Administrative Tribunals Support Service of Canada 2024-2025 Departmental Results Report

On this page

At a glance

This departmental results report details the Administrative Tribunals Support Service of Canada’s (ATSSC) actual accomplishments against the plans, priorities and expected results outlined in its 2024 to 2025 Departmental Plan.

Key priorities

The ATSSC identified the following key priorities for 2024 to 2025:

Collaborating with tribunal leadership and one another: Collaborate with tribunals and across secretariats and business lines on service to tribunals and those seeking access to justice, exchange information and resources, and enhance accountability and transparency.

Delivering business excellence through innovation at work: Be a model of administrative support to the tribunal sector by adapting practices and embrace changing realities by investing in digital solutions and infrastructure and prioritizing workplace evolution to facilitate access to justice.

Supporting our people: Ensure that the ATSSC remains a place where people feel valued and respected, where they can grow and evolve by fostering employee well-being, promoting diversity and inclusion, and improving training, mobility, talent management and retention.

Highlights for the ATSSC in 2024 to 2025

- Total actual spending (including internal services): $85,958,680

- Total full-time equivalent staff (including internal services): 717

For complete information on the ATSSC’s total spending and human resources, read the Spending and human resources section of its full departmental results report.

Summary of results

The following provides a summary of the results the department achieved in 2024 to 2025 under its main areas of activity, called “core responsibilities.”

Core responsibility: Support services and facilities to federal administrative tribunals and its members

Actual spending: $60,153,920

Actual human resources: 562

In 2024 to 2025, the ATSSC’s accomplishments for this core responsibility revolved around its 3 strategic pillars:

Collaborating with tribunal leadership and one another

- We strengthened collaboration with tribunal leadership and expanded shared registry and member services, enabling tribunals to more effectively manage workload peaks

- In collaboration with tribunal Chairpersons, we finalized a plan to streamline operations by restructuring our secretariats—from 5 to 3—with the new structure taking effect on April 1, 2025

- Through the ATSSC Artificial Intelligence (AI) Working Group, we fostered cross-sector collaboration by exploring and piloting AI translation tools, developing a costing matrix, and engaging with external partners such as the Courts Administration Service

- We worked closely with tribunals to test and refine audiovisual setups and provided training and technical support to ensure seamless, accessible hearing experiences

- To improve access to justice and provide greater clarity for parties, we supported updates to tribunal practice directions

- We supported tribunals in hosting stakeholder engagement and outreach activities, which helped to clarify procedures

- We guided tribunals in reviewing and updating public-facing materials—including letters, decision templates and websites—to ensure they used plain and inclusive language

- We developed a new strategic plan for 2025 to 2030, shaped through extensive internal collaboration and consultations with tribunal Chairpersons, that:

- outlines our organizational priorities and guiding values

- focuses on strengthening service delivery, advancing organizational excellence, and empowering employees

Delivering business excellence through innovation at work

- We advanced our commitment to business excellence by driving innovation across tribunal operations and support services

- To strengthen data-informed decision-making, we enhanced the use of Power BI and Case Management Systems to monitor trends, track caseloads, and guide strategic planning

- We improved operational efficiency by:

- streamlining registry processes, which reduced the Canada Industrial Relations Board’s decision review time to 30 days

- successfully implementing a LEAN-based Registry standardization initiative at the Canadian Human Rights Tribunal

- We modernized hearing infrastructure by:

- upgrading audiovisual equipment in 3 National Capital Region hearing rooms, enabling reliable in-person, virtual, and hybrid proceedings

- supported tribunals in offering more virtual hearings, which increase flexibility for participants, improve access to justice and allow cases to be resolved more efficiently

- To improve translation workflows, we piloted and expanded the use of AI tools such as DeepL Pro and Systran, reducing turnaround times and reliance on external service providers

- We modernized digital platforms by redesigning websites and integrating accessibility tools like UserWay

- To help Canadians better understand tribunal processes, we developed accessible educational resources, including the Social Security Tribunal Secretariat’s first fully accessible video

- Together, these initiatives enhanced service delivery, improved access to justice, and positioned the ATSSC as a leader in innovative administrative support

Supporting our people

- We supported our people by equipping staff with the training and tools they needed to adapt to evolving legislative and operational changes

- To foster an inclusive and respectful workplace culture, we facilitated equity, diversity, and inclusion discussions and created safe spaces for dialogue

- We shared resources and training on change management, accessibility and inclusive language—such as the Fostering an Inclusive Workplace course and the Positive Space initiative—reinforcing our commitment to support a, a skilled, inclusive and adaptable workforce

For more information on the ATSSC’s Support services and facilities to federal administrative tribunals and its members, read the ‘Results – what we achieved” section of its departmental results report.

From the Chief Administrator

Orlando Da Silva, LSM

Chief Administrator

It is my pleasure to present the 2024 to 2025 Departmental Results Report for the Administrative Tribunals Support Service of Canada (ATSSC).

The ATSSC provides facilities and administrative support to 12 federal administrative tribunals1 and the National Joint Council2 , helping them carry out their respective responsibilities and make decisions in line with the laws and procedures that govern their work. This report provides detailed information about the organization’s achievements during fiscal year 2024 to 2025.

During fiscal year 2024 to 2025, we celebrated the ATSSC’s 10th anniversary—a milestone that highlighted our continued commitment to the original purpose of our organization: providing expert, efficient, and centralized support to federal administrative tribunals.

This was a period of meaningful progress for the ATSSC as the organization focused on the following key priorities: collaborating with tribunal leadership and one another; delivering business excellence through innovation at work; and supporting our people. These priorities form the basis of our new 2025 to 2030 Strategic Plan that will guide us in strengthening service delivery, organizational excellence and employee empowerment in the years ahead.

The ATSSC worked closely with tribunal leadership and across secretariats to strengthen access to justice. We helped the tribunals handle another high volume of cases, and they managed to resolve more cases than were opened for the second year in a row. By modernizing our hearing infrastructure, piloting and expanding the use of Artificial Intelligence (AI) translation tools and incorporating plain and inclusive communication, our efforts have made tribunal services more accessible, efficient and responsive for those navigating the administrative justice system.

These initiatives further positioned the ATSSC as a leader in the provision of support services to administrative tribunals and they highlight our dedication to continuous improvement.

But foremost, our people are at the heart of our success. In 2024 to 2025, we continued to invest in training, foster an inclusive and respectful workplace culture and prioritize employee well-being. Our goal is to ensure that the ATSSC remains a workplace where employees feel valued, respected and empowered.

I am deeply grateful to our staff for their professionalism, adaptability and commitment to public service. I would also like to thank tribunal chairpersons and members for their ongoing collaboration and leadership.

I invite you to read this report for more details about the ATSSC’s achievements over the past fiscal year. These results reflect our efforts in carrying out our mandate to support Canada’s federal administrative tribunals in delivering fair, timely and accessible justice.

Orlando Da Silva, LSM

Chief Administrator

1- As per the Administrative Tribunals Support Service of Canada Act, the ATSSC provides facilities and administrative support to 11 federal administrative tribunals. The ATSSC also supports the Environmental Protection Tribunal of Canada through a memorandum of understanding with Environment and Climate Change Canada.

2- Section 11 (2) of the Federal Public Sector Labour Relations Act.

Results—what we achieved

Core responsibilities and internal services

Core responsibility: Support services and facilities to federal administrative tribunals and its members

Description

The ATSSC is responsible for providing support services required by each tribunal by way of a single, integrated organization.

Quality of life impacts

This core responsibility contributes to the “Good Governance” domain of the Quality of Life Framework for Canada—and more specifically, the “Democracy and institutions” subdomain and the “Confidence in institutions” indicator—through all of the activities mentioned in the core responsibility description.

Progress on results

This section details the department’s performance against its targets for each departmental result under Core responsibility 1: Support services and facilities to federal administrative tribunals and its members.

Table 1: Tribunal members receive the specialized support services they require to hear matters, to resolve files, or to render decisions

Table 1 shows the target, the date to achieve the target and the actual result for each indicator under Tribunal members receive the specialized support services they require to hear matters, to resolve files, or to render decisions in the last 3 fiscal years.

| Departmental Result Indicator | Target | Date to achieve target | Actual results |

|---|---|---|---|

| Percentage of files examined where the preparatory information was deemed complete and provided within the timeframes established by Chairpersons‡ | 85% | March 2025 | 2022 to 2023: 95.80%1 2023 to 2024: 96.91%2 2024 to 2025: 93.52%3 |

| Level of satisfaction of tribunal members with the quality of the specialized services offered by their assigned secretariats | 85% | March 2025 | 2022 to 2023: 85.12% 2023 to 2024: 95.02%4 2024 to 2025: 94.91% |

‡Established timeframes are set for each individual tribunal as the timing for the receipt of preparatory information varies by tribunal. Timeframes are established by Chairpersons in collaboration with the relevant secretariat and, if applicable, in accordance with legislative or regulatory requirements.

1Percentage is based on the average results of 11 out of 12 tribunals. One tribunal had not finalized their methodology by the end of the fiscal year.

2Percentage is based on the average results of 10 out of 12 tribunals. Of the 2 remaining tribunals, one had no cases to report, and the other had not finalized their methodology by the end of the fiscal year.

3Percentage is based on the average results of 11 out of 12 tribunals. One tribunal had not finalized their methodology by the end of the fiscal year.

4In 2023 to 2024, the ATSCC implemented the client satisfaction score (CSAT) to calculate members’ level of satisfaction.

The Results section of the Infographic for the ATSSC on GC Infobase page provides additional information on results and performance related to its program inventory.

Details on results

The following section describes the results for Support services and facilities to federal administrative tribunals and its members in 2024 to 2025 compared with the planned results set out in the ATSSC’s departmental plan for the year.

Tribunal members receive the specialized support services they require to hear matters, to resolve files, or to render decisions.

Results achieved

Tribunal caseloads and mandates

With our support, the tribunals:

opened a similar volume of case files (11,184) as the previous year (11,100)

closed more case files (12,175) than they opened for the second consecutive year

conducted 5,908 hearings

issued 7,689 decisions

held 70% of hearings by videoconference or teleconference

We helped tribunals to advance data-informed decision-making by enhancing the use of Power BI and Case Management Systems to monitor trends, track file inflows and outputs and guide strategic planning

We facilitated resource sharing among select tribunals by coordinating shared registry and member services, allowing tribunals to manage workload peaks more effectively and improve service delivery

We facilitated regular data vetting for the Federal Public Sector Labour Relations and Employment Board (FPSLREB)—such as file reviews and compliance checks—to ensure the accuracy and reliability of data used by ATSSC leadership

We supported the Social Security Tribunal (SST) in conducting regular forecasting exercises and monitoring key performance indicators, ensuring that resources were aligned with intake volumes and service standards

We used client feedback and performance data during the SST forecasting exercises to continuously refine services and improve user experience

To help the Canada Industrial Relations Board (CIRB) streamline its operations, we established a triage and liaison unit and improved its decision review process, which reduced the average review time to 30 days

We supported the CIRB to prepare for legislative changes by drafting procedural rules related to the replacement workers ban and the new maintenance of activities regime

We coordinated and delivered training to CIRB tribunal members and staff to ensure they were ready for the new requirements

For the Canadian Human Rights Tribunal (CHRT), we supported a 2-year LEAN-based Registry standardization initiative—applying LEAN principles to eliminate inefficiencies and streamline workflows—by reviewing 11 work modules and implementing consistent, standardized procedures

We optimized support services for the Canadian International Trade Tribunal (CITT) by reducing redundant tasks and duplication, and aligning responsibilities with staff expertise

We made significant changes to better align services provided to the CITT with those provided to other tribunals and to prioritize inquiries subject to legislated timeframes, improving consistency and responsiveness

For the Competition Tribunal (CT), we supported cross-training for Registry Officers and legal staff, reviewed and modernized registry procedures, and developed new templates

Across all secretariats, we created standardized job descriptions for editors to promote consistency, clarify roles, and support more efficient service delivery

Translation services

To provide faster, more efficient translation services and reduce our reliance on external providers, we supported several tribunals in piloting and expanding the use of AI translation tools, including DeepL Pro, Systran, and Alexa AI

We used these tools to support the translation of decisions and internal documents, and we saw measurable improvements in workflow efficiency

While AI-generated translations required additional internal review to ensure quality, they contributed to faster turnaround times

To improve translation accuracy and reduce revision time, we regularly updated glossaries and used LogiTerm software to make terminology more consistent

While we increased our use of AI tools, we continued to use external translation services as needed to ensure high-quality outcomes, allowing us to balance cost-efficiency with the delivery of high-quality translations

We developed a costing matrix to assess the value of AI tools and collaborated with external partners, including the Courts Administration Service, to share insights and explore new technologies

Virtual hearings

We modernized 3 hearing rooms in the National Capital Region with state-of-the-art audiovisual (AV) equipment to support in-person, virtual, and hybrid proceedings

Tribunals continued to use virtual and hybrid hearings extensively and the upgraded hearing rooms contributed to increased flexibility and access to justice

We trained staff to use the new AV systems so that they could confidently support tribunal members and participants during hearings

Staff practised using the new AV systems independently and collaborated with IT teams to ensure smooth delivery of services

Virtual hearings, as leveraged by the Environmental Protection Tribunal of Canada (EPTC), remained a key tool for improving efficiency and reducing travel-related costs

Some tribunals explored or finalized directives to use virtual hearings more often for specific types of cases, making hearings more accessible for people across Canada

Access to justice

We renewed our 2024 to 2027 Digital Strategy to guide innovation across the ATSSC and accelerate access to justice

The strategy includes new digital initiatives like the Access to justice (A2J)-bot chatbot, mobile hearing rooms, and a pilot project on the responsible use of AI

Focused on citizens’ needs, the strategy aims to deliver digital services that are accessible, inclusive, and responsive to Canadians

We helped tribunals to improve the accessibility of their websites, including:

adding an accessibility menu on the CIRB website

adding closed captioning to online videos

adding the UserWay accessibility tool to the CHRT website

We worked with tribunals such as the Canada Agricultural Review Tribunal (CART) and Transportation Appeal Tribunal of Canada (TATC) to redesign and revise their websites, improving navigation and accessibility

We helped the SST publish its first fully accessible video to help Canadians better understand their appeal process

We supported the SST in collecting and analyzing Gender-based Analysis Plus data to better understand the diverse needs of its users and improve services by considering education, age, access to technology, and physical limitations

We helped the Specific Claims Tribunal (SCT) update its Practice Directions to improve procedural clarity and efficiency

We also supported the Canadian Cultural Property Export Review Board (CCPERB) in delivering a workshop to help stakeholders better understand its certification process and improve procedural accessibility

We assisted the Public Servants Disclosure Protection Tribunal (PSDPT) in updating its website, focusing on improving the information it provides and adopting a more contemporary, accessible layout

Secretariat staff reviewed and updated decision templates, letters, and other public-facing materials to use plain and inclusive language

2025-2030 Strategic Plan

In 2024 to 2025, the ATSSC developed a new strategic plan—shaped through extensive collaboration within the organization and consultations with tribunal Chairpersons—that outlines the priorities and values that will guide it from 2025 to 2030. The plan is anchored on the following strategic pillars:

Tribunal leadership engagement: Engaging meaningfully with tribunals and other federal bodies by responding to their unique needs

Operational and service excellence: Optimizing resources, technology, and processes to enhance agility, responsiveness, and efficiency

Empowering our people: Fostering an inclusive, supportive workplace where employees are equipped with the tools, technology, and opportunities they need to thrive

Organizational realignment

To streamline operations and improve efficiency, the ATSSC restructured its secretariats in collaboration with tribunal Chairpersons. This resulted in the number of secretariats going from 5 to 3, effective April 1, 2025. This realignment will improve service delivery and achieve greater economies of scale.

Key risks

We continued to manage the risk of insufficient resources as we supported tribunals facing growing mandates, rising caseloads, and evolving needs. As the number of tribunal members, caseloads, and operational costs increased, we remained focused on delivering high-quality services within our available means.

To address this challenge, we invested in staff capacity and improved operational efficiency. We strengthened data-informed planning, streamlined processes, and made better use of shared services to optimize our resources. We encouraged all staff to identify practical ways to improve operations, while managers took a proactive approach to workload management—emphasizing realistic priorities and open communication.

Aware of how increased workloads can affect employee well-being, morale, and retention, we promoted mental health resources, encouraged healthy workload practices, and explored operational solutions to ease pressure on staff during peak periods. When we carried out a Workforce Adjustment exercise in 2024 to 2025, we ensured that the process was transparent and handled with care. Aware of how increased workloads can affect employee well-being, morale, and retention, we promoted mental health resources, encouraged healthy workload practices, and explored operational solutions to ease pressure on staff during peak periods. These initiatives supported a resilient workforce and helped maintain service continuity across tribunals.

We also took proactive steps to assess emerging risks related to climate change. Aligned with the Greening Government Strategy, we conducted a Climate Risk Assessment to understand how climate-related impacts could affect our ability to deliver on our mandate. Through document reviews, staff interviews, and a workshop, we identified 2 low-rated risks: potential service disruptions due to climate-related events (such as travel delays or impacts on hearing facilities), and increased demand for tribunal services stemming from climate-related issues (such as workplace safety complaints). While both risks were assessed as low, we will include these findings in our broader risk management approach and continue to monitor them to ensure resilience and preparedness.

Resources required to achieve results

Table 2: Snapshot of resources required for Support services and facilities to federal administrative tribunals and its members

Table 2 provides a summary of the planned and actual spending and full-time equivalents required to achieve results.

| Resource | Planned | Actual |

|---|---|---|

| Spending | $58,016,917 | $60,153,920 |

| Full-time equivalents | 588 | 562 |

The Finances section of the Infographic for the ATSSC on GC Infobase page and the People section of the Infographic for the ATSSC on GC Infobase page provide complete financial and human resources information related to its program inventory.

Related government-wide priorities

This section highlights government priorities that are being addressed through this core responsibility.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

More information on the ATSSC’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy.

Program inventory

Support services and facilities to federal administrative tribunals and its members is supported by the following programs:

Program 1.1: Registry Services

Program 1.2: Legal Services

Program 1.3: Mandate and Member Services

Additional information related to the program inventory for Support services and facilities to federal administrative tribunals and its members is available on the Results page on GC InfoBase.

Internal services

Description

Internal services refer to the activities and resources that support a department in its work to meet its corporate obligations and deliver its programs. The 10 categories of internal services are:

Management and Oversight Services

Communications Services

Legal Services

Human Resources Management

Financial Management

Information Management

Information Technology

Real Property

Materiel

Acquisitions

Progress on results

This section presents details on how the department performed to achieve results and meet targets for internal services.

Corporate Services Innovation Initiative

As a result of feedback from travelers, we launched a LEAN-inspired Travel Mapping Process

This led to the implementation of redesigned travel management processes, reducing the number of steps by 61%, making them more efficient, consistent, and focused on client needs

People management and work environment

We continued to implement our Accessibility Plan through several internal services initiatives, including launching a new, more accessible intranet and developing accessible communications products

In line with our Equity, Diversity and Inclusion (EDI) and talent acquisition strategies, we continued to foster an inclusive and healthy workplace by:

promoting EDI and wellbeing learning opportunities

encouraging open dialogue

developing resources and tools for management and staff

We completed an Employment Systems Review (ESR) to identify systemic hiring and retention barriers for members of employment equity groups and will include actions stemming from the ESR in the upcoming ATSSC EDI Action Plan

All teams followed the Fostering an Inclusive Workplace course and then held meaningful discussions about what they learned

We supported informal discussion groups and regularly promoted EDI-related events and themes through internal communications to compliment the values and ethics discussions held at all levels of the organization

Senior management completed Positive Space Initiative training, reinforcing our organization’s commitment to inclusion

We trained managers on building resilience, managing change, and having difficult discussions to help them support employees through significant organizational changes

We continued efforts to modernize and enhance workforce planning and HR management tools, including migrating to a new HR management system (MyGCHR), analyzing core positions, and making significant progress on a PowerBI HR dashboard solution

To support accessibility and inclusion and to ensure all Canadians could access our services and information in their preferred official language, we ensured that all public-facing content—including job postings, procurement documents, and intranet and internet pages—was published simultaneously in both official languages

Facilities

We continued work on the installation of a permanent power generator to ensure uninterrupted access to digital services during planned building maintenance shutdowns

We advanced space optimization efforts to support hybrid work and improve workspace functionality, including:

- adding 33 additional workstations to Internal Services office spaces

- completing a new collaboration space in the CIRB’s National Capital Region office

- refitting the CIRB’s Vancouver office by turning a former file room into a meeting and collaboration space, and improving ergonomics by updating furniture in offices, shared work areas, and boardrooms

- initiating improvements to the CHRT’s workspace, including installing new ergonomic furniture

To improve accessibility, we installed automatic door openers on all hearing and meetings rooms at 240 Sparks, 333 Laurier and 344 Slater

We reduced costs by consolidating mail services

Resources required to achieve results

Table 3: Resources required to achieve results for internal services this year

Table 3 provides a summary of the planned and actual spending and full-time equivalents required to achieve results.

| Resource | Planned | Actual |

|---|---|---|

| Spending | $22,641,996 | $25,804,760 |

| Full-time equivalents | 159 | 155 |

The Finances section of the Infographic for the ATSSC on GC Infobase page and the People section of the Infographic for the ATSSC on GC Infobase page provide complete financial and human resources information related to its program inventory.

Contracts awarded to Indigenous businesses

Government of Canada departments are required to award at least 5% of the total value of contracts to Indigenous businesses every year.

ATSSC’s result for 2024-25:

Table 4: Total value of contracts awarded to Indigenous businesses1

As shown in Table 4, the ATSSC awarded 9.87% of the total value of all contracts to Indigenous businesses for the fiscal year.

| Contracting performance indicators | 2024 to 2025 Results |

|---|---|

| Total value of contracts awarded to Indigenous businesses2 (A) | $530,394.30 |

| Total value of contracts awarded to Indigenous and non‑Indigenous businesses3 (B) | $5,599,245.70 |

| Value of exceptions approved by deputy head (C) | $0.00 |

| Proportion of contracts awarded to Indigenous businesses [A / (B−C) × 100] | 9.47% |

-1 “Contract” is a binding agreement for the procurement of a good, service, or construction and does not include real property leases. It includes contract amendments and contracts entered into by means of acquisition cards of more than $10,000.00.

-2For the purposes of the minimum 5% target, the data in this table reflects how Indigenous Services Canada (ISC) defines “Indigenous business” as either:

- owned and operated by Elders, band and tribal councils

- registered in the Indigenous Business Directory

- owned and operated by Elders, band and tribal councils

In its 2025 to 2026 Departmental Plan, the ATSSC estimated that it would award 5% of the total value of its contracts to Indigenous businesses by the end of 2024 to 2025.

Spending and human resources

-

In this section

Spending

This section presents an overview of the department's actual and planned expenditures from the 2022 to 2023 fiscal year to the 2027 to 2028 fiscal year.

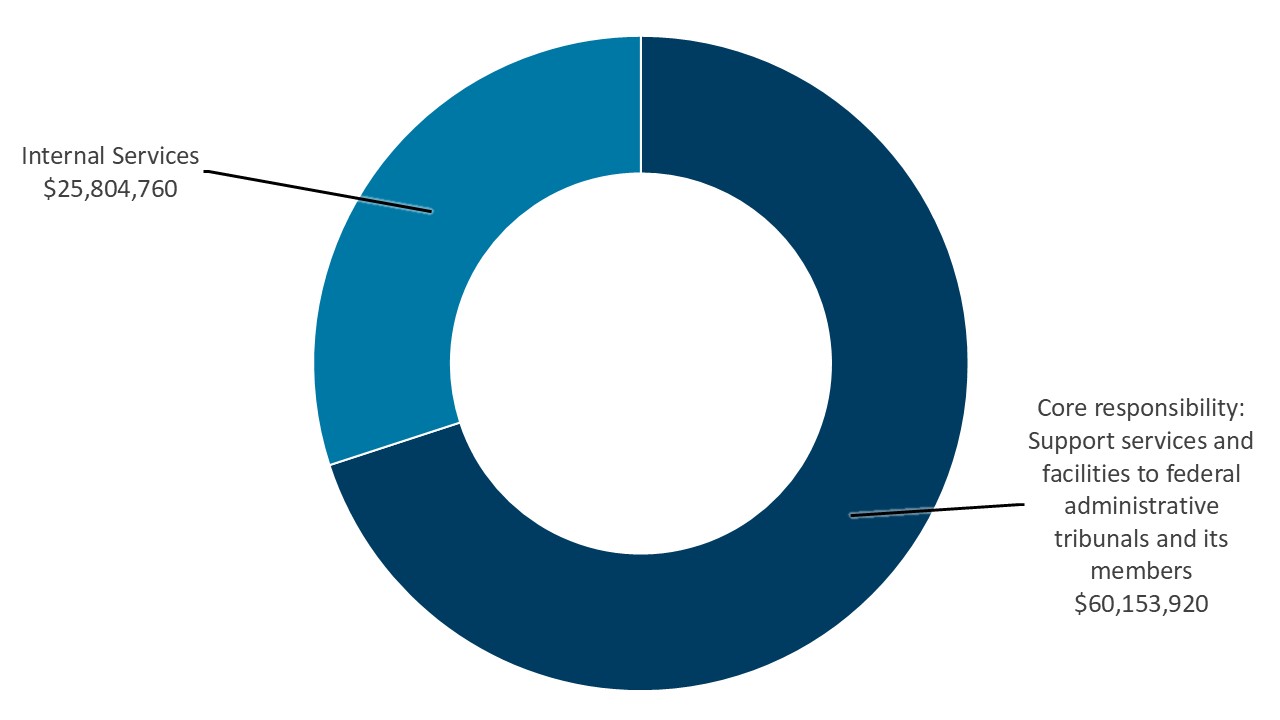

Graph 1: Actual spending by core responsibility in 2024 to 2025

Graph 1 presents how much the department spent in 2024 to 2025 to carry out core responsibilities and internal services.

Text version of Graph 1

This graph summarizes the ATSSC’s actual spending for its core responsibility and internal services for the 2024 to 2025 fiscal year. In the 2024 to 2025 fiscal year, actual spending for Support services and facilities to federal administrative tribunals and its members was $60,153,920. Actual spending for internal services was $25,804,760.

Analysis of actual spending by core responsibility

This graph summarizes the ATSSC’s actual spending for its core responsibility and internal services. In fiscal year 2024 to 2025, actual spending for Support services and facilities to federal administrative tribunals and its members is $60,153,920, corresponding to 69.98% of actual spending. Actual spending for internal services is $25,804,760, corresponding to 30.02% of actual spending.

All numbers presented are net of vote-netted revenue.

Refocusing Government Spending

In Budget 2023, the government committed to reducing spending by $14.1 billion over 5 years, starting in 2023 to 2024, and by $4.1 billion annually after that.

As part of meeting this commitment, the ATSSC identified the following spending reductions.

- 2024 to 2025: $1,344,000

- 2025 to 2026: $1,560,226

- 2026 to 2027 and after: $1,826,849

During 2024 to 2025, the ATSSC worked to realize these reductions through the following measures:

- Reducing spending on IT professional services

Budgetary performance summary

Table 5: Actual 3-year spending on core responsibilities and internal services (dollars)

Table 5 shows the money that the ATSSC spent in each of the past 3 years on its core responsibilities and on internal services.

| Core responsibilities and internal services | 2024 to 2025 Main Estimates | 2024 to 2025 total authorities available for use | Actual spending over 3 years (authorities used) |

|---|---|---|---|

| Support services and facilities to federal administrative tribunals and its members | $58,016,917 | $62,416,167 |

|

| Subtotal | $58,016,917 | $62,416,167 |

|

| Internal services | $22,641,996 | $26,185,309 |

|

| Total | $80,658,913 | $88,601,476 |

|

Analysis of the past 3 years of spending

Spending increased by $6.1 million from 2022 to 2023 and 2023 to 2024. This was due to:

continued efforts to build capacity across the organization

new or modified legislative mandates for tribunals

a higher volume of cases in some tribunals

higher salary costs resulting from several updated collective agreements

In 2024 to 2025, actual spending was $2.7 million lower than in 2023 to 2024. This was mainly due to changes in tribunal caseloads and the Refocusing Government Spending to Deliver for Canadians initiative.

All numbers are net of vote-netted revenue.

The Finances section of the Infographic for the ATSSC on GC Infobase offers more financial information from previous years.

