Briefing binder created for the Deputy Minister of Finance on the occasion of his appearance before the House of Commons Standing Committee on Public Accounts on May 3, 2022 on the Public Accounts of Canada 2021

Table of contents

Issue Notes

Extraordinary Borrowing Authority

Fiscal Anchor and Outlook

Hibernia Payments to Newfoundland and Labrador

Hot Issues (Including Budget 2022)

- Ban on Foreign Investment in Housing

- Canada Growth Fund

- Council of the Federation's Request to Increase the Canada Health Transfer

- Digitization of Money

- Financial Assistance to Ukraine

- Misalignment in Defence Spending

Inflation

Mortgage Insurance Fund

Overpayments of COVID-19 Measures

Pollution Pricing

Quantitative Easing – Impact on the Government's Financial Results

Subsequent Events

Trans Mountain Expansion

Key Figures and Statistics

Annual Financial Report 2020-21

Fiscal Reference Tables December 2021

Parliamentary and Media Environment

Committee Members Overview

Transcripts of Last Three PACP Meetings on the Public Accounts

Additional Reference Documents

Public Accounts of Canada 2021

Meeting Scenario

Committee mandate and study of the Public Accounts of Canada

- Studying and reporting to the House on the Public Accounts of Canada (the government's consolidated financial statements) is a core part of PACP's mandate as provided by the Standing Orders of the House of Commons. The other part is studying and reporting on reports of the Auditor General of Canada, which the committee spends most of its time on over the course of a parliament.

- For its study on the Public Accounts the committee typically holds three meetings:

- An in-camera "training" session to educate members about the technical aspects of the public accounts generally, including how they are prepared and presented. Members pose questions to representatives from the Treasury Board Secretariat's (TBS) Office of the Comptroller General (OCG), the Office of the Auditor General (OAG), and the Canadian Audit and Accountability Foundation. This year, this meeting took place on Tuesday, April 26, 2022.

- A public meeting with the Auditor General, Comptroller General, and Deputy Minister of Finance. This is the meeting being held on May 3, 2022, for the 2021 Public Accounts.

Typically, members use this meeting to ask substantive questions about that year's public accounts. Many of the questions focus on any issues or areas for improvement noted in the Auditor General's independent auditor's opinion of the consolidated financial statements. - One or more meetings to develop a report to the House of Commons on their study.

The committee's reports have typically provided on average one to four recommendations for improvements in administrative and financial practices and controls of federal departments and agencies. Usually, the committee requests a Government response to its report, which is approved via a memorandum to Cabinet, and must be tabled within 120 days.

- According to the committee's web site, "Government policy, and the extent to which policy objectives are achieved, are generally not examined by PACP. Instead, the Committee focuses on government administration – the economy and efficiency of program delivery as well as the adherence to government policies, directives and standards. The Committee seeks to hold the government to account for effective public administration and due regard for public funds."

Department and Deputy Minister of Finance role in preparing the Public Accounts

- As one of the four signatories of the government's consolidated financial statements in the Public Accounts, the Deputy Minister of Finance, along with the Comptroller General of Canada, the Secretary of the Treasury Board of Canada, and the Deputy Receiver General for Canada, are responsible for the preparation and fair presentation of the financial statements in accordance the government's accounting policies, which are based on Canadian Public Sector Accounting Standards.

- From a production perspective, the Department of Finance is responsible for the preparation of the financial statements discussion and analysis included in Section 1, Volume I, of the Public Accounts.

- The Deputy Minister of Finance is also responsible for the proper recording and reporting of financial information pertaining to the Department of Finance included in the Public Accounts (e.g. public debt charges, major transfers to other levels of government, unmatured debt, and foreign exchange accounts).

The May 3 PACP meeting – questions and answers

- * Bullet redacted *

- PACP members ask questions of any witnesses they choose in rotating rounds. The first round provides five minutes for questions and answers to each party in ascending order of party size (i.e. beginning with Liberals). For all subsequent rounds, the Liberals and Conservatives receive five minutes, while the Bloc Québécois and New Democratic Party receive two and a half minutes, until the meeting time is exhausted.

- While the committee Chair is expected to keep questions focused on the topic of the meeting, the Chair may exercise considerable discretion in allowing a wider range of questions.

- All questions and answers are addressed to the Chair.

- Generally, the Comptroller General is responsible for responding to questions related to accounting matters. The Deputy Minister of Finance may be asked questions related to the variance between forecast and actual results for 2020-21 (included on page 14 and 15 of the Annual Financial Report), as well as the economic and fiscal position of the government, including projections included in Budget 2022.

- The issue notes in this binder provide background information and recommended answers to questions expected to be posed to Finance officials in relation to the Public Accounts.

- Although questioning during this meeting in past years remained fairly focussed on the Public Accounts, Finance officials may be asked questions about specific items in Budget 2022 given its recent tabling. Tab 5 provides as series of notes containing information and recommended responses to possible questions on Budget 2022 and other issues of particularly high interest to opposition party members right now.

- Should Finance officials be unable to answer a question, they may commit to providing a written response following the meeting. Parliamentary Affairs will co-ordinate the preparation of any such responses.

- Questions may also be posed about individual departmental line items. However, unless a general answer can be provided, officials will normally defer these detailed questions to the responsible department or agency.

Duties of Deputy Heads and public servants appearing before parliamentary committees

- In Open and Accountable Government (2015) the Prime Minister set out expectations for appearances before parliamentary committees by deputy ministers, who are designated accounting officers for their organizations by the Financial Administration Act. It states, "Under the law, the responsibilities of accounting officers arise within the framework of ministerial responsibility and accountability to Parliament (i.e. deputy ministers are accountable to Ministers, while Ministers are accountable to Parliament). Thus the legislation specifies that accounting officers are accountable before committees—that is, they are required to provide information and explanations to committees, and in so doing to assist Parliament in holding the government to account."

- Open and Accountable Government refers to separate, detailed guidance for accounting officers which sets out recognized practices. These include providing factual, non-partisan answers, protecting confidential information, and that "public servants do not engage in broad policy discussions, debate the merits of policies, options or actions (as opposed to explaining their rationale), [or] express personal opinions…".

Extraordinary Borrowing Authority

Issue

Given that the period of extraordinary circumstances from spring of 2021 has ended and that the Extraordinary Boworring Report has been tabled in Parliament, the Government announced in Budget 2022 that the $8.4 billion extraordinary borrowings will be treated as "regular" borrowings and be reported as such. This will provide greater transparency on the stock of the Government's debt and greater accountability to Parliament for the total amount borrowed.

Talking Points

- The Government is proposing amendments in the Budget Implementation Act to improve transparency and accountability to Parliament related to extraordinary borrowing.

- Government borrowings are subject to a legislative maximum amount, but the Government may borrow funds that do not count against the maximum amount under extraordinary circumstances.

- In response to COVID, the government borrowed $8.4 billion under the extraordinary borrowing framework in Spring 2021.

- Proposed amendments would treat this $8.4 billion as regular borrowings, and count it against the maximum borrowing limit.

- Treating extraordinary borrowings as regular debt when conditions allow is consistent with past practice.

- A separate proposed amendment would align reporting on extraordinary borrowings with the reporting of regular debt in the annual Debt Management Report.

- This would simplify reporting requirements and provide Parliamentarians with a full picture of Government borrowings as of fiscal year end.

Background

The Borrowing Authority Act (the BAA) authorizes the Minister of Finance to borrow money on behalf of the Crown and provides for the maximum amount of Government and agent Crown corporation borrowings. The Financial Administration Act (the FAA) authorizes the Minister to borrow funds under extraordinary circumstances, which are excluded from the calculation of the maximum amount.

To cover costs associated with COVID, in 2020, the Minister used the extraordinary borrowing power to cover the bulk of extra borrowings ($288B). The 2020 extraordinary borrowing authority period ended on September 30, 2020. Shortly after the government introduced amendments to start treating extraordinary borrowing as regular debt and counting toward the maximum amount limit. Accordingly, in December 2020, legislation was tabled to "roll in" the extraordinary borrowings into regular debt and increase the maximum borrowing amount, this legislation did not come into force until May 6, 2021.

In March 2021, the Minister again invoked extraordinary borrowing powers to avoid reaching the maximum borrowing limit. This extraordinary borrowing period ended when the higher maximum borrowing amount ($1,831 billion) came into force on May 6, 2021. The extraordinary borrowings that occurred between March 23, 2021, and May 6, 2021 totaled $8.4 billion. The proposed amendment would count this amount as regular borrowings.

The FAA also details annual reporting requirements in relation to extraordinary borrowings. Proposed amendments would require outstanding extraordinary borrowing to be reported in the annual Debt Management Report only as at the fiscal year-end. Currently, extraordinary borrowing is subject to separate reporting timelines compared to regular debt.

The government reported to Parliament on the most recent extraordinary borrowings through the Extraordinary Borrowing Authority Report, tabled in Parliament on May 25, 2021.

Anticipated Areas of Questioning

1. What is the maximum borrowing amount and how close is the Government to this maximum?

- The maximum borrowing amount is $1,831 billion. This maximum came into force on May 6, 2021.

- As of fiscal year end 2021-22, total market debt is estimated at about $1,600 billion.

2. Is the Government still borrowing under this extraordinary borrowing framework?

- No, the extraordinary borrowing period ended on May 6, 2021.

3. Why did the Government need to invoke extraordinary borrowing authority, and why is it now including these amounts as regular borrowings?

- The response to Covid-19 required an unprecedented, unexpected financial commitment that required extraordinary borrowing beyond the legislative maximum at the time.

- On May 6, 2021, Parliament approved an increase in the maximum borrowing limit.

- To ensure transparency and accountability, we now propose to report extraordinary borrowing amounts as regular debt against the maximum borrowing limit.

4. Why is a change needed to extraordinary borrowing reporting requirements?

- This will provide greater transparency and accountability on the stock of the Government’s total debt.

- The amendments also change reporting for extraordinary borrowings to align with Canada’s regular borrowings to the fiscal year end in the annual Debt Management Reports.

Fiscal Anchor and Outlook

Talking Points

Fiscal Anchor

- The government's fiscal anchor is unchanged: the federal government remains committed to unwinding COVID-19-related deficits and reducing the federal debt-to-GDP ratio over the medium term.

- Budget 2022 meets this test. The government is winding down emergency COVID-19 expenditures and implementing a fiscal plan that ensures federal debt remains on a downward track as a share of the economy.

- This plan also effectively brings the deficit-to-GDP ratio back to its pre-pandemic track by the end of the budget forecast horizon

- After accounting for Budget 2022 measures and incremental policy actions since the 2021 Economic and Fiscal Update, the budgetary balance is expected to remain below that projected in the 2021 Economic and Fiscal Update.

- Both the deficit and the debt-to-GDP ratio are projected to decline in every year of the forecast, with the deficit reaching just 0.3 per cent of GDP ($8.4 billion) by 2026-27.

- Through a continuously declining federal debt-to-GDP ratio over the next three decades, the long-term fiscal projections presented in the budget show that the government's plan is fiscally sustainable for current and future generations.

Public Debt Charges

- Public debt charges are forecast to remain at historically low levels, even after accounting for the expected rise in interest rates by private sector forecasters.

- Public debt charges are expected to be $26.9 billion in 2022-23, or 1.0 per cent of GDP.

- Accounting for the rise in interest rates foreseen by the private sector forecasters, these charges are projected to rise to $42.9 billion, or about 1.4 per cent of GDP, by the end of the forecast horizon (2026-27). This is well below the pre-financial crisis level of 2.1 per cent in 2007-08.

- The budget plan also includes a stress-test scenario, where interest rates are 100 basis points higher than forecast by private sector economists across the forecast horizon. In this scenario, public debt charges would rise by an additional $9.3 billion (0.3 percentage points of GDP) by 2026, bringing them to 1.7 per cent of GDP, which is still lower than at the end of the 2000s.

International Standing

- Canada is a leader in the G7, with the second-lowest deficit as a per cent of GDP and the lowest net debt-to-GDP ratio. The IMF fiscal outlook also shows Canada having the fastest pace of deficit reduction by next year.

- Budget 2022 positions Canada well to maintain these fiscal advantages in the future.

Fiscal Outlook

- Budget 2022 projected a deficit of $113.8 billion for 2021-22—a significant improvement from the $144.5 billion deficit forecast for the year in the 2021 Economic and Fiscal Update.

- The improvement stems in large part from exceptionally strong income tax revenues – in particular corporate income tax revenues, which are now expected to rise some 35% in 2021-22 (following 8.1% growth in 2020-21). Anticipated departmental spending is also lower, in part from reduced COVID-related program expenses.

- Year-to-date results up to February 2022 show a deficit of $69.8 billion through the first 11 months of the fiscal year. Revenues continue to be strong, suggesting upside potential compared to the Budget 2022 outlook. (Note: these results for February will be publicly released on April 29.)

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | |

|---|---|---|---|---|---|---|---|

| Budgetary Balance ($B) | -327.7 | -113.8 | -52.8 | -39.9 | -27.8 | -18.6 | -8.4 |

| % GDP | -14.9 | -4.6 | -2.0 | -1.4 | -0.9 | -0.6 | -0.3 |

| Federal Debt (% GDP) | 47.5 | 46.5 | 45.1 | 44.5 | 43.8 | 42.8 | 41.5 |

Hibernia Payments to Newfoundland and Labrador

Issue

The Public Accounts of Canada, 2021 includes a line item on the government's 2020 payment to Newfoundland and Labrador (NL) under the Hibernia Dividend Backed Annuity (HDBA) Agreement.

Talking Points

- Canada and NL entered into the HDBA Agreement in 2019. It provides annual, defined payments from Canada to NL with a net value of $2.5 billion, beginning in 2019 and ending in 2056.

- In 2020, the Office of the Auditor General of Canada (OAG) recommended that the Department of Finance obtain authority from Parliament in order to make payments to NL under this agreement.

- Following the OAG's recommendation, the Department of Finance sought Parliament's authority to make the 2020 HDBA payment of $109,888,000 through the 2020 Supplementary Estimates (B), 2020-21. The bill, Appropriation Act No. 5, 2020-21, received Royal Assent on December 10, 2020.

- The government obtained Parliament's authority to make all future payments to NL under the HDBA in the Budget Implementation Act 2021, which received Royal Assent in June 2021.

If pressed:

- The HDBA Agreement allows Canada to net out from its annual payments to NL the estimated annual provincial corporate income taxes paid by the Canada Hibernia Holding Corporation (CHHC) to NL. Canada netted out from its 2020 payment approximately $7.5 million in provincial corporate income taxes to be paid by CHHC to NL.

Background

- In April 2019, the Government of Canada and the Government of Newfoundland and Labrador (NL) entered into the Hibernia Dividend Backed Annuity (HDBA) Agreement. The HDBA Agreement commits Canada to make annual, defined payments to NL totalling $3.3 billion, starting in 2019 and ending in 2056. The HDBA Agreement also commits NL to make annual, defined payments to Canada totalling $800 million, beginning in 2046 and ending in 2052. Therefore, Canada will pay a net amount of $2.5 billion to NL over the life of the Agreement. Payments are to be made to NL before December 31 of each year, with a true-up payment to occur before April 1 of the following year.

- CHHC is a wholly-owned subsidiary of the Canada Development Investment Corporation (CDEV). CHHC owns and operates Canada's working interest in the Hibernia offshore oil project. Canada is able to net out of its payments to NL provincial corporate income taxes paid by CHHC to NL.

- To make the initial payment to NL by December 2019, the Department of Finance created a Special Purpose Account (SPA) in the Consolidated Revenue Fund (CRF) from which dividends declared to Canada by CDEV, including CHHC's annual revenues, were remitted to NL.

- In 2020, the Office of the Auditor General of Canada issued an opinion on the Government of Canada's 2019-2020 consolidated financial statements stating that this payment was made without obtaining the authority of Parliament, and recommended that the Department of Finance seek parliamentary approval before making any future HDBA payments to NL.

- To ensure payments going forward met with approval by Parliament, the Department of Finance sought voted appropriations to make the 2020 HDBA payment to NL. The Budget Implementation Act, 2021 provides the Minister of Finance with statutory authority to make future HDBA payments, which received Royal Assent in June 2021.

Anticipated Areas of Questioning

1. Why is there over $7 million of lapsed funding for the 2020 HDBA payment to NL?

- Following the OAG's commentary recommending that the government obtain parliamentary authority to make HDBA payments to NL, the government sought voted appropriations to make the 2020 HDBA payment.

- CHHC's provincial corporate income taxes are netted out of the HDBA payments to NL. However, as these amounts were not known at the time of the request for voted appropriations, the government sought the full 2020 amount as outlined in the HDBA Agreement of $109,888,000.

- The approximately $7.5 million lapsed amount represents CHHC's corporate income taxes to NL that were deducted from the actual amount paid to NL for 2020 of $102,414,655.

2. Is this payment related to the Prime Minister's announcement in 2021 that the government will transfer its annual net revenues from the Hibernia offshore oil project Net Profits Interest (NPI) and Incidental Net Profits Interest (INPI)?

- These two payments are unrelated.The HDBA Agreement was entered into by Canada and NL in 2019. This Agreement makes defined, annual payments to NL on an annual basis. The transfer of net annual NPI and INPI revenues to NL was announced by the Prime Minister on July 28, 2021, and will transfer to the province an amount equivalent to Canada's yearly net revenues as they arise (an amount that is not pre-defined).

If pressed:

- The HDBA amounts were determined based on forecasts of estimated revenues of CHHC for its working interest in the Hibernia project. The NPI and INPI are commercial agreements entered into between the government and the Hibernia project owners in exchange for substantial government support for the Hibernia project, including loan guarantees and non-repayable contributions.

3. Why did Canada enter into the HDBA Agreement with NL?

- The HDBA Agreement entered into by Canada and NL maintains and enhances the province's right under the Atlantic Accord to be the principal beneficiary of the oil and gas resources off its shores, consistent with the requirement for a strong and unified Canada.

Ban on Foreign Investment in Housing

Issue

Budget 2022 announced the government’s intent to implement a ban on foreign investment in Canadian housing.

Budget Implementation Act, 2022, No. 1, tabled in Parliament on April 28, 2022, proposes legislation to implement the ban.

Talking Points

- With housing costs rising in many Canadian cities, there are concerns that foreign buyers may be contributing to pricing some Canadians out of the housing market.

- The proposed ban aims to curb foreign demand for Canadian housing. It is one part of a broader package of housing measures announced in Budget 2022.

If pressed:

- As proposed in the legislation, the ban would work by prohibiting people who are neither Canadian citizens nor permanent residents from acquiring residential property in Canada for a period of two years.

- Foreign individuals with work permits and who reside in Canada would be exempted, as would refugees and people fleeing international crises. International students on the path to becoming permanent residents would also be exempted in certain circumstances.

- To prevent foreign buyers from avoiding the ban through corporate structures, foreign entities such as trusts and corporations would also be subject to the prohibition.

- Foreign buyers acquiring residential property during the two-year ban may face offence charges and penalties, including forced divestment through a judicial sale.

- Further details will be communicated in the coming months.

Anticipated Areas of Questioning

1. What are the final details and when will they be released?

- The proposed legislation would set the basic architecture for the ban, including key definitions, exemptions and regulatory authorities.

- Final details would be implemented by subsequent regulations.

- The ban would only come into force once these final details are in place.

2. How will the government enforce the ban?

- Under the proposed legislation, the government would be able to pursue fines and judicial sale through the courts for instances of non-compliance with the ban.

- The government may come forward with additional measures to strengthen enforcement if needed.

3. What real impact will the ban have on affordability?

- The ban forms part of a broader package of housing affordability and supply measures announced in Budget 2022.

- Further details will be communicated in the coming months.

Canada Growth Fund

Issue

Members of the Standing Committee on Public Accounts may ask questions related to the announcement of the government’s intention to stand up a Canada Growth Fund in Budget 2022.

Talking Points

- The government announced in Budget 2022 its intention to launch the Canada Growth Fund.

- The Canada Growth Fund will be an arms-length public investment vehicle that will invest with the intention of attracting private capital to help meet Canada’s important national economic policy objectives.

- The Canada Growth Fund is expected to help close the underinvestment gap in Canada’s economy, with the intention of attracting $45 billion of private investment alongside the fund’s investment of $15 billion—an aggregate amount of $60 billion, which will contribute significantly to the annual amount of investment needed by Canada to reach net-zero by 2050 ($125-140 billion).

- The Canada Growth Fund will allow Canada to keep pace with its international peers, who have begun to launch growth funds that will attract trillions of dollars of private investment.

Background

Budget 2022 proposes to establish the Canada Growth Fund to attract substantial private sector investment to help meet important national economic policy goals:

- To reduce emissions and contribute to achieving Canada’s climate goals;

- To diversify our economy and bolster our exports by investing in the growth of low-carbon industries and new technologies across new and traditional sectors of Canada’s industrial base; and

- To support the restructuring of critical supply chains in areas important to Canada’s future prosperity—including our natural resources sector.

The Canada Growth Fund will be a new public investment vehicle that will operate at arms-length from the federal government. It will invest using a broad suite of financial instruments including all forms of debt, equity, guarantees, and specialized contracts. The fund will be initially capitalized at $15 billion over the next five years. It will invest on a concessionary basis, with the goal that for every dollar invested by the fund, it will aim to attract at least three dollars of private capital.

In standing up the Canada Growth Fund, the government intends to seek expert advice from within Canada and abroad. Following these consultations, details about the launch of the fund will be included in the 2022 fall economic and fiscal update. Funding for the Canada Growth Fund will be sourced from the existing fiscal framework.

Anticipated Areas of Questioning

1. The government has announced that funding for the Canada Growth Fund will be drawn from the existing fiscal framework. From where will these sources of funds be drawn?

- Final details on the Canada Growth Fund, including its sources of funds, will be announced in the 2022 fall economic and fiscal update.

2. Budget 2022 announces that the Canada Growth Fund will be capitalized with $15 billion over five years, but there is only $1.5 billion provisioned. What explains this discrepancy?

- The $15 billion of funding for the Canada Growth Fund refers to the fund’s capitalization from the government.

- The $1.51 billion amount set out in the table represents an initial estimate of the difference between what the fund will invest and what it will not earn back—approximately 10 per cent—due to the concessionary financing proposed to be provided by the Canada Growth Fund.

3. Budget 2022 states that the Canada Growth Fund will be initially capitalized with $15 billion. Does the government expect to provide future incremental funding to the Canada Growth Fund?

- The Canada Growth Fund will operate on commercial principles, and is intended to become a self-sustaining entity, with returns being reinvested by the fund.

The Council of the Federation’s Request to Increase the Canada Health Transfer

Issue

Since September 2020, provincial and territorial premiers have been calling on the federal government to increase the Canada Health Transfer to cover 35 per cent of their health expenditures and to maintain this level over time (i.e., an injection of $28 billion and annual growth of at least 5 per cent). In the lead up to the federal Budget 2022, the premiers launched an online awareness campaign to engage Canadians on this matter.

Talking Points

- Compared to the pre-pandemic growth track, the Canada Health Transfer is forecast to provide $12.6 billion in additional support over 5 years, starting in 2022-23, due to a strong post-pandemic GDP outlook.

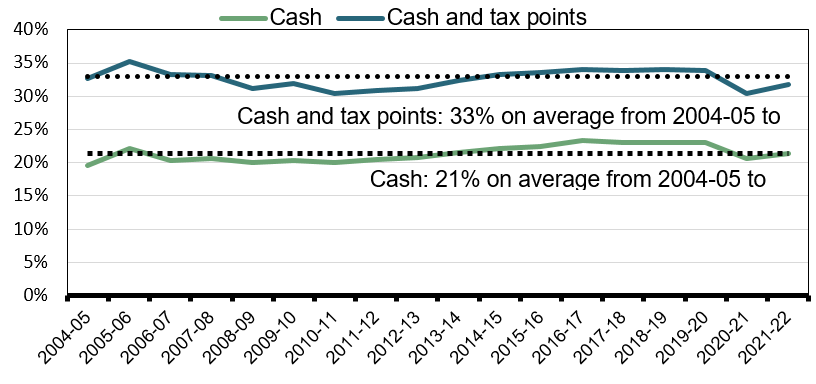

- Since the establishment of the Canada Health Transfer in 2004, the federal government has supported, on average, 33 per cent of provincial and territorial health expenditures through cash and tax point transfers.

- Since the start of the pandemic, the federal government has invested more than $69 billion, with more funding to be rolled out in future years, to lead a coordinated federal, provincial and territorial response to fight COVID-19 and protect the health and safety of Canadians.

Background

The Canada Health and Social Transfer (CHST) was restructured into two separate transfers – the Canada Health Transfer and the Canada Social Transfer, effective April 1, 2004. Since 2004, the Canada Health Transfer, on average, has covered 33 per cent of provincial and territorial health expenditures when accounting for the federal tax point transfer.

Statutory Federal Health Transfer (as % of PT Health Expenditures)

| Cash ($M) | Tax points ($M) | PT health expenditure ($M) | Cash as a share of PT expenditures | Cash and tax points as a share of PT expenditures | |

|---|---|---|---|---|---|

| 2004-05 | 16,770 | 11,206 | 85,738 | 20% | 33% |

| 2005-06 | 20,310 | 11,969 | 91,789 | 22% | 35% |

| 2006-07 | 20,140 | 12,713 | 98,713 | 20% | 33% |

| 2007-08 | 21,729 | 13,140 | 105,204 | 21% | 33% |

| 2008-09 | 22,768 | 12,670 | 113,552 | 20% | 31% |

| 2009-10 | 24,476 | 13,962 | 120,325 | 20% | 32% |

| 2010-11 | 25,672 | 13,086 | 127,716 | 20% | 30% |

| 2011-12 | 26,952 | 13,691 | 131,794 | 20% | 31% |

| 2012-13 | 28,569 | 14,399 | 137,632 | 21% | 31% |

| 2013-14 | 30,283 | 15,253 | 140,921 | 21% | 32% |

| 2014-15 | 32,113 | 16,098 | 144,792 | 22% | 33% |

| 2015-16 | 34,026 | 17,005 | 151,999 | 22% | 34% |

| 2016-17 | 36,068 | 16,593 | 154,516 | 23% | 34% |

| 2017-18 | 37,150 | 17,403 | 161,000 | 23% | 34% |

| 2018-19 | 38,584 | 18,298 | 167,507 | 23% | 34% |

| 2019-20 | 40,373 | 19,026 | 175,055 | 23% | 34% |

| 2020-21 | 41,870 | 19,944 | 203,573 | 21% | 30% |

| 2021-22 | 43,126 | 20,969 | 201,598 | 21% | 32% |

| Average | 21% | 33% |

Anticipated Areas of Questioning

1. Provinces and territories have been asking for a permanent increase to the Canada Health Transfer. Why has the Government not addressed this request?

- The Canada Health Transfer grows in line with a three-year moving average of nominal GDP, with total funding guaranteed to increase by at least 3 per cent per year. In 2022-23, the Canada Health Transfer will provide provinces and territories with $45.2 billion in support—an increase of 4.8 per cent over the 2021-22 baseline.

- Over the next five years, the Canada Health Transfer will provide provinces and territories with $12.6 billion more compared to the pre-pandemic growth track. This forecasted level of growth – 5.4 per cent on annual average – is significantly stronger than the previous five years of growth (3.6 per cent on annual average).

- Budget 2022 shows the government’s ongoing commitment to work with provinces and territories to deliver better health care outcomes for Canadians and proposes immediate investments to increase access to mental health care, and to strengthen the public health systems that keep Canadians safe. This includes a $2 billion top-up to the Canada Health Transfer to address medical backlogs, building on $4.5 billion of previous top-ups to the Transfer.

- $4 billion was provided in the fiscal year 2020-21. Volume 2 of the 2021 Public Accounts include this top‑up.

Digitalization of Money

Issue

The digitalization of money and financial services are transforming financial systems and challenging democratic institutions around the world.

Talking Points

- In Budget 2022, the Government of Canada announced a financial sector legislative review to ensure that the digitalization of money and financial services takes place responsibly, helps maintain the integrity of the financial system, promotes fair competition and protects both the finances of Canadians and our national security.

- Digital assets, including cryptocurrencies, should not be used to avoid global sanctions and fund illegal activities.

Background

Digital money and financial services innovations create a number of risks and challenges that need to be addressed. For instance, cryptocurrencies that have the potential to become more readily accepted as a means of payment and store of value might pose significant risks to financial stability and national security. They could also facilitate illicit activities while exposing consumers to financial risks.

The first phase of the review announced in Budget 2022 will focus on the digitalization of money, including digital currencies such as cryptocurrencies, stablecoins and Central Bank Digital Currency.

The legislative review will examine, among other factors: how to adapt the financial sector regulatory framework and toolbox to manage new digitalization risks; how to maintain the security and stability of the financial system in light of these evolving business models and technological capabilities; and the potential need for a central bank digital currency in Canada.

Federal and provincial regulators are collaborating and discussing regulatory approaches for stablecoins. The Bank of Canada has also been researching a CBDC.

Canada is engaged in several international fora that are examining the impact of crypto assets on the global financial system. This work across jurisdictions is important due to the globally integrated nature of financial markets and the transborder design of the technology underpinning crypto assets.

A Private Member’s Bill (Bill C-249, An Act respecting the encouragement of the growth of the cryptoasset sector)was introduced on February 9, 2022 by a Conservative Party MP and has been debated for one hour. This Bill focuses on encouraging the growth of the crypto-asset sector.

The Government has yet to publicly announce its position on Bill C-249.

Anticipated Areas of Questioning (Responsive)

1. When will consultations for the legislative review be launched and when will key policy decisions be implemented?

- We anticipate that further details on the process will be provided soon.

2. Is the government planning to regulate stablecoins? When?

- The Government is considering regulatory approaches to stablecoins.

- We need to consider the risks associated with stablecoin arrangements and the toolbox available to regulators to manage these new digitalization risks.

- This work will accelerate as part of the first phase of the financial sector legislative review announced in Budget 2022.

3. Has Canada fallen behind the curve in terms of crypto regulation, given movement in the US and elsewhere?

- This industry is evolving rapidly. Canadian regulators are working closely with international counterparts to stay on top of developments.

- The Government is also participating in international fora to ensure alignment with international standards and best practices regarding stablecoins.

- We recognize the need to provide regulatory clarity on these new products. Budget 2022 announced the launch of a financial sector legislative review focused on the digitalization of money and maintaining financial sector stability and security. The immediate focus is on digital currencies, including cryptocurrencies, stablecoins and Central Bank Digital Currencies.

4. Is the government planning to issue a Central Bank Digital Currency?

- As per Budget 2022, the Government of Canada is assessing the need of introducing a Central Bank Digital Currency in Canada.

- We are engaged with the Bank of Canada to further our policy thinking.

- We recognize the need to work with our international partners to explore the feasibility of CBDC, particularly as it pertains to the interoperability of our international financial system.

5. What is the Government’s position on Private Members Bill C-249 (An Act respecting the encouragement of the growth of the cryptoasset sector)?

- A safe and secure financial system is a cornerstone of our economy. The digitalization of money, including crypto-assets, creates benefits as well as risks that need to be addressed.

- Bill C-249 focuses solely on promoting the growth of crypto-assets. It does not address risks to consumer protection and the ongoing safety and security of the Canadian financial system.

- Budget 2022 announced that the Government would launch a legislative review process focused on the digitalization of money and maintaining financial sector stability and security. As part of this review, the federal government will work in collaboration with federal and provincial financial sector regulators to examine regulatory approaches to crypto-assets in a responsible manner.

- The Government will announce its position on Bill C-249 in due course.

Financial Assistance Provided to Ukraine

Issue

Canada has moved quickly to provide direct, substantial and meaningful financial assistance to Ukraine, to meet its urgent short-term financing needs, strengthen its economic resilience and respond to the ongoing humanitarian crisis.

Talking Points

- The Ukrainian government requires significant resources to stabilize its economy and – eventually – begin rebuilding.

- Canada has agreed to provide a loan of up to C$500 million to Ukraine under the Bretton Woods and Related Agreements Act (BWRAA), to support Ukraine’s budgetary needs.

- The first C$300 million of this loan was disbursed on April 20.

- In addition, Budget 2022 announced that Canada will offer up to C$1 billion in new loan resources through a new Administered Account for Ukraine at the International Monetary Fund.

- Financing provided through the Administered Account will help the Ukrainian government meet its urgent balance of payments needs, and support macro-economic stability in Ukraine.

- To date in 2022, Canada has also committed $245 million in humanitarian assistance and $35 million in development assistance to respond to the evolving needs of people affected by the situation. This is in addition to direct support for Ukraine’s military needs.

Background

In addition to the C$500 million BWRAA loan and the C$1 billion IMF Administered Account loan, Canada has also offered a C$120 million bilateral loan to support Ukraine’s economic resilience and governance reforms. Canada has also committed C$245 million in humanitarian assistance to help experienced partners in Ukraine and neighboring countries provide emergency health services, protection, support to displaced populations and essential life-saving services. An additional C$35 million in development assistance funding was provided to address emerging priorities, including supporting the resilience of Ukraine's government institutions and civil society organisations so they are able to meet the needs of Ukrainians – in particular women and vulnerable groups.

| Financial Assistance | Administered Amount |

|---|---|

| Previously announced military aid | $93.5 million |

| Additional military aid (lethal and non lethal) | $500 million |

| Humanitarian assistance | $245 million |

| Development assistance | $35 million |

| Immigration measures | $117 million |

| Operation UNIFIER | $338 million |

| Sub-total direct support: | $1.3 billion |

| Bilateral loans | $620 million |

| IMF Administered Account for Ukraine | $1 billion |

| Sub-total loan support: | $1.6 billion |

Anticipated Areas of Questioning

1. How will the Administered Account for Ukraine work?

- The IMF will administer donor loans and/or grants on a pass-through basis.

- Canada will account for its contributions to Ukraine in the same manner as a direct bilateral loan, including liability for all credit risk.

- The Administered Account may include some standardization of the terms to reduce burden for Ukraine. This remains subject to further discussion with Ukraine and other potential donors.

2. What are the advantages of the Administered Account, relative to direct bilateral lending to Ukraine?

- The establishment and use of a multi-donor account sends a strong signal of international support for Ukraine.

- Donors can minimize the administrative burden for Ukrainian authorities by streamlining the financing process for Ukraine, such as by agreeing on a certain standardization of terms.

- Resources will be disbursed to Ukraine in IMF Special Drawing Rights, which provides a safeguard to protect against the misuse of these resources in the event of an unrecognized regime change.

3. What is the purpose of the bilateral loan to Ukraine?

- On February 14, 2022, the Deputy Prime Minister announced that Canada had offered a loan of up to $500 million to Ukraine.

- On April 13, 2022, Canada and Ukraine finalized the loan agreement. The first disbursement ($300 million) was provided to Ukraine on April 2022, and the second disbursement is expected to follow shortly.

- The loan provides timely budgetary support that is critical to helping Ukraine provide basic supports to its population.

- As per the terms of the loan agreement, the funds may not be used, directly or indirectly, for lethal purposes.

- The loan was provided under the Bretton Woods and Related Agreements Act (BWRAA). Canada provided loans to Ukraine under this authority in 2014 and 2015. Ukraine fully repaid these loans in 2020.

4. Is Canada providing financial support to Ukraine?

- So far this year, Canada has offered almost $3.0 billion in assistance to Ukraine, in both direct support and loan support.

- Direct assistance includes military support, emergency health services, protection, support to displaced populations, and essential life-saving services such as shelter, water and sanitation, and food.

- Canada has also offered a total of $1.62 billion in loans to support Ukraine’s financial stability.

Budget 2022: Misalignment in Defence Spending

Issue

On April 22, 2022, the Parliamentary Budget Office highlighted a misalignment between funding figures for the Department of National Defence (DND) illustrated in a chart in Budget 2022 and those reported by DND in its 2022 Departmental Plan.

A Globe and Mail article subsequently characterized this difference as $15 billion in “unexplained” and “unaccounted for” military spending in Budget 2022.

Talking Points

- The difference in funding figures identified in the PBO report can be explained by the Budget 2022 forecast using more comprehensive information than DND’s Departmental Plan.

- Consistent with standard practice, DND’s Departmental Plan only includes funding that has been fully approved by the Treasury Board through the Treasury Board submission process.

- The Budget 2022 chart provides a forecast of all planned funding for DND, whether or not Treasury Board approvals have been sought yet. This is the forecast that best reflects current planned funding for the department.

- The difference in this case is mainly composed of capital funding and funding for military operations. For such expenditures, DND will only seek to access funding when it is needed.

Background

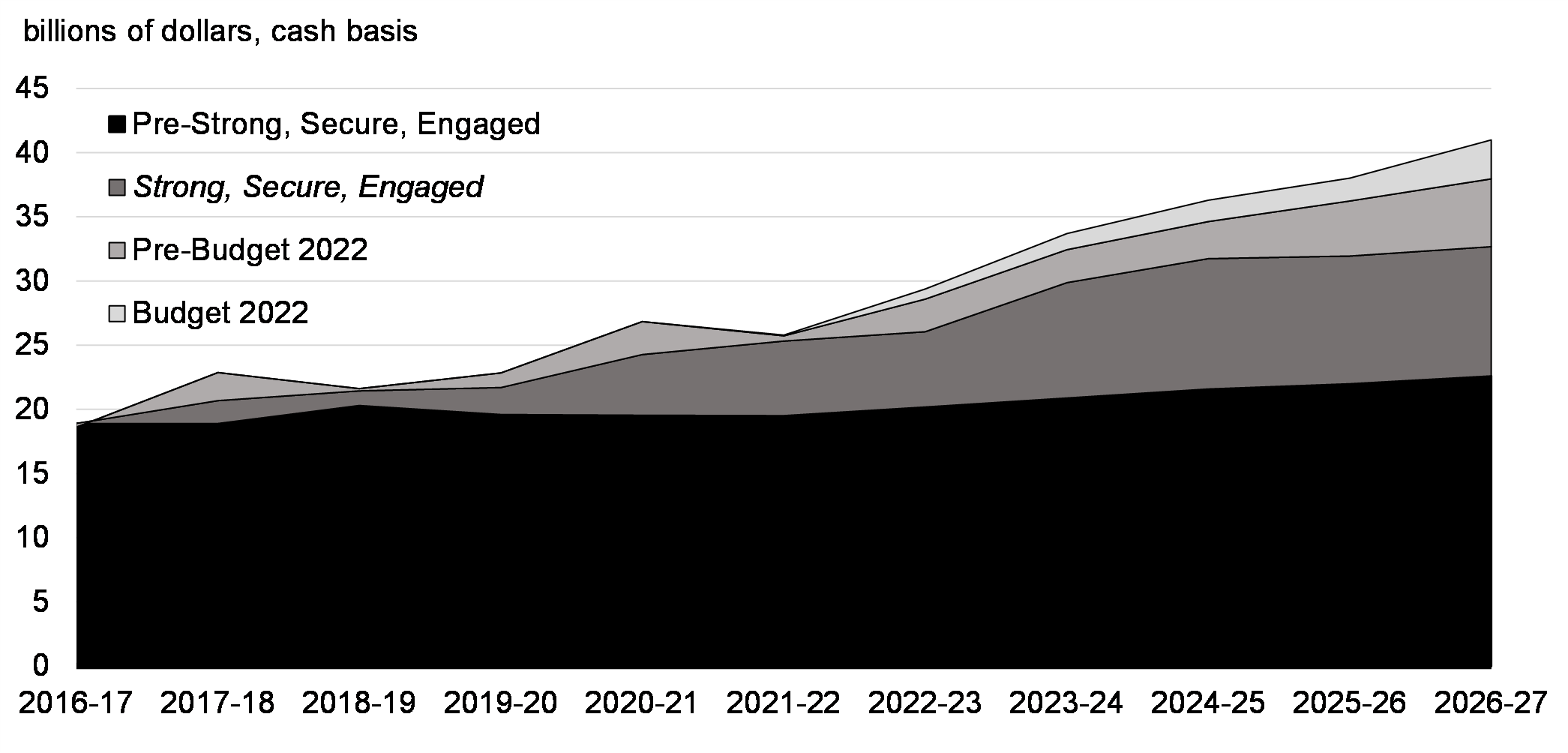

- Budget 2022 announced a total of more than $8 billion in new defence funding over five years – on top of planned increases associated with Canada’s 2017 defence policy, Strong, Secure, Engaged. This increase is illustrated in Chart 5.1 in the Budget Plan (below).

- In its April 22, 2022 report entitled “Budget 2022: Issues for Parliamentarians”, the Parliamentary Budget Office highlights a misalignment between the pre‑Budget 2022 funding levels shown in Chart 5.1 and forecasted spending reported by the Department of National Defence (DND) in its 2022 Departmental Plan. This difference is presented in the table below.

The difference is largely driven by major capital projects that were approved under Strong, Secure, Engaged, but that have not yet received Treasury Board approval, and as such are not captured in DND’s Departmental Plan. In addition, forecasted Canadian Armed Forces operations costs are not included in DND’s Departmental Plan as associated incremental funding is only accessed in-year. These would include Operations IMPACT, REASSURANCE, UNIFIER, and ARTEMIS, and peace support operations.

Funding for the Department of National Defence

| Pre-Budget 2022 funding levels as shown in Chart 5.1 of Budget 2022 | DND Departmental Plan 2022-23 | Difference | |

|---|---|---|---|

| 2022-23 | 28.599 | 25.950 | 2.649 |

| 2023-24 | 32.450 | 25.945 | 6.505 |

| 2024-25 | 34.632 | 24.963 | 9.669 |

Anticipated Areas of Questioning

1. Does Budget 2022 present larger figures for defence spending in order to boost Canada’s defence-to-GDP ratio and bring it closer to the 2 per cent NATO target?

- The forecast in Budget 2022 best reflects current planned funding for the Department of National Defence.

- With the funding announced in Budget 2022, we estimate that Canada’s defence spending as a share of GDP will rise to about 1.5 per cent, up from 1.36 per cent in 2021.

- Budget 2022 also announced a review of Canada’s defence policy. This review will focus on, amongst other things, the roles and responsibilities of the Canadian Armed Forces; its size and capabilities; and, the resources it requires.

2. The PBO has separately reported on delays in implementing capital projects. Given this, what certainty is there that defence funding will be spent as forecast in the Budget?

- The Budget 2022 projection of funding for DND reflects the current information regarding the status of DND capital projects, and the government is making its best efforts to move these projects forward to ensure the women and men of the Canadian Armed Forces get the equipment they need, when they need it.

- However, capital spending in the context of defence procurement is complex, and can be subject to delays.

- The fact that future spending is uncertain is precisely why DND’s Departmental Plan only includes funding that has been fully approved by the Treasury Board.

Inflation (Economic Impacts)

Issue

Consumer price inflation has risen significantly in recent months.

Talking Points

- We are acutely aware that many Canadians are being squeezed by higher prices, from gasoline to groceries to rent.

- With the Canadian economy just back to full capacity, the unusually high inflation we are experiencing is not the result of too much demand in the economy.

- This is a global phenomenon, where inflation beyond our borders has been boosted by:

- Higher global food, energy and other key commodity prices due to supply issues and the Russian invasion of Ukraine;

- Higher prices for manufactured and other traded goods caused by ongoing supply chain disruptions and unusually strong demand for goods as many services were restricted.

- The Bank of Canada and private sector economists expect inflation to ease over the next two-years and settle closer to the target range in 2023 as global inflationary pressures from higher commodity prices and clogged supply chains fade.

- Last December, the government and the Bank of Canada renewed the inflation target. The target has served Canada well for 30 years, maintaining inflation close to 2 per cent on average and will help ensure that prices normalize over the medium term.

- Budget 2022 firmly pivots the government’s focus from emergency COVID-19 expenditures toward targeted investments that will build Canada’s economic capacity for the long-term.

- These investments are designed to expand the capacity of the Canadian economy to supply goods, services and housing, thereby mitigating pressures on inflation and the cost of living.

Background

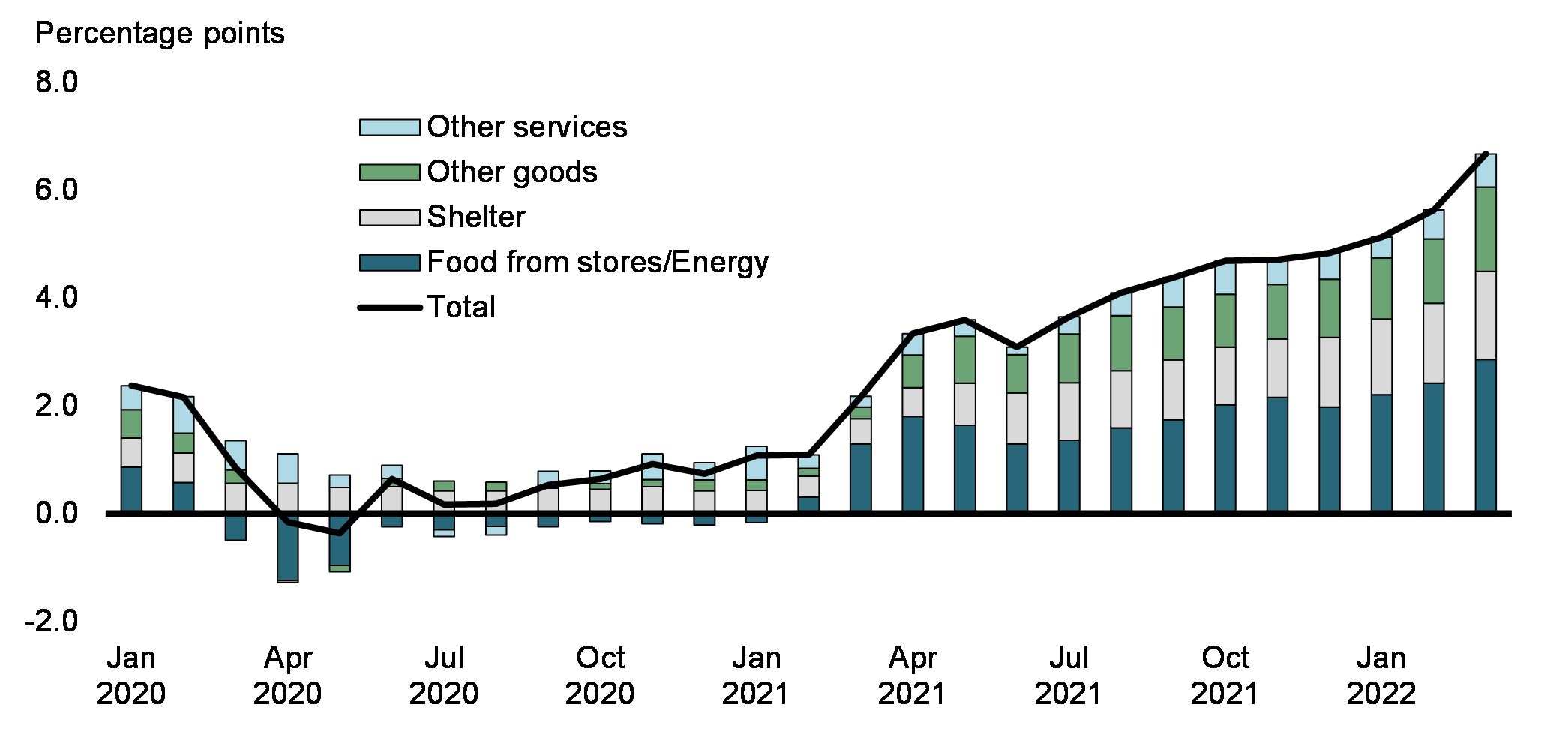

Total CPI inflation accelerated to 6.7% year-over-year in March 2022, a 31-year high and a full percentage point higher than February (Table 1). Inflation has been above the 3% upper end of the Bank of Canada’s inflation control range for twelve consecutive months – the longest period since the introduction of inflation targeting. CPI inflation excluding volatile energy and food components reached 4.6% in March.

| 2021-Q4 | 2022-Q1 | 2022-Q2 | Jan-22 | Feb-22 | Mar-22 | |

|---|---|---|---|---|---|---|

| Total CPI Inflation | ||||||

| Year-over-year, not seasonally adjusted | 4.7 | 5.8 | 5.1 | 5.7 | 6.7 | |

Bank of Canada April MPR Outlook |

4.7 | 5.6 | 5.8 | |||

| Period-over-period, seasonally adjusted | 1.4 | 1.8 | 0.6 | 0.8 | 0.9 | |

| Core Inflation | ||||||

| CPI-common* | 2.1 | 2.7 | 2.5 | 2.7 | 2.8 | |

| CPI-median* | 3.0 | 3.5 | 3.3 | 3.5 | 3.8 | |

| CPI-trim* | 3.6 | 4.4 | 4.1 | 4.4 | 4.7 | |

|

Sources: Statistics Canada; Department of Finance calculations. |

||||||

The acceleration of consumer prices is not unique to Canada as inflation in most of the largest OECD economies has increased sharply since early 2021 and reached record highs in March 2022. Nevertheless, current inflation levels differ across countries. Outside Japan, inflation ranges from 4.5% in France to 8.5% in the United States (see International Comparisons section for more detail) in March 2022.

The global concern over inflation comes after decades during which inflation was relatively low. Several global factors have driven inflation up in Canada, including higher energy and food prices, strains in supply chains, and unprecedented demand for goods (Figure 1). The Russian invasion of Ukraine has exacerbated these pressures more recently. Overall, unusually high inflation in Canada has been concentrated in traded goods prices.

- Oil prices are set in global markets, and the pass‑through to the price of gasoline in Canada is typically rapid and high. Domestic food prices are also affected because they are linked to global agricultural prices as well as domestic crop conditions and local supply constraints. Combined with unfavorable weather conditions last year in many parts of the world, the Russian invasion of Ukraine has pushed agricultural prices such as wheat futures to a 14-year high. Energy and food price inflation are at 28% and 8% in March, respectively (while they had increased by about 2% per year over the 10 years prior to the pandemic). Together, these components are contributing roughly 3.0 percentage points to CPI inflation in Canada.

- Prices of durable goods, such as furniture, household appliances and motor vehicles, have surged along with strong global demand and supply chain disruptions. Motor vehicle prices continued to be supported by tight inventory owing to the ongoing global semi-conductor shortage, which limited production of new vehicles.

Contribution to Year-Over-Year Consumer Price Inflation, Canada

More recently, price of services has also strengthened, mainly attributable to the shelter services components, which accounted for more than two-thirds of service prices growth. Low interest rates and a desire for more housing space, combined with limited supply and higher inputs costs for construction, resulted in strong house price appreciation. Other services prices, however, are rising at a slower pace. For example, child care and personal care services are growing at less than 2% and 3%, respectively, because price developments in these categories primarily reflect pressures on domestic wages. Moreover, some categories, such as communications, have seen prices fall.

Prior to the war in Ukraine, there was some evidence that the supply-side issues in the global economy were gradually being resolved. Delivery times had shortened a bit, global car production was increasing again and the prices of semiconductors had come off their peaks. Combined with an expected rebalancing of global demand towards services, these developments were providing a basis for expecting that inflationary pressures would ease over time, both globally and here in Canada.

Overall, in its most recent Monetary Policy Report, the Bank of Canada expects inflation to stay higher for longer than previously projected. CPI inflation is expected to average just below 6% through the first half of 2022, averaging 5.3% in 2022 (up from 4.2% expected in January) before slowing to 2.8% in 2023 (up from 2.3% previously) (Table 2). The upward revision reflects higher food and energy costs due to the Russian invasion of Ukraine, as well as ongoing impacts from supply chain disruptions.

| 2022Q1 | 2022Q2 | 2023Q3 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Bank of Canada MPR – April 2022 | 5.6 | 5.8 | 5.3 | 5.3 | 2.8 |

| February Survey (Finance Canada) | 5.0 | 4.3 | 3.6 | 3.9 | 2.4 |

International Comparisons

Inflation in Canada is elevated but comparatively lower than in some other countries and regions. Canada (6.7%) currently has the fourth highest rate of headline inflation in the G7, surpassed by the U.S. (8.5%), Germany (7.3%) and U.K. (7.0%).

Soaring energy and food prices are a global phenomenon currently pushing up inflation in most countries. Among the G7 economies, they are large contributors to inflation, explaining around 65% of the price increase over the last year in Germany and France and 80% in Italy.

Underlying inflation, defined as inflation excluding food and energy, is also a key driver. These underlying pressures have been more pronounced in the U.S., the U.K., and Canada. In Canada as well as in the U.S., shelter costs have made larger contribution to inflation than in most other countries amid strength in the housing market. Supply-chain disruptions, including bottlenecks in the supply of semiconductors weighing on the productive capacity of the automotive sector, and pent-up consumer demand due to COVID-19 have contributed to high inflation in most countries but particularly so in the U.S. and the U.K. Tight labour markets, as well as reductions in labour supply due to health concerns and restrictions to cross-border movements, likely contributed more to price pressures for services in the U.K. and the U.S.

| March 2022 (Year-over-year) |

|

|---|---|

| U.S. | 8.5 |

| OECD* | 7.7 |

| Euro Area | 7.5 |

| Germany | 7.3 |

| U.K. | 7.0 |

| G20* | 6.8 |

| Canada | 6.7 |

| Italy | 6.5 |

| G7* | 6.3 |

| France | 4.5 |

| Japan* | 0.9 |

|

Source: Haver Analytics, OECD. |

|

Inflation (Fiscal Impact)

Issue

What is the impact of inflation on the budgetary balance?

Talking Points

- In the short-term, higher inflation generally means an improved fiscal outlook for the federal government.

- Based on Department of Finance sensitivity analysis, a one percentage point increase in nominal GDP inflation would mean about $2 billion annually, on average, in additional net revenue (i.e. increase in revenues less the increase in expenses) over the medium term – all else equal.

- Revenues rise as corporate and personal income tax and GST, among other, revenues rise. However, some offsetting occurs as a large portion of government expenses also increase.

- Old Age Security and the Canada Child Benefit are indexed to CPI;

- The Canada Health Transfer and Equalization are indexed to nominal GDP growth.

- That said, this analysis has a number of caveats:

- It assumes that higher inflation does not lead to higher interest rates – which is not usually the case, nor is it in current circumstances.

- An increase in interest rates above assumed levels leads to higher public debt charge payments that would further offset higher net revenues arising from inflation.

- The more inflation is sustained, the costs of goods and services will also rise for the government, meaning higher costs for providing services and benefits to Canadians – this is not fully reflected in the above analysis.

- The extent to which inflation is beneficial for government bottom lines in Canada also depends on how the price of our exports is being affected relative to that of our imports.

- That is, when the price of our exports rises relative to that of our imports, which is the case now given the higher price of oil, Canada as a whole experiences a real income gain – i.e. higher real profits and real personal incomes. Net federal tax revenues therefore rise more than if this were not the case.

- The above analysis assumes that the two prices (exports and imports) rise equally together.

- It assumes that higher inflation does not lead to higher interest rates – which is not usually the case, nor is it in current circumstances.

Background

More than half of federal transfer payment dollars are indexed to inflation – whether the Consumer Price Index (CPI) or nominal GDP – sometimes with a lag. This share is forecasted at 60 per cent in 2023-24 (an indicative year), based on Economic and Fiscal Update (EFU) 2021.

| ($B) | |

|---|---|

| Transfer payments indexed to CPI or nominal GDP | 178.2 |

| Seniors benefits | 73.0 |

| Canada Health Transfer | 48.7 |

| Canada Child Benefit | 25.8 |

| Equalization | 23.6 |

| Other* | 7.1 |

| Transfer payments not directly indexed to CPI or nominal GDP | 118.7 |

| Total transfer payments** | 296.9 |

|

*Other includes refundable tax credits for individuals (e.g. Canada Workers Benefit), and certain escalators for Indigenous transfer payments. |

|

Question 1: For the transfer payments linked to CPI or nominal GDP, how are they indexed?

Seniors benefits: Payments are indexed quarterly for CPI increases. Payments do not decrease if CPI decreases.

Canada Health Transfer: Grows in line with a three-year moving average of nominal GDP (the projection for that fiscal year as determined by the Minister of Finance no later than 3 months before the start of the fiscal year, and the previous 2 years), with funding guaranteed to increase by at least 3 per cent per year.

Equalization: Grows in line with a three-year moving average of nominal GDP (current year forecast, and previous 2 years).

Personal income tax refundable tax credits, e.g. Canada Child Benefit and Canada Workers Benefit: Inflation protected with a one-year lag. Payments are calculated based on CPI inflation adjusted net family incomes from the previous year (e.g. payments for benefit year 2022-23 will be based on incomes and inflation in 2021). The benefit year begins in July.

- Note: the same applies for the GST credit. For example, beginning in July 2022, payments will be adjusted for CPI inflation that occurred in 2021 (September 2021 vs. September 2020).

10-year grant funding for First Nations: Grows with CPI inflation and beneficiary population growth, with floor of 2 per cent per year.

The CMHC’s Mortgage Insurance Fund

Issue

The term ‘Mortgage Insurance Fund’ in the Public Accounts refers to the government’s public mortgage insurance, provided through Canada Mortgage and Housing Corporation. In the past, Parlimantarians have asked questions about the Government’s exposure to the housing market in general.

Talking Points

- Government-backed mortgage insurance provides first-time homebuyers and other Canadians access to mortgage credit.

- The Minister of Finance sets the minimum standards for mortgage insurance. Adjustments have been made to support the stability of the housing market.

- Mortgage insurance is provided on a commercial basis by the Canada Mortgage and Housing Corporation and two private-sector competitors.

- The risk management practices of these financial institutions are overseen by the Office of the Superintendent of Financial Institutions.

- There are legislated limits on the dollar amount of CMHC-insured mortgage loans and privately insured mortgage loans. These limits are in place to provide Parliament with oversight of taxpayer exposure to the housing finance system.

Background

- The Government has taken a number of actions to contain risks in the housing market and support long-term affordability and financial stability.

- In recent years, the Government has announced adjustments to the rules for government-backed insured mortgages, to ensure Canadians take on mortgages they can afford and government-backed programs support safer forms of lending.

- The Office of the Superintendent of Financial Institutions (OSFI) also plays an important role. The mortgage insurers, including CMHC, follow OSFI guidance for stress testing to ensure they have the capital required to withstand economic and housing market downturns.

- The Government aims to manage its exposure to the housing market while at the same time supporting competition and ensuring adequate access to housing finance for Canadians.

- The ‘Mortgage Insurance Fund’ properly refers to the government’s public mortgage insurance, provided through Canada Mortgage and Housing Corporation. Separate from this Fund, legislation authorizes the Minister of Finance to guarantee mortgage loan contracts written by the two private mortgage insurance companies – Sagen and Canada Guaranty.

- CMHC administers two funds: The Mortgage Insurance Fund and the Mortgage-Backed Securities Guarantee Fund.

| As at March 31, 2021 | CMHC (Vol 1 – Table 11.8) (pg. 397, English) (pg. 404, French) |

Private mortgage insurers (Vol 1 – Table 11.6) (pg. 392, English) (pg. 398, French) |

Total |

|---|---|---|---|

| Legislative limit | 750 | 350 | 1,050 |

| Insurance-in-force | 422 | 255 | 677 |

|

N.B. CMHC legislative limit was temporarily increased at outset of the pandemic and reverts back to pre-COVID level of $600B in 2025. |

|||

Anticipated Areas of Questioning

1. Why does the government guarantee the contracts of private mortgage insurers?

- The Government guarantees the contracts of private mortgage insurers to help provide choice to lenders and facilitate competition in the market place.

- Private mortgage insurers provide an important buffer of private capital to draw from in the event of mortgage defaults before the Government steps in.

- Private mortgage insurers pay the Government of Canada for the guarantee they receive. These funds go into the Consolidated Revenue Fund and help to fund government programs. Private mortgage insurers pay the government for their guarantee ($38 million in respect of 2020).

2. Is the Mortgage Insurance Fund solvent?

- An Actuarial Study of the Mortgage Insurance Fund is produced as of September 30 of each year.

- The most recent independent Actuarial Report indicates that the financial condition is “satisfactory.”

Overpayments of COVID-19 Measures

Issue

What overpayments were recorded in the Public Accounts 2021 due to COVID-19?

Talking Points

- In the Public Accounts 2021, $3.7 billion in overpayments were recorded for the Canada Emergency Response Benefit (CERB) and the Employment Insurance Emergency Response Benefit (EI ERB).

- In the COVID-19 context, response measures were designed to support Canadians and businesses rapidly by issuing payments on an expedited basis using an attestation-based approach, as a first line of action.

- Robust post-payment verification by the Canada Revenue Agency (CRA) and Employment and Social Development Canada (ESDC) will use a risk-based approach focusing on high-risk cases for overpayment and fraud.

- The focus was on responding quickly to the needs of Canadians.

- Once an overpayment is determined, the repayment is recognized as a reduction of transfer payments expenses and reflected in the Public Accounts.

Background

- For the CERB and EI ERB payments, ESDC and CRA relied on client attestation— in order to deliver the financial support to Canadians as quickly as possible. Both ESDC and CRA will be undertaking integrity and compliance work in subsequent years to establish if an overpayment was made.

- The $3.7 billion benefit overpayment recorded as a receivable largely relates to overpayments of $3B reported within the EI operating account for EI ERB. The remaining difference of $0.7B relates to CERB overpayments.

- If pressed on questions related to post-payment verification:

- Canada Revenue Agency and ESDC would be best positioned to discuss plans for post-payment verification.

- Where overpayments have been determined, the government work with Canadians to recover these funds.

Carbon Pollution Pricing

Issue

The Government publishes an annual accounting of pollution pricing proceeds assessed and returned in each jurisdiction where the federal system applies. Members of Parliament and the public continue to take an interest in understanding the financial flows.

Talking Points

- Carbon pollution pricing has been in place across Canada since 2019, when it was introduced at a price of $20/tonne of CO2-equivalent emissions.

- The national benchmark for the carbon pollution price has increased each year since, and now sits at $50/tonne.

- The federal system for pricing carbon pollution applies in full or in part in jurisdictions that choose to voluntarily adopt the federal system, or in those that do not have their own system which meets the federal benchmark.

- All proceeds from the federal system are returned to the jurisdiction of origin – either through direct payments to ‘voluntary’ governments, or through support to households, farmers, Indigenous groups, and businesses in other jurisdictions.

- For clarity and transparency, the Minister of Environment and Climate Change publishes a report each year detailing the amounts assessed and returned in each jurisdiction where the federal system applies.

- The most recent Report was tabled in Parliament in March 2022, for the April 2020 to March 2021 fuel charge year, when the carbon price was $30/tonne.

- The Public Accounts of Canada has also reported pertinent financial information on federal carbon pollution pricing since the 2018-19 report, as the first Climate Action Incentive payments were made in early 2019. The Public Accounts information, however, is presented only at a national level.

If pressed:

- There are some differences between aggregate financial figures published in the Public Accounts and the Minister of Environment and Climate Change’s report. These are due to differences in reporting periods and definitions.

Background

Proceeds

The Greenhouse Gas Pollution Pricing Act (the Act) establishes the framework for the federal carbon pollution pricing system (the “backstop”) and is comprised of two components:

- A regulatory charge on fossil fuels ("fuel charge") which is under the policy purview of the Minister of Finance and administered by the Canada Revenue Agency (CRA); and

- An output-based pricing system (OBPS) for industrial facilities which is under the policy purview of the Minister of Environment and administered by Environment and Climate Change Canada.

The benchmark carbon price is set at $50/tonne of CO2-equivalent emissions ($50/t) in 2022-23. The Government confirmed that the price will rise to $65 in 2023-24, increasing by $15 annually until it reaches $170 in 2030-31.

The federal backstop system applies, in whole or in part, in provinces and territories that request it and in those that do not have a system in place that meets certain minimum requirements. Specifically, the federal fuel charge applies, in Ontario, Manitoba, Saskatchewan, Alberta, Yukon and Nunavut (with the latter two being ‘voluntary’). The federal output-based pricing system applies in Prince Edward Island, Manitoba, partially in Saskatchewan, Yukon and Nunavut (with all but Manitoba and Saskatchewan being ‘voluntary’).

Return of Proceeds from the Federal Carbon Pollution Pricing System

By law, the Government must distribute the net fuel charge proceeds in respect of a given province or territory to either the provincial/territorial government, prescribed persons in that province/territory, or a combination of both. Similar provisions are in place regarding the excess emissions charge under the OBPS.

- In the case of the two voluntary fuel charge jurisdictions of Yukon and Nunavut, all direct proceeds are returned directly to those governments.

- In the case of ‘non-voluntary’ jurisdictions, the bulk of the direct proceeds from the fuel charge are returned through quarterly Climate Action Incentive (CAI) payments. The remainder of proceeds are planned to be returned to farmers through refundable tax credits (Bill C-8, currently before Parliament, contains the proposed mechanism), to Indigenous communities, and to small and medium-sized enterprises through federal programming.

With respect to the return of OBPS proceeds, in February 2022, ECCC announced that all proceeds collected under the OBPS would be returned to the jurisdiction of origin via two programs: the Decarbonization Incentive Program and the Future Electricity Fund.

CAI Payments for 2022-23

On March 21, 2022, the Government released the following CAI payment amounts for the 2022-23 fuel charge year (carbon price of $50/t), to be delivered via quarterly benefit payments beginning in July 2022.

| Family Member | Ontario | Manitoba | Saskatchewan | Alberta |

|---|---|---|---|---|

| First adult | $373 | $416 | $550 | $539 |

| Second adult | $186 | $208 | $275 | $270 |

| First child | $93 | $104 | $138 | $135 |

| Second child | $93 | $104 | $138 | $135 |

| Total | $745 | $832 | $1,101 | $1,079 |

|

Amounts do not reflect the 10 per cent supplement for residents of small and rural communities. |

||||

Anticipated Areas of Questioning

1. Why are the aggregate amounts in the Public Accounts different from the aggregate amounts in the GGPPA Annual Report (the “Report”) for the year 2020-21?

- The Public Accounts figures include both federal fuel charge and federal output-based pricing system (OBPS) amounts, while the Report only included federal fuel charge amounts.

- With respect to fuel charge proceeds and CAI payments, the Report attributes these amounts to the fuel charge year to which they relate.

- The Public Accounts, on the other hand, attributes these amounts to the fiscal year in which they were assessed.

2. Why has the Government not returned all proceeds assessed to-date?

- The federal carbon pollution pricing system is “revenue neutral” and returns all direct proceeds back to the jurisdictions of origin. For 2019-20 and 2020-21, more than 90% of the proceeds have been returned.

- The remaining amounts mostly pertain to yet-to-be-spent federal programming, will be returned to SMEs through a program which was announced in Budget 2022.

- The Government also is finalizing a program to return fuel charge proceeds to Indigenous communities through co-developed solutions.

- By law, the Government cannot retain any fuel charge proceeds.

3. Please explain the amounts related to carbon pollution pricing in the 2020-21 Public Accounts and in the Report.

- For the 2020-21 fiscal year. the Public Accounts report:

- $4.2 billion in fuel charge proceeds assessed;

- $0.2 billion in output-based pricing system (OBPS) proceeds assessed; and,

- $4.6 billion in fuel charge proceeds returned.

- Over $4.5 billion of this is due to CAI payments.

- Amounts returned exceed the amounts assessed due to timing factors.

- For example, some CAI payments in 2020-21 pertain to the 2021-22 fuel charge year, when the price on carbon was $40 per tonne, whereas the revenues collected in 2020-21 reflect a price of $30 per tonne.

- Cumulative amounts returned and assessed in each jurisdiction will equalize over time.

- By way of comparison, the Report shows:

- $4.2 billion in fuel charge proceeds (no OBPS proceeds were reported);

- $4.1 billion in CAI payments made; and,

- $0.5 billion in funds set aside to be returned through other federal programming that has not yet been publicly specified or spent.

- Note, in particular, the difference in CAI payments between the Public Accounts (over $4.5 billion) and the Report ($4.1 billion).

Quantitative Easing – Impact on the Government's Financial Results

- The Bank of Canada launched a range of measures during the COVID-19 pandemic to keep markets functioning and credit flowing. Among these measures, the Bank introduced several large-scale asset purchase programs, including:

- the Bankers’ Acceptance Purchase Facility;

- the Canada Mortgage Bond Purchase Program;

- the Corporate Bond Purchase Program;

- the Commercial Paper Purchase Program;

- the Provincial Bond Purchase Program;

- the Provincial Money Market Purchase Program; and,

- the Government of Canada Bond Purchase Program (GBPP), also referred to as quantitative easing.

- Under these programs, the Bank purchased securities on financial markets from financial institutions. The Bank paid for these purchases by increasing financial institutions’ settlement balances, or deposits, with the Bank. Settlement balances earn interest for the financial institutions (currently at a rate of 0.5 per cent) and can be used to settle transactions with other financial institutions at the end of every day.

- With the exception of the GBPP, these programs were discontinued as market conditions improved. The GBPP is now in a reinvestment phase, during which the Bank is purchasing Government of Canada bonds solely to replace maturing GBPP purchases.

- For accounting purposes in the Public Accounts, because the Bank of Canada, as a Crown corporation, is part of the government, its purchase of Government of Canada bonds is treated as the government’s repurchase and retirement of its own debt.

- This means that when the Bank purchases Government of Canada bonds, the government records as a gain or loss the difference between the purchase price of these bonds and their value in the government’s books. Because interest rates have been on a general downward trend in recent years, bond prices have generally been higher than their book value, resulting in a net loss. This net loss, which totaled $19 billion for GBPP purchases in 2020-21, is reflected in the Public Accounts as a reduction in the Bank of Canada’s profit recorded as part of “Other revenues – Enterprise Crown corporations and other government business enterprises” on the Consolidated Statement of Operations and Accumulated Deficit.

- Over the period the securities are held by the Bank, the Bank will continue to record coupon interest received on the securities as revenue, and the government will continue to record the payment of this interest as part of public debt charges, with no overall impact on the budgetary balance.

Contingent Liabilities Subsequent Event

Issue

Why was a transaction/event from October 2021 booked in the prior year?

Talking Points

- The federal election in September 2021 resulted in a delay in the release of Public Accounts 2021.

- On September 29, 2021, the Federal Court dismissed Canada's application for a judicial review of the Canadian Human Rights Tribunal's (CHRT) orders on compensation and definition of a First Nations child for Jordan's Principle.

- Accounting and auditing standards require a review of subsequent events up to the date of signature of the financial statements and completion of their audit (September 9, 2021 in this year's instance).

- However, when there is a material event prior to the release of the financial statements, management is required to consider if the financial statements need to be revised.

- Therefore, as a result of the Federal Court's decision, the government reassessed its best estimate of contingent liability based on information up to November 19, 2021.

- It is important to note that this amount will continue to be reassessed on a periodic basis until a final resolution is reached, with adjustments reflected in the annual deficit amount in future years.

Background

- The government is continuing its efforts to negotiate a settlement for the resolution of all current litigation related to the First Nations Child and Family Services (FNCFS) Program and Jordan's Principle.

- Release of Public Accounts 2021 was delayed due to the federal election which occurred on September 20, 2021.

- For reporting purposes, the subsequent event period typically refers to the time between the end of the fiscal year and the date the financial statements are made public.

- Accounting and auditing standards include provisions for material subsequent events which provide sufficient, additional evidence relating to conditions that existed at the date of the financial statements.