History of Health and Social Transfers

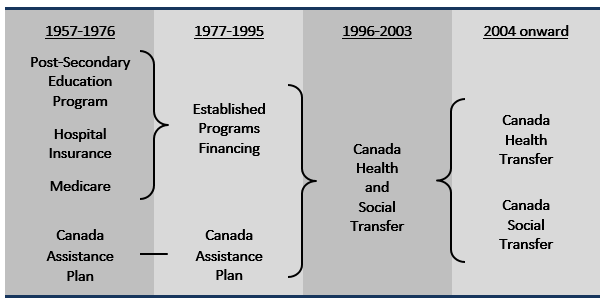

Health and social transfer payments have developed over the years from cost-sharing programs to block funding transfers. The illustration below shows the evolution of those transfers.

The following is a brief timeline of the evolution of health and social transfers within Canada:

Health and social transfers were either provided as cash grants or were cost-shared to encourage the establishment of national social programs. In 1966, the Canada Assistance Plan (CAP) was introduced, creating a cost-sharing arrangement for social assistance programs. Conditions were attached to federal funding, including the provision that provinces and territories not require a period of residency in the province or territory as a condition of eligibility for social assistance or for the receipt of social assistance.

The Established Programs Financing (EPF) was introduced, replacing cost-sharing programs for health and post-secondary education. Federal funding provided through the EPF initially took the form of equal portions of a tax transfer and a cash transfer. Provinces received 13.5 percentage points of personal income tax (PIT) and 1 percentage point of corporate income tax (CIT), including some points carried over from the previous post-secondary education program. Provinces and territories received equal per capita total EPF support through a mix of cash and equalized tax points. The value of the tax points grew in line with the economy. The growth rate of the cash transfer was modified several times as the program underwent changes throughout the years.

The Canada Health Act was enacted. EPF funding was made conditional on respect for the five criteria of the Canada Health Act (universality, accessibility, portability, comprehensiveness, and public administration) and provisions for withholding funding were introduced.

The federal budget announced that the CAP and EPF would be combined into one block fund – the Canada Health and Social Transfer, or CHST. The CHST provided funds to provincial and territorial governments in support of health care, post-secondary education, social assistance and social services. Like the EPF, the CHST was a combination of the 1977 tax transfer and a cash transfer and the total was allocated on an equal per capita basis.

In 2000 and 2003, the Government of Canada and provincial and territorial governments entered into a series of agreements to strengthen and renew Canada's publicly funded health care system. These agreements also sought to improve accountability and reporting to Canadians.

As part of the First Ministers' Accord on Health Care Renewal in February 2003, First Ministers also agreed to restructure the CHST effective April 1, 2004 to create two new transfers - the Canada Health Transfer, or CHT, and the Canada Social Transfer, or CST – to improve the transparency and accountability of federal support to provinces and territories. Reflecting provincial spending patterns, 62 percent of the CHST was allocated towards health and the remaining 38 percent was allocated towards post-secondary education, programs for children and other social programs.

Budget 2003 allocated $16 billion over five years through a new Health Reform Transfer targeted to primary health care, home care and catastrophic drug coverage.

In September 2004, First Ministers signed the 10-Year Plan to Strengthen Health Care. In support of this 10-year plan, the Government of Canada committed additional funding to provinces and territories for health that included increases to the CHT through a base adjustment and an annual six percent escalator.

Under the 2004 10-Year Plan to Strengthen Health Care, the Health Reform Transfer was incorporated into the CHT effective April 1, 2005.

Pursuant to the federal government's commitment to restore fiscal balance in Canada, Budget 2007 put all major transfers to provinces and territories on a legislated, long-term track out to 2013-14.

Budget 2007 restructured the CST to provide equal per capita cash support to provinces and territories. Additional investments were made to facilitate this transition and to enhance the stability and predictability of support to provinces and territories for post-secondary, education programs for children and other social programs. Total CST cash levels were also set in legislation to grow by three percent annually.

Respecting the 2004 10-Year Plan to Strengthen Health Care agreement, the CHT was legislated to move to equal per capita cash in 2014-15.

For a smooth transition and to provide certainty in budget planning, Budget 2007 also ensured that no province or territory would receive lower cash transfers under the CST or CHT relative to what they would have received in 2007–08 prior to the implementation of the new Equalization system and an equal per capita cash allocation for the CST.

The Budget Implementation Act 2009 legislated a technical adjustment to ensure that Ontario, as an Equalization-receiving province, received the same per capita CHT cash as other Equalization-receiving provinces.

The Government of Canada announced in December 2011, that the CHT will continue to grow at six percent annually until 2016-17. Starting in 2017-18, the CHT will grow in line with a three-year moving average of nominal gross domestic product (GDP) growth, with funding guaranteed to increase by at least three percent per year. In addition the CST will continue to grow at its current rate of three percent annually in 2014-15 and beyond.

Budget 2012 confirmed the move to an equal per capita cash allocation of the CHT in 2014-15 and included a provision to ensure that no province or territory would receive lower cash payments under the CHT due to the move to an equal per capita cash CHT allocation.

The CHT annual growth rate changed to grow in line with a three-year moving average of nominal GDP, with total funding guaranteed to increase by at least 3 per cent per year, as announced in 2011. The CST growth rate remained unchanged at 3 per cent annually.

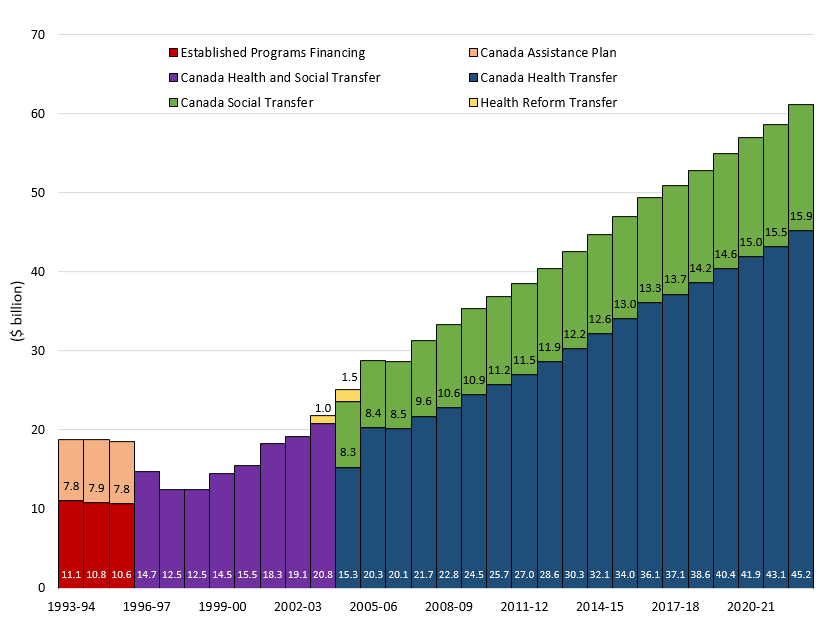

Health and social transfers are at record highs and continue to grow.

Federal accountability for how provincial and territorial governments spend transferred funds has evolved along with fiscal arrangements. In the 1950s and 60s, federal transfers were conditional cost-sharing grants that encouraged the establishment of national programs and ensured comparable quality across provinces. As these programs became more established, there was less necessity for the rigorous and comprehensive reporting and auditing required on the part of the federal government. Federal support for national priorities began to shift to block funding based on acceptance of broad principles and shared objectives. The block funding structure gives provinces and territories greater flexibility in designing and administering programs.

As a result of this evolution, today governments focus on accountability to the public, rather than to other levels of governments. This recognizes that governments are accountable directly to their residents for their spending in their areas of responsibility.