Table 6: Planned 3-year spending on core responsibilities and internal services (dollars)

Table 6 shows the ATSSC’s planned spending for each of the next 3 years on its core responsibilities and on internal services.

| Core responsibilities and internal services | 2025 to 2026 planned spending | 2026 to 2027 planned spending | 2027 to 2028 planned spending |

|---|---|---|---|

| Support services and facilities to federal administrative tribunals and its members | $58,991,644 | $58,429,983 | $57,915,449 |

| Subtotal | $58,991,644 | $58,429,983 | $57,915,449 |

| Internal services | $23,478,629 | $23,255,089 | $23,050,305 |

| Total | $82,470,273 | $81,685,072 | $80,965,754 |

Analysis of the next 3 years of spending

Spending is expected to decrease slightly in 2026 to 2027 and following years due to the continued implementation of the Refocusing Government Spending to Deliver for Canadians initiative.

All numbers are net of vote-netted revenue.

The Finances section of the Infographic for the ATSSC on GC Infobase offers more detailed financial information related to future years.

Table 7: Budgetary actual gross spending summary (dollars)

Table 7 reconciles gross planned spending with net spending for 2024 to 2025.

| Core responsibilities and internal services | 2024 to 2025 actual gross spending | 2024 to 2025 actual revenues netted against expenditures | 2024 to 2025 actual net spending (authorities used) |

|---|---|---|---|

| Support services and facilities to federal administrative tribunals and its members | $89,222,422 | $29,068,502 | $60,153,920 |

| Subtotal | $89,222,422 | $29,068,502 | $60,153,920 |

| Internal services | $28,489,766 | $2,685,006 | $25,804,760 |

| Total | $117,712,188 | $31,753,508 | $85,958,680 |

Analysis of budgetary actual gross spending summary

The ATSSC is partially funded by vote-netted revenue (a cost recovery mechanism) for the operation of the SST. As the SST's expenses increase, so does the revenue, which reduces the net cost of its operations. These planned expenses are authorized for expenditure on behalf of the Canada Pension Plan and the Employment Insurance Operating Account.

The Finances section of the Infographic for the ATSSC on GC Infobase offers information on the alignment of the ATSSC’s spending with Government of Canada’s spending and activities.

Funding

This section provides an overview of the department’s voted and statutory funding for its core responsibilities and for internal services. Consult the Government of Canada budgets and expenditures for further information on funding authorities.

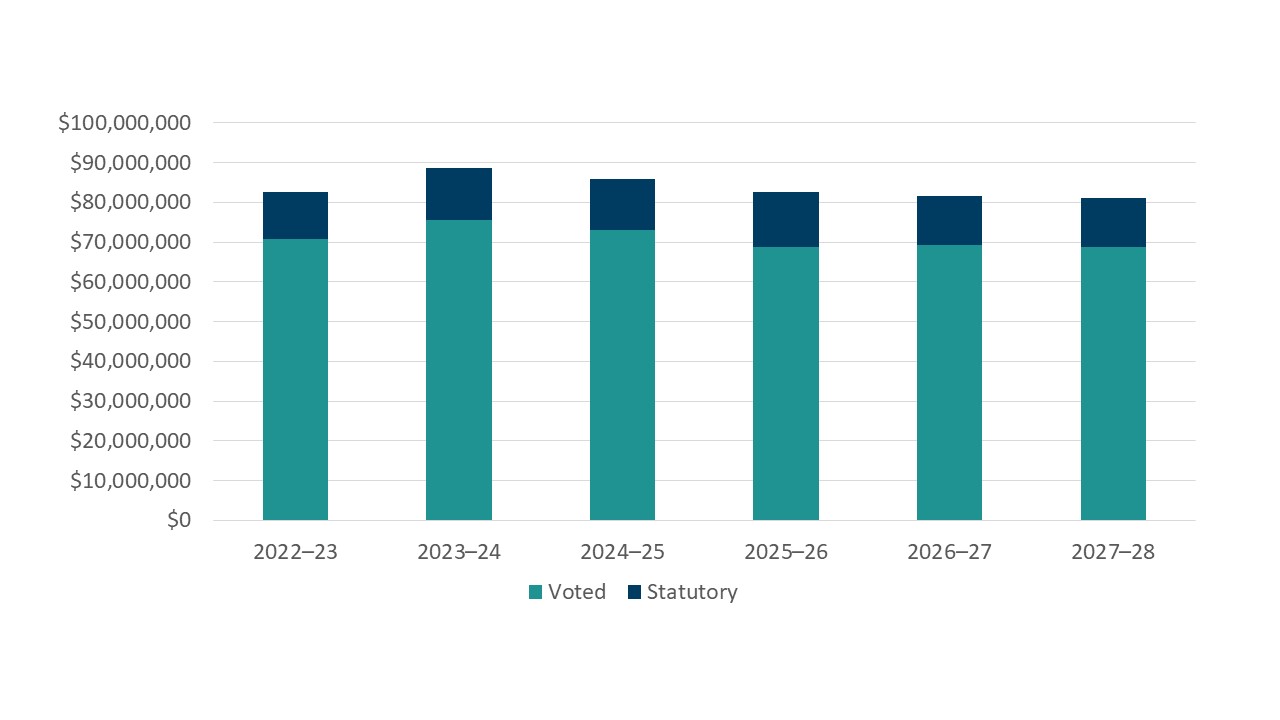

Graph 2: Approved funding (statutory and voted) over a 6-year period

Graph 2 summarizes the department's approved voted and statutory funding from the 2022 to 2023 fiscal year to the 2027 to 2028 fiscal year.

Text version of graph 2

This graph illustrates the ATSSC’s actual and planned spending over a 6-year period starting in 2022 to 2023 and ending in 2027 to 2028. In fiscal year 2022 to 2023, statutory spending was $11,861,206 and voted spending was $70,734,220, for a total of $82,595,426. In fiscal year 2023 to 2024, statutory spending was $13,135,087 and voted spending was $75,557,474, for a total of $88,692,561. In fiscal year 2024 to 2025, forecasted statutory spending is $12,997,869 and voted spending is $72,960,811, for a total of $85,958,680. In fiscal year 2025 to 2026, planned statutory spending is $13,621,885 and voted spending is $68,848,388, for a total of $82,470,273. In fiscal year 2026 to 2027, planned statutory spending is $12,495,034 and voted spending is $69,190,038, for a total of $81,685,072. In fiscal year 2027 to 2028, planned statutory spending is $12,258,928 and voted spending is $68,706,826, for a total of $80,965,754.

Graph 2 includes the following information in a bar graph:

| Fiscal year | Statutory | Voted | Total |

|---|---|---|---|

| 2022 to 2023 | $11,861,206 | $70,734,220 | $82,595,426 |

| 2023 to 2024 | $13,135,087 | $75,557,474 | $88,692,561 |

| 2024 to 2025 | $12,997,869 | $72,960,811 | $85,958,680 |

| 2025 to 2026 | $13,621,885 | $68,848,388 | $82,470,273 |

| 2026 to 2027 | $12,495,034 | $69,190,038 | $81,685,072 |

| 2027 to 2028 | $12,258,928 | $68,706,826 | $80,965,754 |

Analysis of statutory and voted funding over a 6-year period

This graph illustrates the ATSSC’s actual and planned spending over a 6-year period. The fiscal years 2022 to 2023, 2023 to 2024 and 2024 to 2025 show actual expenditure as reported in the Public Accounts.

In 2024 to 2025, actual spending was $2.7 million lower than in 2023 to 2024, mainly due to tribunal caseloads and the Refocusing Government Spending to Deliver for Canadians initiative.

Between 2024 to 2025 and 2025 to 2026, spending is projected to decrease by $3.5 million due to the implementation of the Refocusing Government Spending to Deliver for Canadians initiative and the sunsetting of program integrity funding.

Spending is expected to decrease by $0.8 million in 2026 to 2027 and following years due to continued implementation of the initiative.

All numbers are net of vote-netted revenue.

Consult the Public Accounts of Canada for further information on the ATSSC’s departmental voted and statutory expenditures.

Financial statement highlights

The ATSSC’s Financial Statements (Unaudited) for the Year Ended March 31, 2025.

Table 8: Condensed Statement of Operations (unaudited or audited) for the year ended March 31, 2025 (dollars)

Table 8 summarizes the expenses and revenues for 2024 to 2025 which net to the cost of operations before government funding and transfers.

| Financial information | 2024 to 2025 actual results | 2024 to 2025 planned results | Difference (actual results minus planned) |

|---|---|---|---|

| Total expenses | $136,958,413 | $129,728,313 | $7,230,100 |

| Total revenues | $31,753,508 | $38,297,068 | -$6,543,560 |

| Net cost of operations before government funding and transfers | $105,204,905 | $91,431,245 | $13,773,660 |

Analysis of expenses and revenues for 2024 to 2025

The variance is mainly because the planned results are based on the Main Estimates, while the actual results reflect the final expenditure.

The 2024 to 2025 planned results information is provided in the ATSSC’s Future-Oriented Statement of Operations and Notes 2024 to 2025.

Table 9: Condensed Statement of Operations (unaudited or audited) for 2023 to 2024 and 2024 to 2025 (dollars)

Table 9 summarizes actual expenses and revenues and shows the net cost of operations before government funding and transfers.

| Financial information | 2024 to 2025 actual results | 2023 to 2024 actual results | Difference (2024 to 2025 minus 2023 to 2024) |

|---|---|---|---|

| Total expenses | $136,958,413 | $136,075,561 | $882,852 |

| Total revenues | $31,753,508 | $33,516,434 | - $1,762,926 |

| Net cost of operations before government funding and transfers | $105,204,905 | $102,559,127 | $2,645,778 |

Analysis of differences in expenses and revenues between 2023 to 2024 and 2024 to 2025

The total increase in expenses of $0.9 million is mainly because of an increase in salaries. The decline in revenues is mainly due to lower recoveries from the Canada Pension Plan and the Employment Insurance Operating Account.

Table 10: Condensed Statement of Financial Position (unaudited or audited) as at March 31, 2025 (dollars)

Table 10 provides a brief snapshot of the amounts the department owes or must spend (liabilities) and its available resources (assets), which helps to indicate its ability to carry out programs and services.

| Financial information | Actual fiscal year (2024 to 2025) | Previous fiscal year (2023 to 2024) | Difference (2024 to 2025 minus 2023 to 2024) |

|---|---|---|---|

| Total net liabilities | $17,068,934 | $15,662,424 | $1,406,510 |

| Total net financial assets | $15,156,144 | $14,574,155 | $581,989 |

| Departmental net debt | $1,912,790 | $1,088,269 | $824,521 |

| Total non-financial assets | $7,715,354 | $10,021,592 | - $2,306,238 |

| Departmental net financial position | $5,802,564 | $8,933,323 | - $3,130,759 |

Analysis of department’s liabilities and assets since last fiscal year

The increase in total net liabilities is due to an increase in accrued salaries (that is, salaries that have been earned but not yet paid) at the end of the year. The decrease in non-financial assets is due to an increase in depreciation expenses.

Human resources

This section presents an overview of the department’s actual and planned human resources from the 2022 to 2023 fiscal year to the 2027 to 2028 fiscal year.

Table 11: Actual human resources for core responsibilities and internal services

Table 11 shows a summary in full-time equivalents of human resources for the ATSSC’s core responsibilities and for its internal services for the previous 3 fiscal years.

| Core responsibilities and internal services | 2022 to 2023 actual full-time equivalents | 2023 to 2024 actual full-time equivalents | 2024 to 2025 actual full-time equivalents |

|---|---|---|---|

| Support services and facilities to federal administrative tribunals and its members | 576 | 586 | 562 |

| Subtotal | 576 | 586 | 562 |

| Internal services | 155 | 157 | 155 |

| Total | 731 | 743 | 717 |

Analysis of human resources for the last 3 years

The explanations for changes in full-time equivalents by year align with those provided for variances in departmental spending.

Table 12: Human resources planning summary for core responsibility and internal services

Table 12 shows the planned full-time equivalents for each of the ATSSC’s core responsibilities and for its internal services for the next 3 years. Human resources for the current fiscal year are forecast based on year to date.

| Core responsibilities and internal services | 2025 to 2026 planned full-time equivalents | 2026 to 2027 planned full-time equivalents | 2027 to 2028 planned full-time equivalents |

|---|---|---|---|

| Support services and facilities to federal administrative tribunals and its members | 570 | 533 | 536 |

| Subtotal | 570 | 533 | 536 |

| Internal services | 150 | 145 | 146 |

| Total | 720 | 678 | 682 |

Analysis of human resources for the next 3 years

The explanations for changes in full-time equivalents by year align with those provided for variances in departmental spending.

Supplementary information tables

The following supplementary information tables are available on the ATSSC’s website:

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Corporate information

Departmental profile

Appropriate minister(s):

The Honourable Sean Fraser, P.C., M.P.

Minister of Justice and Attorney General of Canada and Minister responsible for the Atlantic Canada Opportunities Agency

Institutional head:

Orlando Da Silva, LSM, Chief Administrator

Ministerial portfolio:

Department of Justice

Enabling instrument(s):

Year of incorporation / commencement:

2014

Departmental contact information

Mailing address:

Administrative Tribunals Support Service of Canada

240 Sparks Street, 4th Floor

Ottawa, Ontario, K1A 0E1

Canada

Telephone:

613-954-6350

Fax:

613-957-3170

Email:

Website(s):

www.canada.ca/en/administrative-tribunals-support-service.html

Definitions

List of terms

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- Operating and capital expenditures; transfer payments to other levels of government, departments or individuals; and payments to Crown corporations.

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- A report that outlines the anticipated activities and expected performance of an appropriated department over a 3-year period. Departmental Plans are usually tabled in Parliament in spring.

- A plan, project or activity that a department focuses and reports on during a specific planning period. Priorities represent the most important things to be done or those to be addressed first to help achieve the desired departmental results.

- A high-level outcome related to the core responsibilities of a department.

- A quantitative or qualitative measure that assesses progress toward a departmental result.

- A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- A report outlining a department’s accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- Measures the person years in a departmental budget. An employee's scheduled hours per week divided by the employer's hours for a full-time workweek calculates a full-time equivalent. For example, an employee who works 20 hours in a 40-hour standard workweek represents a 0.5 full-time equivalent.

- An analytical tool that helps to understand the ways diverse individuals experience policies, programs and other initiatives. Applying GBA Plus to policies, programs and other initiatives helps to identify the different needs of the people affected, the ways to be more responsive and inclusive, and the methods to anticipate and mitigate potential barriers to accessing or benefitting from the initiative. GBA Plus goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography (including rurality), language, race, religion, and sexual orientation.

- For the purpose of the 2024–25 Departmental Results Report, government priorities are the high-level themes outlining the government’s agenda as announced in the 2021 Speech from the Throne.

- A program, project or other initiative where 2 or more federal departments receive funding to work collaboratively on a shared outcome usually linked to a government priority, and where the ministers involved agree to designate it as horizontal. Specific reporting requirements apply, including that the lead department must report on combined expenditures and results.

- For the purposes of a Departmental Result Report, this includes any entity that meets the Indigenous Services Canada’s criteria of being owned and operated by Elders, band and tribal councils, registered in the Indigenous Business Directory or registered on a modern treaty beneficiary business list.

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- What a department did with its resources to achieve its results, how well those results compare to what the department intended to achieve, and how well lessons learned have been identified.

- A qualitative or quantitative measure that assesses progress toward a departmental-level or program-level result, or the expected outputs or outcomes of a program, policy or initiative.

- The articulation of strategic choices, which provides information on how a department intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

For Departmental Plans and Departmental Results Reports, planned spending refers to the amounts presented in Main Estimates. Departments must determine their planned spending and be able to defend the financial numbers presented in their Departmental Plans and Departmental Results Reports.

- An Individual, group, or combination of services and activities managed together within a department and focused on a specific set of outputs, outcomes or service levels.

- A listing that identifies all the department’s programs and the resources that contribute to delivering on the department’s core responsibilities and achieving its results.

- An outcome or output related to the activities of a department, policy, program or initiative.

- Spending approved through legislation passed in Parliament, other than appropriation acts. The legislation sets out the purpose and the terms and conditions of the expenditures.

- A quantitative or qualitative, measurable goal that a department, program or initiative plans to achieve within a specified time period.

- Spending approved annually through an appropriation act passed in Parliament. The vote also outlines the conditions that govern the spending.

appropriation (crédit)

budgetary expenditures (dépenses budgétaires)

core responsibility (responsabilité essentielle)

Departmental Plan (plan ministériel)

departmental priority (priorité)

departmental result (résultat ministériel)

departmental result indicator (indicateur de résultat ministériel)

departmental results framework (cadre ministériel des résultats)

Departmental Results Report (rapport sur les résultats ministériels)

Full-time equivalent (équivalent temps plein)

Gender-based Analysis Plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

government priorities (priorités pangouvernementales)

horizontal initiative (initiative horizontale)

Indigenous business (entreprise autochtones)

non budgetary expenditures (dépenses non budgétaires)

performance (performance)

performance indicator (indicateur de rendement)

plan (plan)

planned spending (dépenses prévues)

program (programme)

program inventory (répertoire des programmes)

result (résultat)

statutory expenditures (dépenses législatives)

target (cible)

voted expenditures (dépenses votées)