Request for Payroll Information Forms

The Employment Insurance (EI) program provides temporary income support to unemployed people, and ensures that the premiums employers and employees pay are spent according to the requirements of the law.

As an employer, Service Canada may occasionally ask you to complete a Request for Payroll Information form. For some companies, this occurs several times a month. In these cases, completing several of these forms can be a very demanding manual task.

How to complete the Request for Payroll Information form (INS5097)

Section 126(14) of the Employment Insurance Act, gives Employment and Social Development Canada (ESDC) the authority to request information on named individuals from employers.

ESDC and Service Canada have created two programs that may reduce the number of Request for Payroll Information forms you receive, or help reduce the burden associated with completing them. If you are interested in finding out more, please visit the Automated Earnings Reporting System and the Report on Hirings program.

Please read through the instructions and guidelines below to ensure your Request for Payroll Information forms are completed as accurately as possible.

Information block

The top of the Request for Payroll Information form provides you with:

- The program type

- User ID

- Case Number

- The name of the claimant

- The Badge or Payroll number of the employee

- The Business Number

- The claimant Social Insurance Number (SIN)

- The date the form was prepared

- The date we expect your reply (BF)

- The Benefit Period Commencement (BPC) date of the claim for EI Benefits in question

- A telephone number that you may call for assistance, usually of the person who sent you the form

- Quick Response Code

- Page

Address block

The left-hand side of the address block displays your business address, and the right-hand side displays the address of the Service Canada Centre where the form is to be returned.

Once you have completed the form, please return it in the envelope provided, with the Service Canada Centre address displayed in the envelope window.

Text block

Please read the text very carefully.

Text description

Service Canada is presently reviewing the claim for Employment Insurance benefits for one of your employees. As a result, we require work and employment related information on the employee named above. Your response to this request will ensure that benefits are paid in the correct amount and only to those entitled to receive them.

This Information is requested under Subsection 126(14) of the Employment Insurance Act, which authorizes the Department to collect required information in support of the EI program. The provision of information known to be false or misleading is an offence under sections 39 and 135 of the employment Insurance Act. Failure to provide true and accurate information as requested within the time specified may result in either the imposition of an administrative penalty pursuant to section 39 of the Employment Insurance Act, or, prosecution of an offence pursuant to section 135 of the Employment Insurance Act, which, upon summary conviction, is punishable by fine or fine and imprisonment for a term not exceeding six month.

Returning this form

Identifies the date you are expected to return the form by.

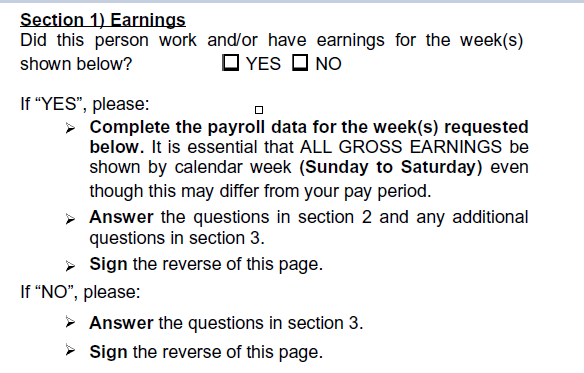

Section 1 – Earnings

First you are asked to check the box yes or no to the question "Did this person work and/or have earnings for the week(s) shown below?"

If you answer yes,

- Complete the payroll data for the week(s) requested below in the Payroll data Block

It is essential that all gross earnings be shown by calendar week (Sunday to Saturday)

- Answer the questions in section 2 of the form (Vacation pay) as well as any additional questions in section 3 of the form (Additional Information)

If you answer no,

- Answer the questions in section 3 of the form

- Sign the reverse of the page

Payroll data block

There are three sections in the payroll data block, and each section has three columns:

- the first column is for office use only

- the second column shows the date of the Sunday of the week for which information is being requested (Please make sure that all earnings are reported on a calendar-week basis from Sunday to Saturday) and

- you complete the third column by reporting all gross earnings, even if they are not insurable

Note: The weeks requested are listed horizontally across the page – not vertically.

Section 2 – Vacation Pay

Use this block to provide details about vacation pay that may have been paid to the employee during any of the weeks listed in the payroll data block.

- Was a vacation pay paid and included in the gross earnings for weeks listed in Section?

- Was a lump sum vacation pay paid but not included in the gross earnings of the weeks included on the reverse of this page (Section 1)?

- Was money paid as result of termination of employment?

Section 3 – Additional information

This space is reserved for you to report any information concerning the employee’s reason for separation. It should also be used to explain any additional earnings that may have been paid or to provide any other information that may assist us in protecting the integrity of the Employment Insurance Fund.

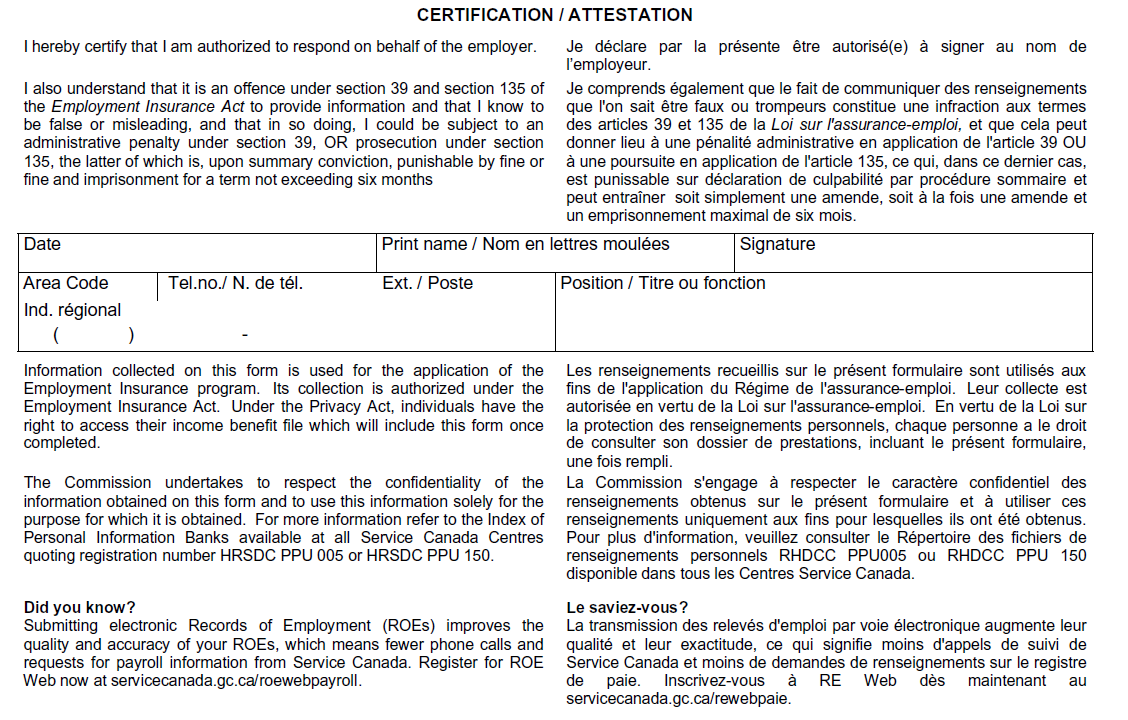

Certification block

It is extremely important that you complete the certification block. This certifies that the information you have provided is correct, and it provides us with a contact person if we need additional information. Please make sure you sign the form and include your telephone number.

Available assistance

Two options are available to help reduce the burden associated with Request for Payroll Information forms.

The Automated Earnings Reporting System

If you have a Sunday-to-Saturday pay period or can report payroll data in this format, you can participate in the Automated Earnings Reporting by submitting your payroll information to Service Canada.

The Report on Hirings program

Regardless of pay period schedule, any business can participate in the Report on Hirings program by providing Service Canada with the Social Insurance Number and first day of work for new and recalled employees.

If you are already a registered user of one of the programs and are looking for assistance or technical support, please call the employer support team at 1-800-367-5693.

Guides and help

- How to complete the Record of Employment (ROE) form

- Guide for the Supplemental Unemployment Benefit (SUB) program

- Supplement to the guide “How to complete the Record of Employment (ROE) form” for all school boards

- Report on Hirings Program User Guide – Form (Data Entry)

- Employer Guide — Automated Earnings Reporting System (AERS)

Related services and information

Page details

- Date modified: