Foreign Trade Zone

- What is a Foreign Trade Zone?

- Canada’s Unmatched Investment Climate

- Canada as a Foreign Trade Zone

- Duty Deferral Program

- Export Distribution Centre Program

- Exporters of Processing Services Program

- Key Contacts

- Strengthening Canada’s Foreign Trade Zone Advantage

- FTZ Point – Canada’s Foreign Trade Zone Advantage

While there is no precise definition of what constitutes a foreign trade zone (FTZ), the term generally refers to a specific location within a country that is officially designated for eligibility for tariff and tax exemptions with respect to the purchase or importation of raw materials, components or finished goods. Such materials and goods can generally be stored, processed or assembled in the FTZ for re-export (in which case taxes and duties generally would not apply) or for entry into the domestic market (in which case taxes and duties would be deferred until the time of entry).

Canada has taken important steps in providing new trade advantages for investors. Canada’s world-class investment environment is underpinned by the lowest overall tax rate on new business investment in the G-7, a duty-free tariff regime on imports of manufacturing inputs and machinery, the fact the Goods and Services Tax/Harmonized Sales Tax (GST/HST) is fully recoverable for most businesses and does not apply to exports, and many other complementary benefits found in FTZs around the world but with a key difference: Canada’s duty and tax relief is geographically flexible. It can be enjoyed anywhere in the country.

Canada’s geographically flexible approach is superior to efforts by other countries that focus on location-specific foreign trade zones by allowing businesses to choose the location that best fits their needs. This makes Canada a destination of choice for foreign investment.

Since 2000, Canada’s federal corporate income tax rate has been cut almost in half, to 15 per cent in 2012. As of 2013, the combined federal-provincial corporate tax rate is slightly above 26 per cent, which is 13 percentage points lower than the comparable rate in the United States.

Taking into account all the federal, provincial and territorial statutory corporate income taxes and other taxes paid by corporations, including capital taxes and retail sales taxes on business inputs, Canada’s overall tax rate on new business investment is the lowest in the G-7, and lower than the OECD average.

The KPMG publication Competitive Alternatives 2012 rigorously analyzed the impact of federal, state, provincial and municipal taxes on business operations. KPMG concluded that Canada’s total business tax costs – corporate income taxes, capital taxes, sales taxes, property taxes, and wage-based taxes – are the lowest in the G7 and more than 40 per cent lower than those in the United States.

Canada has a value-added consumption tax - the Goods and Services Tax (GST) - which does not apply to exports and is fully recoverable for businesses engaged in commercial activities. The provinces of Ontario, Nova Scotia, New Brunswick, Prince Edward Island and Newfoundland and Labrador have harmonized their provincial sales taxes with the GST under the Harmonized Sales Tax (HST). Businesses operating in these provinces therefore use one set of consumption tax rules, have one consumption tax administrator and use one form to report and recover these taxes. The province of Quebec has a value-added tax that is harmonized with the GST base, which also does not apply to exports and is fully recoverable for businesses engaged in commercial activities.

In recent years, Canada has implemented a major new initiative that will eliminate tariffs on all manufacturing inputs by 2015—the first country in the G-20 to offer a tariff-free zone for industrial manufacturers. Canada’s initiative applies across the entire country, making Canada one large FTZ for firms importing manufacturing inputs.

Free trade in manufacturing inputs is an important source of competitive strength for businesses in Canada. By reducing the cost of importing key factors of production, tariff relief encourages innovation, enhances productivity, reduces customs compliance costs and eliminates the administrative burden of complying with various rules and regulations.

In addition, investors who choose Canada for their next investment destination will have the advantage of importing advanced machinery and equipment into Canada free of import duties. This reduces the import cost of advanced machinery and equipment, thereby realising productivity gains from efficient production.

The duty-free treatment of manufacturing or processing equipment reduces costs and increases profitability of investors’ global operations. By reducing the cost of importing key factors of production, the elimination of tariffs encourages innovation and allows businesses to enhance their stock of capital equipment. This is particularly important to small and medium-sized foreign investors who choose Canada as a place to invest and as a base from which to operate and export.

