Borrowing Authority Act - Report to Parliament 2024

Borrowing Authority Act Report – Foreword

Since the last Borrowing Authority Act Report in November 2020, Canada and Canadians prevailed and overcame immense challenges, beginning with the onset of the COVID-19 pandemic earlier that year. At that time, the federal government greatly expanded its fiscal balance sheet to support Canada's COVID-19 response, which saved millions of jobs, provided emergency support to millions of families, and kept businesses large and small solvent across the country.

Canada's economy remains resilient following a strong recovery from the pandemic recession. Wage growth has outpaced inflation for the past 13 months, and compared to before the pandemic, real wages are now higher and 1.1 million more Canadians are employed, marking the fastest jobs recovery in the G7. Real gross domestic product (GDP) grew 1.1 per cent in 2023, which is more than triple what was forecast in Budget 2023. Private sector forecasters are now predicting a soft landing for the Canadian economy—avoiding the recession that many had thought was inevitable.

Our government continues to stick to a responsible economic plan while investing with purpose for the benefit of younger Canadians.

As part of that plan, in the 2023 Fall Economic Statement we set three specific fiscal guideposts:

- Maintaining the 2023-24 deficit at or below $40.1 billion;

- Lowering the debt-to-GDP ratio in 2024-25, relative to the 2023 Fall Economic Statement, and keeping it on a declining track thereafter;

- And maintaining a declining deficit-to-GDP ratio in 2024-25 and keeping deficits below 1 per cent of GDP in 2026-27 and future years.

Today, each one of these objectives is being met, as is our fiscal anchor—a declining federal debt-to-GDP ratio over the medium term.

In fact, Canada has the lowest deficit- and net debt-to-GDP ratios in the G7, as recognized in our triple-A credit ratings.

Canada has a well-deserved international reputation for prudent fiscal stewardship. In the International Monetary Fund's most recent Fiscal Monitor report, Canada was the strongest of all G20 countries with respect to overall budget balance.

We will continue our responsible approach to ensure that government investments help to deliver real economic opportunities for every generation of Canadians.

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

Ottawa, April 2024

Introduction

The authority to manage public debt is governed by the Borrowing Authority Act (BAA) and Part IV of the Financial Administration Act (FAA), which together allow the Minister of Finance (the "Minister") to borrow money up to a maximum amount as approved by Parliament. Parliament granted its approval of a maximum stock of outstanding government and agent Crown corporation market debt of $1,831 billion under section 4 of the BAA, which came into force on May 6, 2021.

Purpose of this Report

This report provides a detailed account, as at March 31, 2024, of amounts borrowed by the Minister on behalf of His Majesty in Right of Canada and by agent Crown corporations, along with Canada Mortgage Bonds guaranteed by the Canada Mortgage and Housing Corporation, as required by the Borrowing Authority Act. It also provides an assessment to Parliament on whether the maximum amount authorized under the Borrowing Authority Act ("BAA") should be adjusted.

Under section 8 of the BAA, the Minister is required to table a report in each House of Parliament on or before the May 31st that follows the end of the third fiscal year after the fiscal year during which a report was previously tabled. The prior report, "Borrowing Authority Act, Report to Parliament 2020" was tabled on November 23, 2020.

The report establishes a framework for enhancing transparency and accountability to Parliament regarding the borrowings of the Government of Canada and of agent Crown corporations (see table 1 for details)

Element |

Description |

|---|---|

Combined Debt Stock |

The total amount of borrowed money referred to in each of paragraphs 4(a) to (c) of the BAA, being money borrowed: |

Government Borrowings |

|

Canada Mortgage Bonds |

|

Agent Crown Corporation Borrowings |

|

Contingency and Extraordinary Borrowings |

The total amount of money borrowed by the Minister under an order made under each of paragraphs 46.1(a) to (c) of the FAA. These paragraphs address contingencies where the Minister might need to borrow:

|

Assessment of Maximum Amount |

The Minister's assessment of whether the maximum amount should be increased or decreased. |

This report supplements annual reporting in the Debt Management Report, which reports on the government's borrowing activities over the previous fiscal year, and the Debt Management Strategy, which lays out the Government's borrowing plans for the coming fiscal year.

Borrowing Authority Act

Under the Parliamentary borrowing authority framework enacted on November 23, 2017, Parliamentary authority is granted through the BAA and Part IV of the FAA, which together give the Minister authority to borrow money up to a maximum overall amount as approved by Parliament. Powers to borrow are granted to agent Crown corporations in their enabling statutes. The Minister of Finance approves borrowings in line with agent Crown corporations' corporate plans, which are approved by the Treasury Board.

The Minister of Finance is required under the BAA to ensure that the maximum amount of borrowed money is not exceeded in the exercise of her approval of borrowings by agent Crown corporations and of guarantees issued by CMHC in respect of CMBs.

Subject to the limited exceptions outlined in paragraphs 46.1 (a) to (c) of the FAA, borrowings undertaken by the Minister – together with amounts borrowed by agent Crown corporations and Canada Mortgage Bonds guaranteed by the Canada Mortgage and Housing Corporation – may not exceed the maximum amount specified in the BAA, which is $1,831 billion, as of May 6, 2021.

Prior to May 6, 2021, the legislative maximum in force was $1,168 billion which came into force on November 23, 2017. This amount was amended in response to the Minister's recommendation based on a three-year forecast horizon of fiscal spending needs. Intuitively, the forecast horizon aligns with the legislatively required tabling date of the next BAA report, where the minister makes an assessment on whether the maximum amount should be increased or decreased.

On June 23, 2022, the BAA was amended to treat the extraordinary borrowings undertaken between March 23, 2021 and May 6, 2021 to fund the government's response to the COVID pandemic as regular borrowings, which in turn would lead them to be counted against the maximum amount set out under section 4 of the BAA. Consequential amendments were made to the FAA to no longer treat this amount as extraordinary borrowings for the purpose of legislative reporting requirements under the FAA.

The Minister is obligated to provide an assessment of the sufficiency of the current maximum amount via her Report to Parliament. The assessment for the need to amend the maximum amount is based on a three fiscal-year forecast, in line with past practice. This allows the end of the forecast horizon to align with the legislatively required tabling date of the next BAA report, where the Minister makes an assessment on whether the maximum amount should be increased or decreased.

Current Maximum Amount that May be Borrowed

Section 4 of the BAA specifies that the maximum amount that may be borrowed is $1,831 billion and lists the categories of borrowings to which, in aggregate, the maximum applies.

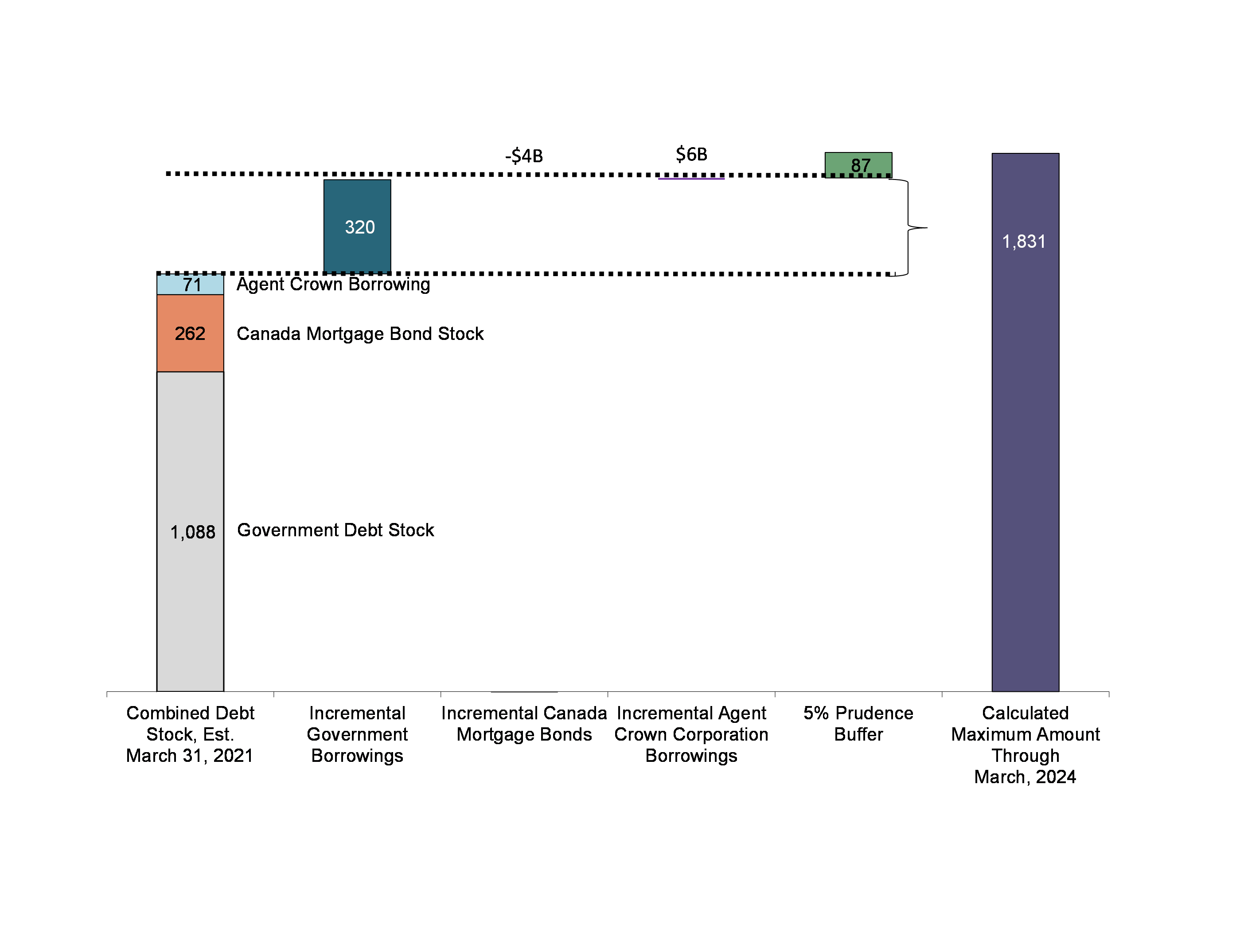

This amount was determined based on the aggregate total maximum level of outstanding debt for the various categories over three fiscal years as projected at the time of Budget 2021, as well as a prudence buffer of 5 per cent (Figure 1).

Components of BAA Maximum Borrowing Amount of $1,831 billion

Report to Parliament on Total Amount of Money Borrowed

| Description | Amount |

|---|---|

a. Government borrowings |

$1,379,707,888,363 |

b. Canada Mortgage Bonds |

$264,500,000,000 |

c. Agent Crown Corporation borrowings |

$66,126,296,000 |

| Combined market debt stock under section 4 of the BAA | $1,710,334,184,363 |

|

Source: Department of Finance estimates. Final figures which include accounting adjustments will be presented in Public Accounts 2024 |

|

As of March 31, 2024, the total of (a) Government borrowings, (b) Canada Mortgage Bonds, and (c) agent Crown corporation borrowings covered by section 4 of the BAAs was estimated to be $1,710.3 billion, about $120.7 billion below the maximum amount of $1,831 billion set out in section 4 of the BAA.

Minister's assessment of whether the maximum amount of borrowings under section 4 of the BAA should be increased or decreased

The BAA also requires the Minister to include in this Report an assessment of whether the maximum amount of borrowings under section 4 of the BAA should be increased or decreased.

As detailed in Table 2, the combined market debt at March 31, 2024 is estimated at $1,710.3 billion. Estimates are subject to revision as Public Accounts for 2024 would be the official source for March 2024 numbers and would normally be released in mid-late 2024.

Considering the financial requirements presented in Budget 2024, the Minister assesses that the maximum amount in section 4 of the BAA should be increased.

The Minister will provide her recommendation for the higher maximum amount when the related legislation is tabled to ensure that the latest estimates of borrowing needs form the basis of her assessment.

Annex A: Estimate of Outstanding Borrowings at March 31, 2024

| Description | Amount |

|---|---|

| Domestic Marketable Bonds | $1,090,573,587,000 |

| Treasury Bills | $267,400,000,000 |

| Foreign Currency Debt | $21,734,301,363 |

a) Government of Canada |

$1,379,707,888,363 |

b) Canada Mortgage Bonds |

$264,500,000,000 |

| Export Development Canada | $63,870,000,000 |

| Canada Post Corporation | $998,004,000 |

| Farm Credit Canada | $947,044,000 |

| Business Development Canada | $0 |

| Freshwater Fish Corporation | $25,023,000 |

| Royal Canadian Mint | $18,000,000 |

| Canada Mortgage and Housing Corporation | $0 |

| Total: Enterprise Agent Crown Corporations | $65,858,071,000 |

| Canada Broadcasting Corporation | $220,000,000 |

| Canadian Dairy Commission | $11,013,000 |

| Federal Bridge Corporation | $37,212,000 |

| Total: Consolidated Agent Crown Corporations | $268,225,000 |

c) Agent Crown Corporations |

$66,126,296,000 |

| Total Combined Market Debt Under Section 4 of the BAA | $1,710,334,184,363 |

|

Source: Department of Finance estimates, agent Crown corporation corporate plans, Bank of Canada. |

|