Demystifying your Pay Stub - New Course on GCcampus!

December 23, 2020 - Defence Stories

Are you struggling to understand your pay stub and deductions? Do you know where to find help? The Canada School of Public Service has just launched the course you need!

Demystifying Your Pay Stub (HRMS code: 303422) is an online, self-paced course for public service employees, and will help you understand the information on your pay stub in only 45 minutes! To access the course you must have a GCcampus account accessible through the DWAN or the Internet. ;If you require help to establish an account, please contact the Canadian School of Public Service (CSPS) at 1-866-703-9598.

The course reviews the Compensation Web Application (CWA) and the Phoenix Pay system pay stubs, describes common deductions, and provide links to government websites where you can find out more information.

Read the Identifying Changes in Net Pay and Accessing Your Pay Stub Online Job Aids available on the HR-Civ intranet page and on the HR GO RH mobile app which is available for download on iOS and Android devices.

Infographic - Text version

Job Aid 001: How to Identify Changes in Net Pay

A change to your net pay may occur for many reasons. Each personal income situation is unique. Some factors to consider are:

- change of your province of work

- changes to salary

- reaching yearly maximum of mandatory deductions

- taxable allowances and benefits

- personal tax credits

- hardship or other exemptions

- leave without pay

- overpayment recoveries

Locating Changes on Your Pay Stub

You can view changes to your Net pay on your Phoenix pay stub or on your Compensation Web Applications (CWA) pay stub.

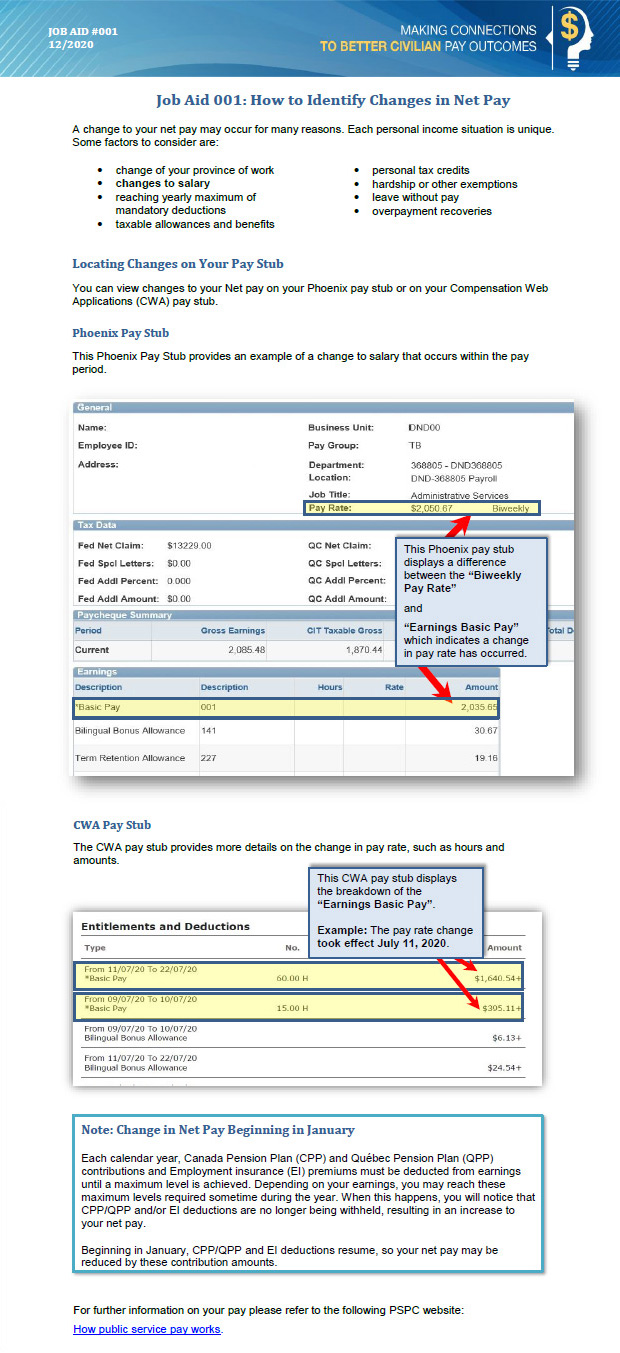

Phoenix Pay Stub

This Phoenix Pay Stub provides an example of a change to salary that occurs within the pay period.

This Phoenix pay stub displays a difference between the “Biweekly Pay Rate” and “Earnings Basic Pay” which indicates a change in pay rate has occurred.

CWA Pay Stub

The CWA pay stub provides more details on the change in pay rate, such as hours and amounts.

This CWA pay stub displays the breakdown of the “Earnings Basic Pay”.

Example: The pay rate change took effect July 11, 2020.

Note: Change in Net Pay Beginning in January

Each calendar year, Canada Pension Plan (CPP) and Québec Pension Plan (QPP) contributions and Employment insurance (EI) premiums must be deducted from earnings until a maximum level is achieved. Depending on your earnings, you may reach these maximum levels required sometime during the year. When this happens, you will notice that CPP/QPP and/or EI deductions are no longer being withheld, resulting in an increase to your net pay.

Beginning in January, CPP/QPP and EI deductions resume, so your net pay may be reduced by these contribution amounts.

For further information on your pay please refer to the following PSPC website: How public service pay works.

Infographic - Text version

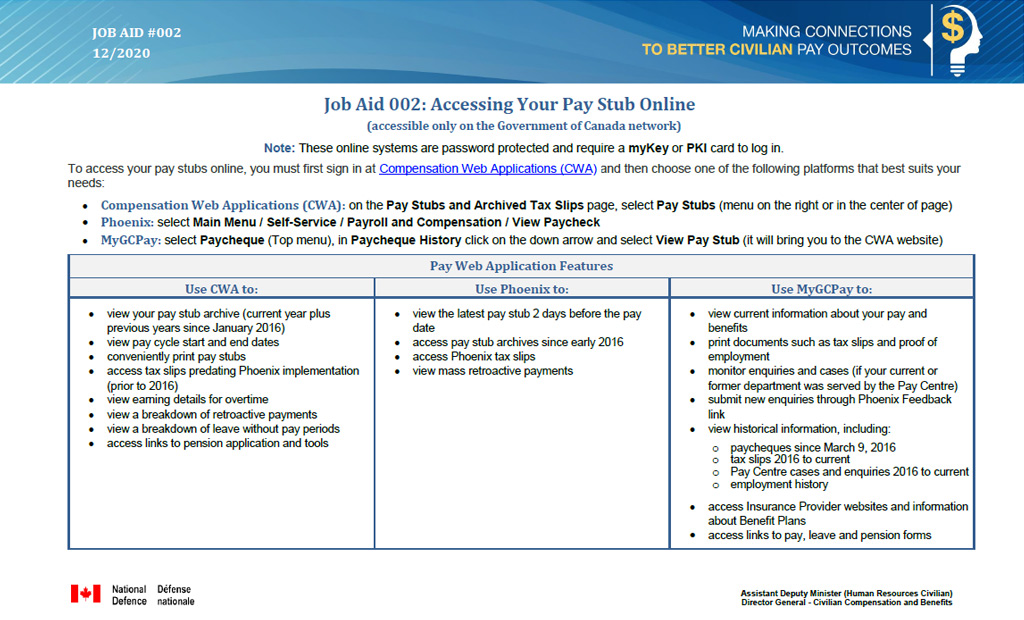

Job Aid 002: Accessing Your Pay Stub Online

(accessible only on the Government of Canada network)

Note: These online systems are password protected and require a myKey or PKI card to log in. To access your pay stubs online, you must first sign in at Compensation Web Applications (CWA) and then choose one of the following platforms that best suits your needs:

- Compensation Web Applications (CWA): on the Pay Stubs and Archived Tax Slips page, select Pay Stubs (menu on the right or in the center of page)

- Phoenix: select Main Menu / Self-Service / Payroll and Compensation / View Paycheck

- MyGCPay: select Paycheque (Top menu), in Paycheque History click on the down arrow and select View Pay Stub (it will bring you to the CWA website)

| Pay Web Application Features | ||

|---|---|---|

| Use CWA to: | Use Phoenix to: | Use MyGCPay to: |

|

|

|