Impact Assessment Agency of Canada’s Quarterly Financial Report for Quarter ended September 30, 2025

Statement outlining results, risks, and significant changes in operations, personnel, and program

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the Main Estimates, Supplementary Estimates, and the previous Quarterly Financial Report for the current year.

This quarterly report has not been subject to an external audit or review.

Mandate and program activities

IAAC delivers high-quality environmental and impact assessments under the Impact Assessment Act (IAA). Through open and efficient assessments, IAAC facilitates the development of major projects. These assessments identify ways to ensure the environment and Indigenous rights are protected as projects get built. To support needed investment in major projects, IAAC works closely with other jurisdictions to achieve the goal of "one project, one review."

Additional information about IAAC’s mandate can be found on its website and additional financial information may be found in IAAC’s 2025-26 Departmental plan and in the 2025-26 Main Estimates.

Under its two programs, IAAC delivers the Impact Assessment Grants and Contributions Program (Funding Programs), which includes:

- Participant Funding Program;

- Indigenous Capacity Support Program;

- Policy Dialogue Program; and

- Research Program.

Basis of presentation

This quarterly report has been prepared by management using the expenditure basis of accounting. The accompanying Statement of Authorities includes IAAC’s spending authorities granted by Parliament, and those used by IAAC consistent with the Main Estimates and Supplementary Estimates for the 2025-2026 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

IAAC uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and the fiscal year-to-date (YTD) results

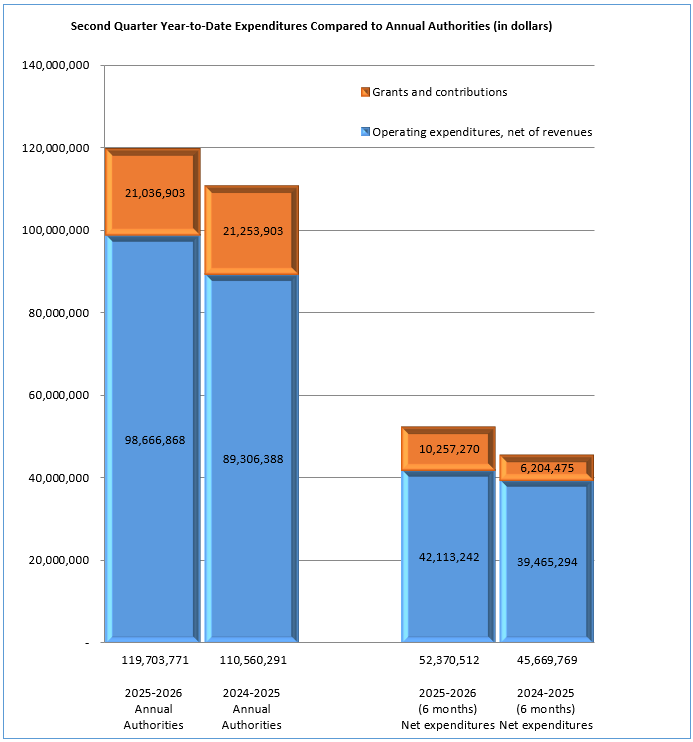

The annual authorities available for use ($119.70M in 2025–2026 and $110.56M in 2024–2025), which represents the budgetary expenditures granted by Parliament at quarter-end less the vote-netted revenue IAAC has authority to collect, increased by $9.14M (8.27%) due to new funding announced in the Fall Economic Statement 2022 (FES 2022) for IAAC to continue to implement the Impact Assessment Act (IAA) and complete assessments started under the Canadian Environmental Assessment Act, 2012 (CEAA 2012).

The second quarter year-to-date budgetary expenditures, net of revenues, increased by $6.70M (14.67%) from the previous year ($52.37M in 2025–2026 and $45.67M in 2024–2025). This increase is explained by the following:

- Transfer payments (grants and contributions) increased by $4.05M ($10.26M in 2025–2026 and $6.21M in 2024–2025). The variance reflects the timing of IAAC’s multi-year contractual obligations maturing, while the full-year forecast of transfer payments remains consistent with planned levels.

- Personnel expenditures increased by $3.87M ($36.83M in 2025–2026 and $32.96M in 2024–2025) due to an increase in the number of employees hired during the 2024-2025 fiscal year, the increase in wages, and the related cost of employee benefits. Staffing levels are not expected to rise in 2025–2026, in alignment with the Government’s direction to exercise discipline in overall government growth. Departments and Agencies are expected to focus on achieving efficiencies through better use of existing capacity rather than expanding staffing levels.

- Other budgetary expenditures decreased by $0.99M ($5.51M in 2025–2026 and $6.50M in 2024–2025) due to expenditures being limited to routine and legally required items at the start of the fiscal year during the caretaker convention.

- Revenues increased by $0.23M ($0.23M in 2025–2026 and $633 in 2024–2025) following the resumption of cost recovery activities once the IAA amendment took effect on June 20, 2024.

Risks and uncertainties

Legal challenges

IAAC is subject to litigation, the extent and costs of which are uncertain. If applicable, these costs are normally covered by IAAC’s annual appropriations. IAAC mitigates these risks through proactive legal oversight, close monitoring of ongoing cases, and the implementation of sound risk management and governance practices.

Digital modernization

IAAC’s limited digitization poses a strategic risk to operational efficiency and service delivery, as reliance on manual processes reduces agility, increases the potential for errors, and constrains our ability to leverage data for timely, evidence-based decision-making. To address these risks, IAAC is strengthening its planning and investment approach for digital initiatives and continues to explore opportunities for collaboration and shared solutions across government.

Financial sustainability

IAAC operates in an environment of growing operational pressures and ongoing government-wide efforts to identify cost efficiencies. While prudent financial management and careful expenditure planning have supported stability, these factors also reduce financial flexibility and can make it more difficult to respond quickly to emerging priorities or unexpected demands. To strengthen long-term financial sustainability, IAAC is modernizing its integrated business planning processes to better align resources with strategic priorities and a more focused mandate. IAAC has begun rethinking how it is structured to operate more efficiently and is taking proactive steps to ensure it can continue delivering effectively under reduced funding levels. These measures will enhance adaptability while ensuring that cost management measures do not compromise program outcomes or service delivery.

Approval by Senior Officials

Approved by:

____________________________________

Terence Hubbard

President

Ottawa, Canada

November 24, 2025

____________________________________

Joelle Raffoul

Vice-President, Corporate Services and Chief Financial Officer

Ottawa, Canada

November 17, 2025

Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2026 1 | Used during the quarter ended September 30, 2025 | Year-to-date used at quarter ended September 30, 2025 | |

|---|---|---|---|

VOTE 1 - Net operating expenditures |

88,480,127 |

18,995,073 |

37,019,872 |

VOTE 5 - Grants and contributions |

21,036,903 |

4,204,193 |

10,257,270 |

Statutory Authorities - Employee benefits |

10,186,741 |

2,546,685 |

5,093,370 |

| Total Authorities |

119,703,771 |

25,745,951 |

52,370,512 |

1Includes authorities available for use and granted by Parliament at quarter-end. |

|||

| Total available for use for the year ended March 31, 2025 1 | Used during the quarter ended September 30, 2024 | Year-to-date used at quarter ended September 30, 2024 | |

|---|---|---|---|

VOTE 1 - Net operating expenditures |

81,274,531 |

18,555,618 |

35,449,365 |

VOTE 5 - Grants and contributions |

21,253,903 |

4,892,638 |

6,204,475 |

Statutory Authorities - Employee benefits |

8,031,857 |

2,007,965 |

4,015,929 |

| Total Authorities |

110,560,291 |

25,456,221 |

45,669,769 |

1Includes authorities available for use and granted by Parliament at quarter-end. |

|||

IAAC Budgetary Expenditures by Standard Object (unaudited)

| Planned expenditures for the year ending March 31, 2026 | Expended during the quarter ended September 30, 2025 | Year-to-date used at quarter ended September 30, 2025 | |

|---|---|---|---|

Expenditures |

|||

Personnel |

76,766,746 |

18,609,056 |

36,831,729 |

Transportation and telecommunications |

3,134,755 |

191,404 |

366,619 |

Information |

807,909 |

100,408 |

124,737 |

Professional services |

17,440,739 |

2,592,094 |

4,772,176 |

Rentals |

139,684 |

14,064 |

25,214 |

Purchased repair and maintenance |

141,810 |

3,987 |

27,728 |

Utilities, materials and supplies |

269,918 |

7,434 |

17,019 |

Acquisition of machinery and equipment |

3,131,792 |

80,307 |

140,777 |

Transfer payments |

21,036,903 |

4,204,193 |

10,257,270 |

Other expenses |

31,406 |

39,507 |

38,835 |

| Total gross budgetary expenditures |

122,901,662 |

25,842,454 |

52,602,104 |

| Less revenues netted against expenditures |

|||

Panel reviews |

3,197,891 |

96,503 |

231,592 |

| Total net budgetary expenditures |

119,703,771 |

25,745,951 |

$52,370,512 |

Note 1: IAAC has authority to collect up to $8,001,000 in vote-netted revenue.

| Planned expenditures for the year ended March 31, 2025 | Expended during the quarter ended September 30, 2024 | Year-to-date used at quarter ended September 30, 2024 | |

|---|---|---|---|

Expenditures |

|||

Personnel |

66,233,721 |

17,183,123 |

32,963,416 |

Transportation and telecommunications |

3,053,660 |

295,980 |

554,193 |

Information |

1,400,061 |

93,585 |

175,672 |

Professional services |

14,455,554 |

2,579,065 |

4,878,654 |

Rentals |

131,600 |

21,437 |

36,072 |

Purchased repair and maintenance |

722,580 |

43,554 |

43,554 |

Utilities, materials and supplies |

664,839 |

32,470 |

44,750 |

Acquisition of machinery and equipment |

3,251,859 |

305,223 |

761,045 |

Transfer payments |

21,253,903 |

4,892,638 |

6,204,475 |

Other expenses |

17,514 |

9,779 |

8,571 |

| Total gross budgetary expenditures |

111,185,291 |

25,456,854 |

45,670,402 |

| Less revenues netted against expenditures |

|||

Panel reviews |

625,000 |

633 |

633 |

| Total net budgetary expenditures |

110,560,291 |

25,456,221 |

45,669,769 |

Note 1: IAAC has authority to collect up to $8,001,000 in vote-netted revenue.