Backgrounder: Competition Bureau sues Google for anti-competitive conduct in online advertising in Canada

Backgrounder

November 28, 2024 – GATINEAU (Québec), Competition Bureau

The Competition Bureau is taking legal action against Google for anti-competitive conduct in online advertising technology services in Canada. The Bureau has filed an application with the Competition Tribunal for an order that, among other things:

- requires Google to sell two of its advertising technology tools: its publisher ad server, DFP, and its ad exchange, AdX;

- directs Google to pay an administrative monetary penalty equal to three times the value of the benefit derived from Google’s anti-competitive practices, or if that amount cannot be reasonably determined, 3% of Google’s worldwide gross revenues; and

- prohibits Google from continuing to engage in anticompetitive conduct and practices.

The final decision in this matter rests with the Competition Tribunal, which is independent from the Bureau.

- The Competition Bureau, headed by the Commissioner of Competition, is responsible for the administration and enforcement of Canadian competition law. The Bureau investigates potentially anticompetitive conduct and decides whether to proceed with filing an application to the Tribunal.

- The Competition Tribunal is similar to a court. It hears applications made under the Competition Act and issues orders where appropriate.

The following provides information about the Bureau’s investigation and outlines key factors behind the Bureau’s decision to take action.

The investigative process

The steps that the Bureau takes during an investigation vary based on the facts of each case. When the Bureau finds evidence of conduct contrary to competition law in Canada we may take any or all of the following actions:

- The Bureau may initiate an investigation as the result of information it obtains about marketplace practices that may contravene Canada's competition laws.

- The Bureau obtains information from a variety of sources, including proactive intelligence gathering by its officers, and complaints made by consumers and businesses.

- During the typical investigation stage, Bureau investigators identify all available sources of information about the relevant marketplace activity, determine whether any issues are raised under the Competition Act and assess whether further investigation is appropriate.

- Bureau investigators may interview suppliers, customers, competitors and other industry sources. They may also use a range of investigative tools to obtain evidence.

- The Bureau is required by law to conduct its investigations confidentially. The Competition Act specifies that sharing information obtained by the Bureau is prohibited, with certain limited exceptions including where information is communicated to a Canadian law enforcement agency or for the purposes of administration or enforcement of the law.

When the Bureau concludes that the conduct under investigation has harmed competition in contravention of the Competition Act, we can negotiate a consensual resolution with the target of the investigation, which is registered with the Competition Tribunal, or we can file an application with the Competition Tribunal. The final decision on any application filed with the Competition Tribunal lies with the Tribunal, not the Bureau.

Our findings

The Competition Bureau’s investigation has found that, in Canada, Google is the largest provider across the ad tech stack for web advertising and has abused its dominant position through conduct intended to ensure that it would maintain and entrench its market power. Google’s conduct locks market participants into using its own ad tech tools, prevents rivals from being able to compete on the merits of their offering, and otherwise distorts the competitive process.

This case is about online web advertising, which consists of ads shown to users when they visit websites. Many publishers count on digital ad revenue to support their activities and reach. To drive this revenue stream, publishers create and design their websites with dedicated space for ads included. Digital ad inventory is often purchased and sold through automated auctions using sophisticated platforms. These individual platforms are known as ad tech tools while the entire suite of tools used throughout the buy and sell process are collectively known as the ad tech stack. No other single ad tech provider has Google’s scale or reach across the ad tech stack, with over 200 billion Canadian web ad transactions flowing through Google’s ad tech tools in 2022.

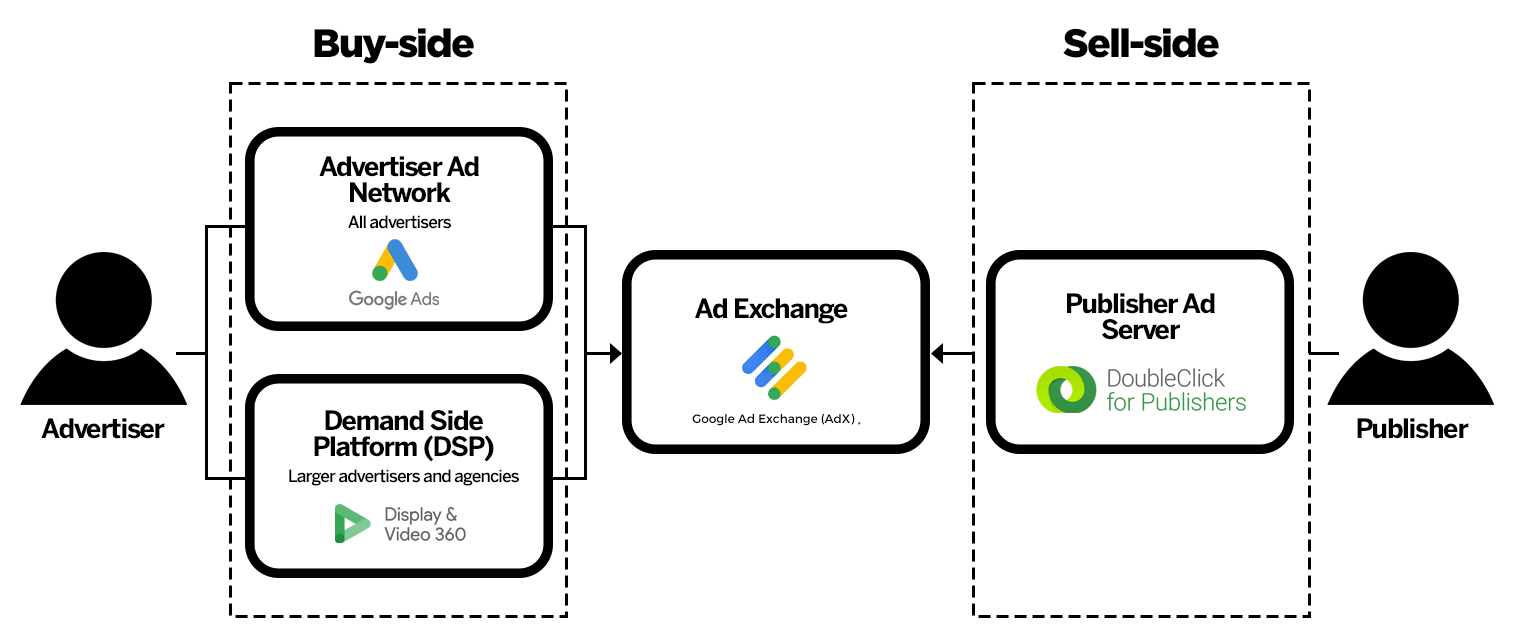

The ad tech stack includes:

- Sell-side tools used by publishers to manage their ad inventory and online advertising (e.g. publisher ad servers);

- Buy-side tools used by advertisers to buy available ad space (e.g. advertiser ad network, demand-side platforms); and

- Tools that serve as the intermediary between the sell-side and buy-side tools allowing publisher ad servers to list available ad space and advertiser ad networks and demand-side platforms to bid on that inventory through automated auctions (e.g. ad exchanges).

Google owns four of the largest online advertising technology services used in Canada: DoubleClick for Publishers, AdX, Display & Video 360 and Google Ads.

Google holds an estimated market share of 90% in publisher ad servers, 70% in advertiser networks, 60% in demand-side platforms and 50% in ad exchanges.

The Bureau’s position is that Google’s near-total control of the ad tech stack is by design. Through a series of related and interdependent actions, Google has, in our view, unlawfully tied together its various ad tech products, impeded rivals’ ability to compete and restrained innovative technologies that could threaten their market power. In particular, we found that Google has:

- Made its advertiser ad network only available to its own ad exchange, and in turn, compelled publishers to use its publisher ad server to access real-time bids from its ad exchange. In other words, Google has tied its different ad tech products together to maintain its market dominance; and

- Used its position across the ad tech stack to distort auction dynamics by:

- Giving its own ad exchange preferential access to ad inventory,

- Taking negative margins in certain circumstances to disadvantage rivals, and

- Dictating the terms on which its own publisher-customers could transact with rival ad tech tools.

The Bureau’s investigation found that, through its conduct, Google positioned itself at the centre of the ad tech ecosystem and used its control across the ad tech stack to unlawfully leverage its market power with one product to strengthen its position with its others. Specifically, Google engaged in conduct that reduces the competitiveness of rival ad tech tools and the likelihood of new entrants in the market.

By implementing this anticompetitive conduct, Google has entrenched its dominance, prevented rivals from competing on merits, prevented innovation, insulated itself from competition, inflated the cost of advertising, and reduced publishers’ revenues. This conduct has had serious consequences for Canadian publishers, advertisers, rivals, and consumers, resulting in a substantial prevention and lessening of competition.

Why we are acting

The Competition Bureau has brought an application to the Competition Tribunal to end Google’s anticompetitive practices in Canada, to restore competition in the digital advertising markets and to safeguard the industry from future harm.

The Bureau asserts that an order from the Competition Tribunal is necessary and appropriate for several reasons:

- Google’s practices have the effect of preventing or lessening competition substantially in Canadian online advertising technology services;

- An order is reasonable and necessary to overcome the anti-competitive effects of Google’s conduct in the marketplace and to restore competition in the market; and

- An order is necessary to prevent Google from engaging in the same or similar conduct in the future.

Next steps

Under the Competition Tribunal’s rules, the Respondent typically has 45 days to file a response. The Bureau then has 14 days to reply.

All other timelines are determined by the Tribunal on a case-by-case basis, therefore, it’s impossible to predict how long the case may take.

The final decision in this matter rests with the Tribunal.