Quarterly Financial Report for the quarter ended September 30, 2020

![]() Quarterly Financial Report for the quarter ended September 30, 2020 (PDF)

Quarterly Financial Report for the quarter ended September 30, 2020 (PDF)

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the 2020-21 Main Estimates and the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. This quarterly report has not been subject to an external audit or review.

The Administrative Tribunals Support Service of Canada (ATSSC) is responsible for providing support services and facilities to 11 federal administrative tribunals by way of a single, integrated organization. These services include the specialized services required by each tribunal (e.g., registry, research and analysis, legal and other mandate or case activities specific to each tribunal), as well as internal services (e.g., human resources, financial services, information management and technology, accommodations, security, planning and communications).

Further information on the mandate, roles, responsibilities and programs of the ATSSC can be found in the organization’s 2020-21 Departmental Plan.

1.1. Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities (Annex A) includes the ATSSC's spending authorities granted by Parliament and those used by the ATSSC, consistent with the Main Estimates for the 2020-21 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The ATSSC uses the full accrual method of accounting to prepare and present its annual departmental financial statements, which are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis. The main difference between the quarterly financial report and the departmental financial statements is the timing of when revenues and expenses are recognized.

2. Highlights of fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year, and actual expenditures for the quarter ended September 30, 2020.

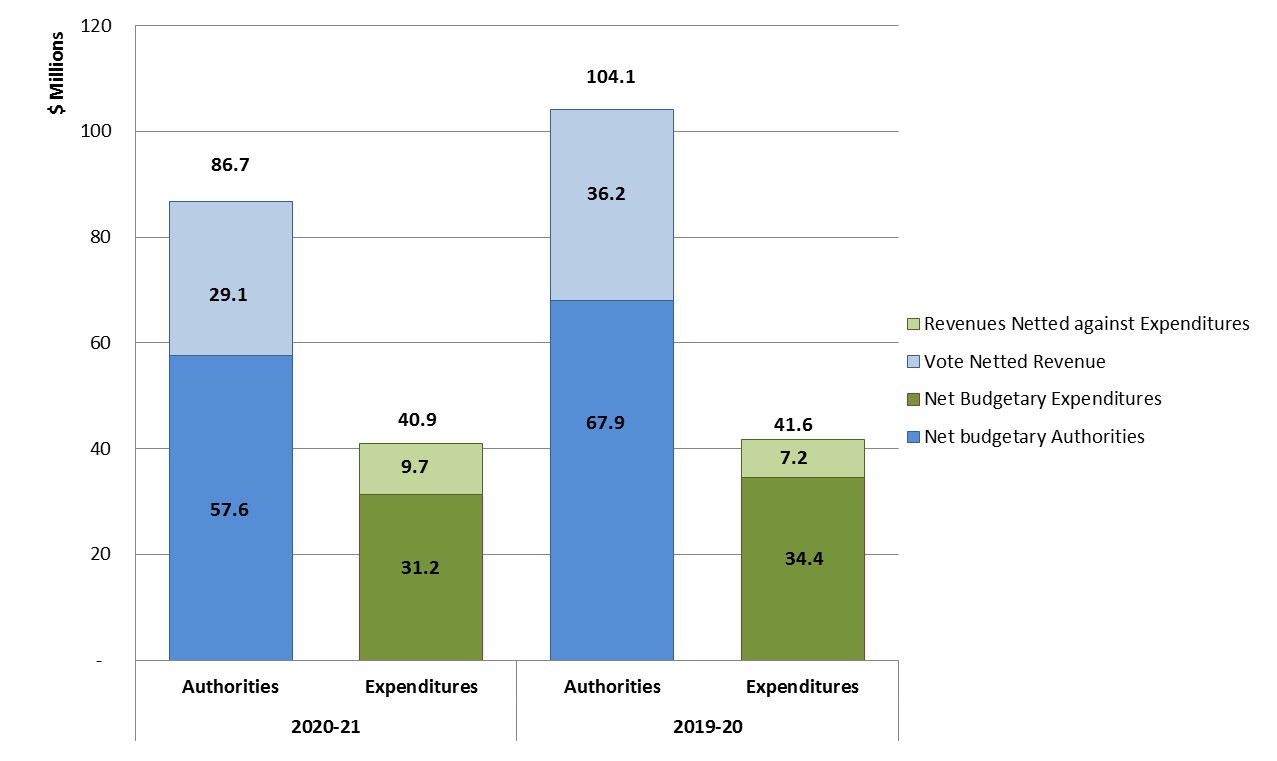

The ATSSC’s financial structure is mainly composed of voted budgetary authorities, namely Vote 1—Program Expenditures and Vote Netted Revenue (VNR) authority, as well as statutory authorities for contributions to employee benefit plans. The VNR gives the ATSSC authority to make recoverable expenditures against the Canada Pension Plan (CPP) and the Employment Insurance (EI) operating accounts. Graph 1 below shows the ATSSC’s gross and net budgetary authorities and expenditures for the second quarter of 2020-21. For more details, refer to the Statement of Authorities table presented in Annex A.

Graph 1: Comparison of budgetary authorities and expenditures for the second quarter ended September 30, 2020, and September 30, 2019.

The ATSSC expended $40.9 million (47% of total authorities available for use), including Employee Benefit Plan (EBP), in the first semester of 2020-21, compared to $41.6 million in the same semester of 2019-20. The majority of expenditures related to personnel, and totaled $35.3 million (86% of gross expenditures). The remaining $5.5 million primarily included professional and special services (mainly informatics services, translation costs and consulting services) and rental costs.

2.1. Significant Changes to Authorities

(Please refer to the Statement of Authorities table presented in Annex A.)

As of September 30, 2020, a decrease of $10.3 million in the net authorities available for use (including EBP), compared to the prior year, is due to the reduced supply of the Main Estimates. Due to the COVID-19 pandemic and limited sessions of Parliament in the spring to study supplies, the Standing Orders of the House of Commons were amended to extend the study period into the fall of 2020. The ATSSC is expected to receive full supply for the 2020-21 Main Estimates in December 2020.

2.2. Significant Changes to Vote Netted Revenue

(Please refer to the Statement of Authorities table presented in Annex A.)

As of September 30, 2020, the VNR authorities decreased from $36.2 million in 2019-20 to $29.1 million in 2020-21 due to the reduced supply of the Main Estimates. As a result of the COVID-19 pandemic and limited sessions for Parliament to study supply, the Standing Orders of the House of Commons were amended to extend the study period into fall. The ATSSC is expected to receive full supply for the 2020-21 Main Estimates in December 2020.

2.3. Significant Changes to Expenditures

(Please refer to the Departmental Budgetary Expenditures by Standard Object table presented in Annex B.)

Expenditures for the Quarter

Second quarter gross budgetary expenditures increased from $21.4 million in 2019-20 to $21.8 million in 2020-21 mainly due to an increase in office rental fees ($0.3 million) caused by a timing difference in the Public Services and Procurement Canada (PSPC) invoicing process, and in personnel expenditures ($0.6 million) related to the increase in salary rates resulting from the signing of collective agreements and a decrease in vacant positions.

This increase is partially offset by a decrease in travel costs ($0.6 million) as a result of the COVID-19 pandemic and its impact on in-person hearings and mediations.

Expenditures Year-to-Date

The year-to-date gross budgetary expenditures decreased from $41.6 million in 2019-20 to $40.9 million in 2020-21 mainly due to:

- $1 million decrease in transportation expenditures due to the impact of COVID-19 on travel; and,

- $0.8 million decrease in professional services due to projects being delayed.

This decrease is partially offset by an increase in personnel expenditures of $1.1 million related to the growth in salary rates resulting from the signing of collective agreements and a decrease in vacant positions.

3. Risks and Uncertainties

The ATSSC is exposed to a variety of risks in its operating environment that could have an impact on the achievement of its objectives. The ATSSC has an efficient risk management process that includes management participation at the organization’s highest levels. This process allows management to identify, evaluate and mitigate key risks to achieving its mandate and organizational priorities, and drives resource allocation accordingly.

Meeting the demanding and dynamic workloads of the tribunals it serves is central to the ATSSC’s operating context. Tribunal legislative and policy mandates are highly sensitive to external demands and, as a result, tribunals can at times face fluctuations in their caseloads, which can create unpredictable workloads. The ATSSC continues to work closely with tribunals to identify factors that could impact caseloads, to allow the ATSSC to plan operations and investments accordingly.

As part of its mandate, the ATSSC supports tribunal efforts in enhancing operations and improving access to justice through the maintenance and modernization of existing IM/IT systems and critical infrastructure. However, there is a risk to operations if critical infrastructure is not consistently assessed, prioritized, and addressed to ensure continuity of business operations and system support. Investments in the modernization of the ATSSC’s aging infrastructure and tribunal Case Management Systems will continue to ensure operational sustainability. The COVID-19 pandemic has affected travel related to in-person hearings and mediations, and case-conferences, which may also result in a larger year-end financial surplus than usual for the ATSSC.

4. Significant Changes Related to Operations, Personnel and Programs

On March 13, 2020, in response to the COVID-19 pandemic, the Government of Canada’s Office of the Chief Human Resources Officer announced the implementation of exceptional measures, which included the requirement for most public servants to work remotely when their functions allowed for it. Since then, almost all the ATSSC workforce and members of the tribunals it supports have been working remotely. The ATSSC is concurrently focusing on supporting staff and member mental health while also beginning work on a long-term strategy.

Approval by Senior Officials

Approved by:

Original signed by

________________________

Orlando Da Silva, LSM

Chief Administrator

Original signed by

________________________

Christopher Bucar, MBA, CPA, CMA, CD

Director General Corporate Services and Chief Financial Officer

Ottawa, Canada

November 19, 2020

Annex A

5. Statement of Authorities (unaudited)

(in dollars)

| Fiscal year 2020-21 | Fiscal year 2019-20 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2021 * |

Used during the quarter ended September 30, 2020 |

Year to date used at quarter end |

Total available for use for the year ending March 31, 2020 * |

Used during the quarter ended September 30, 2019 |

Year to date used at quarter-end |

|

| Vote 1 - Program expenditures** | 78,433,900 | 19,013,421 | 35,413,761 | 92,917,366 | 19,012,145 | 36,795,207 |

| Less: Revenues netted against expenditures | (29,129,843) | (9,709,950) | (9,709,950) | (36,208,947) | (7,218,710) | (7,218,710) |

| Net Program expenditures | 49,304,057 | 9,303,471 | 25,703,811 | 56,708,419 | 11,793,435 | 29,576,497 |

| Budgetary statutory authorities | 8,301,630 | 2,767,210 | 5,534,420 | 11,266,046 | 2,432,343 | 4,864,686 |

| Total Budgetary authorities | 57,605,687 | 12,070,681 | 31,238,231 | 67,974,465 | 14,225,779 | 34,441,184 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

**Employee benefit plan (EBP) is excluded from Program expenditures as it is included in the Budgetary statutory authorities

Annex B

6. Departmental Budgetary Expenditures by Standard Object (unaudited)

(in dollars)

| Fiscal year 2020-21 | Fiscal year 2019-20 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2021 |

Expended during the quarter ended September 30, 2020 |

Year to date used at quarter end |

Planned expenditures for the year ending March 31, 2020 |

Expended during the quarter ended September 30, 2019 |

Year to date used at quarter-end |

|

| Expenditures: | ||||||

| Personnel* | 66,095,382 | 18,047,780 | 35,387,291 | 84,886,092 | 17,459,214 | 34,201,958 |

| Transportation and communications | 3,711,110 | 215,758 | 359,415 | 3,874,684 | 775,068 | 1,352,016 |

| Information | 715,476 | 283,356 | 326,255 | 658,697 | 97,349 | 427,816 |

| Professional and special services | 7,804,123 | 1,615,459 | 2,509,993 | 8,216,056 | 1,973,539 | 3,289,612 |

| Rentals | 3,025,822 | 1,002,379 | 1,423,197 | 2,585,045 | 744,412 | 1,585,612 |

| Repair and maintenance | 1,713,515 | 183,674 | 261,066 | 528,996 | 54,895 | 100,612 |

| Utilities, materials and supplies | 639,449 | 167,045 | 212,826 | 649,097 | 98,851 | 412,884 |

| Acquisition of land, building and works | 545,803 | - | - | - | - | - |

| Acquisition of machinery and equipment | 2,386,390 | 265,270 | 468,227 | 2,130,210 | 246,787 | 297,313 |

| Other subsidies and payments | 98,460 | (90) | (89) | 654,535 | (5,627) | (7,929) |

| Total gross budgetary expenditures | 86,735,530 | 21,780,631 | 40,948,181 | 104,183,412 | 21,444,489 | 41,659,894 |

| Less Revenues netted against expenditures: | ||||||

| Revenues | (29,129,843) | (9,709,950) | (9,709,950) | (36,208,947) | (7,218,710) | (7,218,710) |

| Total Revenues netted against expenditures: | (29,129,843) | (9,709,950) | (9,709,950) | (36,208,947) | (7,218,710) | (7,218,710) |

| Total net budgetary expenditures | 57,605,687 | 12,070,681 | 31,238,231 | 67,974,465 | 14,225,779 | 34,441,184 |

* Employee benefit plan (EBP) is included