How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability

Alternate formats

How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability [PDF - 213 KB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

Text version of How to open a Registered Disability Savings Plan (RDSP)

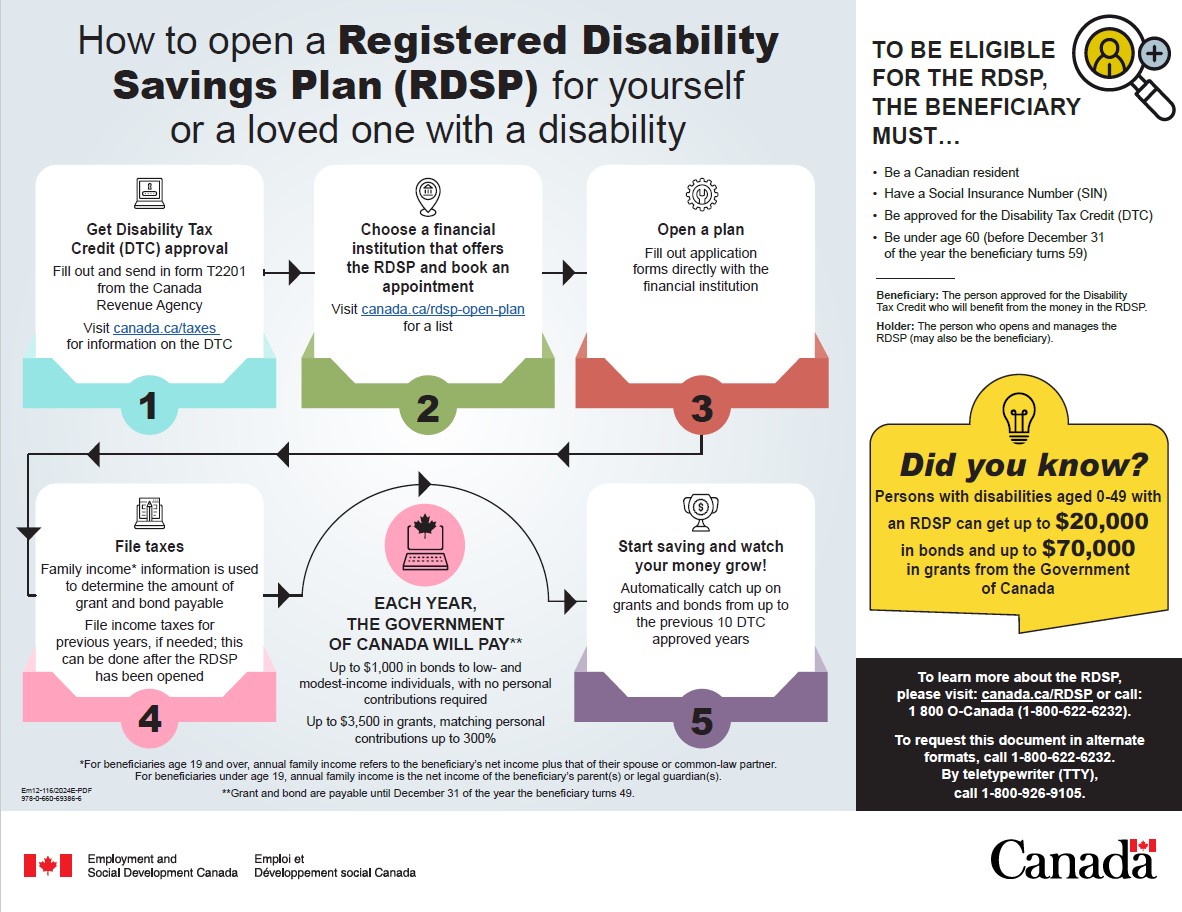

How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability

1: Get Disability Tax Credit (DTC) approval

- Fill out and send in form T2201 from the Canada Revenue Agency (CRA)

- Visit www.canada.ca/taxes for information on the DTC

2: Choose a financial institution that offers the RDSP and book an appointment

- Visit canada.ca/rdsp-open-plan for a list

3: Open a plan

- Fill out application forms directly with the financial institution

4: File taxes

- Family income information is used to determine the amount of grant and bond payable

- File income taxes for previous years, if needed; this can be done after the RDSP has been opened

Note: For beneficiaries age 19 and over, annual family income refers to the beneficiary’s net income plus that of their spouse or common-law partner. For beneficiaries under age 19, annual family income is the net income of the beneficiary’s parent(s) or legal guardian(s).

5: Start saving and watch your money grow

- Automatically catch up on grants and bonds from up to the previous 10 DTC approved years

Each year, the government of Canada will pay

- Up to $1,000 in bonds to low- and modest-income individuals, with no personal contributions required

- Up to $3,500 in grants, matching personal contributions up to 300%

Note: Grant and bond are payable until December 31 of the year the beneficiary turns 49.

To be eligible for the RDSP, the beneficiary must

- Be a Canadian resident

- Have a Social Insurance Number (SIN)

- Be approved for the Disability Tax Credit (DTC)

- Be under age 60 (before December 31 of the year the beneficiary turns 59)

Beneficiary: The person approved for the Disability Tax Credit who will benefit from the money in the RDSP.

Holder: The person who opens and manages the RDSP (may also be the beneficiary).

Did you know

- Persons with disabilities aged 0 to 49 with an RDSP can get up to $20,000 in bonds and up to $70,000 in grants from the Government of Canada

To learn more about the RDSP, please visit: canada.ca/RDSP or call: 1 800 O-Canada (1-800-622-6232).

To request this document in alternate formats, call 1-800-622-6232. By teletypewriter (TTY), call 1-800-926-9105.

Page details

- Date modified: