A Blueprint for the Canada Innovation Corporation

Foreword

The global economy is changing—and this represents a generational opportunity for Canada and Canadian workers. If we continue to make smart investments today, we can create more good middle class jobs that Canadians will count on for decades to come.

Canada has all of the building blocks required for an innovation-driven economy. Federal investments in discovery and invention have supported the creation of world-class research facilities, helped to employ top global talent in emerging technology areas, and supported start-up ecosystems that have given rise to new, innovative companies. We have long excelled at producing ground-breaking ideas and inventions.

However, Canadian businesses do not invest in research and development (R&D) at the same level as their global peers. This has resulted in their reduced capacity for turning new ideas and inventions into globally competitive products and processes, and challenges in creating and protecting intangible assets, such as intellectual property.

Too often, this means new opportunities for growth move elsewhere, and it has led, for decades, to economic productivity that lags many of our global peers. This is Canada’s longstanding economic Achilles’ heel.

To address this challenge, a new approach is needed. That is why we are establishing the Canada Innovation Corporation (CIC).

The CIC will not be just another funding agency. It will be an outcome-driven organization with a clear and focused mandate to help Canadian businesses across all sectors and regions become more innovative and productive. It will support them in developing and protecting intellectual property, and in capturing important segments of global supply chains that will help drive Canada’s economic growth and create good jobs.

The CIC will be led by private sector experts, and it will deliver the support that Canadian businesses need, at the speed of business.

Canadians are talented, creative, and inventive. Our country has never been short on good ideas. By helping Canadians and Canadian businesses take their new ideas and new technologies and turn them into new products, services, and growing businesses, the CIC will play an important role in building a stronger and more innovative Canadian economy for generations to come.

1. Rationale

1.1 The Urgent Need to Address Low Business Investment in R&D

Canadian science, technology, and innovation policies have successfully supported scientific discovery and established Canada as a world leader in invention. Canadian research facilities are home to some of the most talented people in their fields in the world. With robust start-up ecosystems across the country and countless firms in established commodity-based and manufacturing industries that have the potential to be transformed into technology-driven global leaders, Canada has all of the fundamentals required to build a stronger and more innovative economy.

