Audit of the PCH Pay System Control Environment

Office of the Chief Audit Executive

May 2018

Cette publication est également disponible en français.

© Her Majesty the Queen in Right of Canada, 2018.

Cat No. CH6-59/2018E-PDF

ISBN: 978-0-660-27284-9

Table of contents

- List of acronyms

- Executive summary

- 1.0 Background

- 2.0 About the audit

- 3.0 Findings and recommendations

- 4.0 Conclusion

- Glossary

- Appendix A — assessment scale and results summary

- Appendix B — management action plan

List of acronyms

- BI

- Business Intelligence

- ESA

- Emergency Salary Advance

- FMB

- Financial Management Branch

- HRWMB

- Human Resources and Workplace Management Branch

- PCH

- Department of Canadian Heritage

- PSPC

- Public Services and Procurement Canada

- RFAS

- Regional Financial and Administrative Services

- RMDs

- Resource Management Directorates

- PeopleSoft

- Departmental human resources management system

- OCAE

- Office of the Chief Audit Executive

- CT

- Conseil du Trésor

- EXCOM

- Executive Committee

Executive summary

In 2016, Public Services and Procurement Canada rolled out the Phoenix Pay System (henceforth referred to as "Phoenix"), the result of its Pay Modernization Initiative. This implementation occurred in two phases. In the first phase, 34 departments and agencies, including the Department of Canadian Heritage (PCH or the Department) were brought online in February of 2016, with the pay information of approximately 120,000 employees being migrated to Phoenix. During the second phase, any remaining departments and agencies were migrated on April 21, 2016 (approximately 170,000 additional employees). From the outset, government-wide challenges occurred with the implementation of Phoenix resulting in significant and direct impacts on federal employees. These ongoing challenges and impacts have and continue to receive local, national and international media coverage.

The implementation of Phoenix resulted in negative impacts on the federal government with thousands of employees being affected financially and in their personal lives. In the Public Service, long perceived as a bastion of workplace and career stability, employees have been deferring promotions and job transfers, refusing overtime, and even delaying retirement because of eroding trust in Phoenix. From data breaches of pay information to employees being under paid, over paid or not paid at all, the Government of Canada, departments, and the Public Service are experiencing the reputational repercussions. In addition, multiple technology projects throughout government have been postponed until Phoenix is fixed because of the uncertainty surrounding the future of the current pay system.

Within the Department, a number of employees have been affected and many continue to experience a variety of pay related issues. New cases are being reported every pay period. On a bi-weekly basis, PSPC provides to all departments a Departmental Dashboard presenting a summary of all open cases that remain unresolved after 30 days. The last PCH Departmental Dashboard closing the fiscal year of 2017-2018, presented a total number of 7057 open cases over 30 days old affecting 2631 active and inactive employees (1902 and 729 respectively).

In order to respond accordingly, PCH quickly put into place emergency measures to assist employees experiencing pay issues, including providing Emergency Salary Advances (ESA) and Hardship Claim Payments.

The objective of this engagement was to provide assurance that PCH's control responsibilities for pay administration, including integration and interface with the Phoenix Pay System and central pay processing centre, are adequate and effective.

The scope of the audit was from the implementation of Phoenix at PCH in February 2016 to the completion of the fieldwork and included all PCH controls, processes and systems which enable the accurate and timely processing of employee compensation through the Phoenix Pay System including the Emergency Salary Advance and Hardship Claim Payment processes.

Audit opinion and conclusion

Based on the audit findings, my opinion is that PCH has put in place a functional control environment for the Phoenix Pay System and is meeting the needs of its employees for what is within its control. The Department is limited in its access to Phoenix and the information the system provides, therefore its ability to assist employees dealing with pay related issues is limited. As issues continue to persist, longer term solutions need to be put in place to support the Department and its employees as the Government of Canada is still several years away from finding a sustainable solution. The audit details opportunities for improvement to support the operations with regards to:

- Defining accountability and establishing roles and responsibilities for addressing Phoenix-related pay issues;

- documenting and communicating processes; and

- improving tools used to identify and detect Phoenix-related pay issues.

Statement of conformance

In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Treasury Board Policy and Directive on Internal Audit, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

Original signed by

Dylan Edgar

Acting Chief Audit Executive

Department of Canadian Heritage

Audit Team Members

Kossi Agbogbe, Senior Auditor

Houssein Ndiaye, Auditor

With the support of external resources.

1.0 Background

Public Services and Procurement Canada (PSPC) is responsible for administering the pay for over 100 departments, agencies, and Crown Corporations, which collectively employ approximately 290,000 public servants. In 2009, the Government of Canada approved PSPC's Transformation of Pay Administration Initiative, which was intended to update the 40 year-old pay system. The Transformation of Pay Administration Initiative consisted of two key components:

- Pay Consolidation: viewed as a critical step to transform the payment process, was executed to centralize pay services delivered to departments and agencies, with the intent to eventually transition the pay services of all departments to a centralized Pay Centre in Miramichi, New Brunswick.

- Pay Modernization: was an ongoing process intended to replace the government's pay system with a new system called "Phoenix", which was based on commercial, off-the-shelf software. Phoenix was designed to increase automation of some administrative processes, allow a degree of self-service for users, and integrate with the government's Human Resources Management Systems.

In 2016, Public Services and Procurement Canada rolled out the Phoenix Pay System (henceforth referred to as "Phoenix"), the result of its Pay Modernization Initiative. This implementation occurred in two phases. In the first phase, 34 departments and agencies, including the Department of Canadian Heritage (PCH or the Department) were brought online in February of 2016, with the pay information of approximately 120,000 employees being migrated to Phoenix. During the second phase, any remaining departments and agencies were migrated on April 21, 2016 (approximately 170,000 additional employees). From the outset, government-wide challenges occurred with the implementation of Phoenix resulting in significant and direct impacts on federal employees. These ongoing challenges and impacts have and continue to receive local, national and international media coverage.

"I used to trust the pay system. Now all I see is errors and know there could be more that I don't see. I have lost confidence."

Disillusioned PCH employee

The implementation of Phoenix resulted in negative impacts on the federal government with thousands of employees being affected financially and in their personal lives. In the Public Service, long perceived as a bastion of workplace and career stability, employees have been deferring promotions and job transfers, refusing overtime, and even delaying retirement because of eroding trust in Phoenix. From data breaches of pay information to employees being under paid, over paid or not paid at all, the Government of Canada, departments, and the Public Service are experiencing the reputational repercussions. In addition, multiple technology projects throughout government have been postponed until Phoenix is fixed because managers don't trust the linkages to the pay system.

Within the Department, a number of employees have been affected with many continuing to experience a variety of pay related issues. They are dealing with multiple individual pay related cases with new ones being reported at every pay period. On a bi-weekly basis, PSPC provides to all departments a Departmental Dashboard presenting a summary of all open cases that remain unresolved after 30 days. The last PCH Departmental Dashboard closing the fiscal year of 2017-2018, presented a total number of 7057 open cases over 30 days old affecting 2631 active and inactive employees (1902 and 729 respectively). Through a quarterly PCH survey entitled "Over to You", the most recent results show that over half the Department's employees have experienced some problems with their pay since the transition to Phoenix.

In order to respond accordingly, PCH quickly put into place emergency measures to assist employees experiencing pay issues, including providing Emergency Salary Advances (ESA) and Hardship Claim Payments. During the fiscal year of 2017-2018, a total of 187 ESA and 14 Hardship Claim Payments were provided to PCH employees who have suffered from either being under paid or not paid at all. On average, 7 ESA were being issued by pay period. These numbers do not take into account employees that didn't request an ESA after experiencing under payments. Working collaboratively to assist employees in addressing pay related issues, the Financial Management (FMB), Human Resources and Workplace Management (HRWMB) branches have assigned specific personnel to process these special payments. This involves logging any identified pay problems, issuing ESA or Hardship Claim Payments when applicable, recovering said payments when Phoenix adjusts for any payment errors, and being a conduit to the PSPC Phoenix team as necessary. In addition, PCH has select personnel within HRWMB who have been trained by PSPC to make some pay adjustments within Phoenix Pay System for certain specific cases.

2.0 About the audit

2.1 Project authority

The Office of the Chief Audit Executive (OCAE) has initiated the Audit of the PCH Pay System Control Environment in accordance with the Risk Based Audit Plan for 2017-2018 to 2019-2020.

2.2 Objective and scope

The objective of this engagement was to provide assurance that PCH's control responsibilities for pay administration, including integration and interface with the Phoenix Pay System and central pay processing centre, are adequate and effective.

The scope of the audit was from the implementation of Phoenix at PCH in February 2016 to the completion of the fieldwork and included all PCH controls, processes and systems which enable the accurate and timely processing of employee compensation through the Phoenix Pay System including the Emergency Salary Advance and Hardship Claim Payment processes.

2.3 Approach and methodology

All audit work was conducted in accordance with the Treasury Board Policy and Directive on Internal Audit. In addition, given the overall sensitivity of this engagement and the personal information found in files, the required privacy measures were embedded in the audit activities to ensure conformance with the Privacy Act.

The audit methodology included the following key activities:

- reviewing the organization's documentation, guidelines and procedures, and relevant policy and legislation;

- collecting data through interviews, and walkthroughs with the relevant entities' personnel to examine processes and controls implemented;

- conducting tests of PCH's payment contingency plans – issuance of ESA or Hardship Claim Payments and develop process maps with controls identified and tested; and

- conducting data analytics using established scripts for applicable criteria and fraud risks.

3.0 Findings and recommendations

The audit findings are based on the overall evidence gathered through the audit methodologies applied for each audit criterion. Appendix A provides a summary of conclusions for each of the criteria assessed during this audit.

While audits are typically fact-based and evidence-driven, the importance of the human factor in this case cannot be understated. The sensitivity of this subject matter and impact of the Phoenix Pay System on employees causes the presentation of this audit's findings to be slightly different from the norm.

As an overarching observation, it should be understood that the Department is limited in its access to Phoenix and its ability to retrieve sufficient information and reports to help understand and resolve PCH employees' pay issues. PSPC delegated to PCH very limited Phoenix-related roles and responsibilities for specific pay actions – Leave without Pay, Return from Leave, and Terminations. All other pay actions must be processed through the Pay Centre (in Miramichi, New Brunswick). This has had a distinct impact on the Department's ability to assist employees in dealing with pay related issues. While the Department has the ability to make some pay adjustments on behalf of the Pay Center for certain specific cases, these transactions are not delegated to PCH and remain PSPC's responsibilities. PCH continues to push for additional access and functionality with regards to the Phoenix Pay System.

"I am seriously considering retiring, but am afraid to leave with my file in such a mess."

Worried PCH employee

In addition, departments and agencies did not expect that processes to address pay issues would be needed when the Phoenix Pay System was launched. This system was lauded to be the replacement of the previous 40 year-old pay system and reassurances were provided that sufficient testing had been conducted prior to implementation. However, within weeks of implementation, it became evident that PCH needed to put temporary processes into place. These reactive and ad hoc processes focused on assisting PCH employees experiencing pay related issues and were developed with the understanding that fixes were imminent and they would be put in place during following few months. This has not been the case and as the Department enters the third year of using the Phoenix Pay System, it was announced in the 2018 federal Budget that it will be years before fixes or a replacement will be in place.

Taking all of this into consideration, the following findings and conclusions were noted.

3.1 Accountability, roles and responsibilities

There is no defined accountability for addressing Phoenix-related pay issues within PCH. Roles and responsibilities are not clearly defined or communicated.

Defined accountability and roles and responsibilities ensure that activities surrounding the detection, resolution, and monitoring of Phoenix pay issues can be carried out with effective coordination between all involved parties across the Department and that all parties within the organization are aware of, and comply with, their responsibilities. The lack of clarity in roles and responsibilities can lead to uninformed decisions, ineffective use of resources, and inadequate control.

The Department shares accountability with PSPC and the Treasury Board Secretariat for paying employees in a timely and accurate manner complying with the terms and conditions of employment of federal employees. The audit team expected to find that overall accountability for addressing Phoenix pay issues, and related roles and responsibilities had been defined and communicated. What was found was that while overall accountability for pay clearly resides with the Deputy Head, PCH had not established clear accountability for addressing Phoenix-related pay issues.

It was noted that PSPC had delegated to PCH very limited Phoenix-related roles and responsibilities for specific pay actions – Leave without Pay, Return from Leave, and Terminations. Documents provided by PSPC established the roles and responsibilities and related processes for both PCH and the Pay Centre.

"The pay center has not corrected my hours worked for last February, March, and May with a disability insured and, so I have never been paid for that period. Because of this I returned to my RMD and to finance for help with my pay."

Worried PCH employee

Prior to the transition to Phoenix, the Department developed the PCH Procedures Guide for Pay which has established roles and responsibilities for regular pay administration but does not include processes for identifying and detecting Phoenix-related pay issues. The audit team noted that the roles and responsibilities related to processes to address Phoenix pay issues have not been clearly defined or communicated. This has led to improvised joint responsibility between FMB and HRWMB, processes being ad hoc and entirely person-dependent, and duplication of efforts. Within PCH, Phoenix pay issues are addressed by a variety of parties, such as: HRWMB, FMB, Resources Management Directorates (RMDs), Regional Financial and Administrative Services (RFAS), and the affected employees along with their delegated managers. The following two diagrams depict how regular payroll transactions are processed within PCH and the process when a pay issue is identified.

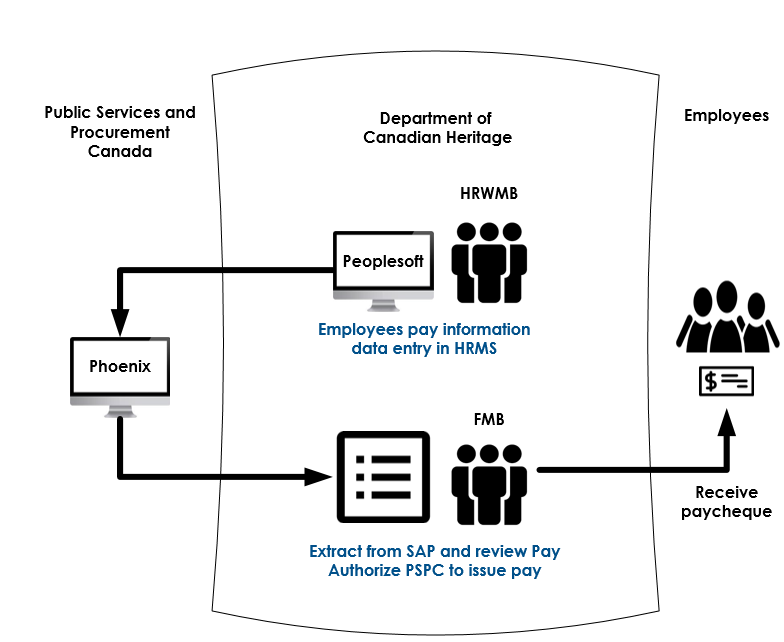

- Figure 1 illustrates the process for regular payroll, from when an employee's pay information is entered into PeopleSoft (PCH departmental Human Resources Management System) to receiving his/her pay cheque.

Figure 1

Figure 1. Process for regular payroll – text version

- Human Resources and Workplace Management branch (HRWMB) proceed to employees pay information data entry in the departmental human resources management system (PeopleSoft).

- This results in data integration with the Phoenix system that produce payroll data sent to the departmental financial system (SAP).

- Canadian Heritage Department's Financial Management Branch extracts and reviews SAP data and authorizes Public Services and Procurement Canada to issue a check to employees.

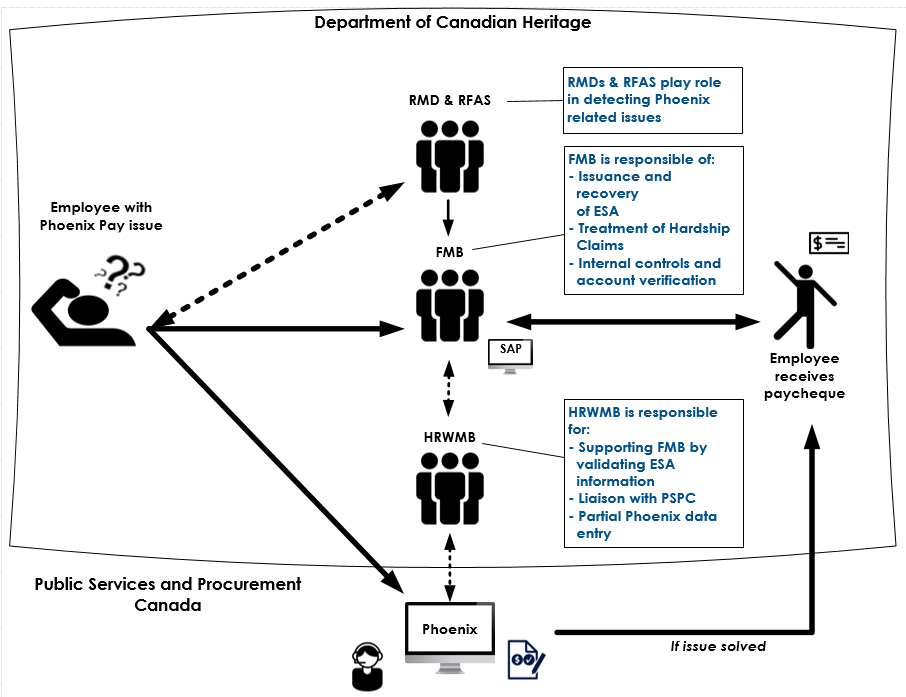

- Figure 2 depicts the current reality and illustrates the process used to address pay related issues.

Figure 2

Figure 2. Process used to address pay related issues – text version

- An employee with Phoenix pay related issue will contact Canadian Heritage Department's Financial Management Branch (FMB) and Public Services and Procurement Canada (PSPC).

- Resources Management Directorates and Regional Financial and Administrative Services identify Phoenix issues and report them to FMB and inform the employee.

- The Human Resources and Workplace Management branch (HRWMB) supports FMB by validating the information on emergency pay advances (ESA) to be issued. FMB makes the necessary data entries into the departmental financial system (SAP) and issue the emergency check to the employee.

- HRWMB performs partial data entry in Phoenix and remains in contact with PSPC for the resolution of employees pay related issue.

- If the issue is solved, the employee receives a paycheque from PSPC and FMB proceeds to recover the ESA

The audit team did observe that FMB has recently developed a robust Pay Administration Process – Pre-Payroll, Payroll and Post-Payroll Sub-processes with defined roles and responsibilities for FMB, HRWMB, RMDs, and delegated managers. It should also be noted that efforts are made within the Department to assist employees with Phoenix-related pay issues, including providing Emergency Salary Advances and Hardship Claim Payments.

Recommendation

- The Chief Financial Officer and the Director General, HRWMB, should collectively develop a roles and responsibilities document for all matters related to Phoenix pay procedures and possible issues – this document should be endorsed by EXCOM and communicated to all employees.

3.2 Guidance, training and support

The Department has adopted and communicated the limited guidance and training provided by PSPC.

Guidance, training and support are key elements to enable employees, their respective managers and functional specialists to understand their respective roles and responsibilities, the functionalities and limitations of any new system or process, including how to address issues and implement resolutions. The audit team expected to find that PCH staff have been provided with appropriate guidance, training, and other support on the Phoenix Pay System and on internal PCH processes to prevent, identify, and/or address Phoenix-related pay issues.

It was noted that PSPC is responsible for providing guidance and training to all Public Service employees with regards to the Phoenix Pay System and the departments and agencies adopt and communicate this guidance and training. The original online training provided by PSPC on the functionalities of the new Phoenix Pay System was delivered several months prior the implementation of the system but did not include training on how to prevent, determine, and address pay related issues. During the fieldwork of this audit, a new mandatory online pay related training for all employees was announced. This training has been tailored to PCH, taking in account PeopleSoft and how it impacts the way pay is processed.

"I feel so powerless. The only time I have had any action is when someone from the liaison group takes it on."

Reaction from a PCH employee

The Department has taken steps to provide awareness and information to employees on pay issues and other pay related subjects. The PCH intranet is a source of information and guidance in areas such as the PCH pay procedures and procedures related to PeopleSoft data entry. Within the last six months, the Department has provided in-house information sessions to employees on retroactive pay calculations and the audit team was informed that future sessions on a variety of pay related topics were being planned. This first-of-its-kind session was well attended and well received by employees.

The audit team noted that HRWMB has good communication practices with respect to providing employees with Phoenix-related information as it becomes available. A liaison unit within HRWMB was created soon after the transition to the Phoenix Pay System. It is tasked with maintaining continuous communication with PSPC and the Pay Centre as well as adopting and disseminating all instructions and updates from PSPC. An example of this is the adoption and integration of the PSPC guidance and procedures related to PeopleSoft data entry into PCH procedures.

PSPC provided selected PCH compensation advisors with eight weeks of in-depth training in Phoenix Pay System, learning how to use the system and its functionalities, how to address specific errors and issues, and how the integration between Phoenix and PeopleSoft generally works. With this training, PCH's onsite compensation advisors are able to access the Phoenix Pay System and address pay issues that relate to the areas of responsibility that have been delegated to PCH. Employees experiencing issues in one of these areas are able to find resolution quicker than if they had to go through the Pay Centre.

3.3 Processes, controls and reporting activities

There is a lack of documentation of processes related to the preventing, identifying and addressing of Phoenix-related pay issues. Segregation of duties controls are in place and working effectively. Regular updates of Phoenix pay related issues and cases are provided to a Level 2 governance committee. A Business Intelligence (BI) tool has recently been developed as a reporting tool but has limited functionality.

Well defined processes, controls, and reporting activities effectively support the Department's operations and ensure compliance with the Financial Administrative Act and the applicable TB policies and directives. A process that includes clear definition of roles and responsibilities, especially a formal one, allows employees to know what is expected of them and where to seek advice and/or expertise required when making decisions. Established processes with proper controls will support the addressing of Phoenix-related pay issues (for all that falls within PCH's authority and control) that might have financial impacts on employees and the Department. The audit team expected to find that PCH had implemented processes with controls that support the identification and detection of Phoenix-related over and under payments. They also expected to find that PCH had implemented a process with controls that supports the processing of Emergency Salary Advances requested by PCH employees. Such processes would include a clear definition of roles and responsibilities that have been communicated to key positions involved.

The audit team found that while the Department is doing well reacting to and addressing pay related issues that were within the Department's control, particularly over and under payments, the preventing, identifying, and/or addressing of Phoenix pay issues are reliant on select key individuals in FMB and HRWMB. The team did not find evidence of defined or formal processes or established workflows related to the detection and identification of pay errors. Without PSPC guidance regarding the identification and reporting of under and over payments, the Department has put into place ad hoc steps reacting to issues as they appear.

It was observed that while there are no established processes or training provided for the detection and identification of pay related issues, PCH employees are heavily reliant on RMDs and RFAS to undertake these activities. As a result, each adopted their own approach and processes. The audit team found that the process of pay issue identification, consisting of comparing actual salary payments from Phoenix to forecasted salaries in SAP using various tools (e.g. BI tool and Excel spreadsheets) is inconsistently performed across the Department.

In order to assist in identifying pay related issues, such as over and under payments, FMB has recently developed a BI Reporting Tool that draws information directly from SAP (departmental financial management system). Through testing and data analytics during the fieldwork, the audit team found that in its current state, the BI Reporting Tool has limited functionality to allow for the proper identification of probable/likely pay errors. However, the potential of this tool was assessed and the results of the analytics conducted were shared with the BI team for their use in improving the tool.

The audit team did note that segregation of duties financial controls are in place and working as required. In addition, the controls around ESA and Hardship Claim Payment issuance and recovery are in place and functioning as expected. While the process of issuing ESA (verification, analysis, calculations, and validations) is dependent on a single person and has not been documented, the Department has been able to issue ESA within 6 to 48 hours of a request or notification of under payment. PCH is among the few departments and agencies taking these steps to assist its employees.

The audit team noted that there is no formal monitoring process regarding Phoenix-related pay issues to track requests and cases managed within PCH or by the Pay Centre. Guidance provided to employees is that each pay issue must be directed to the Pay Centre and the involvement of the RMDs and HRWMB has come from the frustration at the lack of resolution, contact and/or information regarding the employees' respective cases. A variety of logs have been developed across the Department to capture these issues and there is a distinct duplication of effort between FMB, HRWMB and the RMDs. The audit found that work has begun with HRWMB to bring some order and cohesion to the information needed to report to senior management. As of December 2017, regular updates on Phoenix-related pay issued are being provided to the PCH Communication and Coordination Committee (Senior-Level Committee).

Recommendation

- The Chief Financial Officer, in conjunction with the Director General, HRWMB, should develop, implement, and communicate standard processes for identifying and detecting Phoenix over and under payments.

- The Chief Financial Officer should continue the development of the BI tool, improving its functionality and ensuring completeness of the data to aid in the identification of probable or likely pay errors.

- The Director General, HRWMB, in conjunction with the Chief Financial Officer, should establish a formal monitoring process for tracking Phoenix-related pay issues.

3.4 Information management/Information technology data requirements

A separate verification of PeopleSoft data entry is not conducted. Errors were found when pay actions were entered after 90 days of the actions occurring. Proper privacy safeguards are in place to protect sensitive and personal information on Hardship Claim Payment requests.

Departments require effective internal controls to ensure that data is valid, complete and accurate as a preventative measure because this data directly impacts the quality of information used for payroll processing. Enforcing strong data quality minimizes the level of effort required to address issues and perform adjustments post-payroll. The audit team expected to find IM/IT controls in place to support the accuracy and completeness of data and to ensure the security and safeguard of the information related to the entire pay process. PeopleSoft is the sole departmental source of HR and pay related data entry with integration to the Phoenix Pay System.

The audit team noted that PeopleSoft controls to support accuracy and completeness of data are based on a proactive error check and according to the guidance and manual, are performed by the same person making the original entries. The team did not find evidence of separate data verification being conducted within the PeopleSoft unit or elsewhere within HRWMB. Separate verification would reduce the number of data entry errors and help prevent some of the pay related issues. In addition, data analytics conducted during the audit fieldwork identified a majority of the errors relating pay action data occurred when the data was entered 90 days after the actions took place.

The audit team found that proper privacy safeguards were in place to protect the sensitive and personal information on Hardship Claim Payment requests. It was also noted that human resource and pay action files are encrypted when transferring data to the Pay Centre in Miramichi, New Brunswick adhering the Policy on Government Security. Information relating to files within HRWMB are subject to the Department's network and access controls, and limit access to the few employees working on those files.

Recommendation

- The Director General, HRWMB, should implement a separate verification process for PeopleSoft data entry in order to reduce errors.

- The Director General, HRWMB, should establish and communicate processes to ensure HR and pay action data are entered within 90 days of the action occurring to reduce Phoenix errors.

3.5 Human factor

The Phoenix Pay System and related pay issues are taking its toll on impacted employees as well as those trying to help resolve these issues.

"I am back at work after having been on disability for mental health so these numerous pay issues and the lack of support at the pay centre have been particularly distressing to me."

Distressed PCH employee

The federal government has an obligation to pay its employees on time and accurately. Not doing so has had serious emotional and financial impacts on its employees. During the course of this audit, the audit team encountered instances and examples of the impact the Pay Centre, the Phoenix Pay System and pay issues is having on employees. Over half of the PCH employees who responded to the most recent "Over to You" survey have experienced some problems with their pay since the transition to Phoenix. It was also noted that employees are able to make use of the services of the Ombudsman at PCH to help them deal on a personal level with Phoenix-related pay issues and the subsequent toll.

Our liaison people were extremely helpful early on, but I have the impression they have been hit by a tsunami and cannot keep up with the demand. They can be a great help, but must be so overwhelmed."

Affected PCH employee

The audit team observed that the emotional investment is high for those experiencing Pay Centre and Phoenix-related pay issues, as well for those helping to address these issues, noting that there is a significant risk of increased stress leave and burnout, particularly for those few key individuals identifying and providing relief on Phoenix-related pay issues. In addition, productivity of employees dealing with these pay issues is impacted, as hours are spent trying to resolve each issue. Career decisions are also being affected as employees are concerned that accepting an acting, assignment, or a new position will impact their pay. There is sense of waiting for the "other shoe to drop" for those who remain "untouched" by Phoenix.

The Department continues to take steps to help ease the burden and the level of stress being experienced by those involved with the issuance of ESA and Hardship Claim Payments when requested.

4.0 Conclusion

The objective of this engagement was to provide assurance that PCH's control responsibilities for pay administration, including integration and interface with the Phoenix Pay System and central pay processing centre, are adequate and effective. Based on the audit findings, PCH has put in place a functional control environment for the Phoenix Pay System and is meeting the needs of its employees for what is within its control. The Department is limited in its access to Phoenix and the information the system provides, therefore its ability to assist employees dealing with pay related issues is limited. As issues continue to persist, longer term solutions need to be put in place to support the Department and its employees as the Government of Canada is still several years away from finding a sustainable solution.

The audit team did find opportunities for improvement with regards to defining accountability and establishing roles and responsibilities for addressing Phoenix-rated pay issues; documenting and communicating processes to ensure they are not person-dependent; and improving tools used to identify and detect Phoenix-related pay issues.

Glossary

Business Intelligence (BI) Tool is a flexible, enriched and integrated analytical reporting solution used by PCH for the data analysis of financial business information. BI technologies provide historical, current and predictive views of business operations with enhanced graphical and interactive presentation. Common functions of business intelligence include reporting, online analytical processing, analytics, data mining, business performance management, benchmarking, predictive analytics, and prescriptive analytics.

Emergency Salary Advances (ESA) are payments made to a federal employee in the event that a salary payment is not issued following an initial appointment, a return from leave without pay or any other event where regular salary is disrupted. To ensure accordance with the Directive on Terms and Conditions of Employment, ESA must be issued only for time worked in a pay period and not paid through the normal processing of that pay.

Hardship Claim Payments are compensation claims made available for federal employees who have suffered financial hardships due to pay problems caused by Phoenix. The Government of Canada established the following 3 types of claims eligible for a Hardship Claim Payment:

- Claims out-of-pocket to compensate employees who were under paid and consequently incurred out-of-pocket expenses such as interest charges on credit card/loan/line of credit, financial penalty charges, NSF (non-sufficient-funds) or insufficient fees, etc.

- Reimbursements for tax advice can be requested if the need to consult an expert for income tax purposes is required, due to pay errors caused by Phoenix.

- Advances for government benefits can be requested in the event that benefits such as Canada child benefit, or other credits were reduced due to a Phoenix over payment.

Public Service Pay Centre (or Pay Centre) provides pay and compensations services to federal employees and managers of 46 departments and agencies.

PeopleSoft is the PCH departmental Human Resources Management System (HRMS) used as a fully integrated information management system to gather, record, and process HR information, payroll and benefits pertaining to the personnel. PeopleSoft information is further used to prepare reports for departmental directors and central agencies. The system also provides self-service functionality to end-users allowing employees to manage their leave requests and managers to review, approve or deny leave transactions.

Resource Management Directorates (RMDs) provide shared management support services for financial management, human resource management and administrative functions to Branches and Direct Reports at the sector level.

Regional Financial and Administrative Services (RFAS) provide similar services as the Resource Management Directorates in the PCH regional offices.

SAP is the PCH Departmental Financial Management System (DFMS) used as a software application to produce financial information and related non-financial information. It supports Payroll System-General Ledger financial and control operations, and manages the Standard Payment System (SPS) which is the system used for issuing payments for the Government of Canada.

Appendix A — assessment scale and results summary

The conclusions reached for each of the criteria used in the audit were developed according to the following definitions.

| Note | Conclusion | Definition |

|---|---|---|

| 1 | Well controlled | Well managed, no material weaknesses noted; and effective. |

| 2 | Controlled | Well managed and effective. Minor improvements are needed. |

| 3 | Moderate issues | Requires management focus (at least one of the following criteria are met):

|

| 4 | Significant improvements required | Requires immediate management focus: At least one of the following three criteria are met:

|

The table below includes all audit criteria and is used to develop audit conclusions.

Audit objective: The objective of this engagement was to provide assurance that PCH's control responsibilities for pay administration, including integration and interface with the Phoenix Pay System and central pay processing centre, are adequate and effective.

| Audit criteria | Conclusion | |

|---|---|---|

| 1. | Overall accountability for addressing Phoenix pay issues, and roles and responsibilities related to specific processes to address Phoenix pay issues are clearly defined and communicated. | 3 |

| 2. | Appropriate guidance, training, and other support is provided to PCH staff on internal PCH processes to prevent, identify, and/or address Phoenix pay issues, specifically ensuring that PCH processes are in line with PSPC expectations and vice versa. | 2 |

| 3. | Identification, monitoring, and reporting processes and controls (automated and manual) are in place and working as expected. | 3 |

| 4. | IM/IT controls are in place to support the accuracy and completeness of data, and to ensure the security and safeguarding of information related to the entire pay process. | 3 |

Appendix B — management action plan

| Recommendations | Management assessment and actions | Responsibility | Target date |

|---|---|---|---|

|

|

Co-lead CFO / DG HRWMB |

September 30, 2018 |

|

|

Co-lead CFO / DG HRWMB |

September 30, 2018 |

|

Co-lead CFO / DG HRWMB |

September 30, 2018 | |

|

DG HRWMB | On-going | |

|

|

CFO | August 30, 2018 |

|

|

Co-lead CFO / DG HRWMB |

September 30, 2018 |

|

DG HRWMB | On-going | |

|

DG HRWMB | On-going | |

|

CFO | July 30, 2018 | |

|

|

DG HRWMB | Completed |

|

|

DG HRWMB | On-going |

|

|||

|

Page details

- Date modified: