Archived - Debt Management Report 2022-2023

Table of Contents

- Foreword by the Deputy Prime Minister and Minister of Finance

- Purpose of This Publication

- Executive Summary

- Part I: 2022-23 Debt Management Context

- Part II: Report on Objectives, Strategic Direction and Principles

- Part III: Report on the 2022-23 Debt Program

- Annex 1: Completed Treasury Evaluation Reports

- Annex 2: Debt Management Policy Measures Taken Since 1997

- Annex 3: Glossary

- Annex 4: Contact Information

- Reference Tables

Foreword by the Deputy Prime Minister and Minister of Finance

Following a robust recovery from the pandemic recession, Canada's economy has remained resilient. Our unemployment rate remains low; over a million more Canadians are employed today compared to when the pandemic first hit; and wage growth has outpaced inflation for the past nine months.

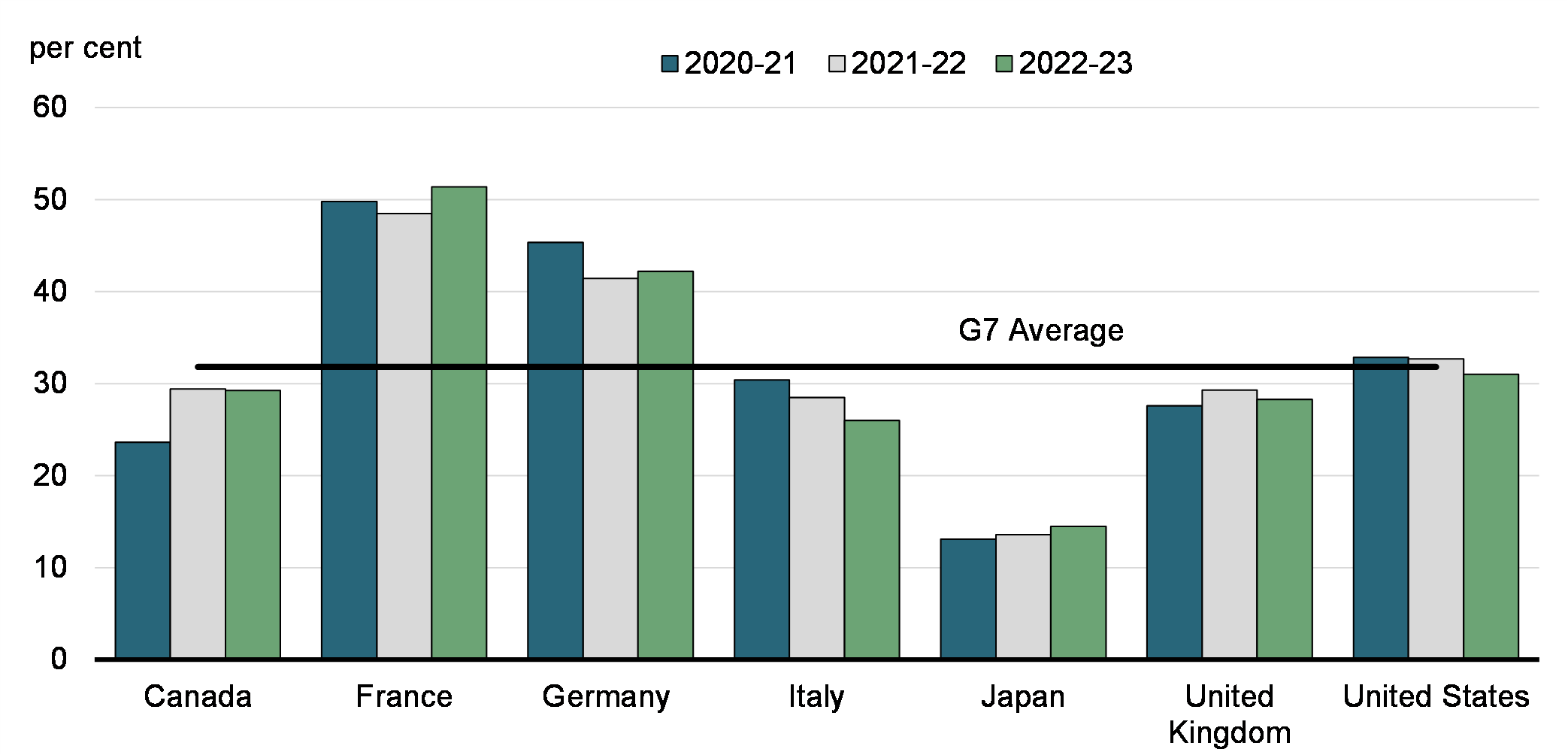

Following the unwinding of pandemic-era emergency supports, Canada's rate of fiscal consolidation has been the fastest in the G7, and we maintain both the lowest deficit and lowest net debt-to-GDP ratio of any G7 country. Together with Germany, Canada is one of only two G7 economies to have a AAA credit rating from at least two of the three major ratings agencies. In early November, Moody's reaffirmed Canada's AAA rating with a stable outlook.

Our government is continuing to deliver on our commitment to responsible fiscal management. In the 2023 Fall Economic Statement, we announced further reductions in public sector spending, as well as other steps to ensure Canada's finances remain sustainable, which will allow us to continue to responsibly invest in Canadians for years to come. Combined with the $15.4 billion in savings introduced in Budget 2023, the government will be saving $4.8 billion per year in 2026-27 and ongoing, helping to return the public service closer to its pre-pandemic growth track.

Every year, the federal government provides a report to Parliament and Canadians that details the government's domestic debt program. This report reflects the main activities of the government's borrowing program, as set out in the 2022-23 Debt Management Strategy, and is guided by the key principles of transparency, regularity, prudence, and liquidity. As in the past, the government has consulted dealers and investors as part of the process for developing the debt management strategy.

Our continued commitment to responsible fiscal management ensures the government's ability to invest in Canadians and the Canadian economy for years to come.

Canada has a proud tradition of fiscal responsibility—and we will ensure that tradition is maintained.

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

Ottawa, 2023

Purpose of This Publication

This edition of the Debt Management Report provides a detailed account of the Government of Canada's borrowing and debt management activities for the fiscal year ending March 31, 2023.

As required under Part IV (Public Debt) of the Financial Administration Act (the "FAA"), this publication provides transparency and accountability regarding these activities. It reports on actual borrowing and uses of funds compared to those forecast in the Debt Management Strategy for 2022-23, published on April 7, 2022, in Budget 2022. It also discusses the environment in which the debt was managed, the composition of the debt, changes in the debt during the year, strategic policy initiatives and performance outcomes.

Other Information

The Public Accounts of Canada is tabled annually in Parliament and is available on the Public Services and Procurement Canada website. The Debt Management Strategy and the Report on the Management of Canada's Official International Reserves, which are also tabled annually in Parliament, are available on the Department of Finance Canada website. Additionally, monthly updates on cash balances and foreign exchange assets are available through The Fiscal Monitor, which is also available on the Department of Finance Canada website. Under the Borrowing Authority Act (the "BAA"), the Minister of Finance (the "Minister") is required to table a report to Parliament every three years on amounts borrowed by the Minister on behalf of His Majesty in right of Canada and by agent Crown corporations, and on Canada Mortgage Bonds guaranteed by Canada Mortgage and Housing Corporation. The most recent report was tabled in Parliament on November 23, 2020 and is available on the Department of Finance Canada website.

Executive Summary

Introduction

This publication reports on two major activities: (i) the management of federal market debt (the portion of the debt that is borrowed in financial markets); and (ii) the investment of cash balances in liquid assets for operational purposes and contingency planning.

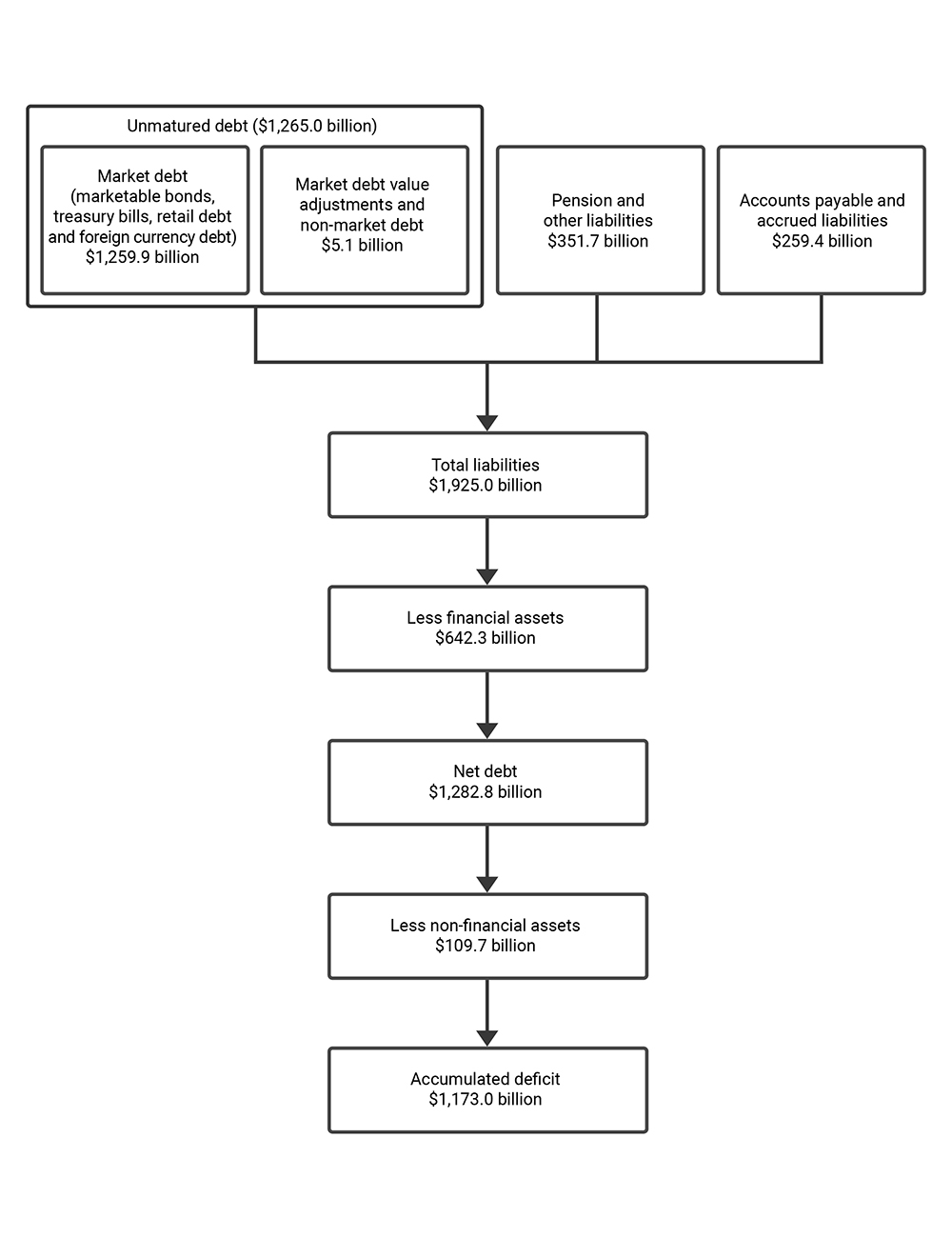

The government's market debt, including marketable bonds, treasury bills, retail debt and foreign currency debt, stood at $1,259.9 billion at the end of fiscal year 2022-23 (see boxed area of Chart 1). In addition to market and other types of unmatured debt, other liabilities brought the total liabilities of the Government of Canada to $1,925.0 billion at that time. When financial and non-financial assetsFootnote 1 are subtracted from total liabilities, the federal debt or accumulated deficit of the Government of Canada was $1,173.0 billion as at March 31, 2023 (see Chart 1).

Domestic funding is conducted through the issuance of marketable securities, which consist of nominal bonds, green bonds and treasury bills, including cash management bills. These securities are generally sold through competitive auctions (occasionally through a syndication process at the government's discretion, such as for green bonds) to government securities distributors, a group of banks and investment dealers in the Canadian market. These government securities distributors then resell these securities to their wholesale and retail clients in the secondary market.

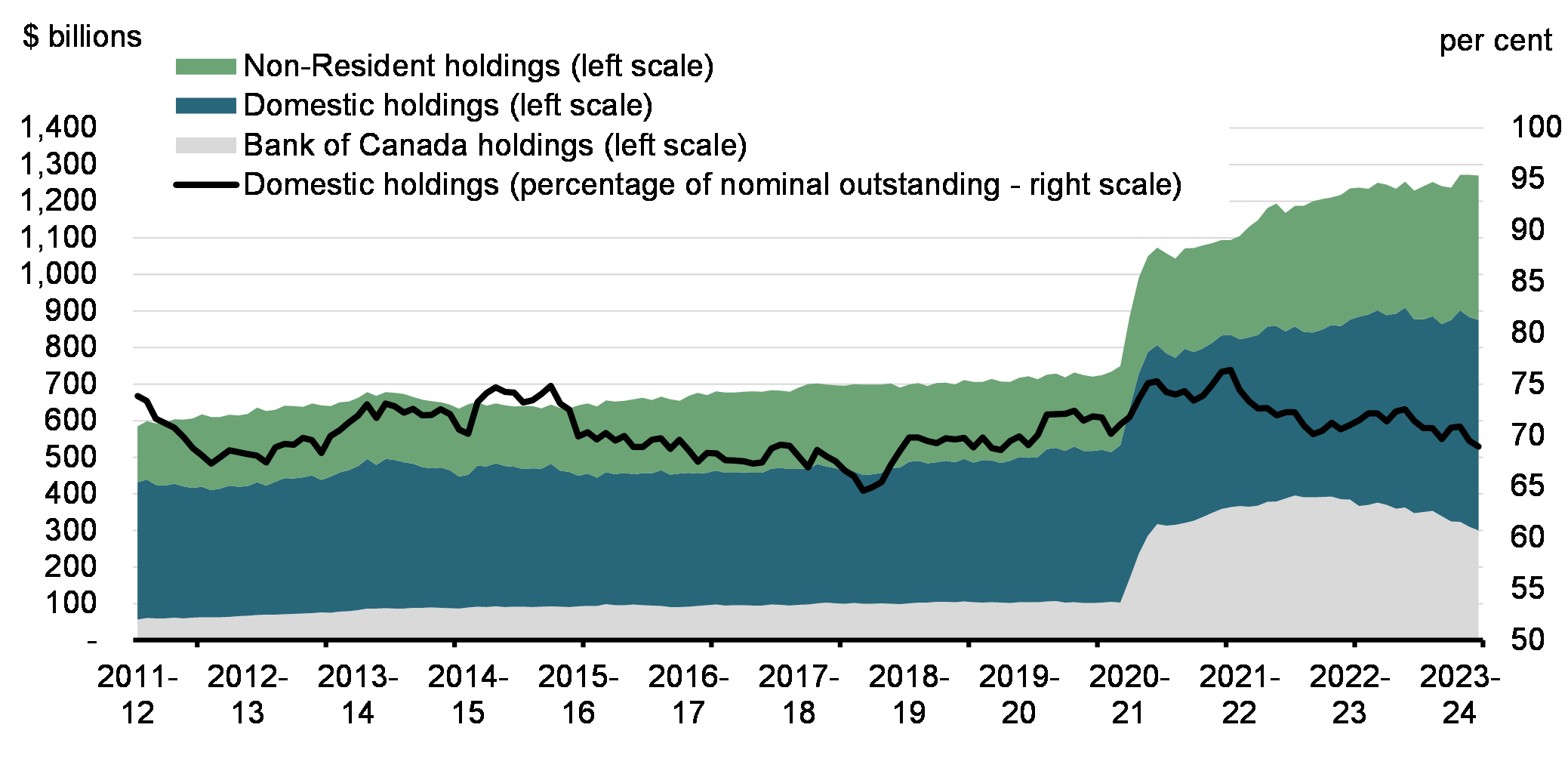

Government of Canada marketable securities are widely held and can be found in retail and institutional investment portfolios, insurance companies and pension funds, central banks (including the Bank of Canada), as well as a variety of other investment vehicles. Overall, about 71 per cent of Government of Canada market debt was held by Canadian investors, including the Bank of Canada, as well as insurance companies and pension funds, and financial institutions and provincial and municipal governments. The participation of international investors in Government of Canada securities markets is of benefit to Canadians, as they serve to increase competition, increase the diversity of the government's investor base, and ultimately reduce borrowing costs for Canadian taxpayers.

Cross-currency swaps and issuance of foreign currency debt are used to fund foreign reserve assets held in the Exchange Fund Account (see the section entitled "Foreign Currency Debt").

Federal Balance Sheet, as at March 31, 2023

Highlights for 2022-23

The Debt Management Report consists of three parts covering the main aspects of the Government of Canada's debt program. "Part I – 2022-23 Debt Management Context" focuses on the state of the accumulated deficit (i.e., federal debt), the year's financial requirements and the sources of borrowings used to raise funds, the federal government's credit ratings, and the authorities required to borrow. "Part II – Report on Objectives, Strategic Direction and Principles" reports on debt management objectives to implement the government's strategic direction to raise stable and low-cost funding to meet the financial needs of the Government of Canada, and to maintain a well-functioning market for Government of Canada securities."Part III – Report on the 2022-23 Debt Program" reports on the operational aspects of the market debt program.

This year's debt management operations continue to support the effective execution of the debt management program. The main highlights are as follows:

Bond Program

In 2022-23, changes were made to the bond program in line with the debt management strategy, and in response to the evolving fiscal outlook. In the Fall Economic Statement 2022, the government announced that it would no longer issue Real Return Bonds due to low demand for the product. The cessation of issuance in this sector would allow the government to promote liquidity in core funding sectors. During 2022-23, $0.7 billion of Real Return Bonds were issued up until the second quarter of the fiscal year, when issuance ceased.

Earlier in the year, as a result of the improving fiscal outlook, the projected deficit declined, leading to a reduction in projected borrowing needs. As a result, in June 2022, the government announced its decision to cancel the issuance of a planned ultra-long bond which would have matured in December 2064.

Ukraine Sovereignty Bond

On November 29, 2022, Canada issued a $500 million Ukraine Sovereignty Bond to provide financial assistance to the government and the people of Ukraine.Footnote 2 Equivalent proceeds from the bond issuance were channeled into a loan via the IMF Administered Account.

Borrowing Authority Act

During the 2022-23 fiscal year, the Borrowing Authority Act (BAA) was amended to cause the approximately $8.4 billion borrowed between March 23, 2021 and May 6, 2021 under paragraph 46.1(c) of the Financial Administration Act (FAA) to be treated as conventional borrowings for the purpose of the maximum amount set out under the BAA.

Budget 2022 announced the government's intent to introduce legislation to treat these extraordinary borrowings as regular borrowings which in turn would lead them to be counted against the maximum amount set out under section 4 of the BAA. On June 23, 2022, the Act was amended to this effect, with consequential amendments being made to the FAA to no longer treat this amount as extraordinary borrowings for the purpose of legislative reporting requirements under the FAA. The amounts will be reported as at the fiscal year-end in the annual Debt Management Report.

Federal Green Bond Program

In March 2023, the government released its inaugural allocation report for the green bond program. This report detailed how the proceeds raised by the bond program were allocated to programs with environmental impacts across a variety of priorities. The release of this report fulfills the allocation reporting and verification requirements set out in the Green Bond Framework.

During the fiscal year, no additional green bonds were issued as the government actively monitors developments, and the evolving market standards and investor preferences in the green bond space. The government remains committed to regular green bond issuances.

Stock of Domestic Market Debt

The stock of domestic market debt increased by $15.3 billion in 2022-23, bringing the total debt stock to $1,259.9 billion. The change in the stock was comprised of a $12.0 billion increase in treasury and cash management bills, a $1.8 billion increase in marketable bonds payable in Canadian dollars, and a $1.5 billion increase in marketable debt payable in foreign currencies. Notwithstanding the increase in debt stock, Canada's general government gross debt-to-GDP (gross domestic product) ratio was among the lowest in the Group of Seven (G7) nations, according to the International Monetary Fund (IMF).

In 2022-23, as interest rates rose from a low level in the two previous fiscal years, the weighted average rate of interest on market debt increased to 2.28 per cent compared to 1.37 per cent in 2021-22.

Strong Demand for Government of Canada Debt Securities

In 2022-23, the relative strength of the Canadian economy and its capital markets continued to support demand for Government of Canada securities in primary and secondary markets. Accordingly, treasury bill and bond auctions remained well-covered and competitively bid, providing an efficient manner for the government to raise funding. The publication of the Quarterly Bond Schedule before each quarter and the Call for Tenders before each auction helped maintain transparency. This promoted well-functioning markets for the government's securities to the benefit of a wide array of domestic market participants, contributing to the objective of raising stable and low-cost funding.

Part I: 2022-23 Debt Management Context

Composition of Federal Debt

In 2022-23, total market debt increased by $15.3 billion to $1,259.9 billion (see Table 1). For additional information on the financial position of the government, see the 2022-23 Annual Financial Report of the Government of Canada.

| 2023 | 2022 | Change | |

|---|---|---|---|

| Payable in Canadian currency | |||

| Marketable bonds | 1,045.0 | 1,043.2 | 1.8 |

| Treasury and cash management bills | 198.9 | 186.9 | 12.0 |

| Total payable in Canadian currency | 1,243.9 | 1,230.1 | 13.8 |

| Payable in foreign currencies | 16.0 | 14.5 | 1.5 |

| Total market debt | 1,259.9 | 1,244.6 | 15.3 |

| Market debt value adjustment, capital lease obligations and other unmatured debt | 5.1 | 5.4 | -0.3 |

| Total unmatured debt | 1,265.0 | 1,250.0 | 15.1 |

| Pension and other accounts | 351.7 | 335.1 | 16.6 |

| Total interest-bearing debt | 1,616.8 | 1,585.0 | 31.7 |

| Accounts payable, accruals and allowances | 259.4 | 262.5 | -3.1 |

| Total liabilities | 1,925.0 | 1,892.3 | 32.7 |

| Total financial assets | 642.3 | 647.5 | -5.2 |

| Total non-financial assets | 109.7 | 104.8 | 4.9 |

| Federal debt (accumulated deficit) | 1,173.0 | 1,140.0 | 33.0 |

Note: Numbers may not add due to rounding. Marketable bonds and treasury and cash management bills (payable in Canadian currency) and amounts payable in foreign currencies include accounting adjustments, such as adjustments to amortized cost and consolidation adjustment. Source: Public Accounts of Canada. |

|||

Sources of Borrowings and Uses of Borrowings

The key reference point for debt management is the financial requirement or financial source, which represents the net cash outflow or inflow for the fiscal year. This measure differs from the budgetary balance (i.e., the deficit or surplus on an accrual basis) by the amount of non-budgetary transactions and the timing of payments on a cash basis, which can be significant. Non-budgetary transactions include changes in federal employee pension liabilities; changes in non-financial assets; investing activities through loans, investments and advances; and changes in other financial assets and liabilities, including foreign exchange activities. Anticipated borrowing and planned uses of borrowings are set out in the Debt Management Strategy, while actual borrowing and uses of borrowings compared to those forecasted are reported in this publication (see Table 2).

There was a financial requirement of $66.2 billion in 2022-23, reflecting $35.3 billion in cash outflows due to a budgetary deficit and a cash outflow of $30.9 billion due to non-budgetary transactions. The financial requirement was $18.8 billion lower than the projection in the Debt Management Strategy for 2022-23. For comparison, the financial requirement in 2021-22 was $84.4 billion.

In 2022-23, loans to the Business Development Bank of Canada, Canada Mortgage and Housing Corporation and Farm Credit Canada under the Crown Borrowing Program were $86.9 billion, $5.1 billion higher than planned in the Debt Management Strategy for 2022-23.

| Planned1 | Actual | Difference | |

|---|---|---|---|

| Sources of borrowings | |||

Payable in Canadian currency |

|||

Treasury bills |

213 | 202 | -11 |

Bonds |

212 | 185 | -27 |

Total payable in Canadian currency |

425 | 387 | -38 |

Payable in foreign currencies |

10 | 8 | -2 |

| Total cash raised through borrowing activities | 435 | 395 | -40 |

| Uses of borrowings2 | |||

| Refinancing needs | |||

Payable in Canadian currency |

|||

Treasury bills |

187 | 187 | 0 |

Bonds |

182 | 182 | 0 |

Of which: |

|||

Bonds that mature |

182 | 181 | -1 |

Switch bond buybacks |

0 | 0 | 0 |

Cash management bond buybacks |

0 | 2 | 2 |

Total payable in Canadian currency |

369 | 370 | 1 |

Payable in foreign currencies |

9 | 6 | -3 |

| Total refinancing needs | 378 | 376 | -2 |

| Financial source/requirement | |||

Budgetary balance |

53 | 35 | -18 |

Non-budgetary transactions |

|||

Pension and other accounts |

-10 | -13 | -3 |

Non-financial assets |

0 | 5 | 5 |

Loans, investments and advances |

10 | 5 | -6 |

Of which: |

|||

Loans to enterprise Crown corporations3 |

7 | 12 | 5 |

Other |

3 | -8 | -11 |

Other transactions4 |

33 | 34 | 1 |

Total non-budgetary transactions |

33 | 31 | -2 |

| Total financial source/requirement | 85 | 66 | -19 |

| Total uses of borrowings | 463 | 478 | 15 |

| Change in other unmatured debt transactions5 | 0 | 8 | 8 |

| Net increase or decrease (-) in cash | -28 | -52 | -24 |

|

Note: Numbers may not add due to rounding. 1 Planned numbers are from the Debt Management Strategy for 2022–23. 2 A negative sign denotes a financial source. 3 Loans to enterprise Crown corporations represent corporations under the Crown Borrowing Program. 4 Primarily includes the conversion of accrual adjustments into cash, such as tax and other account receivables; provincial and territorial tax collection agreements; and tax payables and other liabilities. 5 Includes obligations related to capital leases and obligations under public-private partnerships. Source: Department of Finance Canada calculations. |

|||

Borrowing Authorities

In order to undertake market borrowing activities, the Minister needs authority from Parliament as well as the Governor in Council (the "GIC").

Under the Parliamentary borrowing authority framework enacted on November 23, 2017, Parliamentary authority is granted through the Borrowing Authority Act (BAA) and Part IV of the Financial Administration Act (FAA), which together allow the Minister to borrow money up to a maximum overall amount as approved by Parliament. The FAA also authorizes the Minister to borrow in excess of the approved maximum amount under limited circumstances for the specific purposes of refinancing outstanding debt, extinguishing or reducing liabilities, and making payments in extraordinary circumstances, such as natural disasters.

Subject to the noted limited exceptions, the maximum stock of borrowings approved by Parliament in effect from May 6, 2021 was $1,831 billion, which also includes amounts borrowed by agent Crown corporations, and Canada Mortgage Bonds guaranteed by Canada Mortgage and Housing Corporation. Following an amendment to the BAA in June 2022 when the Budget Implementation Act, 2022 received Royal Assent, extraordinary borrowings raised under paragraph 46.1(c) of the FAA between March 23, 2021 and May 6, 2021 will be counted against the maximum stock of borrowings. As at March 31, 2023, the outstanding borrowings subject to the maximum amount was $1,574 billion ($1,529 billion as at March 31, 2022).

Part IV of the FAA also requires the Minister to receive annual approval from the GIC to carry out borrowing for the Government of Canada for each fiscal year, including issuing securities in financial markets and undertaking related activities subject to a maximum aggregate amount. On the recommendation of the Minister, the GIC approved $513.3 billion to be the maximum aggregate principal amount of money that may be borrowed by the Minister in 2022-23.Footnote 3 The maximum aggregate principal amount is the sum of the following sub-components:

(i) the maximum stock of treasury bills anticipated to be outstanding during the year; (ii) the total value of refinanced and anticipated new issuances of marketable bonds; and (iii) amounts to facilitate intra-year management of the debt and foreign exchange accounts.

During 2022-23, $394.5 billion of the GIC-approved borrowing authority was used, $118.8 billion below the authorized borrowing authority limit (see Table 2).

Government of Canada Credit Rating Profile

Throughout 2022-23, the Government of Canada continued to benefit from high credit ratings from rating agencies, with a stable outlook, on Canadian-dollar and foreign-currency-denominated short- and long-term debt (see Table 3).

The rating agencies focusing on general government net debt-to-GDP have indicated that Canada's sound macroeconomic policy framework and financial system, as well as Canada's economic resilience and diversity and the strength of monetary and fiscal flexibility, are all reflected in Canada's strong current credit ratings: Moody's (Aaa), Fitch (AA+), S&P (AAA), DBRS (AAA) and JCRA (AAA).

| Rating agency | Term | Domestic currency | Foreign currency | Outlook | Previous rating action |

|---|---|---|---|---|---|

| Moody's Investors Service | Long-term |

Aaa | Aaa | Stable | Nov 2003 |

| Short-term | - | - | |||

| Standard & Poor's | Long-term |

AAA | AAA | Stable | July 2002 |

| Short-term | A-1+ | A-1+ | |||

| Fitch Ratings | Long-term | AA+ | AA+ | Stable | June 2020 |

| Short-term | F1+ | F1+ | |||

| Dominion Bond Rating Service | Long-term | AAA | AAA | Stable | n/a |

| Short-term | R-1 (High) | R-1 (High) | |||

| Japan Credit Rating Agency | Long-term | AAA | AAA | Stable | n/a |

| Source: Rating agency reports. | |||||

Part II: Report on Objectives, Strategic Direction and Principles

Objectives, Strategic Direction and Principles

Objectives

The debt management objectives in 2022-23 were to raise stable and low-cost funding to meet the financial needs of the Government of Canada and to maintain a well-functioning market for Government of Canada securities.

Strategic Direction

During the past two fiscal years, the government maintained its long-term emphasis in the debt management strategy to manage the significant increase in debt resulting from the response to COVID-19. The government closely monitors financial markets and adjusts issuance if necessary to appropriately and prudently respond to shifts in market demand and changes to financial requirements. During 2022-23, in response to an improved fiscal position and declining borrowing needs, the government reduced its borrowing program, and announced its decision to cancel the issuance of its ultra-long bond. In response to low market demand, the government also ceased issuance of Real Return Bonds during the fiscal year, allowing the government to promote liquidity by consolidating funding within its core funding sectors.

Principles

In support of the objectives and strategic direction, the design and implementation of the domestic debt program are guided by the key principles of transparency, regularity, prudence and liquidity. Towards this end, the government publishes strategies and plans, and consults regularly with market participants to ensure the integrity and attractiveness of the market for dealers and investors. The structure of the market debt is managed conservatively in a cost-risk framework, preserving access to diversified sources of funding and supporting a broad investor base.

Raising Stable and Low-Cost Funding

In general, achieving stable and low-cost funding involves striking a balance between debt costs and various risks in the debt structure. This selected balance between cost and risk is mostly achieved through the deliberate allocation of issuance among various debt instruments and terms.

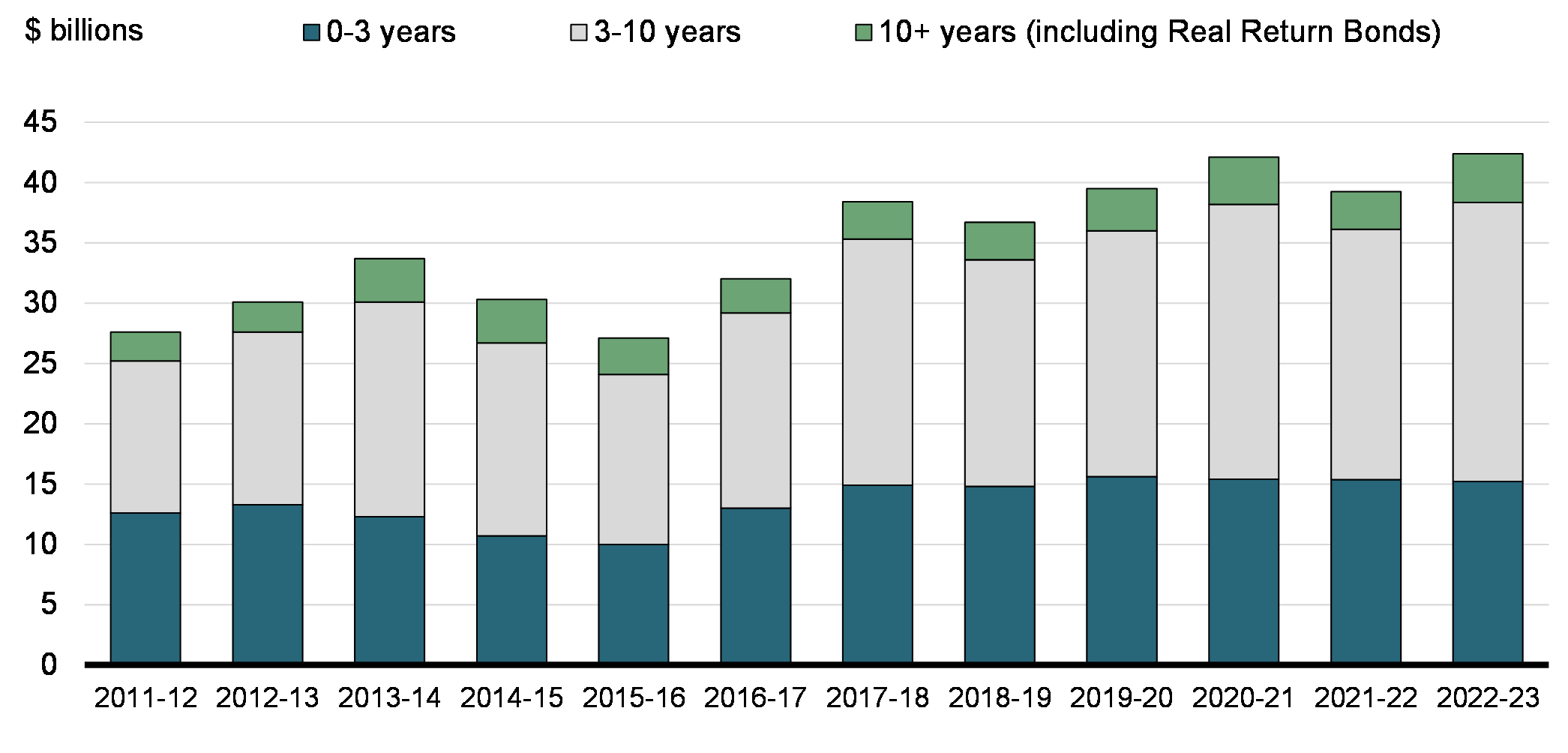

Market Debt Issuance in 2022-23

In 2022-23, total bond issuance was $185.2 billion, down from $257.4 billion in 2021-22, reflecting lower financial requirements. As a result, issuance in both long and short sectors was lower. Issuance of short-term debt instruments (2-, 3- and 5-year sectors) decreased to $118.0 billion in 2022-23 from $140.0 billion in 2021-22. On a percentage basis, the share of bond issuance made up by short-term bonds increased to 64 per cent in 2022-23, up from 54 per cent in 2021-22 (see Table 4.2).

The allocation of long bond issuance (i.e., 10-year maturities and longer) was 36 per cent in 2022-23, 8 percentage points lower than the previous fiscal year, when it was 44 per cent (see Table 4.2) and 1 percentage point higher than the plan set out in the Debt Management Strategy for 2022-23 (see Table 4.3).Issuanceacross all tenors was lower than expected as the financial requirement came in $18.8 billion lower than projected.

| 2021-22 Previous Year | 2022-23 Planned | 2022-23 Actual | Difference between Actual and Planned | 2022-23 Actual vs 2021-22 % change | |

|---|---|---|---|---|---|

| Treasury bills | 187 | 213 | 202 | -11 | 8% |

2-year |

67 | 74 | 67 | -7 | - |

3-year |

29 | 24 | 20 | -4 | -31% |

5-year |

44 | 34 | 31 | -3 | -30% |

10-year |

79 | 54 | 52 | -2 | -34% |

30-year |

28 | 16 | 15 | -2 | -48% |

Real Return Bonds |

1 | 1 | 1 | -1 | -50% |

Ultra-long |

4 | 4 | 0 | -4 | -100% |

Green bonds |

5 | 5 | 0 | -5 | -100% |

| Total bonds | 257 | 212 | 185 | -27 | -28% |

| Total gross issuance1 | 444 | 425 | 387 | -38 | -13% |

1 Issuance is estimated from Bank of Canada data, using issuance date to determine the amount issued in each sector and fiscal year, consistent with Bank of Canada methodology. The use of issuance date instead of auction date results in slight differences in some sectors. Source: Bank of Canada; Department of Finance Canada calculations. |

|||||

| 2021-22 Previous Year | 2022-23 Actual | |||

|---|---|---|---|---|

| Issuance ($ billions) | Share of Bond Issuance | Issuance ($ billions) | Share of Bond Issuance | |

| Short (2-, 3-, 5-year sectors) | 140 | 54% | 118 | 64% |

| Long (10-year+) | 112 | 44% | 67 | 36% |

| Green bonds | 5 | 2% | - | - |

| Gross bond issuance | 257 | 100% | 185 | 100% |

Source: Bank of Canada; Department of Finance Canada calculations. |

||||

| 2022-23 Planned | 2022-23 Actual | |||

|---|---|---|---|---|

| Issuance ($ billions) | Share of Bond Issuance | Issuance ($ billions) | Share of Bond Issuance | |

| Short (2-, 3-, 5-year sectors) | 132 | 62% | 118 | 64% |

| Long (10-year+) | 75 | 35% | 67 | 36% |

| Green bonds | 5 | 2% | - | - |

| Gross bond issuance | 212 | 100% | 257 | 100% |

Source: Bank of Canada; Department of Finance Canada calculations. |

||||

Market Debt Composition

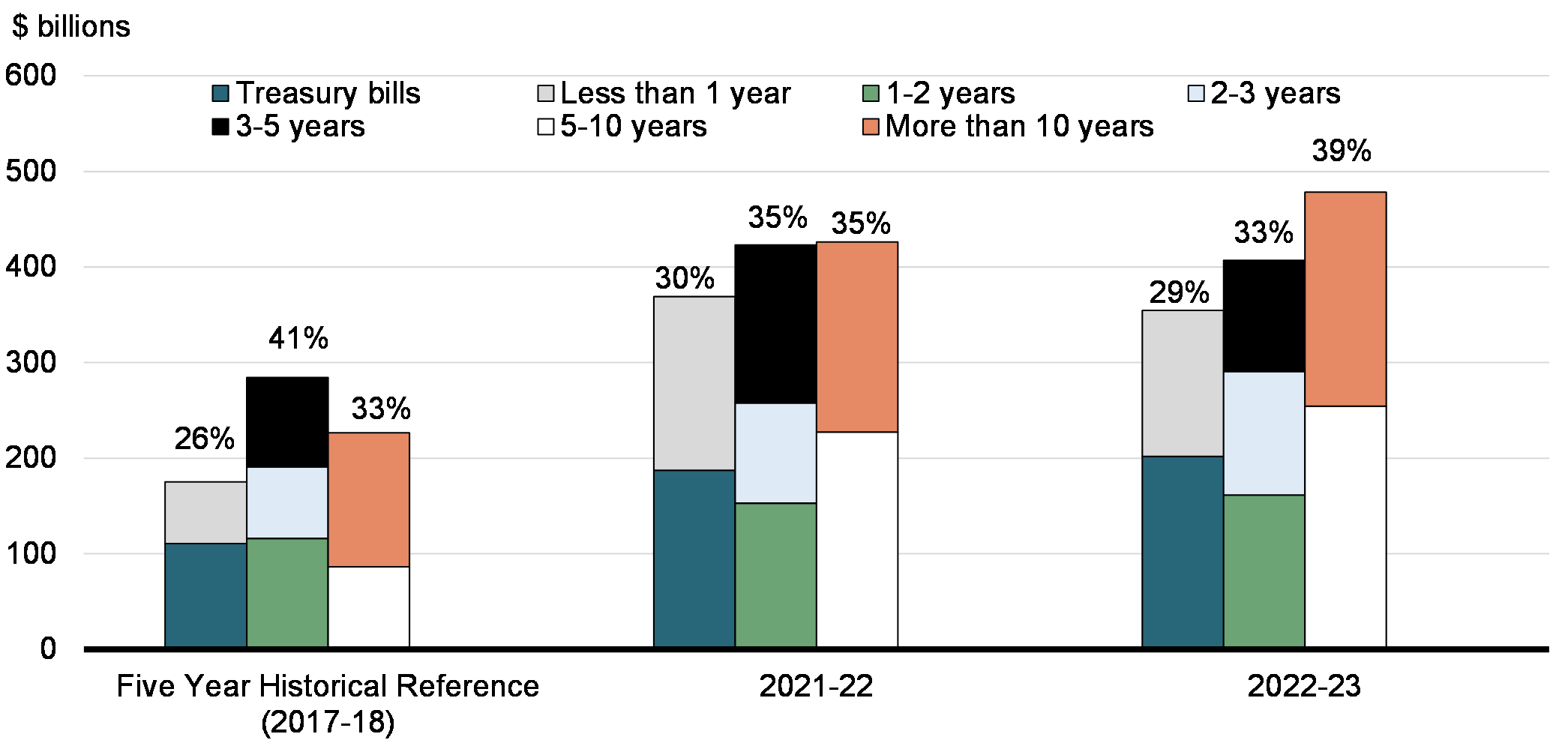

The composition of the stock of market debt is a reflection of past debt issuance choices (e.g., over the last 30 years for the 30-year sector). The effects of changes in issuance patterns of short-term debt instruments become visible relatively quickly, while the full effect of issuance changes in longer-term debt instruments takes the entire maturity period to be fully appreciated. A well-distributed maturity profile helps maintain a prudent risk exposure to changes in interest rates over time at an affordable cost, while promoting well-functioning markets by providing liquidity across different maturity sectors.

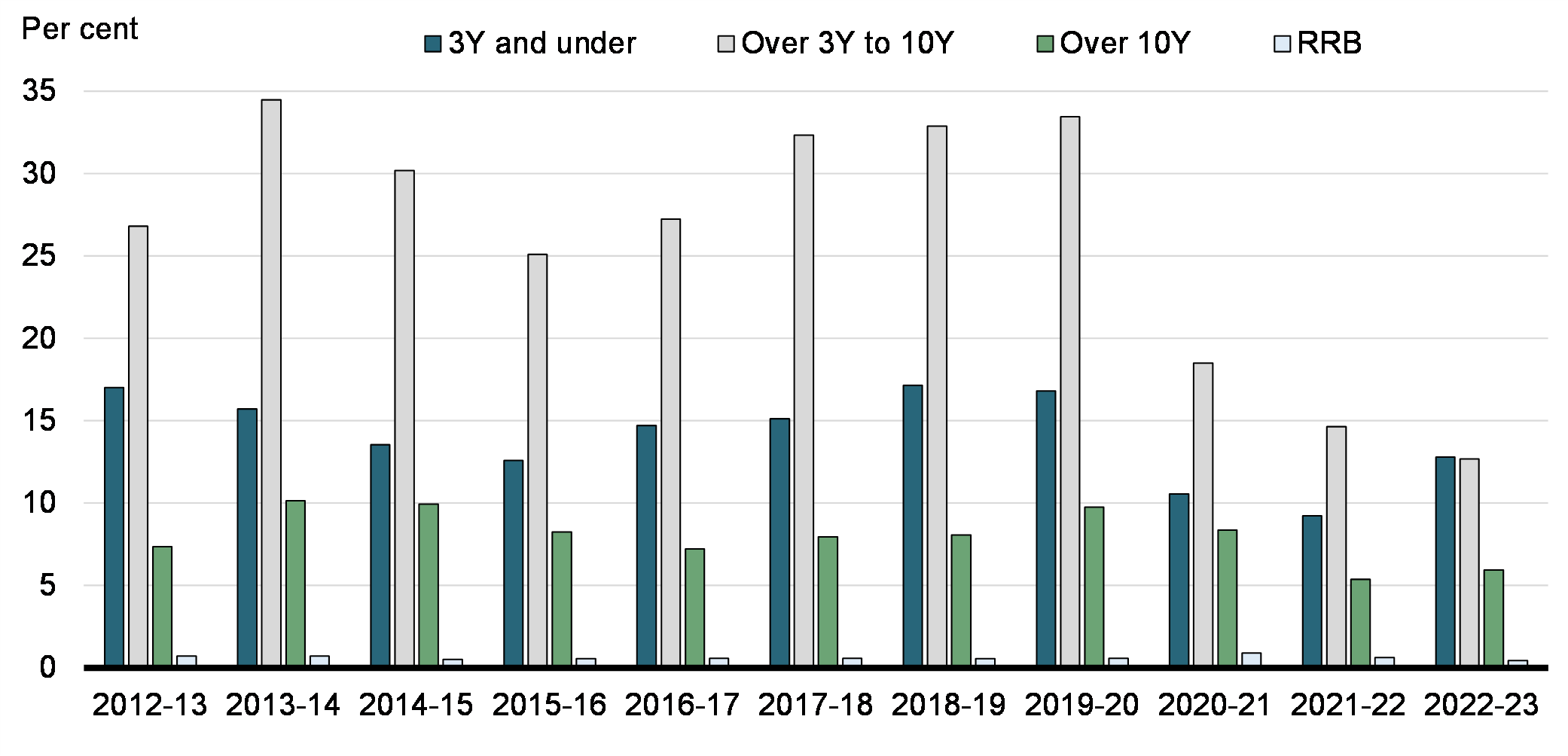

Composition of Market Debt by Remaining Term to Maturity

As a result of the significant increase in long-term bond issuance during 2020-21 and 2021-22, the composition of market debt made up by long-term debt stock continued to grow in 2022-23 even as the proportion of long-term issuance decreased. This is as a result of the short-term portion of the increased issuances of the previous two fiscal years coming up for maturity, while the long debt issued in the same period will not mature for some years. Correspondingly, the proportion of short-term bonds declined (see Chart 2).

Composition of Market Debt by Remaining Term to Maturity, as at March 31

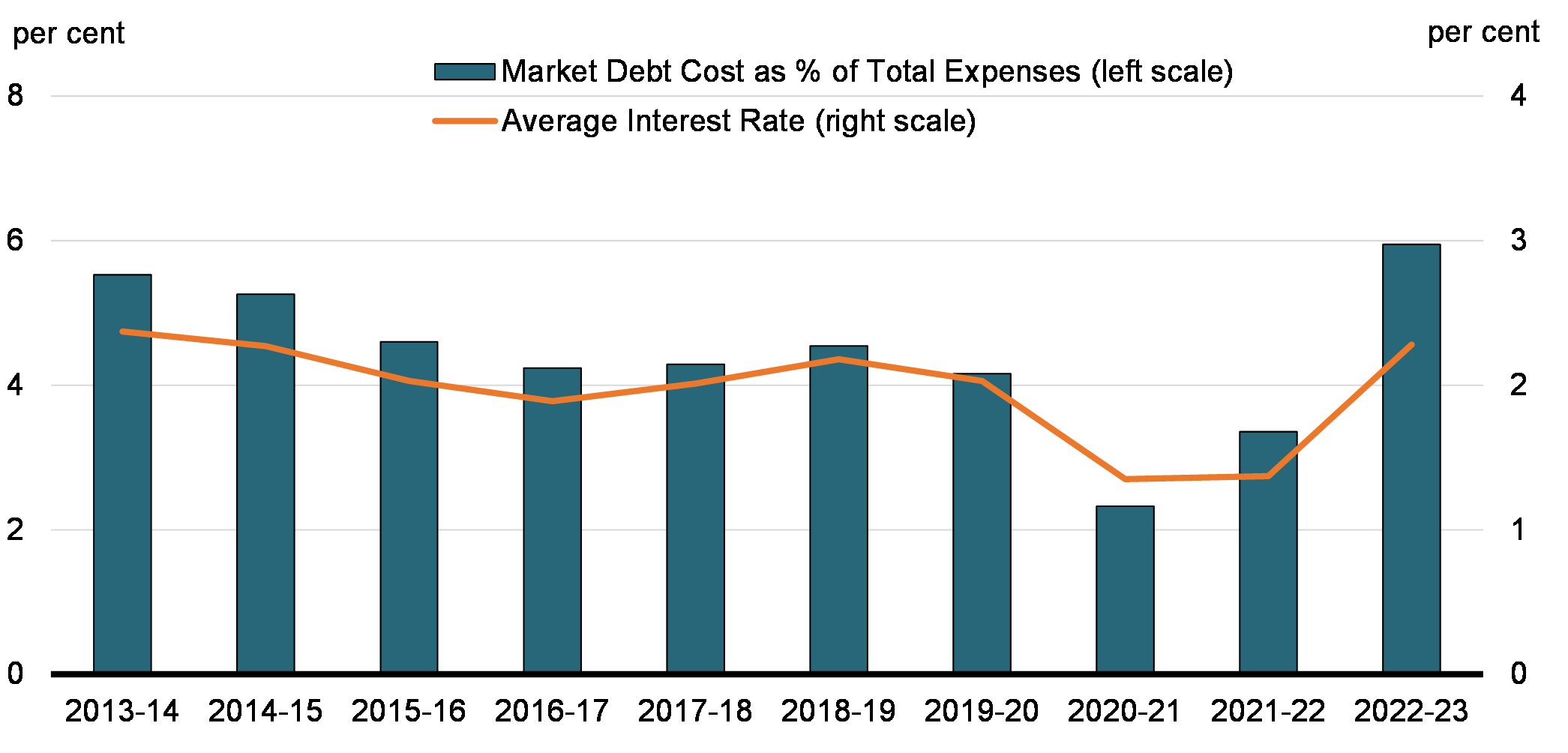

Cost of Market Debt

Annual interest rate costs on market debt are the largest component of public debt charges (which also include interest expenses on non-market liabilities).Footnote 4 The weighted average rate of interest on the stock of market debt was 2.28 per cent in 2022-23, up from 1.37 per cent in 2021-22. Interest on market debt as a share of total government expenses increased from 3.35 per cent in 2021-22 to 5.95 per cent in 2022-23 (see Chart 3). This was primarily due to a higher cost of borrowing which was most evident in the treasury bills sector given the high rollover.

Market Debt Costs and Average Effective Interest Rate

Market Debt: Average Term to Maturity and Debt Rollover

Prudent management of debt refinancing needs, which promotes investor confidence, involves Government of Canada actions that strive to minimize the impact of market volatility or disruptions to the funding program. According to a number of common measures of market debt refinancing risks, including average term to maturity (ATM) and debt rollover, the Government of Canada's market debt remained prudent through 2022-23 when compared to historical averages.

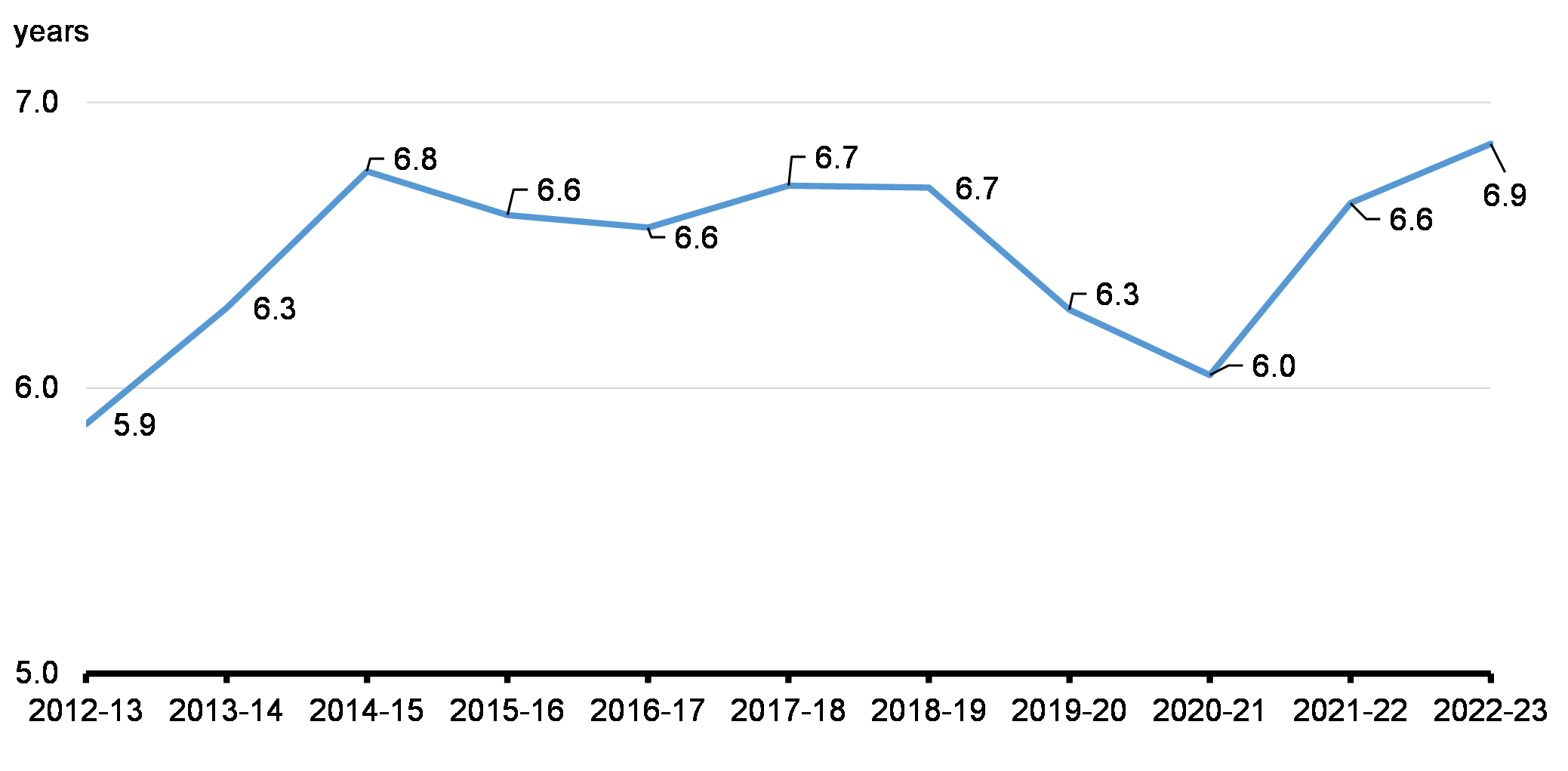

Average Term to Maturity

The ATM of market debt tends to rise and fall mostly with the stock of treasury bills. In 2022-23, the ATM increased to 6.9 years, up from 6.6 years in 2021-22, reflecting the Government of Canada's strategic direction to maximize long-term issuance in the previous two fiscal years (see Chart 4.1).

Average Term to Maturity of Government of Canada Market Debt

The weighted ATM is measured by weighting the remaining term to maturity of issued debt by its proportion to the overall debt stock.Footnote 5

Canada has successfully built a prudent debt structure relative to GDP over the last 30 years. In general, low debt-to-GDP countries can choose a higher risk level (i.e., lower ATM) in exchange for lower interest rate costs. Overall, Canada is in line with other AAA-rated countries (see Chart 4.2).

Weighted ATM vs Market Debt-to-GDP

Debt Rollover: Quarterly Maturities to GDP

Debt rollover, measured as the amount of debt maturing per quarter as a percentage of GDP, decreased to an average of 5.2 per cent in 2022-23 from an average of 5.8 per cent in 2021-22 (see Chart 5). This decrease reflects a slight decline in the amount of debt maturing as well as an increase in GDP. The average annual debt rollover in 2022-23 is relatively in line with the average over the previous decade of 5.6 per cent.

Quarterly Maturities of Domestic Market Debt as a percentage of GDP

Debt Rollover: Single-Day Maturities

The government maintained 10 maturity dates in 2022-23, which was the same as in 2021-22. Following the significant increase in debt which began in 2020-21, single-day maturities remain high relative to historical averages. The government monitors the level of single-day maturities and may implement programs to effectively manage Government of Canada cash flows ahead of large debt maturities.

The benchmark maturity date profile is as follows:

- 2-year bonds: February 1, May 1, August 1, November 1

- 3-year bonds: April 1, October 1

- 5-year bonds: March 1, September 1

- 10-year bonds: June 1, December 1

- 30-year bonds: December 1 – although Real Return Bonds and nominal 30-year bonds mature on December 1, they do not mature in the same year.

Maintaining a Well-Functioning Government Securities Market

A well-functioning market in Government of Canada securities benefits the government as a borrower as it directly supports the fundamental objective of raising stable, low-cost funding, while also benefiting a wide range of market participants.

A well-functioning market helps the government to have more certain access to funding markets over time, contributes to lower and less volatile interest rate costs for the government, and provides flexibility to meet changing financial requirements. For market participants, a liquid and transparent secondary market in government debt instruments provides risk-free assets for investment portfolios, stability to other domestic fixed-income markets for which Government of Canada securities serve as benchmarks (e.g., provinces, municipalities and corporations), and a useful tool for hedging interest rate risk.

Providing Regular and Transparent Issuance

During 2022-23, the Government of Canada continued announcing bond auction schedules prior to the start of each quarter, and provided details for each operation in a Call for Tender in the week leading up to an auction.Footnote 6 In 2022-23, there were regular auctions for 2-, 3-, 5-, 10- and 30-year bonds. There were also auctions for Real Return Bonds prior to being canceled. To promote transparency in the market for Government of Canada securities, the Bank of Canada published bond issuance schedules as well as benchmark details ahead of each fiscal quarter within its Quarterly Bond Schedule publications available on the Bank website.

Concentrating on Key Benchmarks

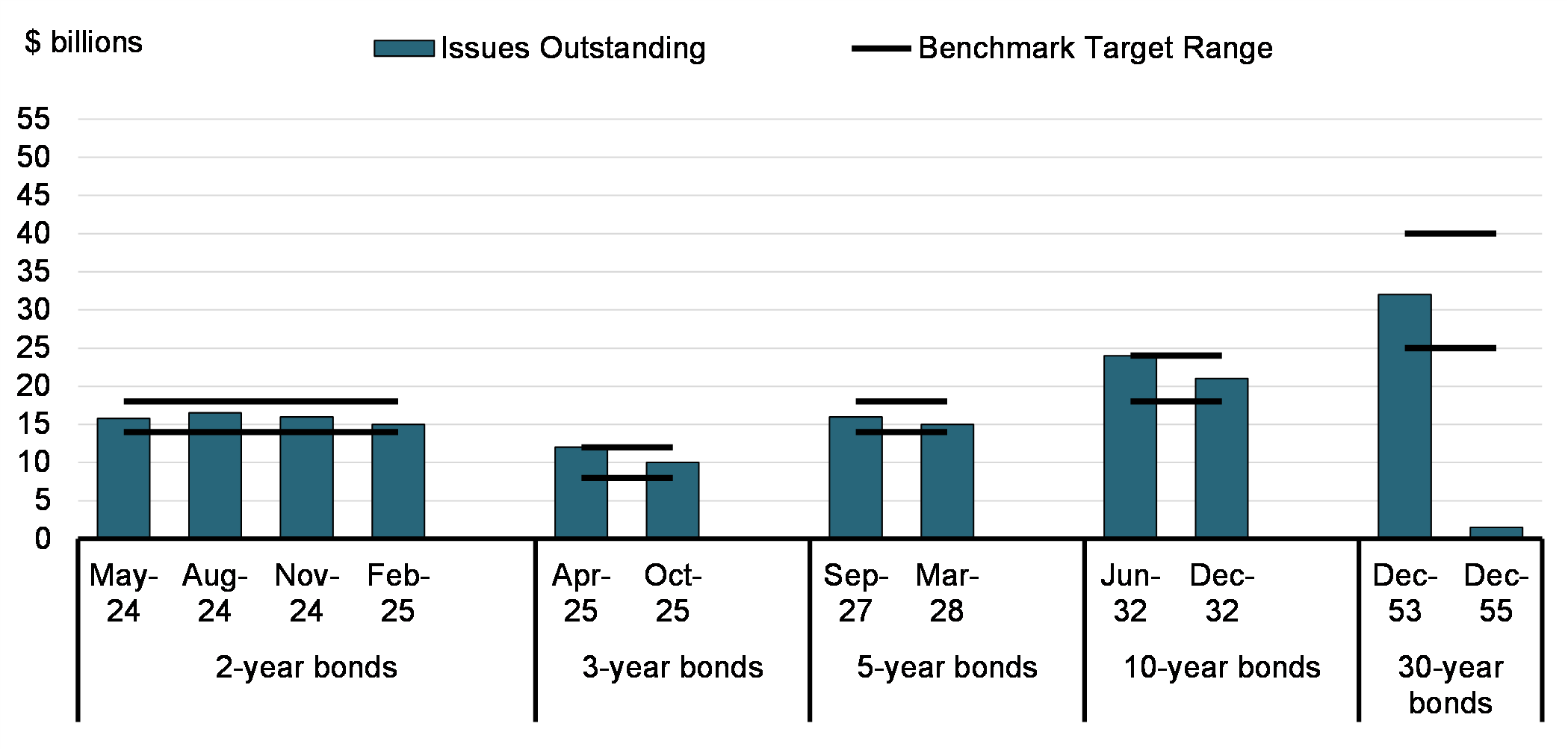

All benchmark bonds in 2022-23 continued to reach or exceed minimum benchmark size targets (see Chart 6).Footnote 7 Compared to 2021-22, the benchmark target sizes for all sectors were reduced due to lower borrowing needs, with the greatest reduction in the 10- and 30-year sectors.

- 2-year bonds: $14 billion to $18 billion

- 3-year bonds: $8 billion to $12 billion

- 5-year bonds: $14 billion to $18 billion

- 10-year bonds: $18 billion to $24 billion

- 30-year nominal bonds: $25 billion to $40 billion

Size of Gross Bond Benchmarks in 2022-2023

Ensuring a Broad Investor Base in Government of Canada Securities

A diversified investor base supports an active secondary market for Government of Canada securities, thereby helping to keep funding costs low and stable. Diversification of the investor base is pursued by maintaining a domestic debt program that issues securities in a wide range of maturity sectors, which meet the needs of different investor types.

During 2022-23, domestic investors (including the Bank of Canada) held about 71 per cent of Government of Canada securities (see Chart 7). Among domestic investors, the Bank of Canada held the largest share of Government of Canada securities (26 per cent), followed by insurance companies and pension funds (16 per cent). Taken together, these top two categories accounted for just under half of outstanding Government of Canada securities.

In 2022-23, non-resident investors held 29 per cent of Government of Canada securities,Footnote 8 similar to 2021-22. This share of non-resident holdings of government securities remains below the average G7 holdings by non-resident investors (see Chart 8).

Distribution of Government of Canada Securities

Percentage of Total Marketable Debt of G7 Countries Held by Non-Residents

Consulting With Market Participants

Formal consultations with market participants are held at least once a year, in order to obtain their views on the design of the borrowing program and on the liquidity and efficiency of the Government of Canada's securities markets. These consultations helped to inform the Debt Strategy Management Strategy for 2022-23.

During the consultations held in October of 2021, the Department of Finance Canada and the Bank of Canada conducted over 30 bilateral virtual meetings with dealers, investors and other relevant market participants. These consultations sought the views of market participants on issues related to the design and operation of the Government of Canada's domestic debt program.

During the fall 2021 consultations, a broad consensus supported keeping treasury bill issuance relatively unchanged even as borrowing needs were expected to decline in 2022-23. Participants however expressed support for reducing long bond issuance. Market participants also broadly supported the termination of ultra-long bonds and the 3-year sector, which they did not consider a useful benchmark. More details on these discussions are available in the Fall 2021 Debt Management Strategy Consultations Summary, published on the Bank of Canada website on December 14, 2021.Footnote 9

Securities Distribution System

As the government's fiscal agent, the Bank of Canada distributes Government of Canada marketable bills and bonds by auction to government securities distributors (GSDs) and customers. GSDs that maintain a certain threshold of activity in the primary and secondary markets for Government of Canada securities may become primary dealers, which form a select core group of distributors for Government of Canada securities. To maintain a well-functioning securities distribution system, government securities auctions are monitored to ensure that GSDs abide by the terms and conditions.Footnote 10

Quick turnaround times enhance the efficiency of auctions and reduce market risk for participants. In 2022-23, the turnaround time for treasury bill and bond auctions averaged 48 seconds, while there were no buyback operations conducted. This compares to an average turnaround time in 2021-22 of 1 minute 58 seconds. Footnote 11 This improvement was a result of the Bank's upgrade of the system used to conduct auctions.

Monitoring Secondary Market Trading in Government of Canada Securities

Two important measures of liquidity and efficiency in the secondary market for Government of Canada securities are trading volume and turnover ratio.

Trading volume represents the amount of securities traded during a specific period (e.g., daily). Large trading volumes typically indicate that participants can buy or sell in the marketplace without a substantial impact on the price of the securities and generally imply lower bid-offer spreads.

The average daily trading volume in the secondary market for Government of Canada's bonds during 2022-23 was $42.4 billion, up $3.0 billion from 2021-22 (see Chart 9), bringing trading volume above its pre-pandemic level.

Turnover ratio, which is the ratio of securities traded relative to the amount of securities outstanding, measures market depth. High turnover implies that a large proportion of securities change hands for a given amount available in the market, which is an indication of a liquid market.

Government of Canada Bond Average Daily Trading Volumes

In 2022-23, the annual debt stock turnover ratio in the Government of Canada secondary bond market, calculated as trading volume divided by average debt stock, decreased slightly to 10.6x from 10.9x in 2021-22. The sectors with the highest monthly turnover during the fiscal year were medium-term bonds with maturities between 3 and 10 years at 12.7x, while Real Return Bonds had the lowest turnover at 0.4x (see Chart 10).

Government of Canada Bond Turnover Ratio by Term to Maturity Annualized Monthly Trading Volume / Total Bond Stock

Supporting Secondary Market Liquidity

The Bank of Canada operates securities repo operations (SROs) whereby it makes a portion of its holdings of Government of Canada securities available through daily repurchase operations.Footnote 12 This provides a temporary source of Government of Canada nominal bonds and treasury bills to primary dealers to support liquidity in the securities financing market. The Bank of Canada conducted 7,609 SROs in 2022-23, compared to 10,900 SROs in 2021-22.

Regular Bond Buyback Program

Bond buyback operations on a cash basis and on a switch basis involve the purchase of bonds with a remaining term to maturity of 12 months to 25 years. Bond buyback operations on a cash basis involve the exchange of a bond for cash. Bond buyback operations on a switch basis, on the other hand, involve the exchange of one bond for another (e.g., an off-the-run bond for the building-to-benchmark bond), on a duration-neutral basis.Footnote 13

There were no regular bond buybacks on a cash or switch basis in 2022-23.

Part III: Report on the 2022-23 Debt Program

Treasury bill and bond auctions performed well and demand for Government of Canada securities remained strong throughout the fiscal year as a result of persistent demand for high-quality sovereign debt securities, and Canada's strong fiscal and economic position.

Domestic Marketable Bonds

Bond Program

In 2022-23, gross bond issuance was $185.2 billion, $72.2 billion lower than the $257.4 billion issued in 2021-22. Gross issuance consisted of $184.5 billion in nominal bonds, and $0.7 billion in Real Return Bonds (see Table 5).

| 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | |

|---|---|---|---|---|---|

| Nominal (auction) | 96.7 | 122.4 | 368.5 | 256.01 | 184.5 |

| Nominal (switch) | 0.8 | 2.8 | 0.0 | 0.0 | 0.0 |

| Real Return Bonds | 2.2 | 1.8 | 1.4 | 1.4 | 0.7 |

| Total gross issuance | 99.7 | 127.0 | 369.9 | 257.4 | 185.2 |

| Cash buyback | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Switch buyback | -0.8 | -2.8 | 0.0 | 0.0 | 0.0 |

| Total buyback | -0.8 | -2.8 | 0.0 | 0.0 | 0.0 |

| Net issuance | 98.9 | 124.2 | 369.9 | 257.4 | 185.2 |

Note: Numbers may not add due to rounding. 1 This figure includes ultra-long bond auctions of $4.0 billion. Excluding ultra-long issuance would result in nominal issuance of $252.0 billion for the 2021-22 fiscal year. Source: Bank of Canada. |

|||||

Auction Result Indicators for Domestic Bonds

A total of 55 nominal bond auctions were conducted in 2022-23, compared to 66 auctions in 2021-22. This decrease in nominal bond auctions was largely due to lower financial requirements compared to 2021-22.

The auction tail represents the number of basis points between the highest yield accepted and the average yield of an auction. A small auction tail is preferable as it is generally indicative of better transparency in the pricing of securities. Average auction tails were higher than the 5-year average across all maturities.Footnote 14

Auction coverage is defined as the total amount of bids received, including bids from the Bank of Canada, divided by the amount auctioned. All else being equal, a higher auction coverage level typically reflects strong demand and therefore should result in a lower average auction yield. Bond auction coverage was lower than the 5-year average for all maturities except the 3- and 10-year sectors (see Table 6).

| Nominal Bonds | Real Return Bonds |

||||||

|---|---|---|---|---|---|---|---|

| 2-year | 3-year | 5-year | 10-year | 30-year | 30-year | ||

| Tail (basis points) | 2022-23 | 0.35 | 0.41 | 0.72 | 0.69 | 0.78 | n/a |

| 5-year average | 0.20 | 0.30 | 0.37 | 0.58 | 0.50 | n/a | |

| Coverage | 2022-23 | 2.35 | 2.54 | 2.21 | 2.31 | 2.37 | 2.19 |

| 5-year average | 2.52 | 2.48 | 2.45 | 2.26 | 2.39 | 2.44 | |

Notes: Tail represents the number of basis points between the highest yield accepted and the average yield of an auction. Coverage is defined as the total amount of bids received, including bids from the Bank of Canada, divided by the amount auctioned. Source: Bank of Canada. |

|||||||

Participation at Domestic Bond Auctions

In 2022-23, primary dealers' (PDs) allotments for nominal bonds increased slightly to 64 per cent from 63 per cent in 2021-22, with customer allocations decreasing slightly from 38 per cent to 36 per cent (see Table 7),Footnote 15 excluding the Bank of Canada's allotment.Footnote 16 In aggregate, the 10 most active participants were in total allotted 78 per cent of nominal bonds auctioned in 2022-23. For Real Return Bonds, primary dealers' share of allotments increased slightly from 43 per cent in 2021-22 to 44 per cent in 2022-23, with customer allocations decreasing from 57 per cent to 56 per cent.

