be addressed through your delegated managers and chains of command.

- L1s are to exercise flexibility in the approval of these claims as not every employee will have been faced with the same situation.

Reimbursable Expenses

Examples of reimbursable expenses may include:

- purchase of small office items;

- office equipment and office supplies; and

- costs incurred to conduct essential/critical tasks.

Reimbursement Claim Process

- The reimbursement of miscellaneous expenses are to be made through the general allowance claim process (CF-52).

- A communique that provides details on the process has been sent to all level one comptrollers and regional departmental accounting offices by the Director of Financial Operations.

- Civilian and Canadian Armed Forces members, along with their section 34 managers, must ensure that appropriate supporting documentation such as invoice and proof of payment is included with the CF-52 request.

- Note that this directive and process is not to be used to circumvent departmental directives for claims that have already been issued and that already have their own processes, such as, pay related claims, local travel, etc.

- Delegated managers should contact their individual Comptroller with any questions regarding the claim process.

- L1 comptrollers are asked to work with their chains of command and local cashiers to meet the intent of this direction and expedite payment to personnel from each L1s budget.

- Note as well that the Corporate Departmental Accounting Office (CDAO) has established a point of contact at p-otg.cdao4-bccm4@intern.mil.ca to assist with the financial aspects of this initiative.

*UPDATE*

Timelines

- Reimbursement can be made for out-of-pocket expenses incurred between April 1, 2021, and September 30, 2021. Employees who have unpaid invoices related to the period March 13, 2020 to March 31, 2021 can claim reimbursement in acknowledgement with CANFORGEN 147/20 (accessible only on the National Defence network). Receipts or proof of purchase (such as a credit card statement) must be provided.

Ergonomic equipment

- You must utilize existing process for either obtaining your existing ergonomic equipment that is already in the workplace, or for acquiring new accommodation requests. This also includes having a virtual ergonomic assessment completed for your small equipment.

- All new accommodation requests and/or ergonomic assessments for small equipment should be discussed with your delegated manager.

- Overall, it should be noted that employees will only be equipped once, meaning if equipment is provided at a remote work location, it will not be provided in the workplace and vice versa.

Taxable Benefits

- We continue to await direction from the Office of the Chief Human Resources Officer (OCHRO) and the Canada Revenue Agency (CRA) who are examining the issue of tax credit and the use of form T2200.

- It is important to note, however, that if you request and are approved to receive a reimbursement, you will not also be eligible for a tax credit for those items.

- More information will follow once CRA issues their direction.

Additional Direction for CAF Members

- As this guidance applies to both civilian and military Defence Team members, we encourage you to read the CANFORGEN found here (Accessible only on the National Defence network) that outlines some additional information.

Next Steps

We will be providing more details and Qs and As as soon as possible regarding this direction. These details will be posted along with other useful information on the Working Remotely page found on the Defence Team Covid-19 web presence.

You may also consult the Information for Government of Canada Employees: Coronavirus Disease (COVID-19) page for additional information.

In the meantime, you are encouraged to keep the lines of communication open with your delegated managers and colleagues. We are a strong Defence Team, and this strength is maintained through positive and open dialogue at all levels.

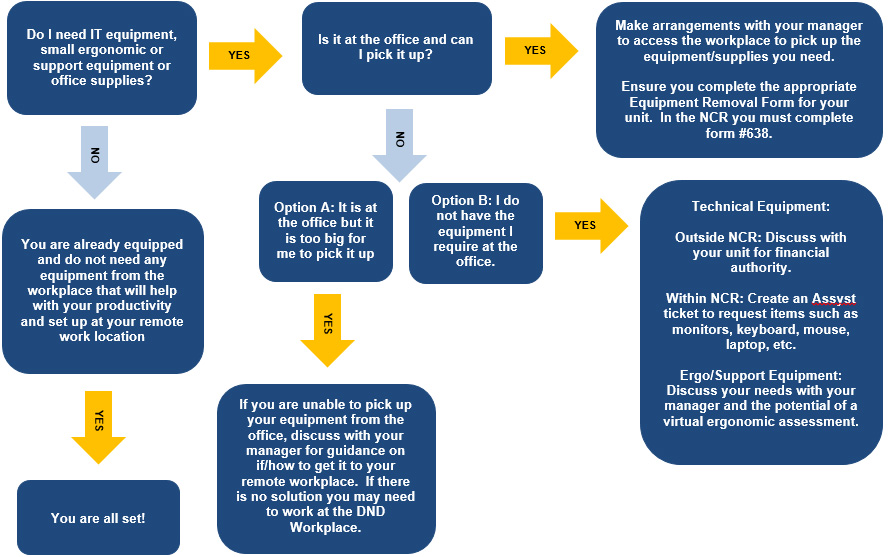

Guidance for Being Equipped for Remote Work

Figure 1 - Long description

September 11, 2020

Before starting work, ask yourself these questions:

- Do I need IT equipment, small ergonomic or support equipment or office supplies?

- YES

- Is it at the office and can I pick it up?

- YES

- Make arrangements with your manager to access the workplace to pick up the equipment/supplies you need.

Ensure you complete the appropriate Equipment Removal Form for your unit. In the NCR you must complete form #638.

- Make arrangements with your manager to access the workplace to pick up the equipment/supplies you need.

- NO

- Option A: It is at the office but it is too big for me to pick it up.

- YES

- If you are unable to pick up your equipment from the office, discuss with your manager for guidance on if/how to get it to your remote workplace. If there is no solution you may need to work at the DND Workplace.

- YES

- Option B: I do not have the equipment I require at the office.

- YES

- Technical Equipment:

- Outside NCR: Discuss with your unit for financial authority.

Within NCR: Create an Assyst ticket to request items such as monitors, keyboard, mouse, laptop, etc.

Ergo/Support Equipment: Discuss your needs with your manager and the potential of a virtual ergonomic assessment.

- Outside NCR: Discuss with your unit for financial authority.

- Technical Equipment:

- YES

- Option A: It is at the office but it is too big for me to pick it up.

- YES

- Is it at the office and can I pick it up?

- NO

- You are already equipped and do not need any equipment from the workplace that will help with your productivity and set up at your remote work location.

- YES

- You are all set!

- YES

- You are already equipped and do not need any equipment from the workplace that will help with your productivity and set up at your remote work location.

- YES

Page details

- Date modified: