COVID-19 Recovery Plan – Draft For Discussion

Finance Canada

August 2020

* Title redacted *

* Chart redacted *

Restart & Rebound

- Rapid gains as restrictions are lifted

- Policy focuses on supporting safe reopening – e.g., Safe Restart Agreement

Recuperation

- Gains slow as the lingering effects and distancing measures holds back economic activity

- Policy pivots to address hardest-hit sectors, and investment in initiatives that strengthen Canada's economic potential.

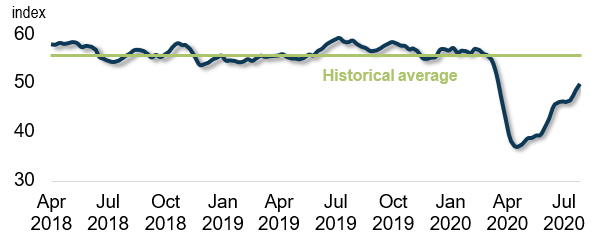

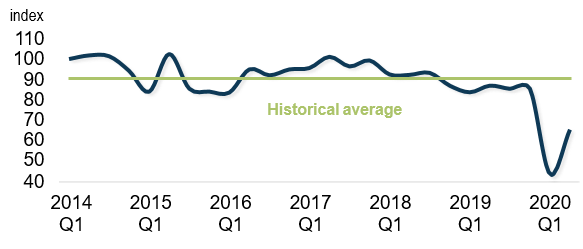

Encouragingly, easing of lockdowns has led to strong initial rebound in economic activity and consumer and business confidence

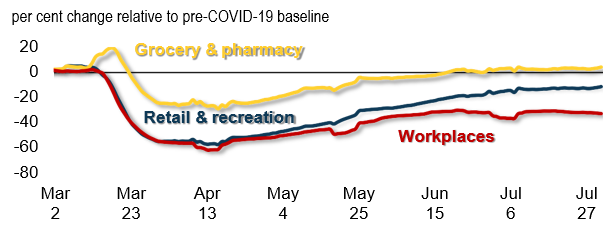

per cent change relative to pre-COVID-19 baseline

*Chart redacted*

Notes: For the Google mobility tracker, 7-day moving average change from baseline (median value of same weekday during Jan. 3 - Feb. 6, 2020 period). Last data points are July 17, 2020 for mobility, and August 5, 2020 for credit card spending. Sources: Google Community Mobility Reports; Visa, Bloomberg, Conference Board of Canada.

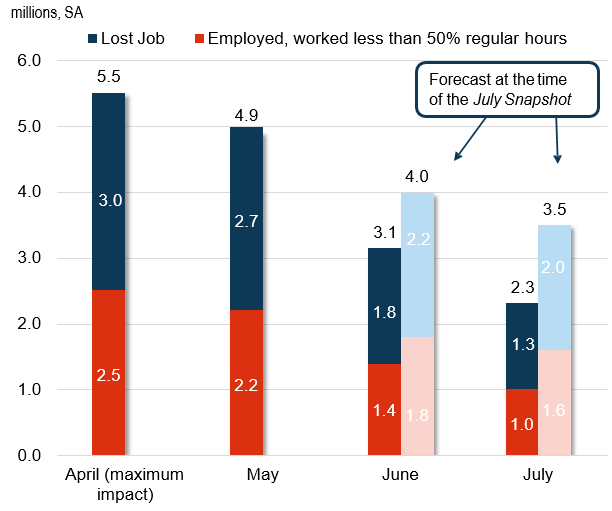

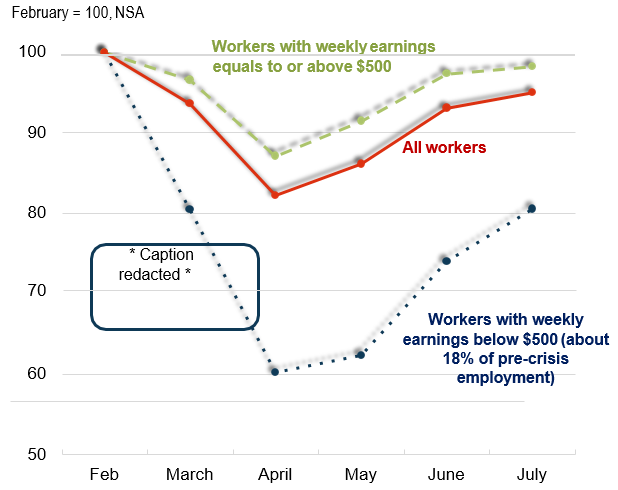

Initial labour market recovery stronger-than-expected – however, 2.3 million workers still affected, especially in lower-wage service sector jobs

millions, SA

Employment Level by Weekly Earnings (2020)

February = 100, NSA

* Title redacted *

- * Bullet redacted *

- * Bullet redacted *

- * Bullet redacted *

- * Bullet redacted *

* Sentence redacted *

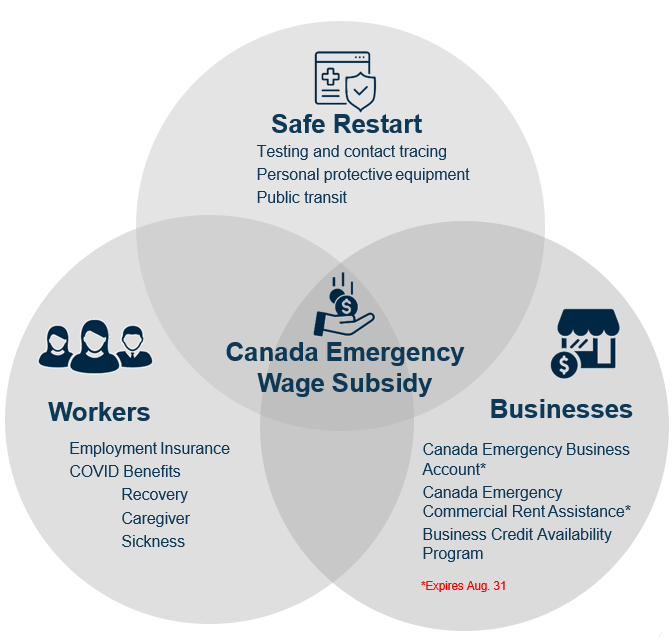

Key elements to a safe restart and building confidence for the resumption of economic activity through the fall

- * Subtitle and bullets redacted *

- * Subtitle and bullets redacted *

- * Subtitle and bullets redacted *

- * Subtitle and bullets redacted *

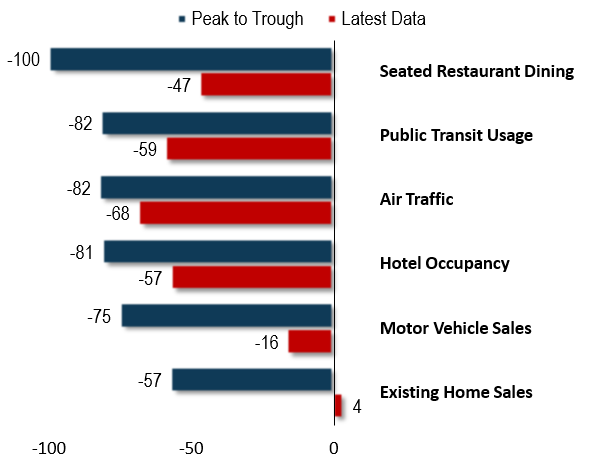

The road to full recovery will vary across sectors - * Part of title redacted *

* Chart redacted *

*Title redacted*

| Sector | Share of GDP, 2019Q4 | Share of Employment, 2019Q4 | GDP Decline, Maximum Impact (Feb to April) | * Portion of table redacted* |

|---|---|---|---|---|

| Accommodation and food services | 2.3 | 6.3 | -66 | |

| Arts, entertainment and recreation | 0.8 | 2.0 | -56 | |

| Transportation and Warehousing | 4.5 | 5.5 | -32 | |

| Manufacturing | 10.0 | 9.2 | -29 | |

| Retail | 5.1 | 10.7 | -28 | |

| Construction | 7.2 | 7.7 | -27 | |

| Wholesale | 5.2 | 4.3 | -22 | |

|

Note: The sub-industries include: Amusement and Recreation Industries; Performing Arts and

Spectator Sports and Related Industries; Transit, Ground Passenger, Scenic and Sightseeing, Air

Transportation; and Food Services and Drinking Places. |

||||

What kind of support is most needed to help businesses pull through the recovery?

- * Bullet redacted *

- * Bullet redacted *

- * Bullet redacted *

- * Bullet redacted *

- * Bullet redacted *

*Title redacted*

* Title redacted *

* Diagram redacted *

* Page redacted *

* Page redacted *

Annex

* Page redacted *

However, virus risks are the biggest brake on local economic activity – with activities that require close contact still depressed

-

Many consumers are hesitant to resume old habits and spending patterns in the face of continued health risks (“FOGO”, fear of going out)

-

Affected businesses are worried about the strength of demand and will be cautious before rehiring and reinvesting.

Potential for the release of significant pent-up consumer demand over the next few months

* Chart redacted *