Archived - Department of Finance Canada 2024–25 Departmental plan

On this page

- From the Deputy Prime Minister

- Plans to deliver on core responsibilities and internal services

- Planned spending and human resources

- Corporate information

- Supplementary information tables

- Federal tax expenditures

- Definitions

From the Deputy Prime Minister

The Honourable Chrystia Freeland P.C., M.P.

Deputy Prime Minister and Minister of Finance

Our government's economic plan is about building an economy that works for all Canadians.

And each day brings more evidence that our plan is working.

Over one million more Canadians are employed today compared to before the pandemic. Inflation is coming down, and wage increases are outpacing inflation. Private sector economists now expect Canada to avoid the recession that many had thought was inevitable, and the International Monetary Fund predicts that, in 2025, Canada will see the strongest economic growth in the G7.

Canada's net debt-to-GDP and deficit-to-GDP ratios remain by far the lowest among G7 countries, and Canada is one of only two major economies to have a AAA credit rating from at least two of the three major credit rating agencies.

Furthermore, in the first half of 2023, Canada received the third-most foreign direct investment, in gross dollar terms, of any country in the entire world, and more investment per capita than any of our G7 allies.

We know that many Canadians are struggling to make ends meet and to feel confident about their future. That is why our government is working hard to unlock a brighter future for all Canadians.

Over the last year, we have committed billions of dollars in new financing to build hundreds of thousands of new homes across Canada, and we are helping over half a million Canadians save up for their first downpayment through the new tax-free First Home Savings Account. With the new Canadian Mortgage Charter, we are protecting Canadians who are facing financial difficulty with their mortgages.

Thanks to our Canada-wide system of early learning and child care, child care fees have now been reduced by an average of 50 per cent across the country, and child care now costs just $10-a-day in seven provinces and territories. This is saving families across Canada thousands of dollars a year—while supporting record women's employment at the same time.

We are working hard, and we know we have more work to do.

In the year ahead, our focus is to balance fiscal responsibility with strategic investments to maintain Canada's strong economy—so we can fight for Canadians and build a brighter, more prosperous future for all.

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services:

- Economic and Fiscal Policy

- Internal services

Economic and Fiscal Policy

Description

The department is committed to developing the federal budget and Fall Economic Statement, as well as providing analysis and advice to the Government of Canada on economic, fiscal, and social policy; federal-provincial relations, including the transfer and taxation payments; the financial sector; tax policy; and international trade and finance.

Quality of life impacts

Quality of life (well-being) refers to the wealth and comfort of individuals, communities and society based on factors that are important to people's lives, such as health and social connections. The Quality of Life Framework for Canada is an analytical tool used to measure the well-being of Canadians. Launched in Budget 2021, it aims to measure what matters most to Canadians, enabling the federal government to identify future policy priorities and helping drive evidence-based decision making and budgeting.

The Framework consists of 84 indicators organized into 5 domains: prosperity, health, society, environment and good governance. The Department's core responsibility to provide sound economic and fiscal policy advice to the Government of Canada contributes to a number of indicators: confidence-in-institutions, Gross Domestic Product (GDP) per capita, employment, and household income.

Results and targets

The following tables show, for each departmental result related to Economic and Fiscal Policy, the indicators, the results from the three most recently reported fiscal years, the targets and target dates for 2024–25.

Table 1: Indicators, results and targets for departmental result

Departmental result: Canadians enjoy stronger, more sustainable, and inclusive economic growth that contributes to higher standards of living

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

Real disposable income across income groups1 |

Met2 |

Met3 |

Met4 |

Growth is broad-based across income groups5 |

March 2025 |

Employment rate among the population age 15 to 64 (ranking among Organisation for Economic Co-operation and Development (OECD) countries) |

Ranked 19th among 38 OECD countries (2020 calendar year) |

Ranked 14th among 38 OECD countries (2021 calendar year) |

Ranked 12th among 38 OECD countries (2022 calendar year) |

Rank in the top 15 OECD countries for highest employment rates |

March 2025 |

Gross domestic product (GDP) per capita (ranking among OECD countries) |

Ranked 16th among 38 OECD countries (2020 calendar year)6 |

Ranked 15th among 38 OECD countries (2021 calendar year) |

Ranked 15th among 38 OECD countries (2022 calendar year) |

Rank in the top 15 OECD countries for highest levels of GDP per capita |

March 2025 |

Amount of Canada's annual greenhouse gas emissions (Mt CO2 equivalent) |

724 Mt CO2 eq in 2019. 1.1% below 2005.7 |

659 Mt CO2 eq in 2020. 10.0% below 2005. |

670 Mt CO2 eq in 2021. 8.4% below 2005. |

40 to 45% reduction in greenhouse gas emissions relative from 2005 levels by 20308 |

March 20259 |

Explanation of table 1

1 This indicator measures inflation-adjusted growth averaged over the previous five years in disposable household incomes across five income groups, ranging from the bottom 20 per cent to the top 20 per cent. Household income is adjusted for household size by dividing household income by the square root of the household size.

2 Based on the most recently available data, income growth rates for the 2020–21 report were: Bottom 20 per cent: 1.8 per cent growth; Second 20 per cent: 1.1 per cent growth; Middle 20 per cent: 1.1 per cent growth; Fourth 20 per cent: 0.9 per cent growth; and Top 20 per cent: 0.4 per cent growth.

