Briefing binder created for the Deputy Minister of Finance on the occasion of his appearance before the Standing Committee on Finance on March 21, 2024 on Bill C-59, An Act to implement certain provisions of the fall economic statement tabled in Parliament on November 21, 2023 and certain provisions of the budget tabled in Parliament on March 28, 2023, and the Main Estimates 2024-25

On this page:

- Alcohol Excise Duty Inflation Adjustment

- Asian Infrastructure Investment Bank

- Bank of Canada Negative Equity

- Canada Emergency Business Account (CEBA) Loans

- Contracting

- Debt Management Strategy

- Projected Deficits

- Disaster Assistance

- Economic Growth Comparisons – G7

- Excess Profit Tax on Large Grocery Companies

- Grocery Affordability

- Housing Affordability and Immigration Growth

- Major Transfers to Provinces and Territories in 2024-25 Main Estimates

- Mortgage Delinquencies

- Price on Pollution and the Canada Carbon Rebate

- Proceeds of Crime, Money Laundering, and Terrorist Financing

- Public Debt Charges

- RBC/HSBC Transaction

- Budget 2023 Spending Reductions – RGS and RPAS

- Indigenous Engagement on Trans Mountain

Alcohol Excise Duty Inflation Adjustment

Issue

Despite the March 9 alcohol excise duty relief announcement, the Conservative Party may continue to advocate against the upcoming increase to excise duty rates.

Key Points

- In Budget 2023, the federal government announced it would temporarily cap the inflation adjustment at two per cent for beer, spirits, and wine excise duties, for one year only, as of April 1, 2023.

- On March 9, the government announced that it proposes to extend the cap on the inflation adjustment factor to two per cent for an additional two years.

- The proposed two-year extension of the two per cent cap recognizes the significant contribution that Canadian wineries, breweries, cideries, and distilleries make to the national economy by creating good jobs and high-quality products.

- The government also proposed to cut by half excise duties on the first 15,000 hL of beer brewed in Canada per year for each brewer.

- The craft beer relief would provide the typical craft brewer with up to $86,952 in additional relief in FY 2024-25.

Anticipated Questions and Answers

1. Why did this government not entirely eliminate the inflation adjustment mechanism?

The government capped the inflation adjustment mechanism last year, and has proposed an extension of the cap for another two years.

The inflation adjustment mechanism only ensures that alcohol excise duties stay constant in real dollar terms. Even before the cap, the increase reflects less than one cent per standard drink. Maintaining this effectiveness over time is an important part of ensuring that alcohol excise duties meet their health objectives.

Under the 2 per cent cap, excise duties are declining in real terms and as a proportion of the retail price of alcohol products.

2. Why do reduced rates apply only to the first 15,000 hL of beer brewed in Canada and not for all reduced rate tiers (up to 75,000 hL)?

The government chose to target local community breweries with this relief. Data shows 94 per cent of breweries in Canada produce below the 15,000 hL threshold. The new reduced rates are, with the exception of Germany, the lowest excise duty rates on beer in the G7.

3. Why is there no support for the wine industry?

The government is supporting the wine industry with the Wine Sector Support Program (WSSP). Originally launched in 2022, the government announced a 3-year extension to the WSSP on March 1, 2024. This three-year extension provides an investment of up to $177 million, bringing total support under the program to $343 million.

Background

Alcohol excise duty rates are adjusted automatically for inflation on April 1 of each year. In 2023, the inflation adjustment factor was set to be 6.3 per cent. The government introduced a 2 per cent cap in Budget 2023 for (at the time) one year only. For the upcoming fiscal year, the inflation adjustment factor is set to be 4.7 per cent.

On March 9, the Minister of Finance and Minister of Small Business jointly announced that the government is proposing to:

- For two additional years, cap the inflation adjustment at two per cent for beer, spirit, and wine excise duties; and,

- For two years, cut by half the excise duty rate on the first 15,000 hectolitres of beer brewed in Canada, to provide the typical craft brewery with up to $86,952 in additional tax relief in 2024-25.

Maintaining the effectiveness of excise duties is an important measure in ensuring the health of Canadians. While a few years of excise duty declines in real terms are not likely to cause changes in demand, over time, the decline of excise duties in real terms could result in increased alcohol consumption. According to the Canadian Centre on Substance Use and Addiction, alcohol use resulted in 18,000 deaths in Canada in 2017 and has been linked to increased risk of cancer, heart disease, liver disease, and stroke.

Asian Infrastructure Investment Bank

Issue

On June 14, 2023, the Deputy Prime Minister and Minister of Finance asked the Department of Finance to review allegations made against the Asian Infrastructure Investment Bank (AIIB) by a former Canadian senior manager at the bank. The Deputy Prime Minister also announced that Canada was halting all activities with the AIIB, pending the outcome of this review.

The Deputy Prime Minister issued an update on Canada's AIIB review on December 8, 2023. As noted in the statement, Canada is continuing its review of the AIIB in consultation with some of its closest international partners. While Canada's engagement with its partners continues, Canada's participation in the AIIB will remain indefinitely suspended.

Key Points

- On June 14, 2023, the Deputy Prime Minister announced that the Government of Canada was halting all government-led activity at the AIIB.

- This step was taken after serious concerns were raised about the AIIB by a former employee.

- The Department of Finance, working with partners across the federal government, including Canada's national security agencies, has undertaken a review of both the allegations raised and Canada's involvement in the AIIB. This internal review has included consultations with many of Canada's closest partners who are also members of the Bank.

- As noted in the statement issued by the Deputy Prime Minister and Minister of Finance on December 8, 2023, Canada is continuing its review of the AIIB in consultation with some of its closest international partners.

- While engagement with our partners continues, Canada's participation in the AIIB will remain indefinitely suspended.

- This suspension includes withdrawing Canadian officials form participation on the AIIB Board of directors, and continuing to withhold any further capital subscription payments owed.

- Canada will continue to follow ongoing developments of the Bank through trusted partners who are active shareholders in the Bank, and with whom we share a collective interest in a transparent and effective international financial architecture.

Background

- Established in January 2016 and based in Beijing, the Asian Infrastructure Investment Bank is a Multilateral Development Bank focused on infrastructure financing in Asia. On March 19, 2018, Canada completed its domestic ratification process and became an operational member of the Bank with a 0.995 per cent shareholding (based on total available AIIB shares). The cost of these shares, as outlined in Budget 2017, was $256 million (US$ 199.1 million). To date, the Government has made four of five payments, amounting to USD 159.3 million. The fifth payment is currently on hold. The Minister of Finance is Canada's Governor to the AIIB.

- On June 14, 2023, the Deputy Prime Minister and Minister of Finance tasked the Department of Finance to lead an expeditious review of allegations raised by Bob Pickard, a former Canadian senior manager at the AIIB, and of Canada's involvement in the AIIB. At the same time, she immediately requested that Canada pause all its activity at the bank, pending the outcome of this review.

- The allegations, which were made publicly on Mr. Pickard's social media accounts, as well as in television/radio interviews and opinion pieces in various print media, argued that: 1) "the AIIB is dominated by Communist Party Members"; 2) "the AIIB has one of the most toxic cultures imaginable"; 3) "Canadian interests are not served by its AIIB membership".

- The Department of Finance, working with partners across the federal government, including Canada's national security agencies, has undertaken a review of both the allegations raised and Canada's involvement in the AIIB. To date, this internal review has included consultations with many of Canada's closest partners, which are also members of the Bank.

- On December 8, 2023, the Deputy Prime Minister and Minister of Finance issued an update on Canada's AIIB review, announcing the continuation of Canada's review of the AIIB in consultation with some of its closest international partners. The statement identified three priorities for Canada's new phase of review:

- Undertaking an analysis of AIIB investments and its governance and management frameworks, as well as assessing whether any further enhancements are needed to decision-making and project selection at the Bank;

- Examining whether existing environmental and social governance safeguards at the Bank are effective and sufficient, with particular concern to forced labour and complaints handling, as well as environmental impacts and gender equality; and,

- Assessing the AIIB's work culture, governance reforms, and management response to the concerns raised in recent months.

- Following the December 8 News Release, Mr. Pickard and officials from the Department of Finance were invited to provide an update on Canada's review of the AIIB to the House of Commons' Special Committee on the Canada–People's Republic of China Relationship on December 11, 2023.

Bank of Canada Negative Equity

Issue

Bank of Canada losses and negative equity may be raised during the Deputy Minister's appearance before the Standing Committee on Finance.

Key Points

- In March 2020 during COVID, the Bank of Canada (Bank) introduced the Government of Canada Bond Purchase Program (GBPP) to provide liquidity to the Canadian financial system.

- At the peak of the purchase program, the Bank had purchased over $300 billion in Government of Canada bonds. These bonds are now declining over time as they mature.

- As interest rates rise, the variable interest (based on the policy rate) the Bank pays on the settlement balances it created to purchase government securities under GBPP has exceeded the fixed interest it receives on the bonds it purchased, so the Bank is now incurring net interest losses.

- The accumulation of these losses has resulted in the Bank of Canada having a negative equity position.

- According to the Bank's 2023 Q3 report, the Bank recorded a net loss of $4.46 billion for the first nine months of 2023. Its negative equity (deficiency) stood at $4.47 billion as of September 30, 2023.

- Going forward, the size and duration of these losses will depend on the path of interest rates.

- Such losses are not unique to the Bank. Many other central banks, including Australia, the U.K. and U.S., are also experiencing such losses.

- Negative equity is not expected to affect the Bank's ability to conduct monetary policy.

- In the Budget Implementation Act, 2023, No. 1 (BIA-1 2023), the government amended the Bank of Canada Act to allow the Bank to not pay the government dividends until such time as the Bank exits from its current negative equity situation.

Canada Emergency Business Account (CEBA) Loans

Issue

The final repayment deadline to still receive partial forgiveness for the Canada Emergency Business Account (CEBA) program is March 28, 2024.

Key Points

- The CEBA program was available from April 2020 to June 2021, and provided $49 billion in interest-free, partially forgivable loans of up to $60,000 to nearly 900,000 small businesses and not-for-profit organizations to help cover their operating costs during the pandemic.

- As of March 15, 2024, approximately $39.1 billion, or 80 per cent, of all CEBA loan value has been repaid or forgiven. The outstanding balance of all CEBA loans is approximately $9.9 billion.

- The outstanding balance of $9.9 billion is an overestimate due to lags in data reporting.

- We expect there may be a small increase in repayments as we near the March 28, 2024, repayment for forgiveness deadline for CEBA borrowers captured by the refinancing extension.

- As of January 19, 2024, outstanding loans, including those that are captured by the refinancing extension, converted to three-year term loans, with five per cent interest per annum, with the outstanding principal due on December 31, 2026.

- For those that are unable to repay, the CRA will work with each business to determine its ability to repay, emphasizing fairness, empathy, and putting people first.

Anticipated Questions and Answers

1. What are the CEBA repayment deadlines?

The repayment deadline to receive forgiveness of up to $20,000 was January 18, 2024. For CEBA loan holders who applied for refinancing with the financial institution that provided their CEBA loan by January 18, 2024, the repayment deadline to qualify for partial loan forgiveness included a refinancing extension until March 28, 2024.

As of January 19, 2024, outstanding loans, including those that are captured by the refinancing extension, converted to three-year term loans, subject to interest of 5 percent per annum, with the term loan repayment date extended by an additional year from December 31, 2025, to December 31, 2026.

If prompted on ineligible loan holders:

Ineligible loan holders (about 6% of the CEBA loan holder population) did not qualify for partial loan forgiveness and were required to repay the CEBA loan by December 31, 2023 (i.e., their loan did not convert to a three-year term loan). As of January 31, 2024, official reporting shows that approximately 13,000 ineligible loans have been fully repaid and 37,500 are outstanding. The outstanding principal of ineligible loans is $1.35 billion.

2. What will happen to businesses that cannot repay by the applicable deadline?

Regardless of eligibility, in the period of 45 days after default, the loan holder's financial institution will contact them twice to request repayment of the outstanding debt, followed by the issuance of a demand letter. After 30 days (total 75-day period), if they are unable to meet their CEBA payment obligations, their loan will likely be assigned to the Canada Revenue Agency (CRA) for collection efforts.

The CRA will work with each business to determine its ability to repay, emphasizing fairness, empathy, and putting people first. The CRA will review the loan holder's circumstances on a case-by-case basis and may work with them to establish a payment arrangement or repayment plan tailored to their ability to repay.

3. What are the statistics on CEBA repayments?

Official reporting from Export Development Canada (EDC) indicates that as of March 15, 2024, total repayments for all CEBA loans are $27.4 billion, forgiveness reported by financial institutions is $11.7 billion, and outstanding principal is $9.9 billion (approximately 80% of loan value repaid).

This is an underestimation, as it does not account for partial loan forgiveness in March and it only accounts for repayments that had flowed back to EDC as there may be a few-days lag between when a loan is repaid at an FI and when EDC is repaid.

Background

- CEBA was launched to support Canadian businesses that had been adversely affected by the COVID-19 pandemic. CEBA provided interest-free loans of up to $60,000 to small businesses to help cover their operating costs. The deadline to apply to the program was June 30, 2021.

- For eligible borrowers, repayment of the loan by the deadline of January 18, 2024, resulted in loan forgiveness of up to 33 per cent (up to $20,000). Additionally, the repayment deadline to qualify for partial loan forgiveness includes a refinancing extension until March 28, 2024.

- As of January 19, 2024, outstanding loans, including those that are captured by the refinancing extension, converted to three-year term loans, subject to interest of five per cent per annum, with the outstanding principal due on December 31, 2026.

- The CEBA program initially offered $40,000 loans with $10,000 in forgiveness (e.g., 25 per cent forgiveness). In December 2020, CEBA loan holders who had received the $40,000 CEBA loan were able to apply for the CEBA expansion, which offered eligible businesses an additional $20,000 of financing with another $10,000 in forgiveness (e.g., for a total of 33 per cent forgiveness).

- Forgiveness is granted when the loan holder has repaid $40,000 for $60,000 CEBA loans or $30,000 for $40,000 CEBA loans. Although it is a zero-interest loan, some loan holders have elected to make partial repayments – but will not receive forgiveness until they have fully repaid by the repayment deadline (January 18/March 28).

Collections and Enforcement

- EDC, in collaboration with the CRA, is currently in the process of implementing a collections approach that aligns with the strategies utilized for other COVID-19 relief programs. We expect for CRA to start contacting loan holders in default in Spring 2024.

- The CRA's approach to collecting funds will emphasize fairness, empathy and putting people first. Practically speaking, the CRA will work with loan holders to help them resolve their debts based on their ability to pay in order to avoid financial hardship. This may include expanded and flexible payment arrangements, or deferred repayment, to allow more time for loan holders to repay their debts.

- *Redacted*

Administration

- CEBA is administered by EDC via the Canada Account and is delivered in partnership with over 230 financial institutions. While the Canada Account, as managed by EDC, is typically limited to supporting Canadian exporters as per EDC's legislative mandate, the Government temporarily expanded EDC's mandate to include domestic supports as part of the Government's economic response to the COVID-19 pandemic.

Contracting

Issue

Recent changes have been made to procurement practices to meet evolving requirements and ensure greater oversight and controls over procurement activities within the department. These changes are also in response to the recent audit findings by the Office of the Auditor General (OAG) and the Office of the Procurement Ombudsman (OPO) audits on McKinsey contracts, the OAG audit findings on ArriveCAN as well as current scrutiny from the public and parliamentary committees around the procurement function.

Key Points

- Contracting for goods and services at the department is highly centralized under the guidance of the CFO and DCFO who is also the Senior Designated Official for the management of Procurement.

- The department has recently increased its oversight over the procurement function by implementing a departmental procurement management framework, consisting of processes, systems and controls. There is now a formal procurement planning exercise in place to ensure procurement strategies are aligned with departmental priorities and investment plan and compliant with current policies and legislations.

- Enhanced controls have also been implemented, such as the introduction of a new Procurement Review Board and the inclusion of new internal controls on contracting in the department's Internal Control Framework over Financial Management.

- Procurement tools, guidance, processes and documentation for procurement professionals and delegated managers have been reviewed and updated. This includes the new TB Manager's Guide: Key Considerations When Procuring Professional Services.

Background

The department's total contracting activity for CY 2023 represented 155 contracts and amendments valued over $10K for a total of $9,781,563. This amount includes both contracts awarded by FIN, and by PSPC or SSC on the department's behalf.

The Department's contracting activity specific to Professional and Special Services contracts valued over $10K is below. All contracts were awarded by FIN.

| Description | Number of Transactions | Contracting Activity ($) |

|---|---|---|

| Other Professional Services | 21 | $1,204,354 |

| Language Training | 13 | $914,994 |

| IT Consultants | 2 | $74,591 |

| Protection Services | 2 | $67,550 |

| Accounting and Audit Services | 2 | $65,540 |

| Other Business Services | 4 | $55,538 |

| Translation Services | 1 | $39,916 |

| Temporary Help Services | 2 | $25,724 |

| Hospitality | 1 | $23,814 |

| Management Consulting | 1 | $19,617 |

| Total | 49 | $2,491,638 |

Note: Values are based on awarded contract value, not total expenditures. Information is from the Open Government website. |

||

Finance Responses to House Committee Requests for Contracts (2023-)

1. Contracts and agreements with McKinsey since 2011 - Government Operations Committee (March 2023)

- The Department of Finance identified one contract with McKinsey awarded on June 22, 2011.

- The total contract value was $743,000, including taxes, and was to assist the Task Force for the Payments System Review in transforming the various inputs and analyses into a coherent statement about the preferred future for the payments system in Canada (Conceptual Framework for the Evolution of the Canadian Payments System).

- The independent Task Force, announced in Budget 2010, was appointed by the Government to conduct a comprehensive review of the Canadian payments system and make recommendations to the then Minister of Finance. The task force was asked to review the safety, soundness and efficiency of the payments system; whether there was sufficient innovation in the system; the competitive landscape; whether businesses and consumers were being well served; and whether current payment system oversight mechanisms remained appropriate.

- Finance's response also included Letters of Agreement, and related documents from 2016 to 2019, for Dominic Barton, then McKinsey and Company Global Managing Partner, related to his appointment as Chair of the Advisory Council on Economic Growth.

2. Contracts with GCStrategies, Dalian, and Coradix - Government Operations Committee (October 2023)

- The only relevant contract Finance had was with Dalian from 2012.

- The contract was awarded by Public Services and Procurement Canada (PSPC), on the department's behalf, on March 22, 2012. The total contract value was $216,351.25, including taxes, and was to provide proxy appliances for the department's computer network. The proxy appliances were routers that acted as an "intermediary" between FIN employees and the internet to help prevent cyber-attacks on the Department's networks.

3. Contracts with GCStrategies, Dalian, and Coradix – Public Accounts Committee (December 2023)

- Request, and therefore the response, was effectively the same as for the Government Operations Committee request 2. noted immediately above.

4. Contracts with companies incorporated by the co-founders of GCStrategies – Public Accounts Committee (March 2024)

- This request was an expansion of the Public Accounts Committee request noted immediately above.

- Finance will be providing the committee a nil response on the afternoon of Thursday, March 21.

Debt Management Strategy

Key Points

- Total borrowing needs in 2023-24 are expected to reach $492 billion, $71 billion higher than planned in Budget 2023.

- This reflects $381 billion for refinancing debt coming to maturity and $111 billion for financial requirements for 2023-24.

- The increase in borrowings compared to Budget 2023 can be explained by higher financial requirements, mismatches between the timing of large outgoing payments and incoming receipts and the purchase of Canada Mortgage Bonds (CMBs).

- The government announced in the FES that it will purchase up to an annual maximum of $30 billion of Canada Mortgage Bonds (CMBs) in order to generate net revenues to fund affordable housing initiatives. The government started to purchase CMBs on February 14, 2024.

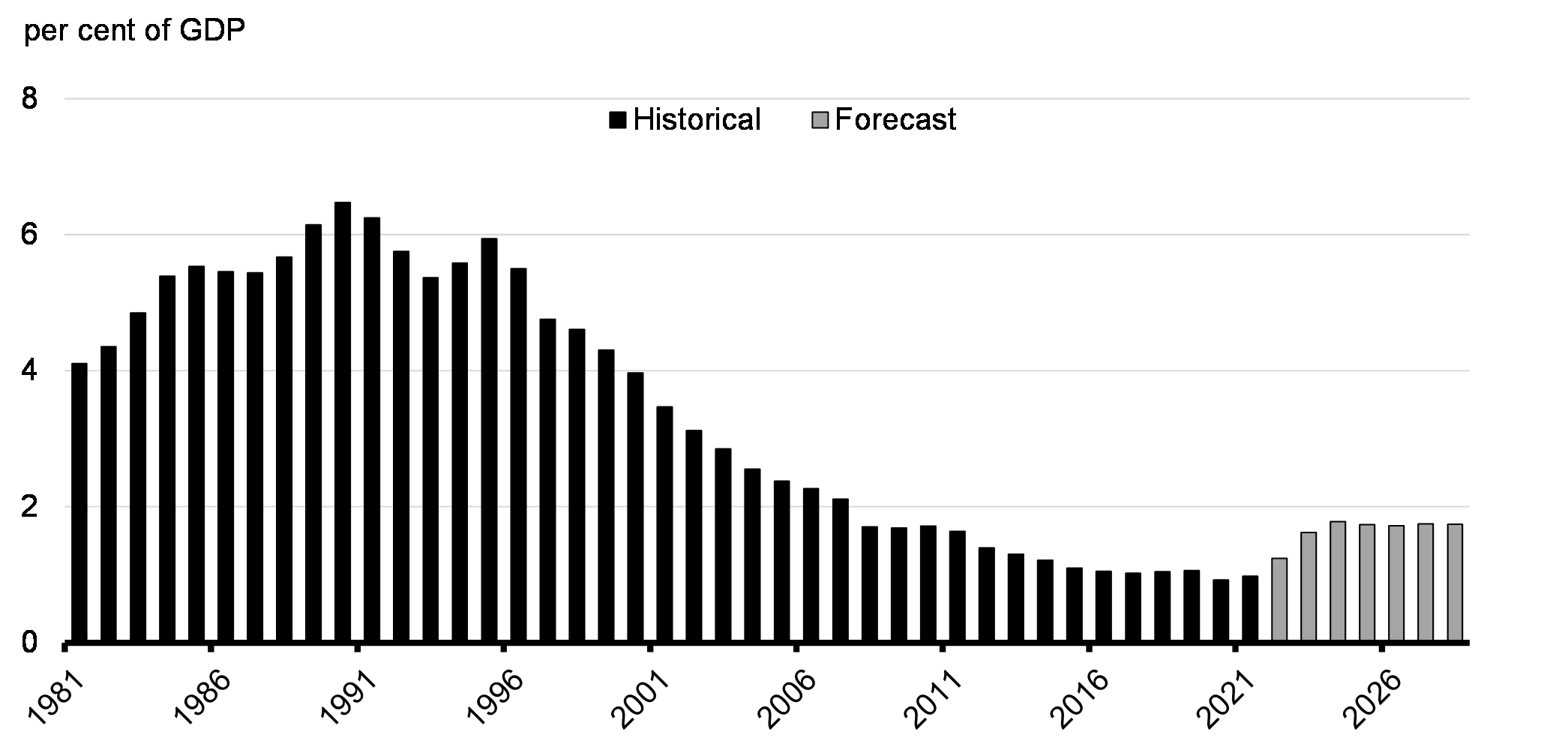

- Despite higher interest rates, debt charges as a share of GDP remain near historic lows.

- Debt charges are expected to account for 1.6 per cent of GDP in 2023-24, which is far below the historical average of 3.4 per cent since 1981 and below that of G7 peers.

- The government successfully issued a $4 billion, second green bond on March 5. Canada is the first sovereign to include nuclear energy in its Green Bond Framework, reflecting the importance of nuclear in Canada's Emissions Reduction Plan, and updated taxonomies and investor preferences more open to nuclear.

- Government borrowing is managed under the Financial Administration Act and the Borrowing Authority Act (BAA). Under the BAA framework, the government is required to table a report every three years on the government's total outstanding debt. This includes Government of Canada debt, borrowings by agent crowns, and Canada Mortgage Bonds (CMBs). This total is estimated to be about $1,694 billion at the end of March 2024.

- The government's total outstanding debt is subject to a legislated maximum amount of $1,831 billion under the BAA. The report is required to provide an assessment of whether or not this maximum amount should be changed.

- The next Borrowing Authority Act report is required to be tabled by May 31, 2024.

Anticipated Questions and Answers

Update of the Debt Management Strategy (FES 2023)

1. Why did the government increase borrowing in the 2023 Fall Economic Statement (FES)?

- Borrowing needs in FES 2023 increased to reflect higher financial requirements, including funding for government's purchases of CMBs, and mismatches between the timing of large outgoing payments and incoming receipts.

- Details on the updated borrowing program can be found in Tables 1 & 2 of the Annex section of this document.

2. What effect do higher interest rates have on debt service costs?

- Current public debt charges reflect past debt issuances and the interest rates prevailing at the time. Public debt charges are expected to reach $46.5 billion or 1.6 per cent of GDP in 2023-24.

- Reflecting higher interest rates, public debt charges in the future will increase as new debt is issued. However, over the next five years, public debt charges as a share of GDP are expected to remain stable at 1.7 per cent as the economy grows.

- Public debt charges will continue to remain far below the historical average over the past 40 years.

3. What is the government's average term to maturity?

- The average term to maturity is expected to reach 6.7 years by the end of 2023-24. This is higher than the pre-COVID average of 6.4 and reflects recent government decisions to favour issuance of long-bonds.

4. Will the increase in borrowing impact Canada's AAA credit rating?

- The higher borrowing requirements are not expected to significantly increase Canada's net debt to GDP ratio. Furthermore, while interest rates have risen since Budget 2023, debt charges are expected to remain well below historical average, at 1.6 per cent of GDP this year.

5. Will this increase cause Canada to breach the Parliamentary Borrowing Authority?

- The increase in the 2023-24 borrowing limit is consistent with the legislated maximum borrowing limit of $1,831 billion set out in the Borrowing Authority Act. The incremental borrowing needs will bring the amount outstanding to $1,694 billion by the end of 2023-24.

6. What's the 1-month treasury-bill item mentioned in FES 2023?

- Changes are expected in the market as it adjusts from using one reference short term interest rate to another. Stakeholders had requested that the government consider issuing 1-month treasury-bills to help in the transition. This is something we are still considering.

2024-25 DMS Estimates

7. What is the government's expectation with respect to borrowing in 2024-25?

- FES 2023 projected a $30 billion increase of financial requirements in 2024-25 relative to 2023-24. Combined with a greater amount of government securities coming up for maturity that have to be refinanced, this would lead to an increase of borrowing needs in 2024-25.

Canada Mortgage Bonds

8. What is the government doing regarding Canada Mortgage Bonds?

- The federal government announced in FES 2023 that it would buy up to an annual maximum of $30 billion in CMBs. The government started to purchase CMBs on February 14, 2024. This is intended to generate net revenues to fund initiatives such as affordable housing.

9. How will the purchase of CMBs affect the government's debt?

- Although the government will issue new debt to purchase CMBs, these transactions will have no impact on the government's net debt since the government will hold an equivalent nominal amount of financial assets.

Annual Borrowing Authority

10. Why was the borrowing limit for 2023-24 increased or why did borrowing needs increase if deficit remained the same?

- Although deficit for 2023-24 remained in line with Budget 2023, the government's cash needs increased reflecting increased financial requirements.

- As such, the higher borrowing requirements are not expected to materially increase Canada's net debt.

11. What is the annual borrowing limit for 2024-25?

- We are in the process of seeking the Governor in Council approval for the 2024-25 annual borrowing limit.

- Once approved, the Order in Council will be posted on the Privy Council Office's website.

Borrowing Authority Act

12. What is the Borrowing Authority Act?

- Enacted in 2017, provides the Minister of Finance the authority to borrow money up to a maximum overall amount as set by Parliament.

- The maximum amount applies to the total outstanding debt of the federal government, its agent Crown corporations, and CMBs issued by the Canada Housing Trust.

- The Act also stipulates that a report must be published on a regular basis.

13. What is the Borrowing Authority Act Report and when will it be published?

- The Borrowing Authority Act report gives a detailed account of the amounts borrowed by the Minister, agent Crown corporations, and Canada Mortgage Bonds guaranteed by Canada Mortgage and Housing Corporation. The report also provides an assessment to parliament on whether the maximum borrowing amount under that Act should be increased or decreased.

- It is projected that the combined debt stock (total borrowings) will be $1,694 billion at the end of FY 2023-24. The maximum borrowing authority limit is $1,831 billion.

- The report was last tabled in November 2020, hence the Act requires the next report to be tabled on or before May 31, 2024.

14. What are our plans for the maximum borrowing limit?

- Based on preliminary Budget 2024 estimates for financial requirements, the government's borrowing needs will remain below the maximum borrowing authority limit of $1,831 billion at the end of fiscal year 2024-25.

- Under the Borrowing Authority Act (BAA), the Minister must table a report to Parliament on the borrowing activities of the government every three fiscal years and provide and assessment of whether the maximum amount of borrowings should be increased or decreased.

- We are in the process of assessing the maximum limit, the result of which will be presented in the Borrowing Authority Act report, and tabled in parliament before May 31, 2024, as required by the Borrowing Authority Act.

ESG Debt Program

15. What was the rationale for including nuclear energy in Canada's Green Bond Framework?

- The Green Bond Framework was updated to better align with Canada's Emissions Reduction plan, which recognizes the role of nuclear energy in achieving net zero.

- This recognizes that nuclear energy will remain an important part of Canada's energy mix in a low carbon future and will facilitate investments to meet Canada's climate commitments.

- The Green Bond Framework was also updated to reflect international trends and updated market expectations with respect to nuclear energy as an eligible use of green bond proceeds.

Annex 1

| Budget 2023 | FES 2023 | |

|---|---|---|

| Total Borrowing Needs1 | 421 | 492 |

| Refinancing Needs | 358 | 3812 |

| Financial Requirement | 63 | 111 |

| Debt Charges | 43.9 | 46.5 |

| Debt charges to GDP | 1.6 | 1.6 |

Sources: Department of Finance Calculations, Bank of Canada Note: 2 This includes the amount required to pre-fund the April 1, 2024 maturity. |

||

| 2022-23 Actual |

2023-24 Budget 2023 |

2023-24 FES 2023 |

Change from Budget 2023 | |

|---|---|---|---|---|

| Treasury Bills | 202 | 242 | 281 | 39 |

| 2-year | 67 | 76 | 86 | 10 |

| 3-year | 20 | 6 | 6 | 0 |

| 5-year | 31 | 40 | 47 | 7 |

| 10-year | 52 | 40 | 47 | 7 |

| 30-year | 14 | 10 | 14 | 4 |

| Green Bonds | - | 0 | 4 | 4 |

| Total Bonds | 185 | 172 | 204 | 32 |

| Total Gross Issuance | 387 | 414 | 485 | 71 |

| Share of Long Bonds to Total Bonds | 36% | 29% | 30% | +1% |

Sources: Bank of Canada; Department of Finance Canada calculations. Notes: Numbers may not add due to rounding. Issuance decision subject to factors such as availability of eligible expenditures and market conditions. 3 Domestic issuance does not include issuance in foreign currencies ($7 billion in 2023-24). |

||||

Projected Deficits

Key Points

- The government recorded a $35.3 billion deficit in 2022-23, $7.7 billion lower than the $43.0 billion projected for the year in Budget 2023.

- The Fall Economic Statement 2023 projects a $40 billion deficit for this year, or 1.4 per cent of GDP, below that projected in Budget 2023.

- Deficits are then expected to decline over the forecast horizon, reaching $18.4 billion, or 0.5 per cent of GDP, by 2028-29.

- As a result, the government continues to deliver on its on its fiscal anchor, enabling Canada's federal debt-to-GDP ratio to decline in 2025-26 and future years, reaching 39.1 per cent in 2028-29 – about 8 per cent lower than its recent peak of 47.5 per cent in 2020-21.

- In addition, in the Fall Statement, the government announced the three fiscal objectives for Budget 2024:

- Maintaining the 2023-24 deficit at or below the Budget 2023 projection of $40.1 billion.

- Lowering the debt-to-GDP ratio in 2024-25, relative to the Fall Economic Statement, and keeping it on a declining track thereafter.

- Maintaining a declining deficit-to-GDP ratio in 2024-25 and keeping deficits below 1 per cent of GDP in 2026-27 and future years.

- The government will table updated economic and fiscal projections in Budget 2024 on April 16th.

Anticipated Questions and Answers

1. What explains the better-than-expected 2022-23 result relative to Budget 2023?

Overall, the economy remained stronger than expected and revenues were $10.6 billion higher than forecast. This was primarily due to higher tax revenues driven by higher-than-expected corporate income tax revenues.

Program expenses, excluding net actuarial losses, were $2.6 billion higher than expected, largely a result of higher-than-anticipated provisions for claims and contingent liabilities.

Public debt charges were $0.5 billion higher than projected resulting from higher-than-expected interest charges on unmatured debt due to higher-than-anticipated borrowing requirements toward the end of the fiscal year, offset in part by lower-than-expected interest expenses on future benefit obligations.

Net actuarial losses were $0.2 billion lower than projected.

2. What explains the deterioration in the budgetary balance from $35.3 billion in 2022-23 to $40 billion in 2023-24 as shown in the 2023 Fall Economic Statement?

The deficit is projected to rise $4.7 billion 2023-24 due to slow revenue growth and rising expenses this fiscal year. The weak expected revenue growth (up only 1.9 per cent) results from the slowdown in economic growth expected by private sector forecasters. Nominal GDP, the broadest measure of the tax base, is expected to grow by only 2 per cent in 2023 (versus 11 per cent in 2022).

Expenses in 2023-24 are expected to be higher than in 2022-23, due to higher major transfers to persons (in part because of the indexation of benefits to inflation), higher transfers to other levels of government (due to legislated arrangements and other agreements), and higher public debt charges resulting largely from the projected rise in interest rates.

3. Last year, the year-to-date deficit as of December was $5.5 billion and the government ended the year with a $35.3-billion deficit. This year, the government is already running a $23.6-billion deficit as of December, but has committed to a deficit no larger than $40 billion for the year. This does not seem likely.

Last year, the government incurred several large, anticipated expenses late in the year that are either not expected to be repeated this year, or are expected to be substantially lower. These expenses included the $2.7 billion Grocery Rebate, $2.0 billion Canada Health Transfer top-up, and those associated with Indigenous claims.

Realizing a $40-billion deficit will be challenging, but provided revenues maintain their current momentum, and the government controls spending, it is certainly achievable.

Disaster Assistance

Issue

Media have published stories comparing 2023-24 and 2024-25 Main Estimates for Public Safety, noting that while Canada has faced more emergencies related to weather and wildfires, the estimates call for a drop in spending for Public Safety by 46% from the $2.6 billion allocated last year to $1.6 billion in 2024-25.

Key Points

- Comparing Main Estimate totals does not present an accurate picture of spending. The apparent decrease is due to the timing of forecasted payments under the Disaster Financial Assistance Arrangements (DFAA):

- Through the DFAA, the federal government reimburses provinces and territories for up to 90% of eligible response and recovery expenses. Provinces and territories must request assistance from the federal government and submit their estimated costs, with final payments often occurring more than five years after the event.

- Funding for any given year depends on the active natural disaster events and when provinces and territories submit expense claims. The Main Estimates 2023-24 showed that the government anticipated to provide $1.7 billion to provinces and territories for natural disasters in that fiscal year, whereas in 2024-25, the Government anticipates providing $550 million.

- The DFAA is an uncapped program, so there is no maximum federal contribution to support provinces and territories in response to natural disaster events. Final figures depend on provinces and territories' actual expenditures.

Anticipated Questions and Answers

1. Why is the federal government providing less funding to provinces and territories for assistance related to natural disasters in 2024-25 than in 2023-24?

The federal government reimburses provinces and territories for up to 90% of response and recovery costs. Required funding fluctuates each year, depending on open disaster events and when provinces and territories submit their expenses. Payments do not necessarily happen the same year as the disaster occurred, as provinces and territories are reimbursed after the fact based on expenses they submit.

2. How much funding is the federal government expecting to provide for provinces and territories under the DFAA in the coming years?

As of December 31, 2023, Public Safety's outstanding liability for 72 active natural disasters where an Order in Council was approved but final payments have not been made, was $4.93 billion, the majority of which is expected to be paid out over the next five years.

The most significant events within this liability are as follows:

- British Columbia 2021 November Storm ($1.4 billion);

- British Columbia 2021 Flood & Landslides ($581 million);

- Alberta 2013 June Flood ($410 million);

- British Columbia 2020 Flood & Landslides ($410 million);

- Manitoba 2022 Spring Flood ($212 million); and

- Quebec 2019 Spring Flood ($163 million).

Background

When large-scale disasters occur, the federal government covers up to 90% of eligible response (e.g., evacuation supports) and recovery (repairs and reconstruction to infrastructure) expenses through the Disaster Financial Assistance Arrangements (DFAA). Since 1970, the Government of Canada has provided over $7.9 billion to provinces and territories through this program – 73% in the past ten years.

Provinces and territories may make a request for assistance under the DFAA within six months after a natural disaster occurs. In response to the request, Public Safety would work on an Order in Council (OiC) that would officially declare the disaster to be of concern to the Government of Canada and authorize financial assistance.

Following approval of the OiC, advance, interim, and final DFAA payments are made at the request of the provinces and territories following a submission of expenditures. Normally, PTs have up to five years after OiC approval to request a final payment, but PTs can also request an extension if necessary.

Economic Growth Comparisons – G7

Issue

How Canada compares to its G7 peers on key macroeconomic metrics.

Key Points

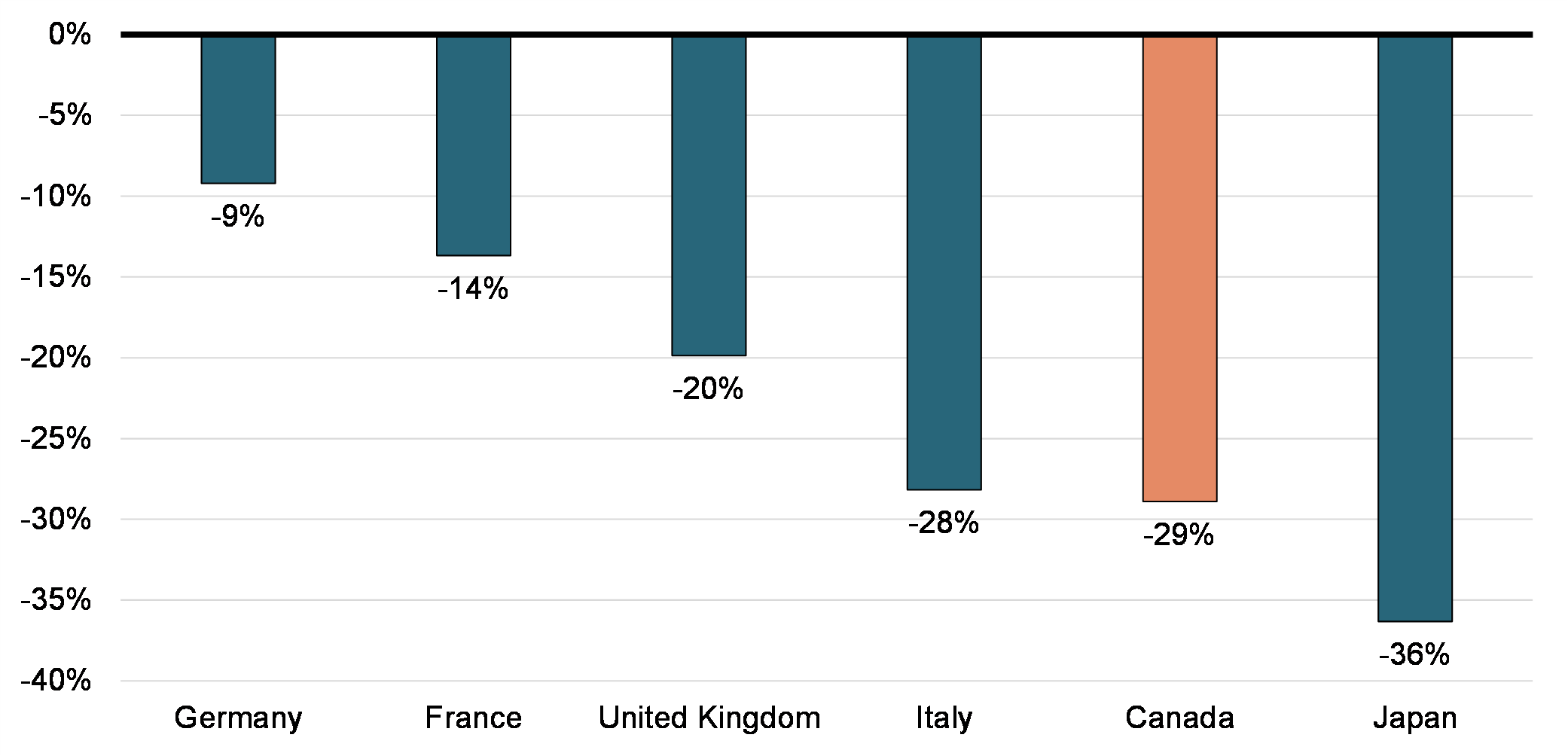

- Canada's macroeconomic performance compares well against its G7 peers.

- Canada has had the strongest employment recovery since the pandemic.

- Canada has had the second strongest real GDP recovery since the pandemic.

- Canada is expected to see the fastest growth in the G7 in 2025, according to the IMF and OECD.

- Canada's inflation has come down, but like most of its peers remains above target.

- Despite this strength, Canada has recently experienced weakness in GDP per capita growth—a key indicator of a country's living standards.

- This largely reflects temporary factors, including soft economic growth in the face of higher interest rates, as well as a surge in newcomers to Canada, who are just beginning to integrate in the economy.

- As interest rates fall and the skills and talents of newcomers are being fully utilized, GDP per capita is expected to rebound. Canada ranked third in the G7 behind the U.S. and Germany for the level of GDP per capita in 2022.

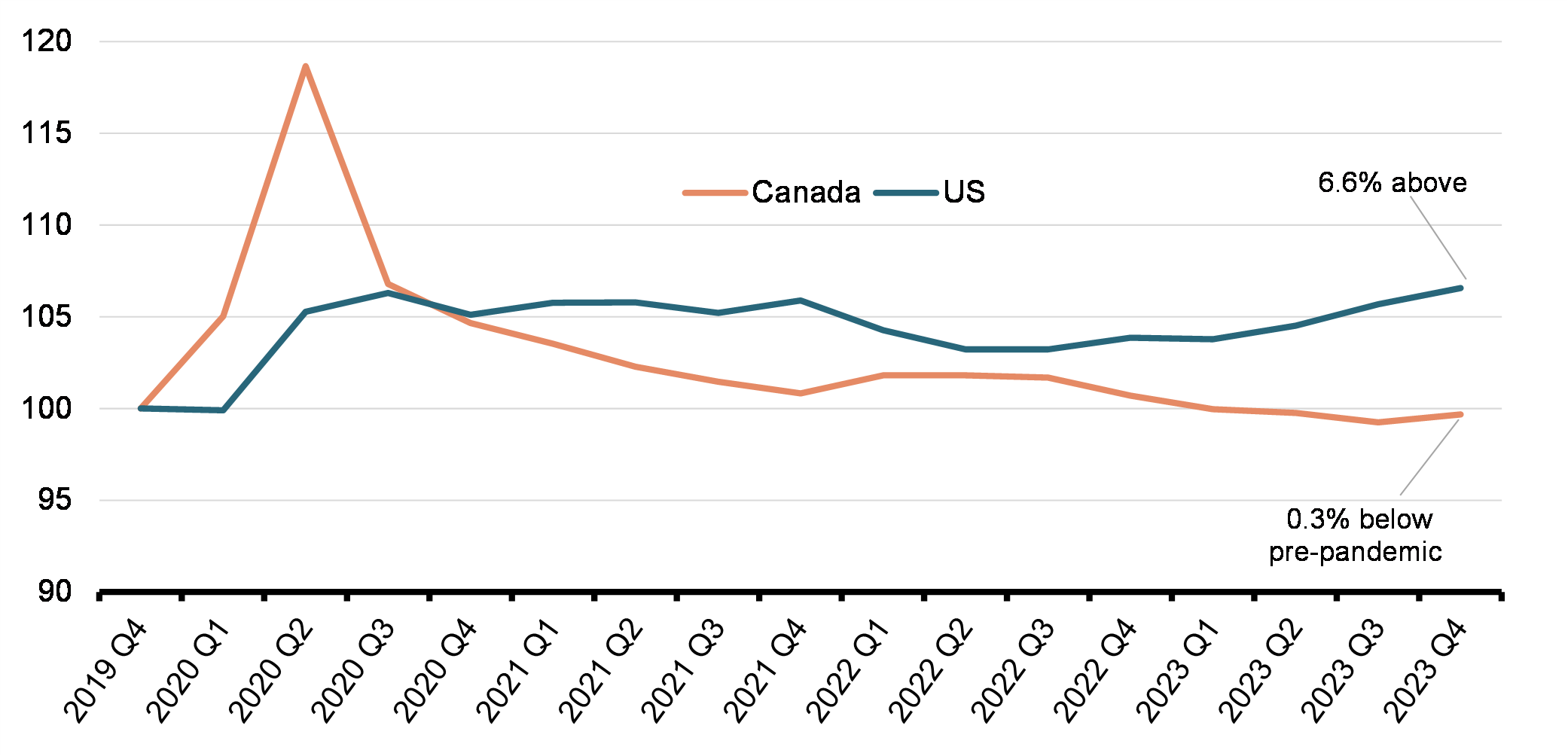

- Canada continues to struggle with longstanding issues with weak productivity growth, which will impact growth in GDP per capita over the long-run.

- Between the mid-1980s and 2019, Canada's productivity relative to the U.S. declined from nearly 90 per cent to just 73 per cent.

- Canada's productivity growth has continued to struggle in the post-pandemic period, with negative growth in business sector productivity over much of 2022 and 2023.

- From 2019 to 2022, Canada's productivity growth was in the middle of the G7 and 14th slowest among 38 OECD countries.

- As of 2022, Canada has the second lowest level of productivity in the G7 and is ranked 18th out of 38 OECD countries.

- To help Canada overcome these challenges in a global economy that is transitioning to net zero, the federal government has put in place various measures to spur investment and productivity growth.

- Since Budget 2021, the government has announced new major investment tax credits for clean electricity, clean technology, clean technology manufacturing, hydrogen, and carbon capture, utilization and storage, which total over $80 billion in support.

- The government has also secured more than $34 billion of public and private investments in EV battery assembly and auto supply chain since 2020.

- The Canada Growth Fund, a $15 billion arm's length public investment vehicle, has been launched and will de-risk and bolster private investment in low-carbon projects, technologies, businesses, and supply chains.

Background

| Latest | |

|---|---|

| Canada | 6.1 |

| France | 5.0 |

| Germany | 3.5 |

| Italy | 3.0 |

| U.S. | 1.4 |

| U.K. | 0.7 |

| Japan | 0.0 |

Notes: Last data points are February 2024 (Canada, U.S.), January 2024 (Germany, Italy, Japan), 2023Q4 (U.K., France). Compares to the level of February 2020, except for France and the UK (2019Q4). Source: Haver Analytics. |

|

| December | January* | February | |

|---|---|---|---|

| U.K. | 4.0 | 4.0 | -- |

| France | 3.7 | 3.1 | 3.0 |

| U.S. | 3.4 | 3.1 | 3.2 |

| Germany | 3.7 | 2.9 | 2.5 |

| Canada | 3.4 | 2.9 | 2.8 |

| Japan | 2.6 | 2.1 | -- |

| Italy | 0.6 | 0.8 | 0.8 |

*ranked by January |

|||

| %, quarterly change at annual rate | % change* | ||||

|---|---|---|---|---|---|

| 23Q2 | 23Q3 | 23Q4 | 2019Q4 to 2020Q2 | 2019Q4 to 2023Q4 | |

| U.S. | 2.1 | 4.9 | 3.2 | -9.1 | 8.2 |

| Canada | 0.6 | -0.5 | 1.0 | -12.7 | 4.4 |

| Italy | -1.0 | 0.9 | 0.7 | -17.2 | 4.2 |

| Japan | 4.2 | -3.2 | 0.4 | -7.3 | 3.1 |

| France | 2.5 | 0.0 | 0.2 | -17.7 | 1.9 |

| U.K. | 0.0 | -0.5 | -1.4 | -22.5 | 1.0 |

| Germany | 0.1 | 0.0 | -1.1 | -10.8 | 0.1 |

*Ranked by 19Q4 to 23Q4 growth |

|||||

| %, quarterly change at annual rate | % change* | |||

|---|---|---|---|---|

| 23Q2 | 23Q3 | 23Q4 | 19Q4-23Q4 | |

| U.S. | 1.6 | 4.2 | 2.6 | 6.7 |

| Italy | -0.7 | 1.0 | 0.7 | 5.5 |

| Japan | 4.2 | -2.5 | - | 4.3 |

| France | 2.2 | -0.4 | -0.2 | 0.4 |

| U.K. | -0.5 | - | - | -0.2 |

| Germany | -0.3 | -0.4 | -1.6 | -1.7 |

| Canada | -1.8 | -4.0 | -3.2 | -2.5 |

*Ranked by 19Q4 to 23Q4 growth. Data for Japan ends in 2023Q3 and for U.K. in 2023Q2. Constant US$, OECD PPP. |

||||

| 2003 | 2022* | |||

|---|---|---|---|---|

| Level ($US) | Relative to US | Level ($US) | Relative to US | |

| U.S. | 39,418 | 100 | 77,176 | 100 |

| Germany | 30,322 | 77 | 66,500 | 86 |

| Canada | 32,393 | 82 | 62,160 | 81 |

| France | 28,217 | 72 | 57,160 | 74 |

| U.K. | 30,302 | 77 | 56,742 | 74 |

| Italy | 29,173 | 74 | 55,863 | 72 |

| Japan | - | - | 47,201 | 61 |

*Ranked by 2022 level. Current US$, OECD PPP. |

||||

| Current Projection* | |||

|---|---|---|---|

| 2023 | 2024 | 2025 | |

| Canada | 1.1 | 1.4 | 2.3 |

| U.S. | 2.5 | 2.1 | 1.7 |

| France | 0.8 | 1.0 | 1.7 |

| U.K. | 0.5 | 0.6 | 1.6 |

| Germany | -0.3 | 0.5 | 1.6 |

| Italy | 0.7 | 0.7 | 1.1 |

| Japan | 1.9 | 0.9 | 0.8 |

*Ranked by 2025 projection IMF World Economic Outlook (January 2025) |

|||

| Latest | |

|---|---|

| U.S. | 4.3 |

| Germany | 2.3 |

| U.K. | 2.2 |

| Canada | 1.8 |

| Japan | 1.5 |

| Italy | 1.0 |

| France | -3.3 |

*Based on constant US$, OECD PPP. |

|

Productivity Gap with US, G7, 2022

Business-sector Productivity, Canada and US (2019 Q4 = 100)

Excess Profit Tax on Large Grocery Companies

Issue

The NDP has proposed "an excess profit tax on large grocery companies that would put money back in the people's pocket with a GST rebate and establish a National School Food Program." The NDP has also indicated that the proposed tax would help to address inflation.

Key Points

- The Government of Canada has taken a range of actions to address tax fairness and cost-of-living pressures.

- To make the tax system fairer, the government has reduced taxes for the middle class while implementing measures to ensure that the wealthiest individuals and corporations are contributing their fair share.

- The government will continue to look at ways to improve the fairness of the tax system and support Canadians who need help most.

Background

One of the government's first actions after taking office was to reduce the rate of the second personal income tax bracket from 22 per cent to 20.5 per cent, while introducing a new top bracket of 33 per cent for the wealthiest Canadians. The government also increased the amount of income middle-class Canadians can earn before paying tax (the basic personal amount) by almost $2,000.

In addition, the government has:

- Permanently increased the corporate income tax by 1.5 per cent on bank and insurance company groups in Canada, and introduced a one-time Canada Recovery Dividend of 15 per cent the largest bank and insurance company groups;

- Introduced a 2 per cent tax that applies on the net value of share buybacks by public corporations in Canada;

- Implemented a luxury tax on private jets and luxury cars priced over $100,000 and boats priced over $250,000; and

- Proposed to modernize the Alternative Minimum Tax to ensure that the wealthiest Canadians do not avoid paying their fair share through the significant use of deductions, credits, and other tax preferences.

The government has also taken action through the tax system to support those who are the most affected by cost-of-living pressures driven by inflation, including through the introduction of one-time targeted payments such as the doubling the GST Credit for six months in the fall of 2022 and the Grocery Rebate in July 2023.

Through the federal pollution pricing system, the government is also putting a price on pollution while making life more affordable for families through the Canada Carbon Rebate.

Grocery Affordability

Issue

Federal initiatives in relation to grocery affordability.

Key Points

- Various factors, such as Russia's invasion of Ukraine and climate change, are playing a role in elevating the price of groceries.

- The federal government is taking a multi-prong approach to address the affordability of groceries in Canada. This includes:

- Amendments to the Competition Act that aim to support a competitive marketplace to help stabilize prices.

- Seeking to recruit new entrants into the market to increase to further increase competition and choice for consumers.

- Improving the availability and accessibility of data on food prices through its Food Price Data Hub, and monitoring prices and other inflationary practices through the Grocery Task Force to hold the sector to account.

- To ensure that Canada has a resilient and competitive grocery supply chain that benefits everyone, the government also sees a major role for a grocery code of conduct in improving predictability, transparency, and the principles of fair dealing.

Anticipated Questions and Answers

1. What are the government initiatives to support grocery affordability?

Among other actions, to improve the competitive landscape in the grocery sector, and help stabilize the price of groceries, and other essentials, the government is:

- Monitoring the big grocers' work to help stabilize prices, as well as investigating other price inflation practices in the grocery sector, through the Grocery Task Force.

- Supporting new consumer advocacy projects, led by the Office of Consumer Affairs in partnership with non-profit organizations, to investigate and reveal price inflation and harmful business practices, such as reducing quantity and quality of products.

- Through Bill C-56, the Affordable Housing and Groceries Act, and Bill C-59, Fall Economic Statement Implementation Act, 2023, the government has proposed a comprehensive modernization of the competition regime in Canada. An increase in competition is expected to create a fair and dynamic marketplace that will allow Canada's economy to innovate and grow, while helping to make life more affordable and increase consumer choice for Canadians.

- Launching the Statistics Canada Food Price Data Hub that provides Canadians with more detailed information on food prices and helps consumers make informed decisions about their food purchases.

- Ongoing discussions to attract more grocery chains to Canada to increase competition and diminish the current big grocery oligopoly.

- Actively engaging with provinces, territories, and industry stakeholders to ensure that a Grocery Code of Conduct is adopted by all major retailers. A Code is intended to improve standards of business behavior through improving predictability, transparency, and the principles of fair dealing across the grocery supply chain, to ultimately benefit consumers by enhancing the supply base and reducing the future supply imbalances.

- In addition, the Government provided a one-time Grocery Rebate last year to 11 million low- and modest-income Canadians and families.

2. Will a grocery sector code of conduct increase food prices?

A code of conduct is an important part of a solution that will improve the strength and resilience of Canada's food supply chain.

While not directly affecting food prices, the code will improve predictability and transparency in supplier-retailer relations, which will ultimately benefit consumers.

3. To what extent are higher prices attributable to grocery chain profiteering?

After peaking at close to 11 per cent in early 2023, year-over-year inflation in grocery prices has eased to 3.4 per cent in January 2024.

Rising grocery prices has been driven by a combination of factors. Most notably external events, such as adverse weather events and geopolitical turmoil, have led to increased input costs.

A related, but less significant factor, is that margins have been increasing: profit margins for food retailers have doubled to more than 4 per cent in recent quarters, from roughly 2 per cent over the previous decade. The other parts of the food supply chain have not experienced this level of increase in their margins. This suggests that retailers have enjoyed more pricing power than farmers and food manufacturers over the recent period. However, the recent increase in margins accounts for less than 10 per cent of grocery price inflation. Therefore, higher margins do not appear to have been the main driver as compared to external events.

Initiative |

Existing Funding |

Description |

|---|---|---|

Grocery Rebate |

$2.5 billion in targeted support |

A one-time Grocery Rebate was delivered in July 2023 to 11 million low- and modest-income Canadians and families. It provided eligible couples with two children with up to an extra $467 and single Canadians without children with up to an extra $234, including single seniors. |

The Office of Consumer Affairs Contributions Program for Non-Profit Consumer and Voluntary Organizations |

Increase from $1.69 million to $5 million over five years |

This increase in funding will allow the government to expand the scope of existing consumer projects to increase research in the retail sector, including groceries. |

Zero cost initiatives |

||

Grocery Code of Conduct |

|

Ongoing efforts to establish a grocery code of conduct that will support fairness and transparency across the grocery industry |

Grocery Task Force |

|

A dedicated Grocery Task Force, that is supervising the big grocers' work to stabilize prices, as well as monitoring and investigating other practices in the grocery sector, such as "shrinkflation." |

Competition Act Amendments – Bill C-56 (passed) |

|

|

Competition Act Amendments – Bill C-59 (active Parliamentary consideration) |

|

|

Recruitment of international grocers |

|

The Minister of Industry, Innovation and Industry continues to engage with international grocers to spur more competition in the Canadian grocery space. |

Food Price Data Hub |

|

A public facing data hub that offers access to a centralized collection of information on food prices in Canada. |

Housing Affordability and Immigration Growth

Issue

High home prices, rising rents, and elevated mortgage rates have caused a deterioration in housing affordability in Canada. Lack of supply and rapid population growth due to immigration remain key issues.

Key Points

- The government is tackling housing affordability challenges on many fronts.

- It is supporting the development of more housing supply by the private sector through the removal of GST from new rental constructions and an expansion of the Canada Mortgage Bond program. It is also providing over $40 billion in concessionary financing through the Apartment Construction Loan Program.

- It is continuing to invest in growing Canada's stock of affordable housing through the $82+ billion National Housing Strategy. A top-up of $1 billion was provided to the Strategy's flagship Affordable Housing Fund in the 2023 Fall Economic Statement, bringing total program funding to $14 billion.

- It is working with other orders of government, through provincial and territorial housing agreements and through the $4 billion Housing Accelerator Fund, to address housing challenges, including by removing key barriers to more housing development.

- It is directly supporting individuals afford their homes through the Canada Housing Benefit, which was topped-up by nearly $100 million in 2023-24, and the Canadian Mortgage Charter, which is ensuring banks are working with Canadians to afford their mortgages.

- And, it has taken steps to align permanent and temporary immigration more closely with housing capacity, such as stabilizing new permanent resident admissions, adjusting travel requirements for Mexican citizens and introducing a two-year cap on study permit applications.

Anticipated Questions and Answers

1. Why is Infrastructure Canada, the department supporting the Minister of Housing during a housing crisis, seeing a nearly 15% decrease in their forecasted budgetary expenditures in 2024-25, with CMHC seeing only modest increases (+10%) relative to most other departments and agencies?

Infrastructure Canada's sunsetting resources are not related to housing programming.

CMHC's Housing Supply Challenge expires in 2024-25. The final of five challenges was launched in late 2023.

The government continues to invest heavily in housing as noted below.

Background

2023 Fall Economic Statement

- $15 billion in loan funding for purpose-built rentals under the Apartment Construction Loan Program (ACLP) beginning in 2025-26. This brings total program funding to over $40 billion, with the goal of supporting over 100,000 homes.

- $1 billion in contributions for the Affordable Housing Fund (AHF) beginning in 2025-26. This brings total program funding to over $14 billion, with the goal of supporting 60,000 new housing units and renewing / repairing another 240,000.

- $50 million to support municipal enforcement of restrictions on short-term rentals.

- Denial of expenses in computing income from a non-compliant short-term rental.

- $309 million in additional investments for the Co-Operative Housing Development Program beginning in 2025-26.

- Canadian Mortgage Charter, which highlights the tailored mortgage relief that the government expects banks to provide to borrowers who are facing financial difficulty with the mortgage on their principal residence.

Other Recent Initiatives

- $100 million top-up to Reaching Homes in 2023-24 for winter homelessness.

- $98 million top-up to the PT administered Canada Housing Benefit in 2023-24.

- Temporarily enhance the Goods and Services Tax (GST) Rental Rebate (to 100%) for new purpose-built rental housing, to incentivize the construction of more apartment buildings and other types of housing built for long-term rental accommodation.

- Up to $20 billion in additional low-cost financing available for rental projects through the Canada Mortgage Bond program. This measure will support the building of up to 30,000 new rental units a year.

- $4 billion Housing Accelerator Fund, which incents municipalities to break down local zoning barriers and create the conditions that will help to rapidly increase Canada's housing supply. This measure will support the creation of 100,000 new homes over four years.

- The government has also taken steps to align permanent and temporary immigration more closely with housing capacity.

- The 2024–2026 Immigration Levels Plan announced the government's intention to welcome 485,000 new permanent residents in 2024, and to stabilize admissions at 500,000 per year beginning in 2025.

- The Safe Third Country Agreement (STCA) between Canada and the United States was expanded in March 2023, resulting in significantly fewer asylum claims at irregular crossings in between land ports of entry.

- The STCA generally requires asylum claimants to request protection in the first safe country they arrive in.

- Between April and December 2023 – after the STCA was expanded – the RCMP intercepted 907 migrants along the Canada-US border, compared to 13,748 between January and March 2023 prior to the new agreement's coming-into-force.

- However, asylum claims made through official channels (i.e. ports of entry and government offices inland) have continued to increase, growing to 143,865 in 2023 compared to 91,735 in 2022.

- As of February 29, 2024, Mexican citizens are now required to apply for a Canadian visitor visa unless they meet certain eligibility requirements for an electronic travel authorization. In recent years, Mexican nationals represented the top source of asylum claims in Canada.

- A two-year cap on study permit application intake by province and territory was announced on January 22, 2024. This cap, along with new work permit restrictions on students attending private colleges with curriculum-licensing agreements, will decrease admissions and relieve some demand-side pressure on housing over the next two years. Other work permit restrictions will now also apply to spouses of some international students.

Major Transfers to Provinces and Territories in 2024-25 Main Estimates

Issue

In 2024-25, major transfers to other levels of government will be $99.4 billion.

Key Points

Based on formulas set out in legislation, major transfers to provinces and territories will increase by $4.8 billion in 2025:

- $2.7 billion under the Canada Health Transfer;

- $492 million under the Canada Social Transfer;

- $1.3 billion under Equalization;

- $325 million under Territorial Formula Financing.

Anticipated Areas of Questioning

1. How was the envelope of the 2024-25 Canada Health Transfer (CHT) determined?

- CHT is distributed on an equal per capita basis and grows in line with a three-year moving average of nominal gross domestic product (GDP) growth, with funding guaranteed to increase by at least 3 per cent per year in 2024-25.

- The 2024-25 CHT amount is $52.1 billion, which is based on the 2023-24 CHT program payout multiplied by a three-year average of growth in nominal GDP (as it is higher than the 3 per cent legislated guaranteed rate).

- Annual growth (5.38 per cent) is based on the three-year average of GDP growth in 2022 (11.77 per cent), 2023 (1.96 per cent) and 2024 (2.42 per cent). This is larger than the 5 per cent guaranteed growth for CHT announced on February 7, 2023.

2. What were the main drivers of the legislated growth in determining the 2024-25 major transfer payments?

- CHT and Equalization were indexed to grow to the three-year average of nominal GDP growth. In the case of the CHT, there was also a legislated guaranteed rate of 3 per cent growth in 2024-25 (the 5 per cent growth guarantee announced in February 2023 has not been legislated).

- The Canada Social Transfer is legislated to grow at 3 per cent per year.

- Territorial Formula Financing increases are mainly due to growth in provincial/local expenditures, which are major components of the formula.

3. What is the timeline for the renewal of Equalization?

- The authority to make new Equalization and Territorial Formula Financing payments was set to expire on March 31, 2024.

- Following consultations with provincial and territorial governments, Budget 2023 renewed these two programs for a five-year period beginning April 1, 2024, and made technical changes to improve the transparency and accuracy of the calculation of entitlements.

- The next legislative renewal of the Equalization and Territorial Formula Financing must take place before March 31, 2029.

4. What is the Equalization floor payment for 2024-25?

- The floor payment for 2024-25 is $1.1 billion and is allocated equally per capita among seven provinces (NL, PE, NS, NB, QC, ON, MB).

- Floor payments have totaled $8.7 billion since 2018-19 (or $1.2 billion on average over the last 7 years).

5. Will the government be initiating a review of the CST, as promised in Budget 2012?

- The Canada Social Transfer will provide $16.9 billion to provinces and territories in 2024-25 in support of social programs, notably social assistance, post-secondary education, and early learning and child care. This amount will grow by 3 per cent each year and is allocated on an equal per capita cash basis to provide stable and comparable treatment for all Canadians.

- The government regularly consults with provincial and territorial partners on federal transfers, including the CST, through meetings of officials and ministers.

- Outside of the CST, the government has made a historic commitment of $30 billion over five years and $8.3 billion ongoing to build a Canada-wide, community-based system of quality child care.

- Engagement is also ongoing to deliver new bilateral agreements related to $200 billion in funding over ten years announced in February 2023 to improve Canada's universal public health care systems and $5.4 billion in funding to help Canadians age with dignity close to home, with access to home care or care in a safe long-term care facility.Engagement is also ongoing to deliver $200 billion in funding over ten years announced in February 2023 to improve Canada's universal public health care systems.

Background

Major Transfers to Other Levels of Government in 2024-25:

Canada Health Transfer ($52.1 billion): The CHT is the largest federal transfer program, providing long-term, predictable funding for health care.

Canada Social Transfer (CST) ($16.9 billion): The CST is a federal transfer that is provided in support of social assistance and social services, post-secondary education, and programs for children.

Equalization ($25.3 billion): Equalization ensures that less prosperous provinces have sufficient revenue to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.

- Budget 2023 renewed Equalization and Territorial Formula Financing for a five-year period beginning April 1, 2024, and made technical changes to improve the transparency and accuracy of the calculation of entitlements. The next renewal of the programs must take place before March 31, 2029.

- Since 2018-19, the fixed envelope for Equalization, based on nominal GDP growth, is resulting in payments exceeding what is required to raise the fiscal capacity of recipient provinces to the national average, including 50 per cent of natural resource revenues. These "floor payments" have totaled $8.7 billion since 2018-19 (or $1.2 billion on average over the last 7 years). The floor for 2024-25 is $1.1billion.

Territorial Formula Financing (TFF) ($5.2 billion): TFF funding enables territorial governments to provide their residents with programs and services comparable to those provided in the rest of Canada.

| 2023-24 | NL | PE | NS | NB | QC | ON | MB | SK | AB | BC | NU | NT | YT | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CHT | 665 | 214 | 1,305 | 1,029 | 10,939 | 19,242 | 1,794 | 1,490 | 5,782 | 6,800 | 50 | 55 | 55 | 49,421 |

| CST | 221 | 71 | 434 | 342 | 3,634 | 6,392 | 596 | 495 | 1,921 | 2,259 | 17 | 18 | 18 | 16,416 |

| Equalization | 0 | 561 | 2,803 | 2,631 | 14,037 | 421 | 3,510 | 0 | 0 | 0 | 0 | 0 | 0 | 23,963 |

| TFF | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1,971 | 1,611 | 1,252 | 4,834 |

| Total | 886 | 847 | 4,541 | 4,002 | 28,610 | 26,054 | 5,900 | 1,985 | 7,703 | 9,058 | 2,038 | 1,685 | 1,326 | 94,634 |

| 2024-25 | NL | PE | NS | NB | QC | ON | MB | SK | AB | BC | NU | NT | YT | Total |

| CHT | 688 | 228 | 1,379 | 1,085 | 11,455 | 20,289 | 1,889 | 1,565 | 6,164 | 7,172 | 52 | 57 | 58 | 52,081 |

| CST | 223 | 74 | 448 | 352 | 3,719 | 6,587 | 613 | 508 | 2,001 | 2,329 | 17 | 19 | 19 | 16,909 |

| Equalization | 218 | 610 | 3,284 | 2,897 | 13,316 | 576 | 4,352 | 0 | 0 | 0 | 0 | 0 | 0 | 25,253 |

| TFF | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2,109 | 1,699 | 1,350 | 5,159 |

| Total | 1,130 | 911 | 5,111 | 4,335 | 28,490 | 27,451 | 6,854 | 2,073 | 8,165 | 9,501 | 2,178 | 1,775 | 1,427 | 99,401 |

| Change | NL | PE | NS | NB | QC | ON | MB | SK | AB | BC | NU | NT | YT | Total |

| CHT | 23 | 14 | 74 | 56 | 516 | 1,047 | 95 | 75 | 382 | 373 | 1 | 2 | 3 | 2,660 (5.4%) |

| CST | 3 | 3 | 14 | 11 | 85 | 195 | 17 | 13 | 81 | 70 | 0 | 0 | 0 | 492 (3.0%) |

| Equalization | 218 | 48 | 481 | 266 | -721 | 155 | 843 | 0 | 0 | 0 | 0 | 0 | 0 | 1,289 (5.4%) |

| TFF | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 138 | 89 | 98 | 325 (6.7%) |

| Total | 244 | 65 | 569 | 333 | -120 | 1,397 | 955 | 88 | 463 | 443 | 139 | 90 | 101 | 4,767 (5.0%) |

CHT and CST 2023-24 represent the second estimation. CHT and CST 2024-25 represent the first estimation. Totals may not add due to rounding. 1 2023-24 amounts for CHT and CST reflect the second estimate. Excludes other fiscal arrangements: Statutory Subsisdies, Québec Abatement, Fiscal Stabilization, Nova Scotia Offset, CHT top-up, Transit and Housing, Safe return to Class, Safe Long-Term Care, Canada-wide ELCC, Home Care and Mental Health, Canada Cities and Communities Fund, Hibernia Dividend Backed Annuity Agreements with Newfoundland and Labrador, and Deduction/Reimbursements related to the Canada Health Act. |

||||||||||||||

Mortgage Delinquencies

Issue

Equifax, a credit bureau, is reporting rising mortgage delinquency rates, particularly in Ontario and British Columbia.

Key Points

- The government has a responsibility to support a stable housing market. Prudent mortgage rules help to ensure that Canadians take on mortgages they can afford, even as interest rates rise or life circumstances change.

- While higher interest rates are making it harder for some Canadians to make their mortgage payments, mortgage delinquency rates remain historically low.

- For those Canadians experiencing mortgage hardship, the government is taking action to ensure Canadians know of the tailored relief they can seek from their financial institutions. This includes:

- The Financial Consumer Agency of Canada publishing the Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances, which assists financial institutions in adopting fair and consistent mortgage relief practices.

- The 2023 Fall Economic Statement introducing the Canadian Mortgage Charter, which underscores the government's expectation for lenders to offer tailored support to Canadians facing financial hardship with their mortgage on their principal residence.

- The government, together with federal financial sector agencies, continues to closely monitor the housing and mortgage markets, including the implementation of mortgage relief measures by financial institutions.

Anticipated Questions and Answers

1. How are mortgage borrowers coping with higher interest rates?

- Many homeowners are in a financial position to manage rising interest rates. However, lenders have been proactively reaching out to those borrowers experiencing hardship to present options to help manage situations on a case-by-case basis.

- The Office of the Superintendent of Financial Institutions (OSFI) closely monitors the mortgage portfolios of federally regulated financial institutions for signs of vulnerability.

2. What is the government doing to support mortgage borrowers experiencing financial hardship?

- The government is taking steps to ensure that federally regulated financial institutions provide Canadians with fair and equitable access to mortgage relief measures appropriate to borrower circumstances.

- In July 2023, the Financial Consumer Agency of Canada (FCAC) published its Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances, which assists financial institutions in adopting fair and consistent approaches when offering relief measures.

- The 2023 Fall Economic Statement introduced the Canadian Mortgage Charter, which underscores the government's expectation for lenders to offer tailored support to Canadians facing financial hardship with their mortgage on their principal residence.

Background

- In March 2024, Equifax published its Quarterly Consumer Credit Trends Report for 2023Q4. It reported that mortgage delinquency rates increased in Ontario by 135 per cent and British Columbia by 62 per cent from 2022Q4 to 2023Q4.

- National mortgage delinquency rates remain historically low and below pre-pandemic levels (around 0.17 per cent in 2023Q4 relative to 0.24 per cent in 2019Q4, according to data from the Canadian Bankers Association).

- According to Bank of Canada data, arrears rates (loans with a missed payment by 90 days or more) for several types of non-mortgage loans now exceed pre-pandemic levels, as per the table below:

|

2019Q4 |

2023Q4 |

|---|---|---|

Auto loans |

0.48 |

0.64 |

Credit cards |

0.87 |

0.91 |

Unsecured lines of credit |

0.21 |

0.28 |

- Consumer insolvencies have also come off their pandemic lows, though remain 8 per cent below their pre-pandemic level in January 2024, based on Innovation, Science and Economic Development Canada data.

- More generally, nearly 40 per cent of consumers are reporting being financially worse off at the end of 2023 compared to 30 per cent at the end of 2022, based on the Bank of Canada's Survey of Consumer Expectations. In addition, the proportion of household income devoted to debt payments - covering both mortgage and non-mortgage debt - has risen from 13.8 per cent in 2021Q4 to 15.0 per cent in 2023Q4, which is an all-time high.

Price on Pollution and the Canada Carbon Rebate

Issue

The federal carbon pollution pricing system applies in all jurisdictions that request it or do not have their own pollution pricing systems which meets the federal benchmark. The federal government must return all direct proceeds from the federal pollution pricing system within the jurisdiction where they were collected.

Key Points

- The federal carbon pollution pricing system applies in jurisdictions that request it or do not have their own systems which meets the federal benchmark.

- The Government of Canada does not keep any direct proceeds from carbon pollution pricing. All direct proceeds are returned in the province of origin.

- In provinces where the federal fuel charge applies, the majority of proceeds go straight back into the pockets of individuals and families via the Canada Carbon Rebate (previously known as the Climate Action Incentive payment), ensuring most households get more money back than they pay as a result of the federal pollution pricing system, with lower-income households benefiting the most.

- By putting a price on carbon pollution and returning most of the proceeds directly to Canadians, Canada is using the most efficient and affordable way to fight climate change and reduce emissions.

Anticipated Questions and Answers

1. What does the federal carbon pollution pricing system cost households?

- The impacts of pollution pricing on households will vary by province. The average estimated cost per household in 2024-25 ranges from about $540 to $1,160, as illustrated in Table 1 below.

- As well, the impacts of pollution pricing will vary depending on many factors such as energy and fuel consumption (including source of power generation) and the change in consumption patterns in response to pollution pricing.

- These estimated impacts include both direct costs from the federal fuel charge (e.g., increased costs of fuels purchased by a household) and indirect costs from both the federal fuel charge and the federal Output-Based pricing system (i.e., costs embedded in goods and services).

| 2024-25 | AB | MB | ON | SK | NB | NS | PEI | NL |

|---|---|---|---|---|---|---|---|---|

| Average Cost Impacts per Household | 1,056 | 828 | 869 | 1,156 | 536 | 609 | 628 | 859 |

| Average CCR per Household | 1,779 | 1,193 | 1,124 | 1,505 | 719 | 766 | 801 | 1,162 |

| Average Net Benefit | 723 | 365 | 255 | 349 | 183 | 157 | 173 | 303 |

Notes:

|

||||||||

2. Is Saskatchewan paying the fuel charge on natural gas in 2024-25? Will Saskatchewan residents stop getting the Canada Carbon Rebate?

- In response to the federal government's decision to temporarily pause the fuel charge on heating oil, Premier Scott Moe announced on October 30, 2023, that SaskEnergy would stop paying the fuel charge in respect of marketable natural gas as of on January 1, 2024.

- Deliveries of natural gas in Saskatchewan remain subject to the fuel charge, as in any other jurisdiction subject to the federal fuel charge.