2020-21 Departmental Results Report

Table of contents

- From the minister

- Results at a glance

- Results: what we achieved

- Analysis of trends in spending and human resources

- Corporate information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

- Endnotes

From the minister

It is my pleasure to present the 2020-21 Departmental Results Report for the Atlantic Canada Opportunities Agency (ACOA).

In a year marked with uncertainty and rapidly shifting priorities resulting from the global COVID-19 pandemic, the Government of Canada remained committed in its continued efforts to meet the evolving needs of Canadians and the Canadian economy.

In Atlantic Canada, those efforts included a number of remarkable contributions from ACOA.

The Agency’s delivery of emergency relief measures under Canada’s COVID-19 Economic Response Plan helped businesses and communities cope with the economic impact of the pandemic. The Agency spent more than $206 million through the Regional Relief and Recovery Fund, as well as over $31 million through the Canadian Seafood Stabilization Fund, to support vulnerable sectors of the economy during a time of unprecedented uncertainty. Furthermore, the Agency launched the Regional Air Transportation Initiative, which is helping regional air services rebound from the challenges caused by the pandemic as Canada moves further into recovery.

In addition, ACOA administered the Black Entrepreneurship Program’s Ecosystem Fund to allow not-for-profit Black-led organizations in Atlantic Canada to develop or expand services for Black entrepreneurs, and continued to deliver its regular suite of programming to foster innovation, trade and growth. For example, through the:

- Regional Economic Growth through Innovation program, ACOA continued to help businesses innovate, scale up and improve their productivity, in particular by adopting digital technology to become more agile, resilient and competitive;

- Women Entrepreneurship Strategy, ACOA spent nearly $3 million to help women business owners grow their companies and help non-profit, third-party organizations provide them support;

- Accelerated Growth Service, ACOA spent $20.9 million to support 75 client-led growth projects;

- Atlantic Trade and Investment Growth Strategy, ACOA and the four Atlantic provincial governments backed 24 projects spending more than $8 million to support export growth in 10 strategic sectors; and

- Canadian Experiences Fund, ACOA spent over $2.5 million in support of 40 projects to address the needs of the tourism sector in Atlantic Canada.

The Agency spent more than $171 million to 772 projects designed to help Atlantic communities grow and become more economically diverse. Moreover, in support of the path to reconciliation, ACOA spent $16.7 million in 114 projects that advanced indigenous economic priorities.

Through all these initiatives and more, we continued to deliver on our commitment to foster a dynamic and growing economy that creates jobs, opportunities and a better quality of life for all Canadians, including those from diverse backgrounds, such as women, Indigenous peoples, racialized Canadians, persons with disabilities and LGBTQ+ groups.

I invite you to read this report to learn more about how ACOA is working to foster a dynamic, growing and inclusive economy that creates jobs, opportunities and a better quality of life for all people of Atlantic Canada.

Results at a glance

| Total actual spending for 2020-21 Footnote 1 | Total actual full-time equivalents for 2020-21 |

|---|---|

| $575,045,616 | 584 |

The COVID-19 global pandemic created challenges in 2020-21 unlike any in the Atlantic Canada Opportunities Agency’s (ACOA) 33 years of working with entrepreneurs and business leaders to strengthen and diversify Atlantic Canada’s economy. The Agency has been at the forefront of the Government of Canada’s (GC) COVID-19 economic response in Atlantic Canada, rolling out emergency relief programs on an unprecedented scale while supporting the GC’s commitment to create over one million jobs to restore employment to pre-pandemic levels. In 2020-21, ACOA nearly doubled its grants and contributions budget to roll out programs and projects to keep Atlantic Canada strong. This is estimated to have helped create or maintain over 16,500 jobsFootnote 2 with expenditures of $496.2 million in 2,797 projects. This includes more than $260 million in COVID-related support in more than 800 projects across all Agency programs. The Agency worked with Atlantic Canadian businesses, communities, stakeholders, federal departments and the four provincial governments to monitor and analyze regional impacts, develop responsive policy and program solutions and protect the economy.

In 2020-21, regional development agencies (RDAs), including ACOA, launched and delivered the Regional Relief and Recovery Fund (RRRF) to provide additional support to businesses and communities to cope with and recover from the pandemic. Since the launch of the RRRF in April 2020, the six RDAs and nearly 270 Community Futures Organizations delivered over $1.7 billion to close to 23,700 businesses and organizations, helping to preserve over 188,000 jobs across the country. In addition to the RRRF, ACOA delivered the Department of Fisheries and Oceans’ Canadian Seafood Stabilization Fund (CSSF) in Atlantic Canada, with a regional allocation of $42.7 million in 2020-21Footnote 3, and launched the Regional Air Transportation Initiative (RATI) with a regional allocation of $10 million in 2020-21 of $41.2 million over two yearsFootnote 4 and the Black Entrepreneurship Program’s Ecosystem Fund’s $270,000 regional allocation in 2020-21 of $2.6 million over four years. This is in addition to regular offerings, including the Regional Economic Growth through Innovation Program along with its Women Entrepreneurship Strategy’s Ecosystem Fund, the Canada Coal Transition Initiative, and the Canadian Experiences Fund. ACOA focused on priorities that are critical for sustainably growing Atlantic Canada’s economy, such as advanced manufacturing, clean growth, life sciences, food, tourism, skills, indigenous economic development, oceans, innovation ecosystems and immigration. Investments embraced inclusivity and reached out to all groups of Atlantic Canadians in the economy across all regions. ACOA programs were delivered with an inclusive lens to ensure under-represented groups were supported, including official language minority communities. Activities included the following:

Businesses – To mitigate COVID-19 disruptions, ACOA helped firms adapt and respond to emerging challenges by addressing safety requirements, increasing e-commerce capacities, building on strengths in key sectors, and by pivoting quickly to find new market opportunities that minimize long-term disruptions to exports. As an exception, the Agency also provided liquidity financing required to respond to pressures created by the pandemic. The Agency spent $243.1 million for 1,618 projects that support the development of products and services, the adoption and adaptation of advanced technology, and the acquisition of skills and market knowledge. It supported company-oriented growth plans under the Accelerated Growth Service, worked with federal and provincial partners to deliver on the Atlantic Trade and Investment Growth Strategy, and helped hard-hit tourism operators. With ACOA’s support:

- Labrador Fishermen’s Union Shrimp Company Limited, a Newfoundland and Labrador Indigenous-owned company, implemented health and safety measures, acquired new fish processing equipment to automate operations, and enhanced its cold storage.

- Prince Edward Island’s regional tourism associations were able to adapt to the unprecedented downturn in global tourism due to COVID-19, quickly identifying operators in need and delivering support to help them safely welcome tourists when travel demand resumes.

Technologies – ACOA spent $78.3 million for 388 projects to support the development and commercialization of innovative technologies, including advanced and clean technologies. During the COVID-19 pandemic, this helped local companies and organizations develop digital technology to protect or improve productivity, resiliency and global competitiveness. The Agency fostered partnerships and collaborations between the private sector, and research and business support organizations. It also supported business accelerators and incubators in the region to address gaps in support of start-ups. As a result of ACOA’s support for technology:

- New Brunswick-based TechImpact’s Digital Boost Program leveraged strong partnerships to accelerate businesses’ digital transformation in the wake of COVID-19.

- Nova Scotia’s Nexus Robotics furthered its smart robotic agriculture weeding technology with field trials, additional research and development, manufacturing design work, and commercialization activities to bring this technology to market.

Communities – ACOA fostered inclusive growth by spending $171.4 million in 772 projects to develop and diversify communities. The Agency helped attract and retain global talent, supported strategic investment to help communities adapt to changing economic circumstances, and engaged with governments, businesses and community stakeholders to foster economic growth in Indigenous communities. During the COVID-19 pandemic, investments by ACOA and the Community Business Development Corporations (CBDCs) helped alleviate the impacts of the pandemic, especially in rural and remote communities with small and highly interwoven economies often relying on a single industry (e.g., main street businesses relying on a major local employer affected by COVID-19). It also spent $15.7 million to help businesses owned or led by women entrepreneurs grow. With ACOA’s support:

- The Nova Scotia Native Women’s Association provided technical support to female Indigenous entrepreneurs to allow them to access the market through online sales and e-commerce, replacing their traditional venues for sales such as Pow Wows and Mawio’mi, which could not take place due to the pandemic.

- The Pan-Atlantic Women in Business initiative launched a program aimed at improving access to consultants to allow women-owned businesses to navigate COVID-19 disruptions.

For more information on ACOA’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Core responsibility: economic development in Atlantic Canada

Description

Support Atlantic Canada’s economic growth, wealth creation and economic prosperity through inclusive clean growth and by building on competitive regional strengths. Help small and medium-sized enterprises (SMEs) grow through direct financial assistance and indirectly through business support organizations. SMEs become more innovative by adopting new technologies and processes and pursuing new avenues for expansion and market diversification in order to compete and succeed in a global market.

Results

In 2020-21, the Agency swiftly helped businesses and business support organizations find new ways to operate in a disrupted and digital environment as a result of COVID-19 restrictions. COVID-19 relief measures nearly doubled ACOA’s grants and contributions budget, going from $275 million to $514 million, which allowed it to support and guide many companies to adapt to stay open, notably by automating processes and digitizing operations. Many SMEs were able to maintain or increase revenues and reach new markets while keeping employees on the payroll by taking their business online, developing new products and services, and implementing new digital marketing tactics, tools and resources. For example, ACOA directly helped over 550 businesses preserve an estimated 6,200 jobs in Atlantic Canada with the RRRF. Combined with support delivered by the Atlantic Association of CBDCs, the RRRF helped over 2,650 businesses and organizations preserve over 12,000 jobs.

The Agency excelled at delivering temporary and regular programs in a timely and efficient way, building in flexibility to meet the changing needs of businesses as they dealt with the effects of the pandemic. It did so collaboratively with several federal departments, including other regional development agencies and the ISED portfolio, provincial governments and stakeholders in the design and delivery of programs. To better understand their needs, the Agency also actively engaged Atlantic businesses, community stakeholders and support organizations such as the Canadian Federation of Independent Business, chambers of commerce, the New Brunswick Business Council, the Atlantic Provinces Economic Council, downtown development associations, CBDCs and other business associations.

In 2020-21, the Agency invested in 2,797 projects for a total of $496.2 million in spending. This includes delivery of ongoing programs such as the Regional Economic Growth through Innovation (REGI) Program in Atlantic Canada to help companies across a range of sectors expand their capacity, hire more people and acquire new, specialized technology to improve their productivity. ACOA also delivered temporary relief programs such as the Atlantic portion of the Government of Canada’s more than $1.7 billion RRRF which represented 535 projects worth $206.2 million of Agency spending in Atlantic Canada. In addition, ACOA delivered the Atlantic component of the CSSF which amounted to $31.7 million spent by the Agency in 126 projects in the region. ACOA also launched the RATI and the Black Entrepreneurship Program’s Ecosystem Fund.

Project investments targeted strategic sectors such as manufacturing and processing, seafood and aquaculture, tourism and cultural industries, information and communications technology, and oceans. Efforts promoted advanced manufacturing, digital transformation, the start-up ecosystem and exports as drivers of competitiveness. Activities also focused on indigenous economic development and supported a skilled workforce through immigration. During the COVID-19 pandemic, the Agency had to rethink its program supports to respond to the unprecedented challenges faced by regional businesses. Under these exceptional circumstances, ACOA provided liquidity supports, paused repayments, and supported new sectors and territories in both urban and rural areas. For example, ACOA worked closely with health organizations to source essential medical and personal protective equipment for health care and industrial use during the early days of the pandemic. ACOA acted as a catalyst for economic development and a convener of partners to take joint action. It played a pathfinding role to improve access to federal investments for Atlantic businesses and communities.

The Agency’s work was in line with the Minister’s mandate letter commitments to deliver regional economic programming that is responsive to the unique opportunities and challenges in Atlantic Canada, including acting as a trusted resource for businesses and communities. Efforts introduced sector-specific measures for hard-hit industries including tourism and advanced the Atlantic Loop initiative in support of the Atlantic Growth Strategy’s objectives. This contributed to the GC’s overall goal of creating over one million jobs, restoring employment to levels prior to the pandemic by leveraging ACOA’s unique expertise.

Businesses are innovative and growing in Atlantic Canada

In 2020-21, ACOA supported businesses at various development stages to accelerate their growth, assist them in scaling up, and enhance their productivity and competitiveness in both domestic and global markets. Firms supported by ACOA programs reported revenue growth, slightly higher than the set target of 8%, at an average rate of 8.2% in 2019-20.Footnote 5 The Agency, in collaboration with federal and provincial partners, targeted strategic support for 15 high-growth potential firms under the Accelerated Growth Service during the year, for a total of 111 Atlantic Canadian firms enrolled and 195 projects since 2017. These efforts helped support the region’s 590 high-growth firms in 2018.Footnote 6

Positioning companies to leverage opportunities in the global ocean sector was key, and ACOA worked with partners to maximize the economic benefit of the blue economy while ensuring long-term sustainability. ACOA contributed to the development of the new Blue Economy Strategy and the Ocean Supercluster by supporting ocean-related sectors and SMEs operating in them, coastal regions and Indigenous communities.

COVID-19 created significant challenges for global supply chains and export markets. Over the course of 2020-21, ACOA spent $8.8 million in trade and investment initiatives to help businesses address these challenges and grow new and existing markets. This included supporting tools for export readiness, adapting to virtual trade shows to foster trade relationships, and attracting foreign direct investment to high quality development sites across the region. Some of these initiatives were supported through the Atlantic Trade and Investment Growth Agreement, under which the Agency and the four Atlantic Provinces spent nearly $1.9 million for 17 projects to support export growth in 10 strategic sectors. These collaborative initiatives addressed the needs of sectors greatly impacted by COVID-19, supported SMEs’ pivot to e-commerce, virtual presence and access to new markets such as the European Union. For example, the agreement supported a project to increase the global e-commerce and online marketing capacity of Atlantic Canada companies across multiple sectors with interests in the European, Asian (Japan, South Korea and Southeast Asia) and Mexican markets. Atlantic Canada’s exports fell by 16.6% from $28.7 billion in 2019 to $23.9 billion in 2020, a greater drop than the national average of 11.5%, driven by a global decline in demand for Atlantic Canadian goods such as seafood. In spite of the decline, export levels for Atlantic Canada in 2020 remained on track with the Agency’s target of $24 billion, which considered the impacts of the pandemic.Footnote 7

Pandemic restrictions had a devastating impact on Canada’s tourism industry - on jobs, businesses and communities – with full recovery expected to take three to five years. Recognizing the disproportionate effect the pandemic had on the sector, tourism operators were provided much needed liquidity assistance through the RRRF, 25 percent of which was earmarked for the tourism sector. ACOA also worked with the four provincial governments in Atlantic Canada to support the tourism sector through the $4.5 million Atlantic Canada Tourism Recovery Initiative. In addition, the Agency spent $2.5 million to support 40 projects to address the needs of the tourism sector in Atlantic Canada through the Canadian Experiences Fund.

ACOA ensured that Atlantic Canada had a strong voice and that advocacy activities were strategically aimed at helping the region recover from the COVID-19 pandemic and take advantage of new and emerging opportunities. Advocacy and engagement supported pathfinding that matched regional economic development opportunities with federal funding. For example, ACOA identified and developed a personal protective equipment supplier database and ensured that information detailing federal COVID-related support programs was disseminated to Atlantic Canadian stakeholders aligned with the joint federal priorities of supporting the economy through the pandemic and supporting the effort to combat COVID-19.

ACOA positioned and promoted regional industry by leveraging major Canadian Coast Guard and defence procurement opportunities through the application of Canada’s Industrial Technological Benefits (ITB) policy. The Agency worked with international aerospace and defence firms to facilitate engagement with regional industry and research institutes through capability requests, “industry days” and other tools adapted to meet the current environment. ACOA facilitated 406 meetings between regional stakeholders and prime contractors, helping secure approximately $305.2 million in ITB commitments in the region.

ACOA fostered the adoption of advanced manufacturing technology and business activities between Atlantic Canada and international markets. For instance:

- New Brunswick’s Sparta Manufacturing is a leader in the design of construction, demolition, and waste recycling systems. The company implemented skills improvement for its national and international market expansions and its lean operations, positioning it for increased sales, profitability and sustainability in the green economy.

- The Scale-Up Hub Atlanta initiative helped high-potential Atlantic Canadian Information Technology companies navigate a complex yet lucrative market. It will enhance collaboration between Georgia’s innovation cluster and Atlantic Canada’s ecosystem.

Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada

ACOA supported firms at all levels, from start-ups to established firms, to accelerate their growth and scale-up, and to enhance their productivity and competitiveness in both domestic and global markets. During the COVID-19 pandemic, this helped local companies and organizations adopt and develop digital technology to protect or improve productivity, resiliency and global competitiveness. The Agency assisted the creation and growth of inclusive regional business ecosystems that support firm needs and foster an entrepreneurial environment, particularly in key sectors such as food and oceans. Efforts from the Agency contributed to private-sector investment in research and technologies in the region, and the value of business expenditures in research and development (R&D) by firms receiving ACOA funding reached an average of $90.3 millionFootnote 8 in 2018, surpassing the Agency’s target of $84 million.

The Agency built linkages with innovation ecosystems by working with other public, private and institutional partners and by supporting start-ups. It addressed gaps in support of start-ups by approving $14 million for 31 projects with Atlantic Canada’s business accelerators and incubators, providing targeted support to foster an entrepreneurial culture, developing a robust financing chain, and ensuring the early-stage companies’ pathways to globalization. It engaged with clients, other federal departments and agencies, organizations, academia and associations outside the GC to improve awareness of national funding sources and enhance industrial sector growth and innovation through R&D activities. A recent evaluation of business innovation programming found that “the programming offers unique features, including flexible, non-dilutive funding options and non-financial supports focused on promoting the growth of SMEs in the region.”Footnote 9

The Agency also worked through the Atlantic Canada Energy Office on issues that affect the competitiveness of the region’s oil and gas industry and to support clean technology and energy. The Agency partnered with the oil and gas sector and the Government of Newfoundland and Labrador to raise awareness on steps needed to continue reducing greenhouse gas emissions. On clean energy, the Agency participated in the Atlantic Loop initiative and the Clean Power Roadmap for Atlantic Canada, a partnership of Atlantic provincial governments and Quebec, along with federal departments to outline a vision for clean energy collaboration over the coming decades. The Agency supported the commercialization and scale-up of clean technology companies with a focus on building commercial capacity in clean energy, air, water and decarbonization. In 2020-21, ACOA spent $32.9 million in 183 projects to accelerate the adoption of clean technologies. In 2019, clean technology exports from Atlantic Canada totalled $481 million.

With these activities, ACOA supported the development of new technologies and a strong innovation ecosystem:

- Newfoundland and Labrador’s Avalon Holographics advancing its company’s proprietary organic light-emitting diode display technology, known as the HoloPanel display, allowing it to meet client demands and expand to new markets. By replicating the experience of looking at real objects, Avalon's displays produce incredibly lifelike and comfortable, accessory-free experiences.

- The University of Prince Edward Island’s Canadian Centre for Climate Change and Adaptation attracted an expert team of researchers with its talent recruitment initiative, strengthening the capacity for research and development collaboration in its School of Sustainable Design Engineering and Climate Research Lab.

- Develop Nova Scotia, Nova Scotia Business Inc., and several private companies were able to support the development of a new multi-sensor seabed platform to test marine instrumentation. The platform will allow multiple organizations to test marine sensors and devices at the same time and reduce the costs and investment needed to bring new technologies to market.

Communities are economically diversified in Atlantic Canada

In 2020-21, ACOA supported the economic diversification of communities and promoted the inclusion of groups such as women, newcomers, Indigenous people, younger and older workers, and persons with disabilities in the Atlantic economy. ACOA has largely met its targets for economic diversification as demonstrated through the percentage of professional, science and technology-related jobs in the region, which represented 33.7% of all jobs in Atlantic Canada’s economy in 2020, above the Agency’s target of 31%.Footnote 10 The Agency’s efforts helped increase inclusiveness among SMEs. Between 2012 and 2016, women-owned ACOA commercial clients not only registered a higher than average labour productivity growth rate than men-owned ACOA commercial clients, but also outperformed women-owned businesses from a comparable group of Atlantic Canadian firms.Footnote 11

Every dollar invested by ACOA in community projects leveraged $0.58 dollar in 2020-21.Footnote 12 Although this is below ACOA’s target, ACOA responded to increased demand for emergency support in communities. These community organizations often had little ability to share costs due to COVID-19 impacts and were sometimes ineligible for other emergency programs. Investments helped alleviate the impacts of the pandemic, especially in rural and remote communities with small and highly interwoven economies often relying on a single industry (e.g., main street businesses relying on a major local employer).

ACOA continued to help bridge the labour and skills divide and increase the region’s capacity to attract global talent and international students, retain newcomers through enhanced settlement support, and ensure immigrant entrepreneurs led successful businesses and were integrated into the economy, including in rural areas. A recent evaluation found that “the program delivery model, with local presence as well as convening and pathfinding roles, allows the Agency to be responsive to the diverse and changing economic needs across the region. ACOA has developed or strengthened collaborations to better address immigration, skills and labour, and funding.”Footnote 13 The Agency played a leadership role in building strategic partnerships with key federal departments such as Immigration, Refugees and Citizenship Canada and the Atlantic Provinces through the promotion of the Atlantic Immigration Pilot.

As part of ACOA’s commitment to reconciliation, the Agency continued to support the Federal Framework for Aboriginal Economic Development with Indigenous stakeholders such as the Ulnooweg Development Group, Indigenous leadership and businesses, the Atlantic provincial governments, and Indigenous Services Canada. In 2020-21, the Agency spent $16.7 million in 114 indigenous projects. ACOA also collaborated with ISED to develop an Indigenous industrial and skills analysis, which led to the identification of over 480 Atlantic Canadian Indigenous firms and 98 Indigenous-related academic activities (e.g., research, partnerships with post-secondary educational institutions).

In support of national programs, ACOA provided $94.2 million to the network of CBDCs and their associations for the Community Futures Program, with $81.6 million above regular funding levels in 2020-21 due to COVID-19Footnote 14, to distribute to main street businesses and retailers in small, rural and remote communities throughout Atlantic Canada. A recent national, horizontal evaluation of the Community Future Program found that the programming contributed to “strengthening business practices, economic growth, job creation and diversification of rural economies.”Footnote 15

ACOA spending of over $462,000 for nine projects supported official language minority community partners through the Agency’s Economic Development Initiative.

ACOA helped communities diversify, supported women entrepreneurs, and enabled partners to attract and retain skilled global talent in Atlantic Canada:

- The Epekwitk Assembly of Councils developed and implemented a plan for Indigenous economic development for Prince Edward Island’s Mi’kmaq community.

- New Brunswick’s FutureNB, Avenir NB (for francophones) and Future Wabanaki (for Indigenous peoples) programs fostered meaningful, inclusive experiential learning opportunities with employers.

Gender-based analysis plus

All ACOA programs were delivered with an inclusive lens to support groups that are under-represented in Atlantic Canada’s economy and among its entrepreneurs, including immigrants, Indigenous people and women. Targeted programming such as the Black Entrepreneurship Program’s Ecosystem Fund marks a continued focus on important members of the business community. COVID-19 impacted some groups and regions more heavily than others. The pandemic brought forward systemic biases in the economy and its workforce. ACOA went beyond its traditional client base with the RRRF to support SMEs where women, immigrants, youth, Indigenous peoples, and other under-represented groups were present. This broadened ACOA’s activities to new areas, new sectors such as retail, and new types of supports such as liquidity.

ACOA continued to integrate gender-based analysis plus (GBA+) into its analyses for new initiatives, program evaluations, data and reporting mechanisms – including agreements with Statistics Canada for disaggregated data – and awareness building across the Agency to highlight the economic benefits of inclusivity.

Experimentation

ACOA implemented the Digital Accelerator Pilot to help growth-oriented SMEs enhance digital adoption by implementing quick impact projects to bring them along digital transformation journeys. It offered support to hire expertise for digital assessment and strategy development and to implement small digital projects, generating quick return on investments and serving as building blocks for further investments along the digital adoption continuum.

2030 Agenda for Sustainable Development

ACOA contributes to the GC’s efforts to create good jobs and power economic opportunities through clean growth, clean energy and a low-carbon government. The Agency supports clean growth by investing in the transition to the green economy by supporting initiatives such as greenhouse gas mitigation, clean technology product development and adoption, as well as the green transformation and adaptation of SMEs. Together, these activities advance the Sustainable Development Goals 7 (Affordable and Clean Energy), 8 (Decent Work and Economic Growth), 9 (Industry, Innovation and Infrastructure) and 12 (Responsible Consumption and Production).

Results achieved

| Departmental results | Performance indicators | Target | Date to achieve target | 2018-19 Actual results |

2019-20 Actual results |

2020-21 Actual results |

|---|---|---|---|---|---|---|

| Communities are economically diversified in Atlantic Canada | Percentage of Atlantic Canadian SMEs that are majority owned by women, Indigenous people, youth, visible minorities and persons with disabilities | Majority owned by: 17% female; 1% Indigenous; 10.5% youth; 4% visible minorities; and 0.3% persons with disabilities |

March 31, 2020 | 17.1% female, 1.1% Indigenous, 10.6% youth, 4.5% visible minorities, and 0.3% persons with disabilities (2017) Footnote 16 |

17.1% female, 1.1% Indigenous, 10.6% youth, 4.5% visible minorities, and 0.3% persons with disabilities (2017) Footnote 16 |

17.1% female, 1.1% Indigenous, 10.6% youth, 4.5% visible minorities, and 0.3% persons with disabilities (2017) Footnote 16 |

| Percentage of professional, science and technology-related jobs in Atlantic Canada’s economy | 31% | March 31, 2020 | 32% (2018) | 31.8% (2019) | 33.7% (2020) | |

| Amount leveraged per dollar invested by ACOA in community projects | $1.20 for every dollar invested by ACOA in Atlantic Canada | March 31, 2020 | $1.32 | $1.00 | $0.58 | |

| Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada | Value of business expenditures in R&D by firms receiving ACOA program funding, in dollars | $84 million | March 31, 2020 | $86.7 million (2012 – 2016) Footnote 17 | $85.3 million (2013 - 2017) Footnote 17 | $90.3 million (2014 – 2018) Footnote 17 |

| Percentage of businesses engaged in collaborations with higher education institutions in Atlantic Canada | 18% | March 31, 2020 | 18% (2017) Footnote 16 | 18% (2017) Footnote 16 | 16.9% (2019) | |

| Businesses are innovative and growing in Atlantic Canada | Number of high-growth firms in Atlantic Canada | 600 | March 31, 2020 | 610 (2016) Footnote 16 | 620 (2017) Footnote 16 | 590 (2018) Footnote 16 |

| Value of export of goods (in dollars) from Atlantic Canada | $24 billion | March 31, 2020 | $26.4 billion | $28.7 billion | $23.9 billion | |

| Value of exports of clean technologies (in dollars) from Atlantic Canada | Not available | March 31, 2020 | $450 million (2017) | $493 million (2018) Footnote 18 | $481 million (2019) Footnote 18 | |

| Revenue growth rate of firms supported by ACOA programs | 8% | March 31, 2020 | 7.2 % (2012 – 2016) Footnote 17 | 9.2% (2013 – 2017) Footnote 17 | 8.2% (2014 – 2019, excl. 2018) Footnote 17 |

Budgetary financial resources (dollars)

| 2020-21 Main Estimates |

2020-21 Planned spending |

2020-21 Total authorities available for use |

2020-21 Actual spending (authorities used) |

2020-21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 274,054,608 | 274,054,608 | 560,929,143 | 545,036,957 | 270,982,349 |

Human resources (full-time equivalents)

| 2020-21 Planned full-time equivalents |

2020-21 Actual full-time equivalents |

2020-21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 381 | 383 | 2 |

Financial, human resources and performance information for ACOA’s Program Inventory is available in GC InfoBase.

Internal services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refer to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are:

- Acquisition Management Services

- Communication Services

- Financial Management Services

- Human Resources Management Services

- Information Management Services

- Information Technology Services

- Legal Services

- Material Management Services

- Management and Oversight Services

- Real Property Management Services

Results

ACOA supported workplace well-being by continuing to foster a healthy, respectful, accessible and inclusive workplace.

During 2020-21, ACOA’s COVID-19 Committee maintained its focus on ensuring the health, safety and continued engagement of employees during their transition to working from home, the delivery of the Agency’s mandate and the support for the Government’s relief efforts to Canadians impacted by the pandemic.

The Agency placed a high priority on building an inclusive workforce, creating the Office of Inclusion, Equity and Anti-Racism, and making strong progress on the first year of its multi-year Employment Equity, Inclusion and Anti-Racism Action Plan. Of note, ACOA implemented and its in-house dialogue session on “Diversity Inclusion Competency Excellence” and delivered it to ACOA executives and employees as well as other government departments and partners. The newly designed Onboarding Program was also implemented, with a focus on welcoming new employees into ACOA’s inclusive workplace culture.

The Agency continued to make progress on its Official Languages Integrated Action Plan 2019 – 2022, with dedicated attention on the assessment and monitoring of the Agency’s current and new programs and services, in light of the needs of the official languages minority communities.

With the passing of Bill-C65, the Agency has also implemented its harassment- and violence-prevention program. ACOA continues to deploy efforts toward the implementation of the related policy and guidelines to assure a safe space for employees to report and resolve any occurrences of incidents.

ACOA implemented several information management/information technology initiatives to support a remote workforce during the pandemic. These initiatives align with the Government of Canada Digital Operations Strategic Plan: 2021 – 2024 and will serve the Agency well post-pandemic. Among the initiatives implemented were several network infrastructure upgrades to improve performance and the deployment of Microsoft Teams. In fact, ACOA was one of six pathfinder government departments to migrate its email system to Microsoft’s cloud platform, and the Agency continues to explore opportunities to migrate its systems to cloud-based solutions. ACOA also offered training sessions on tools to improve employee productivity, as well as conduct exercises to enhance employee awareness of cyber-security risks. Work continued on ACOA’s new Grants and Contributions Program Management System, which is scheduled to launch in 2022.

ACOA completed the GC workplace modernization of the New Brunswick regional office, providing open, modern, flexible and collaborative space for its agile workforce.

ACOA implemented organizational initiatives to strengthen and improve the efficiency of service and program delivery. For example, the Agency enhanced its financial planning and forecasting capacity by launching corporate financial dashboards, and further streamlined processes related to contracting of services, procurement of goods, delegation, travel and hospitality approvals as well as internal controls.