| Participant type | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ||

| Nominal Bonds | |||||||||||

| PDs | 61 | 63 | 75 | 61 | 237 | 64 | 140 | 63 | 117 | 64 | |

| Customers | 36 | 37 | 47 | 39 | 135 | 36 | 84 | 38 | 67 | 36 | |

| Top 5 participants | 46 | 48 | 68 | 55 | 207 | 56 | 112 | 50 | 96 | 52 | |

| Top 10 participants | 74 | 77 | 98 | 80 | 299 | 80 | 168 | 75 | 144 | 78 | |

| Total nominal bonds issued | 97 | 122 | 373 | 223 | 185 | ||||||

| Real Return Bonds | |||||||||||

| PDs | 1 | 40 | 1 | 38 | 1 | 45 | 1 | 43 | 0.3 | 44 | |

| Customers | 1 | 60 | 1 | 62 | 1 | 55 | 1 | 57 | 0.4 | 56 | |

| Top 5 participants | 1 | 46 | 1 | 40 | 1 | 60 | 1 | 61 | 0.5 | 69 | |

| Top 10 participants | 2 | 68 | 1 | 65 | 1 | 81 | 1 | 76 | 0.7 | 98 | |

| Total Real Return Bonds issued | 2 | 2 | 1 | 1 | 0.7 | ||||||

Note: Numbers may not add due to rounding. 1 Not including Bank of Canada allotment. Source: Bank of Canada. |

|||||||||||

Treasury Bills and Cash Management Bills

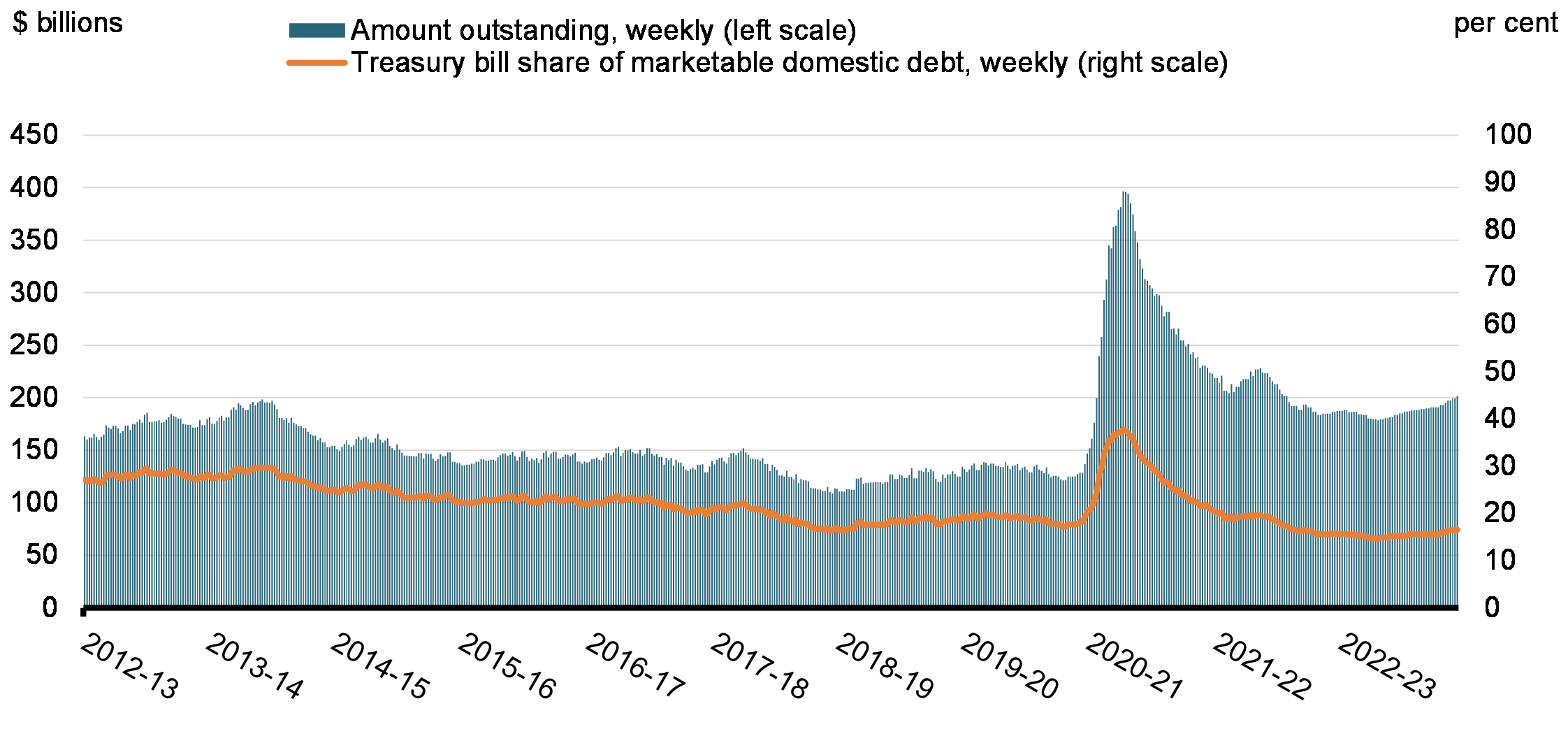

During 2022-23, $416.0 billion in 3-, 6- and 12-month treasury bills were issued, a decrease of $16 billion from the previous year. There were no cash management bill operations compared to two operations in 2021-22 for a total issuance amount of $8.0 billion. As at March 31, 2023, the combined treasury bill and cash management bill stock totaled $201.8 billion, an increase of $14.4 billion from the end of 2021-22 (see Chart 11).

Treasury Bills Outstanding and as a Share of Marketable Domestic Debt

In 2022-23, all treasury bill and cash management bill auctions were fully covered. For all treasury bill maturity sectors, auction tails were larger than the 5-year average. Coverage ratios for treasury bill auctions in 2022-23 were lower than the 5-year average for all treasury bill maturity sectors (see Table 8).

| 3-month | 6-month | 12-month | Cash management bills |

||

|---|---|---|---|---|---|

| Tail | 2022-23 | 1.12 | 1.29 | 1.47 | n/a |

| 5-year average | 0.74 | 0.79 | 0.83 | 2.73 | |

| Coverage | 2022-23 | 1.98 | 2.15 | 2.17 | n/a |

| 5-year average | 2.01 | 2.21 | 2.22 | 2.44 | |

|

Notes: Tail represents the number of basis points between the highest yield accepted and the average yield of an auction. Coverage is defined as the total amount of bids received, including bids from the Bank of Canada, divided by the amount auctioned. Tail and coverage ratio were calculated as the weighted averages, where the weight assigned to each auction equals the percentage total allotment in the auction's issuance sector. Source: Bank of Canada. |

|||||

Participation at Treasury Bill Auctions

In 2022-23, the share of treasury bills allotted to primary dealers declined by 12 percentage points to 62 per cent from 74 per cent in 2021-22, and the share allotted to customers increased to 38 per cent from 26 per cent (see Table 9). The 10 most active participants were in total allotted 84 per cent of these securities.

| Participant type | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | |

| PDs | 239 | 88 | 246 | 84 | 543 | 84 | 318 | 74 | 258 | 62 |

| Customers | 33 | 12 | 45 | 16 | 103 | 16 | 114 | 26 | 157 | 38 |

| Top 5 participants | 190 | 70 | 190 | 65 | 431 | 67 | 260 | 59 | 249 | 60 |

| Top 10 participants | 242 | 89 | 246 | 85 | 577 | 89 | 379 | 86 | 350 | 84 |

| Total treasury bills issued | 272 | 291 | 646 | 432 | 416 | |||||

|

Note: Numbers may not add due to rounding. 1 Net of Bank of Canada allotment. Source: Bank of Canada. |

||||||||||

Foreign Currency Debt

Foreign currency debt is used to fund the Exchange Fund Account (EFA), which represents the largest component of the official international reserves. The primary objectives of the international reserves are to aid in the control and protection of the external value of the Canadian dollar and provide a source of liquidity to the Government of Canada.

The EFA is primarily made up of liquid foreign currency securities and special drawing rights (SDRs). Liquid foreign currency securities are composed primarily of debt securities of highly rated sovereigns, their agencies that borrow in public markets and are supported by a comprehensive government guarantee, and highly rated supranational organizations. SDRs are international reserve assets created by the IMF, the value of which is based on a basket of international currencies. The official international reserves also include Canada's reserve position at the IMF. This position, which represents Canada's investment in the activities of the IMF, fluctuates according to drawdowns and repayments from the IMF. The Report on the Management of Canada's Official International Reserves provides information on the objectives, composition and performance of the reserves portfolio.

The market value of Canada's official international reserves as at March 31, 2023 increased to US$110.0 billion from US$103.8 billion as at March 31, 2022. EFA assets, which totaled US$105.2 billion as at March 31, 2023, up from US$99.4 billion as at March 31, 2022, were held at a level that is consistent with the government's commitment to maintain holdings of liquid foreign currency securities at or above 3 per cent of nominal GDP.

The EFA is funded by liabilities of the Government of Canada denominated in, or converted to, foreign currencies. Funding requirements are primarily met through an ongoing program of cross-currency swaps funded by domestic issuances. As at March 31, 2023, Government of Canada cross-currency swaps outstanding stood at US$74.2 billion (par value).

In addition to cross-currency swaps funded by domestic issuances, the EFA is funded through a short-term US-dollar paper program (Canada bills), a global bond program, and a medium-term note (MTN) program (Canada notes and euro medium-term notes) which had a value of zero at year end. The funding method of choice depends on funding needs, costs, market conditions and funding diversification objectives (see Table 10).

| March 31, 2023 | March 31, 2022 | Change | ||

|---|---|---|---|---|

| Swapped domestic issues | 74,233 | 64,754 | 9,479 | |

| Global bonds | 10,000 | 9,500 | 500 | |

| Canada bills | 1,830 | 2,060 | -230 | |

| Medium-term notes | ||||

Euro medium-term notes |

0 | 0 | 0 | |

Canada notes |

0 | 0 | 0 | |

| Total | 86,063 | 76,314 | 9,749 | |

|

Note: Liabilities are stated at the exchange rates prevailing on March 31, 2023. Source: Department of Finance Canada. |

||||

As at March 31, 2023, the Government of Canada had three global bonds outstanding (see Table 11). The government had no medium-term notes outstanding as of March 31, 2023.

| Year of issuance | Market | Amount in original currency | Yield (%) |

Term to maturity (years) |

Coupon (%) |

Benchmark interest rate—government bonds |

Spread from benchmark at issuance (basis points) |

Spread over swap curve in relevant currency on issuance date (basis points) |

|---|---|---|---|---|---|---|---|---|

| 2020 | Global | US$3 billion | 1.690 | 5 | 1.625 | US | 6.0 | LIBOR - 6.5 |

| 2021 | Global | US$3.5 billion | 0.854 | 5 | 0.750 | US | 6.0 | LIBOR - 2 |

| 2022 | Global | US$3.5 billion | 2.877 | 3 | 2.875 | US | 9.0 | SOFR + 181 |

|

1 LIBOR = London Interbank Offered Rate. The LIBOR rate was discontinued in 2021 so all Government of Canada global bonds will be priced using the Secured Overnight Financing Rate (SOFR) swap curve from 2022 onwards. Source: Department of Finance Canada. The MTN program provides the government with additional flexibility to raise foreign currency. The program allows for issuance in a number of currencies, including the US dollar, euro and British pound sterling, using either a US MTN or EMTN prospectus. During 2022-23, no medium-term notes were issued. |

||||||||

Cash Management

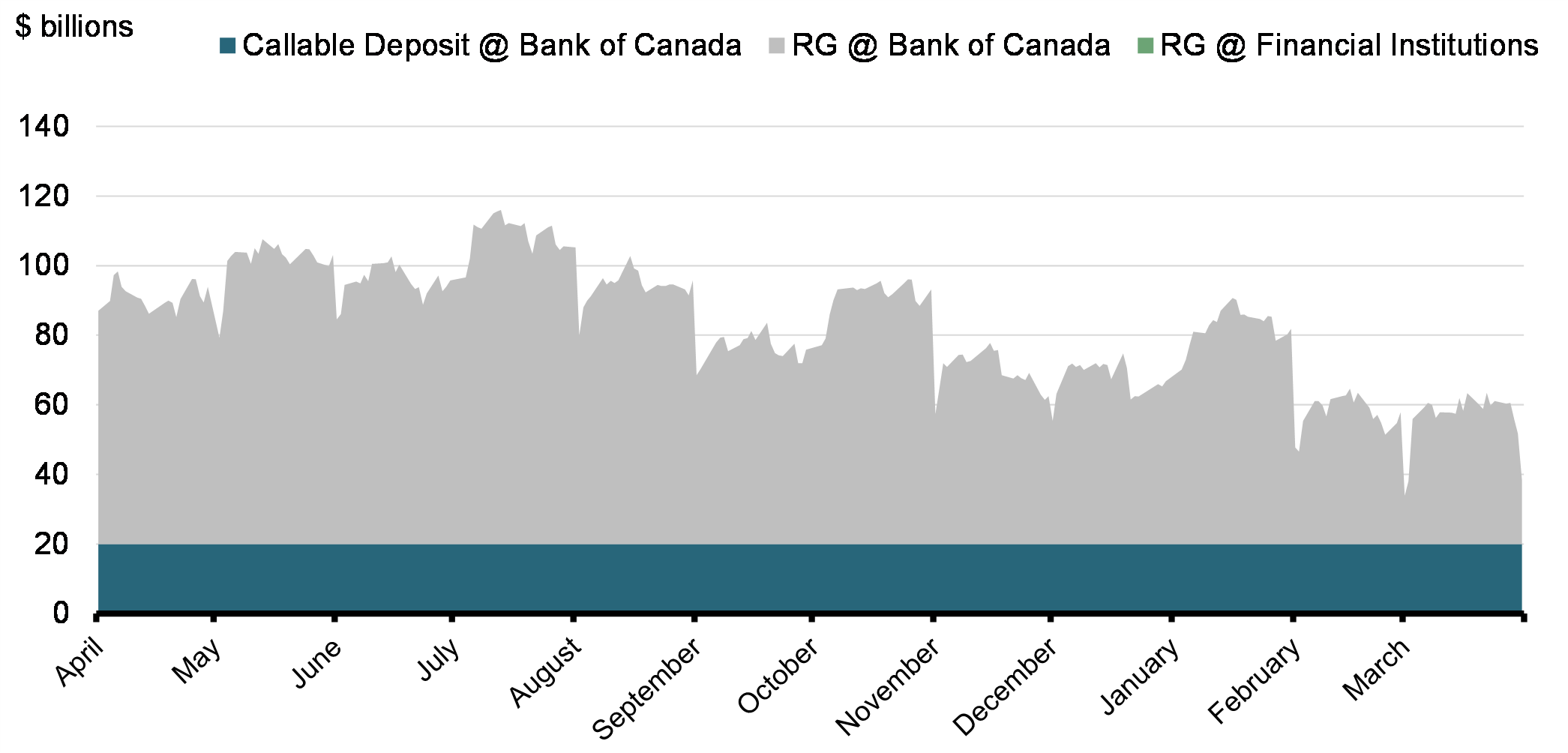

The Bank of Canada, as the government's fiscal agent, manages the Receiver General (RG) Consolidated Revenue Fund, from which the balances required for the government's day-to-day operations are drawn. The core objective of cash management is to ensure that the government has sufficient cash available, at all times, to meet its operating requirements.

Cash consists of money on deposit to the credit of the RG for Canada with the Bank of Canada. Cash with the Bank of Canada includes RG operating balances and a $20 billion callable demand deposit held for the prudential liquidity plan (PLP).

During the COVID-19 crisis, the federal government built up its cash position in order to ensure that funds were available for contingency purposes. In 2022-23, the year-end daily liquidity position decreased by $52.8 billion to $38.2 billion (see Chart 12 and Table 12), similar to its level prior to the crisis.

Daily Liquidity Position for 2022-23

| March 31, 2022 | March 31, 2023 | Annual average | Net change | |

|---|---|---|---|---|

| Callable deposits with the Bank of Canada | 20.0 | 20.0 | 20.0 | 0.0 |

| RG balances with the Bank of Canada | 71.0 | 18.2 | 62.7 | -52.8 |

| Total | 91.0 | 38.2 | 82.7 | -52.8 |

|

Note: Numbers may not add due to rounding. Source: Bank of Canada. |

||||

Prudential Liquidity Management

The government holds liquid financial assets in the form of domestic cash deposits and foreign exchange reservesFootnote 17 to promote investor confidence and safeguard its ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed. The government's overall liquidity levels are managed to normally cover at least one month (i.e., 23 business days) of net projected cash flows, including coupon payments and debt refinancing needs. The 23-day PLP requirement is a forward-looking measure that changes daily due to daily actual cash balances and new projected cash requirements.

Investment of Receiver General Cash Balances

In April 2022, the Bank of Canada indefinitely moved to a floor system of conducting monetary policy, which it implemented on March 23, 2020. Prior to the COVID-19 crisis, the Bank implemented monetary policy through a corridor system.

Under a corridor system, the Bank targets only a small amount of excess settlement balances. This creates an occasional need to inject liquidity into the payment system by auctioning off government funds that are in excess of the government's day-to-day operating needs and prudential liquidity plan. The Bank's auction of Receiver General cash balances to payment system participants thus allows participants to settle their payments without needing overnight advances from the Bank.

Conversely, under a floor system, the Bank does not target a specific level of settlement balances, but instead provides a supply that is sufficiently large. Payment system participants can use these excess settlement balances to fund payments during the day, rendering liquidity injection through Receiver General auctions unnecessary.

There were no RG auctions conducted in 2022-23, as the Bank continued to operate a floor system.

Annex 1: Completed Treasury Evaluation Reports

In order to inform future decision making and to support transparency and accountability, different aspects of the Government of Canada's treasury activities are reviewed periodically under the Treasury Evaluation Program. The program's purpose is to obtain periodic external assessments of the frameworks and processes used in the management of wholesale and retail market debt, cash and reserves as well as the treasury activities of other entities under the authority of the Minister.

Reports on the findings of these evaluations and the government's response to each evaluation are tabled with the House of Commons Standing Committee on Public Accounts by the Minister. Copies are also sent to the Auditor General of Canada. The reports are posted on the Department of Finance Canada website.

| Area | Year |

|---|---|

| Debt Management Objectives | 1992 |

| Debt Structure—Fixed/Floating Mix | 1992 |

| Internal Review Process | 1992 |

| External Review Process | 1992 |

| Benchmarks and Performance Measures | 1994 |

| Foreign Currency Borrowing—Canada Bills Program | 1994 |

| Developing Well-Functioning Bond and Bill Markets | 1994 |

| Liability Portfolio Performance Measurement | 1994 |

| Retail Debt Program | 1994 |

| Guidelines for Dealing With Auction Difficulties | 1995 |

| Foreign Currency Borrowing—Standby Line of Credit and FRN | 1995 |

| Treasury Bill Program Design | 1995 |

| Real Return Bond Program | 1998 |

| Foreign Currency Borrowing Programs | 1998 |

| Initiatives to Support a Well-Functioning Wholesale Market | 2001 |

| Debt Structure Target/Modelling | 2001 |

| Reserves Management Framework1 | 2002 |

| Bond Buybacks1 | 2003 |

| Funds Management Governance Framework1 | 2004 |

| Retail Debt Program1 | 2004 |

| Borrowing Framework of Major Federal Government-Backed Entities1 | 2005 |

| Receiver General Cash Management Program1 | 2006 |

| Exchange Fund Account Evaluation1 | 2006 |

| Risk Management Report1 | 2007 |

| Evaluation of the Debt Auction Process1 | 2010 |

| Evaluation of the Asset Allocation Framework of the Exchange Fund Account1 | 2012 |

| Report of the Auditor General of Canada on Interest-Bearing Debt2 | 2012 |

| Crown Borrowing Program Evaluation1 | 2013 |

| Retail Debt Evaluation1 | 2015 |

|

1 Available on the Department of Finance Canada website. 2 This audit was conducted outside of the Treasury Evaluation Program. |

|

Annex 2: Debt Management Policy Measures Taken Since 1997

The fundamental objectives of debt management are to raise stable and low-cost funding to meet the financial needs of the Government of Canada and to maintain a well-functioning market for Government of Canada securities. For the government as a debt issuer, a well-functioning market attracts investors and contributes to keeping funding costs low and stable over time. For market participants, a liquid and transparent secondary market in government debt provides risk-free assets for investment portfolios, a pricing benchmark for other debt issues and derivatives, and a primary tool for hedging interest rate risk. The following table lists significant policy measures that have been taken to achieve stable, low-cost funding and ensure a well-functioning Government of Canada securities market.

| Measure | Year |

|---|---|

| Discontinued the 3-year bond benchmark | 1997 |

| Moved from weekly to bi-weekly treasury bill auctions | 1998 |

| Introduced a cash-based bond buyback program | 1999 |

| Introduced standardized benchmarks (fixed maturities and increased size) | 1999 |

| Started regular cross-currency swap-based funding of foreign assets | 1999 |

| Introduced a switch-based bond buyback program | 2001 |

| Allowed the reconstitution of bonds beyond the size of the original amount issued | 2001 |

| Introduced the cash management bond buyback (CMBB) program | 2001 |

| Reduced targeted turnaround times for auctions and buyback operations | 2001 |

| Advanced the timing of treasury bill auctions from 12:30 p.m. to 10:30 a.m. | 2004 |

| Advanced the timing of bond auctions from 12:30 p.m. to 12:00 p.m. | 2005 |

| Reduced the timing between bond auctions and cash buybacks to 20 minutes | 2005 |

| Dropped one quarterly 2-year auction | 2006 |

| Announced the maintenance of benchmark targets through fungibility (common dates) | 2006 |

| Consolidated the borrowings of three Crown corporations | 2007 |

| Changed the maturity of the 5-year benchmark and dropped one quarterly 5-year auction | 2007 |

| Reintroduced the 3-year bond benchmark | 2009 |

| Increased the frequency of CMBB operations from bi-weekly to weekly | 2010 |

| Announced a new framework for the medium-term debt management strategy | 2011 |

| Announced plans to increase the level of prudential liquidity by $35 billion over 3 years | 2011 |

| Added four new maturity dates—February 1, May 1, August 1 and November 1 | 2011 |

| Increased benchmark target range sizes in the 2-, 3- and 5-year sectors | 2011 |

| Announced a temporary increase in longer-term debt issuance | 2012 |

| Announced changes to the Terms and Conditions Governing the Morning Auction of Receiver General Cash Balances | 2013 |

| Introduced ultra-long bond issuance | 2014 |

| Discontinued 3-year issuance | 2015 |

| Increased benchmark target range sizes in the 2- and 5-year sectors | 2015 |

| Increased benchmark target range sizes in the 2-, 5- and 10-year sectors | 2016 |

| Reintroduced the 3-year bond benchmark | 2016 |

| Introduced a pilot program to increase flexibility in the maximum repurchase amount at CMBB operations | 2017 |

| Discontinued the sales of new Canada Savings Bonds | 2017 |

| Pilot program to increase flexibility of CMBB operations made permanent | 2018 |

| Ceased all buyback operations and RG auctions | 2020 |

| Added a second 10-year benchmark bond per year—December 1 | 2020 |

| Increased the frequency of treasury bills auctions from bi-weekly to weekly (i.e., first half of the fiscal year) | 2020 |

| Reduced the frequency of treasury bills auctions from weekly to bi-weekly (i.e., second half of the fiscal year) | 2020 |

| Introduced federal green bond program | 2022 |

| Discontinued the Real Return Bond program | 2022 |

Annex 3: Glossary

asset-liability management: An investment decision-making framework that is used to concurrently manage a portfolio of assets and liabilities.

average term to maturity: The weighted average amount of time until the securities in the debt portfolio mature.

benchmark bond: A bond that is considered by the market to be the standard against which all other bonds in that term area are evaluated against. It is typically a bond issued by a sovereign, since sovereign debt is usually the most creditworthy within a domestic market. Usually it is the most liquid bond within each range of maturities and is therefore priced accurately.

budgetary deficit: The shortfall between government annual revenues and annual budgetary expenses.

buyback on a cash basis: The repurchase of bonds for cash. Buybacks on a cash basis are used to maintain the size of bond auctions and new issuances.

buyback on a switch basis: The exchange of outstanding bonds for new bonds in the current building benchmark bond.

Canada bill: A promissory note denominated in US dollars, issued for terms of up to 270 days. Canada bills are issued for foreign exchange reserves funding purposes only.

Canada Investment Bond: A non-marketable fixed-term security instrument issued by the Government of Canada.

Canada note: A promissory note usually denominated in US dollars, and available in book-entry form. Canada notes can be issued for terms of nine months or longer, and can be issued at a fixed or a floating rate. Canada notes are issued for foreign exchange reserves funding purposes only.

Canada Premium Bond: A non-marketable security instrument issued by the Government of Canada, which is redeemable once a year on the anniversary date or during the 30 days thereafter without penalty.

Canada Savings Bond: A non-marketable security instrument issued by the Government of Canada, which is redeemable on demand by the registered owner(s), and which, after the first three months, pays interest up to the end of the month prior to cashing.

cross-currency swap: An agreement that exchanges one type of debt obligation for another involving different currencies and the exchange of the principal amounts and interest payments.

duration: Measures the sensitivity of the price of a bond or portfolio to fluctuations in interest rates. It is a measure of volatility and is expressed in years. The higher the duration number, the greater the interest rate risk for bond or portfolio prices.

electronic trading system: An electronic system that provides real-time information about securities and enables the user to execute financial trades.

Exchange Fund Account (EFA): An account that aids in the control and protection of the external value of the Canadian dollar and which provides a source of liquidity for the Government of Canada. Assets held in the EFA are managed to provide liquidity to the government and to promote orderly conditions for the Canadian dollar in the foreign exchange markets, if required.

financial source/requirement: The difference between the cash inflows and outflows of the government's Receiver General account. In the case of a financial requirement, it is the amount of new borrowing required from outside lenders to meet financing needs in any given year.

fixed-rate share of market debt: The proportion of market debt that does not mature or need to be repriced within one year (i.e. the inverse of the refixing share of market debt).

foreign exchange reserves: The foreign currency assets (e.g. interest-earning bonds) held to support the value of the domestic currency. Canada's foreign exchange reserves are held in the Exchange Fund Account.

Government of Canada securities auction: A process used for selling Government of Canada debt securities (mostly marketable bonds and treasury bills) in which issues are sold by public tender to government securities distributors and approved clients.

government securities distributor: An investment dealer or bank that is authorized to bid at Government of Canada auctions and through which the government distributes Government of Canada treasury bills and marketable bonds.

interest-bearing debt: Debt consisting of unmatured debt, or debt issued on the credit markets, liabilities for pensions and other future benefits, and other liabilities.

Large Value Transfer System: An electronic funds transfer system introduced in February 1999 and operated by the Canadian Payments Association. It facilitates the electronic transfer of Canadian-dollar payments across the country virtually instantaneously.

marketable bond: An interest-bearing certificate of indebtedness issued by the Government of Canada, having the following characteristics: bought and sold on the open market; payable in Canadian or foreign currency; having a fixed date of maturity; interest payable either in coupon or registered form; face value guaranteed at maturity.

marketable debt: Market debt that is issued by the Government of Canada and sold via public tender or syndication. These issues can be traded between investors while outstanding.

money market: The market in which short-term capital is raised, invested and traded using financial instruments such as treasury bills, bankers' acceptances, commercial paper, and bonds maturing in one year or less.

non-market debt: The government's internal debt, which is, for the most part, federal public sector pension liabilities and the government's current liabilities (such as accounts payable, accrued liabilities, interest payments and payments of matured debt).

overnight rate; overnight financing rate; overnight money market rate; overnight lending rate: An interest rate at which participants with a temporary surplus or shortage of funds are able to lend or borrow until the next business day. It is the shortest term to maturity in the money market.

primary dealer: A member of the core group of government securities distributors that maintain a certain threshold of activity in the market for Government of Canada securities. The primary dealer classification can be attained in either treasury bills or marketable bonds, or both.

primary market: The market in which issues of securities are first offered to the public.

Real Return Bond: A bond whose interest payments are based on real interest rates. Unlike standard fixed-coupon marketable bonds, the semi-annual interest payments on Government of Canada Real Return Bonds are determined by adjusting the principal by the change in the Consumer Price Index.

refixing share of market debt: The proportion of market debt that matures or needs to be repriced within one year (i.e., the inverse of the fixed-rate share of market debt).

refixing share of market debt to gross domestic product (GDP): The amount of market debt that matures or needs to be repriced within one year relative to nominal GDP for that year.

secondary market: The market where existing securities trade after they have been sold to the public in the primary market.

sovereign market: The market for debt issued by a government.

treasury bill: A short-term obligation sold by public tender. Treasury bills, with terms to maturity of 3, 6 or 12 months, are currently auctioned on a bi-weekly basis.

ultra-long bond: A bond with a maturity of 40 years or longer.

yield curve: The conceptual or graphic representation of the term structure of interest rates. A "normal" yield curve is upward sloping, with short-term rates lower than long-term rates. An "inverted" yield curve is downward sloping, with short-term rates higher than long-term rates. A "flat" yield curve occurs when short-term rates are the same as long-term rates.

Annex 4: Contact Information

Consultations and Communications Branch

Department of Finance Canada

14th floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Phone: 613-369-3710

Facsimile: 613-369-4065

TTY: 613-369-3230

E-mail: financepublic-financepublique@fin.gc.ca

Media Enquiries:

613-369-4000

Reference Tables

- I - Total Liabilities, Outstanding Market Debt and Debt Charges, as at March 31

- II - Government of Canada Outstanding Market Debt, as at March 31

- III - Issuance of Government of Canada Domestic Bonds

- IV - Outstanding Government of Canada Domestic Bonds, as at March 31, 2023

- V - Government of Canada Cross-Currency Swaps Outstanding, as at March 31, 2023

- VI - Crown Corporation Borrowings, as at March 31

| Liabilities | |||||

|---|---|---|---|---|---|

| Year | Market debt | Market debt value adjustments | Accounts payable and accrued liabilities | Pension and other liabilities | Total liabilities |

| 1986 | 201.2 | -0.4 | 39.4 | 79.1 | 319.4 |

| 1987 | 228.6 | -0.4 | 42.1 | 84.7 | 355.0 |

| 1988 | 250.8 | -0.9 | 47.2 | 90.9 | 388.0 |

| 1989 | 276.3 | -2.2 | 50.2 | 97.1 | 421.4 |

| 1990 | 294.6 | -2.9 | 53.2 | 104.5 | 449.3 |

| 1991 | 323.9 | -3.2 | 54.9 | 112.1 | 487.7 |

| 1992 | 351.9 | -2.2 | 56.1 | 118.5 | 524.2 |

| 1993 | 382.7 | -3.0 | 58.4 | 125.1 | 563.2 |

| 1994 | 414.0 | -1.8 | 63.7 | 131.4 | 607.3 |

| 1995 | 441.0 | -3.4 | 71.3 | 139.8 | 648.7 |

| 1996 | 469.5 | -1.7 | 74.9 | 148.5 | 691.3 |

| 1997 | 476.9 | 0.3 | 75.9 | 156.3 | 709.4 |

| 1998 | 466.8 | 1.4 | 81.7 | 160.9 | 710.8 |

| 1999 | 457.7 | 2.6 | 83.7 | 168.2 | 712.2 |

| 2000 | 454.2 | -0.2 | 83.9 | 175.8 | 713.6 |

| 2001 | 444.9 | 1.3 | 88.5 | 179.0 | 713.6 |

| 2002 | 440.9 | 0.9 | 83.2 | 177.9 | 703.0 |

| 2003 | 438.6 | -1.1 | 83.2 | 178.3 | 699.0 |

| 2004 | 436.5 | -2.5 | 85.2 | 180.9 | 700.1 |

| 2005 | 431.8 | -4.3 | 97.7 | 179.8 | 705.0 |

| 2006 | 427.3 | -6.1 | 101.4 | 179.9 | 702.5 |

| 2007 | 418.8 | -4.7 | 106.5 | 185.1 | 705.8 |

| 2008 | 394.1 | -3.4 | 110.5 | 191.2 | 692.3 |

| 2009 | 510.9 | 3.1 | 114.0 | 200.4 | 828.4 |

| 2010 | 564.4 | -5.3 | 120.5 | 208.7 | 888.3 |

| 2011 | 596.8 | -5.7 | 119.1 | 217.2 | 927.5 |

| 2012 | 631.0 | -4.7 | 125.0 | 226.1 | 977.5 |

| 2013 | 668.0 | 4.4 | 118.7 | 236.2 | 1,027.4 |

| 2014 | 648.7 | 10.3 | 111.4 | 245.2 | 1,015.8 |

| 2015 | 649.5 | 15.7 | 123.6 | 251.4 | 1,040.2 |

| 2016 | 669.7 | 18.5 | 127.9 | 262.0 | 1,078.0 |

| 2017 | 695.1 | 18.5 | 132.5 | 270.7 | 1,116.9 |

| 2018 | 704.3 | 16.9 | 154.8 | 281.4 | 1,157.4 |

| 2019 | 721.1 | 15.8 | 159.7 | 282.6 | 1,185.2 |

| 2020 | 765.2 | 18.6 | 163.8 | 301.0 | 1,248.6 |

| 2021 | 1,109.8 | 15.4 | 207.4 | 319.7 | 1,652.2 |

| 2022 | 1,244.6 | 5.4 | 262.5 | 335.1 | 1,892.3 |

| 2023 | 1,259.9 | 5.1 | 259.4 | 351.7 | 1,925.0 |

| Accumulated deficit and debt charges | ||||||

|---|---|---|---|---|---|---|

| Year | Total liabilities | Financial assets | Net debt | Non-financial assets | Accumulated deficit | Gross public debt charges |

| 1986 | 319.4 | 70.1 | 249.2 | 21.4 | 227.8 | 27.7 |

| 1987 | 355.0 | 73.2 | 281.8 | 24.2 | 257.7 | 28.7 |

| 1988 | 388.0 | 75.0 | 313.0 | 26.3 | 286.7 | 31.2 |

| 1989 | 421.4 | 77.9 | 343.6 | 29.0 | 314.6 | 35.5 |

| 1990 | 449.3 | 74.5 | 374.8 | 31.0 | 343.8 | 41.2 |

| 1991 | 487.7 | 76.6 | 411.1 | 33.4 | 377.7 | 45.0 |

| 1992 | 524.2 | 78.5 | 445.7 | 35.8 | 410.0 | 43.9 |

| 1993 | 563.2 | 76.0 | 487.2 | 38.2 | 449.0 | 41.3 |

| 1994 | 607.3 | 79.3 | 527.9 | 40.4 | 487.5 | 40.1 |

| 1995 | 648.7 | 81.2 | 567.5 | 43.3 | 524.2 | 44.2 |

| 1996 | 691.3 | 92.7 | 598.6 | 44.4 | 554.2 | 49.4 |

| 1997 | 709.4 | 100.4 | 609.0 | 46.1 | 562.9 | 47.3 |

| 1998 | 710.8 | 103.6 | 607.2 | 47.2 | 559.9 | 43.1 |

| 1999 | 712.2 | 109.3 | 602.9 | 48.7 | 554.1 | 43.3 |

| 2000 | 713.6 | 123.5 | 590.1 | 50.2 | 539.9 | 43.4 |

| 2001 | 713.6 | 141.9 | 571.7 | 51.7 | 520.0 | 43.9 |

| 2002 | 703.0 | 137.7 | 565.3 | 53.4 | 511.9 | 39.7 |

| 2003 | 699.0 | 139.5 | 559.6 | 54.2 | 505.3 | 37.3 |

| 2004 | 700.1 | 149.1 | 551.0 | 54.8 | 496.2 | 35.8 |

| 2005 | 705.0 | 155.4 | 549.6 | 54.9 | 494.7 | 34.1 |

| 2006 | 702.5 | 165.6 | 536.9 | 55.4 | 481.5 | 33.8 |

| 2007 | 705.8 | 181.9 | 523.9 | 56.6 | 467.3 | 33.9 |

| 2008 | 692.3 | 176.0 | 516.3 | 58.6 | 457.6 | 33.3 |

| 2009 | 828.4 | 298.9 | 529.4 | 61.5 | 467.9 | 28.3 |

| 2010 | 888.3 | 300.8 | 587.5 | 63.4 | 524.1 | 26.6 |

| 2011 | 927.5 | 304.0 | 623.5 | 66.6 | 556.9 | 28.6 |

| 2012 | 977.5 | 317.6 | 659.9 | 68.0 | 591.9 | 29.0 |

| 2013 | 1,027.4 | 337.8 | 689.5 | 68.9 | 620.6 | 25.5 |

| 2014 | 1,015.8 | 318.5 | 696.4 | 70.4 | 626.0 | 24.7 |

| 2015 | 1,040.2 | 336.7 | 703.5 | 74.6 | 628.9 | 24.2 |

| 2016 | 1,078.0 | 365.8 | 712.2 | 77.8 | 634.4 | 21.8 |

| 2017 | 1,116.9 | 382.8 | 734.1 | 82.6 | 651.5 | 21.2 |

| 2018 | 1,157.4 | 397.5 | 752.9 | 81.6 | 671.3 | 21.9 |

| 2019 | 1,185.2 | 413.0 | 772.1 | 86.7 | 685.5 | 23.3 |

| 2020 | 1,248.6 | 435.7 | 812.9 | 91.5 | 721.4 | 24.5 |

| 2021 | 1,652.2 | 502.4 | 1,149.8 | 101.1 | 1,048.8 | 20.4 |

| 2022 | 1,892.3 | 647.5 | 1,244.7 | 104.8 | 1,140.0 | 24.5 |

| 2023 | 1,925.0 | 642.3 | 1,282.7 | 109.7 | 1,173.0 | 35.0 |

| Payable in Canadian dollars | |||||

|---|---|---|---|---|---|

| Year | Treasury bills | Marketable bonds1 | Retail debt | Canada Pension Plan bonds |

Total |

| 1986 | 62.0 | 81.1 | 44.2 | 0.4 | 187.7 |

| 1987 | 77.0 | 94.4 | 44.3 | 1.8 | 217.5 |

| 1988 | 81.1 | 103.9 | 53.3 | 2.5 | 240.8 |

| 1989 | 102.7 | 115.7 | 47.8 | 3.0 | 269.2 |

| 1990 | 118.6 | 127.7 | 40.9 | 3.1 | 290.2 |

| 1991 | 139.2 | 143.6 | 34.4 | 3.5 | 320.7 |

| 1992 | 152.3 | 158.1 | 35.6 | 3.5 | 349.5 |

| 1993 | 162.1 | 178.5 | 34.4 | 3.5 | 378.4 |

| 1994 | 166.0 | 203.4 | 31.3 | 3.5 | 404.3 |

| 1995 | 164.5 | 225.7 | 31.4 | 3.5 | 425.1 |

| 1996 | 166.1 | 252.8 | 31.4 | 3.5 | 453.8 |

| 1997 | 135.4 | 282.6 | 33.5 | 3.5 | 454.9 |

| 1998 | 112.3 | 294.6 | 30.5 | 3.5 | 440.8 |

| 1999 | 97.0 | 295.8 | 28.2 | 4.1 | 425.0 |

| 2000 | 99.9 | 294.4 | 26.9 | 3.6 | 424.7 |

| 2001 | 88.7 | 295.5 | 26.4 | 3.5 | 414.1 |

| 2002 | 94.2 | 294.9 | 24.0 | 3.4 | 416.5 |

| 2003 | 104.6 | 289.2 | 22.6 | 3.4 | 419.8 |

| 2004 | 113.4 | 279.0 | 21.3 | 3.4 | 417.1 |

| 2005 | 127.2 | 266.7 | 19.1 | 3.4 | 416.3 |

| 2006 | 131.6 | 261.9 | 17.3 | 3.1 | 413.9 |

| 2007 | 134.1 | 257.9 | 15.2 | 1.7 | 408.9 |

| 2008 | 117.0 | 253.8 | 13.1 | 1.0 | 384.9 |

| 2009 | 192.5 | 295.3 | 12.5 | 0.5 | 500.8 |

| 2010 | 175.9 | 367.9 | 11.8 | 0.5 | 556.1 |

| 2011 | 163.0 | 416.1 | 10.1 | 0.0 | 589.2 |

| 2012 | 163.2 | 448.1 | 8.9 | 0.0 | 620.3 |

| 2013 | 180.7 | 469.0 | 7.5 | 0.0 | 657.2 |

| 2014 | 153.0 | 473.3 | 6.3 | 0.0 | 632.6 |

| 2015 | 135.7 | 487.9 | 5.7 | 0.0 | 629.2 |

| 2016 | 138.1 | 504.1 | 5.1 | 0.0 | 647.2 |

| 2017 | 136.7 | 536.3 | 4.5 | 0.0 | 677.5 |

| 2018 | 110.7 | 575.0 | 2.6 | 0.0 | 688.2 |

| 2019 | 134.3 | 569.5 | 1.2 | 0.0 | 705.1 |

| 2020 | 151.9 | 596.9 | 0.5 | 0.0 | 749.2 |

| 2021 | 218.8 | 875.3 | 0.3 | 0.0 | 1,109.8 |

| 2022 | 186.9 | 1,043.2 | 0.0 | 0.0 | 1,230.1 |

| 2023 | 198.9 | 1,045.0 | 0.0 | 0.0 | 1,243.9 |

|

1 Inflation adjusted. |

|||||

| Payable in foreign currencies | |||||||

|---|---|---|---|---|---|---|---|

| Year | Canada bills | Marketable bonds | Canada notes1 | Euro medium-term notes1 | Standby drawings |

Term loans | Total |

| 1986 | 0.0 | 9.3 | 0.0 | 0.0 | 2.2 | 2.2 | 13.8 |

| 1987 | 1.0 | 8.9 | 0.0 | 0.0 | 0.0 | 2.0 | 12.0 |

| 1988 | 1.0 | 7.9 | 0.0 | 0.0 | 0.0 | 2.3 | 11.3 |

| 1989 | 1.1 | 6.3 | 0.0 | 0.0 | 0.0 | 0.9 | 8.3 |

| 1990 | 1.4 | 4.3 | 0.0 | 0.0 | 0.0 | 0.0 | 5.7 |

| 1991 | 1.0 | 3.6 | 0.0 | 0.0 | 0.0 | 0.0 | 4.5 |

| 1992 | 0.0 | 3.4 | 0.0 | 0.0 | 0.0 | 0.0 | 3.4 |

| 1993 | 2.6 | 2.8 | 0.0 | 0.0 | 0.0 | 0.0 | 5.4 |

| 1994 | 5.6 | 5.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10.7 |

| 1995 | 9.0 | 7.9 | 0.0 | 0.0 | 0.0 | 0.0 | 16.9 |

| 1996 | 7.0 | 9.5 | 0.3 | 0.0 | 0.0 | 0.0 | 16.8 |

| 1997 | 8.4 | 12.5 | 2.1 | 0.0 | 0.0 | 0.0 | 23.0 |

| 1998 | 9.4 | 14.6 | 1.7 | 1.5 | 0.0 | 0.0 | 27.2 |

| 1999 | 10.2 | 19.7 | 1.3 | 4.9 | 0.0 | 0.0 | 36.0 |