Budget 2021 Low-wage workers

Backgrounder

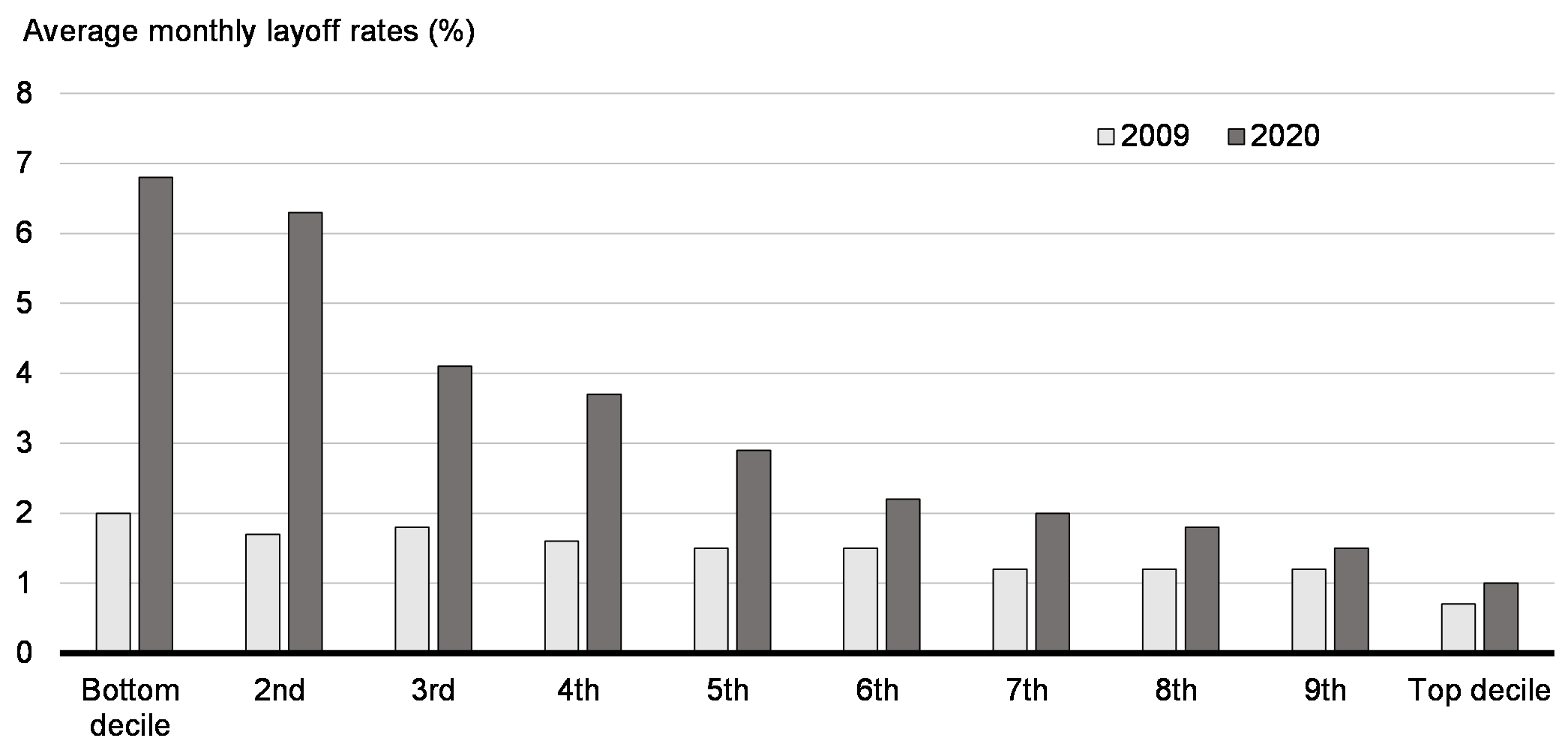

The worst economic impacts of the pandemic have been suffered by those who could least afford it. Low-wage workers have been up to six times more likely to suffer layoffs than wealthy Canadians. Estimates suggest that today there have been about 268,000 net job losses among low-wage workers since February of 2020, compared to about 40,000 over the same time period during the Great Recession, adjusting for population growth. Racialized and Black Canadians have much higher representation in low-wage work.

Canada's economic recovery plan must address the unique challenges of the pandemic recession—and must include all Canadians. If we are to have a full and fair recovery, Canada needs all of these workers to rejoin the workforce and to make sure they earn a decent living. The full participation of all Canadians in the labour market generates economic growth, and improves the standard of living and quality of life for everyone.

Establishing a $15 Federal Minimum Wage

Canada's prosperity and stability depend on every Canadian having a fair chance to join the middle class. Yet some Canadians struggle to do so while supporting families in part-time, temporary, and low-wage jobs. To support low-wage workers in the federally regulated private sector:

The Government of Canada is announcing its intention to introduce legislation that will establish a federal minimum wage of $15 per hour, rising with inflation, with provisions to ensure that where provincial or territorial minimum wages are higher, that wage will prevail. This will directly benefit over 26,000 workers who currently make less than $15 per hour in the federally regulated private sector.

Enhancing the Canada Workers Benefit

To support low-wage workers who have been most negatively affected by the pandemic and make our workforce stronger:

Budget 2021 proposes to expand the Canada Workers Benefit to support about 1 million additional Canadians in low-wage jobs, helping them return to work and increasing benefits for Canada's most vulnerable.

The government would raise the income level at which the benefit starts being reduced to $22,944 for single individuals without children and to $26,177 for families.

The government also recognizes that benefits targeted on the basis of family income can deter secondary earners in couples from going back to work. To further boost workforce participation by reducing these barriers:

Budget 2021 proposes to allow secondary earners in couples to exclude up to $14,000 of their working income when income-testing the Canada Workers Benefit.

Benefit to Full-Time Workers

A single, full-time, minimum wage worker could receive about $1,000 more in benefits than they would under the current system, and could continue to receive the benefit at up to $32,000 of net income in 2021.

The proposed enhancement will especially benefit single workers without children. These are workers who often have few other federal supports available to them. For example, a typical worker living in Toronto working full time at the minimum wage does not receive any Canada Workers Benefit under the current system. By raising their entitlement to $1,100, the proposed enhancement would lift this worker out of poverty.

Almost 100,000 people will be lifted out of poverty by this investment.

Extending the Canada Emergency Wage Subsidy Until September 2021

The Canada Emergency Wage Subsidy has helped more than 5.3 million Canadians keep their jobs. The wage subsidy is currently set to expire in June 2021. In order to bridge Canadians through the rest of this crisis to recovery, continued support is needed. To give workers and employers certainty and stability over the coming months:

Budget 2021 proposes to extend the wage subsidy until September 25, 2021. It also proposes to gradually decrease the subsidy rate, beginning July 4, 2021, in order to ensure an orderly phase-out of the program as vaccinations are completed and the economy reopens.

Extending this support will mean that millions of jobs will continue to be protected. In addition, the government is proposing to introduce the new Canada Recovery Hiring Program. This would provide an alternative support for businesses affected by the pandemic to help them hire more workers as the economy reopens. The hiring program would be in place from June until November 2021, allowing firms to shift from the Canada Emergency Wage Subsidy to this new support.

Providing Additional Weeks of Recovery Benefits and EI Regular Benefits

After the creation of the Canada Emergency Response Benefit, which supported over 8 million Canadians, the government transitioned the support to a suite of new temporary benefits: the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit, and the Canada Recovery Sickness Benefit.

To continue to support workers through a transition away from emergency income supports and position Canadians for the recovery, the government proposes to provide up to 12 additional weeks of Canada Recovery Benefit to a maximum of 50 weeks. The first four of these additional 12 weeks will be paid at $500 per week. As the economy reopens over the coming months, the government intends that the remaining 8 weeks of this extension will be paid at a lower amount of $300 per week claimed.

Budget 2021 also proposes to extend the Canada Recovery Caregiving Benefit an additional 4 weeks, to a maximum of 42 weeks, at $500 per week, in the event that caregiving options, particularly for those supporting children, are not sufficiently available in the interim as the economy begins to safely reopen.

If additional flexibility is required based on public health considerations later this year, the government will continue to do whatever it takes to be there for Canadians. To ensure this flexibility:

Budget 2021 proposes legislative amendments to provide authority for additional potential extensions of the Canada Recovery Benefit and its associated suite of sickness and caregiving benefits, as well as regular EI benefits until no later than November 20, 2021, should they be needed.

Maintaining Flexible Access to Employment Insurance Benefits

Following the end of the Canada Emergency Response Benefit last fall, over 3.3 million Canadians have accessed EI and $25.3 billion in benefits have been paid since.

As the economy reopens, the EI system must remain responsive to the needs of Canadians.

Budget 2021 proposes $3.9 billion over three years, starting in 2021-22, for a suite of legislative changes to make EI more accessible and simple for Canadians over the coming year while the job market begins to improve. The changes would:

- Maintain uniform access to EI benefits across all regions, including through a 420-hour entrance requirement for regular and special benefits, with a 14-week minimum entitlement for regular benefits, and a new common earnings threshold for fishing benefits.

- Support multiple job holders and those who switch jobs to improve their situation as the recovery firms up, by ensuring that all insurable hours and employment count towards a claimant's eligibility, as long as the last job separation is found to be valid.

- Allow claimants to start receiving EI benefits sooner by simplifying rules around the treatment of severance, vacation pay, and other monies paid on separation.

- Extend the temporary enhancements to the Work-Sharing program such as the possibility to establish longer work-sharing agreements and a streamlined application process, which will continue to help employers and workers avoid layoffs.

As has been identified by the International Monetary Fund, the Organisation for Economic Co-operation and Development, and other experts, the pandemic has shown that Canada needs a more effective income support system for the 21st century. For this reason:

Budget 2021 announces forthcoming consultations on future, long-term reforms to EI. To support this effort, the government proposes to provide $5 million over two years, starting in 2021-22, to conduct targeted consultations with Canadians, employers, and other stakeholders from across the country. Consultations will examine systemic gaps exposed by COVID-19, such as the need for income support for self-employed and gig workers; how best to support Canadians through different life events such as adoption; and how to provide more consistent and reliable benefits to workers in seasonal industries. Any permanent changes to further improve access to EI will be made following these consultations and once the recovery is fully underway.

Better Labour Protection for Gig Workers

As demand for gig work increases with the rise in new digital platforms, more and more Canadians are relying on jobs that do not come with the same level of job protection as other employees in the economy.

Budget 2021 reiterates the government's commitment to making legislative changes to improve labour protection for gig workers, including those who work through digital platforms. Following the conclusion of consultations recently launched on this topic by the Minister of Labour, the government will bring forward amendments to the Canada Labour Code to make these new, modernized protections a reality.

Helping Employers Train and Recruit Workers

The government is taking action to help employers train and reskill people, and help the workforce grow and meet demand. To help Canadians gain skills for good jobs in growing sectors:

Budget 2021 proposes to provide $960 million over three years, beginning in 2021-22, for a new Sectoral Workforce Solutions Program. Working primarily with sector associations and employers, funding would help design and deliver training that is relevant to the needs of businesses, especially small- and medium-sized businesses, and their employees. This funding would also help businesses recruit and retain a diverse and inclusive workforce.

This investment will help connect up to 90,000 Canadians with the training they need to access good jobs in sectors where employers are looking for skilled workers. It will also help diversify sectors by ensuring that 40 per cent of supported workers are from underrepresented groups, including women, persons with disabilities, and Indigenous people.

Supporting Skills for Success

The skills needs of businesses are changing as they adopt new technologies and new ways of doing things. Yet, today, 45 per cent of Canadians lack the literacy, numeracy, and digital skills that are increasingly necessary to succeed in jobs in the knowledge economy.

Budget 2021 proposes to invest $298 million over three years, beginning in 2021-22, in a new Skills for Success program that would help Canadians at all skills levels improve their skills.

The program will fund organizations to design and deliver training to enhance foundational skills, such as literacy and numeracy, as well as transferable and soft skills. Additionally, funding will support the creation of assessments and training resources available online to all Canadians at no cost. Approximately 90,000 Canadians will be able to improve their literacy and essential skills to better prepare for, get, and keep a job, and adapt and succeed at work.

Ensuring Communities Recover Through Skills Training and Workforce Planning

For the recovery to succeed, communities must be at the heart of determining their economic futures by diversifying their economies and improving resilience.

Budget 2021 proposes to provide $55 million over three years, starting in 2021-22, for a Community Workforce Development Program. The program will support communities to develop local plans that identify high potential growth organizations, and connect these employers with training providers to develop and deliver training and work placements to upskill and reskill jobseekers to fill jobs in demand.

This initiative will benefit approximately 25,000 workers, 250 businesses, and 25 communities, by accelerating job creation and the re-employment and deployment of workers to growth areas to meet employers' needs.

Helping Workers Transition to New Jobs

As the economy reopens, many people will return to their previous jobs. But for some, shifts in the economy mean that they need to find new jobs. To address this need, and help Canadians find new jobs as quickly and as easily as possible, workers need to be able to rapidly adapt and upgrade their transferable skills for newer industries.

Budget 2021 proposes to provide $250 million over three years, starting in 2021-22, for an initiative to scale-up proven industry-led, third-party delivered approaches to upskill and redeploy workers to meet the needs of growing industries.

This initiative will help approximately 15,500 Canadians connect with new work opportunities.

Support for Personal Support Workers

Personal support workers perform jobs that are mentally and physically exhausting, and do not enjoy the same job protections, compensation, and benefits of their peers in the health care sector. To follow through on commitments made to personal support workers, homecare workers, and essential workers involved in senior care in the 2020 Fall Economic Statement:

Budget 2021 proposes to provide funding of $27.6 million over three years for my65+, a Group Tax-Free Savings Account offered by the Service Employees International Union Healthcare.

The funding will support incentives for worker participation. The Service Employees International Union Healthcare will work with other unions and employers across the country to make this portable savings tool available to other workers in the elder care sector. The government also remains open to engaging with other interested unions and employer sponsors who wish to come forward with other targeted, kick-start options to strengthen retirement security for those involved in senior care who do not currently have workplace retirement security coverage.

Affordable Housing

The COVID-19 recession has widened gaps in Canadians' access to housing. These gaps, if not addressed, could deepen cleavages in our communities and exacerbate social inequalities. By contrast, investments in affordable housing can act fast to create jobs and prosperity.

High housing costs, especially in urban centres, continue to place middle class and low-income Canadians under huge financial pressure. Stable housing is critical for communities and for a strong middle class.

That's why the government has a plan to invest $2.5 billion, and reallocate $1.3 billion in existing funding to speed up the construction, repair, or support of 35,000 affordable housing units.

This will help families, young people, low-income Canadians, people experiencing homelessness, and women and children fleeing violence find a safe and affordable place to call home. For example, the proposed investments include $1.5 billion in 2021-22 for the Rapid Housing Initiative, which supports the construction of new affordable housing units to meet the urgent housing needs of vulnerable Canadians.