Annual Report of the Canada Pension Plan 2014–2015

His Excellency

The Governor General of Canada

May it please Your Excellency:

We have the pleasure of submitting the Annual Report of the Canada Pension Plan for the fiscal year 2014–2015.

Respectfully,

The Honourable William Francis Morneau

Minister of Finance

The Honourable Jean-Yves Duclos

Minister of Families, Children and Social Development

2014–2015 at a glance

- The maximum pensionable earnings of the Canada Pension Plan (CPP) increased from $52,500 in 2014 to $53,600 in 2015. The contribution rate remained unchanged at 9.9 percent.

- CPP contributions totalled $45.0 billion this year.

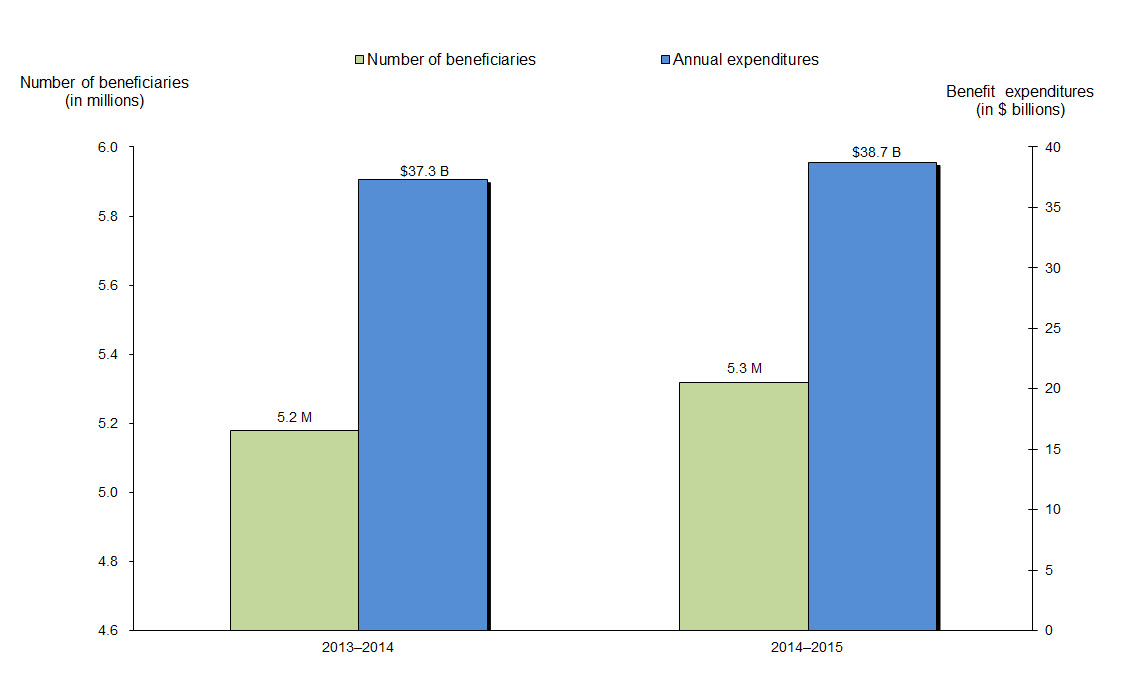

- 5.3 million CPP beneficiaries were paid, representing a total annual benefit value of $38.7 billion.

- 4.6 million CPP retirement pensioners were paid $29.6 billion this year.

- 1.1 million surviving spouses or common-law partners and 67,000 children of deceased contributors were paid $4.5 billion this year.

- 329,000 people with disabilities and 83,000 of their children were paid $4.2 billion this year.

- 139,000 recipients of death benefits were paid $312 million this year.

- 755,000 post-retirement beneficiaries were paid $142 million this year.

- Operating expenses amounted to $1.3 billion, or 3.45 percent of the $38.7 billion in benefits.

- As at March 31, 2015, total CPP net assets were valued at $269.6 billion, of which $264.6 billion is managed by the CPP Investment Board.

Note: Figures above have been rounded. A beneficiary may receive more than one type of benefit.

Canada Pension Plan in brief

Most employees in Canada over the age of 18 contribute either to the CPP or to its sister plan, the Quebec Pension Plan (QPP).

The CPP is managed jointly by the federal and provincial governments. Quebec manages and administers its own comparable plan, the QPP, and participates in decision-making for the CPP. Benefits from either plan are based on pension credits accumulated under both plans.

For more information on the QPP, visit the Retraite Quebec website

Contributions

The CPP is financed through investment income and through mandatory contributions from employees, employers and those who are self-employed.

Workers start contributing to the Plan at age 18, or from the Plan's beginning in 1966, whichever is later. The first $3,500 of annual earnings is exempted from contributions. Contributions are then made on earnings between $3,500 and $53,600, which is the earnings ceiling for 2015.

Employees contribute at a rate of 4.95 percent, and employers match that with an equal contribution. Self-employed individuals contribute at the combined rate for employees and employers of 9.9 percent on net business income, after expenses.

While many Canadians associate the CPP with retirement pensions, the CPP also provides disability, death, survivor, children's and post-retirement benefits. The CPP administers the largest long-term disability plan in Canada. It pays monthly benefits to eligible contributors with a disability and also to their children, helps some beneficiaries return to the workforce through vocational rehabilitation services and offers return-to-work support.

Most benefit calculations are based on how much and for how long a contributor has paid into the CPP and, in some cases, the age of the beneficiary. With the exception of the post-retirement benefit, benefits are not paid automatically—everyone must apply.

Contributions for 2015

- Year's maximum pensionable earnings

- $53,600.00

- Year's basic exemption

- $3,500.00

- Year's maximum contributory earnings

- $50,100.00

- Year's maximum employee/employer contribution (4.95%)

- $2,479.95

- Year's maximum self-employed person's contribution (9.9%)

- $4,959.90

Benefits and expenditures

Given the aging of our population, the number of people receiving CPP benefits has increased steadily over the past decade. As a result, expenditures have also increased. Figure 1 shows the yearly increases in beneficiaries and expenditures during 2014–2015; Figure 2 shows the percentage of expenditures by type of benefit.

Text description

| Year |

Number of beneficiaries (in millions) |

Benefit expenditures (in $ billions) |

|---|---|---|

2013–2014 |

5.2 |

37.3 |

2014–2015 |

5.3 |

38.7 |

Text description

| Benefit type | Percentage |

|---|---|

| Retirement (including post-retirement benefit and net overpayments of 0.2%) | 76.5 |

| Disability | 10.9 |

| Survivor | 11.8 |

| Death | 0.8 |

| Benefit type | Percentage |

|---|---|

| Disability | 93.0 |

| Dependent children of contributors with disabilities | 7.0 |

| Benefit type | Percentage |

|---|---|

| Survivor | 95.3 |

| Dependent children of deceased contributors | 4.7 |

Retirement pensions

To begin receiving a retirement pension, the applicant must have made at least one valid contribution to the Plan and must have reached the age of 60.

Retirement pensions represent nearly 77 percent ($29.6 billion) of the total benefit amount paid out ($38.7 billion) by the CPP in 2014–2015. The amount of contributors' pensions depends on how much and for how long they have contributed and at what age they begin to receive the benefits. In 2015, the maximum monthly retirement pension at age 65 was $1,065. The average payment in 2014–2015 was $543.05.

Adjustments for early and late receipt of a retirement pension

Canadians are living longer and healthier lives, and the transition from work to retirement is increasingly diverse. The CPP offers flexibility for older workers who are making the transition to retirement.

CPP contributors can choose the right time for their retirement pension based on their individual circumstances and needs. Contributors have the flexibility to take their retirement pension earlier or later than the normal age of 65. In order to ensure fair treatment of contributors and beneficiaries, those who take their retirement pension after age 65 receive a higher amount. This adjustment reflects the fact that these beneficiaries will, on average, make contributions to the CPP for a longer period of time but receive their benefit for a shorter period of time. Conversely, those who take their retirement pension before age 65 receive a reduced amount, reflecting the fact that they will, on average, make contributions to the CPP for a shorter period of time but receive their benefit for a longer period of time.

Since 2011, a gradual change in these adjustment factors was implemented to modernize the CPP. By 2016, the adjustment factors will have reached their adjusted actuarially fair levels. The new factors will ensure that, on average, payments of retirement pensions are the same over time regardless of when individuals choose to begin their pensions.

Retirement pension taken before age 65

Since 2012, the adjustment factor for early retirement has been increased on an annual basis; this annual increase will continue until 2016. In 2015, those who started receiving their retirement pension before age 65 had the amount permanently reduced by 0.58 percent per month. The maximum reduction was 34.8 percent for those who took their retirement pension when they turned 60. By 2016, it will be 0.6 percent per month, which means that a contributor who starts receiving a retirement pension at age 60 will receive 36 percent less than if it were taken at age 65.

Retirement pension taken after age 65

From 2011 to 2013, the adjustment factor for late retirement was increased annually. Those who started receiving their retirement pension after age 65 had the amount permanently increased by 0.57 percent per month in 2011, by 0.64 percent per month in 2012 and by 0.7 percent per month in 2013. This means that a contributor who delays receiving a retirement pension until age 70 will receive 42 percent more than if it were taken at age 65.

Post-retirement benefits

In 2012, a new CPP benefit, the post-retirement benefit, was implemented. It allows CPP retirement pension beneficiaries who keep working to increase their retirement income by continuing to participate in the CPP, even if they are already receiving the maximum CPP retirement pension.

Canadians between the ages of 60 and 64 who receive a CPP or QPP retirement pension and work outside of Quebec began making mandatory CPP contributions toward the post-retirement benefit on January 1, 2012, while those between the ages of 65 and 70 who receive the retirement benefit while working can choose whether to continue contributing. No contributions are made after age 70. Contributions toward the post-retirement benefit do not create eligibility for or increase the amount of other CPP benefits. Payment of the benefit started in 2013.

In 2014–2015, 755,000 CPP retirement pensioners received a post-retirement benefit. The maximum monthly benefit amount at age 65 for 2015 was $26.63. The average monthly payment in 2014–2015 was $11.84. As a working beneficiary, each year of contributions results in a post-retirement benefit, which is payable the following year. It is added to any previously earned post-retirement benefits. The amount of these benefits increases with the cost of living and is payable until the death of the contributor.

Disability benefits

The disability pension provides partial earnings replacement to CPP contributors who cannot work due to a severe and prolonged disability resulting from a physical or mental condition. Dependent children of disabled beneficiaries may also be eligible for children's benefits.

In 2014–2015, a total of $4.2 billion in benefits were paid to 329,000 disabled beneficiaries and to 83,000 children of disabled beneficiaries. These benefits represented approximately 11 percent of the total benefits paid out by the CPP in 2014–2015.

The disability pension includes a monthly flat rate, which was $465.84 in 2015. It also includes an earnings-related portion, which is 75 percent of the retirement pension that would have been earned had the contributor not become disabled. In 2015, the maximum disability benefit was $1,264.59 per month. The average monthly payment in 2014–2015 was $866.53.

The benefit paid to dependent children of disabled beneficiaries is a flat rate. In 2015, the amount was $234.87 per month. To be eligible, children must be either under age 18, or between ages 18 and 25 and in full-time attendance at school or university.

Survivor benefits

Survivor benefits are paid to the surviving spouse or common-law partner of the contributor and his or her dependent children. The benefit amount varies depending on a number of factors, including the age of the surviving spouse or common-law partner at the time of the contributor's death and whether the survivor also receives other CPP benefits.

In 2014–2015, there were 1.1 million survivors receiving benefits. In 2014–2015, survivor benefits represented nearly 12 percent ($4.5 billion) of the total benefits paid out by the CPP.

The maximum survivor's pension for those under age 65 was $581.13 per month in 2015. This includes a flat-rate portion of $181.75 and an earnings-related portion, which is 37.5 percent of the deceased contributor's retirement pension. The maximum monthly amount at age 65 and over was $639.00, consisting of 60 percent of the deceased contributor's retirement pension. For 2014–2015, the average monthly payment for all survivor pensions was $328.27.

The benefit paid to dependent children of deceased contributors is a flat rate. In 2015, the amount was $234.87 per month. To be eligible, children must be either under age 18, or between ages 18 and 25 and in full-time attendance at school or university.

Death benefits

The CPP death benefit is a lump-sum payment that amounts to six times the amount of the deceased contributor's monthly retirement pension, up to a maximum of $2,500. In 2014–2015, death benefit payments represented less than 1 percent of the total benefits paid out by the CPP. The average payment was $2,294 in 2014–2015.

Benefit summary

The table below summarizes the maximum and average monthly amounts paid to beneficiaries by benefit type.

| Benefit type | Maximum monthly amount 2015 | Average monthly amount (in 2014–2015) |

|---|---|---|

| Retirement pension | $1,065.00* | $543.05 |

| Post-retirement benefit | $26.63* | $11.84 |

| Survivor benefit | $639.00 | $328.27 |

| Disability benefit | $1,264.59 | $866.53 |

| Death benefit (one-time payment) | $2,500.00 | $2,294.00 |

* at age 65

Provisions

The CPP includes provisions that help to compensate for periods when individuals may have relatively low or no earnings. Dropping low- or no-earnings periods from the calculation of average earnings increases the amount of one's CPP benefit.

General drop-out

The general drop-out provision helps to offset periods of low or no earnings due to unemployment, schooling or other reasons. As a result, this increases the benefit amount for most people. For benefits starting in 2014 and thereafter, up to 17 percent of lowest earnings, representing a maximum of eight years, can be dropped from the benefit calculation.

Child rearing provision

The child rearing provision excludes from the calculation of benefits the periods during which contributors have remained at home, or have reduced their participation in the workforce, to care for children under the age of seven. Until the child reaches seven years of age, every month following the birth of the child can be excluded from the benefit calculation, provided the contributor meets all criteria, including low or no earnings. The provision may also assist those applying for survivor or disability benefits in meeting the contributory requirements for benefit eligibility.

Disability exclusion

Periods during which individuals are disabled in accordance with the CPP or QPP legislation are not included in their contributory period. This ensures that individuals who are not able to pursue any substantially gainful work are not penalized.

Over-65 drop-out

This provision may help to increase the benefit amounts of workers who continue to work and make CPP contributions after reaching age 65, but do not yet receive the CPP retirement pension. It allows periods of relatively low earnings before age 65 to be replaced by higher earnings after age 65.

Features

The CPP also includes many progressive features that recognize family and individual circumstances. These features include pension sharing, credit splitting, portability and indexation.

Pension sharing

Pension sharing allows spouses or common-law partners who are together and receiving their CPP retirement pensions to share a portion of each other's pensions. This feature also allows one pension to be shared between them even if only one person has contributed to the Plan. The amount that is shared depends on the time the couple has lived together and their joint CPP contributory period. Pension sharing affords a measure of financial protection to the lower-earning spouse or common-law partner. Also, while it does not increase or decrease the overall pension amount paid, it may result in tax savings. Each person is responsible for any income tax that may be payable on the pension amount they receive.

Credit splitting

When a marriage or common-law relationship ends, the CPP credits accumulated by the couple during the time they lived together can be divided equally between them, if requested by or on behalf of either spouse or common-law partner. This is called "credit splitting." Credits can be split even if only one partner contributed to the Plan. Credit splitting may increase the amount of CPP benefits payable, or even create eligibility for benefits.

Credit splitting permanently alters the Record of Earnings, even after the death of a former spouse or common-law partner.

Portability

No matter how many times workers change jobs, and no matter in which province they work, CPP and QPP coverage remains uninterrupted.

Indexation

CPP payments are indexed to the cost of living. Benefit amounts are adjusted in January of each year to reflect increases in the Consumer Price Index published by Statistics Canada. As CPP beneficiaries age, the value of their CPP benefit is protected against inflation.

Reconsideration and appeals process

Clients who are not satisfied with an initial decision on their CPP application may ask the Minister of Employment and Social Development to reconsider, or administratively review, the decision. The majority of reconsideration requests pertain to disability benefit applications.

In 2014–2015, Service Canada issued approximately 14,700 reconsiderations of decisions related to CPP benefits, division of pension credits and pension sharing. Of these reconsidered decisions, 66 percent were upheld while 34 percent were reversed.

Clients who are not satisfied with the Minister's reconsidered decision may appeal to the Social Security Tribunal (SST).

The SST is an independent administrative tribunal that makes fair and impartial quasi-judicial decisions on appeals related to the Canada Pension Plan, the Old Age Security Act and the Employment Insurance Act.

The SST began its operations on April 1, 2013, and was created to simplify and streamline income security and Employment Insurance appeal processes by offering a single point of contact for all cases.

The SST is divided into two separate divisions: a General Division and an Appeal Division. All decisions are made by individual members. The General Divisionincludes two sections:

- The Income Security Section makes decisions on appeals from decisions of Employment and Social Development Canada related to the Canada Pension Plan and Old Age Security Act; and

- The Employment Insurance Section makes decisions on appeals from decisions of the Canada Employment Insurance Commission related to the Employment Insurance Act.

The Appeal Division reviews the decisions issued from both sections of the General Division.

General Division, Income Security Section

Before April 1, 2013, income security appeals were filed with the Office of the Commissioner of Review Tribunals (OCRT). On April 1, 2013, 7,255 Footnote 1 appeals from the OCRT (of which 6,929 are related to CPP benefits) were transferred to the General Division, Income Security Section. As of March 31, 2015, of the 6,929 CPP-related cases transferred, 3,956 (57 percent) were concluded.

In 2014–2015, the General Division, Income Security Section, received 4,158 new appeals related to CPP benefits. As of March 31, 2015, there were 551 new CPP appeals concluded.

Appeal Division, Income Security Cases

Before the SST was created, OCRT decisions pertaining to the CPP could be appealed to the Pension Appeals Board (PAB). On April 1, 2013, in addition to 194 cases received throughout the year, 466 Footnote 2 income security appeals, previously filed with the PAB, were transferred to the SST's Appeal Division. As of March 31, 2015, of the 466 CPP-related cases transferred from the PAB, 464 (99.5 percent) were concluded.

In 2014–2015, the Appeal Division received 150 new cases related to CPP benefits from the General Division, Income Security Section. As of March 31, 2015, there were 260 Footnote 3 new appeals related to CPP benefits concluded.

Ensuring financial sustainability

As joint stewards of the CPP, the federal and provincial Ministers of Finance review the CPP's financial state every three years and make recommendations as to whether benefits and/or contribution rates should be changed. They base their recommendations on a number of factors, including the results of an examination of the CPP by the Chief Actuary. The Chief Actuary is required under the legislation to produce an actuarial report on the CPP every three years (in the first year of the legislated ministerial triennial review of the Plan). The CPP legislation also provides that upon request of the Minister of Finance, the Chief Actuary prepares an actuarial report any time a bill is introduced in the House of Commons that has, in the view of the Chief Actuary, a material impact on the estimates in the most recent triennial actuarial report. This reporting ensures that the long-term financial implications of proposed Plan changes are given timely consideration by the Ministers of Finance.

The most recent actuarial report on the CPP, the Twenty-sixth Actuarial Report on the Canada Pension Plan, prepared by the Office of the Chief Actuary (OCA), was tabled by the Minister of Finance in Parliament on December 3, 2013. The report stated that over the long term, the Plan remains sustainable at the current contribution rate of 9.9 percent. The Finance Ministers will base their 2013–2015 triennial review on a number of factors, including the conclusions of the Twenty-sixth Actuarial Report on the Canada Pension Plan.

Changes to the CPP legislation governing the level of benefits, the rate of contributions or the investment policy framework can be made only through an Act of Parliament. Any such changes also require the agreement of at least two-thirds of the provinces, representing at least two-thirds of the population of all the provinces. The changes come into force only after a notice period, unless all of the provinces waive this requirement, and only after provincial Orders in Council have provided formal consent by the provinces to the federal legislation enacting the changes. Quebec participates in decision-making regarding changes to the CPP legislation to ensure a high degree of portability of QPP and CPP benefits across Canada.

As the result of a past triennial review, changes were made to the CPP legislation to modernize the Plan. These changes enhance flexibility and support both older and younger workers in a fair and affordable way, as described earlier under "Benefits and expenditures."

To read more about the recent amendments to the CPP, visit the Changes to the Canada Pension Plan web page.

Actuarial reporting

The Twenty-sixth Actuarial Report on the Canada Pension Plan presents the financial status of the CPP as of December 31, 2012, and takes into account the recent changes to modernize the Plan, as well as the actual demographic and economic trends since December 31, 2009. According to the Report, the CPP is expected to meet its obligations and remain financially sustainable over the long term under the current contribution rate of 9.9 percent.

A panel of three independent Canadian actuaries, selected by the United Kingdom Government Actuary's Department (GAD) through an arm's length process, reviewed the Twenty-sixth Actuarial Report on the Canada Pension Plan. The external panel's findings confirmed that the work performed by the OCA on the Report met all professional standards of practice and statutory requirements, and stated that the assumptions and methods used were reasonable. In addition to these main conclusions, the panel made a number of recommendations regarding the preparation of future actuarial reports. The recommendations dealt with various aspects of the reporting process, including data, methodology, assumptions and communication of results. The GAD concluded that the opinions given by the panel adequately addressed all the main issues. As a result, Canadians can have confidence in the results of the Twenty-sixth Actuarial Report on the Canada Pension Plan and the conclusions reached by the Chief Actuary about the long-term financial sustainability of the Plan.

The next triennial actuarial report on the Canada Pension Plan, which reports on the financial status of the Plan as of December 31, 2015, is due by December 2016.

To view the CPP's actuarial reports, reviews and studies, visit the Office of the Superintendent of Financial Institutions website.

Funding approach

When it was introduced in 1966, the CPP was designed as a pay-as-you-go plan with a small reserve. This meant that the benefits for one generation would be paid largely from the contributions of later generations. This approach made sense under the demographic and economic circumstances of the time, due to the rapid growth in wages, labour force participation and the low rates of return on investments.

However, demographic and economic developments, as well as changes to benefits and an increase in disability claims in the following three decades, resulted in significantly higher costs.

When federal, provincial and territorial Ministers of Finance began their review of the CPP's finances in 1996, contribution rates, already legislated to rise to 10.1 percent by 2016, were expected to rise again—to 14.2 percent by 2030—to continue to finance the CPP on a pay-as-you-go basis. Continuing to finance the CPP on the same basis as in the past would have meant imposing a heavy financial burden on the future Canadian workforce. This was deemed unacceptable by the participating governments.

Amendments were therefore made in 1998 to gradually raise the level of CPP funding by: increasing contribution rates over the short term; reducing the growth of benefits over the long term; and investing cash flows not needed to pay benefits in the financial markets through the CPP Investment Board in order to achieve higher rates of return. A further amendment was included to ensure that any increase in benefits or new benefits provided under the CPP would be fully funded. The reform package agreed to by the federal and provincial governments in 1997 included:

- The introduction of steady-state funding – This replaced pay-as-you-go financing to build a reserve of assets and stabilize the ratio of assets to expenditures over time. According to the Twenty-sixth Actuarial Report on the Canada Pension Plan, the level of assets under steady-state funding is projected to stabilize at a level equal to about five years of expenditures. Investment income from this pool of assets will help pay benefits as the large cohort of baby boomers retires. Steady-state funding is based on a constant rate that finances the CPP without the full-funding requirement for increased or new benefits. The steady-state rate was determined to be 9.84 percent for 2016 and thereafter in the Twenty-sixth Actuarial Report on the Canada Pension Plan.

- The introduction of incremental full funding – This means that changes to the CPP that increase or add new benefits will be fully funded. In other words, benefit costs are paid as the benefit is earned, and any costs associated with benefits that are already earned and not paid for are amortized and paid for over a defined period of time, consistent with common actuarial practice. In the Twenty-sixth Actuarial Report on the Canada Pension Plan, the full-funding rate was determined to be 0.01 percent for 2013 and thereafter. According to CPP Regulations regarding the calculation of the Plan's contribution rates, if the full-funding rate is less than 0.02 percent, then it is deemed to be zero. As a result, the full-funding rate under the Twenty-sixth Actuarial Report on the Canada Pension Plan is deemed to be zero, and the funding of the most recent amendments to the CPP is provided entirely by the steady-state rate. The minimum contribution rate required to fund the CPP, which is the sum of the steady-state and full-funding rates, is thus equal to the steady-state rate of 9.84 percent for 2016 and thereafter.

Both of these funding objectives were introduced to improve fairness across generations. The move to steady-state funding eases some of the contribution burden on future generations. Under full funding, each generation that receives benefit enrichments is more likely to pay for them in full and not pass on the cost to future generations. These full-funding requirements were made operational through new regulations that came into effect with the passage of An Act to amend the Canada Pension Plan and the Old Age Security Act (2008).

Financing

According to the financial projections of the Twenty-sixth Actuarial Report on the Canada Pension Plan, the annual amount of contributions paid by Canadians into the CPP is expected to exceed the annual amount of benefits paid out up to and including 2022, and to be less than the amount of benefits thereafter. Funds not immediately required to pay benefits will be transferred to the CPP Investment Board for investment. Plan assets are expected to accumulate rapidly over this period and, over time, will help pay for benefits as more and more baby boomers begin to collect their retirement pensions. In 2023 and thereafter, as baby boomers continue to retire and benefits paid begin to exceed contributions, investment income from the accumulated assets will provide the funds necessary to make up the difference; however, contributions will remain the main source of funding for benefits.

The goal of the financing policy of the CPP is to ensure the long-term financial sustainability of the Plan by stabilizing the ratio of assets to expenditures under the steady-state contribution rate. As such, the key measure of the financial health of the CPP is the adequacy and stability of the CPP's steady-state contribution rate and, thus, the legislated rate over time. The Twenty-sixth Actuarial Report on the Canada Pension Plan provides comparisons of the assets, actuarial liabilities, asset shortfall and assets to liability percentages under two approaches. The first, referred to as the "open group approach," considers the benefits and contributions of both current and future Plan participants and is consistent with the partial funding design of the CPP. Under this approach, the Plan's assets represented 99.6 percent of the actuarial liability (with an asset shortfall of $8.9 billion) as at December 31, 2012. The open group approach is considered by the OCA as being the most appropriate in the context of the CPP and confirms the Plan's long-term financial sustainability under a 9.9 percent contribution rate. The second approach, the "closed group approach," considers only current participants and does not recognize future contributions as a major source of financing and, as such, it is considered by the OCA as being inappropriate in assessing the financial sustainability of the CPP. A study, titled Assessing the Sustainability of the Canada Pension Plan through Actuarial Balance Sheets – Actuarial Study No. 13 describes both approaches in more detail and is available on the website of the Office of the Superintendent of Financial Institutions.

If, at any time, the legislated contribution rate is lower than the minimum contribution rate, and if the Ministers of Finance do not recommend either increasing the legislated rate or maintaining it, then legislative provisions would apply to sustain the CPP. An increase in the legislated rate would be phased in over three years, and benefit indexation would be suspended until the following triennial review. By law, any further enhancement of the CPP must be fully funded. The next triennial review in 2016–2018 will examine the financial status of the CPP based on the results of the next triennial actuarial report.

Financial accountability

The CPP uses the accrual basis of accounting for revenues and expenditures. This method gives administrators a detailed financial picture and allows accurate matching of revenue and expenditures in the year in which they occur.

CPP Account

A separate account, the CPP Account, has been established in the accounts of the Government of Canada to record the financial elements of the CPP (i.e. contributions, interest, earned pensions and other benefits paid, as well as administrative expenditures). The CPP Account also records the amounts transferred to, or received from, the CPP Investment Board (CPPIB). Spending authority is limited to the CPP's net assets. The CPP assets are not part of the federal government's revenues and expenditures.

In keeping with An Act to amend the Canada Pension Plan and the Canada Pension Plan Investment Board Act (Bill C-3), which came into force on April 1, 2004, the CPPIB is responsible for investing the remaining funds after the CPP operational needs have been met. The CPP Account's operating balance is managed by the Government of Canada.

CPP Investment Board

Created by an Act of Parliament in 1997, the CPPIB is a professional investment management organization with a critical purpose—to help provide a foundation on which Canadians build financial security in retirement. The CPPIB invests the assets of the CPP not currently needed to pay pension, disability and survivor benefits.

The CPPIB is accountable to Parliament and to the federal and provincial Ministers of Finance who serve as the CPP's stewards. However, the CPPIB is governed independently from the CPP, operating at arm's length from governments. Its headquarters are located in Toronto, with offices in Hong Kong, London, Luxembourg, New York and São Paulo.

The CPPIB's legislated mandate is to maximize investment returns without undue risk, taking into account the factors that may affect the funding of the CPP and its ability to meet its financial obligations.

According to the Twenty-sixth Actuarial Report on the Canada Pension Plan, the Chief Actuary reaffirmed that the CPP remains sustainable at the current contribution rate of 9.9 percent throughout the 75-year period of his report. The report also indicates that CPP contributions are expected to exceed annual benefits paid until 2023, when a portion of the investment income from the CPPIB will be needed to help pay CPP benefits.

For more information on the CPPIB mandate, governance structure and investment policy, visit the Canada Pension Plan Investment Board website.

CPP assets and cash management

The 2004 legislation (Bill C-3) stipulates that any excess cash to the CPP must be transferred to the CPPIB once the benefit and administration expenses have been paid, to gain a better return. The cash flow forecasts of the CPP determine the amount of funds to be transferred to or from the CPPIB, and these forecasts are updated regularly.

The CPP administration continues to work closely with the CPPIB, various government departments and banks to coordinate these transfers and manage a tightly controlled process. A control framework is in place to ensure that the transfer process is followed correctly and that all controls are effective. For instance, the CPP administration obtains confirmation at all critical transfer points and can therefore monitor the cash flow from one point to the next.

CPP net assets

As at March 31, 2015, the CPP net assets totalled $269.6 billion. The Government of Canada held $5.0 billion to meet CPP financial needs. The remaining $264.6 billion is managed by the CPPIB.

For the 10-year period ending March 31, 2015, the Fund held by the CPPIB had an annualized net rate of return of 8 percent or $129.5 billion in cumulative net investment income.

Investing for our future

In terms of net assets, the CPP Fund ranks among the world's 10 largest retirement funds. In managing the Fund, the CPPIB pursues a diverse set of investment programs that contribute to the long-term sustainability of the CPP.

In 2006, the CPPIB made the strategic decision to move away from index-based investments towards a more active investment approach in order to seek returns higher than those available from passive investments.

The CPPIB invests in public equities, private equities, bonds, private debt, real estate, infrastructure, agriculture and other investment areas. The CPPIB's investments have become increasingly international, as it diversifies risk and seeks growth opportunities in global markets. In doing so, the CPPIB applies its comparative advantages—scale, certainty of assets and a long investment horizon—to pursue the best investment opportunities in the world.

The CPPIB draws on internal expertise and partnerships with external investment managers to build its global portfolio.

CPPIB reporting

The CPPIB reports on a quarterly basis. Legislation requires the CPPIB to hold public meetings at least every two years in each province, excluding Quebec, which operates the QPP.

The purpose of these meetings is for the CPPIB to present its most recent annual report and to provide the public with the opportunity to ask questions about the policies, operations and future plans of the CPPIB.

International agreements

Many individuals have lived or worked in Canada and in other countries. Consequently, Canada has entered into social security agreements with other countries to help people in Canada and abroad to qualify for CPP benefits and pensions from partner countries to which they would otherwise not be entitled. Furthermore, social security agreements enable Canadian companies and their employees who are sent to work temporarily outside the country to maintain their CPP coverage and eliminate the need to contribute to the social security program of the other country for the same work.

As of March 31, 2015, Canada has social security agreements in force with 56 countries. In addition, three new social security agreements have been signed and will enter into force once legal procedures have been completed. Negotiations towards social security agreements are ongoing with many other countries. The names of countries with which Canada has concluded social security agreements are listed in the following table.

| Country name | Date of agreement |

|---|---|

| Antigua and Barbuda | January 1, 1994 |

| Australia | September 1, 1989 |

| Austria | November 1, 1987 |

| Barbados | January 1, 1986 |

| Belgium | January 1, 1987 |

| Brazil | August 1, 2014 |

| Bulgaria | March 1, 2014 |

| Chile | June 1, 1998 |

| Croatia | May 1, 1999 |

| Cyprus | May 1, 1991 |

| Czech Republic | January 1, 2003 |

| Denmark | January 1, 1986 |

| Dominica | January 1, 1989 |

| Estonia | November 1, 2006 |

| Finland | February 1, 1988 |

| France | March 1, 1981 |

| Germany | April 1, 1988 |

| Greece | May 1, 1983 |

| Grenada | February 1, 1999 |

| Hungary | October 1, 2003 |

| Iceland | October 1, 1989 |

| Ireland | January 1, 1992 |

| Israel* | September 1, 2003 |

| Italy | January 1, 1979 |

| Jamaica | January 1, 1984 |

| Japan | March 1, 2008 |

| Jersey and Guernsey | January 1, 1994 |

| Korea | May 1, 1999 |

| Latvia | November 1,2006 |

| Lithuania | November 1, 2006 |

| Luxembourg | April 1, 1990 |

| Malta | March 1, 1992 |

| Mexico | May 1, 1996 |

| Morocco | March 1, 2010 |

| Netherlands | October 1, 1990 |

| New Zealand | May 1, 1997 |

| Norway | January 1, 1987 |

| Philippines | March 1, 1997 |

| Poland | October 1, 2009 |

| Portugal | May 1, 1981 |

| Republic of Macedonia | November 1, 2011 |

| Romania | November 1, 2011 |

| Saint Lucia | January 1, 1988 |

| Saint Vincent and the Grenadines | November 1, 1998 |

| Serbia | December 1, 2014 |

| Slovak Republic | January 1, 2003 |

| Slovenia | January 1, 2001 |

| St. Kitts and Nevis | January 1, 1994 |

| Spain | January 1, 1988 |

| Sweden | January 1, 1986 |

| Switzerland | October 1, 1995 |

| Trinidad and Tobago | July 1, 1999 |

| Turkey | January 1, 2005 |

| United Kingdom* | April 1, 1998 |

| United States of America | August 1, 1984 |

| Uruguay | January 1, 2002 |

In addition, social security agreements have been signed with China, India and Peru. They will enter into force once legal procedures have been completed.

*The social security agreements with China, Israel and the United Kingdom provide an exemption from the obligation to contribute to the social security system of the other country for employers and their employees temporarily posted abroad. These agreements do not contain provisions concerning eligibility for pension benefits.

Managing the CPP

Collecting and recording contributions

All CPP contributions are remitted to the Canada Revenue Agency (CRA). The CRA also assesses and verifies earnings and contributions, advises employers and employees of their rights and responsibilities, conducts audits and reconciles reports and T4 slips. To verify that contribution requirements are met, the CRA applies a compliance and enforcement process that can vary from a computerized data match to an on-site audit.

As of March 31, 2015, there were 1,734,765 existing employer accounts. In 2014–2015, the CRA conducted 51,331 examinations to promote compliance with the requirements to withhold, report and remit employer source deductions. Employers and employees account for approximately 95 percent of contributions, and the remaining 5 percent comes from the self-employed. In 2014–2015, contributions amounted to $45.0 billion.

Overpayment of benefits

Consistent with its mandate to manage the CPP effectively, Employment and Social Development Canada (ESDC) has procedures in place to detect benefit overpayments. During 2014–2015, overpayments totalling $75 million were detected, $49 million in overpayments were recovered and debts of $4 million were forgiven. The above figures represent a net increase of $22 million in the accounts receivable for the year.

Operating expenses

CPP operating expenses of $1.337 billion in 2014–2015 represent 3.45 percent of the $38.7 billion in benefits paid. Table 1 presents the CPP's operating expenses for the last two years.

| Department/Agency/Crown Corporation | In millions of dollars | |

|---|---|---|

| 2014–2015 | 2013–2014 | |

| CPP Investment Board Footnote 4 | 803 | 576 |

| Employment and Social Development Canada | 326 | 313 |

| Canada Revenue Agency | 173 | 169 |

| Treasury Board Secretariat Footnote 5 | 17 | 15 |

| Public Works and Government Services Canada | 9 | 9 |

| Administrative Tribunals Support Service of Canada Footnote 6 | 7 | - |

| Office of the Superintendent of Financial Institutions (where the Office of the Chief Actuary is housed)/Finance Canada | 2 | 3 |

| Total | 1,337 | 1,085 |

Improving service delivery

Within ESDC, Service Canada is the Government of Canada's one-stop service delivery network. In partnership with other departments, it provides Canadians with easy access to a growing range of government programs and services.

In 2014–2015, Service Canada continued its efforts to ensure that eligible Canadians are receiving public pensions and to encourage Canadians to actively plan and prepare for their own retirement. Information on the CPP is available in print, on the Internet, in person at local offices, by phone and at electronic kiosks in government offices and public buildings. Service Canada is advancing its e-service agenda through enhancements in the secure online My Service Canada Account that will position Service Canada to further leverage electronic service offerings.

Currently underway is the development of a multi-year service improvement strategy for the CPP. This strategy among other activities will help streamline business operations, enhance e-service delivery and increase processing automation.

Online service delivery

Service Canada is continually improving its self-service web-based options. Clients can now use the Internet to make enquiries, apply for a CPP retirement pension, conduct transactions and access other information on CPP benefits and provisions by visiting the website http://www.esdc.gc.ca/en/msca/cpp_oas_information.page . CPP contributors can also view and print an official copy of their Statement of Contributions (SOC) by visiting the website http://www.servicecanada.gc.ca/eng/services/pensions/cpp/contributions/soc.shtml. Contributors can also use this online service to request that copies of their SOC be issued by mail. Further, CPP recipients can view and print copies of their tax slips for the current year and the previous six years. In 2014–2015, approximately 91,000 individuals applied for their CPP retirement benefits online.

Service Canada has responded in the past few years to growing expectations regarding service delivery. My Service Canada Account and other self-serve tools have expanded citizens' capacity to find and access information online. My Service Canada Account provides a single point of access for users to apply for a CPP retirement pension and to view and update their information with the CPP program. Enhancements to the My Service Canada Account will further promote self-serve options for clients within the secure online tool.

Since 2005, CPP clients have been able to access their personal information securely online. They can view their monthly payment amounts and, if they live in Canada, can update their mailing address, phone numbers and direct deposit information.

Service Canada has promoted the use of online services through:

- targeted mailing of promotional inserts in existing mass mailings;

- promotional messages within standard client correspondence;

- improved navigation to online services on the Service Canada home page; and

- promotional messages from staff at points of service and call centres.

Seasonal promotional activities are also undertaken where appropriate, such as promoting the online tax slip service during the tax-filing season. A significant increase in the use of online services is anticipated for benefit applications within the next few years.

Processing benefits

In 2014–2015, Service Canada processed approximately 280,300 applications for retirement benefits, and 91 percent of these benefits were paid within the first month of entitlement, exceeding the national objective (see Table 2).

During the same period, Service Canada also processed approximately 70,000 initial applications for disability benefits. Decisions were made on 81 percent of these initial applications within 120 calendar days of receipt of the completed application.

With regard to disability benefit reconsiderations, Service Canada processed approximately 13,200 requests. Seventy-eight percent of all reconsideration decisions were made within 120 calendar days of receipt of the request.

The 2014–2015 national results for disability benefits represent the third year of strong results after the targets were missed in 2011–2012. These results reflect the Department's ongoing workload recovery efforts that focused on improving service levels and reducing the average processing times.

A continued strong emphasis on communication with clients and their physicians helped Service Canada staff make well-informed decisions and helped disability applicants better understand the reasons for those decisions.

| National measure | National objective | 2014–2015 National result |

|---|---|---|

| CPP retirement applications Percentage of benefits paid within the first month of entitlement |

90% | 91% |

| CPP disability (initial decisions) Percentage of initial decisions made within 120 calendar days of receipt of applications |

75% | 81% |

| CPP disability (reconsideration decisions) Percentage of reconsideration decisions made within 120 calendar days of receipt of applications |

70% | 78% |

Ensuring program integrity

To ensure the accuracy of benefit payments, the security and privacy of personal information and the overall quality of service, ESDC continues to modernize the CPP program and further enhance the efficiency, accuracy and integrity of its operations.

Meeting the expectations of Canadians—that government services and benefits be delivered to the right person, for the right amount, for the intended purpose and at the right time—is a cornerstone of ESDC's service commitment. Enhanced and modernized integrity-related activities within the CPP program are essential to meeting these expectations and ensuring the public's trust and confidence in the effective management of this program.

These activities consist of risk-based analysis measures, which ensure that appropriate and effective controls are in place and that the causes of incorrect payments are understood. Integrity-related activities also include reviews of benefit entitlements and investigations to address situations in which clients are receiving benefits to which they are not entitled.

Integrity-related activities also detect and correct existing incorrect payments, reduce program costs by preventing incorrect payments and identify systemic impediments to clients receiving their correct and full benefit entitlement.

As part of its efforts to address overpayment situations, ESDC has a program-integrity function that investigates suspected client error and fraud. By recovering overpayments and preventing future incorrect payments, these activities resulted in $9.4 million in accounts receivable as overpayments and prevented an estimated $7.1 million from being incorrectly paid in 2014–2015. A further estimated $59.8 million has been prevented from being incorrectly paid for future years after 2014–2015. The recovered overpayments are credited to the CPP, thereby helping to maintain the long-term sustainability of the Plan.

In 2011, ESDC adopted the Identity Management Policy Suite, which aims to enhance program integrity while safeguarding and streamlining identity management processes in a manner that mitigates risks to personal and organizational security, and enables well-managed citizen-centered service delivery.

The Identity Management Policy Suite provides guiding principles for ESDC organizations delivering services, benefits or programs, including the CPP. It assists them in the implementation of sound identity management practices across multiple service delivery channels (in-person, phone, mail and online).

The Identity Management Policy Suite also helps reduce costs, inefficiencies and the risk of errors, as well as improves the service experience for CPP clients. The mitigation of risks associated with false or inaccurate claims regarding the true identity of an individual or an organization is fundamental to the integrity of the CPP program.

Looking to the future

Since it began in 1966, the CPP has continually adapted to social and economic changes in order to respond to the evolving needs of Canadians. The Plan will continue to do so in the future.

Given the increasing CPP workload volumes and changing service expectations of Canadians, Service Canada is continuing to develop a strategy for the CPP in order to improve service and generate administrative efficiencies. The strategy will leverage work undertaken as part of government-wide reviews. In June 2015, an initial service improvement eliminated the ink-based signature requirements for the CPP, enabling fully automated processing of CPP retirement applications.

Canada Pension plan Consolidated financial statements

Please visit the Public Works and Government Services Canada website to view the Canada Pension Plan Consolidated Financial Statements for the year ended March 31, 2015.