ACOA ministerial briefing 2025

Outline

Introduction to Canada's Regional Development Agencies

Canada's Regional Development Agencies

A growing national economy relies on strong regional economies.

RDAs are adaptive to ever-changing economic challenges

- The Challenge: Finding our footing in a rapidly changing trade environment

- The Opportunity: RDAs understand impacts region-by-region and can rapidly implement responsive programming to boost internal trade and market diversification

- The Challenge: Growing our productivity and competitiveness

- The Opportunity: RDAs’ targeted investments support growth in productivity and innovation capacity – keys to a competitive, prosperous, and resilient Canadian economy.

- The Challenge: Helping communities prosper

- The Opportunity: RDAs work with communities to create an environment for business attraction and growth.

Moving forward on your mandate

- Regional Economic Growth through Innovation (REGI)

- Economic Development (Program Name Varies by RDA)

- Community Futures*

Atlantic Canada Opportunities Agency

Atlantic Canada’s Economic Context

- Building on Strong Momentum

- Atlantic Canada Challenges

- Tariff/Trade Related Threats

- Catalyzing Growth

Introduction to Canada's Regional Development Agencies

April 2025

Canada's Regional Development Agencies

Partnering with stakeholders at the local level to contribute to national economic growth and prosperity.

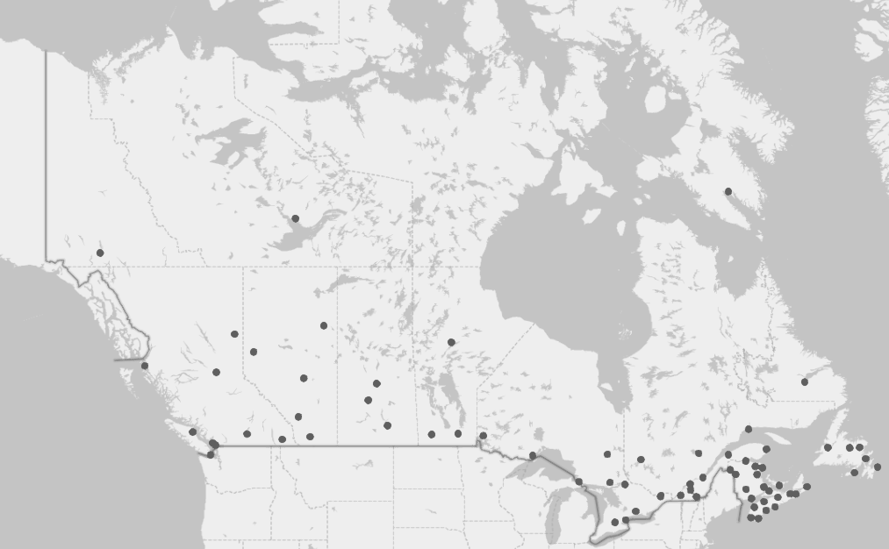

Local Presence

RDAs are the federal government’s front line for regional economic development with points of service in communities of all sizes.

RDA Points of Service

A growing national economy relies on strong regional economies

National Economy

The work of RDAs is to empower local businesses and communities to contribute to the national economy and support regional implementation of national priorities.Through this work, RDAs are adaptive to complex and evolving economic challenges

Regional Strengths

RDAs work across industries and geographies to seize on regional economic opportunities and bring regional perspectives to grow the national economy.

Local Solutions

RDAs work on-the-ground with entrepreneurs, SMEs, not-for-profits, and communities to accelerate growth and build economic resilience.

Mandate & Expertise

RDAs play a key role in regional economic development and diversification, helping SMEs and communities to grow and thrive.

RDAs are:

- Grounded

Source of on-the-ground experience, place-based intelligence, and advancing regional perspectives in Ottawa. - Catalyzers

Making targeted investments to accelerate SME growth in key regional industries. - Trusted

With headquarters in the regions they serve, relied upon and trusted by partners and stakeholders. - Connectors

Leveraging local relationships with government and stakeholders to take action.

RDAs are adaptive to ever-changing economic challenges

RDAs use their combined areas of expertise to respond to regional and national economic opportunities, needs, and disruptions.

- RDAs have a proven track record of providing regional intelligence to inform national responses and rapidly implementing regionally-tailored and nationally coherent responses to complex and evolving economic issues

- RDAs provided essential investments during the COVID-19 pandemic and critical coordination and community and business support after natural disasters including Hurricane Fiona and the Jasper and Lytton wildfires

- In response to U.S.-imposed tariffs in 2018, RDAs delivered the Steel and Aluminum Initiative, supporting SMEs in the Canadian steel and aluminum supply chains

- Delivering on national priorities such as accelerating artificial intelligence in critical sectors, supporting local innovative housing solutions across the country, and the Inuit Nunangat Policy.

- RDAs work with other government departments, such as Innovation, Science and Economic Development Canada, Business Development Bank of Canada, and Export Development Canada, to complement federal supports to businesses

The Challenge: Finding our footing in a rapidly changing trade environment

- Trade uncertainty is increasing costs and disrupting supply chains for SMEs, who are more trade exposed than ever

- Tariffs and uncertainty are having a chilling effect on business investment and expansion, key factors in competitiveness and productivity

- Tariffs and counter tariffs will particularly hurt key sectors such as manufacturing (auto, steel & aluminum), food (pork, canola, seafood), and mining/extraction (potash, oil)

The Opportunity: RDAs understand impacts region-by-region and can rapidly implement responsive programming to boost internal trade and market diversification

- RDAs make targeted project-based investments to catalyze SME growth in regionally relevant industries

- RDAs are already developing a tariff response program to support businesses that reflects the uncertain environment and unique regional needs, complementing the broader work of other government departments

- RDAs’ on-the-ground experience, regional advocacy, and place-based regional intelligence can inform responses that address unique regional needs and strengths.

- Trade disruptions are having varied impacts by region, depending on major industries and export exposure

- Regional tariff impacts are seen first-hand by RDAs. RDAs can provide critical regional intelligence to inform decision-making within regions and in Ottawa across the spectrum of tariff response measures

The Challenge: Growing our productivity and competitiveness

- Compared to the U.S., Canada's productivity performance has lagged for decades, and among G7 countries, Canada is second only to Italy in productivity decline

- Canadian SMEs face a high cost of borrowing and are often unable to take advantage of the economies of scale afforded to larger companies

- This disproportionately impacts rural and remote locations, Indigenous communities, and individuals from underrepresented groups due to reduced access to supports and services

The Opportunity: RDAs’ targeted investments support growth in productivity and innovation capacity – keys to a competitive, prosperous, and resilient Canadian economy.

- RDA investments catalyze SME growth in high-value industries unique to each region, fostering more productive and competitive regional economies.

- SMEs and entrepreneurs have the supports they need to scale up groundbreaking ideas that drive productivity

- RDAs help accelerate the growth of businesses through interest-free loans with flexible repayment terms to SMEs and improve access to private sector lenders

- The (cross-RDA) Regional Economic Growth through Innovation (REGI) program delivers value in its reach, leveraged investments, and job creation

Compared to non-clients, REGI clients experience:

- +18.3% revenue growth

- +12.8% employment growth

- +13.5% export growth

The Challenge: Helping communities prosper

- National economic disruptions require communities to adapt their economies now and for the future

- Severe weather events are increasing in frequency and severity across Canada, with significant community and business consequences

- Rural, remote, and northern communities often have less access to services, less diversified labour markets, and higher capital costs

The Opportunity: RDAs work with communities to create an environment for business attraction and growth.

- RDAs have a unique position in the federal departmental landscape as agents not directly involved in regulation.

- Through strong relationships and local connections, RDAs advance community economic development that matters to Canadians

- RDAs’ established and reliable presence allows the federal government to respond in regionally relevant ways

- RDAs leverage their positive relationships to bring the right stakeholders to the table.

- RDAs provide critical links between government departments, orders of government including Indigenous, municipalities and stakeholders during economic disruptions or opportunities and the planning and implementation of national initiatives

- RDAs support communities through pathfinding and bringing partners together to access supports through regional and national programming

- RDAs provide non-repayable project-based funding to not-for-profits to help communities prosper and support the conditions for SMEs and entrepreneurs to thrive

Examples of RDA results

RDAs are committed to the goals of ensuring businesses are growing, communities are developing, and businesses are commercializing and adopting technology.

Across Canada in 2023-2024, RDAs investments of $1.4B led to:*

- Over 70,000 SMEs assisted

- Over 130,000 jobs created or maintained

- Over $2.8B investments leveraged from other partners

* Methodologies underlying these indicators may vary. Estimates provided by RDAs have been aggregated

Moving forward on your mandate

RDAs look forward to supporting you to:

- Implement your priorities;

- Make investment decisions; and

- Communicate with Canadians on investments, progress, and successes

Annex: RDA funding programs

Regional Economic Growth through Innovation (REGI)

- Helps businesses accelerate growth and commercialize new products and supports scale-up, productivity and global competitiveness.

- Fosters entrepreneurial environment necessary for more innovative regional economies and increases competitiveness of SMEs.

- Often leveraged for regionally tailored temporary initiates.

Economic Development (Program Name Varies by RDA)

- Various programming aimed at enhancing community resilience to ensure opportunities are available to all Canadians and tailored to the needs and realities of regions across the country, including Indigenous communities.

- Provides funding for projects that encourage economic growth in Official Language Minority Communities.

- Provides targeted funding to support development of the northern food sector (territories, Nunavik, and Nunatsiavut only).

Community Futures*

- Key RDA partners, these not-for-profit organizations across Canada foster entrepreneurship and community economic development, particularly in rural areas.

- Provides a variety of services ranging from strategic economic planning, technical and advisory services to businesses, loans to SMEs, self-employment assistance programs, and services targeted to youth and entrepreneurs with disabilities.

*not delivered by CanNor as program was devolved in the territories

RDAs also leverage their core programs to deliver nationally consistent, regionally-tailored temporary initiatives, including the Homebuilding Innovation Initiative and Artificial Intelligence Initiative.

Atlantic Canada Opportunities Agency

April 2025

Building on Strong Momentum

- 2023 real GDP was 3.0% higher than pre-pandemic level in 2019

- Real GDP growth in region estimated to have surpassed national average in 2024 and projected to match it in 2025

- GHG reductions of 32% outpaced national rate of 7% (2005-2022)

- In 2024, employment rose by 3.1% compared to 2023, surpassing national growth (1.9%)

- 2024 – unemployment rate at 7.5%, just above its record level

- Communities with unemployment rates below national average

- 8.2% of new immigrants to Canada in 2024 came to Atlantic Canada, up from 2.7% in 2008

- 15.2% of workforce born outside of Canada in 2024 (up from 7.8% in 2019)

- Highest share of rural population in Canada (44%)

- Urban centres outpacing national population growth

Atlantic Canada Challenges

US TRADE POLICY

- 73% ($29.2B) of Atlantic region’s $40.2B in exports went to U.S. in 2024

- Heavy reliance on U.S. makes the Atlantic economy vulnerable to disruption

- Energy, seafood, forest products, tires, and food are among the key sectors at risk

- NB and PEI are among the most exposed provinces in Canada

- Uncertainty is already causing businesses to delay investment plans or move production to the US, eroding business investment and productivity in the region

Limited access to business financing

Companies less likely to seek debt financing from a financial institution (24% vs 26% nationally) and are approved for smaller amounts

Low levels of business investment

The region’s share of business investment has declined since 2015, with the region accounting for only 5% of Canada’s investments

Lagging productivity

Atlantic productivity has declined from 87% of the national average in 2016 to 82% in 2023

Cost of doing business

Commercial electricity rates and corporate tax rates among the highest in the country

Demographic challenges

More than 20% of working age Atlantic Canadians are between 55 and 64 years old; population growth still key to the region’s economic success

Access to housing

Between 2019 and 2024, home prices rose by 84% in NB, 78% in NS, 66% in PEI, and 28% in NL

Tariff/Trade Related Threats

What we are hearing from Atlantic Businesses

- SMEs across various sectors are increasingly focused on diversification strategies to strengthen resilience.

- These efforts include expanding supply chain networks and pursuing new market opportunities both domestically and internationally.

- Certain sectors may be able to pivot faster than others due to regulatory and commercialization complexities and time to market.

FOOD AND SEAFOOD:

- Clients concerned about U.S./Chinese tariffs.

- Some companies cancelling expansions due to the uncertainty.

- Others wanting to diversify but are challenged with higher shipping costs.

FORESTRY:

- NB and NS stakeholders note the sector’s vulnerability due to high U.S. reliance that cannot be replaced with overseas markets.

BIOSCIENCE:

- Concerns around market diversification outside the U.S. given regulatory requirements.

- Companies looking at options including shifting manufacturing to U.S.

MINING:

- Uncertainty causing delays in investment decisions.

- Concerns that steel tariffs will depress iron ore prices with negative impact on producers and suppliers.

CLEAN ENERGY:

- Scale-back of offshore wind projects in the U.S. will impact Atlantic supply chain firms and ports.

- High levels of global wind build-out is impacting opportunity to source equipment outside the U.S.

OIL AND GAS:

- Atlantic natural gas distributors concerned about potential for multiple tariffs as imports flow back-and-forth across the border.

STARTUPS:

- Insights from companies suggests VC investment pipeline is slowing.

- Startups and growth-stage companies that are focused on the U.S. market fear not being able to raise capital.

DEFENCE:

- Some Atlantic companies noting that tariffs could lead to supply chain disruptions, reduced profitability, and cancelled contracts.

Catalyzing Growth

While challenging, the current context is an opportunity to promote the value of Atlantic Canada products and innovations that the world needs now, including energy, critical minerals and other key sectors.

ENERGY

Potential export nexus for clean fuels and electricity; green investment expected to rise from $2.2B in 2024 to over $5.6B in 2025.

CYBERSECURITY

NB home to the Canadian Institute for Cybersecurity; Institute is a member of the national consortium that manages $80M in federal funding.

CRITICAL MINERALS

NL 4th most attractive jurisdiction for mining investments in the world; province possesses 27 of 34 critical minerals found in Canada.

BIOSCIENCE

PEI’s bioscience sector has quadrupled in size since 2012; the sector employs over 1,900 people and contributes $214M in GDP.

AEROSPACE AND DEFENCE

Leader in shipbuilding and aircraft repair. Home to 20% of Canada’s defence industry employment and 30% of marine sector employment (and growing). Halifax was selected as one of the two Canadian accelerators for NATO DIANA.

OCEAN TECH

Eighth best blue ecosystem in the world; as of 2020, the sector accounted for over half of the country’s $30B ocean economy.

Taking a Long-Term Focus

Helping Tackle the Productivity Gap

PRODUCTIVITY AND GROWTH

- Atlantic Canada has the potential to become an economic powerhouse and a magnet for investment in the next decade.

- It has seen recent population, employment, and capital investment growth that create the right conditions for growth.

- Yet facing productivity gaps due to smaller urban centres and limited access to capital, business financing and national programs.

- Enhancing the region’s productivity will foster economic competitiveness, boost business growth and lead to higher living standards.

- With focus and agility, the region can overcome obstacles and leverage its growth potential to capitalize on current momentum, diversify and seize new opportunities.

PRODUCTIVITY AND GROWTH ENABLERS

GROWTH SECTORS

Promote place-based economic diversification and market expansion by propelling key sectors such as bioscience, cyber security, clean tech, energy and aerospace and defence toward increased growth.

TECHNOLOGY ADOPTION

Increase adoption of automation and advanced digital technologies, including AI, to help businesses optimize value, create efficiencies and reduce waste.

WORKFORCE DEVELOPMENT

Work with businesses to ensure that key industries have the skilled workers needed to enhance their productivity, and help communities attract and develop the talent required to foster economic growth.

Delivering on the Government’s Agenda

Priorities and ACOA actions to advance the priority in Atlantic Canada

Trade and International Relations

Encourage the development of new export markets by increasing trade with other domestic and international partners.

- Leading an RDA Treasury Board submission for the Regional Tariff Response Initiative.

- Announced by PM on March 21.

- Launch of the initiative is expected imminently.

- Working with Atlantic provincial governments and GAC to increase the number of Atlantic exporters and encourage market diversification.

- Delivering programming to manage current uncertainties, including support for Atlantic businesses to become CUSMA compliant.

National Security and Infrastructure

Accelerate defence spending to meet international commitments and strengthen Canadian defence supply chains.

- Working with the region’s firms to optimize their participation in procurement processes and will continue to strengthen the region’s contribution to Canada’s defence objectives.

- Atlantic Canada has strong A&D presence including in naval shipbuilding, aircraft maintenance repair and overhaul, and naval systems and components.

- A&D employment represents approximately 9,800 jobs across 200 firms in the region.

Housing

Get new homes built for Canadians while increasing innovation and productivity in the construction industry.

- Collaborating with Atlantic provinces on the development of an Atlantic offsite construction roadmap to help inform future actions to unlock the potential of innovative home construction in the region.

- Delivering the Regional Homebuilding Innovation Initiative to support novel housing solutions and boost efficiency in the homebuilding sector.

- Four projects for a combined investment of $2.3 million ready to announce.

Climate and Energy

Kickstart the clean energy supply chain, invest in critical minerals, and secure Canada's energy security.

- Strategically positioning Atlantic Canada as an important clean energy partner. This market-driven effort supports industry in navigating a shifting landscape and seizing emerging opportunities, in collaboration with the region’s Indigenous communities.

- Engaging with key federal departments to put forward the region’s assets in support of the overall national approach.

Workforce

Incentivize uptake and training in skilled trades and increase labour mobility / credential recognition.

- Collaborating with skills providers and industry to identify opportunities for industry-focused workforce projects, and to strategically support initiatives with a productivity focus, ensuring alignment with other government programs.

- Through the Economic Development Initiative, the Agency helps entrepreneurs in French communities in accessing the skilled labour needed for success.

Economy of the Future

Take advantage of the opportunities presented by AI to make firms more competitive.

- Deploying a strategic approach for AI adoption, including through the Regional Artificial Intelligence Initiative, complementing other AI initiatives.

- Eight projects for a combined investment of $3.6 million ready to announce.

- Atlantic Canada has a young, yet active, AI ecosystem with several researchers, companies and organizations engaged in R&D and commercialization.

Federal-Provincial Collaboration

Work together to advance projects and reduce interprovincial trade barriers.

- Leveraging the strong relationships with provinces, Indigenous communities and other regional actors in the region to bring partners to the table in support of a one Canadian economy approach.

Organized to Deliver

Leadership Team

- Minister

- President

Laura Lee Langley

- Francis Jobin, Chief of Staff and Ministerial Liaison Office

- Christine Calvé, Legal Services

- Vice-Presidents

Daryell Nowlan, Policy, Programs and Communications

Kurt Chin Quee, Finance and Corporate Services

Dave Boland, Newfoundland and Labrador

Kalie Hatt-Kilburn, New Brunswick

Chuck Maillet, Nova Scotia

Patrick Dorsey, PEI and Tourism

- Francis Jobin, Chief of Staff and Ministerial Liaison Office

- President

Mandate, Culture and Footprint

ACOA’s MANDATE

Create opportunities for economic growth by helping Atlantic businesses become more productive and competitive, working with communities to develop and diversify local economies, and championing the growth potential of the region.

CORE VALUES

- Agile and responsive to region’s needs

- Strong advocates for the region

- Focused on innovation and collaboration

Working with Atlantic Canadians

- Part of a network of seven regional development agencies offering tailored, place-based programs and services that fuel economic growth, create well-paying jobs and help deliver on federal priorities in the region.

- In Atlantic Canada, ACOA is the face of the Government of Canada, with a solid on-the-ground presence, strong client relationships and a deep understanding of business and community needs.

- ACOA’s staffing levels have not grown in over 12 years, demonstrating the Agency’s commitment to delivering for Atlantic Canadians in fiscally prudent manner.

Core Functions

PROGRAM DELIVERY

- Delivering programming directly to Atlantic Canadians

- Pathfinding by providing connections to other federal programs and initiatives

- Delivery Partners

- Provinces |Other RDAs | Other federal funders | Industry associations

ADVOCACY

- Advocating for Atlantic Canada by contributing to the development of effective economic policy that considers the unique aspects/realities of Atlantic Canada and aligns with the priorities of the Government of Canada.

- Nurturing effective relationships and strong collaboration to ensure Atlantic Canadian issues and opportunities are well understood in the federal system (by key ministers and officials).

- Advocacy Stakeholders

- ISED | ESDC | NRCan | ECCC | DFO | AAFC | IRCC | TC | PCO |GAC

ACOA and other RDAs are:

- Grounded

- Trusted

- Catalyzers

- Connectors

Programs and Initiatives

CORE PROGRAMS

Providing strategic support through repayable, provisionally repayable and non-repayable contributions

Regional Economic Growth through Innovation (REGI) (all RDAs)

Business Development Program (BDP)

Innovative Communities Fund (ICF)

- For non-commercial projects and contributions

Community Futures Program (CFP)

- Funds 41 independent Community Business Development Corporations, 3 provincial associations, as well as the Atlantic Association of CBDCs

TEMPORARY INITIATIVES

Delivering short-term initiatives to respond to emerging needs and government priorities

- National Ecosystem Fund / Black Entrepreneurship Program (all RDAs) – Original end date of March 2025; Fall Economic Statement 2024 proposed to extend for five years starting in 2025-2026

- Canada Coal Transition Initiative (ACOA and PrairiesCan) – Ended March 31, 2025

- Tourism Growth Program (all RDAs) – Ending March 31, 2026

- Regional Homebuilding Innovation Initiative (all RDAs)– Ending March 31, 2026

- Northern Isolated Communities Initiative (ACOA, CanNor and CED) – Ending March 31, 2027

- Regional Artificial Intelligence Initiative (all RDAs) – Ending March 31, 2029

The Atlantic Canda Opportunities Agency: Proven Ability to Respond in Times of Need

- ACOA’s mandate, regional footprint and program tools can address urgent economic disruptions.

- The Agency is an effective federal lever to coordinate action and convene partners.

- ACOA’s place-based interventions can help drive productivity, leverage additional investment, and strengthen resilience.

Regional Expertise

ACOA has deep client relationships and on-the-ground regional knowledge.

Flexible Programs

ACOA’s programs are flexible and can be leveraged to deliver on government priorities.

Agility and Adaptability

ACOA is agile and responsive to evolving issues, crises and economic disruptions.

2019: Steel and Aluminum Initiative - $6.8M to help impacted SMEs innovate to drive productivity, scale up and expand into new markets.

2020: Canadian Seafood Stabilization Fund - $42.7M into support fish and seafood processors that incurred COVID-19 related costs.

2022: PEI Potato Stabilization and Innovation Initiative - $16M to help SMEs modernize, diversify and adapt to meet changing market conditions.

2022: Hurricane Fiona Recovery Fund - over $105M to to support local communities and businesses affected by the storm and to help long-term recovery efforts.

Results

Impact of ACOA Investments

WAGES

Workers at ACOA-assisted firms earn an average of $36.90 per hour, compared to $28.20 at non-assisted firms. (StatsCan, 2021)

JOBS

ACOA’s investments in commercial clients supported at least 100,000 jobs across Atlantic Canada. (StatsCan, CRA data, 2023-24 – ACOA core programs only)

INVESTMENT

Every $1 ACOA invests in client projects attracts an additional $1.46 from other sources, driving economic growth. (ACOA data, 2018-19 to 2023-24 – ACOA core programs only)

PRODUCTIVITY

ACOA clients are more productive, generating $313,400 in sales per employee compared to $265,089 for non-clients. (StatsCan, 2021 data)

INCREMENTAL IMPACTS

A 1% increase in ACOA funding per project ($1,846) results in $35,000 more in client revenue and $3,500 more in annual wages per employee. (StatsCan elasticity study, 2007-08 to 2017-18)

BUSINESS GROWTH

ACOA clients achieve revenue and employment growth that is over 15 percentage points better than other firms. (REGI National Evaluation, StatsCan data, 2018-2023)

LONG-TERM RESULTS

ACOA’s BDP boosts productivity, R&D, and job growth within a year, while export gains typically appear nine years later. (Saint Mary’s University, 2021 study)

ACOA Financial Overview

| Actual Expenditures* | Planned Expenditures | |||||

|---|---|---|---|---|---|---|

| in $M | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

| Operations & Maintenance | 71 | 72 | 72 | 77 | 70 | 70 |

| Grants & Contributions - Core | 220 | 231 | 255 | 172 | 172 | 172 |

| Grants & Contributions - Temp | 144 | 121 | 142 | 142 | 110 | 20 |

| Grants & Contributions Total | 364 | 351 | 397 | 314 | 282 | 192 |

| Total Voted (O&M & G&C) | 435 | 424 | 469 | 391 | 353 | 261 |

| EBP (Statutory) | 9 | 9 | 9 | 9 | 9 | 9 |

| Grand Total | 443 | 433 | 478 | 400 | 362 | 271 |

Over the past decade (2015-16 to 2024-25)

- ACOA approved an annual average of 1,261 projects.

- Average approved contribution: $264,501.

- On average each year, ACOA assisted 539 businesses and invested in 101 communities.

- On average, ACOA’s annual project spending was $294M.

Over the past year (2024-25)*

- ACOA approved 1,054 projects for a total value of $313,203,172.

*As of March 31, 2025

Notes :

- Figures reflect ACOA’s reference levels, including Main Estimates pending approval and may not exactly add up due to rounding.

- The decrease in core G&C from 2023-24 to 2024-25 and ongoing is due to the phasing out of ACOA’s core funding received through the Repayment Recycling Mechanism. ACOA was directed to return with options to replace the Recycling Mechanism and in the interim, temporary budgets were provided for 2024-25 and 2025-26. Discussions are underway with the Centre regarding permanent replacement funding starting in 2026-27 and ongoing. The decrease in 2025-26 is mainly due to the conclusion of temporary initiatives, such as the Hurricane Fiona Recovery Fund.

- The Agency is one of only two federal departments that have not increased their workforce from 2015 to 2024. ACOA’s planned FTE usage for fiscal year 2024-25 was set at 573 employees.

Near-Term Focus

- Mitigating the impacts of U.S. and China tariffs and other protectionist trade policies on the region’s businesses.

- Working towards operational efficiencies by modernizing structure, programs and processes.

- Doubling down on productivity and growth as an overarching focus that guides our approaches and interventions.

- Collaborating with region’s provinces on priority opportunities and challenges.

Outreach Opportunities

Potential keynote events

Community Futures National Conference – May 4-6, 2025, St. John’s (NL)

- Aims to bring together 500-700 businesses and community leaders from across Canada to discuss strategies for building stronger, sustainable rural economies through innovation, entrepreneurship and community business development.

CANSEC’s Atlantic Reception – May 28-29, 2025, Ottawa (ON)

- CANSEC is the largest defence industry trade show in Canada, showcasing leading-edge technology, products and services for land-based, naval, aerospace and joint forces military units. The Atlantic reception is hosted by the Atlantic Canada Aerospace and Defence Association.

Energy NL Conference – June 3-5, 2025, St. John’s (NL)

- Offers the opportunity to engage directly with leaders in NL’s energy sector, including the province’s offshore oil and gas industry and its emerging green hydrogen and wind energy sector.

H2O Home to Overseas – June 9-12, 2025, Halifax (NS)

- The H2O conference is one of Canada’s prime events showcasing the ocean technology sector. This will be the conference’s tenth year and highlights the region’s sector to national and international stakeholders.