Reporting to Atlantic Canadians on the Atlantic Growth Strategy (2017)

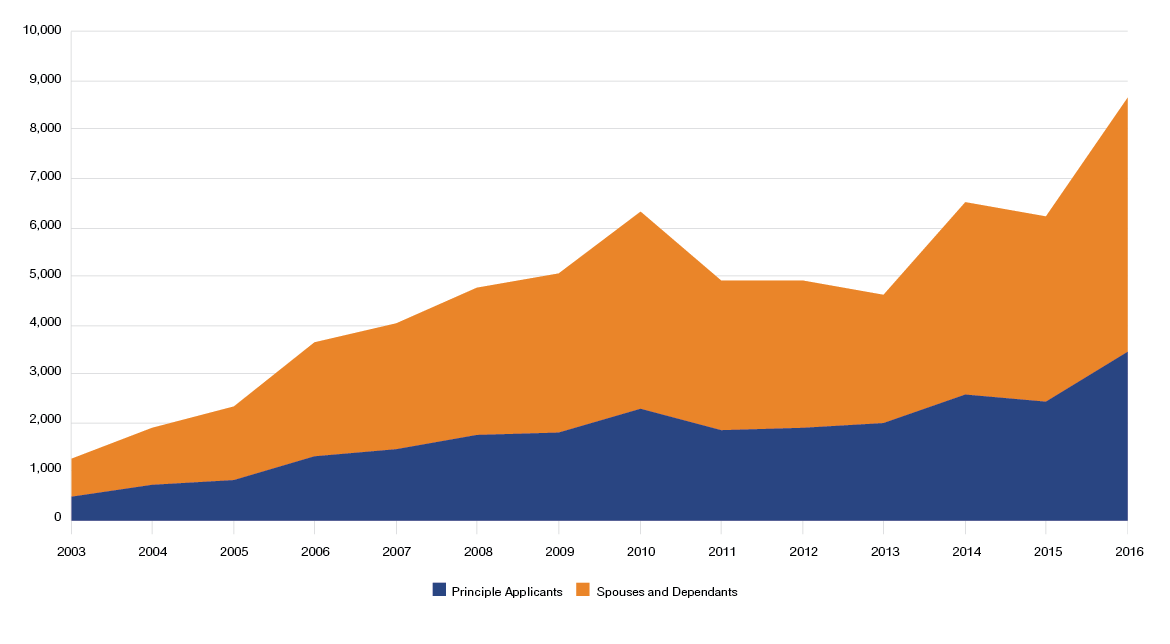

The Atlantic Growth Strategy is about growing Atlantic Canada’s economy. It was launched by the Government of Canada and the four provincial governments in Atlantic Canada in July 2016 to create good-paying middle class jobs, strengthen local communities, and grow innovative, world-class companies in the region. The Atlantic Growth Strategy is led by the Leadership Committee, which released a Two-Year Action Plan in July 2016 to guide short and medium-term collaborative actions under the strategy. The strategy is collaborative and pan-Atlantic, reflects the priorities of the four Atlantic provinces and the Government of Canada, and is focused on results. The Atlantic Growth Strategy will drive sustainable economic growth through strategic initiatives and investments in five key areas: Atlantic Canada is home to great ideas, great products, great innovators, and a strong drive to succeed. Harnessing these assets and competing in a rapidly changing global environment are key to sustained economic growth in Atlantic Canada. Our region’s businesses must innovate, must attract, develop and retain skilled workers, and must compete globally if they are to grow and create high-quality jobs for Atlantic Canadians. However, Atlantic Canada is facing slow economic growth, an aging workforce, low levels of business R&D, and difficulty retaining immigrants. These are important challenges that require a coordinated regional approach. Together, through the Atlantic Growth Strategy, we are working to address these challenges and build on Atlantic Canada’s competitive advantages, including its strong export potential, its growing innovation ecosystem and its skilled workforce. Our efforts together over the past year have produced results for Atlantic Canadians. Here’s some of the progress we’ve achieved working collaboratively on key areas of the Atlantic Growth Strategy. This pilot program is helping attract and retain skilled workers and international graduates in Atlantic Canada. Since the Pilot launched on January 27, 2017, more than 400 Atlantic employers have been designated by an Atlantic provincial government, meaning they can recruit immigrants under the Atlantic Intermediate-Skilled Program, the Atlantic High-Skilled Program, and the Atlantic International Graduate Program to fill job vacancies. Application intake commenced in March 2017, and to date, over 250 skilled immigrants and Atlantic international graduates have been recruited by designated employers and begun the application process. This service provides customized support to high-growth companies across Atlantic Canada in areas such as financing, exporting, advisory support and innovation services. As of July 2017, 39 Atlantic Canadian companies were participating and another 17 will join by March 2018. We also continue to support development and use of big data analytics, to enhance the ability of Atlantic Canadian industries to innovate and grow. For example, we have facilitated greater collaboration across Atlantic Canada’s network of incubators and accelerators to strengthen the start-up ecosystem in the region, resulting in enhanced support to help launch and grow new start-ups. For example, we introduced a $280 million financing package through the Business Development Bank of Canada to support small and medium-sized businesses in Atlantic Canada. Targeted industries include information and communication technology (ICT), agri-food, ocean technology, and tourism. The amount represents a $100 million increase in the bank’s normal lending volume for these industries. This fund will drive innovation in the fish and seafood sector in Canada, with a focus on developing the sector to better meet growing market demand for sustainably sourced, high-quality fish and seafood products. As part of this fund, the Government of Canada is investing $30 million in a National Market Access and Development Initiative to support and drive innovation in the fish and seafood industry in partnership with the provinces and territories. Aspin Kemp & Associates already has over 100 employees and 100,000 square feet of manufacturing space between two Prince Edward Island communities. And with the support of the Accelerated Growth Service, this high-growth company will continue to provide jobs on the Island as it explores using its innovative marine technology on land to develop micro-grids: small, self-contained power grids that could potentially supply and store low-cost, renewable energy. More than 90 per cent of Bluedrop Performance Learning staff are employed in Atlantic Canada. And that figure is about to rise as the world-class innovator in computer-based simulation, training and e-learning solutions takes advantage of options offered under the Atlantic Growth Strategy. The high-impact tech company will be able to capitalize on both national and international opportunities and improve the effectiveness, speed and costs of its leading-edge programs. All four Atlantic Provinces were actively engaged in developing this Framework, and in it they identified key priorities for collaborative work with the federal government. They include strengthening regional electricity systems by expanding clean energy generation, transmission and storage; improving energy efficiency; and working to adapt to the effects of climate change that are already being felt across the region. This $2 billion fund will provide funding for Atlantic Provinces to invest in priority projects that reduce greenhouse gas emissions and help advance the objectives of the Pan-Canadian Framework. We are working together under the Regional Electricity Cooperation and Strategic Infrastructure initiative to identify the most promising electricity infrastructure projects that will reduce greenhouse gas emissions in Atlantic Canada. The Government of Canada announced new funding to support the development and use of clean technologies in critical sectors for Atlantic Canada’s economy, including energy, mining, forestry, agriculture, fisheries and transportation. These programs complement investments targeting later stages of the innovation continuum, including scaling up clean tech companies and promoting exports. Mara Renewables Corporation, a Nova Scotia research firm, is developing sustainable, low-cost renewable oils from micro-organisms for fuel applications. As a recipient of the Atlantic Innovation Fund, this company is able to develop, more quickly, algae-based biofuels that may potentially provide a clean, green alternative to fossil fuels. This pan-Atlantic strategy is working to help companies from across Atlantic Canada sell their products and services internationally and to attract foreign investments. Our governments are also jointly investing $20 million to provide Atlantic firms with competitive intelligence and market analysis, training and skills development, and in-market activities. The strategy includes $24.5 million in federal-provincial-industry investments for three initiatives aimed at positioning Atlantic Canada as a top destination in the global tourism sector, creating more jobs for Atlantic Canadians and giving a boost to small businesses. For example, this new, multi-year partnership will promote the region’s tourism offerings in key international markets and prepare Atlantic tourism operators to offer in-demand products and experiences. This initiative brings together the purchasing power of federal, provincial, territorial and municipal governments, as well as hospitals, educational institutions and other organizations to purchase goods more efficiently and with less administration while benefitting from rates negotiated by the Government of Canada. The agreement aims to save taxpayers’ money, reduce costs and make it easier for businesses to sell to multiple levels of government and expand their market. Masitek’s cutting-edge technology is used to pinpoint damage during processing and handling in the food, beverage and agriculture industries. Recently, the company was part of an Atlantic Canadian trade mission to Europe. According to Tracy Clinch, president and CEO, she estimates that the connections made overseas will translate into a substantial amount of new business, measured in millions of dollars in increased sales and exports for the Moncton, New Brunswick-based company. More than 1.4 million Canadians self-identify as Aboriginal – the fastest-growing segment of the population in Canada. With the support of the Atlantic Growth Strategy, the Aboriginal Tourism Association of Canada is creating an Atlantic chapter to develop a regional strategy for aboriginal tourism in Atlantic Canada. This will allow the region to speak with a unified voice as it shares its Indigenous stories and celebrates aboriginal culture, language and communities with the rest of Canada, and beyond. (Photo: Destination Membertou) We signed agreements for Phase I of the Canada Infrastructure Plan for a total federal investment of over $339 million in Atlantic Canada. The town of Pouch Cove, NL will soon benefit from a highly anticipated water treatment plant, which will ensure the water entering local businesses, schools and homes is safe, clear and free from contaminants. This new facility is being funded through the New Building Canada Plan. The modern facility will put an end to boil water advisories by providing an ample supply of high-quality drinking water for residents now and well into the future. (Photo: Town of Pouch Cove) Public transit users in Fredericton, NB, will be riding with comfort and ease thanks to the addition of eight buses, accessible transit stops throughout the city, and new technology on board. Fredericton is using its allocation from the Public Transit Infrastructure Fund to revamp the fleet with accessible buses featuring systems that facilitate announcements, track passenger counts, display stops and offer Wi-Fi access. (Photo: City of Fredericton) Charlottetown, PEI, is another step closer to a sustainable, green future with the help of the Clean Water and Wastewater Fund. Recently announced investments are allowing for important upgrades and expansion of its Pollution Control Plant, the removal of an outdated waste-water lagoon, and consolidation of the Town of Stratford’s waste-water system. These measures will go a long way to ensuring the Island’s coastline and waterways remain pristine for generations to come. For the thousands of Nova Scotians who cross the pond between Dartmouth and Halifax each day by ferry, the announcement of a new pontoon, funded through the Public Transit Infrastructure Fund, was great news. The new vessel will ensure safe and efficient travel to and from work, school and leisure activities. (Photo: Halifax Regional Municipality) The Advisory Group, which was formed in April 2017, conducted consultations with Atlantic Canadians this spring and will provide us with their strategic advice and recommendations in the fall of 2017 to help guide collaborative approaches and actions moving forward. A skilled and talented workforce is a fundamental pillar of a modern, growing economy, and will help address persistent and emerging labour-market challenges. Under the Atlantic Immigration Pilot, up to 2,000 applications, which include the skilled worker and any family members coming with them, will be accepted for the three programs in 2017. High-growth companies are key drivers of Canada’s economic growth and long-term prosperity. In 2014, there were 310 high-growth firms by employment in Atlantic Canada, representing 2.7 percent of enterprises in the region with at least 10 employees. In Atlantic Canada, they have a greater impact than the rest of Canada as they are twice as likely to innovate and to invest in advanced processes and skills development. They also generally export more than the average Canadian business. We will address climate change and protect our environment. The emerging clean technology industry represents an opportunity to support inclusive and sustainable economic growth. On December 9, 2016, all four Atlantic Provinces adopted the Pan-Canadian Framework on Clean Growth and Climate Change (PCF) to grow the economy while reducing emissions and working to build resilience to adapt to a changing climate. The measures included in the PCF will allow Canada to meet or even exceed its 2030 target to reduce GHG emissions to 30 percent below 2005 levels. Since firms that export tend to be more innovative, pay higher wages, hire more and are generally more productive than non-exporters, the Atlantic Growth Strategy plans to double the number of exporters in Atlantic Canada to 4,000 by 2025. Atlantic Canada has a higher proportion of its population in rural areas than the Canadian average (45 percent versus 19 percent nationally). In order to expand online access by 2025, we must extend coverage to rural areas and encourage citizens that are not currently online to take advantage of this important technology. In order to measure our progress, we need to watch certain trends in the economy. Tracking growth in the value of goods and services produced in Atlantic Canada, as well as employment and demographic shifts, is crucial to gauging the Atlantic Growth Strategy’s success. Gross Domestic Product (GDP) measures the value of goods and services produced and is a key indicator of economic health. It can also be used to show the economic contributions of sectors or industries. For example, the graph below compares the main industries in Atlantic Canada in 2016. GDP also provides a picture of how an economy grows or shrinks over time. From 2000 to 2007, Atlantic Canada saw its economy accelerate, beating the national average in terms of GDP growth. In 2008 and 2009, however, the global recession hit Atlantic Canada harder than the rest of the country. Since 2009, economic growth in Atlantic Canada has been slower to recover than the rest of Canada. However, increased investment in Atlantic Canada – in the form of major infrastructure projects and support for innovative sectors of the economy – will help spur future growth. Employment data, like GDP, shows how the economy is changing. In Atlantic Canada, the trend has been to more service-sector jobs, and away from resource-based industries. People, skills and ideas are fundamental to economic growth. However, Atlantic Canada’s population is generally older than the rest of Canada, and growing more slowly. Atlantic Canada is also losing workers to other parts of Canada. As a result, it is important to find ways to attract people to the region to replace workers who are retiring or moving away. One way to increase the Atlantic Canadian population is to attract new permanent residents. Immigrants to Atlantic Canada bring new skills, ideas and ways of doing business. As shown below, admissions of permanent residents to Atlantic Canada have increased almost 600 percent since 2003. However, the challenge continues to be retaining those newcomers who land in Atlantic Canada.Table of Contents

What is the Atlantic Growth Strategy?

Our goals

Why is this strategy a priority?

What we’ve done so far

Skilled Workforce and Immigration

We launched a three-year Atlantic Immigration Pilot.

Innovation

We launched the Accelerated Growth Service in Atlantic Canada.

We supported business incubators and accelerators to help launch and grow new start-ups.

We supported research and innovation in areas such as biosciences, aquaculture, ocean technology, renewable energy, fisheries, agriculture and forestry.

We announced the creation of a $325 million Atlantic Fisheries Fund.

Early results

Clean Growth and Climate Change

We developed the Pan-Canadian Framework on Clean Growth and Climate Change.

We launched the Low Carbon Economy Fund.

We announced a provincially-led Atlantic Clean Energy Partnership in April 2017.

We advanced work on regional electricity grids and renewable power generation.

We invested in clean technologies.

Early results

Trade and Investment

We launched a multi-year, international Atlantic Trade and Investment Growth Strategy, supported by a $20 million funding agreement.

We developed a strategic and collaborative approach to tourism.

We rolled out a Collaborative Procurement Initiative across all four Atlantic provinces.

Early results

Infrastructure

We worked to build better infrastructure in Atlantic Canada.

Early results

Atlantic Growth Advisory Group

We established an Atlantic Growth Advisory Group to provide strategic advice on the Atlantic Growth Strategy.

Longer-term outcomes

Skilled Workforce and Immigration: Admit up to 2,000 new permanent residents and accompanying families in 2017

Innovation: Double the number of high-growth firms in Atlantic Canada by 2025

Climate Change and Clean Growth: Reduce GHG emissions

Trade and Investment: Double the number of exporters in Atlantic Canada by 2025

Infrastructure: Bring rural and remote areas online by 2025

Trends we are following

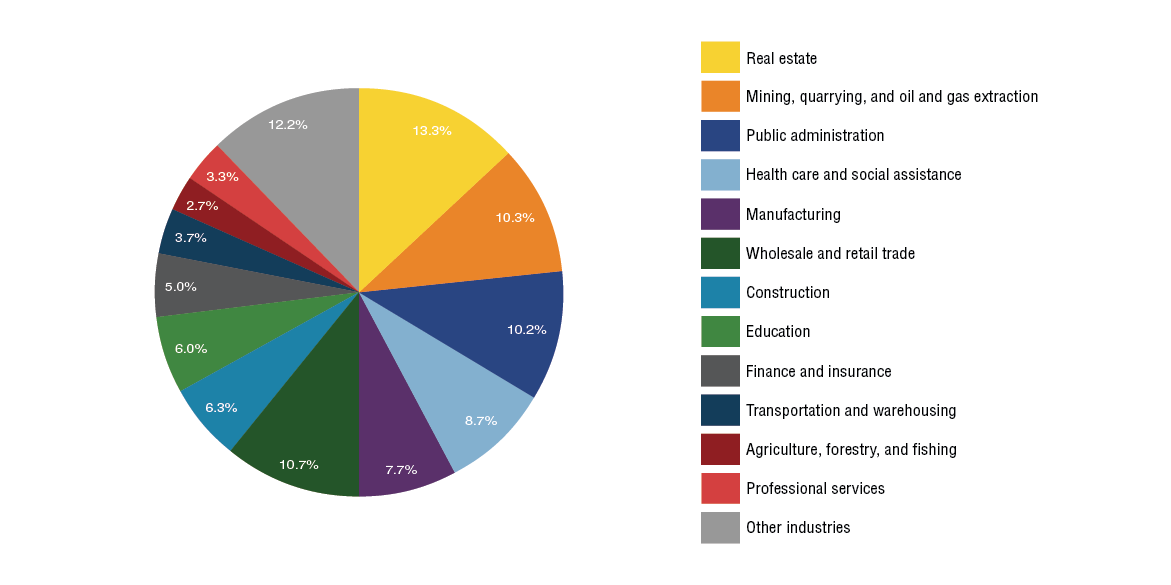

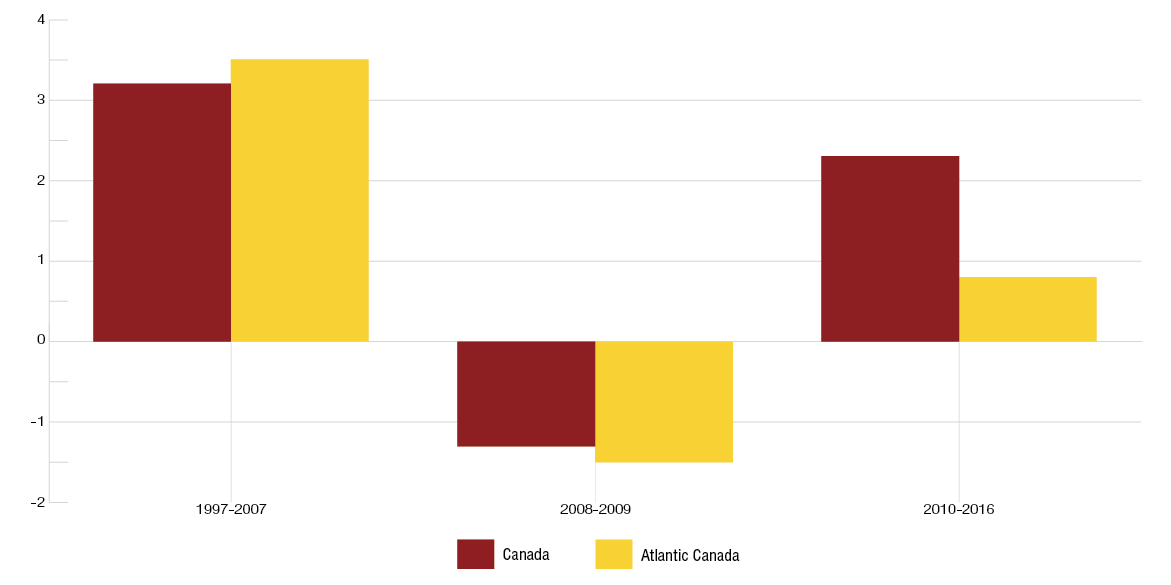

Growth in the value of goods and services

Main Industries in Atlantic Canada, 2016 (% of total GDP)

Main Industries in Atlantic Canada, 2016 (% of total GDP) – Table

Industry

% of total GDP

Real estate

13.3%

Mining, quarrying, and oil and gas extraction

10.3%

Public administration

10.2%

Health care and social assistance

8.7%

Manufacturing

7.7%

Wholesale and retail trade

10.7%

Construction

6.3%

Education

6.0%

Finance and insurance

5.0%

Transportation and warehousing

3.7%

Agriculture, forestry and fishing

2.7%

Professional services

3.3%

Other industries

12.2%

Real GDP Growth (Annual Average %): Atlantic Canada and Canada

Real GDP Growth (Annual Average %): Atlantic Canada and Canada – Table

1997-2007

2008-2009

2010-2016

Canada

3.2%

-1.3%

2.3%

Atlantic Canada

3.5%

-1.5%

0.8%

Employment by sector

Net employment change in Atlantic Canada by industry, 2000-2016

Net employment change in Atlantic Canada by industry, 2000-2016 – Table

Industry

2000-2014 (Thousands)

Health care and social assistance

50.8

Construction

26.3

Professional, scientific and technical services

20.3

Business, building and other support services

7.7

Mining, quarrying, and oil and gas extraction

6.9

Accommodation and food services

8.0

Educational services

6.9

Wholesale and retail trade

8.5

Finance and insurance

4.4

Public administration

2.8

Information, culture and recreation

0.1

Utilities

1.2

Real estate and rental and leasing

2.7

Transportation and warehousing

-2.2

Other services (except public administration)

-2.2

Forestry and logging and support activities for forestry

-4.8

Agriculture

-4.0

Fishing, hunting and trapping

-8.3

Manufacturing

-28.3

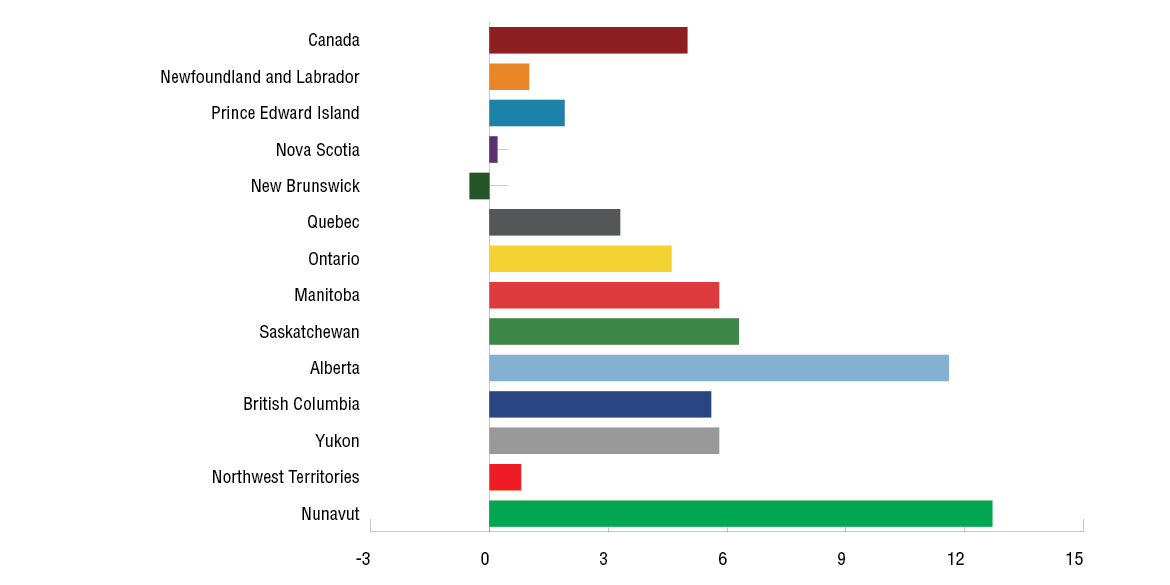

Demographics

Population Growth - Canada and Provinces Percentage Change Between 2011 and 2016

Population Growth - Canada and Provinces Percentage Change Between 2011 and 2016 – Table

2011 to 2016

Canada

5.0%

Newfoundland and Labrador

1.0%

Prince Edward Island

1.9%

Nova Scotia

0.2%

New Brunswick

-0.5%

Quebec

3.3%

Ontario

4.6%

Manitoba

5.8%

Saskatchewan

6.3%

Alberta

11.6%

British Columbia

5.6%

Yukon

5.8%

Northwest Territories

0.8%

Nunavut

12.7%

Admissions of Permanent Residents as Economic Immigrants Indicating Atlantic Canada as Intended Destination, 2003-2016

Admissions of Permanent Residents as Economic Immigrants Indicating Atlantic Canada as Intended Destination, 2003-2016 – Table

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Principal Applicants

477

708

849

1,320

1,471

1,744

1,821

2,281

1,830

1,902

2,019

2,560

2,418

3,437

Spouses and Dependants

772

1,184

1,488

2,335

2,583

3,039

3,255

4,017

3,058

3,020

2,593

3,941

3,817

5,228