Evaluation of the Canada Music Fund 2012-13 to 2017-18

Evaluation Services Directorate

July 26, 2019

Cette publication est aussi disponible en français.

On this page

- List of tables

- List of figures

- List of acronyms and abbreviations

- Executive summary

- 1. Introduction

- 2. Program profile

- 3. Approach and methodology

- 4. Findings

- 5. Conclusions

- Annex A: logic model of the Canada Music Fund

- Annex B: bibliography

List of tables

- Table 1: Canada Music Fund expected results

- Table 2: target population and key stakeholders

- Table 3: program resources

- Table 4: Canada Music Fund Full-time equivalents

- Table 5: evaluation questions

List of figures

- Figure 1: modelling of the Canada Music Fund's structure before the modernization

- Figure 2: number of conferences, award shows and industry events supported by the Canada Music Fund in comparison to the target in PIP

- Figure 3: number of supported music entrepreneurs in comparison to the target

- Figure 4: average number of Canadian artists represented by MEC – aid to Canadian sound recording firms' recipients

- Figure 5: business support offered by FACTOR and Musicaction

- Figure 6: number of albums produced and released by MEC, FACTOR and Musicaction recipients

- Figure 7: average number of eligible musical works published by MEC recipients

- Figure 8: number of NMW domestic and international marketing, showcase and tour projects funded

- Figure 9: number of CI international marketing projects funded

- Figure 10: number of digital market development projects funded and amount awarded

- Figure 11: market share of Canada Music Fund-supported artists on domestic consumption charts (albums and streaming)

- Figure 12: domestic and international sales in units of eligible sound recordings released by Canada Music Fund recipients

- Figure 13: market share of Canadian artists on domestic consumption charts (albums and streaming)

- Figure 14: domestic and international performance royalties for Canadian artists

- Figure 15: the value chain at the beginning of the evaluation period

- Figure 16: value chain less segmented as stakeholders adapt to new environment

- Figure 17: modelling of the Canada Music Fund's structure after the modernization

List of acronyms and abbreviations

- BC

- Province of British Columbia

- CI

- Collective Initiatives component

- FACTOR

- Foundation Assisting Canadian Talent on Recordings

- FTEs

- Full-Time Equivalents

- GBA+

- Gender-Based Analysis Plus

- IFPI

- International Federation of the Phonographic Industry

- LAC

- Library and Archives Canada

- MEC

- Music Entrepreneur Component

- NMW

- New Musical Works component

- OLMCs

- Official Language Minority Communities

- OMF

- Ontario Music Fund

- PCH

- Department of Canadian Heritage

- PIP

- Performance Information Profile

- PMERS

- Performance Measurement, Evaluation and Risk Strategy

- SOCAN

- Society of Composers, Authors and Music Publishers of Canada

- SODEC

- Société de développement des entreprises culturelles

Executive summary

This report presents the findings of the evaluation of the Canada Music Fund.

Program description

The Canada Music Fund is the federal government's main funding program for Canadian music, supporting the activities of music creators, artists, and entrepreneurs to ensure Canadians' access to a diverse range of Canadian music. The Program aims to increase the creation of and access to a diversity of Canadian music for audiences everywhere by enhancing the sector's ability to compete in domestic and international markets. The Program is delivered by the Cultural Industries Branch of the Cultural Affairs Sector of Canadian Heritage (PCH).

The Canada Music Fund currently delivers its mandate through four components:

The Music Entrepreneur component (MEC) of the Canada Music Fund is delivered internally by PCH. This component helps to ensure that well established Canadian music entrepreneurs build a strong and competitive industry capable of contributing to the Canadian musical experience over the long term through a diverse range of compelling Canadian choices.

The New Musical Works component (NMW) – delivered by third-party administrators: The Foundation Assisting Canadian Talent on Recordings (FACTOR) and Musicaction – helps ensure that diverse Canadian musical works are created and promoted by supporting the projects of Canadian music artists, sound recording companies and other music entrepreneurs.

The Collective Initiatives (CI) component of the Program – also delivered by FACTOR and Musicaction – helps to create opportunities for Canadian music artists and independent music companies to enhance their visibility both domestically and internationally.

The Canadian Music Memories component – delivered by Library and Archives Canada (LAC) – helps to ensure Canadians can access their musical heritage, by supporting initiatives undertaken by LAC.

Evaluation approach and methodology

The evaluation covered the period of 2012-13 to 2017-18 and, was conducted pursuant to Treasury Board Secretariat's 2016 Policy on Results and the Financial Administration Act.

This evaluation assessed efficiency and progress toward the achievement of the Canada Music Fund expected results with an emphasis on a developmental evaluation approach to frame the quickly evolving music industry in which the Program operates. This approach provided evidence to support the Program's modernization efforts given the evaluation was being conducted while the modernization of the program was being designed and approved.

The evaluation involved a multi-method approach and included a combination of qualitative and quantitative data collection methods and primary and secondary data sources to address the evaluation issues and questions.

Past performances

Efficiency

Over the six-year period evaluated, the operating costs of the Canada Music Fund were stable ranging from 4.8% in 2012-13 to 4.9% in 2017-18, with a peak at 5.9% in 2013-14. While overall, the Program met the acknowledgment standards for receipt of application forms within 2 weeks of the date of receipt, it experienced some challenges to comply with decision standards which fluctuated over the evaluation period due to delays in the approval of funding. However, improvements have been observed following the introduction of measures that significantly reduced the number of files required to be approved by the Minister.

Achievement of expected immediate outcomes

The evaluation found that the Program progressed toward its immediate expected outcomes. Between 2012-13 and 2017-18, the Canada Music Fund funded specific activities such as domestic, international and digital projects, music production, promotion and preservation as well as skills and knowledge development projects that provided opportunities for Canadian music artists and entrepreneurs to build skills and knowledge.

The number of collective projects, such as conferences and award shows increased over the period evaluated. Bootcamps were also initiated as a way to provide opportunities for Canadian music artists and entrepreneurs to build skills and knowledge. Almost all interviewees noted with appreciation the emphasis that was placed on innovation, export activities and networking opportunities as part of these collective projects.

The Canada Music Fund also enabled an increasing number of entrepreneurs who invested in the development of Canadian artists. Over the evaluation period, the average number of Canadian artists represented by MEC – Aid to Canadian sound recording firms' recipients increased by 23.3%, suggesting that they increasingly invest in the development of Canadian artists.

The Program met the outcome of enabling Canadian artists to produce and publish sound recordings. FACTOR/Musicaction play a key role in supporting the creation of homegrown musical content. The Canada Music Fund surpassed its targets with an average of 498 albums produced and released by MEC, FACTOR and Musicaction recipients.

The number of NMW projects for marketing, showcasing or touring increased by 46.4% between 2013-14 and 2017-18. Collectives Initiatives projects for international marketing increased by 123% over the evaluation period.

To ensure Canadians can access their musical heritage, funds are allocated for the acquisition, cataloguing, and preservation of Canadian sound recordings. For theses activities, the Canadian Music Memories component's targets of 185 sound recording acquisitions and 4300 hours of Canadian musical works digitized per year both were exceeded in 2017-18.

Achievement of expected intermediate and ultimate outcomes

Domestically, the Program enabled Canadian music produced and published by recipients to be accessed and consumed. Overall, the program has achieved its target of maintaining the market share of CMF-supported artists on the top 2,000 albums chart at 8% and was working toward achieving the target of 6% of CMF-supported artists' market share for streaming, by 2022. The domestic and international sales in units of eligible sound recording released by Program recipients increased by 21.2% between 2014-15 and 2015-16.

The Canada Music Fund contributed to making accessible for consumption a wide range of Canadian musical choice. While Canadian artists may see their market share on domestic consumption charts slightly decrease, the domestic and international royalties have steadily increased between 2012-13 and 2016-17 (by 26.30% and 41.66% respectively).

A need for modernization

During the period under evaluation, the music industry has continued the multiple decades of disruption. While the physical album sales continued to decline, the online streaming services has generated growth for the global music industry for the first time in nearly two decades. However, the evaluation showed that as increased revenues from streaming have been concentrated in the hands of larger players so too has the power over what and how music goes out onto mainstream platforms.

Faced with declining revenues from sound recording sales and to better capture multiplying revenue streams, music entrepreneurs began to diversify their business models and revenue sources. The new business model of accessing music through online platforms has imposed burdens on the time and resources of emerging and independent artists, who have had to learn and get involved in the business aspect of their careers at the expense of being solely devoted to creating.

Over the evaluation period, the Program has implemented incremental changes to address and adapt to the recent shifts in the industry. Program has completed studies and mapped the ongoing evolution in the music industry. However, the Program staff and industry stakeholders have widely acknowledged that the program is out-of-date and requires modernization. At the time of writing this report, program management had received approval to implement a modernization.

How a modernization could work

The approved modernization of the Canada Music Fund should provide a more streamlined program administration, reduce the complexity of reporting on outcomes, and provide much needed flexibility.

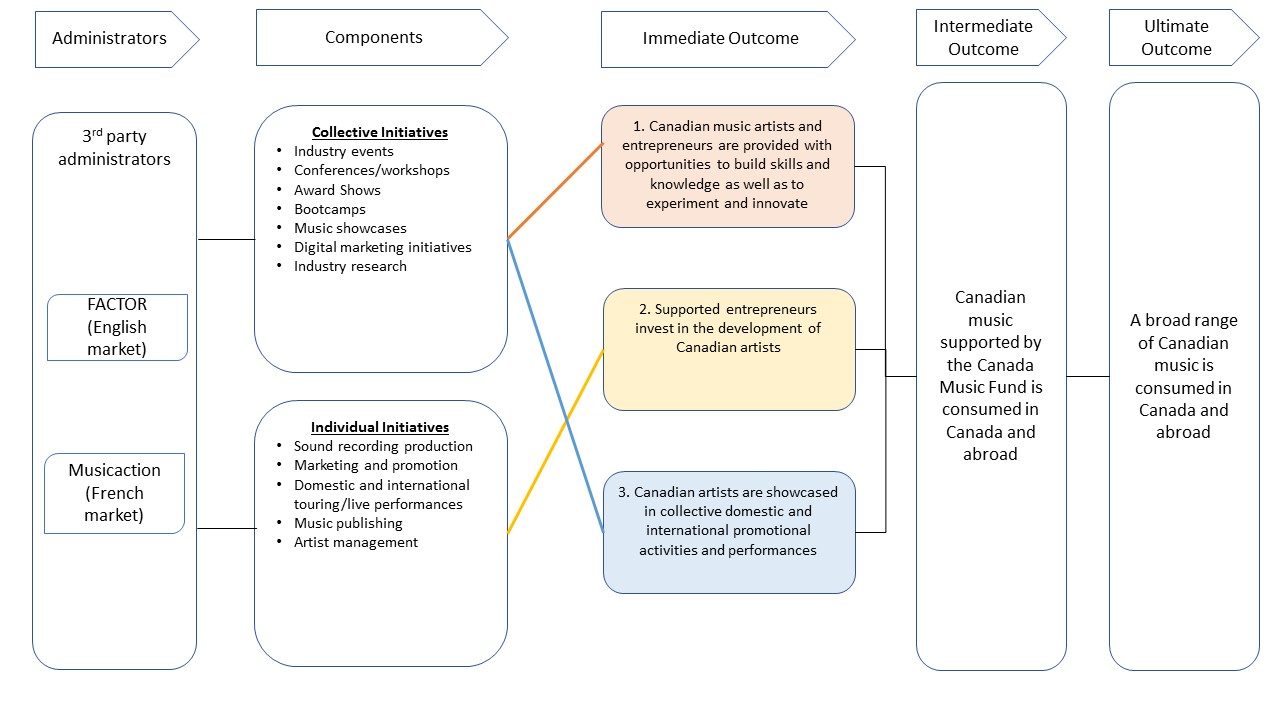

Among other, the proposed changes to modernize include:

- the Program will be exclusively administered through FACTOR and Musicaction, for the English and the French markets respectively – reducing the number of Program components from four to two (Collectives initiatives and Individuals initiatives); and

- the reduction of immediate outcomes from five to three.

Overall, these changes represent a significant and positive update. As the music industry ecosystem is very complex and that technological advancements and business models evolve quickly, articulating the Program's theory of change could prove beneficial to facilitate comprehension of the Program's interventions toward its expected immediate, intermediate and ultimate outcomes.

In light of the evaluation findings and given the recent modernization that is being implemented, no recommendations have been made. However, the ESD proposes that a subsequent evaluation of the first 18-24 months of the modernization be conducted in order to assess the improvement of the performance measurement through the new flexibility of the program delivery. Additionally, the evaluation will assess how the program has addressed the internal incoherencies associated with the multiple components of the program and reduced the patchwork effect.

1. Introduction

This report presents the findings of the evaluation of the Department of Canadian Heritage's (PCH) Canada Music Fund. The evaluation was conducted in accordance with the requirements of the Financial Administration Act and Treasury Board 2016 Policy on Results. It was undertaken in accordance with the 2018-19 to 2022-23 Departmental Evaluation Plan, approved by the Deputy Minister. The evaluation covered the period of 2012-13 through 2017-18 and assessed efficiency and progress toward the achievement of the Canada Music Fund expected results, with an emphasis on a developmental evaluation approach to frame the quickly evolving music industry in which the Program operates.

The report is divided into five sections, including the introduction. Section 2 provides the program profile. Section 3 describes the approach and methodology for the evaluation. Section 4 presents the evaluation findings. Section 5 summarizes the main conclusions.

2. Program profile

2.1. Overview

The Canada Music Fund is delivered by the Cultural Industries Branch of PCH and it aims to increase the creation of and access to a diversity of Canadian music for audiences everywhere by enhancing the sector's ability to compete in domestic and international markets.Footnote 1 The Program supports a broad range of activities including the production of Canadian sound recordings, marketing and promotion initiatives, as well as domestic and international touring and showcasing, digital distribution, artist and business development, music publishing, music management, award shows and professional conferences as well as preservation.Footnote 2

The support to Canadian music artists and entrepreneurs is offered through the following four complementary funding components:

Music Entrepreneur ($9.53M)

The Music Entrepreneur component (MEC) of the Canada Music Fund is delivered internally by PCH. This component helps to ensure that well established Canadian music entrepreneurs build a strong and competitive industry capable of contributing to the Canadian musical experience over the long term through a diverse range of compelling Canadian choices.Footnote 3

The bulk of this component's funding is allocated to Canadian sound recording firms, with a proven track record, in support of the creation, publishing, production, distribution or marketing of Canadian music by new, emerging, and established Canadian music artists, including touring related activities (Aid to Canadian Sound Recording Firms sub-component). Project funding is also available for Canadian music publishing firms to undertake activities relating to the promotion of Canadian musical works and the development of Canadian songwriters or composers (Aid to Canadian Music Publishing Firms sub-component). National music associations may also receive funding to undertake collective promotional activities in international and domestic markets for Canadian music content and artists (Aid to Canadian Music Industry National Service Organizations sub-component).

New Musical Works ($11.80M)

The New Musical Works component (NMW) – delivered by third-party administrators: The Foundation Assisting Canadian Talent on Recordings (FACTOR) and Musicaction – helps ensure that diverse Canadian musical works are created and promoted by supporting the projects of Canadian music artists, sound recording companies and other music entrepreneurs. This component funds the production of sound recordings and music videos by new and emerging Canadian artists. It also supports marketing activities and provides funding for artists to tour and take part in showcasing events, both domestically and internationally.Footnote 4

Collective Initiatives ($5.63M)

The Collective Initiatives (CI) component of the Program – also delivered by third-party administrators FACTOR and Musicaction – helps to create opportunities for Canadian music artists and independent music companies to enhance their visibility both domestically and internationally. It does so by providing support to not-for-profit organizations and to Canadian companies for the organization of events that benefit the Canadian music industry, such as conferences, award shows, and domestic and international music events that showcase Canadian music. It also supports digital market development initiatives that enhance the accessibility of Canadian music on new and emerging platforms.

Canadian Music Memories ($360K)

The Canadian Music Memories component – delivered by Library and Archives Canada (LAC) – helps to ensure Canadians can access their musical heritage, by supporting initiatives undertaken by LAC. Funds are allocated for the acquisition, cataloguing, and preservation of Canadian sound recordings, as well as for the storage, access and, where necessary, restoration of Canadian musical heritage.

2.2. Program history and previous evaluation

The Program was launched in 2001 as part of a suite of arts and culture programs, replacing the Sound Recording Development Program introduced in 1986. The Program is the federal government's main funding program for Canadian music, supporting the activities of music creators, artists, and entrepreneurs to ensure Canadians' access to a diverse range of Canadian music.Footnote 5

A Cultural Industries Cluster Evaluation (Canada Music Fund and Canada Book Fund) covering the period 2007-08 to 2011-12 was completed in July 2014. The evaluation found that the Program was relevant and achieved its expected results. The evaluation recommended that the Program review its performance measurement strategy, in order to gather the information it needed to demonstrate the level of achievement against expected results on an annual and five-year basis. The evaluation suggested that the Program gather information on the language of artistic expression used in each album produced with MEC support, as well as sales figures (in dollars and in units) for sound recordings produced with program support. The recommendation was accepted by management and the indicators were included in the Program's 2015 Performance Measurement, Evaluation and Risk Strategy (PMERS).Footnote 6

2.3. Program expected results

As stated in the 2017 Performance Information Profile (PIP), the Canada Music Fund "supports the activities of Canadian music artists and entrepreneurs aimed at increasing the creation of and access to a diversity of Canadian music for audiences everywhere by enhancing the sector's ability to compete in domestic and international markets."Footnote 7

Table 1 provides the expected results of the Canada Music Fund.

| Immediate results |

|

|---|---|

| Intermediate result | Canadian music supported by the Canada Music Fund is accessed in Canada and abroad |

| Ultimate result | A broad range of Canadian music is consumed in Canada and abroad |

2.4. Target population, stakeholders and delivery partners

Table 2 describes the program's target population and key stakeholders.

| Target Population | Key Stakeholders |

|---|---|

| The Canada Music Fund benefits different segments of the Canadian music sector, across the country and in both official languages. Ultimate recipients include Canadian artists, Canadian owned and operated music recording, publishing and management companies, Canadian not-for-profit music sector organizations or associations representing Canadian artists or entrepreneurs, as well as digital entrepreneurs. |

Key stakeholders include Canadians, music artists and entrepreneurs, Canada Music Fund third-party administrators, as well as organizations that directly benefit – or whose members directly benefit – from Canada Music Fund support, including:

|

The Canada Music Fund's four complementary components are administered by PCH and are delivered by PCH, FACTOR, Musicaction and LAC. FACTOR and Musicaction are private, not-for-profit organizations providing financial assistance to the English- and French-language sectors of the Canadian music industry, respectively. Created by Canadian private radio broadcasters in the mid-80s as a way to fulfill their commitments to the CRTC, these third-party administrators also administer contributions from commercial radio broadcasters.

2.5. Program management and governance

Accountability for the Canada Music Fund lies with the Assistant Deputy Minister, Cultural Affairs sector. Responsibility for the Canada Music Fund rests with the Director General, Cultural Industries Branch of the Cultural Affairs Sector. The Department's Cultural Industries Branch is responsible for the overall management of the four Canada Music Fund components and it also provides policy advice and remains accountable for the program's design, results, and oversight of third-party administrators.

2.6. Program resources

Table 3 provides a summary of the Canada Music Fund's actual financial resources for each fiscal year between 2012-13 and 2017-18.

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | |

|---|---|---|---|---|---|---|

| Operating Expenditures | $1,238,832 | $1,478,607 | $1,395,491 | $1,337,221 | $1,280,363 | $1,407,030 |

| Contributions | $24,681,586 | $23,547,884 | $23,557,050 | $23,684,854 | $26,240,731 | $27,289,309 |

| Total | $25,920,418 | $25,026,491 | $24,952,541 | $25,022,075 | $27,521,094 | $28,696,339 |

Source: Canadian Heritage. (2018). Financial information – Canada Music Fund. Internal document.

Full-time equivalents (FTE) ranged between 14.0 and 16.0 (Table 4).

| 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|

| 15.7 | 15.3 | 15.8 | 15.0 | 14.0 | 16.0 |

Source: Departmental Performance Reports and Departmental Results Reports from 2012-13 to 2017-18.

3. Approach and methodology

This section outlines the evaluation approach and methodology including scope, calibration, evaluation questions, data collection methods, limitations and mitigation strategies. The methodology included a combination of qualitative and quantitative data collection methods and used primary and secondary sources of information designed to address the evaluation issues and questions.

3.1. Scope and quality control

The evaluation of the Canada Music Fund, led by the Evaluation Services Directorate, was conducted pursuant to Treasury Board Secretariat's 2016 Policy on Results and the Financial Administration Act. The evaluation was undertaken in accordance with the Departmental Evaluation Plan 2018-19 to 2022-23 and covered the six-year period from 2012-13 to 2017-18.

This evaluation assessed efficiency and progress toward the achievement of the Canada Music Fund expected results with an emphasis on a developmental evaluation approach to frame the quickly evolving music industry in which the Program operates. This approach provided evidence to support the Program's modernization efforts.

Quality assurance measures were undertaken during the evaluation including developing a clear description of the evaluation methodology and its limitations so that the data collected could be evaluated reliably and satisfactorily, using multiple sources of primary and secondary data to ensure that findings were reliable and defensible, and engaging representatives of the Program to discuss evaluation issues and to validate the preliminary findings.

3.2. Calibration

The evaluation was calibrated as follows:

- The evaluation relied on existing data sources. For example, the document and file review relied on data provided by the Program to evaluate the achievement of results. Additional data was collected when insufficient information was available from existing sources or to validate the available secondary data.

- In order to avoid respondent fatigue, a limited number of external industry stakeholders were interviewed as part of the evaluation given the program had recently held consultations (n=119) regarding the modernization. Program consultation summaries were included in the document review.

3.3. Evaluation questions

Table 5 below outlines the specific evaluation questions that were used to guide this evaluation.

Table 5: evaluation questions

Theme 1: past performance

EQ1. To what extent has Canada Music Fund delivery been efficient?

EQ2. To what extent has the Canada Music Fund progressed toward expected outcomes?

Theme 2: a need for modernization

EQ3. To what extent does the Canada Music Fund require modernization?

Theme 3: how a modernized Canada Music Fund could work

EQ4. How could the Canada Music Fund better address the evolving ecosystem and modernize its service delivery?

3.4. Data collection methods

A mixed-method approach was utilized for this evaluation including a document and file review, media scan and literature review, an international and subnational comparative review and key informant interviews. The following describes each of the data collection methods.

3.4.1. Study of program documents and files

This line of evidence looked at program documents produced on program results, internal research studies on various aspects of the music industry, and proposed changes—including stakeholder consultations—in response to the music industry's environmental changes. In total, 142 documents and files, such as foundational documents, annual reports, business reports, research conducted by the program and application guides were reviewed to gather detailed information related to the evaluation questions and issues.

3.4.2. Media scan and literature review

This review examined the evolving environment of the music industry as it has been analyzed and discussed on a broad range of platforms and from a variety of sources. An extensive search and review of online media and literature, including academic literature, news articles, blog posts, and industry reports were conducted. In total, nearly 700 articles were identified, from which a sample of 100 was selected for analysis based on relevance and content categories.

3.4.3. International and subnational comparative review

This review looked at how international governments and subnational governments—including Canadian provincial and territorial governments—have studied the evolving environment of the music industry and sought to adapt their programming to respond to changes. The government responses and funding of the music industry in Australia, the United Kingdom, the United States of America, France and Belgium as well as sub-national governments of Canada were assessed as part of this review.

3.4.4. Interviews with key informants

In total, 31 key informant interviews were conducted [in person and/or by telephone], to gather detailed information related to the evaluation questions and issues. Ten of the 31 interviews were conducted with internal stakeholders, including program personnel and representatives from third-party delivery organizations. The remaining 21 key informant interviewees were considered as external stakeholders and were composed of international, provincial and territorial government representatives, representatives from music industry associations, and program beneficiaries.

3.4.5. Environment modelling and persona simulation

A modelling of the music industry's environment was completed to inform and contextualize the way that the Program has operated and could operate in that environment. To do so, findings from the above methodologies were triangulated to provide a graphic representation of the music industry environment. Other factors such as the role of social media and possible future technological developments were also accounted for.

3.5. Constraints, limitations and mitigation strategies

The following outlines the key constraints and limitations of the evaluation process as well as identifies the mitigation strategies utilized to minimize the impact of these limitations:

- A number of data continuity issues were encountered given performance reporting data and program model changes,Footnote 10 including:

- Transition from PMERS to PIP (Annex A) reporting update: among others the program removed indicators that were not relevant to inform decision-making;

- Changes to the reporting requirement of Canadian Heritage on service standards for the component of the Canada Music Fund delivered internally;

- Other reporting and design updates driven by program to address changes in the music industry, such as measuring the streaming market share to capture the Program's performance on this new important platform;

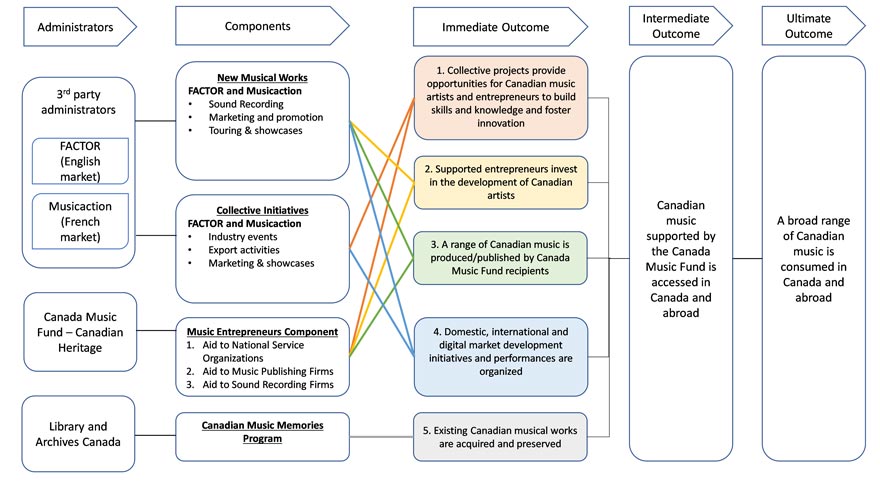

- Both internally and externally delivered program components have different reporting requirements. As seen in Figure 1, the delivery structure of the Canada Music Fund consists of four separate administrators delivering four components and multiple sub-components. The link between some components/sub-components and immediate outcomes is not always apparent, which can make it difficult for reviewers to easily understand the different streams of data that inform the achievement of outcomes.

To mitigate, evaluators held evaluation working group meetings with the Program to ensure continuity issues were clarified.

- There were limitations associated with the fact that many aspects of the Canada Music Fund were generally acknowledged to be out-of-date, especially given the major industry disruptions of the last decade. The evaluation was also being conducted while the modernization of the program was being designed and approved (as shown in Figure 17). As such, the Program was already working on how to best modernize the Canada Music Fund to remain up to date and to ensure that it best supports the evolving music industry. To mitigate this, the evaluation design included the use of past performance data but also took into consideration the work already undertaken by the Program as part of their effort to modernize.

Figure 1: modelling of the Canada Music Fund's structure before the modernization – text version

This figure shows the links between the administrators, the components and the outcomes of the Canada Music Fund's structure before the modernization.

The third party administrators, FACTOR (English market) and Musicaction (French market) are linked to two components: New Musical Works and Collective Initiatives.

The New Musical Works component includes: sound recording, marketing and promotion as well as touring and showcases. The New Musical Works component is linked to the immediate outcomes number 2, 3 and 4, which are respectively: supported entrepreneurs invest in the development of Canadian artists, a range or Canadian music is produced / published by Canada Music Fund recipients and domestic, international and digital market development initiatives and performances are organized. These immediate outcomes are then linked to the intermediate outcome and finally to the ultimate outcome, which are respectively: Canadian music supported by the Canada Music Fund is accessed in Canada and abroad, and a broad range of Canadian music is consumed in Canada and abroad.

The second component under the third party administrators is Collective Initiatives, which includes: industry events, export activities and marketing and showcases. This component is linked to the immediate outcomes number 1 and 4, which are respectively: collective projects provide opportunities for Canadian music artists and entrepreneurs to build skills and knowledge and foster innovation, and domestic, international and digital market development initiatives and performances are organized. These immediate outcomes are then linked to the intermediate outcome and finally to the ultimate outcome, which are respectively: Canadian music supported by the Canada Music Fund is accessed in Canada and abroad, and a broad range of Canadian music is consumed in Canada and abroad.

The second administrator is the Canada Music Fund Program at Canadian Heritage, which is linked to the Music Entrepreneurs component including: aid to national service organizations, aid to music publishing firms and aid to sound recording firms. This component is linked to immediate outcomes number 1, 2 and 3, which are respectively: collective projects provide opportunities for Canadian music artists and entrepreneurs to build skills and knowledge and foster innovation, supported entrepreneurs invest in the development of Canadian artists, and a range or Canadian music is produced / published by Canada Music Fund recipients. These immediate outcomes are then linked to the intermediate outcome and finally to the ultimate outcome, which are respectively: Canadian music supported by the Canada Music Fund is accessed in Canada and abroad, and a broad range of Canadian music is consumed in Canada and abroad."

Finally, the administrator Library and Archives Canada connects to the Canadian Music Memories component, which is linked to the immediate outcome number 5 described as: existing Canadians musical works are acquired and preserved. This immediate outcomes is then linked to the intermediate outcome and finally to the ultimate outcome, which are respectively: Canadian music supported by the Canada Music Fund is accessed in Canada and abroad, and a broad range of Canadian music is consumed in Canada and abroad.

4. Findings

4.1. Past performance

This section provides the evaluation findings regarding the past performance for the Canada Music Fund, including the program's efficiency and the achievement of expected outcomes.

4.1.1. Past performance: efficiency

Evaluation question 1: to what extent has Canada Music Fund delivery been efficient?

- The operating costs of the Canada Music Fund were stable over the six-year period evaluated.

- The one CMF component administered internally, the MEC component, has been delivered in an efficient manner within prescribed timelines and cost ratios, with minimal fluctuations. This component met the acknowledgment service standard established by PCH, but variance in the achievement of the decision service standards was observed.

Trends in operating costs versus total funds

Over the six-year period evaluated, an average of 5.2% of the total program funds were allocated to operating costs (salaries, operating and maintenance),Footnote 11 ranging from 4.8% in 2012-13 to 4.9% in 2017-18, with a peak at 5.9% in 2013-14. The fluctuations observed over the evaluation period were due in large part to overall budget increases through Creative Canada Initiatives – approximately $5.4M between 2016-17 and 2017-18. Internal interviewees were of the opinion the ratio of the operating costs to total funds was good. However, internal interviewees highlighted that efficiencies could be gained by streamlining the number of program sub-components. Having FACTOR and Musicaction deliver the entire funding was also seen as a way to make the Canada Music Fund more efficient, as the two organizations were seen as experts in the field and able to quickly adapt to the changes in the industry.

Some challenges with service standards but improvements observed

PCH establishes service standards to ensure the timely delivery of its funding programs. Service standards results are published every year to ensure accountability to Canadians.Footnote 12 Given that MEC is the only component of the Canada Music Fund being delivered internally, it is the only component required to adhere to PCH's service standards.Footnote 13 PCH commits to acknowledge the receipt of application forms within two weeks of the date of receipt. The decision standards are specific to each MEC sub-component, to reflect the scope of the funding activities and to take into account the volume of applications for each sub-component.

Overall, the Canada Music Fund met the acknowledgment standards, ranging between 70% and 100%. The percentage of compliance with the decision standards, however, greatly fluctuated from year-to-year, ranging from 0% to 100%.Footnote 14 Internal interviewees recognized the difficulties in achieving service standards for fiscal years 2013-14 and 2014-15, but explained that the difficulties were due to delays in the approval of funding. The achievement of service standards was facilitated by recently introduced measures – allowing the Director General to approve contributions of less than $75,000 as well as contribution amounts calculated through a formula – which significantly reduced the number of files that required to be approved by the Minister.

4.1.2. Past performance: achievement of expected outcomes

Evaluation question 2: to what extent has the Canada Music Fund progressed toward expected outcomes?

- Between 2012-13 and 2017-18, the Canada Music Fund funded specific activities such as domestic, international and digital projects, music production, promotion and preservation as well as skills and knowledge development projects, which enabled the Program to progress toward its immediate outcomes.

- The evaluation showed that the Program made progress toward the intermediate and ultimate outcomes. The market share of Canada Music Fund supported artists on the top 2000 domestic album sales chart has increased since the Program changed data provider in 2016, however data continuity challenges limited the conclusions that could be drawn.

- Overall, while it may be harder for Canadian artists to stand out against the vast variety of music now available through new technologies such as streaming, the different activities funded by the Canada Music Fund ensured that Canadian artists remained visible to both domestic and international audiences.

Immediate outcome 1: collective projects provide opportunities for Canadian music artists and entrepreneurs to build skills and knowledge and foster innovation

The opportunities offered to Canadian artists and entrepreneurs were reflected in the number of conferences, award shows and industry events, as well as other export-related activities for the Canadian music industry,Footnote 15 such as training and professional development. These events may have received funding from either or both the CI component – delivered by FACTOR and Musicaction – and/or the Aid to Canadian Music Industry National Service Organizations sub-component of MEC – delivered by PCH.

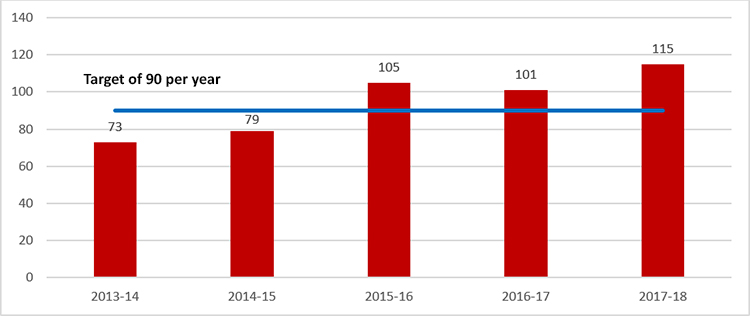

Increase in the number of conferences, award shows and events funded by the Canada Music Fund

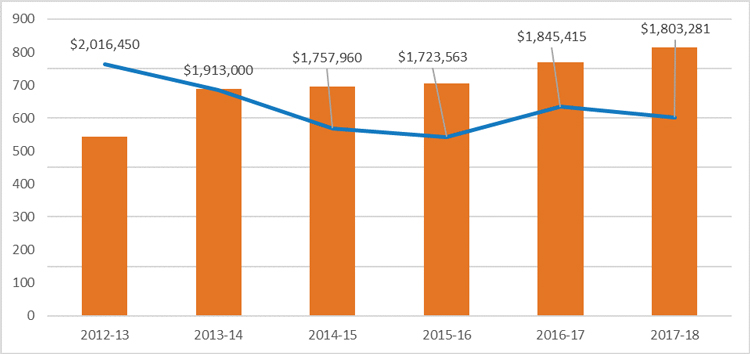

The PIP of the Canada Music Fund states that the program aims to fund approximately 90 conferences, award shows and industry events annually. Figure 2 presents the number of conferences, award shows and events funded over the period examined in comparison to the target established by the Canada Music Fund.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 2: number of conferences, award shows and industry events supported by the Canada Music Fund in comparison to the target in PIPFootnote 17 – text version

| Fiscal year | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|

| Number | 73 | 79 | 105 | 101 | 115 |

| Target in PIP | 90 | 90 | 90 | 90 | 90 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

The data shows a steady increase in the number of events funded between 2013-14 and 2017-18.

The experimental projectsFootnote 18 put forward by the Canada Music Fund also supported this outcome as a way to foster innovationFootnote 19, but the four official initiatives described in the Canada Music Fund Experimentation Proposal started in 2018-19, which is outside of the evaluation period.

Bootcamps were initiated in 2017-18 through additional funding received as part of the Creative Industries Export Strategy. They are intense training sessions combining mentorship services, networking activities, performance competencies, operational training activities and other similar activities. They assist emerging artists and artist managers to acquire the know-how to:

- Better compete on digital platforms;

- Improve their artistic skills such as song writing and the ability to perform live; and

- Improve their business skills to better position themselves when negotiating contracts.Footnote 20

The objective of these bootcamps is to help artists' build audience and to enhance their export readiness. In 2017-18, six intensive skill development sessions were held, allowing 32 artists and 43 promising professionals managing and promotion Canadian artists to participate.

Canada Music Fund's support of collective projects was appreciated

Almost all interviewees stated that the first immediate outcome of the Canada Music Fund was being met and noted with appreciation the emphasis that was placed on innovation, export activities and networking opportunities. They also reaffirmed the importance of collective projects and the importance of the Canada Music Fund supporting those projects. Some interviewees noted that the Canada Music Fund components (CI and MEC - Aid to Canadian Music Industry National Service Organizations) falling under this outcome could benefit from more flexibility and innovation. It was also noted in the media and literature that the collective projects funded by the Canada Music Fund did provide opportunities for Canadian music artists and entrepreneurs to build skills and knowledge but a need was expressed for additional opportunities for independent artist-entrepreneurs and smaller or emerging firms and entrepreneurs.Footnote 21

Immediate outcome 2: supported entrepreneurs invest in the development of Canadian artists

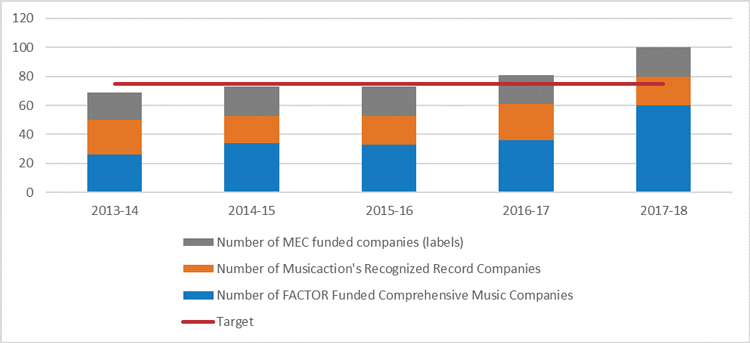

For this outcome, supported entrepreneurs include MEC label recipients, FACTOR's Comprehensive Music Companies and Musicaction's Recognized Record Companies. The support offered to entrepreneurs was also reflected in the number of business development and travel projects funded by FACTOR and Musicaction under the NMW component to further develop Canadian artists.

An increasing number of supported entrepreneurs were able to invest in the development of Canadian artists

Interviewees stated that funding from the Canada Music Fund allowed entrepreneurs to invest in the development of Canadian artists, noting that the program facilitates access to capital, which is a challenge for music companies since funding from financial institutions is usually not available.

Figure 3 presents the number of music entrepreneurs supported through MEC-label, FACTOR and Musicaction in comparison to the target of 75. While the number of Musicaction's Recognized Record Companies and the number of MEC- Aid to Canadian sound recording firms funded companies stayed relatively stable over the years, FACTOR doubled the number of Comprehensive Music Companies funded, going from 26 companies funded in 2013-14 to 60 in 2017-18. Program staff indicated that this sudden increase in the number of companies funded by FACTOR is attributable to changes made in the eligibility criteria to introduce a lower tier for the Comprehensive music companies program. As such, the increase is linked to FACTOR supporting more entrepreneurs as part of their Comprehensive Music Companies component. FACTOR and Musicaction do not report on the number of artists or projects supported by the music entrepreneurs who received funding. This prevents drawing specific conclusions regarding the number of Canadian artists who have been supported by music entrepreneurs in their development.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 3: number of supported music entrepreneurs in comparison to the targetFootnote 23 – text version

| Fiscal year | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|

| Number of FACTOR Funded Comprehensive Music Companies | 26 | 34 | 33 | 36 | 60 |

| Number of Musicaction's Recognized Record Companies | 24 | 19 | 20 | 25 | 20 |

| Number of MEC funded companies (labels) | 19 | 20 | 20 | 20 | 20 |

| Target | 75 | 75 | 75 | 75 | 75 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

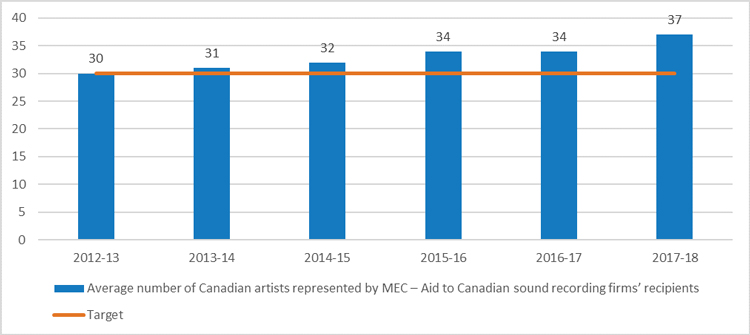

The number of MEC – Aid to Canadian sound recording firms' recipients remained stable over the years, but the average number of Canadian artists supported by each recipient has increased (Figure 4). Between 2012-13 and 2017-18, the average number of Canadian artists represented by MEC – Aid to Canadian sound recording firms' recipients increased by 23.3%, suggesting that they increasingly invest in the development of Canadian artists. For this indicator, the Canada Music Fund does not aim to increase the number of Canadian artists represented by MEC – Aid to Canadian sound recording firms' recipients, but rather to keep the average number of artists represented above 30.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 4: average number of Canadian artists represented by MEC – aid to Canadian sound recording firms' recipients – text version

| Fiscal year | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|---|

| Average number of Canadian artists represented by MEC – Aid to Canadian sound recording firms' recipients | 30 | 31 | 32 | 34 | 34 | 37 |

| Target | 30 | 30 | 30 | 30 | 30 | 30 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Although there has been an increase in the number of projects, overall funding amount trending downwards

To support the music entrepreneurs such as record labels, managers, publishers, FACTOR and Musicaction provide funding for business development initiatives that support the marketing and promotion of the company and its services, as well as domestic and international travel to support the company's development objectives. FACTOR and Musicaction also offer funding to help entrepreneurs invest in the development of Canadian artists by offering funding for activities that contribute to career development and the professionalization of emerging artists.

Figure 5 presents the number of projects funded by FACTOR and Musicaction from 2012-13 to 2017-18 for business development and business travel. The total funding allocated to these components for each fiscal year is also included in the figure. It should be noted that the funds for these projects come from both the Canada Music Fund and private radio broadcasters.

Source: Annual reports (2012-13 to 2017-18) from FACTOR and Musicaction.

Figure 5: business support offered by FACTOR and Musicaction – text version

| Fiscal year | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|---|

| Total amount funded | $2,016,450 | $1,913,000 | $1,757,960 | $1,723,563 | $1,845,415 | $1,803,281 |

| Number of projects funded | 543 | 688 | 696 | 706 | 768 | 815 |

Source: Annual reports (2012-13 to 2017-18) from FACTOR and Musicaction

As shown in Figure 5, there was an increase in the number of projects funded, despite fluctuations in the amount of money allocated. The increased amount of funding provided in 2016-17 and 2017-18 is linked to additional funding delivered in Budget 2016 to showcase Canada's cultural industries to the world. Despite the additional funding, the total amount awarded for business support by FACTOR and Musicaction was lower than in 2012-13, suggesting that less money was awarded to each project. However, it should be noted that the same amount of funding was distributed by the Canada Music Fund. If less funding was offered in business support projects, it indicates that the funding was invested in other FACTOR/Musicaction sub-components that are tied to entrepreneurs investing in Canadian artists. The Program aims to see an additional increase of 5% in the number of projects funded between 2017 and 2022Footnote 24, which suggests that these projects have a pivotal role in the development of Canadian businesses and the support they are able to offer to music artists.

Immediate outcome 3: a range of Canadian music is produced/published by Canada Music Fund recipients

Multiple funding streams were made available by the Canada Music Fund to enable Canadian artists to produce and publish music. All internal and external interviewees agreed that this outcome was being met, some of them noting that awareness and efforts to promote diversity and inclusion had grown in recent years. The report of the Standing Committee on Canadian Heritage also noted that "there was a consensus among witnesses that FACTOR/Musicaction play a key role in supporting the creation of homegrown musical content; [t]he organizations sharing this point of view included the Canadian Independent Music Association, Music BC, Association québécoise de l'industrie du disque, the Songwriters Association of Canada, the Alliance nationale de l'industrie musicale, the Polaris Music Prize, Warner Music Canada, Nettwerk Music Group, Deezer, Music/Musique NB and Manitoba Music".Footnote 25

Targets achieved overall

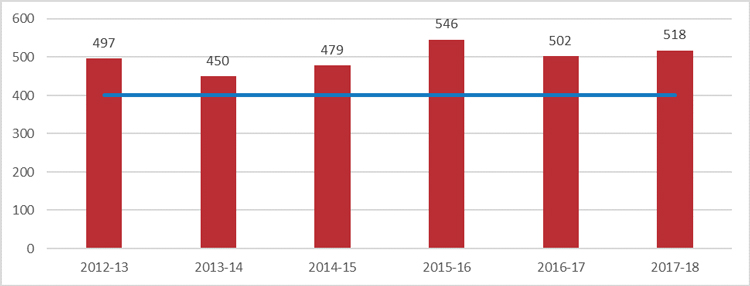

To report on this outcome, the Canada Music Fund compiles the number of albums produced and released by MEC, FACTOR and Musicaction recipients. These numbers are presented in Figure 6.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 6: number of albums produced and released by MEC, FACTOR and Musicaction – text version recipientsFootnote 27 – text version

| Fiscal year | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|---|

| Number of albums | 497 | 450 | 479 | 546 | 502 | 518 |

| Target | 400 | 400 | 400 | 400 | 400 | 400 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Over the last six years, an average of 498 albums were produced and released each year by MEC, FACTOR and Musicaction's recipients. Little fluctuation can be observed from year to year. The target of 400 albums produced and released by the Program is linked to the overarching goal of the program, which is not only to produce albums but also to ensure that these albums are consumed domestically and internationally. Internal key informants explained that producing a high number of albums is irrelevant if they are not promoted and listened to by consumers. It should also be noted that the Canada Music Fund, also funds artists to produce between one and four sound recordings, which are not compiled in the data presented above, as they are not considered albums.

While the production of sound recording is a key element of the Canada Music Fund, funding offered through MEC – Publishing Firms also ensures that Canadian musical works are published to be then commercialized.

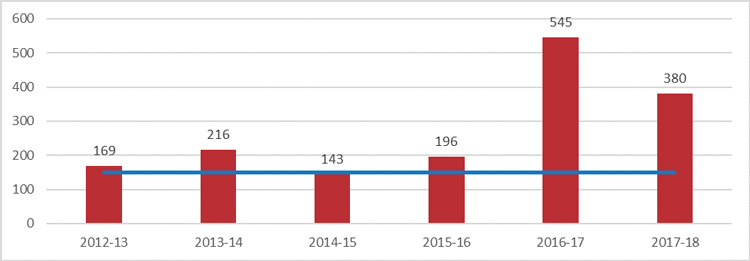

Figure 7 presents the number of MEC eligible musical works published on average by MEC recipients in a fiscal year in comparison to the 150 target. The data compiled by the program shows relative stability in the number of musical works being published by MEC recipients, with an increase in 2016-17 which appears to show signs of softening in the following year. This analysis is limited given data is presented through averages. For example, it is unclear if increases are associated with some specific recipients publishing more in 2016-17 or if overall, all recipients published more that fiscal year.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 7: average number of eligible musical works published by MEC recipients – text version

| Fiscal year | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|---|

| Average number of eligible musical works | 169 | 216 | 143 | 196 | 545 | 380 |

| Target | 150 | 150 | 150 | 150 | 150 | 150 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Immediate outcome 4: domestic, international and digital market development initiatives and performances are organized

Almost all interviewees agreed that this outcome was being met. They noted a move from domestic to international market development initiatives, stating the increasing importance of touring and live performances. Additional funding received for export and trade was also viewed as beneficial and necessary.

The number of projects funded increased – additional funds made available in 2016

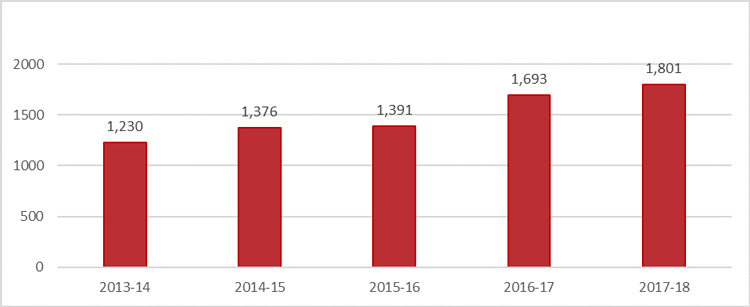

To report on this outcome, domestic and international market development initiatives and performances were measured through the number of NMW domestic and international marketing, showcase and tour projects funded (Figure 8), as well as in the number of CI marketing projects funded (Figure 9).

The graph below illustrates an increased in the number of projects funded, going from 1,230 in 2013-14 to 1,801 in 2017-18, which represents an increase of 46.4%. The increase is mostly linked to the additional funding made available for export in Budget 2016. As stated in the 2017 PIP, the program aims to increase the number of NMW domestic and international marketing, showcase and tour projects funded by 5% between 2017 and 2022.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 8: number of NMW domestic and international marketing, showcase and tour projects fundedFootnote 29 – text version

| Fiscal year | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|

| Number | 1,230 | 1,376 | 1,391 | 1,693 | 1,801 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

As reflected in Figure 9, projects in support of international marketing were also funded under the CI component. The projects funded highlighted the works of Canadian artists in foreign countries, allowed artists to participate in showcases held outside of Canada and also enabled international professionals to travel to Canada to see Canadian artists perform.

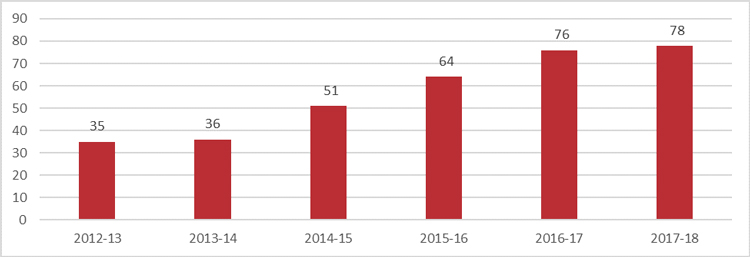

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 9: number of CI international marketing projects funded – text version

| Fiscal year | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|---|

| Number | 35 | 36 | 51 | 64 | 76 | 78 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

The number of CI international marketing projects funded has more than doubled over the period evaluated, going from 35 in 2012-13 to 78 in 2017-18, representing a 123% increase. As stated previously, additional funding was provided in 2016-17 and 2017-18 through Budget 2016 to showcase Canada's cultural industries to the world. The Canada Music Fund aims to increase the number of CI international marketing projects funded by 40% between 2017 and 2022.

Increase in the number of showcases for Official Languages Roadmap initiatives

Through the Roadmap for Canada's Official Languages, the Canada Music Fund received ongoing additional funding to support artists from Official Language Minority Communities (OLMCs). Both FACTOR and Musicaction have specific programs available to increase the accessibility and visibility of OLMCs artists in new markets. During the evaluation period, the number of CI showcases for Official Languages Roadmap initiatives increased, ranging from 753 in 2013-14 to 910 in 2017-18, with a peak of 933 in 2014-15. The number of OLMCs artists showcased at Official Languages Roadmap events followed a similar trend, increasing from 372 in 2013-14 to 425 in 2017-18, with a peak of 452 in 2014-15.

Variance in the number of digital development projects associated with changes in funding approach

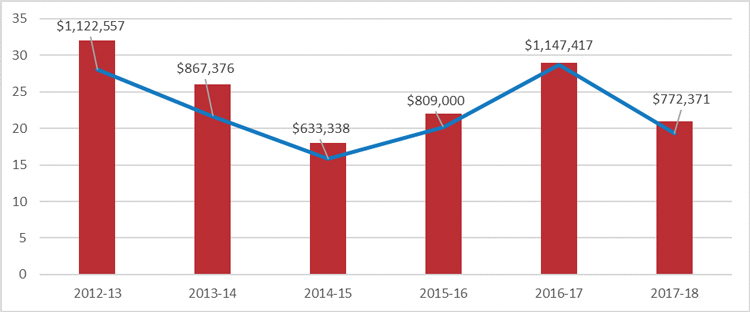

Funding to increase the accessibility of Canadian music content online, while also optimizing and supporting efforts to promote Canadian content on various digital platforms is offered by FACTOR and Musicaction through the CI component. The numbers of projects funded between 2012-13 and 2017-18 are presented in Figure 10. While the number of digital projects funded has varied, interviewees explained that, in today's environment, the digital projects funded are collective projects with bigger scope than they were in 2012-13. As such, the need expressed by the industry went from many small contributions for tailored projects (i.e. the development of an application) to projects with larger scope.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 10: number of digital market development projects funded and amount awarded – text version

| Fiscal year | 2012-2013 | 2013-2014 | 2014-2015 | 2015-2016 | 2016-2017 | 2017-2018 |

|---|---|---|---|---|---|---|

| Number of projects funded | 32 | 26 | 18 | 22 | 29 | 21 |

| Total amount funded | $1,122,557 | $867,376 | $633,338 | $809,000 | $1,147,417 | $772,371 |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Immediate outcome 5: existing Canadian musical works are acquired and preserved

This outcome is directly tied to the Canadian Music Memories component of the Canada Music Fund. This component's objective is to ensure Canadians can access their musical heritage and funds are allocated for the acquisition, cataloguing, and preservation of Canadian sound recordings.Footnote 30 PCH has a Memorandum of Understanding with LAC to undertake these activities. To report on this outcome, the Canada Music Fund looked at the acquisition of retrospective sound recordings and the digitization of sound recordings. Footnote 31

The acquisition of retrospective sound recordings was made through purchase as well as donations. The Canada Music Fund aims to acquire more than 185 sound recordings per year (established in 2017-18 in collaboration with LAC), a target that was largely exceeded in 2017-18. The achievement of digitization of sound recordings is measured by the number of hours of Canadian musical works preserved by being digitized. According to LAC, the increase observed in recent years is attributed to investments in infrastructure and equipment. The target to achieve this outcome was set at 4300 hours (target established in 2017 based on the three previous years), which may have been ambitious before 2015-16; however, after that it may be conservative given the purchase of new equipment.

Intermediate outcome: Canadian music supported by the Canada Music Fund is accessed in Canada and abroad

Almost all interviewees stated that the Canada Music Fund allowed for the Canadian music produced and published by recipients to be accessed in Canada and abroad. Specifically, interviewees were of the opinion that the Program greatly supports the export of Canadian artists and entrepreneurs.

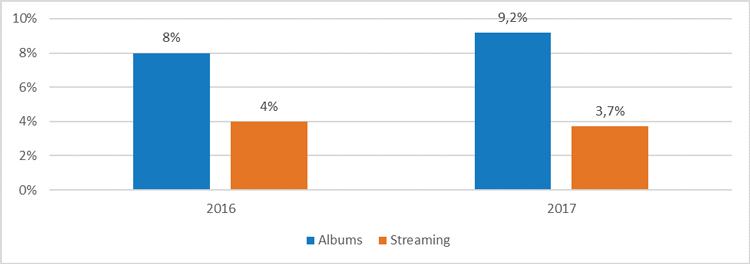

Domestically, the Canada Music Fund also enabled Canadian music produced and published by recipients to be accessed and consumed. While data from 2012 to 2015 showed a decrease in the top 2,000 album market share of Canada Music Fund supported artists on domestic consumption charts, going from 14.7% in 2012 to 13.4% in 2015, the market share increased between 2016 and 2017 (Figure 11). However, 2012-15 data cannot be compared with 2016 and 2017 data, as the Canada Music Fund changed data provider in 2015. The decision to change data provider was a result of the new provider being less costly and providing more detailed data in a user-friendly interface. Overall, the program has achieved its target of maintaining the market share of albums at 8% and was working toward achieving the target of 6% of market share for streaming, by 2022.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 11: market share of Canada Music Fund-supported artists on domestic consumption charts (albums and streaming) – text version

| Year | 2016 | 2017 |

|---|---|---|

| % of albums | 8% | 9.2% |

| % of streaming | 4% | 3.7% |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

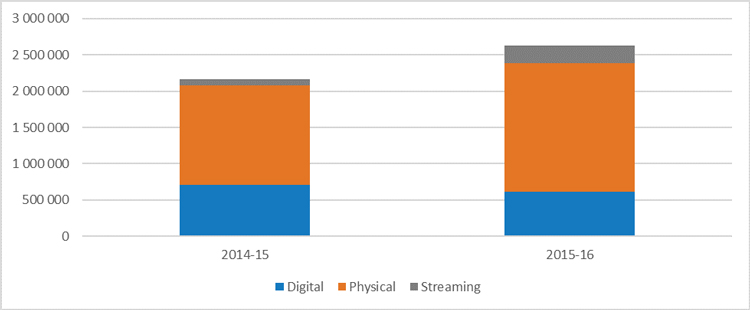

As shown in Figure 12, the domestic and international sales in units of eligible sound recording released by Canada Music Fund recipients increased by 21.2% between 2014-15 and 2015-16.

Source: Canadian Heritage. (n.d.). 2014-15 Sales Figures of Musical Works Produced with Canada Music Fund Support. Internal document.

Figure 12: domestic and international sales in units of eligible sound recordings released by Canada Music Fund recipientsFootnote 33 – text version

| Fiscal year | 2014-15 | 2015-16 |

|---|---|---|

| Digital | 706,852 | 612,976 |

| Physical | 1,370,972 | 1,776,019 |

| Streaming | 91,649 | 240,436 |

Source: Canadian Heritage. (n.d.). 2014-15 Sales Figures of Musical Works Produced with Canada Music Fund Support. Internal document.

On average, 2 399 451 units were sold per year between 2014-15 and 2015-16. An increase can be observed for physical sales as well as streaming, while the digital sales slightly declined.

Ultimate outcome: a broad range of Canadian music is consumed in Canada and abroad

The Canada Music Fund contributed to making accessible (for consumption) a wide range of Canadian musical choice. For example, in 2015-16, "the Canada Music Fund provided production support to 546 albums and helped Canadian artists connect with audiences at home and abroad by providing marketing, touring and showcasing support to nearly 2,100 projects through the New Musical Works component and close to 300 projects through the Collective Initiative component. According to the Society of Composers, Authors and Music Publishers of Canada (SOCAN), international consumption of music by Canadian artists increased by 8.0% to a value of $55.3 million"Footnote 34. To measure if Canadian music is consumed in Canada, the program compiles the market share of Canadian artists on domestic consumption charts, for album and streaming.

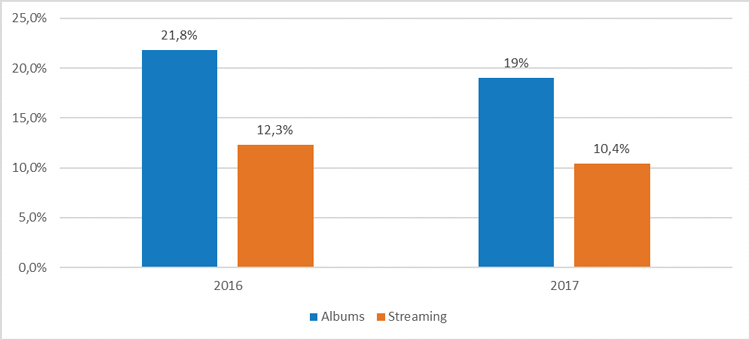

Data from 2012 to 2015 showed an overall decrease in the market share of Canadian artists on domestic consumption charts, going from 25.7% in 2012 to 23.8% in 2015. However, this data cannot be compared with 2016 and 2017 data (Figure 13), as the Canada Music Fund changed data provider between 2015 and 2016.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 13: market share of Canadian artists on domestic consumption charts (albums and streaming) – text version

| Year | 2016 | 2017 |

|---|---|---|

| % of albums | 21.8% | 19% |

| % of streaming | 12.3% | 10.4% |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

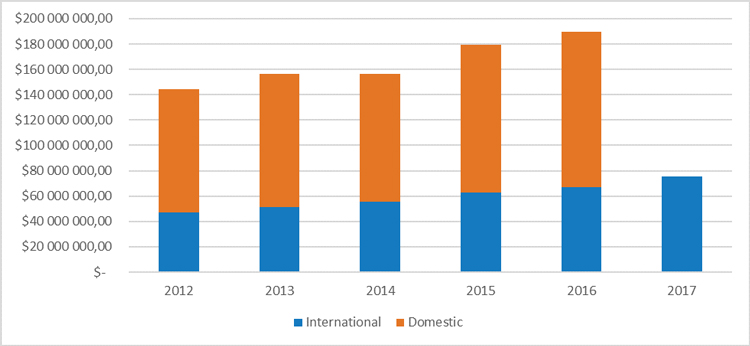

While Canadian artists may see their market share on domestic consumption charts slightly decrease over the evaluation period, the domestic and international royalties have steadily increased between 2012-13 and 2016-17, as shown in Figure 14.

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Figure 14: domestic and international performance royalties for Canadian artistsFootnote 36 – text version

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| International | $47,305,000.00 | $51,183,000.00 | $55,325,000.00 | $62,733,000.00 | $67,013,000.00 | $75,652,000.00 |

| Domestic | $97,181,000.00 | $105,085,000.00 | $101,244,000.00 | $116,738,000.00 | $122,747,000.00 | - |

| Total | $144,486,000 | $156,268,000 | $156,569,000 | $179,471,000 | $189,760,000 | - |

Source: Canadian Heritage. (n.d.) PIP Dashboard. Internal document.

Domestic performance royalties increased by 26.30% between 2012-13 and 2016-17, while the international performance royalties increased by 41.66% between 2012-13 and 2016-17. The increase in performance royalties coincided with the Society of Composers, Authors and Music Publishers of Canada beginning collecting from additional foreign performance royalty organizations late in 2014.

In an effort to measure the success of Canadian artists around the world, the Canada Music Fund measures the "overall success of Canadian artists gauged against their counterparts in other countries."Footnote 37 In 2016 and 2017, Canada ranked as the third largest music exporter,Footnote 38Footnote 39 behind the United States and the United Kingdom. In 2016, Canada ranked as the second largest music exporter, but Program personnel explained that 2016 was an exceptional year for Canadian artists such as Drake, Justin Bieber and the Weeknd, while also being a quiet year for British artists.Footnote 40

4.2. A need for modernization

Evaluation question 3: to what extent does the Canada Music Fund require modernization?

- The growing popularity of online streaming services has generated growth for the global music industry for the first time in nearly two decades.

- Ways to connect creators with consumers are now diverse with increasing possibilities for innovation. The lines between creation, production, promotion, distribution and consumption are blurred as are the tradition roles.

- Similar to comparative countries, Canadian federal, provincial, and territorial governments have now established programs to support the commercial music sector.

- Although the Canada Music Fund program has been slightly updated over the period under evaluation, the Program has received approval to implement significant changes on June 13, 2019.

A shift from purchasing (physical and digital) to accessing music online occurring as industry becomes profitable after a decades-long slump

All lines of evidence indicated that during the period under evaluation, the music industry has continued the multiple decades of disruption associated with the decline in physical album sales. The growth of online streaming services, however, has generated growth for the global music industry for the first time in nearly two decades. In Canada, in 2017, streaming revenues comprised 46% of the sound recording revenues that year.Footnote 41 Yet, as one of the largest players remained unprofitable,Footnote 42 the new business model of accessing music online may not be the final stage of the transformation observed in the music industry.

Based on the literature review, the online access model, which consists of accessing music through online streaming platforms rather than buying it, appears to have established itself as the central factor around which the music industry has continued a profound restructuring. For example, the literature review and media scan indicated that because of the ongoing slump in profits from physical purchase, industry stakeholders were required to diversify their revenue streams to adapt to the new music environment.

To date, key stakeholder groups saw their global average revenues increased due to the growth of online streaming services. This revenue, however, was funnelled in a larger percentage to the major labels, then further distributed as per the individual contracts with artists. Independent labels have given artists back shares that are four to five times larger than the percentage major labels give back; however, major labels were noted to have given out significantly larger advances and had more resources to invest in artists.

The majority of the major labels and the leaders in the concert business have all seen significant financial gains in recent years. Statistics Canada reported that, overall, the Canada's sound recording and music publishing industriesFootnote 43 experienced an increase in their operating profit margin, from 9.7% in 2015 to 10.0% in 2017.Footnote 44 There was also no indication that this trend would not continue as sound recording costs had achieved historically low levels and given that music publishers see a continuous return on their licensing investments as their catalogues continue to grow and remain intact for several decades after an artist's death.

Literature review shows that despite this growth, artists appeared to be getting the smallest piece of the pie, even though they are the content creators upon which the rest of the industry relies. Rather than selling a product and having each part of the supply chain add their own mark-up going forward (e.g. with distribution), as is the case in other industries, music artists often find themselves at the end of the chain when revenues are redistributed, taking the last cut.Footnote 45

The inequitable distribution of revenues among music industry players in the digital age is often referred to as the "value gap". While the "value gap" has had a significant impact on artists, the issue has been defined significantly more broadly within the industry, with the largest industry associations noting the loss of revenues caused by what they see as outdated laws for the digital era. In 2016, for example, the then Chief Executive Officer of the International Federation of the Phonographic Industry defined the value gap as "the unfair return of revenues generated by the explosion of music consumption worldwide to those who create, own and invest in music."Footnote 46

Music industry players have reacted to adapt to the changes in the environment

Interview and literature and media review data show that as increased revenues from streaming have been concentrated in the hands of larger players so too has the power over what and how music goes out onto mainstream platforms. For artists, the digitization of the music industry has led to independent artists with new skill sets, financial freedom from intermediaries, and creative emancipation while other artists have simply replaced record labels with separate services of their own choosing, assembling a team to help them succeed in the industry.

The key challenge associated with the shifts in the music industry environment is to "cut through the clutter and monetize music to its full potential".Footnote 47 The main expenses related to sound recordings nowadays is the marketing of artists and the content they produced on traditional and emerging platforms such as social media and streaming. As highlighted by the Canada Music Fund, the

"…visibility challenge means that marketing efforts are constant for artists and entrepreneurs. Content must be marketed across all traditional and digital platforms and beyond, and touring is more important than ever. While streaming services and other digital tools generate rich consumer metadata allowing artists and entrepreneurs to better direct their marketing efforts, this means that new skill sets are required for modernized marketing techniques. International success has always been key because of Canada's small domestic market and globalization has made it even more pressing."Footnote 48

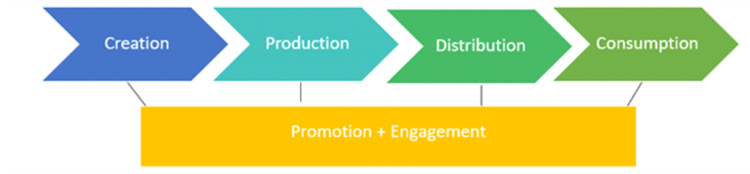

The environmental modelling exercise undertaken as part of this evaluation showed that at the beginning of the evaluation period (around 2012-13) "promotion and engagement" began to emerge from what was traditionally interpreted as a five step segmented "value chain" (Figure 15). For example, newer methods of promotion and engagement through radio marketing, tours and showcases at festivals and events, as well as the addition of social media, and online purchase platforms provided a new means of breaking through. At the same time "creation" and "production" were becoming more accessible through less expensive technology. "Distribution" of music as a product has been almost completely overhauled with online access making it easier to release material but more difficult to have it consumed. And while traditional consumption of a physical commodity such as a CD remains a reality, the average consumer accesses or pays for music through online platforms.

Figure 15: the value chain at the beginning of the evaluation period – text version

This figure shows the segmented value chain at the beginning of the evaluation period. The creation process is feeding into the production, production into distribution, and then distribution into consumption. All of the components are linked to the promotion and engagement box.

Faced with declining revenues from sound recording sales and to better capture multiplying revenue streams, music entrepreneurs began to diversify their business models and revenue sources. Music entrepreneurs were able to do so by focusing on emerging platforms and cross-sectorial activities, as well as through more traditional means such as domestic and international touring and CD sales.

The evolution of the music industry business model has increased the opportunities made available to independent labels and artists choosing not to initially affiliate with major label through digital platforms and international touring. Canada's independent labels and their rosters are also "playing an increasingly influential role in shaping the future as the music business evolves globally".Footnote 49 As explained by the Canada Music Fund, "independent managers have emerged as key players in early stage artist development and in the marketing process, since labels have shifted away from early stage artist development and are increasingly seeking out artists whose self-funded recordings have generated early excitement in the marketplace."Footnote 50

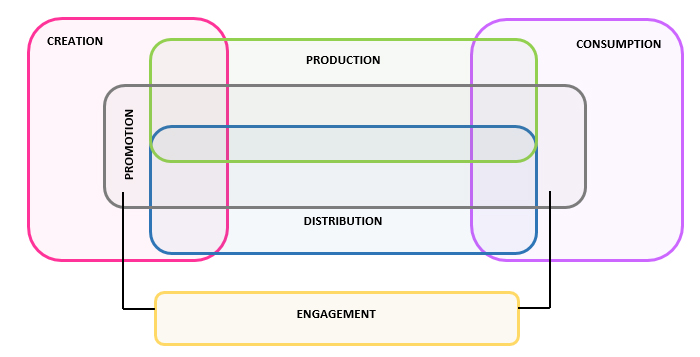

As Figure 16 illustrates, the value chain has required stakeholders to bridge roles in new and unpredictable ways, including partnering between stakeholders and media types (e.g., a song promoting a product and vice versa), and direct engagement and interaction between artists and consumers (audiences) via social media.

Figure 16: value chain less segmented as stakeholders adapt to new environment – text version

This figure show the value chain less segmented, as stakeholders adapt to new environment. The creation interconnects with the promotion, production and distribution components. The consumption also interconnects with the promotion, production and distribution components. All of the components are connected to the engagement box.

Ways to connect creators with consumers have also diversified with increasing possibilities for innovation as the lines between creation, production, promotion, distribution and consumption became blurred as are the tradition roles. However, the new business model of accessing music through online platforms has imposed burdens on the time and resources of emerging and independent artists, who have had to learn and get involved in the business aspect of their careers at the expense of being solely devoted to creating.

While the largest national markets have little government programming, governments with smaller national markets have responded to new challenges

The international and subnational comparative review line of evidence indicated that the two largest national markets studied provided minimal support to their respective music industry. The United Kingdom and the United States, as the two largest markets, lacked mature central funding mechanism for commercially-driven music, even though the US National Endowment for the Arts and British Council had mandates similar to the one of the Canada Council for the Arts. In September 2016, however, UK MusicFootnote 51 presented to the British government to advocate for an industrial strategy for broader creative industries, showing, perhaps, that even the largest music industries may require governmental support.

In the three smaller markets studied, there was evidence of established programs that were in the midst of being actively strengthening. In Australia the 2016 National ContemporaryFootnote 52 Music Plan was to dedicate public funding to address key challenges and needs in the music sector.Footnote 53 At state level, the Music Development Office of the South Australian Government, for example, launched a Music Industry Strategy in February 2018. The strategy sets out a plan to increase vibrancy and cultural activity, and drive economic growth and employment for South Australia by facilitating collaboration between all levels of government, industry, and not-for-profit support organizations.

Belgium and France were the remaining two markets studied to inform issues related to Francophone and minority language markets. Both countries had central funding programs to promote French (and Flamand in Belgium) language commercial music. Belgium and France had also implemented strategies addressing digital conversion and export challenges. In this respect, the Canadian federal governmental initiatives to support the commercial music industry were aligned with international counterparts. For example, key informants from international governments indicated a distinct shift to focus on export strategies similar to the Canadian model.

Also, the notion of Music CitiesFootnote 54 appears to have spread because of the recognition of their economic impact. This concept originated in Austin and Nashville, which are now internationally recognized as music cities. More recently, Liverpool City Council, commissioned a reportFootnote 55 on the music sector of the city. In Canada, Toronto has an established music city program while Hamilton, London, Ottawa, and Vancouver are being rolled out.

Canada is also among other countries making revisions to copyright, broadcasting and domestic content rules and laws. The Government of Canada's statutory review of the Copyright Act, which coincides with the review of the Broadcasting Act, the Telecommunications Act, and the Radiocommunication Act, is expected to be completed in the spring 2019. Meanwhile, in 2018, the European Union adopted new rules mandating to ensure that platforms offer a minimum of 30% of national content and approved the new Copyright Directive, in part of an attempt to address the "value gap".Footnote 56

Canadian provincial programs have reached maturity while territorial and some municipal government programs are becoming established