Atlantic Canada Opportunities Agency - Quarterly Financial Report for the quarter ending December 31, 2023

About this publication

© His Majesty the King in Right of Canada, as represented by the

Minister of Rural Economic Development and Minister responsible for

the Atlantic Canada Opportunities Agency, 2023.

Catalogue No. AC3-1E-PDF

ISSN 2817-3694

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

Introduction

This quarterly financial report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA) and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subjected to an external audit or review.

A summary description of the Atlantic Canada Opportunities Agency (ACOA) program activities can be found in Part II of the 2023-2024 Main Estimates.

Basis of presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities is consistent with the Main Estimates, Supplementary Estimates (A) and Supplementary Estimates (B) for the 2023-2024 fiscal year and includes ACOA’s total authorities available for use as granted by Parliament and those used by the Agency during this quarter. Authorities available for use are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory authorities for specific purposes.

The authority of Parliament is required before monies can be spent by the Government.

When Parliament is dissolved for the purposes of a general election, section 30 of the FAA authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

As part of the departmental results reporting process, the Agency prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies. However, the spending authorities voted by Parliament remain on an expenditure basis of accounting.

ACOA financial structure

ACOA manages its expenditures under two votes:

- Vote 1 – Net operating expenditures, includes the Agency’s authorities related to personnel costs (e.g., salaries) and operation and maintenance expenditures (e.g., travel).

- Vote 5 – Grants and contributions, includes authorities related to transfer payments.

Costs under Statutory Authorities, which represent payments made under legislation approved previously by Parliament and which are not part of the annual appropriation bills, include such items as the employer’s share of the employee benefits plan and other minor items.

Highlights of fiscal quarter and fiscal year-to-date results

This section highlights significant changes to the fiscal quarter results as of December 31, 2023.

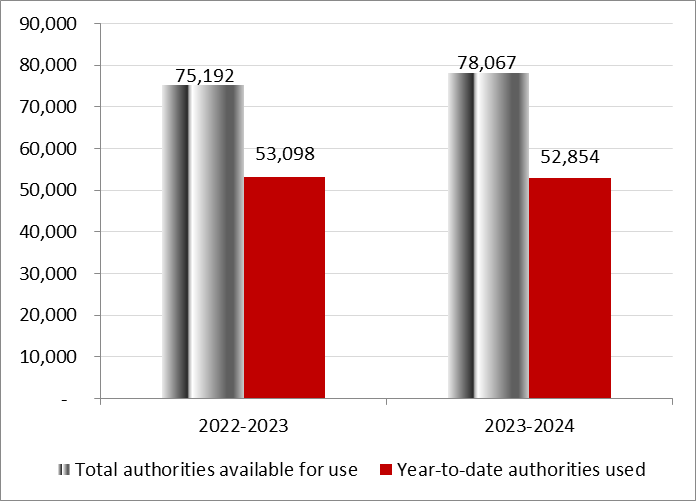

Statement of authorities: Vote 1 – Net Operating Expenditures

Total authorities available for fiscal year 2023-2024 are $78.1 million, with no significant variance compared to $75.2 million as of December 31, 2022.

Vote 1 authorities used year-to-date are $52.9 million at the end of the third quarter this fiscal year, with no significant variance compared to $53.1 million as of December 31, 2022.

Graph 1 illustrates the total authorities available for use for the year as well as the amount used year-to-date at quarter-end.

Graph 1: Comparison of Net Budgetary Authorities and Expenditures for Vote 1 as of December 31, 2022-2023 and 2023-2024.

(in thousands of dollars)

Long description

For the year ending March 31, 2023, total authorities available for use for Vote 1 is $75,192 in thousands of dollars, while year to date authorities used for Vote 1 is $53,098 in thousands of dollars.

For the year ending March 31, 2024, total authorities available for use for Vote 1 is $78,067 in thousands of dollars, while year to date authorities used for Vote 1 is $52,854 in thousands of dollars.

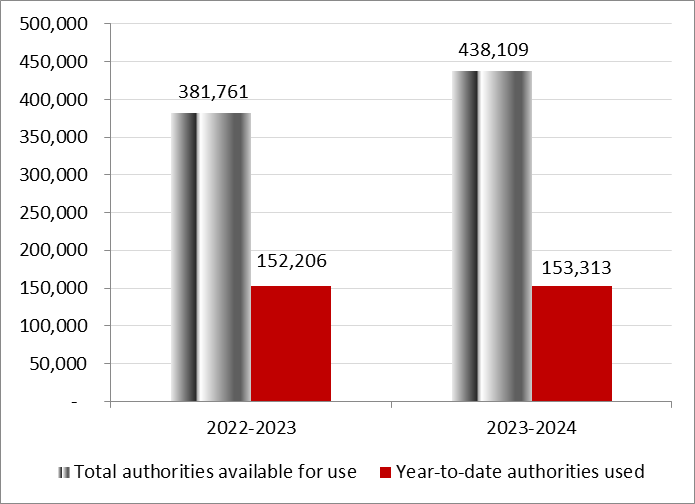

Statement of authorities: Vote 5 – Grants and Contributions

Total authorities available for use for the year ending March 31, 2024, amount to $438.1 million, an increase of $56.3 million compared to the $381.8 million available for use as of December 31, 2022. The increase of $56.3 million, or 14.8%, is explained below.

A total increase of $154.7 million in Vote 5 authorities available for use related to:

- a $102.2 million increase in temporary funding for the Hurricane Fiona Recovery Fund;

- a $31.5 million increase in excess amounts of collections related to the reinvestment of repayable contributions in prior years;

- an $11.0 million increase in temporary funding for the BioAccelerator Project;

- a $5.5 million increase in temporary funding for the Renewal of Funding for the Regional Economic Growth through Innovation Program;

- a $2.5 million increase in temporary funding (resulting in a transfer of funds from the Department of Agriculture and Agri-Food) to support the establishment of a Dairy Secondary Processing Project in Newfoundland and Labrador; and

- a $2.0 million increase in temporary funding for the Tourism Growth Program.

This increase is offset by a total decrease of $98.4 million in Vote 5 authorities available for use related to:

- a $29.0 million decrease in temporary funding for the Canada Community Revitalization Fund;

- a $28.2 million decrease in temporary funding for the Tourism Relief Fund;

- a $17.0 million decrease in temporary funding for the Jobs and Growth Fund;

- a $15.3 million decrease related to a reprofile of funds as a result of project/contracting delays; and

- an $8.9 million decrease in temporary funding announced in Budget 2018 in support of Regional Economic Growth through Innovation measures.

Vote 5 authorities used year-to-date are $153.3 million at the end of the third quarter this fiscal year, with no significant variance compared to $152.2 million as of December 31, 2022.

Graph 2 illustrates the total authorities available for use for the year as well as the amount used year-to-date at quarter-end.

Graph 2: Comparison of Net Budgetary Authorities and Expenditures for Vote 5 as of December 31, 2022-2023 and 2023-2024.

(in thousands of dollars)

Long description

For the year ending March 31, 2023, total authorities available for use for Vote 5 is $381,761 in thousands of dollars, while year to date authorities used for Vote 5 is $152,206 in thousands of dollars.

For the year ending March 31, 2024, total authorities available for use for Vote 5 is $438,109 in thousands of dollars, while year to date authorities used for Vote 5 is $153,313 in thousands of dollars.

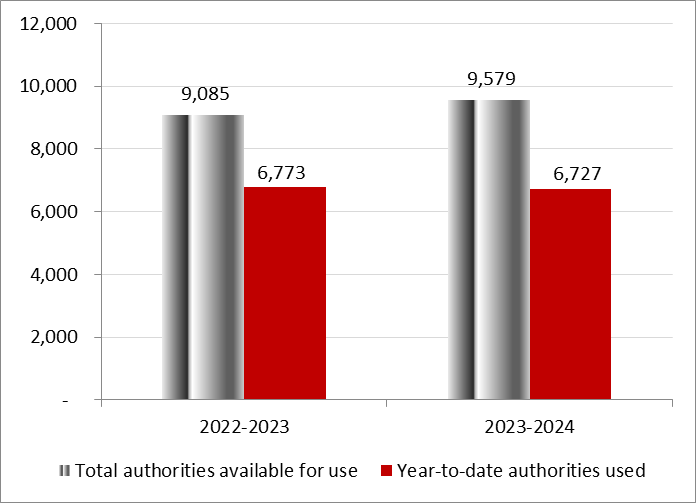

Statement of authorities: budgetary statutory authorities

Budgetary statutory authorities available for use for the year ending March 31, 2024, have increased by $0.5 million, or 5.4%, to $9.6 million compared to the previous fiscal year at the same time.

Budgetary statutory authorities used year-to-date are $6.7 million at the end of the third quarter this fiscal year, with no significant variance compared to $6.8 million as of December 31, 2022.

Graph 3 illustrates the total authorities available for use for the year as well as the amount used year-to-date at quarter-end.

Graph 3: Comparison of Net Budgetary Authorities and Expenditures for Statutory Authorities as of December 31, 2022-2023 and 2023-2024.

(in thousands of dollars)

Long description

For the year ending March 31, 2023, total authorities available for use for Statutory authorities is $9,085 in thousands of dollars, while year to date authorities used for Statutory authorities is $6,773 in thousands of dollars.

For the year ending March 31, 2024, total authorities available for use for Statutory authorities is $9,579 in thousands of dollars, while year to date authorities used for Statutory authorities is $6,727 in thousands of dollars.

Statement of the Agency’s budgetary expenditures by standard object

The Agency’s budgetary expenditures by Standard Object for the quarter ended December 31, 2023, were $212.9 million, which reflects an increase of $0.8 million, or 0.4%, from the $212.1 million in overall expenditures for the quarter ended December 31, 2022. This variance over the previous fiscal year’s third quarter is deemed insignificant.

Risks and uncertainties

ACOA conducts a regular assessment of its overarching corporate risk profile. ACOA manages financial risks through a set of appropriate mitigation measures. The financial risks are mitigated in large part by the implementation of strong internal controls over financial reporting. These include the periodic assessment of entity-level controls, general computer controls, and controls in ACOA’s key business processes such as payments on grants and contributions, regular operating expenses and accounts receivable.

Furthermore, ACOA manages its budgetary and allocation processes through a well-defined framework supported by a series of automated financial controls. Periodic forecasts are required and analyses are done regularly to ensure that funds are properly managed.

Significant changes in relation to operations, personnel and programs

There have been no significant changes in relation to operations, personnel and programs impacting the results of this quarter.

Approval by senior officials

Approved by:

Pat Dorsey

Acting Deputy Head

Moncton, Canada

Date February 15, 2024

Stéphane Lagacé, CPA-CMA

Chief Financial Officer

Moncton, Canada

Date February 14, 2024

| Authorities | Total available for use for the year ending March 31, 2024* |

Used during the quarter ended December 31, 2023 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | 78,067 | 18,418 | 52,854 |

| Vote 5 - Grants and contributions | 438,109 | 77,257 | 153,313 |

| Budgetary statutory authorities | 9,579 | 2,237 | 6,727 |

| Total authorities | 525,755 | 97,912 | 212,894 |

| Authorities | Total available for use for the year ending March 31, 2023* |

Used during the quarter ended December 31, 2022 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Net operating expenditures | 75,192 | 18,505 | 53,098 |

| Vote 5 – Grants and contributions | 381,761 | 70,319 | 152,206 |

| Budgetary statutory authorities | 9,085 | 2,259 | 6,773 |

| Total authorities | 466,038 | 91,083 | 212,077 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures | Planned expenditures for the year ending March 31, 2024* |

Expended during the quarter ended December 31, 2023 |

Year-to-date expended at quarter-end |

|---|---|---|---|

| Personnel | 75,206 | 19,101 | 53,881 |

| Transportation and communications | 2,371 | 366 | 1,060 |

| Information | 520 | 62 | 271 |

| Professional and special services | 3,867 | (107) | 841 |

| Rentals | 2,807 | 365 | 1,232 |

| Repair and maintenance | 146 | 10 | 37 |

| Utilities, materials and supplies | 156 | 107 | 160 |

| Acquisition of machinery and equipment | 864 | 76 | 442 |

| Transfer payments | 438,109 | 77,257 | 153,313 |

| Other subsidies and payments | 1,709 | 675 | 1,657 |

| Total net budgetary expenditures | 525,755 | 97,912 | 212,894 |

| Expenditures | Planned expenditures for the year ending March 31, 2023* |

Expended during the quarter ended December 31, 2022 |

Year-to-date expended at quarter-end |

|---|---|---|---|

| Personnel | 71,147 | 18,568 | 53,691 |

| Transportation and communications | 1,602 | 572 | 1,154 |

| Information | 663 | 62 | 263 |

| Professional and special services | 4,461 | 812 | 1,814 |

| Rentals | 2,547 | 475 | 1,423 |

| Repair and maintenance | 205 | 40 | 74 |

| Utilities, materials and supplies | 315 | 50 | 79 |

| Acquisition of machinery and equipment | 1,350 | 181 | 432 |

| Transfer payments | 381,761 | 70,319 | 152,206 |

| Other subsidies and payments | 1,987 | 4 | 941 |

| Total net budgetary expenditures | 466,038 | 91,083 | 212,077 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.