Report on Key Compliance Attributes of the Internal Audit Function for the 2017 to 2018 Fiscal Year

The internal audit function at the Treasury Board of Canada Secretariat

The Internal Audit and Evaluation Bureau (IAEB) was created in February 2009 as a dedicated service to the Treasury Board of Canada Secretariat (TBS). It provides independent and objective assurance and evaluation services that add value in managing TBS’s programs and operations.

IAEB conducts its audit work in accordance with:

- the Policy on Internal Audit

- the International Standards for the Professional Practice of Internal Auditing (the Standards)

IAEB helps TBS meet its objectives by assessing the relevance and performance of TBS programs. It does so by using a systematic, disciplined approach to improve the effectiveness of processes for risk management, control and governance.

This report provides information to Canadians and parliamentarians on the professionalism, performance and impact of the internal audit function at TBS.

The Directive on Internal Audit requires all departments to provide information on key compliance attributes to demonstrate that the internal audit function is in place and operating as intended.

1. Do internal auditors at TBS have the training required to do the job effectively, and are multidisciplinary teams in place to address diverse risks?

Yes. Collectively, IAEB staff have the knowledge, skills and other competencies required to fulfill their responsibilities. The compliance attribute used to measure training is the percentage of staff:

- who have Certified Internal Auditor (CIA) or Chartered Professional Accountant (CPA) designations

- who are working on obtaining a CIA or CPA designation

- who have other designations such as:

- Certified Government Auditing Professional (CGAP)

- Certification in Risk Management Assurance (CRMA)

- Internal Audit Practitioner (IAP)

- Certified Information Systems Auditor (CISA)

- Certified Fraud Examiner (CFE)

For the purposes of this report, 12 IAEB staff members are included in the staff composition of TBS’s internal audit function. This staff includes:

- the Chief Audit Executive

- the manager of the Government of Canada Audit Committee secretariat

- quality assurance staff

- internal audit managers

- auditors

- staff dedicated to work related to enterprise transformation assessments

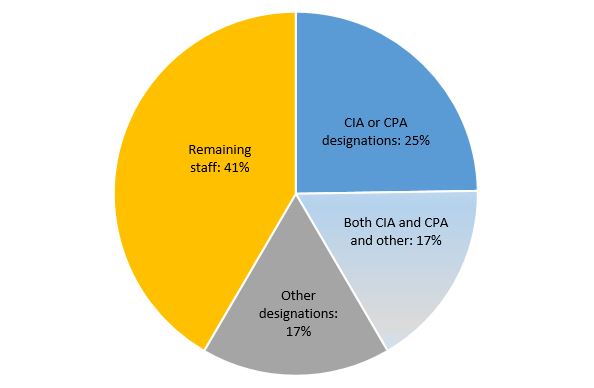

The breakdown of IAEB staff composition is shown in Figure 1.

Figure 1 - Text version

The pie chart shows the breakdown of the internal audit staff composition as of May 31, 2018.

| CIA/CPA Designations | 25% |

|---|---|

| Both CIA/CPA and Other Designations | 17% |

| Other Designations | 17% |

| Remaining Staff | 41% |

In addition, there are two IAEB staff (17%) who are working on obtaining their CIA or CPA designations.

IAEB values staff who have multidisciplinary backgrounds and, since 2014, has had a rotation of staff on temporary assignments. High-performing staff from other areas of TBS and other government departments have joined IAEB, bringing diverse skill sets and backgrounds other than auditing or accounting, including staff who:

- have master’s degrees

- have advanced knowledge of data analytics

- have extensive experience in risk and project management

2. Is internal audit work performed in conformance with international standards for the profession of internal audit as required by Treasury Board policy?

Yes. IAEB’s internal audit work conforms to international standards for the profession. The compliance attribute used to measure conformance is the date of the last comprehensive briefing to the Government of Canada Audit Committee and the date of IAEB’s last external assessment. A comprehensive briefing consists of an update on:

- internal processes, tools and information considered necessary to evaluate conformance with the Institute of Internal Auditors’ Code of Ethics and Standards

- the results of IAEB’s Quality Assurance and Improvement Program

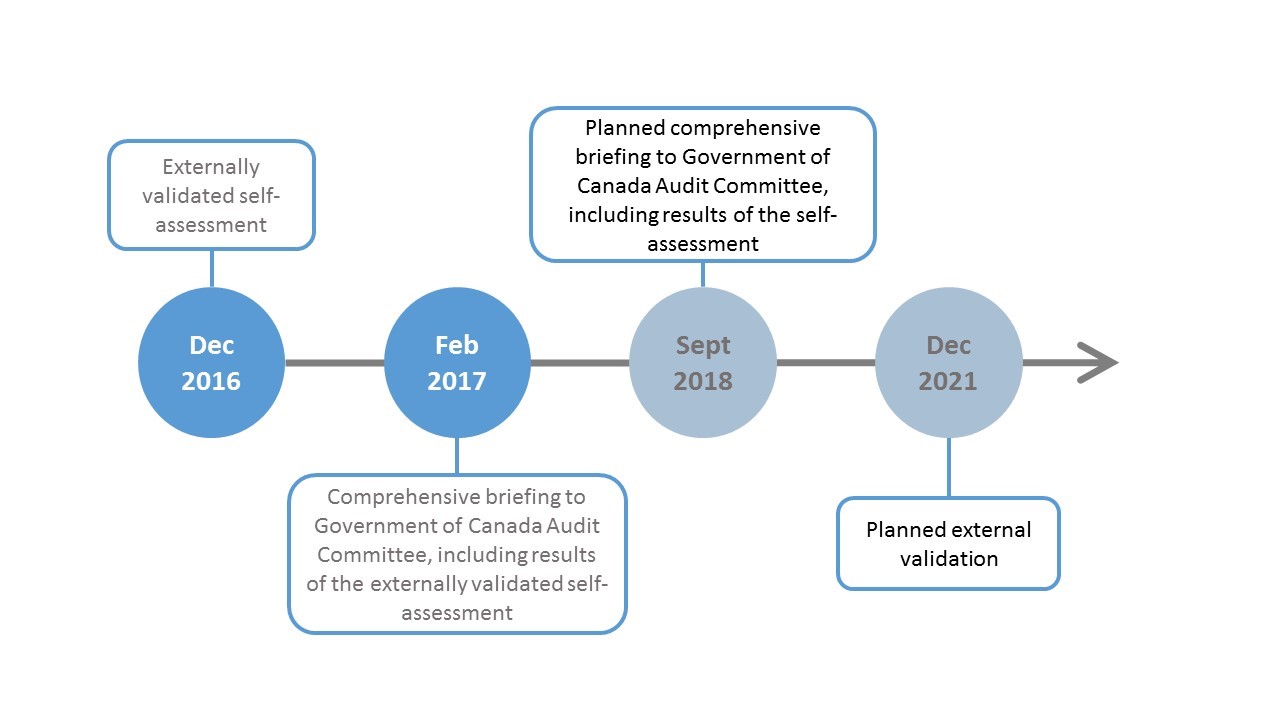

Figure 2 - Text version

This timeline diagram presents key dates and activities related to this key compliance attribute.

| Key Dates | Related Activities |

|---|---|

| December 2016 | Externally validated self-assessment |

| February 2017 | Comprehensive briefing to Government of Canada Audit Committee, including results of the externally validated self-assessment |

| September 2018 | Planned Comprehensive briefing to Government of Canada Audit Committee, including results of the self-assessment |

| December 2021 | Planned external validation |

3. Are Risk-Based Audit Plans (RBAP) submitted to audit committees and approved by deputy heads? Are they implemented as planned, with resulting reports published? Is management acting on audit recommendations?

The internal audits conducted by IAEB are planned based on the approved RBAP for the 2018 to 2019 fiscal year and the 2019 to 2020 fiscal year. They are listed in a table that will be updated to track:

- planned internal audits

- progress in implementing actions as a result of the internal audits

Table 1. Overview of internal audits planned or conducted by IAEB as of

4. Is internal audit credible and adding value in support of TBS’s mandate and strategic objectives?

Yes. Based on post-audit survey results received during the 2017 to 2018 fiscal year, TBS’s senior management stated that it somewhat agrees that the audit conducted was beneficial to the department, which means in its opinion that the internal audit:

- addressed most risks

- will lead to necessary improvements

The compliance attribute to measure the credibility and value added by internal audit is an average overall usefulness rating from senior management, which is information gathered in post-audit surveys issued to senior management.

The current IAEB post-audit survey requests a rating on whether the audit was beneficial to the department rather than whether the audit was useful overall. During this fiscal year, IAEB will revise its post-audit survey to ensure that the appropriate information is captured so that IAEB can report on this compliance attribute in the future.

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2018,

Catalogue No.BT1-55E-PDF, ISSN: 2562-7449

Page details

- Date modified: