Pacific Economic Development Canada’s Quarterly Financial Report for the quarter ended September 30, 2025

View the print-friendly version (PDF, 417 kB)

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly financial report should be read in conjunction with Main Estimates and Supplementary Estimates (A). It has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA) and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subject to an external audit or review.

Authority, mandate and program activities

PacifiCan is the Regional Development Agency focused on British Columbia’s evolving economy. PacifiCan leads in building a strong, competitive Canadian economy by supporting business, innovation and community economic development unique to British Columbia. PacifiCan operates under the provision of the Western Economic Diversification Act.

PacifiCan is mandated to “support the growth and diversification of British Columbia’s economy and advance the interests of the region in national economic policy, programs and projects.”

The Departmental Plan and Main Estimates provide further information on PacifiCan's authority, mandate and program activities.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department's spending authorities granted by Parliament and those used by the department, consistent with the Main Estimates for the 2025-2026 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

The Agency uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Financial structure

PacifiCan manages its expenditures under two votes:

- Vote 1 – Net operating expenditures include salary, and other operating costs (e.g., transportation and communications; professional and special services).

- Vote 5 – Grants and contributions include all transfer payments.

Budgetary statutory authorities represent payments made under legislation approved by Parliament and include items such as the Government of Canada's share of Employee Benefit Plans (EBP).

Highlights of fiscal quarter and fiscal year-to-date (YTD) results

The following section highlights significant changes to fiscal quarter results as of September 30, 2025.

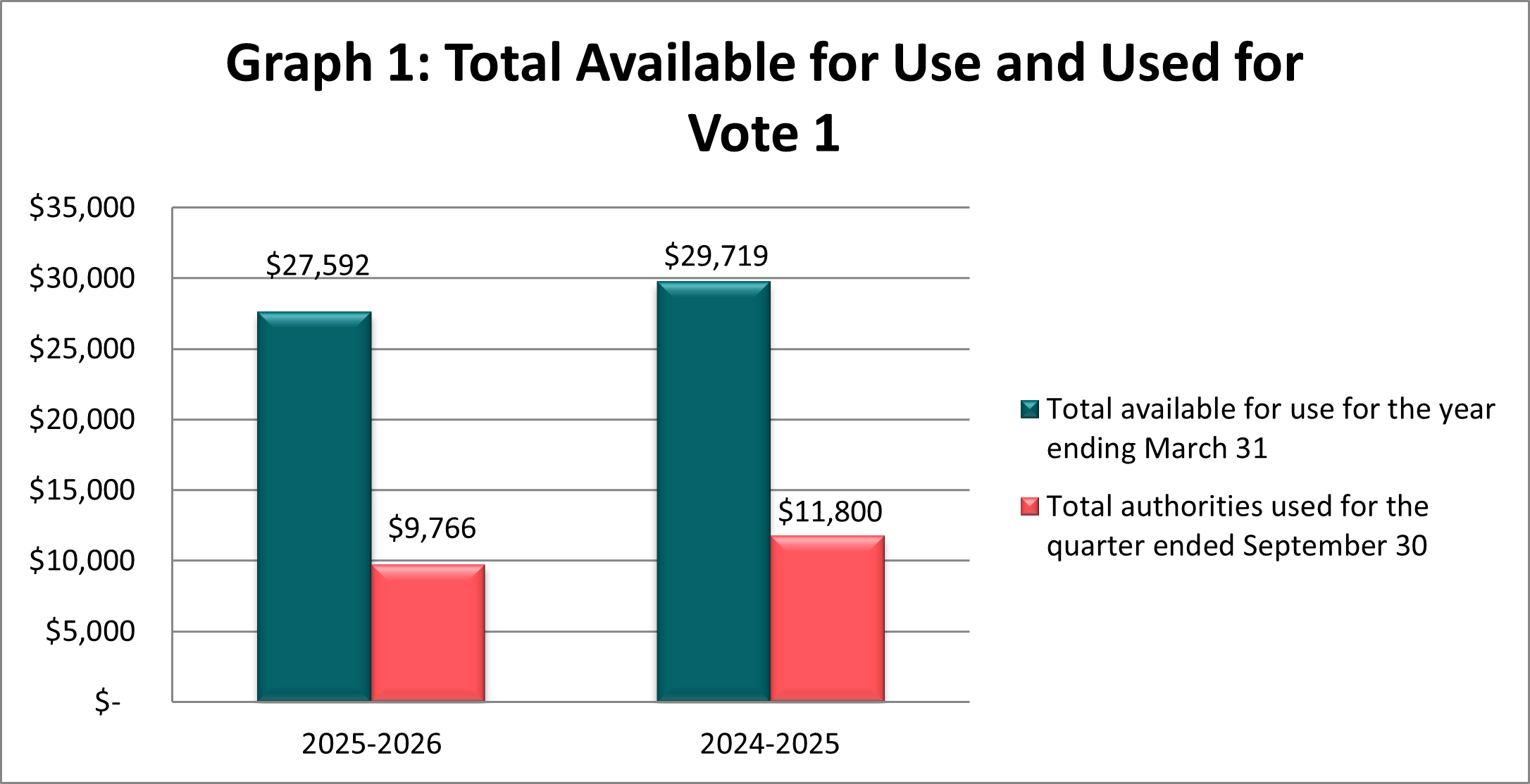

Statement of authorities: Vote 1 – Net operating expenditures

Total authorities available for use for fiscal year 2025-2026 are $27.6 million, a net decrease of $2.1 million compared to $29.7 million for 2024-2025. The net decrease is explained by:

- $2.0 million increase in Critical Operating requirements to cover increases related to collective agreements;

- $0.6 million net funding increase in time-limited programs and other operating funding; and

- $4.7 million decrease reflects the conclusion of funding supports to establish seven new offices across British Columbia and headquarters office in Surrey.

Total authorities used year-to-date are $9.8 million for the quarter ended September 30, 2025 compared to $11.8 million at September 30, 2024. The decrease of $2.0 million is due to lower spending in travel and professional services.

Graph 1 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end

(In thousands of dollars)

Text version: Total available for use and used for Vote 1 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2025-26 and compares the authorities used at quarter end.

2025-2026

- $27,592 represents total available for use for the year ending March 31

- $9,766 represents total authorities used for the quarter ending September 30

2024-2025

- $29,719 represents total available for use for the year ending March 31

- $11,800 represents total authorities used for the quarter ending September 30

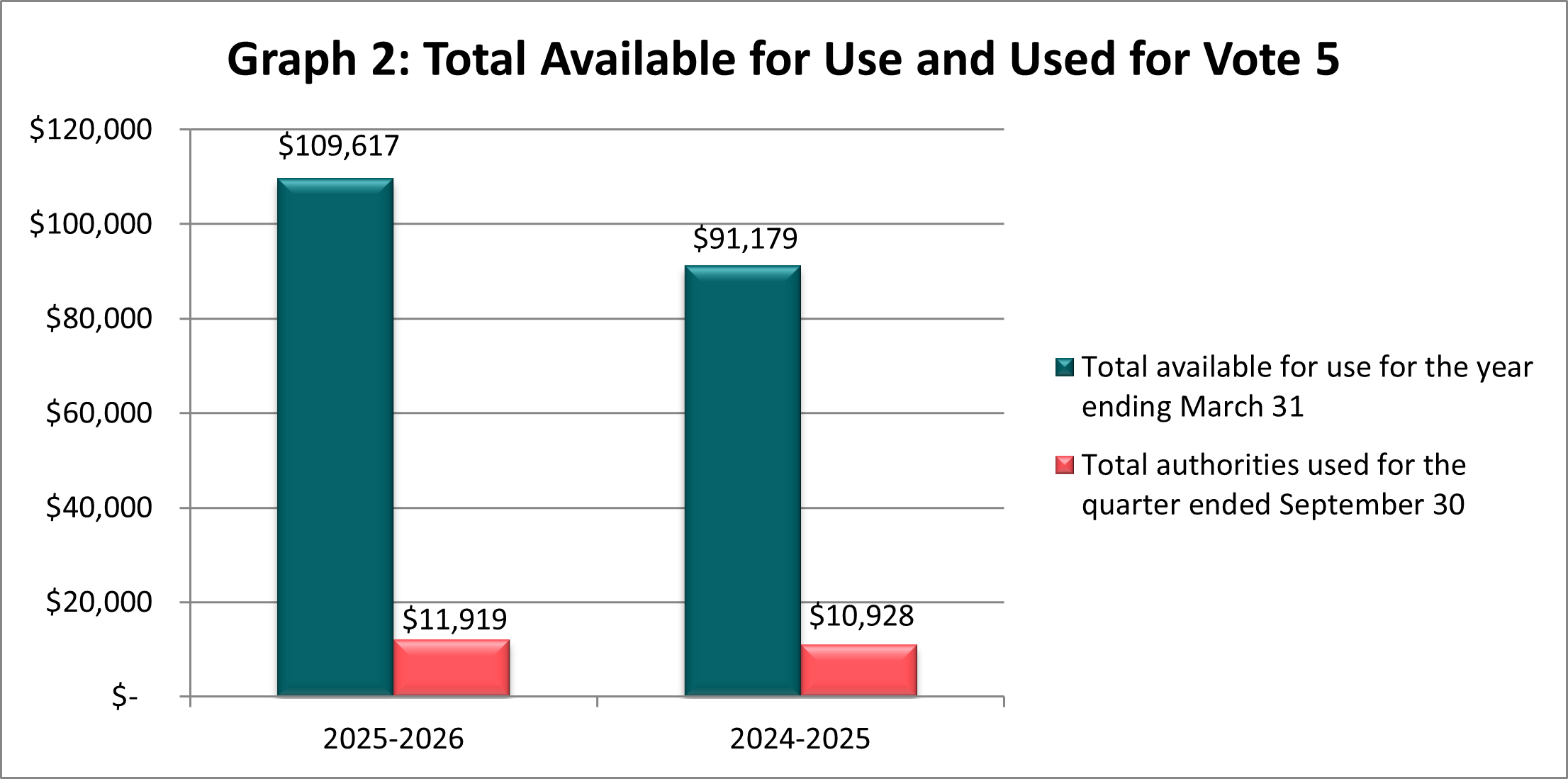

Statement of authorities: Vote 5 – Grants and contributions

Total authorities available for use for fiscal year 2025-2026 are $109.6 million, a net increase of $18.4 million compared to the $91.2 million for 2024-2025. The net increase is mainly due to:

- $10.9 million increase in funding for the Regional Economic Growth Through Innovation (REGI) program;

- $4.4 million increase in funding for the Regional Artificial Intelligence Initiative;

- $1.9 million increase in funding due to the Lytton Home and Business Rebuild Programs reprofile;

- $0.9 million increase in funding for the Federal Tourism Growth Strategy; and

- $0.3 million increase in other time-limited programs.

Total authorities used year-to-date for the quarter ended September 30, 2025 are $11.9 million compared to $10.9 million at September 30, 2024. The $1.0 million increase is mainly explained by:

- $2.0 million net increase in payments made under the REGI program to support businesses in priority sectors to innovate, grow and compete globally;

- $0.7 million net increase in payment timing differences made to support network partners;

- $0.1 million net increase in payment made to support the Lytton Business Restart Program and the Lytton Homeowner Resilient Rebuild Program; and

- $1.8 million net decrease in payments made under the Pacific Economic Development Program (PEDP).

Graph 2 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(In thousands of dollars)

Text version: Total available for use and used for Vote 5 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2025-26 and compares the authorities used at quarter end.

2025-2026

- $109,617 represents total available for use for the year ending March 31

- $11,919 represents total authorities used for the quarter ending September 30

2024-2025

- $91,179 represents total available for use for the year ending March 31

- $10,928 represents total authorities used for the quarter ending September 30

Statement of authorities: Budgetary statutory authorities

Budgetary statutory authorities for use in fiscal year 2025-2026 are $3.1 million, an increase of $0.7 million when compared to $2.4 million in 2024-2025. The variance is due to minor adjustments in funding.

There are no significant variances in budgetary statutory authorities in this reporting period when compared to fiscal year 2024-2025.

Graph 3 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(In thousands of dollars)

Text version: Total available for use and used for budgetary statutory authorities (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2025-26 and compares the authorities used at quarter end.

2025-2026- $3,082 represents total available for use for the year ending March 31

- $1,542 represents total authorities used for the quarter ending September 30

2024-2025

- $2,353 represents total available for use for the year ending March 31

- $1,176 represents total authorities used for the quarter ending September 30

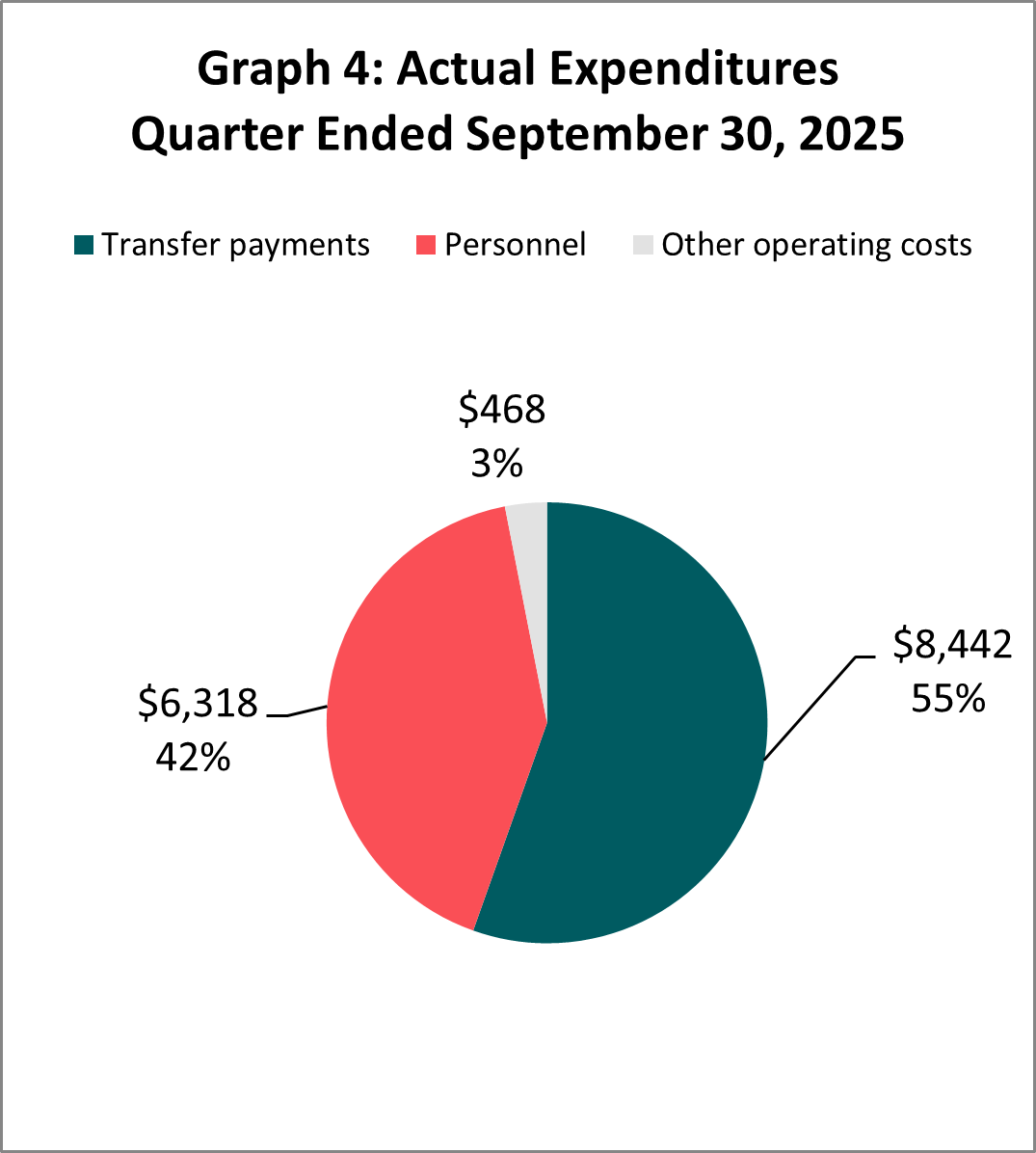

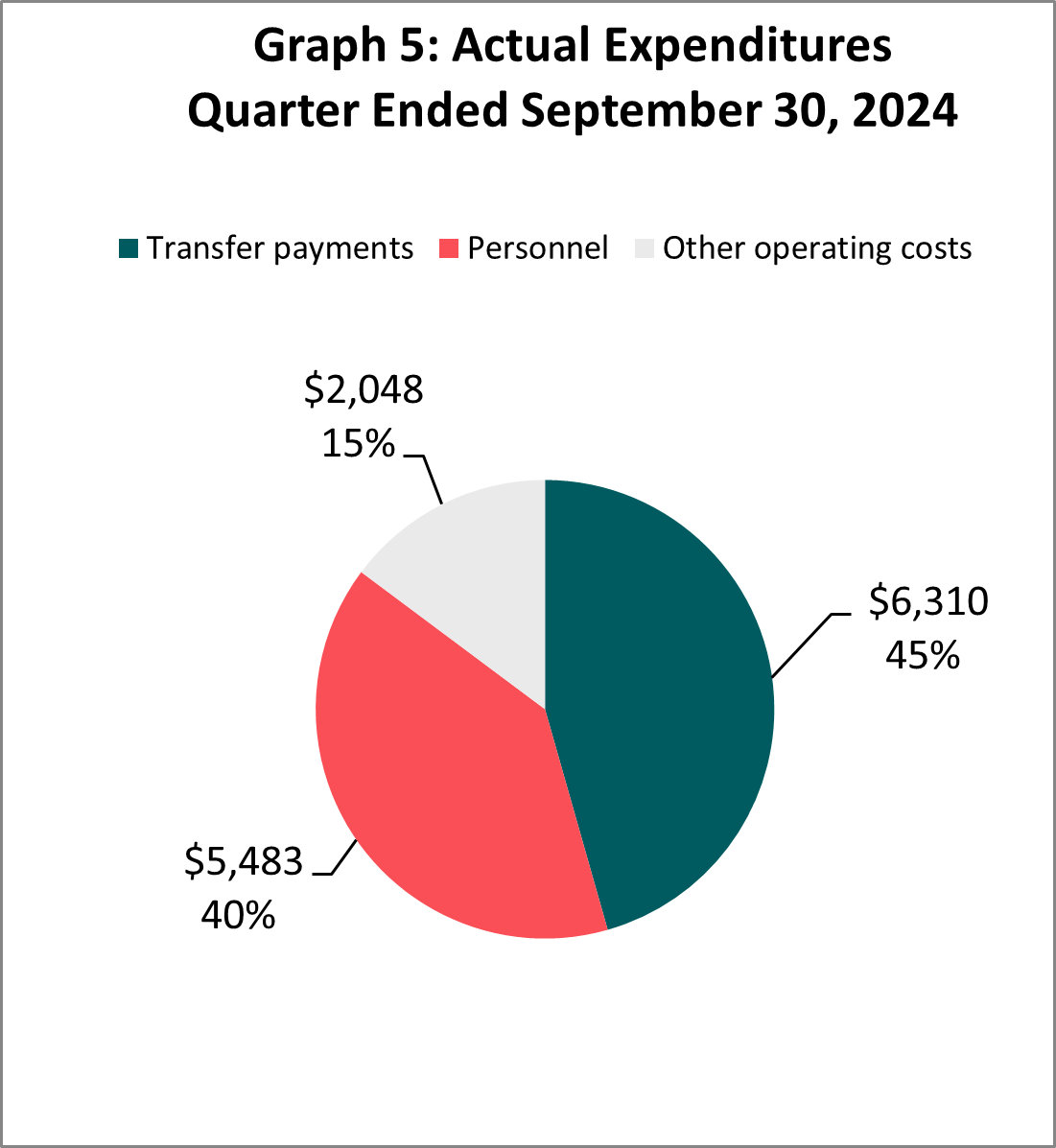

Statement of the departmental budgetary expenditures by standard object

Expenditures by standard object for the quarter ended September 30, 2025 are $15.2 million, compared to $13.8 million at September 30, 2024. The $1.4 million increase is mainly explained by:

- $2.1 million increase to support Regional Innovation Ecosystems and other programs;

- $0.8 million increase in salary and other personnel expenses; and

- $1.5 million decrease in professional services, travel and other operating and maintenance expenses.

Additional information can be found in the Statement of Authorities, Vote 1 and Vote 5 sections above.

Graph 4 and 5 illustrate the actual baseline expenditures for the quarter-end.

(In thousands of dollars)

Text version: Actual expenditures quarter ended September 30, 2025 (in thousands of dollars)

This pie chart breaks down actual expenditures for quarter ended September 30, 2025.

- $8,442 represents actual spending on Transfer Payments, which accounts for 55% of Actual Expenditures quarter ended September 30, 2025

- $6,318 represents actual spending on Personnel, which accounts for 42% of Actual Expenditures quarter ended September 30, 2025

- $468 represents actual spending on Other operating costs, which accounts for 3% of Actual Expenditures quarter ended September 30, 2025

Text version: Actual expenditures quarter ended September 30, 2024 (in thousands of dollars)

This pie chart breaks down actual expenditures for quarter ended September 30, 2024.

- $6,310 represents actual spending on Transfer Payments, which accounts for 45% of Actual Expenditures quarter ended September 30, 2024

- $5,483 represents actual spending on Personnel, which accounts for 40% of Actual Expenditures quarter ended September 30, 2024

- $2,048 represents actual spending on Other operating costs, which accounts for 15% of Actual Expenditures quarter ended September 30, 2024

Risks and uncertainties

The agency is managing the allocation of resources within a well-defined framework of accountabilities, policies and procedures including a system of budgets, reporting and other internal controls to manage within available resources and authorities from Treasury Board.

PacifiCan’s internal operations, staff recruitment and retention are affected by the high cost of living in the Lower Mainland, the bilingual position requirements in a unilingual region, and the demands of delivering a wide range of temporary programs. The agency recognizes the potential risk of reduced spending capacity, which could impact the organizational responsiveness, internal support and service delivery. The agency will monitor risks and allocate resources to priority functions to mitigate risks on the delivery of our mandate.

British Columbians continue to face economic challenges such as rising costs of doing business, supply chain disruptions, labour disruptions, and increasingly severe weather events. These and other such risks continue to pose challenges for businesses, innovators, and communities in British Columbia. Moreover, any modifications to international or North American trade policies and systems, such as changes to tariffs, may negatively impact the Canadian economy. To mitigate risks, PacifiCan proactively collaborates with applicants and recipients to address challenges and structure projects accordingly, while maintaining agility and responsiveness to clients’ needs through effective mandates delivery, strategic resource reallocation, and timely implementation of budget initiatives.

Significant changes in relation to operations, personnel and programs

There are no significant changes in relation to operations and personnel for this reporting period.

Approval by senior officials

Approved by:

Original signed by:

________________________

Naina Sloan

President

Vancouver, Canada

Date:

Original signed by:

________________________

Tom Switzer

Acting Chief Financial Officer

Statement of authorities (unaudited)

| Authorities | Total available for use for the year ending March 31, 2026* | Used during the quarter ended September 30, 2025 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $27,592 | $6,015 | $9,766 |

| Vote 5 - Grants and contributions | 109,617 | 8,442 | 11,919 |

| Budgetary statutory authorities - Employee Benefit Plans | 3,082 | 771 | 1,542 |

| Total authorities | $140,291 | $15,228 | $23,227 |

*Includes only authorities available for use and granted by Parliament at quarter-end.

| Authorities | Total available for use for the year ending March 31, 2025* | Used during the quarter ended September 30, 2024 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $29,719 | $6,943 | $11,800 |

| Vote 5 - Grants and contributions | 91,179 | 6,310 | 10,928 |

| Budgetary statutory authorities - Employee Benefit Plans | 2,353 | 588 | 1,176 |

| Total authorities | $123,251 | $13,841 | $23,904 |

*Includes only authorities available for use and granted by Parliament at quarter-end.

Departmental budgetary expenditures by standard object (unaudited)

| Expenditures | Total available for use for the year ending March 31, 2026* | Expended during the quarter ended September 30, 2025 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $23,227 | $6,318 | $10,622 |

| Transportation and communications | 678 | 76 | 147 |

| Information | 525 | 79 | 80 |

| Professional and special services | 5,254 | 254 | 316 |

| Rentals | 239 | 73 | 83 |

| Repair and maintenance | 0 | 0 | 0 |

| Utilities, materials and supplies | 75 | 4 | 6 |

| Acquisition of machinery and equipment | 676 | 2 | 13 |

| Transfer payments | 109,617 | 8,442 | 11,919 |

| Other subsidies and payments | 0 | (20) | 41 |

| Total net budgetary expenditures | $140,291 | $15,228 | $23,227 |

*Includes only authorities available for use and granted by Parliament at quarter-end.

| Expenditures | Total available for use for the year ending March 31, 2025* | Expended during the quarter ended September 30, 2024 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $19,912 | $5,483 | $10,396 |

| Transportation and communications | 1,216 | 164 | 383 |

| Information | 1,094 | 70 | 72 |

| Professional and special services | 8,391 | 1,761 | 2,028 |

| Rentals | 730 | 11 | 36 |

| Repair and maintenance | 0 | 0 | 0 |

| Utilities, materials and supplies | 121 | 7 | 8 |

| Acquisition of machinery and equipment | 608 | 34 | 52 |

| Transfer payments | 91,179 | 6,310 | 10,928 |

| Other subsidies and payments | 0 | 1 | 3 |

| Total net budgetary expenditures | $123,251 | $13,841 | $23,904 |

*Includes only authorities available for use and granted by Parliament at quarter-end.