Atlantic Canada Opportunities Agency - quarterly financial report for the quarter ending September 30, 2021

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

INTRODUCTION

This quarterly financial report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA) and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subjected to an external audit or review.

A summary description of the Atlantic Canada Opportunities Agency (ACOA) program activities can be found in the 2021-2022 Part II of the Main Estimates.

Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities is consistent with the Main Estimates and Supplementary Estimates (A) for the 2021-2022 fiscal year and includes ACOA’s total authorities available for use as granted by Parliament and those used by the Agency during this quarter. Authorities available for use are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory authorities for specific purposes.

The authority of Parliament is required before monies can be spent by the Government.

When Parliament is dissolved for the purposes of a general election, section 30 of the FAA authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

As part of the departmental results reporting process, the Agency prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies. However, the spending authorities voted by Parliament remain on an expenditure basis of accounting.

ACOA Financial Structure

ACOA manages its expenditures under two votes:

- Vote 1 – Net operating expenditures, includes the Agency’s authorities related to personnel costs (e.g. salaries) and operation and maintenance expenditures (e.g. travel).

- Vote 5 – Grants and contributions, includes authorities related to transfer payments.

Costs under Statutory Authorities, which represent payments made under legislation approved previously by Parliament and which are not part of the annual appropriation bills, include such items as the authorization received from the Minister of Health and the Minister of Finance to issue transfer payments pursuant to the Public Health Events of National Concern Payments Act, the employer’s share of the employee benefits plan and other minor items.

HIGHLIGHTS OF FISCAL QUARTER AND FISCAL YEAR-TO-DATE RESULTS

This section highlights significant changes to the fiscal quarter results as of September 30, 2021.

Statement of Authorities: Vote 1 – Net Operating Expenditures

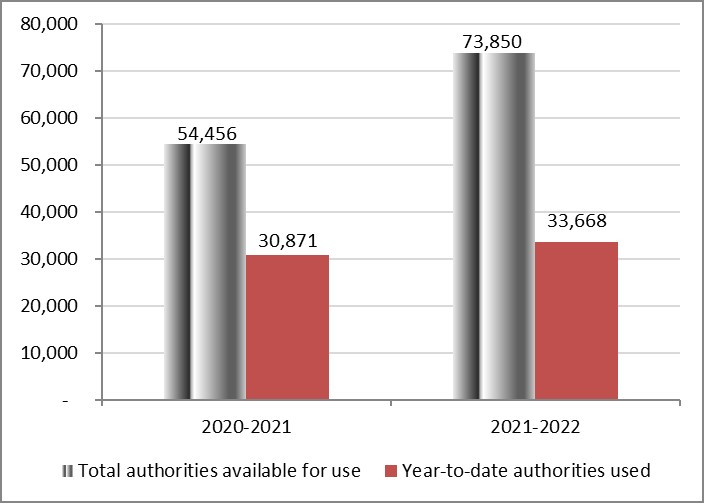

Total authorities available for fiscal year 2021-2022 are $73.9 million compared to $54.5 million as of September 30, 2020. The increase of $19.4 million, or 35.6%, is explained by the following.

A total increase of $19.7 million in Vote 1 authorities available for use related to:

- a $17.1 million technical increase resulting from a change in the timing of approval of the interim supply in 2020-2021. Due to the COVID-19 pandemic and limited sessions in the spring of 2020 for Parliament to study supply, the Standing Orders of the House of Commons were amended to exceptionally extend the study period to the fall of 2020, resulting in the full supply for 2020-2021 being approved only in December 2020;

- a $0.9 million increase in temporary funding for the Regional Air Transportation Initiative;

- a $0.8 million increase as a result of an internal transfer from Statutory authorities to Other Operating;

- a $0.3 million increase in temporary funding for the Regional Relief and Recovery Fund to support small and medium-sized businesses;

- a $0.3 million increase in temporary funding announced in Budget 2019 for the Canada Coal Transition Initiative – Infrastructure Fund; and

- a $0.3 million increase in Operating Budget Carry Forward.

The increase is offset by a total decrease of $0.3 million in Vote 1 authorities available for use related to:

- a $0.2 million decrease in temporary funding announced in Budget 2019 related to launching a federal strategy on jobs and tourism; and

- a $0.1 million decrease in various other adjustments.

Vote 1 authorities used year-to-date have increased from $30.9 million at the end of the second quarter in 2020-2021 to $33.7 million this fiscal year. This $2.8 million increase in authorities used, or 9.1%, is mainly explained by an increase in personnel costs resulting from revised collective agreements.

Graph 1 illustrates the total authorities available for use for the year as well as the amount used year-to-date at quarter-end.

Graph 1: Comparison of Net Budgetary Authorities and Expenditures for Vote 1 as of September 30, 2020-2021 and 2021-2022.

(in thousands of dollars)

Description: Graph 1

For the year ending March 31, 2021, total authorities available for use for Vote 1 is $54,456 in thousands of dollars, while year to date authorities used for Vote 1 is $30,871 in thousands of dollars.

For the year ending March 31, 2022, total authorities available for use for Vote 1 is $73,850 in thousands of dollars, while year to date authorities used for Vote 1 is $33,668 in thousands of dollars.

Statement of Authorities: Vote 5 – Grants and Contributions

Total authorities available for use for the year ending March 31, 2022, amount to $330.0 million, an increase of $92.6 million compared to the $237.4 million available for use as of September 30, 2020. The increase of $92.6 million, or 39.0%, is explained by the following.

A total increase of $115.8 million in Vote 5 authorities available for use related to:

- a $56.0 million technical increase resulting from a change in the timing of approval of the interim supply in 2020-2021. Due to the COVID-19 pandemic and limited sessions in the spring of 2020 for Parliament to study supply, the Standing Orders of the House of Commons were amended to exceptionally extend the study period to the fall of 2020, resulting in the full supply for 2020-2021 being approved only in December 2020;

- a $30.0 million increase in temporary funding for the Regional Air Transportation Initiative;

- a $20.5 million increase related to a reprofile of funds as a result of project/ contracting delays;

- an $8.6 million increase in temporary funding announced in Budget 2019 for the Canada Coal Transition Initiative – Infrastructure Fund; and

- a $0.7 million increase in temporary funding for the Black Entrepreneurship Program.

This increase is offset by a total decrease of $23.2 million in Vote 5 authorities available for use related to:

- a $16.3 million decrease in temporary funding for the Regional Relief and Recovery Fund to support the Community Futures Network;

- a $4.5 million decrease in temporary funding announced in Budget 2019 related to launching a federal strategy on jobs and tourism;

- a $1.6 million decrease in temporary funding for the Regional Relief and Recovery Fund to support small and medium-sized businesses; and

- a $0.8 million decrease in temporary funding announced in Budget 2018 (resulting in a transfer of funds to Natural Resources Canada) related to Protecting Jobs in Eastern Canada’s Forestry Sector.

Vote 5 authorities used have increased from $108.8 million last fiscal year to $126.2 million this fiscal year. This $17.4 million increase in authorities used, or 16.0%, is mainly due to the amount of contribution payments expended with regards to COVID-19 temporary initiatives.

Graph 2 illustrates the total authorities available for use for the year as well as the amount used year-to-date at quarter-end.

Graph 2: Comparison of Net Budgetary Authorities and Expenditures for Vote 5 as of September 30, 2020-2021 and 2021-2022.

(in thousands of dollars)

Description: Graph 2

For the year ending March 31, 2021, total authorities available for use for Vote 5 is $237,377 in thousands of dollars, while year to date authorities used for Vote 5 is $108,833 in thousands of dollars.

For the year ending March 31, 2022, total authorities available for use for Vote 5 is $329,972 in thousands of dollars, while year to date authorities used for Vote 5 is $126,224 in thousands of dollars.

Statement of Authorities: Budgetary Statutory Authorities

Budgetary statutory authorities available for use for the year ending March 31, 2022, have decreased by $78.4 million, or 90.2%, to $8.5 million compared to the previous fiscal year at the same time. The decrease is mainly explained by funding received last fiscal year that provided financing support pursuant to the Public Health Events of National Concern Payments Act. These authorities were provided via statutory authorities to ACOA. This amount can be broken down as follows.

A total decrease of $78.9 million in Statutory Vote authorities available for use related to:

- a $38.1 million decrease in temporary funding for the Canadian Seafood Stabilization Fund;

- a $31.0 million decrease in temporary funding for the Regional Relief and Recovery Fund to support small and medium-sized businesses;

- a $9.0 million decrease in temporary funding for the Regional Relief and Recovery Fund to support the Community Futures Network; and

- a $0.8 million decrease as a result of an internal transfer from Statutory authorities to Other Operating.

This decrease is offset by a total increase of $0.5 million in Statutory Vote authorities available for use related to:

- a $0.2 million increase in temporary funding for the Regional Air Transportation Initiative;

- a $0.2 million increase in compensation allocations resulting from revised collective agreements; and

- a $0.1 million increase in various other adjustments.

Statutory authorities used have decreased from $48.1 million last fiscal year to $4.1 million this fiscal year. This $44.0 million decrease in authorities used, or 91.4%, is due to the contribution payments expended last fiscal year with regards to the Regional Relief and Recovery Fund and the Canadian Seafood Stabilization Fund.

Graph 3 illustrates the total authorities available for use for the year as well as the amount used year-to-date at quarter-end.

Graph 3: Comparison of Net Budgetary Authorities and Expenditures for Statutory Authorities as of September 30, 2020-2021 and 2021-2022.

(in thousands of dollars)

Description: Graph 3

For the year ending March 31, 2021, total authorities available for use for Statutory authorities is $86,892 in thousands of dollars, while year to date authorities used for Statutory authorities is $48,125 in thousands of dollars.

For the year ending March 31, 2022, total authorities available for use for Statutory authorities is $8,488 in thousands of dollars, while year to date authorities used for Statutory authorities is $4,143 in thousands of dollars.

Statement of the Agency’s Budgetary Expenditures by Standard Object

The Agency’s budgetary expenditures by Standard Object for the quarter ended September 30, 2021, were $164.0 million, which reflects a decrease of $23.8 million, or 12.7%, from the $187.8 million in overall expenditures for the quarter ended September 30, 2020. The variance by Standard Object relates mainly to transfer payments. The variance is explained in the Statement of Authorities: Vote 5 – Grants and Contributions and in the Statement of Authorities: Budgetary Statutory Authorities.

Risks and Uncertainties

ACOA conducts an annual risk assessment process to update its overarching corporate risk profile. The key corporate risks being used for 2021-2022 were established prior to the COVID-19 pandemic. Despite this, it is plausible that the eventual review of internal corporate risks may have an impact on certain operational aspects of the Agency, while not necessarily having a direct impact on financial reporting, as ACOA manages financial risks through a set of appropriate mitigation measures. The financial risks are mitigated in large part by the implementation of strong internal controls over financial reporting. These include the periodic assessment of entity-level controls, general computer controls and controls in ACOA’s key business processes such as payments on grants and contributions, regular operating expenses and accounts receivable.

Furthermore, ACOA manages its budgetary and allocation processes through a well-defined framework supported by a series of automated financial controls. Periodic forecasts are required and analyses are done regularly to ensure that funds are properly managed.

Significant changes in relation to operations, personnel and programs

In March 2020, the World Health Organization declared a global pandemic following the outbreak of a novel strain of the coronavirus (COVID-19). For the protection of personnel and that of communities right across the country, efforts were made to take all public health precautions to prevent the spread of COVID-19. As a result, the following significant changes occurred in relation to operations, personnel and programs during the 2020-2021 fiscal year and remained in effect for the second quarter of 2021-2022:

- In line with the Government of Canada’s Chief Human Resources Officer’s recommendation, and to ensure the Agency was adhering to federal and provincial public safety requirements, employees were asked to work from home as of March 16, 2020.

- While offices remained open, most employees worked from home whenever and wherever possible to comply with the health measures for physical distancing to keep employees and Canadians safe.

- International travel was banned, and all but essential domestic travel was deferred. As such, the Agency encouraged the use of technology (e.g. virtual meeting applications) to replace in-person meetings with clients and other stakeholders, and as a means of communication within and among teams at ACOA.

During the first quarter of 2021-2022, the Deputy Prime Minister and Minister of Finance delivered Budget 2021: A Recovery Plan for Jobs, Growth and Resilience. This budget is the Government of Canada’s roadmap to finishing the fight against COVID-19. The budget contains many regional development agency-led measures that will help grow the Canadian economy. ACOA has started to deliver on these initiatives and is helping Atlantic Canada’s businesses and communities get through the pandemic. ACOA is also preparing to take on a convener and pathfinding role to ensure businesses, business-support organizations and communities across the Atlantic region get their share of the significant budget measures delivered by other organizations.

Approval by Senior Officials

Approved by:

Daryell Nowlan

Acting Deputy Head

Moncton, Canada

Date: November 8, 2021

Stéphane Lagacé, CPA-CMA

Chief Financial Officer

Moncton, Canada

Date: November 5, 2021

| Authorities | Total available for use for the year ending March 31, 2022* |

Used during the quarter ended September 30, 2021 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Net operating expenditures | 73,850 | 17,089 | 33,668 |

| Vote 5 – Grants and contributions | 329,972 | 71,427 | 126,224 |

| Budgetary statutory authorities | 8,488 | 2,071 | 4,143 |

| Total authorities | 412,310 | 90,587 | 164,035 |

| Authorities | Total available for use for the year ending March 31, 2021* |

Used during the quarter ended September 30, 2020 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Net operating expenditures | 54,456 | 16,052 | 30,871 |

| Vote 5 – Grants and contributions | 237,377 | 56,464 | 108,833 |

| Budgetary statutory authorities | 86,892 | 26,817 | 48,125 |

| Total authorities | 378,725 | 99,333 | 187,829 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures | Planned expenditures for the year ending March 31, 2022* |

Expended during the quarter ended September 30, 2021 |

Year-to-date expended at quarter-end |

|---|---|---|---|

| Personnel | 65,067 | 17,923 | 35,179 |

| Transportation and communications | 4,250 | 53 | 74 |

| Information | 895 | 96 | 201 |

| Professional and special services | 5,146 | 786 | 1,144 |

| Rentals | 2,621 | 385 | 955 |

| Repair and maintenance | 384 | 8 | 23 |

| Utilities, materials and supplies | 661 | 25 | 43 |

| Acquisition of machinery and equipment | 1,340 | 59 | 85 |

| Transfer payments | 329,972 | 71,427 | 126,224 |

| Other subsidies and payments | 1,974 | (175) | 107 |

| Total net budgetary expenditures | 412,310 | 90,587 | 164,035 |

| Expenditures | Planned expenditures for the year ending March 31, 2021* |

Expended during the quarter ended September 30, 2020 |

Year-to-date expended at quarter-end |

|---|---|---|---|

| Personnel | 52,839 | 16,446 | 32,480 |

| Transportation and communications | 2,856 | 45 | 59 |

| Information | 510 | 69 | 173 |

| Professional and special services | 3,592 | 511 | 704 |

| Rentals | 1,672 | 443 | 1,048 |

| Repair and maintenance | 132 | 13 | 19 |

| Utilities, materials and supplies | 528 | 60 | 70 |

| Acquisition of machinery and equipment | 650 | 149 | 180 |

| Transfer payments | 315,517 | 81,124 | 152,644 |

| Other subsidies and payments | 429 | 473 | 452 |

| Total net budgetary expenditures | 378,725 | 99,333 | 187,829 |

*Includes only Authorities available for use and granted by Parliament at quarter-end.