The elimination of tariffs will reduce customs compliance costs, simplify the tariff structure and eliminate the administrative burden of complying with multiple rules and regulations. This makes Canada a tariff-free zone for industrial manufacturers and a more attractive place for investors.

Canada’s Duty-free Manufacturing Tariff Regime: Summary of Key Benefits

- Complements Canada’s business tax advantage and stable financial sector

- Lowers costs of production to increase business competitiveness

- Makes productivity-enhancing advanced machinery and equipment purchases more affordable

- Simplifies tariff structure

- Takes away the need of applying for duties relief and drawback (refund) by manufacturers

- Reduces overall tariff compliance cost and administrative burden

- Provides duty-free manufacturing and maintains preferential market access under the North American Free Trade Agreement (NAFTA).

There are important complementary programs that - together with the broad macroeconomic policies - greatly enhance the appeal of Canada as a unique FTZ. These programs, available across Canada, offer benefits found in locally-oriented FTZs (e.g., in the United States). Thus, Canada’s FTZ-type programs offer investors the vitally important advantage of geographic flexibility. Canada’s programs do not restrict investors to a handful of locations that may be distant from their best markets or may have inadequate infrastructure and poor logistics. In effect, programs such as the Duty Deferral Program, the Export Distribution Centre Program and Exporters of Processing Services Program make it possible to create an FTZ environment exactly where the business needs it, while offering all the benefits of a traditional FTZ.

Benefits for business

- No heavy paper burden

- No geographic restriction - accessible regardless of location

- Improved cash flow

- Reduced operating expenses

- Increased international competitiveness

| Program | Main Benefit | Main Qualifications |

|---|---|---|

| Duties Relief Program | Upfront relief of duties | Goods must be exported within four years |

| Drawback Program | Refunds duties for exported goods | Goods must have been exported within four years |

| Customs Bonded Warehouse | Defers/relieves duties and taxes | Goods must not be substantially altered |

| Export Distribution Centre Program | Upfront relief of GST/HST on certain imports and domestic purchases | Must be export-oriented commercial entity that adds only limited value to goods |

| The Exporters of Processing Services Program | Upfront relief of GST/HST on certain imports | Goods must belong to non-resident and be re-exported after being processed |

The CBSA will strive to process Customs Sufferance Warehouses License applications within 60 business days from the date of the receipt of the complete application.

The CBSA will strive to process applications no later than 90 calendar days from the date of receipt of a correctly completed and supported application.

The CBSA will strive to process drawback claims no later than 90 calendar days from the date of receipt of a correctly completed and supported application.

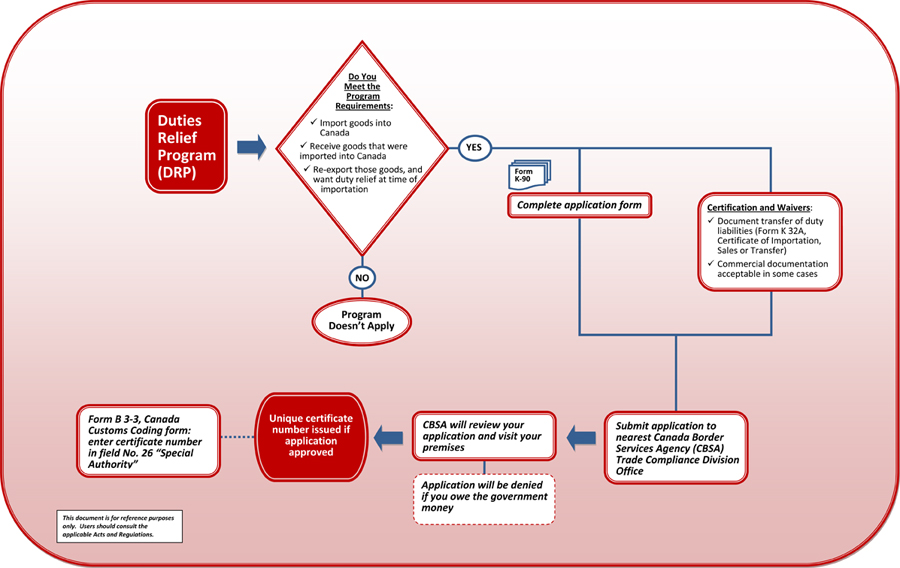

The DDP is administered by the CBSA. This is Canada’s main FTZ-type program. The program covers three components which can be used individually or in combination, depending on your unique business needs. These are:

- the duties relief program – provides upfront duties relief;

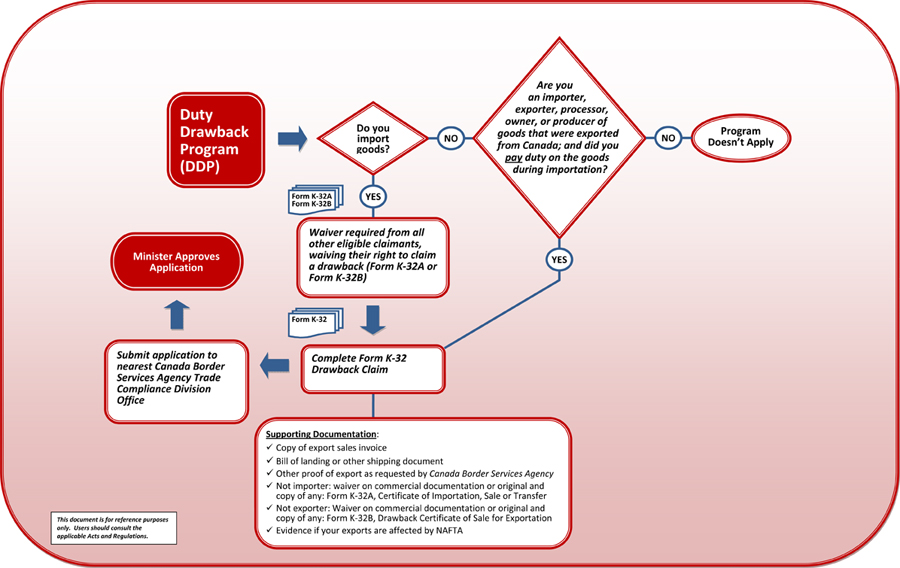

- the drawback program – provides repayment of import duties (after the imported goods have been re-exported or used in the manufacture of exported goods); and

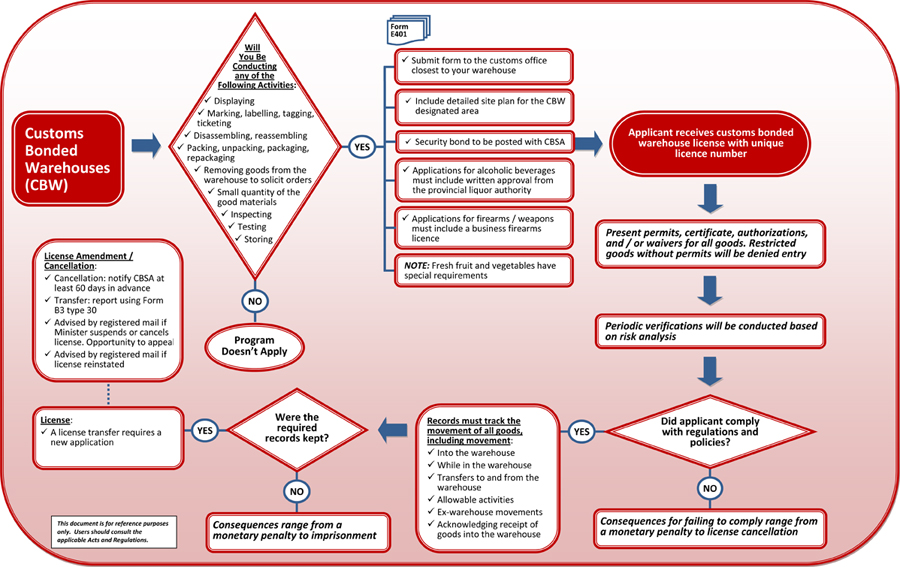

- the customs bonded warehouse program (CBW) – allows for the deferral of duties and GST/HST for up to four years.

