Change organization's fiscal period end

A registered charity must get permission from the Charities Directorate before it can change its fiscal year-end, since such a change affects the charity's filing obligations.

To submit a change

Through MyBA

1. Log in to your My Business Account (MyBA) account.

2. Scroll down to the menu for your charity’s RR account.

3. Select “Update registered charity or RCAAA information”.

4. Then, select “Change organization's fiscal period end” from the dropdown menu.

5. Provide a detailed description of your request in the text box

6. Make sure to include the following information:

- the new fiscal year-end

- the proposed effective date of the change

7. You may upload any supporting document.

On paper

Prepare a letter with the following information:

- the name and the registration number of your charity

- the new fiscal year-end

- the proposed effective year of the change

- the signature of a director/trustee or other authorized representative of the charity

Send the letter by:

Mail:

Charities Directorate

Canada Revenue Agency

Ottawa ON K1A 0L5

Fax:

833-339-0997 (toll-free number)

418-556-1813

Send your documents to only one number and avoid duplication.

Note

Do not include the letter with the charity's annual information return since this may cause processing delays.

Filing for the transition period

If a registered charity receives approval to change its fiscal year-end, it will have a transition period that is not a full 12 months. Therefore, it must file a separate information return for the months of transition. For example, if the charity's fiscal year-end was originally December 31, and the charity received approval to change it to March 31, one complete return is required for the original fiscal year of January 1 to December 31, and a separate complete return is required for the transition period from January 1 to March 31.

A registered charity's fiscal year generally should not be more than 12 months.

A return for the transition period or for the new fiscal year cannot be processed until the change in fiscal year-end has been approved. Therefore, the charity should submit a request as soon as it decides to make the change.

The charity may also need to amend its governing document if it includes a fiscal year-end (for example, bylaws state the fiscal year-end is December 31, and the charity is changing the fiscal year-end to March 31). We will still process this change; however, the charity must amend the date in its governing documents and submit a certified copy to the Charities Directorate. For more information, go to Change bylaws.

Graphic educational tool: Changing your fiscal-year end (FYE) (PDF)

Image description

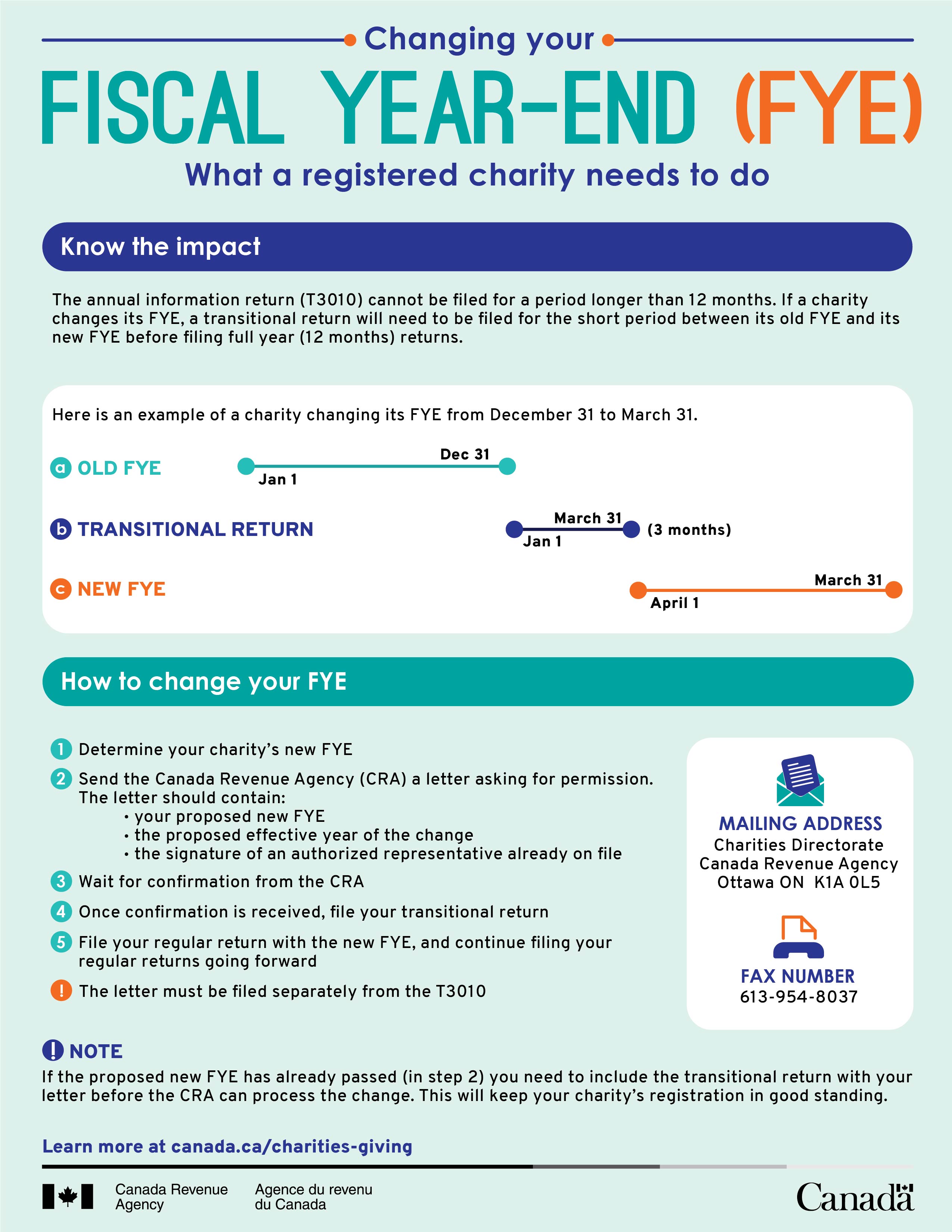

Changing your fiscal year end (FYE)

What a registered charity needs to do

Know the impact

The annual information return (T3010) cannot be filed for a period longer than 12 months. If a charity changes its FYE, a transitional return will need to be filed for the short period between its old FYE and its new FYE before filing full year (12 months) returns.

Here is an example of a charity changing its FYE from December 31 to March 31.

This graphic is an image representation of a filing timeline for a charity changing its FYE from December 31 to March 31.

In the first section, a line displays the old FYE period of January 1 to December 31. The second section displays the transitional return period, which will be from the following January 1 to March 31. The third section shows the new FYE period of April 1 to March 31.

How to change your FYE

- Determine your charity’s new FYE

- Send the Canada Revenue Agency (CRA) a letter asking for permission;

The letter should contain:- your proposed new FYE

- your proposed effective year of the change

- the signature of an authorized representative already on file

- Wait for confirmation from the CRA

- Once confirmation is received, file your transitional return

- File your regular return with the new FYE, and continue filing your regular returns going forward

- The letter must be filed separately from the T3010

NOTE

If the proposed new FYE has already passed (in step 2) you need to include the transitional return with your letter before the CRA can process the change. This will keep your charity’s registration in good standing.

Mailing address

Charities Directorate

Canada Revenue Agency

Ottawa ON K1A 0L5

Fax number

613-954-8037

Learn more at canada.ca/charities-giving

Page details

- Date modified: