Quarterly Financial Report For the quarter ended December 31, 2023

![]() Quarterly Financial Report for the quarter ended December 31, 2023 (PDF)

Quarterly Financial Report for the quarter ended December 31, 2023 (PDF)

ISSN: 2563-8890

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

1. Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the Main Estimates and Supplementary Estimates. This quarterly financial report has not been subject to an external audit or review.

The Administrative Tribunals Support Service of Canada (ATSSC) is responsible for providing support services and facilities to several federal administrative tribunals by way of a single, integrated organization. These services include the specialized services required by each tribunal (e.g., registry, research and analysis, legal and other mandate or case activities specific to each tribunal), as well as internal services (e.g., human resources, financial services, information management and technology, accommodations, security, planning and communications).

Further information on the mandate, roles, responsibilities and programs of the ATSSC can be found in the organization’s 2023-24 Departmental Plan.

1.1. Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes ATSSC’s spending authorities granted by Parliament, and those used by the department consistent with the Main Estimates and Supplementary Estimates for the 2023-2024 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

ATSSC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year, and actual expenditures for the quarter ended December 31, 2023.

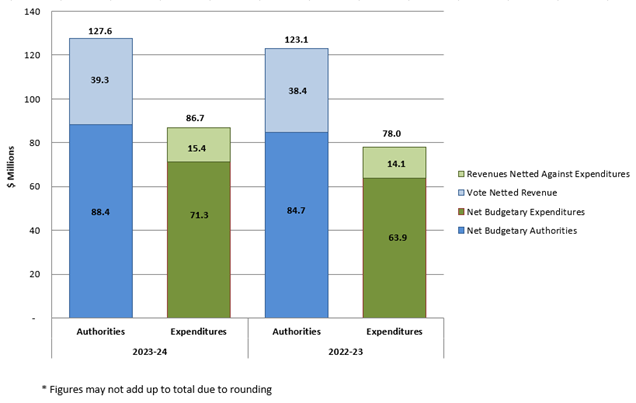

The ATSSC’s financial structure is mainly composed of voted budgetary authorities, namely Vote 1—Program Expenditures, Vote Netted Revenue (VNR) authorities, as well as statutory authorities for contributions to employee benefit plans. The VNR gives the ATSSC authority to make recoverable expenditures against the Canada Pension Plan (CPP) and the Employment Insurance (EI) operating accounts. Graph 1 below shows the ATSSC’s gross and net budgetary authorities and expenditures for the third quarter of 2023-24. For more details, refer to the Statement of Authorities table presented in Annex A.

Graph 1: Comparison of year-to-date budgetary authorities and expenditures for the third quarter ended December 31, 2023, and December 31, 2022.

The ATSSC expended $86.7 million (68% of total authorities available for use), including Employee Benefit Plan (EBP), in the third quarter of 2023-24. This is compared to $78.0 million (63% of total authorities available for use) in the same quarter of 2022-23. The majority of expenditures in the third quarter of 2023-24 are related to personnel and totaled $75.0 million (87% of gross expenditures). The remaining $11.7 million primarily included professional and special services (mainly informatics services, translation costs and consulting services) and rental costs.

2.1. Significant Changes to Authorities

(Please refer to the Statement of Authorities table presented in Annex A.)

As of December 31, 2023, the net authorities available for use (including EBP) totaled $88.4 million, an increase of $3.7 million compared to the prior year. This increase is mainly due to funding received to cover salary increases included in new collective agreements.

2.2. Significant Changes to Vote Netted Revenue (VNR)

(Please refer to the Statement of Authorities table presented in Annex A.)

As of December 31, 2023, the VNR authorities increased from $38.4 million in 2022-23 to $39.3 million in 2023-24. There are no significant changes to VNR this quarter.

2.3. Significant Changes to Expenditures

(Please refer to the Departmental Budgetary Expenditures by Standard Object table presented in Annex B.)

Expenditures for the Quarter

Third quarter gross budgetary expenditures increased from $31.2 million in 2022-23 to $34.8 million in 2023-24 mainly due to an increase in personnel expenditures ($2.8 million) consisting of additional employees to address the growth in caseloads arising from external factors, and salary increases included in new collective agreements.

Expenditures Year-to-Date

The year-to-date gross budgetary expenditures increased from $78.0 million in 2022-23 to $86.7 million in 2023-24 mainly due to an increase in personnel expenditures ($7.3 million) consisting of additional employees to address the growth in caseloads arising from external factors, and salary increases included in new collective agreements.

3. Risks and Uncertainties

The ATSSC is exposed to a variety of risks in its operating environment that could have a negative effect in achieving its objectives. The ATSSC is monitoring these risks at all management levels through various lenses. This allows management to identify, evaluate and mitigate key risks by implementing risk mitigation strategies, which include the reallocation of resources, if so required.

Meeting the demanding and dynamic workloads of the tribunals it serves is central to the ATSSC’s operating context. Tribunal legislative and policy mandates are highly sensitive to external demands and, as a result, tribunals can at times face fluctuations in their caseloads, which can create unpredictable workloads. The ATSSC works closely with tribunals to identify factors that affect caseloads and plan operations and investments accordingly.

4. Significant Changes Related to Operations, Personnel and Programs

The ATSSC is implementing mitigation measures to meet the financial objectives of Budget 2023 while minimizing impacts on operations.

The ATSSC has also adopted the Common hybrid work model for the federal Public Service as per Government of Canada’s direction. Employees are required to work at least two days per week, or 40% of their regular schedule, in their designated workplace. This model provides flexibility to employees and will contribute to reducing the overall infrastructure footprint of the Government of Canada while ensuring that the ATSSC maintains the high quality of service it is known for.

Approval by Senior Officials

Approved by:

________________________

Orlando Da Silva, LSM

Chief Administrator

________________________

Stéphane Lavigne, CPA

Director General, Corporate Services and

Chief Financial Officer

Ottawa, Canada.

February 29, 2024

ANNEX A

5. Statement of Authorities (unaudited)

(in dollars)

| Authorities available for use | Fiscal year 2023-24: Total available for use for the year ending March 31, 2024 * |

Fiscal year 2023-24: Used during the quarter ended December 31, 2023 |

Fiscal year 2023-24: Year to date used at quarter end |

Fiscal year 2022-23: Total available for use for the year ending March 31, 2023 * |

Fiscal year 2022-23: Used during the quarter ended December 31, 2022 |

Fiscal year 2022-23: Year to date used at quarter end |

| Vote 1 - Program expenditures** | 115,227,514 | 31,694,504 | 77,392,812 | 111,248,723 | 28,346,259 | 69,532,693 |

| Less: Revenues netted against expenditures | -39,253,058 | -7,718,689 | -15,368,550 | -38,355,112 | -6,873,032 | -14,122,149 |

| Net Program expenditures | 75,974,456 | 23,975,815 | 62,024,262 | 72,893,611 | 21,473,227 | 55,410,544 |

| Budgetary statutory authorities | 12,401,922 | 3,100,481 | 9,301,442 | 11,820,039 | 2,830,342 | 8,491,027 |

| Total Budgetary authorities | 88,376,378 | 27,076,296 | 71,325,704 | 84,713,650 | 24,303,570 | 63,901,571 |

* Includes only authorities available for use and granted by Parliament at quarter end.

**Employee Benefit Plan (EBP) is excluded from Program expenditures as it is included in the Budgetary statutory authorities.

ANNEX B

6. Departmental Budgetary Expenditures by Standard Object (unaudited)

(in dollars)

| Expenditures and Revenues |

Fiscal year 2023-24: Planned expenditures for the year ending March 31, 2024 |

Fiscal year 2023-24: Expended during the quarter ended December 31, 2023 |

Fiscal year 2023-24: Year to date used at quarter end |

Fiscal year 2022-23: Planned expenditures for the year ending March 31, 2023 |

Fiscal year 2022-23: Expended during the quarter ended December 31, 2022 |

Fiscal year 2022-23: Year to date used at quarter end |

Expenditures: Personnel* |

102,538,403 | 29,646,070 | 75,001,748 | 97,488,055 | 26,796,197 | 67,717,326 |

Expenditures: Transportation and communications |

1,407,238 | 795,771 | 1,507,694 | 2,861,622 | 399,022 | 1,047,211 |

Expenditures: Information |

1,243,035 | 288,282 | 1,016,136 | 930,678 | 260,945 | 525,433 |

Expenditures: Professional and special services |

14,051,882 | 2,511,645 | 5,961,577 | 12,513,915 | 2,341,207 | 5,321,864 |

Expenditures: Rentals |

5,769,067 | 692,365 | 1,736,597 | 5,038,032 | 683,421 | 1,925,992 |

Expenditures: Repair and maintenance |

581,442 | 135,307 | 197,814 | 1,719,675 | 558,732 | 727,352 |

Expenditures: Utilities, materials and supplies |

641,388 | 89,739 | 239,631 | 706,776 | 12,989 | 212,611 |

Expenditures: Acquisition of land, building and works |

0 | 0 | 0 | 0 | 0 | 0 |

Expenditures: Acquisition of machinery and equipment |

1,381,244 | 634,949 | 1,040,607 | 1,807,986 | 124,088 | 551,126 |

Expenditures: Other subsidies and payments |

15,737 | 857 | -7,550 | 2,023 | 0 | -5,194 |

Total gross budgetary expenditures |

127,629,436 | 34,794,985 | 86,694,254 | 123,068,762 | 31,176,602 | 78,023,720 |

Revenues |

-39,253,058 | -7,718,689 | -15,368,550 | -38,355,112 | -6,873,032 | -14,122,149 |

Total Revenues netted against expenditures |

-39,253,058 | -7,718,689 | -15,368,550 | -38,355,112 | -6,873,032 | -14,122,149 |

Total net budgetary expenditures |

88,376,378 | 27,076,296 | 71,325,704 | 84,713,650 | 24,303,570 | 63,901,571 |

*Employee Benefit Plan (EBP) is included.