3 Based on the most recently available data, income growth rates for the 2021–22 report were: Bottom 20 per cent: 5.3 per cent growth; Second 20 per cent: 2.9 per cent growth; Middle 20 per cent: 1.8 per cent growth; Fourth 20 per cent: 1.6 per cent growth; and Top 20 per cent: 0.7 per cent growth.

4 Based on the most recently available data, income growth rates for the 2022–23 report were: Bottom 20 per cent: 3.5 per cent growth; Second 20 per cent: 2.6 per cent growth; Middle 20 per cent: 1.8 per cent growth; Fourth 20 per cent: 1.5 per cent growth; and Top 20 per cent: 1.3 per cent growth.

5 The target for this indicator is met if annual real disposable income growth is positive for all five income quintiles.

6 Data from 2020–21 has been revised. The result is that Canadian GDP per capita for 2020 is now relatively higher and Canada's ranking among OECD countries improved from 17th to 16th.

7Data was not previously reported for this indicator in 2020–21 because the indicator was added in 2021.

8Baseline: 732Mt CO2 equivalent in 2005.

9Canada's greenhouse gas emissions target is to be achieved by 2030. However, the Department reports annually on its progress towards achieving this target.

Table 2: Indicators, results and targets for departmental result

Departmental result: Canada's public finances are sound, sustainable and inclusive

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

The annual federal budget includes an assessment of the impact of new expenditure and revenue measures on diverse groups of people |

Met, see Budget 2021 Impacts Report |

Met, see Budget 2022 Impacts Report |

Met, see Budget 2023 Impacts Report |

Presence of a clear "Gender Statement" in the annual budget document where the impact of budgetary measures is presented from a gender perspective |

March 2025 |

General government net debt-to-gross domestic product (GDP) ratio |

Met10 |

Met |

Met |

Low by international standards defined as compared to G7 countries |

March 2025 |

Ratio of federal debt-to-gross domestic product (GDP) |

Met |

Met11 |

Met |

Stable over the medium term (defined as the end of the five-year projection period for the Budget) |

March 2025 |

Explanation of table 2

10 Indicator added in 2021 with results met given net debt was low relative to G7 comparators.

11 The pandemic-induced economic downturn and significant federal government policy response led to a sharp one-time increase in the federal debt-to-GDP ratio between 2019–20 and 2020–21, of 16.3 percentage points of GDP. As the pandemic subsided and the economy recovered, support programs were pared back. As a result, the federal debt-to-GDP ratio is expected to edge down from its peak of 47.5 per cent in 2020–21 to 39.9 per cent of GDP in 2027–28, the end of the Budget 2023forecast horizon.

Table 3: Indicators, results and targets for departmental result

Departmental result: Canada has a fair and competitive tax system

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

Taxes on labour income |

Met |

Met |

Met12 |

Lower than the G7 average |

March 2025 |

Tax rate on new business investment |

Data not available13 |

Met |

Met14 |

Lower than the G7 average |

March 2025 |

Explanation of table 3

12 For the eight family types reported by the OECD, Canada's average tax wedge (as a % of labour costs) was lower than the G7 average in 2022:

Family Type |

Avg Tax Wedge Canada /G7 |

|---|---|

(% of avg earnings) |

|

Single person (67%) without child |

30.0/34.3 |

Single person (100%) without child |

31.9/38.2 |

Single person (167%) without child |

35.4/43.1 |

Single person (67%) with two children |

7.5/18.7 |

One-earner couple (100%/0%) with 2 children |

21.8/29.0 |

Two-earner couple (100%/67%) with 2 children |

28.9/32.8 |

Two-earner couple (100%/100%) with 2 children |

30.9/35.3 |

Two-earner couple (100%/67%) without child |

31.3/36.4 |

13 The Department reported on a new indicator "Tax rate on new business investment" as of the 2021–22 reporting cycle. The previous indicator "Total business tax costs" was measured by KPMG in a biennial report that has since been discontinued.

14 Canada's marginal effective tax rate (METR) on new business investment for 2023 was 13 per cent, lower than the G7 average of 23 per cent.

Table 4: Indicators, results and targets for departmental result

Departmental result: Canada has a sound efficient financial sector

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

Ranking of Canada's financial sector in the World Economic Forum's Global Competitiveness Report |

Data not available |

Data not available |

Data not available15 |

Above the G7 average |

March 2025 |

Percentage of leading international organizations and major ratings agencies that rate Canada's financial policy framework as favourable |

100% |

100% |

100% |

100% |

March 2025 |

Explanation of table 4

15 The World Economic Forum has paused comparative country rankings on the Global Competitiveness Index since 2020.

Table 5: Indicators, results and targets for departmental result

Departmental result: The Government of Canada's borrowing requirements are met at a low and stable cost to support an effective management of the federal debt on behalf of Canadians

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

Canada's sovereign rating |

Canada was the second highest rated among G7 countries, tied with the US |

Canada was the second highest rated among G7 countries, tied with the US |

Canada was the second highest rated among G7 countries, tied with the US |

Equal to or better than the G7 median |

March 2025 |

Percentage of the government's borrowing requirements met within the fiscal year |

100% |

100% |

100% |

100% |

March 2025 |

Table 6: Indicators, results and targets for departmental result

Departmental result: The Government of Canada effectively supports provinces, territories and Indigenous governments

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

Degree to which payment issues identified with respect to tax agreements with provinces, territories and Indigenous governments are addressed |

1 (fully addressed) |

Not applicable16 |

Not applicable16 |

At most 2 (mostly addressed)17 |

March 2025 |

Degree to which timely statutory federal transfer programs assist and support provincial and territorial governments in delivering important public services, including accessible and quality health care |

5 |

5 |

5 |

5 (100% of payments reviewed did not reveal errors; 100% of payments to provincial and territorial governments were made within the required time frames)18 |

March 2025 |

Explanation of table 6

16 Data for this indicator is reported every three years on payment issues that arise during the previous three-year period. This indicator was last reported on in 2022–23 for the 2018–19 to 2020–21 reporting period. Results for fiscal years 2021-22 and 2022-23 will be included in the next three-year reporting period.

17 The unit of measure is a normative scale consisting of four grades: 1) Fully addressed; 2) Mostly addressed; 3) Partially addressed; or 4) Not addressed.

18 The unit of measure is a scale consisting of five grades: 1 - less than or equal to 96 per cent of the time; 2 - 97 per cent of the time; 3 - 98 per cent of the time; 4 - 99 per cent of the time; and 5 - 100 per cent of the time. For this indicator's target to be met, a rating of 5 (100 per cent of the time) is needed for each of the following:

1) Percentage of payments reviewed that did not reveal errors, and

2) Percentage of payments to provincial and territorial governments that were made within the required timeframes

Table 7: Indicators, results and targets for departmental result

Departmental result: Canada maintains its leadership and engagement globally and deepens its trading relationships

Indicator |

2020–2021 result |

2021–2022 result |

2022–2023 result |

Target |

Date to achieve |

|---|---|---|---|---|---|

Canada's overall score on the OECD Trade Facilitation Indicators |

Data not available |

Data not available |

1.8119 |

Score of 1.7 or higher20 |

March 2025 |

Degree to which Canadian priorities are reflected in initiatives at various international financial institutions (IFIs) to which the Department of Finance provided resources |

Met |

Met |

Met21 |

Score of 4 or higher22 |

March 2025 |

Explanation of table 7

19 Based on the most recent data available (2022).

20 The overall indicator is comprised of 11 Trade Facilitation Indicators (TFIs), such as information availability, fees and charges, and appeal procedures. Each TFI is assessed with a value from 0 to 2, where 2 designates the best performance that can be achieved.

21 In 2022-23, IFIs to which the Department of Finance provided resources have implemented a number of measures aligned with Canada's international priorities, including: increased support to Ukraine; enhanced action to support developing countries in mitigating and adapting to climate change; and measures to more effectively deploy their existing capital.

22 The score is a rating on a 1 to 5 normative performance scale, where 1 signals a priority that is not reflected by the institutional financing vehicle to which resources were provided; and 5 signals a priority that is reflected entirely by the institutional financing vehicle to which resources were provided. Each international financial institution (IFI) (or institutional financing vehicle within an IFI) to which the Department of Finance has provided resources gets an average score. The final score corresponds to the average of all scores of the assessed institution/financing vehicles.

The financial, human resources and performance information for the Department of Finance's program inventory is available on GC InfoBase.

Plans to achieve results

Sound Fiscal Management

The Department plans to achieve the departmental result that Canada's public finances are sound, sustainable and inclusive by focusing on the following in 2024-25:

- Support the government's responsible management of the federal budget and federal debt by providing analysis and advice consistent with preserving Canada's low-debt advantage.

- Support the implementation of targeted investments to improve the quality of life of Canadians by building a stronger, greener, and more resilient and sustainable society.

- Manage the government's debt program in order to maintain well-functioning markets for Government of Canada securities.

- Continue to efficiently manage Canada's currency system and foreign reserves.

- Implement Canada's updated Green Bond Framework, including issuing a green bond and exploring the development of a sustainable bond framework that could permit the issuance of social or transition bonds.

Through this work, the Department will provide advice consistent with ensuring that Canada's federal debt-to-gross-domestic-product ratio is stable over the medium term, the general government net-debt-to-gross-domestic-product ratio is low compared to G7 countries, and that the government's annual budget document includes a clear Gender Statement on the impact of the budget's measures from a gender perspective.

The Department plans to achieve the departmental result that Canada has a fair and competitive tax system by undertaking the following in 2024-25:

- Develop new proposals aimed at improving the fairness of Canada's tax system and support the implementation of previously announced tax fairness measures, including a tax on share buybacks, the modernization of the Income Tax Act's general anti-avoidance rule, and the excessive interest and financing expenses limitation regime.

- Work with international partners on the Two-Pillar tax reform plan to ensure multinational corporations pay their fair share of tax wherever they do business.

Through this work, the Department aims to support the government in its efforts to enhance tax fairness and provide advice consistent with ensuring Canada has a competitive tax system, under which tax rates on both labour income and new business investment are lower in Canada than the average of the G7 countries.

The Department plans to achieve the departmental result that the Government of Canada's borrowing requirements are met at a low and stable cost to support effective management of the federal debt on behalf of Canadians by undertaking the following in 2024-25:

- Manage the government's debt program in order to raise stable and low-cost funding.

- Adapt the government's debt management strategy to respond to Canada's evolving economic needs and to support Canadians and Canadian businesses in an environment of elevated interest rates and heightened geopolitical uncertainty.

Through this work, the Department plans to ensure that the government's borrowing requirements are met within the fiscal year and that Canada's sovereign rating is equal to or greater than the median of the G7 countries.

Inclusive and Sustainable Economic Growth

The Department plans to achieve the departmental result that Canadians enjoy stronger, more sustainable, and inclusive economic growth that contributes to higher standards of living by doing the following in 2024-25:

- Conduct evidence-based analysis to support policies that are effective in building a green, equitable, and strong economy.

- Continue work with departments and other central agencies to advance long-term inclusive economic growth through policies that advance access to skills training, labour force participation, inclusion of under-represented groups, immigration, internal trade, and labour mobility.

- Work with other government departments and leverage internal expertise on the financial and policy mechanisms available to support Indigenous economic participation, including increased access to affordable capital, in the advancement of economic reconciliation with Indigenous Peoples.

- Continue to support the government's commitments to see the Trans Mountain Expansion Project built and operated in the right way and to divest the Trans Mountain Corporation to a new owner or owners in a manner and at a time that protects the public interest and the government's investment. This includes continuing to advance opportunities for meaningful economic participation in Trans Mountain with Indigenous groups who live along the pipeline corridor and marine shipping route, in keeping with the spirit of reconciliation.

- Support the establishment of a new fiscal relationship with Indigenous Peoples, and the negotiation of tax jurisdiction arrangements to support revenue generation opportunities for interested Indigenous governments.

Implementing Canada's Clean Economy and Jobs Plan

Budget 2023 proposed a range of measures to encourage businesses to invest in Canada's clean economy and create good-paying jobs for Canadian workers.

To support the government's plans, in 2024-25, the Department will help implement tax measures to advance the government's climate goals, secure Canada's competitive advantage, and create opportunities for Canadian workers. These include investment tax credits (ITCs) for carbon capture, utilization and storage, as well as clean technology adoption, clean hydrogen, clean technology manufacturing and clean electricity. The ITCs are expected to make an important contribution to improving competitiveness with the United States.

To further help stimulate investment, the Department will support the ongoing implementation of the Canada Growth Fund (CGF), an arm's length public investment fund announced in Budget 2022 that will help attract and accelerate private sector investment in Canada's clean economy. The CGF can enter into Carbon Contracts for Difference, an investment tool that will help de-risk clean growth projects by providing predictability of the future price of carbon and hydrogen.

- Collaborate with departments and other central agencies to advance policies and programs that promote economic development and make life more affordable for Canadians. This includes measures that support innovative and growing businesses as well as sector-specific strategies in traditional sectors (agriculture, fisheries, mining, and forestry).

- Continue to develop and support the implementation of policies that enable fair dealings among businesses and a commercial marketplace that is conducive to competition, investment, and growth. This will include supporting the government's plan to amend the Competition Act and efforts to reign in hidden or unexpected junk fees, like international roaming fees.

- Collaborate with federal organizations to implement section 23 of the Canadian Net-Zero Emissions Accountability Act. This will include preparing and publishing an annual report on key measures taken by the federal public administration to manage its financial risks and opportunities related to climate change.

- Advance policies and support the implementation of measures that increase the supply of market-based and social and affordable housing across the country, including removing barriers that restrict new housing from being built, and accelerate the overall pace of construction.

Through these actions, the Department aims to achieve broad-based growth across income groups in Canada, help Canada achieve its target of a 40 to 45 per cent reduction in greenhouse gas emissions by 2030, and ensure Canada ranks in the top 15 OECD countries in both GDP per capita and employment rates for those aged 15 to 64.

The Department plans to achieve the departmental result that Canada has a sound and efficient financial sector by undertaking the following in 2024-25:

- Advise on insurance-based strategies for addressing natural disaster protection gaps such as flood and earthquake risks.

- Assess housing market developments and advise on the domestic housing finance system, including to address mortgage hardship and incentivize housing supply.

- Address financial sector integrity and security risks, including foreign interference, combat money laundering and terrorist financing, and support the development and implementation of financial sanctions.

- Strengthen the sustainability of federally regulated private sector pension plans.

- Work with partners on the digitalization of money.

- Implement a Consumer-Directed Banking Framework.

- Modernize the payment system, including implementing a new supervisory framework for retail payments.

- Take steps to establish a well-functioning and sustainable finance market.

Fighting Predatory Lending

Predatory lenders can take advantage of some of the most vulnerable Canadians by extending very high interest rate loans.

To protect Canadians from predatory loans, the Department will implement a lower criminal rate of interest of 35 per cent annual percentage rate (APR), introduce regulations to cap payday loans at $14 per $100 of borrowings and exempt certain loans from the criminal rate of interest, as announced in Budget 2023.

In addition, based on consultations with Canadians in fall 2023, the Department will work with stakeholders and the Department of Justice to fight predatory lending faster.

Through this work, the Department will support the government's objective that Canada's financial policy framework is rated favourably by all leading international organizations and major ratings agencies.

Sound Social Policy Framework

The Department plans to achieve the departmental result that the Government of Canada effectively supports provinces, territories, and Indigenous governments by undertaking the following in 2024-25:

- Continue convening meetings with provinces and territories, including meetings of finance ministers, to advance issues of shared interest.

- Continue to advance priority policies and advise on potential measures aimed at improving the availability and quality of social and affordable housing.

- Work in collaboration with provinces and territories to conclude the 2022-2024 Triennial Review of the Canada Pension Plan and implement any changes.

- Work in collaboration with provinces and territories on the 2029 Renewal of the Equalization and Territorial Formula Financing programs.

- Work with other government departments and central agencies to advance health and social priorities, including in public safety and justice, culture, immigration, diversity and inclusion.

- Work with other government departments and central agencies to support reconciliation with Indigenous Peoples, including the implementation of the United Nations Declaration Act Action Plan, the establishment of a new fiscal relationship with Indigenous Peoples, the delivery of government priorities in areas such as Indigenous social and economic policy, and the application of a distinctions-based lens in funding approaches.

Through these actions, the Department aims to ensure that 100 per cent of statutory federal transfer payments to provincial and territorial governments will be made accurately and within the required time frames and that payment issues identified with respect to tax agreements with provinces, territories and Indigenous governments are addressed.

Effective International Engagement

The Department plans to achieve the departmental result that Canada maintains its leadership and engagement globally and deepens its trading relationships by implementing the following in 2024-25:

- Continue to monitor and analyze international economic and policy developments, including in the context of Russia's war in Ukraine and heightened tensions in the Middle East, with a view to ensuring strong, sustainable, inclusive and balanced global economic growth.

- Continue to work with G7 and G20 members to address short- and long-run global economic challenges.

- Coordinate with allies, including G7 members, on support for Ukraine against the illegal invasion by Russia.

- Work with international counterparts to advance the goal that multilateral development banks use resources efficiently, including through developing innovative instruments and mobilizing private capital, and implement key reforms in order to meet global challenges, including promoting economic stability as well as creating a stronger, greener, and more inclusive economy.

- Continue to exercise leadership at the International Monetary Fund to support its efforts to continue to meet the needs of member countries.

- Continue efforts to improve debt sustainability and transparency across the international system.

- Lead Canada's engagement in negotiations on multilateral export credit disciplines, including work to restrict export credit support for fossil fuels in alignment with the Glasgow Statement on International Public Support for the Clean Energy Transition.

- Expand preferential trade through the exploration, negotiation, and implementation of free trade agreements.

- Support Canadian leadership on reform to the World Trade Organization and modernizing the multilateral trading system.

- Support the government's response to protectionist measures by major trading partners, including a Reciprocal Procurement Policy.

- Engage with international partners to promote climate ambition through development and trade policy and address ongoing trade irritants (for example, non-market excess capacity).

- Prepare for and assume the Presidency of the G7 in 2025, for which the Department will play a key policy and advisory role to the Deputy Prime Minister and Minister of Finance and leadership for the G7 Finance Track overall.

- Continue to monitor and advise on issues related to the import of goods to preserve Canada's manufacturing competitiveness and protect domestic industries against unfair trade practices.

Through this work, the Department aims to support the government in its efforts to have Canadian priorities reflected in initiatives of international financial institutions to which the Department provides resources and that Canada's import policy lowers the incidence of tariffs, including import fees and charges on businesses, eases the administration of tariff law and regulations, and provides global leadership in support of tariff and trade liberalization.

Snapshot of planned resources in 2024-25

- Planned spending: $143,000,447,717 (includes $142,900,365,720 for statutory programs and transfers to other levels of government)

- Planned full-time resources: 671 full-time equivalents

Related government priorities

Gender-based Analysis Plus

Gender-based analysis plus (GBA Plus) is an analytical process used to assess systemic inequalities and determine how gender and other diverse identity factors impact access to programs and services. Gender-based analysis was originally conceived to reveal and address the inequalities experienced by women and girls in the implementation of policies, programs, and initiatives. Gender-based analysis "Plus" emerged with the recognition that other diverse identity factors such as age, ethnicity, sexual orientation, disability, and geography also require analysis, as they can intersect with sex and gender identity and reinforce gender inequalities. A consistent approach to GBA Plus ensures that funding decisions are made with an understanding of how diverse groups of Canadians will be affected.

The Department plays a pivotal role in ensuring that public policies are informed and developed through an intersectional lens, including through the consistent application of frameworks such as GBA Plus and the Quality of Life indicators. In 2024-25, all budgetary and off-cycle proposals will continue to be informed by gender and diversity analysis, setting the expectation that GBA Plus considerations be addressed early in the development of funding proposals and when additional funding is sought.

The Department also plays a lead role in advancing Canada's approach to gender budgeting. As required by the Canadian Gender Budgeting Act (CGBA), the Department will continue to ensure that the gender and diversity impacts of all new budget measures are reported. The CGBA also requires that the Minister of Finance publish an annual GBA Plus study of the impacts of existing tax expenditures based on various key identity factors. Budget 2024 will include impact summaries for budget measures that will illustrate how decisions will be expected to impact various demographic groups across intersecting factors such as gender, income level and age. The impact summaries will also highlight measures expected to advance the Gender Results Framework. Further, Budget 2024 will include a Statement on Gender Equality and Diversity in Canada with key statistics to summarize the status of gender equality and diversity. Finally, the 2024 Report on Federal Tax Expenditures will provide analysis of the benefits from federal tax expenditures accruing to diverse Canadians.

More detailed information about the Department's GBA Plus activities, including data collection strategies, can be found in the GBA Plus Supplementary Information Table.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

The Department's sustainable development strategy aligns with its plan to keep the economy growing in a way that benefits more people today and in the future, contributing to a better quality of life for all Canadians.

In 2024–25, the Department will remain focused on ensuring Canada's economy grows in a sustainable and inclusive manner. For example, all budgetary and off-cycle funding proposals submitted to the Department will meet strategic environmental assessment requirements and demonstrate that the potential impact on climate change has been considered and mitigated. In reviewing these packages, the Department will contribute to meeting the Federal Sustainable Development Strategy Goal 13: Take action on climate change and its impacts.

The Department is also a key contributor to six other Federal Sustainable Development Strategy goals: Reduce Poverty in Canada in all its Forms; Increase Canadians' Access to Clean Energy; Encourage Inclusive and Sustainable Economic Growth in Canada; Foster Innovation and Green Infrastructure in Canada; Advance Reconciliation with Indigenous Peoples and Take Action to Reduce Inequality; and Reduce Waste and Transition to Zero-Emission Vehicles.

More information on the Department's contributions to Canada's Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our departmental Sustainable Development Strategy.

Program inventory

Economic and Fiscal Policy is supported by the following programs:

- Tax Policy and Legislation

- Canada Health Transfer

- Economic and Fiscal Policy, Planning and Forecasting

- Fiscal Arrangements with Provinces and Territories

- Economic Development Policy

- Tax Collection and Administration Agreements

- Federal-Provincial Relations and Social Policy

- Commitments to International Financial Organizations

- Financial Sector Policy

- Market Debt and Foreign Reserves Management

- International Trade and Finance Policy

Supporting information on planned expenditures, human resources, and results related to the Department of Finance's program inventory is available on GC Infobase.

Summary of changes made to reporting framework since last year

The Department regularly reviews its Economic and Fiscal Policy reporting framework to ensure meaningful reporting of its results. There were no changes to the Department's results framework for the 2024-25 reporting year.

Internal services

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Plans to achieve results

In 2024-25, the Department will:

- Maintain a healthy, safe and respectful workplace that promotes and supports employee well-being.

- Attract, develop and retain a diverse and skilled workforce. In particular, the Department will focus on identifying and addressing barriers to accessibility and representation and bolstering a respectful culture that values equity and inclusion.

- Enhance business effectiveness, collaboration, and mobility by implementing departmental solutions that simplify, modernize, and innovate information management and information technology (IT) tools and services.

- Partner with Shared Services Canada to modernize and transform the Department's existing IT infrastructure, disaster recovery and business continuity solutions.

- Invest in the evergreening of IT assets to ensure employees have modern and mobile services, and that boardrooms and the conference centre support a hybrid work model.

- Enhance the departmental security posture.

- Provide effective stewardship of financial resource management within the Department, including leadership on the implementation of refocusing government spending.

- Maintain enhanced controls and oversight to support the management of procurements in a fair, open, and transparent manner that meets public expectations in matters of prudence and probity.

- Ensure Canadians have access to factual, non-partisan, and plain language information on the Government of Canada's policies and programs designed to create a healthy and inclusive Canadian economy, including through the publication and communication of the 2024 federal budget and 2024 Fall Economic Statement.

Snapshot of planned resources in 2024-25

- Planned spending: $49,721,131

- Planned full-time resources: 251 full-time equivalents

Related government priorities

Planning for contracts awarded to Indigenous businesses

The Government of Canada is committed to reconciliation with Indigenous Peoples and to improving socio-economic outcomes by increasing opportunities for First Nations, Inuit and Métis businesses through the federal procurement process.

Under the Directive on the Management of Procurement, which came into effect on May 13, 2021, departments must ensure that a minimum of 5 per cent of the total value of the contracts they award are held by Indigenous businesses. The Department has committed to award 7 per cent of the total value of its contracts to Indigenous businesses by the end of fiscal year 2024-25.

To support the government's commitment, in 2024-25, the Department will:

- Continue to incorporate Indigenous procurement into its Annual Procurement Plan, monitor contracting activity and make adjustments as needed to ensure the 7 per cent target is achieved.

- Identify commodities for which Indigenous businesses have market capacity for various goods and services and ensure businesses are aware of Indigenous suppliers qualified to complete the work.

- Ensure new procurement officers complete Indigenous procurement training courses within six months of arrival at the Department.

- Participate in intergovernmental working groups and training sessions on Indigenous procurement and collaborate with government departments and other central agencies on various Indigenous procurement initiatives.

5% reporting field |

2022-23 actual result |

2023-24 forecasted result |

2024-25 planned result |

|---|---|---|---|

Total percentage of contracts with Indigenous businesses |

Not applicable |

5% |

7% |

Planned spending and human resources

This section provides an overview of the Department's planned spending and human resources for the next three fiscal years and compares planned spending for 2024–25 with actual spending from previous years.

Spending

Table 8: Actual spending summary for core responsibilities and internal services ($ dollars)

The following table shows information on spending for each of the Department's core responsibilities and for its internal services for the previous three fiscal years. Amounts for the current fiscal year are forecasted based on spending to date.

Core responsibilities and internal services |

2021–2022 actual expenditures |

2022–2023 actual expenditures |

2023–2024 forecast spending |

|---|---|---|---|

Economic and Fiscal Policy |

106,340,024,056 |

117,257,491,324 |

135,990,147,922 |

Internal services |

48,028,313 |

57,499,024 |

57,236,448 |

Total |

106,388,052,369 |

117,314,990,348 |

136,047,384,370 |

Explanation of table 8

The cumulative net increase of $29.7 billion in spending from 2021-22 to 2023-24 mainly relates to:

- an increase in interest on unmatured debt due to higher borrowing requirements and revisions to interest rates ($18.7 billion)

- legislated increases for the Canada Health Transfer payment program ($6.3 billion) and fiscal arrangements with provinces and territories transfer payment programs ($4.7 billion)

Table 9: Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of the Department's core responsibilities and for its internal services for the upcoming three fiscal years.

Core responsibilities and internal services |

2024-25 budgetary spending (as indicated in Main Estimates) |

2024-25 planned spending |

2025-26 planned spending |

2026-27 planned spending |

|---|---|---|---|---|

Economic and Fiscal Policy |

143,000,447,717 |

143,000,447,717 |

149,065,931,906 |

155,651,598,680 |

Internal services |

49,721,131 |

49,721,131 |

49,619,638 |

49,432,142 |

Total |

143,050,168,848 |

143,050,168,848 |

149,115,551,544 |

155,701,030,822 |

Explanation of table 9

The cumulative increase of $12.7 billion in planned spending from 2024-25 to 2026-27 mainly relates to the following statutory items:

- legislated and forecasted increases to the Canada Health Transfer ($5.3 billion) and fiscal arrangements with provinces and territories transfer payment programs ($2.3 billion)

- an increase in interest on unmatured debt due to higher borrowing requirements and revisions to interest rates ($3.1 billion)

- an increase in approved authorities for capital and operating expenses for the Canada Infrastructure Bank ($1.8 billion)

Funding

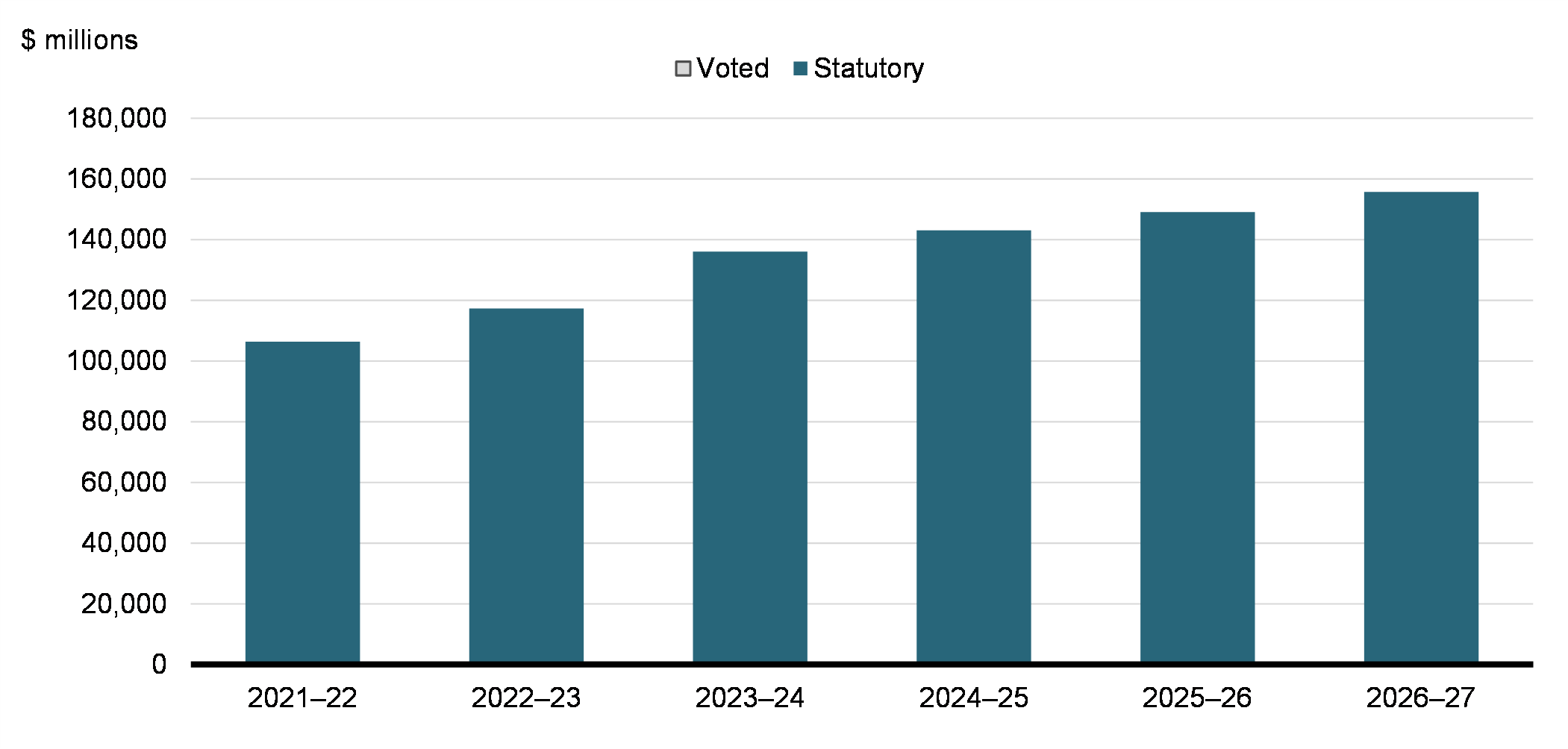

The following graph presents planned spending (voted and statutory expenditures) over time.

Text description of figure 1

Fiscal year |

Total |

Voted |

Statutory |

|---|---|---|---|

2021–22 |

106,388 |

129 |

106,259 |

2022–23 |

117,315 |

329 |

116,986 |

2023–24 |

136,047 |

440 |

135,607 |

2024–25 |

143,050 |

145 |

142,905 |

2025–26 |

149,116 |

133 |

148,983 |

2026–27 |

155,701 |

131 |

155,570 |

Estimates by vote

Information on the Department of Finance's organizational appropriations is available in the 2024–25 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of the Department's operations for 2023–24 to 2024–25.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on the Department's website.

Table 10: Future-oriented condensed statement of operations for the year ending March 31, 2025 (dollars)

Financial information |

2023–24 forecast results |

2024–25 planned results |

Difference (2024–25 planned results minus 2023–24 forecast results) |

|---|---|---|---|

Total expenses |

130,481,400,624 |

139,663,107,660 |

9,181,707,036 |

Total revenues |

- |

- |

- |

Net cost of operations before government funding and transfers |

130,481,400,624 |

139,663,107,660 |

9,181,707,036 |

Explanation of table 10

Planned net cost of operations (before government funding and transfers) shows an increase of $9.2 billion in 2024-25, primarily due to legislated and forecasted increases in major transfer payments to provinces and territories ($4.4 billion) and a planned increase in interest expense ($4.8 billion), due to the rise in short-term interest rates.

Human resources

Table 11: Actual human resources for core responsibilities and internal services

The following table shows a summary of human resources, in full-time equivalents (FTEs), for the Department's core responsibilities and for its internal services for the previous three fiscal years. Human resources for the current fiscal year are forecasted based on year to date FTEs.

Core responsibilities and internal services |

2021–22 actual FTEs |

2022–23 actual FTEs |

2023–24 forecasted FTEs |

|---|---|---|---|

Economic and Fiscal Policy |

589 |

602 |

696 |

Internal services |

310 |

322 |

256 |

Total |

899 |

924 |

952 |

Explanation of table 11

The increased use of full-time equivalents from 2021-22 to 2023-24 is primarily due to funding received to support the work on key government priorities in areas such as tax policy, financial sector policy and economic development.

Table 12: Human resources planning summary for core responsibilities and internal services

The following table shows information on human resources, in full-time equivalents (FTEs), for each of the Department's core responsibilities and for its internal services planned for 2024–25 and future years.

Core responsibilities and internal services |

2024–25 planned FTEs |

2025–26 planned FTEs |

2026–27 planned FTEs |

|---|---|---|---|

Economic and Fiscal Policy |

671 |

668 |

665 |

Internal services |

251 |

250 |

250 |

Total |

922 |

918 |

915 |

Corporate information

Organizational profile

Appropriate minister(s):

The Honourable Chrystia Freeland P.C, M.P.

Institutional head:

Chris Forbes, Deputy Minister

Ministerial portfolio:

Minister of Finance

Enabling instrument(s):

https://www.canada.ca/en/department-finance/corporate/laws-regulations/list-acts-regulations.html

Year of incorporation / commencement:

1867

Organizational contact information

Mailing address:

Department of Finance Canada

15th Floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Telephone:

613-369-3710

TTY:

613-995-1455

Fax:

613-369-4065

Email:

Website(s):

Supplementary information tables

The following supplementary information tables are available on the Department of Finance Canada's website:

Information on the Department of Finance Canada's Sustainable Development Strategy can be found on the Department's website.

Federal tax expenditures

The Department of Finance Canada's Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government-wide tax expenditures each year in the Report on Federal Tax Expenditures.

This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and Gender-based Analysis Plus.

Definitions

List of terms

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a threeyear period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

- A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- fulltime equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full personyear charge against a departmental budget. Fulltime equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- Gender-based Analysis Plus (GBA Plus) (analyse comparative entre les sexes plus ACS Plus)

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

- government-wide priorities (priorités pangouvernementales)

For the purpose of the 2024–25 Departmental Plan, government-wide priorities are the high-level themes outlining the government’s agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world.

- horizontal initiative (initiative horizontale)

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- Indigenous business

- As defined on the Indigenous Services Canada website in accordance with the Government of Canada’s commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous businesses annually.

- non‑budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

An inventory of a department's programs that describes how resources are organized to carry out the department's core responsibilities and achieve its planned results.

- result (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization's influence.