Factsheet: The Underused Housing Tax (UHT): What is it?

General information on what the UHT is, who is affected, and how to file a return and pay the tax.

Factsheet description

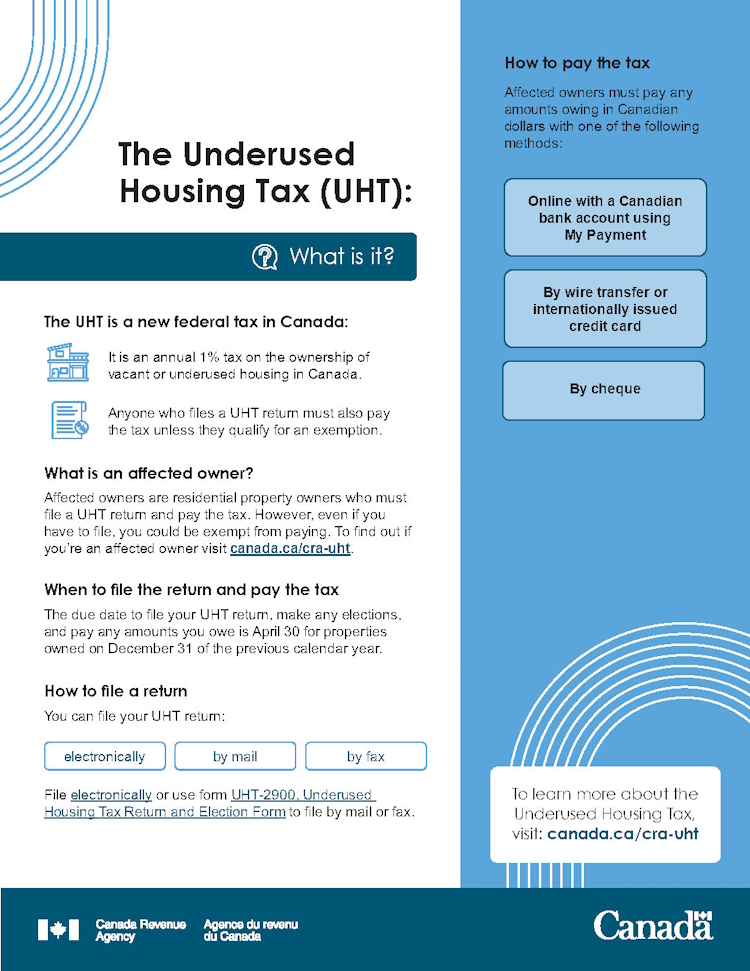

The Underused Housing Tax (UHT): What is it?

The UHT is a new federal tax in Canada:

- It is an annual 1% tax on the ownership of vacant or underused housing in Canada.

- Anyone who files a UHT return must also pay the tax unless they qualify for an exemption.

What is an affected owner?

Affected owners are residential property owners who must file a UHT return and pay the tax. However, even if you have to file, you could be exempt from paying. To find out if you’re an affected owner visit canada.ca/cra-uht.

When to file the return and pay the tax

The due date to file your UHT return, make any elections, and pay any amounts you owe is April 30th for properties owned on December 31st of the previous calendar year.

How to file a return

You can file your UHT return:

- electronically

- by mail

- by fax

File electronically or use form UHT-2900, Underused Housing Tax Return and Election Form to file by mail or fax.

How to pay the tax

Affected owners must pay any amounts owing in Canadian dollars with one of the following methods:

- Online with a Canadian bank account using My Payment

- By wire transfer or internationally issued credit card

- By cheque

To learn more about the Underused Housing Tax, visit: canada.ca/cra-uht.

Page details

- Date modified: