Quarterly Financial Report for the quarter ended December 31, 2016

![]() Quarterly Financial Report for the quarter ended December 31, 2016 (PDF)

Quarterly Financial Report for the quarter ended December 31, 2016 (PDF)

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

Introduction

This quarterly financial report has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This report should be read in conjunction with the 2016-17 Main Estimates and Supplementary Estimates (A & B). This quarterly report has not been subject to an external audit or review.

The Administrative Tribunals Support Service of Canada (ATSSC) is responsible for providing support services and facilities to 11 federal administrative tribunals by way of a single, integrated organization.

These services include the specialized services required by each tribunal (e.g. registry, research and analysis, legal and other mandate or case activities specific to each tribunal), as well as internal services (e.g., human resources, financial services, information management and technology, accommodations, security and communications).

Further information on the mandate, roles, responsibilities and programs of the ATSSC can be found by accessing the 2016-17 Main Estimates.

Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities includes the ATSSC's spending authorities granted by Parliament and those used by the ATSSC, consistent with the Main Estimates and the Supplementary Estimates for the 2016-17 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The ATSSC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of Fiscal Quarter and Fiscal Year to Date (YTD) Results

The ATSSC’s financial structure is mainly composed of voted budgetary authorities namely, Vote 1—Program expenditures and vote-netted revenue authority, as well as statutory authorities for contributions to employee benefit plans.

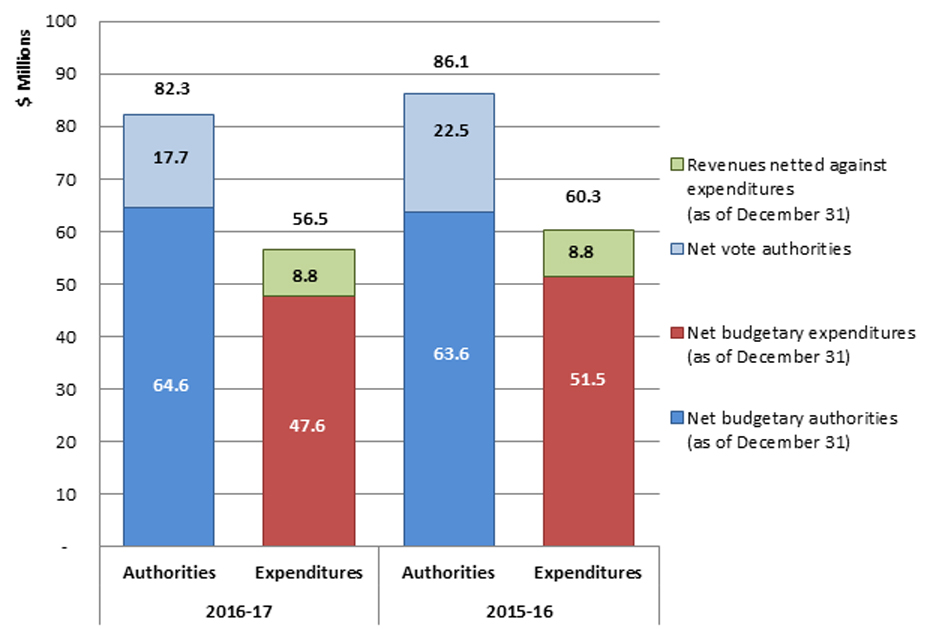

For the period ending December 31, 2016, the ATSSC had total authorities of $82.3 million, including budgetary authorities of $64.6 million and vote-netted revenue (VNR) of $17.7 million. Budgetary authorities include an amount of $58 million from the Main Estimates, $2.9 million from the Supplementary Estimates (A), $0.2 million from the Supplementary Estimates (B) and $3.5 million from Treasury Board Central Votes (Operating Budget Carry Forward). The VNR gives the ATSSC authority to make recoverable expenditures on behalf of the Canada Pension Plan and the Employment Insurance Operating Account. Presented in Graph 1 below are the gross and net budgetary authorities and expenditures for the third quarter of 2016-17. For more details, refer to the Statement of Authorities.

Graph 1: Comparison of budgetary authorities and expenditures for the third quarter

ended December 31, 2016, and December 31, 2015.

The ATSSC expended $56.5 million (69% of total authorities) in the first three quarters of 2016-17. Of this total, $8.8 million was offset by revenues for a total of $47.6 million in net budgetary expenditures. The majority of expenditures relate to personnel which totaled $47.7 million (84% of gross expenditures). The remaining 16% primarily comprises professional and special services (mainly legal services and translation costs), transportation and communications (mainly travel costs), acquisition of machinery & equipment, including parts and consumable tools (mainly acquisition of informatics equipment and parts and acquisition of office equipment and furniture including parts), and rentals (mainly meeting rooms, software licences and network maintenance costs).

Significant Changes to Authorities

(Please refer to the Statement of Authorities table)

As of December 31, 2016, the total budgetary authorities available for use for the year increased from $63.6 million in 2015-16 to $64.6 million in 2016-17. This change is primarily due to an increase of $1M from Treasury Board Central Votes (Operating Budget Carry Forward).

Significant Changes to Revenues Collected

(Please refer to the Statement of Authorities table)

The $8.8 million of revenues collected by the third quarter ending December 31, 2016 equal the revenues collected by the third quarter in 2015-16.

Significant Changes to Expenditures

(Please refer to the Departmental Budgetary Expenditures by Standard Object table)

Year-to-Date Expenditures

The year-to-date gross budgetary expenditures decreased from $60.3 million in 2015-16 to $56.5 million in 2016-17. This decrease of $3.8 million consists of variances associated with the following:

- a decrease of $5.6 million in ‘’Other subsidies and payments’’ expenditures which is related to a decrease in the advance payment issued to Employment and Social Development Canada (ESDC) for the administration of the Social Security Tribunal;

- an increase of $1.2 million in personnel; and

- an increase of $0.6 million relating to various other expenditures.

Expenditures for the Quarter

Third quarter gross budgetary expenditures increased from $18.9 million in 2015-16 to $19.9 million in 2016-17. This increase of $1 million consists of variances associated with the following:

- an increase of $0.8 million in ‘’Other subsidies and payments’’ expenditures which is related to an increase in the advance payment compared to the same quarter last year issued to ESDC for the administration of the Social Security Tribunal; and

- an increase of $0.2 million relating to various other expenditures.

Risks and Uncertainties

The ATSSC has identified three key risks and responses for 2016-17.

As the caseload depends on external factors, it is often challenging for tribunals to predict their operational demands from year to year. There is a risk that caseload surges or other unexpected tribunal-specific operational demands could challenge the ATSSC’s ability to provide the support services the tribunals require to fulfill their mandates. While the caseload is beyond the tribunals’ control, strategies will be developed to address circumstances where tribunals face higher than expected demands. Emerging trends are being monitored to determine the potential impact on caseloads, legislative changes are being monitored to assess the impact on ATSSC resources, and budgets and allocations are monitored closely to appropriately reallocate resources if and where required.

There is also a risk that the ongoing change agenda both within the ATSSC and across government will challenge the organization’s resiliency. Senior management will champion change, foster a culture of leadership at all levels and promote employee well-being. As well, the ATSSC will work closely with its partners, including tribunals, central agencies and departments, to synchronize the changes ahead so that resources are well positioned to implement and support change initiatives.

Lastly, the ATSSC must maintain appropriate delivery capacity to meet the mandates and the evolving needs and priorities of the tribunals it serves. The ATSSC is in the process of developing a corporate policy framework and a multi-year implementation strategy taking into account identified gaps, risks and priorities.

The ATSSC supports 11 tribunals with different mandates, each operating under different statutes, regulations and policies. The risks identified are in keeping with those of a recently formed organization that is tasked with delivering existing support services while also seeking to improve its service delivery model. As the ATSSC continues to evolve and build organizational capacity, it will strive to meet its goal of being recognized as a centre of excellence for service delivery; innovative, efficient and effective operations; and improved access to justice.

Significant Changes in Relation to Operations, Personnel and Programs

There has been no significant change to the programs or structure since the ATSSC was established on November 1, 2014. The Social Security Tribunal continues to be partially supported by ESDC as its transition to the ATSSC is still ongoing.

Approval by Senior Officials

Approved by:

Original signed by

________________________

Marie-France Pelletier, Chief Administrator

Ottawa, Canada

February 24, 2017

________________________

Luc Robitaille, Director General and Chief Financial Officer

Corporate Services

Statement of Authorities (unaudited)

(in dollars)

| Fiscal year 2016-17 | Fiscal year 2015-16 | ||||||

|---|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2017 * |

Used during the quarter ended December 31, 2016 |

Year to date used at quarter-end | Total available for use for the year ending March 31, 2016 * |

Used during the quarter ended December 31, 2015 |

Year to date used at quarter-end | ||

| Vote 1 - Program expenditures | 72,923,445 | 16,852,599 | 48,857,045 | 76,894,679 | 16,765,582 | 53,885,812 | |

| Less: Revenues netted against expenditures | (17,690,600) | (4,422,650) | (8,845,300) | (22,540,600) | (8,845,300) | (8,845,300) | |

| Net Program expenditures | 55,232,845 | 12,429,949 | 40,011,745 | 54,354,079 | 7,920,282 | 45,040,512 | |

| Budgetary statutory authorities | 9,413,110 | 3,048,392 | 7,620,978 | 9,226,993 | 2,149,748 | 6,449,245 | |

| Total Budgetary authorities | 64,645,955 | 15,478,341 | 47,632,723 | 63,581,072 | 10,070,030 | 51,489,757 | |

*Includes only Authorities available for use and granted by Parliament at quarter-end

Departmental Budgetary Expenditures by Standard Object (unaudited)

(in dollars)

| Fiscal year 2016-17 | Fiscal year 2015-16 | ||||||

|---|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2017 |

Expended during the quarter ended December 31, 2016 |

Year to date used at quarter-end | Planned expenditures for the year ending March 31, 2016 |

Expended during the quarter ended December 31, 2015 |

Year to date used at quarter-end | ||

| Expenditures: | |||||||

| Personnel | 64,200,078 | 16,167,300 | 47,702,175 | 63,796,494 | 16,044,342 | 46,520,614 | |

| Transportation and communications | 3,735,799 | 750,584 | 1,880,455 | 5,220,842 | 812,379 | 1,880,381 | |

| Information | 624,823 | 148,658 | 413,228 | 557,271 | 106,639 | 331,512 | |

| Professional and special services | 8,825,183 | 1,030,050 | 3,206,011 | 10,989,840 | 1,410,687 | 3,415,529 | |

| Rentals | 2,094,126 | 267,297 | 824,114 | 2,349,812 | 187,101 | 614,753 | |

| Purchased repair and maintenance | 579,380 | 83,565 | 113,700 | 421,232 | 10,195 | 42,125 | |

| Utilities, materials and supplies | 529,340 | 201,218 | 409,587 | 827,708 | 160,313 | 378,162 | |

| Acquisition of machinery and equipment | 1,747,826 | 605,463 | 824,999 | 1,550,746 | 301,513 | 485,257 | |

| Other subsidies and payments | 646,854 | 1,103,754 | 407,727 | (117,839) | 6,666,724 | ||

| Total gross budgetary expenditures | 82,336,555 | 19,900,989 | 56,478,022 | 86,121,672 | 18,915,330 | 60,335,057 | |

| Less Revenues netted against expenditures: | |||||||

| Revenues | (17,690,600) | (4,422,650) | (8,845,300) | (22,540,600) | (8,845,300) | (8,845,300) | |

| Total Revenues netted against expenditures: | (17,690,600) | (4,422,650) | (8,845,300) | (22,540,600) | (8,845,300) | (8,845,300) | |

| Total net budgetary expenditures | 64,645,955 | 15,478,339 | 47,632,722 | 63,581,072 | 10,070,030 | 51,489,757 | |