Evaluation of the Atlantic Canada Opportunities Agency’s Tourism Programming FINAL REPORT

Evaluation Unit Evaluation and Risk Directorate Atlantic Canada Opportunities Agency

April 29, 2016

List of Acronyms

ACOA Atlantic Canada Opportunities Agency

ACTP Atlantic Canada Tourism Partnership

AGST ACOA Growth Strategy for Tourism

AMR Accelerated Market Readiness

BDP Business Development Program

CD Community Development

CI Community Investment

ECBC Enterprise Cape Breton Corporation

ED Enterprise Development

EAC evaluation advisory committee

FedNor Federal Economic Development Initiative for Northern Ontario

FTE full-time equivalent

G&Cs grants and contributions

GDP gross domestic product

GMIST Gros Morne Institute for Sustainable Tourism

ICF Innovative Communities Fund

O&M operations and maintenance

PAC Policy, Advocacy and Coordination

PG Productivity and Growth Sub-program

RDAs regional development agencies

SMEs small and medium-sized enterprises

STEP Strategic Tourism Expansion Program

TIAPEI Tourism Industry Association of Prince Edward Island

VISIT Vision in Steering Intelligent Tourism

Table of Contents

2.0 Evaluation Design and Methodology

3.0 Tourism Programming Profile

3.1 ACOA’s Tourism-Related Expenditure Profile

4.1 Continued Need for Programming

4.2 Alignment with Federal Roles, Responsibilities and Priorities

4.3 Extent of Overlap, Duplication and Complementarity

5.0 Performance – Effectiveness, Efficiency and Economy

5.1 Extent to Which the AGST Was Implemented

5.3 Achievement of Expected Results

Objective 1 – Provide leadership in research excellence and product mobilization

Objective 2 – Heighten ACOA’s policy, advocacy and coordination role and effectiveness

Objective 3 – Stimulate Focused Investment in the Tourism Sector

Objective 4 – Provide Effective Education, Communication and Awareness Concerning the Tourism Sector

Objective 6 – Effectively Measure ACOA’s Strategic Actions

5.4 Tourism-Related Outcomes Noted in Other ACOA Evaluation Studies

Appendix A – Evaluation Questions, Judgment Criteria and Methods

Appendix C – Complementary Tourism Sector Programming

List of Figures

Figure 1: ACOA Growth Strategy for Tourism Proactive Tools and Solutions

List of Tables

Table 1: ACOA’s Growth Strategy for Tourism Logic Model

Table 3: Alignment of Findings and Conclusions

Acknowledgements

This evaluation was undertaken to provide the Atlantic Canada Opportunities Agency management with systematic, neutral evidence on the relevance and performance of tourism-related programming, including the Growth Strategy for Tourism. It is expected that the results of this study will be used to support the future direction of the strategy and delivery of programming. The study was managed and completed by ACOA’s Evaluation Unit.

The evaluation team thanks the members of the evaluation advisory committee for their advice and support throughout the study. Their contributions helped to ensure the relevance and usefulness of the evaluation. Very special thanks go to external expert members of the committee: Houda Boutaicha, Evaluation Analyst, Community Economic Development for the Region of Quebec; and Dr. Laurel Reid, Adjunct Professor at the University of New Brunswick. Internal members of the committee included: Rob McCloskey, Director General, Atlantic Tourism; Kent MacDonald, Director, Tourism Atlantic; Daniel Scholten, Director, Enterprise Development (N.B.); Joanne Smyth, Economic Development Manager (N.L.); Janine Fraser, Director, Community Development (N.S.), Tom Plumridge, Director Community Development (C.B.); Michael Dillon, Director, Enterprise Development (P.E.I.); and Bill Grandy, Director General, International Business Development (H.O.). The evaluation team acknowledges the important contributions of Dave Bryanton of Tourism Atlantic for ongoing information and support.

We are also grateful to the external key informants as well as the many ACOA employees, including the tourism evaluation working group members and staff from the Evaluation Unit, who provided their time and knowledge in support of this study.

Christa Gillis A/Director, Evaluation and Risk Directorate Atlantic Canada Opportunities Agency

Executive Summary

This report presents the findings, conclusions and recommendations of the evaluation of the Atlantic Canada Opportunities Agency’s (ACOA) tourism-related programming. The evaluation examined the relevance and performance of the programming, with an emphasis on the implementation of the ACOA Growth Strategy for Tourism (AGST) from 2009-2010 to 2013-2014. The recommendations and conclusions are meant to support decision making related to the expected update of the AGST in 2016-2017.

The evaluation was conducted between June 2015 and March 2016. The methodological approach was calibrated to align with senior management information needs. The study included a synthesis of existing information, six group discussions encompassing 20 participants, and 15 interviews with external key informants.

Findings and Conclusions

Relevance

There is a demonstrable need for ACOA’s research, planning and investment in tourism activities. Various factors continue to challenge small and medium-sized enterprises, communities and other not-for-profit organizations that operate in the tourism sector. Tourism Atlantic developed a suite of proactive tools and solutions that were designed to address these challenges and enhance the Atlantic region’s tourism competitiveness.

The goals of the tourism strategy are aligned with ACOA’s strategic outcome and the ACOA Act, and are consistent with the Agency’s mandate and broader federal priorities. In general, the Agency’s programming complements rather than duplicates that of other organizations. ACOA distinguishes its tourism initiatives from the programming offered by other stakeholders through the type and nature of funding supports made available and through its decentralized delivery model.

Performance

Tourism-related activities are delivered by all parts of the Agency, with Tourism Atlantic acting as the corporate secretariat for tourism and providing direction for the implementation of the AGST. Key informants said that Tourism Atlantic has strong tourism expertise and knowledge, and is responsive to internal, provincial, industry and national stakeholder requests for support and information. Opportunities exist to enhance efforts to proactively promote, share and make readily available research and programming information with partners and stakeholders to increase their capacity to strategically invest in tourism activities.

Evidence suggests that ACOA’s tourism programming was adapted according to regional needs and opportunities. The degree of flexibility to deliver ACOA programming in their respective regions is regarded as a strength of ACOA programming. Moving forward, it will be important to consider how to best capitalize on flexibilities while promoting continued strategic alignment across sub-programs and regions as well as with provincial governments and among Canada’s federal regional development agencies.

The AGST provides important direction and tools to advance the competitiveness of Atlantic Canada’s Tourism economy. The Vision in Steering Intelligent Tourism (VISIT) training, proactive assessment tools and solutions were developed and delivered as stipulated in the AGST to assist ACOA staff and the tourism industry to identify, plan and develop transformative products and experiences. The training and programming information provided to clients and stakeholders were positively received and participants reported that the material was directly relevant to their organizations. Given changes in the Atlantic Canadian context since the inception of the strategy, there are opportunities to update the strategy, its tools and training materials to continue to meet the specific regional needs of the tourism industry.

Tourism Atlantic contributes to policy, advocacy and coordination for the sector. It advocates on behalf of the Atlantic Canadian tourism industry at a national level to increase the profile and create opportunities for the sector. Tourism Atlantic has collaborated with over 15 federal departments on key tourism activities to support the sector. With current federal and provincial government interests in the tourism sector, coupled with fiscal restraints and changes to global tourism trends, opportunities exist to continue to engage with all partners and stakeholders and share its best practices and expertise to ensure a cohesive and integrated approach to tourism in Atlantic Canada.

Tourism Atlantic has assisted provincial governments and industry associations to market their transformative products and services by supporting pan-Atlantic marketing projects that benefit specific segments of the tourism sector. The Atlantic Canada Agreement on Tourism in support of the Atlantic Canada Tourism Partnership (ACTP) has been a successful marketing partnership, generating revenues, high return on investments and marketing efficiencies. Federal and provincial partners view Tourism Atlantic’s programming, notably the ACTP, as a best practice model.

Tourism Atlantic undertook measures to collect and monitor performance information over the five-year scope of this evaluation. With the renewal of the AGST, it will be important to update the performance measurement strategy, framework and data collection tools to support sound planning, decision making and reporting of outcomes.

Recommendations

Overall, the evaluation’s recommendations are aimed at renewing the Agency’s tourism strategy, ensuring strong coordination and communication within and outside of the Agency in the achievement of expected results, and improving the availability of and access to information and knowledge to enhance results management.

Recommendation 1: In collaboration with internal and external stakeholders, ACOA’s Tourism Atlantic should review and update the ACOA Growth Strategy for Tourism. It should ensure that the Agency’s policies and programming support the growth, expansion and modernization of the tourism industry by drawing upon its corporate knowledge, expertise, lessons learned and best practices to:

- outline the Agency’s strategic approach to tourism programming, including the types of activities and initiatives that will be supported;

- review and update existing programming tools, training and the VISIT website;

- allow for regional variability and flexibility as needed while promoting alignment across sub-programs and regions;

- further strengthen internal engagement, coordination and communication by leveraging the use of existing senior-level committees such as the Director General Operations Committee, the Director General PAC Committee, and other existing groups such as the Strategic Tourism Actions Committee to support strategic planning and decision making; and

- include a knowledge transfer and communication plan to regularly and proactively share information on the updated strategy, its tools and programming, research, lessons learned and best practices internally, across sub-programs and regions, as well as externally with partners and stakeholders.

Recommendation 2: Considering the changing context within the federal and provincial governments, ACOA’s Tourism Atlantic should capitalize on its strong knowledge, expertise and relationships to serve a convening role within Atlantic Canada and across federal departments toward an integrated approach to tourism.

The Agency should continue to work closely with other federal and provincial governments, non-governmental organizations and tourism industry representatives to ensure strong coordination and communication. To promote a federal whole-of-government approach to the sector, it is timely for ACOA to continue to engage with the Department of Innovation, Science and Economic Development and with the other regional economic development agencies.

Recommendation 3: Tourism Atlantic collects information to support results-based management and made improvements to performance measurement, including the introduction of a corporate dashboard and consistent ACTP reporting. ACOA should build on its previous efforts to improve the tourism performance measurement strategy by reviewing and updating the program’s indicators and expected outcomes, and revising tools and processes.

With the current review of the ED Sub-program performance measurement strategies and the development of an International Business Development strategy and a Productivity and Growth framework, ACOA should ensure that there is clear articulation of any common tourism indicators and expected outcomes.

1.0 Introduction

This report presents the findings, conclusions and recommendations of ACOA’s tourism-related programming, with a focus on the Agency’s Growth Strategy for Tourism (AGST). The evaluation assessed the extent to which the AGST was implemented, as well as its relevance and performance in accordance with the Agency’s approved evaluation plan. The scope of the evaluation included projects approved from fiscal year 2009-2010 to fiscal 2013-2014, funded through the Business Development Program and the Innovative Communities Fund.

ACOA supports the competitiveness of the tourism sector of Atlantic Canada both at a pan-Atlantic level, through Tourism Atlantic, and at a provincial level through its regional offices. Tourism Atlantic is responsible for implementing the AGST, a pan-Atlantic strategy that aims to grow the tourism sector by supporting research-driven, transformative products and experiences in partnership with stakeholders, including business and other levels of government. ACOA, through Tourism Atlantic, supports the Atlantic Canada Tourism Partnership (ACTP), a strategic international tourism marketing collaboration with industry, the provincial governments and other stakeholders to promote the region.

In total, ACOA approved $181.2 million for 903 tourism-related projects during the period of this evaluation. Of that total, 235 projects directly supported the AGST, representing $67.7 million in approved ACOA assistance, or approximately 35% of total ACOA investments for tourism activities.

This evaluation report contains seven sections. Following the evaluation overview, Section 3 of the evaluation report provides a programming profile. Sections 4 and 5 present the findings, organized by broad evaluation questions (relevance and performance, presented by strategy objectives). The recommendations resulting from the study are outlined in Section 6. The management action plan, which contains ACOA’s response to and planned actions for each of the recommendations, can be found in Section 7.

2.0 Evaluation Design and Methodology

This evaluation was conducted between June 2015 and January 2016. ACOA’s Evaluation Unit planned and conducted the evaluation with the assistance and guidance of an evaluation advisory committee (EAC) composed of regional representatives from ACOA management, as well as two external stakeholders with specialized knowledge in the tourism sector and evaluation. A working group formed of account managers from each region supported the evaluation team by providing and validating information. The EAC and working group helped ensure clear understanding of the programming and supported the interpretation of findings.

A risk-based and calibrated approach was adopted to align with ACOA’s information needs regarding its tourism-related activities, with emphasis on the AGST. Consultations with Tourism Atlantic were conducted as part of the planning phase to assist in identifying programming assumptions and factors that affected the implementation of the strategy. Guidance was also provided by EAC members who reviewed the terms of reference, provided support in the development of the evaluation approach and validated findings. Appendix A details the evaluation questions and methodological approach, as well as the risks and mitigation strategies.

3.0 Tourism Programming Profile

Tourism has long been important to the economy of Atlantic Canada. Building upon the region’s unique natural resources, the sector helps to create jobs and wealth for Atlantic Canadians. ACOA plans and delivers programming aimed at growing the competitiveness of the sector at both the provincial level – through its regional offices – as well as at the pan-Atlantic level – through Tourism Atlantic.

In keeping with the Agency’s decentralized delivery model, ACOA’s regional offices are located in each of the four Atlantic provinces and fall under the direction of regional vice-presidents. Regional ACOA staff work directly with small and medium-sized enterprises (SMEs), communities, provinces and other levels of government to support the specific needs and opportunities of their local tourism industry. The regional offices implement programming that supports the AGST as well as other tourism-related activities not directly linked to its objectives (e.g. support for recreational and community centres that host small-scale, local events and festivals that are not meant to draw national or international visitors to the region).

Under the leadership of ACOA’s Vice-President, Prince Edward Island and Tourism, Tourism Atlantic acts as the Agency’s corporate secretariat for the delivery of tourism programming. Working on a pan-Atlantic level in collaboration with the regional offices, Tourism Atlantic led the development of the AGST in 2009 and its implementation beginning in 2010-11. In addition to the AGST, Tourism Atlantic funds the ACTP, a collaboration between the federal government, the Provinces and industry to plan and implement strategic pan-Atlantic international tourism marketing.

The ACOA Growth Strategy for Tourism

The AGST was designed to engage stakeholders in the collaborative advancement of Atlantic Canada’s tourism economy through a common agenda. The vision of the AGST is to “create a vibrant and growing sector that contributes significantly and reliably to the economic prosperity of Atlantic Canadians.”[i] Grounded in research and in partnership with entrepreneurs, businesses, organizations, provincial governments and other federal departments, the strategy focuses on tourism capacity building, product development and marketing initiatives for the Atlantic region. The AGST is guided by the research-product-marketing continuum, meaning that strong research is used to develop strategic tourism products prior to the implementation of marketing tools.

The AGST has six objectives:

- Provide leadership in research excellence and product mobilization.

- Heighten ACOA’s tourism policy, advocacy and coordination role and effectiveness.

- Stimulate focused investment in the tourism sector.

- Provide effective education, communication and awareness of the tourism sector.

- Assist provincial and industry partners to effectively market their transformative tourism products.

- Effectively measure and hold accountable ACOA’s strategic actions in tourism.

The AGST logic model (Table 1) provides an overview of the strategy’s principle activities and reach as well as its expected outputs and outcomes.

Table 1: ACOA’s Growth Strategy for Tourism Logic Model

Component |

Horizontal Tourism Initiative |

|

|---|---|---|

Activities |

Tourism capacity building |

|

Outputs |

SME outreach sessions and workshops |

|

Reach |

Clients: non-commercial organizations, local governments, SMEs |

|

Immediate Outcomes |

SMEs have access to accurate, timely and relevant tourism information |

|

Intermediate Outcomes |

Improved quality of tourism products/ services based on market demand and expectations | Strategic infrastructure, product development and marketing investments based on primary visitation motivators |

Economic Development Outcome |

Improved growth and competitiveness of Atlantic Canadian SMEs |

|

Community Development Outcome |

Dynamic and sustainable communities for Atlantic Canada |

|

ACOA Strategic Outcome |

A competitive Atlantic Canadian economy |

|

Source: Adapted from ACOA’s Performance Measurement Strategy, June 2010.

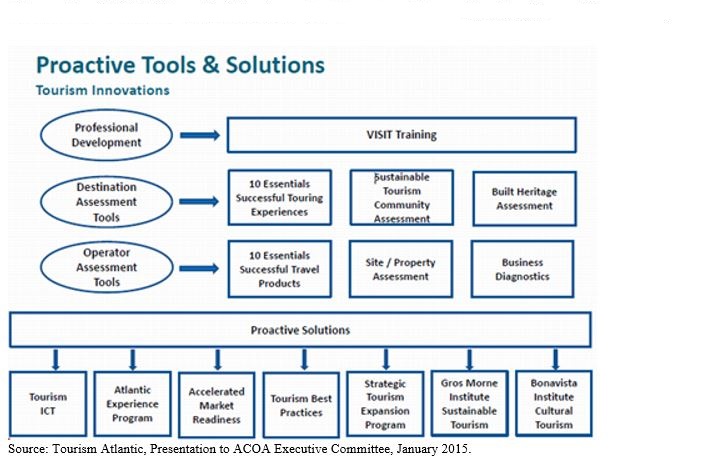

Tourism Atlantic developed 14 proactive tools and solutions to meet the objectives of the AGST and guide ACOA’s pan-Atlantic programming (Figure 1). The tools focus on capacity building, experiential product development and strategic marketing. They are the VISIT training program, focusing on professional development, three destination assessment tools, and three operator assessment tools. Seven specific programs, referred to as proactive solutions, were designed to mitigate issues commonly identified through the assessments.

Figure 1: ACOA Growth Strategy for Tourism Proactive Tools and Solutions

Source: Tourism Atlantic, Presentation to ACOA Executive Committee, January 2015.

VISIT training aims to increase the knowledge of ACOA economic development officers, managers and senior management as well as federal, provincial and industry partners. It provides information on all the tools and solutions included in the AGST and aims to facilitate a more proactive approach in supporting the tourism sector and advancing high potential projects.

The three destination assessment tools were developed to help communities better assess their products and services. The tools measure the overall quality of visitor experience and the level of readiness and potential of a community to undertake sustainable tourism development. They assist in identifying landmark sites and buildings that could be enhanced to attract visitors.

The three operator assessment tools enable tourism operators to undertake a critical assessment of their product, property or business, either independently or with tourism partners. The tools help to identify strengths and weaknesses and gauge market readiness and attractiveness. They consider current market research and visitor survey information.

The seven proactive solutions, designed to address key tourism sector issues that may be identified through the destination and operator assessment tools, are as follows:

1) Tourism ICT (TourismTechnology.com)

Established in 2000, TourismTechnology.com is a strategic partnership with ACOA, three provincial tourism departments and three industry associations from New Brunswick, Newfoundland and Labrador, and Prince Edward Island. Its aim is to help tourism operators better use technology for sales and promotion. Through workshops and one-on-one mentoring, it assists operators in creating and maintaining an online presence (e.g. websites, social media, mobile devices).

2) Your Atlantic Experience Program

The Your Atlantic Experience program helps operators better understand visitors’ needs and expectations. The program, customized for different tourism segments, including golf, cruises and events, allows visitors to Atlantic Canada to provide feedback to operators on their vacation experience. The information helps operators focus on the key drivers of loyalty and deliver quality customer experiences for visitors to Atlantic Canada.

3) Accelerated Market Readiness

The Accelerated Market Readiness (AMR) program is delivered in partnership with ACOA, the four Atlantic Provinces and the four Atlantic tourism industry associations. It features tourism market-readiness clinics that are provided through certified suppliers, as well as online business reviews, a mentoring clinic and an optional mystery shopper report. Ultimately, the AMR helps operators to improve their standards of excellence, respond to emerging market trends and take action to increase revenues.

4) Tourism Best Practice Missions

The tourism best practice program was developed in 2000 and designed to expose private-sector operators and communities to successful tourism entrepreneurs and products with the aim of stimulating new product ideas, better customer service, innovative operational techniques, and sound planning models and partnership opportunities for the Atlantic tourism sector.

5) Strategic Tourism Expansion Program

The Strategic Tourism Expansion Program (STEP) was first implemented in 2012 to help communities address gaps between strategic planning and experiential product development. STEP builds on the existing strengths and unique assets of communities and guides them through a strategic process of building and executing a sustainable tourism action plan.

6) Gros Morne Institute for Sustainable Tourism

The Gros Morne Institute for Sustainable Tourism (GMIST) is situated on Newfoundland and Labrador’s west coast. It was established in 2003 to advance quality tourism experiences by providing training in sustainable tourism practices, experiential tourism and eco-adventure tourism capabilities. Examples of the Institute’s programs include Edge of the Wedge, Beacons for Effective Sustainable Tourism and Partnering and Packaging.

7) Bonavista Institute for Sustainable Tourism

The Bonavista Institute for Sustainable Tourism, founded in 2008 and located within the College of the North Atlantic’s Bonavista Campus in Newfoundland and Labrador, is a professional development centre for the cultural tourism sector in Atlantic Canada. The institute assists tourism operators and cultural organizations to develop and deliver cultural and heritage experiences for visitors. It works in partnership with ACOA, the College of the North Atlantic and the Government of Newfoundland and Labrador.

Atlantic Canada Tourism Partnership

The ACTP is a pan-Atlantic partnership that promotes Atlantic Canada as a leading vacation destination in key American and European markets. Established in 1991, the ACTP enables the government of Canada, the four Atlantic provinces and the tourism industry to pool resources and penetrate markets that are largely inaccessible to them individually. It focuses on increasing capacity, experiential product development and strategic marketing to support an integrated, research-driven approach to consumer, trade and media relations campaigns for attracting visitors to Atlantic Canada.

The nine-member partnership includes ACOA, the four provincial tourism industry associations and the provincial government departments responsible for tourism. Since its inception in 1994, the ACTP has been continually renewed for three-year terms, with the most recent agreement signed in April 2015. Tourism Atlantic provides funding to the ACTP through the Tourism Industry Association of Prince Edward Island.[ii]

3.1 ACOA’s Tourism-Related Expenditure Profile

Overall, ACOA expended approximately $1.8 billion from 2009-2010 to 2013-2014, including grants and contributions (G&Cs) and operations and maintenance (O&M).[iii] Agency spending declined over the five-year period, partly due to the sunsetting of some programs and cross-government spending reviews that resulted in the implementation of cost efficiencies as well as improvements to the effectiveness of operations and programs.[iv] A similar decreasing trend in spending occurred for tourism-related programming (see Appendix B for tourism-related spending).

The G&C, salary and O&M expenditures directly delivered by Tourism Atlantic were analyzed using ACOA’s financial management system.[v] From 2009-2010 to 2013-2014, Tourism Atlantic expended $25.8 million in G&C expenditures; $16.6 million toward the ACTP and $9.2 million for other pan-Atlantic projects.

Salary expenditures represented $3.6 million in Tourism Atlantic spending over this period. There was a decreasing trend in human resources, from nine full-time equivalent (FTE) positions in 2009-2010 to 6.5 FTEs in 2013-2014.[vi] Tourism Atlantic had $1 million in O&M expenditures over the five years, with the majority of expenditures (69%) allocated to professional services and travel.

4.0 Relevance

The results of this evaluation demonstrate that there continues to be a need for ACOA’s research, planning and investments in the tourism sector. The goals of the AGST are aligned with ACOA’s strategic outcome and the ACOA Act, and they are consistent with the Agency’s roles and responsibilities and with broader federal priorities. Moving forward, it will be important to build on the progress achieved in recent years in order to respond to new and unique challenges and opportunities faced by the Atlantic Canadian tourism industry.

4.1 Continued Need for Programming

There is a continued need for ACOA to have dedicated programming aimed at enhancing the competitiveness of the tourism sector. The AGST is relevant and is needed to help plan and develop strategic tourism activities in the region.

Tourism Is an Important Sector to the Economy

Across Canada, tourism plays a significant role in the economy. In 2010, tourism was responsible for $73.4 billion in revenues and 594,500 jobs – as much as the combined gross domestic product (GDP) of the agricultural, forestry and fishing sectors[vii] Tourism revenues from international visitors increased to $88.5 billion in 2014, generated 627,600 jobs and sustained more than 170,000 tourism businesses.

Similar to national figures, revenues from tourism in Atlantic Canada have grown over time.[viii] In 2011, the Atlantic Canadian provinces generated $1.6 billion in gross domestic product and 39,728 jobs.[ix] In 2012, jobs in tourism industries accounted for 9.6% of all jobs in Prince Edward Island, 8.8% of jobs in Nova Scotia, 8% in Newfoundland and Labrador, and 7.6% in New Brunswick.[x] Tourism revenues increased to $4.7 billion in 2014, of which 15.2%, or $712 million, was derived from international markets, and comprised 4.2% of GDP in Atlantic Canada.

Tourism directly supported 9,596 Atlantic Canadian businesses and provided FTE jobs for 56,883 Atlantic Canadians.[xi] It is expected that the number of such jobs will continue to grow, and that there will be increasing shortages of workers to fill them over the next 15 years.[xii]The problem of labour shortages is likely to be exacerbated by the fact that many tourism-related jobs are seasonal, are generally in remote areas, are more likely to be part-time, and can be poorly paid.

Most tourism businesses are small and medium-sized.[xiii] Tourism drives key service industries such as accommodations, food and beverages, passenger transportation, recreation, entertainment and travel services and represents two percent of the national GDP. Tourism businesses are more likely to be owned by women, immigrants and people who are visible minorities.[xiv]

Many Factors Influence the Tourism Sector

While Canada’s popularity as a tourism destination is strong, it may be slipping, affected by a number of dynamic factors, including geopolitical and economic conditions, increased globalization of tourism and changing consumer travel behaviours and interests.[xv] Canada was ranked 9th among 133 countries in 2009-2010 by the World Economic Forum study in terms of competitiveness as a tourism destination for international travellers.[xvi] Canada’s ranking has since slipped to 15th place among 144 countries in 2014-2015.[xvii] According to the World Trade Organization, Canada stood at 17th position in 2014 for hosting international visitors.[xviii]

The 2008-2009 recession was the most challenging factor that influenced the economy, including the tourism sector in the Atlantic region. Since the recession, the Maritime economies have not fully recuperated, though Newfoundland and Labrador experienced record employment levels and strong growth up to the end of 2014 due to the success of its oil and gas industries.[xix] However, all four Atlantic provinces continued to have the highest unemployment rates in the country. They continue to face issues related to outmigration and the fastest aging population rate in the country, predicted to cause future labour shortages that could impede economic growth and development."[xx] The decline of traditional industries affects employment, particularly in rural areas of the Atlantic region.[xxi]

In spite of the global recession, the travel and tourism sector around the world continues to grow and is supported by more accessible air travel and higher income levels in some developing countries.[xxii] A number of factors make Canada attractive to visitors, including its natural beauty and the global perception that it has a safe and strong business environment. However, price, increased competition and visa requirements have impeded visitation. Recent changes to visa requirements, however, have mitigated some of the barriers experienced by potential visitors.

Prices in Canada are comparatively high for many global visitors. As the number of possible destinations grows worldwide, Canada’s relative share of international arrivals and of tourism revenues have decreased, even though the actual amount of tourism revenues has been increasing.[xxiii] Comparing trends in exchange rates with changes in the number of international visitors shows that the exchange rate has an impact on the decisions of many international visitors and potential visitors to Canada, particularly those from the United States and the United Kingdom.[xxiv] Increasing gas costs over the period of the evaluation, up until late 2014, negatively affected the cost of air transportation.[xxv]

ACOA Adapted Tourism Programming Based on Changing Factors

Through the development and ongoing implementation of the AGST and other interventions, ACOA and Tourism Atlantic provide programming that addresses key challenges and enhances the Atlantic region’s tourism competitiveness. The programming aims to help SMEs, communities and other non-profit organizations with tourism research, planning and development supports that lead to improved tourism products and services. It supports marketing of the Atlantic region as a tourism destination in international markets.

ACOA plays an important role in funding tourism initiatives that other lenders may consider to be higher risk and may be more reluctant to support.[xxvi] Issues related to risk are the main reasons credit providers hesitate to lend to SMEs in accommodations and food services. Across sectors, access to financing is one of the most critical factors for the growth of communities and SMEs.[xxvii] According to an Industry Canada study, tourism SMEs’ main source of financial investments come from personal financing and credit from financial institutions such as domestic chartered banks and leases. However, they experience more difficulty in obtaining financial support from domestic chartered banks than other SMEs.[xxviii]

Since the implementation of the AGST, Tourism Atlantic has taken measures to remain aware of changing economic development needs and opportunities. It monitored economic and tourism data from Statistics Canada, industry associations and provincial tourism departments. Tourism Atlantic also monitored and evaluated its programming, including risks, which resulted in the implementation of programming changes to improve results. For example, changes were made to the ACTP’s market focus.[xxix] STEP’s curriculum was updated to reflect feedback from community surveys and consultant input, and TourismTechnology.com was updated to put more emphasis on social media tools. To increase the impacts within the tourism industry, Tourism Atlantic adjusted its client focus in 2012 from serving not-for-profit and SME participants to focusing on SMEs with the best practice missions and the GMIST.

4.2 Alignment with Federal Roles, Responsibilities and Priorities

By investing in initiatives that support communities and SMEs, ACOA’s tourism activities contribute to the Agency’s strategic outcome of “a competitive Atlantic Canadian economy” and its mandate to “increase opportunities for economic development in Atlantic Canada and, more particularly, enhance the growth of earned incomes and employment opportunities in that region.”[xxx] Other federal regional development agencies (RDAs) have similar mandates and tourism programming, including support for acquiring equipment and infrastructure, conducting research, marketing and promotion, and implementing business innovations and improvements.

The goal of the AGST is to “enact an integrated pan-Atlantic strategy that helps to grow tourism’s already extraordinary contribution to the GDP of Atlantic Canada,” with a vision that “tourism will be a vibrant, growing sector contributing significantly and reliably to the economic prosperity of Atlantic Canadians.”[xxxi] The AGST objectives directly support the achievement of ACOA’s Community Development (CD) program goal “to foster dynamic and sustainable Atlantic communities” as well as Enterprise Development’s (ED) program goal “to improve growth and competitiveness of Atlantic Canadian SMEs.”[xxxii]

ACOA’s tourism programming is aligned with federal government priorities. The 2009 Government of Canada speech from the throne highlighted support for the tourism sector. The focus on the tourism industry was reinforced with the launch of the Federal Tourism Strategy in 2011.[xxxiii] The AGST aligns with three of the four Federal Tourism Strategy objectives: increasing awareness of Canada as a premier tourist destination; encouraging product development and investments in Canadian tourism assets and products; and fostering an adequate supply of skills and labour to enhance visitor experiences through quality service and hospitality.[xxxiv]

The focus on the tourism industry continued in the 2013 speech from the throne, in which the Government of Canada stated that it would continue to work with industry partners to promote Canada as a top destination for tourism. With the introduction of a new government in 2015, all regional development agencies, including ACOA, now report to the Minister of Innovation, Science and Economic Development (ISED). Under the ISED portfolio, the Government also created the Ministry of Small Business and Tourism with a mandate to help SMEs grow through trade, innovation and the promotion of increased tourism to Canada.[xxxv] The Government of Canada plans to continue to engage with partners to strengthen the Canadian brand for tourism and to ensure alignment with complementary programs.

4.3 Extent of Overlap, Duplication and Complementarity

ACOA’s tourism-related programming complements rather than duplicates that of other organizations. Provincial governments and other federal departments have roles and programming that support the tourism sector. However, the type and nature of funding supports made available, its Atlantic-wide program scope, and its decentralized delivery model distinguish ACOA’s tourism programming. See Appendix C for more information on the tourism programming offered by other organizations.

ACOA’s programming allows financial supports to higher-risk projects and more flexible terms of repayment compared to other organizations. In particular, commercial lenders offer repayable loans and have higher interest rates. Provincial governments and some other federal government departments provide funding and other supports to the tourism sector but do not offer the same types or levels of funding for tourism-related capacity building, marketing or infrastructure projects. Eligible costs and priority areas differ for each provincial department.

Unlike other organizations, the Agency’s Atlantic Canadian focus allows it to respond to regional needs and opportunities, taking advantage of synergies among the Atlantic provinces. However, through its decentralized model, with offices situated across the four Atlantic Canadian provinces serving SMEs, communities and not-for-profit organizations in both rural and urban areas, ACOA has a far-reaching scope and develops relationships with a broad range of local stakeholders.

4.4 Relevance Conclusions

Based on the relevance findings of ACOA’s tourism-related programming, the following conclusions, including opportunities for improvement, were identified:

- Tourism activities are an integral part of regional development and play a significant role in Atlantic Canada’s economy. There is a demonstrable need for ACOA’s research, planning and investment in tourism activities as various factors continue to challenge SMEs, communities and not-for-profit organizations that operate in the tourism sector.

- Tourism Atlantic developed a suite of tools and proactive solutions that were designed to address these challenges and enhance the Atlantic region’s tourism competitiveness. ACOA has made adjustments to its programming over time in response to changes in the environment. Opportunities exist to review and implement further program improvements to continue to meet clients’ evolving needs, including adaptations to reflect changes in the tourism and regional context since the inception of the AGST.

- The goals of the AGST are aligned with ACOA’s strategic outcome and the ACOA Act, and are consistent with the Agency’s roles and responsibilities and broader federal priorities.

- The Agency’s programming complements rather than duplicates that of other organizations. The AGST programming is both complementary to that of other organizations and unique in Atlantic Canada. It distinguishes itself through the type and nature of funding supports made available, the Atlantic-wide scope of its program and its decentralized delivery model.

- With all the RDAs reporting under the ISED portfolio, it is important for ACOA to continue to engage with key stakeholders and partners to coordinate and share best practices.

5.0 Performance – Effectiveness, Efficiency and Economy

Overall, Tourism Atlantic implemented the AGST as planned. Tourism Atlantic plays an important policy, advocacy and coordination role in both Atlantic Canada and at the national level. ACOA staff, clients and stakeholders reported that the strategy, its tools and training were useful to the development of tourism projects.

ACOA provided significant support to the tourism industry over the time frame of this evaluation and influenced partners and stakeholder to mobilize investments in the development of strategic tourism activities. The Agency’s tourism programming resulted in increased awareness by clients, partners and stakeholders of tourism opportunities as well as the increased capacity of tourism operators, communities and not-for-profit organizations to develop transformative and experiential products and services.

Tourism Atlantic contributed to pan-Atlantic tourism marketing efficiencies and there were high returns on tourism investments and strong tourism export revenues. Given the changing context within the tourism sector and with federal and provincial governments, there are opportunities to update the AGST to continue to meet clients’ regional and industry needs. ACOA should capitalize on programming flexibilities, lessons learned and best practices while promoting continued strategic alignment across regions and with the RDAs.

5.1 Extent to Which the AGST Was Implemented

From 2009-2010 to 2013-2014, ACOA approved $181 million for 903 tourism-related projects.[xxxvi] Of this, $67.7 million was approved for 235 projects that supported the AGST. Most of the projects were non-commercial, particularly those coded to the AGST. The numbers of projects identified as supporting the AGST and/or flagged as relating to tourism in general are likely underestimated due to coding issues associated with ACOA’s project management system, QAccess.

In considering the 235 AGST projects only, nearly all (91%) were approved through ACOA’s Community Development program, with 9% approved through the ED program. Ninety six per cent of the projects were non-commercial in nature, representing $65.2 million in approved ACOA assistance, while commercial projects represented only 4% ($2.5 million). The Business Development Program (BDP) was the main transfer payment program used to support AGST projects (65% of total assistance), with the remaining 35% coming from the Innovative Communities Fund.

ACOA provided support toward a variety of tourism-related activities over the period. Though marketing was the most commonly used code according to the project management system (54% of total AGST approved assistance), as many as half of these projects were for tourism product development.[xxxvii] Infrastructure and equipment projects, which included expansion and modernization activities, represented approximately 34% of total AGST approved assistance. The remaining 12% of projects were related to planning and studies, capacity building, counselling and mentoring, and training, promotion and awareness.[xxxviii]

The implementation of tourism-related programming was adapted to meet regional needs and opportunities, and some key informants reported that this flexibility was one of the strengths of the programming. Table 2 provides an overview of the AGST and other tourism programming approved from 2009-2010 to 2013-2014.

Of all ACOA regions, New Brunswick provided the highest amount of funding toward AGST projects (24% of total approved assistance) but had the fourth lowest number of approved projects (21 of 235). Prince Edward Island had the highest number of AGST projects approved (112 of 235) and provided the second highest amount of funding (20% of total approved assistance).[xxxix] These two regions supported both commercial and non-commercial tourism projects.

All AGST projects funded through ACOA’s Newfoundland and Labrador and Nova Scotia regional offices were coded as non-commercial. The Nova Scotia regional office approved a notable number of AGST projects at the inception of the strategy, though support declined sharply over the period of this evaluation, from 20 mainland projects in 2009-2010 to one project in 2013-2014. Key informants from Nova Scotia reported that the decline was related to a priority shift away from the tourism industry to higher growth sectors in that region. In Cape Breton, which reported separately from the Nova Scotia region until 2014, there was a steady increase in AGST projects and expenditures over the period of the evaluation.[xl] Newfoundland and Labrador had the least amount of approved assistance in AGST projects, though it delivered the most significant financial support toward tourism-related activities overall.

Table 2: Number of Tourism-related and AGST Projects and Total Approved Assistance, FY 2009-2010 to 2013-2014

Tourism Program |

Number of Approved Projects |

Total Approved ACOA Assistance ($M) |

Total Number of Approved Projects |

Total Approved ACOA Assistance ($M) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2009-2010 |

2010-2011 |

2011-2012 |

2012-2013 |

2013-2014 |

2009-2010 |

2010-2011 |

2011-2012 |

2012-2013 |

2013-2014 |

|||

AGST* |

42 |

53 |

29 |

59 |

52 |

18.6 |

8.6 |

4.9 |

18.9 |

16.8 |

235 |

67.7 |

P.E.I. |

20 |

31 |

16 |

36 |

31 |

15.5 |

4.2 |

1.7 |

14.9 |

3.2 |

134 |

39.5 |

N.B. |

2 |

6 |

4 |

6 |

3 |

0.7 |

2.4 |

2.4 |

1.1 |

9.9 |

21 |

16.5 |

C.B. |

0 |

1 |

1 |

7 |

11 |

0 |

0.02 |

0.2 |

1.6 |

3.0 |

20 |

4.9 |

N.S. |

20 |

8 |

5 |

1 |

1 |

2.4 |

0.7 |

0.4 |

0.03 |

0.08 |

35 |

3.6 |

N.L. |

0 |

7 |

3 |

9 |

6 |

0 |

1.3 |

0.2 |

1.2 |

0.6 |

25 |

3.2 |

Other Tourism Programming |

212 |

146 |

130 |

84 |

96 |

37.7 |

23.6 |

19.6 |

17.9 |

12.6 |

668 |

113.5 |

N.L. |

90 |

70 |

72 |

32 |

44 |

14.3 |

12.6 |

9.2 |

5.9 |

7.1 |

308 |

49.0 |

N.B. |

28 |

19 |

16 |

16 |

14 |

6.8 |

6.2 |

2.5 |

7.2 |

1.4 |

93 |

24.2 |

C.B. |

40 |

23 |

15 |

18 |

11 |

8.5 |

3.6 |

2.8 |

2.5 |

1.8 |

107 |

19.1 |

N.S. |

25 |

19 |

12 |

14 |

17 |

2.6 |

2.2 |

4.2 |

2.1 |

1.3 |

87 |

12.4 |

P.E.I. |

28 |

15 |

14 |

3 |

10 |

5.4 |

1.2 |

0.6 |

0.04 |

1.1 |

70 |

8.3 |

H.O. |

1 |

0 |

1 |

1 |

0 |

0.05 |

0 |

0.2 |

0.2 |

0 |

3 |

0.4 |

Grand Total |

254 |

199 |

159 |

143 |

148 |

56.6 |

34.3 |

24.5 |

36.8 |

29.4 |

903 |

181.2 |

Source: QAccess data, extracted February 2016.

*The AGST includes projects that are pan-Atlantic in scope.

Overall, for those projects coded to the ASGT, 92% were developed by not-for-profit organizations, and 8% by SMEs. Based on the total project count, 4% were associated with Official Language Minority Communities and 1% with Indigenous clients.

Some key informants noted barriers to the full implementation of tourism-related activities. Several internal key informants stated that the lack of continued outreach and training by was an impediment to a full understanding and implementation of the strategy. This may have contributed to internal project coding issues. Some internal key informants also suggested that the BDP funding mechanism posed difficulties for supporting particular types of tourism projects such as skills development, productivity improvements and the purchase of rolling stock that are important to tour operators. Other key informants noted that internal changes, including decreased staffing over the period of the AGST implementation, were barriers to the achievement of planned activities.

5.2 Incrementality

All clients had financial partners that contributed to their projects, such as federal and provincial governments. Overall, for every ACOA dollar invested in AGST projects, $1.64 was leveraged by partners. According to QAccess data, ACOA contributed 37% of overall project costs for AGST projects, while other sources of funding included 22% from provincial governments and 5% from other federal departments. The balance of project funding was provided by the proponents through their cash flow, revenues from resulting products or other investments.

A review of ACOA’s regional operational plans for the period of this evaluation identified a number of challenging factors, notably changing provincial priorities and fiscal restraint as potential risks to the development of projects. An assessment of overall provincial support toward the total cost of ACOA projects shows variations in support provided in each region: Prince Edward Island at 36%; New Brunswick at 30%; Newfoundland and Labrador at 21%; and Nova Scotia at 12%. Data from the QAccess project management system indicates that the Nova Scotian provincial government is the only Atlantic province that showed a steady decrease in support for ACOA’s tourism projects.

5.3 Achievement of Expected Results

This section provides results for the six objectives set out in the AGST. The results are mainly related to outputs with some limited immediate outcome data. The evaluation identified a certain amount of overlap among the objectives. Consultations with internal stakeholders have helped to present results in consideration of best fit.

Objective 1 – Provide leadership in research excellence and product mobilization

The first objective of the AGST focuses on capacity building in order to provide leadership in research excellence and strategic product development.[xli] It recognizes that front-line economic development professionals need to access timely research and programming information to effectively and proactively identify, plan and implement high potential tourism products and experiences.

Tourism Atlantic developed the AGST and its tools as stipulated in the strategy. It provided VISIT training to develop the capacity of front-line economic development personnel to advance transformative, consumer-driven products and experiences. The majority of key informants indicated that the strategy, VISIT training, the assessment tools and the proactive solutions are relevant and useful to the conduct of their work. Some key informants suggested that the tools could be updated and tailored to better meet regional and industry needs of clients, notably for the delivery of the AMR and STEP.

Tourism Atlantic leads the development of the ACTP research and evaluation agenda. Supported by its wide range of contacts and monitoring and research activities, it ensures that consumer and travel trade research and information are available to tourism operators and other stakeholders through the ACTP website.

Tourism Atlantic conducted analyses and provided advice to ACOA account managers as well as managers and stakeholders at large. It contracted tourism experts to conduct particular research studies on regional economic and market trends. Tourism trend presentations were provided. Key informants emphasized the importance of research in the development of tourism projects. Some key informants noted that knowledge transfer efforts by Tourism Atlantic decreased over time and suggested that greater efforts in sharing research and programming information in a more consistent and proactive manner would better support the work of ACOA staff, partners and stakeholders for strategic investments in tourism activities.

Objective 2 – Heighten ACOA’s policy, advocacy and coordination role and effectiveness

The strategy’s second objective relates to using ACOA’s policy, advocacy and coordination roles to enhance the state and economic value of the tourism industry in the Atlantic region. The main actions associated with this objective are related to strong regional policy, coordination and leadership for the sector. Coordination and collaboration, internally and externally, among networks and partners are important to tourism planning and development. This can help identify solutions to resource management, and effectively deliver the AGST and related programming.[xlii]

Over the period of this evaluation, Tourism Atlantic coordinated tourism policy and planning activities toward an integrated approach for the Atlantic region. Tourism Atlantic acts as the secretariat for the programming and provides direction for the implementation of the strategy. It advocates on behalf of SMEs, communities and other not-for-profit organizations at the national level to increase the Atlantic Canadian tourism profile and create opportunities for the sector.

Internal key informants said that Tourism Atlantic has expertise and knowledge and has been responsive to requests for support by regional offices as well as partners and stakeholders. For example, Tourism Atlantic provided support to the Agency’s CD program during the development of the Community Investment (CI) Framework. Tourism Atlantic’s assistance led to the inclusion and description of project types specific to the tourism sector and the AGST.

On an external level, Tourism Atlantic worked collaboratively with at least 15 other federal departments and agencies as well as with international bodies to develop and implement initiatives aimed to grow the tourism industry. For example, Tourism Atlantic:

- participated in the development of a federal tourism framework in 2009 and helped shape the Federal Tourism Strategy. Tourism Atlantic co-chaired the Federal Tourism Strategy’s Product Development Committee and sat on its Marketing Committee. ACOA Vice-President, PEI and Tourism participated in an Assistant Deputy Ministers’ steering committee for the implementation of the Federal Tourism Strategy;

- signed a memorandum of understanding with Parks Canada to help develop experiential products in six regional national park gateway communities;

- through the ACTP, worked with the Canadian Tourism Commission (now Destination Canada) in 2012 to promote Atlantic Canada as a leisure destination in priority international markets. Tourism Atlantic holds monthly discussions on mutual points of interest to advance tourism priorities;

- provided awareness, information and training on its VISIT program to the Federal Economic Development Initiative for Northern Ontario (FedNor). Based on the AGST, and with Tourism Atlantic support, FedNor designed and implemented its own tourism programming called Tourism Excellence North (the TEN Program) in 2014;[xliii]

- worked closely with Canada Economic Development for Quebec Regions and Canadian Heritage for the development of the cruise ship industry;[xliv]

- liaised and collaborated with other key tourism stakeholders such as the National Tourism Research Partners Forum, the Federal Provincial Territorial Tourism Working Group, the Federal Tourism Research Forum, as well as the Travel Tourism Research Association; and

- assisted industry groups and provincial government departments in identifying and focusing attention on the primary drivers of tourism, and in some cases, with the development of provincial tourism strategies.

Key informants said that Tourism Atlantic has an important coordinating role to play in Atlantic Canada and across other federal departments given its tourism knowledge and expertise. Internal and external key informants said that there is a strong and meaningful relationship between ACOA, federal and provincial partners, and tourism stakeholders. For example, during the development of projects in Prince Edward Island, Tourism Atlantic and ACOA PEI work collaboratively with the provincial department of Economic Development and Tourism, the PEI Tourism Advisory Council, the Tourism Industry Association of Prince Edward Island and the regional tourism associations (destination marketing organizations). This collaborative approach facilitates the identification and strategic investment in transformative, evidence-based tourism products and service projects that promote the growth of the tourism sector.

Objective 3 – Stimulate Focused Investment in the Tourism Sector

The third objective of the AGST centres on stimulating focused investment in the tourism sector toward transformative, research-driven, primary-visitation motivator products and experiences. The objective is grounded in the research-product-marketing continuum.

Tourism Atlantic developed proactive tools and solutions to facilitate investments in the industry. Throughout the period of the evaluation, Tourism Atlantic helped SMEs, communities and other not-for-profit organizations to develop demand-driven, research-based, experiential products based on primary motivators of travel that reach their target markets. A summary of the programming results achieved for each of the proactive tools is outlined below.

Tourism ICT

Since 2009, a total of 1,075 tourism SMEs across Atlantic Canada accessed Tourism ICT services.[xlv] An independent client survey conducted in 2011[xlvi] showed that 81 percent of participants acquired new skills and knowledge that were applicable to their business operations and practices. All respondents indicated being highly satisfied with the TourismTechnology.com programming, and 81 percent would recommend it to others.[xlvii] Key informants were positive about Tourism ICT; some indicated that further benefits would be possible by providing more aftercare to clients to support subsequent phases of development.

In addition to the support provided through TourismTechnology.com, Tourism Atlantic advocated for broadband access in rural areas to enable tourism SMEs to have a functional online presence and to allow potential visitors to access internet services in the region. For example, when the Government of Prince Edward Island’s broadband initiative was being developed and the PEI Broadband Fund created, ACOA PEI & Tourism advocated for the eligibility of tourism projects in rural areas. As a result, SiteValet was established as an innovative, web-based tool for inns and bed and breakfasts to easily build and manage better websites for their businesses. With proceeds from the Rural Broadband Fund, SiteValet offers a series of special programs to help more of Prince Edward Island’s rural tourism operators improve their websites and their overall web presence.

Your Atlantic Experience Program

There are limited output or outcome data available for this program element, which focuses on an online survey that captures visitors’ satisfaction and feedback on their use of local accommodations. The results are tabulated by a third party, who shares it with the tourism operator to enhance their product offering(s). Since 2009, 235 tourism operators in six sectors across Atlantic Canada have enrolled in the program.[xlviii] In addition to benefiting individual tourism operators, aggregate data also supports provincial governments and industry associations with visitor trends, which aids in strategic tourism planning at those levels.

Accelerated Market Readiness

From 2009-2010 to 2013-2014, the Agency supported seven AMR projects totalling approximately $374,000 dollars in ACOA assistance.[xlix] Since 2009, 165 tourism SMEs across Atlantic Canada have participated in the AMR.[l]

Key internal informants reported that the AMR is valuable to client business operations and practices. They emphasized the importance of accessing consultants who can tailor their training to clients’ language needs and who have knowledge of regional context, challenges and opportunities. Some key informants suggested that there were opportunities for ACOA to enhance follow-up and after-care activities following an AMR assessment, and continue to develop consultant capacity across Atlantic Canada.

Tourism Best Practice Missions

Three hundred and twelve tourism SMEs across Atlantic Canada have participated in 39 tourism best practice sessions since 2009.[li] In an independent client survey conducted in 2011,[lii]most clients (85%) indicated having applied the new skills and knowledge as a result of tourism best practice missions[liii] and almost all (95%) expressed a high overall satisfaction rating with this program,[liv] with 86% indicating they would recommend this program to others.[lv]

Internal key informants reported that regular communication from Tourism Atlantic on upcoming tourism missions and events was important though it was primarily offered only during the early phase of the AGST implementation. They stated that more regular updates for account managers would be useful.

Strategic Tourism Expansion Program

From 2009-2010 to 2013-2014, seven communities across Atlantic Canada received a total of approximately $313,000 in assistance to participate in STEP[lvi]: In Prince Edward Island, Tignish Initiative Corporation and Montague; in Newfoundland and Labrador, the Town of St. Anthony and Twillingate-New World Islands; in New Brunswick, the Town of Dalhousie, the Village of St. Martins, and Alma.

Overall, key informants were positive about the STEP program and its results. Some internal key informants indicated that the STEP program could enhance its outcomes by extending the programming to adjacent communities. This would optimize the use of local assets and limited resources toward a common strategic plan for the development of experiential products and services to maximize tourism impacts. Some internal key informants stated that additional tools and training would be helpful to better assess project viability and community economic impacts.

Gros Morne Institute for Sustainable Tourism

Clients and other stakeholders consider the GMIST a valuable training program. Since 2009, three hundred and seventy-four tourism SMEs across Atlantic Canada have attended GMIST training in Newfoundland and Labrador and almost 1,000 individuals have attended GMIST outreach sessions.[lvii] According to a 2011 independent client survey,[lviii] 87% of interviewees indicated that the GMIST experience provided learning opportunities that led to meaningful skills development applicable to their business operations and practices. Similarly, 87% of participants also said that the experience increased their market readiness. A majority of clients surveyed indicated being satisfied with the GMIST program and would have recommended it to others. Similar results were noted in the 2014 client survey,[lix] with 95% indicating that the GMIST was a valuable resource for the industry.[lx]

According to key informants from a leading national tourism organization, GMIST training is a best practice model[lxi] and has been replicated in Manitoba. It recently received the Leadership Award given out by the Responsible Travel and Tourism Forum in recognition of its demonstrated commitment to social, economic and environmentally responsible practices in delivering its programs and services.[lxii]

Some key informants reported that the GMIST poses significant accessibility challenges for clients, especially those living outside of Newfoundland and Labrador. Restrictions on eligible expenditures and the high cost of travel are impediments to clients’ participation in this program. A number of key informants suggested that the GMIST develop regional champions or that other options be considered to mitigate this issue.

Bonavista Institute for Sustainable Tourism

Four hundred and fifteen tourism SMEs across Atlantic Canada have attended the Bonavista Institute for Sustainable Tourism since 2009.[lxiii] Results from the 2011 independent client survey[lxiv] show that 75% of participants gained meaningful skills and knowledge applicable to the business operations and practices. All participants who answered the client survey indicated a high satisfaction with their Bonavista experience, with 83% indicating they would recommend this program to others.

Participants who took part in training offered through Tourism Best Practices, Gros Morne Institute of Sustainable Tourism and the Bonavista Institute for Sustainable Tourism, noted two key programming strengths: the quality, knowledge and expertise of instructors; and the ability to interact, share experiences and learn new skills from other tourism operators.[lxv] Internal key informants stated that ACOA’s Cape Breton and Newfoundland and Labrador offices in particular developed strong relationships with Tourism Atlantic and that successful results were achieved through the AGST programming, particularly the GMIST, the Bonavista Institute for Sustainable Tourism and the AMR proactive solution tools.

Objective 4 – Provide Effective Education, Communication and Awareness Concerning the Tourism Sector

The fourth objective of the AGST centres on effective education, communication and awareness to ensure that ACOA staff have the resources and the tools required to mobilize new tourism products and experiences.[lxvi] Activities identified to meet this objective include the implementation of VISIT training and other tools as well as internal coordination mechanisms.

At the outset of the AGST implementation, Tourism Atlantic had aimed to establish and support an internal oversight committee to provide guidance and oversee the implementation of ACOA’s tourism strategy on a pan-Atlantic level. It identified the need to help regional ACOA offices establish regional tourism working groups to encourage program coordination and communication. Tourism Atlantic planned to deliver tourism training to ACOA account managers and managers across Atlantic Canada, with ongoing training as required. A number of factors during the period from 2009-2010 to 2013-2014 negatively impacted Tourism Atlantic’s ability to offer training and conduct ongoing internal coordination on an ongoing basis, including financial restrictions and a decrease in human resources.

The Strategic Tourism Actions Committee was put in place in 2011 to guide the implementation of the strategy; it includes senior representatives from Tourism Atlantic, ACOA regional offices, and head office. The group held quarterly meetings throughout 2011-2012, but activities paused in 2012-2013. The committee was reconvened in 2014-2015 to support the review and renewal of the strategy. Some key informants indicated that the committee assisted senior management in promoting awareness of tourism activities at a corporate and provincial level. A number of external key informants suggested the desire for a pan-Atlantic communication mechanism. They said that this would be helpful to improve the planning and development of tourism projects among key partners and stakeholders.

To increase the knowledge and capacity of ACOA staff in proactively identifying, planning and developing tourism projects and to stimulate focused investments in the tourism industry, some internal key informants indicated that there is a need to create a forum through which Tourism Atlantic, in collaboration with front-line economic development officers, could share information, lessons learned and best practices on a regular basis. The Newfoundland and Labrador region provides an example of a strong collaborative practice to optimize information sharing and capacity building. It has an active tourism working group composed of representatives from the ED, CD, and Policy, Advocacy and Coordination (PAC) Sub-programs that meets monthly to share updates on projects and activities taking place with key stakeholders and partners.

Between spring 2009 and summer 2010, Tourism Atlantic delivered VISIT Training Program to a total of 110 governmental participants in six locations across Atlantic Canada (98 ACOA account managers, 5 Parks Canada officials, 2 Industry Canada officials, 5 provincial product development managers, and some key industry stakeholders).[lxvii] Key informants noted that VISIT training was highly useful but that improvements could be gained by offering it more regularly and tailoring it to regional and industry needs. Some key informants stated that a “train-the-trainer” approach could be beneficial to reinvigorate the knowledge of account managers peripherally involved with Tourism. Also, as noted earlier, key informants suggest that regularly updated training material would enhance account managers’ capacity to mobilize tourism products and experiences.

Tourism Atlantic provided ACOA’s front-line economic development personnel with information on global, national, regional and provincial tourism industry forecasts and market trends on an ad hoc basis. Tourism Atlantic, in collaboration with provincial tourism departments and industry associations, hosted a series of industry outreach sessions across Atlantic Canada.[lxviii] Between 2009-2010 and 2013-2014, approximately 100 sessions were delivered across Atlantic Canada to industry stakeholders on experiential product development, primary motivators of travel for Atlantic Canada and ACOA’s assessment and proactive tools.

Participants who completed the training and participated in the information sessions were asked to rate how satisfied they were with the sessions. On a scale of 1 to 5, where 1 is very poor and 5 is excellent, participants indicated a high degree of satisfaction with the sessions[lxix]: ACOA non-commercial program, 3.8; ACOA commercial program, 3.9; visitor satisfaction program, 3.9; TourismTechnology.com, 4.1; Pan-Atlantic program, 4.1; GMIST, 4.3; and AGST, 4.4.

In March 2009, Tourism Atlantic developed an internal website dedicated to the VISIT training program to support front-line economic development officers and managers in accessing training material, tools and tourism news. While the site contains relevant information, key informants noted it had not been updated consistently over the last several years, and some indicated that they were not aware of the site or indicated that information was difficult to find. A number of external key informants said that the Strategy, as well as awareness presentations and research studies were not available on ACOA’s public website to clients and partners, and indicated that increased accessibility to such material could contribute to enhanced coordination with stakeholders, partners and Tourism Atlantic.[lxx]

Objective 5 – Assist the Provinces and the Industry to Effectively Market Transformative Products and Experiences

Tourism Atlantic has played a leadership role for the tourism industry by collaborating with partners and stakeholders and creating synergies among tourism players. More specifically, it assists provincial governments and the tourism industry to effectively market transformative products and experiences. Tourism Atlantic provides support to various not-for profit organizations and industry associations that advocate on behalf of tourism operators. These industry associations partner with stakeholders across Atlantic Canada to leverage resources in marketing products and experiences.

From 2009-2010 to 2013-2014, a total of $6.3 million dollars was approved for 21 pan-Atlantic marketing projects that assisted product clusters in reaching the marketplace.[lxxi]

This included the Atlantic Canada Cruise Association, which leverages resources and investments in an effort to achieve cruise business growth in the region, as well as the Atlantic Golf Organization Incorporated, which promotes and markets the Atlantic Canada golf product in new and developing markets and in the United States. Tourism Atlantic supported the Commission du tourisme acadien du Canada atlantique, which develops and promotes experiential tourism products with Acadian cultural components, the Atlantic Canada Trails initiative, which focuses on the development of destination trails in Atlantic Canada, and the Chambre de commerce française au Canada, which promotes the French business community in Canada and support for mutual trade objectives between Canada and France.

ACOA provided 10 destination marketing organisations a total of $1.8 million in approved assistance to conduct strategic planning and promoting of regional tourism. For example, the Destination Cape Breton organization has assimilated and implemented the principles of the AGST in its region and has had success in implementing many of its tools with its regional industry clients.

Tourism Atlantic also supported individual marketing activities across Atlantic Canada. Approximately $12 million in assistance was approved in support of 105 regional marketing and product development projects to help not-for-profit organizations, municipalities, and industry associations to market experiential products and services, including festivals, cultural and sporting events, natural and historical destinations, in order to attract visitors.

The ACTP is ACOA’s single largest investment in tourism, with $19.9 million approved over the period of the evaluation. The ACTP directly supports the Federal Tourism Strategy’s strategic priority of “inspiring the world to explore Canada.” It is a successful pan-Atlantic partnership that promotes the four Atlantic provinces as leading vacation destinations in key American and European markets. The ACTP enables the government of Canada, the four Atlantic provinces and the tourism industry to pool resources and penetrate markets that are largely inaccessible to them individually. It conducts and shares research in support of marketing strategies and tactics.[lxxii] A memorandum of understanding was signed in 2012 between the ACTP and the Canadian Tourism Commission (now called Destination Canada) to formalize their collaborative work in support of promoting Atlantic Canada as a leisure destination.

According to data reported in the Agency’s departmental performance reports, the ACTP generated $142.3 million in tourism-related export revenues between 2009-2010 and 2011-2012, with a return of $12.97 for every dollar invested.[lxxiii] From 2012-2013 to 2014-2015, $164.4 million in export revenues was generated, with a return on investment of $15.33 in direct-to-consumer advertising, joint marketing partnerships with the travel trade, and media relations ($17.94 in 2014). The ACTP’s marketing activities generated over $35.5 million in earned media value (almost $14.6 million in 2014), and leveraged $2.1 million in incremental marketing investments through joint marketing agreements with tour operators in the United States and the United Kingdom ($436,000 in 2014).[lxxiv] External key informants consider ACOA’s marketing activities, including the ACTP, as best practices, generating significant regional marketing economies and efficiencies.

Objective 6 – Effectively Measure ACOA’s Strategic Actions

Over the time frame of this evaluation, Tourism Atlantic was accountable for its programming by providing annual progress updates to the Agency’s executive committee. It undertook two programming reviews and hired external independent consultants to examine results specifically related to capacity building tools on two occasions.

At the federal level, Tourism Atlantic reported annually to Industry Canada on its investment toward tourism activities in the Federal Contributions to Canadian Tourism report. It reported on the ACTP outcomes to the Treasury Board Secretariat of Canada in annual departmental performance reports. Performance measurement information related to the ACTP was consistently monitored, collected and reported as required for parliamentary reporting.

At the inception of the strategy, a performance measurement framework, including a logic model for the AGST, was developed and partially implemented. With the introduction of Agency dashboards in 2011-2012, monitoring of performance information was enhanced. However, key informants suggested that the data collection and monitoring approach does not adequately and systematically track the performance of AGST initiatives and activities to support program reporting and management.