The DDP can postpone or refund duties and taxes investors would otherwise have to pay on goods they import and subsequently export. For example, in the 2019 – 2020 fiscal year, there were approximately 1,300 companies earning $176 million dollars in duty refund benefits and approximately $255 million was deferred to 310 clients via the duties relief program. To round it up, the CBW program offers importers an effective storage option. It allows for the deferring of all import levies, and the GST/HST, and for taking advantage of just-in-time inventory practices which deferred approximately $129 million in duties and $315 million in GST/HST in the 2019-2020 fiscal year to 200 clients.

Unlike in local foreign trade zones, there are no geographic restrictions. The business benefits are straightforward: lower duty costs, help increase cash flow, free up working capital, and permit more competitively priced goods. Taking advantage of the DDP also makes it easier to attract new investment and to partner with other companies.

In general, anyone can apply for any or all of the DDP components if you are an importer, exporter, processor, owner, producer or a warehouse operator. All you need to do is submit the appropriate documentation to your local CBSA office, which reviews your application to determine eligibility.

This program may be of value for business involved in:

- storing goods before releasing them for sale into the Canadian marketplace; or

- importing goods and later exporting them without substantially altering them; or

- using imported goods in the production of other goods for export.

The North American Free Trade Agreement (NAFTA) can limit the benefits from the duties relief and drawback programs with respect to non-originating goods — that is, goods which do not originate in the United States, Canada or Mexico but are used as materials for manufacturing Canadian products that are subsequently exported to a NAFTA partner. For more information regarding NAFTA’s effects on the DDP, please visit the CBSA Web site or contact your local CBSA office.

With duties relief, you may not have to pay duties on imports that you store, process or use to manufacture other products, provided you later export the goods or products. Duties relief has other benefits, such as the following:

- You have up to four years from the date of importation to export your goods before you have to pay duties.

- You can sell or transfer the goods to other authorized duties relief participants without having to pay duties. In this case, the receiving company assumes liability for any duties.

- You can substitute Canadian-made parts for imported ones to produce a finished good to help you meet changing market conditions.

- You do not need to post security: for example, no bonds or licensing fees are required.

Note that the CBSA may occasionally check to make sure you are complying with these requirements.

How does the program work?

Text Version View Large Image

Duties Relief Application Form - PDF (89 KB)

More information

For more information on the Duties Relief Program, please visit the CBSA Web site or contact your local CBSA office.

Did you already pay duties on goods that you subsequently exported? You may still be able to recover those duties under the duty drawback option. It allows you to apply for a refund of duties you paid on imported goods that you later export. You have to file the claim within four years of the date of importation.

You can apply for a drawback if you export the goods in the same condition in which they were imported, or if you use them in the manufacture of other goods that are exported.

How does the program work?

Text Version View Large Image

Drawback Application Forms -PDF (772 KB)

More information

For more information on the Drawback Program, please visit the CBSA Web site or contact your local CBSA office.

A customs bonded warehouse is a storage facility that your company operates under the authority of the CBSA. However, it does not have to be a conventional warehouse — it could be part of your office building or even a hotel conference room, depending on your immediate requirements. This gives you enormous flexibility in how you store, handle and move your goods, which can translate into a valuable competitive edge.

The following are some of the benefits of using a customs bonded warehouse:

- You do not pay duties and taxes until the goods enter the Canadian marketplace.

- If you export the goods from Canada, you do not pay duties and taxes.

- You can import goods in bulk, store them in your warehouse and remove them as you need them. This reduces your up-front costs because you pay duties and taxes only on the goods that enter the Canadian market.

- You can store the goods in your warehouse for up to four years, during which time you can handle them in a variety of ways, providing that you do not substantially alter the goods.

How does the program work?

Text Version View Large Image

Customs Bonded Warehouse Application Form -PDF (26 KB)

More information

For more information on the Customs Bonded Warehouse Program, please visit the CBSA Web site or contact your local CBSA office.

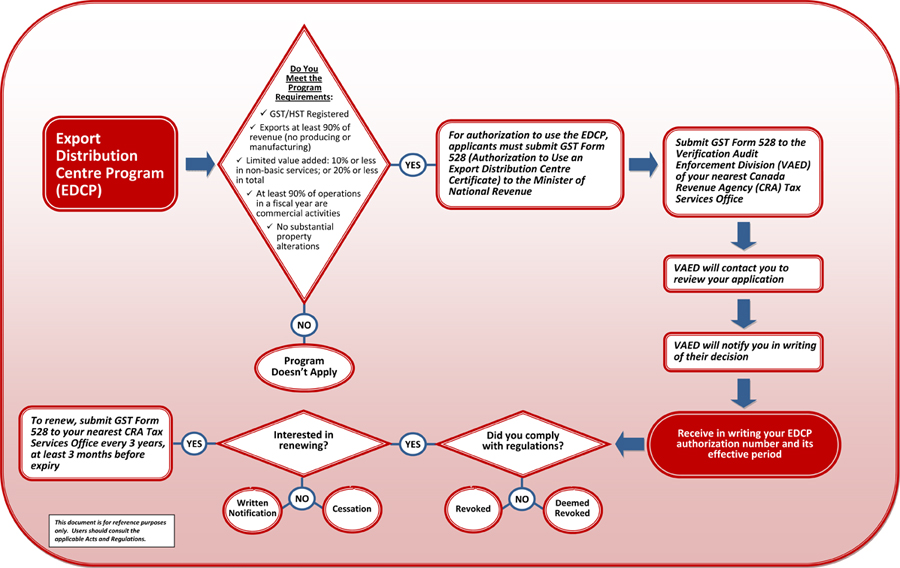

What is the EDCP and how can it help my business?

The EDCP is administered by the Canada Revenue Agency (CRA). The program is intended to benefit export-oriented businesses that import goods and/or acquire goods in Canada, process them to add limited value and then export them. The “limited value” criterion is a key factor here, since the EDCP is not intended for companies that manufacture or produce new products for export. The program is of particular value to businesses involved in the processing of goods, such as distributing, disassembling or reassembling. Under the program, EDCP participants do not pay federal Goods and Services Tax (GST) or a Harmonized Sales Tax (HST) on most imported goods or on domestic purchases of goods worth $1,000 or more. This improves cash flow as EDCP participants do not need to pay the taxes up front, claim an input tax credit on their GST/HST return and then wait for their net tax refund.

Who can participate in the EDCP?

You may be eligible for the EDCP if you are registered for GST/HST purposes and the following applies to you:

- At least 90 per cent of your operations for the fiscal year are commercial activities.

- At least 90 per cent of your business revenues for the fiscal year come from export sales.

- You add only limited value to your customers’ goods that you import or take possession of in Canada during the fiscal year, as follows:

- the value you add through the provision of non-basic services is 10 per cent or less; or

- the total value, from basic and non-basic services, you add is 20 per cent or less.

- You do not substantially alter goods, for example by producing or manufacturing goods.

“Basic services” are distinguished from “non-basic services” when the value added is assessed. Generally, “basic services” in this context means a type of service that may be performed in a Customs Bonded Warehouse and includes:

- disassembling or reassembling the goods;

- displaying, inspecting, labelling, packing, storing or testing the goods;

- removing a small sample of the goods to solicit orders for goods or services; and

- cleaning, diluting, maintaining, servicing, preserving, separating defective goods, sorting or grading, trimming, filing, slitting, cutting, and complying with any applicable law of Canada or a province, as long as the characteristics of the goods are not materially altered.

Generally speaking, if a service does not fulfil one of these functions, it is a non-basic service. EDCP participants must ensure that they meet the EDCP eligibility criteria throughout the course of their authorization.

How does the program work?

Text Version View Large Image

Export Distribution Centre Application Form - PDF (46 KB)

For more information on the EDCP or for help preparing your application, contact your CRA Tax Services Office or visit the CRA Web site.

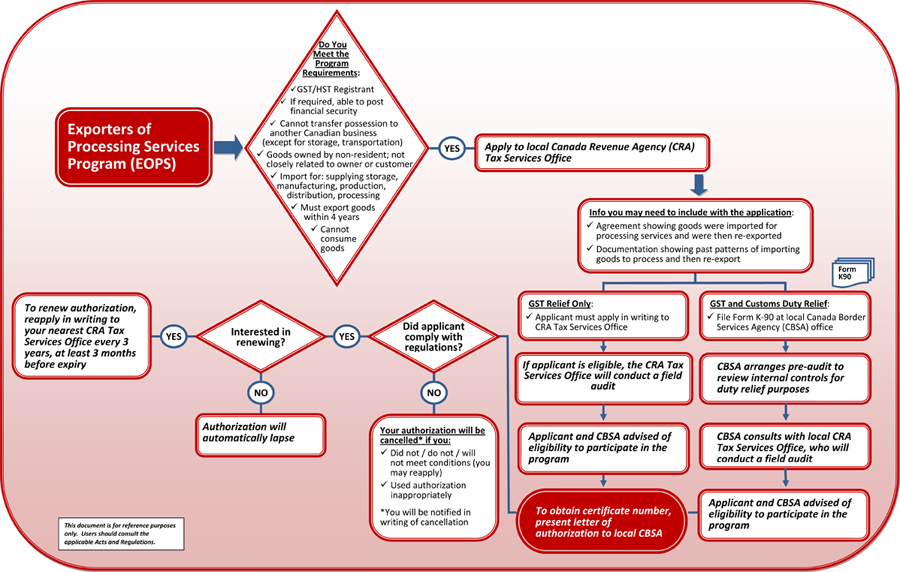

Administered by the CRA, the EOPS program relieves participants of the obligation to pay GST/HST on imports of goods belonging to non-residents, provided that these goods are imported for processing, distribution or storage and are subsequently exported. Thus, participation in the program helps EOPS program participants increase cash flow and reduce operating expenses.

Unlike the EDCP, however, the EOPS program imposes no minimum level of export sales that you must meet in order to maintain your eligibility. It also sets no limits on the value you can add to a non-resident’s goods, which means you can use those goods to manufacture or produce other products for foreign customers, all without compromising your EOPS eligibility.

As an EOPS program participant, you use your EOPS authorization number to be relieved of the obligation to pay GST/HST on the goods of non-residents that you import for processing, distribution or storage and subsequent export.

Who can participate in the EOPS program?

To participate in the EOPS program, you must be a registrant for GST/HST purposes and meet the following eligibility requirements.

- You cannot own the imported goods or resultant processed goods at any time while they are in Canada. They must always be owned by a non-resident and the customer cannot be resident in Canada.

- You must import the goods for the sole purpose of supplying storage, distribution, processing, manufacturing or production services to your foreign customer.

- You cannot be closely related (generally, where there is a degree of common ownership of at least 90 per cent) to your foreign customer or a foreign owner of the goods.

- You cannot transfer physical possession of the goods to another business in Canada, except for storage or transportation.

- You must export the goods within four years of accounting for them.

- The goods cannot be consumed in Canada.

- You must provide any financial security that is required to import the goods.

How does the program work?

Text Version View Large Image

To apply to the EOPS program, please prepare and send an application letter requesting authorization to use the EOPS Program to your local CRA Tax Services Office.

When you apply to the EOPS program, you can also apply for duty relief under the DDP. In this case you may send your application letter for the EOPS program with the completed DDP application form to your local CBSA office.

For more information on the EOPS program or for help preparing your claim, contact the CRA or visit the CRA Web site.

For further information on the Duty Deferral Program, please contact the CBSA Business Information System (BIS) at 1-800-461-9999 (for service in English) and 1-800-959-2036 (for service in French).

Calls outside Canada

Service in English:

204-983-3500 / 506-636-5064

Service in French:

204-983-3700 / 506-636-5067

For further information on the Export Distribution Centre Program and the Exporters of Processing Services Program, please contact the CRA at 613-952-8810. Facsimile: 613-990-1233.

Address: Border Issues Unit

General Operations and Border Issues Division

Excise and GST/HST Rulings Directorate

Place de Ville, Tower A, 15th floor

320 Queen Street, Ottawa ON K1A 0L5

Informed by stakeholder advice, Economic Action Plan 2013 delivers a package of measures to reduce red tape, cut costs, improve access to existing programs and promote Canada’s FTZ advantage, including:

- Eliminating the annual registration fee for the Customs Bonded Warehouse Program, Canada’s most-used FTZ program.

- Simplifying the application process to access Canada’s FTZ programs.

- Introducing service standards for application processing times.

- Accepting requests for new “FTZ Point” single windows to enhance delivery of FTZ programs at strategic locations in Canada.

