Backgrounder: Passive Investment Income

Backgrounder

The Government of Canada is working to build a fairer tax system that benefits the middle class and those working hard to join it. As one of its first actions, the Government raised taxes on the wealthiest one per cent in order to cut taxes for the middle class. As well, the Government’s first budget replaced the previous child benefit system with the Canada Child Benefit, which is simpler, more generous, and better-targeted to those who need it most.

On October 16, 2017, the Government announced its intention to reduce the small business tax rate to 9%. As it does so, it is committed to ensuring that this low tax rate is used to support small businesses, not to provide tax advantages to high-income and wealthy individuals.

Budget 2017 highlighted a number of issues regarding tax planning strategies using private corporations. In July 2017, the Government released a consultation paper with proposals to address these strategies, and has engaged Canadians in an open dialogue on a way forward.

The Government is grateful for the input that Canadians have shared, and is moving forward while taking into account the feedback received from Canadians.

Striking a Balance

During the consultation period, the Government heard from business owners that the flexibility afforded from savings accumulated in the corporation is important to their success. For example, savings can be held within a corporation to finance an upcoming business expansion or to face business contingencies. These savings are also sometimes used to provide flexibility to deal with personal circumstances such as for parental leave, sick days or retirement – in such cases, savings held within the corporation can have both a business and personal component.

At the same time, Canadians pointed out that while there is a need for some flexibility, this needs to be provided in a manner that does not encourage wealthy individuals to have unlimited tax assisted savings over and above the RRSP and TFSA limits available to everyone else. The Government is committed to addressing the inherent unfairness in the current rules, while providing flexibility for middle class business owners.

The Government is moving forward with measures to limit the deferral benefits of passive investments within private corporations while:

- Ensuring that investments already made by private corporations’ owners, including the future income earned from such investments, are protected. The measures will only apply on a go-forward basis;

- Protecting the ability of businesses to save the funds they need for contingencies or future investments, such as the purchase of equipment, hiring and training of staff or business expansion;

- Including a passive income threshold of $50,0001 per year for future, go-forward investments (equivalent to $1 million in savings based on a nominal 5 per cent rate of return) to provide more flexibility for business owners to hold savings for multiple purposes, including savings that can later be used for personal benefits such as sick leave, parental leave, or retirement. There will be no tax increase on investment income below this threshold; and

- Ensuring that as the Government moves forward with tax changes, incentives are maintained so that Canada’s venture capital and angel investors can continue to invest in the next generation of Canadian innovation. The Government will work with the venture capital and angel investment sectors to identify how this can be best achieved.

Preserving Financial Flexibility

Example – Expanding the Business

Victoria owns and operates an incorporated car dealership, and has aspirations of significantly expanding the repair and maintenance shop. She sets aside a portion of her profits every year and accumulates those savings inside her corporation.

- After paying herself a salary of $90,000, Victoria’s corporation has taxable income (net profit) of $180,000.

- Her corporation pays $24,300 in corporate income tax, leaving $155,700 for savings each year.

- Those savings accumulate inside the corporation and are invested in passive investment assets earning a 5-per-cent rate of return.

- The investment income is subject to tax at the corporate level. That investment income grows over time, to reach $41,000 in the fifth year.

After five years, Victoria has accumulated some $840,000 in savings that she uses to buy equipment for her expansion.

- Her savings consist of $778,500 in after-tax profits plus $61,500 in cumulative after-tax interest income earned on her passive investments.

- The Government’s proposals will not affect the amount of savings she has to buy equipment. No tax is payable when she re-invests the proceeds in her corporation.

Once fully implemented, the reduction in the small business income tax rate to 9 per cent will enhance her ability to save for future business expansion. It will allow her corporation to save an additional $2,700 every year. Over five years, accounting for compounded returns, this translates into about $14,500.

Example – Saving for a Downturn

Mohamed is a property surveyor who owns and runs his own surveying corporation. While he has been successful so far, he worries about the unexpected, and wishes to plan ahead for various eventualities.

- After paying himself a salary of $110,000, Mohamed has $23,000 of pre-tax corporate income, leaving him with about $20,000 to save per year in his corporation after he pays corporate taxes. By saving inside his corporation, Mohamed has the flexibility to use the money in his business, as needed. He also benefits from the lower small business tax rate, which leaves him with more money to use in his business. Once fully implemented, the announced small business rate reduction will allow him to save $345 more annually.

- After five years, Mohamed managed to save $100,000 in his corporation, on which investment income is generated. These savings offer him the security of knowing he could manage short-term challenges to pay himself as well as pay for the salaries of his employees and other expenses for several months in case of a downturn.

Next Steps

The Government will move forward with measures to limit tax deferral opportunities related to passive investments, and will release draft legislation as part of Budget 2018. Any proposals will apply on a go-forward basis. The Government will also examine all deferral benefits from passive investments and will continue to assess key design aspects. For example, consideration will be given as to the appropriate scope of the new tax regime with respect to capital gains, including whether in certain circumstances the new rules should exclude capital gains realized on the sale of shares of a corporation engaged in an active business. The proposed changes to passive investment will not apply to income from AgriInvest, which is a self-managed producer-government savings account that allows producers to set money aside which can be used to recover from small income shortfalls, or to make investments to reduce on-farm risks – under the current system, investment income in an AgriInvest account is treated as active business income. The government's intention is to maintain this approach.

As with all measures related to tax planning involving private corporations, the Government will be guided by its five key principles:

- Support small businesses and their contributions to our communities and our economy.

- Keep taxes low for small businesses, and support owners to actively invest in their growth, create jobs, strengthen entrepreneurship and grow our economy.

- Avoid creating unnecessary red tape for hard-working small business owners.

- Recognize the importance of maintaining family farms, and work with Canadians to ensure that the transfer of a family business to the next generation is not affected.

- Conduct a gender-based analysis on finalized proposals, to ensure any changes to the tax system promote gender equity.

Annex

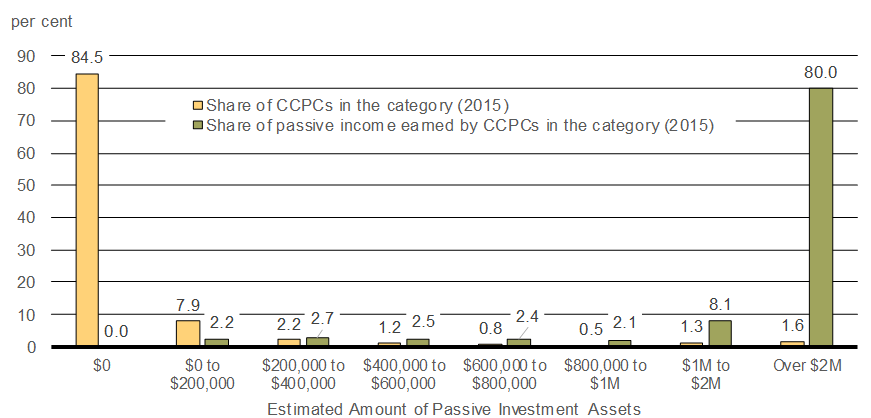

Chart 1

Distribution of CCPCs and their Share of Taxable Passive Investment Income (2015)

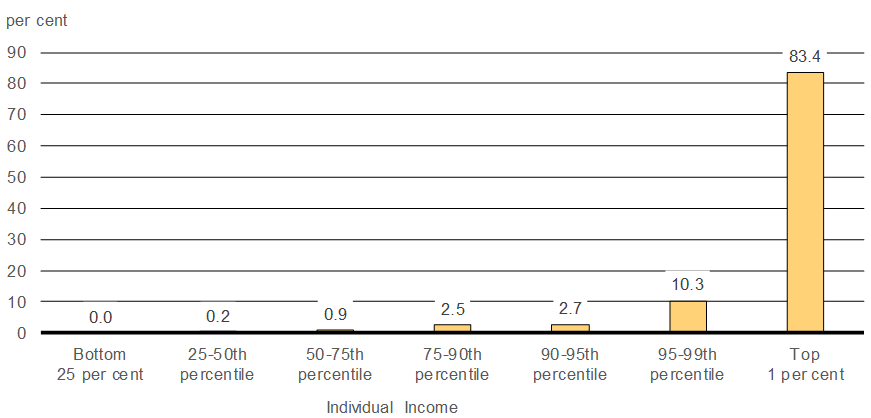

Chart 2

Share of Taxable Passive Investment Income, CCPCs, by Individual Income Range

| Income Range | Gender | Share of Overall Taxable Passive Investment Income | Share of Taxable Passive Investment Income within Income Range |

|---|---|---|---|

| 1. Less than $14,500 (bottom 25 per cent) |

Female | 0.0% | 61.6% |

| Male | 0.0% | 38.4% | |

| All | 0.0% | ||

| 2. $14,500 to $31,500 (25-50th percentile) |

Female | 0.1% | 53.4% |

| Male | 0.1% | 46.6% | |

| All | 0.2% | ||

| 3. $31,500 to $58,500 (50-75th percentile) |

Female | 0.4% | 48.7% |

| Male | 0.5% | 51.3% | |

| All | 0.9% | ||

| 4. $58,500 to $93,500 (75-90th percentile) |

Female | 1.1% | 43.7% |

| Male | 1.4% | 56.3% | |

| All | 2.5% | ||

| 5. $93,500 to $123,000 (90-95th percentile) |

Female | 1.1% | 41.4% |

| Male | 1.6% | 58.6% | |

| All | 2.7% | ||

| 6. $123,000 to $250,000 (95-99th percentile) |

Female | 4.0% | 38.5% |

| Male | 6.4% | 61.5% | |

| All | 10.3% | ||

| 7. $250,000 + (top 1 per cent) |

Female | 21.4% | 25.6% |

| Male | 62.0% | 74.4% | |

| All | 83.4% | ||

| All | Female | 28.1% | 28.1% |

| Male | 71.9% | 71.9% | |

| All | 100.0% |