In support of accountability and evidence-based decision-making, ACOA maintained a strong focus on results and impact through ongoing performance measurement, evaluation and analysis of its programs and services. In 2020-21, the Agency completed an evaluation of its business growth and trade and investment programming.Footnote 19

ACOA ensured that its key activities and budgetary resources remain aligned with GC priorities and the Agency’s mandate. To do so, it integrated human resources, financial management, risk management, performance measurement and evaluation considerations into its planning and decision-making processes.

Budgetary financial resources (dollars)

| 2020-21 Main Estimates |

2020-21 Planned spending |

2020-21 Total authorities available for use |

2020-21 Actual spending (authorities used) |

2020-21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 26,961,156 | 26,961,156 | 29,726,077 | 30,008,659 | 3,047,503 |

Human resources (full-time equivalents)

| 2020-21 Planned full-time equivalents |

2020-21 Actual full-time equivalents |

2020-21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 196 | 201 | 5 |

Analysis of trends in spending and human resources

Actual expenditures

Departmental spending trend graph

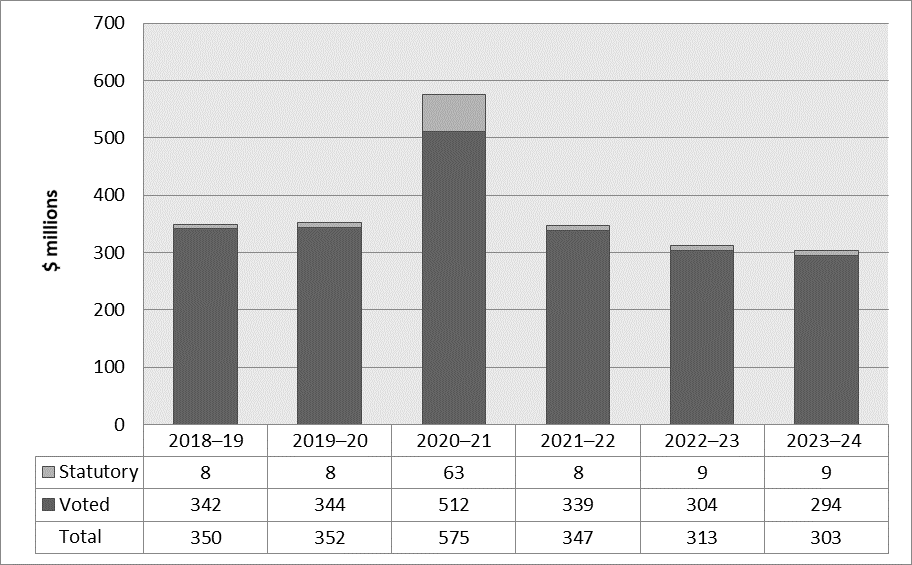

The following graph presents planned (voted and statutory) spending over time.

Description: Departmental spending trend

This trend graph illustrates ACOA’s actual and planned spending over 6 fiscal years, 2018-2019 through 2023-2024, indicating voted and statutory spending.

In 2018-2019, voted spending was $342 million and statutory spending was $8 million. Total $350 million.

In 2019-2020, voted spending was $344 million and statutory spending was $8 million. Total $352 million.

In 2020-2021, voted spending was $512 million and statutory spending was $63 million. Total $575 million.

In 2021-2022, voted spending will be $339 million and statutory spending will be $8 million. Total $347 million.

In 2022-2023, voted spending will be $304 million and statutory spending will be $9 million. Total $313 million.

In 2023-2024, voted spending will be $294 million and statutory spending will be $9 million. Total $303 million.

Actual spending: 2018-19, 2019-20, 2020-21. Planned spending: 2021-22, 2022-23, 2023-24.

Planned spending for 2021-22, 2022-23 and 2023-24 does not include Budget 2021 COVID-19 related amounts and excess amounts related to the collection of repayable contributions because decisions on the excess amount of collections that can be reinvested by the Agency are made later in the fiscal cycle.

In 2020-21, the Agency’s spending was $223.4 million more than the previous year, mainly due to the following changes in authorities:

- an increase of $201 million related to temporary funding for the Regional Relief and Recovery Fund, of which:

- $77.9 million to support small and medium-sized businesses pursuant to Canada’s COVID-19 Economic Response Plan;

- $52.3 million to support the Community Futures Network pursuant to Canada’s COVID-19 Economic Response Plan;

- $31.0 million to support small and medium-sized businesses pursuant to the Public Health Events of National Concern Payments Act;

- $20.3 million announced in the Fall Economic Statement, 2020 to support the Community Futures Network;

- $10.5 million announced in the Fall Economic Statement, 2020 to support small and medium-sized businesses;

- $9.0 million to support the Community Futures Network pursuant to the Public Health Events of National Concern Payments Act;

- an increase of $35.9 million related to temporary funding for the Canadian Seafood Stabilization Fund, of which:

- $21.6 million pursuant to Canada’s COVID-19 Economic Response Plan;

- $14.3 million pursuant to the Public Health Events of National Concern Payments Act;

- an increase of $8.1 million related to temporary funding announced in Budget 2019 for the Canada Coal Transition Initiative – Infrastructure Fund;

- an increase of $2.6 million related to temporary funding for the Budget 2019 measure: launching a federal strategy on jobs and tourism;

- an increase of $2.1 million related to compensation allocations resulting from revised collective agreements;

- an increase of $1.1 million related to temporary funding for the Women Entrepreneurship Strategy – Ecosystem fund;

- an increase of $0.3 million related to temporary funding announced on September 9, 2020, by the Prime Minister of Canada related to the Black Entrepreneurship Program;

- a decrease of $12.5 million related to a reprofile of funds in 2019-20 as a result of project/contracting delays;

- a decrease of $6.8 million related to the expiration of temporary funding for the Regional Economic Growth through Innovation program (REGI) – Supporting SME users of steel and aluminum initiative;

- a decrease of $3.4 million in excess amounts of collections related to the reinvestment of repayable contributions;

- a decrease of $2.5 million related to temporary funding transferred to Natural Resources Canada for Protecting Jobs in Eastern Canada’s Forestry Sector, as announced in Budget 2018; and

- various adjustments due to variations that occurred in the normal course of business.

The decrease of $228.2 million in planned spending from 2020-21 to 2021-22 is attributable mainly to:

- the return to normal levels of spending prior to 2020-21, excluding Budget 2021 initiatives and the inability to include excess amounts of collections related to the reinvestment of repayable contributions, as explained in the note under the above graph.

The decrease of $34.2 million in planned spending from 2021-22 to 2022-23 is attributable mainly to:

- a total decrease of $41.6 million due to:

- $31.1 million related to the conclusion of temporary funding announced in the Fall Economic Statement, 2020 related to the Regional Air Transportation Initiative; and

- $10.5 million related to a reprofile of funds as a result of project/contracting delays.

- The decrease is offset by an increase of $7.4 million attributable to the conclusion of funding transferred to Natural Resources Canada for Protecting Jobs in Eastern Canada’s Forestry Sector, as announced in Budget 2018.

The decrease of $9.6 million in planned spending from 2022-23 to 2023-24 is attributable mainly to:

- a decrease of $9.3 million due to the conclusion of temporary funding announced in Budget 2018 in support of the REGI measures: regional development agencies; and

- a decrease of $0.3 million for the Women Entrepreneurship Strategy Ecosystem Fund National Stream.

Budgetary performance summary for core responsibilities and Internal services (dollars)

| Core responsibilities and Internal Services | 2020-21 Main Estimates |

2020-21 Planned spending |

2021-22 Planned spending |

2022-23 Planned spending |

2020-21 Total authorities available for use |

2018-19 Actual spending (authorities used) | 2019-20 Actual spending (authorities used) | 2020-21 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Economic development in Atlantic Canada | 274,054,608 | 274,054,608 | 319,416,160 | 285,340,452 | 560,929,143 | 323,354,426 | 324,518,205 | 545,036,957 |

| Subtotal | 274,054,608 | 274,054,608 | 319,416,160 | 285,340,452 | 560,929,143 | 323,354,426 | 324,518,205 | 545,036,957 |

| Internal Services | 26,961,156 | 26,961,156 | 27,420,904 | 27,255,430 | 29,726,077 | 26,243,126 | 27,141,436 | 30,008,659 |

| Total | 301,015,764 | 301,015,764 | 346,837,064 | 312,595,882 | 590,655,220 | 349,597,552 | 351,659,641 | 575,045,616 |

For 2020-21, planned spending of $301.0 million increased by $289.6 million, resulting in total authorities available for use of $590.6 million. This was due to the following additional authorities received during the fiscal year:

- $201.0 million related to temporary funding for the Regional Relief and Recovery Fund, of which:

- $77.9 million to support small and medium-sized businesses pursuant to Canada’s COVID-19 Economic Response Plan;

- $52.3 million to support the Community Futures Network pursuant to Canada’s COVID-19 Economic Response Plan;

- $31.0 million to support small and medium-sized businesses pursuant to the Public Health Events of National Concern Payments Act;

- $20.3 million announced in the Fall Economic Statement, 2020 to support the Community Futures Network;

- $10.5 million announced in the Fall Economic Statement, 2020 to support small and medium-sized businesses;

- $9.0 million to support the Community Futures Network pursuant to the Public Health Events of National Concern Payments Act;

- $35.9 million related to temporary funding for the Canadian Seafood Stabilization Fund, of which:

- $21.6 million pursuant to Canada’s COVID-19 Economic Response Plan;

- $14.3 million pursuant to the Public Health Events of National Concern Payments Act;

- $24.1 million related to the collection of repayable contributions. This is an adjustment required annually to account for collections in excess of the base amount included in ACOA’s reference levels;

- $10.0 million related to temporary funding announced in the Fall Economic Statement, 2020 related to the Regional Air Transportation Initiative;

- $8.9 million related to temporary funding announced in Budget 2019 for the Canada Coal Transition Initiative – Infrastructure Fund;

- $3.3 million related to temporary funding in support of the Halifax International Security Forum. (ACOA continues its role as the delivering agency with a transfer of funds from the Department of National Defence for the annual initiative);

- $2.7 million related to the Operating Budget Carry Forward from 2019-20;

- $2.1 million related to compensation allocations resulting from revised collective agreements;

- $1.1 million related to temporary funding for the Women Entrepreneurship Strategy Ecosystem Fund;

- $0.3 million related to temporary funding announced on September 9, 2020, by the Prime Minister of Canada related to the Black Entrepreneurship Program; and

- $0.2 million in various adjustments.

From the 2020-21 total authorities of $590.6 million, actual spending was $575.0 million. This resulted in a surplus of $15.6 million. Of that amount, $2.9 million was carried forward as part of the Agency’s operating budget, $10.9 million was reprofiled as a result of project/contracting delays, $0.7 million was set aside to help offset anticipated future pressures for vacation liabilities due to the postponing of automatic cash-outs of excess vacation hours; and the remaining balance lapsed.

Actual human resources

Human resources summary for core responsibilities and Internal services

| Core responsibilities and Internal Services | 2018-19 Actual full-time equivalents | 2019-20 Actual full-time equivalents | 2020-21 Planned full-time equivalents |

2020-21 Actual full-time equivalents | 2021-22 Planned full-time equivalents | 2022-23 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| Economic development in Atlantic Canada | 378 | 378 | 381 | 383 | 394 | 386 |

| Subtotal | 378 | 378 | 381 | 383 | 394 | 386 |

| Internal Services | 194 | 197 | 196 | 201 | 199 | 198 |

| Total | 572 | 575 | 577 | 584 | 593 | 584 |

Human resource levels at ACOA show an increase starting in 2020-21 that reflects the additional human resources required to support the effort by the Government of Canada and ACOA to effectively deliver on COVID-19 emergency measures. The situation normalizes starting in fiscal year 2023-24 and the remaining fluctuations occurring reflect the realignment of human resources to support priorities, projects and new, temporary initiatives. The Agency will continue to achieve its results by allocating its human resources to best support its priorities and programs.

Expenditures by vote

For information on ACOA’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2020-2021.

Government of Canada spending and activities

Information on the alignment of ACOA’s spending with the Government of Canada’s spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

ACOA’s financial statements (unaudited) for the year ended March 31, 2021, are available on the Agency’s website.

Financial statement highlights

Condensed Statement of Operations (unaudited) for the year ended March 31, 2021 (dollars)

| Financial information | 2020-21 Planned results |

2020-21 Actual results |

2019-20 Actual results |

Difference (2020-21 Actual results minus 2020-21 Planned results) |

Difference (2020-21 Actual results minus 2019-20 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 245,390,294 | 371,479,101 | 268,888,565 | 126,088,807 | 102,590,536 |

| Total revenues | 17,058 | 20,071 | 20,204 | 3,013 | (133) |

| Net cost of operations before government funding and transfers | 245,373,236 | 371,459,030 | 268,868,361 | 126,085,794 | 102,590,669 |

Actual total expenses were $371.5 million in fiscal year 2020-21, an increase of $102.6 million (38.2%) compared to 2019-20.

