Committee of the Whole (House of Commons) 2021-22 Supplementary Estimates (B) December 7 and 8, 2021

Table of Contents

Anchor Issues

Inflation

Economic Recovery

Summary of Canada's COVID-19 Economic Response Plan

• Support for P/Ts

• Worker Benefits

Debt and Deficit Levels

Debt ManagementSupporting Low- and Middle-Income Individuals and Families

Supporting Small Businesses During the Pandemic

Fighting Tax Evasion and Avoidance

Housing

Trade Irritants with the U.S.

Other Issues

Equalization (AB referendum, floor payments)

Provincial/territorial request to increase the Canada Health Transfer

CPP contribution rate increase

Border Carbon Adjustments (BCA)

Trans Mountain

• Trans Mountain Expansion Project

• Funding for Indigenous engagement on economic participation in Trans Mountain

Supplementary Estimates B

2021-22 Supplementary Estimate (B)

• Finance 2021-22 Supplementary Estimate (B)

• FINTRAC 2021-22 Supplementary Estimate (B)

Canadian Commercial Corporation (CCC)

Federal Payments to Western Provinces for Enhanced Oil and Gas Well Clean-up

Key Figures and Statistics

Quick Facts

• Economic Fact Sheet

• Fiscal Fact Sheet (Budget 2021)

Economic Indicators Fact Sheet

• Alberta Economic and Fiscal Factsheet

Parliamentary and Media Environment

Party Leaders and Finance Critics

Parliamentary Environmental Analysis

*Redacted*

Scenario Note

Appearance at House of Commons Committee of the Whole

Tuesday, December 7, 2021 and Wednesday, December 8, 2021

Ottawa, Ontario

Description: Pursuant to a motion adopted in the House of Commons on November 25, 2021, the House will consider the Supplementary Estimates in two Committees of the Whole. A Committee of the Whole is the entire membership of the House of Commons sitting as a committee.

Ministers Fortier, Boissonault, Duclos, Joly and Miller are expected to appear before the House of Commons Committee of the Whole.

Location: Chamber, House of Commons

Day of Committee of the Whole Timing and Officials

Supporting Officials

- Chamber Floor of the House of Commons

- Nick Leswick, Associate Deputy Minister

Teams/Virtual Support

- A Teams Channel will be used to provide support to the lead Minister/departments

Timing

- Debate is expected to begin at the regular time of adjournment (around 6:30 p.m., unless delayed by earlier proceedings) and is expected to conclude around 10:30 p.m. (4 hours)

- Debate may be delayed on Wednesday, December 8th due to expected votes in the House of Commons

Day of Committee of the Whole

- At the time of day set for Committee of the Whole, proceedings then underway in the House of Commons will come to an end. The Chair of the Committee of the Whole (the Speaker or Deputy Speaker) will give the MPs a brief overview of the rules for this Committee:

- The study will cover all of the items, or Votes, contained in the Estimates, which have been referred to the Committee of the Whole for consideration.

- The Speaker will explain the order in which the speaking slots will be divided amongst the parties and will explain other relevant agreements/arrangements that may have been reached.

- The Chair will emphasize speaking times for questions/answers and speeches.

- A reminder that there must be unanimous consent for MPs to split their time with another member.

- The seating will likely reflect the following:

- Ministers with Estimates to be reviewed (as identified by the agreed upon motion) will sit in the front row benches (usually in the centre) on the Government side.

- The Parliamentary Secretaries to the Ministers will sit in the second row.

- A small table will be placed directly in front of the Ministers (on the floor of the House) for the above identified Government officials.

- The officials will be escorted from the Government Lobby to this table, by an official of the House. The Minister may (or may not) choose to introduce officials to the House.

- Officials are not allowed to address the Chamber directly but may discretely provide information and advice to Ministers.

- Other officials of the Ministers are allowed to sit in the command centre room.

- MPs are allowed to sit where they wish, and some will likely participate virtually.

- The round of questions will then begin. The Speaker Chair of the Committee will usually moderate the debate of Committee of the Whole by matching the amount of time given to each answer with the amount of time used to pose the question (e.g. short question will be responded to with a short answer). The rounds of questioning are proportionate to standings in the House.

- In the opening round, each recognized party gets a 15 minute slot, in the following order:

- Opposition Q&A (Conservative) (15 minutes)

- Government Speech (10 minutes), followed by government-led Q&A (5 minutes)

- Opposition Q&A (Bloc Quebecois) (15 minutes)

- Opposition Q&A (New Democratic Party) (15 minutes)

- The remaining speaking slots will follow a rotation that match the strength of each party’s standings. Approximately half the speaking slots will go to the government, and the opposition will get the other half of the speaking slots (Conservatives getting the majority of opposition speaking slots, followed by the Bloc Quebecois and the New Democratic Party). (Full rounds in Annex)

- Speeches are being provided by: TBS (2), GAC (3), CIRNAC/ISC (3), HC (2), FIN (2), PS (1), DND (8), PCH (1), ECCC (1), INF (1)

- Tuesday, December 7, 2021 (Committee of the Whole 1):

- At the expiry of the time provide for the study (4 hours), or if the debate collapses, the meeting of the Committee will come to an end.

- Officials are then allowed to leave the House and the House immediately adjourns to the next sitting day.

- Wednesday, December 8, 2021 (Committee of the Whole 2):

- At the expiry of the time provided for the study (4 hours), or if the debate collapses, the meeting of the Committee will come to an end and the Estimates will be "deemed' reported back to the House. Contrary to what is possible in a Standing Committee, the rules of the House provide no procedure under which MPs in Committee of the Whole can reduce or reject the estimates they are examining.

- Officials are then allowed to leave the House and the House immediately adjourns to the next sitting day.

Contact List

[TBS Strategic Communications and Ministerial Affairs]

Assistant Secretary

Name: Kelly Acton

Title: Assistant Secretary

Email: Kelly.Acton@tbs-sct.gc.ca

Cell: *Redacted*

Executive Director

Name: Mark Stokes

Title: Executive Director of Communications

Email *Redacted*

Director, Parliamentary and Public Affairs

Name: Alain Belle-Isle

Title: Senior Manager, Parliamentary Affairs

Email: alain.belle-isle@tbs-sct.gc.ca

Cell: *Redacted*

Senior Manager, Parliamentary Affairs

Name: Émilie Anne Duval

Title: Senior Manager, Parliamentary Affairs

Email: emilieanne.duval@tbs-sct.gc.ca

Cell: *Redacted*

| Branch / Office | Name | |

|---|---|---|

| DMO | Nick Leswick | Nick.Leswick@fin.gc.ca |

| DPMO / MinO | Farees Nathoo | farees.nathoo@fin.gc.ca |

| Brendon Legault | brendon.legault@fin.gc.ca | |

| CSB / CFO | John Daley | John.Daley@fin.gc.ca |

| TAX | Miodrag Jovanovic | Miodrag.Jovanovic@fin.gc.ca |

| Shawn Porter | shawn.porter@fin.gc.ca | |

| Maude Lavoie | Maude.Lavoie@fin.gc.ca | |

| ITF | Patrick Halley | Patrick.Halley@fin.gc.ca |

| FSP | Isabelle Jacques | isabelle.jacques@fin.gc.ca |

| Soren Halverson | Soren.Halverson@fin.gc.ca | |

| Nicolas Moreau | Nicolas.Moreau@fin.gc.ca | |

| EFP | Brad Recker | Bradley.Recker@fin.gc.ca |

| Julie Turcotte | Julie.Turcotte@fin.gc.ca | |

| EDCF | TBD | |

| FPRSP | Alison McDermott | Alison.McDermott@fin.gc.ca |

| Galen Countryman | Galen.Countryman@fin.gc.ca | |

| C&C | Marie-Elise Rancourt | Marie-Elise.Rancourt@fin.gc.ca |

| Frank Harvey | Francois.Harvey@fin.gc.ca |

Annex (Rounds)

Opening Round

CPC (15 minutes)

LPC (15 minutes)

BQ (15 minutes)

NDP (15 minutes)

Rotations

Tuesday

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

BQ (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

NDP (15 minutes)

--------------

Wednesday

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

BQ (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

NDP (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

BQ (15 minutes)

CPC (15 minutes)

LPC (15 minutes)

CPC (15 minutes)

*exact split between each day is subject to change

Anchor Issues

Inflation

Issue

Consumer price inflation has risen significantly in recent months.

Talking points

- First, let’s remember that the pandemic was a massive shock with Canada seeing its largest recession on record. Extraordinary policy supports were needed to help businesses bridge the crisis and keep as many workers connected to their jobs as possible.

- The government and the Bank of Canada responded in force at the acute stages in the pandemic when the fear was deflation, and that worked. Canadians can be just as confident that the Bank of Canada will keep inflation on target over time.

- We are acutely aware that Canadians are paying higher prices for some goods and services that they are buying.

- But higher inflation is not due to an overheating economy related to too much spending in Canada.

- This is a global phenomenon, where inflation everywhere has been boosted by temporary effects including:

- A return of some prices to more normal levels from very low levels during the early days in the pandemic;

- Higher global energy and other commodity prices due to supply and severe weather issues;

- Higher prices for manufactured and other goods caused by ongoing production bottlenecks due to the pandemic and unusually strong demand for goods, as many services were restricted.

- As we have always said, restarting the economy is a complex process. There are good reasons to expect that the special factors pushing inflation across the world will ease, even if they are taking a little longer to get resolved.

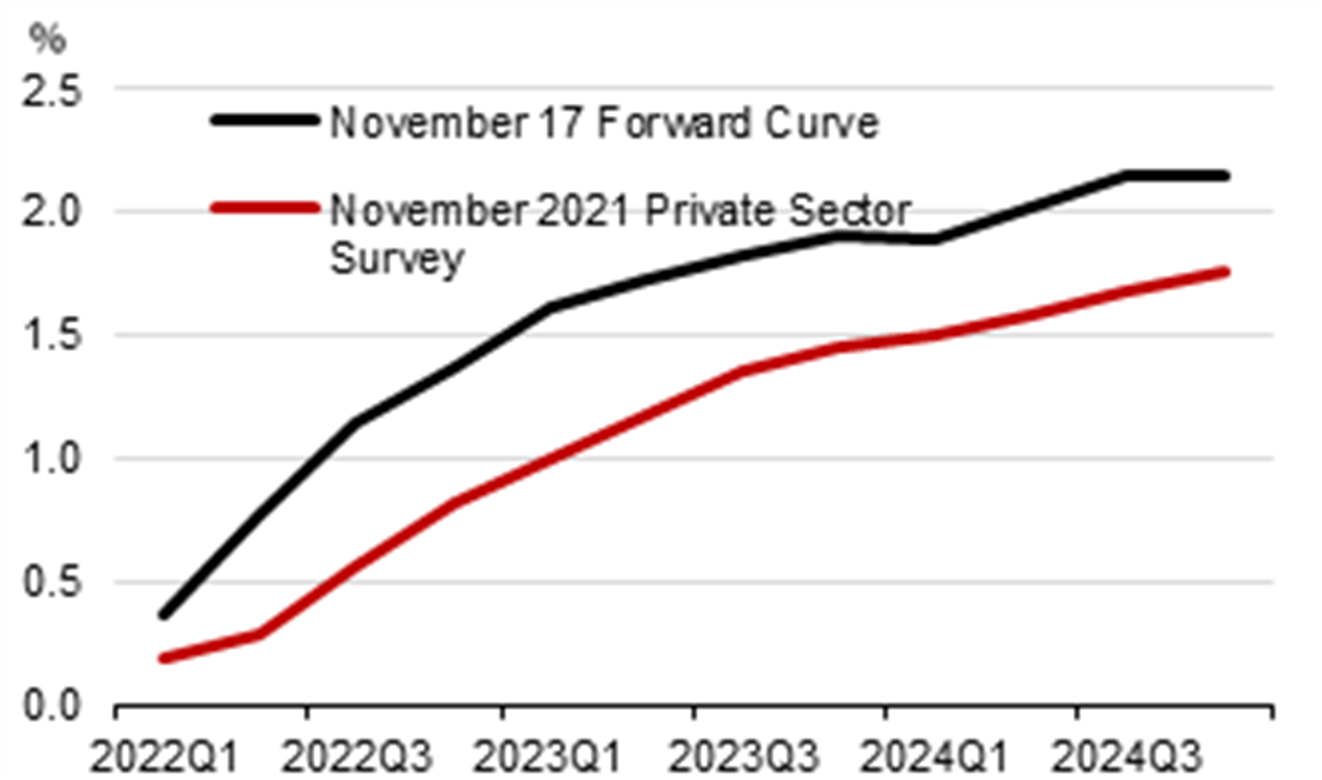

- The Bank of Canada and private sector economists expect that inflation may stay higher for longer, before easing back towards the 2% target throughout 2022.

- The government is moving from very broad-based support to more targeted measures that will provide help where it is needed, when it is needed.

- The vast majority of the government's Recovery Plan is targeted towards growth-enhancing and job creating initiatives – initiatives such as investments to support childcare and the adoption of new technologies that will help boost supply, increasing space for the economy to grow without the risk of higher inflation.

Background

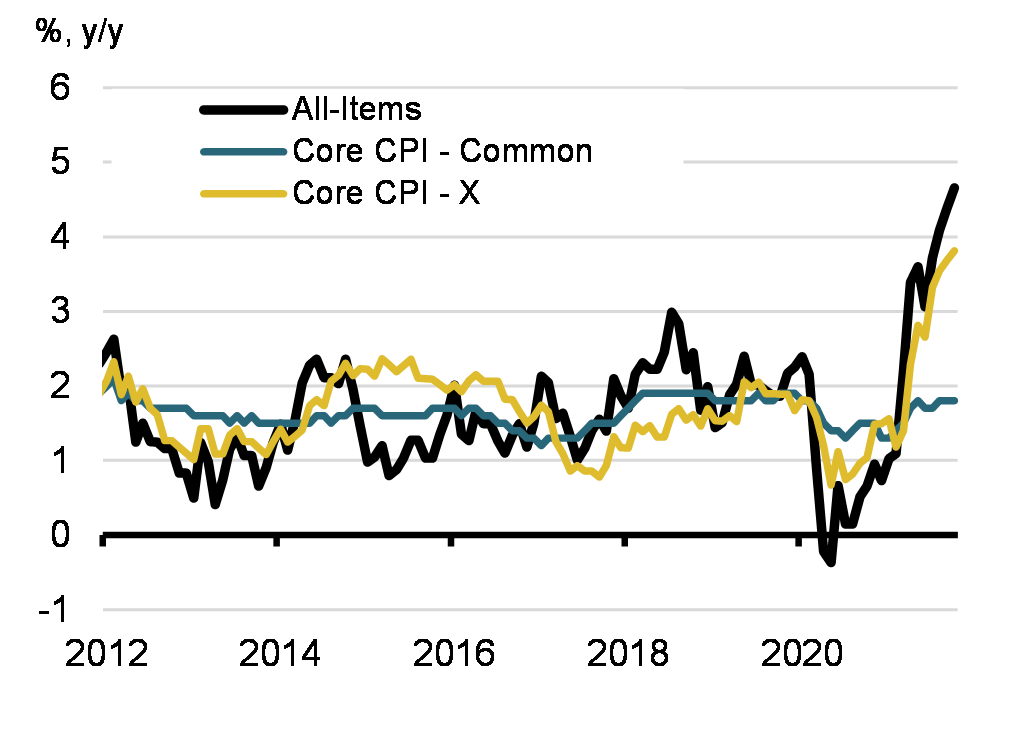

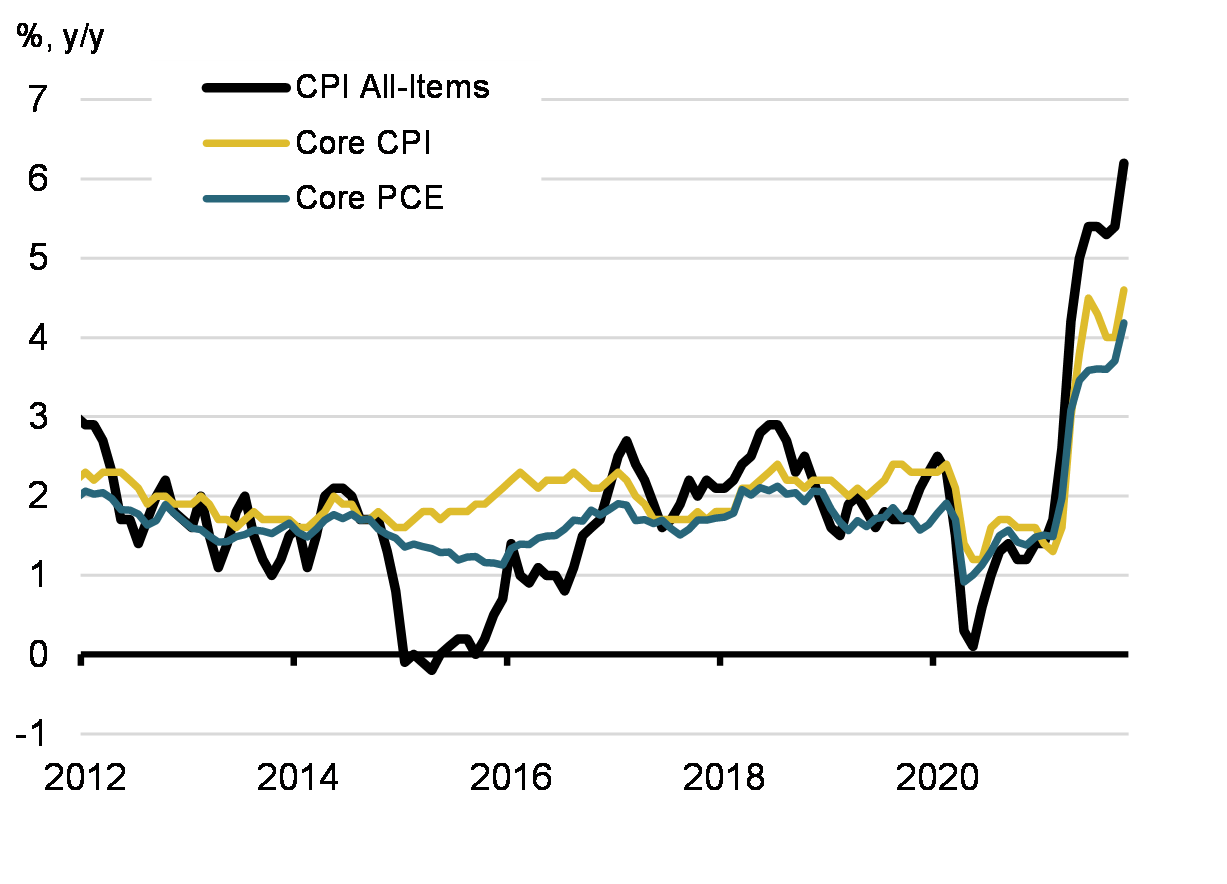

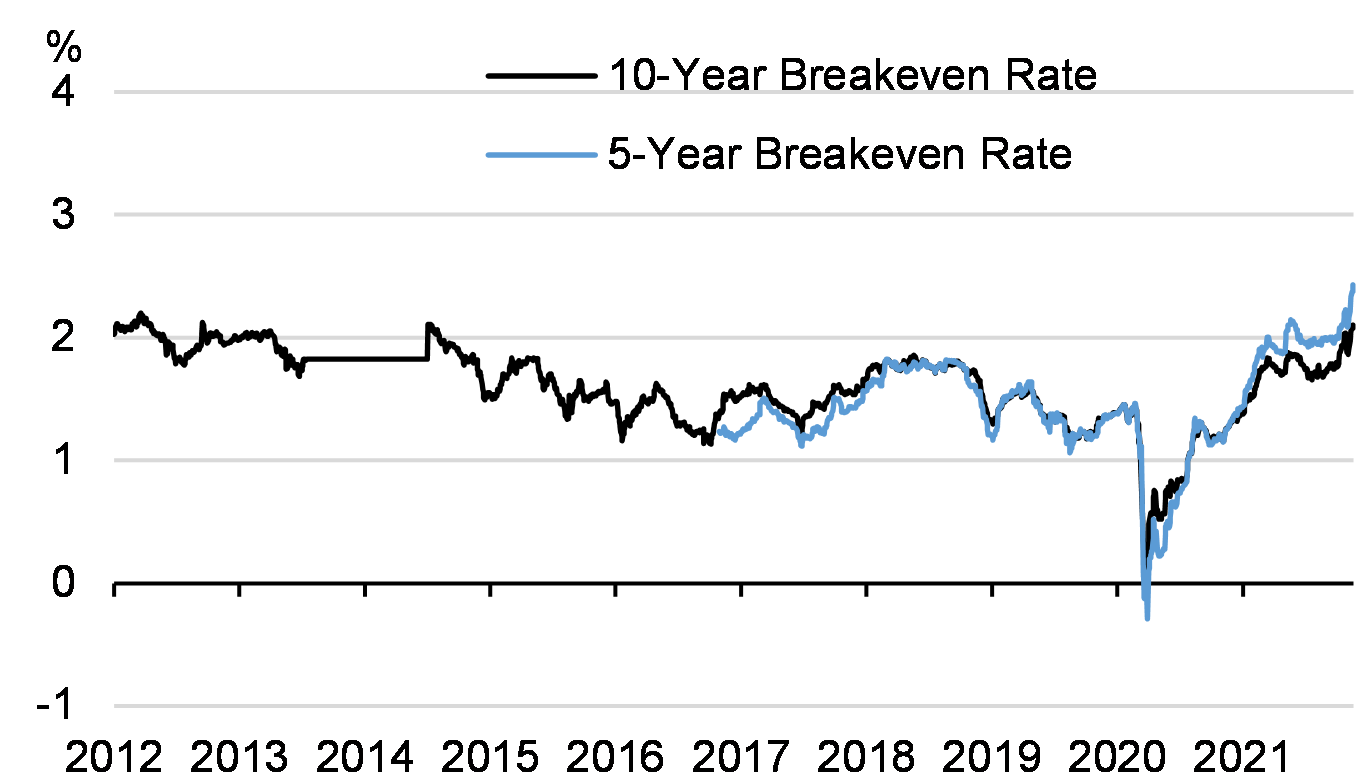

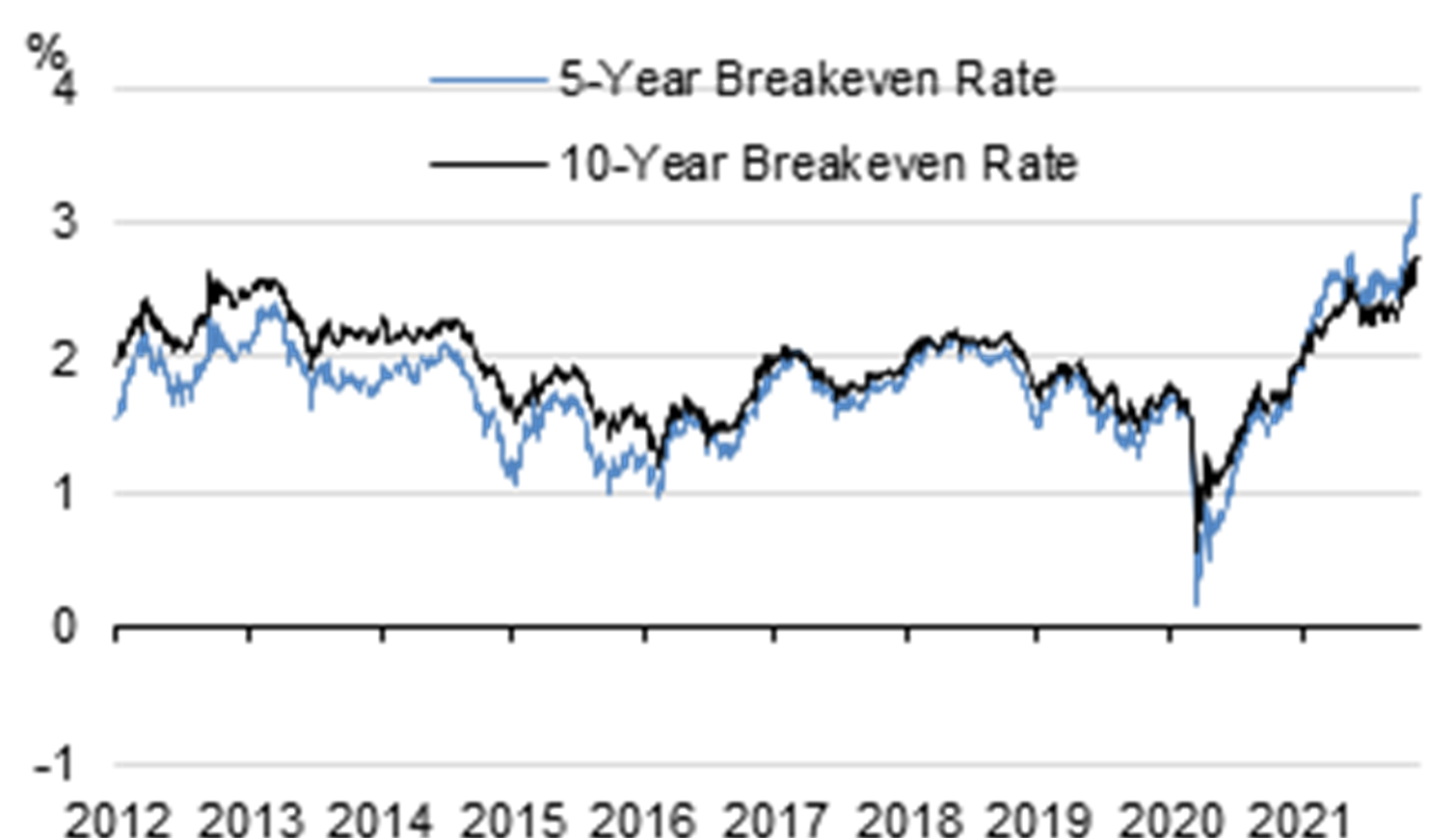

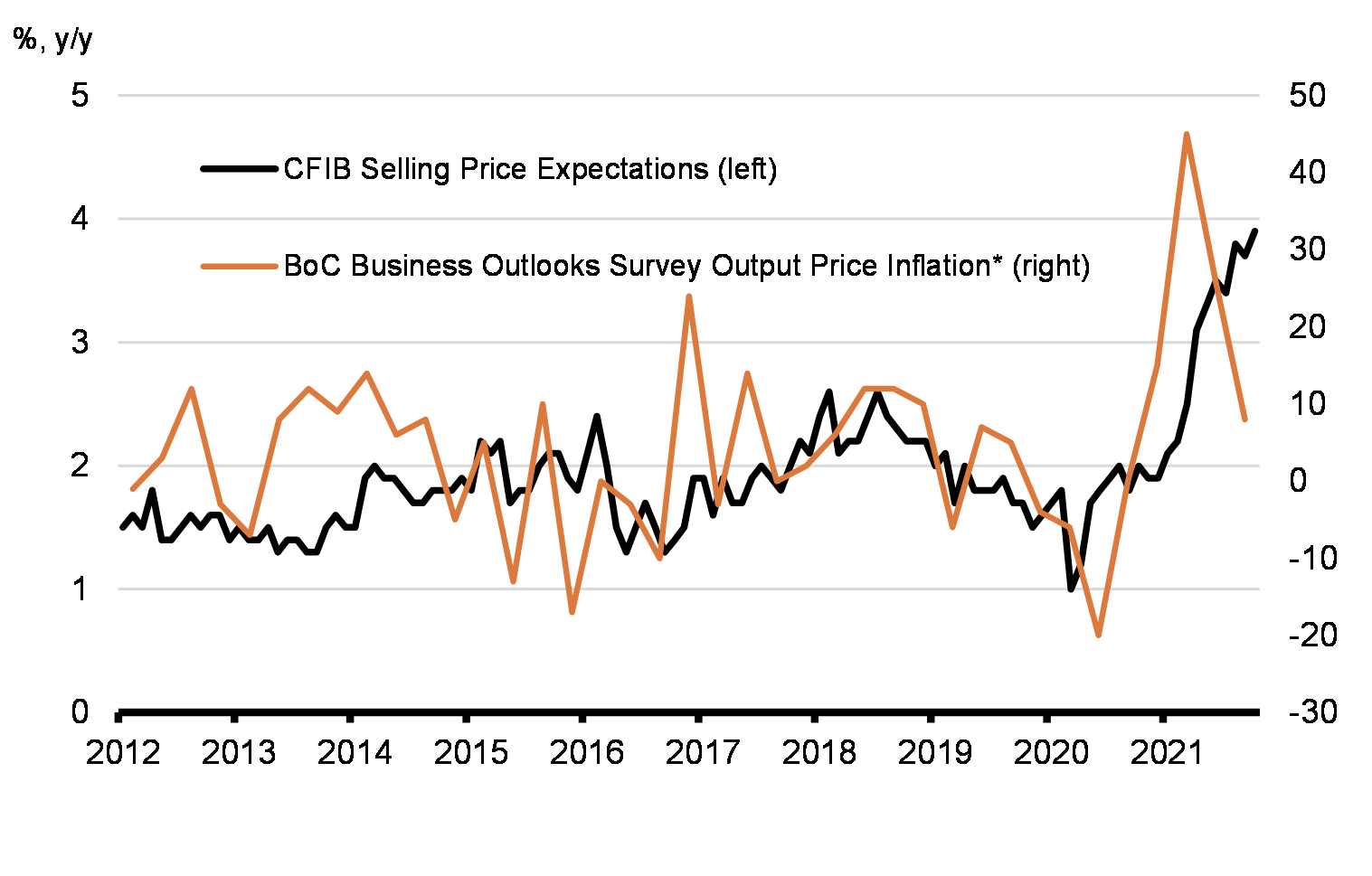

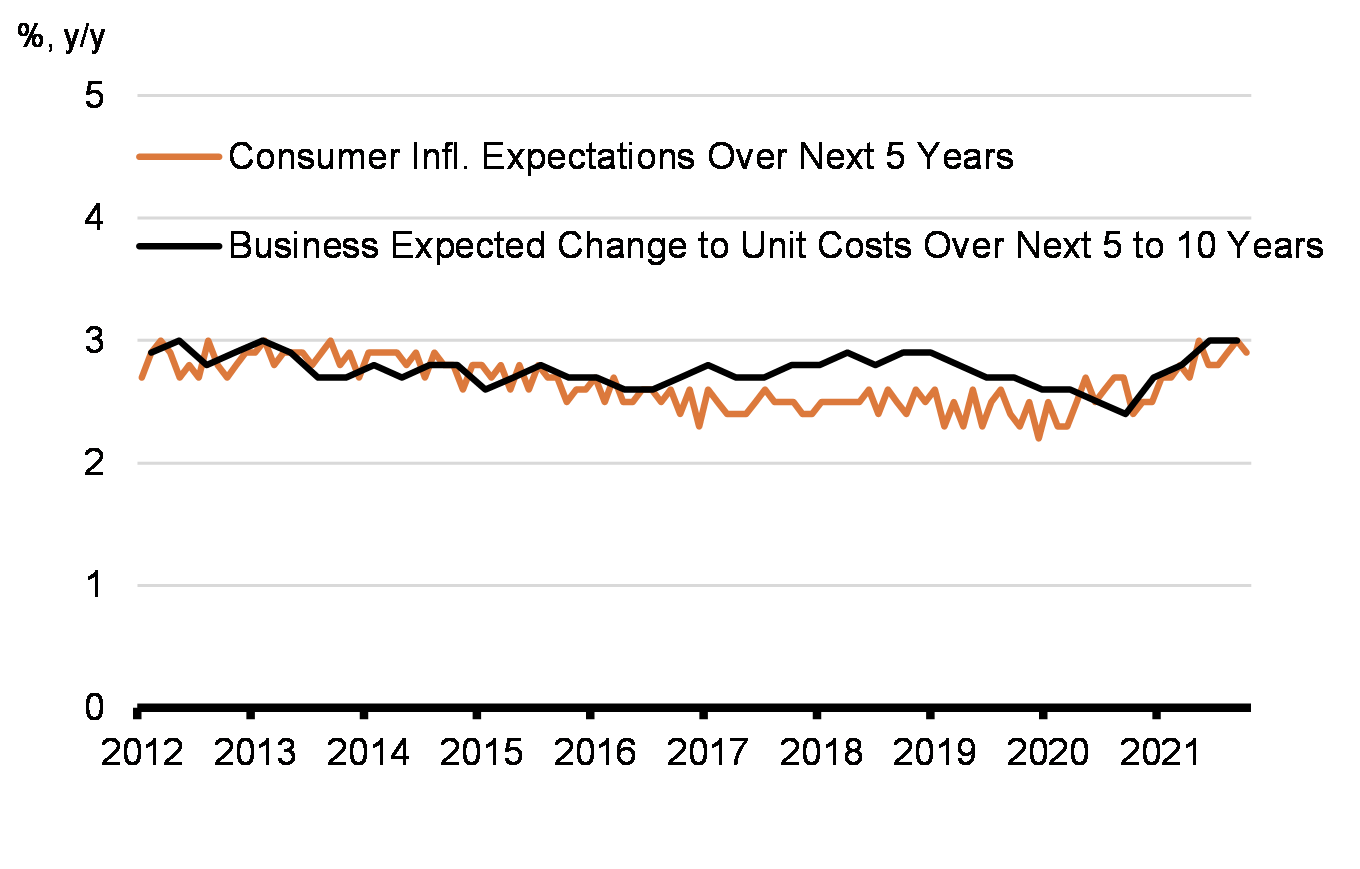

Canada’s headline inflation rose to 4.7% year-over-year in October 2021, the fastest pace since February 2003 (Table 1). Inflation has been above the 3% upper end of the Bank of Canada’s inflation-control range for seven consecutive months. The acceleration of consumer prices on a year-over-year basis is not unique to the Canadian economy as other G7 countries such as the United States, Germany and United Kingdom are also facing higher prices for their goods and services (see International Comparisons section for more detail).

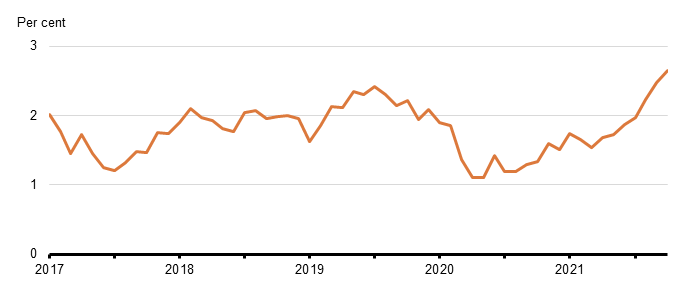

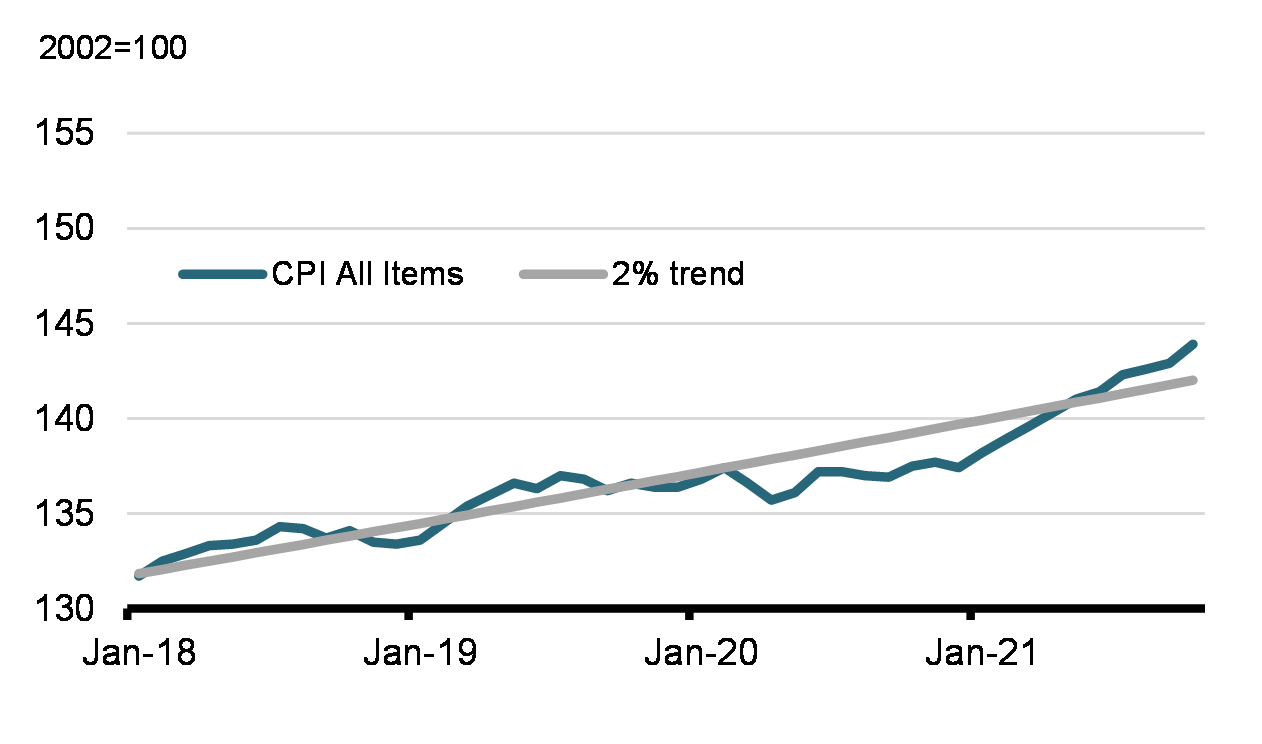

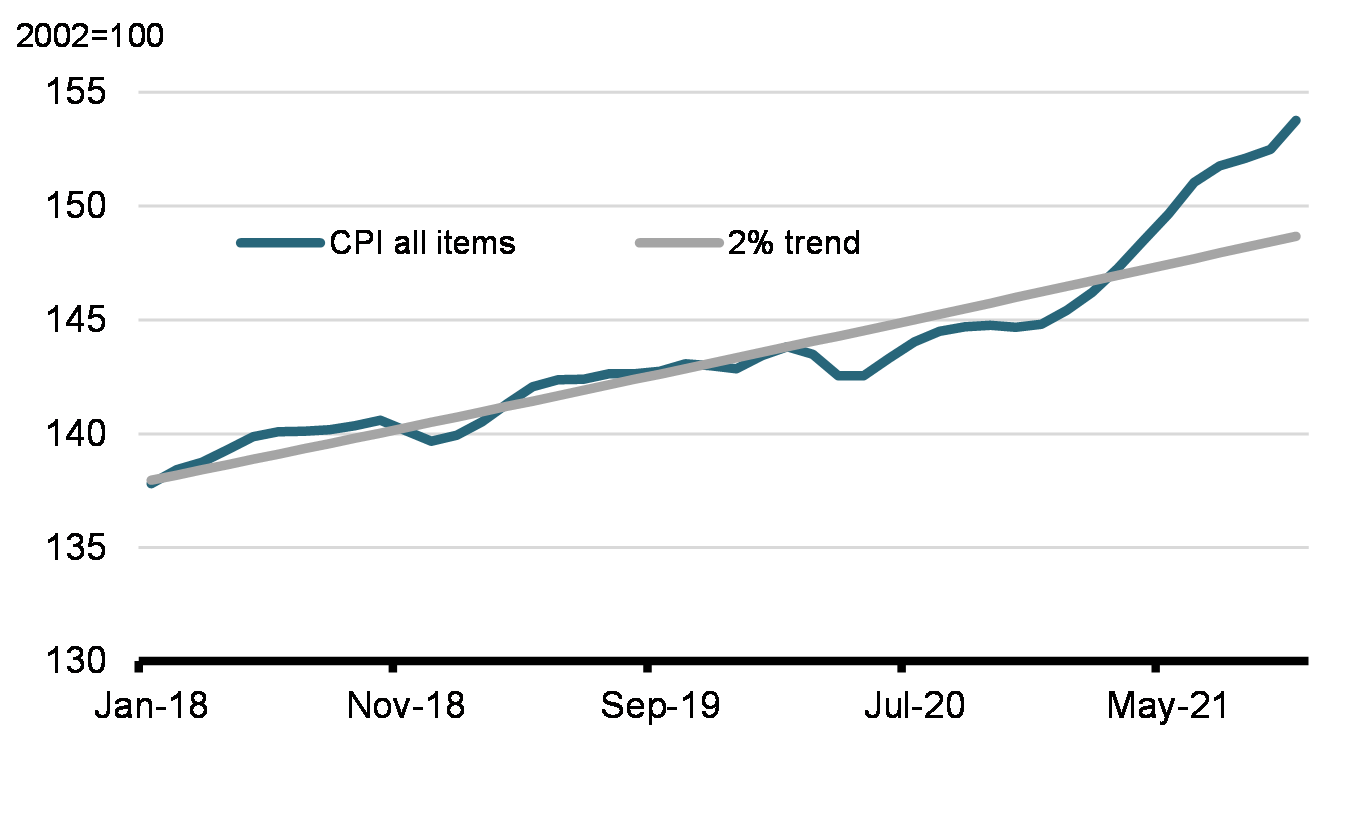

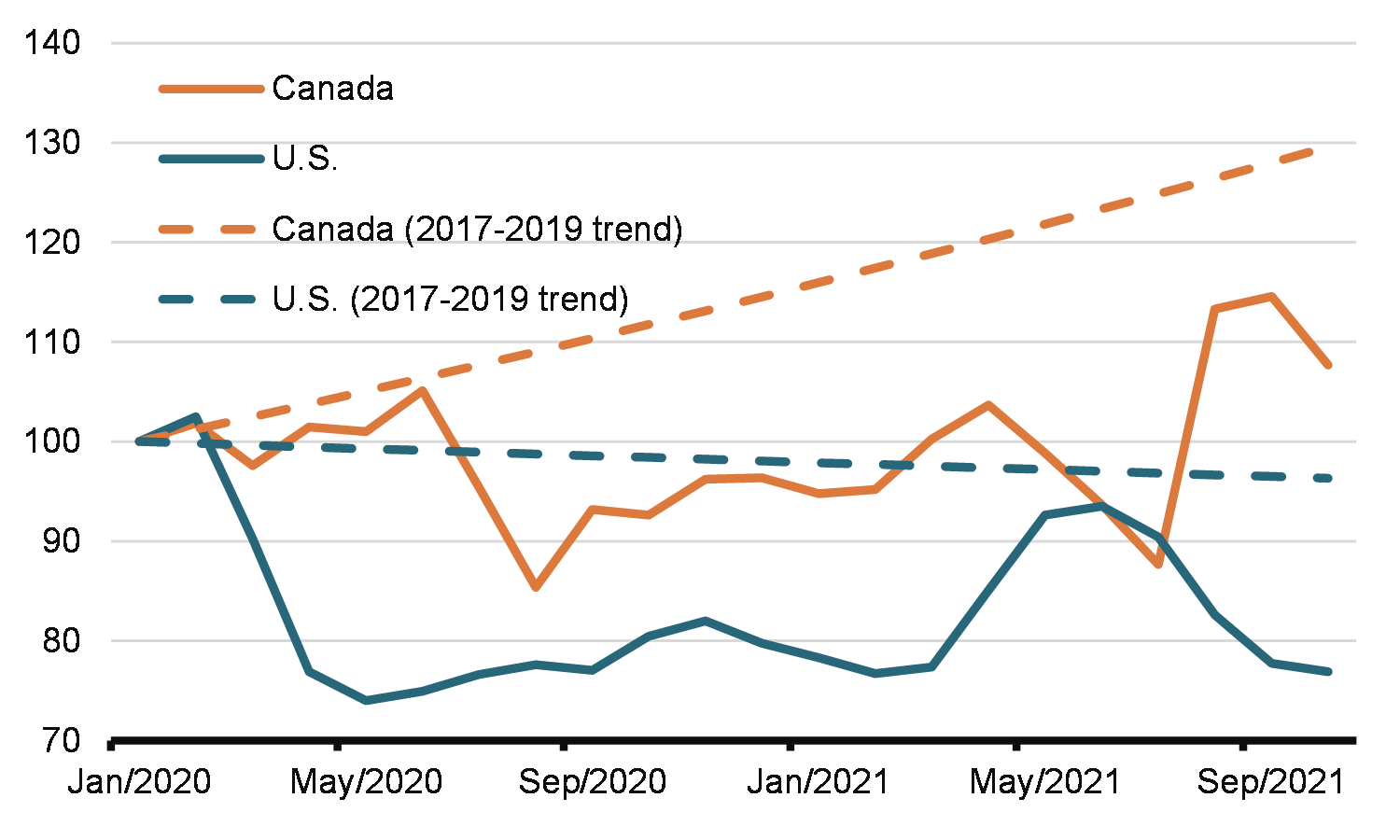

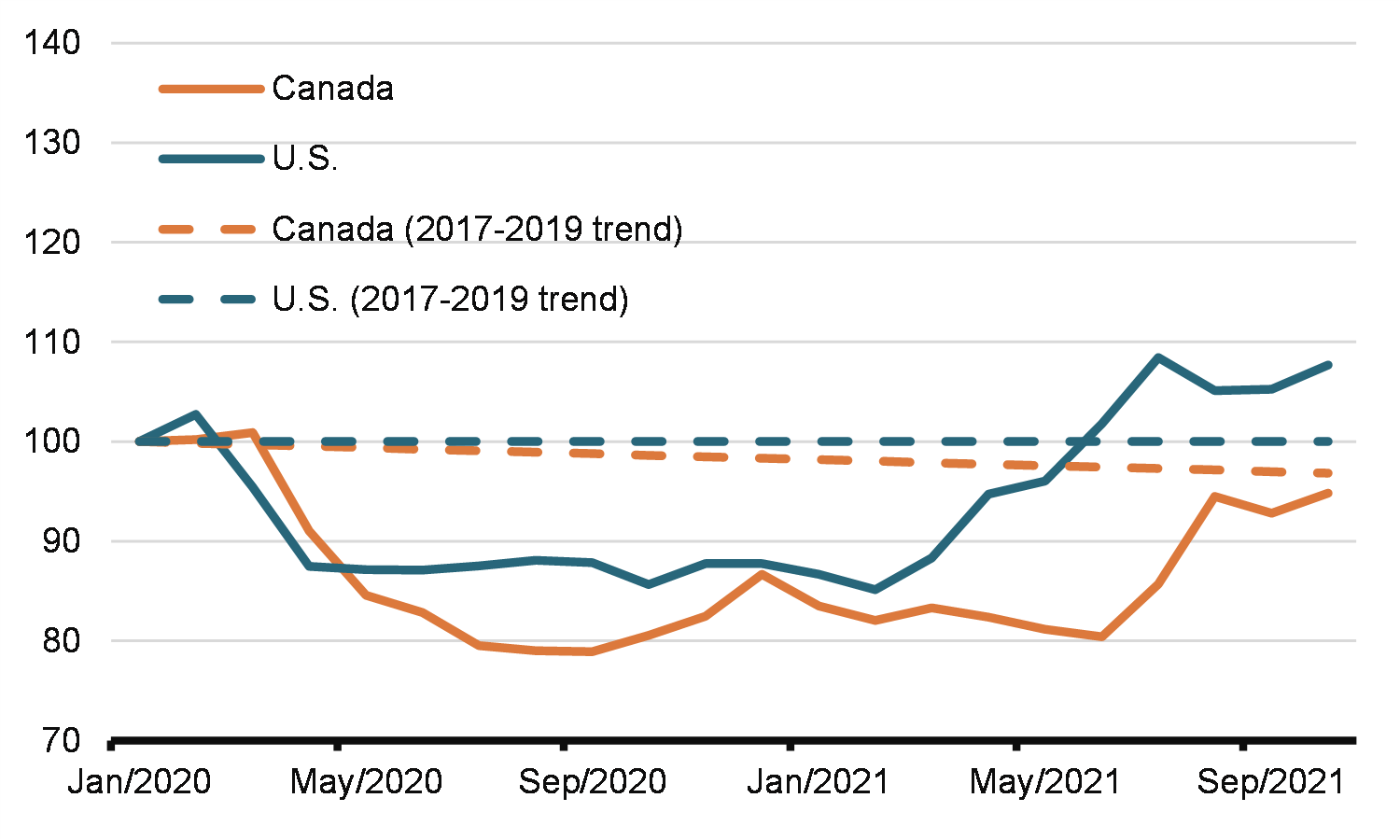

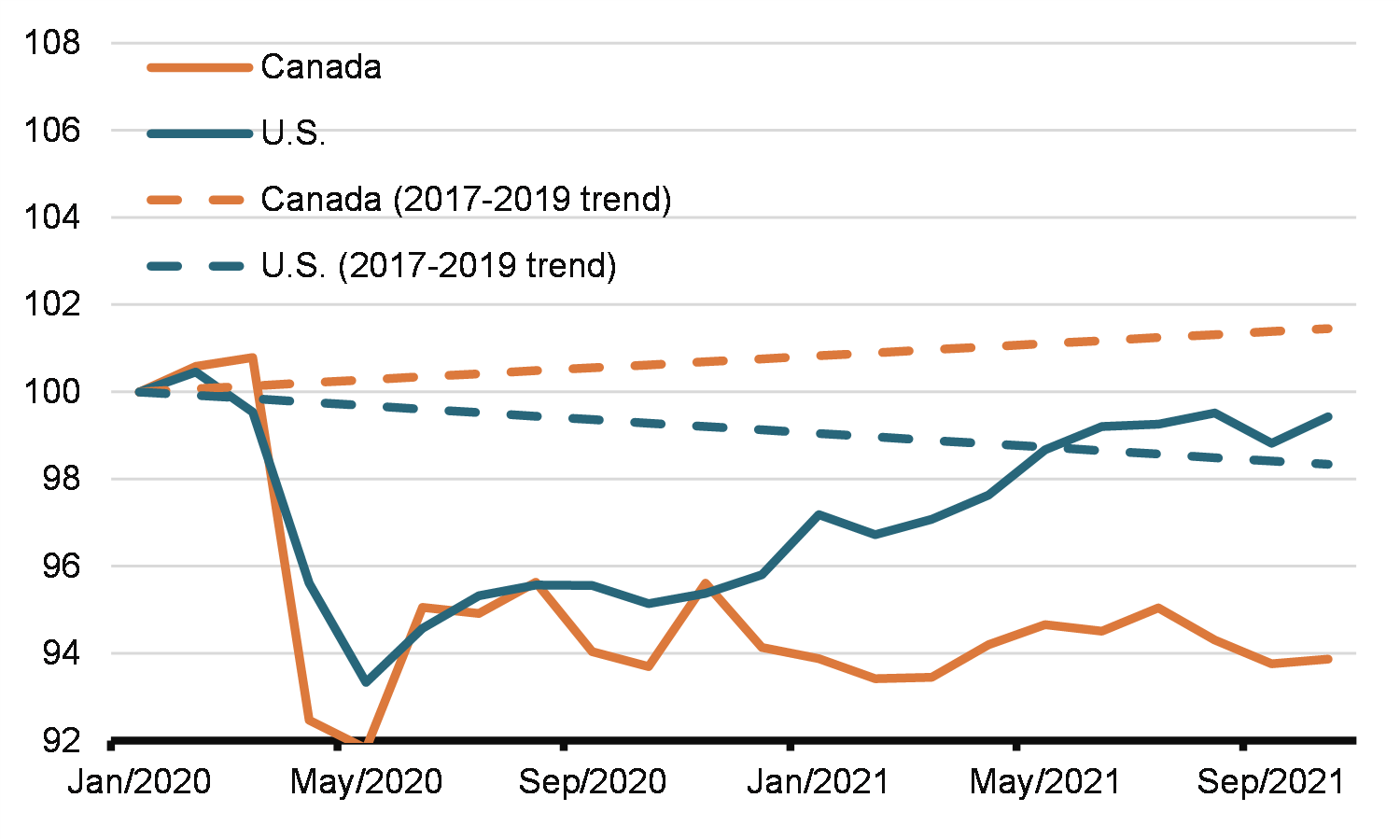

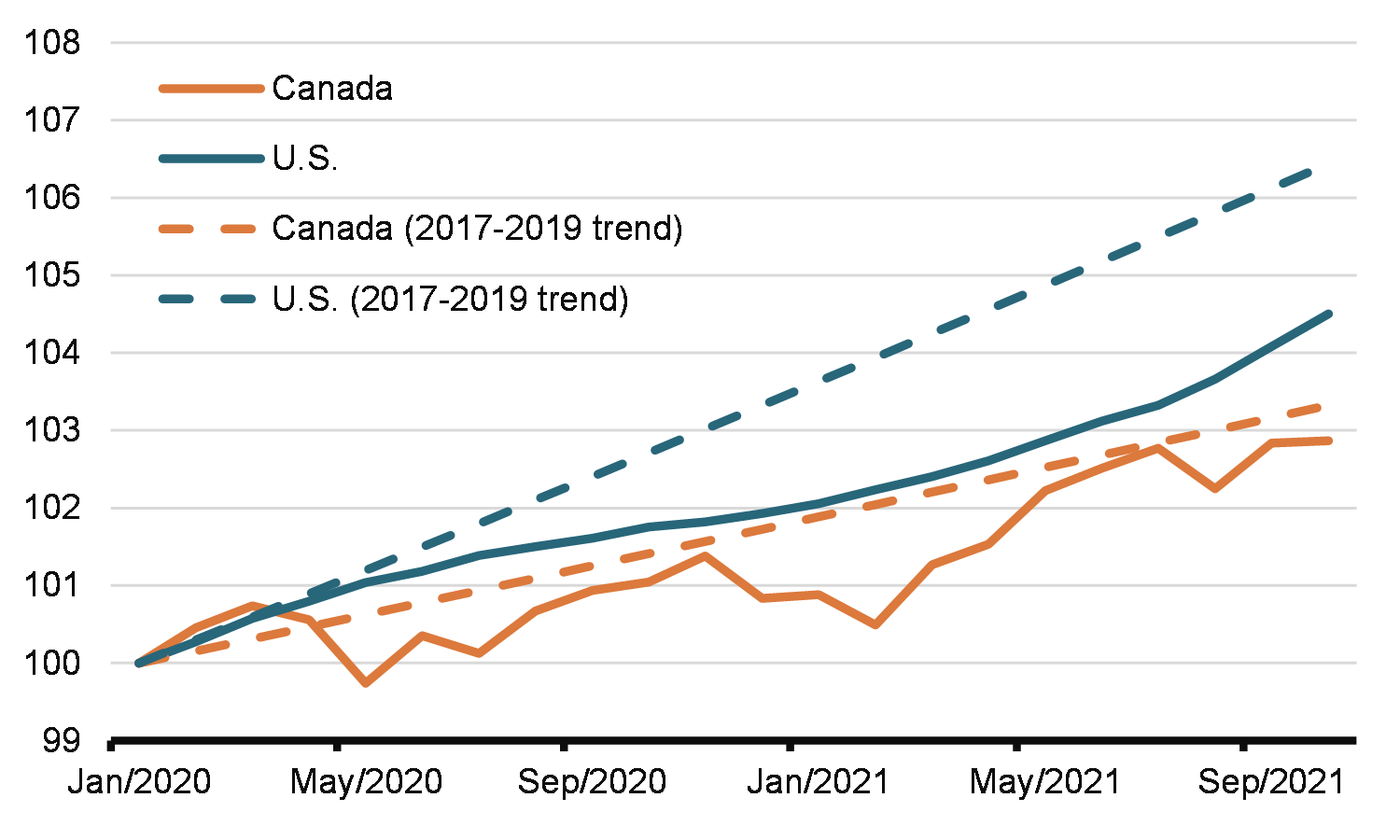

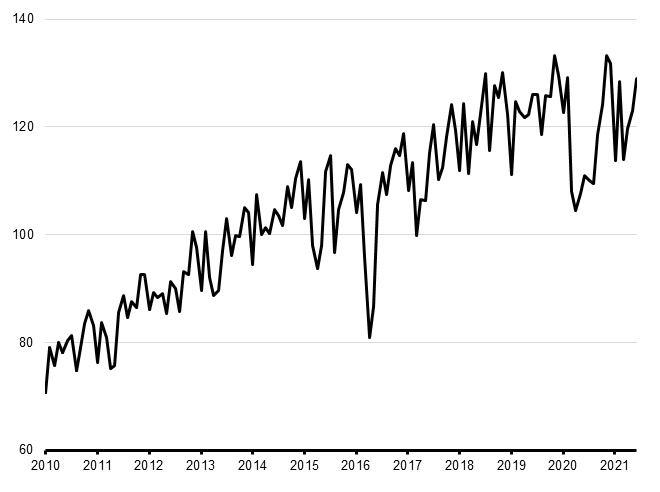

Higher prices around the world have largely been the result of pressures associated with the complex task of reopening the economy. Prices are currently being boosted by the “base-year” effects, where prices are recovering following sharp declines early in the pandemic. In particular, the easing of restrictions and the rapid return of economic activity globally has pushed up energy and other prices since the start of the year. These factors are causing a rapid increase in year-over-year inflation. However, changes in prices from two years ago are considerably less pronounced in advanced economies, including in Canada (Figure 1).

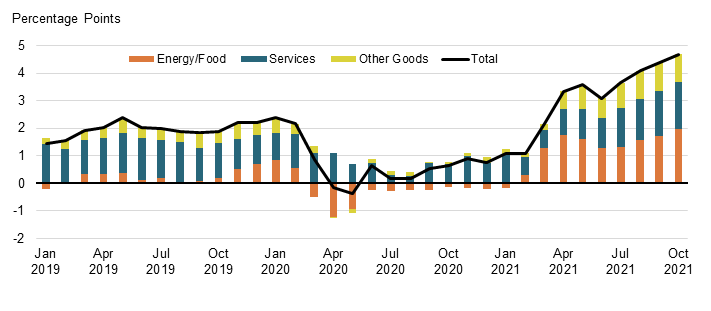

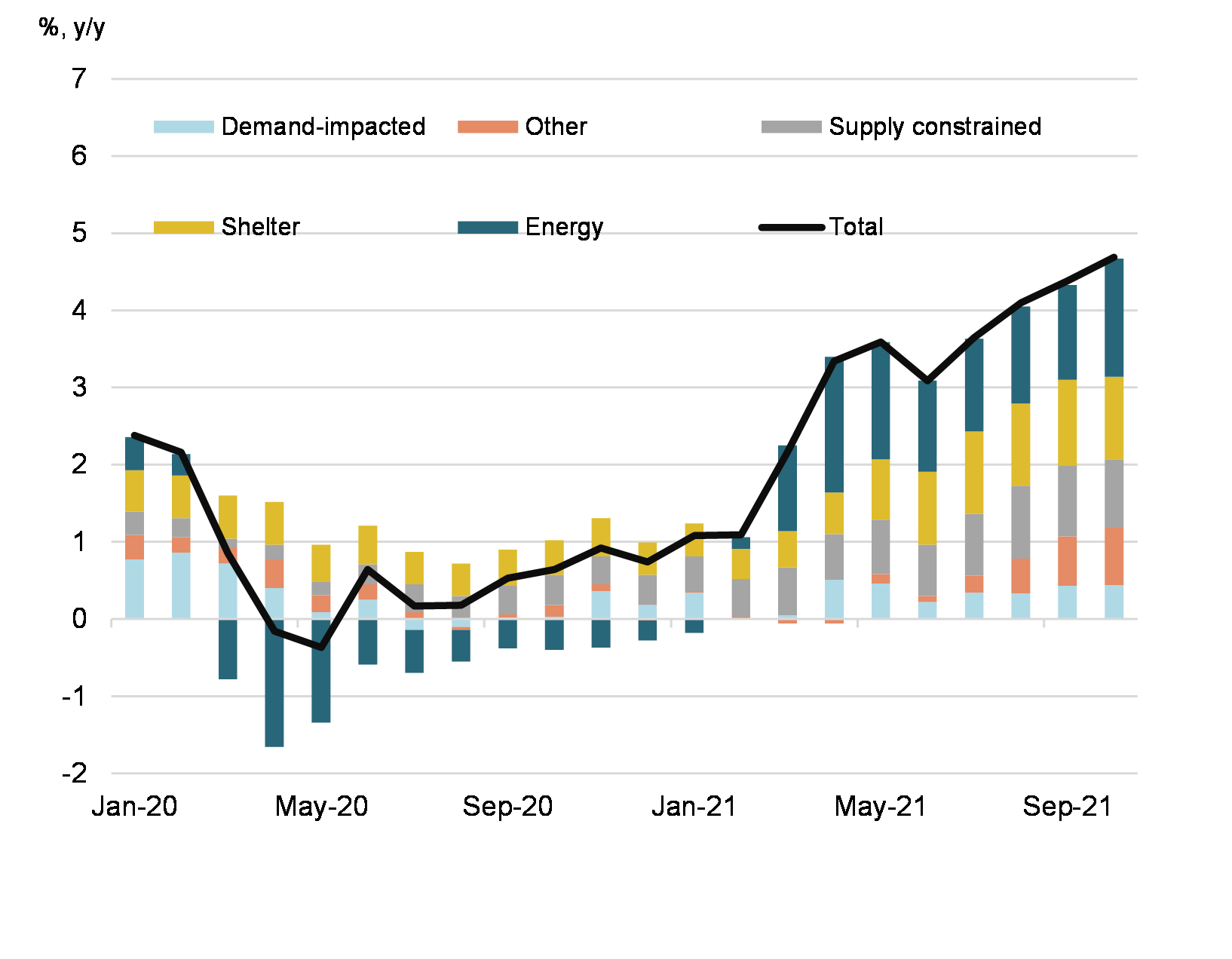

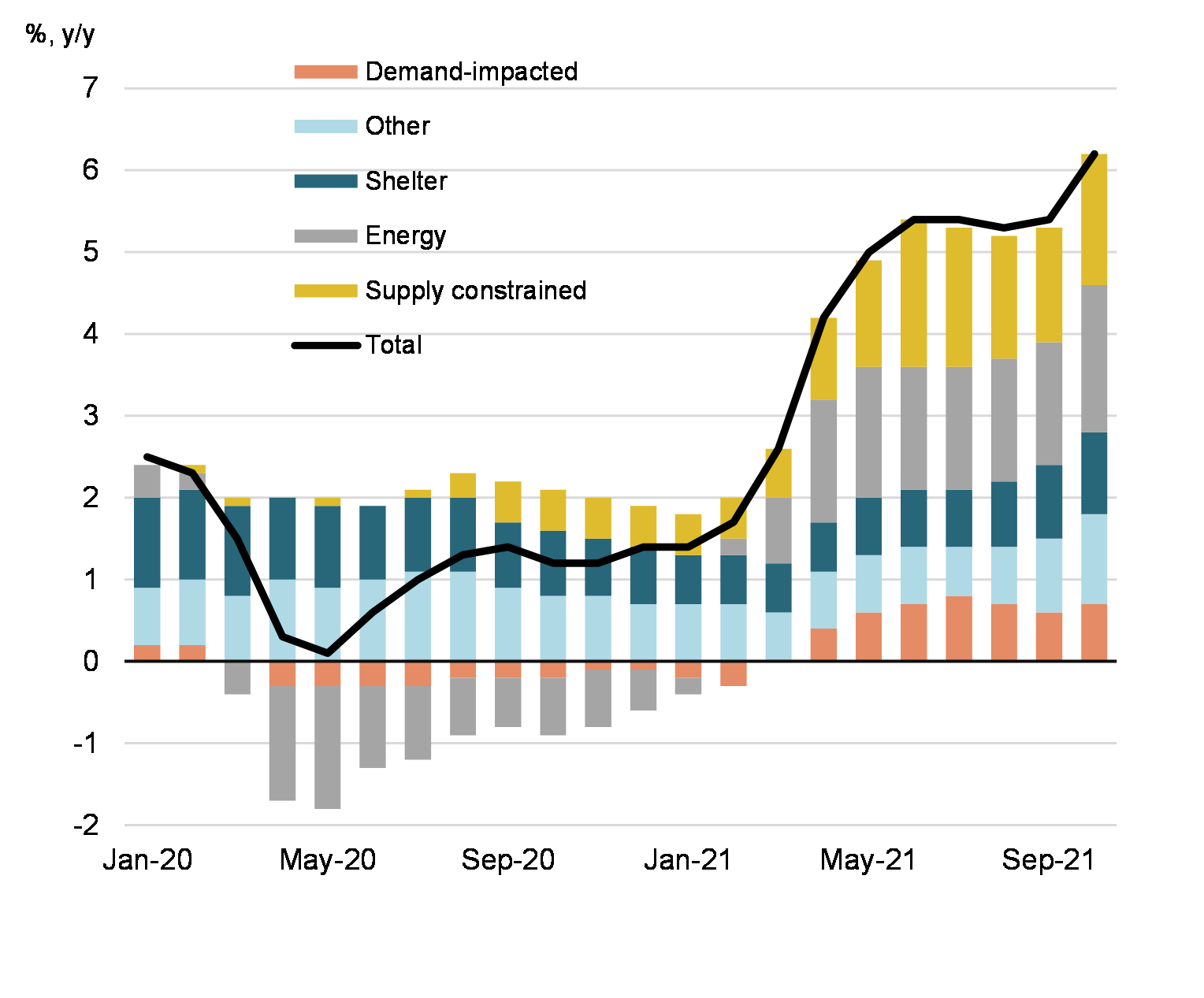

Inflation has also been boosted by higher energy prices and supply shortages (Figure 2):

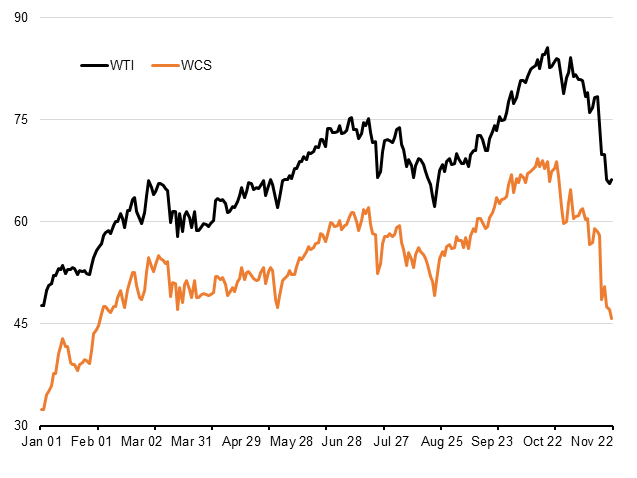

- The strength in energy prices reflects imbalance between supply and demand, as oil production by countries from OPEC+ remained below pre-pandemic levels and supply was affected by severe weather events, while global demand increased.

- Prices of some durable goods, particularly cars, have surged along with stronger than usual demand amid restricted services and supply bottlenecks, such as that experienced with the global shortage of semiconductors. Public health restrictions at ports and plants are also contributing to supply disruptions and higher shipping costs. Food prices increased recently due to droughts and other adverse weather events, as well recent supply disruptions related to temporary plant closures following outbreaks.

These unusual factors are not expected to permanently increase inflationary pressures. Supply bottlenecks are expected to fade people returning to consuming more services and demand for goods normalizes. As the pandemic becomes less disruptive, supply capacity issues will ease, helping inflation to come down over the course of 2022. Finally, the impact of higher energy prices on inflation is expected to dissipate over 2022. Accordingly, in its most recent Monetary Policy Report, the Bank of Canada expects that inflation will remain elevated for the rest of 2021, before easing back towards the 2% target throughout 2022 (Table 2). This is broadly consistent with recent private sector forecasts.

| 2021-Q2 | 2021-Q3 | Aug-21 | Sep-21 | Oct-21 | |||

|---|---|---|---|---|---|---|---|

| Total CPI Inflation | |||||||

| Actual, Year-over-year, not seasonally adjusted | 3.3 | 4.1 | 4.1 | 4.4 | 4.7 | ||

|

Excluding Energy

|

1.9 | 3.0 | 3.0 | 3.3 | 3.3 | ||

| Period-over-period, seasonally adjusted | 1.0 | 1.4 | 0.5 | 0.6 | 0.5 | ||

| Core inflation | |||||||

| CPI-common* | 1.7 | 1.8 | 1.8 | 1.8 | 1.8 | ||

| CPI-median* | 2.3 | 2.8 | 2.8 | 2.9 | 2.9 | ||

| CPI-trim* | 2.5 | 3.2 | 3.2 | 3.3 | 3.3 | ||

| Sources: Statistics Canada; Department of Finance calculatons. *CPI-common (common component) is an estimated measure of core inflation that tracks common price changes across categories in the CPI basket. CPI-median is based on a single component, the component with the monthly inflation rate at the 50th percentile of the distribution. CPI-trim excludes the 20% slowest-and fastest-growing components of the CPI (by weight). |

|||||||

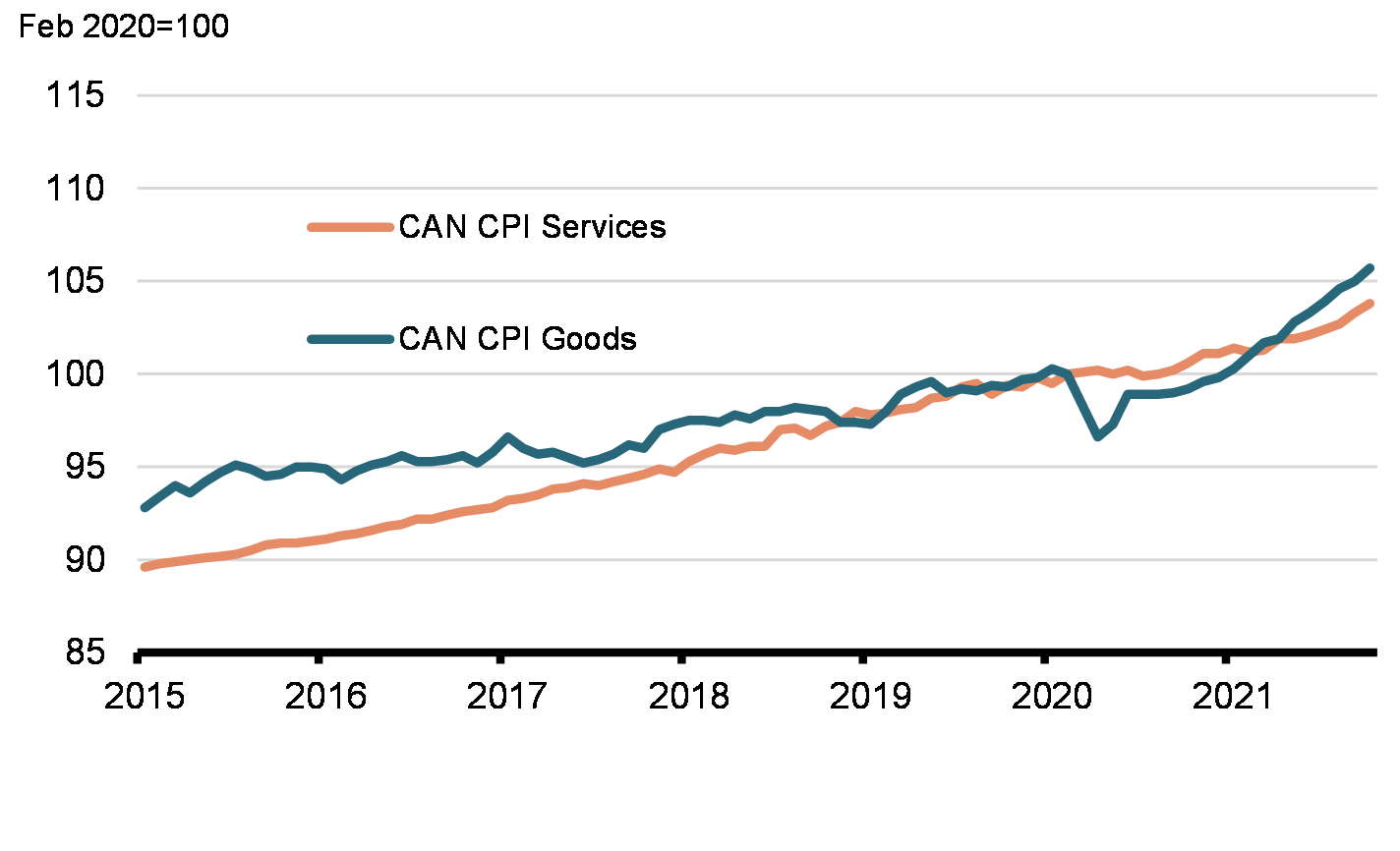

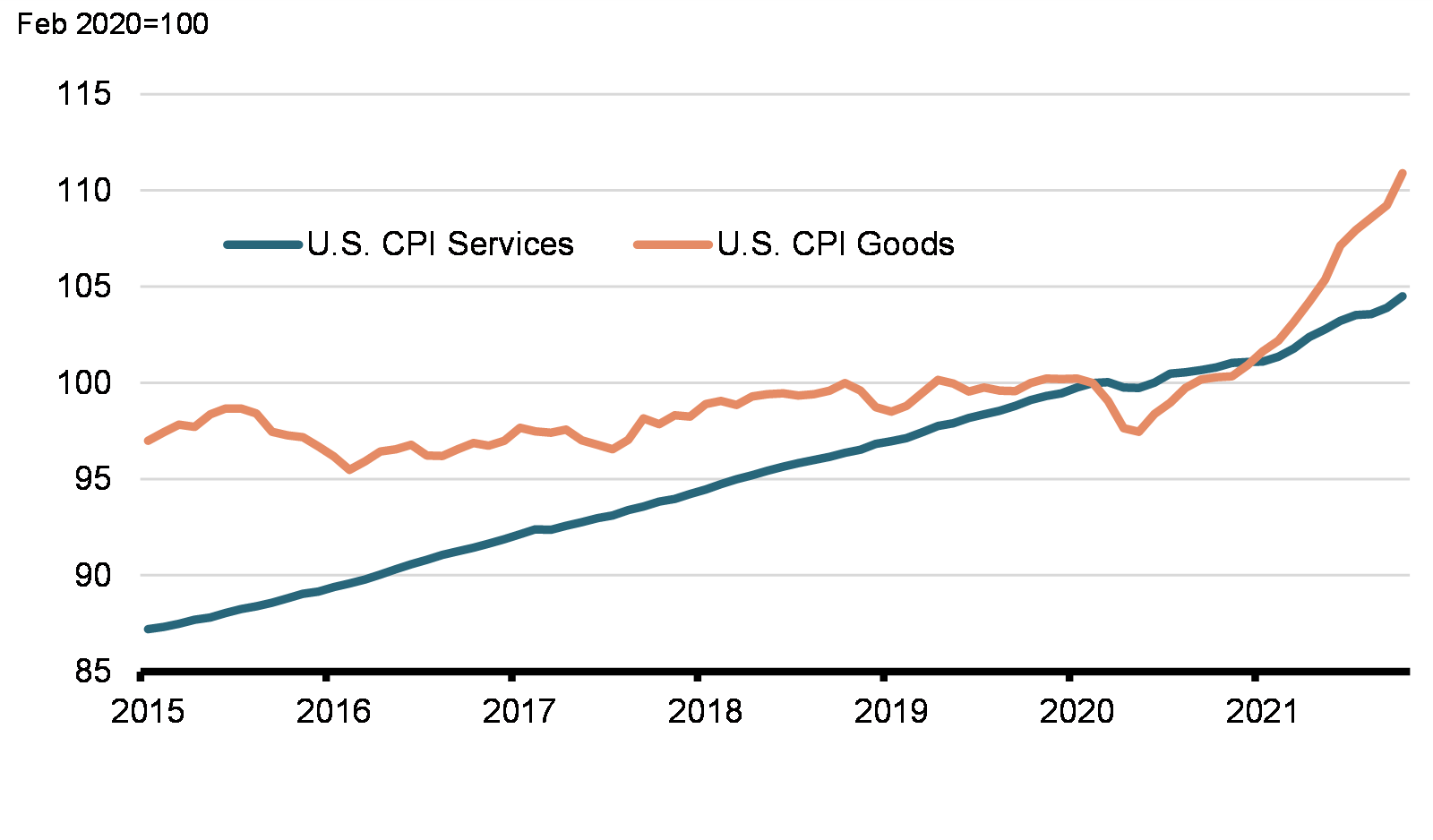

Consumer Price Inflation over a Two-Year Period, Canada

(month-to-month, two-year moving average annualized growth)

Contribution to Year-Over-Year Consumer Price Inflation, Canada

| 21Q4 | 22Q1 | 22Q2 | 22Q3 | 22Q4 | |

|---|---|---|---|---|---|

| Bank of Canada MPR – October 2021 | 4.8 | 4.4 | 3.9 | 3.1 | 2.1 |

International Comparisons

Canada currently has the second-highest rate of headline inflation in the G7, surpassed by only the United States, and is also currently higher than several developing economies (Saudi Arabia, Singapore, India and China).

However, international comparisons are problematic and can be misleading as countries account for price changes in very different manner. In particular, the treatment of housing costs is currently boosting Canada’s inflation rate relative to peer countries who either account for new housing differently (for example, Canada includes new home prices while others use slower-growing rent costs) or do not account for it at all. Further, comparisons between developed and emerging economies are not relevant, as many prices – particularly gasoline prices which have risen by over 40% in Canada over the past year – are controlled by legislation or with subsidies in emerging countries. In the current context, this understates price inflation in these developing countries.

| October 2021 | |

|---|---|

|

U.S.

|

6.2 |

|

Canada

|

4.7 |

|

Germany

|

4.5 |

|

U.K.

|

3.8 |

|

Italy

|

3.0 |

|

France

|

2.6 |

|

Japan

|

0.1 |

| Sources: Haver Analytics | |

| Product | Price | Y/Y Change (%) | |

|---|---|---|---|

| Sirloin steak, 1 kg | $26.45 | 13.6 | |

| Blade roast, 1 kg | $18.52 | 8.6 | |

| Ground beef, 1 kg | $12.31 | 8.2 | |

| Pork chops, 1 kg | $12.43 | 6.7 | |

| Chicken, 1 kg | $8.51 | 7.2 | |

| Bacon, 500 g | $8.29 | 19.1 | |

| Wieners, 450 g | $5.42 | 11.3 | |

| Canned salmon, 213 g | $6.66 | -0.7 | |

| Partly skimmed milk, 4 l | $5.52 | 4.2 | |

| Butter, 454 g | $5.60 | 6.3 | |

| Processed cheese, 250 g | $2.66 | -2.9 | |

| Eggs, 1 dozen | $3.87 | 7.2 | |

| Bread, 675 g | $2.84 | 0.4 | |

| Macaroni, 500 g | $1.53 | -7.3 | |

| Flour, 2.5 kgs | $4.19 | -1.2 | |

| Corn flakes, 675 g | $6.37 | 9.3 | |

| Apples, 1 kg | $4.61 | 1.8 | |

| Bananas, 1 kg | $1.60 | 1.9 | |

| Oranges, 1 kg | $4.02 | 1.5 | |

| Orange juice, 1 l | $4.35 | 7.1 | |

| Carrots, 1 kg | $2.32 | 8.4 | |

| Mushrooms, 1 kg | $9.43 | 1.7 | |

| Onions, 1 kg | $2.14 | -4.0 | |

| Potatoes, 4.54 kg | $10.17 | 3.6 | |

| French fries, frozen, 1 kg | $3.20 | 7.7 | |

| Baked beans, canned, 398 ml | $1.44 | 2.9 | |

| Ketchup, 1 l | $4.04 | 8.6 | |

| Sugar, white, 2 kg | $2.57 | 10.3 | |

| Coffee, roasted, 300 g | $5.21 | 4.6 | |

| Tea (72 bags) | $4.29 | 3.9 | |

| Cooking or salad oil, 1 l | $4.14 | 34.9 | |

| Soup, canned, 284 ml | $1.29 | 4.9 | |

| Baby food, 128 ml | $1.66 | 5.1 | |

| Peanut butter, 500 g | $2.78 | -0.4 | |

| Paper towels (2 rolls) | $3.31 | -0.6 | |

| Facial tissue (200 tissues) | $2.81 | 0.7 | |

| Bathroom tissue (4 rolls) | $2.95 | 12.2 | |

| Shampoo, 300 ml | $4.08 | 1.2 | |

| Deodorant, 60 g | $4.32 | 8.5 | |

| Toothpaste, 100 ml | $3.49 | 4.2 | |

| Cigarettes (200) | $140.99 | 9.3 | |

| Gasoline, l | $1.46 | 42.3 | |

Canada–U.S. Inflation Monitor

| Canada | U.S. |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

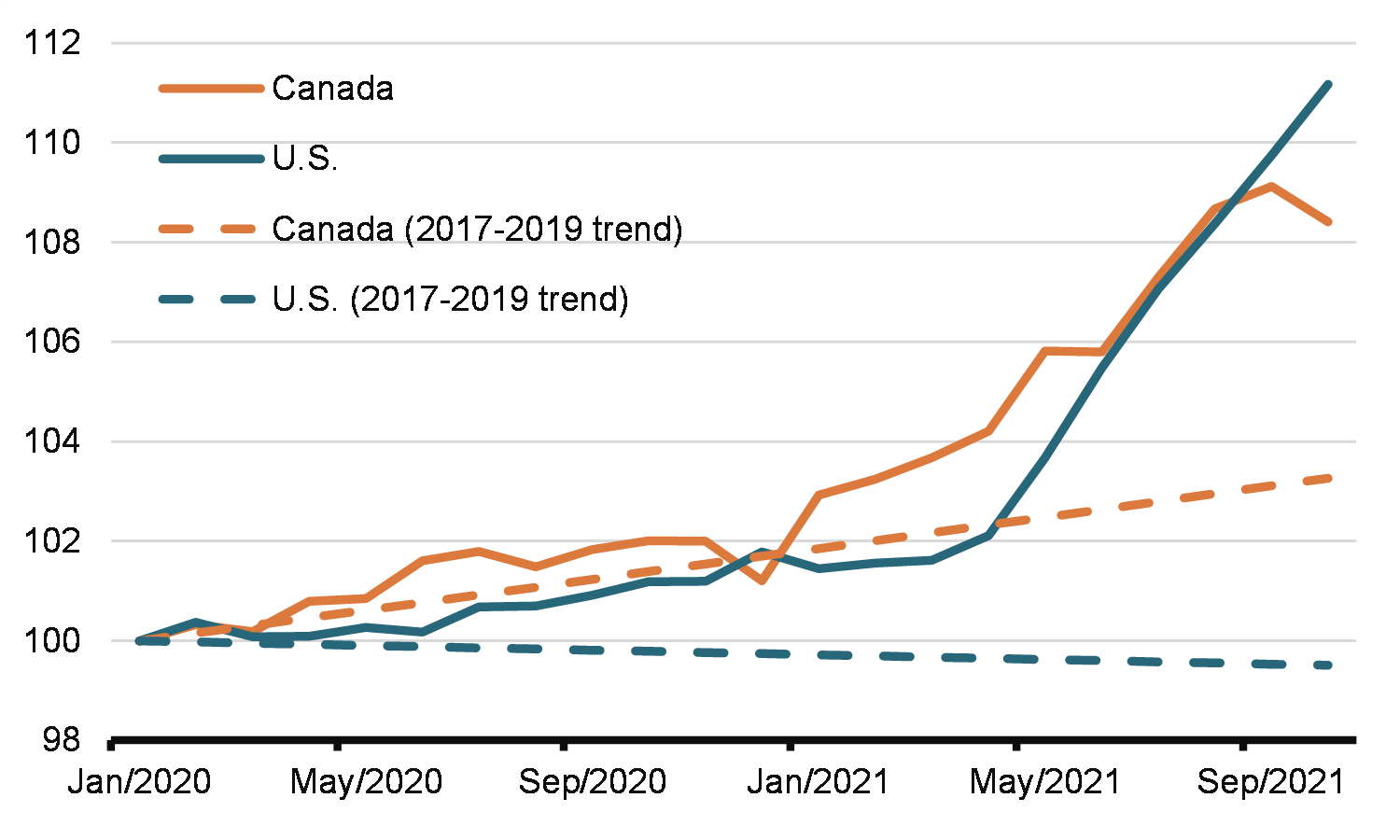

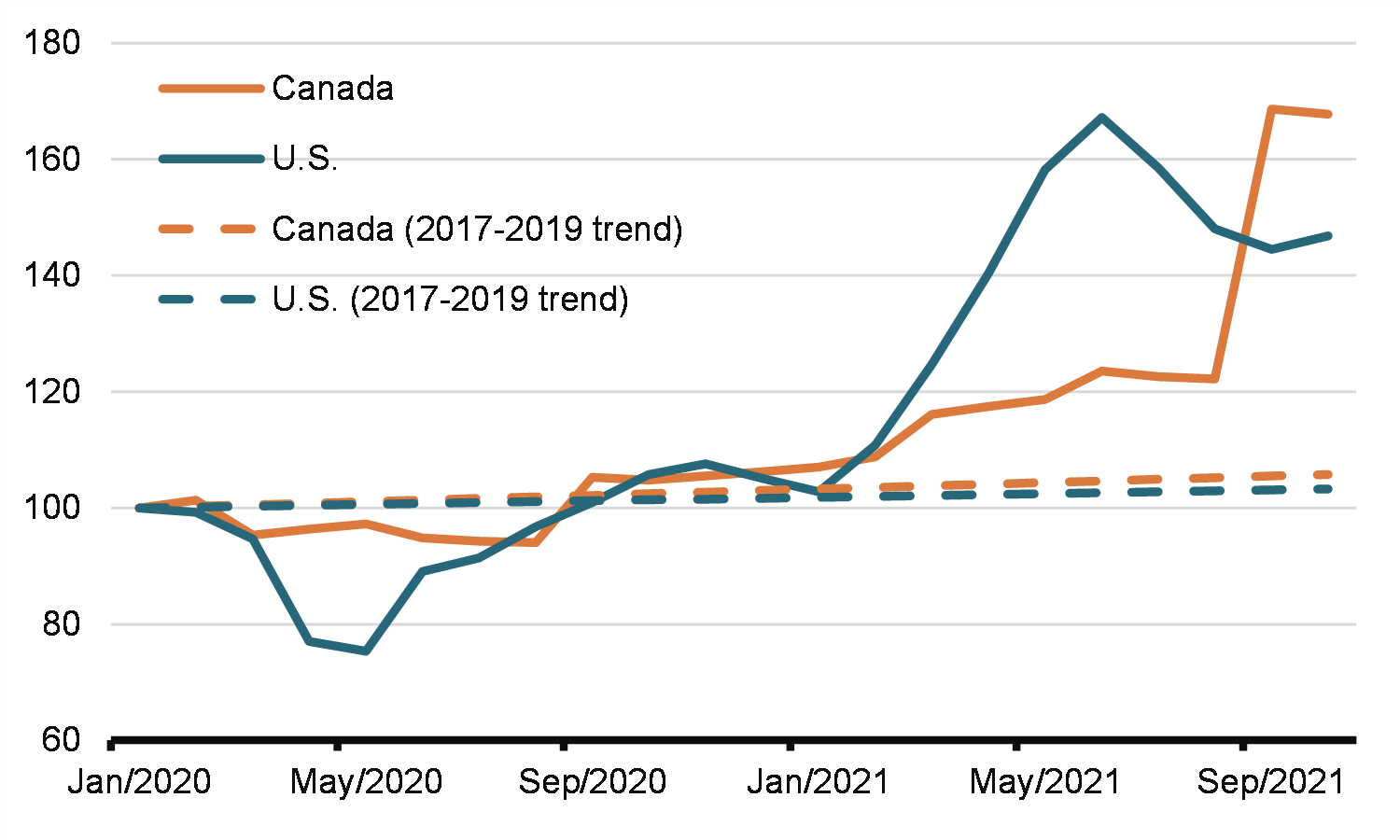

Prices of certain goods and services fell sharply or increased at a subdued pace during lockdowns. As economies reopen, many prices are returning to pre-pandemic trends, boosting inflation.

Note: All series are seasonally adjusted.

Supply-constrained segment

Demand-impacted segment

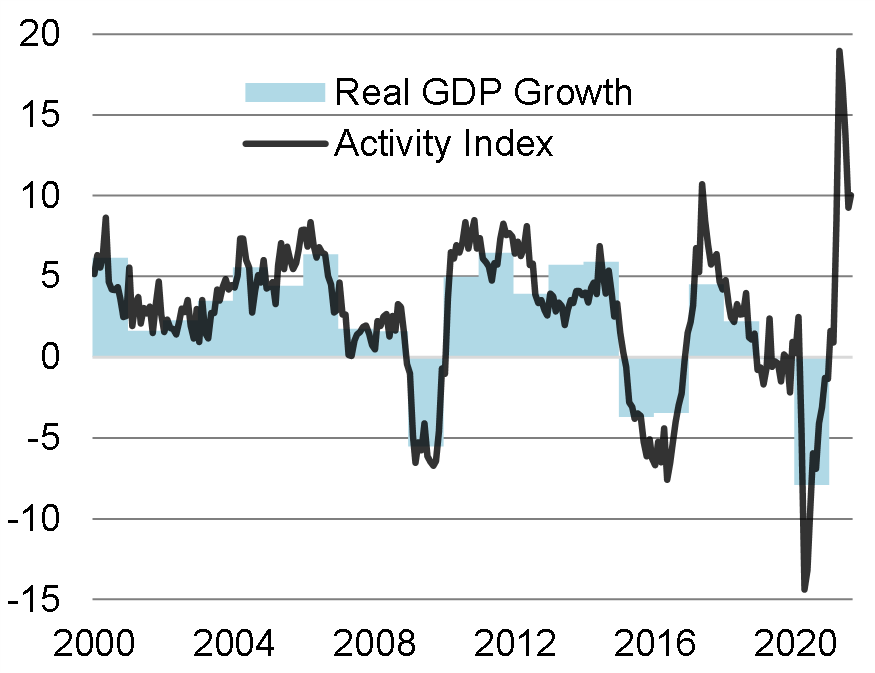

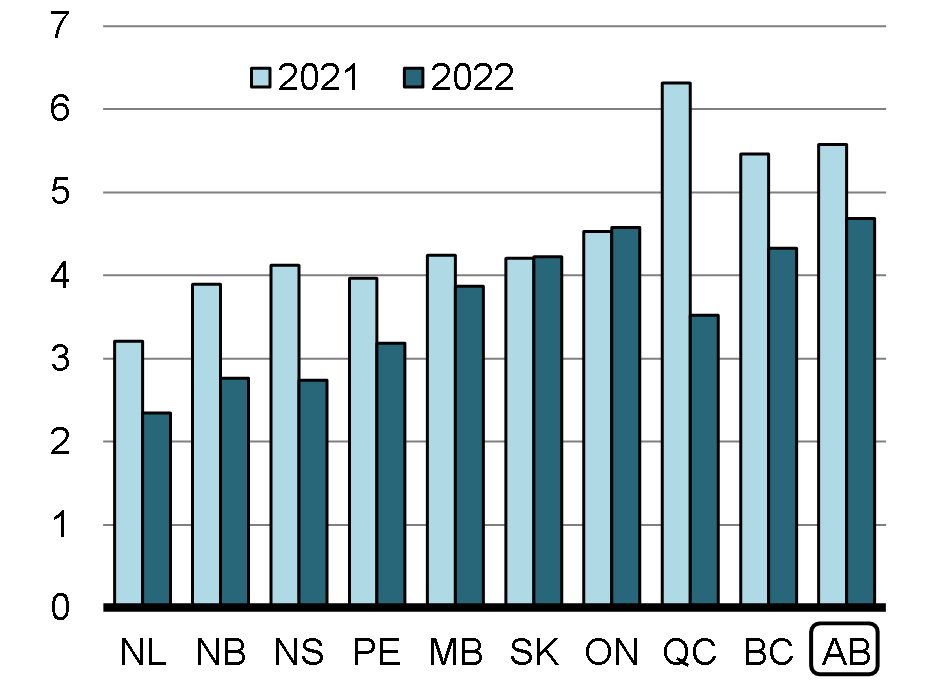

Economic Recovery

Issue

Canada’s economic recovery is well on track.

Talking points

- Canada’s economic recovery is well on track, with economic activity rebounding 5.4 per cent in the third quarter.

- That robust performance beat economists’ expectations of 3 per cent growth.

- The labour market recovery also took a larger-than-expected step forward in November, adding 154,000 jobs.

- Canada has now recovered 106 per cent of the jobs lost during the pandemic compared to just 83 per cent in the U.S.

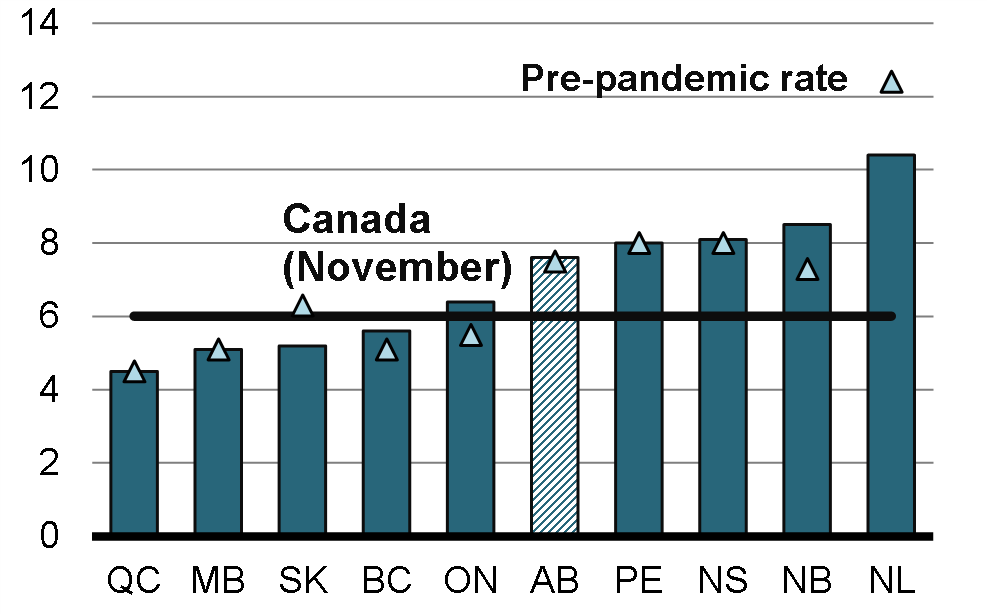

- At 6.0 per cent in November, the unemployment rate is at its lowest since the start of the pandemic and very close to its pre-pandemic level.

- Equally as encouraging, job prospects for some of Canada’s most vulnerable, who bore the brunt of the pandemic’s wrath – such as women, young people, and racialized workers – have greatly improved.

- This is a tribute to the resilience and hard work of Canadians.

- Government supports have prevented unnecessary increases in insolvencies and kept Canadians’ and businesses’ finances largely intact, limiting economic scarring and laying the foundation for a strong recovery.

- Canada’s successful vaccination rollout and easing of public health restrictions have allowed businesses in many hard-hit sectors to reopen safely and start hiring back workers.

- Over the rest of the year and into 2022, Canada’s recovery will continue to build as our successes with vaccination and reopening allow Canadians to get back to things they have been missing these past nearly two years.

- Still, the recovery is uneven and as the recent Omicron variant demonstrates the pandemic is still with us, threatening Canadians health and livelihoods.

- Restarting the economy is a complex process, as we are seeing, with surging global demand disrupting global supply chains, and driving prices higher for many goods.

- The recent flooding in B.C. is also presenting challenges to many businesses by hampering supplies of goods and inputs as well as limiting exports of our key commodities and other goods.

- The government is determined to do what is necessary to accelerate the recovery, moving from very broad-based support to more targeted measures that will provide help where it is needed, to create jobs and set the stage for strong, sustained growth for years to come.

Background

The Canadian economy is on the road to recovery. After GDP slipped in the second quarter of 2021 (-3.2 per cent, at annual rate), Canada’s recovery regained its footing in the third quarter (5.4 per cent) as Canada’s vaccination campaign and lifting of public health restrictions drove a substantial rebound. Hard-hit services, such as restaurants, arts, and entertainment, saw sharp increases in activity as easing restrictions allowed households to start normalizing spending patterns. Exporters made solid gains in the third quarter, despite ongoing global supply chain issues, with higher exports of energy products, minerals, and machinery and equipment.

This robust performance in the third quarter was above market expectations of 3.0 per cent growth, but close to the Bank of Canada’s October Monetary Policy Report outlook (5.5 per cent). However, accounting for the downward revision to the second quarter, Canada’s real GDP level (at 1.4 per cent below its pre-pandemic level as of the third quarter) is at a similar point to what was expected by markets.

Canada’s real GDP growth in the third quarter was faster than in the U.S., the U.K. and Japan in the third quarter, but behind its European peers who saw large gains from re-opening and less drag from supply-chain disruptions and housing normalization. Among G7 countries, Canada’s real GDP level is now the fifth farthest from pre-pandemic levels, only ahead of the U.K. and Japan. OECD projections suggest Canada’s economic recovery will improve and is expected to rank the second fastest (relative to pre-pandemic level of GDP) among G7 countries by 2023.

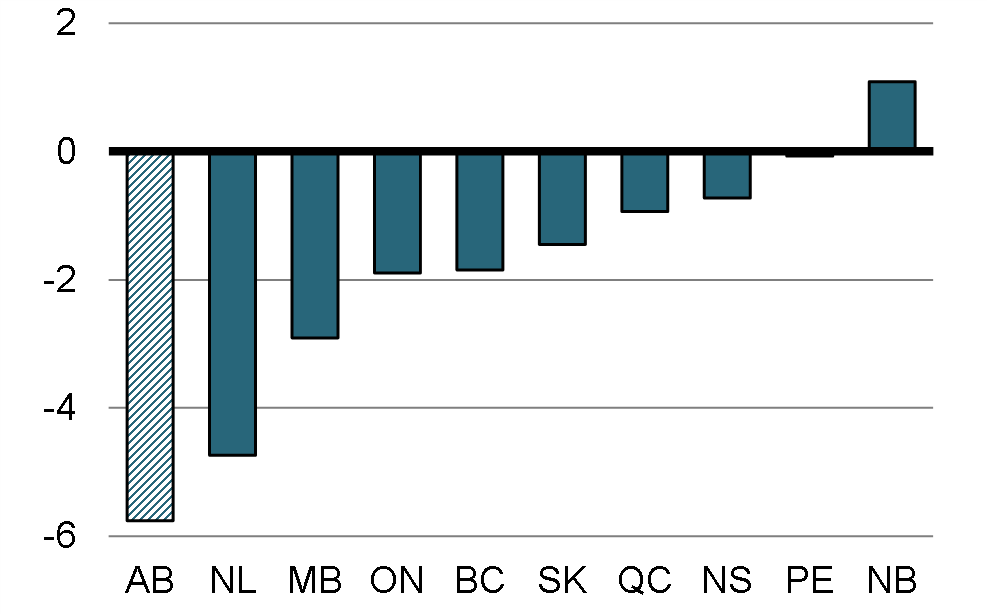

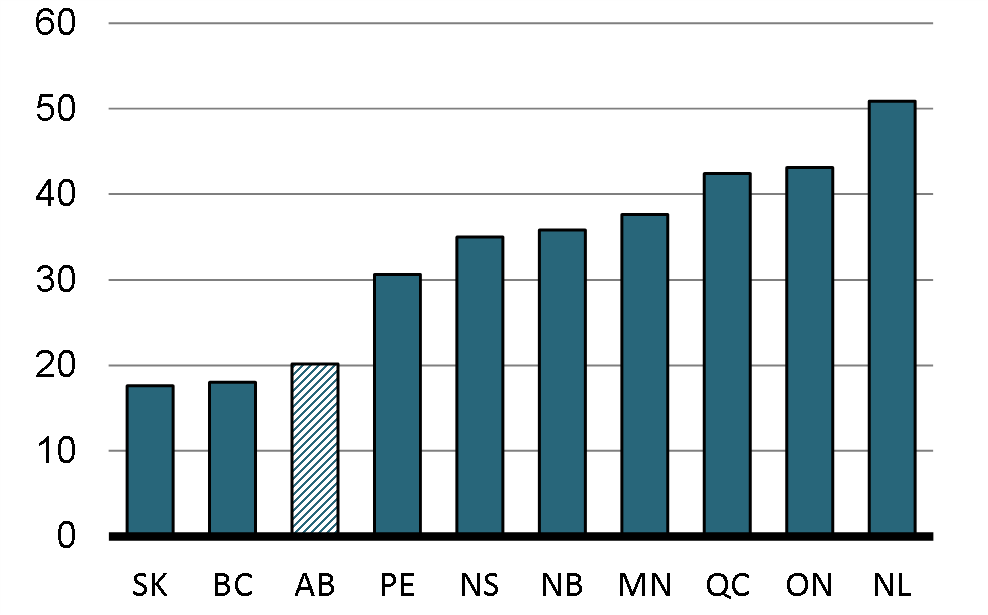

With Canada’s recovery on more solid footing, job creation surged over the summer, with the government’s commitment to create one million new jobs achieved in September – well ahead of expectations. Moreover, employment jumped by 154,000 in November, now exceeding its pre-pandemic level by about 186,000 positions, a recovery that has been faster than most of Canada’s peers (among the G7 second only to France) and than any previous recessions. The unemployment rate has declined for six consecutive months, reaching 6.0 per cent in November, its lowest level since the start of the pandemic and just a bit higher than before the pandemic hit (when is was 5.7 per cent). Many businesses in the hardest-hit sectors are safely re-opening and actively hiring again, helping to reduce same of the unevenness that characterized the earlier part of the recovery. Canadians are confident in their labour market prospects with the share of Canadians aged 15 to 64 with a job or looking for a job reaching a record high in November, including for women, in contrast with the U.S. where labour force participation for this group remains below its pre-pandemic level.

Nevertheless, re-opening the domestic and global economy has been a complex task, and the process has not been smooth. Some of the optimism seen earlier in the year among households and businesses has faded amidst supply chain issues, higher inflation, and a fourth wave of the pandemic in some areas. More recently, the Omicron variant is posing renewed health risks, with many countries already imposing travel measures. While Canada faces this latest variant from a position of strength with 80 per cent of eligible Canadians (i.e. 5 years and older) fully vaccinated, if the variant proves to have greater health risks global efforts to contain its spread could exacerbate existing supply chain strains, slow the recovery and add more upward pressure to goods inflation.

As of September, economic activity in the Canadian economy is about 1.4 per cent below its pre-pandemic level. However, this aggregate change masks some of the deep and enduring impact on the hardest-hit sectors. Accommodation remains down about 20 per cent from pre-pandemic levels while food service is down 9 per cent. The air transportation sector and public transit have seen the severest decline, with activity in September more than 70 per cent and 40 per cent below, respectively, their pre-pandemic levels. For the rest of the year, we expect that these sectors will continue to see activity improving as vaccination and fewer restrictions drive a rebound. However, the rise of the Omicron variant highlights again that managing health risks remains key to a complete recovery.

Canada’s recovery should continue in the fourth quarter with ongoing improvements in hard-hit sectors, some easing of supply-chain issues, and less drag from housing normalization. Encouragingly, after a flat reading in September, Statistics Canada’s preliminary data points to a strong gain of 0.8 per cent (monthly rate) in October, with increases in most sectors and led by manufacturing. The severe flooding in B.C. is expected to take a toll on the economy in November (potentially leading to the first decline in real GDP since July)—slowing growth in the fourth quarter. Still, real GDP is on track for a solid 3.5 per cent gain in the quarter (vs. 4.0 per cent in the Bank of Canada’s October Monetary Policy Report outlook).

Further ahead, any drag from B.C. floods in the fourth quarter is likely to be recouped in December and at the start of 2022. Continuing progress in hard-hit sectors, easing supply-chain disruptions, and solid fundamentals such as the still-strong level of savings will all support growth. Meanwhile, the housing sector will likely continue to normalize, as spending patterns re-balance and mortgage rates continue rising. The Omicron variant also adds a new challenge heading into 2022, adding further evidence that real GDP is likely to remain uneven in the near term. Higher prices and the persistence of inflationary pressures remains an important risk for Canada, and may hold back consumer spending and real incomes.

As we look forward to the end of this year and into 2022, there is still work to do. About 155,000 Canadians are still working sharply reduced hours because of the pandemic. Long-term unemployment remains elevated, with 318,000 workers unemployed for more than 6 months (about 139,000 above pre-pandemic level). Jobs in the hard-hit accommodation and food services sectors are still more than 200,000 below pre-pandemic levels.

High vaccination rates and vaccine passports should mitigate the risk of widespread public health restrictions. However, some headwinds could slow the job recovery in the near-term including the new Omicron variant and ongoing supply chain issues. Any impact from the B.C. floods will be evident beginning with the December LFS (to be released Jan. 7) as the floods started just after the November reference week (November 7 – 13).

|

Pre-pandemic Level (February 2020) |

Current Nov-2021 |

|

|---|---|---|

| Employment (thousands) | 19,130 | 19,316 |

| Actual hours worked (thousands of hours per week) | 630,722 | 631,665 |

| Working-age (15-64) employment rate (per cent) | 74.4 | 74.9 |

| Number of unemployed (thousands) | 1,146 | 1,244 |

| Unemployement rate (per cent) | 5.7 | 6.0 |

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| OECD Economic Outlook – December 2021 | 4.8 | 3.9 | 2.8 |

| Bank of Canada MPR – October 2021 | 5.1 | 4.3 | 3.7 |

| IMF World Economic Outlook – October 2021 | 5.7 | 4.9 | 2.6 |

| Budget 2021 – April 2021 | 5.8 | 4.0 | 2.1 |

| Real GDP Growth in 2021Q3 (annualized) | Real GDP Growth since 2019Q4 | |

|---|---|---|

| Canada | 5.4 | -1.4 |

| United States | 2.1 | 1.4 |

| France | 12.6 | -0.1 |

| Germany | 6.9 | -1.1 |

| Italy | 11.0 | -1.3 |

| United Kingdom | 5.1 | -2.1 |

| Japan | -3.0 | -2.2 |

Summary of Canada's COVID-19 Economic Response Plan

Issue

In March 2020, the Government of Canada rolled out its COVID-19 Economic Response Plan (ERP). In conjunction with measures that address the pandemic from an epidemiological and public health perspective, the ERP provided support to individuals, families, and businesses. Over time, the ERP evolved in response to the changing nature of COVID-19 in Canada, and wound down as policy shifted focus towards recovery.

Talking points

- The Government of Canada fulfilled its role to stabilize the economy and responded with rapid and broad-based emergency support. Measures were aimed at protecting the health of Canadians and providing a safety net to support families, workers and businesses across the country.

- Canada’s Economic Response Plan has been key in bridging Canadians and businesses through the COVID-19 shock waves and stabilized the economy. Canada’s response has been one of the largest and fastest among G7 countries.

- The government’s plan has positioned the Canadian economy to recover strongly.

- IMF analysis indicates that without direct support measures, Canada’s real GDP would have declined by about 13.2 per cent in 2020 (versus an actual decline of 5.4 per cent), a difference of about 8 percentage points. Further, without support measures, the IMF estimates that the unemployment rate would have risen by an additional 3.2 percentage points in 2020.

Background

The key policy pillars of Canada’s COVID-19 ERP include:

Protecting the Health and Safety of Canadians

- The Safe Restart Agreement provided $13 billion to Canada’s provinces and territories to support the restarting of the country’s economy, including by funding testing and contact tracing and capacity to manage outbreaks. This funding also supported vulnerable populations and communities. The agreement also provided over $4.5 billion for the centralized federal procurement of personal protective equipment (PPE). Value: $19.9 billion.

- PPE and ventilator procurement, including bulk purchases with provinces and territories. Value: $5.4 billion.

- Vaccine procurement, research, development, and production. Value: $14.3 billion.

- Immunization and health care system support payments to provinces and territories. Value: $5.5 billion.

Support for Individuals

- The Canada Emergency Response Benefit (CERB), which provided immediate and responsive income support to individuals who lost their jobs or faced reduced hours due to the pandemic, at a rate of $500 per week. Value: $73.1 billion.

- CERB was replaced by the Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB), and Canada Recovery Caregiving Benefit (CRCB), which continued to provide support to Canadians who could not work or whose incomes had dropped significantly due to COVID-19, including those who had to miss work due to illness, increased susceptibility to contracting COVID-19, or caregiving responsibilities. These recovery benefits provided support at a rate of $500 per week, with the CRB decreasing to $300 per week as the economic situation improved. Value: $36.1 billion.

- It was recently announced that the CRB would be allowed to expire in October 2021 and would be replaced by the Canada Worker Lockdown Benefit, which would provide $300 a week in income support to eligible workers should they be unable to work due to a local lockdown. The CRSB and CRCB will be extended.

- Temporary increases to the Goods and Services Tax (GST) Credit and the Canada Child Benefit (CCB). Value: $7.5 billion. Legislation passed March 25.

Support for Businesses

- Canada Emergency Commercial Rent Assistance (CECRA), which provided forgivable loans to qualifying commercial property owners to reduce the rent owed by eligible small businesses by 75 per cent. Value: $2.97 billion.

- CECRA was replaced by the Canada Emergency Rent Subsidy (CERS) and Lockdown Support measures, which, at its most generous, provided up to a 65 per cent subsidy for small businesses paying rent or mortgages, and extended support up to 90 per cent for businesses that were closed or significantly restricted due to public health orders.

- Wage subsidies to support businesses and workers while encouraging continued labour-market attachment. The first measure introduced was a 10-per-cent Temporary Wage Subsidy. The Canada Emergency Wage Subsidy (CEWS) was subsequently introduced, which, at its most generous, provided a subsidy of up to 75 per cent for qualifying employers, up to $847 per week per employee.

- The government has recently introduced legislation to provide continued support through rent and wage subsidies to tourism, hospitality and other hard-hit organizations that have been deeply affected by the pandemic, until May 7, 2022.

- The Canada Emergency Business Account (CEBA) and related programs, providing interest-free loans of up to $60,000 to small businesses and not-for-profits. Up to 1/3 ($20,000) of the loan may be forgiven if fully repaid by December 31, 2022. Value: $50 billion.

- The Business Credit Availability Program (BCAP) and Highly Affected Sectors Credit Availability Program (HASCAP) provide loan guarantees and financing to Canadian businesses of all sizes in all sectors and regions. Current take-up: $7.4 billion (varying program data, August to October 2021). The Large Employer Financing Facility (LEEFF) supports large Canadian employers, and has provided financial support, including loans and equity, to seven firms, with an approved value of $6.1 billion, plus an airline loan voucher facility of $1.8 billion for customer refunds.

- Income tax, Goods and Services Tax/Harmonized Sales Tax (GST/HST) and customs duty payment deferrals. Liquidity support value: $85 billion until the end of September 2020. Implemented under existing administrative authority.

- Co-ordinated measures taken by the Minister of Finance and financial sector partners to support the functioning of markets and continued access to financing for Canadian businesses.

Support for Vulnerable Groups

- Support for community partners to address the shelter and safety needs of people experiencing homelessness, with funding used to help manage or prevent an outbreak in the shelter system. Value: $695 million.

- Support for nearly 3,000 food banks and local food and service organizations to address emergency hunger relief across Canada. Value: $200 million.

- Women’s Employment Readiness Pilot to support marginalized women by providing and testing pre-employment and skill development supports. Value: $50 million over two years.

- National Workplace Accessibility Stream of the Opportunities Fund for Persons with Disabilities to help Canadians with disabilities secure and maintain good jobs, and to help set up accessible work-from-home arrangements and expanding accessible online training opportunities. Value: $15 million.

The table annexed below gives a detailed overview of the measures introduced as part of the Government of Canada’s COVID-19 ERP, along with their ‘impact value’; that is, the total cash value over 2019-20 to 2021-22 for direct support measures, or the total liquidity support provided through loans or other measures.

Anticipated areas of questioning

- What is the total amount that has been announced by the Government of Canada on the COVID-19 Economic Response Plan?

- As of October 21, the government has provided $355 billion in direct supports, including $60 billion in health and safety spending and $295 billion in income and economic supports.

- In addition, the government has provided $85 billion in tax liquidity support.

- This represents total support of $440 billion, or 20 per cent of 2020 GDP, excluding other liquidity support and capital relief.

- How much funding has been provided for vaccine procurement?

- As of Budget 2021, over $9 billion has been allocated for vaccine procurement.

| Protecting Health and Safety | Impact1 ($M) |

|---|---|

| Safe Restart Agreement | 19,909 |

| Safe Return to Class | 2,000 |

| Vaccines and Therapeutics | 14,340 |

| PPE and Medical Equipment | 5,352 |

| Long-Term Care | 1,340 |

| Other Public Health Support | 9,579 |

| Helping Health Care Systems Recover | 4,000 |

| Canada's COVID-19 Immunization Plan | 1,000 |

| Supporting the Mental Health of Those Most Affected by COVID-19 | 140 |

| Supporting Indigenous Communities in the Fight Against COVID-19 | 1,239 |

| Safe Return to School on Reserve | 112 |

| International COVID-19 Response and Recovery | 375 |

| Enhanced Border and Quarantine Measures (Re-classified)3 | 894 |

| Sub-Total – Protecting Health and Safety | 60,279 |

| Direct Support Measures | Impact1 ($M) |

| Canada Emergency Wage Subsidy* | 111,385 |

| Canada Emergency Rent Subsidy and Lockdown Support* | 8,645 |

| Canada Emergency Response Benefit | 73,056 |

| Enhancements to Employment Insurance* | 13,133 |

| Canada Recovery Benefit* | 28,662 |

| Canada Recovery Sickness Benefit* | 823 |

| Canada Recovery Caregiver Benefit* | 3,763 |

| Canada Emergency Business Account - Incentive | 13,822 |

| Other Direct Support Measures (FES 2020) | 34,359 |

Of Which: Support for Sectors |

|

Support for Workers in the Live Events and Arts Sector |

322 |

Air Sector Support |

1,028 |

Support for Innovative Businesses |

535 |

Support for Local Indigenous Businesses and Economies |

133 |

Financial Relief for First Nations through the First Nations Finance Authority |

17 |

Support for Indigenous Businesses and Aboriginal Financial Institutions |

307 |

Support for Main Street Businesses |

47 |

Support for Food Inspection Services |

20 |

Support for Cultural, Heritage and Sport Organizations |

500 |

Support for Canada's National Museums |

26 |

Support for Canada's National Arts Centre |

18 |

Cleaning Up Former Oil and Gas Wells |

1,720 |

Emissions Reduction Fund for the Oil and Gas Sector |

750 |

Supporting Canada's Farmers, Food Businesses and Food Supply |

453 |

Support for Fish and Seafood Processors |

63 |

Support for Canada's Fish Harvesters |

469 |

Support for Canada's Academic Research Community |

450 |

Support for Workers in the Nfld. Labrador Offshore Energy Sector |

320 |

Of Which |

|

10% Temporary Wage Subsidy |

2,505 |

Enhanced GST Credit |

5,4254 |

Enhanced Canada Child Benefit |

1,9764 |

| Other Direct Support Measures in Budget 2021 | 1,829 |

Of Which: Support for Sectors: |

|

Supporting Temporary Foreign Workers While They Quarantine |

58 |

Supporting Safe Air Travel |

104 |

Extending Temporary Support for Seasonal Workers Who Continue to be Affected by the Pandemic |

4 |

Revitalizing Tourism |

425 |

Supporting Canada's Arts, Heritage, and Cultural Workers and Institutions |

222 |

Helping Canadian TV and Film Productions Through COVID-19 |

100 |

Support for the Canadian Broadcasting Corporation / Radio-Canada |

21 |

Support for the Canadian Book Industry |

23 |

Enhancing Digital Access to our Heritage |

5 |

Support for National Museums and the National Battlefields Commission |

73 |

Supporting Indigenous Economies (Renewal of Indigenous Community Business Fund) |

117 |

Supporting Indigenous Economies (First Nations Finance Authority) |

33 |

Other: |

|

Regional Relief and Recovery Fund Top-Up |

80 |

Parks Canada Anticipated Revenue Losses |

72 |

Improving Food Security |

140 |

Granville Island Emergency Relief Fund Extension |

22 |

Supporting Indigenous Post-Secondary Education during COVID-19 |

102 |

Maintaining Federal Court Services During COVID-19 |

5 |

Preventing the Spread of COVID-19 in Correctional Institutions |

155 |

Addressing Financial Impacts on Atomic Energy of Canada Limited |

39 |

Public Services and Procurement Canada Program Integrity |

30 |

| Total – Direct Support Measures | 289,477 |

| Sub-Total – Protecting Health and Safety, Direct Support Measures | 349,756 |

| As % of 2020 GDP | 15.9% |

| Tax Liquidity Support | Impact1 ($M) |

| CRA/CBSA liquidity support to businesses and individuals | |

Income Tax Payment Deferral until September 30, 2020 |

55,000 |

Sales Tax Remittance and Customs Duty Payments Deferral until June 30, 2020 |

30,000 |

| Supporting Jobs and Safe Operations of Junior Mining Companies | 50 |

| Sub-Total – Tax Liquidity Support | 85,050 |

| Other Liquidity Support and Capital Relief | Impact1 ($M) |

| Business Credit Availability Program and Other Credit Liquidity Support | 81,889 |

Of Which: |

|

Canada Emergency Business Account (not including incentive) |

36,689 |

Business Credit Availability Program |

|

Small- and Medium-sized Enterprise Loan and Guarantee Program |

40,0005 |

Mid-Market Guarantee and Financing Program |

TBD6 |

Highly Affected Sectors Credit Availability Program |

TBD6 |

Large Employer Emergency Financing Facility |

TBD6 |

Support for the Agriculture and Agri-Food Sector |

5,200 |

| Total – COVID-19 Economic Response Plan (Protecting Health and Safety, Direct Support Measures, Tax and Other Liquidity Support) | 516,695 |

| Other Liquidity Support | |

| Credit and Liquidity Support through the Bank of Canada, CMHC and Commercial Lenders7 | 300,000 |

| Capital Relief | |

| Capital Relief (OSFI Domestic Stability Buffer)8 | 300,000 |

|

Note: Numbers may not add due to rounding.

* Updated to include the estimated cost of extensions to COVID-19 benefits and business supports announced on July 30, 2021. |

|

Support for P/Ts

Issue

Since the onset of the pandemic, the Government of Canada has led a coordinated federal-provincial-territorial (FPT) response to fight COVID-19 and has provided unprecedented levels of support to provinces and territories (PTs).

Talking points

- Federal support provided directly to provinces and territories’ throughout the pandemic includes:

- $13 billion in direct support for provinces and territories provided through the nearly $20 billion Safe Restart Agreement;

- $4.5 billion in one-time payments through the Canada Health Transfer to support immediate health system needs;

- $1 billion to support the rollout of provincial and territorial immunization campaigns;

- $2.9 billion to help boost wages for essential workers across the country when we relied on them most;

- $2 billion to support a safe return to school for children and staff; and

- Up to $3.3 billion to support resilient communities through the COVID-19 Resilience Funding Stream;

- Other federal investments have directly supported provincial and territorial pandemic management, including:

- More than $9 billion to support vaccine purchases and access to vaccines through international collaboration; and

- $2 billion to support the purchase of personal protective equipment for health care and essential workers.

- The Government has also nearly tripled the cap on payments under the Fiscal Stabilization program. The higher cap will ensure provinces have additional resources to manage economic fluctuations in extraordinary times.

- The Government is committed to continuing to support provinces and territories throughout the pandemic and on the priorities that matter to Canadians. This includes:

- Developing a proof of vaccination credentials approach that will ensure fully vaccinated Canadians can move freely within Canada and that will support international travel. The government is also committed to supporting provincial and territorial proof of vaccination programs;

- Providing up to $30 billion, and combined with previous investments announced since 2015, $9.2 billion every year – to build a high-quality, affordable, flexible and inclusive early learning and childcare system in partnership with provincial, territorial and Indigenous partners; and

- Providing up to $1 billion to establish a Safe Long-term Care Fund with another up to $3 billion to ensure standards of care are applied and permanent changes are made.

Background (if required)

Safe Restart Agreement: Nearly $20 billion to help provinces and territories safely restart their economies and prepare for future waves of COVID-19. The Agreement included $13 billion in direct transfers to provinces and territories and addressed seven key priorities:

- Testing, contact tracing, and data management

- Health care capacity, including mental health and substance use

- Protecting vulnerable populations, including seniors

- Securing personal protective equipment

- Child care for people returning to work

- Support for municipalities, including for public transit

- Sick leave

Safe Return to Class Fund (and Safe Indoor Air Top-Up): The original Safe Return to Class Fund provided provinces and territories $2 billion in support towards the costs of adapting the education sector to ensure a safe return to class for students and staff throughout the 2020-21 school year. Through the platform, the government has also committed to provide a $100 million top-up to the fund, targeted towards supporting safe indoor air in schools.

Essential Workers Support Fund: The COVID-19 Essential Workers Support Fund was a federal transfer to provinces and territories to cost-share a temporary top-up to the salaries of workers deemed essential in the fight against COVID-19. All PTs received funding, totalling $2,884,208,769 in federal support.

Early Learning and Child Care: The Government has reached individual agreements with AB, BC, MB, NL, NS, PE, SK and the YK. Negotiations are ongoing with the remaining provinces and territories.

Long-term Care: Safe Long-term Care Fund agreements – being used as launching points for negotiations- have been reached with NL, PEI, NT, YK, and BC to date. Negotiations with other jurisdictions remain ongoing.

Public health / vaccine procurement: Canada has secured among the most diverse portfolio of vaccines in the world, with the Government of Canada covering the full cost of procured vaccines thus far, ensuring that they are free of charge to every Canadian.

Stabilization program reforms: The Government nearly tripled the cap on payments from $60 per capita to about $170 per capita in 2020-21, and indexed the cap to grow in line with economic growth per person in future years. Furthermore, the Minister of Finance has the discretion to grant interest-free loans to provinces for eligible revenue declines above the cap.

Anticipated areas of questioning

- Why was the Premiers’ proposal for the Fiscal Stabilization Program not adopted?

- The higher cap will ensure provinces have additional resources to manage economic fluctuations in extraordinary times.

- Furthermore, the Minister of Finance has the discretion to grant interest-free loans to provinces for eligible revenue declines above the cap.

- How much funding has been provided to buy vaccines for Canadians? Please breakdown the funding provided for vaccine purchases.

- As noted in Budget 2021, over $9 billion has been provided to secure COVID-19 vaccines for Canadians.

- The government has entered into a series of contracts with vaccine manufacturers, including Pfizer, Moderna and others. Details on the existing COVID-19 vaccine agreements are available on the government’s website.

Worker Benefits

Issue

On October 21, 2021, the government announced it would establish the Canada Worker Lockdown Benefit and extend the recovery sickness and caregiving benefits until May 7, 2022.

Talking points

- The government is transitioning from the very broad-based support that was appropriate at the height of the lockdowns, to more targeted measures that can provide help where it is needed.

- Despite making significant progress on Canada’s fight against COVID-19, the government recognizes that restrictions may still be required over the coming months to limit spread of the virus.

- The Canada Worker Lockdown Benefit will ensure that those whose employment is directly interrupted by a future public-health lockdown have the support they need – in case the pandemic requires further lockdowns to curtail the spread of COVID-19.

- The extension of the Canada Recovery Sickness Benefit and the Canada Recovery Caregiving Benefit – and additional 2 weeks proposed – will also continue to help Canadians who protect themselves and others by staying home when they are sick or helping a loved one.

If pressed:

- The Government will continue to monitor the public health situation and will ensure that workers continue to have the support they need and that no one is left behind.

Anticipated areas of questioning

- What is the government doing for individuals who are no longer eligible for the Canada Recovery Benefit?

- Over the last year, the Canada Recovery Benefits provided income support to millions of individuals directly affected by COVID-19.

- With the economy having recovered 100% of the jobs lost due to the COVID recession, the Government is adapting its income support.

- The Canada Worker Lockdown Benefit will support workers directly affected by lockdown situations, while the extension of the sickness and caregiving benefits will continue to provide support to those who are sick or must care for a relative.

- In addition, the extension of the Canada Recovery Hiring Program and the additional supports to firms in hard hit sectors, will help businesses continue to hire back workers and to create the additional jobs Canada needs for a full recovery.

- What is the expected cost of the Canada Worker Lockdown Benefit.

- This benefit would be triggered by lockdowns in a given region. As a result, the cost will vary based on the presence, scope and duration of lockdowns moving forward, should there be any at all.

- The Government will monitor the public health situation going forward, and provide cost projections accordingly as part of regular reporting.

- When will Canadians be able to apply for the new Canada Worker Lockdown Benefit?

- Only once legislation receives Royal Assent can the benefit be launched and Canadians be able to apply for the new benefit. The Governor-in-Council would then be empowered to designate the regions where these lockdowns occur. Should there be applicable lockdown situations before its launch, Canadians will be able to apply retroactively.

Debt and Deficit Levels

Issue

As a result of the COVID-19 pandemic and the government’s emergency response plan, the deficit is expected to rise to $354.2 billion in 2020-21, or 16.1 per cent of GDP. The federal debt-to-GDP ratio is expected to reach 51.2 per cent of GDP in 2021-22.

Talking points

- Canada entered this crisis in a strong fiscal position, allowing the government to take decisive action to put in place the support necessary for people and businesses to weather the storm and support a robust and inclusive recovery of the Canadian economy.

- However, those actions, combined with lower revenues due to the recession, have increased public debt sharply.

- The government is committed to unwinding COVID-related deficits and reducing the federal debt as a share of the economy over the medium-term.

- This fiscal anchor will continue to protect Canada’s low debt advantage so that borrowing costs remain low, and future generations are not burdened with COVID-19-related debt.

- In the current low-interest rate environment, the government is making investments that will drive future growth and prosperity. These actions can help to improve fiscal sustainability by raising GDP growth more than the costs in terms of increased debt service over the longer term.

- Finally, Canada’s history of prudent fiscal management means that, despite the unprecedented actions we took to fight the virus, we continue to have:

- The lowest net debt-to-GDP ratio in the G7; and,

- Excellent credit ratings from the four major credit rating agencies: Moody’s (Aaa), S&P (AAA), DBRS (AAA), and Fitch (AA+)

Anticipated areas of questioning

- Does the government ever intend to balance the budget?

- The government is committed to unwinding COVID-related deficits and reducing the federal debt as a share of the economy over the medium-term.

- This fiscal anchor will continue to protect Canada’s low debt advantage so that borrowing costs remain low, and future generations are not burdened with COVID-19-related debt.

- How is the government managing the large increase in debt?

- The government has and will continue to manage its finances prudently, retaining its low-debt advantage among G7 peers. The government’s strategy will be implemented responsibly, with a sustainable approach for future generations.

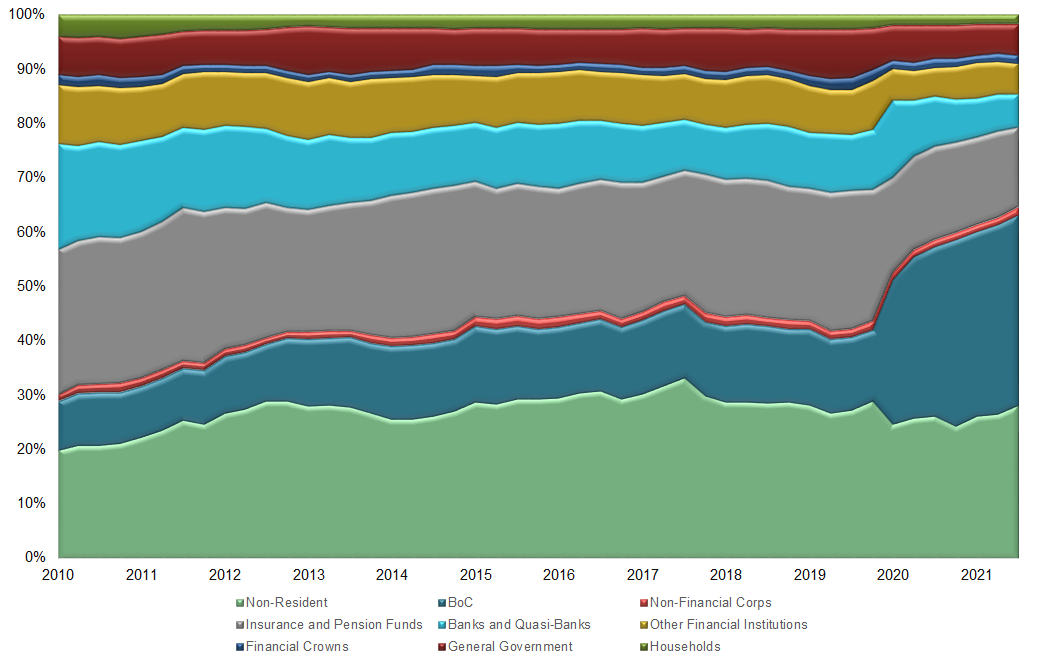

- The government will continue to maximize the financing of COVID-19-related debt through long-term issuance.

- Before the pandemic, 15 per cent of the bonds issued by the government were issued at maturities of 10 years or greater. In 2020, federal government allocations of long bonds rose to almost 30 per cent. The government is now proposing to increase that proportion to over 40 per cent.

- This will protect Canada from rollover risks and provide more predictability in the cost of servicing debt.

- Does the government’s debt program have sufficient capacity to handle the current planned spending and the possibility of another wave?

- Canada entered the pandemic in a position of fiscal strength and the demand for Government of Canada securities remains strong.

- The government will continue to maximize the financing of COVID-19-related debt through long-term issuance for the benefit of future generations, a fiscally prudent approach that provides security by lowering debt rollover.

Debt Management

Issue

The fundamental objectives of debt management are to raise stable and low-cost funding to meet the financial requirements of the Government of Canada and to maintain a well-functioning market for its securities. For 2021-22, the government will seek to maximize the financing of COVID-19-related debt through long-term issuance.

Talking points

- Canada entered the pandemic in a position of fiscal strength, allowing it to support to Canadians and Canadian businesses through the COVID-19 pandemic.

- The government has and will continue to prudently manage its finances, while retaining its low-debt advantage among its G7 peers.

- Demand for Canada’s securities remains strong.

- Maximizing the financing of COVID-19-related debt through long-term issuance will benefit future generations.

- Canada continues to hold a AAA rating, with a stable outlook, from most credit rating agencies.

If pressed on rising interest rates:

- While interest rates have recently risen, they still remain near historically low levels and the Debt Management Strategy has been crafted to be robust to different interest rate scenarios.

If pressed on Fitch downgrade:

- Canada remains among the top rated countries in the G7, despite Fitch’s downgrade of Canada last year.

Anticipated areas of questioning

- Does the government’s debt program have sufficient capacity to handle the current planned spending and the possibility of another wave?

- Canada entered the pandemic in a position of fiscal strength and the demand for Government of Canada securities remains strong.

- The government will continue to maximize the financing of COVID-19-related debt through long-term issuance for the benefit of future generations, a fiscally prudent approach that provides security by lowering debt rollover.

- How is the Government going to manage rising interest rates?

- Since the beginning of the COVID-19 pandemic, the Government has taken a prudent approach to finance the deficit by significantly increasing its issuance of long-term bonds to unprecedented levels.

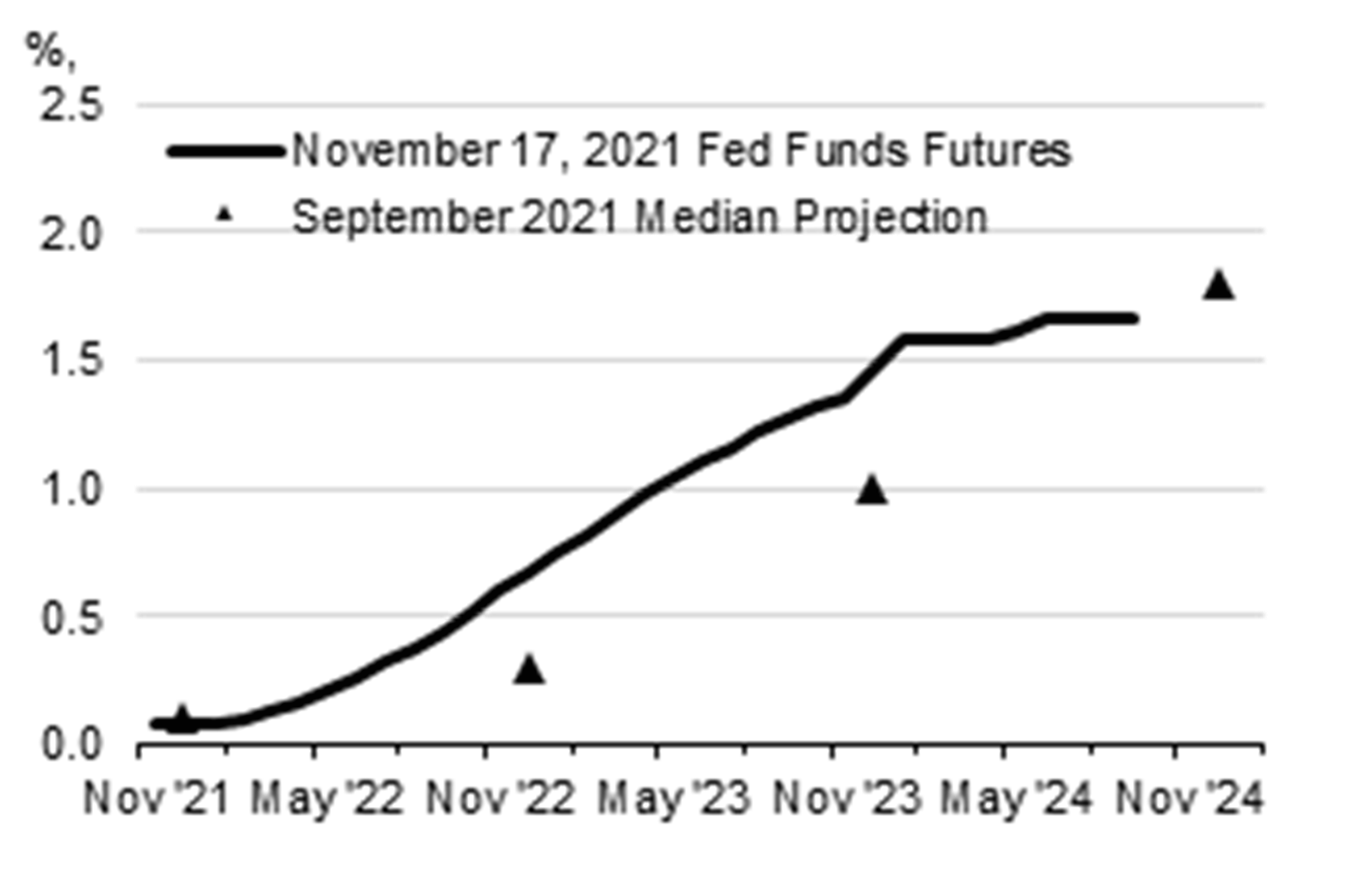

- The Debt Management Strategy accounts for the projected increases in interest rate by the private sector and is robust to a wide range of potential interest rate scenarios.

- Despite record borrowings, public debt charges as a per cent of GDP are expected to stay near their lowest level in over a century over the forecast horizon.

- With the forecasted increase to interest rates in Budget 2021, public debt charges are projected to only rise to 1.4 per cent of GDP by 2025-26 to a level of $39.3 billion, substantially lower than the average cost of financing debt over the last two decades.

Supporting Low- and Middle-Income Individuals and Families

Issue

Since taking office in 2015, the Government has taken several actions to support low- and middle-income Canadians through the tax and benefit system.

Talking points

- Supporting the middle class and those working hard to join it has been a key priority of our Government.

- We have reduced taxes for middle class Canadians while raising them on the wealthiest 1%.

- We increased support for families and low-income workers through programs such as the Canada Child Benefit and the Canada Workers Benefit, which have helped lift over 1 million Canadians out of poverty since 2015, including 435,000 children.

- We increased the Guaranteed Income Supplement top‑up benefit for low‑income single seniors, enhanced the GIS earnings exemption, and we are increasing Old Age Security for Canadians aged 75 and older in July 2022.

- We will continue to examine ways to improve the tax and benefit system to ensure it is well targeted and fair.

Supporting Small Businesses During the Pandemic

Issue

The government has taken several actions, through the tax system, to support small businesses and protect jobs during the pandemic.

Talking points

- In the face of the pandemic, the government acted swiftly to support businesses, including small businesses, and protect jobs, adapting as the pandemic evolved.

- We implemented a broad suite of measures for businesses, including the Canada Emergency Wage Subsidy, Canada Emergency Rent Subsidy and Lockdown Support, and the Canada Recovery Hiring Program.

- The Canada Emergency Wage Subsidy has helped more than 5.3 million Canadians keep their jobs, with over $97 billion in support paid out to help employers re-hire workers and avoid layoffs.

- The Canada Emergency Rent Subsidy and Lockdown Support have helped more than 215,000 organizations with over $7 billion in support for rent, mortgage, and other expenses.

- The government is now moving away from broad-based support that was appropriate at the height of lockdows, to a more targeted approach. We introduced legislation to provide continued support through wage and rent subsidies to tourism, hospitality and other hard-hit organizations that have been deeply affected by the pandemic, until May 7, 2022.

Fighting Tax Evasion and Avoidance

Issue

Since taking office in 2015, the Government has taken several actions to combat tax evasion and avoidance.

Talking points

- Our Government is committed to a fair tax system where everyone pays their fair share.

- To that end, we have made significant investments to strengthen the Canada Revenue Agency’s ability to crack down on tax evasion and combat tax avoidance.

- In each of our budgets, we have taken legislative actions to close tax loopholes.

- Canada continues to work with its international partners to address corporations and wealthy individuals inappropriately shifting profits offshore and using other schemes.

- Canada is one of 137 countries that recently entered into a historic agreement on a global minimum tax regime that would ensure that income earned by the foreign subsidiaries of large multinational corporations is subject to tax at a rate of at least 15%.

- This new minimum tax regime is aimed at reducing the incentives for such corporations to shift income into offshore companies located in low-tax jurisdictions.

- The Government will continue to crack down on international tax evasion and aggressive tax avoidance, through all available avenues.

Housing

Issue

Housing affordability remains a growing concern for many Canadians as housing prices are rapidly increasing across the country. This issue is most acute in Toronto and Vancouver and their surrounding regions.

Talking points

- With rent increasing and housing prices continuing to rise, we recognize that housing affordability is a growing concern for many Canadians.

- Addressing housing affordability for all Canadians is an important, complex issue that will require a comprehensive policy approach. More information on our plan and next steps will be released in due course.

- Considering shared jurisdiction, we understand that this plan will need a coordinated approach with other levels of government.

If pressed on actions to date:

- In 2017, the government launched the National Housing Strategy, an ambitious 10-year plan that will invest over $72 billion to address the housing challenge.

- As of March 2021, over $19.6 billion in funding commitments have been made under the National Housing Strategy, supporting the creation of 75,600 new housing units and the repair of 189,400 existing housing units.

Background

In 2017, the government commited over $72 billion to the National Housing Strategy (NHS), a 10-year plan to address homelessness and improve the affordability, quality, and availability of housing.

The NHS currently targets:

- Building 160,000 new homes

- Renovating and modernizing 300,000 homes

- Removing 530,000 families from housing need

- Cutting chronic homelessness by 50% (note: the government has since committed to eliminating chronic homelessness)

In May 2021, Minister Hussen tabled the first triennial report to Parliament on NHS implementation to date, indicating NHS is largely progressing as planned and the overall expected results for most initiatives slightly exceed their original targets.

In addition, the Governments of Canada and British Columbia partnered to launch the Canada-B.C. Expert Panel on the Future of Housing Supply and Affordability, tasked with identifying and evaluating federal and provincial measures to increase the supply of housing and improve affordability. The Panel published its Final Report in June 2021, and our Government is actively reviewing its recommendations.

Trade Irritants with the U.S.

Issue

Recent or planned U.S. measures (e.g., tax credits favouring U.S.-made electric vehicles, increased softwood lumber duties) threaten integrated supply chains and the free and open Canada-U.S. trading relationship that is underpinned by the CUSMA.

Talking points

- U.S. protectionist policies run counter to CUSMA obligations and are inconsistent with shared objectives on supply chain collaboration.

- The Government is very concerned with the protectionist elements of the proposed U.S. tax credits for electric vehicles.

- Canada continues to work diligently towards an outcome that does not discriminate against Canadian-made vehicles and batteries.

- Canada is also disappointed by the increased duties on softwood lumber as well as the proposed expansion of Buy America provisions.

- We are engaging at all levels with U.S. officials and stakeholders to highlight the negative impact that U.S. protectionist measures can have, not just on the industry in Canada, but for jobs and consumers on both sides of the border.

- The Government of Canada will always defend the interests of Canadians against U.S. measures that harm Canadian businesses and workers.

Background

The U.S. has recently considered or implemented several measures that threaten the Canada-U.S. trading relationship, including:

- Proposals before Congress for tax credits for electric vehicles that would discriminate against Canadian-produced electric vehicles and batteries.

- A recent Department of Commerce finding resulted in the doubling of trade remedy duties being applied to most Canadian exports of softwood lumber.

- The infrastructure bill recently signed by President Biden included an expansion of Buy America provisions that would restrict access to the U.S. procurement market for Canadian suppliers.

The Prime Minister, Deputy Prime Minister, Canada’s Ambassador to the U.S., Minister Ng, and other Ministers have engaged with the U.S. administration, congressional leaders, and other U.S. interlocutors to express Canada’s concerns and work towards a favourable resolution of these issues for Canada.

Other Issues

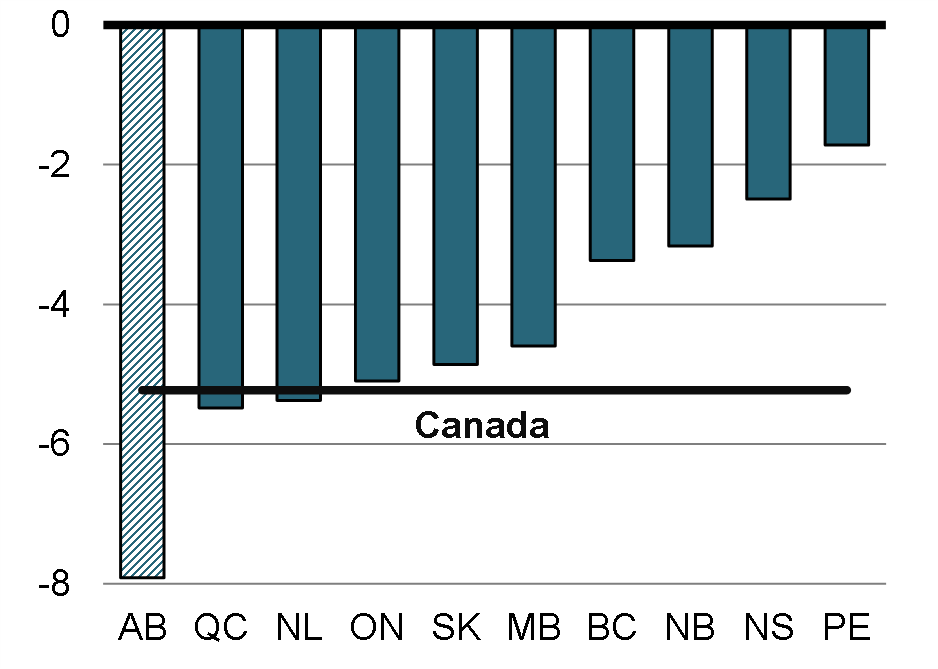

Equalization (AB referendum, floor payments)

Issue

On October 18, 2021, 62% of Albertans voted “yes” to a referendum about removing section 36(2) on the principle of Equalization from the Constitution. On November 18, 2021, the Legislative Assembly of Alberta passed a motion to amend the Constitution as outlined in the referendum.

Talking points

- The Government of Canada believes in a strong role for Alberta in the federation, and values Albertans’ contributions to our national debates, including on constitutional issues.

- The principle of Equalization is enshrined in Canada’s Constitution and who we are as a country.

- Equalization helps ensure that all provinces can give their residents a fair chance at success.

- It enables provinces to deliver education, world-class health care and other essential services that Canadians rely on. Every province has benefitted from the program at some point.

- The Equalization formula is reviewed every 5 years to ensure that the program continues to serve its purpose. The next renewal must take place by 2024. Our government is open to discussing the program with the Government of Alberta, as well as all provincial governments, to ensure that Equalization continues to be there for Canadians.

If pressed:

- Amending the Consititution would require resolutions of the Senate, the House of Commons and the legislatures of at least seven provinces representing at least 50 per cent of the population of all the provinces.

Background (if required)

Premier Kenney has been using the referendum as leverage to fight for a “fair deal” for Alberta and it has been framed in the context of Alberta citizens’ large net fiscal contribution to the federation and perceived lack of support on pipelines and resource development.

Following the referendum, Premier Kenney has stated that it is unlikely that the Constitution will actually be amended, given the requirements of the amending formula, but that he expects this vote to pressure the federal government to act on a range of issues that concern Alberta, including Bills C-48 (Oil Tanker Moratorium Act), C-69 (Impact Assessment Act) and the cancellation of several pipelines.

Alberta has contrasted the generosity of Equalization, which grows in line with the economy despite declining disparities among provinces, to the low level of support it received through the Fiscal Stabilization program. Alberta argues that the recent changes to Fiscal Stabilization were inadequate and that Alberta should receive an additional $2.4 billion in retroactive payments.

Equalization entitlements for 2022-23 have not yet been announced but must be shared with provinces before December 31, 2021. Think tanks such as the Fraser Institute and academics such as Trevor Tombe have been critical that the Equalization payout continues to increase while disparities amongst provinces are falling. Trevor Tombe has projected floors of $2.5 billion in 2022-23.

Anticipated areas of questioning

- Will the Government provide more support to Alberta through the Fiscal Stabilization Program?

- The government has nearly tripled the cap on Fiscal Stabilization from $60 per capita to about $170 per capita in 2020-21, and the cap is indexed to grow with economic growth per person in future years.

- In addition, the Minister of Finance has the discretion to grant interest-free loans to provinces for eligible revenue declines above the cap.

- Provinces must submit claims in order to receive Fiscal Stabilization payments. No applications have yet been made for 2020-21.

- Since the onset of the pandemic, the Government of Canada has undertaken a coordinated federal-provincial-territorial response to fight COVID-19 and has provided unprecedented levels of support to provinces and territories including through the nearly $20 billion Safe Restart Agreement. Alberta received $2.55 billion through various measures of Canada’s COVID-19 Economic Response Plan. The Government also provided $1 billion to the Government of Alberta and a $200 million loan to the Alberta Orphan Well Association, to clean up orphan and inactive oil and gas wells. This helped maintain approximately 5,200 jobs in Alberta alone.

- Why is Equalization growing while the disparities it is meant to address are declining?

- Since 2009-10, the total Equalization payout has been set in legislation to grow in line with a three-year moving average of national nominal GDP growth to provide stable and predictable funding for the program.

- The Government will continue to consult with all provinces on Equalization in the lead-up to the next renewal of the program, which must take place before March 31, 2024.

Provincial/territorial request to increase the Canada Health Transfer

Issue

Since September 2020, provincial and territorial premiers have been calling for an immediate and significant increase to the Canada Health Transfer (i.e., $28 billion growing at a minimum of 5 per cent).

Talking points

- This year the Government is providing over $43 billion through the Canada Health Transfer, the largest federal transfer program to provinces and territories.

- The Government has been there from the beginning of the pandemic to ensure that health care systems receive the additional funding they need to manage COVID-19.

- The Government is providing more than 8 out of every 10 dollars spent during the pandemic. This includes $4.5 billion in one-time top-ups to the Canada Health Transfer to address immediate health system pressures.

If pressed:

- Once we are out of the pandemic, the Government will be there to discuss long-term health care funding with provinces and territories to ensure that Canadians continue to receive the care that they deserve.

Background

- The Canada Health Transfer (CHT) is the largest major transfer to provinces and territories. It provides long-term predictable funding for health care and supports the principles of the Canada Health Act.

- Since 2017-18, the CHT has been legislated to grow in line with a three-year moving average of nominal Gross Domestic Product (GDP) growth, with total funding guaranteed to increase by at least 3.0 per cent annually. CHT payments are made on an equal per capita basis.

- Provinces and territories are not required to report to the Government on how CHT funds are disbursed.

- In the decade prior to the pandemic (2010-11 to 2019-20), CHT growth exceeded that of provincial and territorial health expenditures (CHT grew on average by 5.1 per cent annually, compared to PT health expenditure growth of 3.8 per cent).

Anticipated areas of questioning

- What is the federal government doing to help provinces and territories and ensure that Canadians get the healthcare that they deserve?

- Our Government has been there from the beginning of the pandemic to ensure that health care systems receive the additional funding they need to manage COVID-19. This includes:

- $13.8 billion of the nearly $20 billion Safe Restart Agreement went to support health care, including testing capacity and procurement of personal protective equipment;

- $9 billion to support vaccine procurement;

- $4.5 billion in one-time top-ups to the CHT to address immediate health system pressures; and

- $1 billion to support provincial and territorial immunization plans and rollout.

- Our Government is also providing significant funding for health care outside of the CHT. This includes through a number of bilateral agreements with provinces and territories, such as $11 billion over ten years to support better home care and mental health initiatives (started in 2017-18).

CPP contribution rate increase

Issue

The maximum Canada Pension Plan (CPP) contributions are set to increase by 10.6% in 2022 due to both the CPP Enhancement and the increase in the Yearly Maximum Pensionable Earnings (YMPE). This primarily affects contributors who will have earnings above $64,900 in 2022 (about a third of all contributors).

Talking points

- The federal government remains committed to ensuring that every Canadian has a secure and dignified retirement.

- As the Canada Pension Plan (CPP) is self-financed by employer and employee contributions, freezing the contribution increases would mean reducing future benefits for Canadians who are currently working.

- The CPP enhancement represents a major step in improving retirement outcomes for workers and reducing the uncertainty that many Canadians feel about being able to save for retirement.

- It addresses important challenges faced by young Canadians saving for retirement, such as declining workplace pension plans and prolonged periods of low interest rates, and it is important that we stay the course at this critical time.

- Any changes to the CPP, including changes to the Yearly Maximum Pensionable Earnings (YMPE) or contribution rates, would need the formal approval of the Parliament of Canada and seven out of ten provinces representing at least two-thirds of the population.

Background

- The maximum employer and employee contributions to the CPP for 2022 will be $3,500 each and the maximum self-employed contributions will be $7,000. The maximums in 2021 were $3,166 and $6,333 respectively.

- The maximum contribution increases for 2022 ($334 for employer/employee and $667 for the self-employed) are a combination of increases to the Yearly Maximum Pensionable Earnings (YMPE) and legislated increases to contribution rates from the CPP enhancement.

- The CPP enhancement is raising the maximum CPP retirement pension by 50 per cent over time. To fund these enhanced benefits, annual CPP contributions are being increased modestly over seven years, starting in 2019. The CPP enhancement increases the employer and employee contribution rates to 5.70 per cent in 2022 (up from 5.45 per cent in 2021) and the self-employed contribution rate to 11.4 per cent (up from 10.9 per cent).

- This represents a maximum annual increase in 2022 of $150 for an employer or an employee and $300 for the self-employed (i.e., for those earning at or above the upper earnings limit); the increase would be lower for workers below the upper earnings limit (about two-thirds of all contributors).

- The YMPE for a calendar year is the limit to which employed and self-employed earnings are subject to contributions. It increases each year by the percentage increase, as of June 30 of the preceding year, in the 12-month average of weekly earnings of the Industrial Aggregate (as published by Statistics Canada).

Anticipated areas of questioning

- Why wouldn’t the Government freeze the increase in CPP contribution rates during a pandemic, like it did for EI?

- The CPP enhancement is raising the maximum CPP retirement pension by 50 per cent over time. Young Canadians just entering the workforce will see the largest increase in benefits.

- Freezing these contribution rate increases would mean reducing future benefits for working Canadians, in particular younger workers. In addition, any such change would need provincial approval given the shared federal-provincial responsibility for the CPP.

- Why is the upper earnings limit for the CPP (i.e., the YMPE) increasing so fast?

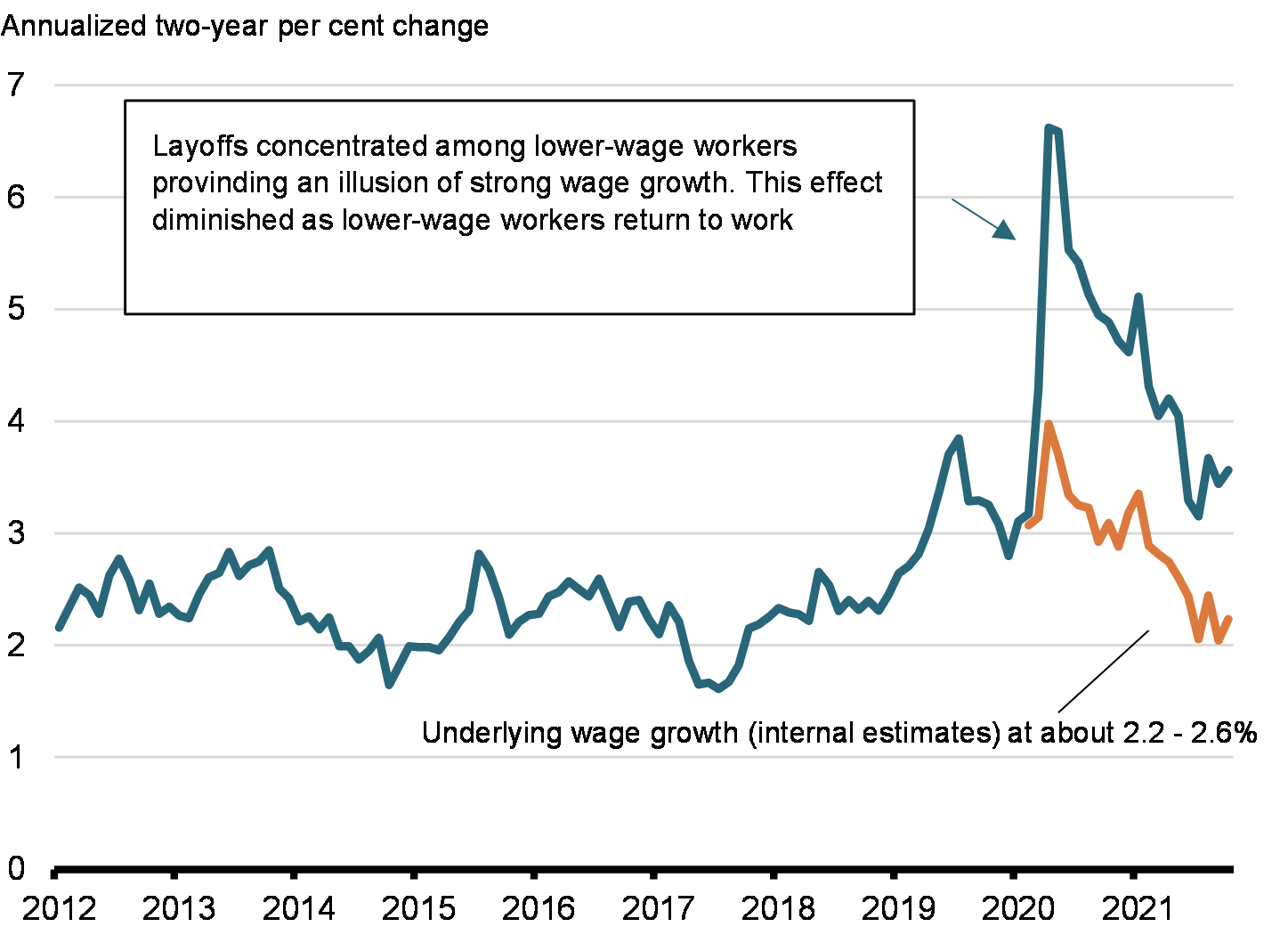

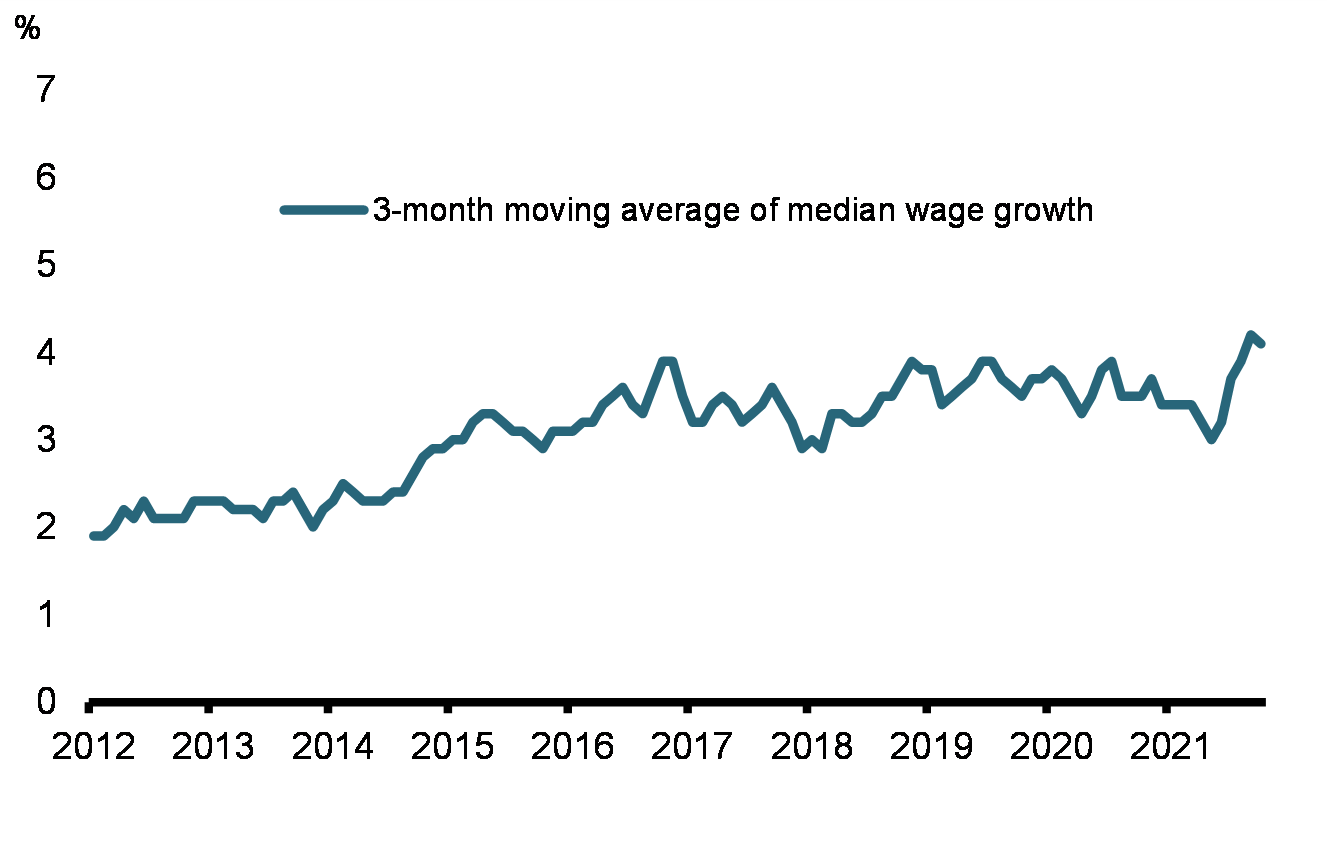

- The growth in the YMPE in 2021 and 2022 was around 5%, much higher than the usual growth rate between 1% and 2%. This is a function of the impact the pandemic has had on employment, which has impacted lower-income workers more than other groups. As a result, with fewer lower income workers in the calculation of average weekly earnings, the YMPE has increased faster than normal.