Building a Canadian Investment Advantage with New Targeted Business Tax Measures

Backgrounder

Canada needs an economy that works for everyone—an economy where the benefits are felt by more and more people, where Canadians have access to high-quality jobs, and where Canadian businesses can confidently invest in creating jobs and in their future growth.

To enhance business confidence and encourage more job-creating investments, the 2018 Fall Economic Statement proposes three immediate changes to Canada's tax system:

- Allow businesses to immediately write off the full cost of machinery and equipment used for the manufacturing or processing of goods—this will spur new investments, and support the adoption of advanced technologies and processes, in this highly mobile sector.

- Allow businesses to immediately write off the full cost of specified clean energy equipment, to spur new investments and the adoption of advanced clean technologies in the Canadian economy.

- The Accelerated Investment Incentive, which will allow businesses of all sizes and in all sectors of the economy to write off a larger share of the cost of newly acquired assets in the year the investment is made.

Responding to the U.S. Tax Reform Challenge

The U.S. Government's Tax Cuts and Jobs Act of 2017 includes a federal corporate rate cut from 35 to 21 per cent. This cut, along with other corporate tax measures, may challenge Canada's ability to attract investment and remain competitive with the U.S.

In the absence of actions proposed in the 2018 Fall Economic Statement, it is expected that these U.S. tax reforms could significantly reduce the overall tax advantage that Canada has built over the years, doing potential harm to investment, jobs, and economic growth in Canada.

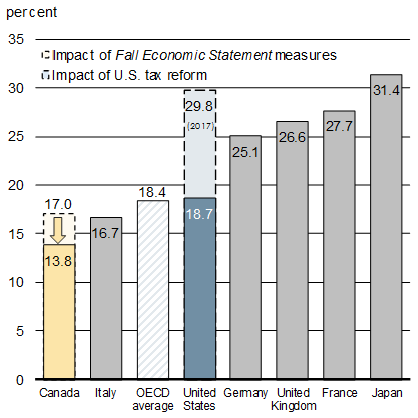

The measures introduced in the Fall Economic Statement will ensure that Canada maintains a tax advantage in attracting new investments. The average overall tax rate in Canada on new business investment—as measured by the Marginal Effective Tax Rate (METR)—will fall from 17.0 per cent to 13.8 per cent. This will give businesses in Canada the lowest overall tax rate on new business investment in the G7, significantly lower than that of the United States.

The Government of Canada's new proposed tax measures will provide focused, fiscally responsible support for growth-generating investments in Canada, while continuing to keep the debt-to-GDP (gross domestic product) ratio low and on a downward track.

Taken together, tax reforms in both countries are expected to deliver positive results for Canadians:

- The U.S. tax reform can be expected to increase U.S. domestic demand for goods and services—including for imports from Canada, one of the top exporters to the U.S.

- Canada's proposed tax changes will support business investment in Canada, accelerate the adoption of advanced technologies and processes, and position Canadian businesses to meet growing U.S. and global demand.

Comparing the Marginal Effective Tax Rates on New Investments, Canada and the G7, 2018

How Do Accelerated Write-Offs Support Business Investment?

When Canadian businesses make investments in capital assets such as buildings, machinery, and equipment, current tax rules require them to deduct the cost of these investments over a time period that corresponds to the expected length of returns from the investment. The new investment incentives proposed in the Fall Economic Statement will allow businesses to write off a larger share of their costs in the year an investment is made. The larger write-off will make it more attractive to invest in assets that will help to drive business growth. This will help to secure jobs for middle class Canadians.