An Action Agenda for Atlantic Growth - February 2018

Table of Contents

Recommendation 1: Create and implement an Atlantic Broadband Action Plan with the objective of providing all Atlantic Canadians with access to Internet service of at least 50 megabits per second (Mbs) down-loading and 10 Mbs up-loading. Recommendation 2: Establish the "FutureSkills Lab" in Atlantic Canada on a pilot basis, governed by a joint federal-provincial-stakeholder board having a majority of members not from government. Recommendation 3.1: Increase annually over the next five years Atlantic Canada's percentage share of the Provincial Nominee Program under the Canada Immigration Plan so long as the region is able to fulfill its allocation. Recommendation 3.2: Establish a procedure to proactively identify and recruit to Atlantic Canada small numbers of exceptionally accomplished individuals with demonstrated entrepreneurial talent and the ability to scale-up businesses in areas that support the Atlantic Growth Strategy. Recommendation 3.3: Enhance the Express Entry program for foreign graduates from Atlantic post-secondary institutions to assign greater weight to their personal suitability — age, skills, and prior work experience — than to possession of an immediate job offer; and increase efforts to inform international students of possible pathways to permanent residence after graduation. Recommendation 4.1: Harmonize across Atlantic Canada the existing provincial investment tax credits, and make them refundable; available to an investor wherever located; and focused on small businesses that are innovation-based. Include as eligible investments: common and preferred shares, convertible debentures and units; and as eligible investors: individuals, corporations, trusts and limited partnerships. Recommendation 4.2: Invest public funds in private-sector-managed regional funds making pre-seed as well as seed and early-stage venture capital investments. The provincial governments should invest, approximately on a pro-rata basis, together with federal government matching, BDC, and the private sector. Recommendation 5: Establish, under the Atlantic Trade and Investment Growth Strategy, a pan-Atlantic "SME Export Accelerator" program. Recommendation 6: Implement a process to reconcile, in a much more timely way, existing regulations that unreasonably impede trade, investment and worker mobility within Atlantic Canada. Recommendation 7: Create a "Community Challenge Fund" that would invite Atlantic Canadians to develop proposals to build on local assets to be employed in innovative community development projects. Recommendation 8.1: Increase support for experiential tourism in Atlantic Canada including a new multi-year initiative to develop Indigenous experiential tourism based on authentic cultural practices and skills. Recommendation 8.2: Identify an initial set of high-potential but under-served air routes to and within Atlantic Canada, and provide subsidies or other incentives sufficient to attract operators for at least a five-year trial period. Recommendation 9: Create "Innovation Marketplaces" in Atlantic Canada to support collaboration among large and small businesses, research performers, and governments in sector clusters, including Oceans, Agfood and Bio-resources, Clean Technologies, and potentially others. Recommendation 10: Create an "Atlantic Digital Health Innovation Foundation" to drive a collaborative strategy and to manage a "Digital Health Innovation Fund" that will support digital health pilot projects and finance small-scale procurements from Atlantic-based technology and service innovators in digital health. In 1934 the Province of Nova Scotia appointed a distinguished commission to conduct a broad enquiry into the province's economic condition. The assessment at the time, which could equally have applied to the entire Atlantic region, included the following words: “…the population of Nova Scotia is slowly dwindling, its industries are languishing, the younger men and women are more or less compelled to leave the province and to search for careers in other parts of Canada or other countries.” Fast forward 80 years to the report of the Nova Scotia Commission on Building Our New Economy—entitled Now or Never: “The Commission's core message is this: Nova Scotia is today in the early stages of what may be a prolonged period of accelerating population loss and economic decline. These negative prospects are not, however, inevitable or irreversible.” Reading these authoritative conclusions, the optimist might believe that the dire circumstances described in 1934 and again in 2014 could likely be put off for another 80 years, so why worry; while the pessimist might conclude that, try as we might, nothing will change, so why bother. The facts point to a different conclusion. Contrary to the pessimistic view, the Atlantic provinces have been making steady economic progress for decades. The region's per capita output has significantly closed the gap with the national average since the 1960s and now equals more than 80% of Canada's per capita GDP. But the optimists are not right either primarily because Atlantic Canada has a serious demographic problem. The region's extremely slow-growing population is the oldest in Canada. Statistics Canada's “high growth” population scenario for the region through 2038 projects a total of only 2.5 million, barely above the current level of 2.4 million. The challenge is clear. Fortunately, population growth is not immutable. But it is linked with economic performance in a circle of mutually reinforcing cause and effect. Population growth is a key driver of economic growth; while economic growth and prospects are the most important factors in attracting and retaining population. So a growth strategy for Atlantic Canada must be both an economic growth strategy and a population growth strategy. Lately there have been plenty of encouraging signs—for example: These factors account for the palpable momentum and optimism in much of Atlantic Canada today even as the shock of lower oil prices and the ever-present demographic challenge make for an uneven picture. We are at a time when the balance of forces favours opportunity. Atlantic Canadians themselves are the ones most responsible for seizing the opportunity and sustaining the momentum. But the long history of the region leaves no doubt that government must continue to complement the capabilities of the private sector and be a key enabler of its success. This is the context in which the governments of Canada and of the four Atlantic provinces launched the Atlantic Growth Strategy (AGS) in July, 2016. An Atlantic Growth Advisory Group was appointed in early 2017 to conduct a series of roundtable consultations on the strategy and to prepare advice for the AGS Leadership Committee of federal ministers and Atlantic premiers. (See the Appendix for short biographies of the members of the Atlantic Growth Advisory Group.) There have been countless reports over the decades recommending measures that might be taken to promote growth in Atlantic Canada. The Advisory Group has taken that good work as given and focused its advice through a relatively limited number of recommendations that satisfy the following criteria. The recommendations resulting from these criteria cover a large part of the growth policy landscape in a mutually reinforcing way. Their structure is diagrammed in the chart below which is also a guide to the ten sections that follow. This diagram shows how universal, affordable high-speed internet connectivity underpins the other recommendations in this report, which fall into two broad categories: strategic sectors, and infrastructure and capacity building. Under strategic sectors, recommendations are included in the areas of oceans, clean energy, agri-food/bio-resources (the three most strategically important sectoral clusters in Atlantic Canada, as identified by the Advisory Group), and also experiential tourism, and digital innovation in health. The recommendations concerning skills creation and application, immigration, financing innovative start-ups, export acceleration, regulatory reconciliation and innovative community development fall under the category of infrastructure and capacity building. The Advisory Group has drawn extensively on the excellent work of the federal Advisory Council on Economic Growth and recommends implementing, in an Atlantic context, a number of the innovative ideas developed by the Council including, in particular, the "FutureSkills Lab" and the concept of an "Innovation Marketplace." In fact, a theme running strongly throughout the recommendations is the opportunity to apply a number of highly innovative approaches first in Atlantic Canada. The region is tailor-made with multiple jurisdictions to learn what is needed to collaborate effectively; large enough to provide adequate scale and scope, yet small enough to avoid too much administrative inertia; and often in particular need of innovative approaches to achieve the objectives of the Atlantic Growth Strategy. The Advisory Group's recommendations follow, organized in ten chapters. Affordable access to high quality broadband Internet service is foundational for the Atlantic Growth Strategy. Quite simply, broadband access is transformative. Virtually all of the recommendations that follow depend on it directly or indirectly including, in particular, the proposed strategy to make Atlantic Canada a leader in digital innovation for the provision of healthcare. The CRTC has established, as a national objective for broadband Internet, a speed of at least 50 megabits per second (Mbs) for download and 10 Mbs for upload—the “50/10” objective. In 2015 about 82% of Canadians had access to a service that met that objective, including most urban residents but fewer than 30% of rural Canadians. The Atlantic region, as the most rural in Canada, is particularly reliant on measures to provide affordable broadband access for all. Recommendation 1: Create and implement an Atlantic Broadband Action Plan with the objective of providing all Atlantic Canadians with access to Internet service of at least 50 Mbs (down) and 10 Mbs (up). Atlantic Canada needs to establish a reputation as a place where youth and entrepreneurial ambition will be served. This will not happen without a comprehensive Atlantic Broadband Action Plan that brings together governments, business, and communities around a common objective of “50/10 access for all”. One benchmark along the way should be for Atlantic Canada to exceed the CRTC's estimate of 90% access to the 50/10 standard by 2021. The Atlantic Provinces should develop collaboratively the Broadband Action Plan so as to maximize, on a regional basis, the opportunity afforded by the new federal “Connect to Innovate” program as well as other funds and initiatives of the federal, provincial and municipal governments, the CRTC, and the private sector. The Action Plan must, at the outset, provide for collection of the detailed community-level data needed to scope out the requirements to meet the 50/10 objective and to set priorities. The asset mapping needs to be undertaken with the assistance of competent professionals and with the co-operation of Internet service providers. The Plan must include a timeline of interim targets and a commitment to publish, at least annually, the state of progress. It would greatly facilitate planning among governments if the various federal sources potentially available to support broadband access were combined into an “Atlantic Broadband Fund”. The “universality” being recommended refers to availability of a service to all Atlantic Canadians at reasonable price. Coverage of the most remote households may not be feasible using terrestrial technology; in which case improving technology for satellite and “fixed wireless” service will eventually fill the remaining gaps, although perhaps not at quite the 50/10 standard. There are no insurmountable technical barriers to eventually achieving the 50/10 objective virtually throughout Atlantic Canada. The issue is cost to provide the physical infrastructure, and affordability of the resulting service. Two national programs—the $500 million “Connect to Innovate” and $750 million through the CRTC—will make available $1.25 billion over the next five to six years to facilitate increased broadband access across Canada. These funds will need to be complemented by financial resources from provincial and local governments and from the private sector. The contribution of provincial and local governments to the Atlantic Broadband Action Plan goes beyond financial resources to include other critically important facilitation within their jurisdictions. For example, the cost of broadband provision is due primarily to factors related to construction—digging trenches for cable; installing towers for wireless; obtaining rights-of-way. Provincial and local governments therefore need to take every opportunity to facilitate installation. For example: when roads are being improved, or water/sewer lines installed, use the opportunity to add fibre. In view of Atlantic Canada's challenging demographic circumstances, the region cannot afford to be a laggard in facing tomorrow's labour market challenges and opportunities. It needs to embrace innovative and inclusive approaches. The 2017 federal Budget allocated $225 million over four years to establish “a new organization to support skills development and measurement in Canada.” The Advisory Council on Economic Growth had earlier proposed an organizational model—dubbed the “FutureSkills Lab”—that would largely fulfill those functions. As a non-governmental organization, although with government financial support, it would: The FutureSkills Lab would perform in essence an “R&D” function for Canada's labour market stakeholders. This is much needed to better inform the enormous labour market expenditures by all levels of government—estimated to be approximately $17 billion annually, not including EI—and to support innovative approaches to the fundamental challenges of connecting jobs with workers, and developing in workers greater resiliency to adapt to a continually changing job market. Since the FutureSkills Lab would be a novel organization its modus operandi and governance will require organizational innovation and some experimentation. Recommendation 2: Establish the “FutureSkills Lab” in Atlantic Canada on a pilot basis, governed by a joint federal-provincial-stakeholder board having a majority of members not from government. There are two main reasons to establish the FutureSkills Lab regionally—first, to get the concept up and running and tested quickly; second, and more important, to make the Lab responsive to the significant variation in labour market circumstances across Canada. While there is a role for a national structure it will need regional manifestations. Atlantic Canada is an ideal pilot candidate because the region represents in miniature the kind of environment in which the Lab would operate at a national scale. It would also be easier in the region than nationally to secure the inter-jurisdictional collaboration to get the FutureSkills Lab up and running quickly. The Atlantic FutureSkills Lab would solicit and support innovative, forward-looking skills development projects in areas particularly relevant to the Atlantic Growth Strategy—for example: A particularly significant labour market need is to equip Atlantic Canadians for the “digitization” of virtually the entire economy. This is increasingly evident in the resource sectors and manufacturing as various forms of sophisticated automation fill the gap created by growing worker shortages. Precisely what kinds of digital skills will be needed for what jobs in Atlantic Canada? How can the skills be most effectively imparted at various life stages and taking into account factors such as culture, gender, and life experience? These are fundamental and very pragmatic questions that might be addressed by the FutureSkills Lab through projects undertaken in practical contexts and by identifying and disseminating relevant experience and best practices from around the world. The length of the pilot phase and the funding level of the Atlantic FutureSkills Lab would be negotiated so as to be sufficient to demonstrate the value of the Lab and to identify the governance and other issues that would need to be addressed when expanding to national scale. In particular, it will be essential to ensure that the Lab complements, and does not duplicate, initiatives of the Forum of Labour Market Ministers, including the new Labour Market Information Council and the Forum's Innovative and Best Practices Working Group. The Advisory Council on Economic Growth recommended that governance of a FutureSkills Lab be modelled on that of the Canadian Institute for Health Information. Adapting the CIHI model, an 11-member board of the Atlantic pilot might have one director nominated by the federal and each provincial government; four by stakeholder groups (one from each province) and two at-large directors, including the Chair. Federal funding support for the Atlantic FutureSkills Lab would be provided by an appropriate fraction of the $225 million committed in Budget 2017. Atlantic Canada's population is the most slow-growing and rapidly ageing in Canada. No region is in greater need of immigration to get the growth process moving. Lagging economic growth and the absence of a critical mass of recent immigrants have nevertheless made it difficult for the region to attract and retain anything close to its per capita proportion of immigration to Canada. But recently, due principally to expanded use of the Provincial Nominee Program (PNP), the situation has begun to turn around. Between 2012 and 2016 immigration to Atlantic Canada increased 113% (from a low base) compared with 12% for Canada as a whole. The PNP affords a Province flexibility in identifying immigrants that can best fulfill local labour market needs and are most likely to integrate successfully. Being “closer to the ground” the Provinces are in the best position to make these calls. Recommendation 3.1: Increase annually over the next five years Atlantic Canada's percentage share of the Provincial Nominee Program under the Canada Immigration Plan so long as the region is able to fulfill its allocation. This recommendation would accommodate the very high priority Atlantic Provinces have placed on immigration as a central pillar of their economic strategies. Increases in the PNP share would of course be contingent on the individual Atlantic Provinces continuing to fill their existing and future allocations. To this end, the four Provinces will need to work closely with the federal government to help ensure the full utilization of allocations. The spirit of the recommendation can be met, while minimizing the impact on other provinces, by increasing, over time, the all-Canada PNP level as a proportion of national immigration. So even if the Atlantic share were to increase, the actual PNP levels available to other provinces would not have to decrease. Growth of the PNP allocation would also need to be accompanied by increasing the resources dedicated to applicant processing. To fill growing PNP allocations, Atlantic Canada needs a stronger economy, boosted by an infusion of experienced entrepreneurial talent. This is not because there are no great entrepreneurs in Atlantic Canada, but because there are not enough of them. Recommendation 3.2: Establish a procedure to proactively identify and recruit to Atlantic Canada small numbers of exceptionally accomplished individuals with demonstrated entrepreneurial talent and the ability to scale-up businesses in areas that support the Atlantic Growth Strategy. This recommendation is about proactivity, not reactivity. It could be most readily implemented as a carve-out under the Atlantic Immigration Pilot Program but with a different objective and focus than the “high- skilled” stream of the AIPP. Applicants for the high-skilled stream are identified by a designated employer to fill a specific job opening whereas the targets of Recommendation 3.2 would be individuals with exceptionally high potential to be job creators. The existing Start-up Visa program should serve as the model for the more general initiative recommended above which would be more akin to a Scale-up Visa. The individuals proactively targeted in this “AGS talent quest” would be world-class entrepreneurs, innovators and researchers with expertise in strategic sectors in Atlantic Canada. To implement the recommendation as an Atlantic Canada pilot: In 2014-15 there were more than 14,200 international students enrolled in universities and colleges (PSEs) in Atlantic Canada, representing 6.6% of the national total and an increase of 27% since 2011-12. (Meanwhile, total PSE enrolment in the region declined by almost 5%.) With their Canadian PSE credentials, language proficiency, and social networking and work experience in Atlantic Canada, these students can integrate quickly into the labour market and society. Immigration policy has become more supportive of graduate retention through measures like the Post-Graduation Work Permit Program, but in view of the exceptional value contributed by international graduates, more should be done1. Echoing a conclusion of The Advisory Council on Economic Growth: Recommendation 3.3: Enhance the Express Entry program for foreign graduates from Atlantic post-secondary institutions to assign greater weight to their personal suitability—age, skills, and prior work experience—than to possession of an immediate job offer; and increase efforts to inform international students of possible pathways to permanent residence after graduation. Building the “ecosystem” of institutions, financing, and experience to nurture innovative companies from concept to maturity is a long-term endeavour. Atlantic Canada is still in the early phases despite having over-performed in the creation of technology-based startups—e.g., there has been on the order of $2 billion received from the sale of venture-backed companies based in the region over the past six years. The thriving startup community makes only a very small contribution to jobs and income today. But like the acorns that eventually grow into oaks, they are the green shoots of the future economy. A strong preponderance of funding in Atlantic Canada, much of it from government sources, is at the earliest stages (“pre-seed” and “seed”) where, relative to international benchmarks, there is no shortage of capital on average. The challenge is the immaturity of the regional ecosystem. There is a dearth of “angel” capital—i.e. early-stage investment by private sector individuals who have worked extensively with startups in specific areas of technology. Gilles Durufle, a leading authority on venture financing, observes: “The Atlantic provinces are all confronted by the same challenge of limited resources and distance from the main technology clusters. Outside investors that are much needed do not make much of a distinction between Nova Scotia and New Brunswick. When facing the development of their tech ecosystem, governments should adopt as much as possible a regional approach.” Each of the Atlantic Provinces has its own version of an investment tax credit for investments in smaller companies and not restricted to those that would usually be described as innovative. A common regional approach, focused on investments in innovative small companies, would be more effective in stimulating development both of high-growth businesses and of knowledgeable angel investors. Recommendation 4.1: Harmonize across Atlantic Canada the existing provincial investment tax credits, and make them refundable; available to an investor wherever located; and focused on small businesses that are innovation-based. Include as eligible investments: common and preferred shares, convertible debentures and units; and as eligible investors: individuals, corporations, trusts and limited partnerships. The terms of the Provincial credits should be made as similar as possible so as to present a unified picture of the region to non-resident investors and to avoid inter-jurisdictional zero-sum competition regarding terms of the investment incentive. Eligible investee companies must be qualified as “innovative” according to criteria related for example to R&D spending, employment of highly-qualified people, export intensity, certain targeted sectors. Many jurisdictions in North America offer tax credits for angel investment, and some are refundable—i.e. paid even where there is less tax owing than the amount of the credit, and thus a form of grant. Since the objective is to attract both risk capital and experienced investors, the credit should be made as widely available as possible, ideally across North America. The next gap to be filled as the Atlantic startup ecosystem matures is to build more companies that can attract “Series A” financing (approximately $3-$10 million). This is not only a funding gap but also an expertise/experience gap. Recommendation 4.2: Invest public funds in private-sector-managed regional funds making pre-seed as well as seed and early-stage venture capital investments. The provincial governments should invest, approximately on a pro-rata basis, together with federal government matching, BDC, and the private sector. The announced $25 million “Nova Scotia Technology Seed Fund” could be extended to a regional project supported by federal agencies, thus making the new fund both stronger and beneficial to the entire region. Atlantic Canada has a regional fund, Build Ventures, which is fully invested and in the process of raising another fund. Recommendation 4.2 will help get startups from pre-seed to Series A funding and the region's ecosystem positioned for the next step of its evolution. The best strategy for that next scale-up step is to attract experienced outside investors that will take the lead in later stage VC rounds2. The need is to broaden awareness of the local talent by bringing to Atlantic Canada VC firms headquartered outside the region and by encouraging early-stage companies to get on a plane and put themselves face-to-face with potential investors. In short, the Atlantic startup ecosystem has to become much more connected to the world. Faced with a slow-growing domestic market, Atlantic Canada's prosperity will be driven by businesses that are able to compete and grow globally. Based on the metric of export performance, there is plenty of work to do: As a group, Atlantic Canada's businesses, particularly SMEs, need to raise their export game significantly. There are two principal challenges to overcome. The first relates to knowledge and awareness. Pressed for time, SMEs often do not know very precisely their current competitive position, or where they need to invest in order to succeed globally. The second and more fundamental challenge is that many smaller businesses believe that the potential reward for the time and expense to enter an unfamiliar market; or to make a significant investment in a leading-edge piece of equipment; or in product development, is simply not worth the risk. This attitude may be quite rational given expectations regarding the trade-off between risk and reward in a chronically lagging economy. That is why a government program to improve the export performance of Atlantic Canadian SMEs must be focused on reducing the perceived risk of an ambitious export strategy while increasing awareness of the reward and of how to achieve it. The effectiveness of such a program in changing behaviour will be greatly amplified if accompanied by a strong signal from the market. Fortunately this appears to be happening in manufacturing and resource sectors in Atlantic Canada. Officials in ACOA are seeing greater preparedness to invest in advanced equipment, at least in part to cope with a tightening labour supply. This trend augers well for productivity growth and greater export competitiveness and will increase business receptivity for government programs to encourage investment in advanced technologies. To address these fundamental issues, the federal and Atlantic provincial governments have committed to an “Atlantic Trade and Investment Growth Strategy” with an investment of $20 million over the next five years. Recommendation 5: Establish, under the Atlantic Trade and Investment Growth Strategy, a pan-Atlantic “SME Export Accelerator” program. The objective would be to increase the export ambition and capabilities of selected SMEs through an intensive program of export strategy development and coaching led by world-class experts. Overall responsibility for the program would rest with ACOA, whereas the content would be organized and run by a top-tier global consulting firm and would include mentoring by entrepreneurs and senior executives that have significant hands-on export business experience in order to ensure actionable, nuts-and-bolts advice. The distinguishing feature will be the quality and reputation of the “faculty”. The SME participants would be selected based on assessment of likelihood to benefit—the commitment of the CEO and metrics demonstrating growth, investment and willingness to pursue broader export opportunities. The program would complement and collaborate closely with the federal “Accelerated Growth Services” initiative. The “cohort” feature of the program—in which a group of companies participate together—would be an essential ingredient. The companies in a particular cohort (say, 10-15) would share experience and insights that would complement the mentored aspect and result in an on-going network of relationships among program graduates as well as with mentors. Most importantly, the program would generate, via a demonstration effect, a new success dynamic among Atlantic SMEs as more and more graduates of the program achieve their export goals. It is essential at the beginning to select strong candidate businesses to get the program successfully launched, rather than try to prop up weak performers. Because the program is targeted on strength and delivered by world-class experts, it will confer prestige and create a strong incentive to be selected. Eventually a “cultural” tipping point would be reached where everyone wants to get with the program. The effectiveness of the SME Export Accelerator could be amplified if SMEs were also encouraged to hire individuals with the skills and motivation to pursue export expansion vigorously—for example, highly-qualified recent graduates trained at the leading edge of a relevant field, equipped with a global outlook, young enough to see a bright future, and lacking the experience to know that “it can't be done”. People with this kind of talent and outlook represent an effective way to spread an export culture throughout Atlantic SMEs. To this end, the Export Accelerator program should be complemented with an “Export Talent Attraction” incentive that would provide time-limited wage subsidies to selected SMEs that hire recent highly-qualified graduates (including international grads) of Atlantic Canada's postsecondary institutions. Support should encourage employment for an extended period—e.g., at least three years—in order to be effective in changing the behaviour of the host business. The incentive would have to be quite large initially to meet the salary expectations of highly-qualified talent, and front-loaded to increase the incentive to hire—e.g., as much as 50% of first year salary, declining to perhaps 10% in the third and final year of support. Eligible SMEs would be selected based on the strength of their potential to become exporters or to significantly improve existing export performance. There is a large body of existing regulation that differs among the four Atlantic Provinces in ways that impede commerce or efficient service to the public but are not essential to the regulatory objective(s). They are distinctions without a difference. They create barriers that fragment a market that is already small, worsen diseconomies of scale and discourage business investment. The four provincial governments have recognized what is at stake, having established in 2015 a Joint Office of Regulatory Affairs and Service Effectiveness to oversee collaboration to increase regulatory efficiency. The work is rarely on the public radar screen, except when controversy erupts, and it can conflict with a variety of vested interests in each jurisdiction. That is why a commitment to regulatory reconciliation in Atlantic Canada must be clearly communicated from the top and followed-up in each Province with the assignment of modest full-time resources and the sustained senior priority needed to complement the work of the Joint Office. Inter-jurisdictional regulatory reconciliation, even when the differences are very small, has proven to be painfully slow—like chipping away at an iceberg with a teaspoon. The key roadblock is that when “sovereign” jurisdictions (the four Atlantic Provinces) attempt to reconcile, there is no supervening authority to break stalemates and force timely conclusions. So even though substantive differences may be slight, why should jurisdiction A's version of a particular regulation be favoured over jurisdiction B's? Recommendation 6: Implement a process to reconcile, in a much more timely way, existing regulations that unreasonably impede trade, investment and worker mobility within Atlantic Canada. The following procedure could be employed to reach a timely conclusion in the case of regulatory harmonization. a) Agree first on a set of regulation topics to be harmonized—e.g., all those dealing directly or indirectly with interprovincial transportation. It is important at this initial step to be guided by the advice of stakeholders as to the regulations that should receive the highest priority for harmonization. b) For any specific sub-topic there will typically be four versions of the regulation, one for each province—call them a “quad.” For any particular quad, select at random one of the four Provinces whose version of the regulation is then designated as the default version. (As the process continues from one quad to the next, a new Province is selected each time to have the default version ensuring that no Province is favoured.) c) When a particular quad and default version have been selected there is discussion among expert representatives of the four Provinces as to improvements that might be made in the default version. A time limit would have been set beforehand for this stage of the process. If consensus is reached within the time limit, the (revised) default version becomes the harmonized regulation. If full agreement cannot be reached within the allotted time, the original default automatically becomes the harmonized regulation, although revised if possible with those specific changes for which there is unanimous agreement. The key innovation in this procedure is that it forces closure. The current default holder will only have that position a quarter of the time so non-cooperative behaviour will be disciplined by peer pressure creating a potent incentive for all-party collaboration. Because the procedure would be applied in cases where distinct versions of a regulation constitute “distinctions without a difference”, no Province should feel aggrieved. On the contrary, the process itself would engender a spirit of compromise and, through informed negotiation, would result in improved regulation. The procedure could only be applied if there were agreement at the outset by the provincial governments to be bound by its results. To that end, it might be trialled first on a group of regulations that were relatively uncontroversial or for which there was strong stakeholder pressure for harmonization. There may be concern that implementation of Recommendation 6 could conflict with the national process of regulatory reconciliation just established as part of the Canadian Free Trade Agreement (CFTA). This valid concern is mitigated by the fact that any regulatory harmonization achieved by the Atlantic Provinces would set an example and would also reduce the number of jurisdictions to be harmonized nationally. To further reduce the risk of overlap, the Atlantic pilot procedure could first address regulations that were unlikely to be taken up in the early phases of the national regulatory reconciliation process. And if the procedure outlined in Recommendation 6 produces agreements among the four Atlantic Provinces, it would demonstrate an efficient path to regulatory reconciliation nationally. Asset-based community development (“ABCD”) is a novel and effective approach that focuses on the capacities and assets of communities rather than on their needs and deficiencies. It provides a way to harness the creativity, entrepreneurship, and local knowledge of Atlantic Canadians to complement the initiatives of governments to implement the Atlantic Growth Strategy. An ABCD-like process sometimes takes hold spontaneously in a community as the result of an initiative by a committed individual or group, but this can be hit or miss. Might there be a way to plant the ABCD seed more systematically? One way to inspire innovative approaches has been to create “prizes” (like the XPRIZE) for the best solutions to an identified challenge. Similarly, a government-funded “Community Challenge” could stimulate collaborative innovation that, once experienced, would make communities much more aware of what can be accomplished by identifying and mobilizing their own assets and talents. Recommendation 7: Create a “Community Challenge Fund” that would invite Atlantic Canadians to develop proposals to build on local assets to be employed in innovative community development projects. a) Individuals and groups would be invited to collaborate to bring forward proposals for leveraging local assets for inclusive community development. For example, a community might develop a way to welcome immigrants of widely varying backgrounds; implement the approach; and then prepare a “toolkit” for other communities to enable the approach to be replicated widely. b) Proposals to the Challenge Fund would be adjudicated by panel(s) of individuals of broadly recognized integrity and experience regarding social innovation in the context of community development. c) Selected proposals would receive support from the Challenge Fund, drawing on ACOA's Innovative Communities Fund together with a contribution from the Province(s) in which the project is to be located. d) To initiate the process, a joint ACOA-Provincial steering group should consult broadly with community stakeholders as to the scope of eligible proposals, selection criteria, eligible participants, and other characteristics of the process. Initially, the most compelling proposals would likely come from communities that already possess considerable social capital—e.g., a high level of volunteerism and many active community improvement groups. That is to be welcomed since the Challenge Fund will need excellent proposals at the outset to demonstrate value and set a standard. The philosophy is that success breeds success, and as examples accumulate others will realize that they can do it too. As one of the world's fastest growing industries, tourism is a major growth opportunity for Atlantic Canada given the region's many advantages as a destination—physical beauty, history, remarkable variety within a reasonably accessible geographical area, and an old-fashioned charm. The tastes of the prime tourism market are increasingly oriented toward experiences, ideally delivered by those whose cultures are believed to embody respect for, and authentic knowledge of Nature. Atlantic Canada needs to build more ambitiously on the exceptional cultural richness of the region—particularly of Indigenous peoples; those of Acadian ancestry; and other groups who have retained distinct cultural identities and a strong sense of place. The opportunity for Indigenous experiential tourism is exceptionally timely since it is closely aligned with the preferences of a growing number of global travellers. Recommendation 8.1: Increase support for experiential tourism in Atlantic Canada, including a new multi-year initiative to develop Indigenous experiential tourism based on authentic cultural practices and skills. Although the requirements below are described in the specific case of Indigenous experiential tourism, most would have counterparts in a strategy to develop the experiential tourism capacities of other cultural groups in Atlantic Canada. Beyond the economic opportunity provided, experiential tourism is an important way to preserve and re-vivify Indigenous and other traditional Atlantic Canadian cultures in a modern context. a) An Indigenous experiential tourism strategy would feature cultural, skill-building, and investment components to underpin a diverse set of unique tourism experiences. The proposed plan must be distinguished from Indigenous tourism activities involving ownership or operation of conventional tourism facilities—those would be only tangentially related to the concept recommended here. b) The strategy must ensure delivery of high-quality, authentic experiences. This will require intensive re-skilling since many of the traditional activities are no longer widely practised. But there remains a core group in Indigenous communities to form the nucleus of teachers who will teach the teachers. c) Aspects of the core training would be undertaken by Indigenous communities and elders, while other elements could be provided through Community Colleges or other specialized facilities. d) Government funding would be needed on a long-term, predictable basis to develop Indigenous experiential tourism “products” that meet high global standards as well as the marketing skills and resources to make them known to the world. Indigenous experiential tourism would be a far-reaching initiative providing lifelong careers, conferring prestige and economic success. It may take more than a decade to build a critical mass of the required capacities and infrastructure. That is the challenge. But the opportunity is to attract far more visitors to Atlantic Canada for whom a culturally and environmentally authentic experience is worth almost any price. Traditional knowledge and culture, in an authentic lived setting, is a movement whose time has come. Increased support for experiential tourism in Atlantic Canada would be undertaken in the context of the federal government's New Tourism Vision and, in the specific case of Indigenous experiential tourism, in close collaboration with the Indigenous Tourism Association of Canada. Collaboration with Parks Canada will also be essential for both Indigenous and other varieties of experiential tourism since national parks are well-endowed with experiential opportunities and parks like Kejimkujik in Nova Scotia and Torngat Mountains at the northern tip of Labrador are profoundly rich in Indigenous tradition. Regarding tourism expansion generally in Atlantic Canada—a denser air network is much needed to afford more convenient intra-regional access, complemented by more routes connecting Atlantic Canada with China and other high-potential markets. Consider that Iceland, with barely 340,000 population, has built a global air network complemented by a primarily internal carrier, Iceland Air Connect. There is a “chicken or egg” dilemma because new routes are not viable without tourist and other traffic, but the traffic will not materialize until the air route is provided. Because the operating economics of short-range aircraft are improving steadily and the willingness of affluent tourists to pay for high-quality experiences is increasing, the time may be at hand when certain intra-Atlantic routes could be facilitated at reasonable cost relative to the developmental potential. Recommendation 8.2: Identify an initial set of high-potential but under-served air routes to and within Atlantic Canada, and provide subsidies or other incentives sufficient to attract operators for at least a five-year trial period. Clusters of related economic activity—entertainment in Hollywood, infotech in Silicon Valley, aerospace in Montreal, among countless examples—constitute the structural foundation of the world's most dynamic regional economies. The Atlantic Growth Strategy needs to further develop the “cluster” dynamics of this region's leading sectors: i.e. areas of significant and successful economic activity that are well-adapted to Atlantic Canadian conditions and already equipped with a base of know-how and investment on which to build. Policy-makers in the OECD countries have been reluctant to implement explicitly sector-based policies believing that market forces are far better than governments at identifying and supporting the best opportunities. In many respects that is certainly true, but it is now being (re)-recognized that there is a role for well-designed public policy to enhance the competitiveness of sectors that are already well-grounded in a region. Government does not have to pick winners; it just has to complement what the market has already created but where there are opportunities to do even better. In the words of the Advisory Council on Economic Growth: “Achieving global scale and competitiveness requires ‘clearing the path’ to growth in our most promising sectors.” There has not been any official designation of the principal strategic sectoral clusters in Atlantic Canada. Significant regional growth sectors would certainly include Tourism and Culture (addressed in Chapter 8); Health and Life Sciences (Chapter 10); and Information and Communications Technologies, both in respect of the startup community (Chapter 4) and ICT as an established industry serving businesses and the broader society with implications for all aspects of the Atlantic Growth Strategy. In this regard, the technologies and methods that constitute what is called “Industry 4.0” must become an integral part of Atlantic Canada's economy, serving as the principal source of productivity growth and industrial competitiveness, and thus of key importance for all sectoral clusters. Based on submissions to the federal supercluster competition it might be inferred that among the most strategically important sectoral clusters in Atlantic Canada would be the following three: While at most the “Oceans” proposal might be selected in the supercluster competition, the collaborative experience of developing proposals for that competition has already demonstrated the value of an on-going version of cluster support at more limited scale. Recommendation 9: Create “Innovation Marketplaces” in Atlantic Canada to support collaboration among large and small businesses, research performers, and governments in sector clusters, including Oceans, Agfood and Bio-resources, Clean Technologies, and potentially others. The innovation marketplace concept, which has been advocated by the Advisory Council on Economic Growth, gives organizational form to collaborative innovation activities such as: joint precompetitive R&D, prototype development and testing, procurement to encourage market readiness of innovative products, specialized skills attraction and training, market expansion, and sector strategy formulation. While the term “innovation marketplace” may be unfamiliar, the basic concept has several analogous antecedents in Canada including CRIAQ in the aerospace sector; FPInnovations in forest products; and SGIN in the smart grid space in Atlantic Canada. In 2014, Norway launched a “Norwegian Innovation Clusters” program that is already supporting 36 clusters in three stages of development—Arena (for the most immature stage); Norwegian Centres of Expertise (for the next stage of evolution); and Global Centres of Expertise (for the most mature). Taking a cue from the Norwegian program, governments and business might adopt an analogous tiered approach to cluster/sectoral support. Beyond the small number of selected superclusters—analogous to Norway's three “Global Centres of Expertise”—there will be several other excellent submissions to the supercluster competition that are now primed to collaborate to improve sectoral performance. Oceans, agfood, and clean electricity are each well-placed to serve as a pilot trial of the innovation marketplace concept. How would it work? The digital revolution has so far had relatively limited impact on innovative products and practices in the health field. Now that is changing rapidly as the Electronic Health Record becomes ubiquitous and the range of services that can be delivered remotely grows both in functionality and cost-effectiveness. A “digital health”3 revolution is inevitable. The question is who will be in the vanguard and thus in the best position not only to reap benefits earlier, but also to host an out-sized share of the new industry that the digital health revolution is already creating. Atlantic Canada can benefit disproportionately by being among the leaders. Here's why: The region's population is the oldest in Canada, creating a heavy burden of chronic conditions which can be managed more effectively via digital health methods. Although the health sector is usually thought of as a source of consumption of publicly funded services, digital health can also be a growth generator for three principal reasons—(i) the development and sale of digital health products and services will be a leading global industry of the future; (ii) digital health services will be essential enablers of rural population retention and thus of rural/small community economic development; and (iii) the cost-efficiencies eventually derived from digital healthcare will ease the growing pressure on public finances and thus increase the resources available for growth-promoting public and private investment. Healthcare is the biggest sector in the advanced economies. It cannot be ignored in an Atlantic Growth Strategy for the long term. With a population of 2.4 million Atlantic Canada is close to ideal as a “living laboratory” for digital health innovation—i.e. large enough to provide needed diversity, yet not so large as to be stymied by inertia. But because each province is sub-scale, a collaborative approach is needed. The challenge is that the four Provinces are at different stages of readiness and have varying conceptions of the best way forward. This can be overcome by ensuring flexibility to build on the strengths of each Province—for example, an individual jurisdiction might take the lead regionally in areas in which it is already most advanced. If Atlantic Canada is to be among the leaders in the digital health revolution there must be a commitment to transformation, not simply to “modernization.” Modernization happens gradually in the normal course as digital methods diffuse intermittently into health practice, but this would not bring the exceptional economic and health system benefits that will come to jurisdictions that embrace digital health in transformational terms. It is emphasized that the strategy being advocated has two principal objectives. One is to be a leader in the use of digital health technology integrated with practice to deliver better, more cost-efficient care to Atlantic Canadians. The second, parallel, objective is to be among the leaders in aspects of the global digital health industry. The two objectives are compatible, indeed mutually supportive, but they speak to often different stakeholders having different priorities. As an Atlantic digital health strategy is developed, it is essential that the parallel objectives be well articulated and constantly borne in mind. Jurisdictional silos and the daily press of operational priorities will stymie collaborative innovation at a strategic scale unless there is some institutional machinery with a strong mandate and resources to implement a multi-province digital health strategy. Therefore: Recommendation 10: Create an “Atlantic Digital Health Innovation Foundation” to drive a collaborative strategy and to manage a “Digital Health Innovation Fund” that will support digital health pilot projects and finance small-scale procurements from Atlantic-based technology and service innovators in digital health. Why is a Digital Health Innovation Fund needed? It is because the day-to-day delivery of care must continue unimpeded by the parallel need to test innovations at pilot scale under realistic conditions. Such “experiments” will be at a disadvantage in the competition for attention and funding from health ministries that are always facing more urgent priorities and stretched budgets. Separate ring-fenced funding for early-stage digital health initiatives is essential. An investment equivalent to roughly 0.5 to 1 percent of the collective health budget of the Atlantic Provinces (or about $50-100 million annually) would support the “R&D” requirements of a digital health strategy and demonstrate commitment. The Atlantic Digital Health Innovation Fund would need federal and Provincial contributions and would be substantially augmented by private investment in, and by, digital health solutions providers. The Atlantic Digital Health Innovation Foundation (ADHIF) would be the institutional embodiment of the collaborative digital health strategy, responsible for sustaining momentum. The mandate, governance and composition of ADHIF would be negotiated among the four provincial governments and might have characteristics such as the following: a) Responsible for allocating the Atlantic Digital Health Innovation Fund subject to a funding agreement with governments. Decisions regarding use of the Fund would be an essential part of the Foundation's mandate and would enable it to attract a first-rate, action-oriented board and staff. The proposed Foundation structure also ensures that financial resources provided to the Innovation Fund would be used only for the intended purposes—pilot projects and small-scale procurements directly related to the digital health innovation strategy. b) Mandated to provide advice to the four Provinces regarding specific elements of the digital health strategy—for example, regarding various harmonization initiatives (see below). The Foundation would serve as a formally neutral advisor thus facilitating pan-jurisdictional consensus. c) Structured as a mixed public-private organization, with a non-government majority of board members; possibly having an appointment structure similar to the Canada Foundation for Innovation. The board must include a strong private sector perspective in view of the twin objectives of Atlantic Canada to be among the leaders both in the quality of digital health care and in the digital health industry. d) Equipped with staff research capacity to remain current with developments in digital health technology and practice. e) Supported by a permanent secretariat, the funding for which might be provided by the federal government. Item (b) of the Foundation's mandate suggested above refers to a role in which it would serve as a neutral expert advisor to the Provinces regarding specific aspects of the digital health strategy. As examples, consider two issues that are currently on the “front burner.” Compatible Infrastructure for Electronic Health Records (EHRs): There should be a pan-Atlantic “open architecture” infrastructure for health data sharing, including interoperability standards for EHRs. This is an urgent issue since new provincial EHR procurements (to implement “one patient one record”) are imminent and delay is not an option. If the proposed Foundation were in place it could objectively review the state of the various provincial EHR initiatives and recommend harmonization around the “best” option for the region as a whole. Provinces would obviously not be under any obligation to accept such advice but if the Foundation became respected as an informed, neutral party, its views would carry weight. Digital health data sharing and privacy: Because the promise of digital health is all about data, the ability to aggregate patient and cost data across the four provinces to achieve scale is essential for digital health leadership. To this end, there should be harmonization, or some other form of reconciliation, of regulations in the Atlantic Provinces regarding digital health data sharing and privacy. The data should be amalgamated into an anonymized “Atlantic Health Data Base” which would be available without charge to researchers (as Alberta is doing), clinicians, and approved applications developers through open architecture to develop digital health solutions. Note too that the ability to link data on patient outcomes with cost of care will enable more accurate “value-based reimbursement” by the public insurer. There may be concern that the Foundation would simply be another layer of bureaucracy; just the opposite of the nimbleness needed to operate in the fast-paced, entrepreneurial digital environment. This is a legitimate worry which underlines the importance of (i) appointing to the board and executive leadership individuals who are passionate about digital health transformation, (ii) providing the Foundation with substantially independent authority over the use of the Digital Health Innovation Fund; and (iii) adopting the best contemporary practices regarding priority setting and project management—e.g., “agile project management”4—so as to maintain an innovator's culture. Speed is now of the essence since big players like Google and Apple, intent on shaping the future of digital health, are looking globally for the right jurisdictions in which to base their innovative initiatives. The Advisory Group's recommendations form a coherent whole that is mutually reinforcing. They address opportunities where pan-Atlantic collaboration can achieve far more than individual governments acting separately. The recommendations build on good work already under way but they break a lot of new ground. Above all, they are specific and actionable. If implemented, the recommendations will have real impact. Implementation is the stage at which many advisory projects fall far short of what was intended. To avoid the proverbial dusty shelf, the recommendations that the Leadership Committee decides to accept will need a focal point of accountability to drive implementation. This is challenging because the Atlantic Growth Strategy not only cuts across five governments but also across many areas of departmental responsibility within each government. The Leadership Committee can provide collaborative direction at the highest level but premiers and federal ministers need “arms and legs” to implement that direction. The primary federal operational accountability would naturally reside with ACOA and that of the Provinces with the Council of Atlantic Premiers and its secretariat. Each of ACOA and CAP should appoint a senior policy official with clear accountability for timely implementation. ACOA, having the most pan-Atlantic resources “on the ground,” will need to be counted on to provide the majority of day-to-day operational leadership and should be assigned the requisite authority and accountability for the job. Because many of the Advisory Group's recommendations will unfold over several years, there is a need for periodic reporting on progress, ideally bi-annually. The public reporting function might be through a small group of well-qualified private citizens appointed by the Leadership Committee. The full membership of the Atlantic Growth Advisory Group can be seen here. The Advisory Group was supported by an informal secretariat comprised of Dr. Peter Nicholson (consultant), Jeff Larsen (in a voluntary capacity), and Ms. Anne Gilbert of the Privy Council Office of the Government of Canada.List of Recommendations

1. Broadband Access

2. Future Skills

3. Immigration

4. Financing Startups

5. SME Export Acceleration

6. Regulatory Reconciliation

7. Community Development

8. Experiential Tourism

9. Sector Clusters

10. Digital Health

Introduction

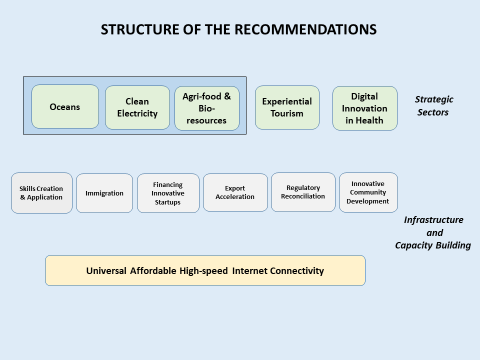

Structure of the recommendations

Structure of the recommendations - explanatory text

1. Providing Universal Broadband Access

2. Creating Future Skills

3. Attracting Talented Immigrants

4. Financing Innovative Startups

5. Accelerating Export Growth

6. Reconciling Regulation Across Atlantic Canada

7. Supporting Innovative Community Development

8. Growing Experiential Tourism

9. Building on Strong Sectoral Clusters

For starters, an innovation marketplace must be led by key private sector players in the particular sectoral cluster to ensure market relevance and the deep commitment of business. The private sector initiators would assemble groups of like-minded companies and research and educational institutions, all interested in investing in, for example, a technology platform, or collaborating to solve a shared problem, or in strengthening sector capacity overall. Larger corporations would play a key role in the development of the sector/cluster ecosystem by serving as a test bed and first customer, and by challenging younger companies to meet global standards of price and quality in order to earn access to the established corporation's supply networks. At the same time, the large corporation would benefit from a window on technological trends and access to talent and to a culture of innovation. Government could provide convening, informational, and operational support—e.g., by co-funding with business sponsors the marketplace's administrative overhead cost as well as projects that benefit multiple industry players.10. Leading in Digital Health Innovation

Conclusion: Advice on Implementation

Appendix: Members of the Atlantic Growth Advisory Group

2. Budget 2017 announced an investment of $400 million in the new Venture Capital Catalyst Initiative (VCCI) to encourage increased later stage VC investment in Canada by the private sector. As the Atlantic startup ecosystem matures, companies in the region will become more able to attract such later stage VC investment. ↩

3. The term “digital health” is broadly inclusive and encompasses the application of information and communications technologies to all aspects of health including, for example: diagnosis and care provision at a distance (telehealth); personal health monitoring/management via digital applications; electronic health information, health data analytics and applications employing artificial intelligence; analysis of genomic and other sources of “big data” in a health context. ↩

4. “Agile” is a flexible approach to project management based on rapid cycles of development, feedback, and path adjustment as necessary. Agile Project Management is suited to situations where the end-product is uncertain; or where the environment is changing rapidly; or for highly complex situations where managers are "feeling their way forward". These are all characteristics of the environment in which the Atlantic Digital Health Innovation Foundation and Fund would operate. ↩