Backgrounder: Reducing the Small Business Tax Rate

Backgrounder

The Government of Canada is committed to an economy that works for the middle class. Canada’s economy is growing faster than it has in over a decade.

The Government is also working to build a fairer and more efficient tax system that benefits all Canadians. As one of its first actions, the Government raised taxes on the wealthiest one per cent in order to cut taxes for the middle class. As well, the Government’s first budget replaced the previous child benefit system with the Canada Child Benefit, which is simpler, more generous, and better-targeted to those who need it most.

The Government supports Canada’s small businesses and continues to support low business tax rates to better enable businesses to grow and create good, well paying jobs. However, tax planning strategies using private corporations can result in high-income individuals gaining unfair tax advantages. In July 2017, the Government released a consultation paper with proposals to address these strategies, and has engaged Canadians in an open dialogue on a way forward.

The Government is thankful for the views that Canadians have shared on the issues raised, and will take action to strengthen small businesses, while reducing unfair advantages that can be used to benefit the wealthiest of Canadians.

Our Commitment to Canadians

“As we reduce the small business tax rate to nine percent ... we will ensure that Canadian-controlled private corporation (CCPC) status is not used to reduce personal income tax obligations for high-income earners rather than supporting small businesses.”

The Government’s commitment – to both reduce the small business tax rate and address tax planning advantages for high-income earners – is a commitment to invest in our economy while ensuring fairness for all taxpayers. The Government is announcing next steps on both elements of this commitment.

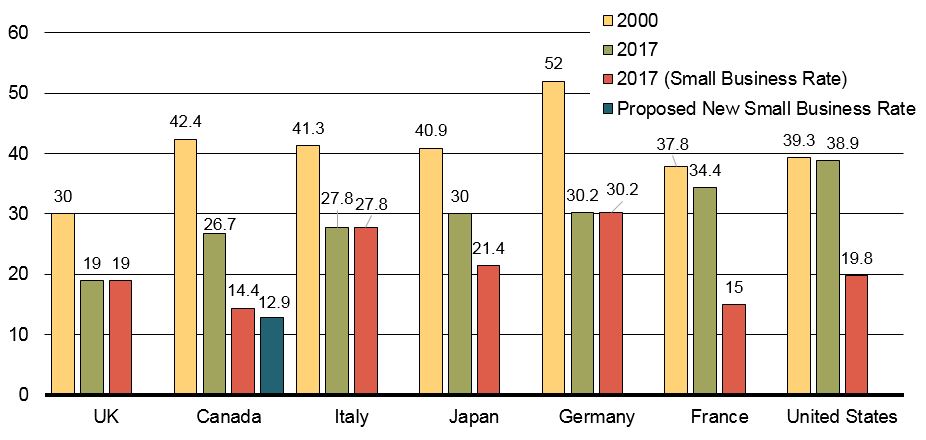

Canada’s current combined federal-provincial-territorial average tax rate for small business is the lowest in the G7 and fourth lowest among Organisation for Economic Co-operation and Development countries (see Chart 1).

Canadian businesses currently benefit from a combined general corporate tax rate that is 12 percentage points lower than that of Canada's largest trading partner, the United States.

Moving forward with further tax reductions will allow businesses to retain more of their earnings to reinvest -- supporting economic growth and job creation in communities across Canada.

Small businesses are a critical part of our economy and the Government is taking action to help them grow, invest and create good, well-paying jobs. In particular, the Government is announcing its intention to lower the federal small business tax rate to nine per cent from 11 per cent in 2015 over the next 14 months (10 per cent, effective January 1, 2018, and nine per cent effective January 1, 20191). The small business tax rate applies to the first $500,000 of active business income.

With this change Canada will have by far the lowest small business tax rate in the G7. As shown in the chart below, a 9-per-cent federal small business tax rate would bring the combined average federal-provincial-territorial small business tax rate to 12.9 per cent, from 14.4 per cent.

General and Small Business Corporate Income Tax Rates

Combined with proposed measures to address tax planning using private corporations, the Government’s actions will strengthen the effectiveness of the preferential small business tax rate enabling small businesses to retain more of their earnings for reinvestment and job creation. The Government will limit the ability of wealthy individuals to use private corporations as a tool to gain an unfair tax advantage. Tax assistance will be better focused on investments in productive capital, such as machinery and equipment, which will help businesses grow and create jobs for the benefit of the economy as a whole.

This intended reduction will provide a small business with up to $7,500 in federal tax savings per year that will be available for reinvestment. For the average small business – with $107,0002 in business income eligible for the lower small business rate – this will leave an additional $1,600 per year for small business entrepreneurs and innovators to reinvest in new equipment, in growth and job creation.

The measure represents a tax cut for small business of $2.9 billion over 2017-18 and the following five fiscal years.

Helping Entrepreneurs Grow their Businesses: Benefit of Reducing the Small Business Rate to nine per cent in 2019

Jeremy runs a small restaurant. His business is incorporated, and four employees help him run his business. After expenses and salaries paid to his employees and himself, the restaurant earns $30,000, before corporate income tax. With the announced reduction in the federal small business tax rate to nine per cent, Jeremy will pay $2,700 in federal corporate income tax – a saving of $450 relative to the current rate of 10.5 per cent. Jeremy plans to use his corporation’s after-tax income to upgrade the restaurant’s kitchen.

Ingrid, Barry and Patrick own a small software company. They have been working hard the last few years to increase their exposure and grow their business. They currently have a team of six employees. After paying expenses and salaries to their employees and themselves, they have $150,000 in business income, before corporate income tax. The announced reduction in the federal tax rate to nine per cent from 10.5 per cent would reduce their total corporate taxes by $2,250 a year – money that will help them grow their business.

1 The taxation of non-eligible dividends will be adjusted to reflect the lower small business tax rate in order to maintain integration of corporate and personal taxes.

2 The median business income eligible for the lower small business rate is $52,000.

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | Total | |

|---|---|---|---|---|---|---|---|

| Reduction of the Small Business Tax Rate | (45) | 90 | 685 | 855 | 655 | 675 | 2,915 |