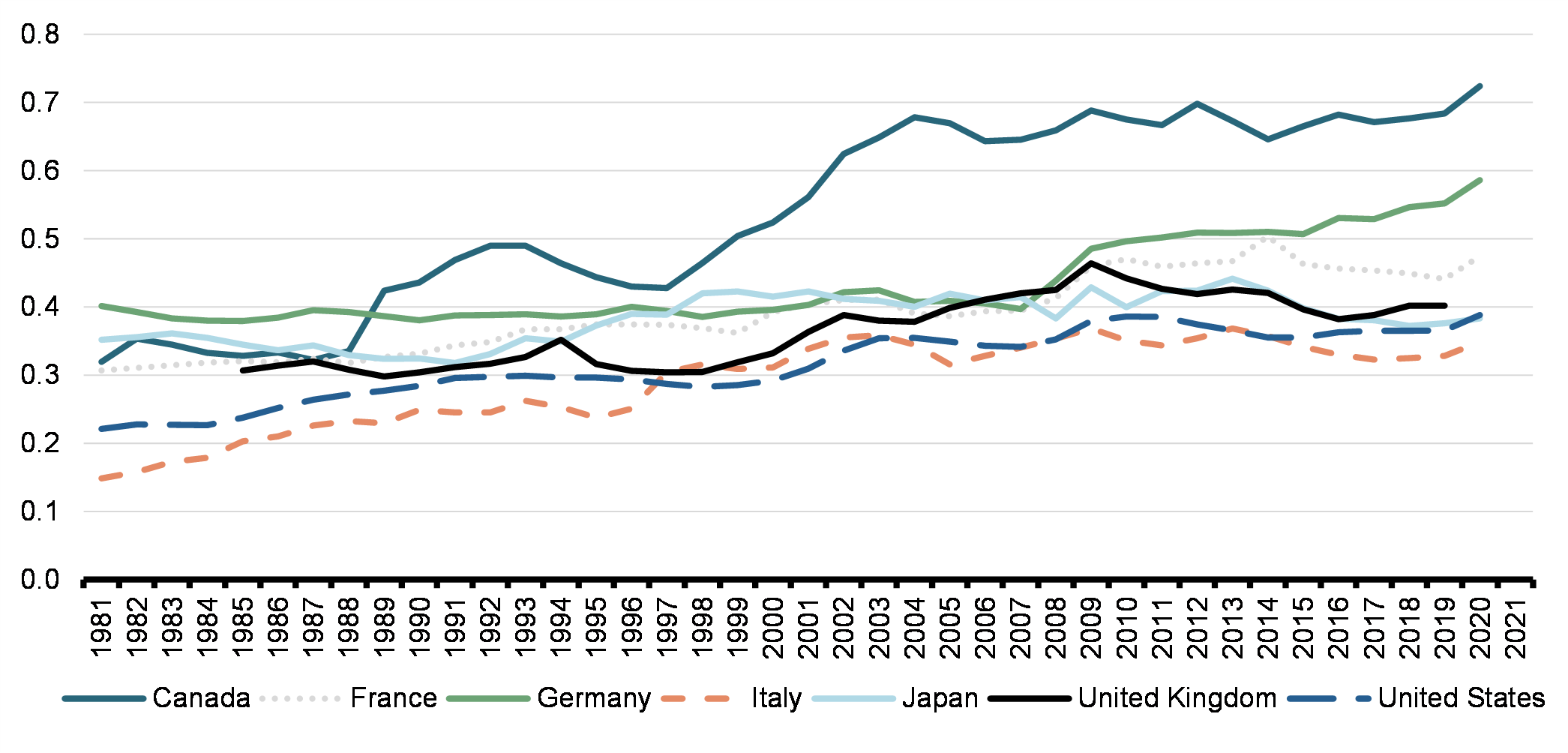

Canada is a World Leader in Higher Education Expenditures on Research and Development (HERD) as a Percentage of GDP

While Canadian higher education expenditures in R&D are among the highest in the world, Canadian businesses do not invest in R&D to the same degree as their global peers. As a result, Canada excels at supplying novel ideas and inventions to the global marketplace. But low business investment in R&D has resulted in a low business demand for these ideas, and their reduced capacity to turn ideas into new products and services.

Canada is one of the only countries in the Organisation for Economic Co-operation and Development that has seen a decrease over the past two decades in the overall level of investment in R&D as a share of GDP. The number of firms conducting R&D in Canada has steadily declined across almost all sectors of the economy.

Canadian businesses also continue to require resources to support their investment in, and protection of, so-called ‘intangible assets’ (including intellectual property rights) that result from R&D. Without proper protections, powerful global multinational firms can challenge the ownership of intangible assets in order to complicate the commercialization of competitive technologies by Canadian companies. These actions can ultimately impair the growth and development of Canadian businesses and prevent them from becoming global leaders in new technologies or products.

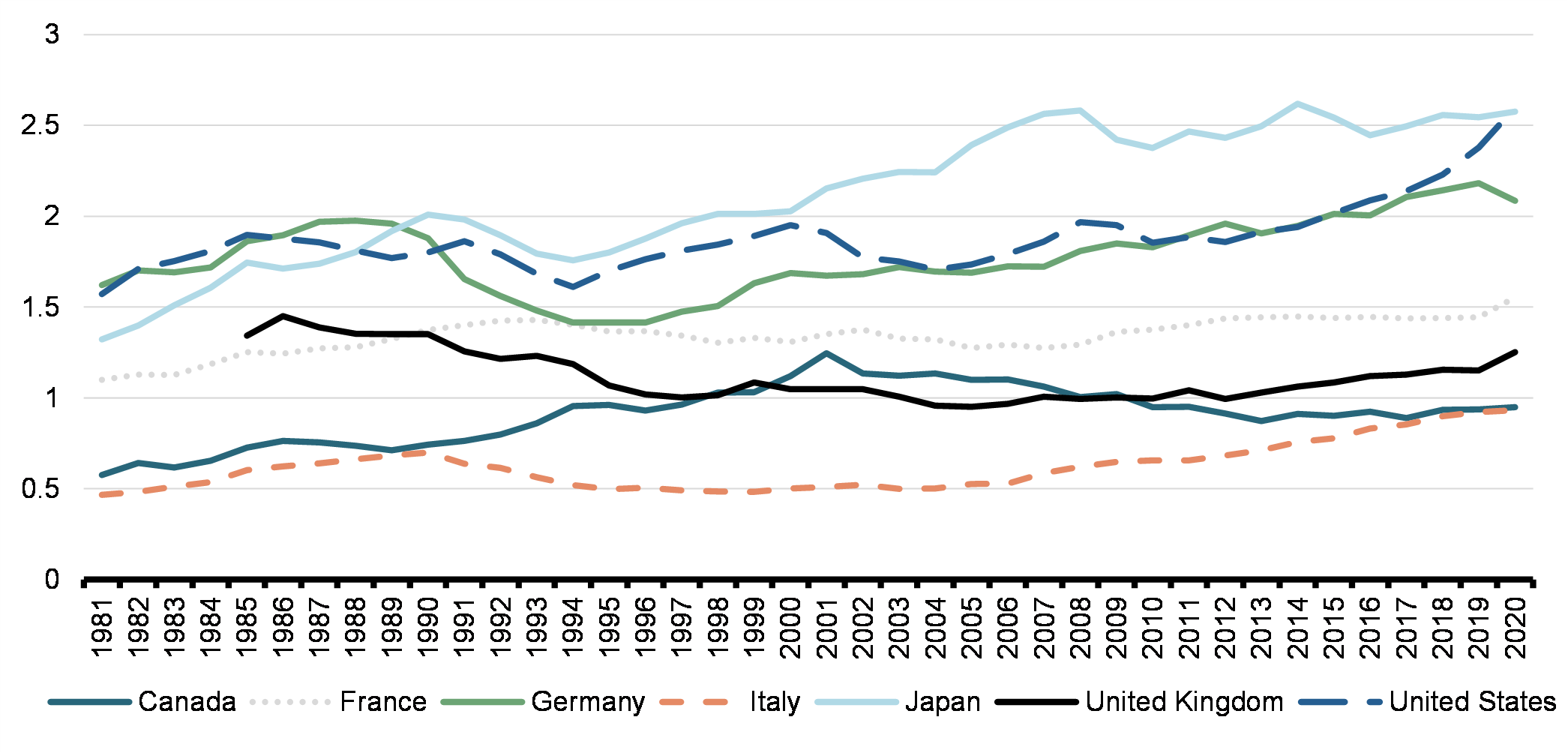

Business Expenditures on Research and Development (BERD) as a Percentage of GDP, Relative to Peer Countries

With low levels of Canadian business investment in R&D, the economic benefit—to both workers and businesses—that results from new Canadian discoveries is often realized outside of Canada.

Low levels of investment in R&D by Canadian businesses also weakens Canada’s global competitiveness and reduces opportunities for Canadian workers. Canada’s productivity level relative to the U.S. has fallen from approximately 90 per cent in 1980 to approximately 75 per cent today. The gap in output per hour between Canada and the U.S. has more than doubled since the 1990s. As a result, for every dollar invested in labour and other inputs, Canadian businesses, on average, generate 75 per cent of the output that U.S. businesses generate.

Recent supply chain disruptions, coupled with U.S. efforts to establish more self-reliant domestic supply chains, are evidence that Canadian businesses could benefit from enhanced support to incent R&D investments that will generate new and improved, globally competitive products, processes, and services. These investments in R&D are increasingly critical to allowing Canadian businesses to leverage existing, and seize new, growth opportunities as new global supply chains are established.

To help drive economic growth, additional support must be structured to reflect the Canadian economy in order to maximize the impact for domestic businesses, including those operating in established commodity-based and manufacturing industries. These resources will be critical to unlocking the tremendous potential of Canadian industries to innovate, compete in global markets, generate wealth for Canada, and create more good jobs for Canadians.

1.2 A New, Outcome-Driven, Approach to Boosting Business Demand for Ideas and Capacity to Innovate

In Budget 2022, the government committed to establishing an innovation agency to launch a new, outcome-driven strategy that will increase Canadian business investment in R&D. The CIC will experiment with different approaches to improving Canadian business demand for novel ideas, and increasing their capacity to invest in R&D projects that will turn these ideas into new and improved products and processes. It will deliver support in a more accessible way across the Canadian economy, to drive innovation-based growth.

The creation of the CIC follows international best practices. Other countries have succeeded in tackling similar challenges by zeroing in on the core problem—low levels of business investment in R&D—and created a targeted, operationally independent organizations that focus on addressing the challenge.

For example, the Israel Innovation Authority has spurred the growth of new R&D-intensive sectors, such as the information and communications technology sector. Business Finland, formerly TEKES, has helped transform Finland's established sectors, such as forestry, into high-technology, prosperous, and globally competitive industries.

The structure of the Canadian economy will inform the strategic operations of the CIC. The CIC will not only focus on high-technology firms, but will design programs and services to target businesses operating in established commodity-based and manufacturing industries to help them turn inventions into innovations and build on Canada's natural comparative advantages.

The CIC will also support Canadian business investment in, and protection of, intellectual property rights to enable the growth of Canadian businesses in global markets. The CIC will also refer clients to a portfolio of recently created programs, including the Innovation Asset Collective, IP Assist, Elevate IP, and Explore IP, to ensure that more Canadian businesses have access to resources that will support the development and exploitation of intellectual property.

The CIC will introduce a new focused approach to Canada’s innovation ecosystem. It will:

- Achieve operational excellence: by recruiting private sector experts to leadership positions and operating at the speed of business. The CIC will quickly develop programs that are responsive to business needs, and deliver minimizingfunding within weeks to minimize clients’ transaction and administrative costs.

- Establish strategic capacity: by constantly monitoring national and international industrial and economic trends. The CIC will analyze this information to identify new approaches that will support business investment in R&D and promote business growth.

- Create a platform for program experimentation: by collecting the data required to conduct effective evaluation and continuous program experimentation, including the development of new initiatives, the scale-up of successful initiatives, and the termination of unsuccessful initiatives.

- Support strategic procurement: by providing robust technical review and validation de-risk and to support government procurement of leading-edge solutions from Canadian businesses, through strategic procurement programs such as Innovative Solutions Canada.

- Create links to complementary organizations: by providing incentives help Canadian businesses take advantage of R&D facilities within colleges, universities, and federal laboratories. It will also build a pipeline of high-potential Canadian firms that can then go on to access growth financing through the Canada Growth Fund, the Business Development Bank of Canada, and other sources of capital.

- Attract talent: by building a culture that attracts leading technical and business experts to advise on strategy, operations, and funding decisions. A reliance on experts to evaluate projects will lend credibility to the organization, help to bring in private sector investments, and unlock procurement opportunities across the public and private sectors.

2. Mandate and Functions

2.1 Mandate

The CIC will have a focused, outcome-driven mandate to increase Canadian business expenditure on R&D across all sectors and regions of Canada, and help to generate new and improved products and processes that will support the productivity and growth of Canadian firms.

2.2 Funding Approach

The CIC will be funded through an annual statutory transfer. This approach will provide consistent, long-term funding to the CIC to ensure operational stability and the ability to establish lasting partnerships with the private sector. It will operate with an initial budget of $2.6 billion over four years, starting in 2023-24. This initial budget includes funding provisioned in Budget 2022, as well as funding associated with the transfer to the CIC of existing federal program resources (see section 3.1). Over the initial four years, the CIC’s budget will grow to support the scale-up of its operations. Ongoing funding beyond this initial period will be confirmed and calibrated to ensure the CIC will be able to have a broad impact across the Canadian economy.

2.3 Scope of Activities

Learning from international examples and building on Canadian program successes, the CIC will deliver funding and advisory services that will encourage more Canadian firms to initiate and scale R&D activities in Canada for the purpose of producing new and improved, globally competitive products, processes, and services. As part of its core mandate, the CIC will help maximize the capacity of Canadian businesses to develop intangible assets, while supporting the retention of these assets in Canada.

The National Research Council R&D facilities have played a critical role in supporting innovative Canadian businesses:

To capture the maximum economic benefit for Canada resulting from Canadian business investments in R&D, the CIC will:

- Conduct an assessment of the potential for the creation, commercialization, and retention of intangible assets in Canada as part of R&D project evaluations.

- Deliver an appropriate mix of funding mechanisms and repayment requirements to minimize the transfer of intellectual property resulting from CIC-funded projects.

- In time, the CIC could experiment with institutional approaches to providing greater protection to growing Canadian companies that are commercializing intangible assets, such as by establishing patent collectives or partnering with existing patent collectives.

The CIC will conduct three main activities:

- Delivery of funding programs: The CIC will administer financial support in the form of grants and contributions to support R&D projects undertaken by businesses across the Canadian economy—from businesses operating in emerging high-technology sectors to those operating within established industries. Initially, the CIC will focus on supporting the following types of projects across different stages of innovation:

- Applied research projects that will allow businesses to acquire new information to build a deeper understanding of a particular industrial challenge and/or market opportunity, and use that knowledge to enable product development or process improvements.

- Experimental development projects that will allow businesses to leverage scientific or technical knowledge to develop new products, processes, and services, or to improve existing ones. These projects could include the creation of a commercially workable prototype required for validation before large-scale commercial production, or the testing of new products or services within environments representative of real-world operating conditions.

- Technological adaptation projects that will allow businesses to adapt existing technologies, such as artificial intelligence algorithms, for new purposes to develop new or improved products, processes, and services.

Technology adaptation versus technology adoption:

The CIC will support business-led technology adaptation projects—a type of R&D project undertaken to determine how an existing technology may be modified for a novel purpose that is unique to the industry. This is distinct from technology adoption projects, where businesses deploy existing solutions in use by the industry.

R&D funding delivered by the CIC will be simple in design and easy to access. The CIC will take a holistic approach to supporting R&D projects, which could include delivering support for components of an R&D project that are key to achieving product or process development goals and to securing an economic return on the R&D activities.

- Delivery of advisory services: The CIC will establish a business development team that will broaden engagement with Canadian businesses to help better understand the barriers to conducting R&D in Canada, and work proactively with businesses to reduce these barriers. This could include:

- Educating businesses on the funding available through the CIC, as well as across other government departments and agencies;

- Helping formulate R&D project proposals, including providing support for the creation and retention of intangible assets;

- Connecting businesses to publicly funded researchers that are advancing projects with industrial applications that could address a business’ challenges;

- Referring businesses to R&D services and facilities at Canadian colleges, universities, and federal laboratories to facilitate R&D activities; and,

- Facilitating linkages between firms in emerging, technology-focused, and established sectors to highlight the value of new technologies in improving productivity and growth.

- Foresight and experimentation functions: The CIC will establish a strategy team to conduct ongoing program impact evaluation in the context of evolving private sector needs. The CIC strategy team will aggregate intelligence gathered from the business development team with ongoing in-house analysis on Canadian research strengths, as well as domestic and international technology trends. This team will allow the CIC to partner with Canadian businesses and build collective awareness of emerging growth opportunities.

2.4 Program Suite

Available funding is expected to range from roughly $50,000 to $5 million per project, depending on project proposals. The CIC will also have the flexibility to support a select number of larger-scale R&D projects, with the ability to provide support up to a maximum contribution of $20 million per project. The project evaluation process will be calibrated to the level of funding requested, including streamlining the review of smaller projects to enable faster decision making, and extensive expert review of large-scale projects, as determined by the CIC Board of Directors and senior leadership.

An initial program suite, based on supporting analysis of the Canadian business innovation ecosystem and international best practices, is outlined below. This program suite is illustrative, but indicative of the type of flexibility in funding programs that the CIC could offer. Program design and launch will be undertaken by the CIC Board of Directors and senior leadership, and will evolve with changing business opportunities.

Graduated Framework of Funding Tools

Smaller-scale grants: to support new R&D projects undertaken by new and existing Canadian businesses.

- The total CIC grant would be delivered at the project outset to provide businesses with the certainty and cash flow required to quickly undertake new R&D activities.

Larger-scale contributions: to support the creation and growth of large-scale R&D capacity in Canada.

- The contribution would be delivered through milestone payments in support of longer-term or multi-year R&D projects undertaken by businesses with the potential and commitment to grow from Canada.

Consortia contributions: to support collaborative R&D projects that will enable the growth of emerging and established industries.

- Total contribution delivered through milestone payments in support of longer-term or multi-year R&D collaboration projects across emerging and established industries, helping to leverage Canadian strengths in high-technology sectors to improve the productivity and competitiveness of Canadian industries.

- By incenting the creation of R&D consortia, the CIC could help Canadian businesses realize the value of existing intangible assets through active collaborations among consortia partners with a multi-sector and national scope.

International collaboration contributions: to support R&D collaboration that will expose Canadian businesses to international R&D leaders and increase export opportunities.

- The contribution would be delivered through milestone payments in support of longer-term or multi-year, impactful R&D projects with international firm(s) to expose Canadian businesses to new export markets.

Example – Applied Research & Experimental Development Project

Alex runs a small life science business in Montreal that has discovered, through preliminary experiments, a new class of potentially life-saving cancer therapeutics that could be effective at treating a type of cancer with no known cure. Her business specializes in methods for quickly turning potential therapeutics into safe market-ready pharmaceuticals through advanced, computational, drug development methods.

Alex sees a large global market opportunity, but up-front financial support is needed for her business to dedicate staff and secure access to facilities to launch the new initiative. To secure funding quickly, she applies for an Early Stage R&D grant through the CIC. The CIC conducts an evaluation of the project, and delivers funding to the company within weeks.

CIC support is provided for the following activities:

- Preliminary design of five potential drug candidates, based on the novel class of drugs, but with modifications that could improve efficacy and safety in humans.

- Systematic testing of the five drug candidates to confirm cancer cell-killing properties, but with improved stability in human blood.

With the results of this R&D project, Alex’s business is ready for pre-clinical studies—a key milestone that will unlock follow-on funding from private investors and allow her to plan for clinical trials of this new therapeutic.

Example – Experimental Development Project

Marlee runs a medium-sized battery manufacturing business in Calgary that specializes in the production of lithium-ion batteries—a key component of electric vehicles, medical devices, and portable electronics. To meet the growing demand for lithium-ion batteries, address the expected increase in used batteries from aging electric vehicles, and take advantage of recent global efforts to re-shore critical mineral supply chains, Marlee sees an opportunity to scale her R&D team and establish her business as a leader in lithium-ion battery recycling processes.

To de-risk investment in a large-scale, multi-year R&D project aimed at investigating novel lithium-ion recycling processes that will optimize the recovery of key metals, such as cobalt, Marlee applies for an R&D Scale contribution. The CIC relies on experts to review the project to assess its technical feasibility and potential for eventual large-scale Canadian production to meet global demands.

CIC support is provided for the following activities:

- Preliminary design of different recycling processes and systematic evaluation of the results relative to material costs.

With this support, Marlee is able to invest in the creation of a battery recycling R&D team that attracts leading scientists and engineers, and is able to develop a novel battery recycling process.

Example – Technology Adaptation Project

Simon’s medium-size forestry business in Powell River, B.C. has struggled to stay competitive in global markets due to its historic reliance on individual experts to analyze raw satellite images and determine the types and age of trees in each area. This process has limited the number of locations his business can operate in and, at times, delayed harvesting schedules.

Simon is interested in exploring the use of machine learning algorithms to process a higher volume of satellite images and scale his business’ operations to more sites. However, his business does not have the expertise needed to develop these computational tools, and the specific tools on the market are not designed to address his particular needs. Simon reaches out to the CIC, who are able to leverage existing connections with machine-learning industry experts to explore opportunities to co-develop new computational tools. The CIC facilitates an introduction to a start-up in Montreal that has built a machine-learning platform for image processing.

At the recommendation of the CIC, Simon reaches out to other businesses in the forestry sector to encourage firms to pool their raw data and financial resources to support the development of an automated image-processing tool that would predict the optimal harvesting schedule. The CIC provides financial support for a collaborative R&D project, submitted by Simon’s forestry business on behalf of a small consortium of business partners.

CIC support is provided for the following activities:

- In-house analysis on how new computational image-processing tools could be used to process satellite images.

- Systematic testing to understand how well the machine-learning image-processing tool is applied to different operational sites, as well as the refinement of the algorithm.

With this support, Simon’s business is able to use the image-processing tool to improve its productivity and scale its operations to more locations. The consortium of forestry businesses is able to market the technology and sell software licenses to other international forestry firms, providing additional revenue streams to the business partners.

3. Complementing Other Federal Programs

3.1 An Anchor Role for the Industrial Research Assistance Program

To build a national-scale platform of business R&D support, the National Research Council’s Industrial Research Assistance Program (IRAP) will join the CIC. IRAP will provide a strong foundation upon which the CIC will be able to build an integrated platform and continuum of support, service, and strategy across all technologies and industries.

To establish a large-scale platform of business R&D support, IRAP will join the CIC. Details on the establishment, mandate, and governance of the CIC will be introduced in legislation. IRAP employees will be transitioned seamlessly, and their employment continued under the CIC. The CIC enabling legislation will specify an extension of pension benefits under the Public Service Superannuation Act. The CIC leadership will work with employee unions to ensure that the transition takes place through an orderly process.

The reorganization of Canada’s research and innovation system from activities spun out of the National Research Council is similar to the creation of other science-based departments and agencies, such as the Canadian Space Agency, the Canadian Institutes of Health Research, and the Natural Sciences and Engineering Research Council. These organizations originated as activities within the National Research Council, and were continued as distinct organizations to scale their impact.

IRAP is considered one of Canada’s foremost business innovation programs and has been operating for more than 75 years. The program has supported innovation-based economic growth through direct engagement with small- and-medium sized businesses operating across all sectors of the economy. IRAP delivers a comprehensive suite of support that helps de-risk R&D activities, bring ideas to market, and drive economic growth.

IRAP’s success is anchored in its network of more than 270 Industrial Technology Advisors (ITAs), located across Canada with a unique combination of technical and business development expertise. Each year, ITAs work with over 8,000 businesses by providing advisory services, funding for impactful projects, and international connections that create important linkages in global value chains. The program also serves a key advisory role to other government departments, supporting program design, delivery, and project evaluation processes.

Over the transition period, there will be no changes to the delivery of IRAP advisory services and funding. In time, IRAP will be integrated into a continuum of programming offered by the CIC. This approach will avoid duplication across the suite of federal programs and reduce confusion for business clients. Following the transition, the total IRAP budget will be transferred to the CIC, and is included in the initial funding provisioned for the CIC.

The evolution of IRAP is happening alongside a broader modernization of the National Research Council.

3.2 National Research Council Revitalization

For more than a century, Canadian businesses have relied on National Research Council facilities to advance the development, adaptation, demonstration, and early production of new products and processes for the global marketplace. The National Research Council provides essential technical expertise and specialized facilities that are often too costly for one business to build.

The 2022 Fall Economic Statement announced that the government proposes to provide a strategic investment of $962.2 million over eight years, and $121.1 million per year ongoing to update the National Research Council’s facilities. This funding will ensure that they are able to keep pace with technological advancements and provide Canadian businesses with relevant laboratories, equipment, and expertise to facilitate the transformation of novel inventions into market-ready products and services.

With IRAP joining the CIC, the National Research Council will focus modernization efforts on establishing new connections with businesses and academia, and unlocking the full potential of its national network of over 100 scientific and commercialization facilities in 24 locations across Canada. Businesses that access funding and support through the CIC may benefit from National Research Council laboratories, equipment, and expertise to undertake R&D.

The National Research Council R&D facilities have played a critical role in supporting innovative Canadian businesses:

KUMA Brakes is a leading manufacturer of brake pads for wind turbine applications. The firm's first brake pad prototypes were completed in early 2011, working in collaboration with the National Research Council of Canada's Boucherville-based Automotive and Surface Transportation Research Centre powder forming facility. The National Research Council's research team supported testing of the mechanical performance of the pads, qualification of the raw material suppliers, the selection of the equipment, and fine-tuning of the manufacturing process. KUMA Brakes is now one of the world’s leading manufacturers of brake pads, serving wind turbine equipment manufacturers around the world.

Zymeworks Incorporated is a global leader in the field of biotherapeutics—the science of treating disease with medicine made from or using living cells. Through the development of a range of technology platforms and resulting therapeutics, the company is now a growing source of hope for the future treatment of a range of cancers. Through a collaborative partnership formalized in 2009, the National Research Council of Canada’s Human Health Therapeutics Research Centre was instrumental in the growth of Zymeworks. By providing laboratory expertise and access to a team of experts, the National Research Council enabled the company to shift its technology platform from cutting-edge theoretical models to practical reality. Now working on new technology to better target and kill cancer cells, collaboration between the National Research Council and Zymeworks is ongoing.

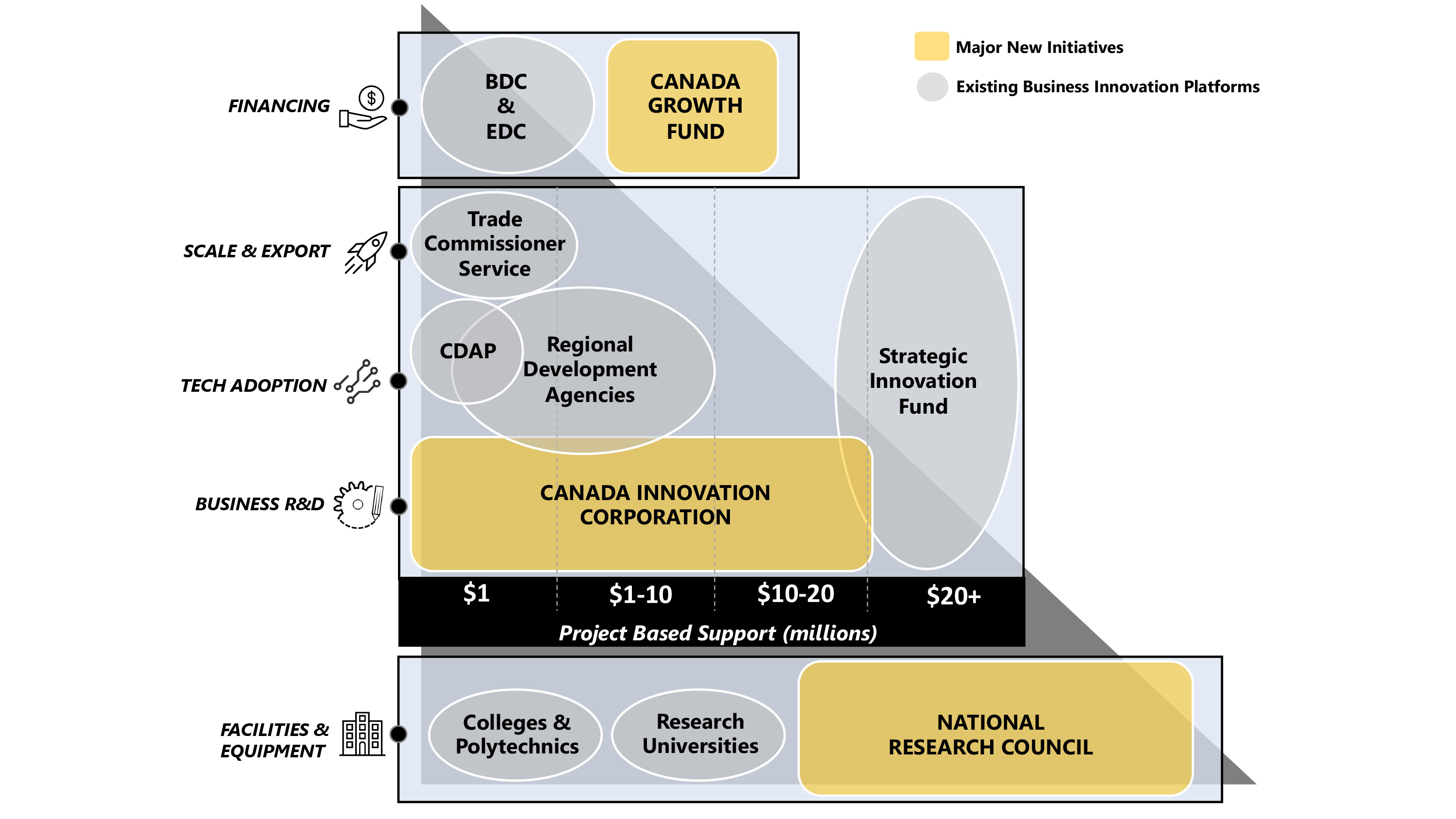

3.3 Existing Suite of Business Innovation Programs

The CIC will build on IRAP operations and continue to function as a partner in the delivery of other government initiatives. Existing direct federal support for business innovation and growth is largely delivered through four main platforms: the Industrial Research Assistance Program; the Regional Development Agencies; the Strategic Innovation Fund; and the Trade Commissioner Service. Together, these platforms provide a continuum of project support to drive early-stage product development, technology adoption, growth, and export activities.

Large-scale investments in innovation and investment attraction, beyond the level expected to be supported by the CIC are made through the Strategic Innovation Fund. Strategic procurement programs, including Innovative Solutions Canada, provide a mechanism to advance Canadian business R&D, technology development, product validation, and a pathway to commercialization.

Nanozen Industries Inc., a Vancouver-based SME that pioneers innovative approaches to aerosol exposure analysis for industrial workplace environments, received a $195K contract through Innovative Solutions Canada to test their Accurate Particle Detector clean-tech innovation with Environment and Climate Change Canada. Within one year following contract completion, the company reported $1.5M in commercial sales and $1.3M in export sales. The CIC will further support procurement by:

- Establishing connections between promising firms and government procurement programs, such Innovative Solutions Canada.

- Building partnerships between new and established firms, resulting in increased procurement by larger businesses.

- Offering technical expertise to support the assessment of submissions for government procurement programs.

Access to facilities, equipment, and technical advisory services that are crucial to enabling R&D, product testing, and demonstration is available at a national scale through the National Research Council, and at a regional level through Canadian universities, colleges, and polytechnics.

In addition to supporting businesses directly, a number of government programs also deliver support that helps to build innovation ecosystems. At a regional level, the Regional Development Agencies provide support to business accelerators, incubators, and other business advisory organizations. The Global Innovation Clusters support larger-scale, multi-sectoral, regionally based clusters that boost innovation and growth within particular industries. The Strategic Innovation Fund also delivers funding that supports national innovation ecosystems that promote business R&D, technology demonstration, and commercialization.

There are also a number of important programs that support the development and adoption of priority technologies and the growth of key Canadian sectors. For example, the Canada Digital Adoption Program (CDAP) helps businesses implement e-commerce capabilities, adopt digital technologies, and digitize their operations to stay competitive and meet their customers' needs in the digital marketplace. Beyond project-based support, business growth financing is currently mainly available through the Business Development Bank of Canada (BDC) and Export Development Canada (EDC). Significant additional support for growth financing will also soon be available through the new Canada Growth Fund.

The CIC will expand on the IRAP platform, but will operate with a new governance model to enhance policy experimentation. The CIC will provide a new continuum of integrated support, aimed at driving business investment in R&D and demand for new technologies. It will operate with more flexibility than the existing suite of programs, and with an ability to quickly adapt its programming to address emerging challenges and opportunities that are presented to Canadian businesses. The CIC will work closely as a partner to other federal departments and agencies that play key roles in delivering business innovation support broadly. For example, the CIC will work collaboratively with the Regional Development Agencies and the Strategic Innovation Fund to ensure that businesses have seamless access to scale-up support and growth financing. The CIC will be able to offer technical expert review and validation of R&D projects to assist with the delivery of support by other departments and agencies. Over time, the CIC will be able to contribute leadership on the development and execution of strategies aimed at promoting innovation-based economic growth.

The Innovation Canada platform, delivered by Innovation, Science and Economic Development Canada, will continue to offer a single-window access to government programs delivered across all departments and agencies, including the CIC and other Crown corporations, such as EDC and BDC.

Support available through the CIC will be included in the Innovation Canada Business Benefits Finder, and the CIC will work with the Accelerated Growth Service and Global Hypergrowth Passport programs to ensure that high-potential Canadian business clients have access to the resources needed to grow in and from Canada.

Illustrative Framework of Generally Available Direct Business Innovation Programs

4. Governance and Operations

4.1 Operating Principles

The CIC will be operationally independent from government, but with clear accountability to Parliament through the Minister of Innovation, Science and Industry. The CIC will operate as a partner to the private sector with the flexibility to deliver funding quickly and adapt programming to meet evolving business needs. The CIC will also recruit private sector experts to advise on program design, and rely on technical experts to support project evaluation. Core to the mandate of the organization will be an ability to experiment with different approaches, measure the effectiveness of these different interventions, rapidly evolve as needs change, and share information across the innovation ecosystem.

4.2 Governance Model

It is proposed that the CIC be established as a new Crown corporation via enabling legislation that will be introduced in 2023. It will be governed by a Board of Directors, and run by a Chief Executive Officer (CEO). The Board of Directors will be appointed by the Minister of Innovation, Science and Industry, following consultation with the Minister of Finance, and on the approval of the Governor in Council. The Board of Directors will recommend a shortlist of candidates for the position of CEO to the Minister of Innovation, Science and Industry, who will then appoint the CEO following consultation with the Minister of Finance.

4.3 Interim Launch Approach

The CIC will be established as a subsidiary of the Canada Development Investment Corporation to facilitate the recruitment of senior leadership and prepare for the establishment of operations. This approach will accelerate the launch of CIC programming.