- Launching a five-year, $5-million program to market Canada’s FTZ advantage and attract foreign investment to strategic locations across Canada.

During consultations, stakeholders noted that the annual registration fee for the Customs Bonded Warehouse imposed a cost that inhibited usage, particularly among small and medium-sized enterprises and occasional users. In response, the Government has eliminated the annual registration fee, effective April 1, 2013. This measure provides an estimated $400,000 per year in total cost savings for companies using the program, lowers the administrative burden and removes a barrier to accessing Canada’s most used FTZ program. For more information see the Proposed Regulatory Amendment to the Customs Bonded Warehouses Regulations.

The Canada Border Services Agency (CBSA) has taken action to streamline the audit process for duties relief clients and provide nationally consistent verification procedures. This measure will further reduce red tape and compliance burdens and costs for businesses.

To reduce red tape and the administrative burden of existing programs, the CBSA has taken action to update and simplify program application forms and eliminate the need to submit duplicate information. The new application forms will be published later in the fiscal year.

An FTZ Point refers to one of Canada’s strategic locations for international trade, where an organization with a mandate to promote local trade and foreign direct investment is uniquely supported by a single-point of access to information on relevant government policies and programs. This information is provided through a designated FTZ Task Force coordinated by the regional development agency responsible for the area, and may be comprised of representatives from the following federal departments:

- Canada Border Services Agency

- Canada Revenue Agency

- Transport Canada

- Global Affairs Canada

- Innovation, Science and Economic Development Canada

- Export Development Canada

The task force acts as a behind-the-scenes facilitator for the organization, with the goal of improving access to existing programs, and promoting Canada’s foreign trade zone advantage.

Coordination and collaboration with other orders of government is essential, since they offer a suite of programs that make up the FTZ advantage. As a prerequisite to establishing a task force, a representative(s) from local and provincial government must commit to participate.

This initiative builds on a pilot project set up at the CentrePort Canada inland port in Winnipeg. In 2009, the Government provided CentrePort with a single point of contact and coordinated service on FTZ programming. This helps CentrePort provide facilitated access to FTZ programming to companies that set up on their site.

Other regions with logistics parks, ports, cargo villages, etc., share unique challenges and could benefit from coordinated access to Canada’s FTZ programming information.

A proponent would initiate a request to establish an FTZ Point through their local Regional Development Agency. This would trigger a process involving relevant departments and agencies across governments whereby the request would be assessed against a broad set of considerations.

| Region | Agency | |

|---|---|---|

| Atlantic | Atlantic Canada Opportunities Agency | 1-800-565-1228 TTY 1-877-456-6500 |

| Quebec | Canada Economic Development for Quebec Regions | 1-800-561-0633 |

| Southern Ontario | Federal Economic Development Agency for Southern Ontario | 1-888-576-4444 TTY Toll-free: 1-800-457-8466 |

| Northern Ontario | Federal Economic Development Initiative in Northern Ontario | 1-877-333-6673 TTY 1-866-694-8389 |

| Northern Canada | Canadian Northern Economic Development Agency | 1-855-897-2667 TTY 1-866-553-0554 |

| West | Western Economic Diversification Canada | 1-888-338-9378 TTY 1-877-303-3388 |

What are the benefits of establishing an FTZ Point?

In addition to the programs offered by the Government of Canada, other levels of government offer a suite of programs that make up the FTZ advantage and therefore require coordination, collaboration and commitment to work together as one body.

The goals of this initiative are to improve access to existing programs, and promote Canada’s foreign trade zone advantage. This will support Canadian manufacturers and business, building on the success of the Government’s gateways and corridors approach to attract foreign investment.

Considerations for requests to establish an FTZ Point at a new location include:

- An economic priority for the region (as identified by local/provincial governments)

- Private sector leadership and commitment

- Dedicated governance body (through legislation/incorporation)

- Having secured local and provincial government support to participate in the task force

- Favourable business environment

- Available land

- High quality infrastructure

- Active participation in and connection to global supply chains

- Access to a skilled labor force

- Access to a multimodal transportation system

The proponent must demonstrate capacity, and will be assessed against the considerations described above. There must be engagement and commitment from the private sector, and by governments.

Page details

- Date modified: