Briefing binder created for the Deputy Minister of Finance on the occasion of his appearance before the Standing Senate Committee on Banking, Commerce and the Economy on May 4, 2023 on “Business Investment in Canada”

Parliamentary Environment Analysis

Standing Senate Committee on Banking, Commerce and the Economy (BANC)

Business Investment in Canada

Background

- On December 16, 2021, the Standing Senate Committee on Banking, Commerce and the Economy (BANC) was authorized by the Senate to examine and report on matters relating to banking, trade and commerce generally. The Committee decided to initiate several exploratory studies on topics they believed important to examine in the aftermath of COVID-19, including "business investment in Canada".

- The Committee first studied business investment in Canada in the spring of 2022 and heard from Bank of Canada Governor Tiff Macklem, and former governors Stephen Poloz and David Dodge.

- Since starting the study, BANC has tabled two reports, an interim report from June 2022 summarizing witness testimony on business investment, and a more recent one titled "The State of the Economy and Inflation", tabled in the Senate in February 2023, in which business investment is identified as a policy challenge.

- In March 2023, the committee resumed this study and has heard from several stakeholders including innovators, lawyers, and academics.

- The committee is particularly interested in understanding the reasons behind the decline of business investment, including regulatory and legislative frameworks, protection of intellectual property (IP), and commercialization of government-funded research.

Independent Senators Group (ISG)

- Senators from the ISG have expressed interest in the protection of intellectual property to support Canada's competitiveness. The Senators recognized that the government has made significant investments to incentivize research and innovation but have often questioned if this is enough to increase productivity and attract private investments.

- A common concern among ISG members is that there is no integration between the investments made by the government and the economy overall and that even though Canadian universities and companies are doing research, it is not being commercialized, the IP is not owned by Canada, or start-ups prefer to scale up in other countries. Senators have requested that invited witnesses address this disconnection, including if IP or commercialization requirements should be attached to government funding, whether the granting councils should play a bigger role in IP, or if funding should be going elsewhere.

- ISG Senators with clearly defined interests include Colin Deacon who is perhaps the most critical of all members about Canada's IP protection framework, and attributes Canada's innovation stagnation to a "regulatory burden".

- Also related to IP, Tony Loffreda's questions have focused on the importance of data governance, accessibility, and sharing, and how to guarantee Canada remains an international player.

- Hassan Yussuff has questioned the role other levels of government should play in the protection of IP and increasing productivity, as he believes any solution will require collaboration between all levels.

Anticipated Areas of Questioning

- Canada has the highest regulatory burden at the municipal, provincial, and federal levels of virtually any economy of the developed world. What is the government doing to ease this and encourage investment in Canadian businesses?

- The government has made significant investments in research to foster innovation; however, we've heard we're missing the opportunity to monetize this research and it is being bought by foreign multinationals. How can we better protect our IP to support our competitiveness internationally?

- Do you think there is value in adding IP or commercialization requirements to government funding?

- Beyond investments and tax incentives, how can we catalyze the growth of Canadian companies?

- How do you see all levels of government collaborating to promote innovation, competitiveness, and growth?

Conservative Party of Canada (CPC)

- Like CPC members in the House, CPC Senators have raised concerns over increased spending by the government, the deficit, and the impact these may have on Canada's competitiveness. At BANC, only Senator Elizabeth Marshall – out of the two CPC Senators on the Committee – has participated in the hearings since the committee resumed its study.

- In line with her party, Senator Marshall has questioned whether increased spending on incentives will result in more productivity and competitiveness. She sought comments from the business community on whether the government's strategy to leverage private investment is effective, and specifically asked about the government's role and governance structures of Crown corporations such as the Canada Infrastructure Bank (CIB), Canada Growth Fund (CGF) and Canada Innovation Corporation (CIC).

- Senator Marshall also noted that big companies continue to leave Canada or prefer to invest elsewhere, and wondered if this is due to the government's focus on supporting small-and-medium enterprises (SMEs).

Anticipated Areas of Questioning

- The government is spending billions of dollars on new Crown corporations such as the CIB, CGF, and CIC to leverage private investment, some may say with limited success. Why is there limited interest from the private sector in these funding mechanisms?

- What is it about Canada that makes many large companies prefer doing business in other jurisdictions, especially the U.S.? Is it our regulatory and fiscal framework?

- Do you think we are over-subsidizing SMEs?

Canadian Senators Group (CSG)

- CSG Senators, Pamela Wallin and Larry Smith, have asked witnesses whether the government's efforts to attract investment are enough. Both Senators have noted that increased government funding for research and development may not be enough and that this funding should come with IP requirements.

- They have also agreed that other approaches should be considered to promote innovation such as regulatory modernization and using public procurement as a tool to promote growth.

- Senator Smith has specifically asked about the importance of having a strong fiscal regime and whether Canada's deficit was creating uncertainty for the business community, hence reducing interest in investing in the country.

- Given repetitive statements by witnesses on Canadian businesses' lack of ambition, Senator Wallin often seeks recommendations on how to build awareness on the issue, promote and support growth within the SMEs community.

Anticipated Areas of Questioning

- There are several government incentives for small businesses, but we have heard they don't have the willingness to grow due to a lack of ambition. What can we do to promote or renew Canada's business culture?

- The U.S. is adopting a more protectionist approach to manufacturing and procurement. Beyond the incentives announced in Budget 2023, is there anything else Canada could be doing to promote investment and growth, such as a new industrial strategy or a "buy Canadian" policy?

Progressive Senate Group (PSG)

- PSG Senators, Clément Gignac and Diane Bellemare, have explored different challenges and policy solutions to increase investment in Canada. They have asked witnesses about government funding, the impact of international trade rules, Canada's demographics, and training.

- Senator Gignac has raised concerns over new tax credits announced in Budget 2023, asking witnesses if these are enough or if streamlining the regulatory and fiscal frameworks may be a better approach.

- Senator Gignac has also questioned the reason why Canada doesn't encourage more public procurement to attract investment and whether it has any relation to international trade rules and strong ties with the U.S. Mr. Gignac has expressed interest in the role pension plans can play in investment, and he will often bring Quebec and some of its policies as an example to questioned if these could be adopted nationally.

- Senator Diane Bellemare has focused on the impact labour shortages have on business investments. She has asked witnesses for recommendations to attract and keep researchers in Canada to foster innovation. She's also questioned if the government should invest more in skills development and promoting entrepreneurship.

Anticipated Areas of Questioning

- Do you have any thoughts about the participation of pension funds, for example, the Canada Pension Plan Investment Board (CPPIB), in fostering innovation and economic growth? Should we revisit its mandate and be inspired by Quebec's Caisse de dépôt?

- Several witnesses have recommended procurement as a tool to increase investment. Do you see the free trade agreements that we have with the U.S. and other countries as impediments to an increase in procurement?

- Are you concerned that Canadian talent, that has been funded by the government, is seeking opportunities abroad due to a lack of support to protect their IP or commercialize it? Do we need a talent retention strategy, or what else can the government do?

Backgrounder on Business Investment in Technology

1. Update on Overall Business Investment Performance

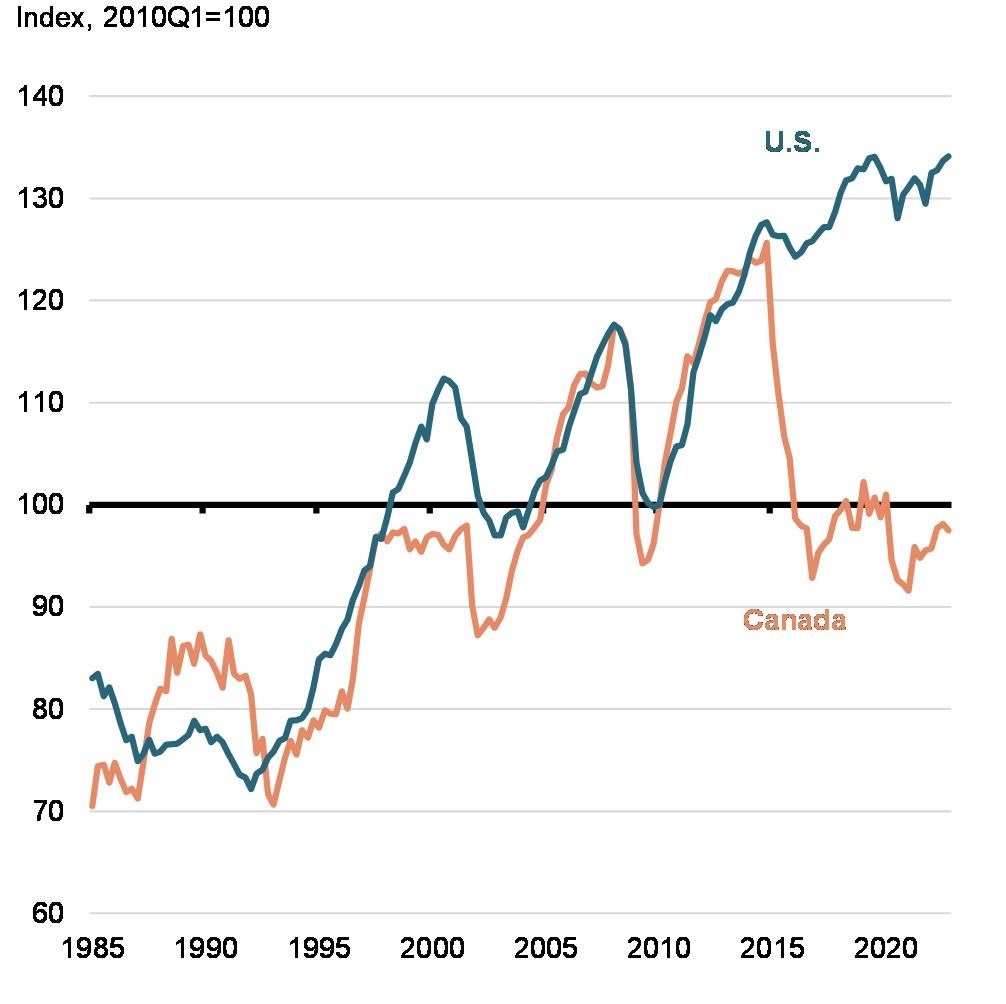

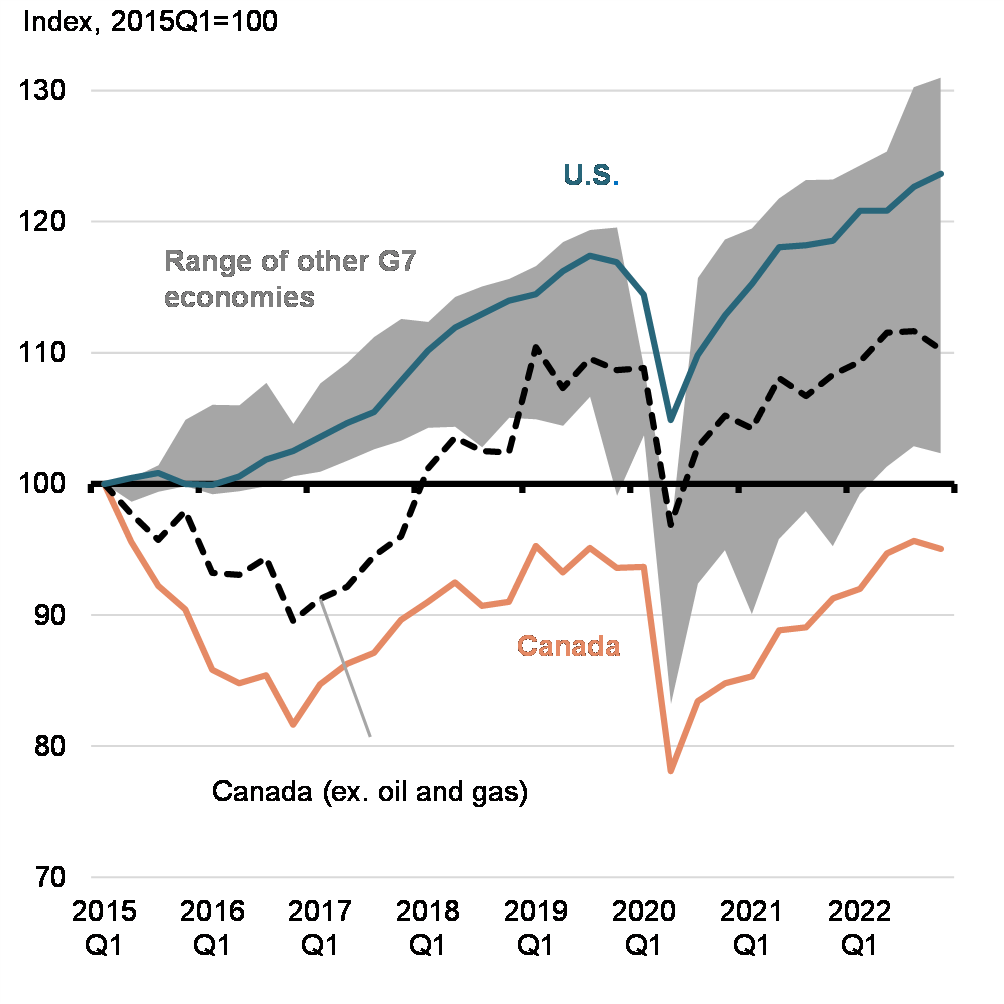

- Business investment in Canada has been particularly weak over the past decade, falling as a share of GDP and lagging the trend seen in the U.S. (Chart 1). In fact, all of our G7 peers have outperformed Canada in business investment since 2015 (Chart 2).

Ratio of Real Business Investment to Real GDP

Real Business Investment Since 2015, G7 Comparison

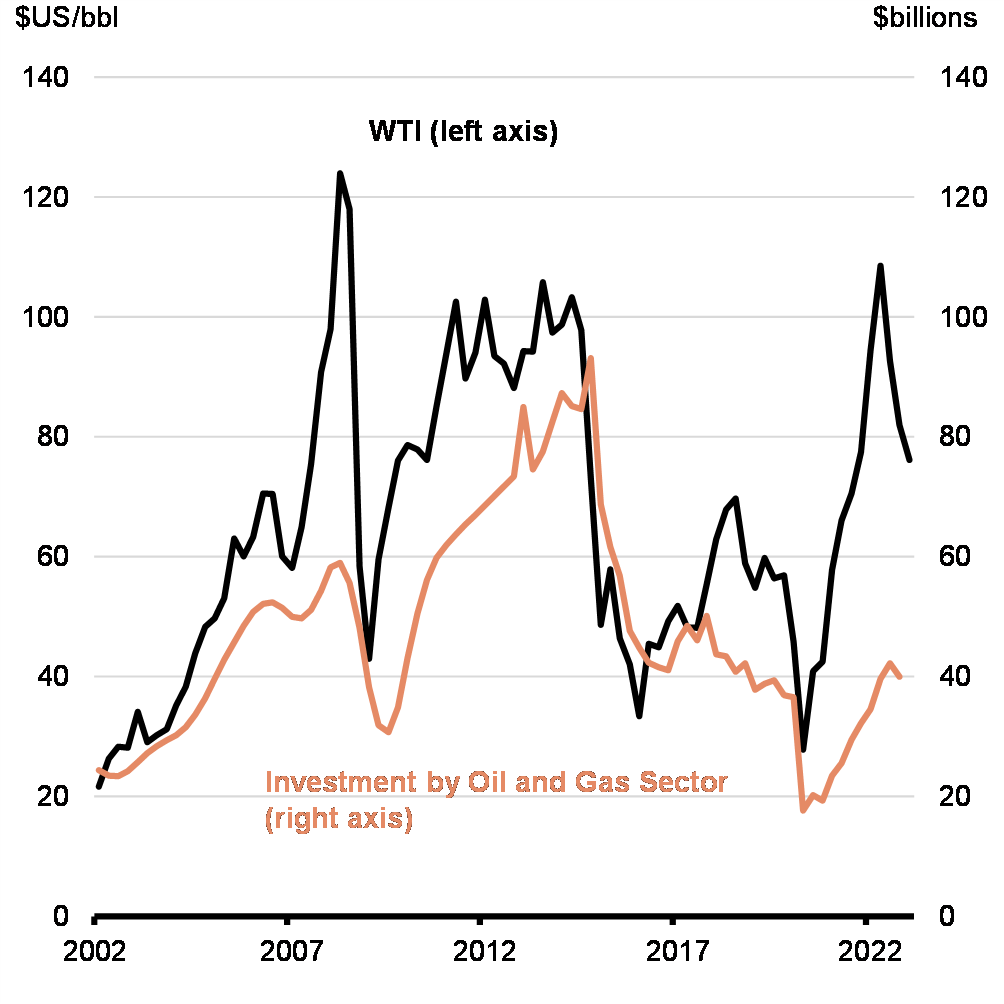

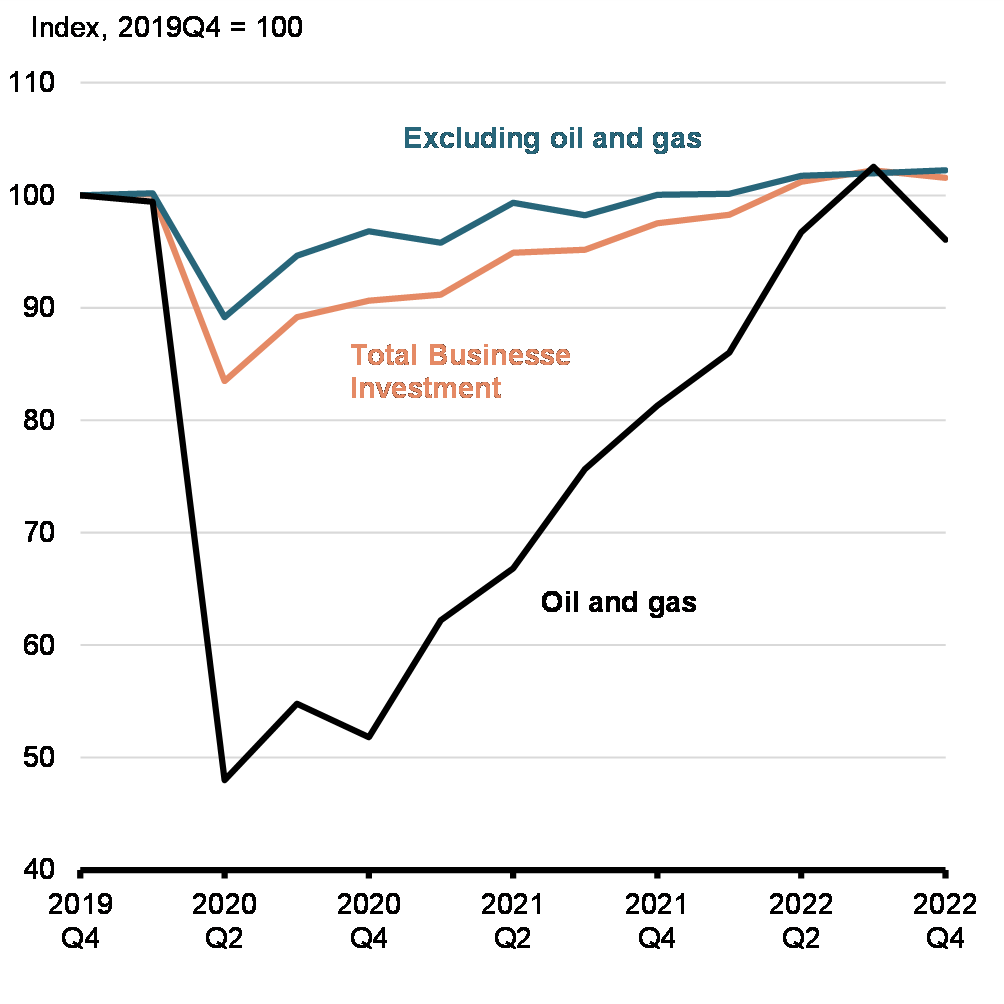

- A slump in Canada's oil and gas sector investment following the 2014 oil-price collapse has been particularly influential. More recently, investment in the oil and gas sector has improved, but not as much as the recent higher oil prices would have suggested according to historical relationship (Chart 3). If investment in oil and gas had followed its historical pattern of behavior, it would have provided an offset to weakness stemming from other sources.

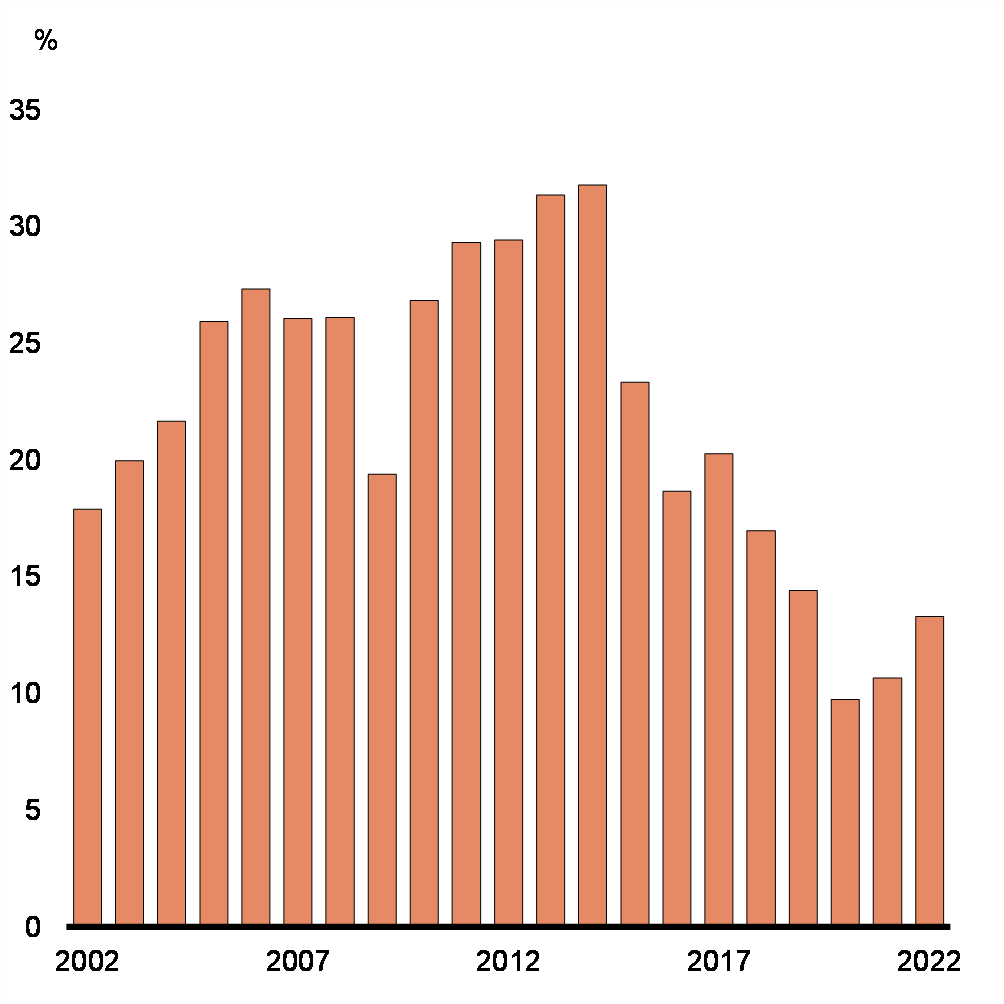

- At its peak in 2014, the oil and gas sector accounted for 32% ($88 billion) of all business investment in Canada (Chart 4). In 2022, it accounted for only 13% (roughly $39 billion at annualized levels) of business investment.

- While the oil and gas sector has played a major role in driving weakness in business investment, Canada's underperformance is broad-based across sectors. Critically, Canada has been investing less in ICT and R&D (see next sections).

Capital Spending by Oil and Gas Sector and Crude Oil Prices

Capital Spending in Oil and Gas Sector as a share of Business Investment

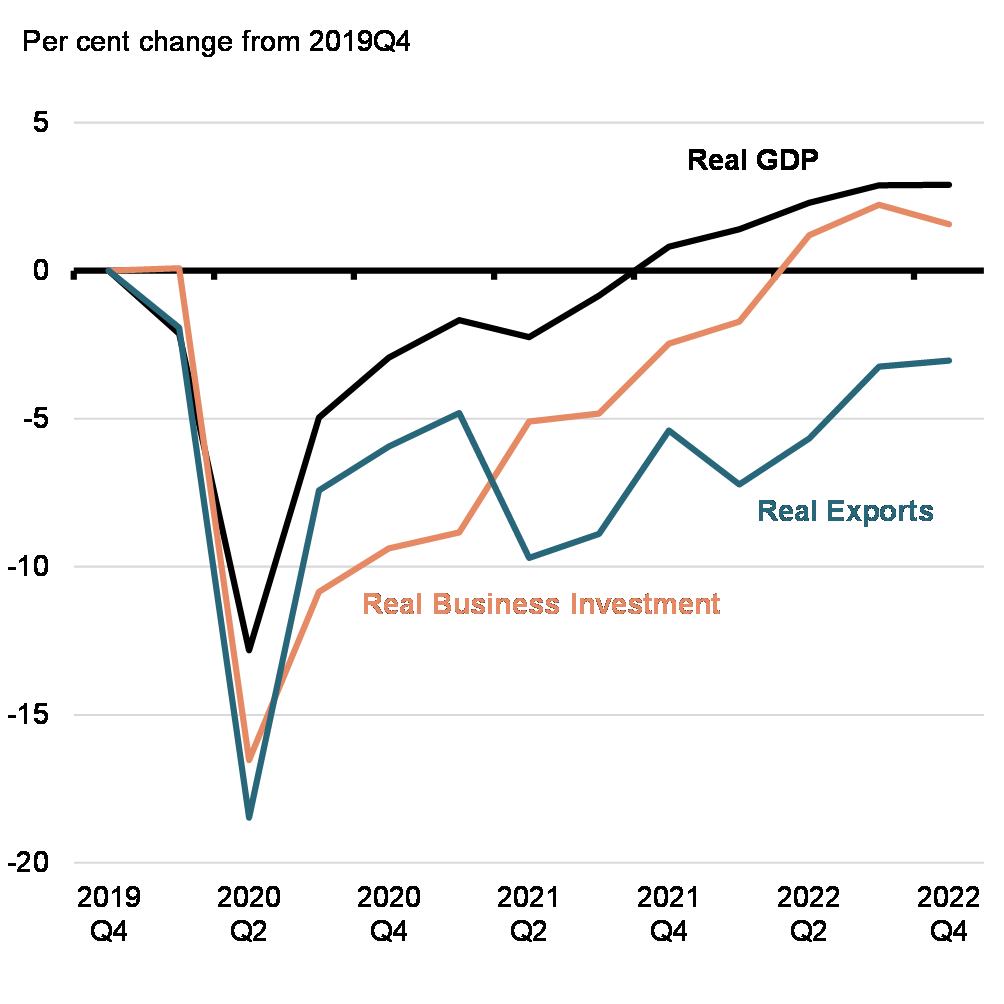

- Canada's long-term underperformance in business investment has continued more recently (see Annex). Business investment in Canada stands 1.6% above its pre-pandemic level as of 2022Q4 (Chart 5), a slower recovery than that of overall GDP (+2.9%) and falling short of the growth rates typically associated with the robust levels of investment intentions we have seen. This stands in contrast to the stronger bounce-back seen in the U.S. whereas business investment is 6.0% above its pre-pandemic level (Chart 6).

Real GDP, Real Business Investment and Real Exports

Real Business Investment Recovery since the Pandemic

2. Business Investment in Technology

Structural challenges to investment in technology

- The inherent uncertainty associated with new technology can leave it predisposed to under investment, both in terms of technology creation and adoption.

- Technology creators often require long and uncertain lead times for development and commercialization. For example, it can take years of research and development and product testing before companies working on pharmaceuticals, artificial intelligence, advanced computing, and other advanced technologies, are in a position to commercialize their innovations. This uncertainty can lead to challenges in securing financing at the early stages of technology development.

- The inability to verify the potential returns from developing new technologies can require technology firms to offer a premium to potential financiers to compensate for the higher levels of risk.

- Technology firms can face specific challenges accessing debt financing as they may lack sufficient collateral to secure debt.

- For cutting edge or niche technologies it can be difficult to find financiers interesting in putting in the groundwork needed to consider offering financing at any premium.

- Venture capital (VC) financing is often better suited than other financing options to overcome these challenges.

- VC financiers have the ability specialize in specific technology areas allowing them to better evaluate the economic potential of new technologies.

- The patient equity financing provided through VCs does not suffer from the challenges posed by a lack of collateral, and often comes with entrepreneurial mentoring services.

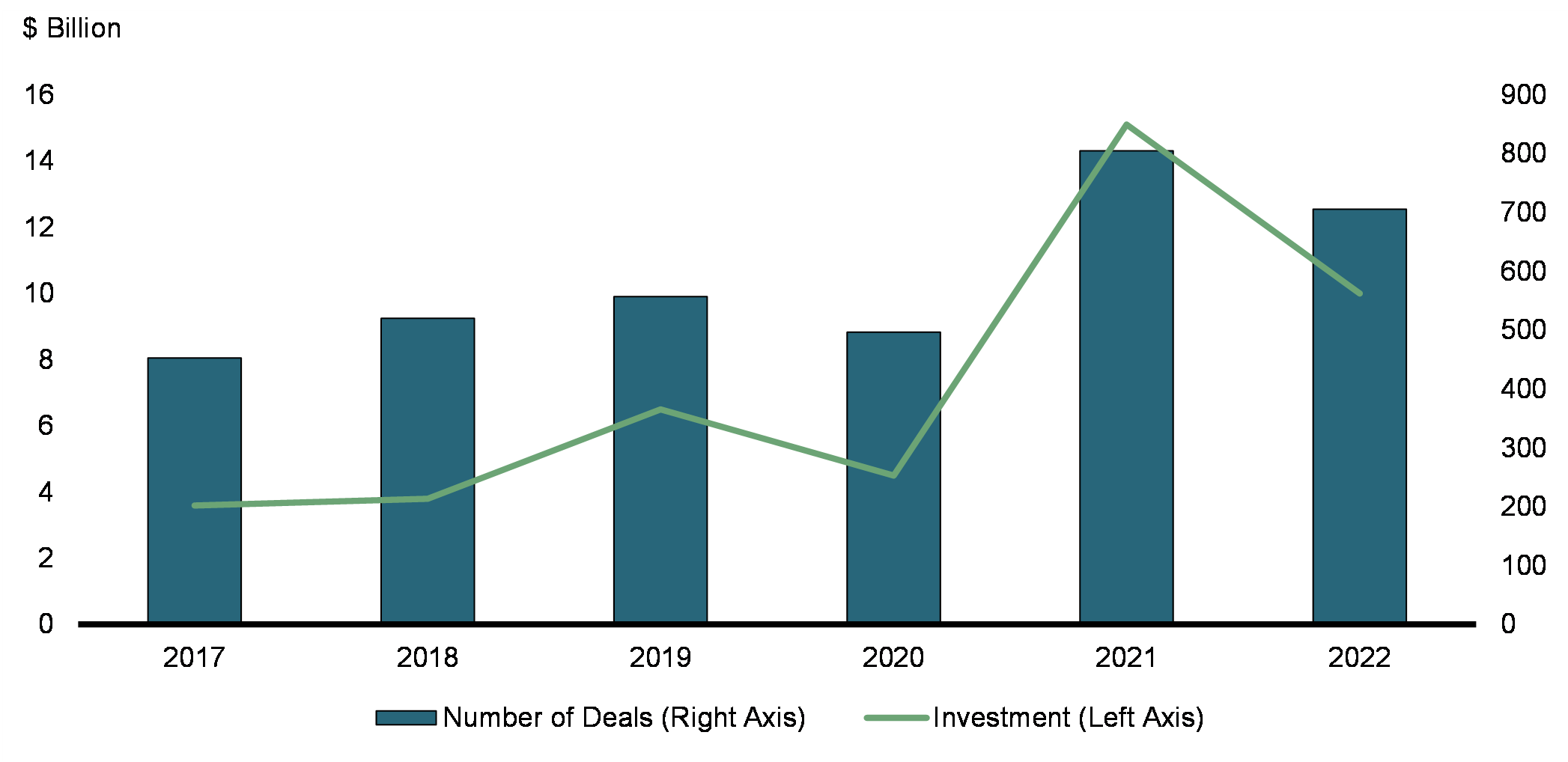

- In the lead up to the pandemic, VC financing in Canada had been steadily rising for several years. While VC financing fell in 2020 at the start of COVID, 2021 saw a record-breaking level of new VC investment, with $15.1B invested over 805 deals, more than doubling the level in 2019. In 2022, investments slowed but still closed with $10B in new financing.

Venture Capital Investment in Canada – 2017-2022

- Once technology firms have established a base of intellectual property (IP) (e.g., patents) which can be evaluated and valued, they may be able to leverage this IP to obtain external financing, earn licensing incomes, or send a signal of its enhanced value to the market (i.e., commercializing IP). Academic literature has shown that IP has positive effects on access to capital especially for start-ups in the IT sector, those facing significant competition for capital, and those founded by inexperienced entrepreneurs.

- Firms seeking to adopt new technologies also face challenges related to uncertainty. Firms may face challenges evaluating the expected return on their investments in new in technologies given risks related to the underlying productivity improving capacity of the new technologies, but also uncertainty in their markets. For example, business face continued uncertainty over the pace of the green transition and speed of advancement in green technologies.

- To reduce uncertainty, governments can use tax, financing, and regulatory polices, and particularly with respect to climate change, set out long term credible policy frameworks to help de-risk investment decisions.

- For example, to de-risk investments in green technology the government is providing tax credits for the adoption of clean technologies in addition to setting a predictable path for carbon pricing that provides a necessary framework to help firms de-risk their investment decisions.

Canada's performance in investment in technology

- Canada lags behind other countries in measures of business investment in technology (Chart 8). Canada ranks in the bottom half of OECD countries in terms investment in both machinery and equipment (M&E) and information and communication technology (ICT) (equipment, software and data) as a share of GDP.

Investment in Information and Communications Technology, 2015-2019

Business Expenditures on Research and Development

- * Portion of sentence redacted *, with the gap in Canada's business R&D spending as a share of GDP and that of the U.S. and OECD average widening over the past 2 decades (Chart 9).

- Currently Canada's business sector R&D intensity is just over one-third of R&D intensity in the U.S. and less than half of the OECD average (Table 1).

- This trend has been continuing despite Canada having relatively better performance in high-education R&D intensity (HERD), which almost 80% higher than the U.S. This suggests that there may be an insufficient link between academic R&D and business R&D.

- The effect of weak business R&D intensity and weak translation between academic R&D and business R&D is reflected in Canada's patent creation. Canada ranks 18th among 37 OECD countries in terms of patents per capita.

| Business R&D | High-Education R&D | ||||

|---|---|---|---|---|---|

| 2021 Values | 2021 OECD Ranking (37 countries) | 2021 Values | 2021 OECD Ranking (37 countries) | ||

| U.S. | 2.7 | 3 | U.K. | 0.7 | 7 |

| Japan | 2.6 | 4 | Canada | 0.6 | 8 |

| Germany | 2.1 | 9 | Australia | 0.6 | 10 |

| U.K. | 2.1 | 10 | Germany | 0.6 | 13 |

| France | 1.5 | 16 | France | 0.4 | 18 |

| Canada | 0.9 | 22 | Japan | 0.4 | 22 |

| Australia | 0.9 | 23 | U.S. | 0.4 | 25 |

| Italy | 0.9 | 24 | Italy | 0.3 | 26 |

| OECD Average | 2.0 | N/A | OECD Average | 0.4 | N/A |

- Despite the importance of IP, particularly in the form of patents, very few Canadian firms invest in patents.

- Only 1% of Canadian firms invested in new patents between 2017 and 2019, while among OECD countries, 6% of firms invested in new patents in 2016 alone.

- In terms of patent ownership, 2% of firms in Canada owned at least one patent with a much higher propensity for large firms than small firms. Within Canada, 23.7% of large firms (500+ employees) own patents, compared to 5.7% of firms with 20-99 employees. The ownership rate was much lower for smaller firms with 2.3% of firms with 5-19 employees and 0.8% of firms with 1-4 employees owning patents. Nevertheless, small firms make up the majority of patent applications per year, at around 56% of applications in 2015, compared to 34% for large firms.

- A lack of awareness of the importance and value of patents or other IP among Canadian firms is often cited as a factor behind this lack of investment in IP. Studies indicate that only 7% of Canadian firms seek information, guidance, or advice on IP, while 67% of Canadian firms indicated they either did not know the importance of IP in securing financing or thought it was unimportant.

A number of structural factors could be driving Canada's weak investment in technology

- Although natural resources sectors are important adopters of technology (i.e., investment in M&E), they are less intensive in terms of technology creation (e.g., low R&D intensity) compared to other sectors. For instance, R&D intensity of oil and gas and mining is only 0.8% as compared to 2.9% of the manufacturing sector (2019). Canada's large resource sector contributes to Canada's the underperformance in technology investment.

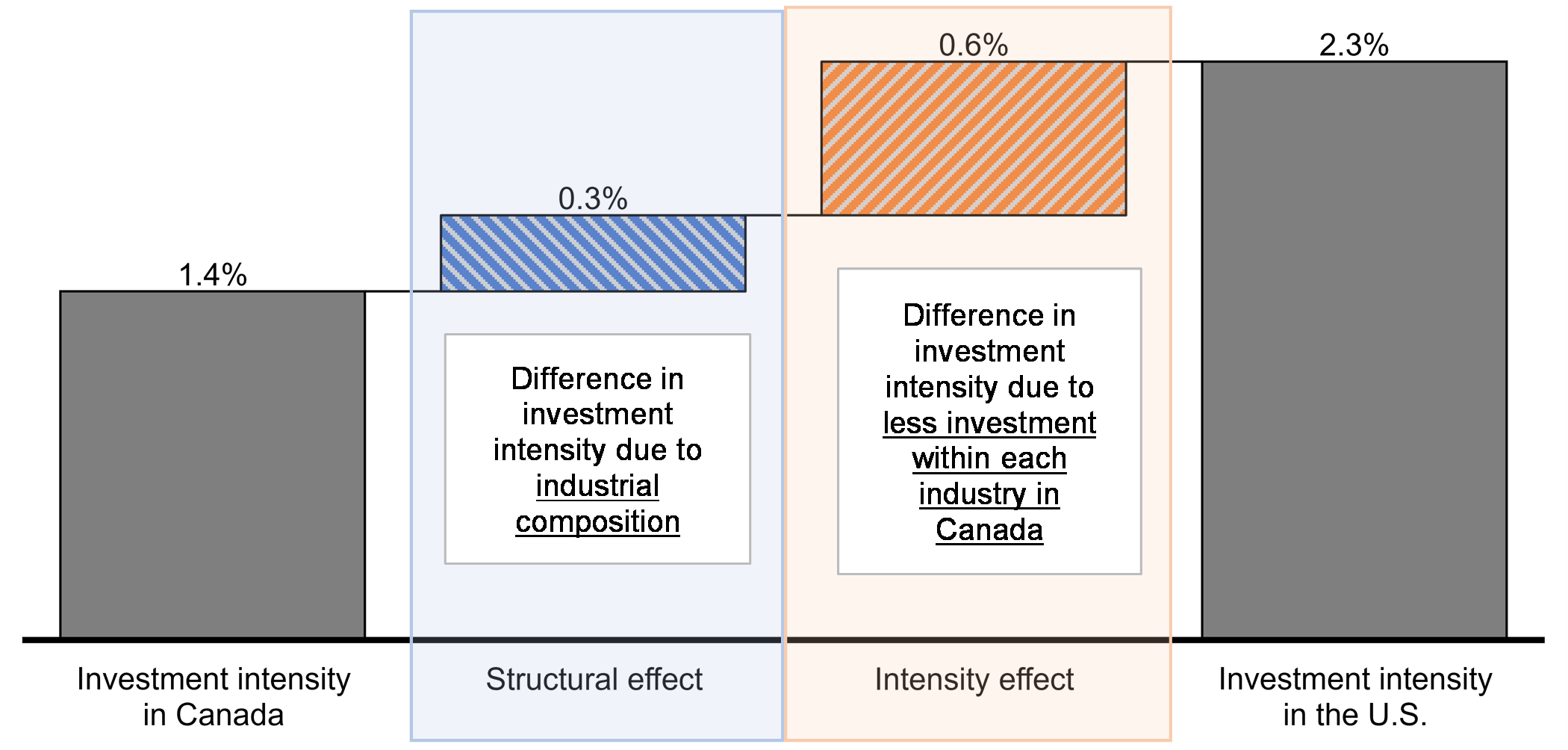

- However, lagging investment in technology is not purely due to the sectoral distribution of Canada's economy. Canada's lack of business investment in technology is broad-based across various sectors. For instance, the majority of Canada's investment gap with the U.S. in R&D or intangible ICT investment (Chart 10) is explained by the difference within sectors between the two countries, rather than the difference in sectoral composition.

Decomposition of computer software and databases investment intensity between Canada and the U.S., 2018

- While regulations are necessary to protect Canada's environment, health and safety of Canadians, and maintain the stability and independence of our economy, regulations can carry economic cost. It is important to strike the right balance between meeting the intended objectives of the regulations and imposing burdensome regulations.

- According to the OECD's 2018 Product Market Regulation (PMR) index, Canada has the 4th most restrictive regulatory environment in the OECD.

- Notably Canada also has high barriers to FDI, ranking the 4th most restrictive in the OECD. FDI can provide important benefits to domestic markets through technological and knowledge spillovers from foreign multinationals, as well as by driving competition and resource reallocation which can spur business investments.

- Canada has fragmented internal markets, with each province and territory having their own, often conflicting, regulatory frameworks. Fragmented markets reduce the size of firm's relevant markets, in turn reducing potential for economies of scale and key investment drivers like competition.

| Overall (38 countries) | Barriers to FDI (38 countries) | ||

|---|---|---|---|

| U.K. | 38 | Germany | 28 |

| Germany | 35 | U.K. | 22 |

| Australia | 31 | France | 20 |

| Italy | 23 | Italy | 16 |

| Japan | 16 | Japan | 16 |

| France | 10 | U.S. | 9 |

| U.S. | 5 | Australia | 5 |

| Canada | 4 | Canada | 4 |

- A lack of university education among managers in Canada could be a factor behind Canada's weak investment in technology.

- Only 43% of Canadian managers are university-educated, compared to approximately 60% of managers in the U.S.

- Lower managerial education could hinder the ability of Canadian firms to make strategic decisions with respect to investments in technology and investment in IP.

Providing incentives for business investment in technology through a broad-based framework policy

- A key principle to supporting technology investment by Canadian businesses is to support the private sector in adapting to digitalization and the green transition.

- Broad-based measures – including financing support, tax incentives, and market framework and regulatory policies supporting the effective functioning of markets – will provide appropriate support and incentives while allowing the market to continue to drive its own investment decisions.

- Targeted direct support can be used to respond to the unique needs of specific sectors or projects that are of significant national economic significance.

- The federal government has made significant investments in Canadian technology and innovation over the past several years:

- Establishing a Canada Innovation Corporation that will help new and established Canadian firms invest in R&D activities that will translate research into new and improved products and processes that will create economic opportunities for workers and businesses in Canada;

- Launching the Canada Digital Adoption Program to help businesses move online, boost their e-commerce presence, and digitalize their businesses;

- Launching and continuing to invest in a national IP Strategy to help Canadian businesses, innovators, and entrepreneurs and understand, protect and access IP.

- Providing support through Canada's Regional Development Agencies to support economic development and diversification through the Regional Economic Growth through Innovation Program.

- Advancing the National Quantum Strategy, Pan-Canadian Genomics Strategy, and the next phase of Canada's Pan-Canadian Artificial Intelligence Strategy to capitalize on emerging technologies of the future;

- Expanding the College and Community Innovation Program administered to help more Canadian businesses access the expertise and research and development facilities from Canada's colleges;

- Providing additional resources to the Strategic Innovation Fund to support investment across the economy, from life sciences to clean technology;

- Increasing funding to support the venture capital ecosystem in Canada;

- Review of Scientific Research and Experimental Development (SR&ED) tax credits and Strategic Intellectual Property Program Review;

- And making significant investments in technology to facilitate the green transition through business tax credits for investments in (1) clean technology manufacturing, (2) clean hydrogen, and (3) carbon capture, utilization, and storage investment.

3. Investment by Canadian Pension Plans in Canadian Businesses

- Workplace pension plans are a shared federal-provincial jurisdiction. The federal government is solely responsible for federally regulated private sector pension plans (7 per cent of plans in Canada) and the Public Service Pension Investment Board (PSPIB). The Canada Pension Plan Investment Board (CPPIB) is a joint responsibility of the federal and provincial governments. All other pension plans fall under provincial jurisdiction (93 per cent of plans), including most of Canada's largest plans.

- The federal and provincial pensions frameworks generally do not have rules related to specific types of investments. Pension plans are intended to provide sustainable benefits to plan beneficiaries to support their retirement security.

- The investment rules for federal and provincial workplace pension plans, as well as the mandates of CPPIB and PSPIB, primarily rely on the fiduciary duty of pension plan administrators to act in the best interests of plan beneficiaries. This responsibility has led them to diversify their investments globally and across asset classes to maximize their risk-adjusted returns.

- While Canadian equities represent around 3% of world markets, Canadian equities accounted for 21% of Canadian pension fund equity investments in 2018. Proportionally, this level of domestic bias by Canadian pension funds was higher than in the U.S., U.K. and Japan, but lower than Australia.

- In Q3 2023, 41.4% of the assets of Canada's largest 250 workplace pension plans (excludes CPP and QPP) were invested domestically.

Annex – Recent Trends in Business Investment in Canada

- This Annex provides an overview of the post-pandemic recovery in business investment in Canada and the U.S.

- In Canada, business investment now stands 1.6% above its pre-pandemic level (Chart A1), but a slower recovery than that of overall GDP (+2.9%).

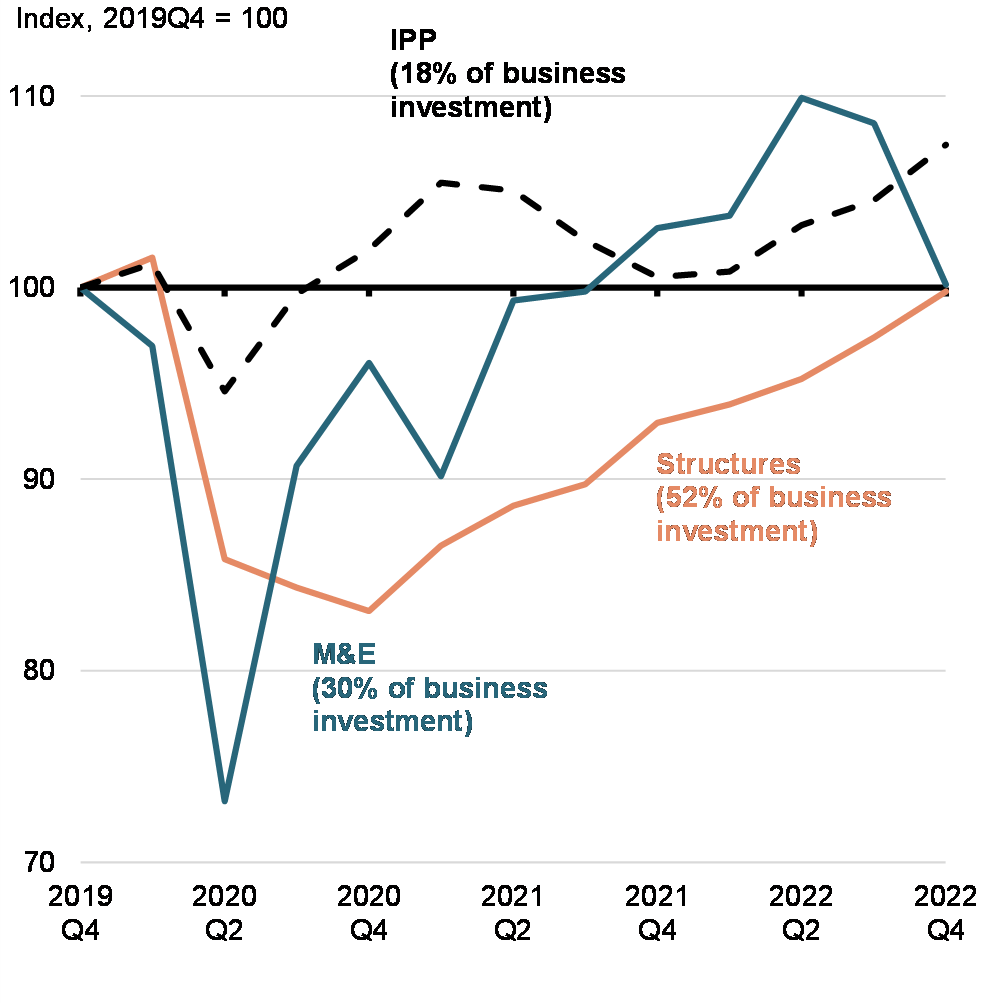

- Subdued recovery in business investment masks uneven performance with weakness concentrated in M&E and non-residential buildings:

- Investment in Intellectual Property Products (IPP) has led the recovery in business investment and stands about 7% above its pre-pandemic level (Chart A2). In particular, software adoption was supported by an acceleration in e-commerce and work from home trends, while mineral exploration rebounded more recently (from very low levels) along with higher commodity prices.

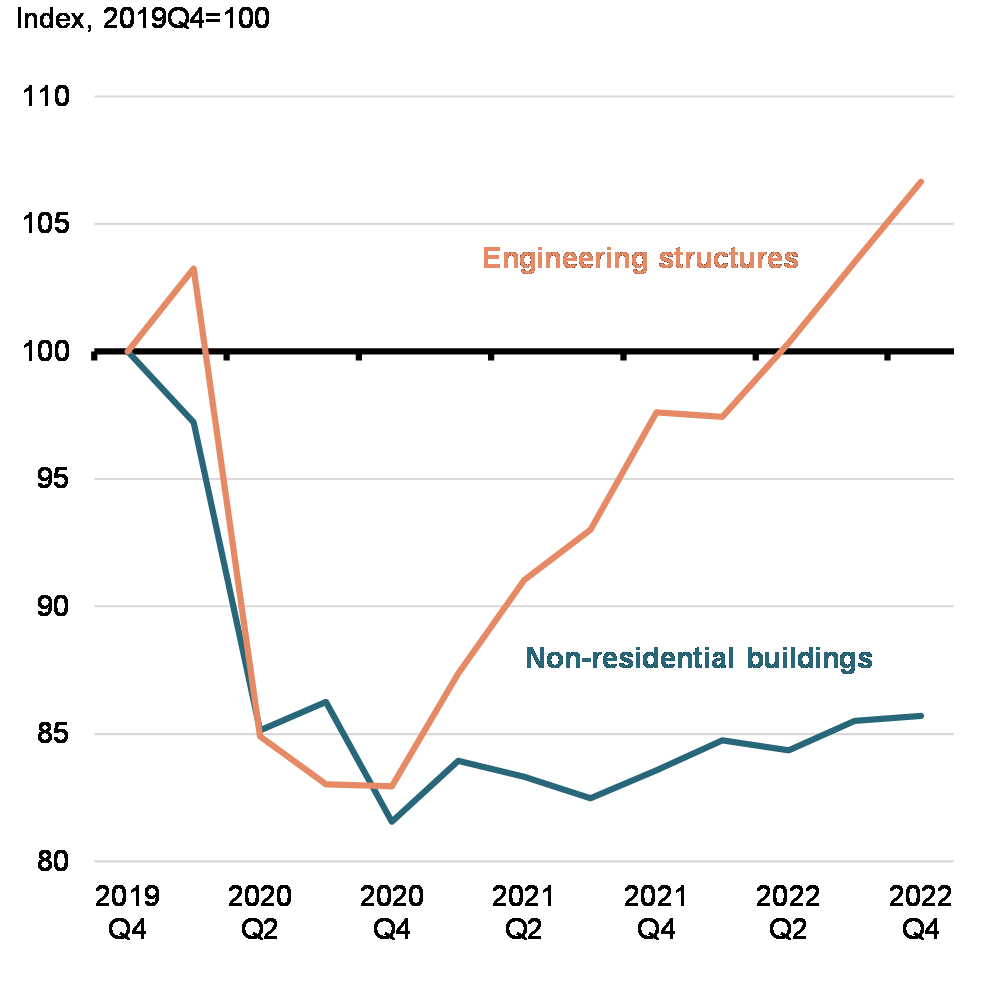

- Business spending in engineering structures is also about 7% higher than its pre-pandemic level (Chart A3), supported by a rebound in commodity prices and higher capital spending in the energy sector.

- An uneven and slower rebound has been seen in M&E investment, held back by weak capital spending in the industrial machinery sector (tied to the energy sector challenges).

- Meanwhile, investment in non-residential buildings has barely nudged after bottoming out in late 2020 and remains 14% below its pre-pandemic level. This weakness is notable for commercial buildings (reflecting challenges faced by office/retail space) while e-commerce has fueled the recent growth of industrial real estate (Chart A4).

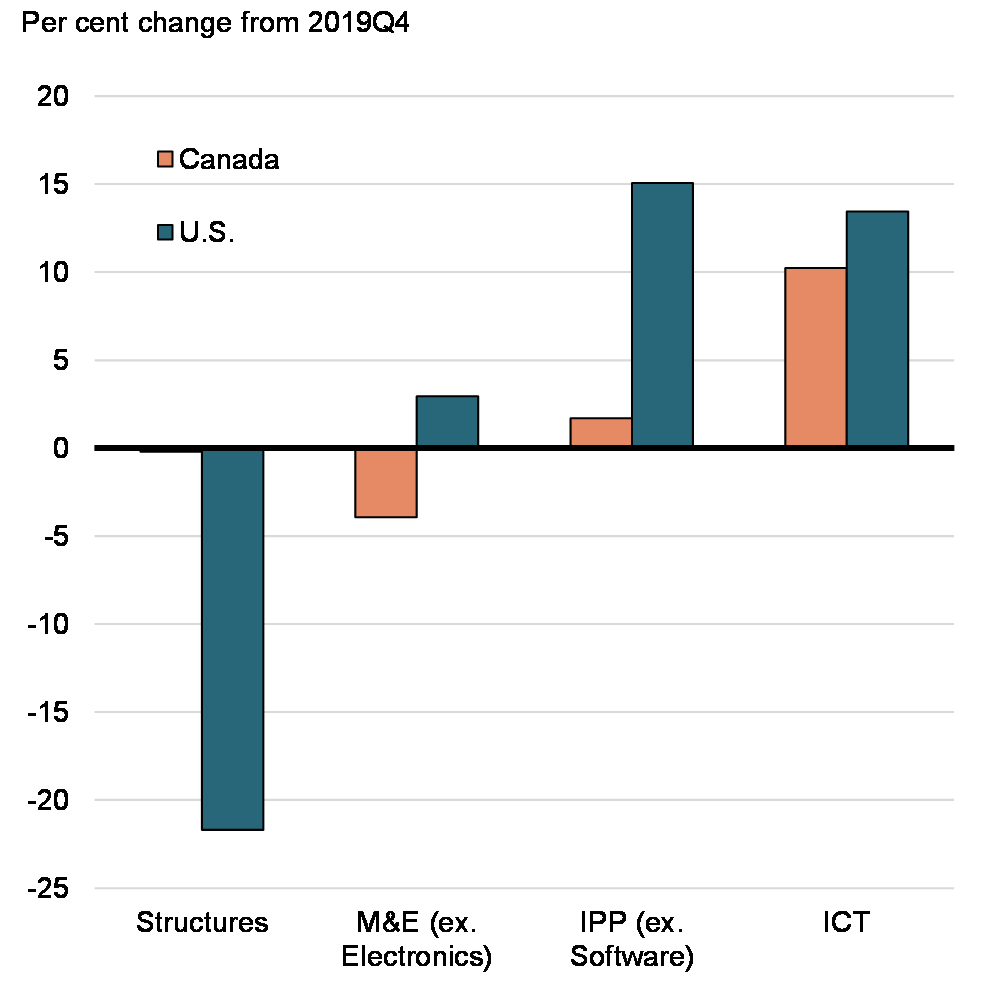

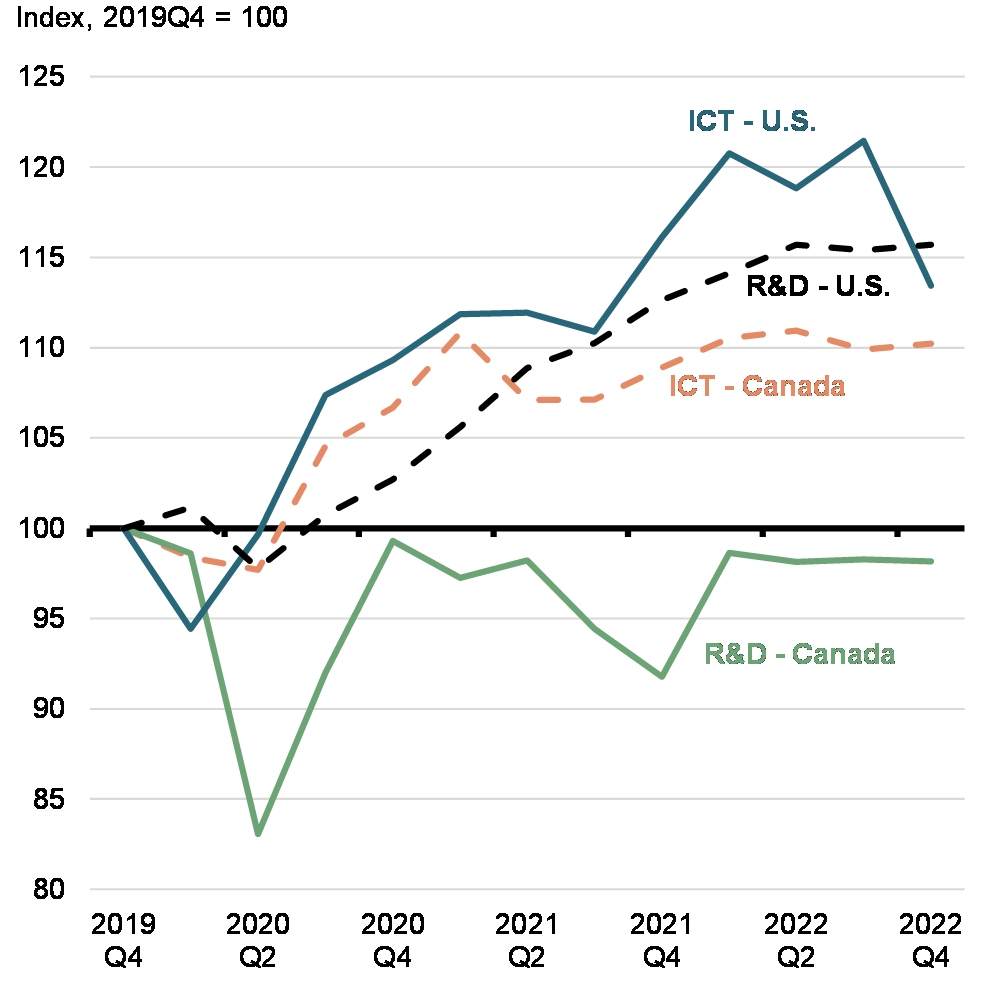

- Having said that, business investment in Canada could, and maybe should, have been even better. In particular, the U.S. has made more substantial strides on IPP (especially R&D), as well as M&E and ICT investments as businesses prioritized spending on new equipment to build a remote work and e-commerce infrastructure (Charts A5 and A6).

Real Business Investment Breakdown

Real Investment in Non-Residential Structures

Real Investment in Structures

Real Investment in Non-Residential Buildings

Real Business Investment Recovery in Canada and the U.S.

Real ICT and R&D Investment in Canada and the U.S.

Committee Member Biographies

Parliamentary Affairs

About the Committee

The Standing Senate Committee on Banking, Trade and Commerce has the mandate to examine legislation and to study issues related to banking, insurance, trust and loan companies, credit societies, caisses populaires and small loans companies. It is also responsible for considering customs and excise issues, taxation legislation, patents, royalties, corporate affairs, and bankruptcy-related issues.

The committee has conducted major studies in areas as diverse as corporate governance, financial sector reform, insolvency, Crown corporations, taxation, business and trade, productivity, financial crimes and retirement.

Independent Senators Group

Colin Deacon, Deputy Chair

Independent Senators Group (Nova Scotia)

The Honourable Colin Deacon's entrepreneurial background brings a unique perspective to Canada's Upper Chamber. Before his June 2018 appointment to the Senate as an Independent Senator representing Nova Scotia, Senator Deacon spent much of his career turning ideas into organizations, products and services that improve lives.

In 2009, he founded BlueLight Analytics, a company in the restorative dentistry field. The company has successfully commercialized new technologies that improve the longevity of dental fillings. Their products were sold in dozens of countries, and they worked with most dental multinationals. Until 2006, he served as CEO of SpellRead, which improved reading skills among children and adults, and was regularly cited as one of Atlantic Canada's fastest-growing companies. Senator Deacon has also contributed to the charitable sector, where he has been an active member on the board of several organizations, including those dedicated to children's health and well-being, mentorship, and celebrating social innovators.

His career has focused on enabling collaboration between research and business, and Senator Deacon continues to be a strong advocate for knowledge mobilization.

As part of the Senate, he has been a strong advocate for entrepreneurs, harnessing the digital economy, updating Canada's privacy legislation, ensuring global competitiveness of Canadian firms, and promoting Canadian leadership on climate change.

Senator Deacon is staunchly independent and believes in collaborative work amongst senators of all groups, and all parliamentarians. He supports efforts that enable the Senate to become a less partisan, more independent-minded, modern and transparent institution.

When appointed to the Senate, he was tasked with one request: to hold the government to account and challenge it to be better. He intends to continue disrupting the status quo and challenging the federal government to improve for the benefit of all Canadians.

Analysis

Senator Deacon's questions focused often on Canada's competition policy, particularly efforts to protect intellectual property and retaining R&D talent in Canada. He has also questioned witnesses on the need for regulatory modernization to better integrate innovation and research into the economy.

Tony Loffreda

Independent Senators Group (Québec – Shawinigan)

Tony Loffreda was appointed to the Senate of Canada in 2019 by the Governor General of Canada on the advice of the Prime Minister. He is the first Canadian born Senator of Italian descent.

He currently sits on the Senate's National Finance Committee, the Committee on Banking, Trade and the Economy, and the Committee on Internal Economy, Budgets and Administration. He also serves on several Senate Working Groups and is Vice-Chair of the Canada-Italy Interparliamentary Group. He is a member of the Independent Senators Group.

Prior to his appointment, Senator Loffreda was a Vice Chairman and Executive at RBC. He brings to the Senate over 35 years of experience in the financial industry.

Senator Loffreda has served on various boards and committees including, but not limited to, the Concordia University Board of Governors; the Integrated Health and Social Services University Network for West-Central Montréal; Montréal International; the Italian-Canadian Community Foundation; the Italian Chamber of Commerce in Canada; and the executive committee of the Chamber of Commerce of Metropolitan Montréal.

Once nominated to the Canadian Senate, Senator Loffreda retired from RBC and resigned from the twenty-one boards he was serving on.

He is a leading philanthropist, active in service to many communities, having chaired fundraising activities across the province for various causes such as the Giant Steps School; the Montréal Jewish General Hospital; McGill University Goodman Research Centre; the Montréal Cancer Institute and many more. He is also a frequent and sought-after speaker on economic and community issues.

Among his many awards and distinctions, he is a recipient of the Lieutenant Governor of Québec's Gold Medal for Exceptional Merit; the Queen Elizabeth II Diamond Jubilee Medal; the Governor General of Canada Sovereign's Medal for Volunteers; the Canadian Italian Business and Professional Association's Person of the Year Award; the Philhellene of the Year Award by the Hellenic Community of Greater Montréal; and the Senate of Canada 150th Anniversary Medal which he received prior to his appointment. He was also inducted as an administrator into the Montréal-Concordia Soccer Hall of Fame.

Senator Loffreda passed the American Institute of Certified Public Accountants Final Exam and earned a USA - Certified Public Accountant designation through the University of Illinois. Senator Loffreda also holds a Chartered Global Management Accountant international designation from the American Institute of Certified Public Accountants. He earned his Bachelor of Commerce degree with a major in accounting from the University of Concordia.

He lives in Montreal with his wife, and they have two children.

Paul J. Massicotte

Independent Senators Group (Québec – De Lanaudière)

Born in Manitoba, Senator Massicotte obtained his Bachelor of Commerce (Dean's Honour List) in 1974, from the University of Manitoba.

In 1976, while working at Pricewaterhouse Coopers, he earned the designation of Chartered Accountant from the Manitoba Institute of Chartered Accountants, and the following year he became a member of the Ordre des comptables agréés du Québec/Ordre des comptables professionnels agréés du Québec. In February 2005, Senator Massicotte was granted the title of Fellow from the Ordre des comptables agréés du Québec/Ordre des comptables professionnels agréés du Québec, the profession's highest honorific designation.

From 1977 onwards, he was successively appointed to senior executive positions with commercial real estate development firms in Western Canada, before moving to Montreal in 1985 to join the Alexis Nihon Group, a major commercial real estate owner. Senator Massicotte was President and co-owner of Alexis Nihon from 1985 to 2006. He was also the owner of Attractions Hippiques from 2006 to 2009.

Senator Massicotte was appointed to the Senate on June 26, 2003, on the advice of the Right Honourable Jean Chrétien. He joined the Independent Senators Group in October 2017. He is currently Chair of the Standing Committee on Energy, the Environment and Natural Resources and a member of the Standing Committee on Rules, Procedures and the Rights of Parliament. He has previously served on numerous other committees including the Standing Committee on Foreign Affairs and International Trade, the Special Committee on Senate Modernization, the Standing Committee on Internal Economy, Budgets and Administration and on the Standing Committee on Banking, Trade and Commerce. Senator Massicotte's committee memberships allow him to work towards the causes that matter deeply to him, such as international trade, action against climate change, and improving Canada's economic conditions to contribute to the prosperity of all Canadians. He is also actively committed to efforts for the Senate modernization.

Senator Massicotte is also very active in interparliamentary work. He is the Co-Chair of the Canada-China Legislative Association, the Vice-Chair of the Canada-United States Inter-Parliamentary Association and a member of the Canada-Japan Inter-Parliamentary Association. In these capacities, he regularly represents Canada at various meetings with his counterparts in such places as Washington, D.C. and Japan.

In the past, Senator Massicotte contributed as Director and Lead Director of the Board of Directors of the Bank of Canada and was the Chairman of the Board of Directors of Agellan Commercial Real Estate Investment Trust. He was also a member of the Advisory Committee of Mercantile Bancorp Limited. He has also been a member of the Board of Directors of the Canadian Chamber of Commerce, the Real Property Association of Canada, the Canadian Home Income Plan, the Board of Trade of Metropolitan Montreal Foundation and the Board of Trade of Metropolitan Montreal.

Senator Massicotte has also been Chairman of the Young Presidents' Organization (Quebec Chapter), past member of the Canadian Board of the Young Presidents' Organization, as well as a member of the Regional Council of the Société du Quartier International de Montréal. He was a founding Director, Chairman and President of the Urban Development Institute of Quebec. He was also a Board member of the insurance company La Solidarité, and a member of the Study Committee on Fiscal Equity at the Municipal Level in the Montreal area.

Senator Massicotte also acted as Honorary Co-Chair at fundraising campaigns for the George Stephen House Trust Fund and was one of the Honorary Patrons for the financial campaigns of Quebec women shelters Le Chaînon. Senator Massicotte and his wife organized different fundraising activities including a fashion show benefitting the Centre d'Action Bénévoles de la Vallée de la Richelieu. Most recently he sat on the Board of Directors of the Ste-Anne's Hospital Foundation. He is still active with several other social and charitable institutions.

Pierrette Ringuette

Independent Senators Group (New Brunswick)

Pierrette Ringuette was educated at the Université de Moncton, Edmundston Campus, where she obtained a B.A in administration and social sciences. She went on to attend Laval University, where she completed her course work towards a Masters of Industrial Relations. She received a Master's of Business Administration from the University of Ottawa in June 2000.

Senator Ringuette worked as supervisor and customer services relations officer for numerous businesses in Northern Quebec. Later, she worked as the manager of the Edmundston Chamber of Commerce. She was also an associate lecturer at the Université du Québec at Rimouski, and, later, a professor of Continuing Education at the Université de Moncton, Edmundston Campus teaching labour economics.

In her community, Senator Ringuette was involved with numerous organizations. In 1986, she served as the first female President of La Foire Brayonne; in 1986-87, she was the Honourary president of Big Brothers/Big Sisters of Madawaska Inc.; served as a director of the board of Cie des Jeunes Travailleurs du Nord-Ouest Inc. and a member of the board of Family Enrichment; was a member of the Cercle de Presse Internationale de la République and a member of the disciplinary committee of the New Brunswick Nurses Association.

In the course of her political career, Senator Ringuette has enjoyed the distinction of being the first Francophone woman in New Brunswick to be elected to the provincial Legislative Assembly having represented the provincial constituency of Madawaska-South from 1987 to 1993. She also enjoyed the distinction of being the first Francophone woman from New Brunswick to be elected to the federal Parliament having represented the federal constituency of Madawaska-Victoria from 1993 to 1997.

During her legislative career in the New Brunswick legislature, she served as deputy speaker from March 1988 until October 1991 and she was also a member of the Standing Committee on Crown Corporations, a member of the Standing Committee on Privileges, a member of the Special Committee on Economic Policy Development, Vice-President of the International Association of French-speaking Parliamentarians – New Brunswick Chapter, a member of the Commonwealth Parliamentary Association and was also appointed to the New Brunswick Commission on Canadian Federalism.

Throughout her mandate as Member of Parliament, she was elected Co-Chair of the Joint Committee on Official Languages, elected Chair of the Sub-Committee responsible for revising Communications for different House of Commons Committees, elected Chair of the Standing Committee on Official Languages and appointed Assistant Deputy Chairman of Committees of the Whole House. She was also a member of the Liaison Committee and was appointed Vice-Chair of the Policy Development Committee for the Liberal Party of Canada.

In 1997, Senator Ringuette joined the Canada Post Corporation as Manager of the international trade development unit, taking part in a number of trade missions promoting Canadian expertise among foreign postal administrations.

On December 12, 2002, she was appointed to the Senate by the Rt. Honourable Jean Chrétien to the Senatorial Division of New Brunswick. As a senator, she has been or still is: member of the Standing Senate Committee on Banking, Trade and Commerce, member of the Standing Senate Committee on National Finance, member of the Standing Senate Committee on Legal and Constitutional Affairs, member of the Joint Standing Committee for the Scrutiny of Regulations, member of the Standing Committee on Internal Economy, Budgets and Administration, member of the Standing Committee on Energy, Environment and Natural Resources, member of the Standing Committee on Agriculture and Forestry, member of the Standing Committee on Transport and Communications, member of the Standing Committee on Rules, Procedures and the Rights of Parliament, and a member of the Standing Committee on Fisheries and Oceans . She is also Co-Chair of the Canada-Cuba Inter-Parliamentary Group. She was also Vice-Chair of the Prime Minister's Task Force on Seasonal Work from 2003 to 2004.

On June 6, 2007, she received the grade of Officer of the Ordre de la Pléiade from the New Brunswick section of the Assemblée Parlementaire de la Francophonie in recognition of her contribution to the development of francophone and Acadian culture.

On February 2, 2016, Senator Ringuette advised the Speaker that she will sit as an Independent Senator for New Brunswick.

Senator Ringuette is currently a member of the Independent Senators Group. Senator Ringuette was born in 1955. She has one daughter.

Sabi Marwah

Independent Senators Group (Ontario)

Mr. Sarabjit S. Marwah was appointed to the Senate in 2016 by the Governor General of Canada on the advice of the Prime Minister. Prior to his appointment, Sabi was the Vice Chairman and Chief Operating Officer of the Bank of Nova Scotia (Scotiabank), a position he had held since 2008. As Vice Chairman, he was responsible for the Bank's corporate financial and administrative functions, and was actively involved in developing the Bank's strategic plans and priorities. Sabi was also the Chairman of several Scotiabank Subsidiaries, and retired from the Bank in 2014

Senator Sabi joined Scotiabank in Toronto as a financial analyst in the Bank's Finance Division in 1979. Over the years, he held successively more senior positions within the Finance Department, including Deputy Comptroller, Senior Vice President & Comptroller, and Executive Vice President. He was appointed Chief Financial Officer (CFO) in 1998 and Senior Executive Vice President & CFO in 2002. During his tenure in Finance, he was also responsible for several functions outside the Finance Division, such as Audit, Economics, General Counsel, Information Technology, Real Estate, Shared Services & Operations and Treasury, and was actively involved in many of the Bank's strategic decisions, including acquisitions both in Canada and internationally. He became Vice Chairman and Chief Administrative Officer in 2005.

Sabi has also been very active in social, arts and community organizations. He currently serves as Chair of the Board of Trustees of the Hospital for Sick Children. He was a Founding Member of the Sikh Foundation of Canada, a member of the 2008 and 2009 United Way Cabinets, a member of the Board of Directors of the C.D. Howe Institute, and past Chair of the Board of Directors of the Humber River Regional Hospital. He is also a past member of the Toronto International Film Festival and selection committee for the Rhodes Scholarship.

Sabi has been recognized with several awards including the following: Professional of the Year Award from the Indo Canada Chamber of Commerce in 1994; the Sewa Award on 2 occasions from the Sikh Centennial Foundation; Queen's Golden Jubilee Award; Words & Deeds award from the United Jewish Federation in 2009; and the Queen's Diamond Jubilee Award in 2012.

On the professional front, Sabi is currently a member of the Board of Directors of a few public sector companies.

Sabi earned an undergraduate Honors degree in Economics from the University of Calcutta, a Master's degree in Economics from the University of Delhi, and a Master of Business Administration (Finance) from the University of California, Los Angeles (UCLA). In 2012, he received an Honorary Doctor of Laws from Ryerson University's Ted Rogers School of Management.

He and his wife, Amrin, have two daughters.

Hassan Yussuff

Independent Senators Group (British Columbia)

Hassan Yussuff is one of Canada's most experienced labour leaders. As the past President of the Canadian Labour Congress, he was the first person of colour to lead Canada's union movement.

After emigrating from Guyana, Senator Yussuff worked as a truck mechanic with General Motors for 10 years before getting involved in the labour movement. In 1988, he joined the Canadian Auto Workers union as the National Staff Representative, and later became their first Director of Human Rights. In 1999, he became Canadian Labour Congress's first person of colour elected to an executive position, as Executive Vice-President. He went on to be elected as Secretary-Treasurer for three terms, from 2002 to 2014, before being elected President in 2014. He was re-elected in this role in 2017.

In addition to his work in Canada, Senator Yussuff is a prominent international activist. In 2016, he was elected for his second term as President of the Trade Union Confederation of the Americas, an organization uniting 48 national organizations and representing more than 55 million workers in 21 countries. He was also a member of the Executive Bureau and General Council of the International Trade Union Confederation and a member of the Ministerial Council of the Trade Union Advisory Committee to the Organisation for Economic Co-operation and Development.

Senator Yussuff served on the Government of Canada's NAFTA Council and its Sustainable Development Advisory Council. He also contributed to numerous other task forces and organizations, including as co-chair of the Task Force on Just Transition for Canadian Coal Power Workers and Communities, and as a member of the Board of Directors of the National Institute of Disability Management and Research. He was recently appointed to the Net-Zero Advisory Body by the Minister of the Environment and Climate Change. He has recently been part of the Industry Advisory Roundtable on COVID-19 Testing, Screening, Tracing and Data Management and the COVID Communications Partners Roundtable.

Senator Yussuff and the Canadian Labour Congress, with their tripartite partners, are recipients of the 2021 Canadian Freedom of Association Award for their instrumental collaboration in Canada's 2017 ratification of the International Labour Organization's Convention No. 98. Senator Yussuff has been a recent recipient of the Pearson Centre Progressive Leadership Award. He has also received honorary Doctorate of Laws from Brock University and Ryerson University.

Conservative Senators

Elizabeth Marshall

Conservative (Newfoundland and Labrador)

Elizabeth Marshall was appointed to the Senate of Canada in January of 2010 having previously spent 30 years with the Newfoundland and Labrador Public Service, the Government of Newfoundland and Labrador, and the Newfoundland and Labrador House of Assembly. Since 1979, she occupied a number of positions in the provincial public service, including Deputy Minister of Transportation and Works, and Deputy Minister of Social Services, as well as several senior positions in the Department of Finance.

She was appointed Auditor General of Newfoundland and Labrador in 1992 and served in that position for 10 years. In 2003 she was elected as the Member of the Newfoundland and Labrador House of Assembly for the District of Topsail and was re-elected in 2007. She served as Minister of Health and Community Services from 2003-2004.

In 2011, Senator Marshall was appointed as the Government Whip in the Senate, a position she held until November 2015. She is currently a member of the Standing Senate Committee on Internal Economy, Budgets and Administration, the Standing Senate Committee on National Finance, and the Standing Senate Committee on Banking, Trade and Commerce.

She holds a Bachelor of Science (Math) degree from Memorial University of Newfoundland and Labrador and has been a Chartered Accountant since 1979.

Senator Marshall has three children and resides in Paradise, Newfoundland and Labrador, with her husband.

Donald Neil Plett

Conservative (Manitoba)

Senator Don Plett has dedicated much of his life to community service in his home province of Manitoba. As a Red River College alumnus, Senator Plett served on the Board of Governors of the College. An active sports enthusiast, he has coached and played hockey, basketball, and golf and was President of the Landmark Minor Hockey Association.

Senator Plett cut his teeth early in politics on the advice of his father, Archie, and served on a local EDA board at the young age of fifteen, helping his local Member of Parliament, the Honourable Jake Epp. He maintained an active interest in politics throughout the years, including serving as the President of the Conservative Party of Canada. He remains the longest-serving president of a conservative party in Canadian history. He also served as President of the Chamber of Commerce, Chair of the Village Council, and Chair of the local Utilities Board. Senator Plett and his wife Betty have four sons and twelve grandchildren.

Senator Plett was appointed to the Senate on August 27, 2009, on the advice of Prime Minister Stephen Harper. Senator Plett is known for taking a strong stance on issues that he is passionate about, some of which include: the protection of children, supporting Canadian farmers, religious freedom, free speech, fair democratic processes, and issues facing the trades and construction industry.

In December 2015, Senator Plett became part of the Senate Conservative leadership team, when he was named Opposition Whip in the Senate.

In November 2019, Senator Plett was elected Leader of the Opposition in the Senate.

Canadian Senators Group

Larry W. Smith

Canadian Senators Group (Québec - Saurel)

Larry Smith is a widely recognized and respected figure in Quebec. He graduated from Bishop's University with a Bachelor of Arts in economics in 1972, and a Bachelor of Civil Law degree from McGill University in 1976. He is well-known in Montreal from his days as a fullback with the Montreal Alouettes from 1972 to 1980, and as President and Chief Executive Officer of the same team from 1997 to 2001 and again since 2004. Working tirelessly to promote professional and amateur football, Senator Smith also served as Commissioner of the Canadian Football League (CFL) prior to his first term as Alouettes' President.

Outside of football, Senator Smith has served on a number of civic charitable boards, including as Co-President of the 2001 Montreal Centraide Campaign and on the board of the Canadian Olympic Committee. He also has extensive experience in the business world, including positions with John Labatt, Ltd., and Ogilvie Mills, Ltd., before becoming CFL Commissioner. In addition, he served as president and publisher of The Montreal Gazette in 2002 and 2003.

He has received numerous awards over the course of his careers, including the Commissioner's Award for outstanding service and dedication in promoting and preserving the CFL (2001), the 1994 American Marketing Association-Toronto chapter Marketer of the Year (consumer products) and Sports Personality of the Year at the Quebec Sports Gala (1998). Mr. Smith was inducted into the Quebec Sports Hall of Fame on September 30, 2015, under the category of "Builder for Football".

Senator Smith resides in Hudson, Quebec, with his wife Leesa. They have three children and two grandchildren.

Pamela Wallin, Chair

Canadian Senators Group (Saskatchewan)

The Honourable Pamela Wallin, O.C., S.O.M. was appointed to the Senate of Canada on December 22, 2008. She sits as an Independent Senator from Saskatchewan. Pamela is an Officer of the Order of Canada, this country's highest civilian honour (2007) and a member of the Saskatchewan Order of Merit (1999). She has fourteen Honourary Doctorates and was named to the Canadian Broadcasting Hall of Fame. She is also a former Chancellor of the University of Guelph.

Senator Wallin served as Canada's Consul General in New York from 2002-2006, in the wake of the tragic and tumultuous events of 9/11. She was then named to the Special Independent Panel on Canada's Future Role in Afghanistan who successfully recommended support and airlift for our service men and women. She is committed to building and enhancing the military/civilian understanding and continues to work with veterans.

She is an active volunteer, and has been recognized by Queen Elizabeth II for her public service and numerous achievements. She is the author of three best-selling books.

The wide-ranging career of the journalist, diplomat, entrepreneur and Senator has spanned more than nearly 40 years, several continents, and always with a focus on politics and foreign policy.

Progressive Senate Group

Diane Bellemare

Progressive Senate Group (Quebec – Alma)

Diane Bellemare completed a PhD in Economics at McGill University in 1981, a Master degree in economics at the University of Western Ontario in 1971 and a BA at the University of Montreal in 1969.

Senator Bellemare taught at the University of Quebec at Montreal from 1972 to 1994 in the economics department and, from 1991 to 1994, in the business administration department. Her areas of specialization included macroeconomics, labour economics and public policy. She published several books and academic articles on the subjects of full employment, income security, pension and population aging. The last one, Créer et Partager la Prospérité, was published in 2013 by the Presses de l'Université du Québec.

Senator Bellemare participated in the creation of the Forum pour l'emploi (1987–1996), a non-profit association of key decision-makers from employers, unions, communities and institutions whose goal was to promote employment.

She was appointed for two terms on the Economic Council of Canada (1983–1991), the National Statistics Council (Statistics Canada) (1990–1996) and the Institut de recherche et d'information sur la rémunération (IRIR) (1991–1994). She also participated weekly from 1988 to 1991 as an economics columnist on Télé-Québec's public affairs program "Questions d'argent".

In 1994, Senator Bellemare was appointed President and Chief Executive Officer of the Société québécoise de développement de la main-d'œuvre (SQDM), whose mandate was to manage the entire range of federal and provincial labour force development programs. She was also Chair of its board of directors. When the SQDM was dissolved in 1997, Senator Bellemare became Chair of the Commission des partenaires du marché du travail, where she served until 1999. She was part of the team who negotiated the labour market agreement between the Québec and the federal government.

Between 2000 and 2003, Senator Bellemare worked as a consultant. During this time, she was responsible for the QFL Solidarity Fund's employment periodical La minute de l'emploi. From the fall of 2003 to the spring of 2007, Senator Bellemare worked at the Conseil du Patronat du Québec, first as Vice-President of Research and later as Senior Vice-President and Chief Economist. She subsequently became Special Economic Advisor to Quebec's Official Opposition Leader, Mario Dumont, through the end of 2008. She was candidate for provincial elections for Action démocratique du Québec (ADQ), serving as the ADQ's spokesperson for public finance and employment.

Senator Bellemare then joined CIRANO (the inter-university research institute) as an associate fellow.

She was appointed Senator in 2012 by Prime Minister Harper. She now sit as an independent senator since March 2016.

In the 42nd Parliament, she served as Legislative Deputy to the Government Representative (formerly Deputy Leader). At the beginning of the 44th Parliament, she joined the Progressive Senate Group (PSG) and became Chair of the Standing Committee on Rules, Procedures and the Rights of Parliament, as well as a member of steering on the Senate Committee on Banking, Trade and Commerce.

Clément Gignac

Progressive Senate Group (Quebec – Kennebec)

The Honourable Clément Gignac is an economist with over 35 years of experience in the public and private sectors. He was appointed as a Senator on July 29, 2021.

From 2012 until he became a senator, he held the position of Senior Vice-President and Chief Economist at iA Financial Group. He was the Group's spokesperson on economic matters and chaired the Asset Allocation Committee. He was also responsible for managing diversified funds with assets in excess of $5 billion.

Prior to joining iA Financial Group, Senator Gignac worked as an economist and strategist for major financial institutions, including as Vice-President and Chief Economist for National Bank Financial from 2000 to 2008.

In 2009, Senator Gignac was elected as a member of the National Assembly of Québec. He was named Minister of Economic Development, Innovation and Export Trade in the Quebec government, and went on to serve as Minister of Natural Resources and Wildlife from 2011 to 2012.

On the international scene, he chaired the World Economic Forum's council on competitiveness in 2012. He is also a standing member of the Conference of Business Economists, a group of distinguished global economists based in Washington, D.C.

Senator Gignac was awarded the Gloire de l'Escolle medal from Université Laval and is an honorary member of the Association des économistes québécois, a prestigious distinction that has only been bestowed upon 10 people since its inception in 1992.

Senator Gignac holds a bachelor's degree and a master's degree in economics from Université Laval. He is a married father of three and the proud grandfather of five.