The increase was mainly due to a rise in transfer payment expenses of $101.0 million. The Agency received incremental funding in support of mitigating the economic impacts of the COVID-19 pandemic.

Of the total expenses of $371.5 million, $339.4 million (91.4%) was used to support economic development in Atlantic Canada while $32.1 million (8.6%) was expended for Internal Services.

Condensed Statement of Financial Position (unaudited) as of March 31, 2021 (dollars)

| Financial information | 2020-21 | 2019-20 | Difference (2020-21 minus 2019-20) |

|---|---|---|---|

| Total net liabilities | 48,988,928 | 36,445,355 | 12,543,573 |

| Total net financial assets | 40,432,814 | 28,606,693 | 11,826,121 |

| Departmental net debt | 8,556,114 | 7,838,662 | 717,452 |

| Total non-financial assets | 3,060,056 | 2,184,920 | 875,136 |

| Departmental net financial position | (5,496,058) | (5,653,742) | 157,684 |

Total net liabilities were $49.0 million at the end of the 2020-21 fiscal year, representing an increase of $12.5 million (34.4%) from fiscal year 2019-20. The increase is the result of a rise in accounts payable. In 2019-20, the Agency’s accounts payable and accrued liabilities were significantly low because of intensified efforts made to issue payments prior to year-end in response to the initial outbreak of COVID-19. Such efforts were not required in 2020-21.

Total net financial assets equaled $40.4 million at the end of the 2020-21 fiscal year, an increase of $11.8 million (41.3%) over 2019-20’s total. The assets primarily consist of the “Due from the Consolidated Revenue Fund” ($40.3 million), which is used to discharge the Agency’s liabilities. The “Due from Consolidated Revenue Fund” is an account that is directly impacted by the Agency’s accounts payable and accrued liabilities and is the reason for the increase in net financial assets.

Total non-financial assets were $3.1 million at the end of 2020-21 fiscal year, an increase of $0.9 million (40.1%) over the 2019-20 fiscal year’s total. The increase is mainly attributable to work in progress related to the Grants and Contributions Program Management System.

Corporate information

Organizational profile

Appropriate minister: The Honourable Mélanie Joly, PC, MP

Institutional head: Francis P. McGuire, President

Ministerial portfolio: Innovation, Science and Economic Development

Enabling instrument: Part I of the Government Organization Act, Atlantic Canada, 1987, R.S.C., 1985, c. 41 (4th Supp.), also known as the Atlantic Canada Opportunities Agency Act.

See the Department of Justice Canada website for more information.

Year of incorporation / commencement: 1987

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on ACOA’s website.

For more information on the department’s organizational mandate letter commitments, see the Minister’s mandate letter.

Operating context

Information on the operating context is available on ACOA’s website.

Reporting framework

ACOA’s Departmental Results Framework and Program Inventory of record for 2020-21 are shown below.

| Departmental Results Framework | Core Responsibility: Economic development in Atlantic Canada |

Internal Services | |

|---|---|---|---|

| Departmental Result: Communities are economically diversified in Atlantic Canada |

Indicator: Percentage of Atlantic Canadian SMEs that are majority owned by women, Indigenous people, youth, visible minorities and persons with disabilities | ||

| Indicator: Percentage of professional, science and technology-related jobs in Atlantic Canada’s economy | |||

| Indicator: Amount leveraged per dollar invested by ACOA in community projects | |||

| Departmental Result: Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada |

Indicator: Value of business expenditures in R&D by firms receiving ACOA program funding in dollars | ||

| Indicator: Percentage of businesses engaged in collaborations with higher education institutions in Atlantic Canada | |||

| Departmental Result: Businesses are innovative and growing in Atlantic Canada |

Indicator: Number of high-growth firms in Atlantic Canada | ||

| Indicator: Value of exports of goods (in dollars) from Atlantic Canada | |||

| Indicator: Value of exports of clean technologies (in dollars) from Atlantic Canada | |||

| Indicator: Revenue growth rate of firms supported by ACOA programs | |||

| Program Inventory | Program: Inclusive Communities | ||

| Program: Diversified Communities | |||

| Program: Research and Development, and Commercialization | |||

| Program: Innovation Ecosystem | |||

| Program: Business Growth | |||

| Program: Trade and Investment | |||

| Program: Policy Research and Engagement | |||

Supporting information on the program inventory

Financial, human resources and performance information for ACOA’s Program Inventory is available in GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on ACOA’s website:

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA+ of tax expenditures.

Organizational contact information

Atlantic Canada Opportunities Agency

P.O. Box 6051

Moncton, New Brunswick E1C 9J8

Courier address:

644 Main Street

Moncton, New Brunswick E1C 1E2

General inquiries: 506-851-2271

Toll free (Canada and the United States): 1-800-561-7862

Facsimile: 506-851-7403

Secure Facsimile: 506-857-1301

TTY: 7-1-1

Access to Information/Privacy: 506-851-2271

https://www.canada.ca/en/atlantic-canada-opportunities.html

Appendix: definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

core responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel)

A report on the plans and expected performance of an appropriated department over a 3-year period. Departmental Plans are usually tabled in Parliament each spring.

departmental priority (priorité)

A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

departmental result (résultat ministériel)

A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

departmental result indicator (indicateur de résultat ministériel)

A quantitative measure of progress on a departmental result.

departmental results framework (cadre ministériel des résultats)

A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

Departmental Results Report (rapport sur les résultats ministériels)

A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

experimentation (expérimentation)

The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

full-time equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. For a particular position, the full-time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+])

An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race ethnicity, religion, age, and mental or physical disability.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2019–20 Departmental Results Report, those high-level themes outlining the government’s agenda in the 2019 Speech from the Throne, namely: Fighting climate change; Strengthening the Middle Class; Walking the road of reconciliation; Keeping Canadians safe and healthy; and Positioning Canada for success in an uncertain world.

horizontal initiative (initiative horizontale)

An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

non-budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement)

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement)

The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

program inventory (répertoire des programmes)

Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

result (résultat)

A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.