Quarterly Financial Report - For the quarter ended June 30, 2025

Table of contents

Permission to reproduce

Unless otherwise specified, you may not reproduce materials in this publication, in whole or in part, for the purposes of commercial redistribution without prior written permission from Shared Services Canada’s copyright administrator. To obtain permission to reproduce Government of Canada materials for commercial purposes, apply for Crown Copyright Clearance by contacting Shared Services Canada at publication-publication@ssc-spc.gc.ca.

© His Majesty the King in Right of Canada, as represented by the Minister responsible for Shared Services Canada, 2025.

Quarterly Financial Report - For the quarter ended June 30, 2025

Catalogue No. P116-1E-PDF

ISSN 2371-4328

Publié aussi en français sous le titre : Rapport financier trimestriel - Pour le trimestre terminé le 30 juin 2025

No. de catalogue P116-1F-PDF

ISSN 2371-4336

1.0 Introduction

This quarterly financial report should be read in conjunction with the 2025-26 Main Estimates. This report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It has not been subject to an external audit or review.

1.1 Authority, mandate and programs

Shared Services Canada (SSC) is responsible for digitally enabling government programs and services by providing secure and reliable digital, network and hosting services that allow public servants to work collaboratively and seamlessly across the Government of Canada to serve Canadians. As a service provider to over 40 government departments and agencies, SSC is focused on moving toward an IT service delivery model that encourages sharing common solutions and platforms across departments in an effort to standardize and consolidate IT solutions while also modernizing and reducing legacy IT. In taking an enterprise approach, SSC is working to provide fast, reliable and secure connections, ensure employees have the digital tools they need, and support partner departments in the development and delivery of their services to Canadians. The Minister of Government Transformation, Public Works and Procurement is the Minister responsible for SSC.

In carrying out its mandate, SSC is supporting the Government of Canada's Digital Ambition, the GC Enterprise Cyber Security Strategy, and the 2024 Application Hosting Strategy. SSC works in partnership with public and private sector stakeholders, implementing enterprise-wide approaches for managing IT infrastructure services, and employing effective and efficient business management processes.

The Shared Services Canada Act and related Orders-in-Council set out the powers, duties and functions of the Minister responsible for SSC. Amendments to the Act in June 2017 allow the Minister to delegate to other Ministers the power to procure certain items, thereby making it easier for federal departments to buy some of the most frequently purchased IT goods and services. SSC remains responsible for setting up IT contracts, standing offers and supply arrangements, and will continue to ensure only trusted IT equipment and software are used. The Minister responsible for SSC may also, in exceptional circumstances, authorize another Minister to obtain services from within their own department or from a source other than SSC. However, this authorization cannot be used to exempt the entire department from using SSC’s services.

Further details on SSC’s authority, mandate, responsibilities and programs may be found in the 2025-26 Main Estimates and in SSC’s 2025-26 Departmental Plan.

1.2 Basis of presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying statement of authorities includes the department's spending authorities granted by Parliament, and those used by the department consistent with the 2025-26 Main Estimates. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes, under certain conditions, the preparation of a special warrant to be signed by the Governor General authorizing payments to be made out of the Consolidated Revenue Fund. Special warrants are deemed to be an appropriation for the fiscal year in which they are issued.

Special warrants issued during the first quarter of 2025-26 were included in the total appropriations in the 2025-26 Main Estimates.

The department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis. The main difference between the quarterly financial report and the departmental financial statements is the timing of when revenues and expenses are recognized. The quarterly financial report presents revenues only when the money is received and expenses only when the money is paid out. The departmental financial statements report revenues when they are earned and expenses when they are incurred. In the latter case, revenues are recorded even if cash has not been received and expenses are incurred even if cash has not yet been paid out.

1.3 Shared Services Canada financial structure

SSC has a financial structure composed mainly of voted budgetary authorities, namely Vote 1 – Operating expenditures, including Vote netted revenues, and Vote 5 – Capital expenditures, including Vote netted revenues. The statutory authorities consist of contributions to the Employee Benefit Plan (EBP).

At the end of the first quarter of 2025-26, 90% of the department’s budget was devoted to supporting its IT consolidation and standardization goals. This ensured that current and future IT infrastructure services offered to the Government of Canada (GC) are maintained in an environment of operational excellence. The remaining 10% was devoted to internal services, which are services in support of SSC’s programs and/or required to meet SSC’s corporate obligations.

Total Vote netted revenue authority for 2025-26 is $853.0 million, which consists of respendable revenue for IT infrastructure services provided by SSC to organizations on a cost-recovery basis.

2.0 Highlights of fiscal quarter and fiscal year-to-date results

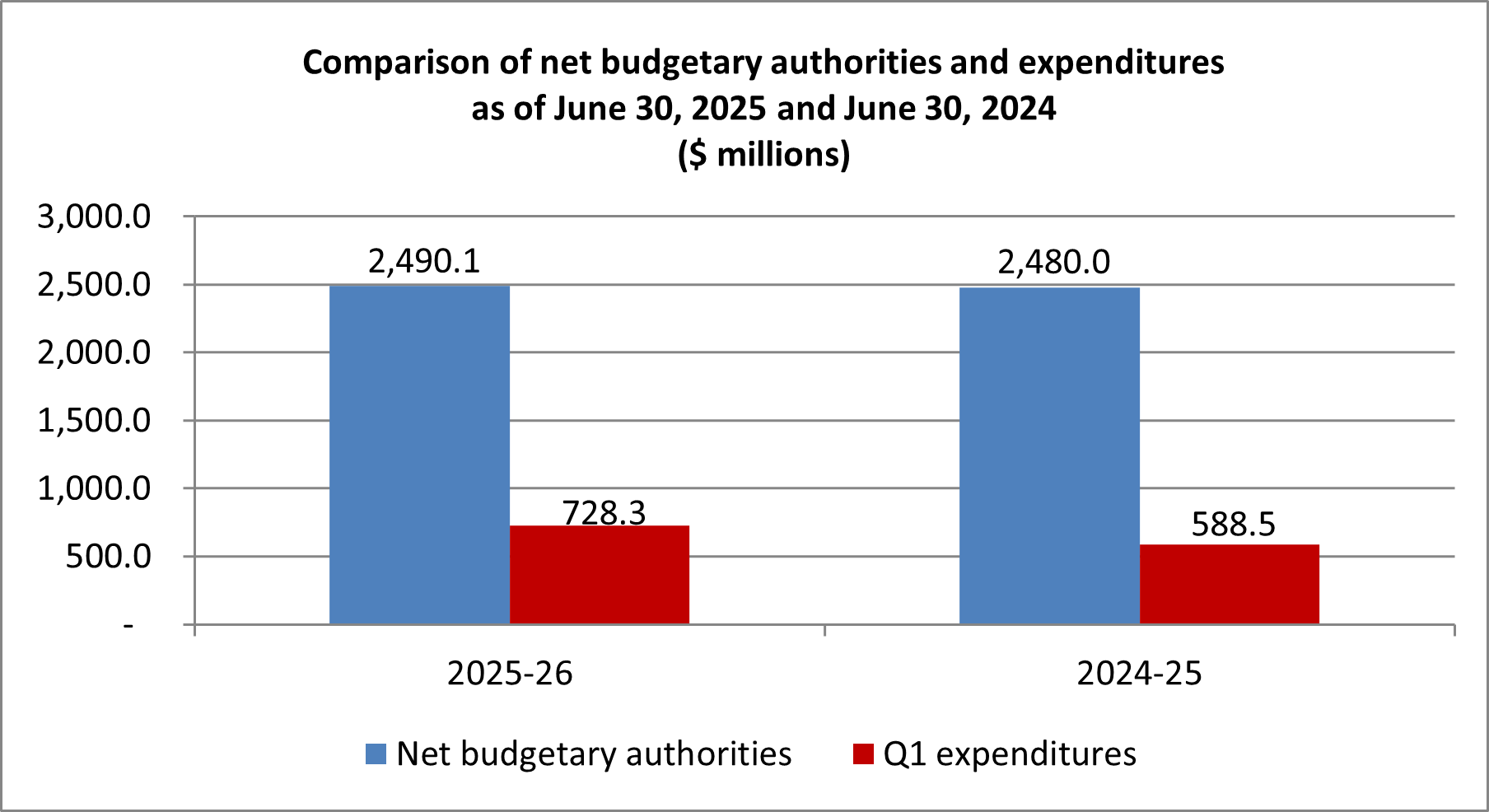

The following graph provides a comparison of the net budgetary authorities available for spending and the expenditures for the quarters ended June 30, 2025, and June 30, 2024, for the department’s combined Vote 1 – Operating expenditures, Vote 5 – Capital expenditures, and statutory authorities.

Long description - Comparison of net budgetary authorities and expenditures as of June 30, 2025 and June 30, 2024

The graph shows total net budgetary authorities available for spending of $2,490.1 million as of June 30, 2025, and $2,480.0 million as of June 30, 2024. It also shows total expenditures of $728.3 million for the first quarter ended June 30, 2025, compared to $588.5 million for the first quarter ended June 30, 2024.

2.1 Significant changes to authorities

As of June 30, 2025, the authorities available to the department include the Main Estimates, as no items were requested for the Supplementary Estimates (A). Authorities available for spending in 2025‑26 are $2,490.1 million at the end of the first quarter, compared to $2,480.0 million at the end of the first quarter of 2024-25, representing an increase of $10.1 million, or 0.4%. This total increase is a combination of an increase of $53.1 million in Vote 1 – Gross operating expenditures, a decrease of $65.4 million in Vote 5 – Gross capital expenditures, and an increase in Budgetary statutory authorities (EBP) of $22.4 million.

In the first quarter of 2025-26, the department operated under the authority of the Governor General special warrants. A total of $872.6 million (Vote 1 – Operating expenditures: $853.8 million, Vote 5 – Capital expenditures: $18.8 million) was issued under the special warrants over two periods: April 1 to May 15, 2025 and May 16 to June 30, 2025. On June 26, 2025, the 2025-26 Main Estimates were approved, followed by the department’s receipt of full supply on June 27, 2025.

| Net authorities available ($ millions) | 2025-26 | 2024-25 | Variance |

|---|---|---|---|

| Vote 1 – Operating expenditures | 2,993.8 | 2,940.7 | 53.1 |

| Vote 5 – Capital expenditures | 206.1 | 271.5 | (65.4) |

| Statutory (EBP) | 143.2 | 120.8 | 22.4 |

| Total gross authorities | 3,343.1 | 3,333.0 | 10.1 |

| Vote netted revenues | (853.0) | (853.0) | - |

| Total net authorities | 2,490.1 | 2,480.0 | 10.1 |

Vote 1 – Gross operating expenditures

The department’s Vote 1 increased by $53.1 million, compared to the first quarter of 2024-25, due to the following:

-

an increase in funding of $157.8 million related to the following projects and initiatives:

- implementing the Microsoft 365 E5 licence as the enterprise standard for the Government of Canada ($108.7 million)

- Presidency of the 2025 G7 Summit in Canada ($16.3 million)

- incremental cost of providing core information technology services to client departments and agencies ($15.4 million)

- Secure Cloud Enablement and Defence Evolution and Departmental Connectivity ($8.7 million)

- collective agreements and other compensation adjustments ($8.1 million)

- a cumulative increase of $0.6 million related to other projects and initiatives

-

this increase is offset by a decrease or sunsetting funding of $97.0 million related to the following projects and initiatives:

-

a cumulative decrease of $70.9 million related to Budget 2021 initiatives:

- IT Repair and Replacement Program ($28.7 million)

- Workload Modernization and Migration Program ($27.9 million)

- Network Modernization and Implementation Fund ($14.3 million)

- reductions in support of initiatives to refocus government spending announced in Budget 2023 ($20.7 million)

- Cyber and Information Technology Security ($5.4 million)

-

a cumulative decrease of $70.9 million related to Budget 2021 initiatives:

- a decrease of $7.7 million related to an internal vote realignment from Vote 1 Operating to Personnel and the associated Employee Benefit Plan costs.

Vote 5 – Gross capital expenditures

The department’s Vote 5 decreased by $65.4 million, compared to the first quarter of 2024-25, due to the following:

-

a decrease or sunsetting funding of $66.8 million related to the following projects and initiatives:

-

a cumulative decrease of $57.3 million related to Budget 2021 initiatives:

- Network Modernization and Implementation Fund ($25.5 million)

- Workload Modernization and Migration Program ($19.9 million)

- IT Repair and Replacement Program ($11.9 million)

- SafeguardingAccess to High Performance Computing for Canada’s Hydro-Meteorological Services ($9.5 million)

-

a cumulative decrease of $57.3 million related to Budget 2021 initiatives:

- this decrease is offset by a cumulative increase of $1.4 million related to other projects and initiatives.

Statutory (EBP)

The department’s EBP authority increased by $22.4 million, compared to the first quarter of 2024-25, due to the following:

-

an increase in funding of $23.5 million for:

- a technical adjustment to the Statutory EBP rate ($13.6 million)

- Statutory EBP costs associated to an internal vote realignment from Vote 1 Operating to Personnel ($7.7 million)

- collective agreements and other compensation adjustments ($1.3 million)

- Presidency of the 2025 G7 Summit in Canada ($0.9 million)

- this increase is offset by a cumulative decrease or sunsetting funding of $1.1 million related to other projects and initiatives.

2.2 Explanations of significant variances from previous year expenditures

Compared to the previous year, the total net year-to-date expenditures for the period ended June 30, 2025, have increased by $139.8 million, from $588.5 million to $728.3 million as per the table below. This represents an increase of 23.8% against expenditures recorded for the same period in 2024-25.

| Net year-to-date expenditures ($ millions) | 2025-26 | 2024-25 | Variance |

|---|---|---|---|

| Vote 1 – Operating expenditures | 800.2 | 660.3 | 139.9 |

| Vote 5 – Capital expenditures | 15.1 | 16.4 | (1.3) |

| Statutory (EBP) | 35.8 | 30.2 | 5.6 |

| Total gross year-to-date expenditures | 851.1 | 706.9 | 144.2 |

| Vote netted revenues | (122.8) | (118.4) | (4.4) |

| Total net year-to-date expenditures | 728.3 | 588.5 | 139.8 |

Vote 1 – Increase of $139.9 million

The net increase in operating expenditures, compared to the first quarter of 2024-25, is mainly attributed to the following:

- rentals expenditures increased by $151.5 million. This increase is mainly attributable to expenditures for licence and maintenance fees for various software, particularly for the implementation of the Microsoft 365 E5 licence.

- acquisitions of machinery and equipment increased by $12.1 million. This increase is mainly attributable to expenditures related to the Presidency of the 2025 G7 Summit in Canada, which are mainly composed of expenditures for communications and networking equipment.

- repair and maintenance expenditures decreased by $11.8 million. This decrease is mainly attributable to expenditures for repair and maintenance of computer equipment.

- professional and special services expenditures decreased by $11.4 million. This decrease is mainly attributable to lower expenditures for management consulting. This decrease is partially offset by an increase in expenditures for informatics services.

- a decrease of $0.5 million in other various expenditures.

3.0 Risks and uncertainty

SSC has identified the following key corporate risks for 2025-26. SSC’s key initiatives and activities provide mitigation measures that reduce the impact and probability of these risks.

IT procurement

Shifting market dynamics, including market consolidation and vendor lock-in, could result in delayed contract awards, higher costs, reduced flexibility, and significant challenges for SSC in transitioning to alternative providers or replicating solutions internally.

Incentives and cost to modernize

Misalignment of incentives across GC to prioritizing replacement of legacy infrastructure and unequal cost-sharing of and commitment to modernization may hinder the pace of digital transformation.

Emerging technologies

Adoption of emerging technologies (most notably Artificial Intelligence [AI] and generative AI) may increase technological vulnerabilities and interoperability issues, increase demand on infrastructure, hinder scalability challenges, and result in heightened costs.

Fiscal environment

Changing fiscal environment may impact revenues and jeopardize planned investments and modernization projects.

Cost overrun

Combination of inflationary pressures and rising IT infrastructure costs, particularly in cloud services and hardware, presents a risk to the sustainability of critical digital transformation initiatives. Volatility in public cloud pricing and an increased reliance on cloud technologies could impact budgets and reduce flexibility in scaling operations efficiently.

Cyber security

Increased frequency and sophistication of cyber security attacks, as well as adoption of new technologies, may lead to vulnerability of SSC’s security posture that may impact the integrity and availability of information and access of services to Canadians.

Reputation for service delivery

Ever-growing demand for digital services and corresponding expectations for timely delivery, coupled with SSC’s efforts to increase transparency and predictability for IT services, may impact service delivery and damage SSC’s reputation.

IT skills and innovation constraints

The rapidly changing IT environment and technology changes will require employees to develop new/different skillsets. Upskilling of SSC’s current workforce is required, or there will be knowledge gaps that could lead to delays in innovation and ability to meet partner and client needs in a timely and cost-effective manner.

4.0 Significant changes in relation to operations, personnel and programs

On May 13, 2025, the Honourable Joël Lightbound was named as the Minister of Government Transformation, Public Works and Procurement and the Minister responsible for SSC.

Approval by senior officials

Original signed by Raj Thuppal for

President

Original signed by Barry Rodger for

Assistant Deputy Minister and Chief Financial Officer

Ottawa, Canada

August 26, 2025

5.0 Statement of authorities (unaudited) (in thousands of dollars)

| Fiscal year 2025-26 | Fiscal year 2024-25 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2026Footnote 1 | Used during the quarter ended June 30, 2025 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2025Footnote 1 | Used during the quarter ended June 30, 2024 | Year-to-date used at quarter-end | |

| Vote 1 – Operating expenditures | ||||||

| Gross operating expenditures | 2,993,788 | 800,174 | 800,174 | 2,940,685 | 660,269 | 660,269 |

| Vote netted revenues | (793,000) | (122,816) | (122,816) | (793,000) | (118,441) | (118,441) |

| Net operating expenditures | 2,200,788 | 677,358 | 677,358 | 2,147,685 | 541,828 | 541,828 |

| Vote 5 – Capital expenditures | ||||||

| Gross capital expenditures | 206,130 | 15,112 | 15,112 | 271,553 | 16,452 | 16,452 |

| Vote netted revenues | (60,000) | - | - | (60,000) | - | - |

| Net capital expenditures | 146,130 | 15,112 | 15,112 | 211,553 | 16,452 | 16,452 |

| (S) Contributions to employee benefit plan | 143,216 | 35,804 | 35,804 | 120,802 | 30,200 | 30,200 |

| Total budgetary authorities | 2,490,134 | 728,274 | 728,274 | 2,480,040 | 588,480 | 588,480 |

6.0 Departmental budgetary expenditures by standard object (unaudited) (in thousands of dollars)

| Fiscal year 2025-26 | Fiscal year 2024-25 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2026Footnote 2 | Expended during the quarter ended June 30, 2025 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2025Footnote 2 | Expended during the quarter ended June 30, 2024 | Year-to-date used at quarter-end | |

| Expenditures: | ||||||

| Personnel (includes EBP) | 1,079,272 | 281,099 | 281,099 | 996,179 | 278,418 | 278,418 |

| Transportation and communications | 659,718 | 76,628 | 76,628 | 683,272 | 74,001 | 74,001 |

| Information | 3,262 | 55 | 55 | 3,663 | 166 | 166 |

| Professional and special services | 337,107 | 51,206 | 51,206 | 431,173 | 62,581 | 62,581 |

| Rentals | 720,422 | 358,546 | 358,546 | 599,006 | 207,041 | 207,041 |

| Repair and maintenance | 253,858 | 51,473 | 51,473 | 276,675 | 63,532 | 63,532 |

| Utilities, materials and supplies | 4,805 | 560 | 560 | 5,690 | 705 | 705 |

| Acquisition of land, buildings and works | 3,575 | 1,069 | 1,069 | 3,191 | 999 | 999 |

| Acquisition of machinery and equipment | 277,008 | 29,193 | 29,193 | 333,319 | 18,227 | 18,227 |

| Public debt charges | 4,107 | 1,006 | 1,006 | 872 | 1,288 | 1,288 |

| Other subsidies and payments | - | 255 | 255 | - | (37) | (37) |

| Total gross budgetary expenditures | 3,343,134 | 851,090 | 851,090 | 3,333,040 | 706,921 | 706,921 |

| Less revenues netted against expenditures: | ||||||

| Vote netted revenues | 853,000 | 122,816 | 122,816 | 853,000 | 118,441 | 118,441 |

| Total revenues netted against expenditures | 853,000 | 122,816 | 122,816 | 853,000 | 118,441 | 118,441 |

| Total net budgetary expenditures | 2,490,134 | 728,274 | 728,274 | 2,480,040 | 588,480 | 588,480 |

7.0 Glossary

- Appropriations/Authorities

-

Expenditure authorities are approvals from Parliament for individual government organizations to spend up to specific amounts. Expenditure authority is provided in two ways: annual appropriation acts that specify the amounts and broad purposes for which funds can be spent; and other specific statutes that authorize payments and set out the amounts and time periods for those payments. The amounts approved in appropriation acts are referred to as voted amounts, and the expenditure authorities provided through other statutes are called statutory authorities.

- Vote 1 - Operating expenditures

-

A vote that covers most day-to-day expenses, such as salaries, utilities and minor capital expenditures.

- Vote 5 - Capital expenditures

-

Capital expenditures are those made for the acquisition or development of items that are classified as tangible capital assets as defined by government accounting policies. This vote is generally used for capital expenditures that exceed $10,000.

- Capital Budget Carry Forward

-

Treasury Board centrally managed vote that permits departments to bring forward eligible lapsing funds from one fiscal year to the next in an amount up to 20% of their year-end allotments in the capital expenditures Vote as reflected in Public Accounts.

- Cash method of accounting

-

The cash method recognizes revenues when they are received and expenses when they are paid for.

- Collective agreement

-

A collective agreement means an agreement in writing entered into under the Public Service Staff Relations Act between the employer and a bargaining agent and containing provisions covering terms and conditions of employment and related matters.

- Departmental Plan

-

The Departmental Plan is an expenditure plan for each department and agency (excluding Crown corporations). It describes departmental priorities, expected results and associated resource requirements covering a three-year period, beginning with the year indicated in the title of the report.

- Employee Benefit Plan (EBP)

-

A statutory item that includes employer contributions for the Public Service Superannuation Plan, the Canada and the Quebec Pension Plans, Death Benefits, and the Employment Insurance accounts. Expressed as a percentage of salary, the EBP rate is changed every year as directed by the Treasury Board Secretariat.

- Expenditure basis of accounting

-

An accounting method that combines elements of the two major accounting methods: the cash method and the accrual method. The expenditure basis of accounting method recognizes revenues when cash is received and expenses when liabilities are incurred or cash is paid out.

- Frozen allotments

-

Frozen allotments are used to prohibit the spending of funds previously appropriated by Parliament. There are two types of frozen allotments:

- permanent: where the Treasury Board has directed that funds lapse at the end of the fiscal year

- temporary: where an appropriation is frozen until such time as conditions have been met

- Full accrual method of accounting

-

An accounting method that measures the performance and position of an organization by recognizing economic events regardless of when cash transactions occur. Therefore, the full accrual method of accounting recognizes revenues when they are earned (for example, when the terms of a contract are fulfilled) and expenses when they are incurred.

- Main Estimates

-

Each year, the government prepares estimates in support of its request to Parliament for authority to spend public funds. This request is formalized through the introduction of appropriation bills in Parliament. In support of the Appropriation Act, the Main Estimates identify the spending authorities (Votes) and amounts to be included in subsequent appropriation bills. Parliament is asked to approve these Votes to enable the government to proceed with its spending plans.

- Operating Budget Carry Forward

-

Treasury Board centrally managed vote that permits departments to bring forward eligible lapsing funds from one fiscal year to the next in an amount up to 5% of their Main Estimates gross operating budget allotment.

- Standard objects

-

A system in accounting that classifies and summarizes expenditures by category, such as type of goods or services acquired, for monitoring and reporting.

- Supplementary Estimates

-

The President of the Treasury Board tables up to three Supplementary Estimates, usually in May, in late October or early November and in February, to obtain the authority of Parliament to adjust the government's expenditure plan set out in the estimates for that fiscal year. Supplementary Estimates serve two purposes. First, they seek authority for revised spending levels that Parliament will be asked to approve in an Appropriation Act. Second, they provide Parliament with information on changes in the estimated expenditures to be made under the authority of statutes previously passed by Parliament. Each Supplementary Estimates document is identified alphabetically (A, B and C).

- Vote netted revenues authority

-

The authority by which Shared Services Canada has permission to collect and spend revenue earned and collected from the provision of IT services within the government.