Section 3 – Financial Information

Excerpt from 2019-20 Main Estimates

Raison d'être

The Administrative Tribunals Support Service of Canada (ATSSC) is responsible for providing the support services and the facilities that are needed by each of the administrative tribunals it serves to enable them to exercise their powers and perform their duties and functions in accordance with their legislation and rules. Additional information can be found in the ATSSC’s Departmental Plan.

The Minister of Justice and Attorney General of Canada is responsible for this organization.

| Organizational Estimates | ||||

| 2017-18 Expenditures |

2018-19 | 2019-20 Main Estimates |

||

| Main Estimates | Estimates To Date | |||

| (dollars) | ||||

| Budgetary | ||||

Voted |

||||

1 Program expendiatures |

57,442,434 | 55,556,354 | 57,396,778 | 53,434,525 |

5 Resolving Income Security Program Disputes More |

. . . . . | . . . . . | . . . . . | 500,000 |

Total Voted |

57,442,434 | 55,556,354 | 57,396,778 | 53,934,525 |

Total Statutory |

8,072,465 | 9,687,430 | 9,948,157 | 9,729,373 |

| Total Budgetary | 65,514,897 | 65,243,784 | 67,344,935 | 63,663,898 |

Measures Announced in Budget 2019

[Vote 5] Resolving Income Security Program Disputes More Quickly and Easily: to make the recourse process for the Employment Insurance, the Canada Pension Plan and the Old Age Security programs easier to navigate and more responsive to the needs of Canadians.

Note on Planned Spending by Purpose

Detailed allocations of new Budget funding to core responsibilities are not yet available. Budget Implementation is shown in these Main Estimates for information; it is not a core responsibility. To support the Departmental Plan, updated information to reflect new spending measures will be made available soon.

| 2019–20 Main Estimates by Purpose | |||||

|---|---|---|---|---|---|

| Budgetary | Operating | Capital | Transfer Payments |

Revenues and other reductions |

Total |

| (dollars) | |||||

| Support services and facilities to federal administrative tribunals and its members |

67,920,283 | . . . . . | . . . . . | (24,595,561) | 43,324,722 |

| Internal Services | 24,118,449 | . . . . . | . . . . . | (4,279,273) | 19,839,176 |

| Budget Implementation (for information) |

500,000 | . . . . . | . . . . . | . . . . . | 500,000 |

| Total | 92,538,732 | . . . . . | . . . . . | (28,874,834) | 63,663,898 |

| Listing of Statutory Authorities | |||

| 2017–18 Expenditures |

2018–19 Estimates To Date |

2019–20 Main Estimates |

|

| (dollars) | |||

| Budgetary | |||

Contributions to employee benefit plans |

8,072,465 | 9,948,157 | 9,729,373 |

Items for inclusion in the Proposed Schedule 1 to the Appropriation Bill

(for the financial year ending March 31, 2020)

Unless specifically identified under the Changes in 2019–20 Main Estimates section, all vote wordings have been provided in earlier appropriation acts.

| Vote No. |

Items | Amount ($) | Total ($) |

| ADMINISTRATIVE TRIBUNALS SUPPORT SERVICE OF CANADA | |||

| 1 | – Program expenditures | 53,434,525 | |

| – Authority to make recoverable expenditures in relation to the application of the Canada Pension Plan and the Employment Insurance Act | |||

| 5 | – Authority granted to the Treasury Board to supplement any appropriation of the organization for the initiative “Resolving Income Security Program Disputes More Quickly and Easily”, announced in the Budget of March 19, 2019, including to allow for the provision of new grants or for any increase to the amount of a grant that is listed in any of the Estimates for the fiscal year, as long as the expenditures made possible are not otherwise provided for | 500,000 | |

| 53,934,525 | |||

| 53,934,525 |

2019-20 ESTIMATES

Statutory Forecasts |

|||

| 2017–18 Expenditures |

2018–19 Estimates To Date |

2019–20 Main Estimates |

|

| (dollars) | |||

| Budgetary | |||

| Administrative Tribunals Support Service of Canada | |||

Contributions to employee benefit plans |

8,072,465 | 9,948,157 | 9,729,373 |

| Total Budgetary | 8,072,465 | 9,948,157 | 9,729,373 |

| Budgetary Expenditures by Standard Object | |||

|---|---|---|---|

| This table shows the forecast of total expenditures by Standard Object, which includes the types of goods or services to be acquired, or the transfer payments to be made and the revenues to be credited to the vote. Definitions of standard objects available at:https://www.tpsgc-pwgsc.gc.ca/recgen/pceaf-gwcoa/1920/7-eng.html |

|||

| Budgetary Expenditures by Standard Object | |||

| No. | Administrative Tribunals Support Service of Canada | Total | |

| Personnel | 1 | 73,320,048 | 73,320,048 |

| Transportation and communications | 2 | 3,858,895 | 3,858,895 |

| Information | 3 | 656,013 | 656,013 |

| Professional and special services | 4 | 8,182,576 | 8,182,576 |

| Rentals | 5 | 2,574,511 | 2,574,511 |

| Purchased repair and maintenance | 6 | 526,840 | 526,840 |

| Utilities, materials and supplies | 7 | 646,452 | 646,452 |

| Acquisition of land, buildings and works | 8 | . . . . . | . . . . . |

| Acquisition of machinery and equipment | 9 | 2,121,529 | 2,121,529 |

| Transfer payments | 10 | . . . . . | . . . . . |

| Public debt charges | 11 | . . . . . | . . . . . |

| Other subsidies and payments | 12 | 651,868 | 651,868 |

| Less: Revenues and other reductions | 28,874,834 | 28,874,834 | |

| Total | 63,663,898 | 63,663,898 | |

Expenditures by Purpose |

||||||

| Budgetary | 2018-19 Main Estimates | 2019–20 Main Estimates | ||||

| Operating | Capital | Transfer Payments |

Revenues and other reductions |

Total | ||

| (dollars) | ||||||

| Administrative Tribunals Support Service of Canada | ||||||

| Support services and facilities to federal administrative tribunals and its members | 44,987,481 | 67,920,283 | . . . . . | . . . . . | (24,595,561) | 43,324,722 |

| Internal Services | 20,256,303 | 24,118,449 | . . . . . | . . . . . | (4,279,273) | 19,839,176 |

| Budget Implementation (for information) | . . . . . | 500,000 | . . . . . | . . . . . | . . . . . | 500,000 |

| Total | 65,243,784 | 92,538,732 | . . . . . | . . . . . | (28,874,834) | 63,663,898 |

2019-20 Main Estimates Overview

| 2019-20 MAIN ESTIMATES FINANCIAL OVERVIEW |

| CONTEXT: The ATSSC’s total authorities in the Main Estimates for 2019-20 are $92.1M including $53.5M in voted appropriations, $9.8M for the Employee Benefits Plan (EBP) and $28.8M in Vote-Netted Revenue (VNR) authority. |

ATSSC VNR Authority

|

ATSSC Budget Management Framework

Administrative Tribunals Support Service of Canada Policy on Budget Management

Effective Date

This policy takes effect on July 1, 2016.

Application

This policy applies to all positions and levels of management with budget and financial risk management responsibilities and related delegated financial signing authorities for the Administrative Tribunals Support Service of Canada (ATSSC).

Context

This policy supports the following legislation and Treasury Board (TB) policy instruments:

The Administrative Tribunals Support Service of Canada Act;

The Financial Administration Act (FAA);

The Federal Accountability Act (FedAA); and

The TB Financial Management Policy Framework.

The Chief Administrator has the rank and status of a Deputy Head of a department as defined by the FAA, the FedAA, and Treasury Board policies.

The Chief Administrator is responsible for the provision of the support services and the facilities that are needed by each of the administrative tribunals to exercise its powers and perform its duties and functions in accordance with the rules that apply to its work. In carrying out his or her functions, the Chief Administrator will promote a collaborative approach with the tribunals in the allocation of resources.

The Chief Administrator’s powers, duties and functions do not extend to any of the powers, duties and functions conferred by law on any administrative tribunal or on any of its members.

The Chief Administrator may delegate to any employee of the Service any of the powers, duties, and functions conferred on the Chief Administrator under the ATSSC Act or any other Act of Parliament.

For greater certainty, the Chairperson of an administrative tribunal continues to have supervision over and direction of the work of the tribunal.

Definitions

Definitions of key terms to be used in the interpretation of this policy are provided in the Appendix.

Statement

Delegations of financial authority are approved by the Minister to positions within the department. All levels of management are accountable for the sound management of resources, and each has a role and a responsibility in ensuring effective and transparent financial management planning, budgeting, spending, monitoring and reporting. The ATSSC has two sources of financial authorities: appropriations authority and vote-netted revenue (VNR) authority. Resources granted to the department must be managed using a robust budget management regime that is effective, efficient and transparent. Budget decisions will be based upon thoroughly documented analysis, forecasts, and accurate, timely information integrated with related non-financial performance information used to achieve results.

Objective

The objective of this policy is to clearly define the roles, responsibilities and accountabilities that managers at all levels must exercise, and be accountable for, in the stewardship and oversight of resources.

Through adherence to this policy, the department endeavours to achieve robust and standardized budget practices and controls across the department.

Principles

The following principles are fundamental to the sound management of resources at the ATSSC:

Sound and pragmatic planning serves as the foundation, and is a prerequisite for robust budget management;

Accountability and responsibility for assigned budgets rests with Fund Centre Managers. This includes effective stewardship and control over budgets and commitments and monitoring of surpluses/deficits, forecasts and funding pressures on an ongoing basis;

Budgets are managed efficiently and effectively in compliance with legislation, TB and departmental policies, authorities, and TB decisions and conditions, and departmental appropriations are not exceeded;

Objective and prudent judgment is exercised through effective budget management and controls that reflect the department’s mandate, activities, values and ethics, and risk tolerance;

Responsibilities set out in the budget management framework are understood and fulfilled by those who are responsible;

Sound budget management practices include ongoing periodic reviews of budgets, forecasts and funding pressures that support objectives and respect TB and departmental policies, directives, standards and guidelines;

The engagement of stakeholders is encouraged for issues relating to the management of resources;

Effective monitoring of resources, the establishment of financial risk mitigation strategies, and policy and legislation compliance and effective processes are the cornerstone of sound budget management and control across the department as articulated in detailed directions, where:

initial budget allocations are distributed to all Fund Centres in the departmental financial system prior to the beginning of the fiscal year, or in extraordinary circumstances at a time specified by the Chief Financial Officer;

periodic forecasts and management variance reporting processes are standardized for use by Fund Centre Managers and expected resource utilization forecasts reflect a realistic outlook of the activities to be carried out;

reallocations are thoroughly documented, approved by the appropriate authority, and accurately reflected in the accounts of the department in a timely manner to ensure budget reallocation decisions are sound and consistent with legislation, TB and departmental policies, directives, standards and guidelines;

reallocation, funding pressures and project requirements are identified promptly, are accurately documented, and are part of an approved management action plan;

activities and related funding requirements are aligned with the TB and departmental budgetary cycles, and modifications of allotments are consistent with TB decisions and/or approvals; and

budget management advice, guidance, training and capabilities, and capacity development are maintained and provided by the Chief Financial Officer to all Fund Centre Managers as described in the departmental Budget Management Framework.

Operations are regularly assessed for opportunities to reallocate funds from lower to higher priorities while ensuring that overall funding limits, policy parameters and TB conditions are respected;

Submissions to TB for Supplementary Estimates and/or related modifications of allotments, are accurately documented and are accurately reflected in the departmental financial system and financial reporting; and

Access to timely budgetary advice, information, and training is critical to ensuring decisions are informed and are high quality.

Roles and Responsibilities

The Chief Administrator, as the ATSSC Accounting Officer, is responsible for:

Establishing a budget the management framework that addresses the department’s financial planning, budgeting, spending, forecasting and reporting needs and that ensures the effective stewardship of resources;

Ensuring resources are sufficient to cover the cost of providing support services and facilities that are needed by each of the administrative tribunals to exercise its powers and perform its duties and functions in accordance with the rules that apply to its work;

Ensuring that resources are allocated according to a shared plan that is anchored in departmental priorities;

Approving the budget and the resource management strategy;

Establishing governance and oversight for effective budget management;

Establishing expectations for effective financial resource management processes, controls, reporting, and financial risk management;

Obtaining advice and confirmation from the Chief Financial Officer that:

financial authorities approved by TB and granted by Parliament are not exceeded;

budgets are regularly reconciled to the approved financial authorities and are monitored;

resources for new or amended financial authorities are used for the purposes intended, allocated or reallocated in an accurate and timely manner, and are thoroughly documented and reported on;

spending is in compliance with financial authorities granted under the Appropriations Act and the FAA; and

operational budgets are aligned with the ATSSC’s strategic direction.

Approving the reallocation of funds from the departmental reserve, and between Senior Departmental Managers’ budgets;

Approving the reallocation of funds between Program Alignment Architecture elements;

Signing and approving financial reports/and documents:

quarterly financial reports;

letter of representation to be submitted with the Public Accounts documents;

complete set of annual financial statements; and

other financial reports and documents.

- Ensuring appropriate and timely action is taken to address any significant issue or instance of non-compliance of any matter related to this policy.

The Chief Financial Officer is responsible for:

Supporting the Chief Administrator in budget management and stewardship across the department, with specific responsibilities for the ATSSC-wide budget management and financial risk mitigation strategies;

Developing and implementing the department’s budget management framework, including all financial resource management internal controls;

Establishing a budget allocation process, including initial budgets and reserve allocation, providing periodic financial reports, overseeing all budget reallocations and managing the departmental reserve;

Certifying to the Chief Administrator that budget and financial management information and reports are reliable and timely;

Providing a signed attestation on the financial aspects of Cabinet documents;

Providing a challenge function on financial management matters;

Providing advice and assurance to the Chief Administrator that:

budgets, reallocations, and amounts included in any funding initiatives or official communications are reliable and reasonable;

approved initial budget allocations have been distributed to Fund Centre Managers on a timely basis in the departmental financial system before the beginning of the fiscal year;

significant financial risks and associated risk mitigation strategies are reasonable;

budget transfers are thoroughly documented, timely and consistently applied in accordance with TB and departmental policies, directives, standards and guidelines, and ATSSC’s delegated financial authorities; and

delegated financial authorities are recorded and exercised as per TB and departmental policies, directives, standards and guidelines.

Advising the Chief Administrator on the financial risks, risk mitigation strategies, and implications associated with existing funding or anticipated new funding initiatives (e.g., business cases, Cabinet documents, reallocations);

Ensuring financial information and all corresponding decisions related to budgets are accurately recorded in the departmental financial system and financial reports; and

Providing functional leadership and ongoing training and support to all personnel who have a role in financial management.

Senior Departmental Managers are responsible for:

Complying with and utilizing the departmental budget management framework;

Managing approved budgets, resources and related budget information within his or her area of responsibility, ensuring they are managed in accordance with Parliamentary budget authorities, legislation, TB and departmental policies and directives, and delegated financial authorities;

Ensuring, and providing assurance to the Chief Administrator and Chief Financial Officer, that the budget management regime and financial information within his or her area of responsibility are effective and accurate, and utilize standard departmental budget management processes and controls as outlined in detailed directions;

Supporting the Chief Administrator in establishing the strategic direction, setting annual priorities, and developing risk mitigation strategies;

For Senior Departmental Managers who lead the direct support of a Tribunal, obtained from the Chairpersons, relevant information related to the work of administrative tribunals, including expected volume of activities and any changes in support service requirements;

Advising the Chief Financial Officer or the Chief Administrator or his or her delegate as appropriate, of any budget issue or material deficiency that may affect operations within his or her area of responsibility;

Ensuring resources are used for their intended purposes;

Managing budgets within his or her area of responsibility, including approving budget reallocations within their envelopes and ensuring budgetary decisions are based on complete and accurate information;

Ensuring proposed or approved plans contain budget forecasts and are properly resourced to achieve results;

Monitoring budgets, forecasts, expenditures, and other financial information within his or her area of responsibility on a continuous basis;

Ensuring initial budget allocations, funding requests, and any subsequent budget transfers within his or her area of responsibility are based on sound analysis;

Identifying budget surpluses or deficits and new funding requirements within his or her area of responsibility;

Seeking the advice of the Chief Financial Officer or delegate on funding requirements for new initiatives, significant budget transfers and resource reallocations; and

Leading the preparation and approving the content of any business cases or Cabinet document affecting his or her area of responsibility and submitting them to the Chief Financial Officer for review, analysis and formal attestation of the financial aspects.

Fund Centre Managers are responsible for:

Complying with and utilizing the departmental budget management framework and using sound budget management practices within his or her area of responsibility;

Reporting budget and financial management issues in a timely manner to his or her Senior Departmental Manager, Financial Management Advisor or the Chief Financial Officer as appropriate;

Utilizing authorized resources for the purpose intended;

Monitoring financial and budget information for accuracy, appropriate coding, comparing actual expenditures against plans and forecasts , and taking timely action to correct any deficiencies;

For Fund Centre Managers who provide direct support to a Tribunal, advising his or her Senior Departmental Manager, as appropriate, of any budget issues or material deficiency that may affect his or her work in supporting the tribunal;

Informing his or her Financial Management Advisor of any transactional discrepancies or concerns;

Reviewing commitments and contracts on an ongoing basis to confirm their continued validity and accuracy;

Preparing and approving forecasts for his or her area of responsibility;

Analyzing and explaining spending variances or discrepancies from plans;

Identifying budget surpluses or deficits and new funding requirements within his or her area of responsibility;

Making optimal use of the resources available to the department to achieve plans and objectives;

Providing financial information or assessments to his or her Senior Departmental Manager, Financial Management Advisor, and the Chief Financial Officer as required for external or internal disclosure or reporting requirements; and

Ensuring the use of public funds is compliant with relevant legislation, TB and departmental policies, directives and granted authorities.

Financial Management Advisors are responsible for:

Providing assurance and advice on financial matters to Fund Centre Managers, Senior Departmental Managers, Fund Centre Administrators and the Deputy Chief Financial Officer;

Providing advice and support to management in their responsibility in ensuring Parliamentary budget authorities and internal budget allocations have not been exceeded and that budgetary usage is compliant with financial authorities granted under the Appropriations Act and the FAA;

Providing advice, recommendations and support to management in his or her responsibility to ensure financial decisions are managed in accordance with TB and departmental policies and directives, delegated financial authorities, legislation and departmental policy instruments;

Advising and supporting Senior Departmental Managers and Fund Centre Managers in exercising his or her delegated budget and financial management responsibilities;

Representing the Chief Financial Officer in providing support and advice to Senior Departmental Managers and Fund Centre Managers on the budget management framework;

Providing recommendations and a challenge function to Senior Departmental Managers and Fund Centre Managers on the quality and accuracy of budget, forecast, and resource allocation information;

Informing Fund Centre Managers or his or her direct Senior Departmental Manager, as appropriate, of any material funding pressures or discrepancies in a timely manner;

Supporting the development of a strong budgetary and financial management culture by assisting Senior Departmental Managers, Fund Centre Managers and Fund Centre Administrators in the effective use of the budget management tools and systems;

Reviewing, providing a challenge function and providing recommendations on business cases and Cabinet documents; and

Supporting the Chief Financial Officer, Senior Departmental Managers and Fund Centre Managers in the development of financial plans, business cases and budget allocation strategies.

Fund Centre Administrators are responsible for:

Understanding and exercising his or her financial and budgetary administrative support responsibilities;

Providing financial administrative support to his or her manager(s) to accurately record and reflect financial transactions in the departmental financial system in a timely manner;

Ensuring inputs are accurately documented, approved, and compliant with the approved departmental financial coding structure and related Program Alignment Architecture;

Providing financial administrative support to his or her Senior Departmental Manager or Fund Centre Manager(s) in the ongoing processing of approved commitments and contractual obligations in a timely manner;

Accurately inputting, verifying and adjusting commitment information in a timely manner in the departmental financial system;

Actively seeking financial administrative support training, on an ongoing basis, to meet departmental standards for budgetary reporting and analysis, and supporting his or her Senior Departmental Manager or his or her Fund Centre Manager(s) in exercising their budget management roles and responsibilities.

Monitoring and Reporting

Monitoring of this policy will be based on the principles of budget and financial risk management and is intended to promote transparency and accountability in the sound management of resources across the department.

A review of this policy will be performed periodically by the Chief Financial Officer to ensure the policy is current and continues to meet the department’s requirements, and that it complies with all legislation and TB and departmental policies and directives.

The implementation of the Budget Management Framework, including this policy, will be monitored by the Chief Financial Officer and will be reported on to the Chief Administrator and governance sub-committees.

Consequences

- Financial management will be monitored through audits, the regular review of transactions, and analysis of financial information. If it becomes apparent that there is a case of noncompliance with the Budget Management Framework, including this policy, the Chief Financial Officer in collaboration with the respective Senior Departmental Manager or the Chief Administrator as appropriate, will apply consequences using TB-recommended processes that are applicable for non-compliance with TB and departmental policies and as set out in the FAA and other policy instruments.

Enquiries

- For additional information or guidance regarding this policy, please direct your enquiries to your Financial Management Advisor.

References

Relevant Legislation

Treasury Board Publications

Related ATSSC Publications

Appendix – Definitions

Approve means to formally consent or agree, normally documented in writing.

Advise means to offer professional counsel or to recommend a course of action.

Administrative Tribunal means a body referred to in the schedule of the Administrative Tribunals Support Service of Canada Act.

Budget means the total amount of funding allocated to a particular area of responsibility.

Budget surplus is the amount determined to be available for use, or will be unspent, after factoring in forecasts, commitments, contracts, and expenditures.

Chairperson means the person appointed to supervise and direct the work of an administrative tribunal.

Challenge Function is the activity of questioning an assumption, proposal, forecast, or result based on analysis, expertise, and experience. A positive result of the challenge function is a more thorough and evidenced-based product that informs management in decision making.

Chief Administrator has the rank and status of a deputy head of a department as defined in Treasury Board policies.

Financial Management Advisor (FMA) means the person assigned to specific Senior Departmental Manager(s) or Fund Centre Manager(s) with the responsibility of providing professional financial management advice. FMAs report to the Chief Financial Officer organization, through the Finance and Planning Directorate. FMAs are concerned with all financial information and plans of the organization, in order to provide their best professional advice.

Financial risk management is the process to identify, assess, manage, and control potential events or situations that may impede the department’s ability to achieve their desired financial objectives.

Forecast is the total amount that is expected to be disbursed within an established budget, after assessment of financial risks and obligations. The forecast may vary from one reporting period to the next, and does not necessarily represent a funding pressure, or a budget surplus.

Fund Centre Administrator (FCA) is the person responsible for providing financial administrative support to Senior Departmental Managers or Fund Centre Managers. FCAs are involved in a wide range of financial functions, including purchasing, monitoring budgets and commitments, and verifying invoices for payment. This function is commonly delegated to the Administrative Assistant or Executive Assistant positions of an organization.

Fund Centre Managers are defined as individuals with budget and financial risk management responsibilities as per their delegated financial signing authorities.

Funding Pressure is an amount identified by the Fund Centre Manager as a requirement for additional funds exceeding his or her budget.

Initial Budget is the budget approved by the Chief Administrator at the beginning of the fiscal year, and is based on the Notional Budget, increased or reduced for permanent or temporary adjustments approved for the fiscal year in question, which had not been included in the Notional Budget.

Notional Budget is the budget that is allocated before the presentation and approval of budget plans. These allocations are the starting point for an approved initial budget. They can be based on analysis of previous years’ expenditures, approved adjustments, and other factors that may influence the level of resources to be allocated.

Reference Levels means the approved upper funding limits to be used by the department.

Recommend means to present a course of action that is favourable to the stated objectives and that takes into consideration legislation, policy, and authorities.

Resource(s) includes human, material, financial and information resources.

Senior Departmental Manager means a position that is allocated resources and the incumbent is a member of the Senior Management Committee or other delegates who have been identified by the CA.

Vote-Netted Revenue Authority is an authority to make recoverable expenditures from another source of funds than the ATSSC’s appropriations. In the case of the SST, the VNR Authority is to make recoveries against the Canada Pension Plan Account and the Employment Insurance Operating Account.

2019-20 ATSSC Budget Allocation

2019-20 Initial Budget Allocation by Secretariats and Internal Services Directorates

| Salary | Non-salary | Total3 | |

| Secretariats | |||

| Canada Agricultural Review Tribunal | 656,693 | 280,549 | 937,242 |

| Canada Industrial Relations Board1 | 7,785,042 | 3,502,577 | 11,287,619 |

| Canadian Cultural Property Export Review Board | 1,502,647 | 404,960 | 1,907,607 |

| Canadian Human Rights Tribunal | 3,683,011 | 456,600 | 3,683,011 |

| Canadian International Trade Tribunal | 5,968,130 | 611,445 | 6,579,575 |

| Competition Tribunal2 | 583,509 | 415,754 | 999,263 |

| Federal Public Sector Labour Relations and Employment Board | 7,432,011 | 2,636,500 | 10,068,511 |

| Public Servants Disclosure Protection Tribunal2 | 226,500 | ||

| Social Security Tribunal | 21,959,300 | 5,135,362 | 27,094,662 |

| Specific Claims Tribunal2 | 1,111,187 | 682,955 | 1,794,142 |

| Transportation Appeal Tribunal of Canada | 1,375,143 | 274,181 | 1,649,324 |

| National Joint Council | 680,188 | 149,249 | 829,437 |

| Sub-total - Secretariats | 67,056,892 | ||

| Internal Services | |||

| Chief Administrator | 798,830 | ||

| Deputy Chief Administrator | 530,519 | ||

| Planning and Communications | 1,117,410 | 173,234 | 1,290,644 |

| Information Services and Solutions Team | 3,836,103 | 3,923,210 | 7,759,313 |

| Strategic Initiatives | 380,779 | 170,815 | 551,594 |

| DG, Corporate Services | 325,675 | 94,800 | 420,475 |

| Accommodations and Security | 1,053,090 | 799,858 | 1,852,949 |

| Finance Directorate | 3,481,431 | 680,643 | 4,162,073 |

| Human Resources | 2,280,220 | 415,168 | 2,695,388 |

| Sub-total - Internal Services | 20,061,785 | ||

| Total | 65,953,717 | 21,164,961 | 87,118,678 |

1 Includes special one-time funding

2 Members’ remunerated by the Office of the Commissioner for Federal Judicial Affairs

3 Total includes A-base appropriations + VNR

Quarterly Financial Report

ADMINISTRATIVE TRIBUNALS SUPPORT SERVICE OF CANADA

Quarterly Financial Report

For the quarter ended June 30, 2019

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

1. Introduction

This quarterly financial report has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This report should be read in conjunction with the 2019-20 Main Estimates. This quarterly report has not been subject to an external audit or review.

The Administrative Tribunals Support Service of Canada (ATSSC) is responsible for providing support services and facilities to 11 federal administrative tribunals by way of a single, integrated organization.

These services include the specialized services required by each tribunal (e.g. registry, research and analysis, legal and other mandate or case activities specific to each tribunal), as well as internal services (e.g., human resources, financial services, information management and technology, accommodations, security, planning and communications).

Further information on the mandate, roles, responsibilities and programs of the ATSSC can be found by accessing the 2019-20 Departmental Plan.

1.1. Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities (Annex A) includes the ATSSC's spending authorities granted by Parliament and those used by the ATSSC, consistent with the Main Estimates for the 2019-20 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The ATSSC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis. The main difference between the quarterly financial report and the departmental financial statements is the timing of when revenues and expenses are recognized.

2. Highlights of Fiscal Quarter and Fiscal Year to Date (YTD) Results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year and actual expenditures for the quarter ended June 30, 2019.

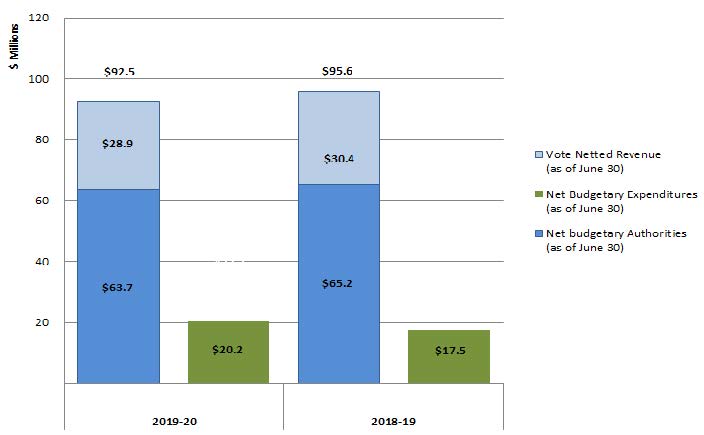

The ATSSC’s financial structure is mainly composed of voted budgetary authorities namely, Vote 1—Program expenditures and Vote Netted Revenue (VNR) authority, as well as statutory authorities for contributions to employee benefit plans. The VNR gives the ATSSC authority to make recoverable expenditures on behalf of the Canada Pension Plan (CPP) and the Employment Insurance (EI) operating accounts. Presented in Graph 1 below are the gross and net budgetary authorities and expenditures for the first quarter of 2019-20. For more details, refer to the Statement of Authorities table presented in Annex A.

Graph 1: Comparison of budgetary authorities and expenditures for the first quarter ended June 30, 2019, and June 30, 2018.

The ATSSC expended $20.2 million (22% of total authorities available for use) in the first quarter of 2019-20, compared to 17.5 million in the same quarter of 2018-19. The majority of expenditures relate to personnel, which totaled $16.7 million (83% of gross expenditures). The remaining $3.5 million primarily comprises professional and special services (mainly informatics services, translation costs and consulting services) and rental costs.

2.1. Significant Changes to Authorities

(Please refer to the Statement of Authorities table presented in Annex A.)

As of June 30, 2019, the total budgetary authorities available for use for the year decreased from $65.2 million in 2018-19 to $63.7 million in 2019-20 mainly due to the following:

$1 million decrease of temporary space optimization project funding; and

$0.5 million decrease of temporary funding for the Information Technology Infrastructure Consolidation (On-boarding) Project.

2.2. Significant Changes to Vote Netted Revenue

(Please refer to the Statement of Authorities table presented in Annex A.)

As of June 30, 2019, the Vote Netted Revenue authority decreased from $30.4 million in 2018-19 to $28.9 million in 2019-20 for the charging of administrative costs to the CPP and EI operating accounts to support the discharge of the mandates of the Social Security Tribunal (SST) and the ATSSC as it relates to the SST.

Temporary authorities were provided in 2017-18 ($1.0 million) and 2018-19 ($3.9 million) for space modernization.

2.3. Significant Changes to Expenditures

(Please refer to the Departmental Budgetary Expenditures by Standard Object table presented in Annex B.)

Expenditures for the Quarter

First quarter gross budgetary expenditures increased from $17.5 million in 2018-19 to $20.2 million in 2019-20 mainly due to:

$1.6 million increase in personnel spending related to an increase in salary rates resulting from the signing of collective agreements and revised remuneration agreements, an increase in number of staff, and an increase in employee benefit plan (EBP) costs due to a delay in the processing of EBP transactions for the first quarter of 2018-19;

$0.5 million increase in professional services spending related to the management of a larger number of projects; and

$0.5 million increase in rental costs due to a timing difference in the Public Services and Procurement Canada invoicing process.

3. Risks and Uncertainties

There is a risk that the ATSSC may not be able to maintain appropriate delivery capacity to meet the mandates of tribunals and the evolving needs of all program and internal service areas. As an organization tasked with delivering existing support services while seeking to improve its service delivery model, the ATSSC must ensure that it maintains appropriate delivery capacity. In particular, the ATSSC must effectively plan its operations and investments to make efficient and effective use of its limited financial and human resources.

To mitigate this risk, emerging trends, priorities, needs and legislative changes are being monitored to identify potential impacts on caseloads and on the ATSSC resources and funding. The ATSSC has built into the budget planning and allocation processes the flexibility to re-allocate resources if and when required. The ATSSC is also developing a long-term investment plan that links proposed investments to organizational and tribunal priorities.

4. Significant Changes in Relation to Operations, Personnel and Programs

Nick Covelli has been appointed as the new Deputy Chief Administrator effective April 15, 2019.

Approval by Senior Officials

Approved by:

| ____________________ | ____________________ |

Nick Covelli |

Christopher Bucar, MBA, CPA, CMA, CD |

A/Chief Administrator |

Director General Corporate Services and Chief Financial Officer |

Ottawa, Canada

August 27th 2019

ANNEX A

| Statement of Authorities (unaudited) | ||||||

| (in dollars) | ||||||

| Fiscal year 2019-20 | Fiscal year 2018-19 | |||||

| Total available for use for the year ending March 31st 2020* |

Used during the quarter ended June 30th 2019 |

Year to date used at quarter end |

Total available for use for the year ending March 31st 2020* |

Used during the quarter ended June 30th 2018 |

Year to date used at quarter end |

|

| Vote 1 - Program expenditures | 82,809,359 | 17,783,062 | 17,783,062 | 85,936,733 | 15,846,069 | 15,846,069 |

| Less: Revenues netted against expenditures | (28,874,834) | - | - | (30,380,379) | - | - |

| Net Program expeditures | 53,934,525 | 17,783,062 | 17,783,062 | 55,556,354 | 15,846,069 | 15,846,069 |

| Budgetary statutory authorities | 9,729,373 | 2,432,343 | 2,432,343 | 9,687,430 | 1,614,572 | 1,614,572 |

| Total Budgetary authorities | 63,663,898 | 20,215,405 | 20,215,405 | 65,243,784 | 17,460,641 | 17,460,641 |

* Includes only Authorithies available for use and granted by Parliament at quarter-end

ANNEX B

| Departmental Budgetary Expenditures by Standard Object (unaudited) | ||||||

| (in dollars) | ||||||

| Fiscal year 2019-20 | Fiscal year 2018-19 | |||||

| Planned expenditures for the year ending March 31st 2020 |

Expended during the quarter ended June 30th 2019 |

Year to date use of at quarter end | Planned expenditures for the year ending March 31st 2019 |

Expended during the quarter ended June 30th 2018 |

Year to date use of at quarter end | |

| Expenditures | ||||||

Personnel |

73,320,048 | 16,742,744 | 16,742,744 | 73,420,523 | 15,112,868 | 15,112,868 |

Professional and special services |

8,182,576 | 1,316,073 | 1,316,073 | 9,120,880 | 836,856 | 836,856 |

Transportation and communications |

3,858,895 | 576,948 | 576,948 | 3,932,933 | 554,744 | 554,744 |

Rentals |

2,574,511 | 841,201 | 841,201 | 3,745,301 | 368,539 | 368,539 |

Acquisition of machinery and equipment |

2,212,529 | 50,525 | 50,525 | 3,261,460 | 78,894 | 78,894 |

Utilities, materials and supplies |

646,452 | 314,033 | 314,033 | 754,318 | 242,218 | 242,218 |

Information |

656,013 | 330,467 | 330,467 | 719,064 | 212,573 | 212,573 |

Repair and maintenance |

526,840 | 45,717 | 45,717 | 377,240 | 53,847 | 53,847 |

Other subsidies and payments |

651,868 | (2,303) | -2,303 | 292,444 | 102 | 102 |

Total gross budgetary expenditures |

92,538,732 | 20,215,405 | 20,215,405 | 95,624,163 | 17,460,641 | 17,460,641 |

| Less Revenues netted against expenditures | ||||||

Revenues |

(28,874,834) | - | - | (30,380,379) | - | - |

Total Revenues netted against expenditures |

(28,874,834) | - | - | (30,380,379) | - | - |

| Total net budgetary expenditures | 63,663,898 | 20,215,405 | 20,215,405 | 65,243,784 | 17,460,641 | 17,460,641 |

2018-19 Public Accounts

Statement of Management Responsibility Including Internal Control Over Financial Reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2019, and all information contained in these statements rests with the management of the Administrative Tribunals Support Service of Canada (ATSSC). These financial statements have been prepared by management using the Government of Canada's accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provide a centralized record of the ATSSC’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in the ATSSC’s Departmental Results Framework, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout the ATSSC, and through conducting an annual risk-based assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level based on an ongoing process to identify key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments.

The ATSSC is subject to periodic Core Control Audits performed by the Office of the Comptroller General of Canada (OCG) and uses the results of such audits to comply with the Treasury Board Policy on Financial Management.

The first Core Control Audit of the ATSSC was conducted by the OCG in two phases in 2017-18 and 2018-19. The Audit Report and related Management Action Plan were tabled at and approved by the Small Departments Audit Committee (SDAC). The Audit Report is posted on the ATSSC’s web site.

The financial statements of the ATSSC have not been audited.

_________________________

Marie-France Pelletier

Chief Administrator

_________________________

Christopher Bucar, CPA, CMA

Chief Financial Officer

Ottawa, Canada

September 6, 2019

| Statement of Financial Position (Unaudited) as of March 31 | ||

|---|---|---|

| (in dollars) | 2019 | 2018 |

Liabilities |

||

Accounts payable and accrued liabilities (note 4) |

14,094,806 | 10,365,620 |

Vacation pay and compensatory leave |

3,228,548 | 3,293,781 |

Employee future benefits (note 5) |

2,849,992 | 3,098,591 |

Total liabilities |

20,173,346 | 16,757,992 |

Financial assets |

||

Due from Consolidated Revenue Fund |

4,669,505 | 4,354,792 |

Accounts receivable and advances (note 6) |

14,875,771 | 10,500,309 |

Total financial assets |

19,545,276 | 14,855,101 |

Departmental net debt |

628,070 | 1,902,891 |

Non-financial assets |

||

Prepaid expenses |

869,176 | 91,040 |

Tangible capital assets (note 7) |

10,215,297 | 5,514,565 |

Total non-financial assets |

11,084,473 | 5,605,605 |

Departmental net financial position |

10,456,403 | 3,702,715 |

| Contractual obligations (note 8) | ||

The accompanying notes form an integral part of the financial statements.

_________________________

Marie-France Pelletier

Chief Administrator

_________________________

Christopher Bucar, CPA, CMA

Chief Financial Officer

Ottawa, Canada

September 6, 2019

Statement of Operations and Departmental Net Financial Position (Unaudited) |

|||

|---|---|---|---|

| (in dollars) | Planned Resuls 2018-19 | For the Year Ended March 31st, 2019 |

For the Year Ended (Restated Note 11) March 31st, 2018 |

| Expenses | |||

Registry services |

19,997,154 | 16,206,638 | 18,132,590 |

Legal services |

7,874,117 | 9,934,408 | 6,987,583 |

Mandate and members services |

59,422,857 | 52,894,514 | 52,740,790 |

Internal services |

23,225,417 | 25,597,826 | 25,377,562 |

| Total expenses | 110,519,545 | 104,633,386 | 103,238,525 |

| Revenues | |||

Recovery of CPP & EI related costs |

34,416,805 | 31,095,435 | 28,293,715 |

Miscellaneous revenues |

727 | 1,111 | 1,726 |

Revenues earned on behalf of Government |

(4,037,153) | (4,590,379) | (5,117,576) |

| Total revenues | 30,380,379 | 26,506,167 | 23,177,865 |

| Net cost of operations before government funding and transfers | 80,139,166 | 78,127,219 | 80,060,660 |

| Government funding and transfers | |||

Net cash provided by Government |

69,223,529 | 63,940,492 | |

Change in due from Consolidated Revenue Fund |

314,713 | 1,912,268 | |

Services provided without charge by other government departments (note 9) |

15,341,534 | 16,105,749 | |

Transfer of overpayment to other government departments |

1,131 | 3,116 | |

| Total government funding and transfers | 84,880,907 | 81,961,625 | |

| Net cost (revenue) of operations after government funding and transfers | (6,753,688) | (1,900,965) | |

| Departmental net financial position - Beginning of year | 3,702,715 | 1,801,751 | |

| Departmental net financial position - End of year | 10,456,403 | 3,702,715 | |

| Segmented information (note 10) | |||

The accompanying notes form an integral part of the financial statements.

Statement of Change in Departmental Net Debt (Unaudited) |

||

|---|---|---|

| (in dollars) | For the Year Ended March 31st, 2019 |

For the Year Ended March 31st, 2018 |

| Net cost (revenue) of operations after government funding and transfers | (6,753,688) | (1,900,965) |

| Change due to tangible capital assets | ||

Acquisition of tangible capital assets (note 7) |

6,685,927 | 3,266,396 |

Amortization of tangible capital assets (note 7) |

(1,985,195) | (1,516,329) |

| Total change due to tangible capital assets | 4,700,732 | 1,750,067 |

| Change due to prepaid expenses | 778,135 | (241) |

| Net increase in net financial assets | (1,274,821) | (151,137) |

| Departmental net debt - Beginning of year | 1,902,891 | 2,054,027 |

| Departmental net debt - End of year | 628,070 | 1,902,891 |

The accompanying notes form an integral part of the financial statements.

Statement of Cash Flows (Unaudited) |

||

|---|---|---|

| (in dollars) | For the Year Ended March 31, 2019 |

For the Year Ended March 31, 2018 |

| Operating activities | ||

| Net cost of operations before government funding and transfers | 78,127,219 | 80,060,660 |

| Non-cash items: | ||

Amortization of tangible capital assets (note 7) |

(1,985,195) | (1,516,329) |

Services provided without charge by other government departments (note 9) |

(15,341,534) | (16,105,749) |

| Transfer of overpayment to other government departments | (1,131) | (3,116) |

| Variations in Statement of Financial Position: | ||

Increase (decrease) in accounts receivable and advances |

4,375,462 | 1,347,242 |

Increase (decrease) in prepaid expenses |

778,135 | (241) |

Decrease (increase) in accounts payable and accrued liabilities |

(3,729,186) | (2,818,472) |

Decrease (increase) in vacation pay and compensatory leave |

65,233 | (90,338) |

Decrease (increase) in employee future benefits |

>248,599 | (199,564) |

| Cash used in operating activities | 62,537,602 | 60,674,095 |

| Capital investing activities | ||

Acquisition of tangible capital assets (note 7) |

6,685,927 | 3,266,396 |

| Cash used in capital investing activities | 6,685,927 | 3,266,396 |

| Net cash provided by Government of Canada | 69,223,529 | 63,940,492 |

The accompanying notes form an integral part of the financial statements.

Notes to the Financial Statements (Unaudited) For the Year ended March 31, 2019

1. Authority and objectives

The Administrative Tribunals Support Service of Canada (ATSSC) was established with the coming into force on November 1, 2014, of the Administrative Tribunals Support Service of Canada Act. The ATSSC is responsible for providing support services and facilities to 11 federal administrative tribunals by way of a single, integrated organization.

These services include the specialized services required to support the mandate of each tribunal (e.g., registry, research and analysis, legal and other case- and mandate specific work), as well as internal services (e.g., human resources, financial services, information management and technology, accommodation, security and communications).

The 11 tribunals are:

- Canada Agricultural Review Tribunal

- Canada Industrial Relations Board

- Canadian Cultural Property Export Review Board

- Canadian Human Rights Tribunal

- Canadian International Trade Tribunal

- Competition Tribunal

- Public Servants Disclosure Protection Tribunal

- Federal Public Sector Labour Relations and Employment Board

- Social Security Tribunal

- Specific Claims Tribunal

- Transportation Appeal Tribunal of Canada

The ATSSC has one core responsibility: To provide support services and facilities to federal administrative tribunals and their members. According to the approved framework, the Statement of Operations and Departmental Net Financial Position was detailed by the following programs (business lines):

Mandate and members services

The Mandate and Members Services Program provides expert research, analysis, drafting support and advisory services, outreach and training activities, investigation support services, mediation as well as policy and procedure development to assist tribunals in the discharge of their statutory responsibilities. These services are provided by ATSSC employees such as sectoral experts, tribunal assistants and research personnel. This program also includes the payment of tribunal member salaries and other expenses related to their duties.

Registry services

The Registry Services Program provides registry services in support of tribunals. The program works closely with tribunal chairs and members to ensure that matters before the tribunals are heard and disposed of in a timely and efficient manner and within statutory obligations. Services provided include: Processing tribunal documents; maintaining and safeguarding tribunal records; providing information to the public regarding tribunal procedures; assisting in the scheduling and conducting of tribunal hearings and assisting in communicating tribunal decisions to the parties and the public. These services are provided by ATSSC employees such as legal counsel and judicial assistants.

Legal services

The Legal Services Program provides legal advice, legal research, and legislative and regulatory support services to the tribunals on their case files and other matters related to the tribunals' mandates. These services are provided by ATSSC employees such as legal counsel and judicial assistants.

Internal services

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal services delivery model in a department. The 10 service categories are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

2. Summary of significant accounting policies

These financial statements are prepared using the Government's accounting policies stated below, which are based on Canadian public sector accounting standards. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian public sector accounting standards.

Significant accounting policies are as follows:

(a) Parliamentary authorities

The ATSSC is financed by the Government of Canada through Parliamentary authorities. Financial reporting of authorities provided to the ATSSC do not parallel financial reporting according to generally accepted accounting principles since authorities are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and Departmental Net Financial Position and in the Statement of Financial Position are not necessarily the same as those provided through authorities from Parliament. Note 3 provides a reconciliation between the bases of reporting. The planned results amounts in the “Expenses” and “Revenues” sections of the Statement of Operations and Departmental Net Financial Position are the amounts reported in the Future-oriented Statement of Operations included in the 2018-19 Departmental Plan. Planned results are not presented in the “Government funding and transfers” section of the Statement of Operations and Departmental Net Financial Position and in the Statement of Change in Departmental Net Debt because these amounts were not included in the 2018-19 Departmental Plan.

(b) Net cash provided by Government

The ATSSC operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the ATSSC is deposited to the CRF, and all cash disbursements made by the ATSSC are paid from the CRF. The net cash provided by Government is the difference between all cash receipts and all cash disbursements, including transactions between departments of the Government.

(c) Due from or to the CRF

Amounts due from or to the CRF are the result of timing differences at year-end between when a transaction affects authorities and when it is processed through the CRF. Amounts due from the CRF represent the net amount of cash that the ATSSC is entitled to draw from the CRF without further authorities to discharge its liabilities.

(d) Revenues

All revenues are recognized in the period the event giving rise to the revenues occurred. Revenues that are non-respendable are not available to discharge the ATSSC's liabilities. While the department head is expected to maintain accounting control, he or she has no authority regarding the disposition of non-respendable revenues. As a result, non-respendable revenues are considered to be earned on behalf of the Government of Canada and are therefore presented as a reduction of the entity's gross revenues.

(e) Expenses

Expenses are recorded on the accrual basis.

Vacation pay and compensatory leave are accrued as the benefits are earned by employees under their respective terms of employment.

Services provided without charge by other government departments for accommodation and employer contributions to the health and dental insurance plans are recorded as operating expenses at their carrying value.

(f) Employee future benefits

Pension benefits: Eligible employees participate in the Public Service Pension Plan, a multi-employer pension plan administered by the Government. The ATSSC’s contributions to the Plan are charged to expenses in the year incurred and represent the total ATSSC obligation to the Plan. The ATSSC’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.

Severance benefits: The accumulation of severance benefits for voluntary departures ceased for applicable employee groups. The remaining obligation for employees who did not withdraw benefits is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole.

(g) Accounts receivable

Accounts receivable are initially recorded at cost. When necessary, an allowance for valuation is recorded to reduce the carrying value of accounts receivable to amounts that approximate their net recoverable value.

(h) Non-financial assets

The costs of acquiring buildings, equipment and other capital property are capitalized as tangible capital assets and are amortized to expense over the estimated useful lives of the assets, as described in Note 7. All tangible capital assets and leasehold improvements having an initial cost of $10,000 or more are recorded at their acquisition cost. Tangible capital assets do not include immovable assets located on reserves as defined in the Indian Act, works of art, museum collection and Crown land to which no acquisition cost is attributable; and intangible assets.

(i) Measurement uncertainty

The preparation of these financial statements requires management to make estimates and assumptions that affect the reported and disclosed amounts of assets, liabilities, revenues and expenses reported in the financial statements and accompanying notes at March 31. The estimates are based on facts and circumstances, historical experience, general economic conditions and reflect the Government's best estimate of the related amount at the end of the reporting period. The most significant items where estimates are used are the liability for employee future benefits and the useful life of tangible capital assets. Actual results could significantly differ from those estimated. Management’s estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

(j) Related party transactions

Related party transactions, other than inter-entity transactions, are recorded at the exchange amount.

Inter-entity transactions are transactions between commonly controlled entities. Inter-entity transactions, other than restructuring transactions, are recorded on a gross basis and are measured at the carrying amount, except for the following:

Services provided on a recovery basis are recognized as revenues and expenses on a gross basis and measured at the exchange amount.

Certain services received on a without-charge basis are recorded for departmental financial statement purposes at the carrying amount.

3. Parliamentary authorities

The ATSSC receives its funding through annual parliamentary authorities. Items recognized in the Statement of Operations and Departmental Net Financial Position and the Statement of Financial Position in one year may be funded through parliamentary authorities in prior, current or future years. Accordingly, the ATSSC has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year authorities used |

||

|---|---|---|

| (in dollars) | 2019 | 2018 |

| Net cost of operations before government funding and transfers | 78,127,219 | 80,060,660 |

| Adjustments for items affecting net cost of operations but not affecting authorities: | ||

Services provided without charge by other government departments |

(15,341,534) | (16,105,749) |

Amortization of tangible capital assets |

(1,985,195) | (1,516,329) |

Decrease (increase) in vacation pay and compensatory leave |

65,233 | (90,338) |

Decrease (increase) in employee future benefits |

248,599 | (199,564) |

Refunds / Adjustments to previous years' expenses |

930,773 | 32,451 |

| Total items affecting net cost of operations but not affecting authorities | (16,082,124) | (17,879,528) |

| Adjustments for items not affecting net cost of operations but affecting authorities: | ||

Acquisition of tangible capital assets |

6,685,927 | 3,266,396 |

Increase (decrease) in prepaid expenses |

778,135 | (241) |

Increase (decrease) in accountable advances |

21,833 | 67,608 |

| Total items not affecting net cost of operations but affecting authorities | 7,485,895 | 3,333,764 |

| Current year authorities used | 69,530,990 | 65,514,897 |

(b) Authorities provided and used |

||

|---|---|---|

| (in dollars) | 2019 | 2018 |

| Authorities provided: | ||

Vote 1 - Program expenditures |

62,104,025 | 61,734,908 |

Statutory – Contributions to employee benefit plans |

8,778,521 | 8,072,465 |

Statutory – Spending of proceeds from the disposal of surplus Crown assets |

2,659 | 2,487 |

| Total authorities provided | 70,885,205 | 69,809,860 |

| Less: | ||

Lapsed: Operating |

(1,353,148) | (4,293,371) |

Authorities available for future years |

(1,067) | (1,592) |

| Current year authorities used | 69,530,990 | 65,514,897 |

4. Accounts payable and accrued liabilities

The following table presents details of the ATSSC's accounts payable and accrued liabilities:

| (in dollars) | 2019 | 2018 |

| Accounts payable - Other government departments and agencies | 1,271,210 | 1,272,858 |

| Accounts payable - External parties | 4,345,368 | 3,536,987 |

| Total accounts payable | 5,616,578 | 4,809,845 |

| Accrued liabilities | 8,478,228 | 5,555,775 |

| Total accounts payable and accrued liabilities | 14,094,806 | 10,365,620 |

5. Employee future benefits

(a) Pension benefits

The ATSSC's employees participate in the Public Service Pension Plan (the ''Plan''), which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Quebec Pension Plans benefits and they are indexed to inflation.

Both the employees and the ATSSC contribute to the cost of the Plan. Due to the amendment of the Public Service Superannuation Act following the implementation of provisions related to the Economic Action Plan 2012, employee contributors have been divided into two groups – Group 1 relates to existing plan members as of December 31, 2012, and Group 2 relates to members joining the Plan as of January 1, 2013. Each group has a distinct contribution rate.

The 2018-19 expense amounts to $6,122,140 ($5,497,349 in 2017–18). For Group 1 members, the expense represents approximately 1.01 times (1.01 times for 2017–18) the employee contributions and, for Group 2 members, approximately 1.00 times (1.00 times for 2017-18) the employee contributions.

The ATSSC's responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the Consolidated Financial Statements of the Government of Canada, as the Plan's sponsor.

(b) Severance benefits

Severance benefits provided to the ATSSC’s employees were previously based on an employee’s eligibility, years of service and salary at termination of employment. However, since 2011 the accumulation of severance benefits for voluntary departures progressively ceased for substantially all employees. Employees subject to these changes were given the option to be paid the full or partial value of benefits earned to date or collect the full or remaining value of benefits upon departure from the public service. By March 31, 2019, all settlements for immediate cash out were completed. Severance benefits are unfunded and, consequently, the outstanding obligation will be paid from future authorities.

The changes in the obligations during the year were as follows:

| (in dollars) | 2019 | 2018 |

| Accrued benefit obligation, beginning of year | 3,098,591 | 2,899,027 |

| Expense for the year | 40,671 | 519,222 |

| Benefits paid during the year | (289,270) | (319,658) |

| Accrued benefit obligation, end of year | 2,849,992 | 3,098,591 |

6. Accounts receivable and advances

The following table presents details of the ATSSC's accounts receivable and advances balances:

| (in dollars) | 2019 | 2018 |

| Accounts receivable - Other government departments and agencies | 9,380,366 | 5,985,394 |

| Accounts receivable - External parties | 5,483,180 | 4,510,864 |

| Temporary advances | 12,225 | 4,051 |

| Total accounts receivable and advances | 14,875,771 | 10,500,309 |

7. Tangible capital assets

Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the asset as follows:

| Asset Class | Amortization Period |

| Informatics hardware | 3 years |

| Informatics software | 3 to 10 years |

| Machinery and equipment | 5 years |

| Other equipment, including furniture | 10 years |

| Leasehold improvements | Lesser of the remaining term of lease or useful life of the improvement |

Assets under construction are recorded in the applicable asset class in the year they are put into service and are not amortized until they are put into service.

| Cost | |||||

| (in dollars) | Opening Balance April 1, 2018 |

Acquisitions | Adjustments | Disposals and Write-Offs |

Closing Balance, March 31, 2019 |

| Informatics hardware | 3,488,592 | 443,092 | - | - | 3,931,684 |

| Informatics software | 7,405,275 | 90,964 | - | - | 7,496,239 |

| Leasehold improvements | 3,599,924 | 3,174,546 | 3,634,515 | - | 10,408,985 |

| Machinery and equipment | 87,940 | - | - | 87,940 | |

| Other equipment, including furniture | 2,300,392 | - | - | - | 2,300,392 |

| Assets under construction | 1,481,597 | 2,977,325 | (3,634,515) | - | 824,407 |

| 18,363,720 | 6,685,927 | - | - | 25,049,647 | |

| Accumulated Amortization | |||||

| (in dollars) | Opening Balance April 1, 2018 |

Amortization | Adjustments | Disposals and Write-Offs |

Closing Balance, March 31, 2019 |

| Informatics hardware | 2,717,351 | 229,248 | - | - | 2,946,599 |

| Informatics software | 5,643,751 | 850,668 | - | - | 6,494,419 |

| Leasehold improvements | 2,451,190 | 813,939 | - | - | 3,265,129 |

| Machinery and equipment | 74,509 | 3,429 | - | - | 77,938 |

| Other equipment, including furniture | 1,962,354 | 87,911 | - | - | 2,050,265 |

| 12,849,155 | 1,985,195 | - | - | 14,834,350 | |

| Net Book Value | |||||

| (in dollars) | Opening Balance April 1, 2018 |

Closing Balance, March 31, 2019 |

|||

| Informatics hardware | 771,241 | 985,085 | |||

| Informatics software | 1,761,524 | 1,001,820 | |||

| Leasehold improvements | 1,148,734 | 7,143,856 | |||

| Machinery and equipment | 13,431 | 10,002 | |||

| Other equipment, including furniture | 338,038 | 250,127 | |||

| Assets under construction | 1,481,597 | 824,407 | |||

| 5,514,565 | 10,215,297 | ||||

8. Contractual obligations

The nature of the ATSSC’s activities may result in some large multi-year contracts and obligations whereby the ATSSC will be obligated to make future payments in order to rent equipment and for professional services. Significant contractual obligations that can be reasonably estimated are summarized as follows:

| (in dollars) | 2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 | Total |

| Equipment rental and service contract | 91,304 | 68,816 | 68,817 | 66,507 | - | 295,444 |

| Total | 91,304 | 68,816 | 68,817 | 66,507 | - | 295,444 |

9. Related party transactions

The ATSSC is related as a result of common ownership to all government departments, agencies, and Crown corporations. Related parties also include individuals who are members of key management personnel or close family members of those individuals, and entities controlled by, or under shared control of, a member of key management personnel or a close family member of that individual.

The ATSSC enters into transactions with these entities in the normal course of business and on normal trade terms. During the year, the ATSSC received common services which were obtained without charge from other government departments as disclosed below.

a) Common services provided without charge by other government departments

During the year, the ATSSC received services without charge from certain common service organizations, related to accommodation and the employer’s contribution to the health and dental insurance plans. These services provided without charge have been recorded at the carrying value in the ATSSC’s Statement of Operations and Departmental Net Financial Position as follows:

| (in dollars) | 2019 | 2018 |

| Accommodation | 10,023,115 | 10,573,102 |

| Employer's contribution to the health and dental insurance plans | 5,318,419 | 5,532,647 |

| Total | 15,341,534 | 16,105,749 |

The Government has centralized some of its administrative activities for efficiency, cost-effectiveness purposes and economic delivery of programs to the public. As a result, the Government uses central agencies and common service organizations so that one department performs services for all other departments and agencies without charge. The costs of these services, such as the payroll and cheque issuance services provided by Public Services and Procurement Canada and audit services provided by the Office of the Auditor General are not included in the ATSSC’s Statement of Operations and Departmental Net Financial Position.

The ATSSC also received services without charge from Employment and Social Development Canada specifically for the administration of the Social Security Tribunal. These services are related to the administration of IT services, Finance and Procurement services, Security service, mailroom service, facilities for hearing and the call center service.

(b) Other transactions with related parties

| (in dollars) | 2019 | 2018 |

| Expenses - Other government departments and agencies | 18,091,264 | 14,088,018 |

| Revenues - Other government departments and agencies | 18,210,467 | 14,199,558 |

Expenses and revenues disclosed in (b) exclude common services provided without charge, which are already disclosed in (a).

10. Segmented information

Presentation by segment is based on the ATSSC's core responsibilities. The presentation by segment is based on the same accounting policies as described in the Summary of significant accounting policies in note 2. The following table presents the expenses incurred and revenues generated for the main programs, by major object of expense and by major type of revenue. The segment results for the period are as follows:

| (in dollars) | Registry services | Legal services | Mandate and members services |

Internal services | 2019 | 2018 |

| Expenses | ||||||

Salaries and employee benefits |

12,357,026 | 8,433,313 | 40,631,088 | 14,996,547 | 76,417,974 | 73,942,138 |

Accommodation |

1,627,496 | 1,085,861 | 5,346,331 | 1,963,427 | 10,023,115 | 10,573,102 |

Professional and special services |

955,981 | 171,003 | 2,574,931 | 2,823,213 | 6,525,128 | 7,157,303 |

Transportation and telecommunications |

487,289 | 119,471 | 1,932,142 | 615,993 | 3,154,895 | 3,154,895 |

Rentals |

331,466 | 3,650 | 1,619,309 | 1,399,130 | 3,353,555 | 3,506,390 |

Amortization of tangible capital assets |

- | - | - | 1,985,195 | 1,985,195 | 1,516,329 |

Acquisition of small equipment |

42,373 | 5,923 | 137,990 | 1,130,598 | 1,316,884 | 1,099,008 |

Information |

351,584 | 53,630 | 224,236 | 297,088 | 926,538 | 699,489 |

Materials and supplies |

50,328 | 55,843 | 396,959 | 76,308 | 579,438 | 487,538 |

Repairs and maintenance |

3,073 | 5,714 | 25,168 | 273,383 | 307,338 | 224,519 |

Utilities |

9 | - | - | 25,475 | 25,484 | 33,300 |

Other |

12 | - | 6,360 | 11,470 | 17,842 | 21,512 |

| Total expenses | 16,206,638 | 9,934,408 | 52,894,514 | 25,597,826 | 104,633,386 | 103,238,525 |

| Revenues | ||||||

Recovery of CPP & EI related costs |

(1,602,215) | 3,499,248 | 22,943,581 | 6,254,821 | 31,095,435 | 28,293,715 |

Miscellaneous revenues |

- | - | - | 1,111 | 1,111 | 1,726 |

Revenues earned on behalf of Government |

(743,185) | (490,427) | (2,414,173) | (942,594) | (4,590,379) | (5,117,576) |

| Total revenues | 2,345,400) | 3,008,821 | 20,529,408 | 5,313,338 | 26,506,167 | 23,177,865 |

| Net cost of operations before government funding and transfers |

18,552,038 | 6,925,587 | 32,365,106 | 20,284,488 | 78,127,219 | 80,060,660 |

11.Comparative information

In 2018-19, the ATSSC replaced its Program Alignment Architecture with the Departmental Results Framework (DRF). The new structure resulted in changes in the programs, aside from the Registry Services Program and the Internal Services Program. For presentation and comparison purposes, the financial statements have been prepared in accordance with the new DRF.

| Restatement of Expenses of 2017-18 | |||

| Before | Before Effect of change | After | |

| Tribunal specialized and expert support services | 34,937,914 | (34,937,914) | - |