Seen on Screens

Viewing Canadian Feature Films on Multiple Platforms 2007 to 2014

This publication is available upon request in alternative formats.

©Her Majesty the Queen in Right of Canada, 2015.

Catalogue No.: CH41-41E-PDF

ISBN: 2371-655X

Table of Contents

- Introduction

- Notes on methodology

- Main findings

- Total views

- Canadian market share

- Theatre

- DVD and Blu-ray sales and rentals

- Conventional television market

- Specialty television market

- Pay television market

- Case study: data for audiovisual coproductions

- Case study: views of select films by platform

Introduction

Highlights

- In 2014, there were over 100 million views of Canadian feature films.

- In total, the market share of views of Canadian productions reached 5.3%, up from the previous year.

- The market share for Canadian films was 8.0% in the French-language market, and 4.2% in the English-language market.

- Video-on-demand services are experiencing rapid growth and now represent 9% of views of Canadian films.

In 2000, the Government of Canada announced the implementation of the Canadian Feature Film Policy (CFFP), From Script to Screen. The CFFP’s target was for Canadian feature films to capture a 5% market share of box office revenues in Canada.

Since the implementation of the CFFP, there has been significant structural changes to the film industry and increasing division of audiences across various broadcast windows. The release of a feature film in theatres remains a key exhibition window for a film’s commercial and cultural success. However, the emergence of online platforms, the arrival of ergonomic technologies on the market that facilitated access to increasingly diverse and comprehensive audiovisual catalogues, and the rapidly growing number of television channels dedicated to showing feature films have considerably altered the viewing habits of Canadians.

The Department of Canadian Heritage is presenting the third edition of its report on viewing Canadian feature films on multiple platforms, which examines data for Canadian feature films viewed in theatres, on DVD and Blu-ray, on television (conventional, specialty and pay), as well as on video-on-demand services licensed by the CRTC. This report also presents case studies on the performance of audiovisual treaty coproductions, as well as on the viewing of select films by broadcast platform.

Notes on methodology

To measure the performance of Canadian feature films, the Department of Canadian Heritage obtains viewing data from various sources: government organizations, professional associations, private companies and audience measurement organizations. Each of these sources has developed methodologies and units of measurement unique to each of the platforms. Performance in theatres is measured in dollars; for the DVD market, it is measured by the number of copies rented and sold; for television, it is minutes of viewing; and for video-on-demand, it is the number of orders. The Department developed a model for converting all these units into one indicator: the number of views.

What is a feature film?

For the purposes of this study, a feature film is a film designed to be presented in theatres, with a run time of at least 75 minutes. Certain productions are excluded, including television films, short films, certain children’s films and adult films.

What is a view?

Quite simply, the number of views corresponds to the number of times a feature film is viewed, regardless of the broadcast platform.

Why use market share?

The feature film industry is constantly changing. The migration of audiences from one platform to another is largely attributable to new technologies, consumer preferences and broadcasters’ business strategies.

Under the circumstances, market share is the statistical tool most capable of absorbing the structural shocks to the industry, such as the emergence of new platforms or the integration of new sources of data. Regardless of how Canadians access domestic feature films, measuring performance using market share makes it possible to compare results over time. This type of indicator also makes it possible to make a simple and direct comparison with foreign feature films.

What is a language market?

- Language markets are defined based on the language in which a film is viewed. For example, the French-language market includes all feature films presented and viewed in French.

- Language markets are not defined based on the language in which a feature film is produced.

- The language market is not the consumer’s native language. A Canadian viewing a film in English at the theatre and another viewing a film in French on television are in the English-language and French-language markets, respectively.

- Lastly, there is no territorial concept. For example, the French-language market does not correspond to Quebec.

Which broadcast platforms are included in the study and how are views measured?

The Department includes all broadcast platforms for which viewing data is available. The model measures the performance of Canadian feature films in theatres; from DVD/Blu-ray retailers (sales and rentals); on conventional, specialty and pay television; and on paid and free video-on-demand (VOD) services provided by cable companies. Online services such as television streamed on the Internet (Netflix, Apple TV), content aggregators (YouTube) and online services provided by cable companies are not included for the time being because viewing data is unavailable.

The study focuses on the performance of Canadian feature films on a variety of broadcast platforms between 2007 and 2014. Canadians’ viewing habits changed considerably during those years. There were major structural changes to the industry, with the emergence and rise of certain platforms (VOD) and the decline of others (DVD). Over the years, data providers also refined their data collection tools and methods, thus improving the scope of analyses.

Movie theatres

Data on box office revenues comes from the Movie Picture Theatre Association of Canada (MPTAC). The number of views is estimated by dividing the number of box office revenues reported by the MPTAC for each language market by the average price of tickets as estimated by Statistics Canada. Average ticket prices are calculated for the Quebec market separately from that of the other Canadian provinces and territories.

DVD and Blu-ray rentals and sales

Data on DVD and Blu-ray sales is collected by Nielsen. The Department analyses the data for the 3,000 most popular feature films in this format. Since peaking in 2009, overall DVD sales in Canada have fallen 35%. There was a significant contraction in broadcast infrastructure since a large portion of in-store sales migrated to the online market.

Data on DVD and Blu-ray rentals comes from Rentrak. The data analyzed includes only rentals from stores, not from online services or kiosks. The Department analyzes the results for the 800 most popular feature films in terms of rentals.

In its model, the Department considers that each copy of a feature film purchased or rented in DVD/Blu-ray format is viewed by 1.5 consumers on average. This multiplier is based on the results of a public opinion poll on the consumption habits of Canadians.Footnote 1 To determine language market share, it is assumed that Canadians view films in French or English in the same proportions as at movie theatres.

Conventional, specialty and pay television

To analyze the audience, the television market is divided into three separate platforms based on their broadcast method.

- Conventional television was traditionally defined as television services that television viewers could access using an antenna without subscribing to a broadcasting distribution undertaking such as a cable company. Conventional television channels can be public (e.g. CBC/Radio-Canada) or private (e.g. CTV, TVA).

- Specialty television includes subscription services for which programming is centred around themes, such as theatre, music, news, sports, lifestyle, family, etc. For example, this category includes channels like ARTV, Showcase and Historia.

- Pay television includes subscription pay services such as those offered by Super Écran and The Movie Network, generally without advertisements. This platform does not include à la carte or video-on-demand television services.

The number of views is estimated based on data collected by Numeris. For each title, the Department divides the total number of minutes viewed by the average film duration.

Video-on-demand

According to the CRTC definition, a video-on-demand (VOD) service enables customers connected to a digital channel and who have a set-top box to browse audiovisual catalogues and access feature films in particular. Programming is available à la carte, by subscription, or free of charge.

Each year, the CRTC publishes data for the main VOD service providers in Canada. For 2014, the data details the activities of 11 providers, namely: Bell Express Vu, Bragg, CNQ, Cogeco, MTS, Rogers Communications, Saskatchewan Telecommunications, Shaw Communications, Telus Communications, Videotron and Wightman.

Data collected by the CRTC does not include online services (such as YouTube and iTunes), streaming, or viewing of programming on Canadian or foreign broadcasters’ websites. Furthermore, there is no detailed information on the viewing of feature films for online television services such as Netflix, CraveTV, Shomi and Videotron.

The CRTC has published data on the performance of Canadian and foreign feature films since 2012, and data for each language market since 2013. Like the DVD sales and rental market, the model assumes that each film ordered from a VOD service is seen on average by 1.5 consumers.

Why are certain broadcast platforms not included in the model?

It is difficult to anticipate the evolution and division of audiovisual markets. They are based largely on new technologies, consumer preferences and broadcasters’ business strategies. As a result, there is generally a delay between the emergence of a new platform or implementation of a new service and the collection of data on its use.

The viewing of feature films on online platforms is the main missing sector of the market. Certain data providers in the United States have started measuring the performance of feature films on the Internet, but for the time being, this data is unavailable for the Canadian market. As consumer data becomes available for Canadian feature films, it can eventually be incorporated into the model.

Main findings

Total views

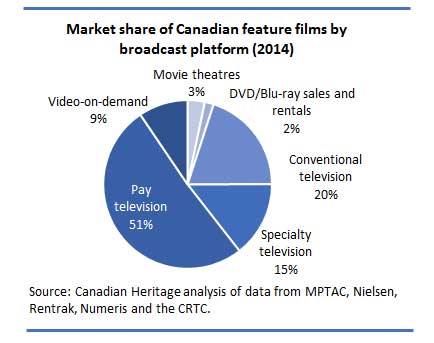

Market share of Canadian feature films by broadcast platform (2014) – text version

The graph shows the market share of feature films by broadcast platform for 2014.

- Pay television: 51 percent

- Conventional television: 20 percent

- Speciality television: 15 percent

- Video-on-demand: 9 percent

- Movie theatres: 3 percent

- DVD/Blu-ray sales and rentals: 2 percent

Source: Canadian Heritage analysis of data from MPTAC, Nielsen, Rentrak, Numeris and the CRTC.

In 2014, the number of views of Canadian feature films was 100.5 million across all broadcast windows measured by the study.

Pay television is the primary broadcast platform for Canadian feature films. In total, 51.3 million views come from pay television services, i.e., 51% of total views. Conventional television (20%) and specialty television (14%) are also major platforms. Video-on-demand is growing sharply, with over 9.5 million views of Canadian feature films (9% of views of Canadian films). Theatres represent 3% of views, and DVD and Blu-ray sales and rentals make up 2% of views.

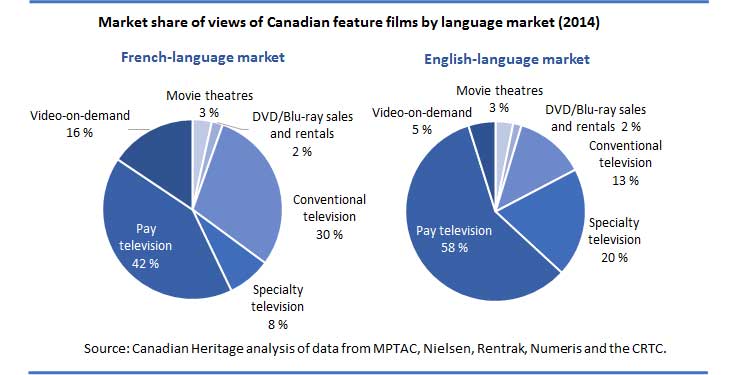

Market share of views of Canadian feature films by language market (2014) – text version

There are two graphs showing views of Canadian feature films by language market and broadcast platforms for 2014.

First graph: French-language market

- Pay television: 42 percent

- Conventional television: 30 percent

- Speciality television: 8 percent

- Video-on-demand: 16 percent

- Movie theatres: 3 percent

- DVD/Blu-ray sales and rentals: 2 percent

Second graph: English-language market

- Pay television: 58 percent

- Conventional television: 13 percent

- Speciality television: 20 percent

- Video-on-demand: 5 percent

- Movie theatres: 3 percent

- DVD/Blu-ray sales and rentals: 2 percent

In the French-language market, Canadians accumulated 43.2 million views of Canadian feature films. Pay television generated the most views of Canadian productions (42%), followed by conventional television (30%). Video-on-demand services are growing sharply, the number of views having more than doubled over the previous year, now amounting to 16% of views in the French-language market. Few French-language specialty television services broadcast feature films, and they account for only 8% of views. Movie theatres and DVD and Blu-ray sales and rentals represent 3% and 2% of views of Canadian films, respectively.

In the English-language market, the number of views of Canadian films was 57.2 million in 2014. Pay television services leveraged recent commercial successes to generate 58% of views of Canadian films. Specialty television accounted for 20% of views, compared with 13% for conventional television and 5% for video-on-demand services. Movie theatres (3%) and DVD and Blu-ray sales and rentals (2%) represent the fewest number of views.

Canadian market share

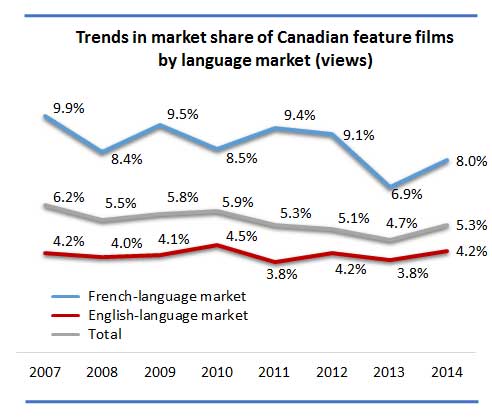

Trends in market share of Canadian feature films by language market (views) – text version

The graph shows trends in market share of Canadian feature films by language market and the Number of Views from 2007 to 2014.

French-language market

- 2007: 9.9 percent

- 2008: 8.4 percent

- 2009: 9.5 percent

- 2010: 8.5 percent

- 2011: 9.4 percent

- 2012: 9.1 percent

- 2013: 6.9 percent

- 2014: 8.0 percent

English-language market

- 2007: 4.2 percent

- 2008: 4.0 percent

- 2009: 4.1 percent

- 2010: 4.5 percent

- 2011: 3.8 percent

- 2012: 4.2 percent

- 2013: 3.8 percent

- 2014: 4.2 percent

Total

- 2007: 6.2 percent

- 2008: 5.5 percent

- 2009: 5.8 percent

- 2010: 5.9 percent

- 2011: 5.3 percent

- 2012: 5.1 percent

- 2013: 4.7 percent

- 2014: 5.3 percent

Canadian films attained a market share of 5.3% in 2014, up from the previous two years. It is important to note that data for video-on-demand was not integrated into the model until 2012.

In total, the model captures nearly 1.9 billion views by Canadians of feature films on all broadcast platforms. For example, the model makes it possible to estimate that each Canadian saw an average of 50 films in 2014 on the platforms measured in the study. Three of those films were Canadian productions.

In 2014, Canadian feature films were viewed in French 43.2 million times on all the platforms examined in the study. Canadian films achieved an overall 8.0% share of the French-language market, up by more than one percent over the previous year.

In 2014, the English-language market generated 57.2 million views of Canadian feature films. Canadian films represented 4.2% of all views in the English-language market. This market share has remained relatively stable since 2007, ranging from 3.8% to 4.5%.

Movie theatres

Movie theatres include all commercial establishments whose main purpose is to show feature films. Movie theatres remain the first exhibition window for feature films. They are a key showcase for a film’s success. It is when films are shown in theatres—either commercially or at festivals—that Canadian productions receive the most media attention and where their cultural impact is greatest. Critical and popular success when a film is released in movie theatres results in reaching larger audiences through subsequent broadcast platforms.

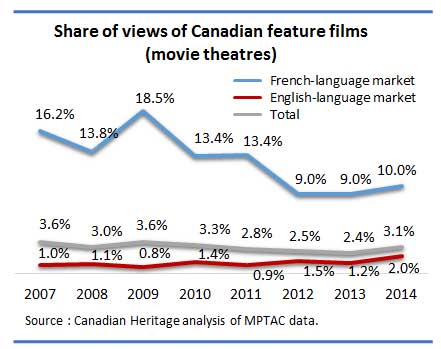

Share of views of Canadian feature films (movie theatres) – text version

The graph shows the share of views of Canadian feature films for movie theatres by language market from 2007 to 2014.

French-language market

- 2007: 16.2 percent

- 2008: 13.8 percent

- 2009: 18.5 percent

- 2010: 13.4 percent

- 2011: 13.4 percent

- 2012: 9.0 percent

- 2013: 9.0 percent

- 2014: 10.0 percent

English-language market

- 2007: 1.0 percent

- 2008: 1.1 percent

- 2009: 0.8 percent

- 2010: 1.4 percent

- 2011: 0.9 percent

- 2012: 1.5 percent

- 2013: 1.2 percent

- 2014: 2.0 percent

Total

- 2007: 3.6 percent

- 2008: 3.0 percent

- 2009: 3.6 percent

- 2010: 3.3 percent

- 2011: 2.8 percent

- 2012: 2.5 percent

- 2013: 2.4 percent

- 2014: 3.1 percent

Source: Canadian Heritage analysis of MPTAC.

In 2014, the box office revenues for all feature films shown in movie theatres amounted to $945 million, a sharp drop of nearly 10% over the previous year and the first time that revenues had fallen below one billion dollars since 2008. Movie theatres are still an exhibition window whose success depends on a limited number of films. In 2014, the 25 most popular titles in Canadian theatres generated half of total revenues.

From a Canadian perspective, 2014 was marked by the release of a number of successful films. Productions such as Pompeii ($4.1 million at the box office), The Grand Seduction ($2.7 million), Trailer Park Boys 3: Don’t Legalize It ($2 million), Brick Mansions ($2 million) and Dr. Cabbie ($1.7 million) helped make 2014 a record year for the English-language movie theatre market. In the French-language market, award-winning films like Mommy ($3.3 million) and popular productions like 1987 ($2.5 million) led the way. A total of 137 new Canadian feature films were released in movie theatres in 2014, compared with 611 foreign films.

Canadian feature films were viewed 3.3 million times in 2014 and generated a 3.1% market share. This was the first increase after four years of decline. The French-language market generated 1.5 million views and a 10% market share. The English-language market generated 1.8 million views—the highest number since this data had been modelled—and a market share of 2%. In total, 45% of views came from the French-language market and 55% from the English-language market.

Most popular Canadian feature films in movie theatres (Number of Views, 2014)

| Film title | Number of Views |

|---|---|

| Mommy | 369,000 |

| 1987 | 305,000 |

| Pompeii | 133,000 |

| La petite reine | 112,000 |

| Brick Mansions | 57,000 |

| All films | 1,494,000 |

| Film title | Number of Views |

|---|---|

| Pompeii | 350,000 |

| The Grand Seduction | 318,000 |

| Trailer Park Boys: Don’t Legalize it | 235,000 |

| Dr. Cabbie | 209,000 |

| Brick Mansions | 176,000 |

| All films | 1,814,000 |

Source: Canadian Heritage analysis of MPTAC data

DVD and Blu-ray sales and rentals

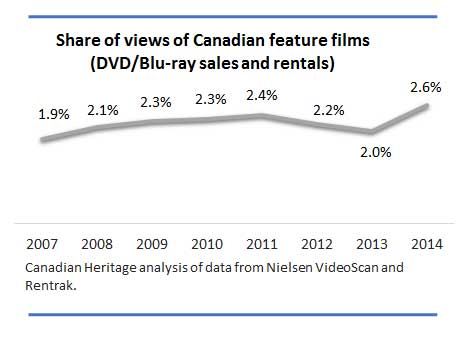

Share of views of Canadian feature films (DVD/Blu-ray sales and rentals) – text version

The graph shows the share of views of Canadian feature films for DVD and Blu-ray sales and rentals from 2007 to 2014.

- 2007: 1.9 percent

- 2008: 2.1 percent

- 2009: 2.3 percent

- 2010: 2.3 percent

- 2011: 2.4 percent

- 2012: 2.2 percent

- 2013: 2.0 percent

- 2014: 2.6 percent

Source: Canadian Heritage analysis of data from Nielsen VideoScan and Rentrak.

This market segment has declined sharply in Canada in recent years, particularly due to the closure of numerous Blockbuster and Rogers stores and the rise of video-on-demand rental services. In fall 2014, Zip.ca, a company that specialized in DVD rentals by mail, ceased operations after over a decade of activity in Canada. In February 2015, RedBox announced the end of rental services by vending machines and of its 1400 kiosks in Canada. In the past five years, revenue from rentals and the number of copies rented in Canada have fallen over 80%. This market segment now represents less than 2% of views of Canadian feature films.

In 2014, sales and rentals of Canadian productions generated more than 1.7 million views. This amounts to 2.6% of all film sales and rentals, up slightly from previous years.

The most popular films in these formats are generally recent productions with high box office revenues when they were shown in movie theatres. Productions like Pompeii (210,000 views), Brick Mansions (162,000 views), Mortal Instruments: City of Bones (110,000 views) and Il était une fois les Boys (68,000 views) are among the most popular Canadian productions.

Conventional television market

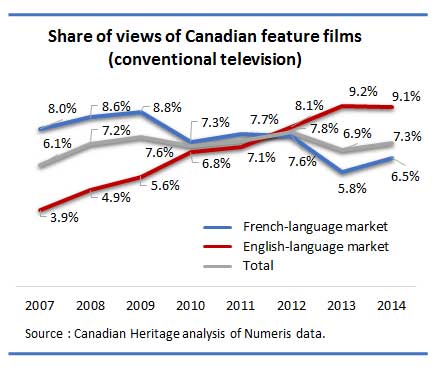

Share of views of Canadian feature films (conventional television) – text version

The graph shows the share of views of Canadian feature films on conventional television by language market from 2007 to 2014.

French-language market

- 2007: 8.0 percent

- 2008: 8.6 percent

- 2009: 8.8 percent

- 2010: 7.3 percent

- 2011: 7.7 percent

- 2012: 7.6 percent

- 2013: 5.8 percent

- 2014: 6.5 percent

English-language market

- 2007: 3.9 percent

- 2008: 4.9 percent

- 2009: 5.6 percent

- 2010: 6.8 percent

- 2011: 7.1 percent

- 2012: 8.1 percent

- 2013: 9.2 percent

- 2014: 9.1 percent

Total

- 2007: 6.1 percent

- 2008: 7.2 percent

- 2009: 7.6 percent

- 2010: 7.0 percent

- 2011: 7.7 percent

- 2012: 7.8 percent

- 2013: 6.9 percent

- 2014: 7.3 percent

Source: Canadian Heritage analysis of Numeris data.

In 2014, Canadian feature films shown on conventional television generated more than 20 million views (12.8 million in French and 7.2 million in English). A total of 7.3% of feature films viewed on conventional television were Canadian productions. This market share has remained relatively stable over the years, even though the language markets have evolved considerably.

In the French-language market, broadcasters showed 107 Canadian titles, amounting to nearly 180 broadcasts. In the English-language market, 71 Canadian feature films generated over 360 broadcasts.

In the French-language market, the Canadian market share has followed a downward trend in recent years, falling to 6.5% in 2014. Conversely, the performance of Canadian feature films is constantly improving in the English-language market, the Canadian market share having more than doubled since 2007 to reach 9.1% in 2014. Conventional television is the only platform where the Canadian market share is larger in the English-language market than the French-language market.

The most popular Canadian productions include classic films (La guerre des tuques, Christmas Story), popular comedies (Les Boys) and art-house films (Monsieur Lazhar, Partition).

Most popular Canadian feature films on conventional television (Number of Views, 2014)

| Film title | Number of Views |

|---|---|

| La guerre des tuques | 860,000 |

| Monsieur Lazhar | 513,000 |

| Les Boys III | 428,000 |

| Les Boys IV | 423,000 |

| L’Empire Bo$$é | 410,000 |

| All films | 12,822,000 |

| Film title | Number of Views |

|---|---|

| Different Loyalty | 402,000 |

| A Christmas Story | 389,000 |

| Partition | 317,000 |

| The Year Dolly Parton was my Mom | 311,000 |

| My Life without Me | 251,000 |

| All films | 7,328,000 |

Source: Canadian Heritage analysis of Numeris data.

Specialty television market

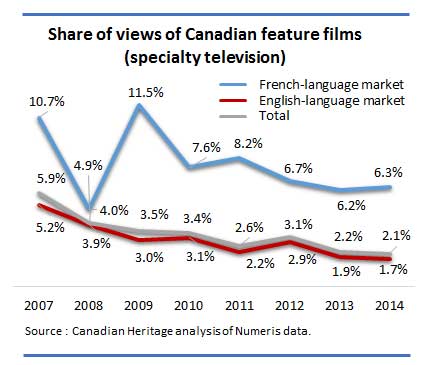

Share of views of Canadian feature films (specialty television) – text version

The graph shows the share of views of Canadian feature films on specialty television by language market from 2007 to 2014.

French-language market

- 2007: 10.7 percent

- 2008: 4.0 percent

- 2009: 11.5 percent

- 2010: 7.6 percent

- 2011: 8.2 percent

- 2012: 6.7 percent

- 2013: 6.2 percent

- 2014: 6.3 percent

English-language market

- 2007: 5.2 percent

- 2008: 3.9 percent

- 2009: 3.0 percent

- 2010: 3.1 percent

- 2011: 2.2 percent

- 2012: 2.9 percent

- 2013: 1.9 percent

- 2014: 1.7 percent

Total

- 2007: 5.9 percent

- 2008: 4.9 percent

- 2009: 3.5 percent

- 2010: 3.4 percent

- 2011: 2.6 percent

- 2012: 3.1 percent

- 2013: 2.2 percent

- 2014: 2.1 percent

Source: Canadian Heritage analysis of Numeris data.

In 2014, Canadian feature films shown on specialty television totalled 14.6 million views: 3.4 million in French and 11.2 million in English. The market share for Canadian productions, in steady decline for a number of years, was 2.1%.

There are far more specialty television services in the English-language market. With a total of nearly 650 million views of feature films, it is the most popular broadcast platform in the English-language market. Comparatively speaking, specialty television generates seven times more views in English than movie theatres do for all productions. The Canadian market share was modest, with 1.7% of views in English in 2014. Specialty services showed over 100 Canadian feature films, which generated over 820 broadcasts.

In the French-language market, 70 Canadian feature films were shown on specialty television, amounting to 211 broadcasts. The Canadian market share was 6.3%, down from previous years.

The most popular Canadian feature films on specialty television are generally not very recent films. Comedies like Elvis Gratton, La Florida and Nuit de noces generated numerous views, as well as family films such as the MVP series and Air Bud.

Most popular Canadian feature films on specialty television (number of views, 2014)

| Film title | Number of Views |

|---|---|

| Elvis Gratton | 320,000 |

| La Florida | 209,000 |

| White Noise | 180,000 |

| Elvis Gratton : Miracle à Memphis | 157,000 |

| Les sept jours du Talion | 145,000 |

| All films | 3,369,000 |

| Film title | Number of Views |

|---|---|

| Resident Evil: Afterlife | 978,000 |

| The Snow Walker | 828,000 |

| MVP: Most Valuable Primate | 710,000 |

| Blizzard | 538,000 |

| MVP 2: Most Vertical Primate | 489,000 |

| All films | 11,183,000 |

Source: Canadian Heritage analysis of Numeris data.

Pay television market

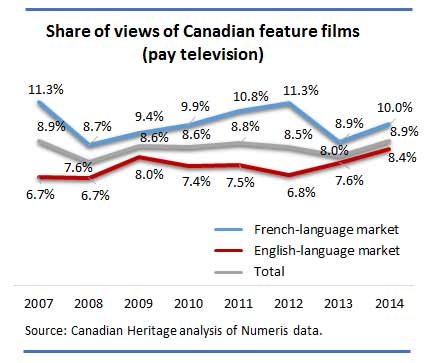

Share of views of Canadian feature films (pay television) – text version

The graph shows the share of views of Canadian feature films on pay television by language market from 2007 to 2014.

French-language market

- 2007: 11.3 percent

- 2008: 8.7 percent

- 2009: 9.4 percent

- 2010: 9.9 percent

- 2011: 10.8 percent

- 2012: 11.3 percent

- 2013: 8.9 percent

- 2014: 10.0 percent

English-language market

- 2007: 6.7 percent

- 2008: 6.7 percent

- 2009: 8.0 percent

- 2010: 7.4 percent

- 2011: 7.5 percent

- 2012: 6.8 percent

- 2013: 7.6 percent

- 2014: 8.4 percent

Total

- 2007: 8.9 percent

- 2008: 7.6 percent

- 2009: 8.6 percent

- 2010: 8.6 percent

- 2011: 8.8 percent

- 2012: 8.5 percent

- 2013: 8.0 percent

- 2014: 8.9 percent

Source: Canadian Heritage analysis of Numeris data.

In 2014, Canadian feature films shown on pay television generated 51.3 million views. This is the biggest broadcast platform for viewing Canadian films. The market share for Canadian productions was 8.9%, up from previous years.

The most popular feature films are generally recent productions that saw major success in theatres. Films like Mortal Instruments: City of Bones, Pompeii and Resident Evil: Retribution were popular in both language markets. For the French-language market, the Canadian market share was 10% in 2014. In all, over 170 Canadian titles were shown on French-language pay television services, which generated nearly 2,800 broadcasts and nearly 18 million views.

For English-language services, the presentation of over 250 Canadian feature films amounted to nearly 8,300 broadcasts on pay television and a total of nearly 33.4 million views of Canadian productions.

Most popular Canadian feature films on pay television

| Film title | Number of Views |

|---|---|

| Mortal Instruments: City of Bones | 648,000 |

| Il était une fois les Boys | 630,000 |

| Louis Cyr: l’homme le plus fort du monde | 624,000 |

| Resident Evil: Retribution | 437,000 |

| Hot Dog | 424,000 |

| All films | 17,952,000 |

| Film title | Number of Views |

|---|---|

| Mortal Instruments: City of Bones | 2,011,000 |

| The Colony | 1,509,000 |

| Pompeii | 1,086,000 |

| Mama | 1,086,000 |

| Resident Evil: Retribution | 1,049,000 |

| All films | 33,354,000 |

Source: Canadian Heritage analysis of Numeris data.

Case study: Data for audiovisual treaty coproductions

-

Coproductions generate a significant portion of views of Canadian feature films for each of the broadcast windows.

-

The market shares of coproductions are particularly high in the English-language market.

Currently, Canada has audiovisual coproduction treaties with 54 countries. Thanks to these treaties, Canadian and foreign producers combine their creative, artistic, technical and financial resources to produce audiovisual coproductions that can be considered national works in their respective countries. This section provides a detailed analysis of the performance of this type of production on each of the broadcast platforms in Canada.

In 2014, 29% of views of Canadian feature films came from audiovisual coproductions, for all broadcast windows. The market share was 32% for the English-language market and 22% for the French-language market. Coproductions hold a larger share of the English-language market across all exhibition windows.

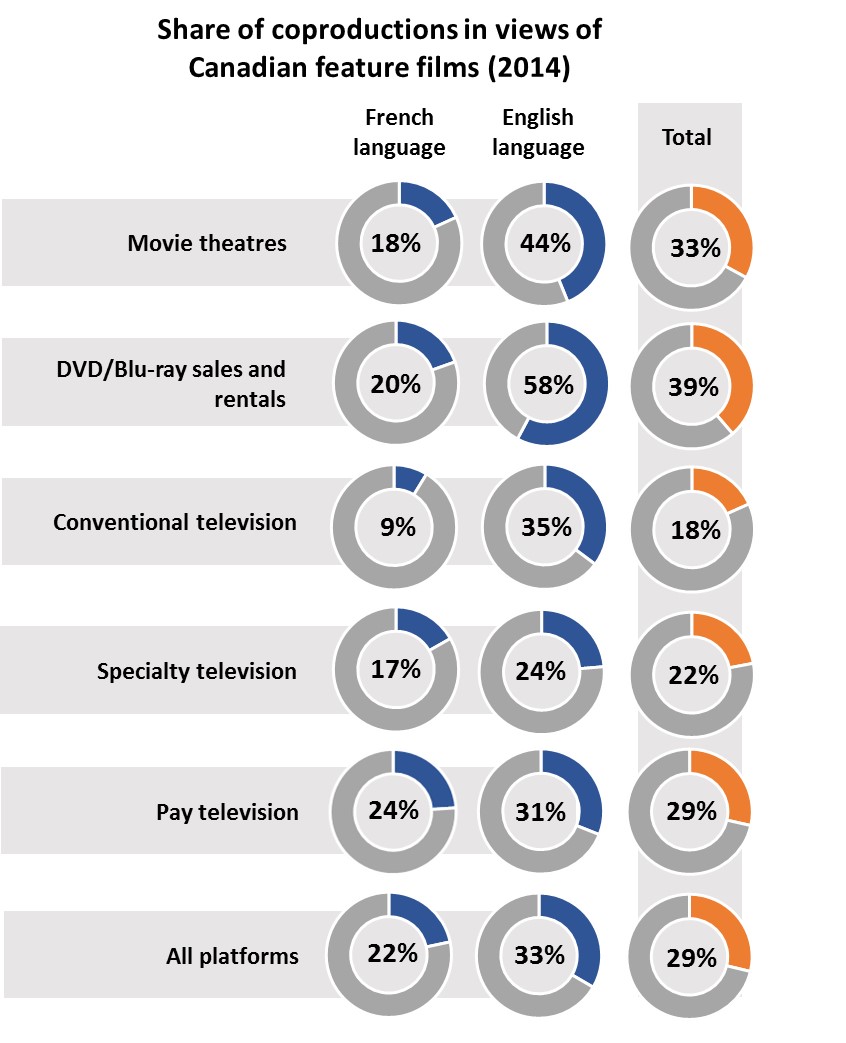

Share of coproductions in views of Canadian feature films (2014) – text version

The graph shows the share of coproductions in views of Canadian feature films by language market in 2014.

French-language market

- Movie theatres: 18 percent

- DVD and Blu-ray sales and rentals: 20 percent

- Conventional television: 9 percent

- Speciality television: 17 percent

- Pay television: 24 percent

- All platforms: 22 percent

English-language market

- Movie theatres: 44 percent

- DVD and Blu-ray sales and rentals: 58 percent

- Conventional television: 35 percent

- Speciality television: 24 percent

- Pay television: 31 percent

- All platforms: 33 percent

Total

- Movie theatres: 33 percent

- DVD and Blu-ray sales and rentals: 39 percent

- Conventional television: 18 percent

- Speciality television: 22 percent

- Pay television: 29 percent

- All platforms: 29 percent

- Movie theatres

In 2014, only 14 of the 171 Canadian feature films presented in theatres were treaty coproductions. However, they generated $9.9 million at the box office and 1.1 million views. Coproductions represent one third of all views of Canadian feature films. Coproductions such as Pompeii (480,000 views), Brick Mansions (230,000 views) and The F Word (147,000 views) achieved resounding success, and are at the top of the list of Canadian feature films. In 2014, 44% of views of Canadian films shown in English were this type of production, compared to 18% for the French-language market.

- DVD and Blu-ray sales and rentals

Coproductions amounted to 39% of views of Canadian feature films. The English-language market especially benefited from recent successes such as Pompeii, Brick Mansions and Mortal Instruments: The City of Bones to achieve a 58% market share of views of Canadian films, the largest share among all the platforms measured.

- Conventional television

In general, conventional television services show a very diverse range of films, including a number of older titles. With an 18% market share, it is the exhibition window where the relative performance of coproductions is the weakest. The most popular coproductions are generally films that were successful in theatres a few years ago, such as Eastern Promises, Grey Owl and The Red Violin. The market share for coproductions was 35% in English and 9% in French.

- Specialty television

Specialty television reaches much larger audiences in English than in French, where the number of services is much more limited. In the English-language market, the film Resident Evil: Afterlife alone generated nearly one million views, while coproductions represented nearly one quarter of views of Canadian feature films. In French, only around 10 coproductions were shown on specialty television, obtaining a 17% market share.

- Pay television

Pay television services are the main television platform for broadcasting Canadian feature films. The most successful films are generally premieres and recent productions. Coproductions amounted to a total of 29% of views of Canadian films. In both language markets, the films Mortal Instruments: City of Bones, Resident Evil: Retribution, Mama and Pompeii were the most popular coproductions.

Case study: Views of select films by platform

This section studies the performance of three Canadian feature films that generated significant revenues when they were shown in movie theatres or attained critical success and won international awards at various festivals.

These films were released in theatres in 2011 and 2012 and have since been shown on all of the viewing platforms. Note that data for each language market is unavailable for video-on-demand services offered by broadcasters. The CRTC does not collect this type of data by title.

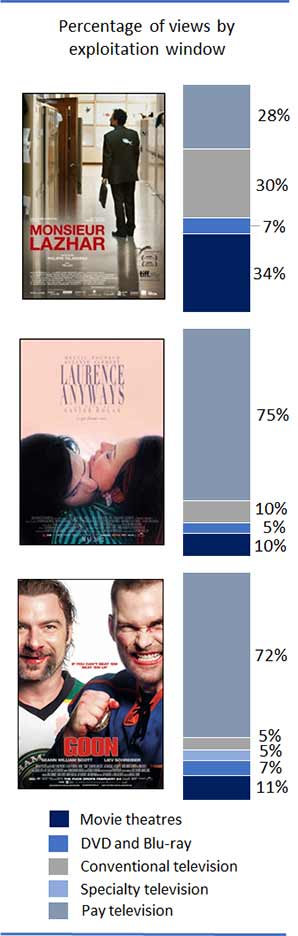

Percentage of views by exploitation window– text version

There are three graphs showing views of three Canadian feature films by boradcast platforms.

Monsieur Lazhar

- Movie theatres: 34 percent

- DVD and Blu-ray: 7 percent

- Conventional television: 30 percent

- Speciality television: 0 percent

- Pay television: 28 percent

Laurence Anyways

- Movie theatres: 10 percent

- DVD and Blu-ray: 5 percent

- Conventional television: 10 percent

- Speciality television: 0 percent

- Pay television: 75 percent

Goon

- Movie theatres: 11 percent

- DVD and Blu-ray: 7 percent

- Conventional television: 5 percent

- Speciality television: 5 percent

- Pay television: 72 percent

The data on film views demonstrates that Canadian feature films that achieved popular success when they were released in theatres generally get good results when they are shown on subsequent exhibition windows. They receive more extensive promotion, are shown on television during peak viewing hours and benefit from profitable business strategies.

Conversely, certain productions that were not as widely distributed in theatres or that occupy a more specific niche targeting a particular audience can nevertheless reach a much larger audience on other broadcast platforms.

Monsieur Lazhar

As of the end of 2014, movie theatres were still the primary platform for viewing a film like Monsieur Lazhar, which earned over $4.8 million when it was shown on the big screen. The film was very popular in both languages, with 58% of its box office revenues in French and 42% in English.

Monsieur Lazhar generated a total of more than 1.7 million views from all exhibition windows. Nearly three quarters of views were from the French-language market. The film was shown 218 times on television and seen by over 500,000 viewers on conventional television.

Note that the study of the performance of Canadian feature films over a longer period would provide different results with regard to the market share of each of the broadcast platforms. In the long term, conventional and specialty television would have a larger share, for example, for films that are no longer being shown in movie theatres or on pay television.

Laurence Anyways

Laurence Anyways, the third production by Xavier Dolan, obtained considerable critical success when it was released in movie theatres. This production earned nearly $500,000 at the box office in Canada.

Nevertheless, Laurence Anyways reached its largest audience outside movie theatres: 90% of views came from exhibition windows that followed the big screen. In all, 69% of views were from the French-language market and 31% from the English-language market.

The film was shown over 200 times on television and reached a vast audience on pay television, which amounted to 75% of total views. Conventional television remains a platform with a very broad outreach. In one broadcast, the film received 30% of all its views.

Goon

The sports comedy Goon was one of the most popular Canadian feature films in theatres in 2012. The film generated substantial box office revenues in both language markets, collecting $4.2 million. The film continued to reach a very large audience in each of the broadcast windows.

Goon was viewed a total of 4.4 million times on all broadcast platforms. The English-language market represented 62% of views (2.8 million views) and the French-language market represented 38% (1.7 million views).

Showings in movie theatres amounted to 11% of total views, compared to 7% for the DVD market, 5% for specialty television and 5% for conventional television. Pay television services made up most of the audience for the film, accounting for nearly three quarters of views. The film, which was broadcast 232 times, received wide exposure on television in both language markets.